Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 12, 2017

Date of Report (Date of earliest event reported)

|

GREEN VISION BIOTECHNOLOGY CORP. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

|

000-55210 |

|

98-1060941 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

1255 W. Rio Salado Parkway, Suite 215 Tempe, Arizona |

|

85281 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(480) 339-0181

Registrant’s telephone number, including area code

__________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 1.01 ENTRY INTO MATERIAL DEFINITIVE AGREEMENT

Use of Certain Defined Terms Used in this Current Report on Form 8-K

Except where the context otherwise requires and for the purposes of this Current Report on Form 8-K only:

|

|

· | “GVBT”, “Company”, "we”, "us” and "our Company" refer to the combined business of Green Vision Biotechnology Corp., its consolidated subsidiaries and its consolidated affiliate, as the case may be; |

Definitions related to the corporate structure of Lutu International:

|

|

· | “Able Lead” refers to Able Lead Holdings Limited, a limited company incorporated in the British Virgin Islands, which holds 89% of the issued and outstanding shares of Lutu International; |

|

|

|

|

|

|

· | “Harcourt” refers to Harcourt Capital Limited, a limited company incorporated in the British Virgin Islands, which holds 6% of the issued and outstanding shares of Lutu International; |

|

|

|

|

|

|

· | “Hong Kong Prolific" refers to Hong Kong Prolific Mineral Resources Limited, a wholly owned subsidiary of Light Raise Limited, incorporated in the Hong Kong; |

|

|

|

|

|

|

· | “Light Raise” refers to Light Raise Limited, a wholly owned subsidiary of Lutu International incorporated in the British Virgin Islands; |

|

|

|

|

|

|

· | "Lutu International" refers to Lutu International Biotechnology Ltd, a limited company incorporated in the Cayman Islands ; |

|

|

|

|

|

|

· | "Shanxi Lutu" refers to Shanxi Green Biotechnology Industry Limited, a wholly owned subsidiary of Hong Kong Prolific and a wholly foreign-owned enterprise incorporated in China; |

|

|

|

|

|

|

· | “Shareholders of Lutu International” refers to Able Lead, Harcourt and Woodhead collectively; |

|

|

|

|

|

|

· | “Shenzhen Lutu” refers to Shenzhen QianHai Lutu Supply Chain Management Co., Ltd, a wholly owned subsidiary of Shanxi Lutu and a limited company incorporated in China; |

|

|

|

|

|

|

· | “the Lutu Group” refers to Lutu International, Light Raise, Hong Kong Prolific, Shanxi Lutu, and Shenzhen Lutu collectively; and |

|

|

|

|

|

|

· | “Woodhead” refers to Woodhead Investments Limited, a limited company incorporated in the British Virgin Islands, which holds 5% of the issued and outstanding shares of Lutu International. |

| Page 1 of 93 |

General definitions:

|

|

· | "China" and " PRC" refer to the People's Republic of China, and for the purpose of this Current Report on Form 8-K, “China” and “PRC” do not include Hong Kong, Macau Special Administrative Region of the People's Republic of China and Taiwan (The Republic of China); |

|

|

|

|

|

|

· | "Exchange Act" refers to the United States Securities Exchange Act of 1934, as amended; |

|

|

|

|

|

|

· | “Hong Kong” refers to the Hong Kong Special Administrative Region of the People's Republic of China; |

|

|

|

|

|

|

· | "Renminbi " and "RMB" refer to the legal currency of China; |

|

|

|

|

|

|

· | "SEC" refers to the United States Securities and Exchange Commission; |

|

|

|

|

|

|

· | "Securities Act" refers to the United States Securities Act of 1933, as amended; |

|

|

|

|

|

|

· | "U.S. Dollar", and "$" refer to the legal currency of the United States; and |

|

|

|

|

|

|

· | “United States” and “U.S.” refer to The United States of America. |

Technical definitions:

|

|

· | “ha” refers to hectare, an accepted metric system unit of area, which equals 10,000 m2; |

|

|

|

|

|

|

· | “ktpa” refers to one thousand tons per annum; |

|

|

|

|

|

|

· | “MBF” refers to mineral based bio-fertilizer, the main product of Shanxi Lutu; |

|

|

|

|

|

|

· | “MAP” refers to mono-ammonium phosphate (NH4H2PO4), a commonly used chemical phosphate fertilizer; |

|

|

|

|

|

|

· | “MOP” refers to muriate of potash or potassium chloride (KCl), the most commonly used chemical potash fertilizer; |

|

|

|

|

|

|

· | “SOP” refers to sulphate of potash or potassium sulphate (K2SO4), a commonly used chemical potash fertilizer; and |

|

|

|

|

|

|

· | “Principles of Organic Agriculture” refers to the Principles of Organic Agriculture established by the International Federation of Organic Agriculture Movements in September, 2005. |

| Page 2 of 93 |

Chemical symbols for elements:

| · | B |

Boron |

|

|

|

|

| · | Cl |

Chlorine |

|

|

|

|

| · | K |

Potassium |

|

|

|

|

| · | Mg |

Magnesium |

|

|

|

|

| · | N |

Nitrogen |

|

|

|

|

| · | P |

Phosphate |

|

|

|

|

| · | S |

Sulphur |

|

|

|

|

| · | Si |

Silicon |

|

|

|

|

| · | Zn |

Zinc |

Solely for the convenience of the reader, this Current Report on Form 8-K contains conversions of certain Renminbi amounts into U.S. Dollars at specified rates. Except as otherwise indicated, all conversions from Renminbi to U.S. Dollars were made based on the exchange rate on 20 March 2017, which was 1 USD to 6.904 RMB. No representation is made that the Renminbi or U.S. Dollar amounts referred to in this Current Report on Form 8-K could have been or could be converted into U.S. Dollar or Renminbi, as the case may be, at any particular rate or at all. See “Risk Factors—Risks factors in doing business in China— Fluctuations in exchange rates could adversely affect our business and the value of our securities” for a discussion of the effects on the Company of fluctuating exchange rates.

Investment Transaction

The investment transaction under the share exchange agreements and contractual agreements as described below (collectively the “Transaction Agreements”) was entered into, between each of the Shareholders of Lutu International and GVBT (the “Investment Transaction”) on May 12, 2017. As a result of closing the Investment Transaction, GVBT acquired part of the shares of Lutu International and assumed management of the Lutu Group.

| Page 3 of 93 |

The terms of the Transaction Agreements were determined through arm’s length negotiations between GVBT, Lutu International, Able Lead, Harcourt and Woodhead, as applicable. Execution of the Transaction Agreements and the closing of the Investment Transaction were approved by GVBT, Lutu International, Able Lead, Harcourt and Woodhead independently.

Share Exchange Agreement with Harcourt and Woodhead

On May 12, 2017, GVBT entered into a Share Exchange Agreement with Harcourt and Woodhead (the “Minority Interest Exchange Agreement”). Under the Minority Interest Exchange Agreement, Woodhead agreed to transfer GVBT a total of 5% of the issued and outstanding shares of Lutu International. In consideration, GVBT agreed to grant Woodhead, or persons designated by Woodhead, a right to receive a total of 5 million shares of GVBT’s common stock. Under the Minority Interest Exchange Agreement, Harcourt agreed to transfer to GVBT a total of 6% of the issued and outstanding shares of Lutu International. In consideration, GVBT agreed to grant Harcourt, or persons designated by Harcourt, a right to receive a total of 6 million shares of GVBT’s common stock. The transactions under the Minority Interest Exchange Agreement were completed on May 12, 2017.

Share Exchange Agreement with Able Lead and Escrow Agreement

Able Lead has an outstanding loan of $4.43 million denominated in RMB owed to an unrelated third party with its maturity date on January 22, 2018 (the “Outstanding Loan”). Shares of Lutu International held by Able Lead were offered by Able Lead as collateral to secure repayment of the Outstanding Loan (the “Security”).

On May 12, 2017, GVBT entered into a share exchange agreement (the “Majority Interest Exchange Agreement”) with Able Lead. Under the Majority Interest Exchange Agreement, Able Lead agreed to enter into a series of contractual arrangements with GVBT (collectively, the “Contractual Arrangements”) (as described below), in which GVBT assumes management control of the Lutu Group. Able Lead further agrees to deliver the shares of Lutu International to GVBT once the Outstanding Loan is fully repaid. In consideration, GVBT agrees to issue and deliver a total of 89 million shares of GVBT’s common stock to an escrow agent (issued in the name of the escrow agent or its nominee) (the “Escrow Shares”). The Escrow Shares shall be held in escrow for a period of one year or such period of time to be agreed by GVBT and Able Lead upon the execution of the Majority Interest Exchange Agreement. Conditional upon the full repayment of the Outstanding Loan and the release of the Security, the Escrow Shares shall be released to Able Lead in exchange for the delivery of a total of 89% of the issued and outstanding shares of Lutu International by Able Lead to GVBT. In the event that Able Lead fully repays the Outstanding Loan and causes the release of the Security, then the Escrow Shares shall be delivered to Able Lead. In the event that Able Lead cannot fully repay the Outstanding Loan (within a period of one year, or such period of time to be agreed by GVBT and Able Lead) and cause the release of the Security, then the Escrow Shares shall be delivered to transfer agent for cancellation. Unless otherwise expressly agreed in writing by GVBT and Able Lead, the Majority Share Exchange Agreement shall be automatically terminated upon the termination of any of the agreements in the Contractual Arrangements described as below. The transactions under the Majority Interest Exchange Agreement was completed on May 12, 2017.

| Page 4 of 93 |

Pursuant to an escrow agreement (the “Escrow Agreement”) entered into between Booth Udall Fuller, PLC (the “Escrow Agent") and GVBT on May 12, 2017, the Escrow Shares shall be held by Booth Udall Fuller, PLC for a year upon the execution of the Majority Share Exchange Agreement. The Escrow Shares shall not be subject to any lien, attachment, or any other judicial process of any creditor of GVBT, and shall be held and disbursed solely for the purposes and in accordance with the terms of the Majority Share Exchange Agreement.

The terms of the Escrow Agreement and the following contractual agreements with the Lutu Group and Able Lead have been agreed to and the agreements were signed and delivered in connection with the closing of the Investment Transaction.

Contractual Arrangements with the Lutu Group and Able Lead

On May 12, 2017, GVBT entered into a series of contractual agreements (term of which are also agreed by Woodhead and Harcount) as described below with Lutu International and/or Able Lead (the “Contractual Arrangements”). Upon execution of the Contractual Arrangements, GVBT assumes management of the Lutu Group and receives economic benefits which includes right to receive the expected residual returns and and/or obligation to absorb expected loss from the Lutu Group. Each agreement in the Contractual Arrangements constitutes valid and binding obligations of the parties of such agreements and is enforceable and valid in accordance with the laws of Cayman Islands. All agreements executed by Lutu International were duly approved by its board of directors and the Shareholders of Lutu International.

Consulting Services Agreement

Pursuant to the exclusive consulting services agreement entered into between GVBT and Lutu International on May 12, 2017, GVBT has the exclusive right to provide to the Lutu Group general business operation services, including advice and strategic planning, as well as consulting services related to the technological research and development of bio-fertilizers. Further, GVBT owns the intellectual property rights developed or discovered through research and development, in the course of providing the consulting services, or derived from the provision of the consulting services. In consideration, Lutu International pays an annual consulting service fees to GVBT in the amount equivalent to all of Lutu International’s profits for the relevant financial year. The term of this consulting service agreement is five (5) years from its effective date and may be extended and terminated upon GVBT’s written confirmation prior to the expiration of this agreement.

| Page 5 of 93 |

Unless otherwise expressly agreed in writing by GVBT and Able Lead, the Consulting Services Agreement shall be automatically terminated upon the termination of any of the agreements in the Contractual Arrangements or the Majority Interest Exchange Agreement.

Operating Agreement

Pursuant to the operating agreement entered into between GVBT, Lutu International and Able Lead on May 12, 2017, GVBT agrees to provide guidance and instructions on the Lutu Group’s daily operations, financial management and employment issues. Able Lead agrees to designate candidates recommended by GVBT as their representatives on the boards of directors of each member of the Lutu Group. GVBT has the right to appoint senior executives of each member of the Lutu Group. In addition, GVBT agrees to guarantee the Lutu Group’s performance under any agreements or arrangements relating to the Lutu Group’s business arrangements with any third party. In consideration, Lutu International agrees that it will not, and will cause the Lutu Group not to, without the prior consent of GVBT, engage in any transactions that could materially affect their respective assets, liabilities, rights or operations, including but not limited to, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of their assets or intellectual property rights in favor of a third party or transfer of any agreements relating to their business operation to any third party. The term of this operating agreement is five (5) years from its effective date and may be extended and terminated only upon GVBT’s written confirmation prior to the expiration of the this agreement.

Unless otherwise expressly agreed in writing by GVBT and Able Lead, the Operating Agreement shall be automatically terminated upon the termination of any of the agreements in the Contractual Arrangements or the Majority Interest Exchange Agreement.

Proxy Agreement

Pursuant to the proxy agreement entered into between Able Lead, Lutu International, and GVBT on May 12, 2017, Able Lead agrees to irrevocably grant a person to be designated by GVBT the right to exercise its voting rights and other rights, including the attendance of, and the voting at the shareholders’ meetings of Lutu International for and on behalf of Able Lead (or the signing of written resolutions in lieu of such meetings) in accordance with applicable laws and its articles of association, including but not limited to the appointment and voting for the directors and chairman of the board as the authorized representative of Able Lead to exercise controlling power in the Lutu Group. The proxy agreement may be terminated by joint consent of the parties or upon 7-day written notice from GVBT.

| Page 6 of 93 |

Unless otherwise expressly agreed in writing by GVBT and Able Lead, the Proxy Agreement shall be automatically terminated upon the termination of any of the agreements in the Contractual Arrangements or the Majority Interest Exchange Agreement.

Changes Resulting from the Investment Transaction

The closing of the Investment Transaction occurred on May 12, 2017, resulting in a change of control of GVBT. Prior to closing of the Investment Transaction, GVBT had a total of 60,790,000 shares of common stock issued and outstanding. As a result of the closing of the Investment Transaction, GVBT now has a total of 160,790,000 shares of its common stock issued and outstanding, of which 60,790,000 shares, or approximately 37.8%, are owned by the previous existing shareholders of GVBT, with the balance of 100,000,000 shares, or approximately 62.2%, owned by the previous shareholders of Lutu International, with certain shares held in escrow pursuant to the Escrow Agreement.

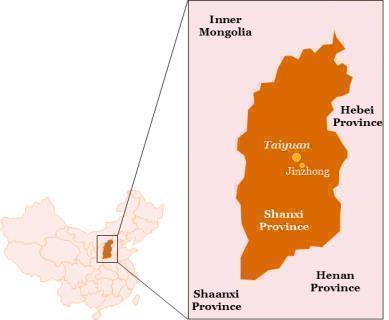

Following the closing of the Investment Transaction, GVBT will carry on the business of the Lutu Group. The Lutu Group, with its operation primarily located in the Shanxi Province of China, is engaged in the biotechnology industry, in particular, the production and distribution of bio-fertilizers. Revenues of the Lutu Group are currently generated from China.

The shareholding structure of GVBT after the Investment Transaction is as follows:

| Page 7 of 93 |

Changes to the Board of Directors and Officers

Simultaneous with the closing of the Investment Transaction, there was a change in the officers and directors of GVBT. As authorized by the bylaws, the existing director of GVBT, Mr. Ma Wai Kin, appointed two (2) additional members to the Board of GVBT. Such members are Mr. Lam Ching Wan (also known as William Lam) and Mr. Leung Kwong Tak (also known as Dr. Michael Leung). Mr. Ma also appointed Mr. William Lam as GVBT’s Chief Executive Officer and Mr. Lo Kwok Leung as GVBT’s Chief Financial Officer. Mr. Lo Kwok Leung is not related to Dr. Michael Leung.

All members of the Board shall hold their respective offices for a term of one year from their respective dates of appointment, or until the election and qualification of their successors, and thereafter to resign as a director of GVBT. In accordance with the bylaws, officers are elected by the board of directors and serve at the discretion of the board of directors.

Accounting Treatment

The Investment Transaction is being accounted for as a reverse-merger and recapitalization. For financial reporting purposes, Lutu International is the acquirer and GVBT is the acquired company. Consequently, the assets, liabilities and operations of GVBT that will be reflected in the historical financial statements prior to the Investment Transaction will be those of Lutu International and will be recorded at the historical cost basis of Lutu International.

Tax Treatment and SEC Filer Status: Small Business Issuer

The Investment Transaction is intended to constitute a reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), or such other tax free reorganization exemptions that may be available under the Code. Immediately following the Investment Transaction, the filer status of GVBT will be a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K, as promulgated by SEC.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| · | a requirement to have only two years of audited financial statements and only two years of related Management's Discussion and Analysis of Financial Condition and Results of Operations disclosure; and |

|

|

|

| · | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes- Oxley Act of 2002. |

We may take advantage of these provisions until the end of the fiscal year ending after the fifth anniversary of our initial public offering or such earlier time that we are no longer an emerging growth company, and if we do, the information that we provide to the stockholders may be different than you might get from other public companies in which you hold equity. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenue, have more than $700 million in market value of our ordinary shares held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period. The JOBS Act permits an "emerging growth company" like us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies.

| Page 8 of 93 |

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

The information provided in Item 1.01 of this Current Report on Form 8-K in relation to the aforementioned Investment Transaction and related Transaction Agreements (as defined therein) is incorporated by reference into this Item 2.01.

The Investment Transaction closed on May 12, 2017 and as a result, GVBT’s principal business will assume the business of Lutu International and GVBT will cease being a shell company. GVBT has included below the information that would be required if the Company were filing a general form for registration of securities on Form 10 under the Securities Exchange Act of 1934

FORM 10 INFORMATION

Item 1. Business

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

THIS CURRENT REPORT ON FORM 8-K CONTAINS FORWARD-LOOKING STATEMENTS THAT INVOLVE RISKS AND UNCERTAINTIES, PRINCIPALLY IN THE SECTIONS ENTITLED “ITEM 1. BUSINESS,” “ITEM 1A. RISK FACTORS,” AND “ITEM 2. FINANCIAL INFORMATION.” ALL STATEMENTS OTHER THAN STATEMENTS OF HISTORICAL FACT CONTAINED IN THIS CURRENT REPORT ON FORM 8-K, INCLUDING STATEMENTS REGARDING FUTURE EVENTS, OUR FUTURE FINANCIAL PERFORMANCE, BUSINESS STRATEGY AND PLANS AND OBJECTIVES OF MANAGEMENT FOR FUTURE OPERATIONS, ARE FORWARD-LOOKING STATEMENTS. WE HAVE ATTEMPTED TO IDENTIFY FORWARD-LOOKING STATEMENTS BY TERMINOLOGY INCLUDING “ANTICIPATES,” “BELIEVES,” “CAN,” “CONTINUE,” “COULD,” “ESTIMATES,” “EXPECTS,” “INTENDS,” “MAY,” “PLANS,” “POTENTIAL,” “PREDICTS,” “SHOULD” OR “WILL” OR THE NEGATIVE OF THESE TERMS OR OTHER COMPARABLE TERMINOLOGY. ALTHOUGH WE DO NOT MAKE FORWARD-LOOKING STATEMENTS UNLESS WE BELIEVE WE HAVE A REASONABLE BASIS FOR DOING SO, WE CANNOT GUARANTEE THEIR ACCURACY. THESE STATEMENTS ARE ONLY PREDICTIONS AND INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS, INCLUDING THE RISKS OUTLINED UNDER “RISK FACTORS” OR ELSEWHERE IN THIS CURRENT REPORT ON FORM 8-K, WHICH MAY CAUSE OUR OR OUR INDUSTRY’S ACTUAL RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS. MOREOVER, WE OPERATE IN A VERY COMPETITIVE AND RAPIDLY CHANGING ENVIRONMENT. NEW RISKS EMERGE FROM TIME TO TIME AND IT IS NOT POSSIBLE FOR US TO PREDICT ALL RISK FACTORS, NOR CAN WE ADDRESS THE IMPACT OF ALL FACTORS ON OUR BUSINESS OR THE EXTENT TO WHICH ANY FACTOR, OR COMBINATION OF FACTORS, MAY CAUSE OUR ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN ANY FORWARD-LOOKING STATEMENTS.

| Page 9 of 93 |

Green Vision Biotechnology Corp. (the “Company”), formerly known as Vibe Wireless Corp., formerly known as Any Translation Corp., was incorporated under the laws of the State of Nevada on July 5, 2012. We were founded to be in the business of translation and interpretation. The Company undertook translation and interpretation projects for various fields from business, economics, to science issues. The Company later adopted a business plan to pursue business opportunities in the global telecommunications industry.

On September 2, 2015, a change in control of the Company took place by virtue of the Company's largest shareholder and sole officer and director at that time, selling 4,000,000 shares of the Company's common stock to Forestbay Capital Partners II, LLC, a Delaware limited liability company. Such shares represented 65.8% of the Company's total issued and outstanding shares of common stock. As part of the sale of the shares, Forestbay Capital Partners arranged with the former officer and director, prior to his resignation as the sole officer and director of the Company Board, to appoint Mr. Edward Mooney as the sole officer and director of the Company. Mr. Mooney is the Manager of Forestbay Capital Partners II, LLC.

On November 12, 2015, we changed our name to Vibe Wireless Corp in connection with merging with our wholly-owned subsidiary. This name change and our ticker symbol change was acknowledged by FINRA and effected in the market on November 23, 2015.

The Company was originally incorporated under the laws of the State of Nevada on July 5, 2012 as Any Translation Corp.

On September 30, 2016, the Company filed a Certificate of Amendment with the Nevada Secretary of State (the “Nevada SOS”) whereby it amended its Articles of Incorporation by increasing the Company’s authorized number of shares of common stock from 75 million to 750 million and increasing all of its issued and outstanding shares of common stock at a ratio of ten (10) shares for every one (1) share held. The Company’s Board of Directors approved this amendment on September 30, 2016.

On September 30, 2016, the Company filed Articles of Merger with the Nevada SOS whereby it entered into a statutory merger with its wholly-owned subsidiary, Green Vision Biotechnology Corp. pursuant to Nevada Revised Statutes 92A.200 et. seq. The effect of such merger is that the Company is the surviving entity and changed its name to “Green Vision Biotechnology Corp.”

| Page 10 of 93 |

On September 30, 2016, the Company filed an Issuer Company-Related Action Notification Form with FINRA requesting that the aforementioned forward split and name change be effected in the market. The Company also requested that its ticker symbol be changed to “GVBT”. Such notification form is being reviewed by FINRA. This name change and our ticker symbol change was acknowledged by FINRA and effected in the market on November 27, 2016.

The investment transaction under the share exchange agreements and contractual agreements as described above in Section 1.01 of this current report on Form 8-K (collectively the “Transaction Agreements”) entered into between each of the Shareholders of Lutu International and GVBT (the “Investment Transaction”) was completed on May 10, 2017. As a result of closing the Investment Transaction, GVBT acquired part of the shares of Lutu International and assumed management of the Lutu Group.

1. Overview

Shanxi Lutu was incorporated in 2006 in the Shanxi Province of China as a domestic company. It was acquired by Hong Kong Prolific and was converted into a wholly foreign-owned enterprise (“WFOE”) in 2012. Its mission is to strive for production of fertilizer products in China which are ecologically, socially and economically friendly. Its production activities and products are based on the Principles of Organic Agriculture.

Figure 1- Jinzhong City, Shanxi Province

| Page 11 of 93 |

2. Corporate History and Background

Microbiologists working for Shanxi Lutu have spent years developing a mixture of microorganisms to manufacture bio-fertilizers from locally available mineral shale which originally cannot be used as fertilizers. They arrived at a mixture of various strains of microorganisms and invented a new product of mineral-based bio-fertilizers (the “MBF”). Shanxi Lutu currently holds a patent in PRC on the production method of the MBF produced (Patent number: ZL200910073705.5) and hence believes possesses the microbial technology to manufacture MBF directly from mineral shale.

In 2011, Shanxi Lutu purchased a piece of industrial land with 34,256 square meters to expand its production capacity. In the same year, an approval to produce 500,000 tons per annum of fertilizers was granted by the PRC Government. After several rounds of corporate transactions and fundraising, Shanxi Lutu is now a WFOE owned by Hong Kong Prolific with the current shareholding structure described in the following section. At present, Shanxi Lutu has a production capacity of 100,000 tons per annum.

3. The Fertilizers Industry

3.1 Essential Plant Nutrients

Nutrients are essential for healthy plant growth. Plants need the right combination of nutrients to live, grow and reproduce. Three (3) non-mineral nutrients, carbon (C), hydrogen (H) and Oxygen (O), are supplied by air (in the form of carbon dioxide) and water. Fifteen (15) essential mineral nutrients are supplied by the soil system. Mineral nutrients in the soil are classified into macro-nutrients and micro-nutrients depending on the quantity required. Macro-nutrients are further categorized into primary and secondary nutrients. Primary nutrients are needed in large quantities and are usually in deficiency. They are Nitrogen (N), Phosphorus (P) and Potassium (K). Secondary nutrients are also needed in large quantities but are usually in sufficient supply in the soil. They are Calcium (Ca), Magnesium (Mg) and Sulphur (S). Micronutrients are needed in small amounts. Examples of micronutrients are Copper (Cu), Boron (B), Iron (Fe), Manganese (Mn), Chlorine (Cl), Molybdenum (Mo) and Zinc (Zn).

| Page 12 of 93 |

|

Table 1. Essential Plant Nutrients for Plant Growth | |||

|

| |||

|

Nutrients Supplied by Air and Water |

Nutrients Supplied by the Soil System | ||

|

Non-Mineral |

Primary Macronutrients |

Secondary Macronutrients |

Micronutrients |

|

Carbon-C Hydrogen-H Oxygen-O |

Nitrogen-N Phosphorous-P Potassium-K |

Calcium-Ca Magnesium-Mg Sulfur-S |

Zinc-Zn Chlorine-CI Boron-B Molybdenum-Mo Copper-CU Iron-Fe Manganese-Mn Cobalt-Co Nickel-Ni |

Source: Hugh Savoy, Fertilizers and Their Use, Agricultural Extension Service, The University of Tennessee, http://www.utextension.utk.edu/

Fertilizers are mainly classified according to three essential crop nutrients: Nitrogen (N), Phosphate (P) and Potassium (K). Each nutrient plays a distinct role in plant development: Nitrogen is a major component of chlorophyll for photosynthesis. Phosphates can promote the development of healthy roots, flowers, and fruits and help plants to mature promptly. Potassium can increase water intake of crops and increase crop resistance to disease and heat (Deloitte: Chemical quarterly 2013-Q2).

To make sure the amounts of mineral nutrients are sufficient for continuing growth of plants and crops, fertilizers containing primary nutrients are usually added to the soil to replenish the lacking of natural supply nutrients after crops harvest. Blended NPK fertilizers for easier application are also found nowadays.

| Page 13 of 93 |

3.2 World Total Fertilizer Nutrients (NPK) Production and Consumption

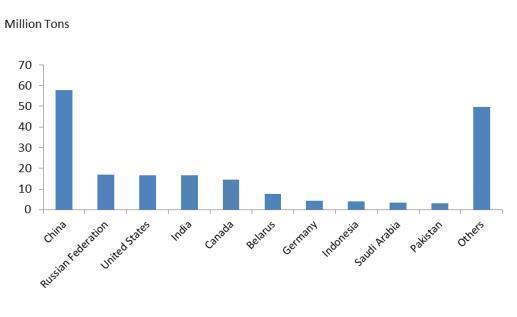

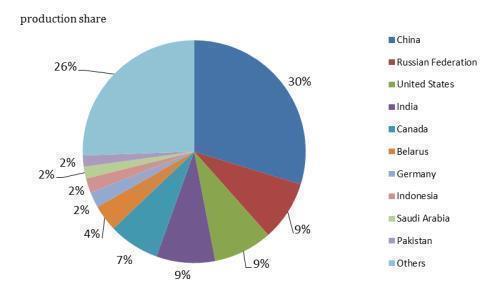

According to IFADATA, the world total fertilizer (NPK) production was around 194 million tons in 2014. China was the largest global producer of total NPK fertilizers, and produced around 58 million tons which represented about 30% of global production share in year 2014 (Figures 1 and 2).

Figure 1 World Total Fertilizer Nutrients (NPK) Production in 2014

Source: IFADATA, http://ifadata.fertilizer.org/ucResult.aspx?temp=20170303042012

Figure 2 World Production Share of Total Fertilizer (NPK) by Countries in 2014

Source: IFADATA, http://ifadata.fertilizer.org/ucResult.aspx?temp=20170303042012

| Page 14 of 93 |

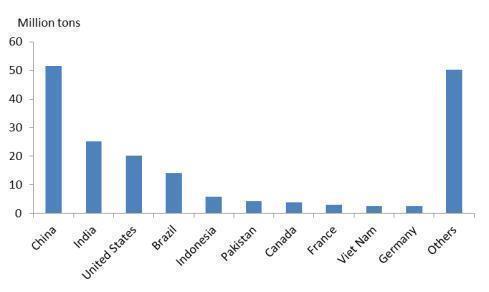

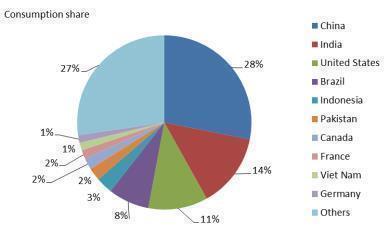

According to IFADATA, the world total fertilizer (NPK) consumption was around 184 million tons in 2014. China was the largest consumer of total NPK, and it consumed around 52 million tons and captured about 28% of consumption share in that year (Figures 3 and 4).

Figure 3 World Total Fertilizer Nutrients (NPK) Consumption in 2014

Source: IFADATA, http://ifadata.fertilizer.org/ucResult.aspx?temp=20170303043213

Figure 4 World Consumption Share of Total Fertilizer (NPK) by Countries in 2014

Source: IFADATA, http://ifadata.fertilizer.org/ucResult.aspx?temp=20170303043213

| Page 15 of 93 |

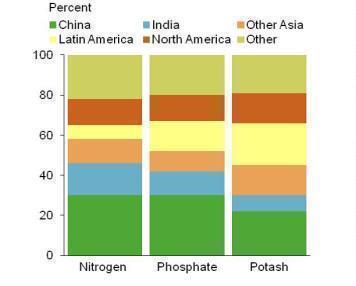

According to the PotashCorp Market Overview presented at the TFI World Fertilizer Conference, September 2015 (the “PotashCorp Market Report”), the major consumption countries of world fertilizer nutrients (NPK) are the developing countries in Asia and Latin America. Together with North America, these major fertilizer-consuming regions account for more than 80% of world fertilizer consumption. Nitrogen and Phosphate use are more heavily concentrated in China and India, while the Potash consumption is dstributed among a number of major regions. Figure 5 depicts the world individual fertilizer consumption distribution by region in 2014. Potash is any of various mined and manufactured salts that contain potassium in water-soluble form. Common potash compounds include potassium chloride, potassium sulfate or potassium nitrate.

Figure 5 – World individual Fertilizer Nutrients Consumption Distribution by Region in 2014

Source: PotashCorp Market Overview, TFI World Fertilizer Conference, September 2015

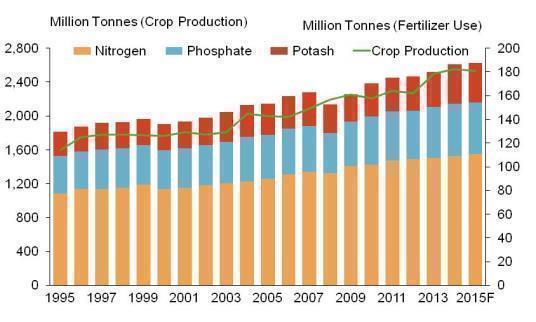

According to the Potash Corp Market Report, the steady growth in crop production serves as a key driver of fertilizer demand. World consumption of grains and oilseeds has grown at an annualized rate of approximately 2.2% from the period of 1995 to 2015. The fertilizer consumption has risen at an average annual rate of approximately 2% over the past same periods, with the rate of Potash consumption growing most quickly among the primary nutrients. Figure 6 indicates the trend of world crop production and fertilizer consumption over the period from 1995 to 2015.

| Page 16 of 93 |

Figure 6 – World Crop Production and Fertilizer Nutrients Consumption, 1995-2015

Source: PotashCorp Market Overview, TFI World Fertilizer Conference, September 2015

3.3 World Fertilizer Nutrients (NPK) Consumption Outlooks

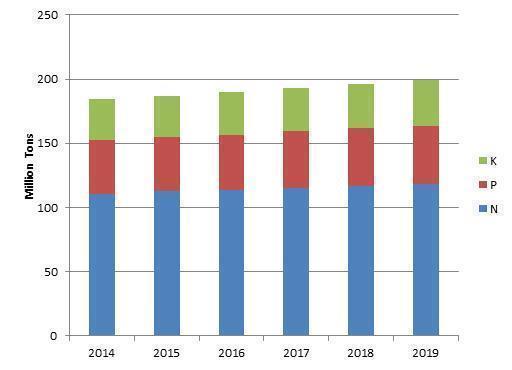

According to the Food and Agriculture Organization of the United Nations (FAO), the total fertilizer nutrient (NPK) consumption is estimated at 185 million tons in 2014 and is forecast to reach 187 million tons in 2015. Meanwhile, the consumption is expected to reach 199 million tons by the end of 2019 with a successive growth of 1.6% per year. Figure 6 shows the forecasts of world demand for total fertilizer nutrients from 2015 to 2019.

| Page 17 of 93 |

Figure 7 – World Fertilizer Nutrients (NPK) Consumption Forecast (Million Tons)

Source: World fertilizer trends and outlook to 2019 Summary report, Food and Agriculture Organization of the United Nations – Rome, 2016

The world demand and the growth forecast for individual fertilizer nutrients (NPK) are also summarized in Table 2. The growth rate of Potash consumption is expected to increase higher than the other two fertilizer nutrients of Nitrogen and Phosphate over the period from 2015 to 2019.

Table 2 – World Demand Forecast for Fertilizer Nutrients (NPK) 2015-2019 (Million Tons)

|

Year |

|

2015 |

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|

2019 |

| |||||

|

Nitrogen (N) |

|

|

113 |

|

|

|

114 |

|

|

|

115 |

|

|

|

117 |

|

|

|

118 |

|

|

Growth |

|

|

1.5 | % |

|

|

1.3 | % |

|

|

1.4 | % |

|

|

1.2 | % |

|

|

1.1 | % |

|

Phosphate (P) |

|

|

42 |

|

|

|

43 |

|

|

|

44 |

|

|

|

45 |

|

|

|

46 |

|

|

Growth |

|

|

0.6 | % |

|

|

1.8 | % |

|

|

2.1 | % |

|

|

2.0 | % |

|

|

2.0 | % |

|

Potash (K) |

|

|

32 |

|

|

|

33 |

|

|

|

34 |

|

|

|

34 |

|

|

|

35 |

|

|

Growth |

|

|

0.3 | % |

|

|

2.6 | % |

|

|

2.5 | % |

|

|

2.4 | % |

|

|

2.3 | % |

|

Total (NPK) |

|

|

187 |

|

|

|

190 |

|

|

|

193 |

|

|

|

196 |

|

|

|

199 |

|

|

Growth |

|

|

1.1 | % |

|

|

1.6 | % |

|

|

1.7 | % |

|

|

1.6 | % |

|

|

1.5 | % |

Source: World fertilizer trends and outlook to 2019 Summary report, Food and Agriculture Organization of the United Nations – Rome, 2016

| Page 18 of 93 |

3.4 China Fertilizer Nutrients (NPK) Consumption

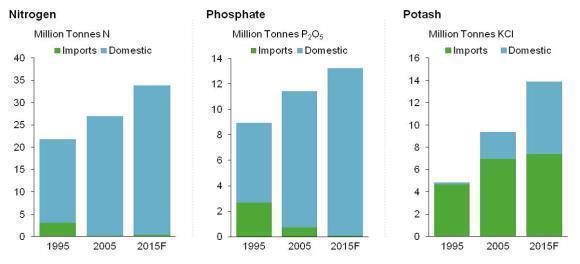

According to the PotashCorp Market Report, China has expanded its Nitrogen and Phosphate capacity over the past two decades. As a result, China is self-sufficient in both Nitrogen and Phosphate nutrients, and in recent years became a significant net exporter of both. In 2015, China’s consumption of Nitrogen and Phosphate were estimated at approximately 34 million tons and 13 million tons respectively. On the other hand, China’s consumption of Potash nutrients was estimated at 14 million tons and it needs to import about 55% of Potash in order to meet its Potash requirement in 2015. In recent years, China has increased its domestic production of Potash nutrient through the ramp-up of domestic capacities. However, additional capacity growth could be limited by the amount of space on the salt lakes and the quality of known reserves in the Qinghai Province of China.

Figure 8 – China Fertilizer Nutrients Consumption Profile

Source: PotashCorp Market Overview, TFI World Fertilizer Conference, September 2015

3.5 World Bio-Fertilizer Outlook

The excessive application of agrochemicals on crops has led to soil contamination and other environmental hazards. The bio-fertilizers, being as an eco-friendly option, help to maintain soil and crop health. Nitrogen-fixing, Phosphate-solubilizing and Potash-mobilizing are currently key bio-fertilizer types.

The NOVONOUS report “Global Bio-Fertilizer 2016-2020” estimates that global bio-fertilizer market will grow at a CAGR of 13.9% by 2020. The growth drivers are mainly due to increasing penetration of bio-fertilizers in agriculture, increasing demand for organic products and easy availability of affordable bio-fertilizer products to end users. The report found that most of the growth in bio-fertilizers can be attributed to the affordable cost of bio-fertilizer, increasing concern on sustainable farming, rising governmental support and environmental regulations.

| Page 19 of 93 |

According to the NOVONOUS report, Nitrogen-fixing and Phosphate-solubilizing bio-fertilizers dominate the first and second largest market share in the global bio-fertilizer market. NOVONOUS estimates that the global Nitrogen-fixing and global Phosphate-solubilizing bio-fertilizer markets are expected to grow at a CAGR of 13.25% and 20.75% respectively till 2020.

In terms of bio-fertilizers by microorganism type, Azospirillum-based and Azotobacter-based bio-fertilizers currently dominate the first and second largest market share in global bio-fertilizers. As per NOVONOUS estimates, global Azospirillum and Azotobacter bio-fertilizers market are expected to grow at a CAGR of 11% and 13% respectively till 2020.

In terms of geographical location, the North America and Europe bio-fertilizer markets dominate the first and second largest market share in global bio-fertilizers. NOVONOUS estimates that the North America and Europe bio-fertilizer markets are expected to grow at a CAGR of 16.65% and 14.90% respectively till 2020. The Asia Pacific bio-fertilizer market captures the third largest market share in global bio-fertilizer market. NOVONOUS estimates that the Asia Pacific bio-fertilizer market is expected to grow at a CAGR of 11.40% till 2020.

3.6 Trend of Using Organic and Bio-fertilizers in China

According to the report “Major Results of Investigation and Assessment of Agricultural Land Classes throughout the Country” released by the PRC Ministry of Land and Resources, about 70.6% of the agricultural land in China was classified as “medium” to “low” classes in terms of soil nutrient conditions, indicating that the fertility of soil in China has been degenerating and affecting the quality of produce and food.

In the last three decades, chemical fertilizers accounted for more than 80% of the fertilizer market in China, and it was commonly believed that it was one of the most important factors attributing to the continuous and serious degeneration of soil fertility in China. Many agronomists in China now believe that the increasing use of organic and bio-fertilizers will be the upcoming solution to improve the soil nutrient quality of farmland in China.

On 29th July 2015, the PRC Ministry of Industry and Information Technology published a policy document titled “Instructive Opinion about the Changing Development of Chemical Fertilizer Industry in China”, encouraging the development of new, effective and environmentally friendly fertilizers, and looking forward to increasing the use of “new fertilizers” (non-chemical fertilizers) from 10% to 30% for fertilizer applications in China.

| Page 20 of 93 |

In addition, the PRC Ministry of Agriculture pronounced in its annual prominent “Document No. 1” in 2016 that the “zero-growth of chemical fertilizers in China” target has to be achieved by 2020 in China. Parallel with this policy, the increasing uses of microbial compound fertilizer, liquid-type, specialized, slow-release and controlled-release fertilizers would become the future trend in the fertilizer market in China in the upcoming years.

3.7 Classification of Fertilizers in the China Market

There are many ways to classify fertilizers. Fertilizers are usually divided into inorganic fertilizers, organic fertilizers and microbial fertilizers. Currently, inorganic fertilizers have a decisive market share and impact in the fertilizer market followed by organic fertilizer. In contrast, microbial fertilizers have a lesser share of the fertilizer market.

According to the rules and regulations under the “Measures for the Administration of Fertilizer Registration”, “PRC National Standard for Fertilizer and Soil Conditioner Terminology” (GB/T 6274-1997), PRC Agricultural Industry Standards NY 525-2012, NY884-2012 and NY/T 798-2015, the following terms shall have the following meanings in China’s fertilizers market:

|

|

i. | Fertilizer: its main function is to provide nutrients for plants. (GB/T 6274-1997) |

|

|

|

|

|

|

ii. | Inorganic [mineral] fertilizer: its nutrients are in the form of inorganic salt fertilizer, which is made by the extraction, physical and/or chemical industrial method (sulfur, calcium cyanamide, urea and its contraction, and bone powder superphosphate are usually classified as inorganic fertilizers). (GB/T 6274-1997) |

|

|

|

|

|

|

iii. | Complex fertilizer: a fertilizer manufactured only by chemical method, and its components are specified with at least 2 out of the 3 nutrients, namely Nitrogen, Phosphorus, Potassium. (GB/T 6274-1997) |

|

|

|

|

|

|

iv. | Organic fertilizer: a fertilizer containing carbon, its components mainly made from plants and/or animals. (NY 525-2012) |

|

|

|

|

|

|

v. | Microbial fertilizer: it refers to fertilizer products which contain specific living microorganisms and have specific fertilizer’s effects when applied to agricultural production. The specific fertilizer’s effects include the provision of good conditions of soil and plant environment, and include the provision of necessary nutrients to crops, together with beneficial effects from metabolism of these microorganisms upon plants. (“Measures for the Administration of Fertilizer Registration”) |

|

|

vi. | Organic microbial fertilizer: it is made by combining microorganisms which have specific function, and organic materials (mainly animal and plant residues such as livestock and poultry manure, crop stalks, etc.) which are disinfected and decomposed. They possess the functions of both microbial fertilizers and organic fertilizers. (NY884-2012) |

|

|

|

|

|

|

vii. | Compound microbial fertilizer: it is a vivo microbial product with a combination of specific microorganisms and nutrients, which can provide, maintain or improve plant nutrition, improve the yield of agricultural products or improve the quality of agricultural products. (NY / T 798-2015) |

| Page 21 of 93 |

3.8 Classification of our Fertilizers

Currently, our fertilizer products have passed the product standard promulgated by the Ministry of Agriculture and hence have obtained the registration certificate of compound microbial fertilizers from the Ministry of Agriculture (as described in Section 5.1 and 5.2 below) pursuant to the “Measures for the Administration of Fertilizer Registration”. In other words, our products are fertilizer products which contain specific living microorganisms and have specific effects when applied in agricultural production. The specific effects include the provision of nutrients to soil and crops and beneficial effects on the metabolism of plants.

4. Production of Mineral-based Bio-fertilizer (“MBF”)

As discussed above, China lacks high-quality soluble Potash resources. Almost all the current proven Potash resources (i.e. soluble ones) are in the remote Provinces of Qinghai and Xinjiang. These Potash resources mainly exist as brine in salt lakes instead of in rock salt mines common in Canada or FSU. Such resources are generally lower in grading and more polluting during the extraction process. China has abundant resources in insoluble Potash. However, it is difficult to convert such insoluble Potash resources into fertilizers under existing technology.

Figure 9 – Distribution of Potash Resources in China

| Page 22 of 93 |

Most common chemical Potash fertilizers are readily available in China. However, the overuse of chemical Potash fertilizers in general can cause pollution problems, deterioration in soil quality including soil hardening and alkalinity, and exhaustion of other secondary and micronutrients not added in chemical fertilizers. All these further reduce soil fertility and ultimately making it barren.

Through repeated research and testing, we developed and invented our MBF out of a mixture of microorganisms from locally available mineral shale which originally cannot be used as fertilizers.

Certain bacteria, called Potash solubilizing bacteria, are capable of decomposing minerals in feldspar and mica crystals present in soils and rocks to release the Potassium contained therein.

A wide range of bacteria has been reported to release K from K-bearing minerals in soils, but little information is available on Potassium solubilization by bacteria, their mechanisms of solubilization and effect of such bacteria inoculation on nutrient availability in soils and growth of different crops.

The efficiency of K solubilization was found to vary with various factors, including:

·

the nature of Potassium bearing minerals;

·

the bacterial strains used;

·

acidity; and

·

aerobic conditions.

A lot of researchers and scholars around the world are carrying out studies in this regard, including China and India where Potash is in serious shortage.

| Page 23 of 93 |

Our new product of MBF is a proven product that can serve as a low cost alternative for China, that is suitable for various applications, and that is sustainable and environmentally friendly. Shanxi Lutu currently holds a patent in PRC on the production method of the MBF produced (Patent number: ZL200910073705.5).

4.1 Production Process

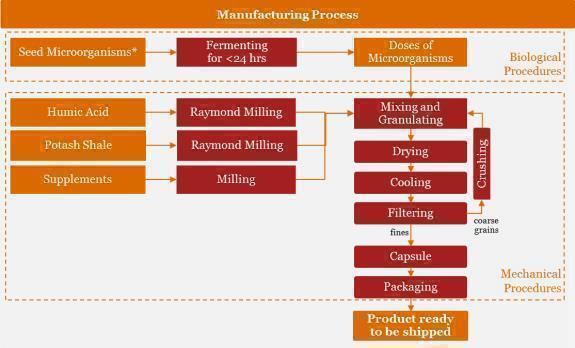

Shanxi Lutu’s MBF are manufactured from mineral shale which contains a significant amount of unavailable Potassium and other minerals beneficial to plants. Microorganisms are added to release such minerals to become rapidly available nutrients and slowly available nutrients in the soil. Our fertilizers can also be doses of Potassium solubilizing bacteria to be applied directly to crops and soils to release unavailable minerals and Potassium already present in the field. Our MBF production process is shown in the following figure:

Figure 10 – Mineral-based Bio-Fertiizer Manufacturing Process

* Potassium Solubilising Bacteria and Phosphate Solubilising Bacteria include Bacillus megairiusdebary, Bacillus mucilaginosus and/or Bacillussubtilis.

| Page 24 of 93 |

4.2 Raw Material Sourcing for Manufacturing of our Mineral-based Bio-fertilizer

The sources of raw materials are elaborated below:

|

Mineral Shale |

Historical Procurement: According to news reports, Shanxi Province ranks as one of the top provinces in China in terms of the reserve of mineral shale. Apart from Shanxi, mineral shale are mainly found in Guizhou Province. |

|

Bacteria |

The mixture of strains of bacteria that is most suitable for application to the local mineral shale was tested and tried by our scientists and researchers in the past years. Our scientists and researchers currently safeguard the exact details of the strains of bacteria used and have been in storage. These act as seed strains which can be later used and multiplied in the production facilities when production starts. |

|

Humic Acid |

Humic acid is obtained after processing the matters obtained from the decay of organic matter. Humic acid is in abundant supply and easily obtained in the Shanxi (especially in the cities of Yangquan, Jinzhong, Xinzhou, Lvliang and Linfen),Yunnan and Guizhou Provinces. |

|

Ammonium Chloride, Urea, MAP, MOP |

These are common chemical fertiliser ingredients and are either industrial products or imported. They are widely available on the market. |

4.3 Existing Facility

We acquired a piece of industrial land in Jinzhong city in Shanxi Province in 2011 as a manufacturing plant. The industrial land use right lasts until 2054. The size of the manufacturing plant is 34,256 square meters. We have completed the phase 1 facilities with an annual production capacity of 100,000 tons per annum. The facilities were tested and adjusted, and are now ready for full scale production.

According to the laws of the PRC, the government owns all the land in the PRC. Companies or individuals are authorized to possess and use the land only through the land use rights granted by the government. The land use rights represent cost of the rights to use the land in respect of properties located in the PRC.

Lutu currently owns the land use right of the production plant. The expiry date of the land use right is May 8, 2054. The building and land use right are under the name of "Shanxi Lutu" or Shanxi Green Biotechnology Industry Limited. Regarding the cost of the land use right and building, please refer to Audit Report F21 and F22: the cost of Land use rights is USD 1,158,222 and Buildings are USD 2,877,610. The address of Lutu’s production plant is Chang Ning Town West, Chang Ning Village, Yuci District, Jinzhong City, Shanxi Province, China.

Once we have entered into full operation, we would like to further expand our existing production facilities from the present phase I (100,000 tons per annum) to phase II (200,000 tons per annum), and then to Phase III (500,000 tons per annum) to address the existing needs of the customers, to grab market share and to expand into other markets such as the soil amendment market.

| Page 25 of 93 |

Figure 11 – Pictures of Shanxi Lutu’s Manufacturing Facilities

Figure 12 - The Manufacturing Plant and the organic microbiogical fertilzers production line

5. Our Products

5.1 Mineral-based Bio-fertilizer (“MBF”)

As described above, we have been applying cutting-edge microbiological technology with high-quality mineral resources to produce organic microbiological fertilizers in order to solve problems such as land pollution due to over-cultivation and overuse of chemical fertilizers and deteriorating food nutrient quality. We have obtained one PRC patent and six registration certificates from the Ministry of Agriculture for our research products as listed in Paragraph 5. 2 below.

At this stage, we produce seven fertilizer products under two own distinctive brands, “Lutu” (“Green Soil”) and “Lu Kun Dan” (“Premium Soil”) for sales:

| Page 26 of 93 |

|

|

Lutu (“Green Soil”) Category: Microbial compound fertilizer

Applicable to vegetables at sowing stage as base fertilizer Pellet fertilizers |

Ingredients: Number of live bacteria (per gram): 20 million NPK content 8% Medium micro-element content: 30% Not less than 20% organic matter |

| ||

|

ii. |

Lu Kun Dan (“Premium Soil”) Category: Microbial compound fertilizer

Applicable to fruit crops (corn, wheat) at the sowing stage as base fertilizer Pellet fertilizers |

Ingredients: Number of live bacteria (per gram): 20 million Organic content: 20% NPK content: 25% Medium micro-element content: 8% |

| ||

|

iii.

|

Fertilizer No.1 for rice Categories: compound microbial fertilizer other categories: root fertilizer, base fertilizer, mineral fertilizer

Applicable to the sowing stage as base fertilizer: |

Ingredients: NPK content: 8% Organic content: 20% Medium micro-element content: 30% Silicon element content: 18.0% Number of live bacteria (per gram): 20 million Live bacteria: Bacillus megaterium and bacillus licheniformis |

Function and use: Used as a root fertilizer and base fertilizer Usage: Spread evenly after the last harrow to maintain the water stability. Product standard: Ministry of Agriculture NYT798-2015 compound microbial fertilizer |

| Page 27 of 93 |

|

iv.

|

Fertilizer No.2 for rice Categories: compound microbial fertilizer other categories: root fertilizer, additional fertilizer, tillering fertilizer, mineral fertilizer

Applicable to the tillering stage: |

Ingredients: NPK content: 25% Organic content: 20% Medium micro-element content: 8% Silicon element content: 4.8% Number of live bacteria (per gram): 20 million Live bacteria: Bacillus megaterium and Bacillus licheniformis |

Function and use: Used as an additional fertilizer at the rice tillering stage. Apart from increasing the Nitrogen content, it also supplements the right amount of Phosphorus and Potassium nutrients, leading to an increase in organic matter and trace elements. At the same time, the biological bacteria hydrolyzes the Nitrogen, Phosphorus and Potassium nutrients retained in the soil Usage: Sprinkle for about 10 days after transplanting, may be varied appropriately according to the local fertilization habits Product standard: Ministry of Agriculture NYT798-2015 Compound microbial fertilizer

| ||

|

v.

|

Fertilizer No.3 for rice Categories: compound microbial fertilizer other categories: root fertilizer, additional fertilizer, booting fertilizer, mineral fertilizer

Applicable to the booting stage: |

Ingredients: NPK content: 15% Organic content: 20% Medium micro-element content: 18% Silicon element content: 10.8% Number of live bacteria (per gram): 20 million Live bacteria: Bacillus megaterium and Bacillus licheniformis |

Function and use: Used as an additional fertilizer at the booting stage to increase the supply of Phosphorus and Potassium; continue to increase the organic matter and trace elements, while the microbial bacteria releases Nitrogen, Phosphorus and Potassium nutrients retained in the soil Usage: Sprinkle about 40 days after transplanting Product standard: Ministry of Agriculture NYT798-2015 Compound microbial fertilizer

| ||

|

vi.

|

Lutu Brand Microbial Organic Fertilizers (specialized for vegetable and fruit crops)

Categories: microbial fertilizer, bio-organic fertilizer other categories: root fertilizer, base fertilizer, mineral fertilizer |

Ingredients: Organic content: 40% Number of live bacteria (per gram): 20 million Live bacteria: Bacillus megaterium and Bacillus licheniformis |

Features: Specialized in enhancing organic matter composition in soil Microbial bacteria are conducive to the activation of soil Effectively solve the problem of consolidation Usage: Apply in soil of 10-20 cm depth Product standard: Ministry of Agriculture NY 884-2012 Bio organic fertilizer OFCD Certification number:IP-0109-914-2040

| ||

|

vii.

|

Lu Kun Dan Brand Multi-Nutrients Water Soluble Fertilizer Categories: compound fertilizer other category: water soluble fertilizer |

Ingredients: NPK content: 55% |

Features: Used as an additional fertilizer for multi-season vegetable planting at the later stage Suitable for drip areas in arid regions To supply a lot of nutrients necessary for crops Usage: Used as an additional fertilizer for 2-3 times during the growing season. Product standard: Ministry of Agriculture NY1107-2010 multi-nutrients water soluble fertilizer |

| Page 28 of 93 |

5.2. List of Registration Certificates of our Products

|

|

1. | Microbial Fertilizer (2015) Preliminary (No.2470) |

|

|

2. | Microbial Fertilizer (2009) Approval (No.0522) |

|

|

3. | Microbial Fertilizer (2016) Preliminary (No.3415) |

|

|

4. | Microbial Fertilizer (2016) Preliminary (No.3414) |

|

|

5. | Microbial Fertilizer (2009) Approval (No.0521) |

|

|

6. | Microbial Fertilizer (2015) Preliminary (No.2457) |

|

|

7. | Agricultural and Fertilizer (2016) Preliminary (No.11624) |

|

|

8. | Certificate of Raw Materials Food issued by the Organic Food Development and Certification Center in Nanjing, China |

Table 3 – Summary of Shanxi Lutu’s Fertilizers

|

Products |

N+P+K Ratio |

Organic Ratio |

Trace element Ratio |

Effective Microbial Concentration |

|

Fertilizers for vegetables |

8% |

20% |

30% |

>=20Mn/g |

|

Fertilizers for fruit crops |

25% |

20% |

18% |

>=20Mn/g |

|

Fertilizer No.1 for rice |

8% |

20% |

30% including Silicon and Zinc |

>=20Mn/g |

|

Fertilizer No.2 for rice |

25% |

20% |

8% including Silicon and Zinc |

>=20Mn/g |

|

Fertilizer No.3 for rice |

15% |

20% |

18% including Silicon and Zinc |

>=20Mn/g |

|

Microbial Organic Fertilizers |

<8% |

40% |

30% |

>=20Mn/g |

|

Multi-Nutrients Water Soluble Fertilizer |

55% |

NA |

NA |

NA |

| Page 29 of 93 |

5.2 Specialized Mineral-based Bio-fertilizer for Rice Production

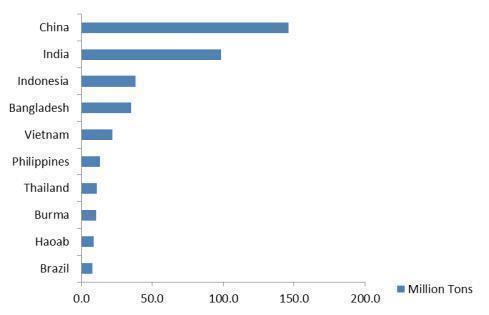

Rice is the major staple food in southern China. According to STATISTA, the statistics portal, China is the largest consumption country of rice in the world in 2015/16, followed by India. Both China and India, the two countries with the first and second largest population, consume the largest amount of rice in 2015/06. Figure 13 indicates the ranking of rice consumption amongst 10 major countries in 2015/16.

Figure 13 Rice Consumption Worldwide in 2015/16, by country (in million tons)

Source: STATISTA, the statistics portal, https://www.statista.com/statistics/255971/top-countries-based-on-rice-consumption-2012-2013/

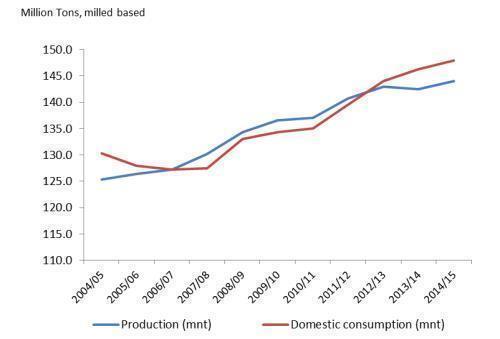

According to the report “China’s agricultural challenges-Roads to be travelled” (October 2015; USDA PWC Report) (the “PWC Report”), milled rice productions in China has been increasing gradually for the period from 2004/05 to 2014/15. However, the increase of milled rice consumption in China has exceeded its production since 2012/13, and therefore China has to increase its milled rice import since 2012/13. Figure 14 depicts the trend of milled rice productions and consumption in China from 2004/05 to 2014/15.

| Page 30 of 93 |

Figure 14 Rice Productions and Consumptions in China, 2004/05 – 2014/15

Source: PWC, China’s agricultural challenges-Roads to be travelled, October 2015; USDA

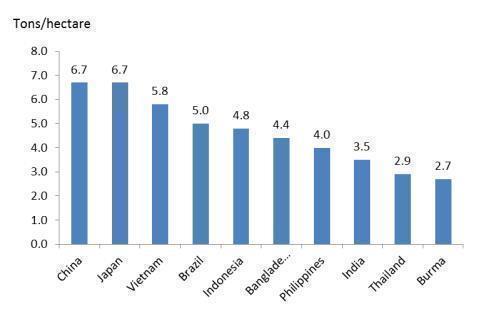

Meanwhile, Figure 15 indicated the global paddy rice yields of major rice producers in 2014/05. China, together with Japan, ranked as the top paddy rice yields producers.

Figure 15 Paddy Rice Yields for Major Producers (2014/15)

Source: PWC, China’s agricultural challenges-Roads to be travelled, October 2015; USDA

During the growth of rice, there are certain peak periods for absorption of nutrients. In addition, there is uniqueness in the nutrients required during the growth of rice in which trace elements like Zinc and Silicon are essential.

| Page 31 of 93 |

Shanxi Lutu’s specialized fertilizers for rice are designed according to the growth characteristics of rice and the nutrients required. According to the field trial conducted by the Soil and Fertilizer Station of Jinzhong City, Shanxi for the period from April 2015 to November 2015, there was a 26.2% increase in output of rice when our 25% Lu Kun Dan microbial compound fertilizer was applied in the field. Our fertilizers also contain major nutrients and trace elements such as Zinc and Silicon, which are essential elements to the proper and normal growth of rice. Our specialized fertilizers for rice have gone through field trial for a full harvesting season. Results of the field trial in Shanxi and reports from some users showed that, by applying our specialized rice fertilizers, the output of rice is higher.

5.3 Clients and Trials

The use of fertilisers affects crop yield significantly, and fertilisers of low quality or with impurities may in fact pollute the soil and kill or inhibit seed germination or plant growth instead. Therefore farmers are very careful when they switch fertilisers and have asked us to provide samples for field trial before extensive use of our fertilizers.

Shanxi Lutu has approached several clients and provided them with samples for field trials throughout 2015 after a small scale production at the plant facilities is possible. Potential clients have designated a small area of their farmland as trial zones and apply fertilizers from us instead of their usual fertilisers, while the rest of their farmland have continued using their usual fertilisers as a control. Germinating and growing condition of the crops are studied during the period, and yield and produce analysis are done after harvest.

Some of our clients have produced internal official reports to evaluate the performance of our fertilizers as shown below. Those reports were in Chinese format and we did not have the translated copies. In summary, our fertilizers generated a positive feedback from field trial around crop yield and the performance results varied from similar performance to significant increase in performance in comparison with the currently available fertilizers in the market.

| Page 32 of 93 |

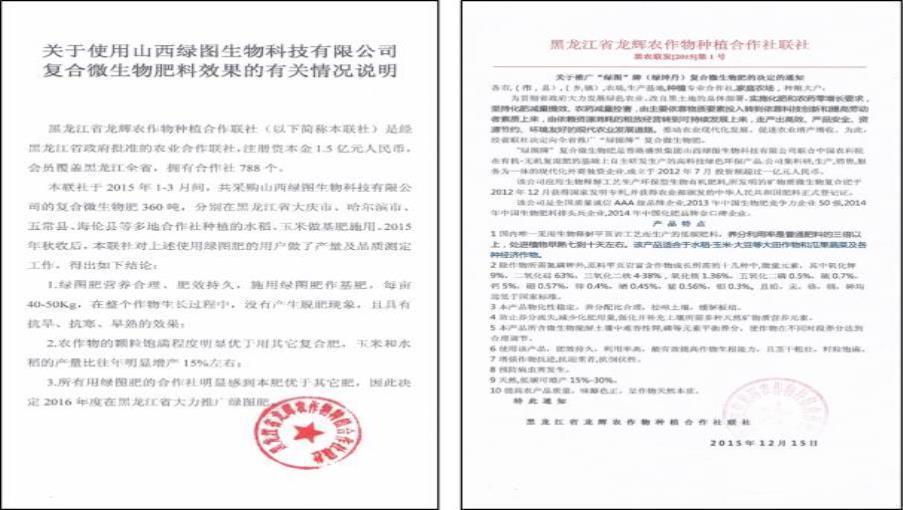

Figure 16 - Trial Results and Promotion Notice of a Heilongjiang based Client

| Page 33 of 93 |

Executive Summary of Figure 16

P.1: Statement illustrating the effects of applying Lutu Compound Microbial Fertilizers

Heilongjiang Longhui Crop Cultivation Cooperative (“Our Co-operative”) is a government approved agricultural cooperative with a registered capital of 150 million RMB with 788 sub-cooperative members.

Our Co-operative purchased 360 tonnes of Lutu Compound Microbial Fertilizers during January to March of 2015. They were applied in multiple cities and towns as the base fertilizer for rice and maze. After the harvesting season in 2015, we have the following observations to the effects of applying Lutu fertilizers.

1. Lutu fertilizers have a long-lasting effect. During the growth process of crops, there are no delineation effects and the crops demonstrate draught-resistant and cold-resistant qualities.

2. The quality of yield is better than other compound fertilizers. The quantity of yield is increased by 15% comparing to last year.

3. All sub-cooperatives which have tried Lutu fertilizers feel that Lutu fertilizers are better and hence will promote the use of Lutu fertilizers in 2016.

P.2: Promotion notice of Lutu Compound Microbial Fertilizers

To each cities and municipals, collective farms and production bases and individuals:

In order to echo with the provincial policy to promote green agriculture and to achieve zero growth of chemical fertilizers, we hereby decided to promote Lutu Compound Microbial Fertilizers.

Lutu Compound Microbial Fertilizer is a green product developed by Hong Kong Prolific Mineral Resources Limited. It has the following features:

Features of Lutu Fertilizer Products:

1. Microbial Mineral Compounds Fertilizer developed by advanced mineral smelting process and decomposition process with nutrition utilization rate higher than regular fetilizers and suitable for rice, maze and other fruit and vegetables.

2. Besides nitrogen, phosphorus and potassium (﹥8%), Microbial Mineral Compounds Fertilizer also contain elements such as calcium, magnesium, sulfur, trace elements: zinc, copper, manganese, boron, molybdenum, iron, selenium, etc. Toxic elements such as lead, mercury, chromium and arsenic are well below the national standard.

3. Soil improvement, resistance to soil hardening.

4. Organic fertilizer features - nutrients can be directly absorbed by plants, dosage reduction.

5. Microbial Mineral Compounds Fertilizer can continuously solubilize the insoluble potassium and phosphorus elements in the soil for plants to absorb and utilize.

6. With long lasting efficiency and high rate of utilization, the fertilizer benefits growing of the root, stem and seed.

7. Enhance resilience, anti-cropping and anti-lodging.

8. Prevent plant diseases and insect pests.

9. Green and environment-friendly. Proven to increase crops production by 15%-30%.

10. Enhance better quality of farm crops and contain higher level of nutrients.

| Page 34 of 93 |

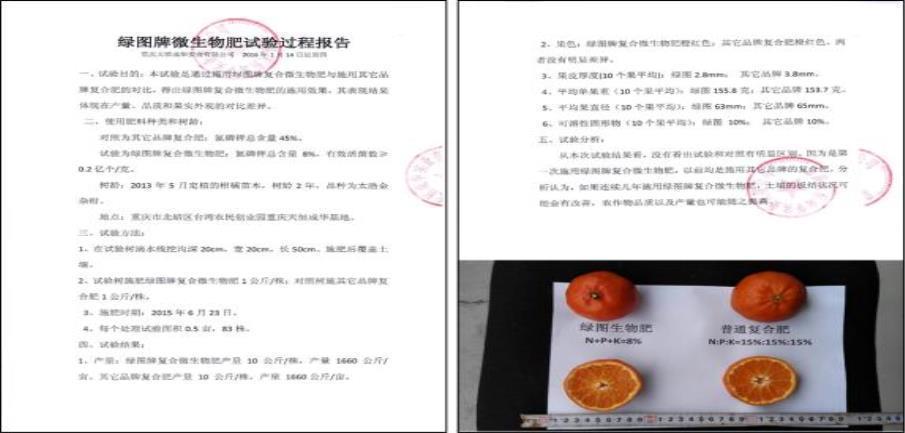

Figure 17 - Trial Results of a Chongqing based Client

| Page 35 of 93 |

Translation of Figure 17

Figure 17:

Trial Report of Lutu Microbial Fertilizer in Chongqing City, China

1. Trial purpose:

To show the actual effects of applying Lutu Microbial Fertilizer and to compare the trial results with other compound fertilizers in terms of yield, quality and appearances.

2. The fertilizers used:

·

other brands of compound fertilizers (the NPK content is 45%)

·

Lutu microbial compound fertilizers (the NPK content is 8%), effective microbial content is greater than or equal to 20 million unit per gram,.

·

The fertilizers are applied to 2-years-old Citrus sinensis.

3. Trial Methodology

·

Dig a hole with length 20cm, width 20cm and height 50cm, apply the ferilizers into the hole;

·

1 kilogram of each types of fertilizers per each plant for comparison;

·

The date when the fertilizers were applied: 23, June 2015;

·

The trial surface area for each control set-up is 0.5 mu and 83 plants of Citrus sinensis are present.

4. Trial Result:

|

|

Lutu |

Other Brands |

|

Yield |

10 kg/plant, 1650 kg/mu |

10kg/plant 1660 kg/mu |

|

Fruit colour |

Pink-red |

Pink-red |

|

Thickness of fruit skin |

2.8mm |

3.8mm |

|

Average weight of fruit |

155.8 |

153.7 |

|

Average diameter |

63mm |

65mm |

|

Soluble residue |

10% |

10% |

5. Experiment Analysis

From the results of the trial, there are no significant differences between the effects of applying Lutu fertilizers and other brands of compound fertilizers. This is the first time we apply Lutu fertilizers and previously we applied other brands of fertilizers.

It is expected that if Lutu fertilizers are applied for consecutive years, the problem of soil compaction can be improved and the quality and quantity of yield can be improved.

| Page 36 of 93 |

6. Our Marketing and Sales Strategy

6.1 Marketing Strategy

As of 2017, Shanxi Lutu is at the development stage of selling its products. Sales of the fertilizers mainly concentrate in various vegetables, fruit crops, rice and maize. As China has over 30 million hectare of rice fields (National Bureau of Statistics of China), consumption of fertilizers was estimated to be in the range of 20-30 million tons per annum.

In 2017, the marketing strategy of Shanxi Lutu in China will be adjusted and will include the following major aspects:-

|

|

(1) | focusing on the sales of specialized fertilizers for rice; |

|

|

|

|

|

|

(2) | continuing to develop the organic fertilizers market for vegetables and fruits; and |

|

|

|

|

|

|

(3) | continuing to develop the organic bio-fertilizers market. |

7. Customers

After years of research and preparation, Shanxi Lutu has begun production and has established a sales team to carry out sales and marketing activities in 2016. Most sales transactions are done through distributorships at the moment. Our major distributors at this stage are as follows:

|

|

a) | Heilongjiang based distributor, which is distributing our products in 10 counties in the Heilongjiang Province; |

|

|

|

|

|

|

b) | Shanxi based distributors, who are distributing our products in 5 counties in the Shanxi Province; and |

|

|

|

|

|

|

c) | Distributors in other provinces: Hainan, Fujian, Inner Mongolia, Hebei, and Yunnan. |

Since China is a big country with huge territories, our marketing strategy is to secure more distributorship deals from nation-wide distributors to penetrate into the markets of different regions in China. In addition to the distributors in the provinces mentioned above, we are developing our sales network in the Provinces of Jilin, Jiangxi, Sichuan, Hunan and Hubei. We are actively looking for distributors in these provinces.

8. Product Delivery

There are two means of transportation for fertilizers in China. If the destination is over 300 km away, rail transportation is preferred. If the destination is within 300 km, road transportation is preferred.

8.1 Rail Transportation

According to the “Notice on Adjusting Railway Freight Price to Further Improve Price Formation Mechanism” promulgated by the National Development and Reform Commission, the national rail freight benchmark rate of goods is increased by an average of 1 cent per ton of kilometers, that is, from the current 14.51 cents to 15.51 cents.

There are also other costs including loading fees, railway station service fees, railway handling costs and other expenses. The freight fees are usually borne by the purchaser.

8.2 Road Transportation

The purchaser normally arranges for the transportation and pays for the freight fees.

| Page 37 of 93 |

8.3 Timing

The location of the client determines their fertiliser application schedule and needs. Farmers in Northern provinces of China need to apply fertilisers in spring. They generally have only one harvest in a year and delivery needs to be made around March. Farmers in southern provinces of China can produce two to three harvests a year and generally order year round.

8.4 Logistics Arrangements and Pricing

Shanxi Lutu generally prices its orders free on board in Taiyuan. We can make logistics arrangements on behalf of the client or deliver the product to designated locations at the cost of the client, either by charging the cost directly back to the client or building the cost into an elevated mark-up unit price.

8.5 Payment Terms

In line with the current practice of payments in the fertilizers industry in China, our clients general will settle the majority of payments with us after harvest, when the produce is sold on the market and their working capital is recouped. This is especially true for clients in the north-eastern provinces as crop growths is slower and produce only one harvest during the year. However, some users (usually the smaller distributors) may agree to paying an upfront payment of around 30-100%, given they can have multiple harvests during the year. Therefore, there is a significant working capital requirement upfront to start production.

9. Employees

Shanxi Lutu currently has about 28 employees in various departments: production, engineering and maintenance, administration, sales and marketing, finance and accounting. Shanxi Lutu usually retains around 50 individuals in the capacity of independent contractors during the peak season to assist production.

10. Competition

10.1 Competitive Advantages

Our developing experience and technology combine to obtain several competitive advantages as follows:

| 1. | Nature of MBF: |

| Page 38 of 93 |

|

|

· | Through the life activities of microorganisms, Shanxi Lutu’s MBF are able to promote crop growth, improve the resistance of crops to pests, improve the quality of crops and provide soil amendment directly or indirectly. |

|

|

|

|

|

|

· |

Our MBF can reduce the usage of chemical fertilizers and pesticides significantly and are proven more efficient than other brands of fertilizers in decomposing the existing chemical fertilizers and pesticides accumulated in soil. (See Figure 16: Trial Results and Promotion Notice of a Heilongjiang based Client and Figure 17: Trial Results of a Chongqing based Client). |

| 2. | Patents were granted for MBF production. |

|

|

· | We obtained a patent of the production method of MBF in 2012. |

|

|

|

|

|

|

· | We also have two other patent applications pending the approval of State Intellectual Property Office in the PRC and one patent application which is in the process of PCT and is prepared to be submitted to United States Patent and Trademark Office (USPTO) for registration. |

|

|

|

|

|

|

· | Once the approval procedures of these patent applications are completed, we can benefit from more tax reductions under the policies of the PRC government. |

| 3. | Our bio-fertiliser products have received positive feedback from clients |

|

|

· | Our products have been tested in several locations in China with local farmers and users, and have received favourable feedbacks. |

| 4. | We do not currently observe the emergence of other significant competitors in the market. |

·

We have already established our phase I production facilities of 100,000 tons per annum and operations.

·

We have not yet been aware that there is another significant competitor within the Shanxi Province with comparable scale or product quality. We do not guarantee that there will be no emergence of other significant competitors in the future.

| 5. | Our research and development capability allows further expansion to other parts of China. |

|

|

· | We have research and development capability and have successfully landed on breakthroughs with further patent applications in 2014 after the initial patent. |

|

|

|

|

|

|

· | We are able to perform studies on the feasibility of utilising mineral resources in other parts of China to establish production facilities outside of our initial facilities. |

| 6. | Our MBF benefits from the following China’s state policies of enhancing the potential of the organic and bio-fertilizers markets in China. These state policies highlight the conservation of agricultural environment and emphasize that preventive measures tackling agricultural pollution should be stepped up and zero growth of the usage of chemical fertilizers should be achieved. |

| Page 39 of 93 |