Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BRT Apartments Corp. | exhibit991q22017.htm |

| 8-K - 8-K - BRT Apartments Corp. | a8-kxq22017.htm |

Supplemental Information

Quarter Ended March 31, 2017

A NATIONAL MULTI-FAMILY EQUITY REIT

SERVING OUR CUSTOMERS FOR OVER 35 YEARS

2

Table of Contents

Description Page #

Table of Contents 2

Disclosure 3

Company Profile 4

Market Information, Per Share Data and Portfolio Data 5

Consolidated Balance Sheets 6

Consolidated Statements of Operations 7

Acquisitions and Sales 8

FFO/AFFO 9

Debt Information 10

Portfolio Summary Data 11

Net Operating Income - Quarterly 13

Net Operating Income – Prior Fiscal Year 14

Reconciliation of Net (Loss) Income to Net Operating

Income

15

Definitions 16

The information presented herein speaks only as of the date or periods indicated, and we do not undertake any

obligation, and disclaim any duty, to update any of this information. Our future financial performance is subject

to various risks and uncertainties that could cause actual results to differ materially from expectations. The

factors that could affect our future financial results are discussed more fully in our reports on Form 10-K, Form

10-Q, and Form 8-K filed with the SEC and in particular, the sections of such reports identified as “Risk Factors”.

Readers are advised to refer to these reports for additional information concerning our activities.

3

Disclosure

We are an internally managed real estate investment trust, also known as a REIT, that is primarily focused

on the ownership, operation and development of multi-family properties. These activities are primarily

conducted through joint ventures in which we typically have an 80% equity interest in the entity owning

the property.

At March 31, 2017, we own 32 multi-family properties (four of which are wholly owned), located in 11

states with an aggregate of 8,805 units, including a 271 unit multi-family property in lease up. Most of our

properties are located in the Southeast United States and Texas. We commenced our multi-family activities

in March 2012.

4

Company Profile

2017 2016 2016 2015 2014

Market Information

Market capitalization 116,677,054$ 97,115,867$ 111,190,680$ 99,976,487$ 107,273,903$

Shares outstanding 14,040,560 13,973,506 13,898,835 14,101,056 14,303,187

Closing share price 8.31$ 6.95$ 8.00$ 7.09$ 7.50$

Portfolio

Multi family properties owned 32 31 33 28 27

Units 8,805 8,793 9,420 8,300 7,609

Average occupancy (1) 93.3% 92.1% 92.8% 94.5% 94.0%

Average total revenue per occupied unit (1) 906$ 861$ 852$ 810$ 785$

2017

(Unaudited)

2016

(Unaudited) 2016 2015 2014

Per Share Data

Earnings per share (basic and diluted) (0.30)$ 1.76$ 2.23$ (0.17)$ (0.66)$

FFO per common share (2) (3) 0.12$ 0.15$ 0.47$ 0.24$ 0.16$

AFFO per common share (2) (4) 0.16$ 0.25$ 0.78$ 0.36$ 0.28$

(1) Weighted average rent and occupancy excludes property in lease up.

(3) The decrease in FFO is due to the recognition, in 2016 quarter, of deferred interest income from the Newark Joint Venture of $1.9 million, or $0.14 per diluted

share, offset primarily by $953,000, or $0.07 per diluted share, of property acquisition costs expensed in the 2016 quarter.

(4) AFFO decreased due primarily to the add-back, in the 2016 quarter, of the $2.7 million loss on extinguishment of debt incurred in connection with profitable

property sales, of which $1.6 million, or $0.11 per share, was allocable to non-controlling interests.

As of March 31, Fiscal Year ended September 30,

Quarter ended March 31, Year ended September 30,

(2) See the reconciliation of Funds From Operations and Adjusted Funds From Operations to net (loss) income, as in accordance with GAAP, at page 9, and

definitions of such terms at page 16.

Market Information, Per Share Data, and Portfolio Data

5

2016 2015 2014

Assets

Real estate properties, net of accumulated depreciation 781,114$ 759,576$ 591,727$ 635,612$

Real estate loan 5,900 19,500 - -

Cash and cash equivalents 43,147 27,399 15,556 23,181

Restricted cash 6,619 7,383 6,518 32,390

Deposits and escrows 13,101 18,972 12,782 12,273

Investment in unconsolidated joint ventures 14,557 298 - -

Other Assets 6,082 7,775 6,882 29,147

Assets of discontinued operations - - 163,545 2,017

Real estate properties held for sale - 33,996 23,859 -

Total Assets 870,520$ 874,899$ 820,869$ 734,620$

Liabilities and equity

Liabilities

Mortgage payable, net of deferred costs 603,133$ 588,457$ 451,159$ 482,406$

Junior subordinated ntoes, net of deferred costs 37,008 36,998 36,978 37,400

Accounts payable and accrued liabilities 13,467 20,716 14,780 15,185

Liabilities of discontinued operations - - 138,530 30,990

Mortgage payable held for sale - 27,052 19,248 -

Total liabilities 653,608 673,223 660,695 565,981

Equity

134 - - -

Shares of beneficial interest - 39,696 40,285 40,965

Additional paid in capital 201,546 161,321 161,842 166,209

Accumulated other comprehensive income 1,518 (1,602) (58) (8)

Accumulated deficit (36,584) (48,125) (79,414) (77,026)

Total BRT Apartments Corp. stockholders' equity 166,614 151,290 122,655 130,140

Non-controlling interests 50,298 50,386 37,519 38,499

Total Equity 216,912 201,676 160,174 168,639

Total Liabilities and Equity 870,520$ 874,899$ 820,869$ 734,620$

March 31 September 30,

2017

(Unaudited)

Common Stock, $.01 par value, 300,000 shares

authorized; 13,352 shares issued at March 31, 2017

Consolidated Balance Sheets

(Dollars in Thousands)

6

2017

(Unaudited)

2016

(Unaudited) 2016 2015 2014

Revenues

Rental and other revenue from real estate properties 24,702$ 23,993$ 90,945$ 77,023$ 61,725$

Other Income 181 2,026 3,319 72 88

Total Revenues 24,883 26,019 94,264 77,095 61,813

Expenses

Real estate operating expenses 11,909 12,097 43,262 38,609 32,984

Interest expense 6,402 6,049 23,878 19,297 16,434

Advisor's fees, related party - - 693 2,448 1,801

Property acquisition costs (A) - 953 3,852 1,885 2,542

General and administrative 2,390 2,280 8,536 6,683 6,324

Depreciation 7,772 5,632 23,180 18,454 13,945

Total Expenses 28,473 27,011 103,401 87,376 74,030

Total revenues less total expenses (3,590) (992) (9,137) (10,281) (12,217)

Gain on sale of real estate - 24,226 46,477 15,005 -

Gain on sale of partnership interest - - 386 - -

Loss on extinguishment of debt - (2,668) (4,547) - -

(Loss) Income from continuing operations (3,590) 20,566 33,179 4,724 (12,217)

Provision for taxes 1,108 - 700 - -

(Loss) income from continuing operations, net of taxes (4,698) 20,566 32,479 4,724 (12,217)

Discontinued operations:

Loss from discontinued operations - (1,188) (2,788) (6,329) (3,949)

Gain on sale of partnership interest - 15,467 15,467 - -

Income (loss) from discontinued operations - 14,279 12,679 (6,329) (3,949)

Net (Loss) income (4,698) 34,845 45,158 (1,605) (16,166)

(Loss) income attributable to non-controlling interests 469 (9,909) (13,869) (783) 6,712

Net (Loss) income attributable to common shareholders (4,229)$ 24,936$ 31,289$ (2,388)$ (9,454)$

Fiscal Year ended September 30,Quarter ended March 31,

Consolidated Statements of Operations

(Dollars in Thousands)

7

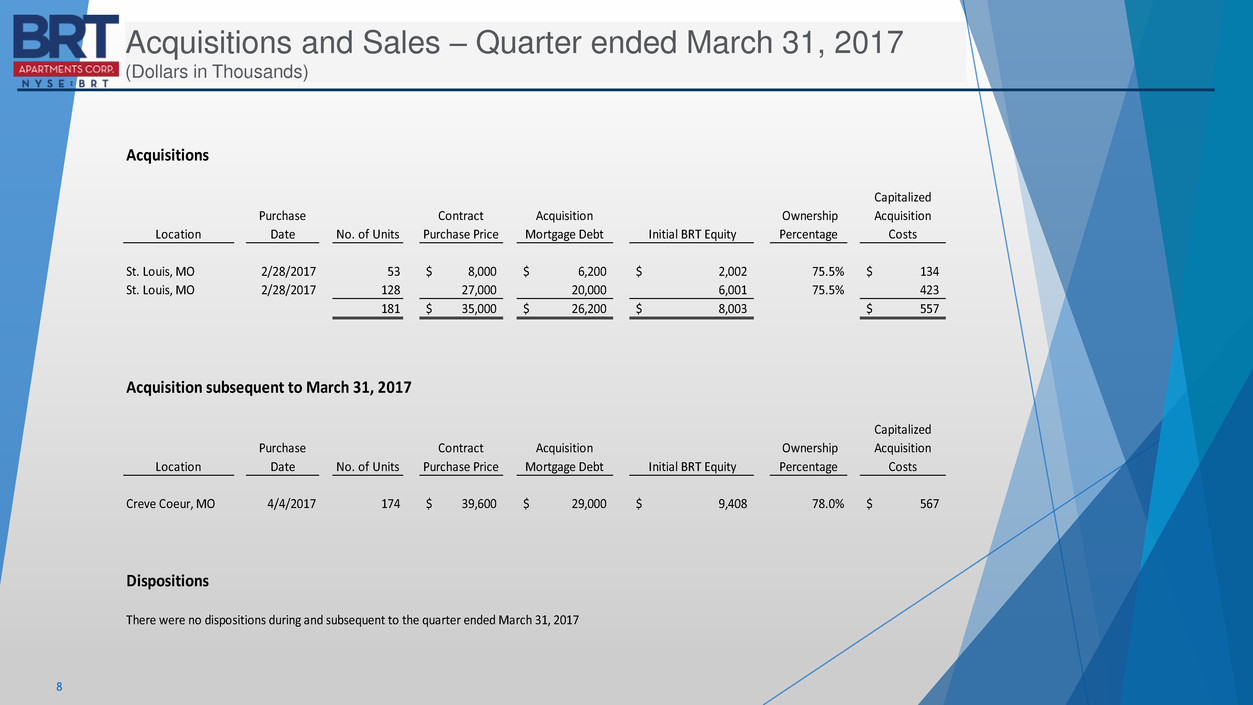

Acquisitions

Location

Purchase

Date No. of Units

Contract

Purchase Price

Acquisition

Mortgage Debt Initial BRT Equity

Ownership

Percentage

Capitalized

Acquisition

Costs

St. Louis, MO 2/28/2017 53 8,000$ 6,200$ 2,002$ 75.5% 134$

St. Louis, MO 2/28/2017 128 27,000 20,000 6,001 75.5% 423

181 35,000$ 26,200$ 8,003$ 557$

Acquisition subsequent to March 31, 2017

Location

Purchase

Date No. of Units

Contract

Purchase Price

Acquisition

Mortgage Debt Initial BRT Equity

Ownership

Percentage

Capitalized

Acquisition

Costs

Creve Coeur, MO 4/4/2017 174 39,600$ 29,000$ 9,408$ 78.0% 567$

Dispositions

There were no dispositions during and subsequent to the quarter ended March 31, 2017

Acquisitions and Sales – Quarter ended March 31, 2017

(Dollars in Thousands)

8

2017

(Unaudited)

2016

(Unaudited) 2016 2015 2014

GAAP Net (loss) income attributable to common stockholders (4,229)$ 24,936$ 31,289$ (2,388)$ (9,454)$

Add: depreciation of properties 7,772 6,104 24,329 20,681 15,562

Add: our share of depreciation in unconsoliated joint ventures 130 5 20 20 20

Add: amortization of deferred leasing costs - 1 15 71 62

Deduct: gain on sales of real estate and partnership interests - (39,693) (62,329) (15,005) -

Adjustment for non-controlling interest (1,923) 10,823 13,319 221 (4,012)

Funds from operations (FFO) attributable to 1,750 2,176 6,643 3,600 2,178

common stockholders

Adjust for: straight line rent accruals (14) (67) (200) (411) (542)

Add: loss on extinguishment of debt - 2,668 4,547 - -

Add: amortization of restricted stock and RSU expense 386 188 1,005 906 805

Add: amortization of deferred mortgage costs 224 483 1,645 2,242 1,825

Adjustment for non-controlling interest (44) (1,677) (2,729) (703) (424)

Adjusted funds from operations (AFFO) 2,302$ 3,771$ 10,911$ 5,634$ 3,842$

attributable to common stockholders

Per Share data

Net (loss) income attributable to common stockholders (0.30)$ 1.76$ 2.23$ (0.17)$ (0.66)$

Add: depreciation of properties 0.55 0.43 1.74 1.46 1.10

Add: our share of depreciation in unconsoliated joint ventures 0.01 - - - -

Add: amortization of deferred leasing costs - - - - -

Deduct: gain on sales of real estate and partnership interests - (2.81) (4.45) (1.07) -

Adjustment for non-controlling interest (0.14) 0.77 0.95 0.02 (0.28)

Funds from operations (FFO) attributable to 0.12 0.15 0.47 0.24 0.16

common stockholders

Adjust for: straight line rent accruals - (0.01) (0.01) (0.04) (0.04)

Add: loss on extinguishment of debt - 0.19 0.32 - -

Add: amortization of restricted stock and RSU expense 0.03 0.01 0.07 0.07 0.06

Add: amortization of deferred mortgage costs 0.02 0.03 0.12 0.16 0.13

Adjustment for non-controlling interest (0.01) (0.12) (0.19) (0.07) (0.03)

Adjusted funds from operations (AFFO) 0.16$ 0.25$ 0.78$ 0.36$ 0.28$

attributable to common stockholders

Refer to page 5 for footnotes 3 and 4 regarding changes in FFO and AFFO for the quarters ending March 31, 2017 and 2016.

Quarter Ended March 31, Fiscal Year ended September 30,

Funds From Operations/Adjusted Funds From Operations

(Dollars in Thousands, except per share amounts)

9

10

Debt Information at March 31, 2017

(Dollars in Thousands)

Mortgage Debt

Year

Total

Principal

Payments

Scheduled

Amortization

Principal

Payments Due

at Maturity

Weighted

Average

Interest

Rate (a)

2017 2,845$ 2,845$ - -

2018 6,231 6,231 - -

2019 75,907 6,394 69,513$ 4.10%

2020 57,666 11,537 46,129 3.08%

2021 22,000 7,998 14,002 4.29%

Thereafter 443,780 40,038 403,742 4.19%

Total 608,429$ 75,043$ 533,386$ 4.09%

(a) Weighted average relating only to balloon payments due at maturity date.

Weighted Average Remaining Term to Maturity 7.8 years

Weighted Average Interest Rate 4.46%

Debt Service Coverage Ratio (1) 1.39

(1) Calculated as Net Operating Income divided by Total Debt Service. See the reconciliation of

Funds From Operations and Adjusted Funds From Operations to net (loss) income, as in

accordance with GAAP, at page 9 and definitions of such terms at page 16.

Junior Subordinated Notes

Principal Balance 37,400$

Interest Rate 3 month LIBOR + 2.00%

Maturity April 30, 2036

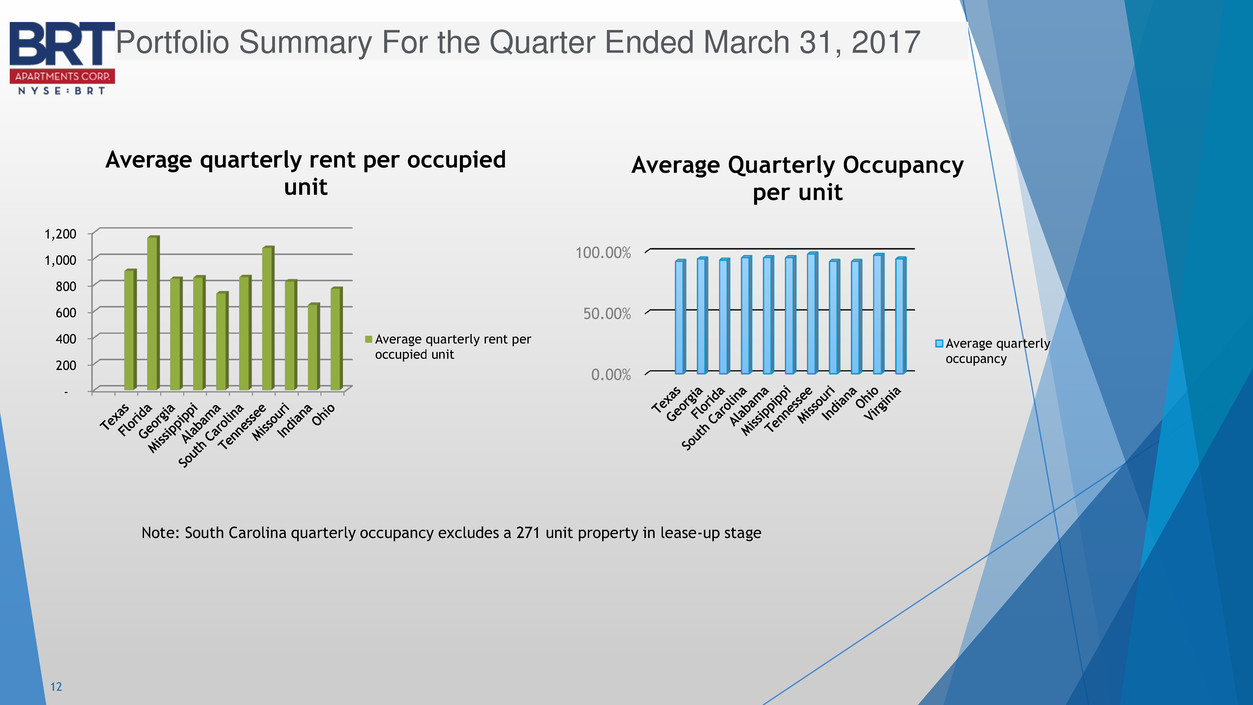

Portfolio Summary

State

Number of

Properties

Number of

Units

Average quarterly rent

per occupied unit

Average quarterly

occupancy

Texas 11 2,750 916$ 92%

Georgia 4 959 917 94%

Florida 3 1,026 1,153 93%

South Carolina 3 683 992 (1) 95% (1)

Alabama 2 826 725 95%

Missippippi 2 776 852 95%

Tennessee 1 300 1,072 98%

Missouri 3 601 889 92%

Indiana 1 400 635 92%

Ohio 1 264 796 97%

Virginia 1 220 957 94%

Total / Weighted Average 32 8,805 900$ 94%

(1) Weighted average rent and occupancy excludes a 271 unit property in lease up

At March 31, 2017 For the Quarter Ended March 31, 2017

11

12

Portfolio Summary For the Quarter Ended March 31, 2017

-

200

400

600

800

1,000

1,200

Average quarterly rent per occupied

unit

Average quarterly rent per

occupied unit

Note: South Carolina quarterly occupancy excludes a 271 unit property in lease-up stage

0.00%

50.00%

100.00%

Average Quarterly Occupancy

per unit

Average quarterly

occupancy

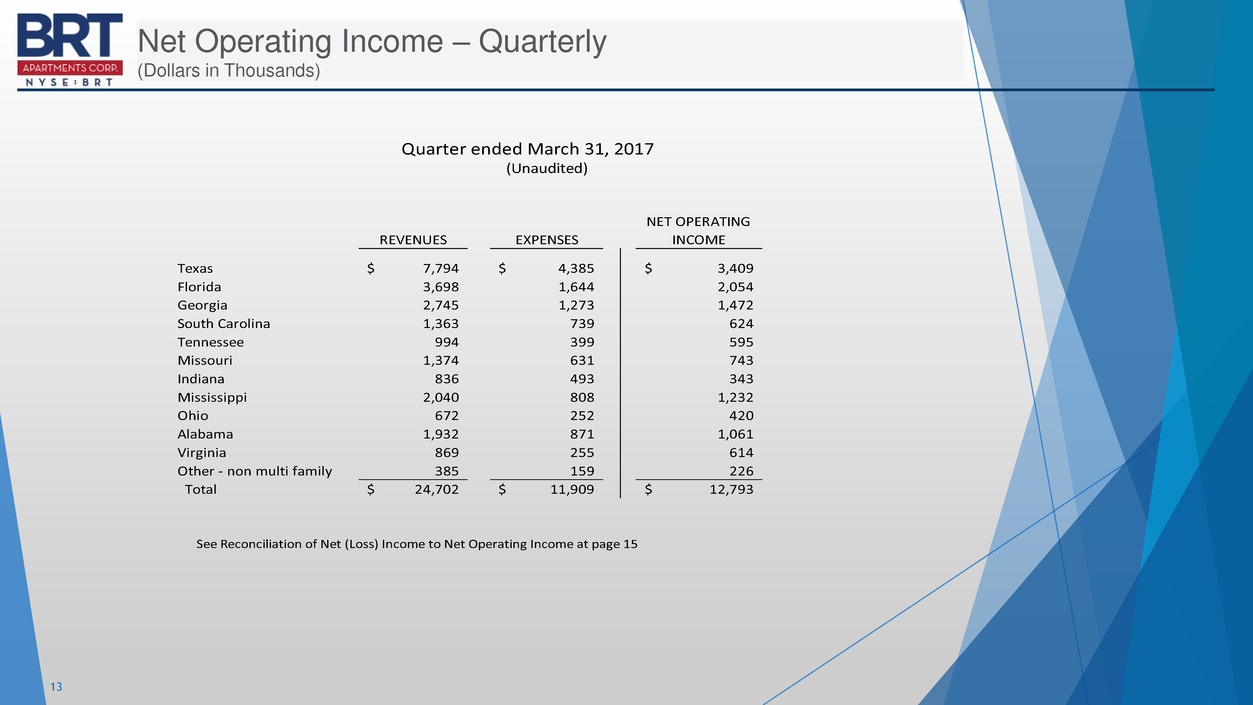

Quarter ended March 31, 2017

(Unaudited)

REVENUES EXPENSES

NET OPERATING

INCOME

Texas 7,794$ 4,385$ 3,409$

Florida 3,698 1,644 2,054

Georgia 2,745 1,273 1,472

South Carolina 1,363 739 624

Tennessee 994 399 595

Missouri 1,374 631 743

Indiana 836 493 343

Mississippi 2,040 808 1,232

Ohio 672 252 420

Alabama 1,932 871 1,061

Virginia 869 255 614

Other - non multi family 385 159 226

Total 24,702$ 11,909$ 12,793$

See Reconciliation of Net (Loss) Income to Net Operating Income at page 15

Net Operating Income – Quarterly

(Dollars in Thousands)

13

Revenues Expenses

Net Operating

Income

Texas 23,827$ 12,158$ 11,669$

Florida 15,652 7,197 8,455

Georgia 10,706 4,422 6,284

South Carolina 6,613 2,973 3,640

Tennessee 9,735 5,653 4,082

Missouri 3,854 1,672 2,182

Indiana 3,152 1,588 1,564

Kansas 3,132 1,325 1,807

Mississippi 2,679 956 1,723

Ohio 2,440 1,088 1,352

Arkansas 783 435 348

Alabama 6,966 3,199 3,767

Other - non multi family 1,406 596 810

Total 90,945$ 43,262$ 47,683$

See Reconciliation of GAAP Net (Loss) Income to Net Operating Income at page 15

Year ended September 30, 2016

Net Operating Income - Prior Fiscal Year

(Dollars in Thousands)

14

We define NOI as total property revenues less total property expenses. Other REIT’s may use different methodologies for calculating

NOI, and accordingly, our NOI may not be comparable to other REIT’s. We believe that this measure provides an operating

perspective not immediately apparent from GAAP operating income or net (loss) income. We use NOI to evaluate our performance

because NOI measures the core operations of property performance by excluding corporate level expenses and other items not related

to property operating performance and captures trends in rental housing and property operating expenses. However, NOI should only

be used as an alternative measure of our financial performance.

The following table reflects NOI together with a reconciliation of NOI to net income attributable to common stock

holders as computed in accordance with GAAP for the periods presented:

15

Reconciliation of Net (Loss) Income to Net Operating

Income (Dollars in Thousands)

Quarter Ended

March 31, 2017

(Unaudited)

Year Ended

September 30,

2016

GAAP Net (loss) income attributable to common stockholders (4,229)$ 31,289$

Less: Other Income (181) (3,319)

Add: Interest expense 6,402 23,878

Advisor's fees, related party - 693

Property acquisition costs - 3,852

General and administrative 2,390 8,536

Depreciation 7,772 23,180

Less: Gain on sale of real estate - (46,477)

Gain on sale of partnership interest - (386)

Add: Loss on extinguishment of debt - 4,547

Provision for taxes 1,108 700

Discontinued operations:

Lo s from discontinued operations - 2,788

Less: Gain on sale of partnership interest - (15,467)

Net loss (income) attributable to non-controlling interests (469) 13,869

Net Operating Income 12,793$ 47,683$

Definitions

Funds from Operations (FFO)

FFO is a non-GAAP financial performance measure defined by the National Association of Real Estate Investment Trusts and is

widely recognized by investors and analysts as one measure of operating performance of a REIT. The FFO calculation excludes

items such as real estate depreciation and amortization, gains and losses on the sale of real estate assets and impairment on

depreciable assets. Historical accounting convention used for real estate assets requires straight-line depreciation of buildings and

improvements, which implies that the value of real estate assets diminishes predictably over time. Since real estate values have

historically risen or fallen with market conditions, it is management’s view, and we believe the view of many industry investors and

analysts, that the presentation of operating results for a REIT using the historical accounting for depreciation is insufficient. FFO

excludes gains and losses from the sale of real estate, which we believe provides management and investors with a helpful

additional measure of the performance of our real estate portfolio, as it allows for comparisons, year to year, that reflect the

impact on operations from trends in items such as occupancy rates, rental rates, operating costs, general, administrative and

other expenses, and interest expenses.

Adjusted Funds from Operations (AFFO)

AFFO, as defined by us, excludes from FFO straight line rent adjustments, loss on extinguishment of debt, amortization of

restricted stock and RSU expense and amortization of deferred mortgage costs. Management believes that excluding acquisition-

related expenses from AFFO provides investors with supplemental performance information that is consistent with the

performance models and analysis used by management and provides investors a view of the performance of our portfolio over

time, including after the time we cease to acquire properties on a frequent and regular basis. We believe that AFFO enables

investors to compare the performance of our portfolio with other REITs that have not recently engaged in acquisitions, as well as a

comparison of our performance with that of other non-traded REITs, as AFFO, or an equivalent measure is routinely reported by

non-traded REITs, and we believe often used by analysts and investors for comparison purposes.

16