Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUPERIOR INDUSTRIES INTERNATIONAL INC | d390693d8k.htm |

Superior Industries International, Inc. 2017 Wells Fargo Industrials Conference May 9, 2017 Exhibit 99.1

Forward-Looking Statements This webcast and presentation contain statements that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts and can generally be identified by the use of future dates or words such as "may," "should," "could," “will,” "expects," "seeks to," "anticipates," "plans," "believes," "estimates," "intends," "predicts," "projects," "potential" or "continue" or the negative of such terms and other comparable terminology. These statements also include, but are not limited to, the 2017 outlook, the Company’s ability to consummate the acquisition of UNIWHEELS AG, and the Company’s strategic and operational initiatives, including the resolution of operating inefficiencies, product mix and overall cost improvement and are based on current expectations, estimates, and projections about the Company's business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements due to numerous factors, risks, and uncertainties discussed in the Company's Securities and Exchange Commission filings and reports, including the Company's Annual Report on Form 10-K for the year-ended December 25, 2016, Quarterly Reports on Form 10-Q and other reports from time to time filed with the Securities and Exchange Commission. You are cautioned not to unduly rely on such forward looking statements when evaluating the information presented in this press release. Such forward-looking statements speak only as of the date on which they are made and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this webcast and presentation. Use of Non-GAAP Financial Measures In addition to the results reported in accordance with GAAP, this presentation refers to “Adjusted EBITDA,” which we have defined as earnings before interest, taxes, depreciation, amortization, restructuring charges and impairments of long-lived assets and investments. Management believes the use of non-GAAP financial measures are useful to both management and investors in their analysis of the Company’s financial position and results of operations. Further, management uses non-GAAP financial measures for planning and forecasting future periods. This non-GAAP financial information is provided as additional information for investors and is not in accordance with or an alternative to GAAP. These non-GAAP measures may be different from similar measures used by other companies. For reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP, see the Company's Securities and Exchange Commission filings and reports, including the Company's Annual Report on Form 10-K for the year-ended December 25, 2016 and Quarterly Reports on Form 10-Q. Non-GAAP Financial Measures and Forward-Looking Statements

Superior Investment Thesis Leading market position in North America with innovative products Strategic and operational transformation foundational for next leg of growth Acquisition of UNIWHEELS AG (“UNIWHEELS”) creates a leading global supplier of aluminum wheels to OEMs Wheel market trends create opportunity both in NA and Europe

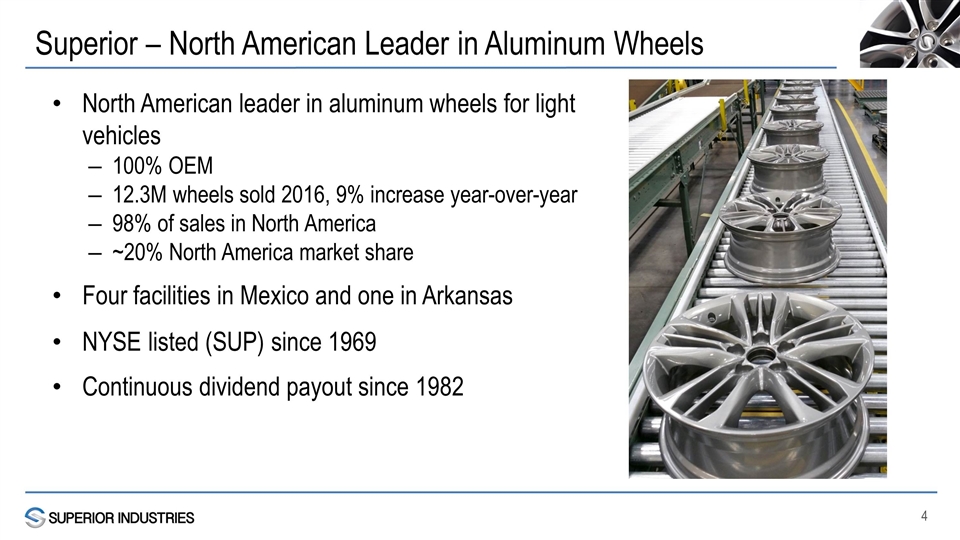

Superior – North American Leader in Aluminum Wheels North American leader in aluminum wheels for light vehicles 100% OEM 12.3M wheels sold 2016, 9% increase year-over-year 98% of sales in North America ~20% North America market share Four facilities in Mexico and one in Arkansas NYSE listed (SUP) since 1969 Continuous dividend payout since 1982

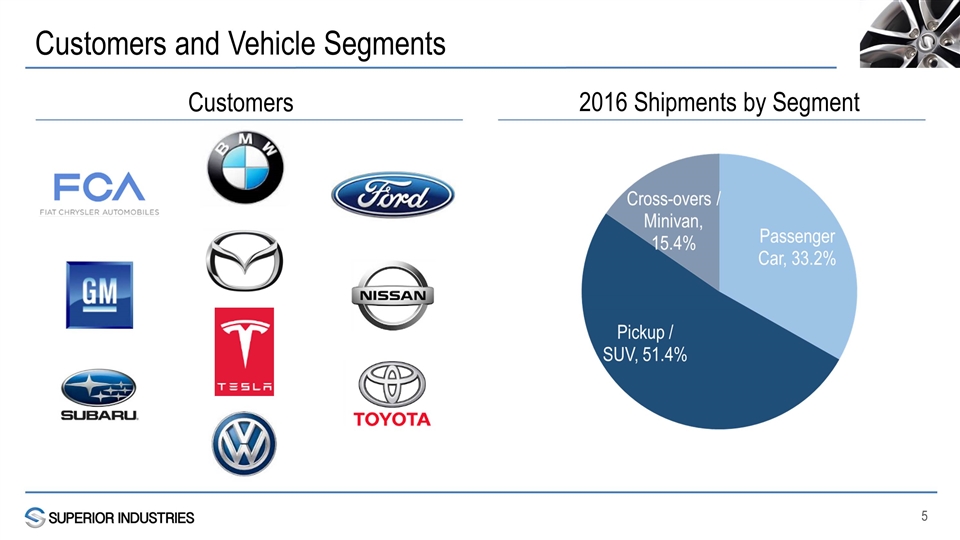

Customers and Vehicle Segments Customers 2016 Shipments by Segment

Strategic and Operational Transformation New executive management team with more than 100 years combined auto experience Six of eight board members joined Board since December 2013 Completed 500,000 wheel capacity expansion at new Mexico facility Established Mexican finishing joint venture Flexed labor scheduling to 24/7 Implemented new tax strategy Initiated investments in additional premium finishing capabilities Awarded our first program for our patented AluliteTM product Established relationship with Chinese supplier

Acquisition of UNIWHEELS Superior commenced tender offer for UNIWHEELS’ outstanding shares Agreement with UNIWHEELS Holdings Malta (“UHM”), ~61% owner of UNIWHEELS, to tender its shares for 226.5zl per share Tender offer for ~39% held by public shareholders for 236.07zl per share Tender offer expires May 22nd Combination of Superior and UNIWHEELS creates a leading global supplier of aluminum wheels to OEMs

UNIWHEELS At a Glance Leading European Aluminum Alloy Wheel Supplier Attractive Underlying Market Trends Diversified and Longstanding Blue Chip Customer Relationships Quality and Technology Leadership Operational Excellence Strong Financial Track Record with Attractive Growth and Profitability Additional Business Development Potential

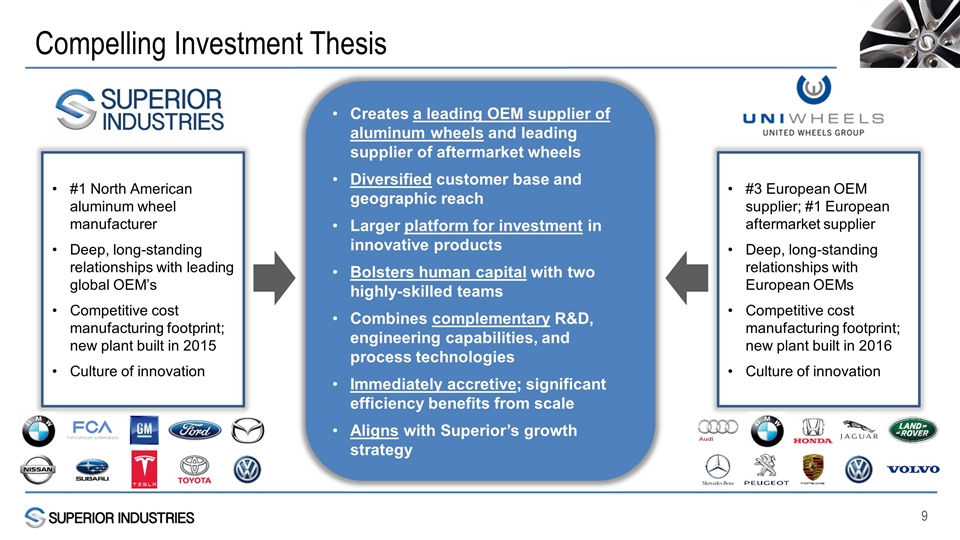

Creates a leading OEM supplier of aluminum wheels and leading supplier of aftermarket wheels Diversified customer base and geographic reach Larger platform for investment in innovative products Bolsters human capital with two highly-skilled teams Combines complementary R&D, engineering capabilities, and process technologies Immediately accretive; significant efficiency benefits from scale Aligns with Superior’s growth strategy #3 European OEM supplier; #1 European aftermarket supplier Deep, long-standing relationships with European OEMs Competitive cost manufacturing footprint; new plant built in 2016 Culture of innovation Compelling Investment Thesis #1 North American aluminum wheel manufacturer Deep, long-standing relationships with leading global OEM’s Competitive cost manufacturing footprint; new plant built in 2015 Culture of innovation

Wheel Market Trends – Wheels Provide Differentiation Consumers increasingly seeking customization, wheels offer key aesthetic differentiator Aftermarket-like styling relevant to OEMs at OEM production levels and standards Wheel options per platform increasing, allowing customers to segment market Lightweighting relevant to achieve fuel efficiency requirements Wheel design can provide improved vehicle handling and comfort

Capital Structure and Allocation Priorities (1) Includes addback for expedited freight costs incurred during 2016 and pro forma run-rate synergies 3.4x net debt to Adjusted EBITDA (1 ) at the close of the transaction Capital expenditures driven by new investments in finishing capabilities Investment in business and debt paydown top priorities Long-term targeted leverage of 2.0x net debt to EBITDA Anticipate reduction of annual dividend from $0.72 cents/share to $0.36 cents/share post close