Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION - Delek US Holdings, Inc. | dk-8kxinvestorpresentation.htm |

May 2017

Delek US Holdings Inc.

Investor Presentation

Disclaimers

2

Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; collectively with Delek US, defined as “we”, “our”) are traded on the New York Stock

Exchange in the United States under the symbols “DK” and ”DKL” respectively, and, as such, are governed by the rules and regulations of the United States Securities and Exchange

Commission. These slides and any accompanying oral and written presentations contain forward-looking statements that are based upon current expectations and involve a

number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans,

actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities

laws. These forward-looking statements include, but are not limited to, statements regarding the proposed merger with Alon USA Energy Inc. (“Alon”) , integration and transition

plans, synergies, opportunities, anticipated future performance and financial position, and other factors.

Investors are cautioned that the following important factors, among others, may affect these forward-looking statements. These factors include but are not limited to: risks and

uncertainties related to the expected timing and likelihood of completion of the proposed merger, including the timing, receipt and terms and conditions of any required

governmental and regulatory approvals of the proposed merger that could reduce anticipated benefits or cause the parties to abandon the transaction, the ability to successfully

integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the possibility that

stockholders of Delek US may not approve the issuance of new shares of common stock in the merger or that stockholders of Alon may not approve the merger agreement, the

risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing

business operations due to the proposed transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of

Delek US' common stock or Alon's common stock, the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Delek US and Alon to

retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk

that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as

expected, the risk that the combined company may be unable to achieve cost-cutting synergies or it may take longer than expected to achieve those synergies, uncertainty related

to timing and amount of future share repurchases and dividend payments, risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and

the price of the refined petroleum products we ultimately sell; gains and losses from derivative instruments; management's ability to execute its strategy of growth through

acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to

record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; operating hazards inherent in

transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of

the industries in which we operate; general economic and business conditions affecting the southern United States; and other risks contained in Delek US’, Delek Logistics’ and

Alon’s filings with the United States Securities and Exchange Commission.

Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by which such performance

or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is

subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics

Partners undertakes any obligation to update or revise any such forward-looking statements.

Non-GAAP Disclosures:

Delek US and Delek Logistics each believe that the presentation of EBITDA, distributable cash flow and distribution coverage ratio provide useful information to investors in

assessing its financial condition, its results of operations and cash flow its business is generating. EBITDA, distributable cash flow and distribution coverage ratio should not be

considered as alternatives to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with U.S.

GAAP. EBITDA, distributable cash flow and distribution coverage ratio have important limitations as analytical tools because they exclude some, but not all items that affect net

income. Additionally, because EBITDA, distributable cash flow and distribution coverage ratio may be defined differently by other companies in its industry, Delek US' and Delek

Logistics’ definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see reconciliations of EBITDA and

distributable cash flow to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix.

Strategic Combination with Financial Flexibility to Support

Growth and Unlock Value

3

• Grown through opportunistic acquisitions across

multiple market cycles

• Expertise to invest in/improve operations

• Strong balance sheet

• Low cost reliable operator

• Retail expertise/largest 7-Eleven licensee

• Asphalt blending and marketing expertise

• Historically capital constrained

Creates a Permian Focused Refining System with Broadened Marketing Reach

Ability to unlock approximately $95 million of synergies (3) and $78 million of Logistics EBITDA(3)

Refining

• 7th largest independent refiner

• 4 locations – (2) TX, (1) AR, (1) LA

• More than 300,000 bpd of crude

throughput capacity

• Near uniform technology and

configuration

• Colonial Pipeline space of 600,000

barrels per month

• TEPPCO Pipeline space of 600,000

to 1.0m barrels per month(2)

Retail

• Integrated system supported

by Big Spring refinery

• Approximately 304 stores in

central/west Texas and New

Mexico

• West Texas wholesale

marketing business

Asphalt

• 15 terminals serving markets

from Tennessee to the West

Coast

• Approaching 1,000,000

tons/year of sales

Logistics

• Consists of Delek Logistics

Partners, LP (NYSE: DKL)

• Drop-able logistics assets fuel

40%+ (1) increase in EBITDA

and further supports double

digit long term distribution

growth

• Material GP benefits

Renewables

• 3 plants / 61 million gal/yr of

biodiesel capacity

1) Growth based on asphalt and Big Spring drop downs. Please see slide 10 for additional information.

2) TEPPCO line space range based on allocation and seasonality through a year. Amounts will vary by month

3) Represents mid points of estimated ranges. Additional information provided on page 12 and page 17. Please see slide 24 for a Logistics EBITDA reconciliation.

Consideration/

Valuation

• All stock transaction for remaining 53% equity ownership

• Each Alon USA Energy, Inc. (“Alon”) shareholder will receive 0.5040 shares of Delek US Holdings, Inc. (“Delek”)

common stock, resulting in pro forma ownership of approximately 76% to Delek shareholders and

approximately 24% to Alon shareholders. This represents a 5.6% premium above the 20 trading day volume

weighted ratio through and including December 30, 2016 of 0.477

• $675 million enterprise value of 53% interest, including proportionate assumption of Alon net debt of

approximately $152 million and $59 million of market value for the non-controlling interest in Alon USA

Partners, LP

Synergies

• Anticipated annual synergies of $85 - $105 million

• Target 3% to 5% capital expenditures savings due to increased scale

• Expect to achieve synergies on a run-rate basis in 2018, the first full year after transaction close through a

combination of commercial, operational, cost of capital and corporate synergies

Financial Strength

and Flexibility

• Transaction expected to be highly accretive to Delek’s earnings per share in 2018 (1)

• 0.9x combined Net Debt / 2017E EBITDA (2); Balance sheet creates the possibility for cost-of-capital synergies

• New $150 million share repurchase authorization in effect, which does not have an expiration date

Dropdown Inventory

• DK can leverage relationship with DKL to take advantage of logistics value to be unlocked from ALJ

• Estimated increase in dropdown inventory of approximately $70 to $85 million in EBITDA (3)

• Provides improved visibility for DKL future growth and supports distribution growth

• As DKL distribution increases, higher cash flow to Delek US through GP, IDR and LP ownership

Growth

Opportunities

• Financial flexibility will provide opportunity to support growth initiatives

• Evaluate organic growth projects created by refining project backlog

• Explore options for value creation from larger asset base

Timing / Closing

Conditions

• Expect to close on July 1, 2017

• Subject to customary closing conditions, including regulatory and shareholder approvals

Transaction Highlights

4

1) Based on 2018 consensus estimates from Factset on 12/30/16 for DK and ALJ plus $95.0 million of pre-tax synergies.

2) Based on 9/30 balance sheet. Delek US cash includes $377 million of proceeds from the sales of the retail related asset before taxes related to the transaction. Taxes are expected to be

paid in early 2017. Based on 2017 as of Dec. 2016 consensus estimates for DK and ALJ plus $75.0 million of synergies excluding cost of capital synergies. Will vary based on actual results.

3) Please see slide 24 for a reconciliation of the logistics EBITDA.

Increased Scale and Asset Diversity

Complementary Businesses with Strategically Located Assets; Increased Permian Basin Exposure

5

Alon USA Asset Overview(1)

Refining

• 147,000 bpd in total

• Big Spring

• 73,000 bpd

• 10.5 complexity

• Krotz Springs

• 74,000 bpd

• 8.4 complexity

Retail

• Approximately 304

stores

• Southwest US locations

• Largest licensee of 7-

Eleven stores in the US

Asphalt

• 11 asphalt terminals

located in TX, WA, CA,

AZ and NV

• Largest asphalt supplier

in CA and second

largest asphalt supplier

in TX

Alon USA Partners

• ALJ owns 100% of the

general partner and

81.6% of the limited

partner interest

interests in ALDW

• ALDW owns the Big

Spring refinery

Delek US Asset Overview

Refining

• 155,000 bpd in total

• El Dorado, AR

• 80,000 bpd

• 10.2 complexity

• Tyler, TX

• 75,000 bpd

• 8.7 complexity

Delek Logistics Partners

• 9 terminals

• Approximately 1,250

miles of pipeline

• 8.5 million bbls of

storage capacity

• West Texas wholesale

• Joint venture crude oil

pipelines: RIO / Caddo

1) ALJ California refineries have not operated since 2012.

Delek US Renewables

• Biodiesel production:

• Crossett, AR 12.3m gallon/yr

• Cleburne, TX 10.6m gallon/yr

Alon Renewables

• Renewable Diesel

• California – Alt Air

37.8m gallon capacity

Permian Basin Attractive Drilling Economics Support Growth

Production continued to grow through the downturn in crude oil prices; Improved Efficiencies

6

Crude Oil Production Grew Despite Rig Decline (2)

1) Deutsche Bank Research, Permian Basin: “You are still the one” 11/28/16, breakeven based on flat natural gas of $3.00/MMbtu; NGLs priced 35% of WTI; regional commodity

differential and 25% royalty

2) EIA for production through Apr. 2017, Drilling Productivity Report; and Baker Hughes drill rig information through Apr. 28, 2017.

3) EIA production information through Apr. 2017, Drilling Productivity Report

Permian Basin Estimated Breakeven Crude Oil Price(1)

Crude Oil Production % Changes since Jan. 2015 (3)

$37.77

$37.95

$36.55

$39.57

$39.60

$39.86

$41.76

$42.39

$43.90

$45.20

$45.42

$45.51

$47.57

$47.68

$47.87

$49.27

$52.01

$52.45

$53.87

$54.83

$56.96

$59.52

$70.80

$- $20 $40 $60 $80

Lower Sprayberry - N Midland

Eagle Ford - Oil Window

Upper Wolfcamp - S Midland

Upper Wolfcamp - N Midland

STACK - Oil Window

Bakken - Core - McKenzie

Upper Wolfcamp - C Reeves

Avalon Oil - New Mexico

Upper Wolfcamp - S Reeves

Niobrara - Middle Core MRL

SCOOP -- Springer

Bone Spring - NM

Jo Mill - N Midland

Middle Sprayberry - N Midland

Niobrara - Middle Core XRL

Bone Spring, TX

Wolfcamp - NM

Bakken - non core

Eagle Ford - Condensate

Lower Wolfcamp - C Reeves

STACK - Condensate

Brushy Canyon - NM

Cline - N Midland

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

Ja

n

-1

5

M

ar

-1

5

M

ay-

1

5

Ju

l-

15

Se

p

-1

5

N

ov

-1

5

Ja

n

-1

6

M

ar

-1

6

M

ay-

1

6

Ju

l-

16

Se

p

-1

6

N

ov-

1

6

Ja

n

-1

7

M

ar

-1

7

%

C

h

an

ge

s

inc

e

Ja

n

. 2

0

1

5

Permian Bakken Eagle Ford

0

100

200

300

400

500

600

-

500

1,000

1,500

2,000

2,500

Ja

n

-0

7

N

ov

-0

7

Se

p

-0

8

Ju

l-

09

M

ay-

1

0

M

ar

-1

1

Ja

n

-1

2

N

ov

-1

2

Se

p

-1

3

Ju

l-

14

M

ay-

1

5

M

ar

-1

6

Ja

n

-1

7

A

ct

iv

e

R

ig

C

o

u

n

t

Cru

d

e

O

il

P

ro

d.,

0

0

0

b

p

d

Oil Prod. 000 Bbl/day Rig Count

Permian

WTI $47

Permian Basin Activity Improving

As production increases should widen the differential between Midland and Cushing

7

1) Source: Baker Hughes Drilling Rig report through April 28, 2017; EIA Drilling Productivity Report.

2) Differential includes contango of $0.40/bbl (2012); contango of $0.07/bbl (2013); backwardation of $0.77/bbl (2014); contango of $0.97/bbl (2015); contango of $1.25/bbl

(2016); contango of $1.00 (1Q17); $0.53 (2Q17); $0.33 (3Q17), $0.19 (4Q17); backwardation of $0.04 (1Q18) and $0.03 in 2Q18. Source: Argus – as of May 5, 2017; NYMEX

futures settle prices.

3) TPH Research report, “Oil Global Supply & Demand: Model Update”, Drillinginfo, EIA, - March 2017.

Permian Basin Drilling Rig Count(1) and WTI Price

$0

$20

$40

$60

$80

$100

$120

0

100

200

300

400

500

600

Ju

l-

1

4

A

u

g-

1

4

Se

p

-1

4

O

ct

-1

4

N

o

v-

1

4

D

e

c-

1

4

Ja

n

-1

5

Fe

b

-1

5

M

ar

-1

5

A

p

r-

1

5

M

ay

-1

5

Ju

n

-1

5

Ju

l-

1

5

A

u

g-

1

5

Se

p

-1

5

O

ct

-1

5

N

o

v-

1

5

D

e

c-

1

5

Ja

n

-1

6

Fe

b

-1

6

M

ar

-1

6

A

p

r-

1

6

M

ay

-1

6

Ju

n

-1

6

Ju

l-

1

6

A

u

g-

1

6

Se

p

-1

6

O

ct

-1

6

N

o

v-

1

6

D

e

c-

1

6

Ja

n

-1

7

Fe

b

-1

7

M

ar

-1

7

A

p

r-

1

7

Cur

re

n

t

WTI,

$

p

er

b

b

l

Ri

g

C

o

u

n

t

Rig Count WTI, $/bbl

-$7.00

-$6.00

-$5.00

-$4.00

-$3.00

-$2.00

-$1.00

$0.00

2

0

1

2

2

0

1

3

2

0

1

4

2

0

1

5

2

0

1

6

1

Q

1

7

A

2

Q

1

7

E

3

Q

1

7

E

4

Q

1

7

E

1

Q

1

8

E

2

Q

1

8

E

S

p

er

b

b

l.

WTI Midland vs WTI Cushing, $/bbl (2)

Permian Basin Crude Oil Production Growth (3)

0

1,000

2,000

3,000

4,000

5,000

2009 2011 2013 2015 2017E 2019E

In

0

0

0

b

p

d

Periods incl. backwardation/contango

Drilling rig count has increased since May 2016 and

is approaching 340 rigs in early May

Improved efficiencies in the Permian Basin have

benefitted rig production levels

Current differentials between Midland and Cushing

have widened on the future curve into 2Q18

Forecast for continued production growth

Current takeaway pipeline capacity is adequate

Potential for tight production/takeaway capacity

in future

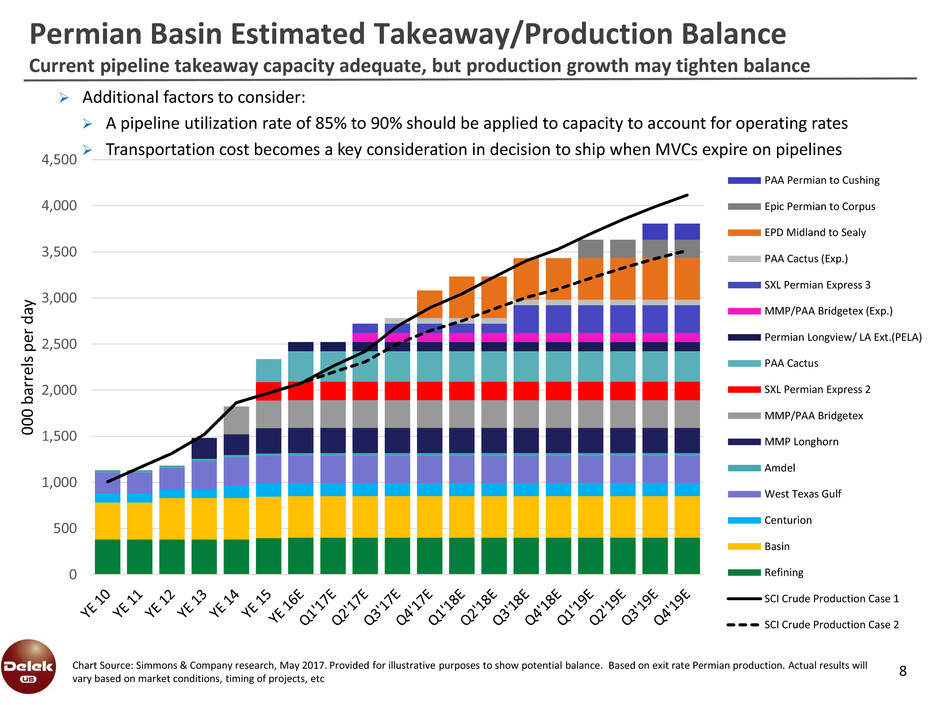

Permian Basin Estimated Takeaway/Production Balance

Current pipeline takeaway capacity adequate, but production growth may tighten balance

8Chart Source: Simmons & Company research, May 2017. Provided for illustrative purposes to show potential balance. Based on exit rate Permian production. Actual results will

vary based on market conditions, timing of projects, etc

Additional factors to consider:

A pipeline utilization rate of 85% to 90% should be applied to capacity to account for operating rates

Transportation cost becomes a key consideration in decision to ship when MVCs expire on pipelines

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

0

0

0

b

ar

re

ls

p

er

d

ay

PAA Permian to Cushing

Epic Permian to Corpus

EPD Midland to Sealy

PAA Cactus (Exp.)

SXL Permian Express 3

MMP/PAA Bridgetex (Exp.)

Permian Longview/ LA Ext.(PELA)

PAA Cactus

SXL Permian Express 2

MMP/PAA Bridgetex

MMP Longhorn

Amdel

West Texas Gulf

Centurion

Basin

Refining

SCI Crude Production Case 1

SCI Crude Production Case 2

Combined System with Over 300,000 bpd of Crude Throughput Capacity (~69% Permian Basin Based)

Refining System with Permian Based Crude Slate

9

Increased Scale and Position

Increased refining capacity from 155,000 bpd to a

302,000 bpd four refinery system:

Tyler (DK) – light crude refinery with access to

Permian Basin and east Texas sourced crude

El Dorado (DK) – flexibility to process medium and

light crude with access to Permian Basin, local

Arkansas, east Texas and Gulf Coast crudes

Big Spring (ALJ/ALDW) – advantageous location in

the Permian Basin

Krotz Springs(ALJ) -- crude slate includes Permian,

local and Gulf Coast sources

1) Provided in the January 3, 2017 presentation announcing the Delek US and Alon Transaction.

2) TPH Research; Crude slate - TSO includes WNR acquisition; WNR includes 100% of NTI; PBF includes both Chalmette & Torrance

Permian Crude Access as % of Crude Slate (2)

Combined access of approximate 207,000 barrels

per day of Permian crude

Equates to approximately 75 million barrels

per year

Leverage to a $1/bbl change in differential is

approximate $75 million

Largest exposure to Permian crude of the

independent refiners as percentage of crude slate

0%

20%

40%

60%

80%

%

o

f

cr

u

d

e

sl

at

e

Combined Access to Permian Basin Crude (1)

90 117

207

61%

75%

69%

0%

20%

40%

60%

80%

0

50

100

150

200

250

ALJ DK Combined

%

o

f

C

ru

d

e

Sl

at

e

In

0

0

0

b

p

d

Reduced capital expenditure needs following investment cycle; Focus on reliability and cost

Delek US Refinery System has Benefited from Active Management

10

Capital Spending Management

Refineries improved through large capital

investment cycle

Expanded capacity and improved flexibility in the

system

Next turnarounds currently scheduled for

2019/2021

Reduced capital expenditure needs creates

opportunity for increased free cash flow generation

$46.1

$123.6

$199.1

$164.5

$27.9

$65.1

2012A 2013A 2014A 2015A 2016A 2017E

($ in millions) $4.00

$4.32 $4.16 $4.21

$3.73

$4.12

$3.71

2012 2013 2014 2015 2016 1Q16 1Q17

Refining System Operating Expense, $/bbl Sold

Cost Management

Procurement savings and cost control initiatives

in place

Playing a role in reduced expenses

Operating reliability plays a key role in cost

management

Reliability consistent with 1st quartile

performance in recent Solomon study (1)

Operating expense per barrel has been reduced

in system

Historical Refining Capital Expenditures

1) As measured by operational availability.

2) 2017E capital expenditures include sustaining maintenance, regulatory and discretionary related spending.

(2)

$-

$2

$4

$6

$8

$10

$12

V

L

O

/N

o

rth

A

tl

a

n

tic

(Q

u

e

b

e

c,

U

K

)

V

L

O

/M

id

-C

o

n

tin

e

n

t (O

K

, T

N,

T

X

)

P

A

R

R

/H

a

wai

i

V

L

O

/G

u

lf C

o

a

s

t (L

A

, T

X

)

P

S

X

/G

u

lf C

o

a

s

t

D

e

lek

/T

yl

e

r, T

X

D

e

lek

/E

l

D

o

ra

d

o

, A

R

A

lo

n

/B

ig

S

p

rin

g

, T

X

W

N

R

/E

l P

a

s

o

, T

X

T

S

O

/P

a

cific N

o

rth

we

s

t (A

K

, W

A

)

A

lo

n

/K

ro

tz

S

p

rin

g

s,

L

A

C

V

R

R

/Co

ffe

yvi

lle

, K

S

P

S

X

/A

tl

a

n

tic

B

a

sin

-E

u

ro

p

e

T

S

O

/M

id

-Co

n

ti

n

e

n

t (N

D

, U

T

)

M

P

C/G

u

lf C

o

a

s

t

P

B

F

/M

id

-C

o

n

H

F

C/

S

o

u

th

wes

t (N

M

)

P

B

F

/E

a

st

Co

a

s

t

M

P

C/

T

o

ta

l

(M

W

, G

C

)

W

N

R

/S

t P

a

u

l

P

a

rk

H

F

C/

M

id

-Co

n

(O

K

, K

S

)

P

B

F

/G

u

lf C

o

a

s

t

M

P

C/

M

id

we

s

t

V

L

O

/W

e

s

t C

o

a

s

t

C

V

R

R

/W

y

n

n

e

w

o

o

d

, O

K

P

S

X

/C

e

n

tra

l C

o

rrid

o

r

P

S

X

/W

e

s

te

rn

-P

a

cifi

c

T

S

O

/C

a

lifo

rn

ia

H

S

E

/M

idw

e

s

t

C

V

E

/U

S

W

N

R

/G

a

llu

p

, N

M

H

F

C/R

o

ckie

s

(U

T

, W

Y

)

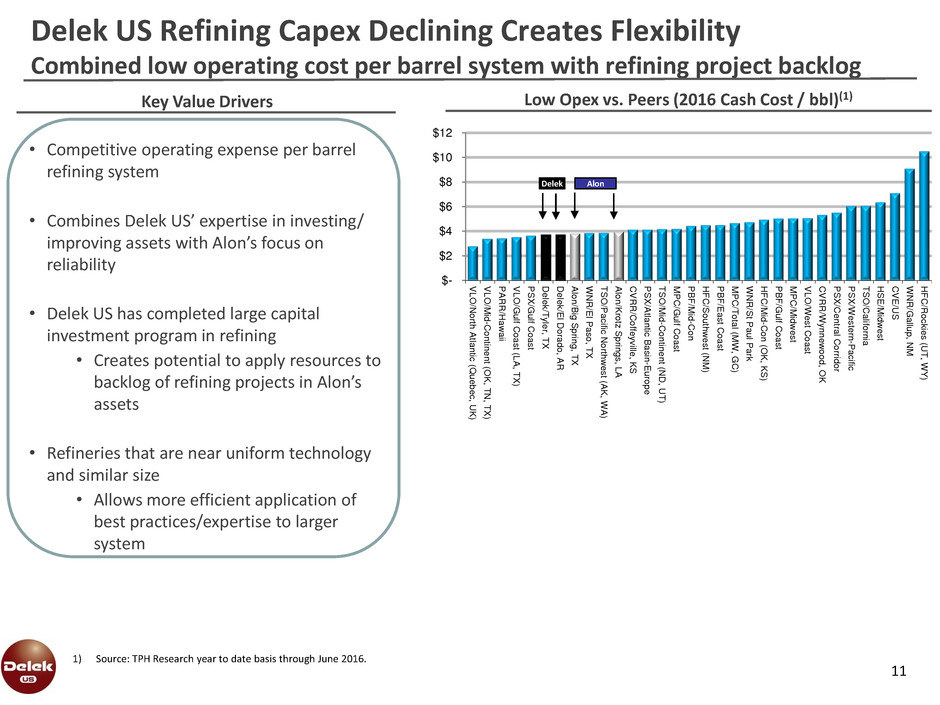

Delek US Refining Capex Declining Creates Flexibility

Combined low operating cost per barrel system with refining project backlog

11

Key Value Drivers

• Competitive operating expense per barrel

refining system

• Combines Delek US’ expertise in investing/

improving assets with Alon’s focus on

reliability

• Delek US has completed large capital

investment program in refining

• Creates potential to apply resources to

backlog of refining projects in Alon’s

assets

• Refineries that are near uniform technology

and similar size

• Allows more efficient application of

best practices/expertise to larger

system

Low Opex vs. Peers (2016 Cash Cost / bbl)(1)

Delek Alon

1) Source: TPH Research year to date basis through June 2016.

Strong Platform for Logistics Growth Created by Combination

Growing Logistics Assets Support Crude Sourcing and Product Marketing

12

Key Value Drivers

• Delek Logistics Partners provides

platform to unlock logistics value

• Increased access to Permian and

Delaware basin through presence of

Big Spring refinery

• Improves ability to develop

crude oil gathering and

terminalling assets

1) 2017E based on sell-side consensus per Factset as of 12/30/16. Information for illustrative purposes only to show potential based on estimated dropdown assets listed.

Actual amounts will vary based on market conditions, which assets are dropped, timing of dropdowns, actual performance of the assets and Delek Logistics in the future.

2) Based on 7x multiple.

3) Please see slide 24 for a reconciliation of EBITDA.

Strong EBITDA Growth Profile Supporting Distribution Growth (1)

$112

$12

$34

$32 $190

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

2017 DKL

EBITDA (1)

Asphalt Drop

down Inventory

Big Spring Drop

Down Inventory

Krotz Springs

Drop Down

Inventory

Total EBITDA

Potential

• Drop downs, excluding Krotz Springs, create significant cash flow to Delek

• $42-$50m EBITDA equates to ~$300-350m cash proceeds to DK (2)

• Provides visibility for continued DKL LP double digit distribution growth

• Significant GP benefits

Dropdown Item

Estimated EBITDA

($ million / year)

Asphalt Terminals $11-13

Big Spring Asphalt Terminal $9-11

Big Spring assets $8-10

Big Spring Wholesale Marketing $14-16

Total Excluding Krotz Springs $42-50

Krotz Springs assets $30-34

Total $72-84 (3)

($ in millions)

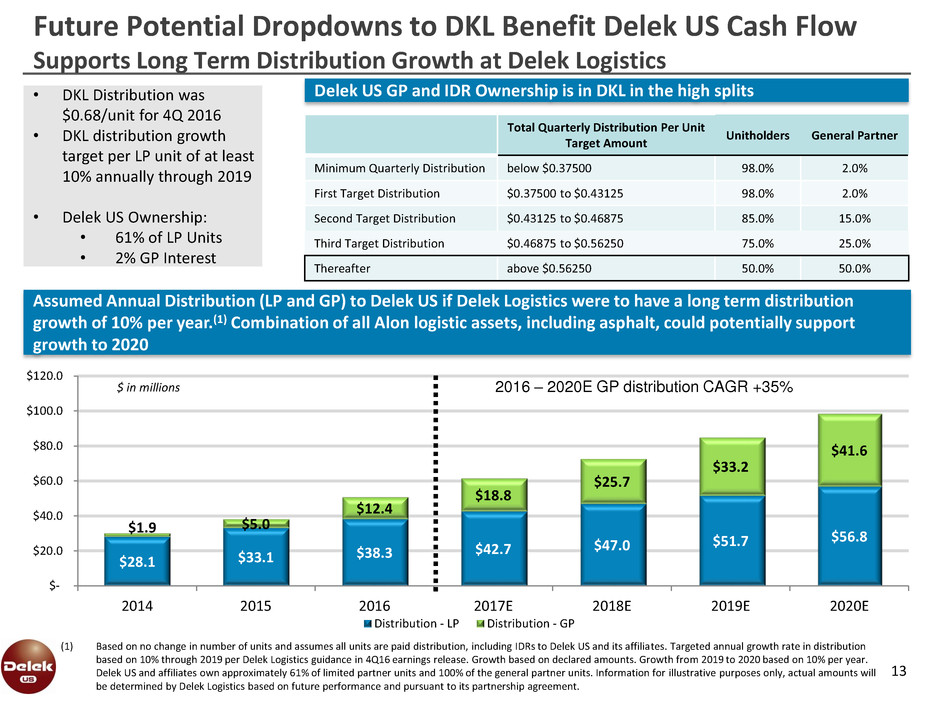

13

Delek US GP and IDR Ownership is in DKL in the high splits

Future Potential Dropdowns to DKL Benefit Delek US Cash Flow

Supports Long Term Distribution Growth at Delek Logistics

Total Quarterly Distribution Per Unit

Target Amount

Unitholders General Partner

Minimum Quarterly Distribution below $0.37500 98.0% 2.0%

First Target Distribution $0.37500 to $0.43125 98.0% 2.0%

Second Target Distribution $0.43125 to $0.46875 85.0% 15.0%

Third Target Distribution $0.46875 to $0.56250 75.0% 25.0%

Thereafter above $0.56250 50.0% 50.0%

• DKL Distribution was

$0.68/unit for 4Q 2016

• DKL distribution growth

target per LP unit of at least

10% annually through 2019

• Delek US Ownership:

• 61% of LP Units

• 2% GP Interest

(1) Based on no change in number of units and assumes all units are paid distribution, including IDRs to Delek US and its affiliates. Targeted annual growth rate in distribution

based on 10% through 2019 per Delek Logistics guidance in 4Q16 earnings release. Growth based on declared amounts. Growth from 2019 to 2020 based on 10% per year.

Delek US and affiliates own approximately 61% of limited partner units and 100% of the general partner units. Information for illustrative purposes only, actual amounts will

be determined by Delek Logistics based on future performance and pursuant to its partnership agreement.

Assumed Annual Distribution (LP and GP) to Delek US if Delek Logistics were to have a long term distribution

growth of 10% per year.(1) Combination of all Alon logistic assets, including asphalt, could potentially support

growth to 2020

$28.1 $33.1

$38.3 $42.7 $47.0

$51.7 $56.8

$1.9 $5.0

$12.4

$18.8

$25.7

$33.2

$41.6

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

2014 2015 2016 2017E 2018E 2019E 2020E

Distribution - LP Distribution - GP

$ in millions 2016 – 2020E GP distribution CAGR +35%

DKL Joint Venture Pipeline Projects

14

Caddo Pipeline

■ DKL (50%)/Plains (50%)

■ Cost: $123 million

■ Capacity: 80,000 bpd

■ Length: 80 miles

■ Completed: Jan. 2017

■ Provides additional logistics

support to El Dorado refinery with

third crude supply source

Rio Pipeline (Delaware Basin)

■ Rangeland (67%)/ DKL (33%)

■ Cost: $119 million

■ Capacity: 55,000 bpd

■ Length: 107 miles

■ Completed: Sept. 2016

■ Benefitting from increased drilling

activity in the area; offers

connection to Midland takeaway

pipelines

(1) Target EBITDA multiple. Actual performance will vary based on market conditions and operations which may change the actual multiple in future periods.

■ DKL targets EBITDA multiple is 8x to 10x investment at the joint venture level (1)

■ DK an anchor shipper on both projects

Strategic position in Delaware Basin; Increased Support to Delek US El Dorado refinery

DKL: Increased Distribution with Conservative Coverage and Leverage

15

Distribution per unit has been increased seventeen consecutive times since the IPO

$0.375 $0.385 $0.395 $0.405 $0.415 $0.425

$0.475 $0.490 $0.510 $0.530 $0.550

$0.570 $0.590 $0.610 $0.630 $0.655

$0.680 $0.690

MQD (1) 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

Increased 84% through 1Q 2017 distribution

1.39x 1.32x 1.35x 1.30x

1.61x 2.02x 1.42x 1.67x

1.23x 1.47x 1.50x 1.17x 1.19x 1.31x 0.99x 0.90x 0.98x

1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17

Distributable Cash Flow Coverage Ratio (2)(3)

1.70x 1.58x

2.28x 2.40x

3.21x 2.69x 2.55x 2.56x 3.00x

3.14x 3.11x 3.49x 3.48x 3.47x 3.70x 3.85x 3.83x

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

Revolver Leverage Ratio (4)

(1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement.

(2) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see page 31 for reconciliation.

(3) 1Q17 based on total distributions payable on May 12, 2017.

(4) Leverage ratio based on LTM EBITDA as defined by credit facility covenants for respective periods.

Avg. 1.35x in 2013

Avg. 1.68x in 2014

Avg. 1.37x in 2015

Avg. 1.09x in 2016

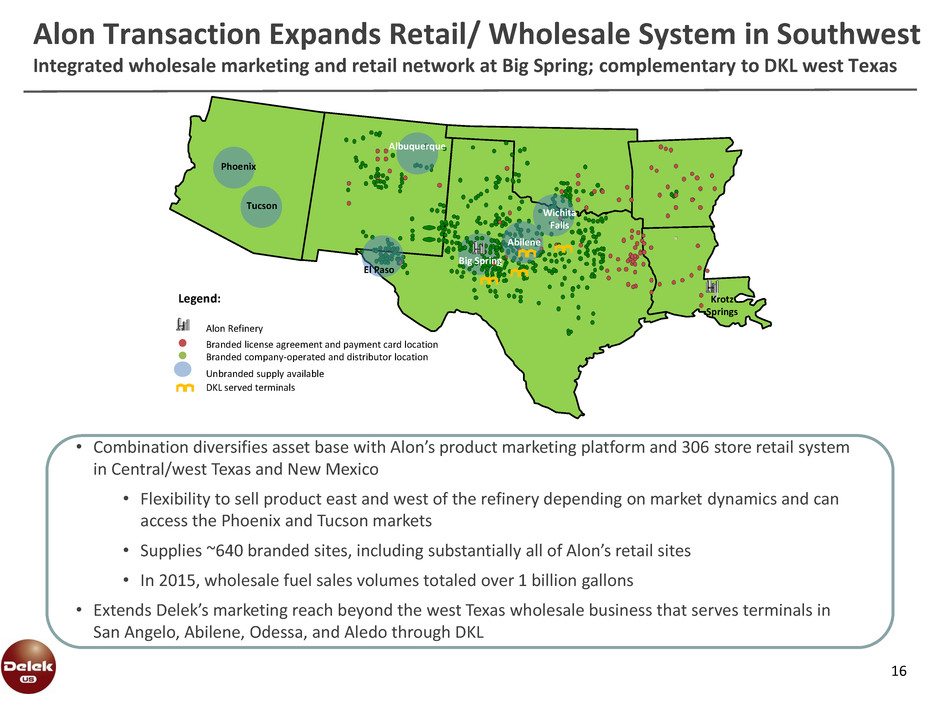

Alon Transaction Expands Retail/ Wholesale System in Southwest

Integrated wholesale marketing and retail network at Big Spring; complementary to DKL west Texas

16

Alon Refinery

Legend:

Big Spring

Krotz

Springs

Branded license agreement and payment card location

Branded company-operated and distributor location

Unbranded supply available

Phoenix

Tucson

El Paso

Abilene

Wichita

Falls

Albuquerque

DKL served terminals

• Combination diversifies asset base with Alon’s product marketing platform and 306 store retail system

in Central/west Texas and New Mexico

• Flexibility to sell product east and west of the refinery depending on market dynamics and can

access the Phoenix and Tucson markets

• Supplies ~640 branded sites, including substantially all of Alon’s retail sites

• In 2015, wholesale fuel sales volumes totaled over 1 billion gallons

• Extends Delek’s marketing reach beyond the west Texas wholesale business that serves terminals in

San Angelo, Abilene, Odessa, and Aledo through DKL

Robust Synergy Opportunity from DK/ALJ Combination

17

Expect to achieve run-rate synergies of approximately $85 - $105 million in 2018

Commercial

• Logistics, purchase and

trading benefits from a

larger platform

• $20-$35 m

Operational

• Sharing of resources

across the platform;

improved insurance and

procurement efficiencies

• $13-$15 m

Cost of

Capital

• Benefit from Delek US’

financial position to

reduce interest expense

through refinancing

efforts

• $19-$20 m

Corporate

• Reducing the number of

public companies;

consolidating functions

to improve efficiencies

• $33-$35 m

Corporate

Cost of Capital

Operational

Commercial

$85-$105

($ in millions)

At March 31, 2017

Cash of $591.4 million; Debt of $824.9 million

Includes $392.0 million of debt at Delek Logistics (DKL)

Excluding DKL, Delek US’ net cash position was

approximately $158.5 million

Closed sale of retail related assets for $535.0 million on

Nov. 14, 2016

Plus $17.9 million net cash on hand and working

capital adjustment

Paid $156.0 million of debt, $13.4 million prepayment

fee and $4.6 million of transaction cost at closing

$378.9 million net cash proceeds before tax (2)

Improved financial flexibility

Capital allocation focused on cash returned to

shareholders, acquisitions and capital program

$30 million DKL limited partner unit repurchase

authorization(3)

$150 million DK share repurchase plan(3)

Financial Highlights Cash Balance ($MM) (1)

Capital Invested in the Business and Returned to Shareholders

18

$61 $40

$219

$590

$383

$430

$287

$689

$591

2009 2010 2011 2012 2013 2014 2015 2016 Q1 2017

Dividends Declared ($/share)

$0.15 $0.15 $0.15 $0.21

$0.40

$0.60 $0.60 $0.60 $0.60

$0.18

$0.39

$0.55

$0.40

$0.15 $0.15

$0.33

$0.60

$0.95 $1.00

$0.60 $0.60 $0.60

2009 2010 2011 2012 2013 2014 2015 2016 LTM 1Q17

Regular Special

$37

$75

$42

$6

2013 2014 2015 2016

DK Share Repurchases ($MM)

1) Amounts prior to 4Q16 have been adjusted to removed cash associated the retail operations that were sold in November 2016.

2) Cash proceeds from retail sale before taxes. Estimated taxes to be in the first half of 2017.

3) These plans do not have expiration dates.

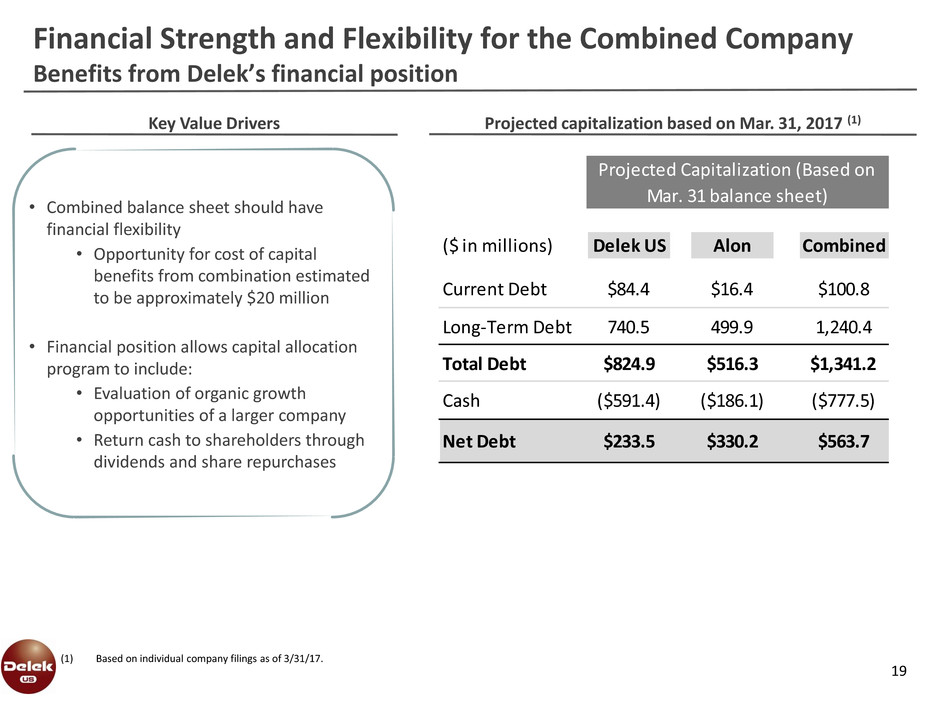

Financial Strength and Flexibility for the Combined Company

Benefits from Delek’s financial position

19

Key Value Drivers

• Combined balance sheet should have

financial flexibility

• Opportunity for cost of capital

benefits from combination estimated

to be approximately $20 million

• Financial position allows capital allocation

program to include:

• Evaluation of organic growth

opportunities of a larger company

• Return cash to shareholders through

dividends and share repurchases

(1) Based on individual company filings as of 3/31/17.

Projected capitalization based on Mar. 31, 2017 (1)

Projected Capitalization (Based on

Mar. 31 balance sheet)

($ in millions) Delek US Alon Combined

Current Debt $84.4 $16.4 $100.8

Long-Term Debt 740.5 499.9 1,240.4

Total Debt $824.9 $516.3 $1,341.2

Cash ($591.4) ($186.1) ($777.5)

Net Debt $233.5 $330.2 $563.7

Initiatives from new administration may benefit refining industry

Government Policy Update

20

Ethanol RINs Prices (1)

1) Ethanol RINs prices from OPIS, May 5, 2017

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

4

Q

1

2

1

Q

1

3

2

Q

1

3

3

Q

1

3

4

Q

1

3

1

Q

1

4

2

Q

1

4

3

Q

1

4

4

Q

1

4

1

Q

1

5

2

Q

1

5

3

Q

1

5

4

Q

1

5

1Q

1

6

2

Q

1

6

3

Q

1

6

4

Q

1

6

1

Q

1

7

Ja

n

.

Fe

b

.

Mar

.

A

p

r.

M

ay

5

$

p

er

b

b

l.

Renewable Fuel Obligation

Potential for a change in program has effected RINs

prices since October. Policy uncertainty has created

volatility.

Positive for refining operations

Lower direct cost for RINs

Reduces margin of non-obligated parties in the

wholesale markets

Corporate Tax Rate

Positive discussions around tax reform that

includes a lower corporate tax rate.

Delek US and Alon USA have deferred tax liabilities

that may be revalued in a lower corporate tax

environment

21

Complementary

Logistics Systems

Significant Organic

Growth / Margin

Improvement

Opportunities

Focus on Shareholder

Returns

Strong Balance Sheet

Strategically Positioned

Refining Platform

Questions and Answers

22

Additional Information

No Offer or Solicitation

This communication relates to a proposed business combination between Delek US and Alon. This announcement is for informational purposes only

and is neither an offer to purchase, nor a solicitation of an offer to sell, any securities or the solicitation of any vote in any jurisdiction pursuant to the

proposed transactions or otherwise, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention of applicable

law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as

amended.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed transaction between Delek US and Alon. In connection with

the proposed transaction, Delek US and/or Alon may file one or more proxy statements, registration statements, proxy statement/prospectuses or

other documents with the SEC. This communication is not a substitute for the proxy statement, registration statement, proxy statement/prospectus or

any other documents that Delek US or Alon may file with the SEC or send to stockholders in connection with the proposed transaction.

STOCKHOLDERS OF DELEK US AND ALON ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE

PROXY STATEMENT(S), REGISTRATION STATEMENT(S) AND/OR PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive proxy statement(s) (if and when available) will be mailed to

stockholders of Delek US and/or Alon, as applicable. Investors and security holders will be able to obtain copies of these documents, including the

proxy statement/prospectus, and other documents filed with the SEC (when available) free of charge at the SEC's website, http://www.sec.gov.

Copies of documents filed with the SEC by Delek US will be made available free of charge on Delek US’ website at http://www.delekus.com or by

contacting Delek US’ Investor Relations Department by phone at 615-435-1366. Copies of documents filed with the SEC by Alon will be made

available free of charge on Alon's website at http://www.alonusa.com or by contacting Alon's Investor Relations Department by phone at 972-367-

3808.

Participants in the Solicitation

Delek US and its directors and executive officers, and Alon and its directors and executive officers, may be deemed to be participants in the

solicitation of proxies from the holders of Delek US common stock and Alon common stock in respect of the proposed transaction. Information about

the directors and executive officers of Delek US is set forth in the proxy statement for Delek US’ 2017 Annual Meeting of Stockholders, which was

filed with the SEC on April 6, 2017, and in the other documents filed after the date thereof by Delek US with the SEC. Information about the directors

and executive officers of Alon is set forth in the Annual Report on Form 10-K/A, which was filed with the SEC on May 1, 2017, and in the other

documents filed after the date thereof by Alon with the SEC. Investors may obtain additional information regarding the interests of such participants

by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these

documents as described in the preceding paragraph.

Appendix

Non GAAP Reconciliations of Potential Dropdown EBITDA (1)

24

(1) Based on projected range of potential future logistics assets that could be dropped to Delek Logistics from Delek US in the future. Amounts of EBITDA, net income and timing

will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be based on timing, performance of the assets,

DKL’s growth plans and valuation multiples for such assets at the time of any transaction.

Reconciliation of Forecasted Logistics Dropdown EBITDA to Forecasted Amounts under US GAAP

Delek Logistics Partners LP

($ in millions)

Forecasted Net Income Range 13.6$ 15.9$

Add: Depreciation and amortization expenses 33.6$ 39.2$

Add: Interest and financing costs, net 24.8$ 28.9$

Forecasted EBITDA Range 72.0$ 84.0$

Potential Dropdown Range

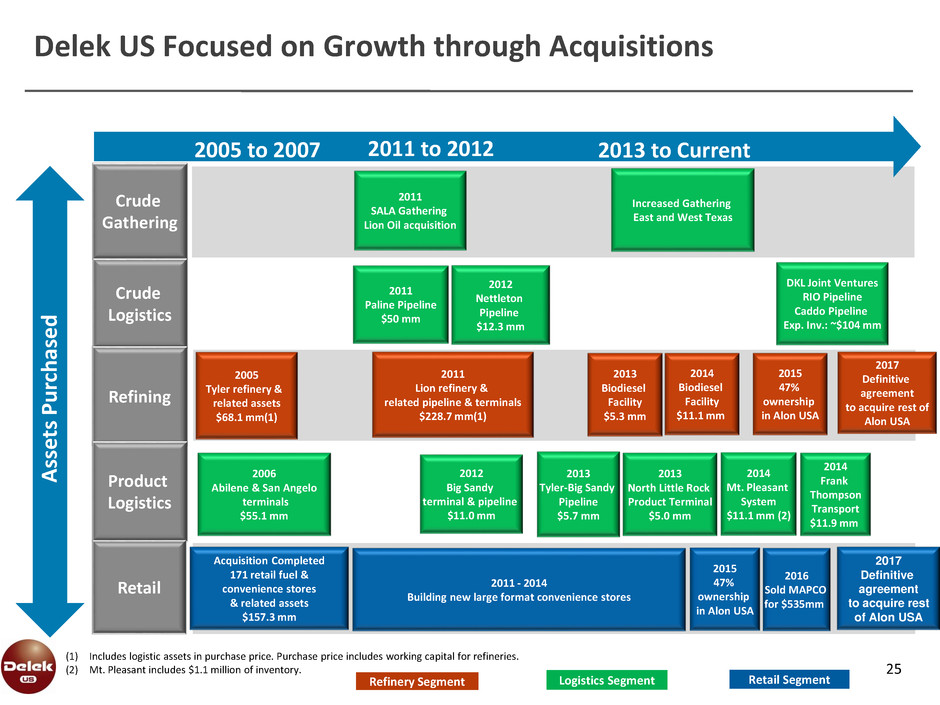

Delek US Focused on Growth through Acquisitions

(1) Includes logistic assets in purchase price. Purchase price includes working capital for refineries.

(2) Mt. Pleasant includes $1.1 million of inventory.

2006

Abilene & San Angelo

terminals

$55.1 mm

2012

Nettleton

Pipeline

$12.3 mm

2011

Paline Pipeline

$50 mm

Acquisition Completed

171 retail fuel &

convenience stores

& related assets

$157.3 mm

2005 to 2007 2011 to 2012 2013 to Current

Crude

Gathering

2013

Biodiesel

Facility

$5.3 mm

2011

Lion refinery &

related pipeline & terminals

$228.7 mm(1)

2005

Tyler refinery &

related assets

$68.1 mm(1)

2011 - 2014

Building new large format convenience stores

2013

Tyler-Big Sandy

Pipeline

$5.7 mm

2014

Biodiesel

Facility

$11.1 mm

Logistics Segment Retail SegmentRefinery Segment

Crude

Logistics

Refining

Product

Logistics

Retail

2012

Big Sandy

terminal & pipeline

$11.0 mm

2013

North Little Rock

Product Terminal

$5.0 mm

2011

SALA Gathering

Lion Oil acquisition

Assets

P

u

rc

h

as

e

d

Increased Gathering

East and West Texas

25

2014

Mt. Pleasant

System

$11.1 mm (2)

2014

Frank

Thompson

Transport

$11.9 mm

DKL Joint Ventures

RIO Pipeline

Caddo Pipeline

Exp. Inv.: ~$104 mm

2015

47%

ownership

in Alon USA

2015

47%

ownership

in Alon USA

2016

Sold MAPCO

for $535mm

2017

Definitive

agreement

to acquire rest of

Alon USA

2017

Definitive

agreement

to acquire rest

of Alon USA

26

Summary Organization Structure

(1) As of December 31, 2016, a 5.1% interest in the Delek US ownership interest in the general partner is held by three members of senior management of Delek US. The

remaining ownership interest is indirectly held by Delek.

Market cap based on share prices on May 5, 2017.

94.9%

ownership interest (1)

2.0% interest

General partner interest

Incentive distribution

rights

Delek Logistics Partners, LP

NYSE: DKL

Market Cap: $716 million

Delek Logistics GP, LLC

(the General Partner)

Delek US Holdings, Inc.

NYSE: DK

Market Cap: $1.5 billion

61.2% interest

Alon USA

NYSE: ALJ

Market Cap: $842 million

47% interest

54% 55% 54% 55% 54% 55%

39% 39% 40% 40% 41% 40%

7% 6% 6% 5% 5% 5%

0%

20%

40%

60%

80%

100%

120%

2013 2014 2015 2016 1Q16 1Q17

Gasoline Diesel Petro/Other

62,304 65,523 60,704 70,773

Tyler Refinery Overview

27

Overview

Niche market generally priced above Gulf Coast;

supported by Delek Logistics' terminals

Crude slate consists of approx. 65 kbpd Midland

sourced crude; plus east Texas and Cushing crudes

Completed schedule turnaround in March 2015;

FCC reactor replaced; next scheduled turnaround

2020

15 kbpd crude processing expansion completed in

March 2015

Achieved 75 kbpd crude throughput rate

Product yield in line with pre-expansion level

Focus on balancing expanded production level

with refining margin to maximize capture rate

75,000 bpd niche refinery serving Tyler, Texas and surrounding area

Total Production, bpd

$4.63 $4.41 $4.52

$3.73

$4.24 $4.23

2013 2014 2015 2016 1Q16 1Q17

Operating Expense Per Barrel Sold

Note: Delek US capture rate is defined as refining gross margin per barrel divided by WTI Gulf Coast 5-3-2 crack spread.

67,879 62,315

80,000 bpd refinery with crude slate flexibility to process light and medium gravity crudes

El Dorado Refinery Overview

281) COPEC is a wholly owned subsidiary of Compania de Petroleos de Chile COPEC S.A, which owns and operates convenience stores in Chile, Columbia, Panama, Ecuador, Peru and

Mexico. On Nov. 14, 2016 Delek US closed the transaction to sell its retail related business to COPEC.

Overview

Inland PADD III refinery located in Southern

Arkansas

Flexible crude sourcing

Access to Gulf Cost crudes beginning

in August 2016

Midland, local Arkansas, east Texas

Rail offloading capability

Mid Valley and Exxon North crude oil

pipeline access

Ability to support a portion of retail fuel

needs on direct/indirect basis through 18

month supply agreement with COPEC (1)

Improved flexibility and throughput in 1Q 2014

turnaround; next scheduled turnaround 2019

Pre-flash tower project improved light

crude processing capability to

approximately 80,000 bpd

Replaced FCC reactor with state of the art

technology

49% 50% 52% 54% 57% 53%

38% 39% 37%

36% 36% 35%

11% 9% 8% 7% 5% 8%

3% 2% 3% 3% 2% 4%

0

0

0

1

1

1

1

2013 2014 2015 2016 1Q16 1Q17

Gasoline Diesel Asphalt Petro/Other

71,642 71,286 77,806 75,027

Total Production, bpd

$4.06 $3.94 $3.97 $3.73 $4.00

$3.31

2013 2014 2015 2016 1Q16 1Q17

Operating Expense Per Barrel Sold

75,405 74,665

-$30

-$20

-$10

$0

$10

$20

$30

$40

$50

J

a

n

-1

0

F

e

b

-1

0

M

a

r-

1

0

A

pr

-1

0

M

a

y

-1

0

J

u

n

-1

0

J

u

l-

1

0

A

u

g

-1

0

S

e

p

-1

0

O

c

t-

1

0

N

o

v

-1

0

De

c

-1

0

J

a

n

-1

1

F

e

b

-1

1

M

a

r-

1

1

A

pr

-1

1

M

a

y

-1

1

J

u

n

-1

1

J

u

l-

1

1

A

u

g

-1

1

S

e

p

-1

1

O

c

t-

1

1

No

v

-1

1

De

c

-1

1

J

a

n

-1

2

F

e

b

-1

2

M

a

r-

1

2

A

pr

-1

2

M

a

y

-1

2

J

u

n

-1

2

J

u

l-

1

2

A

u

g

-1

2

S

e

p

-1

2

O

c

t-

1

2

No

v

-1

2

De

c

-1

2

J

a

n

-1

3

F

e

b

-1

3

M

a

r-

1

3

A

pr

-1

3

M

a

y

-1

3

J

u

n

-1

3

J

u

l-

1

3

A

u

g

-1

3

S

e

p

-1

3

O

c

t-

1

3

No

v

-1

3

De

c

-1

3

J

a

n

-1

4

F

e

b

-1

4

M

a

r-

1

4

A

pr

-1

4

M

a

y

-1

4

J

u

n

-1

4

J

u

l-

1

4

A

u

g

-1

4

S

e

p

-1

4

O

c

t-

1

4

No

v

-1

4

De

c

-1

4

J

a

n

-1

5

F

e

b

-1

5

M

a

r-

1

5

A

pr

-1

5

M

a

y

-1

5

J

u

n

-1

5

J

u

l-

1

5

A

u

g

-1

5

S

e

p

-1

5

O

c

t-

1

5

N

o

v

-1

5

De

c

-1

5

J

a

n

-1

6

F

e

b

-1

6

M

a

r-

1

6

A

pr

-1

6

M

a

y

-1

6

J

u

n

-1

6

J

u

l-

1

6

A

u

g

-1

6

S

e

p

-1

6

O

c

t-

1

6

No

v

-1

6

De

c

-1

6

J

a

n

-1

7

F

e

b

-1

7

M

a

r-

1

7

A

pr

-1

7

M

a

y

-1

7

Brent-WTI Cushing Spread Per Barrel WTI 5-3-2 Gulf Coast Crack Spread Per Barrel LLS 5-3-2 Gulf Coast Crack Spread Per Barrel

U.S. Refining Environment Trends

Refined Product Margins and WTI-Linked Feedstock Favor Delek US

(1) Source: Platts; 2016 data is as of May 5, 2017; 5-3-2 crack spread based on HSD

(2) Crack Spreads: (+/-) Contango/Backwardation

(1) (2) (2)

29

($14.00)

($12.00)

($10.00)

($8.00)

($6.00)

($4.00)

($2.00)

$0.00

$2.00

Ja

n

-1

1

Fe

b

-1

1

M

ar

-1

1

A

p

r-

11

M

ay

-1

1

Ju

n

-1

1

Ju

l-1

1

A

u

g-

1

1

Se

p

-1

1

O

ct-1

1

N

o

v-

1

1

De

c-

1

1

Ja

n

-1

2

Fe

b

-1

2

M

ar

-1

2

A

p

r-

12

M

ay

-1

2

Ju

n

-1

2

Ju

l-1

2

A

u

g-

1

2

Se

p

-1

2

O

ct-1

2

N

o

v-

1

2

De

c-

1

2

Ja

n

-1

3

Fe

b

-1

3

M

ar

-1

3

A

p

r-

13

M

ay

-1

3

Ju

n

-1

3

Ju

l-1

3

A

u

g-

1

3

Se

p

-1

3

O

ct-1

3

N

o

v-

1

3

De

c-

1

3

Ja

n

-1

4

Fe

b

-1

4

M

ar

-1

4

A

p

r-

14

M

ay

-1

4

Ju

n

-1

4

Ju

l-1

4

A

u

g-

1

4

Se

p

-1

4

O

ct-1

4

N

o

v-

1

4

De

c-

1

4

Ja

n

-1

5

Fe

b

-1

5

M

ar

-1

5

A

p

r-

15

M

ay

-1

5

Ju

n

-1

5

Ju

l-1

5

A

u

g-

1

5

Se

p

-1

5

O

ct-1

5

N

o

v-

1

5

De

c-

1

5

Ja

n

-1

6

Fe

b

-1

6

M

ar

-1

6

A

p

r-

16

M

ay

-1

6

Ju

n

-1

6

Ju

l-1

6

A

u

g-

1

6

Se

p

-1

6

O

ct-1

6

N

o

v-

1

6

De

c-

1

6

Ja

n

-1

7

Fe

b

-1

7

M

ar

-1

7

A

p

r-

17

M

ay

-1

7

Ju

n

-1

7

WTI Midland vs. WTI Cushing Crude Pricing

Access to Midland Crudes Benefits Margins

($ per barrel)

117,000 bpd of

Midland crude in

DK system

30

Source: Argus – as of May 5, 2017

DKL: Reconciliation of Cash Available for Distribution

31

(1) Distribution for forecast period based on $1.50 per unit; Distribution for year ended December 31, 2013, 2014, 2015 and 2016 based on actual amounts distributed during the periods; does

not include a LTIP accrual. Coverage is defined as cash available for distribution divided by total distribution.

(2) Results in 2013, 2014 and 2015 are as reported excluding predecessor costs related to the drop down of the tank farms and product terminals at both Tyler and El Dorado during the

respective periods.

Note: May not foot due to rounding and annual adjustments that occurred in year end reporting.

(dollars in millions, except coverage) 1Q13 (2) 2Q13(2) 3Q13(2) 4Q13(2) 2013 (2) 1Q14 (2) 2Q14(2) 3Q14(2) 4Q14(2) 2014 (2) 1Q15(2) 12Q15(2 3Q15(2) 4Q15(2) 2015 (2) 1Q16 2Q16 3Q16 4Q16 2016 (2) 1Q17

Reconciliation of Distributable Cash Flow to net cash from operating activities

Net cash provided by operating activities $2.0 $18.7 $19.9 $8.9 $49.4 $14.4 $31.2 $20.1 $20.8 $86.6 $15.9 $30.8 $20.2 $1.3 $68.2 $26.4 $31.2 $29.2 $13.9 $100.7 $23.5

Accretion of asset retirement obligations (0.0) (0.1) (0.0) (0.1) (0.2) (0.1) (0.1) (0.1) 0.0 (0.2) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1)

Deferred income taxes 0.0 0.0 (0.1) (0.3) (0.3) 0.0 (0.1) (0.0) 0.2 0.1 (0.2) 0.2 0.0 0.0 (0.0) - - - 0.2 0.2 -

Gain (Loss) on asset disposals - - - (0.2) (0.2) - (0.1) - (0.0) (0.1) (0.0) 0.0 - (0.1) (0.1) 0.0 - (0.0) - 0.0 (0.0)

Changes in assets and liabilities 12.1 (4.9) (5.1) 6.3 8.3 3.4 (6.0) (1.6) 3.0 (1.2) 3.3 (7.3) 3.6 20.5 20.1 (5.4) (7.1) (10.0) 7.7 (14.9) (3.6)

Maint. & Reg. Capital Expenditures (1.3) (1.1) (1.3) (1.8) (5.1) (0.8) (1.0) (0.8) (3.9) (6.5) (3.3) (3.9) (3.5) (2.7) (11.8) (0.7) (0.9) (0.7) (3.6) (5.9) (2.2)

Reimbursement for Capital Expenditures 0.3 0.2 - 0.4 0.8 - - - 1.6 1.6 1.2 1.4 2.3 0.0 5.2 0.2 0.6 0.7 0.4 1.9 3.1

Distributable Cash Flow $13.1 $12.8 $13.4 $13.3 $52.9 $17.0 $24.0 $17.7 $21.8 $80.3 $16.8 $21.1 $22.6 $18.9 $81.3 $20.4 $23.7 $19.1 $18.5 $81.7 $20.6

Coverage (1) 1.39x 1.32x 1.35x 1.30x 1.35x 1.61x 2.02x 1.42x 1.67x 1.68x 1.23x 1.47x 1.50x 1.17x 1.37x 1.19x 1.31x 0.99x 0.90x 1.09x 0.98x

Total Distribution (1) $9.4 $9.7 $9.9 $10.2 $39.3 $10.5 $11.9 $12.4 $13.1 $47.9 $13.7 $14.4 $15.1 $16.1 $59.3 $17.1 $18.1 $19.3 $20.5 $75.0 $21.0

DKL: Income Statement and Non-GAAP EBITDA Reconciliation

32

(1) Includes approximately $2.0 million of estimated annual incremental general and administrative expenses expected to incur as a result of being a separate publicly traded partnership.

(2) Interest expense and cash interest both include commitment fees and interest expense that would have been paid by the predecessor had the revolving credit facility been in place during the 12

months ended 9/30/13 period presented and Delek Logistics had borrowed $90.0 million under the facility at the beginning of the period. Interest expense also includes the amortization of debt

issuance costs incurred in connection with our revolving credit facility.

(3) Forecast provided in the IPO prospectus on Nov. 1, 2012.

(4) Results in 2013 and 2014 are as reported excluding predecessor costs related to the drop down of the tank farms and product terminals at both Tyler and El Dorado during the respective periods.

(5) Results for 1Q15 are as reported excluding predecessor costs related to the 1Q15 drop downs.

Note: May not foot due to rounding.

Investor Relations Contact:

Assi Ginzburg Keith Johnson

Chief Financial Officer Vice President of Investor Relations

615-435-1452 615-435-1366