Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CALGON CARBON Corp | a51555370ex99_1.htm |

| 8-K - CALGON CARBON CORPORATION 8-K - CALGON CARBON Corp | a51555370.htm |

Exhibit 99.2

Calgon Carbon Corporation1Q 2017 Earnings Presentation May 9, 2017

Safe Harbor Statement This presentation contains historical information and forward-looking statements. Forward-looking statements typically contain words such as “expect,” “believe,” “estimate,” “anticipate,” or similar words indicating that future outcomes are uncertain. Statements looking forward in time, including statements regarding future growth and profitability, price increases, cost savings, broader product lines, enhanced competitive posture and acquisitions, are included in this presentation pursuant to the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks and uncertainties that may cause Calgon Carbon Corporation’s (the Company’s) actual results in future periods to be materially different from any future performance suggested herein. Further, the Company operates in an industry sector where securities values may be volatile and may be influenced by economic and other factors beyond the Company’s control. Factors that could affect future performance of the Company include, without limitation: the Company’s ability to successfully integrate the November 2, 2016 acquisition of the assets and business of the wood-based activated carbon, reactivation, and mineral-based filtration media of CECA, a subsidiary of Arkema Group (the New Business) and achieve the expected results of the acquisition, including any expected synergies and the expected future accretion to earnings; changes in, or delays in the implementation of, regulations that cause a market for our products; changes in competitor prices for products similar to ours; higher energy and raw material costs; costs of imports and related tariffs; unfavorable weather conditions and changes in market prices of natural gas relative to prices of coal; changes in foreign currency exchange rates and interest rates; changes in corporate income and cross-border tax policies of the United States and other countries; labor relations; availability of capital and environmental requirements as they relate to both our operations and to those of our customers; borrowing restrictions; validity of patents and other intellectual property; and pension costs. In the context of the forward-looking information provided in this presentation, please refer to the discussions of risk factors and other information detailed in, as well as the other information contained in the Company’s most recently filed Annual Report. Any forward-looking statement speaks only as of the date on which such statement is made and the Company does not intend to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise, unless required to do so by the Federal securities laws of the United States.

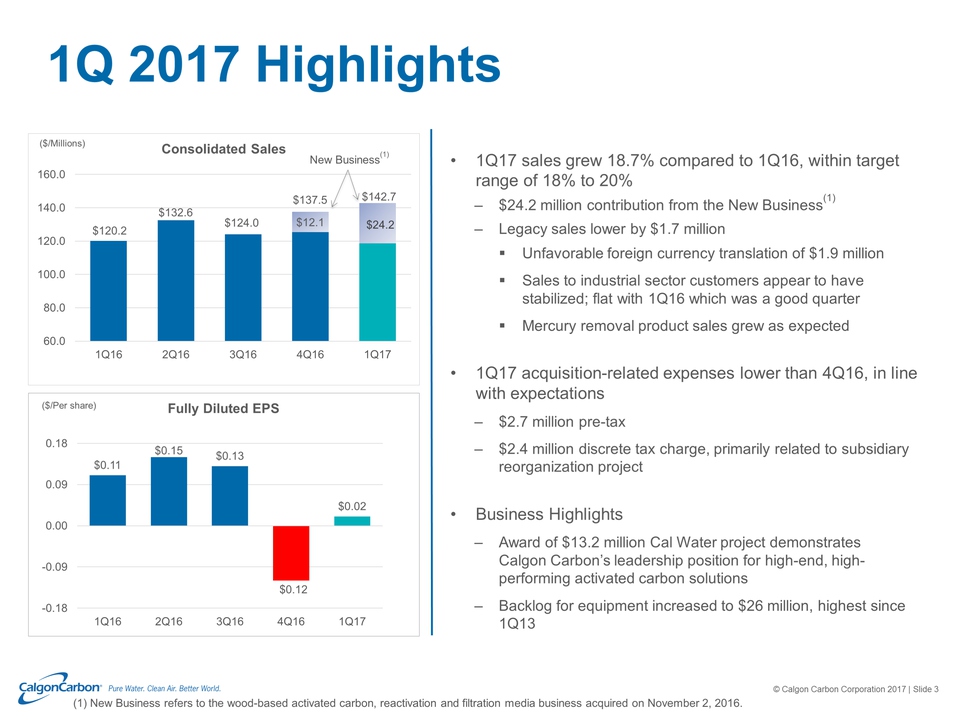

($/Millions) ($/Per share) (1) New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016. New Business(1) $24.2 1Q17 sales grew 18.7% compared to 1Q16, within target range of 18% to 20% $24.2 million contribution from the New Business(1) Legacy sales lower by $1.7 million Unfavorable foreign currency translation of $1.9 millionSales to industrial sector customers appear to have stabilized; flat with 1Q16 which was a good quarterMercury removal product sales grew as expected1Q17 acquisition-related expenses lower than 4Q16, in line with expectations$2.7 million pre-tax $2.4 million discrete tax charge, primarily related to subsidiary reorganization projectBusiness HighlightsAward of $13.2 million Cal Water project demonstrates Calgon Carbon’s leadership position for high-end, high-performing activated carbon solutions Backlog for equipment increased to $26 million, highest since 1Q13 1Q 2017 Highlights

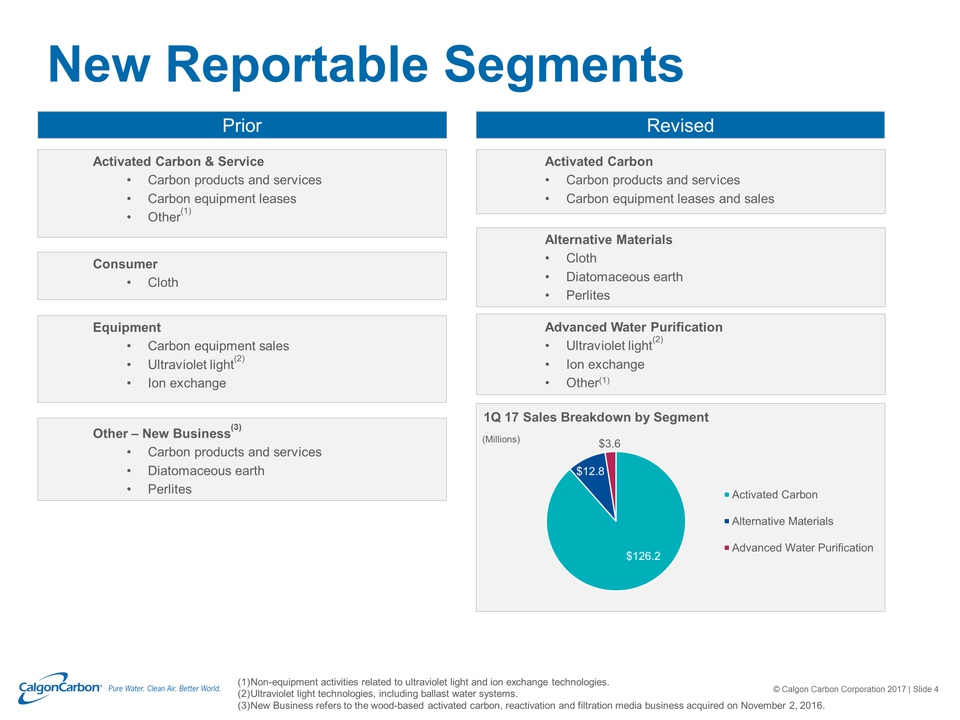

New Reportable Segments Prior Activated Carbon & ServiceCarbon products and servicesCarbon equipment leasesOther(1) EquipmentCarbon equipment salesUltraviolet light(2) Ion exchange ConsumerCloth Other – New Business(3)Carbon products and services Diatomaceous earth Perlites Activated Carbon Carbon products and servicesCarbon equipment leases and sales Alternative Materials ClothDiatomaceous earth Perlites Advanced Water Purification Ultraviolet light(2)Ion exchangeOther(1) Revised Non-equipment activities related to ultraviolet light and ion exchange technologies.Ultraviolet light technologies, including ballast water systems.New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016. 1Q 17 Sales Breakdown by Segment (Millions)

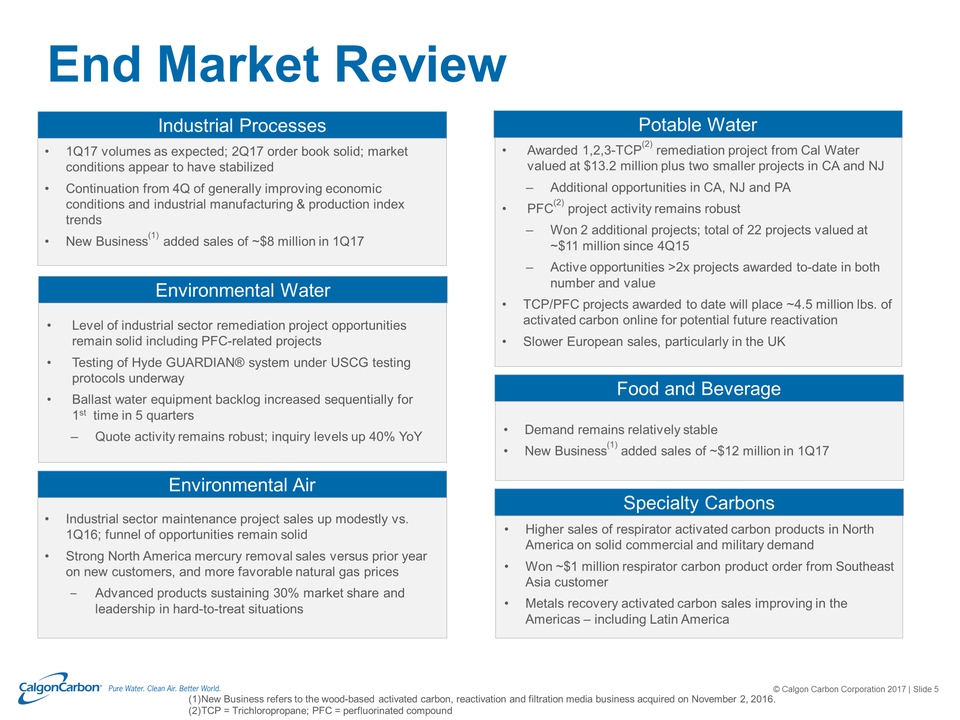

End Market Review Potable Water Awarded 1,2,3-TCP(2) remediation project from Cal Water valued at $13.2 million plus two smaller projects in CA and NJAdditional opportunities in CA, NJ and PAPFC(2) project activity remains robustWon 2 additional projects; total of 22 projects valued at ~$11 million since 4Q15Active opportunities >2x projects awarded to-date in both number and valueTCP/PFC projects awarded to date will place ~4.5 million lbs. of activated carbon online for potential future reactivationSlower European sales, particularly in the UK Industrial Processes 1Q17 volumes as expected; 2Q17 order book solid; market conditions appear to have stabilizedContinuation from 4Q of generally improving economic conditions and industrial manufacturing & production index trends New Business(1) added sales of ~$8 million in 1Q17 Environmental Air Environmental Water Level of industrial sector remediation project opportunities remain solid including PFC-related projectsTesting of Hyde GUARDIAN® system under USCG testing protocols underwayBallast water equipment backlog increased sequentially for 1st time in 5 quartersQuote activity remains robust; inquiry levels up 40% YoY Industrial sector maintenance project sales up modestly vs. 1Q16; funnel of opportunities remain solidStrong North America mercury removal sales versus prior year on new customers, and more favorable natural gas pricesAdvanced products sustaining 30% market share and leadership in hard-to-treat situations Food and Beverage Demand remains relatively stableNew Business(1) added sales of ~$12 million in 1Q17 Specialty Carbons Higher sales of respirator activated carbon products in North America on solid commercial and military demandWon ~$1 million respirator carbon product order from Southeast Asia customerMetals recovery activated carbon sales improving in the Americas – including Latin America New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016.TCP = Trichloropropane; PFC = perfluorinated compound

Solid 1Q sales and profitability Value creation path - synergies and projects remain on track for realization by 2019 Debottlenecking of wood-based carbon facility proceeding smoothly Capture of expected cost synergies on track Legnago, Italy reactivation facility running very well – achieved a record reactivation volume level in March; 1Q17 reactivation volumes improved nearly 85% from last year 1Q16Continue to sell all the wood-based activated carbon products we produceBusiness integration proceeding as planned with completion expected during 3Q Financial impact status update – unchanged from 4Q16 earnings call New Business(1) Update (1) New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016.

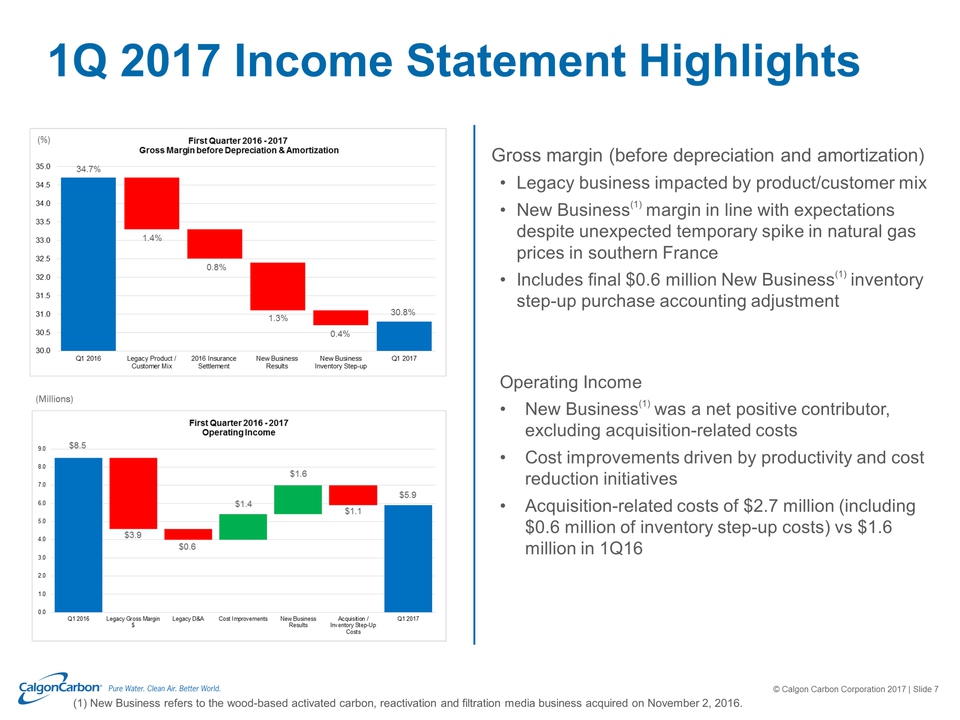

1Q 2017 Income Statement Highlights Gross margin (before depreciation and amortization) Legacy business impacted by product/customer mixNew Business(1) margin in line with expectations despite unexpected temporary spike in natural gas prices in southern France Includes final $0.6 million New Business(1) inventory step-up purchase accounting adjustment Operating Income New Business(1) was a net positive contributor, excluding acquisition-related costsCost improvements driven by productivity and cost reduction initiativesAcquisition-related costs of $2.7 million (including $0.6 million of inventory step-up costs) vs $1.6 million in 1Q16 (1) New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016.

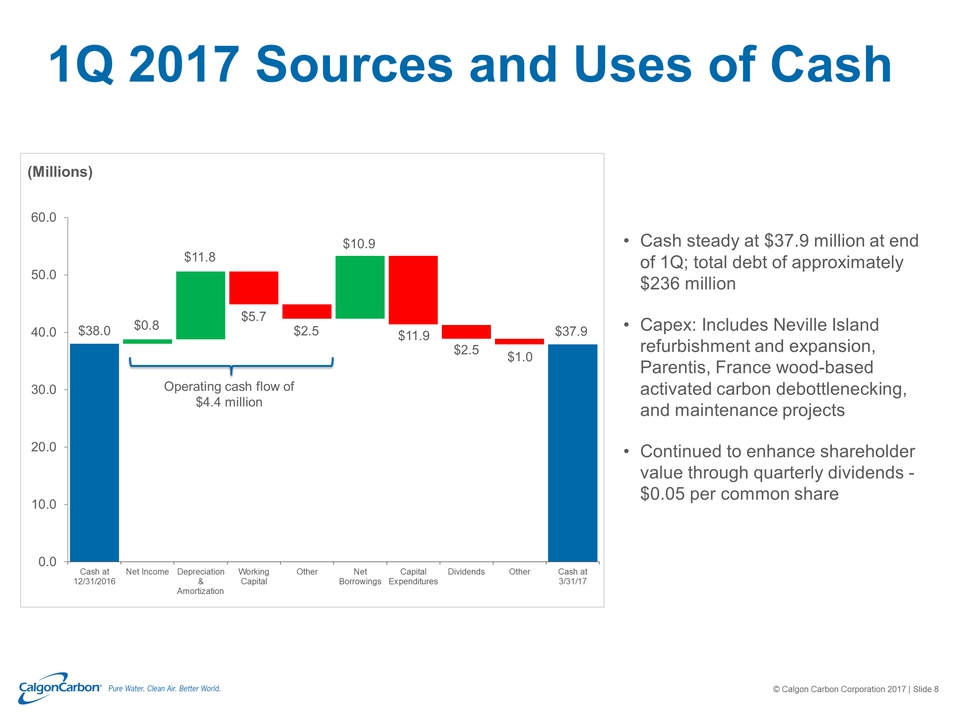

1Q 2017 Sources and Uses of Cash (Millions) Cash steady at $37.9 million at end of 1Q; total debt of approximately $236 million Capex: Includes Neville Island refurbishment and expansion, Parentis, France wood-based activated carbon debottlenecking, and maintenance projectsContinued to enhance shareholder value through quarterly dividends - $0.05 per common share Operating cash flow of$4.4 million $38.0 $0.8 $11.8 $5.7 $2.5 $10.9 $11.9 $2.5 $1.0 $37.9

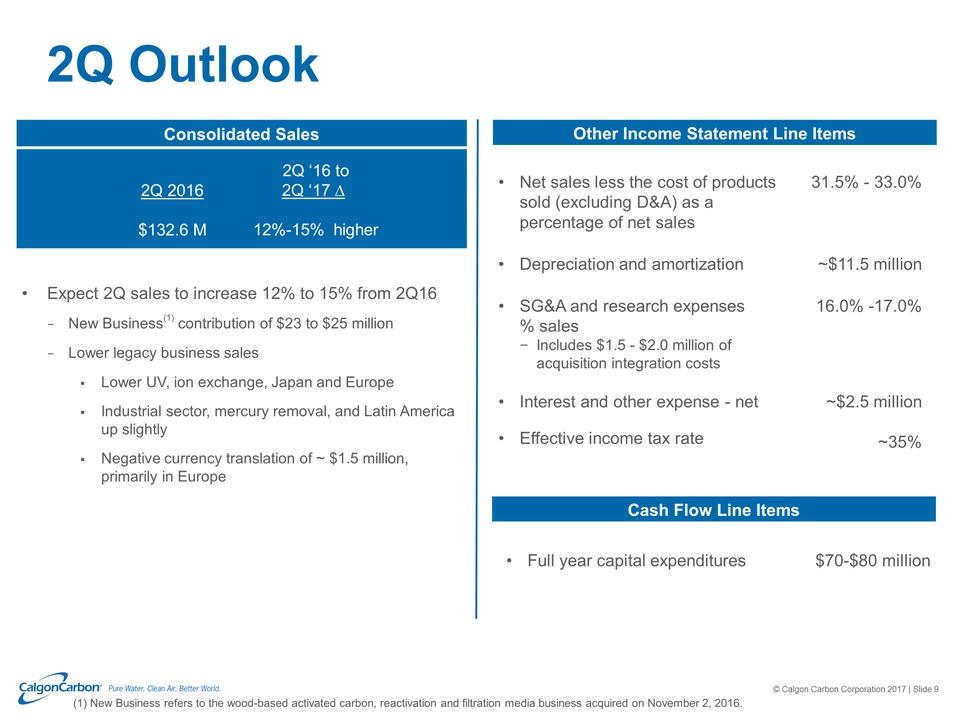

2Q Outlook 3Q ‘16 to 4Q ‘16 ∆ 2% - 5% higher Other Income Statement Line Items Cash Flow Line Items Full year capital expenditures $70-$80 million Consolidated Sales 2Q ‘16 to 2Q ‘17 ∆ 12%-15% higher 2Q 2016 $132.6 M Expect 2Q sales to increase 12% to 15% from 2Q16 New Business(1) contribution of $23 to $25 millionLower legacy business salesLower UV, ion exchange, Japan and EuropeIndustrial sector, mercury removal, and Latin America up slightlyNegative currency translation of ~ $1.5 million, primarily in Europe Net sales less the cost of products sold (excluding D&A) as a percentage of net sales 31.5% - 33.0% Depreciation and amortization ~$11.5 million SG&A and research expenses % salesIncludes $1.5 - $2.0 million of acquisition integration costs 16.0% -17.0% Interest and other expense - net Effective income tax rate ~$2.5 million~35% (1) New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016.

2017 Outlook and Priorities Cautiously optimistic about recovery in industrial sector demand Legacy business sales growth drivers: PFC and 1,2,3-TCP removal opportunities in the potable water market Mercury removal product sales from elevated natural gas prices and new customers requiring hard-to-treat solutionsHigher ballast water equipment sales toward the end of the year assuming regulatory compliance remains on trackNew Business(1) expected to contribute ~$100 million in sales Operating income to improve to ~$55 million from $24.5 million in 2016 (1) New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016.

Questions & Answers Session Randall S. DearthChairman, President and Chief Executive Officer James A. Coccagno Executive Vice President of Core Carbon and Services Division Stevan R. SchottExecutive Vice President of Advanced Materials, Manufacturing, and Equipment Division Robert FortwanglerSenior Vice President and Chief Financial Officer