Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Air Transport Services Group, Inc. | a2017form8kcoverannualmeet.htm |

The global leader in midsize wide-body

leasing and operating solutions

Annual Meeting

of Shareholders

May 5, 2017

Joe Hete

President & CEO

Quint Turner

Chief Financial Officer

Rich Corrado

Chief Commercial Officer

Safe Harbor Statement

2

Except for historical information contained herein, the matters discussed in this presentation contain forward-looking

statements that involve risks and uncertainties. There are a number of important factors that could cause Air Transport

Services Group's ("ATSG's") actual results to differ materially from those indicated by such forward-looking

statements. These factors include, but are not limited to, changes in market demand for our assets and services; our

operating airlines' ability to maintain on-time service and control costs; the cost and timing with respect to which we

are able to purchase and modify aircraft to a cargo configuration; the number and timing of deployments and

redeployments of our aircraft to customers; the completion of anticipated commercial arrangements with new and

existing customers, and other factors that are contained from time to time in ATSG's filings with the U.S. Securities and

Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers

should carefully review this presentation and should not place undue reliance on ATSG's forward-looking statements.

These forward-looking statements were based on information, plans and estimates as of the date of this presentation.

ATSG undertakes no obligation to update any forward-looking statements to reflect changes in underlying

assumptions or factors, new information, future events or other changes.

2016 Accomplishments

3

• Freighter fleet expands as five Boeing 767s entered service in 2016; eleven more due in 2017, six

in 2018. Of 767s in service at YE2016, 80% were dry-leased; typical lease durations 5 to 8 years.

• Agreements with Amazon completed in March call for long-term placements of 20 leased and

operated 767 freighters, plus warrants for Amazon to acquire up to 19.9% of ATSG shares.

• Diversified, growing revenue streams 2016 revenues up 18% excluding reimbursements. DHL

represented 34% of revenues; Amazon 29%, U.S. Military 12%.

• Record Adjusted EBITDA for 2016 of $212MM, up 7%.

• Logistics business grows through expanded ground support roles for major customers.

• PEMCO acquired at year-end, expanding AMES’s MRO capabilities and capacity, and adding

conversion and MRO facilities in China, S. America and U.S. serving Boeing and Airbus airframes.

• Improved shareholder value as stock price grew more than 2x major market indexes and most

peers in 2016, backed by $64MM in share repurchases. 2016 credit facility amendment added

$100MM in capacity and more buyback flexibility.

Rich Corrado

Chief Commercial Officer

11

52

6

10

41

7

17

30

2

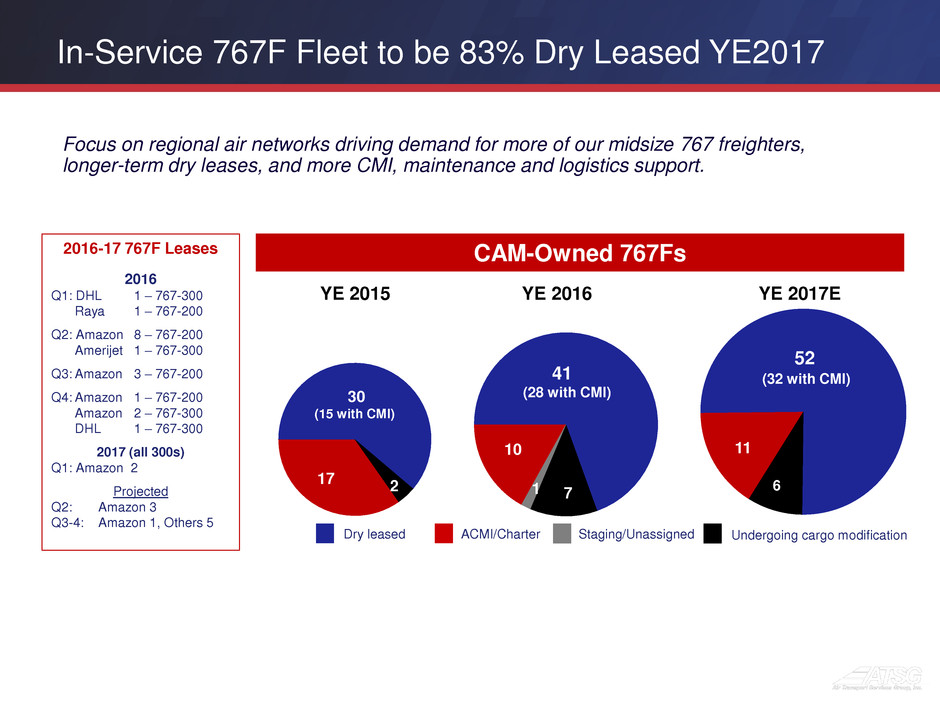

In-Service 767F Fleet to be 83% Dry Leased YE2017

5

Focus on regional air networks driving demand for more of our midsize 767 freighters,

longer-term dry leases, and more CMI, maintenance and logistics support.

YE 2015

CAM-Owned 767Fs

YE 2016

(15 with CMI)

(28 with CMI)

Dry leased ACMI/Charter Staging/Unassigned Undergoing cargo modification

2016-17 767F Leases

2016

Q1: DHL 1 – 767-300

Raya 1 – 767-200

Q2: Amazon 8 – 767-200

Amerijet 1 – 767-300

Q3: Amazon 3 – 767-200

Q4: Amazon 1 – 767-200

Amazon 2 – 767-300

DHL 1 – 767-300

2017 (all 300s)

Q1: Amazon 2

Projected

Q2: Amazon 3

Q3-4: Amazon 1, Others 5

YE 2017E

(32 with CMI)

1

767-300 Investments & Deployments

6

CAM-Owned 767-300Fs 2016 2017E 2018E

In Service at Start 11 16 27

Complete Modification & Deploy 5 11 6

Deploying To

Amazon,

DHL,

Amerijet

Amazon, other

external, ATI

TBA

In Service at End 16 27 33

In/Awaiting Modification 7 6 -

Customer demand for additional 767-300 freighters in 2017 and 2018 beyond the

eight we will lease to and operate for Amazon

PEMCO Boosts MRO Capacity, Adds 737 Conversions

• 2 Large Hangars, 300,000+ sq ft

• Heavy Maintenance

• Narrowbody / Widebody support

• Complex structural modifications

• Component and Backshop services

• Line Maintenance and AOG Teams

Expands ATSG MRO Capacity New to ATSG Portfolio

REGIONAL

CRJ, Embraer, MRJ (LOI)

AIRBUS

A320 Family

BOEING

B737 CLASSIC / NG, B757, B767

• Southern USA location

• Extensive Airbus experience

• Robust passenger customer portfolio

• Pax to Freighter 737 Conversions

• 70% China market share in B737 cargo

conversions

• China satellite locations

• Established relationships with airlines

Enhanced China Strategy

Amazon Support

8

• Five-year operating agreement

signed March 8, 2016, effective

April 1, 2016

• Seven-year lease terms for eight

767-300s; five-year terms for

twelve 767-200s

• Aircraft are CAM-leased, ABX Air/

ATI operated, AMES maintained,

LGSTX supported

Trial network launched in September 2015 with support from five ATSG businesses leads to

contracts for 20 CAM-leased 767 freighters, crews and support services

ATSG to lease, operate & support 20 767s by mid-2017

May 2017 July 2017

767-300 767-200

LEASING CMI SERVICES HUB & GATEWAY MAINTENANCE

Quint Turner

Chief Financial Officer

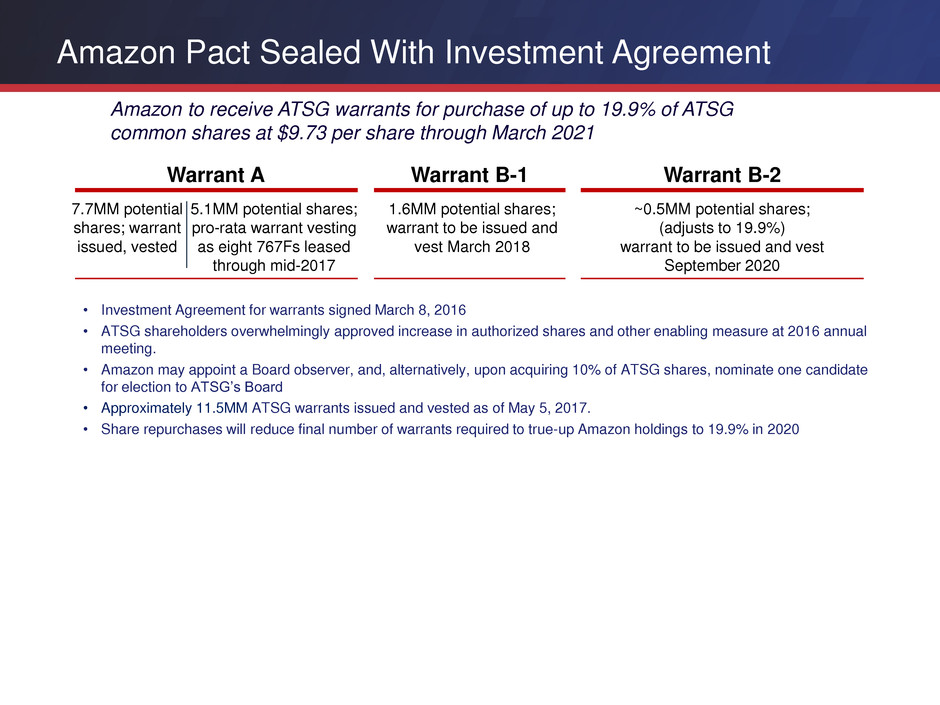

Amazon to receive ATSG warrants for purchase of up to 19.9% of ATSG

common shares at $9.73 per share through March 2021

Warrant A Warrant B-1

7.7MM potential

shares; warrant

issued, vested

1.6MM potential shares;

warrant to be issued and

vest March 2018

Warrant B-2

~0.5MM potential shares;

(adjusts to 19.9%)

warrant to be issued and vest

September 2020

5.1MM potential shares;

pro-rata warrant vesting

as eight 767Fs leased

through mid-2017

• Investment Agreement for warrants signed March 8, 2016

• ATSG shareholders overwhelmingly approved increase in authorized shares and other enabling measure at 2016 annual

meeting.

• Amazon may appoint a Board observer, and, alternatively, upon acquiring 10% of ATSG shares, nominate one candidate

for election to ATSG’s Board

• Approximately 11.5MM ATSG warrants issued and vested as of May 5, 2017.

• Share repurchases will reduce final number of warrants required to true-up Amazon holdings to 19.9% in 2020

Amazon Pact Sealed With Investment Agreement

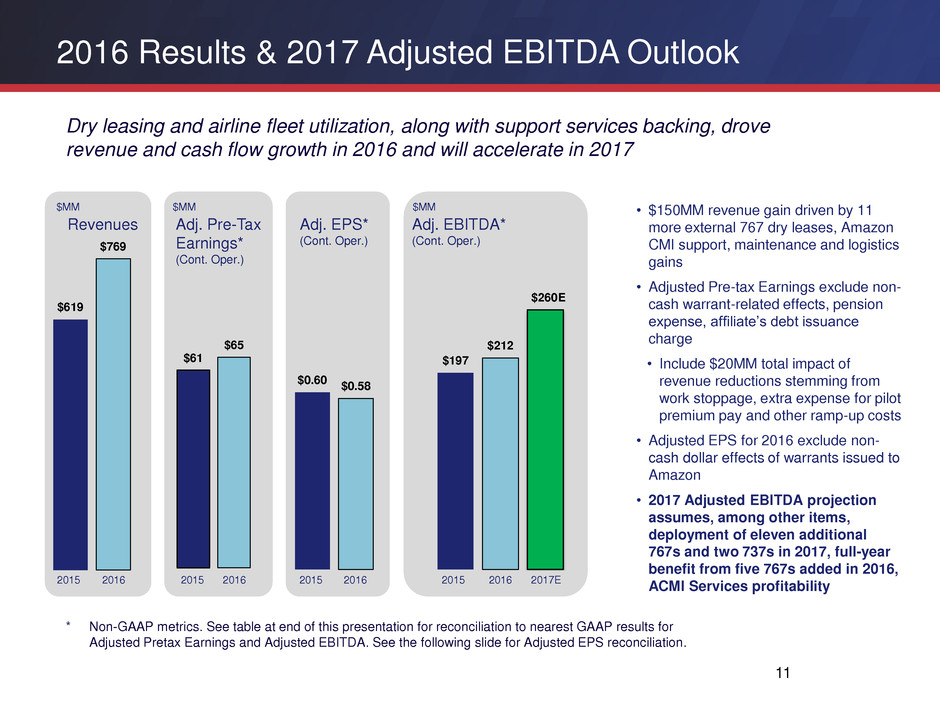

2016 Results & 2017 Adjusted EBITDA Outlook

11

• $150MM revenue gain driven by 11

more external 767 dry leases, Amazon

CMI support, maintenance and logistics

gains

• Adjusted Pre-tax Earnings exclude non-

cash warrant-related effects, pension

expense, affiliate’s debt issuance

charge

• Include $20MM total impact of

revenue reductions stemming from

work stoppage, extra expense for pilot

premium pay and other ramp-up costs

• Adjusted EPS for 2016 exclude non-

cash dollar effects of warrants issued to

Amazon

• 2017 Adjusted EBITDA projection

assumes, among other items,

deployment of eleven additional

767s and two 737s in 2017, full-year

benefit from five 767s added in 2016,

ACMI Services profitability

Dry leasing and airline fleet utilization, along with support services backing, drove

revenue and cash flow growth in 2016 and will accelerate in 2017

$619

$769

$61

$65

$0.60

$0.58

$197

$212

$260

Revenues Adj. Pre-Tax

Earnings*

(Cont. Oper.)

Adj. EPS*

(Cont. Oper.)

Adj. EBITDA*

(Cont. Oper.)

2015 2016 2015 2016 2015 2016 2015 2016

* Non-GAAP metrics. See table at end of this presentation for reconciliation to nearest GAAP results for

Adjusted Pretax Earnings and Adjusted EBITDA. See the following slide for Adjusted EPS reconciliation.

$MM $MM $MM

2017E

E

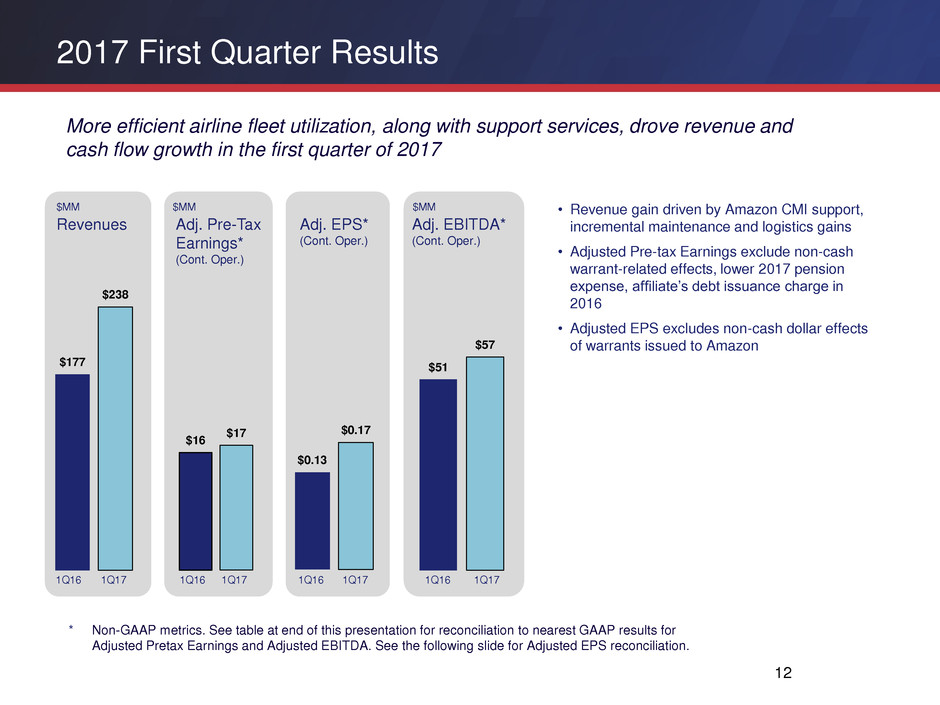

2017 First Quarter Results

12

• Revenue gain driven by Amazon CMI support,

incremental maintenance and logistics gains

• Adjusted Pre-tax Earnings exclude non-cash

warrant-related effects, lower 2017 pension

expense, affiliate’s debt issuance charge in

2016

• Adjusted EPS excludes non-cash dollar effects

of warrants issued to Amazon

More efficient airline fleet utilization, along with support services, drove revenue and

cash flow growth in the first quarter of 2017

$177

$238

$16

$17

$0.13

$0.17

$51

$57

Revenues Adj. Pre-Tax

Earnings*

(Cont. Oper.)

Adj. EPS*

(Cont. Oper.)

Adj. EBITDA*

(Cont. Oper.)

1Q16 1Q17 1Q16 1Q17 1Q16 1Q17 1Q16 1Q17

* Non-GAAP metrics. See table at end of this presentation for reconciliation to nearest GAAP results for

Adjusted Pretax Earnings and Adjusted EBITDA. See the following slide for Adjusted EPS reconciliation.

$MM $MM $MM

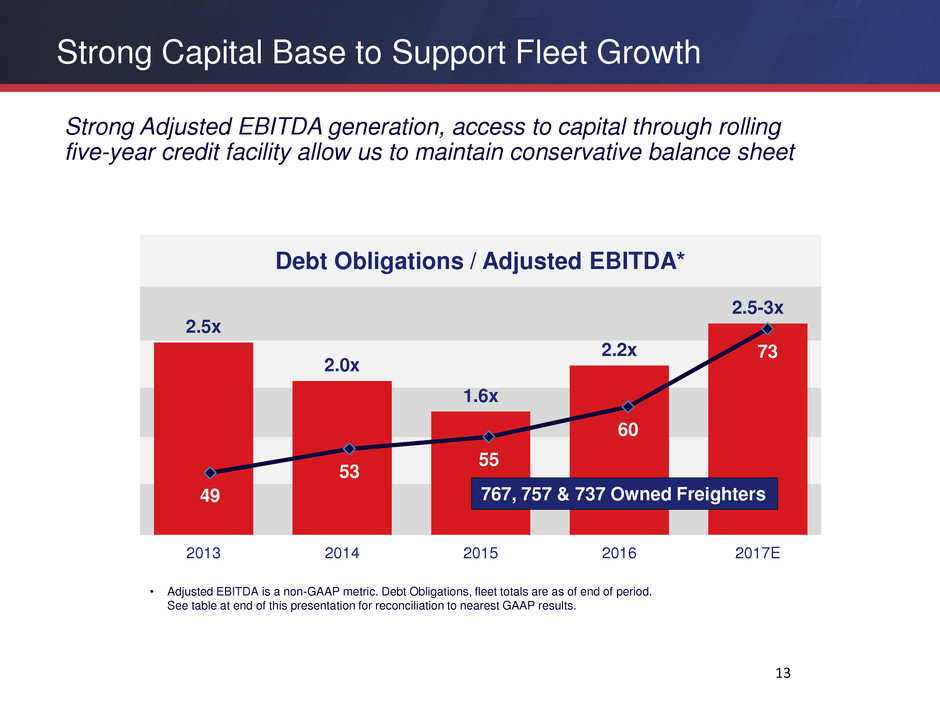

2.5x

2.0x

1.6x

2.2x

2.5-3x

2013 2014 2015 2016 2017E

Debt Obligations / Adjusted EBITDA*

49

53

55

60

73

Strong Capital Base to Support Fleet Growth

13

Strong Adjusted EBITDA generation, access to capital through rolling

five-year credit facility allow us to maintain conservative balance sheet

• Adjusted EBITDA is a non-GAAP metric. Debt Obligations, fleet totals are as of end of period.

See table at end of this presentation for reconciliation to nearest GAAP results.

767, 757 & 737 Owned Freighters

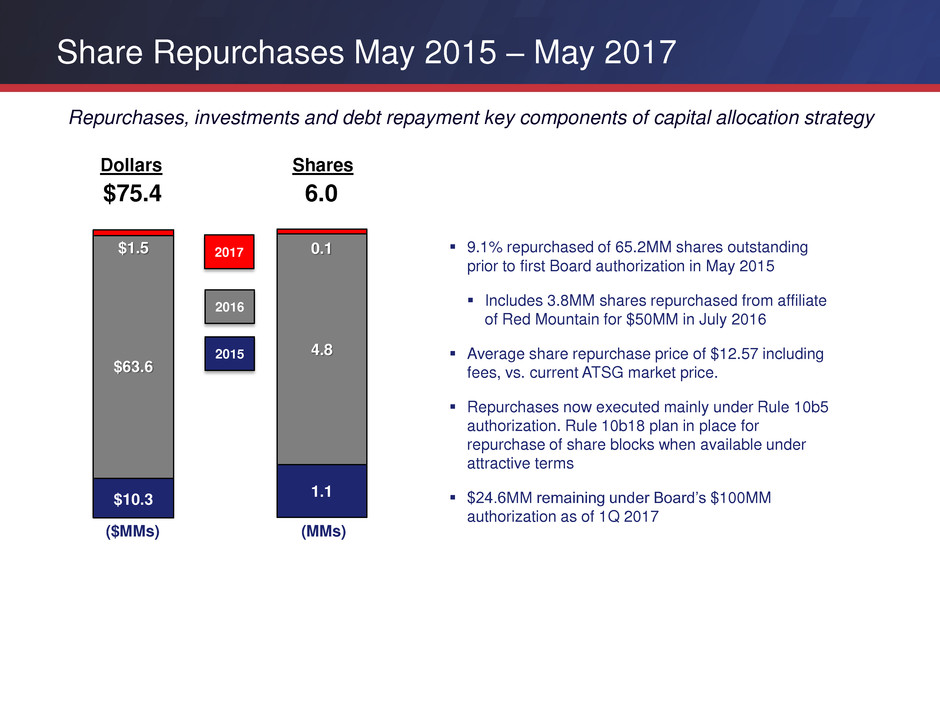

Share Repurchases May 2015 – May 2017

14

Repurchases, investments and debt repayment key components of capital allocation strategy

1.1

4.8

0.1

6.0

(MMs)

$10.3

$63.6

$1.5

$75.4

($MMs)

2016

2015

9.1% repurchased of 65.2MM shares outstanding

prior to first Board authorization in May 2015

Includes 3.8MM shares repurchased from affiliate

of Red Mountain for $50MM in July 2016

Average share repurchase price of $12.57 including

fees, vs. current ATSG market price.

Repurchases now executed mainly under Rule 10b5

authorization. Rule 10b18 plan in place for

repurchase of share blocks when available under

attractive terms

$24.6MM remaining under Board’s $100MM

authorization as of 1Q 2017

Dollars Shares

2017

Joe Hete

President & CEO

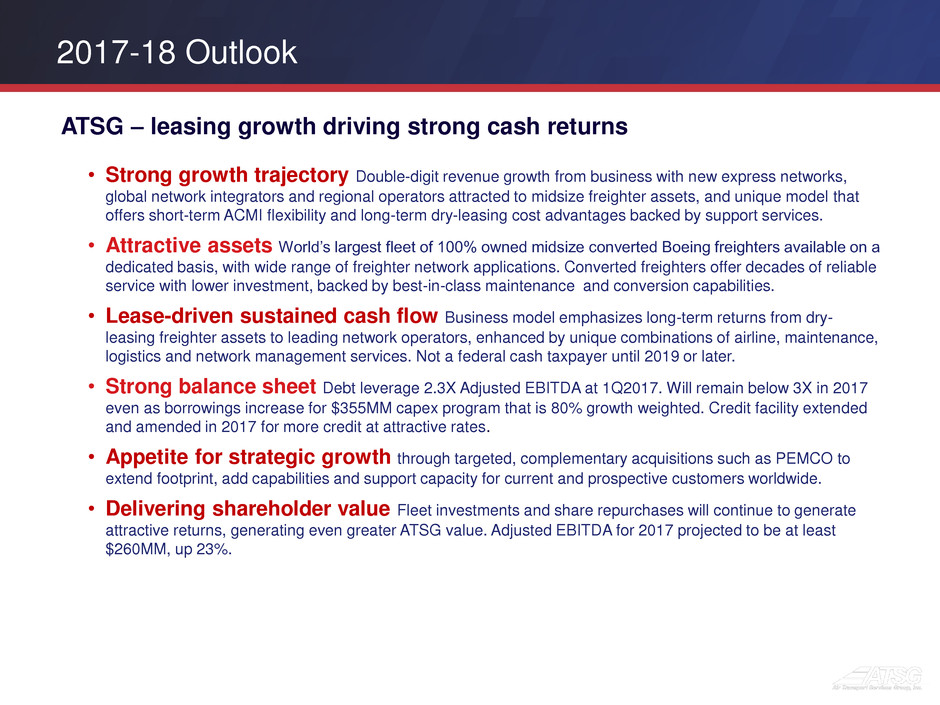

2017-18 Outlook

16

• Strong growth trajectory Double-digit revenue growth from business with new express networks,

global network integrators and regional operators attracted to midsize freighter assets, and unique model that

offers short-term ACMI flexibility and long-term dry-leasing cost advantages backed by support services.

• Attractive assets World’s largest fleet of 100% owned midsize converted Boeing freighters available on a

dedicated basis, with wide range of freighter network applications. Converted freighters offer decades of reliable

service with lower investment, backed by best-in-class maintenance and conversion capabilities.

• Lease-driven sustained cash flow Business model emphasizes long-term returns from dry-

leasing freighter assets to leading network operators, enhanced by unique combinations of airline, maintenance,

logistics and network management services. Not a federal cash taxpayer until 2019 or later.

• Strong balance sheet Debt leverage 2.3X Adjusted EBITDA at 1Q2017. Will remain below 3X in 2017

even as borrowings increase for $355MM capex program that is 80% growth weighted. Credit facility extended

and amended in 2017 for more credit at attractive rates.

• Appetite for strategic growth through targeted, complementary acquisitions such as PEMCO to

extend footprint, add capabilities and support capacity for current and prospective customers worldwide.

• Delivering shareholder value Fleet investments and share repurchases will continue to generate

attractive returns, generating even greater ATSG value. Adjusted EBITDA for 2017 projected to be at least

$260MM, up 23%.

ATSG – leasing growth driving strong cash returns

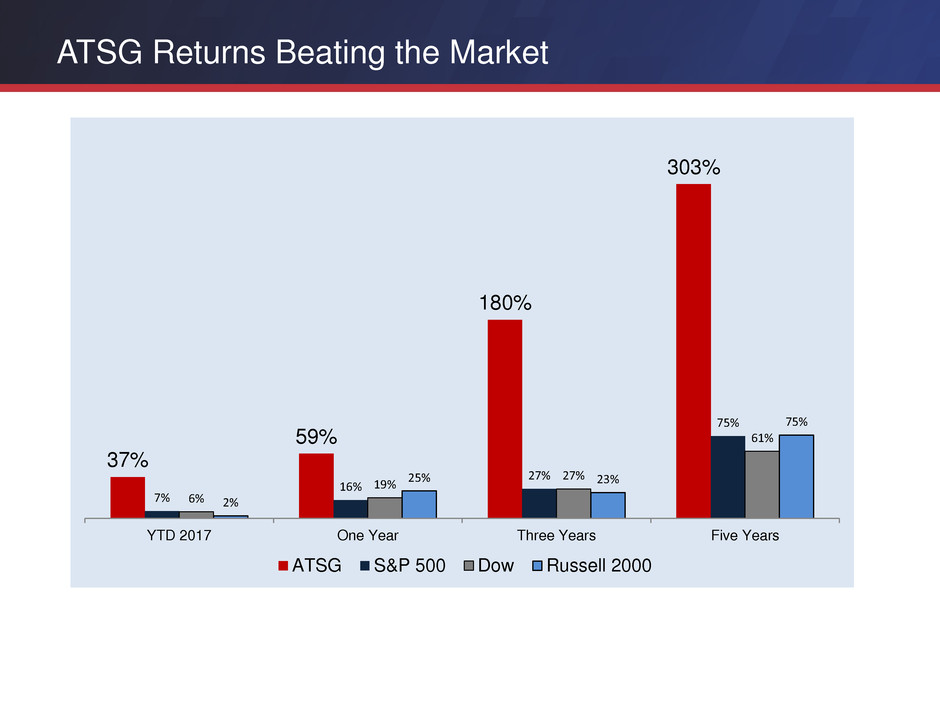

ATSG Returns Beating the Market

37%

59%

180%

303%

7%

16%

27%

75%

6%

19%

27%

61%

2%

25% 23%

75%

YTD 2017 One Year Three Years Five Years

ATSG S&P 500 Dow Russell 2000

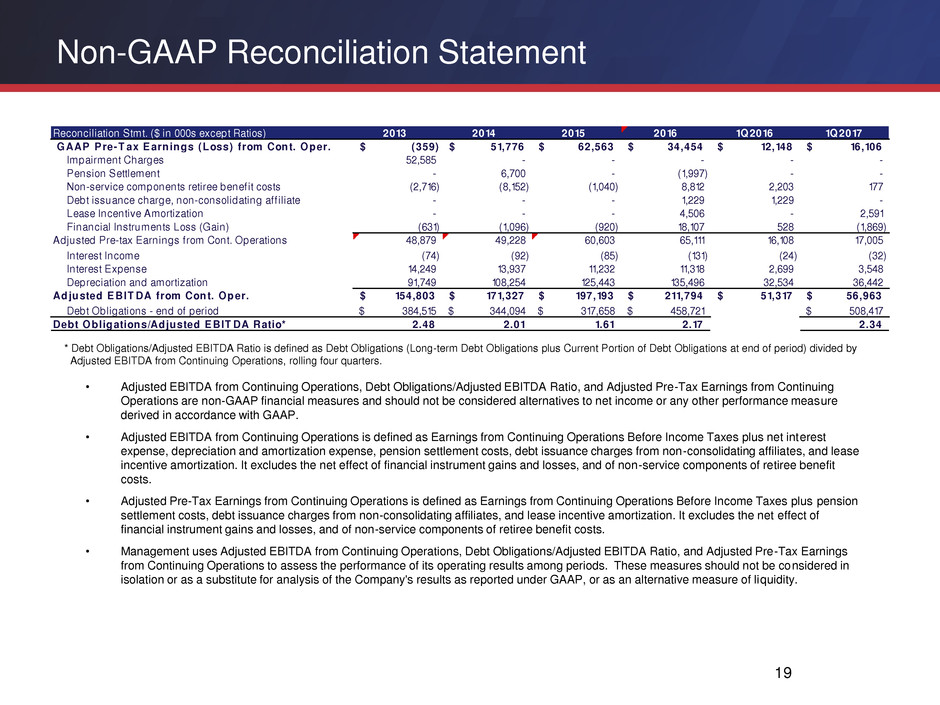

Non-GAAP Reconciliation Statement

19

• Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA Ratio, and Adjusted Pre-Tax Earnings from Continuing

Operations are non-GAAP financial measures and should not be considered alternatives to net income or any other performance measure

derived in accordance with GAAP.

• Adjusted EBITDA from Continuing Operations is defined as Earnings from Continuing Operations Before Income Taxes plus net interest

expense, depreciation and amortization expense, pension settlement costs, debt issuance charges from non-consolidating affiliates, and lease

incentive amortization. It excludes the net effect of financial instrument gains and losses, and of non-service components of retiree benefit

costs.

• Adjusted Pre-Tax Earnings from Continuing Operations is defined as Earnings from Continuing Operations Before Income Taxes plus pension

settlement costs, debt issuance charges from non-consolidating affiliates, and lease incentive amortization. It excludes the net effect of

financial instrument gains and losses, and of non-service components of retiree benefit costs.

• Management uses Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA Ratio, and Adjusted Pre-Tax Earnings

from Continuing Operations to assess the performance of its operating results among periods. These measures should not be considered in

isolation or as a substitute for analysis of the Company's results as reported under GAAP, or as an alternative measure of liquidity.

2013 2014 2015 2016 1Q2016 1Q2017

(359)$ 51,776$ 62,563$ 34,454$ 12,148$ 16,106$

Impairment Charges 52,585 - - - - -

Pension Settlement - 6,700 - (1,997) - -

Non-service components retiree benefit costs (2,716) (8,152) (1,040) 8,812 2,203 177

Debt issuance charge, non-consolidating aff iliate - - - 1,229 1,229 -

Lease Incentive Amortization - - - 4,506 - 2,591

Financial Instruments Loss (Gain) (631) (1,096) (920) 18,107 528 (1,869)

48,879 49,228 60,603 65,111 16,108 17,005

Interest Income (74) (92) (85) (131) (24) (32)

Interest Expense 14,249 13,937 11,232 11,318 2,699 3,548

Depreciation and amortization 91,749 108,254 125,443 135,496 32,534 36,442

154,803$ 171,327$ 197,193$ 211,794$ 51,317$ 56,963$

384,515$ 344,094$ 317,658$ 458,721$ 508,417$

2.48 2.01 1.61 2.17 2.34

Reconciliation Stmt. ($ in 000s except Ratios)

Debt Obligations/Adjusted E BIT DA Ratio*

GAAP P re-T ax E arnings (Loss) f rom Cont. Oper.

Adjusted E BIT DA from Cont. Oper.

Debt Obligations - end of period

Adjusted Pre-tax Earnings from Cont. Operations

* Debt Obligations/Adjusted EBITDA Ratio is defined as Debt Obligations (Long-term Debt Obligations plus Current Portion of Debt Obligations at end of period) divided by

Adjusted EBITDA from Continuing Operations, rolling four quarters.

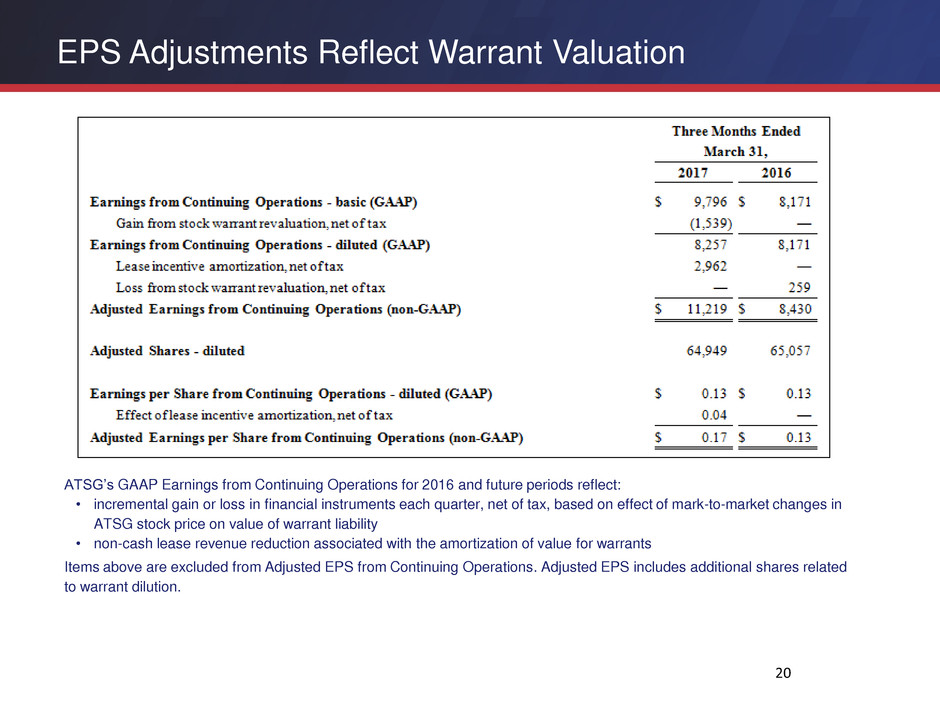

EPS Adjustments Reflect Warrant Valuation

20

ATSG’s GAAP Earnings from Continuing Operations for 2016 and future periods reflect:

• incremental gain or loss in financial instruments each quarter, net of tax, based on effect of mark-to-market changes in

ATSG stock price on value of warrant liability

• non-cash lease revenue reduction associated with the amortization of value for warrants

Items above are excluded from Adjusted EPS from Continuing Operations. Adjusted EPS includes additional shares related

to warrant dilution.