Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TELLURIAN INC. /DE/ | d390940d8k.htm |

Corporate presentation May 2017 Exhibit 99.1

Cautionary statement

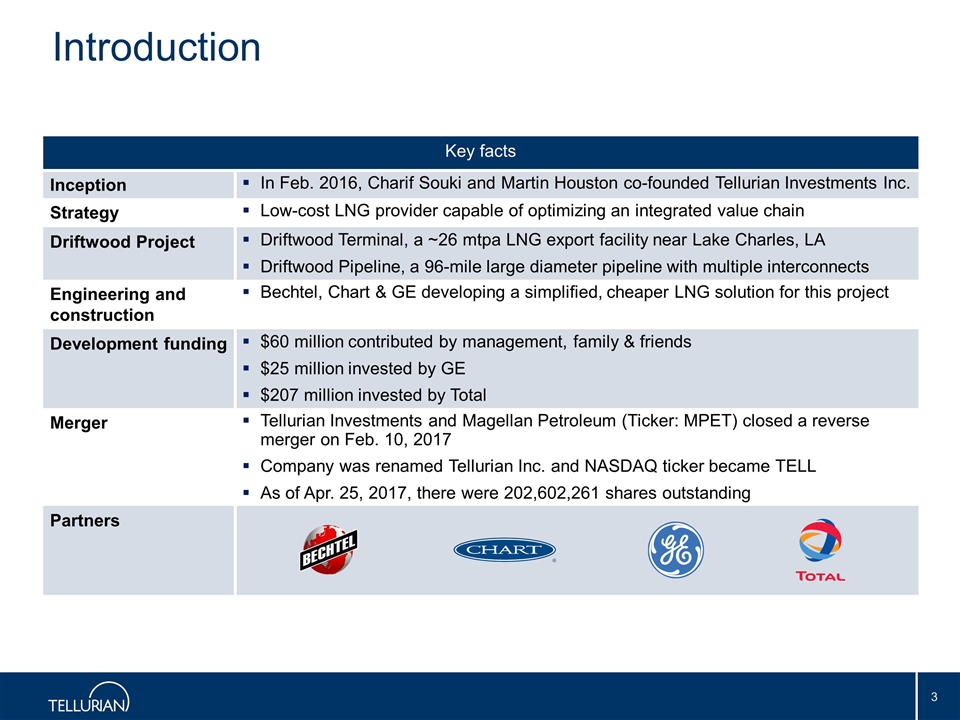

Introduction Key facts Inception In Feb. 2016, Charif Souki and Martin Houston co-founded Tellurian Investments Inc. Strategy Low-cost LNG provider capable of optimizing an integrated value chain Driftwood Project Driftwood Terminal, a ~26 mtpa LNG export facility near Lake Charles, LA Driftwood Pipeline, a 96-mile large diameter pipeline with multiple interconnects Engineering and construction Bechtel, Chart & GE developing a simplified, cheaper LNG solution for this project Development funding $60 million contributed by management, family & friends $25 million invested by GE $207 million invested by Total Merger Tellurian Investments and Magellan Petroleum (Ticker: MPET) closed a reverse merger on Feb. 10, 2017 Company was renamed Tellurian Inc. and NASDAQ ticker became TELL As of Apr. 25, 2017, there were 202,602,261 shares outstanding Partners

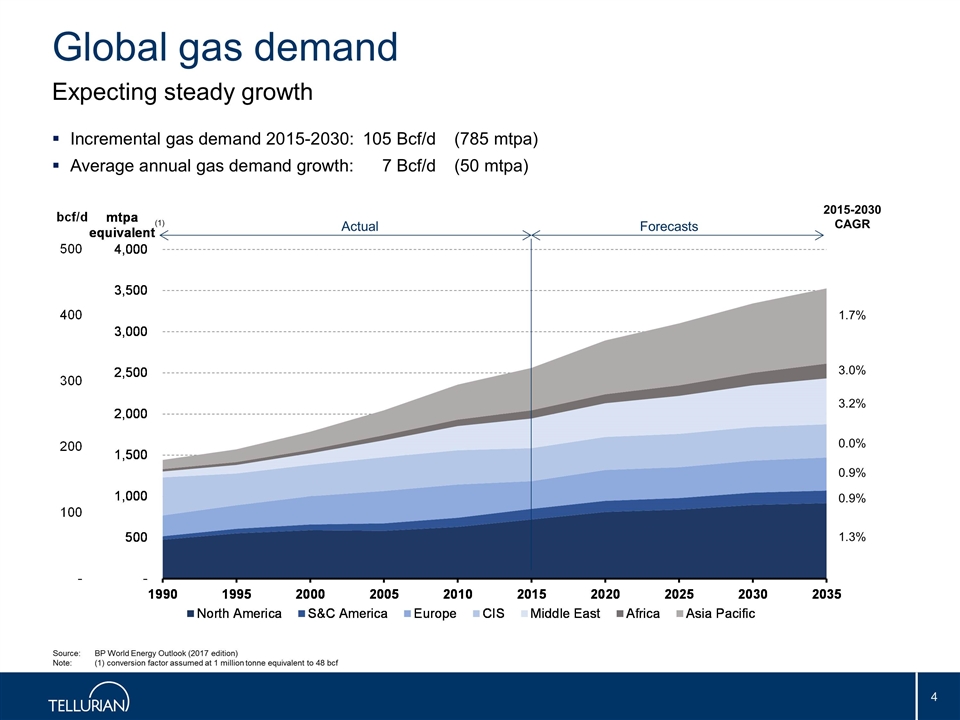

Global gas demand Expecting steady growth Source:BP World Energy Outlook (2017 edition) Note:(1) conversion factor assumed at 1 million tonne equivalent to 48 bcf Incremental gas demand 2015-2030:105 Bcf/d(785 mtpa) Average annual gas demand growth:7 Bcf/d(50 mtpa) 2015-2030 CAGR 1.7% 3.0% 3.2% 0.0% 0.9% 0.9% 1.3% (1) Actual Forecasts

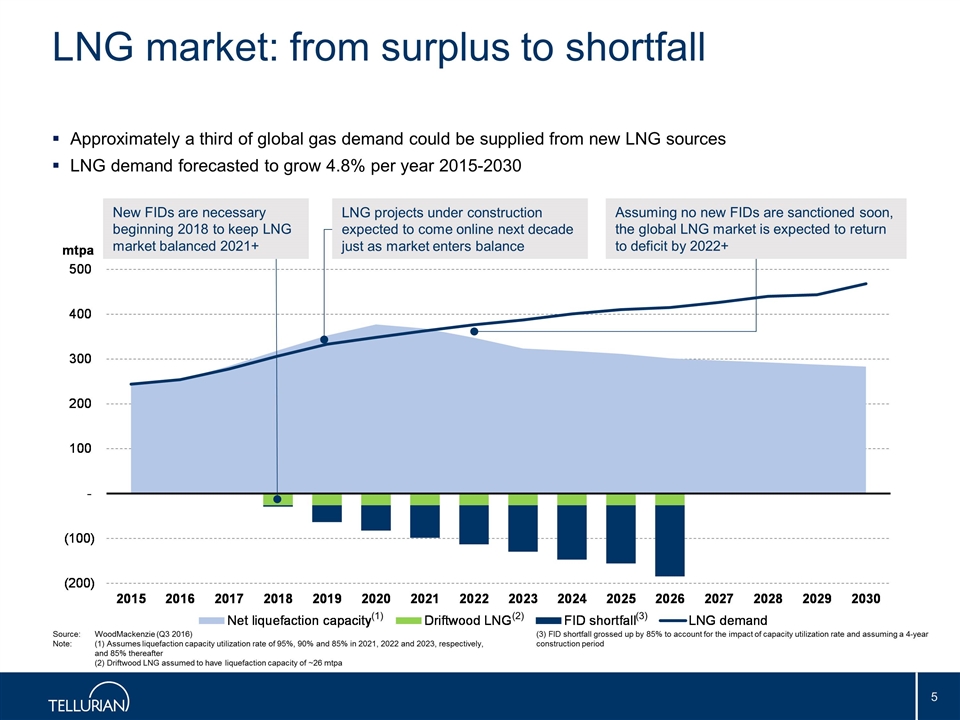

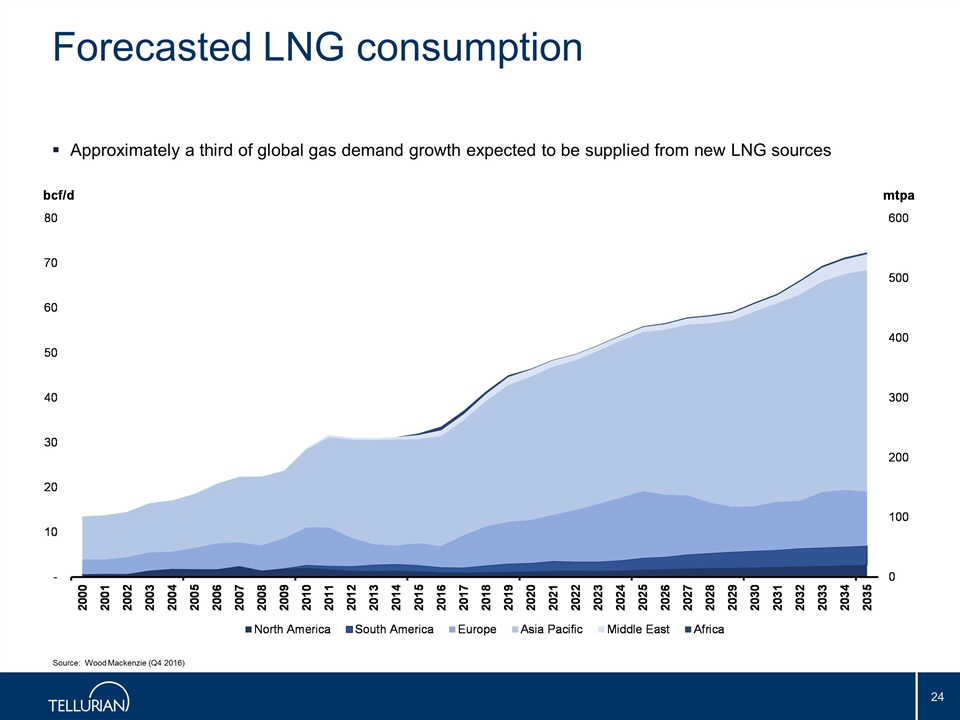

LNG market: from surplus to shortfall Source:WoodMackenzie (Q3 2016) Note:(1) Assumes liquefaction capacity utilization rate of 95%, 90% and 85% in 2021, 2022 and 2023, respectively, and 85% thereafter (2) Driftwood LNG assumed to have liquefaction capacity of ~26 mtpa (3) FID shortfall grossed up by 85% to account for the impact of capacity utilization rate and assuming a 4-year construction period Assuming no new FIDs are sanctioned soon, the global LNG market is expected to return to deficit by 2022+ New FIDs are necessary beginning 2018 to keep LNG market balanced 2021+ LNG projects under construction expected to come online next decade just as market enters balance Approximately a third of global gas demand could be supplied from new LNG sources LNG demand forecasted to grow 4.8% per year 2015-2030 (1) (2) (3)

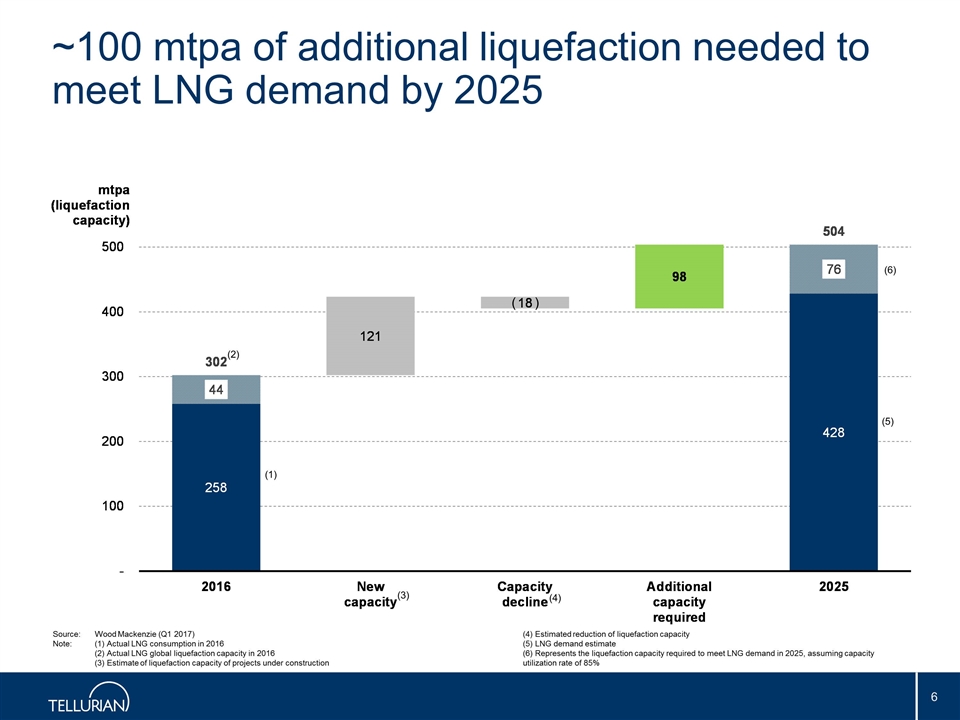

~100 mtpa of additional liquefaction needed to meet LNG demand by 2025 Source:Wood Mackenzie (Q1 2017) Note:(1) Actual LNG consumption in 2016 (2) Actual LNG global liquefaction capacity in 2016 (3) Estimate of liquefaction capacity of projects under construction (4) Estimated reduction of liquefaction capacity (5) LNG demand estimate (6) Represents the liquefaction capacity required to meet LNG demand in 2025, assuming capacity utilization rate of 85% (2) (6) ( ) (4) (1) (5) (3)

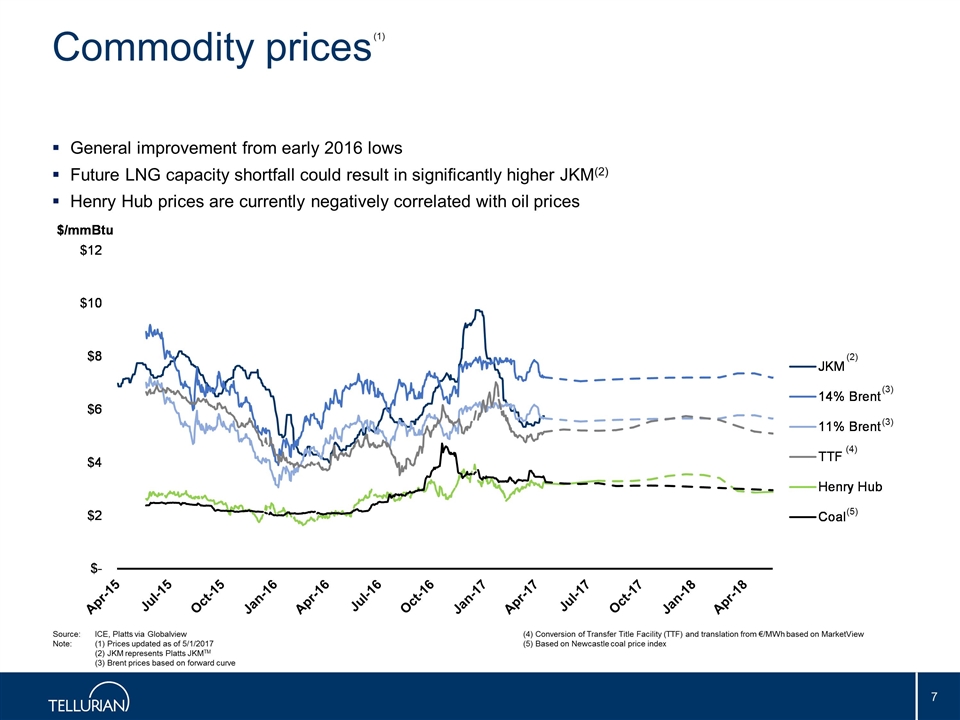

Commodity prices Source:ICE, Platts via Globalview Note:(1) Prices updated as of 5/1/2017 (2) JKM represents Platts JKMTM (3) Brent prices based on forward curve (4) Conversion of Transfer Title Facility (TTF) and translation from €/MWh based on MarketView (5) Based on Newcastle coal price index (3) (3) General improvement from early 2016 lows Future LNG capacity shortfall could result in significantly higher JKM(2) Henry Hub prices are currently negatively correlated with oil prices (1) (4) (2) (5)

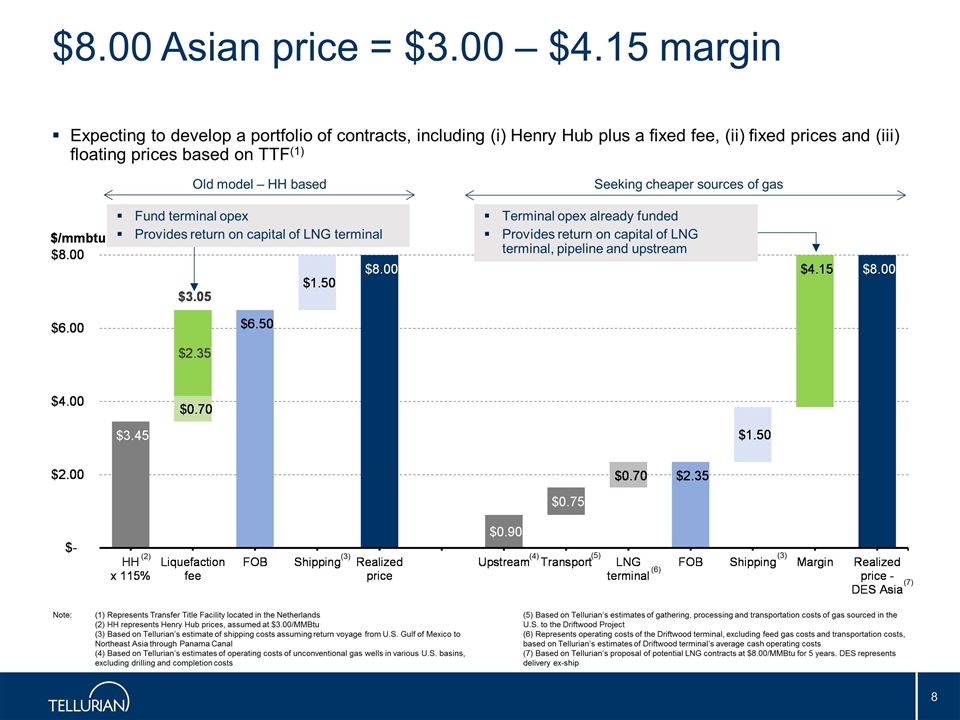

$8.00 Asian price = $3.00 – $4.15 margin Note:(1) Represents Transfer Title Facility located in the Netherlands (2) HH represents Henry Hub prices, assumed at $3.00/MMBtu (3) Based on Tellurian’s estimate of shipping costs assuming return voyage from U.S. Gulf of Mexico to Northeast Asia through Panama Canal (4) Based on Tellurian’s estimates of operating costs of unconventional gas wells in various U.S. basins, excluding drilling and completion costs (5) Based on Tellurian’s estimates of gathering, processing and transportation costs of gas sourced in the U.S. to the Driftwood Project (6) Represents operating costs of the Driftwood terminal, excluding feed gas costs and transportation costs, based on Tellurian’s estimates of Driftwood terminal’s average cash operating costs (7) Based on Tellurian’s proposal of potential LNG contracts at $8.00/MMBtu for 5 years. DES represents delivery ex-ship Old model – HH based Seeking cheaper sources of gas Terminal opex already funded Provides return on capital of LNG terminal, pipeline and upstream Fund terminal opex Provides return on capital of LNG terminal (2) (3) (3) (4) (5) (6) (7) Expecting to develop a portfolio of contracts, including (i) Henry Hub plus a fixed fee, (ii) fixed prices and (iii) floating prices based on TTF(1)

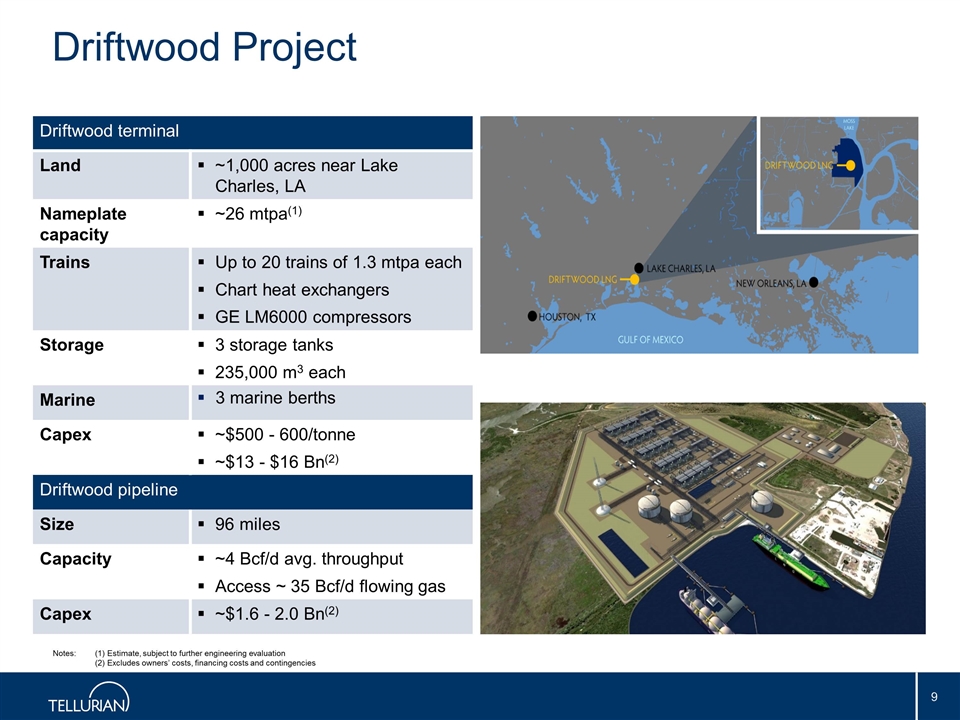

Driftwood Project Notes:(1) Estimate, subject to further engineering evaluation (2) Excludes owners’ costs, financing costs and contingencies Driftwood terminal Land ~1,000 acres near Lake Charles, LA Nameplate capacity ~26 mtpa(1) Trains Up to 20 trains of 1.3 mtpa each Chart heat exchangers GE LM6000 compressors Storage 3 storage tanks 235,000 m3 each Marine 3 marine berths Capex ~$500 - 600/tonne ~$13 - $16 Bn(2) Driftwood pipeline Size 96 miles Capacity ~4 Bcf/d avg. throughput Access ~ 35 Bcf/d flowing gas Capex ~$1.6 - 2.0 Bn(2)

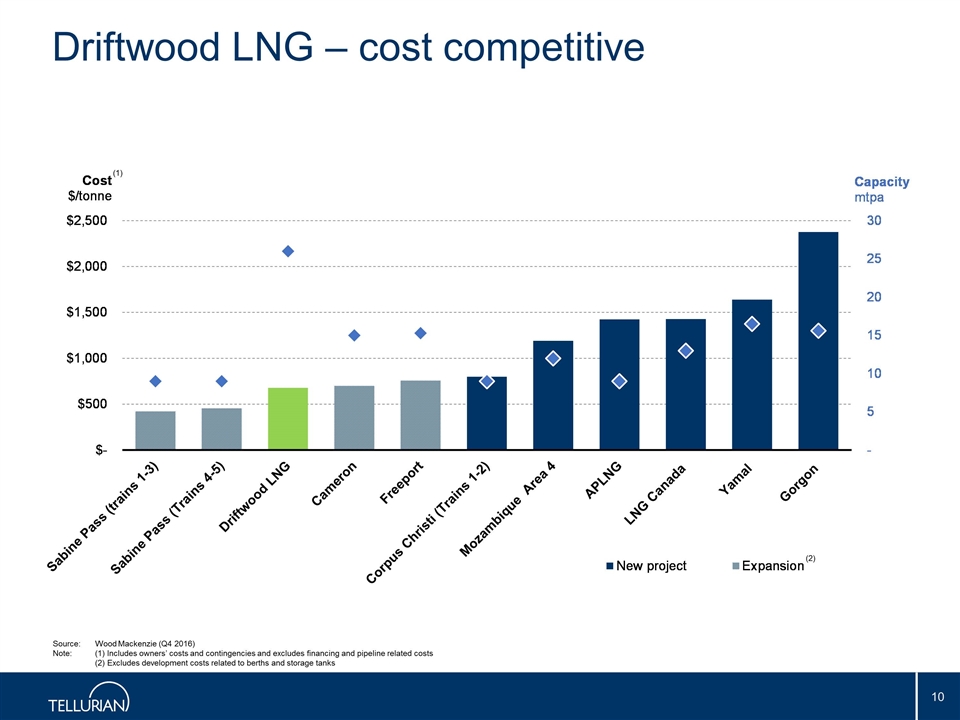

Driftwood LNG – cost competitive Source:Wood Mackenzie (Q4 2016) Note:(1) Includes owners’ costs and contingencies and excludes financing and pipeline related costs (2) Excludes development costs related to berths and storage tanks (2) (1)

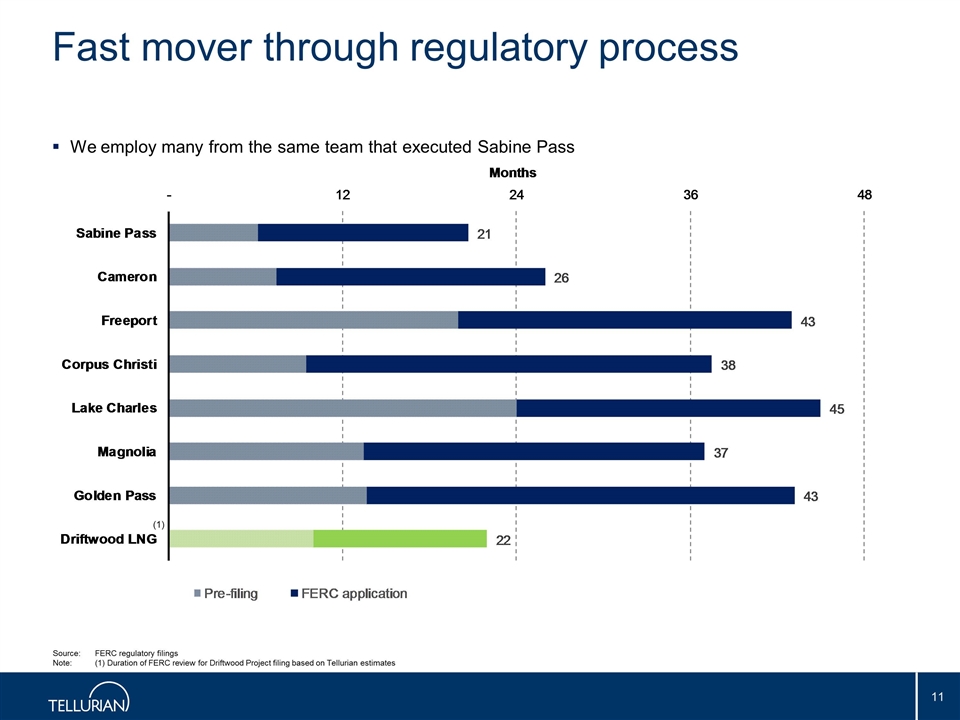

Fast mover through regulatory process Source: FERC regulatory filings Note:(1) Duration of FERC review for Driftwood Project filing based on Tellurian estimates (1) We employ many from the same team that executed Sabine Pass

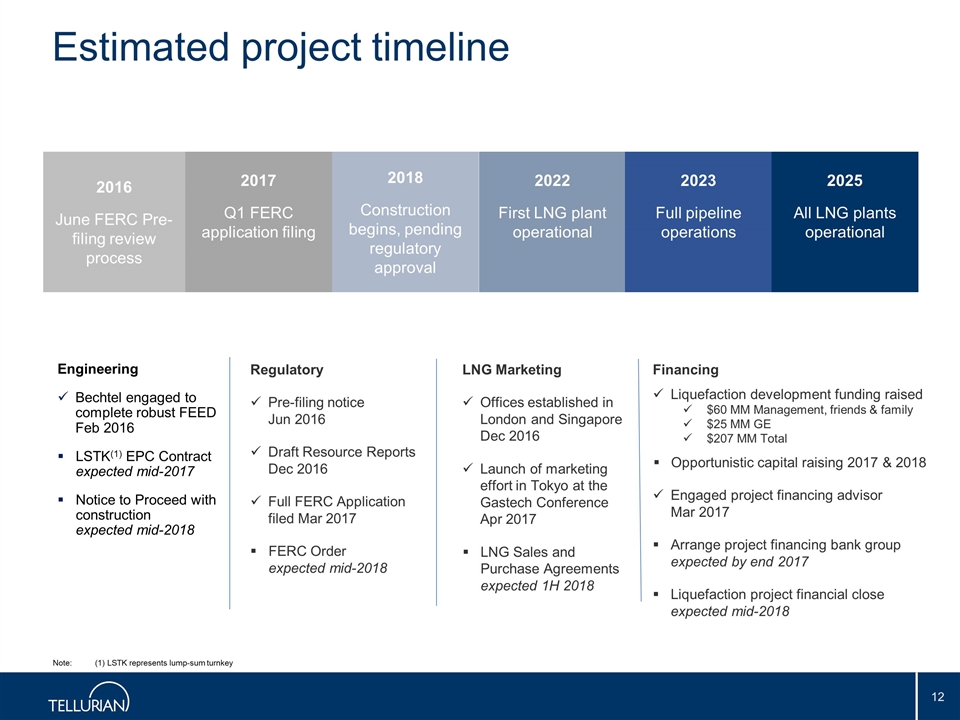

2016 June FERC Pre-filing review process Estimated project timeline 2018 Construction begins, pending regulatory approval 2022 First LNG plant operational 2023 Full pipeline operations 2017 Q1 FERC application filing 2025 All LNG plants operational Note:(1) LSTK represents lump-sum turnkey Engineering Bechtel engaged to complete robust FEED Feb 2016 LSTK(1) EPC Contract expected mid-2017 Notice to Proceed with construction expected mid-2018 Regulatory Pre-filing notice Jun 2016 Draft Resource Reports Dec 2016 Full FERC Application filed Mar 2017 FERC Order expected mid-2018 LNG Marketing Offices established in London and Singapore Dec 2016 Launch of marketing effort in Tokyo at the Gastech Conference Apr 2017 LNG Sales and Purchase Agreements expected 1H 2018 Financing Liquefaction development funding raised $60 MM Management, friends & family $25 MM GE $207 MM Total Opportunistic capital raising 2017 & 2018 Engaged project financing advisor Mar 2017 Arrange project financing bank group expected by end 2017 Liquefaction project financial close expected mid-2018

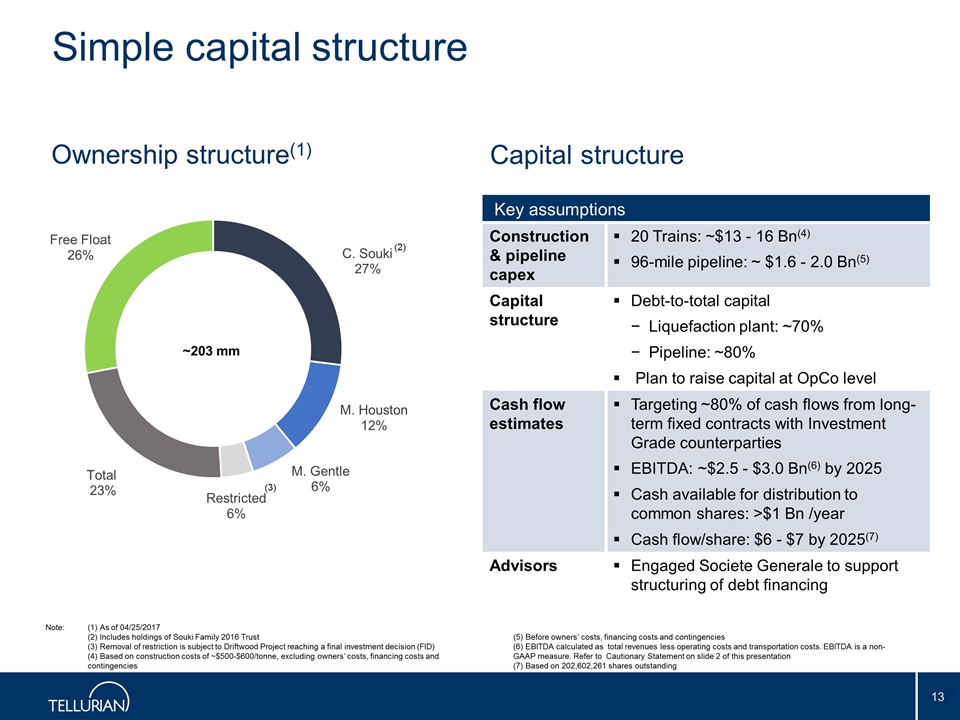

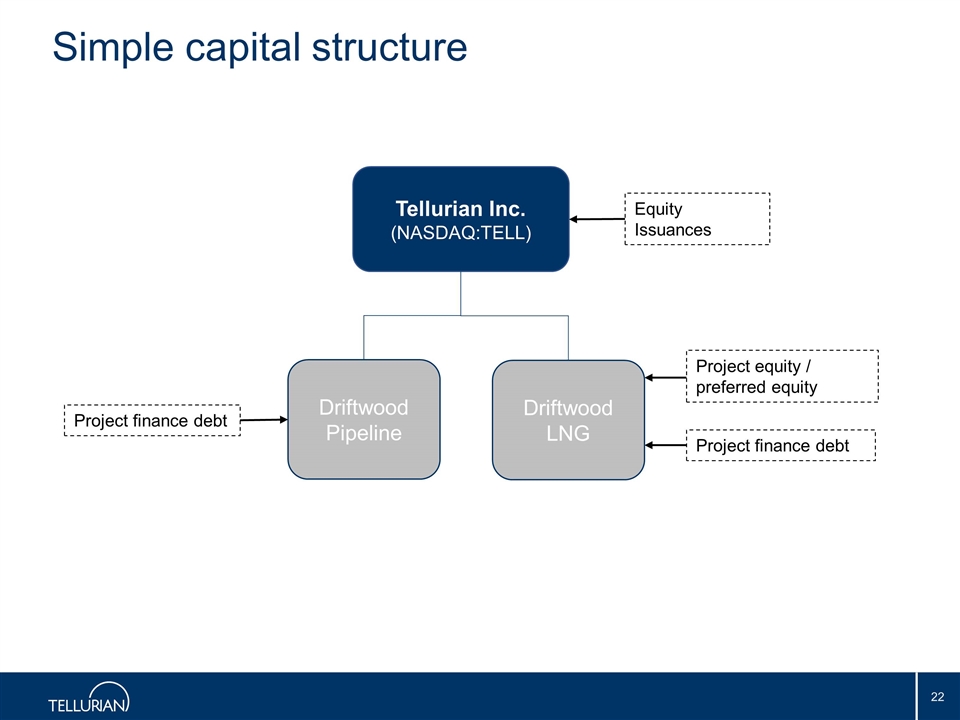

Simple capital structure Capital structure Note:(1) As of 04/25/2017 (2) Includes holdings of Souki Family 2016 Trust (3) Removal of restriction is subject to Driftwood Project reaching a final investment decision (FID) (4) Based on construction costs of ~$500-$600/tonne, excluding owners’ costs, financing costs and contingencies (5) Before owners’ costs, financing costs and contingencies (6) EBITDA calculated as total revenues less operating costs and transportation costs. EBITDA is a non-GAAP measure. Refer to Cautionary Statement on slide 2 of this presentation (7) Based on 202,602,261 shares outstanding Ownership structure(1) (2) Key assumptions Construction & pipeline capex 20 Trains: ~$13 - 16 Bn(4) 96-mile pipeline: ~ $1.6 - 2.0 Bn(5) Capital structure Debt-to-total capital Liquefaction plant: ~70% Pipeline: ~80% Plan to raise capital at OpCo level Cash flow estimates Targeting ~80% of cash flows from long-term fixed contracts with Investment Grade counterparties EBITDA: ~$2.5 - $3.0 Bn(6) by 2025 Cash available for distribution to common shares: >$1 Bn /year Cash flow/share: $6 - $7 by 2025(7) Advisors Engaged Societe Generale to support structuring of debt financing (3) C. Souki 27% M. Houston 12% M. Gentle 6% Restricted 6% Total 23% Free Float 26% ~203 mm

We aim to create value and help improve air quality by delivering clean, low-cost, flexible and reliable liquefied natural gas to growing markets(1) We are building a natural gas business that includes ~26 mtpa of production from the Driftwood Project, trading of LNG cargoes and development of new markets globally(1) Our strategy is to: Secure low-cost natural gas Design and construct low-cost liquefaction Deliver reliable and flexible LNG to a portfolio of customers globally Operate our business safely, efficiently and reliably Strategy Note:(1) Assumes successful execution of our strategy and is subject to risks. Refer to Cautionary Statement on slide 2 of this presentation

Driftwood Project illustration

Amit Marwaha Director, Investor Relations & Finance +1.832-485-2004 amit.marwaha@tellurianinc.com David Castaneda Investor Relations +1.414-351-9758 dcastaneda@mdcgroup.com Contact us Joi Lecznar SVP, Public Affairs and Communication +1.832-962-4044 joi.lecznar@tellurianinc.com

Appendix

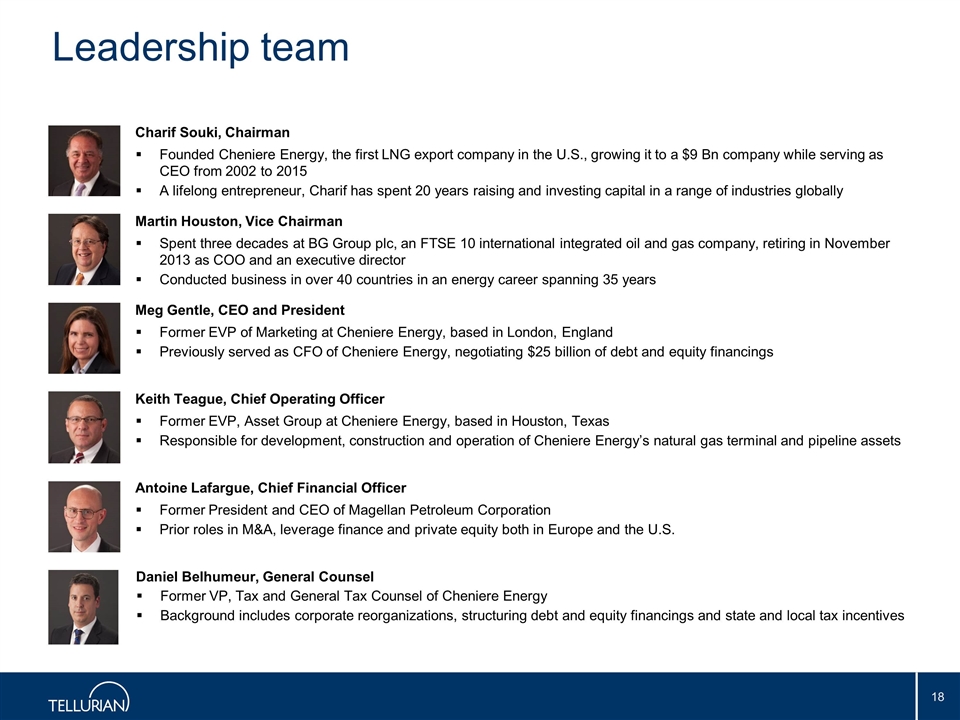

Leadership team Charif Souki, Chairman Founded Cheniere Energy, the first LNG export company in the U.S., growing it to a $9 Bn company while serving as CEO from 2002 to 2015 A lifelong entrepreneur, Charif has spent 20 years raising and investing capital in a range of industries globally Martin Houston, Vice Chairman Spent three decades at BG Group plc, an FTSE 10 international integrated oil and gas company, retiring in November 2013 as COO and an executive director Conducted business in over 40 countries in an energy career spanning 35 years Meg Gentle, CEO and President Former EVP of Marketing at Cheniere Energy, based in London, England Previously served as CFO of Cheniere Energy, negotiating $25 billion of debt and equity financings Keith Teague, Chief Operating Officer Former EVP, Asset Group at Cheniere Energy, based in Houston, Texas Responsible for development, construction and operation of Cheniere Energy’s natural gas terminal and pipeline assets Antoine Lafargue, Chief Financial Officer Former President and CEO of Magellan Petroleum Corporation Prior roles in M&A, leverage finance and private equity both in Europe and the U.S. Daniel Belhumeur, General Counsel Former VP, Tax and General Tax Counsel of Cheniere Energy Background includes corporate reorganizations, structuring debt and equity financings and state and local tax incentives

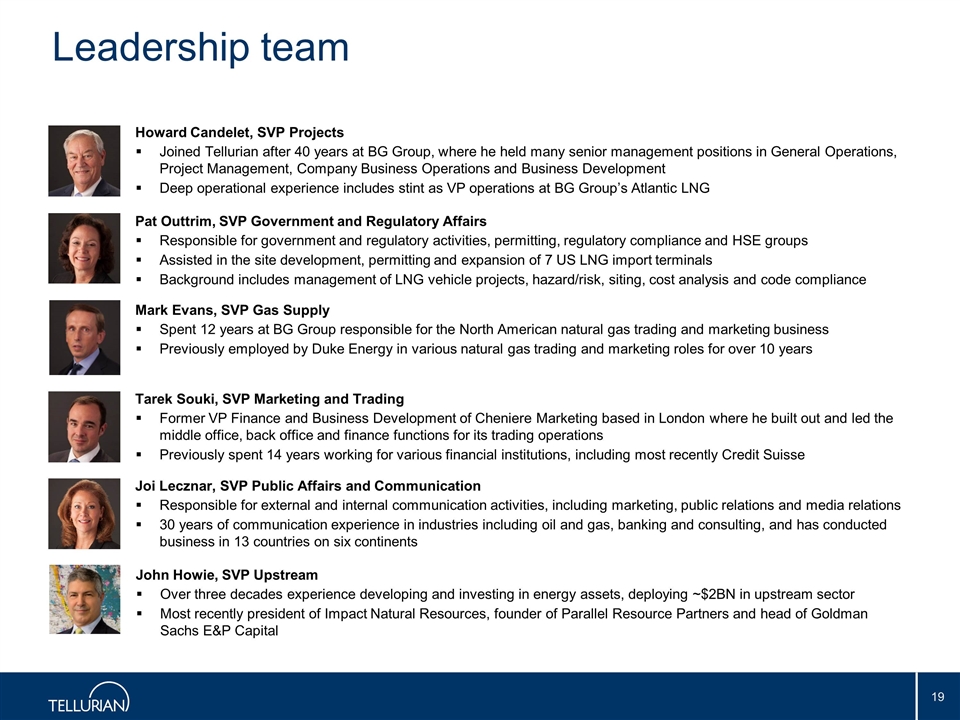

Leadership team Howard Candelet, SVP Projects Joined Tellurian after 40 years at BG Group, where he held many senior management positions in General Operations, Project Management, Company Business Operations and Business Development Deep operational experience includes stint as VP operations at BG Group’s Atlantic LNG Pat Outtrim, SVP Government and Regulatory Affairs Responsible for government and regulatory activities, permitting, regulatory compliance and HSE groups Assisted in the site development, permitting and expansion of 7 US LNG import terminals Background includes management of LNG vehicle projects, hazard/risk, siting, cost analysis and code compliance Mark Evans, SVP Gas Supply Spent 12 years at BG Group responsible for the North American natural gas trading and marketing business Previously employed by Duke Energy in various natural gas trading and marketing roles for over 10 years Tarek Souki, SVP Marketing and Trading Former VP Finance and Business Development of Cheniere Marketing based in London where he built out and led the middle office, back office and finance functions for its trading operations Previously spent 14 years working for various financial institutions, including most recently Credit Suisse Joi Lecznar, SVP Public Affairs and Communication Responsible for external and internal communication activities, including marketing, public relations and media relations 30 years of communication experience in industries including oil and gas, banking and consulting, and has conducted business in 13 countries on six continents John Howie, SVP Upstream Over three decades experience developing and investing in energy assets, deploying ~$2BN in upstream sector Most recently president of Impact Natural Resources, founder of Parallel Resource Partners and head of Goldman Sachs E&P Capital

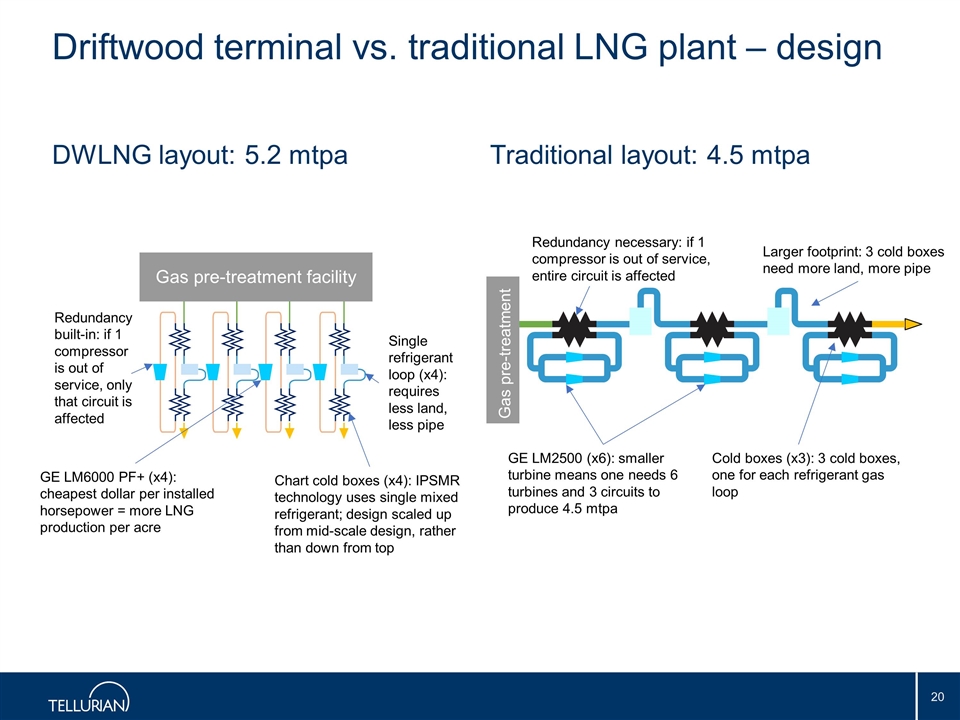

Driftwood terminal vs. traditional LNG plant – design DWLNG layout: 5.2 mtpa Traditional layout: 4.5 mtpa GE LM6000 PF+ (x4): cheapest dollar per installed horsepower = more LNG production per acre Gas pre-treatment facility Chart cold boxes (x4): IPSMR technology uses single mixed refrigerant; design scaled up from mid-scale design, rather than down from top Cold boxes (x3): 3 cold boxes, one for each refrigerant gas loop GE LM2500 (x6): smaller turbine means one needs 6 turbines and 3 circuits to produce 4.5 mtpa Gas pre-treatment Single refrigerant loop (x4): requires less land, less pipe Redundancy built-in: if 1 compressor is out of service, only that circuit is affected Larger footprint: 3 cold boxes need more land, more pipe Redundancy necessary: if 1 compressor is out of service, entire circuit is affected

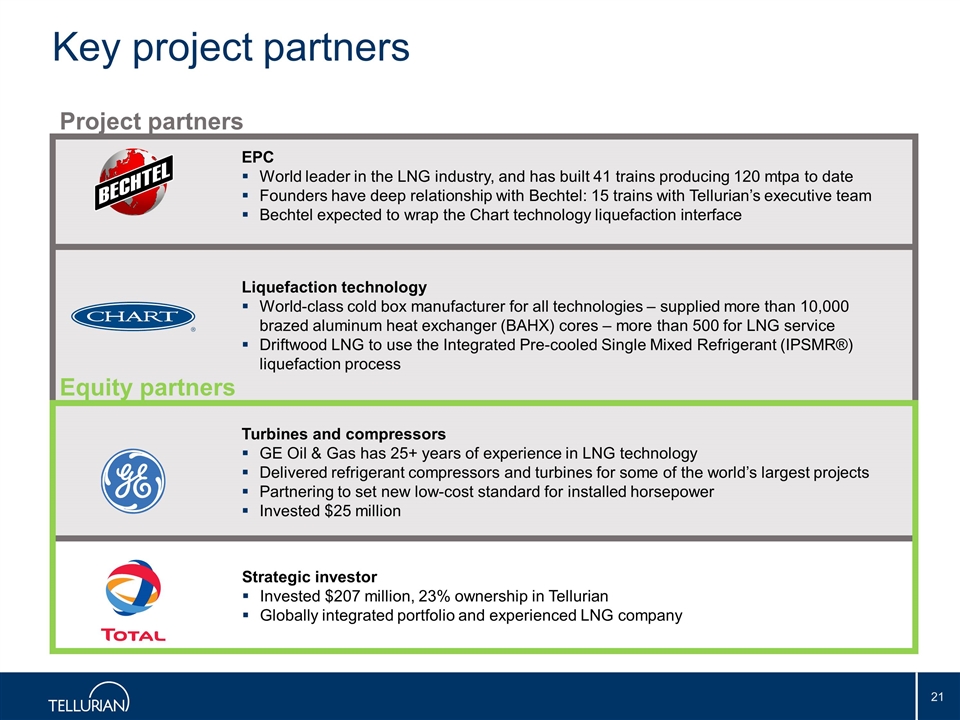

Key project partners Liquefaction technology World-class cold box manufacturer for all technologies – supplied more than 10,000 brazed aluminum heat exchanger (BAHX) cores – more than 500 for LNG service Driftwood LNG to use the Integrated Pre-cooled Single Mixed Refrigerant (IPSMR®) liquefaction process Turbines and compressors GE Oil & Gas has 25+ years of experience in LNG technology Delivered refrigerant compressors and turbines for some of the world’s largest projects Partnering to set new low-cost standard for installed horsepower Invested $25 million Equity partners Strategic investor Invested $207 million, 23% ownership in Tellurian Globally integrated portfolio and experienced LNG company EPC World leader in the LNG industry, and has built 41 trains producing 120 mtpa to date Founders have deep relationship with Bechtel: 15 trains with Tellurian’s executive team Bechtel expected to wrap the Chart technology liquefaction interface Project partners

Simple capital structure Tellurian Inc. (NASDAQ:TELL) Equity Issuances Driftwood Pipeline Project finance debt Project equity / preferred equity Project finance debt Driftwood LNG

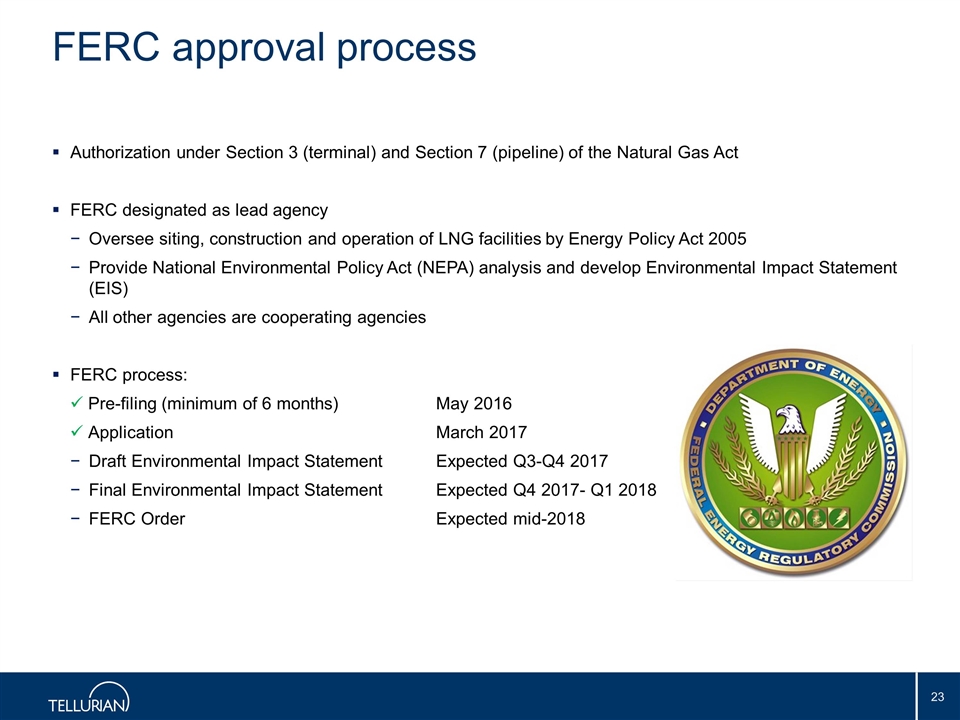

Authorization under Section 3 (terminal) and Section 7 (pipeline) of the Natural Gas Act FERC designated as lead agency Oversee siting, construction and operation of LNG facilities by Energy Policy Act 2005 Provide National Environmental Policy Act (NEPA) analysis and develop Environmental Impact Statement (EIS) All other agencies are cooperating agencies FERC process: Pre-filing (minimum of 6 months)May 2016 ApplicationMarch 2017 Draft Environmental Impact StatementExpected Q3-Q4 2017 Final Environmental Impact StatementExpected Q4 2017- Q1 2018 FERC OrderExpected mid-2018 FERC approval process

Forecasted LNG consumption Source: Wood Mackenzie (Q4 2016) Approximately a third of global gas demand growth expected to be supplied from new LNG sources

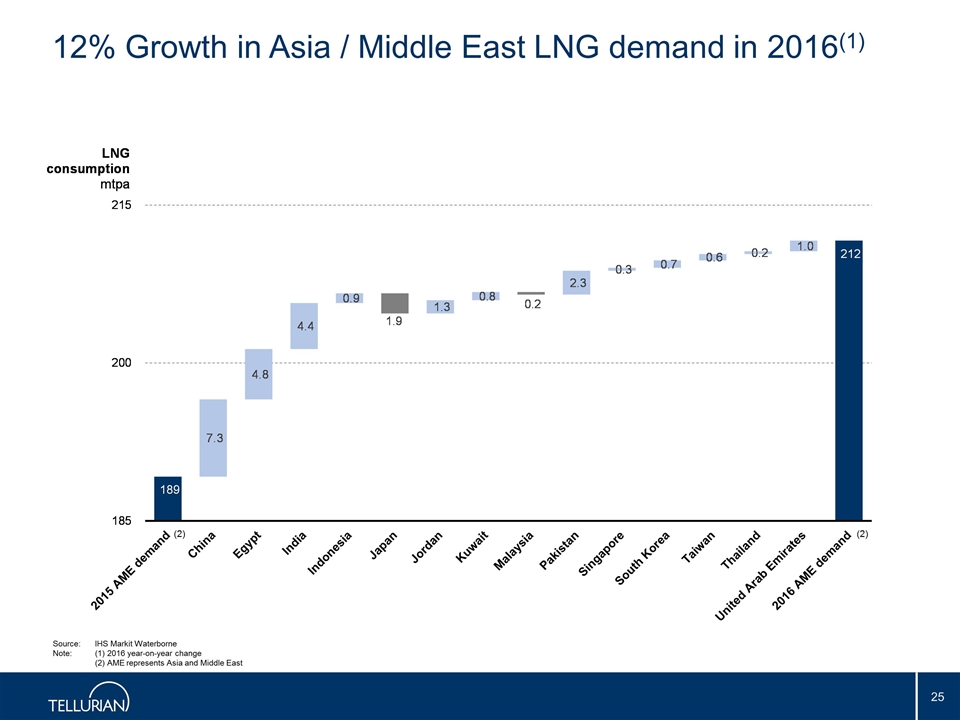

12% Growth in Asia / Middle East LNG demand in 2016(1) Source:IHS Markit Waterborne Note:(1) 2016 year-on-year change (2) AME represents Asia and Middle East (2) (2)

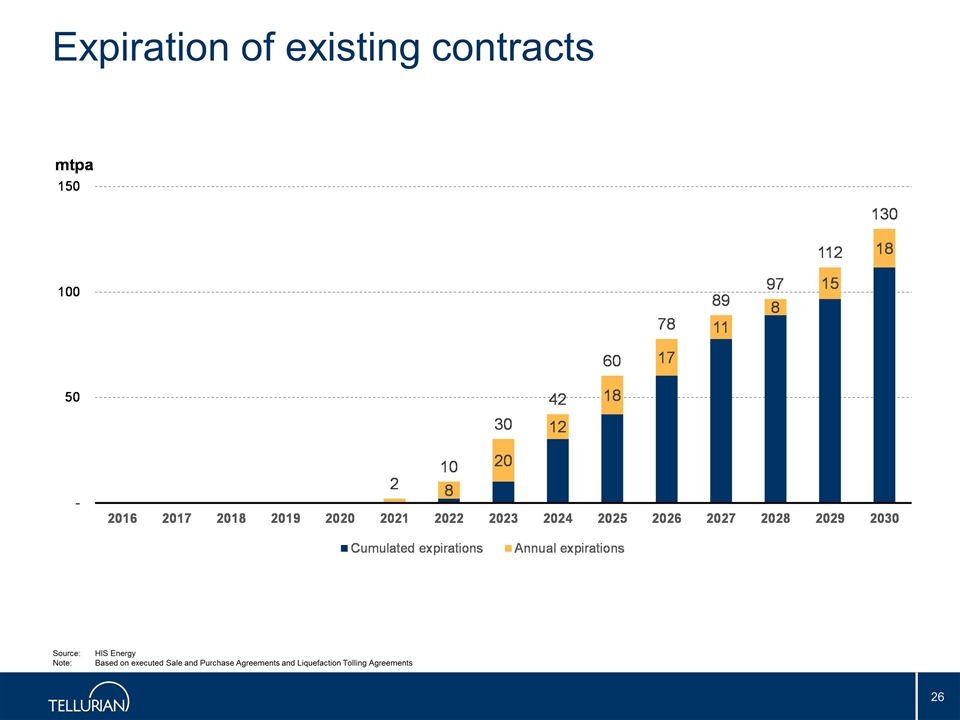

Expiration of existing contracts Source:HIS Energy Note:Based on executed Sale and Purchase Agreements and Liquefaction Tolling Agreements

The U.S. offers the right product to customers Lower 48/GOM Liquefaction Projects in Bottom Quartile of Cost Curve Source: IHS Energy

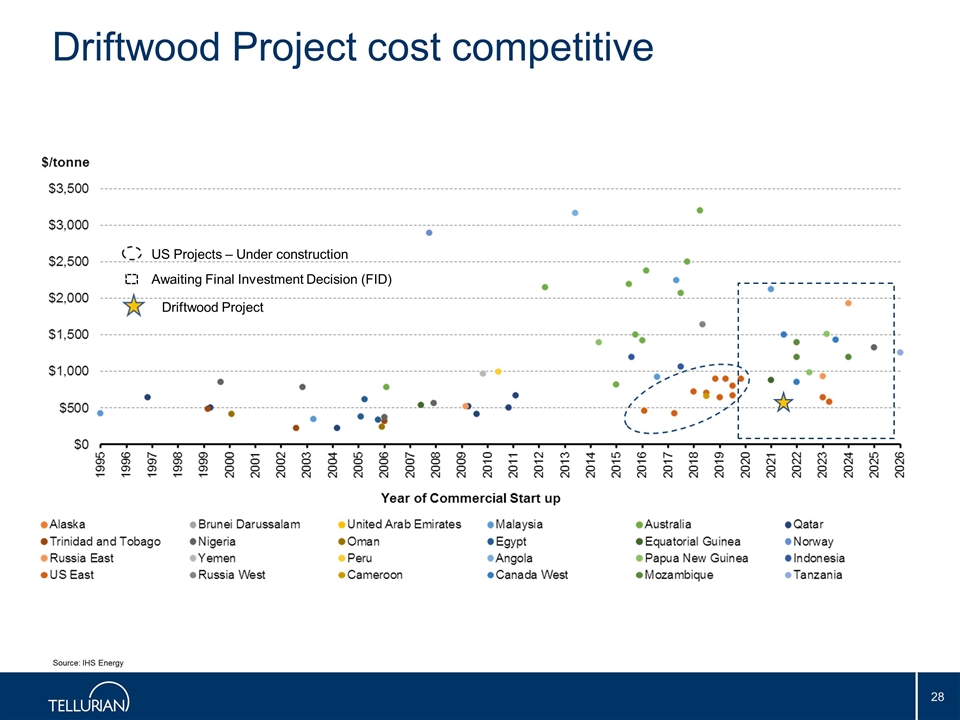

Driftwood Project cost competitive Source: IHS Energy Driftwood Project Awaiting Final Investment Decision (FID) US Projects – Under construction