Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - KERYX BIOPHARMACEUTICALS INC | d392831dex991.htm |

| 8-K - FORM 8-K - KERYX BIOPHARMACEUTICALS INC | d392831d8k.htm |

Keryx Biopharmaceuticals, Inc. First Quarter 2017 Financial Results May 4, 2017 Building a Leading Renal Company Exhibit 99.2

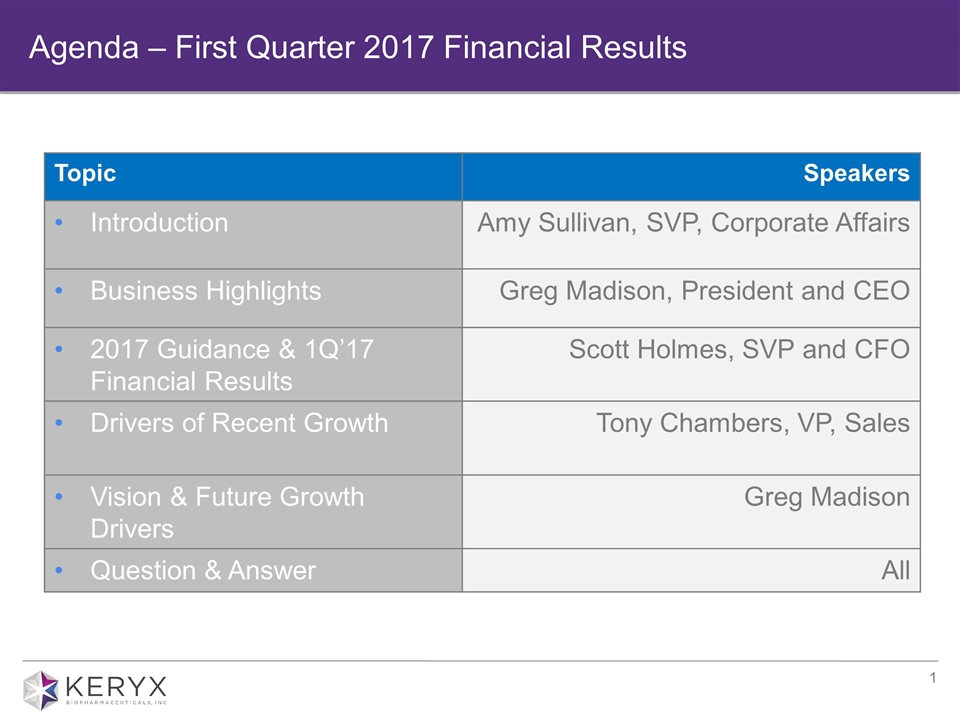

Agenda – First Quarter 2017 Financial Results Topic Speakers Introduction Amy Sullivan, SVP, Corporate Affairs Business Highlights Greg Madison, President and CEO 2017 Guidance & 1Q’17 Financial Results Scott Holmes, SVP and CFO Drivers of Recent Growth Tony Chambers, VP, Sales Vision & Future Growth Drivers Greg Madison Question & Answer All

Forward-looking Statements Some of the statements included in this presentation, particularly those regarding the commercialization and ongoing clinical development of Auryxia, our 2017 financial guidance and the submission of an sNDA to the FDA to expand the label of ferric citrate to include the treatment of IDA in adults with stage 3-5 NDD-CKD and the potential approval in this indication and the impact thereof on Keryx, may be forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Among the factors that could cause our actual results to differ materially are the following: whether we can increase adoption of Auryxia in patients with CKD on dialysis in order to achieve our 2017 financial guidance; whether we can maintain our operating expenses to projected levels while continuing our current clinical, regulatory and commercial activities; the risk that the FDA may not concur with our interpretation of our Phase 3 study results in NDD- CKD, supportive data, conduct of the studies, or any other part of our regulatory submission and could ultimately deny approval of ferric citrate for the treatment of IDA in adults with stage 3-5 NDD-CKD; the risk that if approved for use in NDD-CKD that we may not be able to successfully market Auryxia for use in this indication; our ability to continue to supply Auryxia following the recent resupply to the market; and other risk factors identified from time to time in our reports filed with the Securities and Exchange Commission. Any forward looking statements set forth in this press release speak only as of the date of this press release. We do not undertake to update any of these forward looking statements to reflect events or circumstances that occur after the date hereof. This press release and prior releases are available at http://www.keryx.com. The information found on our website is not incorporated by reference into this presentation and is included for reference purposes only.

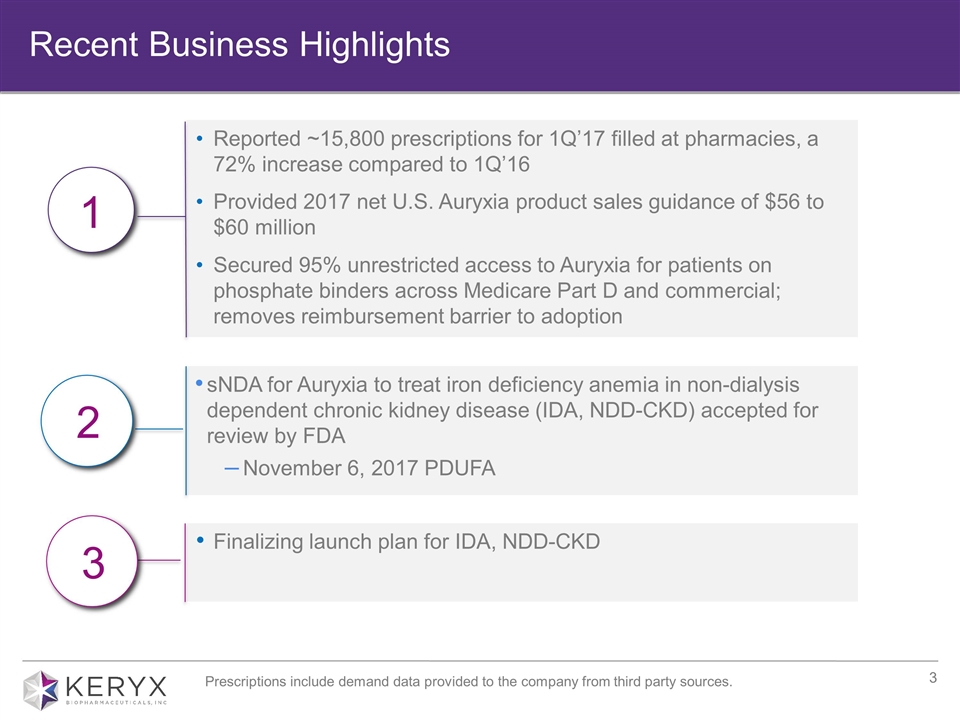

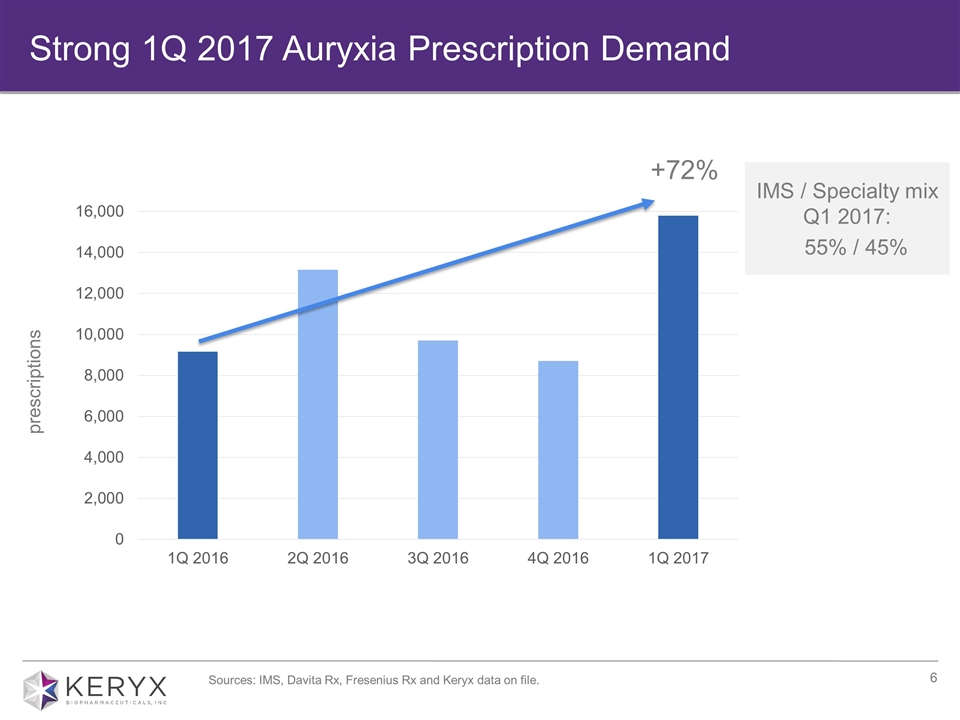

Reported ~15,800 prescriptions for 1Q’17 filled at pharmacies, a 72% increase compared to 1Q’16 Provided 2017 net U.S. Auryxia product sales guidance of $56 to $60 million Secured 95% unrestricted access to Auryxia for patients on phosphate binders across Medicare Part D and commercial; removes reimbursement barrier to adoption Recent Business Highlights sNDA for Auryxia to treat iron deficiency anemia in non-dialysis dependent chronic kidney disease (IDA, NDD-CKD) accepted for review by FDA November 6, 2017 PDUFA Prescriptions include demand data provided to the company from third party sources. Finalizing launch plan for IDA, NDD-CKD 3 2 1

Financial Highlights Scott Holmes SVP and Chief Financial Officer

Guidance: 2017 Net U.S. Auryxia Product Sales Providing 2017 Auryxia guidance of $56 to $60 million, based upon: Strong 1Q prescription demand and underlying trajectory Strong prescription growth as a result of increased breadth and depth of prescribing Impact of broad formulary access: 95% of phosphate binder patients with commercial or Medicare Part D insurance now have unrestricted access Guidance excludes revenues from the potential approval in November 2017 of ferric citrate in the U.S. for the treatment of adults with NDD-CKD and iron deficiency anemia.

Sources: IMS, Davita Rx, Fresenius Rx and Keryx data on file. Strong 1Q 2017 Auryxia Prescription Demand +72% IMS / Specialty mix Q1 2017: 55% / 45% prescriptions

First Quarter 2017 Financial Highlights ($ in millions) 1Q 2017 (unaudited) 1Q 2016 (unaudited) Net U.S. Auryxia Product Sales $ 10.5 $ 5.6 License Revenue $ 1.3 $ 1.2 Total Revenue $ 11.8 $ 6.8 Cost of Goods Sold $ 4.3 $ 1.1 Operating Expenses* $ 29.9 $ 28.4 ($ in millions) March 31, 2017 (unaudited) December 31, 2016 (audited) Cash and Cash Equivalents $90.9 $111.8 Convertible Debt (at face value) $125.0 $125.0 * Reflects SG&A expenses, plus R&D expenses

Drivers of Recent Growth Tony Chambers Vice President Sales

Increased breadth and depth of prescribing High level of brand awareness and growing clinical familiarity, with 50% more prescribers writing in 1Q’17 vs 1Q’16 Increased yield from our prescriber interactions, with 72% increase in prescriptions, including growth in number of new Auryxia patients Meaningful conversations with nephrologists and renal care teams, directed toward: 30-40% of ESRD patients with uncontrolled phosphate levels Key message: Auryxia as the non-calcium, non-chewable choice for clinically proven control of hyperphosphatemia 1Q 2017 Growth in Dialysis Driven by Many Factors *Source: Spherix RealTime Dynamix

Future Growth Drivers & Vision Greg Madison President and Chief Executive Officer

Building a Leading Renal Company: Three Strategic Pathways Drive and Support Keryx’s Planned Growth GROW INSPIRE Maximize Auryxia’s Potential Grow in US dialysis market Launch & grow in US IDA, NDD- CKD market Expand Portfolio Build Keryx by adding strategic assets to our portfolio Manage Growth & Talent Create a culture of success Appropriately staff with high-quality talent to support planned growth Expand Portfolio Manage Growth & Talent Maximize Auryxia’s Potential

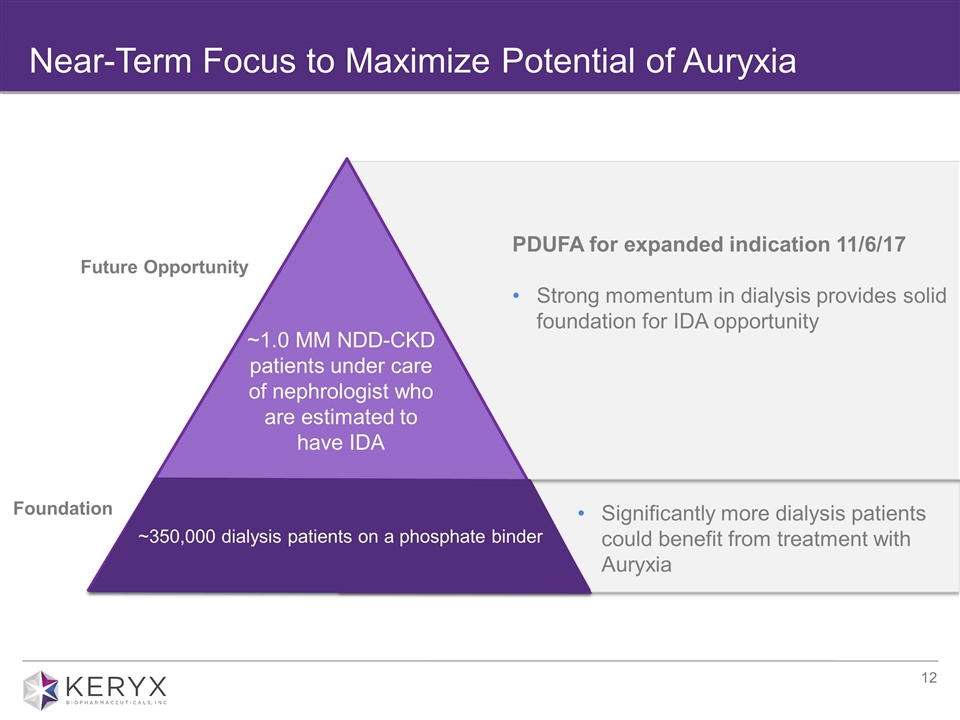

Near-Term Focus to Maximize Potential of Auryxia Significantly more dialysis patients could benefit from treatment with Auryxia Foundation PDUFA for expanded indication 11/6/17 Strong momentum in dialysis provides solid foundation for IDA opportunity Future Opportunity ~350,000 dialysis patients on a phosphate binder ~1.0 MM NDD-CKD patients under care of nephrologist who are estimated to have IDA

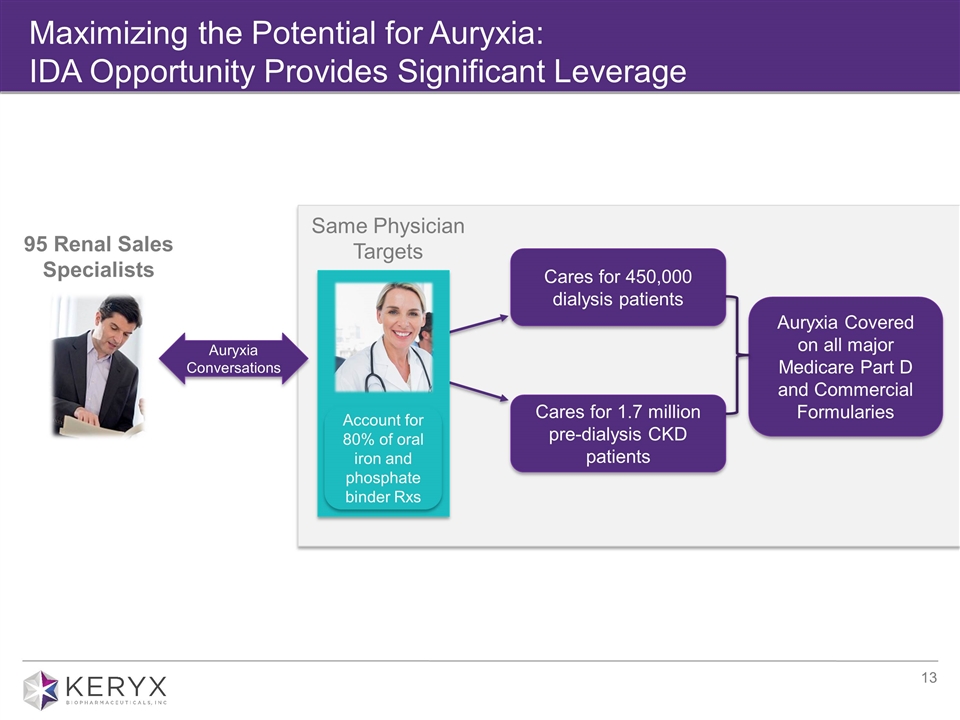

Maximizing the Potential for Auryxia: IDA Opportunity Provides Significant Leverage 95 Renal Sales Specialists Same Physician Targets Cares for 450,000 dialysis patients Cares for 1.7 million pre-dialysis CKD patients Auryxia Conversations Auryxia Covered on all major Medicare Part D and Commercial Formularies Account for 80% of oral iron and phosphate binder Rxs

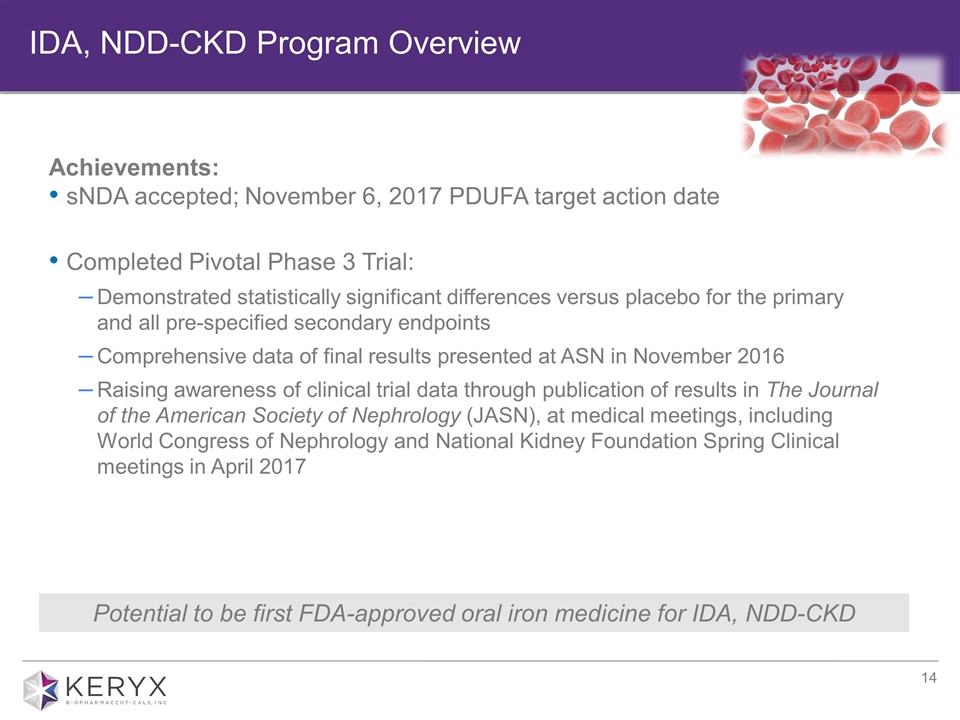

Achievements: sNDA accepted; November 6, 2017 PDUFA target action date Completed Pivotal Phase 3 Trial: Demonstrated statistically significant differences versus placebo for the primary and all pre-specified secondary endpoints Comprehensive data of final results presented at ASN in November 2016 Raising awareness of clinical trial data through publication of results in The Journal of the American Society of Nephrology (JASN), at medical meetings, including World Congress of Nephrology and National Kidney Foundation Spring Clinical meetings in April 2017 IDA, NDD-CKD Program Overview Potential to be first FDA-approved oral iron medicine for IDA, NDD-CKD

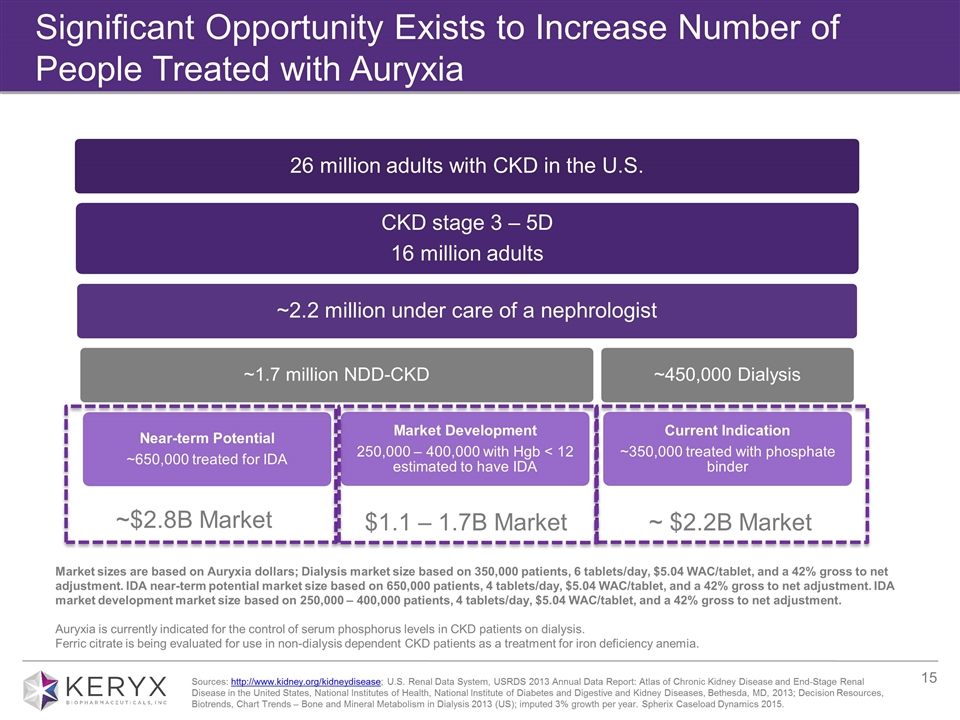

Significant Opportunity Exists to Increase Number of People Treated with Auryxia ~ $2.2B Market ~$2.8B Market Market sizes are based on Auryxia dollars; Dialysis market size based on 350,000 patients, 6 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. IDA near-term potential market size based on 650,000 patients, 4 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. IDA market development market size based on 250,000 – 400,000 patients, 4 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis. Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia. $1.1 – 1.7B Market Sources: http://www.kidney.org/kidneydisease; U.S. Renal Data System, USRDS 2013 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2013; Decision Resources, Biotrends, Chart Trends – Bone and Mineral Metabolism in Dialysis 2013 (US); imputed 3% growth per year. Spherix Caseload Dynamics 2015. CKD stage 3 – 5D 16 million adults ~2.2 million under care of a nephrologist ~450,000 Dialysis ~1.7 million NDD-CKD Near-term Potential ~650,000 treated for IDA Current Indication ~350,000 treated with phosphate binder 26 million adults with CKD in the U.S. Market Development 250,000 – 400,000 with Hgb < 12 estimated to have IDA

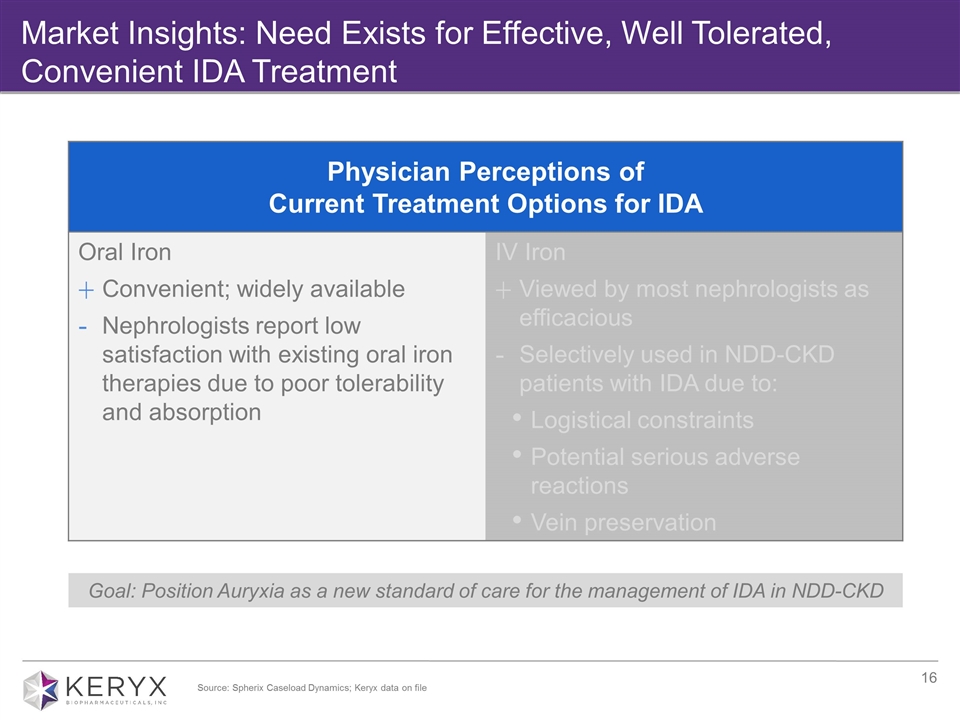

Market Insights: Need Exists for Effective, Well Tolerated, Convenient IDA Treatment Goal: Position Auryxia as a new standard of care for the management of IDA in NDD-CKD Physician Perceptions of Current Treatment Options for IDA Oral Iron Convenient; widely available Nephrologists report low satisfaction with existing oral iron therapies due to poor tolerability and absorption IV Iron Viewed by most nephrologists as efficacious Selectively used in NDD-CKD patients with IDA due to: Logistical constraints Potential serious adverse reactions Vein preservation Source: Spherix Caseload Dynamics; Keryx data on file

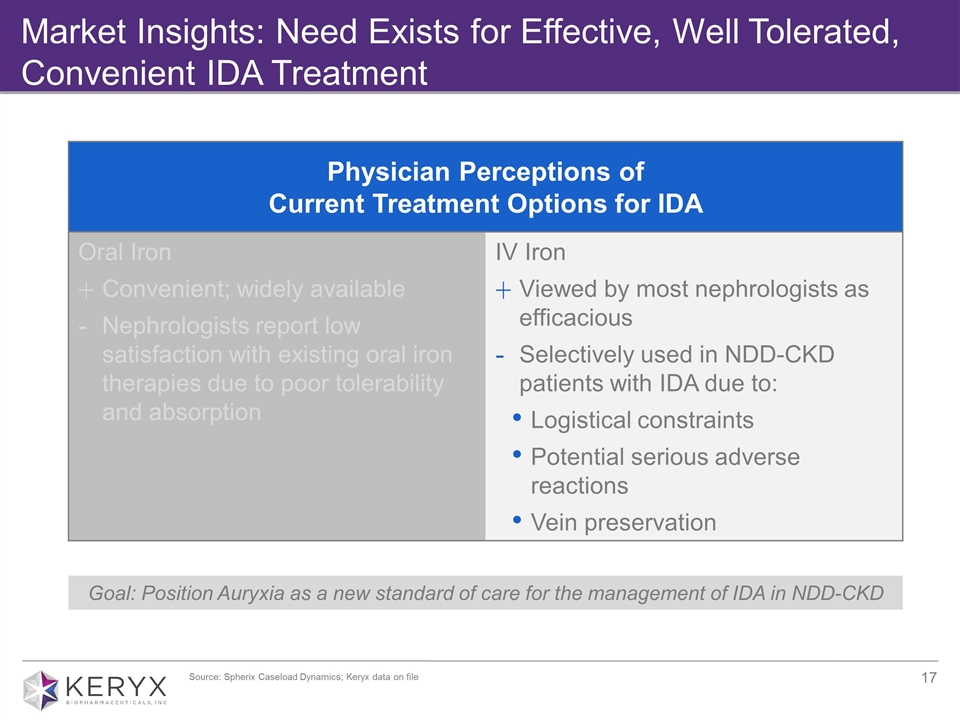

Market Insights: Need Exists for Effective, Well Tolerated, Convenient IDA Treatment Goal: Position Auryxia as a new standard of care for the management of IDA in NDD-CKD Physician Perceptions of Current Treatment Options for IDA Oral Iron Convenient; widely available Nephrologists report low satisfaction with existing oral iron therapies due to poor tolerability and absorption IV Iron Viewed by most nephrologists as efficacious Selectively used in NDD-CKD patients with IDA due to: Logistical constraints Potential serious adverse reactions Vein preservation Source: Spherix Caseload Dynamics; Keryx data on file

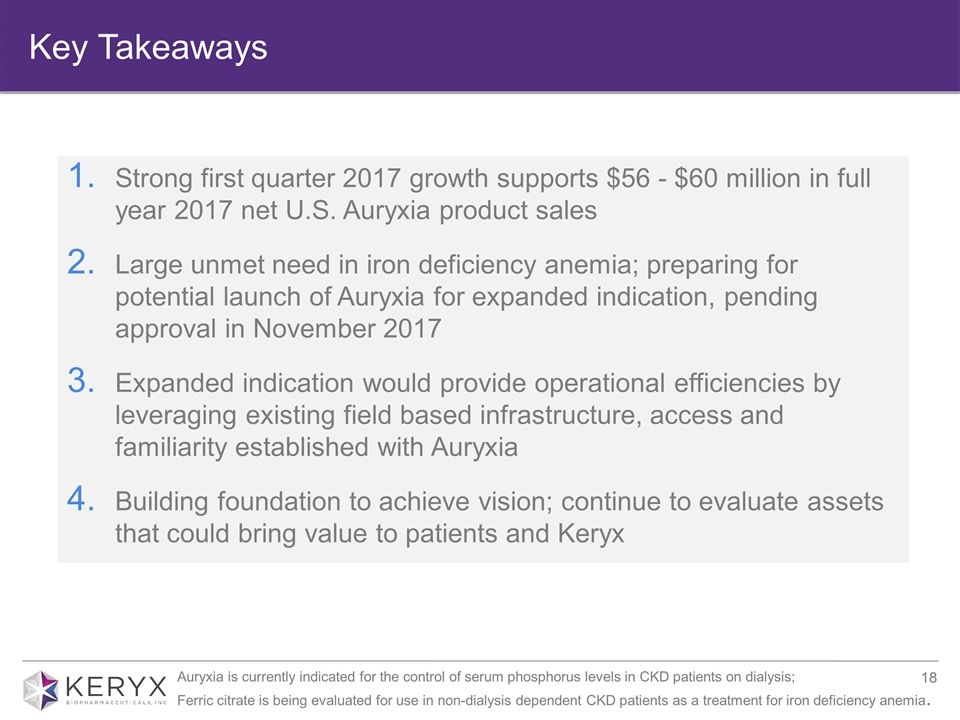

Key Takeaways Strong first quarter 2017 growth supports $56 - $60 million in full year 2017 net U.S. Auryxia product sales Large unmet need in iron deficiency anemia; preparing for potential launch of Auryxia for expanded indication, pending approval in November 2017 Expanded indication would provide operational efficiencies by leveraging existing field based infrastructure, access and familiarity established with Auryxia Building foundation to achieve vision; continue to evaluate assets that could bring value to patients and Keryx Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis; Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia.

Keryx Biopharmaceuticals, Inc. First Quarter 2017 Financial Results May 4, 2017 Building a Leading Renal Company