Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Black Knight, Inc. | bkfsq12017ex991.htm |

| 8-K - 8-K - Black Knight, Inc. | bkfsq120178k.htm |

1Black Knight Financial Services TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2016 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affili te. © 2017 Bl ck Knight Financial Tech ology Solutions, LLC. All Rights Reserved.

Black Knight Financial Services, Inc.

First Quarter 2017 Earnings Results

May 3, 2017

2Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

Disclaimer

Forward-Looking Statements

This presentation contains forward-looking statements that involve a number of risks and uncertainties. Statements that are not historical facts,

including statements regarding expectations, hopes, intentions or strategies regarding the future are forward-looking statements. Forward-looking

statements are based on Black Knight management's beliefs, as well as assumptions made by, and information currently available to, them.

Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may

differ materially from those projected. Black Knight undertakes no obligation to update any forward-looking statements, whether as a result of new

information, future events or otherwise. The risks and uncertainties that forward-looking statements are subject to include, but are not limited to:

our ability to successfully achieve the conditions to and consummate the tax-free spin-off of Black Knight from FNF; electronic security breaches

against our information systems; our ability to maintain and grow our relationships with our customers; changes to the laws, rules and regulations

that impact our and our customers’ businesses; our ability to adapt our services to changes in technology or the marketplace; the impact of any

potential defects, development delays, installation difficulties or system failures on our business and reputation; changes in general economic,

business, regulatory and political conditions, particularly as they affect the mortgage industry; risks associated with the availability of data; the

effects of our substantial leverage on our ability to make acquisitions and invest in our business; risks associated with our structure and status as

a “controlled company;” our ability to successfully integrate strategic acquisitions; and other risks and uncertainties detailed in the “Statement

Regarding Forward-Looking Information,” “Risk Factors” and other sections of our Annual Report on Form 10-K and other filings with the

Securities and Exchange Commission.

Non-GAAP Financial Measures

This presentation contains non-GAAP financial information, including Adjusted Revenues, Adjusted Revenues excluding the effect of the Property

Insight realignment, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Earnings and Adjusted Net Earnings Per Share. These are

important financial performance measures for Black Knight, but are not financial measures as defined by generally accepted accounting principles

("GAAP"). The presentation of this financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the

financial information prepared and presented in accordance with GAAP. Black Knight uses these non-GAAP financial performance measures for

financial and operational decision making and as a means to evaluate period-to-period comparisons. Black Knight believes they provide useful

information about operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater

transparency with respect to key metrics used by management in its financial and operational decision making, including determining a portion

of executive compensation. Black Knight has not provided a reconciliation of forward-looking Adjusted Net Earnings Per Share and Adjusted

EBITDA growth to the most directly comparable GAAP financial measures, due primarily to variability and difficulty in making accurate forecasts

and projections of non-operating matters that may arise, as not all of the information necessary for a quantitative reconciliation is available to

Black Knight without unreasonable effort. See the Appendix for further information.

3Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

GAAP Financial Results

Metrics First Quarter

Revenues $258.1 million, +7%

Net Earnings Attributable to Black

Knight Financial Services, Inc.

$12.2 million

Net Earnings Per Share Attributable

to Black Knight Financial Services,

Inc. - Diluted

$0.18

4Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

Financial Highlights

Metrics(1) First Quarter

Adjusted Revenues $259.5 million, +6%

Adjusted Revenues growth excluding the

effect of the Property Insight realignment

+9%

Adjusted EBITDA $119.4 million, +8%

Adjusted EBITDA Margin 46.0%, +90 bps

Adjusted Net Earnings $45.3 million, +11%

Adjusted Net Earnings Per Share $0.30

(1) See appendix for non-GAAP reconciliations

5Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

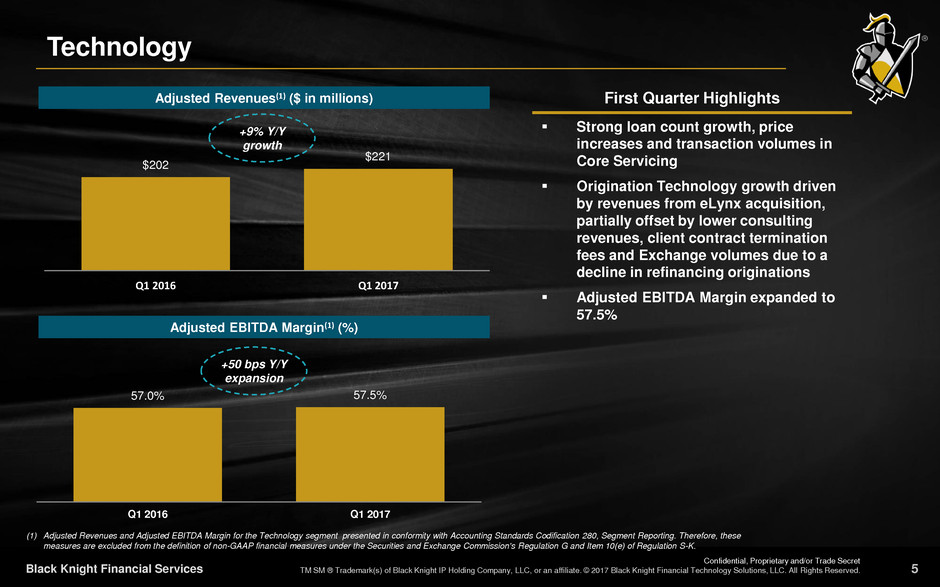

Technology

(1) Adjusted Revenues and Adjusted EBITDA Margin for the Technology segment presented in conformity with Accounting Standards Codification 280, Segment Reporting. Therefore, these

measures are excluded from the definition of non-GAAP financial measures under the Securities and Exchange Commission's Regulation G and Item 10(e) of Regulation S-K.

57.0% 57.5%

Q1 2016 Q1 2017

$202

$221

Q1 2016 Q1 2017

+50 bps Y/Y

expansion

+9% Y/Y

growth

Adjusted EBITDA Margin(1) (%)

Strong loan count growth, price

increases and transaction volumes in

Core Servicing

Origination Technology growth driven

by revenues from eLynx acquisition,

partially offset by lower consulting

revenues, client contract termination

fees and Exchange volumes due to a

decline in refinancing originations

Adjusted EBITDA Margin expanded to

57.5%

First Quarter HighlightsAdjusted Revenues(1) ($ in millions)

6Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

Data and Analytics

(1) Adjusted Revenues and Adjusted EBITDA Margin for the Data and Analytics segment presented in conformity with Accounting Standards Codification 280, Segment Reporting. Therefore,

these measures are excluded from the definition of non-GAAP financial measures under the Securities and Exchange Commission's Regulation G and Item 10(e) of Regulation S-K.

16.3%

13.9%

Q1 2016 Q1 2017

$42

$39

Q1 2016 Q1 2017

240 bps Y/Y

reduction

-7% Y/Y

change

Adjusted EBITDA Margin(1) (%)

Adjusted revenues growth of 12%

excluding the effect of the Property

Insight realignment, driven by Motivity

Solutions acquisition and growth in

our multiple listing service and

property data businesses

Adjusted EBITDA Margin reflects

higher expense associated with the

LoanSphere Data Hub

First Quarter HighlightsAdjusted Revenues(1) ($ in millions)

7Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

Capital Structure

(1) Excludes unamortized bond premium, original issue discount and debt issuance costs

(2) See appendix for non-GAAP reconciliations

($ in millions) As of 3/31/17 Maturity Interest Rate

Cash and Cash Equivalents $ 108

Revolver ($400mm) 50 2020 LIBOR + 200bps

Term A Loan 730 2020 LIBOR + 200bps

Term B Loan 393 2022 LIBOR + 225bps / 75bps floor

Senior Notes 390 2023 5.75%

Total Long-term Debt(1) $1,563

Capital Lease Obligation 9 2017 0.00%

Total Debt $1,572

Net Debt $1,464

LTM 3/31/17 Adjusted EBITDA(2) $ 472

Total Debt / LTM Adjusted EBITDA 3.3x

Net Debt / LTM Adjusted EBITDA 3.1x

8Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

Full Year 2017 Financial Guidance

Financial Metric Guidance

Revenues and Adjusted Revenues Growth

+3% to 5%

(+6% to 8% adjusting to reflect the Property Insight

realignment as if it took place on January 1, 2016)

Adjusted EBITDA Growth +10% to 12%

Adjusted Net Earnings Per Share $1.34 to $1.38

Full Year 2017 guidance is based upon the following estimates and assumptions:

Interest expense of ~$62 million

Depreciation and amortization expense of ~$120 million (excluding incremental depreciation and

amortization expense resulting from purchase accounting)

Fully-distributed effective tax rate of ~37%

Diluted weighted-average shares outstanding of ~153 million shares

CAPEX of approximately $90 million

9Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

Appendix

10Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

Non-GAAP Financial Measures

Adjusted Revenues –We define Adjusted Revenues as Revenues adjusted to include the revenues that were not recorded by

Black Knight during the periods presented due to the deferred revenue purchase accounting adjustment recorded in accordance

with GAAP. These adjustments are reflected in Corporate and Other. This adjustment for the full year 2017 is expected to be

approximately $4.5 million.

Adjusted Revenues Excluding the Effect of the Property Insight Realignment –We define Adjusted Revenues excluding the

effect of the Property Insight realignment as Adjusted Revenues for the respective 2016 period determined on the basis as if the

Property Insight realignment had taken place on January 1, 2016.

Adjusted EBITDA –We define Adjusted EBITDA as Net earnings, with adjustments to reflect the addition or elimination of certain

income statement items including, but not limited to: (i) Depreciation and amortization; (ii) Interest expense; (iii) Income tax

expense; (iv) Other expense, net; (v) Loss (gain) from discontinued operations, net of tax; (vi) deferred revenue purchase

accounting adjustment recorded in accordance with GAAP; (vii) equity-based compensation, including related payroll taxes; (viii)

costs associated with debt and/or equity offerings, including the planned tax-free spin-off of Black Knight from FNF; and (ix)

acquisition-related costs. These adjustments are reflected in Corporate and Other.

Adjusted EBITDA Margin – Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by Adjusted Revenues.

Adjusted Net Earnings –We define Adjusted Net Earnings as Net earnings with adjustments to reflect the addition or elimination

of certain income statement items including, but not limited to: (i) the net incremental depreciation and amortization adjustments

associated with the application of purchase accounting; (ii) deferred revenue purchase accounting adjustment recorded in

accordance with GAAP; (iii) equity-based compensation, including related payroll taxes; (iv) costs associated with debt and/or equity

offerings, including the planned tax-free spin-off of Black Knight from FNF; (v) significant legal and regulatory matters; and (vi)

adjustment for income tax expense at our full year estimated effective tax rate of 37.0% for the three months ended March 31, 2017

and 2016, assuming the conversion of all the shares of Class B common stock into shares of Class A common stock, assuming that

Black Knight was a taxable entity as of the beginning of the earliest period presented and assuming the effect of the non-GAAP

adjustments.

Adjusted Net Earnings Per Share –We calculate per share amounts assuming the exchange of all shares of Class B common

stock into shares of our Class A common stock at the beginning of the respective period, as well as the dilutive effect of any

unvested restricted shares of Class A common stock.

11Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

Non-GAAP Reconciliations: Adjusted Revenues / Adjusted Revenues

Excluding the Effect of the Property Insight Realignment

Consolidated:

Three Months Ended

March 31,

($ in millions) 2017 2016

Revenues $ 258.1 $ 241.9

Deferred revenue purchase accounting adjustment 1.4 2.3

Adjusted Revenues 259.5 244.2

Effect of Property Insight realignment — (7.2)

Adjusted Revenues Excluding the Effect of the Property Insight Realignment $ 259.5 $ 237.0

Adjusted Revenues Growth Excluding the Effect of the Property Insight Realignment 9%

Data and Analytics:

Three Months Ended

March 31,

($ in millions) 2017 2016

Adjusted Revenues $ 38.9 $ 41.8

Effect of Property Insight realignment — (7.2)

Adjusted Revenues Excluding the Effect of the Property Insight Realignment $ 38.9 $ 34.6

Adjusted Revenues Growth Excluding the Effect of the Property Insight Realignment 12%

12Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

Non-GAAP Reconciliations: Adjusted EBITDA

Three Months Ended

March 31,

LTM Ended

($ in millions) 2017 2016 March 31, 2017

Net earnings $ 33.9 $ 33.1 $ 133.8

Depreciation and amortization 52.8 48.2 212.9

Interest expense 16.7 16.8 67.5

Income tax expense 6.0 6.2 25.6

Other expense, net 2.0 0.8 7.6

EBITDA 111.4 105.1 447.4

Deferred revenue purchase accounting adjustment 1.4 2.3 6.4

Equity-based compensation 5.4 2.7 15.1

Debt and/or equity offering expenses 1.2 — 1.8

Acquisition-related costs — — 1.7

Adjusted EBITDA $ 119.4 $ 110.1 $ 472.4

Adjusted EBITDA Margin (%) 46.0% 45.1%

13Black Knight Financial Services

Confidential, Proprietary and/or Trade Secret

TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved.

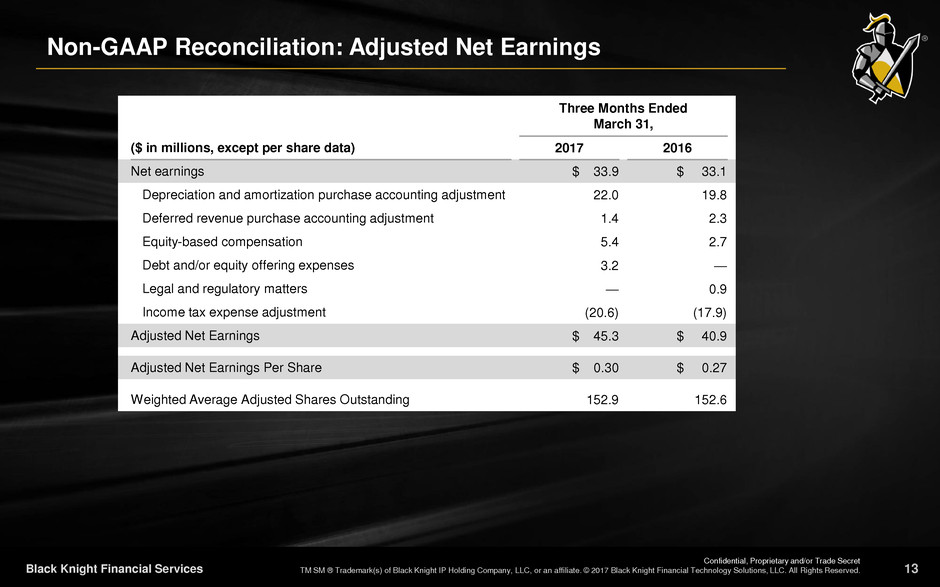

Non-GAAP Reconciliation: Adjusted Net Earnings

Three Months Ended

March 31,

($ in millions, except per share data) 2017 2016

Net earnings $ 33.9 $ 33.1

Depreciation and amortization purchase accounting adjustment 22.0 19.8

Deferred revenue purchase accounting adjustment 1.4 2.3

Equity-based compensation 5.4 2.7

Debt and/or equity offering expenses 3.2 —

Legal and regulatory matters — 0.9

Income tax expense adjustment (20.6) (17.9)

Adjusted Net Earnings $ 45.3 $ 40.9

Adjusted Net Earnings Per Share $ 0.30 $ 0.27

Weighted Average Adjusted Shares Outstanding 152.9 152.6