Attached files

| file | filename |

|---|---|

| EX-99.1 - TRUEBLUE PRESS RELEASE - TrueBlue, Inc. | tbi2017q1pressreleaseexhib.htm |

| EX-99.2 - TRUEBLUE Q1 2017 EARNINGS RELEASE PRESENTATION - TrueBlue, Inc. | earningspresentationq120.htm |

| 8-K - TRUEBLUE FORM 8-K - TrueBlue, Inc. | tbi2017q1pressrelease.htm |

Forward-Looking Statements

May 2017

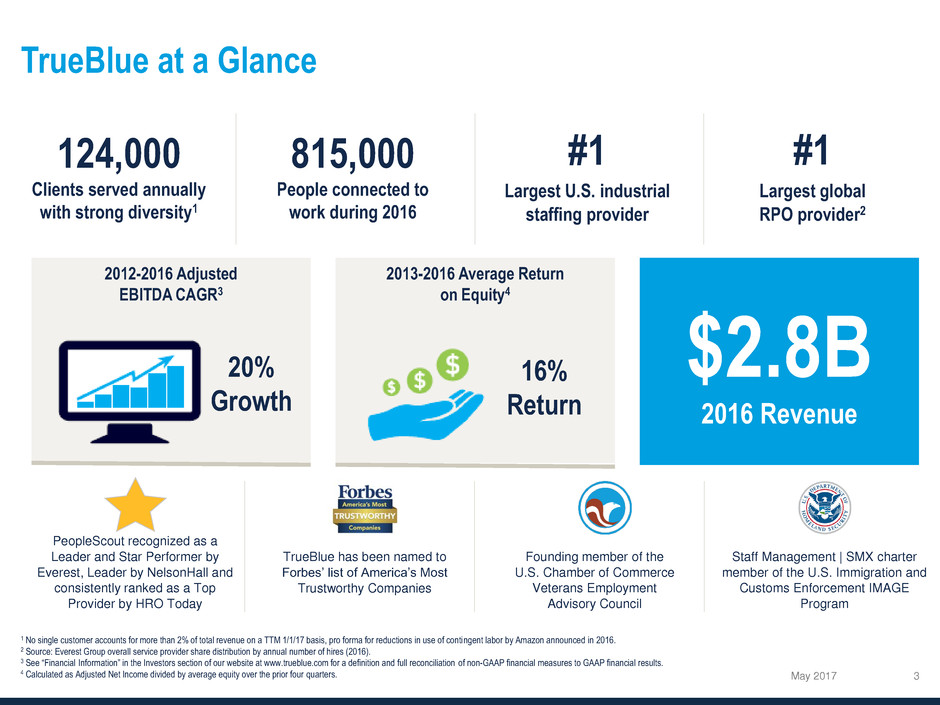

TrueBlue at a Glance

May 2017 3

124,000

Clients served annually

with strong diversity1

815,000

People connected to

work during 2016

#1

Largest U.S. industrial

staffing provider

#1

Largest global

RPO provider2

2013-2016 Average Return

on Equity4

2012-2016 Adjusted

EBITDA CAGR3

$2.8B

2016 Revenue

20%

Growth

16%

Return

PeopleScout recognized as a

Leader and Star Performer by

Everest, Leader by NelsonHall and

consistently ranked as a Top

Provider by HRO Today

TrueBlue has been named to

Forbes’ list of America’s Most

Trustworthy Companies

Founding member of the

U.S. Chamber of Commerce

Veterans Employment

Advisory Council

Staff Management | SMX charter

member of the U.S. Immigration and

Customs Enforcement IMAGE

Program

1 No single customer accounts for more than 2% of total revenue on a TTM 1/1/17 basis, pro forma for reductions in use of contingent labor by Amazon announced in 2016.

2 Source: Everest Group overall service provider share distribution by annual number of hires (2016).

3 See “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

4 Calculated as Adjusted Net Income divided by average equity over the prior four quarters.

Investment Highlights

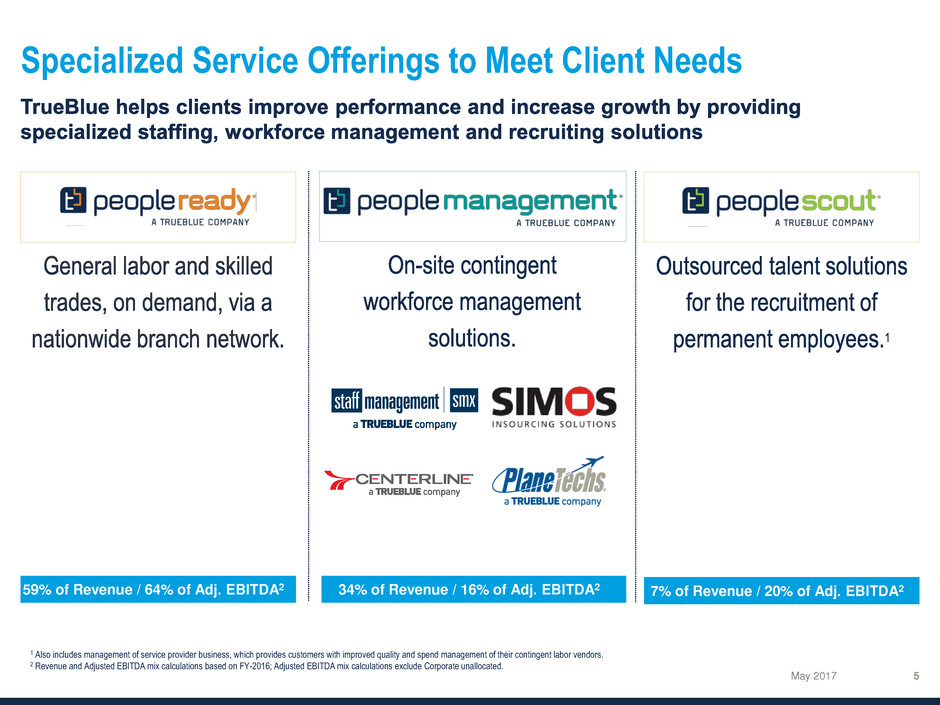

Specialized Service Offerings to Meet Client Needs

May 2017

7% of Revenue / 20% of Adj. EBITDA2 34% of Revenue / 16% of Adj. EBITDA2 59% of Revenue / 64% of Adj. EBITDA2

1 Also includes management of service provider business, which provides customers with improved quality and spend management of their contingent labor vendors.

2 Revenue and Adjusted EBITDA mix calculations based on FY-2016; Adjusted EBITDA mix calculations exclude Corporate unallocated.

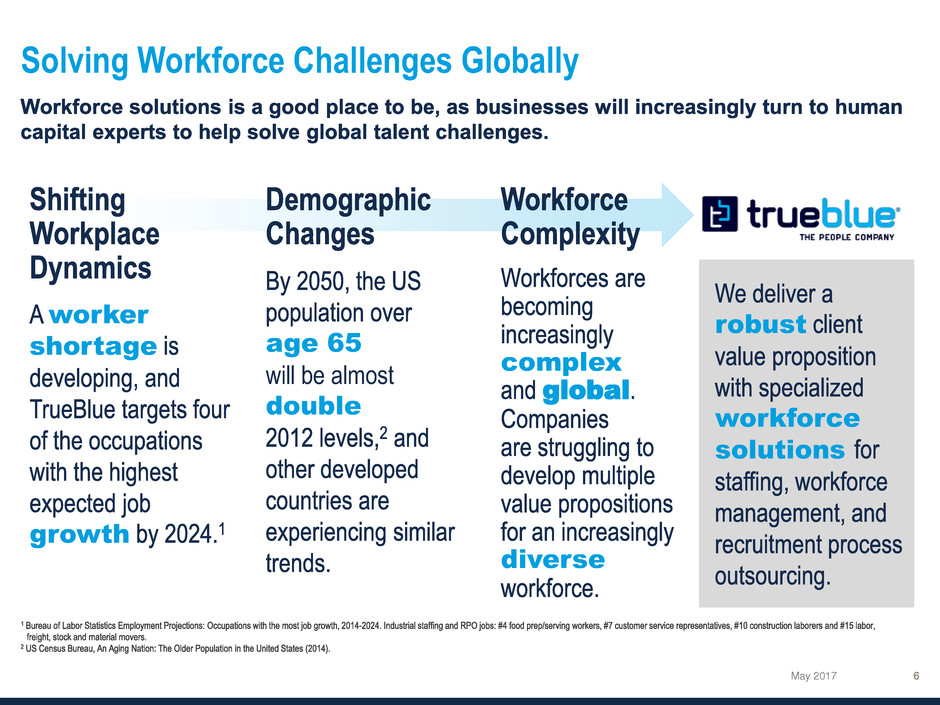

Solving Workforce Challenges Globally

May 2017

complex

global

diverse

age 65

will be almost

double

worker

shortage

growth

robust

workforce

solutions

Construction Manufacturing Transport & Wholesale Retail

In

d

u

s

tr

y

D

y

n

a

m

ic

s

Housing Starts Have Not Kept Pace US Manufacturing Renaissance Wholesale Trade At New High eCommerce Growing % of Retail Sales

Source: U.S. Census Bureau Source: U.S. Board of Governors of the Federal Reserve System (FRB) Source: Bureau of Labor Statistics Source: US Census Bureau

60

65

70

75

80

85

90

95

100

105

110

19

90

19

93

19

96

19

99

20

02

20

05

20

08

20

11

20

14

20

17

Industrial Production

Index

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

19

93

19

96

19

99

20

02

20

05

20

08

20

11

20

14

20

17

eCommerce % of Retail Sales

3.0

3.5

4.0

4.5

5.0

5.5

19

90

19

93

19

96

19

99

20

02

20

05

20

08

20

11

20

14

20

17

Transportation and Warehousing Employment

Millions

Strong Position in Attractive Vertical Markets

May 2017

-

500

1,000

1,500

2,000

2,500

150

170

190

210

230

250

270

290

310

330

350

19

70

19

75

19

80

19

85

19

90

19

95

20

00

20

05

20

10

20

15

US Population Housing Permits

Millions Thousands

7%

Growing Market

Capitalizing on Secular Forces in Industrial Staffing

May 2017

o

o

o

o

Positive

Demographic

Trends

Temp Penetration

Growth

Compelling

Technology

Rise of

eCommerce

On-Shoring

Comeback

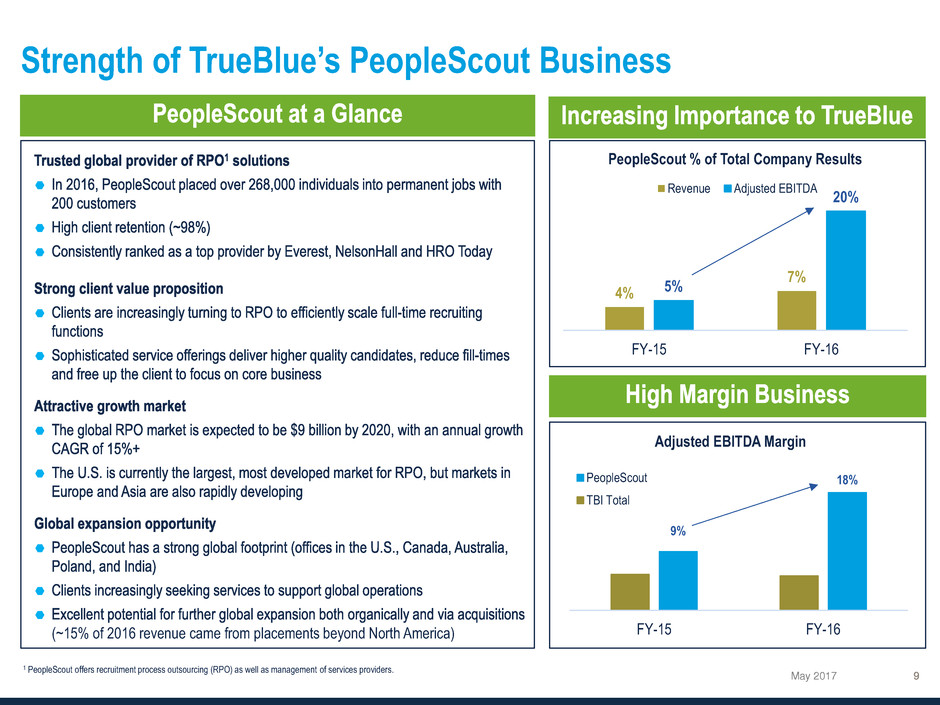

Strength of TrueBlue’s PeopleScout Business

May 2017

4%

7%

5%

20%

FY-15 FY-16

PeopleScout % of Total Company Results

Revenue Adjusted EBITDA

18%

9%

FY-16FY-15

Adjusted EBITDA Margin

PeopleScout

TBI Total

(~15% of 2016 revenue came from placements beyond North America)

1 PeopleScout offers recruitment process outsourcing (RPO) as well as management of services providers.

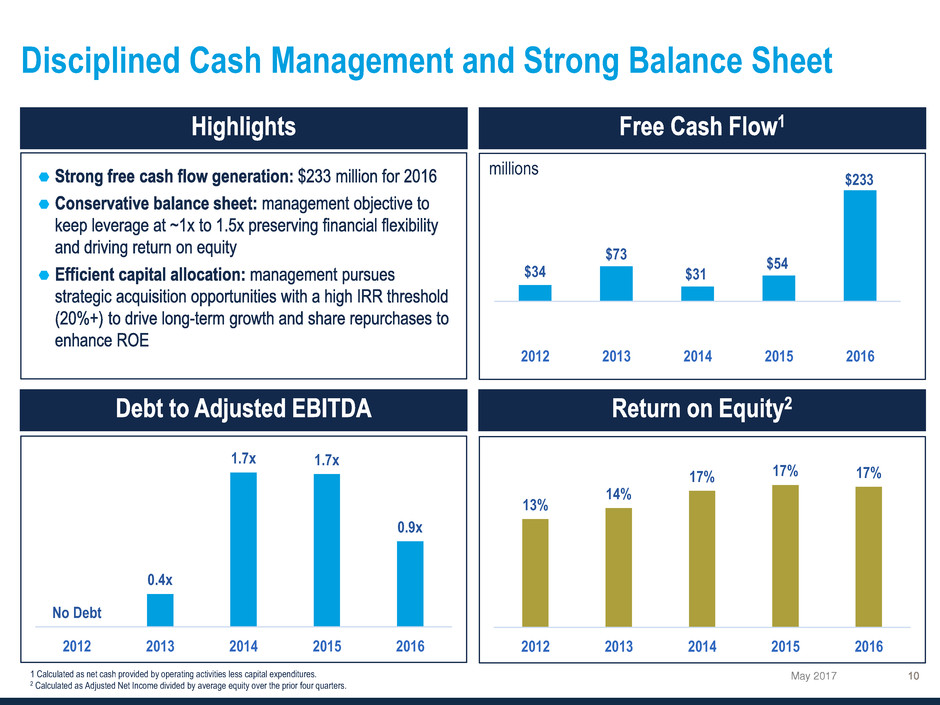

Disciplined Cash Management and Strong Balance Sheet

May 2017 1 Calculated as net cash provided by operating activities less capital expenditures.

2 Calculated as Adjusted Net Income divided by average equity over the prior four quarters.

$34

$73

$31

$54

$233

2012 2013 2014 2015 2016

No Debt

0.4x

1.7x 1.7x

0.9x

2012 2013 2014 2015 2016

13%

14%

17% 17% 17%

2012 2013 2014 2015 2016

millions

Strategic Priorities

May 2017

PeopleReady Transition

May 2017

Legacy branch based business transitioned to one brand/one system.

Expanding Scope of Services

• Within our legacy structure, only 12 of

our top 40 markets had access to all 3

service lines.

• PeopleReady will bring more

specialized services to more markets

while leveraging central resources to

streamline operations.

Increasing Operational Agility

• >50% of PeopleReady’s revenue is

generated from customers who

already work with multiple brands;

single point of contact makes it easier.

• One set of operating procedures and

systems provide a better customer

experience empowering staff to move

quickly and capture market share.

Larger Talent Pool

• Associates and customers benefit

from scale when information is visible

across all systems.

• Common information systems and

compelling new technology platforms

(i.e. mobile app) increases our ability

to attract a more diverse population of

workers.

Str

a

tegic R

a

ti

o

nal

e

Priorit

ie

s

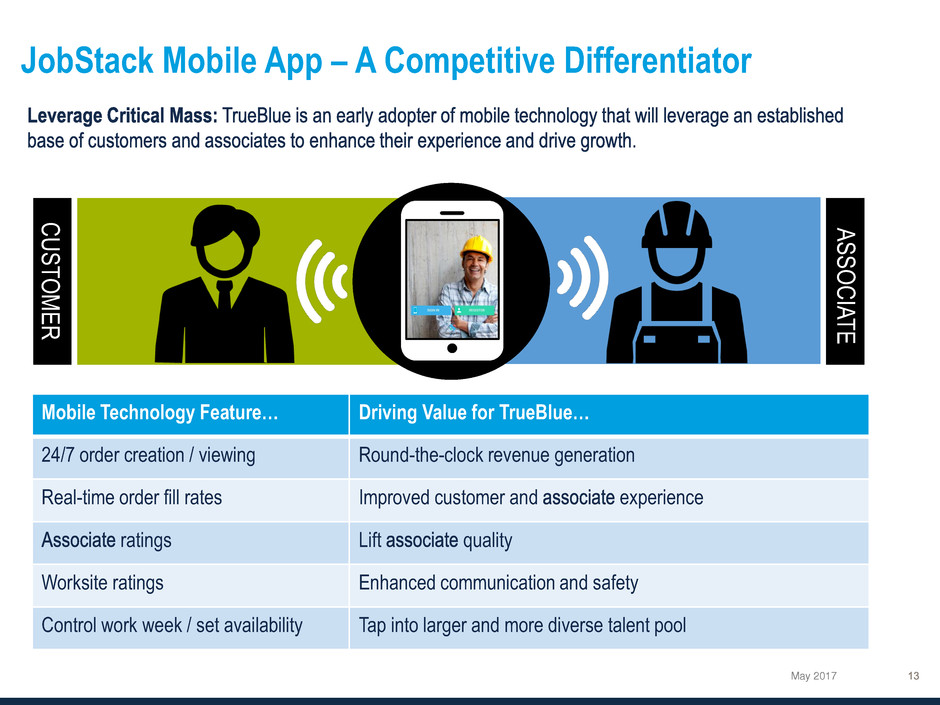

JobStack Mobile App – A Competitive Differentiator

May 2017

CUSTOMER

ASSOCIATE

Mobile Technology Feature… Driving Value for TrueBlue…

24/7 order creation / viewing Round-the-clock revenue generation

Real-time order fill rates Improved customer and experience

ratings Lift quality

Worksite ratings Enhanced communication and safety

Control work week / set availability Tap into larger and more diverse talent pool

Non-GAAP Terms and Definitions

May 2017

EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA excludes interest, taxes, depreciation and

amortization. Adjusted EBITDA further excludes from EBITDA costs related to acquisition and integration costs and

Work Opportunity Tax Credit third-party processing fees. EBITDA and Adjusted EBITDA are key measures used by

management to assess performance and, in our opinion, enhance comparability and provide investors with useful insight into

the underlying trends of the business. EBITDA and Adjusted EBITDA should not be considered measures of financial

performance in isolation or as an alternative to Income from operations in the Consolidated Statements of Operations in

accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

Adjusted net income and Adjusted net income per diluted share are non-GAAP financial measures, which exclude from Net

income and Net income on a per diluted share basis, costs related to acquisition and integration costs, amortization of

intangibles of acquired businesses as well as accretion expense related to acquisition earn-out, tax effect of each adjustment

to U.S. GAAP Net income, and adjusts income taxes to the expected ongoing effective tax rate. Adjusted net income and

Adjusted net income per diluted share are key measures used by management to assess performance and, in our opinion,

enhance comparability and provide investors with useful insight into the underlying trends of the business. Adjusted net

income and Adjusted net income per diluted share should not be considered measures of financial performance in isolation

or as an alternative to net income or net income per diluted share in the Consolidated Statements of Operations in accordance

with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

Free cash flow is defined as net cash provided by operating activities, minus purchases for property and equipment. Free cash flow is a

non-GAAP financial measure and is not intended to replace net cash provided by operating activities, the most directly comparable

financial measure prepared in accordance with GAAP. We present free cash flow because we believe it indicates the amount of cash

available after capital expenditures for, among other things, investments in our existing business, debt service obligations, repurchase

of our common stock, and strategic acquisitions.

See “Financials” in the Investors section of our web site at www.trueblue.com for a full reconciliation of non-GAAP financial measures

to U.S. GAAP financial results.