Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - NEXEON MEDSYSTEMS INC | ex23_1.htm |

As filed with the Securities and Exchange Commission on April 28, 2017

Registration No. 333-____________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

NEXEON MEDSYSTEMS INC

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

3841

|

|

81-0756622

|

|

(State or other jurisdiction

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

of incorporation or organization)

|

|

Classification Code Number)

|

|

Identification Number)

|

1708 Jaggie Fox Way

Lexington, Kentucky

Telephone: (844) 919-9990

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William Rosellini

Chief Executive Officer

Nexeon MedSystems Inc

1708 Jaggie Fox Way

Lexington, Kentucky

Telephone: (844) 919-9990

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Harvey Kesner, Esq.

Sichenzia Ross Ference Kesner LLP

61 Broadway, 32nd Floor

New York, NY 10006

(212) 930-9700

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company)

|

Smaller reporting company ☑

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

Amount to be

Registered(1)

|

Proposed

Maximum

Offering Price

per Share(2)

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee

|

||||||||||||

|

|

||||||||||||||||

|

Common Stock, $0.001 par value

per share

|

6,052,240

|

$

|

1.00

|

$

|

6,052,240

|

$

|

701.45

|

|||||||||

+

| (1) |

Pursuant to Rule 416 under the Securities Act of 1933, as amended, the shares being registered hereunder include such indeterminate number of shares of common stock, as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions.

|

| (2) |

Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED APRIL 28, 2017

|

6,052,240 Shares of Common Stock

We are registering an aggregate of 6,052,240 shares of common stock, $0.001 par value per share (the “Common Stock”) (collectively, the “Resale Shares”) of Nexeon MedSystems Inc (referred to herein as “we”, “us”, “our”, “Nexeon”, “Registrant”, or the “Company”) for resale by certain of our shareholders identified in this prospectus (the “Selling Shareholders”). Please see “Selling Shareholders” beginning at page 43.

The Selling Shareholders may sell some or all of their shares at a fixed price of $1.00 per share until our shares are quoted on the OTCQX for anticipated aggregate net proceeds of approximately $6,052,240 and thereafter at prevailing market prices or privately negotiated prices. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria. We will not receive any proceeds from the sale of the Resale Shares by the Selling Shareholders. We will bear all costs relating to the registration of the Resale Shares.

Our Common Stock is not currently listed for trading on any exchange. It is our intention to seek quotation on the OTCQX. The Company and its sponsoring broker dealer have filed form 211 with FINRA to obtain the Company’s trading symbol and are waiting for the issuance; provided, however, there can be no assurance that our Common Stock will be approved for trading on the OTCQX Marketplace or any other trading exchange.

The Resale Shares may be sold by the Selling Shareholders to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale you should refer to the section entitled “Plan of Distribution” in this Prospectus.

Our business and an investment in our securities involve a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2017

|

|

Page

|

|

|

|

|

3

|

|

|

5

|

|

|

12

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

14

|

|

|

19

|

|

|

34

|

|

|

42

|

|

|

44

|

|

|

45

|

|

|

46

|

|

|

50

|

|

|

51

|

|

|

52

|

|

|

53

|

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our Common Stock, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Unless the context otherwise requires, references to “we,” “our,” “us,” “Nexeon” or the “Company” in this prospectus mean Nexeon MedSystems Inc., a Nevada corporation, on a consolidated basis with its wholly-owned subsidiaries, as applicable.

COMPANY BACKGROUND

We were incorporated in the State of Nevada on December 7, 2015. Our principal corporate office is located at 1708 Jaggie Fox Way, Lexington, Kentucky 40511 and our phone number is (844) 919-9990. Our internet address is www.nexeonmed.com.

We are a bioelectronics company developing active medical devices for the treatment of chronic medical conditions. The solutions we are developing are a unique blend of traditional device technologies such as electronics, software, mechanical engineering, and material science, as well as pharmaceuticals, protein chemistry, and cell biology.

On February 16, 2016, Nexeon MedSystems, Inc., a Delaware corporation (“NXDE”) merged with and into the Company (the “Merger”) with the Company surviving the Merger as the surviving corporation. As a result of the Merger, (i) 100% of NXDE’s issued and outstanding shares of preferred stock were converted into an aggregate of 1,659,943 shares of the Company’s Common Stock and (ii) all shares of NXDE’s common stock, options and deferred compensation units were cancelled. In addition, pursuant to the terms of the Merger, the Company will pay Nexeon Shareholder Royalty Group LLC, a West Virginia limited liability company formed in connection with the Merger, a 3% royalty on net product sales derived by the Company, its affiliates and licensees in connection with the commercialization of patents and intellectual property acquired by the Company pursuant to the Merger. Former NXDE shareholders are members of Nexeon Shareholder Royalty Group LLC.

The Nexeon Neurostimulation System

The Nexeon Neurostimulation System (the “NNS”) was developed to address the shortcomings of present day neuromodulators. The NNS is an implantable neurostimulation and recording platform, and is one of the very few implantable stimulation and recording devices that has received regulatory approval (Conformité Européenne, or “CE” conformity) for human use in connection with use as a deep brain stimulation system in the treatment of certain movement disorders. The Multi-Purpose Implant Controller is the engine of the NNS system. This custom-made computer chip utilizes features from cochlear implants and we believe addresses the shortcomings of present day neuromodulators. The flexibility of in-house manufacturing and the unique ability to reprogram the operation of the NNS allows anticipation of future needs and increasing knowledge of deep brain stimulation therapy for a broad spectrum of neural diseases.

On January 10, 2017, we entered into an exclusive, irrevocable agreement with Rosellini Scientific LLC (“Rosellini Scientific”) pursuant to which we will acquire 100% of the issued and outstanding capital stock of Nexeon Medsystems Belgium, SPRL (“NMB”), an entity controlled by William Rosellini, our Chief Executive Officer. In conjunction with the acquisition of NMB, we will be continuing the development of the NNS that was initially developed by NMB. As part of the continued development, we intend to extend capabilities and target new diseases and disorders.

Micro-Perforated Catheter Balloon

We have developed, Micro-Perforated Catheter Balloon, a novel balloon material that utilizes carbon nanotubes and polymer. The carbon nanotubes help maintain structural integrity of the Micro-Perforated Catheter Balloon during inflation and drug delivery while allowing a more compliant polymer, such as nylon, to be used. While current drug-coated balloons provide only passive drug delivery, management believes that Micro-Perforated Catheter Balloon brings a much-needed, innovative improvement to intravascular drug delivery by enabling controllable pulsed flow delivery of anti-restenotic drugs to the diseased site. If successful, our approach will reduce the need for follow up procedures by efficiently delivering anti-restenotic drugs, intravascularly, to direct the therapy immediately into the lesion. The foregoing balloon material is protected by approximately 36 patents which we acquired in the Merger, and we anticipate that federal and state funding will enable us to develop our solution and proceed with a U.S. Food & Drug Administration (“FDA”) 510(k) approval. We expect to develop a suite of passive and electrically-active drug eluting balloons that will be owned by our wholly-owned subsidiary, Pulsus Medical LLC, a Kentucky limited liability company and wholly-owned subsidiary of the Company (“Pulsus”).

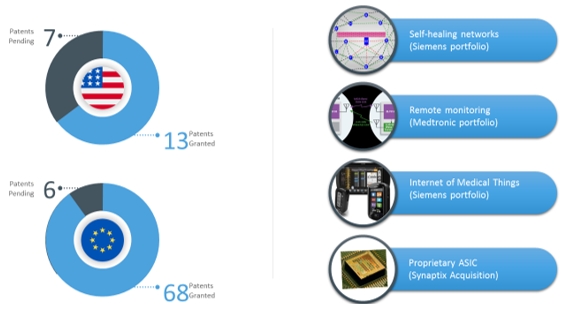

Siemens Intellectual Property

Effective as of December 15, 2016, we acquired a non-exclusive license to a portfolio of 86 patents that originated from Siemens AG, a global technology powerhouse and one of the world’s preeminent engineering companies. The intellectual property relates to Internet-of-Things (“IOT”) technology as described by a system of interrelated computing devices, mechanical and digital machines, objects, animals, and/or people that have unique identifiers and a subsequent ability to transfer data over a network without requiring human-to-human or human-to-computer interaction. This technology can be utilized in a wide variety of medical device applications, most notably in hospitals, nursing facilities, or patients’ homes.

Summary of the Offering

|

Resale Shares

|

6,052,240 shares of Common Stock (collectively, the “Resale Shares”)

|

|

|

Offering Price

|

$1.00 per share until a market develops and thereafter at market prices or privately negotiated prices.

|

|

|

Common Stock Outstanding

Before and After this Offering

|

(1) 22,663,621 and (2) 22,663,621

|

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of the Resale Shares by the Selling Shareholders.

|

|

|

Market for our Common

Stock

|

There is currently no market for our securities. Our Common Stock is not currently listed for trading on any exchange. It is our intention to seek quotation on the OTCQX.The Company and its sponsoring broker dealer have filed form 211 with FINRA to obtain the Company’s trading symbol and are waiting for the issuance; provided, however, there can be no assurance that our Common Stock will be approved for trading on the OTCQX or any other trading exchange.

|

|

|

|

|

|

|

Risk Factors

|

See “Risk Factors” beginning on page 5 of this prospectus and the other information included in this prospectus for a discussion of factors you should carefully consider before investing in our securities.

|

| (1) |

The number of outstanding shares before the offering is based upon 22,663,621 shares outstanding as of April 27, 2017, and excludes:

|

| · |

757,997 shares of our Common Stock issuable upon exercise of outstanding vested options at a weighted average exercise price of $1.00 per share as of April 27, 2017 and 2,024,003 shares of our Common Stock issuable upon exercise of outstanding unvested options at a weighted average exercise price of $1.00 per share as of April 27, 2017; and

|

| · |

2,458,762 shares of our Common Stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $2.00 per share as of April 27, 2017.

|

| (2) |

The number of outstanding shares after the offering includes the Resale Shares already issued and outstanding.

|

Any investment in our Common Stock involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our Common Stock. Our business, financial condition and results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

We have only a limited history upon which an evaluation of our prospects and future performance can be made and have no history of profitable operations. Since we have a limited operating history, it may be difficult for potential investors to evaluate our business.

We were incorporated in the State in Nevada on December 7, 2015, and as a result, we have only a limited history upon which an evaluation of our prospects and future performance can be made and have no history of profitable operations. Due to our lack of operating history, our proposed operations are subject to all business risks associated with new enterprises. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the startup of a business and operation in a competitive and regulated industry. We may sustain losses in the future as we implement our business plan. There can be no assurance that we will ever generate revenues or operate profitably. Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive environment. Our business is dependent upon the implementation of our business plan. We may not be successful in implementing such plan and cannot guarantee that, if implemented, we will ultimately be able to attain profitability.

We will need to obtain additional financing to fund our operations.

We will need additional capital in the future to continue to execute our business plan. Therefore, we will be dependent upon additional capital in the form of either debt or equity to continue our operations and commercialize our products. At the present time, we do not have arrangements to raise all of the needed additional capital and we will need to identify potential investors and negotiate appropriate arrangements with them. We may not be able to arrange enough investment within the time the investment is required or that if it is arranged, that it will be on favorable terms. If we cannot get the needed capital, we may not be able to become profitable and may have to curtail or cease our operations.

We have a history of losses, and we anticipate that we will continue to incur losses in the future. Our auditors have included in their audit report an explanatory paragraph as to substantial doubt as to our ability to continue as a going concern.

We have experienced net losses since our inception. As of December 31, 2016, our net loss was $1,591,423 compared to a net loss of $915 for the period between December 7, 2015 (inception) and December 31, 2015. As of December 31, 2016, we had an accumulated deficit of $1,592,338. Our auditors have included in their audit report a “going concern” explanatory paragraph as to substantial doubt as to our ability to continue as a going concern that assumes the realization of our assets and the satisfaction of our liabilities and commitments in the normal course of business. We anticipate continuing to incur substantial additional losses over at least the next several years due to, among other factors, expenses related to the following: investor and public relations, SEC compliance efforts, anticipated research and development activities and the general and administrative expenses associated with each of these activities. We may never achieve profitability, and even if we do, we may not be able to sustain being profitable.

Our management and our independent registered public accounting firm have not identified any material weaknesses in our internal control over financial reporting. However, if we are unable to maintain certain internal controls, we may not be able to produce timely and accurate financial statements, and our independent registered public accounting firm could conclude that our internal control over financial reporting is not effective, which could adversely impact investor confidence and our stock price.

In connection with the audit of our financial statements for the year ended December 31, 2016, our management and our independent registered public accounting firm have not identified any material weaknesses in our internal control over financial reporting. However, due to the size of our current operation and existing personnel, errors may occur if we are not able to maintain certain internal controls over financial reporting. Our management is responsible for maintaining, implementing and testing our internal controls over financial reporting. These efforts are intended to maintain an effective control environment but may not prevent significant deficiencies from occurring. If we are unable to maintain such internal controls, we may not be able to produce timely and accurate financial statements, and our independent registered public accounting firm could conclude that our internal control over financial reporting is not effective, which could adversely impact investor confidence and our stock price.

We may be unable to complete or integrate intellectual property acquisitions effectively, which may adversely affect our growth, profitability, and results of operations.

The Company expects future acquisitions of intellectual property to play a significant role in the Company’s product development growth. As of the date hereof, we have made two such acquisition; however, we cannot be certain that we will be able to continue to identify attractive acquisition opportunities, obtain financing for acquisitions on satisfactory terms if needed, or successfully acquire identified targets. Additionally, we may not be successful in integrating acquired intellectual property into our existing operations and realizing anticipated synergies. Competition for acquisition opportunities in the industry in which we operate may increase our costs of acquisitions or causing us to refrain from engaging in acquisitions. These and other factors relating to our acquisition of intellectual property could negatively and adversely impact our growth, profitability, and results of operations.

The Company may experience delays or unforeseen issues during the requisite studies and trials required prior to regulatory approval of our medical devices.

Although there are no foreseeable risks with respect to obtaining an Investigational Device Exemption (“IDE”) following biocompatibility and active animal safety testing, even minor issues with the testing and application process can delay the IDE, which will in turn delay the clinical studies and increase the costs to complete the testing. For our FDA premarket approval (“PMA”), we will hire a regulatory consultant to facilitate all interactions with the FDA and ensure that we make the most time and capital efficient steps towards regulatory approval.

The Company may not be able to compete effectively with larger companies in the medical device space with greater resources and market recognition.

Our primary competitor, Medtronic, a provider of medical devices has been involved in the manufacturing and sale of deep brain stimulation devices for several years. In addition, Boston Scientific and Abbott (formerly St. Jude Medical) have a CE mark and PMA approval to market and sell their neurostimulation implant devices in Europe and in the U.S. These companies may have substantially greater financial, research and development, manufacturing, marketing and sales experience, and resources than us. As a result, our competitors may be more successful than us in developing their products, obtaining regulatory approvals, and marketing their products to consumers. We cannot assure investors that we will be able to compete effectively against current and future competitors.

The Company’s neurostimulation device may not be approved for reimbursement which could adversely affect the adoption of our device.

Even if the device and treatment are successful and approved for use, reimbursement may not be forthcoming, which could lead to slower than anticipated adoption of this technology. Additionally, new drugs or devices may also affect market acceptance. These risks are mitigated by the current reimbursement standards, which we believe our system will be reimbursed under. Additionally, the Company’s management team is experienced in device reimbursement, in the U.S. and in Germany, as well as throughout the European Union (“EU”). William Rosellini, our Chief Executive Officer, is a published author in the area of Medicare and Medicaid reimbursement. Previously, he has utilized reimbursement consultants to map existing reimbursement codes in order to develop proper data collection and clinical trial design strategies to shorten the path to eventual Medicare reimbursement. Although the Company’s management team is experienced in device reimbursement there can be no guarantee that the Company’s neurostimulation device will be approved for reimbursement, which could adversely affect the adoption of our device.

Laws and regulations that could affect the industry in which we operate may be enacted, which could result in a delay or cessation of our research and development activities or the imposition of additional costs that could hinder our ability to achieve and maintain profitable operations.

Current laws and regulations with respect to our industry and additional laws and regulations which may be enacted in the future could impose new and/or unexpected operational considerations or constraints upon us. Complying with existing laws or regulations may require significant time and resource allocation for medical device manufacturers, including us. Additionally, changing or new legislation may force us to redesign one or more of our products. In such an event, our proprietary neurostimulation device may have to be altered or modified as to ensure that it is in compliance with all applicable laws and regulations. Such alterations or modifications would cause us to incur substantial research and development costs. Moreover, if we cannot modify or alter our neurostimulation device’s design or functionality, then our device could be rendered obsolete, which would substantially reduce our future profitability and harm our business. Additionally, since we intend to operate both domestically and in the European Union, we must remain cognizant of the legislative and regulatory landscape in both regions. Compliance with these regulations, when applicable, increases the research and development and production costs and could make our proposed products and services less attractive to potential customers.

International operations, if conducted by us in the future, would subject us to a number of risks, including unfavorable political, regulatory, labor, and tax conditions.

We may sell medical devices to customers located outside the United States in the future. International operations are subject to the legal, political, regulatory, and social requirements and economic conditions in the jurisdictions in which they are conducted. Risks inherent to international operations and sales, include, but are not limited to, the following:

| · |

exposure to violations of the Foreign Corrupt Practices Act of 1977, as amended;

|

| · |

difficulty in enforcing agreements, judgments, and arbitration awards in foreign legal systems;

|

| · |

impediments to the flow of foreign exchange capital payments and receipts due to exchange controls instituted by certain foreign governments and the fact that the local currencies of these countries are not freely convertible;

|

| · |

inability to obtain maintain, or enforce our intellectual property rights;

|

| · |

changes in general economic and political conditions in foreign countries;

|

| · |

changes in foreign government regulations and technical standards, including additional regulation of medical devices, which may reduce or eliminate our ability to sell or license in certain markets;

|

| · |

requirements or preferences of foreign nations for domestic technologies, which could reduce demand for our technologies;

|

| · |

trade barriers such as export requirements, tariffs, taxes, and other restrictions and expenses, which could increase the prices of our technologies and make us less competitive; and

|

| · |

longer payment cycles typically associated with international sales and potential difficulties in collecting accounts receivable, which may reduce the future profitability of foreign sales or licensing.

|

Conducting business in foreign jurisdictions would require us to respond to rapid changes in market conditions in these countries. The Company believes that its overall success as a global business would depend on its ability to succeed in different legal, regulatory, economic, social, and political situations and conditions. We may not be able to develop and implement effective policies and strategies in each foreign jurisdiction where we may do business in the future.

The Company depends on its key management personnel for its future success.

The Company’s success depends largely on the skills of its key management and technical personnel. The loss of one or more of its key management and technical personnel may materially and adversely affect business and results of operations. The Company does not maintain key person insurance for any of its employees. The Company cannot guarantee that it will be able to replace any of its key management personnel in the event that their services become unavailable.

We only have a limited number of employees to manage and operate our business.

As of April 27, 2017, we had a total of 10 full-time employees and 1 part-time employees. We cannot assure you that we will be able to retain adequate staffing levels to run our operations and/or to accomplish all of the objectives that we otherwise would seek to accomplish.

Failure to raise the necessary capital could restrict the Company’s growth, limit its development of new products and services and hinder its ability to compete.

The Company needs to raise funds in order to achieve its business objectives. Failure to raise these funds may:

| · |

Restrict its growth;

|

| · |

Limit its development of new products and services; and

|

| · |

Hinder its ability to compete.

|

Any of these aforementioned consequences would have a materially adverse effect on the Company’s business, operations, and financial position.

We may be subject to product liability claims, and may not have sufficient product liability insurance to cover any such claims, which may expose us to substantial liabilities.

We may be exposed to product liability claims from consumers of our products. It is possible that any product liability insurance coverage we obtain will be insufficient to protect us from future claims. Further, we may not be able to obtain or maintain insurance on acceptable terms or that such insurance would be sufficient to cover any potential product liability claim or recall. Failure to obtain or maintain sufficient insurance coverage could have a material adverse effect on our business, prospects, and results of operations if claims are made that exceed our coverage.

Our revenues will depend upon adequate reimbursement from public and private insurers and health systems.

Our success will depend on the extent to which reimbursement for the costs of its treatments will be available from third party payers, such as public and private insurers and health systems. Government and other third party payers attempt to contain healthcare costs by limiting both coverage and the level of reimbursement of new treatments. Therefore, significant uncertainty usually exists as to the reimbursement status of new healthcare treatments. If we are not successful in obtaining adequate reimbursement for our treatment from these third party payers, the market’s acceptance of our treatment could be adversely affected. Inadequate reimbursement levels also likely would create downward price pressure on our treatment. Even if we succeed in obtaining widespread reimbursement for our treatment, future changes in reimbursement policies could have a negative impact on our business, financial condition and results of operations.

To be commercially successful, we must convince physicians that our devices are safe and effective alternatives to existing medical devices and that our devices should be used.

We believe physicians will only adopt our devices if they determine, based on experience, clinical data and published peer reviewed journal articles, that the use of our devices is a favorable alternative to conventional devices/methods. Physicians may be slow to change their practices for the following reasons, among others:

| · |

Lack of evidence supporting additional patient benefits and our devices over conventional devices/methods;

|

| · |

Perceived liability risks generally associated with the use of new devices; and

|

| · |

Limited availability of reimbursement from third party payers

|

In addition, we believe that recommendations for and support of our devices by influential physicians are essential for market acceptance and adoption. If we do not receive this support or are unable to demonstrate favorable long-term clinical data, physicians and hospitals may not use our devices, which would significantly reduce our ability to achieve revenue and would prevent us from sustaining profitability.

We are an “emerging growth company,” and the reduced disclosure requirements applicable to emerging growth companies may make our Common Stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups (“JOBS”) Act, and may remain an emerging growth company for up to five years. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include:

| · |

being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure;

|

| · |

not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting;

|

| · |

not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements;

|

| · |

reduced disclosure obligations regarding executive compensation; and

|

| · |

exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

|

We cannot predict whether investors will find our Common Stock less attractive if we rely on these exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile.

RISKS RELATED TO OUR INTELLECTUAL PROPERTY

Variability in intellectual property laws may adversely affect our intellectual property position.

Intellectual property laws, and patent laws and regulations in particular, have been subject to significant variability either through administrative or legislative changes to such laws or regulations or changes or differences in judicial interpretation, and it is expected that such variability will continue to occur. Additionally, intellectual property laws and regulations differ among countries. Variations in the patent laws and regulations or in interpretations of patent laws and regulations in the United States and other countries may diminish the value of our intellectual property and may change the impact of third-party intellectual property on us. Accordingly, we cannot predict the scope of patents that may be granted to us, the extent to which we will be able to enforce our patents against third parties, or the extent to which third parties may be able to enforce their patents against us.

We may need to negotiate modifications or extensions of existing intellectual property agreements.

We license intellectual property from third parties. We may in the future need to extend, modify, or otherwise negotiate changes to such licenses. There can be no assurance that the third parties with whom we have (or in the future may have) agreements will agree to such modifications, or that if they do, that they will do so on terms favorable to us.

We, or the third parties whom we license intellectual property from, may become involved in legal proceedings to protect or enforce our intellectual property rights, which could be expensive and time-consuming.

Competitors or others may infringe upon our intellectual property rights. To counteract infringement or unauthorized use, we or third parties whom we license intellectual property from may be required to file patent infringement claims, which can be expensive and time-consuming. In addition, in an infringement proceeding, a court may decide that certain of our intellectual property is not valid or is unenforceable, or the court may refuse to stop the other party from using the technology at issue on the grounds that our intellectual property rights do not cover such technology.

An adverse determination of any litigation or defense proceedings could put our intellectual property at risk of being invalidated or interpreted narrowly, and could put outstanding intellectual property applications at risk of not being granted.

Interference proceedings brought by the United States Patent and Trademark Office may be necessary to determine the priority of inventions with respect to our intellectual property applications. Litigation or interference proceedings may fail and, even if successful, may result in substantial costs, diversion of resources, and distraction of our management. We, or our licensors, may not be able to prevent misappropriation of our proprietary rights, particularly in countries where the laws may not protect such rights as comprehensively as in the United States.

Furthermore, due to the substantial amount of discovery associated with intellectual property litigation, there is a risk that some of our, or our licensors’, confidential information could be compromised by disclosure. In addition, during the course of this litigation, there could be public announcement of the results of hearings, motions, or other interim proceedings or developments. If securities analysts or investors perceive these results to be negative, then it could have a substantial adverse effect on the price of our Common Stock. We, or our licensors, may not prevail in any litigation or interference proceeding in which we may be involved in the future. Even if we, or our licensors prevail, such legal proceedings would likely be expensive and time-consuming.

RISKS RELATED TO OUR COMMON STOCK

Our shareholders may not be able to resell their stock due to a lack of public trading market.

There is presently no public trading market for our Common Stock. Although the Company and its sponsoring broker dealer have filed form 211 with FINRA to obtain the Company’s trading symbol and are waiting for the issuance, there can be no assurance that our shares of Common Stock will be quoted in a public trading market. Until there is an established trading market, holders of our Common Stock may find it difficult to sell their stock or to obtain accurate quotations for the price of the Common Stock. If a market for our Common Stock does develop, our stock price may be volatile.

Even if a market develops for our shares, our shares may be thinly traded with wide share price fluctuations, low share process and minimal liquidity.

If a market for our shares develops, the share price may be volatile with wide fluctuations in response to several factors, including:

| · |

potential investors’ anticipated feeling regarding our results of operations;

|

| · |

increased competition;

|

| · |

our ability or inability to generate future revenues; and

|

| · |

market perception of the future of development of the products and services we offer.

|

In addition, if our shares are quoted on the OTC Markets or another trading platform or exchange for which we qualify, our share price may be affected by factors that are unrelated or disproportionate to our operating performance. Our share price might be affected by general economic, political, and market conditions such as recessions, interest rates or international currency fluctuations. In addition, even if our stock is approved for quotation by a market maker through the OTC Markets or on another trading platform or exchange, stocks traded over this quotation system are usually thinly traded, highly volatile and not followed by analysts. These factors, which are not under our control, may have a material effect on our share price.

Because we can issue additional shares of Common Stock, purchasers of our Common Stock will suffer immediate dilution, and may experience further dilution in the future.

We are authorized to issue up to 75,000,000 shares of Common Stock. As of April 27, 2017, 22,663,621 shares of Common Stock are issued and outstanding. Our Board of Directors has the authority to mandate the issuance of additional shares of Common Stock without the consent of any of our shareholders. Consequently, our shareholders may experience further dilution of their ownership of the Company in the future, which could have an adverse effect on the trading market for our Common Stock.

We have not paid cash dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our Common Stock.

We have never paid cash dividends on our Common Stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our Common Stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our Board of Director may consider relevant. If we do not pay dividends, our Common Stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

Our Common Stock is deemed a “penny stock,” which would make it more difficult for our investors to sell their shares.

Our Common Stock is subject to the “penny stock” rules adopted under Section 15(g) of the Securities Exchange Act of 1934, as amended (“Exchange Act”). The penny stock rules generally apply to companies whose Common Stock is not listed on the NASDAQ Stock Market or other national securities exchange and trades at less than $4.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

Our stock price may be volatile; you may not be able to resell your shares at or above your purchase price.

The market prices for securities of companies similar to ours have been highly volatile, with price and volume fluctuations, and may continue to be highly volatile in the future. Although there is presently no public trading market for our Common Stock, if a market for our shares develops, the following factors, in addition to other risk factors described in this section, may have a significant impact on the market price of our common stock, some of which are beyond our control:

| · |

announcements of technological innovations or new commercial products by our competitors or us

|

| · |

our issuance of equity or debt securities, or disclosure or announcements relating thereto;

|

| · |

developments concerning proprietary rights, including patents;

|

| · |

regulatory developments in the United States and foreign countries;

|

| · |

litigation;

|

| · |

economic and other external factors or other disaster or crisis; or

|

| · |

period-to-period fluctuations in our financial results.

|

We may not be able to achieve secondary trading of our stock in certain states because our Common Stock is not nationally traded, which could subject our shareholders to significant restrictions and costs.

Our Common Stock is not eligible for trading on The NASDAQ Capital Market or on a national securities exchange. Therefore, our Common Stock is subject to the securities laws of the various states and jurisdictions of the United States in addition to federal securities law. While we may register our Common Stock or qualify for exemptions for our Common Stock in one of more states, if we fail to do so the investors in those states where we have not taken such steps may not be allowed to purchase our stock or those who presently hold our stock may not be able to resell their shares without substantial effort and expense. These restrictions and potential costs could be significant burdens on our shareholders.

This prospectus contains forward-looking statements. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact. These forward-looking statements are based on our current expectations and projections about future events and they are subject to risks and uncertainties known and unknown that could cause actual results and developments to differ materially from those expressed or implied in such statements.

In some cases, you can identify forward-looking statements by terminology, such as “expects”, “anticipates”, “intends”, “estimates”, “plans”, “potential”, “possible”, “probable”, “believes”, “seeks”, “may”, “will”, “should”, “could” or the negative of such terms or other similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus.

You should read this prospectus and the documents that we reference herein and therein and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Because the risk factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. These risks and uncertainties, along with others, are described above under the heading “Risk Factors” beginning on page 5 of this prospectus. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus, and particularly our forward-looking statements, by these cautionary statements.

This prospectus also includes estimates of market size and industry data that we obtained from industry publications and surveys and internal company sources. The industry publications and surveys used by management to determine market size and industry data contained in this prospectus have been obtained from sources believed to be reliable.

The Company will not receive any proceeds from this offering. The Selling Shareholders will receive all of the net proceeds from the offering of their shares of Common Stock.

There is currently no public or other market for our Common Stock, and we cannot guarantee that any such market will develop in the foreseeable future. It is our intention to seek quotation on OTCQX. The Company and its sponsoring broker dealer have filed form 211 with FINRA to obtain the Company’s trading symbol and are waiting for the issuance; provided, however, there can be no assurances that our Common Stock will be approved for trading on the OTCQX or any other trading exchange.

As of April 27, 2017, there were 154 shareholders of record of our Common Stock.

Since inception we have not declared or paid any cash dividends and do not intend to declare any such dividends in the foreseeable future. We currently intend to retain any future earnings for use in the operation of our business. Our ability to pay dividends is subject to limitations imposed by Nevada law. Under Nevada law, dividends may be paid to the extent that a corporation’s assets exceed its liabilities and it is able to pay its debts as they become due in the usual course of business. Any future determination to pay dividends will be at the discretion of our Board of Directors.

We may, from time to time, issue certain equity awards pursuant to our 2016 Omnibus Incentive Plan (the "2016 Plan''). The 2016 Plan was adopted by our Board of Directors on January 2, 2016 and was subsequently approved by our shareholders on January 2, 2016. As of December 31, 2016, incentive stock options to purchase an aggregate of 1,178,000 shares of Common Stock and non-qualified options to purchase an aggregate of 1,154,000 shares of the Company's Common Stock were issued under the 2016 Plan, all with an exercise price of $1.00 per share. Of such issuances, 138,000 options vested immediately upon grant and the remaining vest in varying amounts ranging from 100,000 annually to monthly increments ranging from 3,333 to 17,000 based on individual stock option agreements. Each option has a three-year term commencing on each date of vesting.

The 2016 Plan will be administered by a committee of two or more non-employee independent directors designated by the Board. The committee shall perform the requisite duties with respect to awards granted. The committee currently determines to whom awards are made, the timing of any such awards, the type of securities, and number of shares covered by each award, as well as the terms, conditions, performance criteria, restrictions and other provisions of awards. The committee has the authority to cancel or suspend awards, accelerate the vesting or extend the exercise period of any awards made pursuant to the 2016 Plan.

Shares Available under the 2016 Plan

The maximum shares available for issuance under the 2016 Plan are 5,000,000, subject to adjustment as set forth in the 2016 Plan. Any shares subject to an award that expires and that are cancelled, forfeited or settled for cash shall become available under the 2016 Plan. The committee can issue awards comprised of restricted stock, stock options, stock appreciation rights, stock units and other awards, as set forth in the 2016 Plan.

The following table sets forth, as of December 31, 2016, (A) the number of securities to be issued upon the exercise of outstanding options, warrants and rights issued under our equity compensation plans, (B) the weighted-average exercise price of such options, warrants and rights, and (C) the number of securities remaining available for future issuance under our equity compensation plans (excluding those securities set forth in Item (A)).

|

Plan Category

|

Number of securities

to be issued upon exercise of outstanding options, warrants and rights (A) |

Weighted average

price of outstanding options, warrants and rights (B) |

Number of securities

remaining available for future issuance under equity compensation plans (excluding (A)) (C) |

|||||||||

|

|

||||||||||||

|

Equity compensation plans approved by

security holders:

|

||||||||||||

|

2016 Plan

|

2,332,000

|

$

|

1.00

|

2,668,000

|

||||||||

|

|

||||||||||||

|

Equity compensation plans not approved by

security holders:

|

||||||||||||

|

Stock options issued outside the plans

|

—

|

—

|

—

|

|||||||||

|

|

||||||||||||

|

Total

|

2,332,000

|

$

|

1.00

|

2,668,000

|

||||||||

The following discussion and analysis of financial condition and results of operations should be read together with our financial statements and accompanying notes appearing elsewhere in this Prospectus. This Management’s Discussion and Analysis contains forward-looking statements that involve risks and uncertainties. Please see “Forward-Looking Statements” set forth in the beginning of this Prospectus, and see “Risk Factors” beginning on page 5 for a discussion of certain risk factors applicable to our business, financial condition, and results of operations. Operating results are not necessarily indicative of results that may occur in future periods.

Overview of Business

Nexeon MedSystems Inc was incorporated on December 7, 2015 in the State of Nevada. We are a development stage enterprise focusing on the development and commercialization of physician-driven medical device innovations for the treatment of cardiovascular disease. The Company’s consolidated operations include operations of the following wholly-owned subsidiaries: Nexeon Medsystems Europe, SARL (“Nexeon Europe”), Nexeon Medsystems Puerto Rico Operating Company Corporation (“NXPROC”) and Pulsus. Nexeon Europe is the holding company for NXPROC and will be the holding company for NMB upon acquisition of NMB. NXPROC is focused on research and development, software development and data analysis for the implantable neurotechnology device, NNS. Pulsus will conduct research and development on the Company’s cardiovascular disease technology (the Micro-Perforated Catheter Balloon).

Our operations to date have been limited to organizing and staffing the Company, limited research and development activities, our Merger with NXDE, which included acquisition of certain intellectual property and organization of a private placement offering.

As of December 31, 2016, we had an accumulated deficit of $1,592,338. Our net loss was $1,591,423 for the year ended December 31, 2016, compared with a net loss of $915 for the period between December 7, 2015 (inception) and December 31, 2015.

We expect that we will continue to incur significant expenses and increasing operating losses in connection with our ongoing activities, particularly as we continue to invest in research and development and initiate clinical trials required to receive regulatory approval for our medical devices in both the United States and European Union. Additionally, if and when we initiate a launch of one or more of our products, we expect to incur substantial commercialization expenses related to the manufacture and distribution, as well as sales and marketing, of these products. In addition, the Company is subject to additional costs associated with operating as a public company. Accordingly, we may need to obtain additional funding to continue operations. Such financing may not be available to us on acceptable terms, or at all. In the event we require additional capital and are unable to secure such funding, we could be forced to delay, reduce, or eliminate our research and development activities, as well as any future commercialization of our products.

Results of Operations - Fiscal year ended December 31, 2016 compared to fiscal year ended December 31, 2015.

Our results of operations reflect the year ended December 31, 2016 and the period from December 7, 2015 (inception) through December 31, 2015.

Revenue

To date, we have not generated any revenues. Our ability to generate revenues will depend heavily on the successful completion of the requisite clinical trials and studies necessary to achieve approval to begin marketing our contemplated medical devices from the relevant regulatory authorities in the United States and European Union.

Research & Development Activities

Research and Development (“R&D”) expenses consist of the costs associated with our research and discovery efforts related to the design and development of our proposed medical devices. Primarily, R&D expenses are expected to include, but may not be limited to:

| · |

Facilities, laboratory supplies, equipment and related expenses;

|

| · |

Employee-related expenses, which among other things includes salaries, benefits, travel, and stock-based compensation;

|

| · |

External R&D activities incurred under arrangements with third-parties such as contract research organizations, manufacturing organizations, consultants, and possibly a scientific advisory board; and

|

| · |

License fees and other costs associated with securing and protecting intellectual property.

|

For the year ending December 31, 2016 and the period ending December 31, 2015, the Company’s R&D expenses were $266,586 and $0, respectively, primarily reflecting fees for consultants, materials and supplies.

It is expected that our R&D activities and related expenses will increase significantly in the future as we increase the scope and rate of such efforts and begin more expensive development activities, including clinical trials and similar studies as required by the relevant regulatory authorities in our targeted jurisdictions (i.e. the United States and European Union).

The successful completion of the requisite clinical trials and studies to bring our contemplated medical devices to the U.S. and E.U. markets is highly uncertain. We cannot reasonably estimate or know the nature, timing, and estimated costs of the related efforts, nor can we make any assurances as to the period, if any, in which material net cash inflows from sales of our medical devices may commence. This uncertainty is due to the numerous risks and variables associated with developing and marketing medical devices, including, but not limited to:

| · |

The scope and degree of progress associated with our research and discovery efforts, as well as related development activities;

|

| · |

The extent of expenses incurred in conjunction with the foregoing activities;

|

| · |

The safety and efficacy of our medical device as compared to traditional treatment modalities;

|

| · |

Our ability to articulate successfully the benefits of our medical device to medical professionals who will be responsible for introducing patients to our product;

|

| · |

The results of anticipated clinical studies and trials as required by the relevant regulatory approval processes;

|

| · |

The terms and timing of potential regulatory approvals, if any; and

|

| · |

The expense of securing licenses to relevant intellectual property and/or the expense of filing, prosecuting, defending, and enforcing patent claims and other intellectual property rights that we either own outright or have licensed.

|

Unfavorable developments with respect to any of the foregoing could mean significant changes in the cost and timing associated with our ability to bring our medical device to market and begin generating revenues.

General & Administrative Expenses

General and administrative expenses generally consist of salaries and similar costs associated with employees, including stock-based compensation expense. This category of expenses may also include facility costs and professional fees related to (i) legal and patent services; (ii) capital formation; (iii) investor and public relations services; and (iv) consulting and accounting services.

For the year ending December 31, 2016 and the period ending December 31, 2015, the Company’s general and administrative expenses were $582,867 and $915, respectively.

It is expected that our general and administrative expenses will increase in the future as we expand our R&D activities in pursuit of regulatory approval for our contemplated medical device. Such a rise in expenses could result from:

| · |

Increased number of employees;

|

| · |

Expanded infrastructure;

|

| · |

Higher legal and compliance costs;

|

| · |

Increased complexity of our financial statements that could precipitate a rise in our bookkeeping and accounting costs;

|

| · |

Higher insurance premiums; or

|

| · |

Increased need for investor and public relation services.

|

Depreciation and Amortization

Depreciation and amortization expenses consist of amortization of acquired intangibles and depreciation for office equipment and furniture and fixtures. Equipment is depreciated using the straight-line method over the estimated useful lives of the assets. During the year ended December 31, 2016, the Company acquired $986 in office equipment. During the year ended December 31, 2016, the Company acquired $6,120,000 in patents pertaining to the cardiovascular disease technology acquired pursuant to the merger with NXDE and $3,190,000 in patent licenses for the underlying patents referred to as the Siemens Intellectual Property. The amortization period for each of the individual patents depends on the legal terms for patents in the countries in which they are granted. In most countries, including the United States, the patent term is generally 20 years from the earliest claimed filing date of a non-provisional patent application in the applicable country. The patents and patent licenses are amortized using the straight-line method over the remaining time until expiration. The majority of these patents and patents underlying the license will expire between 2020 and 2036.

For the year ended December 31, 2016 and the period ending December 31, 2015, the Company's depreciation expenses were $99 and $0, respectively. For the year ended December 31, 2016 and the period ending December 31, 2015, the Company's amortization expenses were $562,714 and $0, respectively.

Liquidity and Capital Resources

Sources of Liquidity

To date, the Company has not generated any revenues and has financed operations through a private placement of our Common Stock and from loans from the Company's largest shareholder, Rosellini Scientific. On December 2, 2016, the Company closed a private placement (the “December Private Placement”) pursuant to which it received $2,860,946 in net cash proceeds from the issuance of 2,840,946 units. The purchase price for each unit was $1.00 per unit and each unit consisted of one share of Common Stock and one warrant to purchase one additional share of Common Stock. The warrants have an exercise price of $2.00 per share and expire 36 months from the date of issuance of the warrants.

In addition, the Company also issued 347,336 shares of Common Stock for certain legal, corporate structuring and research and development consulting services rendered by third-party consultants. These shares were valued at $347,336. During the next 12 months, the Company may elect to issue additional debt or equity capital either by private placement or a registered offering. There can be no assurance that the Company will be successful in completing any new debt and/or equity financing or receive assignments of grants. In the event that the Company is unable to secure needed financing or is unable to secure such financing on terms it finds favorable, the Company may be forced to delay, limit, or terminate product development and/or future product commercialization.

As of December 31, 2016, we had cash on hand of $2,039,907 and a working capital surplus of $2,004,347. Based upon our budgeted burn rate, we currently have operating capital for approximately five months. The Company has historically relied on equity or debt financings to finance its ongoing operations.

During 2016, Rosellini Scientific, an affiliate of the Company, transferred approximately $751,000 of federal research grants applicable to Pulsus’ products to the Company. These awards commence in the first quarter of 2017. Pulsus has applied for Matching Funds from the Kentucky SBIR Matching Funds Program funded by the Cabinet for Economic Development (“CED”), Office of Entrepreneurship. The Kentucky Science and Technology Corporation administers the Kentucky SBIR Matching Funds Program under a contract with the CED. If the Kentucky Matching Funds applications are approved, the state of Kentucky will award up to $150,000 associated with the National Institute of Health (“NIH”)/ Small Business Innovative Research Program (“SBIR”) Phase I Grant and up to $500,000 associated with the NIH/SBIR Phase II Grant. The Company and Pulsus have several additional NIH/SBIR Grant applications pending.

NMB currently has €1,496,000 (approximately US$1,615,000) in remaining funds from previously awarded grants and €1,203,000 (approximately US$1,299,000) in pending grant applications from the La Region Wallone in Belgium. Subjection to the competition of the acquisition of NMN, the NMB grant revenues would be beneficial to the Company.

From December 7, 2015 (inception) until December 31, 2015, the Company did not generate any revenues and did not raise any funds through equity or debt financings.

Material changes in the financial condition of the Company during the year ended December 31, 2016 are as follows:

| · |

The contribution on January 2, 2016 of various securities with a fair market value of $322,360 for 15,000,000 shares of the Company’s Common Stock.

|

| · |

On February 16, 2016, the Company entered into a Merger Agreement with NXDE pursuant to which the Company issued aggregate of 1,659,943 shares of the Company’s Common Stock in exchange for 100% of NXDE’s issued and outstanding shares of preferred stock and the assumption of $1,614,513 of NXDE’s liabilities. As part of the Merger Agreement, $821,482 of assumed stockholder loans and accrued interest was converted into 821,482 shares of the Company’s Common Stock and $202,825 of assumed accrued interest was cancelled. In subsequent transactions, the Company converted $466,082 of assumed stockholder loans and accrued interest into 466,082 shares of the Company’s Common Stock.

|

| · |

On December 15, 2016, pursuant to the terms of the License Agreement, William Rosellini sold, assigned and transferred any and all of his right, title and interest in and to the License owned by him related to the Siemens Intellectual Property to the Company. As consideration for the transfer of the Siemens Intellectual Property and the license related thereto, the Company paid to Mr. Rosellini the sum of $140,000 in cash and will issue to Mr. Rosellini 3,050,000 shares of the Company’s Common Stock valued at $3,050,000. The Company has not yet issued the shares of Common Stock to Mr. Rosellini.

|

Future Financing; Continued Operations

Until such time, if ever, as we can generate substantial revenues, we expect to finance our cash needs through a combination of future debt and equity financing, as well as expected non-dilutive research grant awards. Besides certain grant awards, as described above, the Company does not have any committed external source of funds. To the extent that the Company secures additional capital through the sale of convertible debt or equity securities, the ownership interest of our shareholders may be diluted, and the terms of any such securities we issue may include liquidation or other preferences that adversely affect the rights of common shareholders. In cases where the Company secures certain debt financing, if any such is available, we may become subject to certain covenants limiting or restricting our ability to take certain actions, such as incurring additional debt, making capital expenditures, or declaring dividends. In the event the Company is unable to secure needed financing, or is unable to secure such financing on terms we find favorable, we may be forced to delay, limit, or terminate product development and/or future commercialization of the same.

Off-Balance Sheet Arrangements

During the fiscal year ended December 31, 2016, we did not engage in any off-balance sheet arrangements as set forth in Item 303(a)(4) of the Regulation S-K. We have no off-balance sheet arrangements, including arrangements that would affect our liquidity, capital resources, market risk support and credit risk support, or other benefits.

Critical Accounting Policies

Our management’s discussion and analysis of the Company’s financial condition and results of operations is based on our consolidated financial statements, which were prepared in conformity with U.S. generally accepted accounting principles. The preparation of our consolidated financial statements requires us to establish accounting policies and make estimates and assumptions that affect our reported amounts of assets and liabilities at the date of the consolidated financial statements. These consolidated financial statements include some estimates and assumptions that are based on informed judgments and estimates of management. We evaluate our policies and estimates on an on-going basis and discuss the development, selection and disclosure of critical accounting policies with the Board of Directors. Predicting future events is inherently an imprecise activity and as such requires the use of judgment. Our consolidated financial statements may differ based upon different estimates and assumptions.

The Company’s significant accounting policies are described in more detail in the notes to our consolidated financial statements, which are included in the Company’s Annual Report on Form 10-K as of and for the year ended December 31, 2016. which we believe sets forth the most critical accounting policies to aid you in fully understanding and evaluating our financial condition and results of operations.

Management does not believe that any recently issued, but not yet effective accounting pronouncements, if adopted, would have a material effect on the accompanying consolidated financial statements.

Business Overview

Nexeon is a bioelectronics company developing active medical devices for the treatment of chronic medical conditions. The solutions we are developing are a unique blend of traditional device technologies such as electronics, software, mechanical engineering, and material science, as well as pharmaceuticals, protein chemistry, and cell biology.

The Company has developed a novel balloon material that utilizes carbon nanotubes and polymer. This technology, in addition to patents related to interventional cardiology products being developed by the Company, are protected with nearly 36 patent matters. Non-dilutive federal and state funding will enable the Company to develop the solution and proceed with an FDA 510(k) approval. If successful, our approach will reduce the need for follow up procedures by efficiently delivering anti-restenotic drugs, intravascularly, to direct the therapy immediately into the lesion. We expect to develop a suite of passive and electrically-active drug eluting balloons that will be owned by our wholly owned subsidiary, Pulsus.

In addition, the Company is developing and commercializing NNS, an implantable neurostimulation and recording platform. The platform is one of the very few implantable stimulation and recording devices that has received regulatory approval (CE conformity) for human use.

Key Transactions:

| · |

On February 16, 2016, NXDE merged with and into the Company, with the Company surviving the Merger as the surviving corporation. As a result of the Merger, the Company converted 100% of NXDE’s issued and outstanding common and preferred stock into an aggregate of 1,659,943 shares of the Company’s Common Stock and all shares of NXDE’s common stock, options and deferred compensation units were cancelled. In addition pursuant to the terms of the Merger, the Company will pay Nexeon Shareholder Royalty Group LLC, a West Virginia limited liability company formed in connection with the Merger, a three percent (3%) royalty of net product sales received by the Company, its affiliates and licensees derived in connection with the commercialization of patents or other intellectual property acquired by the Company pursuant to the Merger. The patents acquired pursuant to the Merger and other intellectual property will be spun-out into Pulsus, and will serve as the basis for our balloon catheter product, which will be the first product we shall attempt to develop to commercialization.

|

| · |

The Company acquired a non-exclusive license, subject to a 6% royalty fee, to a portfolio of 86 patents that originated from Siemens AG, a global technology company. With this license, the Company controls nearly 125 patents and patent applications in the bioelectronics space. The intellectual property relates to IOT technology as described by a system of interrelated computing devices, mechanical and digital machines, objects, animals, and/or people that have unique identifiers and a subsequent ability to transfer data over a network without requiring human-to-human or human-to-computer interaction. This technology, with further development, can be utilized in a wide variety of medical device applications, most notably in hospitals, nursing facilities, or patients’ homes.

|

| · |

On January 10, 2017, the Company has entered into an exclusive, irrevocable agreement with Rosellini Scientific pursuant to which the Company will acquire 100% of the issued and outstanding shares of NMB, an entity controlled by William Rosellini, our Chief Executive Officer.

|

Neurological Disease Markets

In conjunction with the acquisition of NMB, Nexeon will be developing implantable neurotechnology to be applied for the relief of chronic diseases and disorders such as using deep brain stimulation (“DBS”). Central to Nexeon’s future products is, NNS, an implantable neurostimulation and recording platform. The platform is one of the very few implantable stimulation and recording devices that has previously received regulatory approval in Europe (CE conformity) for human use.

The complete system is designed, developed, and validated according to International Organization for Standardization (“ISO”) 14708-3 and ISO 10993 standards. The programmer software and all embedded software in the Implantable Pulse Generator, Remote Control and Battery Charger are compliant with the International Electrontechnical Commission (“IEC”) 62304 standard.