Attached files

| file | filename |

|---|---|

| EX-31.8 - 2017 Q2 EXHIBIT 31.8 - FelCor Lodging Trust Inc | a2017q210k-aexh318.htm |

| EX-31.7 - 2017 Q2 EXHIBIT 31.7 - FelCor Lodging Trust Inc | a2017q210k-aexh317.htm |

| EX-31.6 - 2017 Q2 EXHIBIT 31.6 - FelCor Lodging Trust Inc | a2017q210k-aexh316.htm |

| EX-31.5 - 2017 Q2 EXHIBIT 31.5 - FelCor Lodging Trust Inc | a2017q210k-aexh315.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One) | ||

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF | |

THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended December 31, 2016 | ||

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF | |

THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from to | ||

Commission file number: 001-14236 | (FelCor Lodging Trust Incorporated) | ||

Commission file number: 333-39595-01 | (FelCor Lodging Limited Partnership) | ||

FelCor Lodging Trust Incorporated

FelCor Lodging Limited Partnership

(Exact Name of Registrant as Specified in Its Charter)

Maryland | (FelCor Lodging Trust Incorporated) | 75-2541756 | |||

Delaware | (FelCor Lodging Limited Partnership) | 75-2544994 | |||

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||||

125 E. John Carpenter Freeway, Suite 1600, Irving, Texas | 75062 | ||

(Address of Principal Executive Offices) | (Zip Code) | ||

(972) 444-4900

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | ||||||||||||||||

FelCor Lodging Trust Incorporated: | |||||||||||||||||

Common Stock | New York Stock Exchange | ||||||||||||||||

$1.95 Series A Cumulative Convertible Preferred Stock | New York Stock Exchange | ||||||||||||||||

FelCor Lodging Limited Partnership: | |||||||||||||||||

None | |||||||||||||||||

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

FelCor Lodging Trust Incorporated | þ | Yes | ¨ | No | ||

FelCor Lodging Limited Partnership | ¨ | Yes | þ | No | ||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

FelCor Lodging Trust Incorporated | ¨ | Yes | þ | No | ||

FelCor Lodging Limited Partnership | þ | Yes | ¨ | No | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

FelCor Lodging Trust Incorporated | þ | Yes | ¨ | No | ||

FelCor Lodging Limited Partnership | ¨ | Yes | þ | No | ||

Note: As a voluntary filer not subject to filing requirements of Section 13 or 15(d) of the Exchange Act, the registrant has filed all reports pursuant to Section 13 or 15(d) as if the registrant was subject to such filing requirements.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

FelCor Lodging Trust Incorporated | þ | Yes | ¨ | No | ||

FelCor Lodging Limited Partnership | þ | Yes | ¨ | No | ||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ | ||||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

FelCor Lodging Trust Incorporated: | ||

Large accelerated filer þ | Accelerated filer ¨ | |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |

Emerging growth company ¨ | ||

FelCor Lodging Limited Partnership: | ||

Large accelerated filer ¨ | Accelerated filer ¨ | |

Non-accelerated filer þ (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |

Emerging growth company ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

FelCor Lodging Trust Incorporated | ¨ | Yes | þ | No | ||

FelCor Lodging Limited Partnership | ¨ | Yes | þ | No | ||

The aggregate market value of shares of common stock held by non-affiliates of FelCor Lodging Trust Incorporated as of June 30, 2016, computed by reference to the price at which its common stock was last sold at June 30, 2016, was approximately $837 million. | ||||||||||||||||||||

As of February 20, 2017, FelCor Lodging Trust Incorporated had issued and outstanding 138,103,326 shares of common stock. | ||||||||||||||||||||

EXPLANATORY NOTE

On February 24, 2017, FelCor Lodging Trust Incorporated ("FelCor", or the "Company") and FelCor Lodging Limited Partnership ("FelCor LP") filed their Annual Report on Form 10-K for the year ended December 31, 2016 (the “Original Form 10-K”). This Amendment No. 1 to Form 10-K on Form 10-K/A (the "Amendment") amends Part III, Items 10 through 14 of the Original Form 10-K to include information previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K. General Instruction G(3) to Form 10-K provides that registrants may incorporate by reference certain information from a definitive proxy statement which involves the election of directors if such definitive proxy statement is filed with the Securities and Exchange Commission (the "SEC") within 120 days after the end of the fiscal year. We do not anticipate that our definitive proxy statement involving the election of directors will be filed within such 120-day period. Accordingly, Part III of the Original Form 10-K is hereby amended and restated as set forth below. The information included herein as required by Part III, Items 10 through 14 of Form 10-K is more limited than what is required to be included in the definitive proxy statement to be filed in connection with our annual meeting of stockholders. Accordingly, any definitive proxy statement filed at a later date will include additional information related to the topics herein and additional information not required by Part III, Items 10 through 14 of Form 10-K. This Amendment also amends and restates Part II, Item 5 of Form 10-K to include our share performance graph. We use the terms "we" or "our" to refer to FelCor (including its consolidated subsidiaries) in this Amendment.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by our principal executive officer and principal financial officer are filed as exhibits to this Amendment under Item 15 of Part IV hereof.

Except as described above, no other changes have been made to the Original Form 10-K. This Amendment continues to speak as of the date of the Original Form 10-K and the Company has not updated the disclosure herein to reflect any events that occurred at a later date other than as expressly stated herein. Accordingly, this Amendment should be read in conjunction with the Original Form 10-K and with our filings made with the SEC subsequent to the filing of the Original Form 10-K.

FELCOR LODGING TRUST INCORPORATED and

FELCOR LODGING LIMITED PARTNERSHIP

INDEX

Item No. | Page | ||

PART II | |||

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||

Share Performance Graph | 4 | ||

PART III | |||

Item 10. Directors, Executive Officers and Corporate Governance | |||

The Board of Directors | |||

Executive Officers | 13 | ||

Corporate Governance | 15 | ||

Board Leadership, Meetings and Performance | 15 | ||

Board Committees | 15 | ||

Risk Oversight | |||

CEO Succession Planning | 18 | ||

Code of Business Conduct and Ethics | 18 | ||

Section 16(a) Beneficial Ownership Compliance | 18 | ||

Item 11. Executive Compensation | |||

Compensation Discussion and Analysis | |||

Compensation Committee Report | |||

2016 Summary Compensation Table | |||

Termination or Change-in-Control Payments | |||

Director Compensation | |||

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||

Stock Ownership | |||

Equity Compensation Plan Information | |||

Item 13. Certain Relationships, Related Party Transactions and Director Independence | |||

Related Party Transactions | |||

Director Independence | |||

Item 14. Principal Accounting Fees and Services | |||

Independent Registered Public Accounting Firm | |||

PART IV | |||

Item 15. Exhibits, Financial Statement Schedules | |||

SIGNATURES | |||

2

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchange under the symbol “FCH.” The following table sets forth the high and low sale prices for our common stock for the indicated periods, as traded on that exchange, and dividends declared per share.

High | Low | Dividends Declared Per Share | ||||||||||||

2016 | ||||||||||||||

First quarter | $ | 8.17 | $ | 5.47 | $ | 0.06 | ||||||||

Second quarter | 8.08 | 5.68 | 0.06 | |||||||||||

Third quarter | 7.19 | 6.00 | 0.06 | |||||||||||

Fourth quarter | 8.44 | 6.07 | 0.06 | |||||||||||

2015 | ||||||||||||||

First quarter | $ | 12.43 | $ | 9.70 | $ | 0.04 | ||||||||

Second quarter | 12.29 | 9.64 | 0.04 | |||||||||||

Third quarter | 10.87 | 6.88 | 0.04 | |||||||||||

Fourth quarter | 8.63 | 6.83 | 0.06 | |||||||||||

Stockholder Information

At February 20, 2017, we had approximately 138 record holders of our common stock and 15 record holders of our Series A preferred stock (which is convertible into common stock). However, because many of the shares of our common stock and Series A preferred stock are held by brokers and other institutions on behalf of stockholders, we believe there are substantially more beneficial holders of our common stock and Series A preferred stock than record holders. At February 20, 2017, there were 18 holders (other than FelCor) of FelCor LP units. FelCor LP units are redeemable for cash or, at our election, for shares of FelCor common stock.

IN ORDER TO COMPLY WITH CERTAIN REQUIREMENTS RELATED TO OUR QUALIFICATION AS A REIT, OUR CHARTER LIMITS, SUBJECT TO CERTAIN EXCEPTIONS, THE NUMBER OF SHARES OF ANY CLASS OR SERIES OF OUR CAPITAL STOCK THAT MAY BE OWNED BY ANY SINGLE PERSON OR AFFILIATED GROUP TO 9.9% OF THE OUTSTANDING SHARES OF THAT CLASS OR SERIES.

Distribution Information

In order to maintain our qualification as a REIT, we must distribute at least 90% of our annual taxable income (other than net capital gains) to our stockholders each year. We distributed in excess of 100% of our taxable income in 2016 and 2015. We had no taxable income for 2014. Under certain circumstances, we may be required to make distributions that exceed cash available for distribution in order to meet REIT distribution requirements. In that event, we expect to borrow funds or sell assets to obtain cash sufficient to make the required distribution.

Our senior notes indentures limit our ability to pay dividends and make other payments based on our ability to satisfy certain financial requirements (except as necessary to retain REIT status). The terms of our outstanding preferred stock prohibit us from paying dividends on our common stock unless all accrued preferred dividends then payable have been paid. None of these restrictions prevent us from paying dividends under current circumstances. We discuss these limitations further in “Liquidity and Capital Resources” in Item 7 and in Item 1A, Risk Factors.

3

Stock Performance Graph

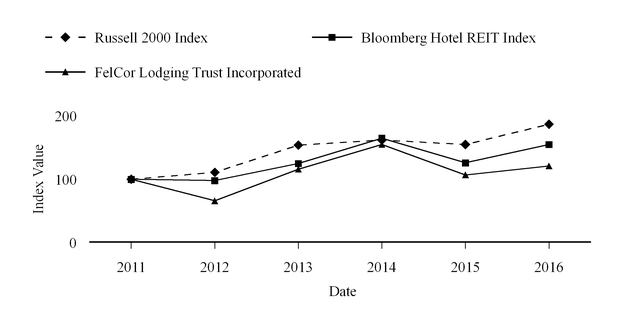

The following graph compares the yearly change in our cumulative shareholder return on our common shares for the period beginning December 31, 2011 and ending December 31, 2016, with the yearly changes in the Bloomberg Hotel REIT Index and Russell 2000 Index for the same period, assuming a base share price of $100.00 for our common shares. The Bloomberg Hotel REIT Index is comprised of publicly traded REITs which focus on investments in hotel properties. Total shareholder return equals appreciation in stock price plus dividends paid and assumes that all dividends are reinvested. The performance graph is not indicative of future investment performance. We do not make or endorse any predictions as to future share price performance.

December 31, | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

FelCor Lodging Trust Incorporated | 100 | 66 | 116 | 155 | 107 | 121 |

Bloomberg Hotel REIT Index | 100 | 98 | 125 | 165 | 126 | 155 |

Russell 2000 Index | 100 | 111 | 154 | 162 | 155 | 187 |

4

PART III

Item 10. Directors, Executive Officers of the Registrant and Corporate Governance

The Board of Directors

The Company's Board of Directors, or the Board, oversees the management of the Company on your behalf. Our Board reviews our long-term strategic plans and exercises direct decision-making authority on key issues, such as hiring and reviewing our Chief Executive Officer, including setting the scope of his authority to manage day-to-day operations and evaluating his performance, declaring dividends, issuing stock, and reviewing and approving strategy and overseeing its execution. Our directors are listed below, along with summaries of their relevant professional experience, individual qualifications, attributes and skills. As disclosed in our preliminary proxy statement on Schedule 14A filed with the Securities and Exchange Commission, or SEC, on March 24, 2017, Thomas J. Corcoran and Robert H. Lutz are not standing for re-election at the Company's 2017 annual meeting of stockholders.

Dana Hamilton and Patricia L. Gibson were first elected to the Board in March 2016 in accordance with our agreement with Land & Buildings Investment Management, LLC, or Land & Buildings, as previously disclosed in our Current Report on Form 8-K filed February 19, 2016, whereby we agreed to take all reasonably necessary actions to appoint two independent directors mutually agreed-upon between us and Land & Buildings. Pursuant to that agreement, Ms. Hamilton was recommended by Land & Buildings, and Ms. Gibson was identified by the Board using a third-party search firm. In addition, the employment agreement of our Chief Executive Officer, Steven R. Goldman, provides that he be appointed to the Board. There are no other arrangements or understandings between any director and any other person pursuant to which that director was nominated.

Glenn A. Carlin (age 56) has served as a director since May 2009. Since 2013, Mr. Carlin has served as Executive Vice President, Corporate Development and Chief Financial Officer of Twin River Management Group, Inc., which indirectly owns and operates gaming and entertainment properties. From October 2009 through August 2013, Mr. Carlin was employed at CBRE Capital Advisors, Inc., the investment banking unit of CBRE Group, Inc., a global real estate services company. He most recently served as its Executive Managing Director and Group Head. Mr. Carlin also served on the board of directors of Twin River Worldwide Holdings, Inc. from 2010 to 2013. From 1992 to 2009, Mr. Carlin was employed by J.P. Morgan Securities Inc. and its predecessors, serving in a variety of capacities, most recently as a Managing Director and Head of Lodging & Gaming - Real Estate Investment Banking. Mr. Carlin previously worked at HVS Financial Services, Morgan Stanley Realty Incorporated and Arthur Andersen & Co. Mr. Carlin graduated from the Wharton School at the University of Pennsylvania and earned a Masters of Business Administration from Columbia Business School. | Qualifications: financial and capital markets expertise; lodging and real estate industries - general and transactional knowledge; Audit Committee financial expert; independent. Mr. Carlin is a seasoned corporate executive who previously had a distinguished career as an investment banker, with a particular focus on real estate finance and the lodging and gaming industries. He brings an insider’s perspective to the Board’s discussions concerning our balance sheet strategy and capital market activities, including equity and debt financings, liquidity, investor relations and other capitalization matters. His financial background is particularly valuable as he serves on our Finance Committee and as the Chair of our Audit Committee. | |

5

Thomas J. Corcoran, Jr. (age 68) is the Chairman of the Board and has served as a director since 1994. He served as the President and Chief Executive Officer of FelCor from its formation in 1994 until February 2006, when he became the non-executive Chairman of the Board. From 1991 to 1994, Mr. Corcoran served as the President and Chief Executive Officer of the general partner of the partnerships that were merged into the Company at its formation. From October 1990 to December 1991, he served as the Chairman, President and Chief Executive Officer of Fiesta Foods, Inc., a manufacturer of tortilla chips and taco shells. From 1979 to 1990, Mr. Corcoran held various positions with ShowBiz Pizza Time, Inc., an operator and franchisor of family entertainment center/pizza restaurants, and with Integra (formerly Brock Hotel Corporation), a hotel and restaurant company of which he served as the President and Chief Executive Officer from 1986 to 1990. Mr. Corcoran has served as a director of Sammons Enterprises, Inc., a diversified portfolio investment company, since December 2010 (he currently chairs that board), and currently serves on the Board of Directors of the American Hospitality & Lodging Association. Mr. Corcoran graduated from Washburn University and earned a law degree from the Washburn University School of Law. | Qualifications: our founder and former President and Chief Executive Officer; extensive lodging industry leadership experience and relationships; general management experience; in-depth knowledge of FelCor, its properties and historical strategic, transactional and tactical decision-making. In addition to his hotel industry and general management and corporate leadership experience, Mr. Corcoran has exceptional in-depth knowledge of our history, assets and strategic relationships. He brings a sophisticated understanding of hotel operations, hotel brands and management, hotel transactions, and general management. As the Chairman of the Board, Mr. Corcoran’s attributes assist in the administration of the Board’s governance, oversight and management responsibilities. | |

Robert F. Cotter (age 65) has served as a director since July 2006. Mr. Cotter founded Cotter and Cotter Inc., a hospitality consultancy in 2010. From March 2007 until his retirement in 2008, he served as President and a director of Kerzner International Holdings Limited, or Kerzner, a developer and operator of luxury hotels and resorts. Prior to joining Kerzner, Mr. Cotter served as President and Chief Operating Officer of Starwood Hotels & Resorts Worldwide, Inc., or Starwood Hotels, from 2003 through his retirement from Starwood Hotels in December 2005. He spent most of his 35-year career with Starwood Hotels and its predecessors and was named Chief Operating Officer in 2000, after serving as President, International Operations, and President and Chief Operating Officer, Europe. Mr. Cotter graduated from Boston College. | Qualifications: long-time lodging industry executive with extensive operating and leadership experience; detailed understanding of hotel brand strategies and management practices; substantial experience managing and compensating executives and managing for performance; independent. Mr. Cotter’s lengthy career in the lodging industry - from postings at individual properties to serving as a senior executive at Starwood Hotels and Kerzner - is the basis for refined strategic insights about our portfolio, the various hotel brands and management companies and opportunities for growth. Mr. Cotter also has substantial experience managing and driving individual and team performance, which is particularly relevant to his work on our Compensation Committee. | |

6

Patricia L. Gibson (age 54) has served as a director since March 2016. She serves as Chief Executive Officer of Banner Oak Capital Partners, or Banner Oak, which she co-founded in October 2016. From April 2007 to October 2016, Ms. Gibson was President of Hunt Realty Investments, Inc., or Hunt, the centralized real estate investment management company for the Hunt family and related entities. She joined Hunt as Senior Vice President in 1997. Prior to joining Hunt in 1997 as Senior Vice President, Ms. Gibson held senior financial positions with Archon Group, a subsidiary of Goldman Sachs & Co. and The Travelers Realty Investment Company. Ms. Gibson serves on the Board of Directors of Pacolet Milliken Enterprises, Inc., a private family-owned investment company focused on energy and real estate investments, and she currently chairs the National Association of Real Estate Managers and is the vice-chair of the Industrial and Office Parks council of the Urban Land Institute, or ULI. She is a graduate of Fairfield University and holds a Master of Business Administration Degree from the University of Connecticut. Ms. Gibson is a Chartered Financial Analyst. | Qualifications: significant financial, transactional and asset management expertise; extensive leadership and general management experience; independent. Ms. Gibson’s financial, financial reporting, underwriting and analytical background, particularly focused on real estate investing and finance, complement the skillsets of our other directors and is particularly relevant to her service as a director. | |

7

Steven R. Goldman (age 56) joined us as our Chief Executive Officer in February 2017 and has served on the Board since that time. Prior to joining us, Mr. Goldman was a Managing Director at Starwood Capital Group, or Starwood, from September 2010 to February 2017. While at Starwood, Mr. Goldman served as President of Starwood’s affiliate SH Group, a hotel brand management company that oversees the development and management of the firm’s two luxury and lifestyle hotel and residence brands, 1 Hotels and Baccarat Hotels & Resorts, and as Chief Executive Officer, President and Director of Groupe du Louvre, Starwood’s portfolio investment holding company in France. Prior to joining Starwood, Mr. Goldman was President, Global Real Estate and Development at Hilton Worldwide Holdings Inc. from April 2008 to June 2010, where he was responsible for global development and oversight of the company’s $15 billion owned and leased real estate portfolio. Mr. Goldman has also previously served as President, Chief Executive Officer and Director of Sunstone Hotel Investors, Inc. from March 2007 to March 2008 and as Executive Vice President and Chief Investment Officer at Hyatt Hotels Corporation from April 2003 through April 2007. Mr. Goldman has served as a member of various professional organizations, including the Industry Real Estate Finance Advisory Council (IREFAC) of the American Hotel & Lodging Association and the Hotel Development Council of the Urban Land Institute, and as a Trustee of the Francis W. Parker School in Chicago. Mr. Goldman received his undergraduate degree from Cornell University and a Masters of Business Administration in Finance from the University of Chicago. | Qualifications: extensive industry experience; executive leadership roles at both public and private lodging companies. Through his 30+ years in the hospitality industry, both in the U.S. and abroad, Mr. Goldman brings to the Board a wealth of experience in all aspects of hotel operations, acquisitions and divestitures, finance and development, along with an international perspective. As a senior executive at both public and private lodging companies, Mr. Goldman possesses proven strategic planning and leadership skills. | |

8

Dana Hamilton (age 48) has served as a director since March 2016. She is co-founder and President of Ameriton LLC, a private real estate investment company. From October 2013 to October 2014, she served as President and Chief Executive Officer, and trustee, of Borderplex Community Trust. From May 2005 until the company was sold in February 2013, Ms. Hamilton served as President - Europe and member of the Executive Committee at Archstone, one of the largest apartment companies in the U.S. and Europe. From August 1994 until May 2005, she held various leadership positions at Archstone, including Executive Vice President - National Operations. Ms. Hamilton graduated from Stanford University and earned a Masters of Business Administration from the Haas School of Business at the University of California at Berkeley. | Qualifications: significant financial, transactional and asset management expertise; extensive leadership and general management experience; independent. Ms. Hamilton’s financial and analytical background, particularly focused on real estate investing and finance, together with her general management and other diverse experience, is particularly relevant to her service as a director. | |

Christopher J. Hartung (age 48) has served as a director since November 2010 and is currently our Lead Director. He has served as a director at Lazard Asset Management, or Lazard, since 2011. Prior to the sale of Grubb & Ellis Alesco Advisors, or Grubb & Ellis, to Lazard, he served as Senior Advisor to Grubb & Ellis from 2011 to 2012. From 2004 to 2010 he served as Managing Director, Real Estate Investment Banking of Wells Fargo Securities/Eastdil Secured, a real estate investment banking firm, where he provided investment banking services to public and private real estate companies. Mr. Hartung also served from 1997 to 2004 as Managing Director, Real Estate Equity Research at WR Hambrecht & Co., Chief Strategy Officer at iBuilding, Inc., Managing Director and Group Head, and Real Estate Equity Research at Banc of America Securities. He also served in various capacities at J.P. Morgan & Co. from 1990 to 1996. Mr. Hartung is currently, or has been, a member of various professional organizations in the real estate industry, including the ULI, Lambda Alpha International, International Council of Shopping Centers and the National Association of Real Estate Investment Trusts. Mr. Hartung previously served on the Advisory Board for the Fisher Center for Real Estate at the Haas School of Business at the University of California at Berkeley. Mr. Hartung graduated from Cornell University. | Qualifications: financial and capital markets expertise; extensive experience evaluating real estate-related businesses, investment performance, industry trends and other information bearing on the merits of investing in real estate and real estate companies such as FelCor; independent. Mr. Hartung is a seasoned financial analyst with broad knowledge of capital markets, investor sentiment and objectives, institutional investors and the dynamics and challenges inherent in real estate investing. He brings sophisticated insights to bear in assessing strategic and tactical options at the Board level, which has enhanced our decision-making process. Moreover, his consultative mindset has enhanced the overall collegiality of our Board and the Governance Committee, which he chairs. Mr. Hartung was elected Lead Director by our independent directors in 2016. | |

9

Charles A. Ledsinger, Jr. (age 67) has served as a director since November 1997. He currently serves (and has served since 2009) as the Chairman and Managing Director of SunBridge Capital Management, L.L.C. From September 2006 to May 2009, Mr. Ledsinger served as Vice Chairman of Choice Hotels International, Inc., or Choice, the parent company of Choice Hotels International, a publicly traded company, where Mr. Ledsinger served as President and Chief Executive Officer from August 1998 to his retirement in 2009. Prior to August 1998, Mr. Ledsinger served as Senior Vice President and Chief Financial Officer of St. Joe Corporation from May 1997 until his election as President and Chief Operating Officer of that company in February 1998. Prior to 1997, Mr. Ledsinger served in management positions at several lodging and gaming companies. Mr. Ledsinger has also served as Senior Vice President and Chief Financial Officer of The Promus Companies Incorporated, the former parent of Harrah’s Entertainment, Inc. He formerly served as a director of Darden Restaurants, Inc., a publicly traded company, until 2014, Choice until 2009 and TBC Corporation until 2005. Mr. Ledsinger also chairs the boards of directors of two privately held companies: Realty Investment Company, Inc., an operating and investment company, and Sunburst Hospitality Corporation, a hotel and real estate operator. Mr. Ledsinger also currently serves as a director of various community and educational institutions, and is the previous Rector (Chair) of the Board of Trustees at the University of Richmond. Mr. Ledsinger graduated from the University of Virginia and earned a Master of Business Administration degree from the University of Memphis. | Qualifications: extensive financial and executive leadership experience at lodging and real estate development companies; public company financial reporting and management experience; lengthy service as a FelCor director; service on every standing FelCor committee; sophisticated knowledge of governance, financial reporting, risk management, investor relations, compensation and other public company issues; service on other public company boards of directors provides additional perspective on governance, compensation and other best practices; independent. Mr. Ledsinger has had a long career as an executive with financial and general management responsibilities with lodging and real estate companies. As one of our longest-serving directors, Mr. Ledsinger has served on all of our standing committees, having chaired both the Audit and Compensation Committees; his own experiences managing businesses, including one of the largest hotel brand franchisors, provide the Board with a uniquely practical strategic perspective. He brings highly sophisticated public company financial and strategic management experience that informs his contributions; he also has a consultative and inclusive leadership style that encourages the collegial dynamics that enhance our Board’s effectiveness. | |

10

Robert H. Lutz, Jr. (age 67) has served as a director since July 1998. Since 2000, Mr. Lutz has served as the President of Lutz Investments LP, through which he holds and manages a variety of investments. From March 2012 to December 2015, Mr. Lutz served as Chairman of the Board of Directors and Chief Executive Officer of Wound Management Technologies, Inc., a leading innovator in advanced wound care solutions. From 1994 until 2000, Mr. Lutz served as the Chairman and Chief Executive Officer, and a member of the executive committee, of Amresco, Inc., a financial services company. From 1991 to 1994, Mr. Lutz served as President and Chief Operating Officer of Balcor/Allegiance Realty Group, a subsidiary of the American Express Company engaged in real estate ownership and management. Mr. Lutz graduated from Furman University and earned a Masters of Business Administration degree from Georgia State University. | Qualifications: extensive management and executive leadership experience; real estate capital markets and investment experience; independent. Mr. Lutz has enjoyed a lengthy career as an executive in the real estate industry and as an investor through several economic cycles. He brings substantial leadership, management and real estate experience to the Board, and his long-standing service as a FelCor director, including serving as our Lead Independent Director from 2010 to 2016, as well as his prior service on various for-profit and non-profit boards, provides an invaluable perspective on matters of corporate governance and executive compensation, as well as commercial real estate transactions and financing. | |

Mark D. Rozells (age 55) has served as a director of FelCor since March 2008. He was, most recently, the Executive Vice President and Chief Financial Officer of Fairmont Raffles Hotels International, or FRHI, a position he held from November 2010 until July 2016, when FRHI was sold. From September 2005 until he joined FRHI, Mr. Rozells was a private investor focused on real estate and entertainment assets. From April 2000 to July 2005, Mr. Rozells worked with Liberty Media Corporation and served as President and Chief Executive Officer of DMX Music, Inc. (a leading provider of music and in-store entertainment services to commercial customers including the lodging industry), and as Executive Vice President and Chief Financial Officer of Liberty Digital, Inc., a publicly-held media and music content production and distribution company. From March 1998 to April 2000, Mr. Rozells was Senior Vice President, Finance and Treasurer of Starwood Hotels & Resorts Worldwide, Inc. Prior to his service at Starwood Hotels, Mr. Rozells held treasury and finance positions with The Walt Disney Company, Imperial Corporation of America and Allied Signal, Inc. Mr. Rozells is an honors graduate of Yale College. | Qualifications: extensive financial and executive management experience, including public company financial reporting; public company leadership experience; independent. Mr. Rozells was, most recently, Executive Vice President and Chief Financial Officer of FRHI and has held executive positions with financial, strategic and general management responsibilities at several leading public companies, including The Walt Disney Company and Starwood Hotels. Mr. Rozells’s financial, lodging industry, general management and transactional expertise are particularly relevant to his work on our Board. | |

11

The following table highlights the experience each director brings to our Board:

Glenn A. Carlin | Thomas J. Corcoran | Robert F. Cotter | Patricia L. Gibson | Steven R. Goldman | Dana Hamilton | Christopher J. Hartung | Charles A. Ledsinger, Jr. | Robert H. Lutz | Mark D. Rozells | |

Financial Expertise/Literacy | ü | ü | ü | ü | ü | ü | ü | ü | ü | |

Capital Markets | ü | ü | ü | ü | ü | ü | ü | ü | ü | |

M&A/Corporate Transactions | ü | ü | ü | ü | ü | ü | ü | ü | ||

Executive Leadership | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü |

Risk Oversight/Management | ü | ü | ü | ü | ü | ü | ü | ü | ü | |

Government Relations | ü | ü | ü | |||||||

Commercial/Hotel Real Estate Investment | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü |

Commercial Real Estate Development | ü | ü | ü | ü | ü | ü | ||||

Hotel Operations | ü | ü | ü | ü | ü | ü | ü | |||

Marketing | ü | ü | ü | ü | ||||||

Consumer Products and Services | ü | ü | ü | ü | ü | |||||

12

Executive Officers

We identify the following officers as our continuing “named executive officers,” or NEOs, as contemplated by the rules and regulations of the SEC:1

Age | Position(s) With FelCor | Named Executive Officer Since | ||||||

Steven R. Goldman | 56 | Chief Executive Officer and Director | 2017 | |||||

Troy A. Pentecost | 55 | President and Chief Operating Officer | 2006 | |||||

Thomas C. Hendrick | 70 | Executive Vice President and Chief Investment Officer | 2015 | |||||

Michael C. Hughes | 42 | Executive Vice President and Chief Financial Officer | 2013 | |||||

Jonathan H. Yellen | 50 | Executive Vice President, General Counsel and Secretary | 2006 | |||||

Steven R. Goldman’s business experience is described in The Board of Directors.

Troy A. Pentecost, our President and Chief Operating Officer, is a hospitality veteran with over 35 years of hospitality industry experience. He joined us as Executive Vice President and Director of Asset Management in March 2006, and was promoted to Chief Operating Officer in August 2010 and President in September 2016. Mr. Pentecost served as our Interim Senior Executive Officer from September 16, 2016, when Mr. Smith retired, until February 27, 2017, when Steven R. Goldman joined FelCor as our Chief Executive Officer. He previously served in various management roles with Remington Hotel Corporation, or Remington, Wyndham Hotels & Resorts and Guild Hotel Management Company. Mr. Pentecost currently serves on owner and/or franchisee councils for various brands, including Doubletree, Embassy Suites, Sheraton and Marriott. Mr. Pentecost attended Bowling Green State University.

Thomas C. Hendrick was appointed Executive Vice President and Chief Investment Officer in July 2015, having previously served as a director from February 2007 until joining management. Mr. Hendrick is a well-known, longtime developer of hotels and mixed-use commercial real estate projects. He is President and Chief Executive Officer of TCH Partners, Inc., a developer of luxury, mixed-use commercial real estate projects in the U.S., the Caribbean, Mexico and Latin America. Mr. Hendrick formerly served as President of Sagewood Partners, LLC, a developer of high-end, mixed-use real estate projects, from December 2007 through July 2009, and the Executive Vice President of Acquisitions and Development for the Kor Group, or Kor, a privately held investment, development and management firm, from November 2006 to November 2007, where he oversaw hotel and resort acquisitions, development opportunities and third-party management agreements on a worldwide basis. Prior to his work with Kor, Mr. Hendrick served in senior development positions for Mandarin Oriental Hotel Group, Rosewood Hotels & Resorts, Regent International Hotels, Remington and Wyndham International, Inc. Mr. Hendrick graduated from Southeast Missouri State University and holds a Master of Business Administration degree from the University of North Florida.

_____________________________

1Richard A. Smith, who served as our President and Chief Executive Officer until September 16, 2016, is also an NEO for 2016 as contemplated by the rules and regulations of the SEC.

13

Michael C. Hughes became our Senior Vice President, Chief Financial Officer and Treasurer in July 2013 and was promoted to Executive Vice President in February 2015. He originally joined us in 2006 as Vice President, Finance, was promoted to Treasurer in February 2009 and to Senior Vice President in February 2013. Prior to joining us, Mr. Hughes was employed by Wyndham International, Inc. from February 2002 to April 2006. Prior to that time, Mr. Hughes was a business consultant with Maverick Management LLC. He was awarded a bachelor’s degree in business from Rhodes College and is a holder of the Chartered Financial Analyst® designation.

Jonathan H. Yellen joined us in July 2006 as Executive Vice President, General Counsel and Secretary. Prior to joining us, Mr. Yellen was engaged in the private practice of law with Fried Frank Harris Shriver & Jacobson LLP, Latham & Watkins LLP and Barclay Damon LLP, where he specialized in mergers and acquisitions, corporate finance and securities law, and in house at Digital Lighthouse Corporation and Starwood Hotels. From 2006 to 2011, Mr. Yellen served as a director (and chaired the Audit Committee) of Avadyne Health, a provider of health care receivable management services to hospitals and other providers. In addition, he has a long history of extensive social and community service, serving as a director of various social service organizations, including Vogel Alcove, Jewish Family Service of Greater Dallas and Buffalo Prep. He is also a member of various professional and industry organizations, including the American Bar Association and the National Association of Real Estate Investment Trusts. Mr. Yellen is a graduate of Amherst College, Columbia University School of Law (where he was a Harlan Fiske Stone Scholar) and Georgetown University Law Center.

Our NEOs are elected annually by our Board, typically at our Board’s first meeting held after the annual meeting and otherwise as necessary and convenient in order to fill vacancies or newly created offices. Each NEO holds office until a successor is duly elected and qualified or, if earlier, until retirement, death, resignation or removal. Our Board may remove any officer whenever, in its judgment, such removal is in FelCor’s best interest. Other than Steven R. Goldman’s employment agreement, there are no arrangements or understandings between any officer and any other person pursuant to which that officer was elected.

14

Corporate Governance

Board Leadership, Meetings and Performance

Leadership. We have historically separated the offices of Chief Executive Officer and Chairman of the Board as a means of distinguishing between management and the Board’s oversight of management. Our current Chairman of the Board, Mr. Corcoran, co-founded the Company and was our President and Chief Executive Officer from 1994 until 2006. In addition to the foregoing, in 2010, the Board established the position of Lead Director (to which Mr. Hartung was elected in 2016). Pursuant to its charter, the position of Lead Director only exists if the Chairman of the Board is an affiliated director or member of management. We believe that this structure provides optimal oversight of the Company’s management and affairs.

Board Meetings; Executive Session; Annual Stockholder Meeting. The Board met 11 times and consented to one action in writing during 2016, and each director attended at least 75% of the meetings of the Board and its committees on which he or she served. In connection with every regular meeting, our Board meets in executive session in the absence of management and also in the absence of any non-independent directors to discuss issues related to management performance and other matters. The Board has not adopted a formal policy with regard to director attendance at the annual meetings of stockholders because fewer than 10 non-management stockholders usually attend our annual meetings in person. Messrs. Corcoran and Smith were the only directors to attend our 2016 annual meeting.

Board Performance. Each of the Board and the Audit, Compensation and Governance Committees undertakes annual performance reviews. The results are reviewed with a view to improving performance and practices. In addition, the full Board reviews annually the qualifications and effectiveness of the Audit Committee and qualifications of its members.

Board Committees

The Board appoints committees to help carry out its duties. In particular, committees work on key issues in greater detail than would be practicable at a full Board meeting. Each committee reviews the results of its deliberations with the full Board. Current copies of the Board-adopted written charters for the Audit, Compensation, Executive, Finance and Governance Committees, as well as our Corporate Governance Guidelines and Code of Business Conduct and Ethics, may be found under the Governance tab on the Investors page of our website at www.felcor.com and are also available in print to any stockholder who requests them by writing to our corporate secretary at 125 E. John Carpenter Freeway, Suite 1600, Irving, Texas 75062.

The Audit Committee oversees audits, accounting, financial reporting and internal control matters. The committee appoints, compensates, evaluates and terminates the independent registered public accounting firm that audits our financial statements. The committee consults with our independent registered public accounting firm and reviews their audit and other work. The committee also consults with our Chief Financial Officer, General Counsel and Chief Accounting Officer and reviews our internal controls and compliance with corporate policies. The committee met six times during 2016, including prior to issuing each earnings release to review the information to be reported and to examine any issues relating to the report of earnings. The committee also reviewed each Quarterly Report on Form 10-Q and the Annual Report on Form 10-K before filing.

The committee currently consists of Ms. Hamilton and Messrs. Carlin (Chair) and Hartung, each of whom is independent in accordance with the listing standards of the New York Stock Exchange, or the NYSE. The Board has reviewed the education, experience and other qualifications of each member of the committee as set forth above and determined that all of its current members meet the SEC’s definition of an “audit committee financial expert” and are independent as contemplated by the applicable rules of the SEC. No one serving on our Audit Committee serves on the audit committees of three or more public companies.

The Compensation Committee reviews and approves the compensation to be paid to our executive officers and advises our Board on the adoption of, and administers, employee benefit and compensation plans. The committee currently consists of Messrs. Ledsinger (Chair), Carlin and Cotter, each of whom is independent in

15

accordance with the listing standards of the NYSE. The committee met two times and acted by written consent three times during 2016. No member of the committee is, or has ever been, one of our officers or employees.

In accordance with its charter, the Compensation Committee:

• | reviews and approves, on an annual basis, the criteria relevant to our annual incentive compensation program, including individual performance objectives of the Chief Executive Officer; |

• | reviews and approves, on an annual basis, the base salaries of the Chief Executive Officer and our other executive officers; |

• | determines and approves, in consultation with the Chief Executive Officer, the performance-based compensation of our other executive officers; |

• | evaluates the Chief Executive Officer’s performance in light of his objectives and accordingly determines his performance-based compensation; |

• | reviews the compensation program for the Chairman of the Board; |

• | reviews, approves, and administers all incentive-compensation plans, deferred compensation plans and equity-based incentive plans; establishes guidelines, rules and interpretations for such plans; approves and ratifies awards, and amendments thereto, made under any such plans, and reviews and monitors awards under such plans; |

• | engages consultants and advisors to provide advice, perform analyses and otherwise assist the committee in its deliberations and reviews the independence of each such advisor; |

• | reviews the compensation discussion and analysis as required by the SEC for inclusion in our annual proxy statement together with the committee’s report; |

• | reviews, annually, director compensation levels and practices and, if determined to be appropriate, approves changes in such compensation levels and practices, taking into account the considerations set forth in our Corporate Governance Guidelines; |

• | reviews and approves guidelines or agreements with respect to severance, change-in-control or other termination payments to be made to executive officers, other officers and key employees and exceptions to those guidelines or agreements with respect to executive officers; and |

• | reviews, on an annual basis, the Company’s compensation policies and practices to confirm that they do not, in any way, create risks that are reasonably likely to have a material adverse effect on the Company. |

The Governance Committee recommends to our Board candidates for election as directors, develops and recommends our Corporate Governance Guidelines (including criteria for membership on the Board and its committees to the Board), reviews the succession plan for our Chief Executive Officer in executive session on an annual basis, and considers other corporate governance issues. This committee currently consists of Ms. Gibson and Messrs. Hartung (Chair), Ledsinger and Lutz, each of whom is independent in accordance with the listing standards of the NYSE. The committee met nine times during 2016.

The committee maintains flexibility when identifying any potential directors in order to give full weight to the circumstance and desired experience. The committee has the ability, as necessary or appropriate, to retain the services of an independent search firm to identify new director candidates. The committee considers any potential candidate proposed by a member of our Board or senior management. Typically, at least two members of the committee, as well as the Chairman of the Board (and, if our Chairman is a member of management, our Lead Director) and our Chief Executive Officer, personally interview any non-incumbent candidate, and the assessments of his or her qualifications are provided to the full committee to assist with its deliberations.

On an annual basis, the Governance Committee reviews with the Board the requisite skills and characteristics required for new directors, as well as the composition, tenure and size of the Board as a whole. This assessment includes a review of (i) independence, experience, expertise and other factors relative to the overall composition of the Board and (ii) whether an incumbent director should continue to serve in light of changed circumstances from when he or she was first elected and his or her performance as a director under these guidelines.

16

With regard to director tenure and term limits, the Board believes that directors with varying tenures ensure an appropriate mix of in-depth knowledge of the Company and its operations and fresh ideas and viewpoints. There is no correlation between director tenure and independence. For similar reasons, the Board has not established term limits. While term limits could help ensure that fresh ideas and viewpoints are available to the Board, they deprive the Board of contributions of directors who have developed, over a period of time, increasing insight into the Company and its assets and operations and, therefore, provide increasingly valuable insight. As an alternative to term limits, the Governance Committee considers each director’s individual tenure, performance and contributions annually, concurrently with the Board’s self-evaluation. This also allows the Board, through the Governance Committee, to consider the appropriateness of each Director’s continued service.

Our policies and procedures regarding stockholder-recommended director candidates are contained in the committee’s charter. The committee may consider stockholder recommendations for candidates to serve on our Board. The committee will consider any candidate for director recommended by any beneficial owner, or group of beneficial owners, that has owned more than 5% of our outstanding common stock for at least one year. The committee will consider the candidate based on the same criteria used for selection of other director nominees. The committee reserves the right to reject any candidate that has a special interest agenda other than the best interests of the Company and our stockholders. Stockholders desiring to nominate persons for director must follow the following procedures:

• | submit, in writing, the following information about the candidate: name, mailing address, telephone number, email address, resume, business history, listing of other past and present directorships and director committees, hotel industry experience and any other relevant information to the Governance Committee, c/o FelCor Lodging Trust Incorporated, 125 E. John Carpenter Freeway, Suite 1600, Irving, Texas 75062-3933, Attention: Secretary; |

• | explain in the submission why the stockholder believes the candidate would be an appropriate member of our Board and the benefits and attributes that the candidate will provide to us in serving as a director; |

• | provide evidence of the requisite stock ownership along with the recommendation; and |

• | indicate whether we may identify the stockholder in any public disclosures that we make regarding the consideration of the director candidate. |

For a candidate to be considered for nomination at the 2018 annual meeting, the submission must be received by us not less than 90 days and not later than 120 days prior to the anniversary date of the Company’s immediately preceding annual meeting and must, in all respects, comply with the requirements set forth in the Company’s Bylaws or under applicable laws or regulations.

Further, in 2016, we amended our bylaws to provide for “proxy access” allowing eligible stockholders (those who meet customary minimum holding requirements) to nominate candidates for election as directors without requiring the proponents to solicit proxies on their own.

Other Committees. The Board established two other standing committees: an Executive Committee and a Finance Committee. The Executive Committee was established to exercise interim and limited authority on behalf of our Board. In practice, the Executive Committee generally meets when it is impractical to call a meeting of the full Board to discuss hotel transactions. In addition, the Executive Committee is often asked by our Board to undertake a preliminary investigation of issues or questions. The Executive Committee currently consists of Ms. Gibson and Messrs. Corcoran (Chair), Cotter and Lutz. The Executive Committee did not meet in 2016. The Finance Committee was established to exercise authority on behalf of our Board on finance and capital markets matters, in particular matters that may require more frequent meetings and consultation than practical for the full Board. The Finance Committee currently consists of Ms. Hamilton and Messrs. Carlin, Ledsinger and Rozells (Chair). In 2016, the Finance Committee consented to four actions in writing.

17

Risk Oversight

Our Board oversees an enterprise-wide approach to risk management, intended to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. Our Board is actively involved in establishing and refining our business strategy, including assessing management’s appetite for risk and determining the appropriate level of risk for FelCor overall. Our Board, various executives and other officers previously engaged in a formal enterprise risk management assessment, which involved a review and analysis of risk throughout the business. The assessment was facilitated by Towers Watson, an independent consulting firm. Towers Watson reported various findings to our Board that were subsequently considered by our Board and management and, where appropriate, integrated with our internal processes. We may conduct additional assessments in the future as circumstances warrant.

While our Board has ultimate oversight responsibility for risk management, various committees of our Board also have subject-matter responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls, and from time to time discusses and evaluates matters of risk, risk assessment and risk management with our management team. The Compensation Committee is responsible for overseeing the management of risk associated with our compensation policies and arrangements. Finally, the Governance Committee ensures that the internal rules and processes by which we are governed are appropriate and consistent with applicable laws and regulations, as well as investor expectations. Our Code of Business Conduct and Ethics, Corporate Governance Guidelines, committee charters and other governance documents are reviewed by the appropriate committees annually to confirm continued compliance, ensure that our overall risk management is appropriately comprehensive, effective and reflects established best practices.

CEO Succession Planning

We maintain two CEO succession plans: one addressing emergency or unanticipated loss of our CEO and one addressing longer-term succession. Material features of these plans include identification of Board members to lead the succession process, identification and development of internal candidates and identification of external resources necessary to ensure a successful transition. The Board regularly reviews and updates these plans.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that is applicable to our directors, officers and other employees. A copy of this code is available on our website at www.felcor.com. We will also post on our website any waivers of the provisions of the code made with respect to any of our directors or executive officers (no such waivers have ever been made).

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires officers and directors, and persons who beneficially own more than 10% of our stock, to file initial reports of ownership and reports of changes in ownership with the SEC. Officers, directors and greater than 10% beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of the copies furnished to us and representations from the officers and directors, we believe that all Section 16(a) filing requirements for the year ended December 31, 2016, applicable to our officers, directors and greater than 10% beneficial owners were satisfied, except Mr. Pentecost filed one late Form 4 reporting late one transaction. Based on written representations from our officers and directors, we believe that no Forms 5 for directors, officers and greater than 10% beneficial owners are required to be filed with the SEC for the period ended December 31, 2016.

18

Item 11. Executive Compensation

Compensation Discussion and Analysis

Our NEO compensation program is designed to retain talented executives to lead FelCor, pay them fairly for their work and accomplishments and discourage unwarranted risk-taking. The Compensation Committee, which has principal responsibility for establishing and administering the program, regularly reviews the amount and mix of compensation and may change the program to keep our NEO compensation competitive or otherwise emphasize a particular set of objectives. The committee approves the compensation of our Chief Executive Officer, or our CEO, and, in consultation with our CEO, determines and approves the compensation of Messrs. Hendrick, Hughes, Pentecost and Yellen (our continuing NEOs1). The committee believes that most of our NEOs’ compensation opportunity should be significantly tied to performance, which motivates performance in-line with annual and long-term objectives, holds our NEOs accountable for business results and discourages unwarranted risk-taking. When formulating compensation, the committee also considers various market data and other factors, such as credentials, length of service, experience and individual performance.

Our 2016 NEO compensation program emphasized market and financial performance by reference to TSR2, Adjusted FFO3 per share and Adjusted EBITDA3 as critical performance criteria. Annual bonuses were entirely at-risk based on performance - for 2016, annual bonuses were 75% at-risk based on corporate performance (of which two-thirds directly tracked financial performance) and 25% at-risk based on individual performance. Long-term incentive (equity) awards were also largely at-risk based on performance - for 2016: 40% at-risk based on relative TSR over a three-year period and 40% at-risk based on cumulative financial performance over a three-year period, with the remaining 20% vesting in three equal annual increments at the end of 2016, 2017 and 2018, assuming continued employment on the vesting date.4

2016 Pay for Performance

While our NEOs’ performance-based compensation is discussed in detail below, we note that their cash bonuses are significantly lower relative to target because our 2016 financial performance was below target. In addition, individual performance may reflect individual NEOs’ achievements relative to expectations. Similarly, our NEOs realized equity compensation (shares that vested with respect to 2014 and 2015 equity awards) was adversely impacted by declining market performance, which may continue to impact realized equity compensation in the future, since the number of shares that actually vest with respect to equity awards depends, to varying degrees, on long-term market performance.

___________________________________

1Where relevant, this discussion and analysis includes information concerning the compensation of Richard A. Smith, who served as our President and Chief Executive Officer, and as an NEO, until September 16, 2016 and who remained a FelCor employee for a subsequent transition period that ended January 1, 2017. Except as otherwise noted, this discussion and analysis does not include information concerning the compensation of Steven R. Goldman, who joined us as our Chief Executive Officer effective February 27, 2017. Mr. Goldman entered into an employment agreement with the Company in connection with his hiring. The terms of that agreement are described below under Employment Agreements with Named Executive Officers - Mr. Goldman’s Employment Agreement.

2Total shareholder return, or TSR, is a market-based measure of the change in value of an investment in a company’s shares, taking into account share price appreciation and dividends paid, over a defined time period.

3We compute FFO in accordance with standards established by The National Association of Real Estate Investment Trusts, or NAREIT, which defines FFO as net income or loss attributable to the Company (computed in accordance with GAAP), excluding gains or losses from sales of property, plus depreciation, amortization and impairment losses. We define EBITDA as net income or loss attributable to the Company (computed in accordance with GAAP) plus interest expenses, income taxes, depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. FFO and EBITDA are adjusted to calculate Adjusted FFO and Adjusted EBITDA in the manner set forth in our periodic filings with the SEC and quarterly earnings releases. We reconcile our non-GAAP financial measures, including FFO, Adjusted FFO, EBITDA and Adjusted EBITDA, in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the year ended December 31, 2016.

4We evaluate our TSR relative to similar hotel REITs, which we refer to as our Performance Peers, all of which are considered by the committee to be comparable to us in size, scope of business and assets, have shares that trade on the NYSE and compete for the same investors. Our Performance Peers are listed under Our 2016 NEO Compensation Program - Long-Term Incentives. Reference to these companies provides a meaningful indication of our relative market performance. We evaluate our Adjusted FFO per share on a three-year cumulative basis, relative to our combined target Adjusted FFO per share for those years.

19

Our 2016 NEO Compensation Program

Base Salaries. Base salaries provide our NEOs with regular predictable fixed base income and are generally increased annually to reflect company-wide cost-of-living adjustments (3% for 2016) or to account for exceptional performance and promotions.5 The committee may also adjust NEO base salaries in order to ensure that overall compensation opportunities are sufficient to retain executive talent in a competitive marketplace and fairly align the long-term interests of our NEOs with those of our stockholders. The committee made no market-based adjustments in 2016. In 2016, we paid our continuing NEOs the following salaries:

Troy A. Pentecost | $513,400 | |

Thomas C. Hendrick | $434,728 | |

Michael C. Hughes | $434,728 | |

Jonathan H. Yellen | $434,728 | |

Pay for Performance. Approximately 70% of each of our continuing NEOs’ potential total direct compensation is at-risk based on performance. The committee strongly believes that our NEOs should be rewarded appropriately for performance, including where that performance is tangibly linked to or drives measurable benefits to our stockholders. Performance criteria should be ambitious but not create incentives that present a material and inappropriate risk and also sufficiently objective to permit a fair review of achievement. These criteria generally relate to furthering achievement of our strategic goals and may, from year to year, differ in terms of weight and character, as the committee deems advisable. The committee may also review and modify performance objectives, thresholds and criteria at any time in light of changes in circumstances. The committee retains the discretion, separate and apart from our annual bonus program, to award greater or lesser bonuses if pre-determined criteria are exceeded or not achieved, depending on circumstances. For 2016, the committee awarded no discretionary bonuses.

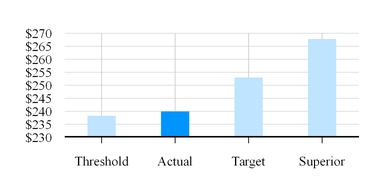

Annual Bonuses. The committee targeted corporate performance with reference to both financial and non-financial goals. Financial performance takes into account a variety of factors, including 2016 budgets, industry projections, individual hotel markets and similar considerations. The committee establishes a financial performance scale from threshold to superior performance. As in recent years, for 2016, the committee selected Adjusted EBITDA to assess financial performance, as that measure provides a degree of stability when setting a range of financial performance in advance. With regard to financial performance, the committee anticipates continuing to use Adjusted EBITDA to measure financial performance; however, it may use other metrics in the future.6 Typically, targeted performance is at the linear mid-point between threshold and superior performance, but not necessarily every year.7 Non-financial corporate performance is evaluated on a quantitative and qualitative basis relative to goals established early in the year. 2016 target weight attributable to corporate performance: 75% (of which, two-thirds relate to financial performance).

______________________________________________________________

5In September 2016, Mr. Pentecost was promoted to President and Interim Senior Executive Officer of the Company following Mr. Smith’s retirement. In connection with his promotion, with the advice of Mercer (see-Our Compensation Decision Process-Role of Compensation Consultant below) the Board increased (a) Mr. Pentecost’s annual base salary to $500,000, (b) his target cash bonus to 90% of his base salary, with a range from 45-135% of his base salary for threshold to superior performance and (c) his target annual equity award to 200% of his base salary, with the actual number of shares vesting depending on a combination of continued employment and market and financial performance over time. The Board also awarded Mr. Pentecost a one-time grant of RSUs entitling him to receive 77,761 shares of our common stock subject to vesting in two equal installments on December 27, 2018 and December 27, 2019, assuming Mr. Pentecost’s continued employment with FelCor through those dates, or earlier if his employment is terminated by the Company other than for cause or by Mr. Pentecost for good reason. In addition, the Compensation Committee authorized paying Mr. Pentecost $10,000 per month in supplemental base salary while serving as Interim Senior Executive Officer.

6Performance criteria may be based on any of the following in the future: net earnings (either before or after interest, taxes, depreciation and amortization); economic value-added; sales or revenue; net income (either before or after taxes); operating earnings; cash flow (including, but not limited to, operating cash flow and free cash flow); return on capital; return on assets (gross or net); return on stockholders’ equity; return on sales; gross or net profit margin; productivity; expense; margins; working capital; earnings per share; price per share of common stock; earnings as a percentage of average capital; earnings as a multiple of interest expense; business unit economic earnings; total capital invested in assets; funds from operations; and total stockholder return, any of which may be measured either in absolute terms, by comparison to comparable performance in an earlier period or periods, or as compared to results of a peer group, industry index, or other company or companies or business units.

7Regardless of other performance, the committee has determined that no programmatic (as opposed to discretionary) bonuses should be paid unless we achieve at least a minimal level of pre-determined financial performance (for 2016: $227.6 million of Adjusted EBITDA).

20

As illustrated below, for 2016, we had $239.9 million of Adjusted EBITDA, which was 95% of targeted Adjusted EBITDA ($252.4 million). As performance fell between established performance levels, we determine the actual bonus payable on a linear scale between threshold and target. As a consequence, our continuing NEOs’ 2016 annual cash bonuses attributable to financial performance were 55% of target.

2016 non-financial corporate performance related to asset sales (we sold two non-strategic hotels during the year), renewing and extending 18 management agreements with Hilton on terms that shifted the emphasis in favor of incentive fees (thereby further aligning the management company with our interests) and ensuring no more than one brand-driven capital plan, commonly referred to as a product improvement plan, or PIP, per property over the 15-year term of the agreements (thereby avoiding additional costly PIPs that do not provide sufficient returns on our investment), and the continuing ramp-up of operations at The Knickerbocker, including improved rate positioning (which is critical to the long-term performance of that hotel).

Each of our employees, including our NEOs, has individual performance objectives that are established at or near the beginning of each year. Our CEO reviews and approves the performance objectives of the Company’s other NEOs, and the committee reviews our CEO’s performance objectives. In the absence of a new CEO, Mr. Pentecost’s individual performance was reviewed by the Compensation Committee, and Mr. Pentecost reviewed the individual performance of our other continuing NEOs, in each case resulting in a composite level of performance from threshold to superior. 2016 target weight attributable to individual performance: 25%.

All of our NEOs participate, to a greater or lesser extent, on a coordinated basis, in the analysis, execution and administration of matters nominally assigned to one or several NEOs. This cooperative environment is a critical component of the executive team’s continued success. The goals and performance of individual NEOs often reflect weight assigned to corporate goals that take into account their functional responsibilities. Mr. Pentecost’s performance was generally measured relative to the overall operating performance of our portfolio, specific property-level objectives (for example, the continued ramp-up of operations at The Knickerbocker) and evaluating and managing long-term brand and management relationships. Mr. Hendrick’s performance was generally measured relative to hotel acquisitions and dispositions, redevelopment and re-branding projects and similar activities, all as determined by our Board. Mr. Hughes’s performance was generally measured relative to the strength of our balance sheet, development and execution of our long-term balance sheet strategy and his role in our ongoing investor relations program. Mr. Yellen’s performance was generally measured relative to the quality of our corporate governance (including the impact on investors’ perception) and his legal counsel to management and our Board. In addition, in September 2016, Mr. Smith retired and the remaining NEOs (particularly Mr. Pentecost) undertook a variety of interim responsibilities, above and beyond their normal responsibilities, while the Board sought to hire a new CEO, and the committee took this into consideration when evaluating their individual performance for the year. In particular, the committee reviewed Mr. Pentecost’s performance, notably his overall leadership through the interim period following Mr. Smith’s retirement, and reviewed with Mr. Pentecost his assessments of the individual performance of our other continuing NEOs. Those reviews took both quantitative metrics and subjective qualitative assessments into account.

21

Mr. Pentecost’s (after accounting for promotion-related changes to his compensation program) and our other continuing NEOs’ potential 2016 cash bonuses ranged from 45-135% and 37.5-112.5%, respectively, of their base salaries, targeting the mid-points of those ranges. FelCor paid our continuing NEOs the following cash bonuses for 2016, which reflect each category of performance:

2016 Bonus | Percent of Target | |||||||

Mr. Pentecost | $ | 365,980 | 89 | % | ||||

Mr. Hendrick | $ | 262,333 | 80 | % | ||||

Mr. Hughes | $ | 217,127 | 67 | % | ||||

Mr. Yellen | $ | 289,503 | 89 | % | ||||

Long-term Incentives. The committee previously adopted a long-term incentive program for our NEOs to award restricted stock units, or RSUs, rather than shares of restricted stock to our NEOs. The committee determined the target number of shares issuable when RSUs awarded in 2016 vest with reference to a percentage of each NEO’s base salary (in 2016, 175% for our continuing NEOs), divided by the closing price of our common stock for the trading day immediately preceding the award date.8 These long-term incentives closely align our NEOs’ ongoing interests with our stockholders’ and also serve as a critical NEO retention tool, ensuring a coherent and experienced leadership team that works together to refine and execute our strategy and build lasting long-term stockholder value.9 Dividends are not paid currently with respect to unvested RSUs; instead, dividends accrue and are paid only to the extent RSUs vest and shares are issued, or the cash value of such shares is paid.

RSUs granted in early 2016 entitle our NEOs to earn shares of common stock, in part as a reward for three-year market and financial performance (up to 40% of the award in each case, assuming achievement of maximum performance), with the remaining 20% of the award vesting in three annual tranches at the end of 2016, 2017 and 2018 (assuming continued employment on the vesting dates). The number of RSUs issued is based on the target award and is weighted equally among the market performance, financial performance and time-based units.

The committee measures market performance by evaluating our TSR relative to our Performance Peers’ TSR.10 The committee identified the following Performance Peers in 2012 with the assistance of Pay Governance LLC, an independent compensation consulting firm engaged by the committee: Ashford Hospitality Trust, DiamondRock Hospitality Company, Hersha Hospitality Trust, Hospitality Properties Trust, LaSalle Hotel Properties, RLJ Lodging Trust, Ryman Hospitality Properties, Inc., Strategic Hotels & Resorts, Inc., Summit Hotel Properties, Inc. and Sunstone Hotel Investors, Inc.11 Relative TSR is determined using the volume-weighted-average trading price of our common stock and our Performance Peers’ common stock for the 20 trading days immediately preceding the beginning and end of the three-year vesting period, plus dividends. As shown in the following table, the actual number of shares that are delivered when market performance RSUs vest depends on what our three-year TSR is relative to our Performance Peers’ TSR.

Relative TSR Performance | ||||||||||||

Rank (Relative to Peers) | Percentile (Among Peer Group) | Payout (Relative to Target) (%) | ||||||||||

1 | 100th | 200 | ||||||||||

2 | 90th | 200 | ||||||||||

3 | 80th | 175 | ||||||||||

4 | 70th | 150 | ||||||||||

5 | 60th | 125 | ||||||||||

6 | 50th | 100 | ||||||||||

7 | 40th | 50 | ||||||||||

8 | 30th | 25 | ||||||||||

9 | 20th | — | ||||||||||

10 | 10th | — | ||||||||||

11 | — | — | ||||||||||

_____________________________________________

8 If, after measuring performance, an award would result in issuing more shares than our equity compensation plan has available, or allows to be issued, the excess above what is available or allowed, upon vesting, will be settled in cash, based on the then-current value of the excess shares that would otherwise have been issued.

9 The committee and our Board may implement other award structures and performance criteria for subsequent awards in the future when such awards are authorized. See footnote 6 for a list of other potential performance criteria.

10 In the future, based on circumstances at the time, the committee may elect to use another performance metric, including for example, absolute TSR or another market-based performance metric.