Attached files

| file | filename |

|---|---|

| EX-99.1 - NEWS RELEASE - WESCO INTERNATIONAL INC | wcc1q2017earningsrelease.htm |

| 8-K - FORM 8-K - WESCO INTERNATIONAL INC | wcc1q2017earnings8-k.htm |

Webcast Presentation

April 27, 2017

Q1 2017 Earnings

2

Q1 2017 Earnings Webcast, 4/27/17

Safe Harbor Statement

All statements made herein that are not historical facts should be considered as “forward-looking

statements” within the meaning of the Private Securities Litigation Act of 1995. Such statements

involve known and unknown risks, uncertainties and other factors that may cause actual results

to differ materially. Such risks, uncertainties and other factors include, but are not limited to:

adverse economic conditions; disruptions in operations or information technology systems;

supply chain disruptions, changes in supplier strategy or loss of key suppliers; product or other

cost fluctuations; expansion of business activities; personnel turnover or labor cost increases;

tax law changes or challenges to tax matters; increase in competition; risks related to

acquisitions, including the integration of acquired businesses; exchange rate fluctuations; legal

or regulatory matters; litigation, disputes, contingencies or claims; debt levels, terms, financial

market conditions or interest rate fluctuations; goodwill or intangible asset impairment; stock

market, economic or political instability; and other factors described in detail in the Form 10-K for

WESCO International, Inc. for the year ended December 31, 2016 and any subsequent filings

with the Securities & Exchange Commission. The following presentation includes a discussion of

certain non-GAAP financial measures. Information required by Regulation G with respect to such

non-GAAP financial measures can be found in the appendix and obtained via WESCO’s website,

www.wesco.com.

3

Q1 2017 Earnings Webcast, 4/27/17

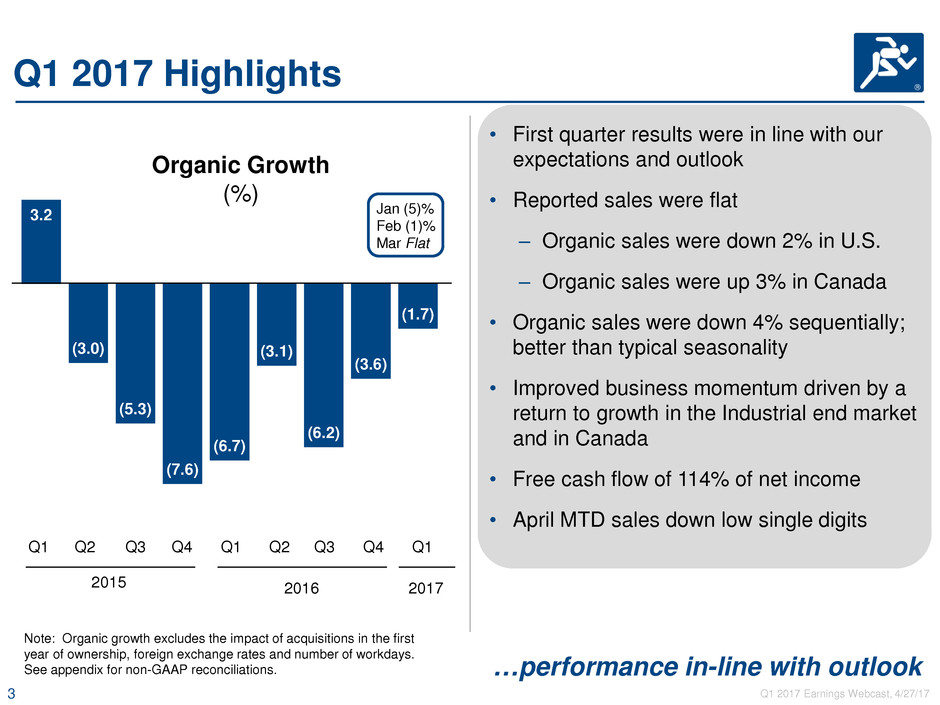

Q1 2017 Highlights

…performance in-line with outlook

• First quarter results were in line with our

expectations and outlook

• Reported sales were flat

‒ Organic sales were down 2% in U.S.

‒ Organic sales were up 3% in Canada

• Organic sales were down 4% sequentially;

better than typical seasonality

• Improved business momentum driven by a

return to growth in the Industrial end market

and in Canada

• Free cash flow of 114% of net income

• April MTD sales down low single digits

3.2

(3.0)

(5.3)

(7.6)

(6.7)

(3.1)

(6.2)

(3.6)

(1.7)

Organic Growth

(%)

Jan (5)%

Feb (1)%

Mar Flat

Note: Organic growth excludes the impact of acquisitions in the first

year of ownership, foreign exchange rates and number of workdays.

See appendix for non-GAAP reconciliations.

Q1 Q2 Q3 Q4

2015

Q1

2016

Q2 Q3 Q4 Q1

2017

4

Q1 2017 Earnings Webcast, 4/27/17

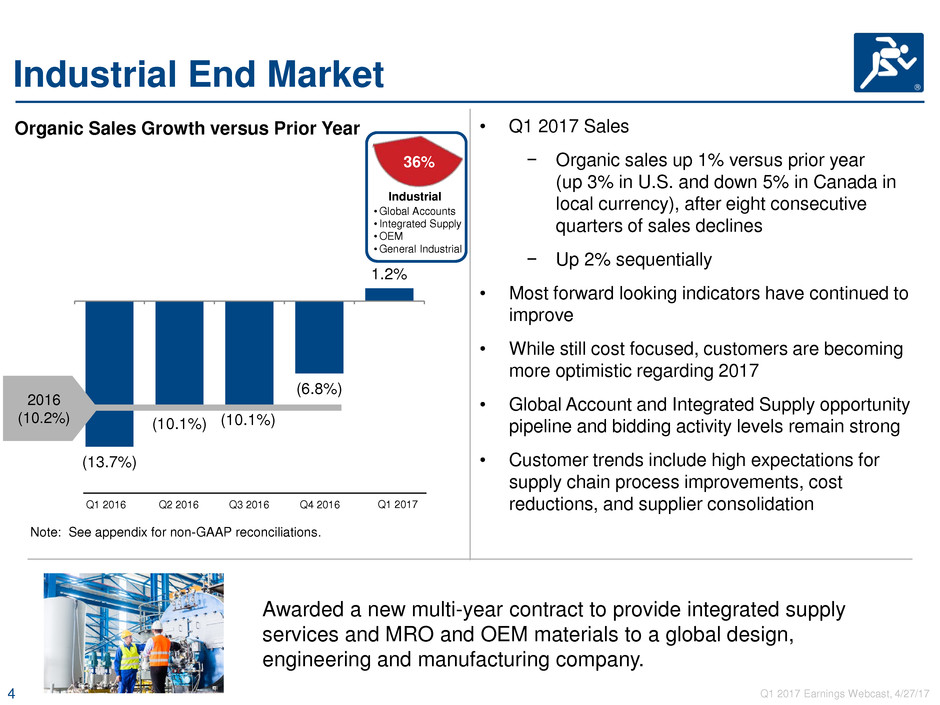

Industrial End Market

• Q1 2017 Sales

− Organic sales up 1% versus prior year

(up 3% in U.S. and down 5% in Canada in

local currency), after eight consecutive

quarters of sales declines

− Up 2% sequentially

• Most forward looking indicators have continued to

improve

• While still cost focused, customers are becoming

more optimistic regarding 2017

• Global Account and Integrated Supply opportunity

pipeline and bidding activity levels remain strong

• Customer trends include high expectations for

supply chain process improvements, cost

reductions, and supplier consolidation

Organic Sales Growth versus Prior Year

36%

Industrial

• Global Accounts

• Integrated Supply

• OEM

• General Industrial

Awarded a new multi-year contract to provide integrated supply

services and MRO and OEM materials to a global design,

engineering and manufacturing company.

Note: See appendix for non-GAAP reconciliations.

(13.7%)

(10.1%) (10.1%)

(6.8%)

1.2%

Q3 2016 Q2 2016 Q1 2016

2016

(10.2%)

Q4 2016 Q1 2017

5

Q1 2017 Earnings Webcast, 4/27/17

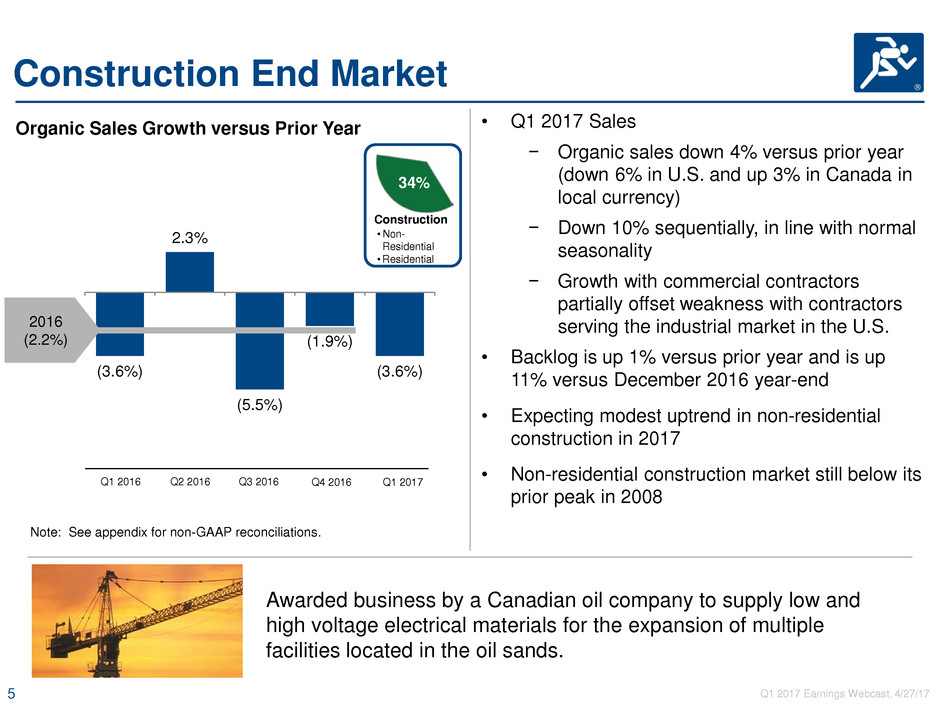

• Q1 2017 Sales

− Organic sales down 4% versus prior year

(down 6% in U.S. and up 3% in Canada in

local currency)

− Down 10% sequentially, in line with normal

seasonality

− Growth with commercial contractors

partially offset weakness with contractors

serving the industrial market in the U.S.

• Backlog is up 1% versus prior year and is up

11% versus December 2016 year-end

• Expecting modest uptrend in non-residential

construction in 2017

• Non-residential construction market still below its

prior peak in 2008

Construction

• Non-

Residential

• Residential

34%

Organic Sales Growth versus Prior Year

Construction End Market

Awarded business by a Canadian oil company to supply low and

high voltage electrical materials for the expansion of multiple

facilities located in the oil sands.

Note: See appendix for non-GAAP reconciliations.

(3.6%)

2.3%

(5.5%)

(1.9%)

(3.6%)

Q2 2016 Q1 2016 Q3 2016 Q4 2016

2016

(2.2%)

Q1 2017

6

Q1 2017 Earnings Webcast, 4/27/17

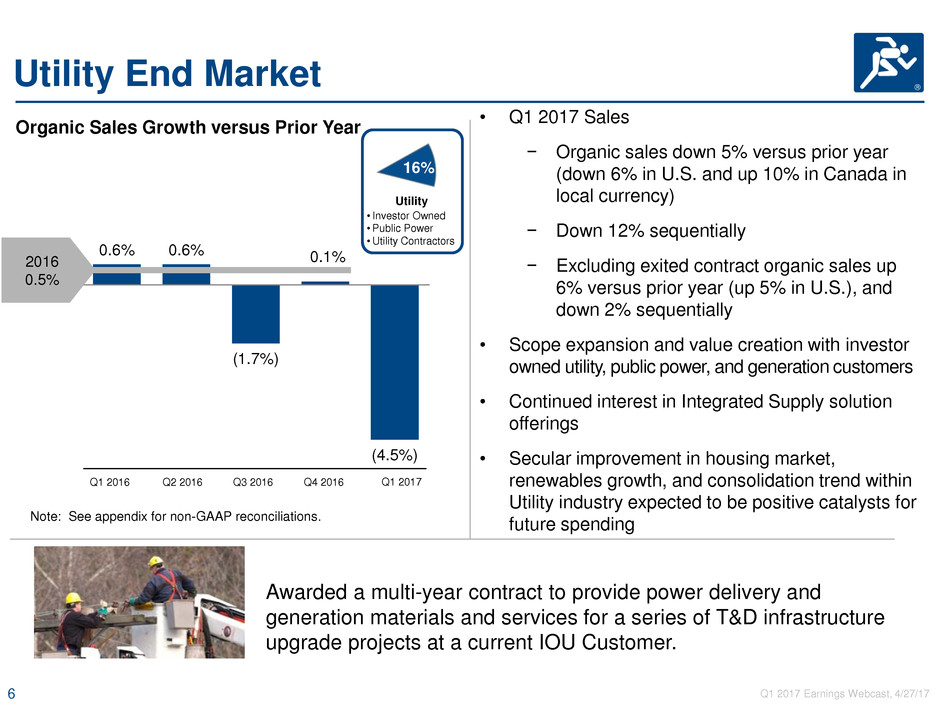

Utility End Market

Organic Sales Growth versus Prior Year

16%

Utility

• Investor Owned

• Public Power

• Utility Contractors

• Q1 2017 Sales

− Organic sales down 5% versus prior year

(down 6% in U.S. and up 10% in Canada in

local currency)

− Down 12% sequentially

− Excluding exited contract organic sales up

6% versus prior year (up 5% in U.S.), and

down 2% sequentially

• Scope expansion and value creation with investor

owned utility, public power, and generation customers

• Continued interest in Integrated Supply solution

offerings

• Secular improvement in housing market,

renewables growth, and consolidation trend within

Utility industry expected to be positive catalysts for

future spending

Awarded a multi-year contract to provide power delivery and

generation materials and services for a series of T&D infrastructure

upgrade projects at a current IOU Customer.

Note: See appendix for non-GAAP reconciliations.

0.6% 0.6%

(1.7%)

0.1%

(4.5%)

2016

0.5%

Q3 2016 Q2 2016 Q1 2016 Q4 2016 Q1 2017

7

Q1 2017 Earnings Webcast, 4/27/17

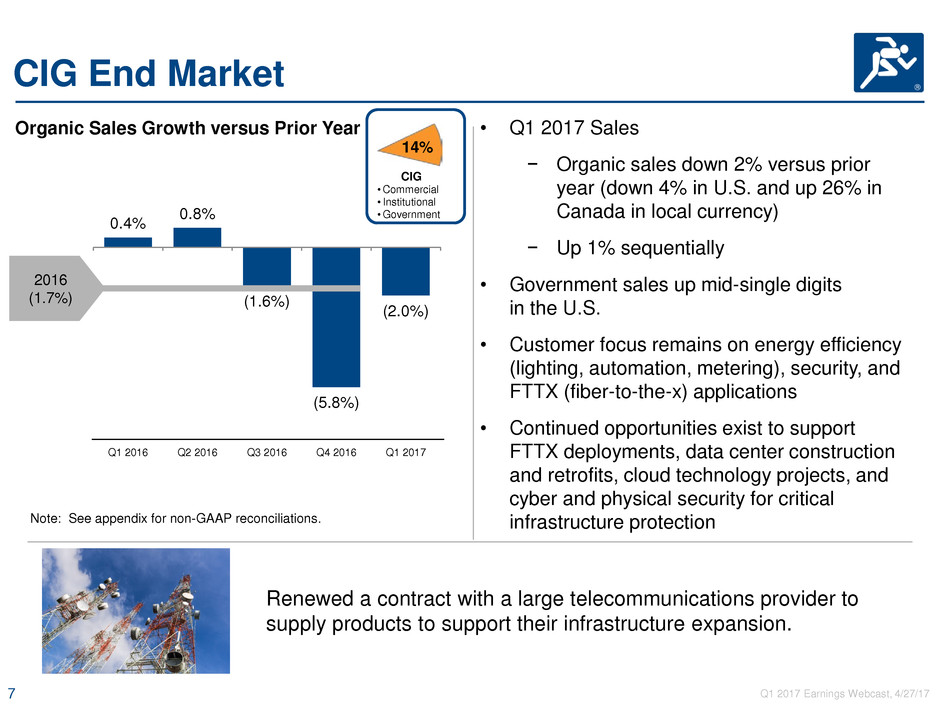

CIG End Market

• Q1 2017 Sales

− Organic sales down 2% versus prior

year (down 4% in U.S. and up 26% in

Canada in local currency)

− Up 1% sequentially

• Government sales up mid-single digits

in the U.S.

• Customer focus remains on energy efficiency

(lighting, automation, metering), security, and

FTTX (fiber-to-the-x) applications

• Continued opportunities exist to support

FTTX deployments, data center construction

and retrofits, cloud technology projects, and

cyber and physical security for critical

infrastructure protection

Organic Sales Growth versus Prior Year

CIG

• Commercial

• Institutional

• Government

14%

Renewed a contract with a large telecommunications provider to

supply products to support their infrastructure expansion.

Note: See appendix for non-GAAP reconciliations.

0.4% 0.8%

(1.6%)

(5.8%)

(2.0%)

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

2016

(1.7%)

8

Q1 2017 Earnings Webcast, 4/27/17

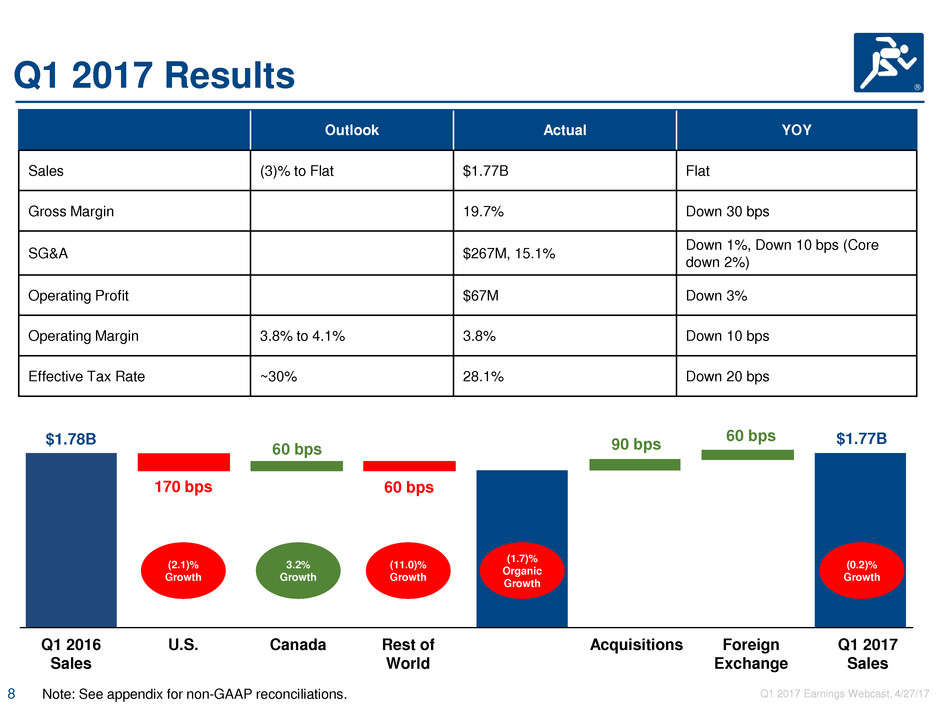

Q1 2017 Results

Outlook Actual YOY

Sales (3)% to Flat $1.77B Flat

Gross Margin 19.7% Down 30 bps

SG&A $267M, 15.1% Down 1%, Down 10 bps (Core down 2%)

Operating Profit $67M Down 3%

Operating Margin 3.8% to 4.1% 3.8% Down 10 bps

Effective Tax Rate ~30% 28.1% Down 20 bps

90 bps

(2.1)%

Growth

60 bps

170 bps

$1.77B $1.78B

Q1 2017

Sales

Acquisitions Rest of

World

Canada U.S. Q1 2016

Sales

60 bps

3.2%

Growth

(11.0)%

Growth

(1.7)%

Organic

Growth

(0.2)%

Growth

Note: See appendix for non-GAAP reconciliations.

Foreign

Exchange

60 bps

9

Q1 2017 Earnings Webcast, 4/27/17

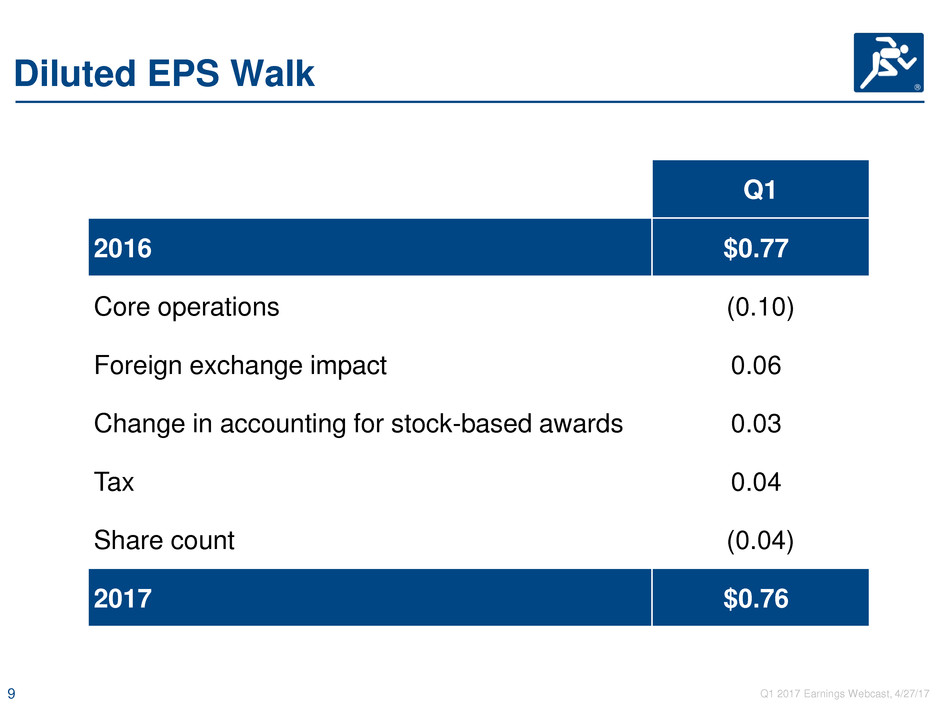

Diluted EPS Walk

Q1

2016 $0.77)

Core operations (0.10)

Foreign exchange impact 0.06)

Change in accounting for stock-based awards 0.03)

Tax 0.04)

Share count (0.04)

2017 $0.76)

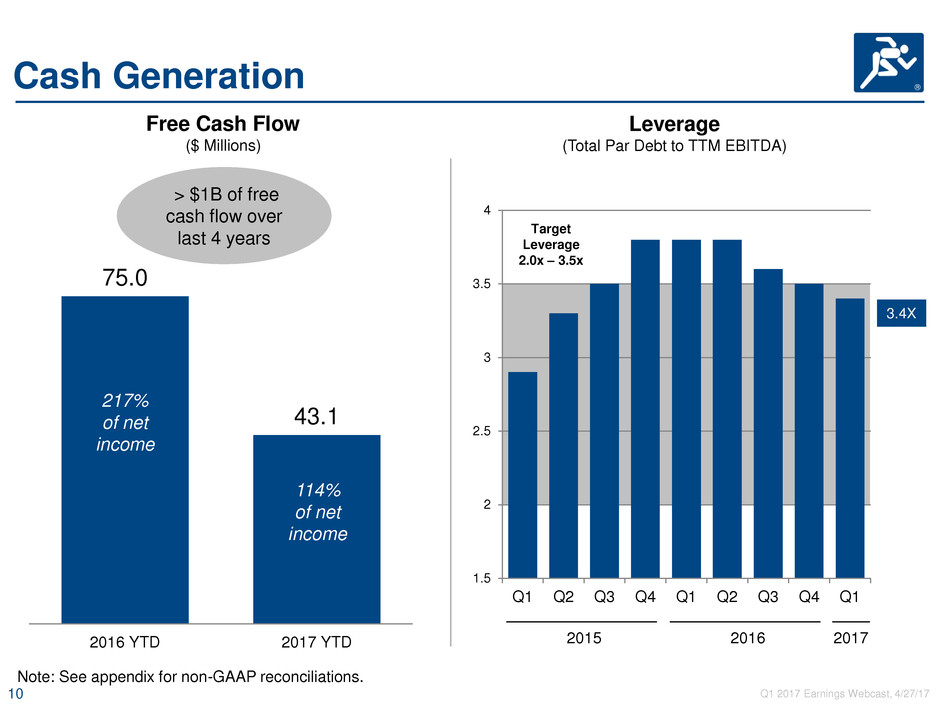

10

Q1 2017 Earnings Webcast, 4/27/17

1.5

2

2.5

3

3.5

4

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

75.0

43.1

2016 YTD 2017 YTD

Cash Generation

Free Cash Flow

($ Millions)

Note: See appendix for non-GAAP reconciliations.

114%

of net

income

217%

of net

income

> $1B of free

cash flow over

last 4 years Target Leverage

2.0x – 3.5x

3.4X

Leverage

(Total Par Debt to TTM EBITDA)

2015 2016 2017

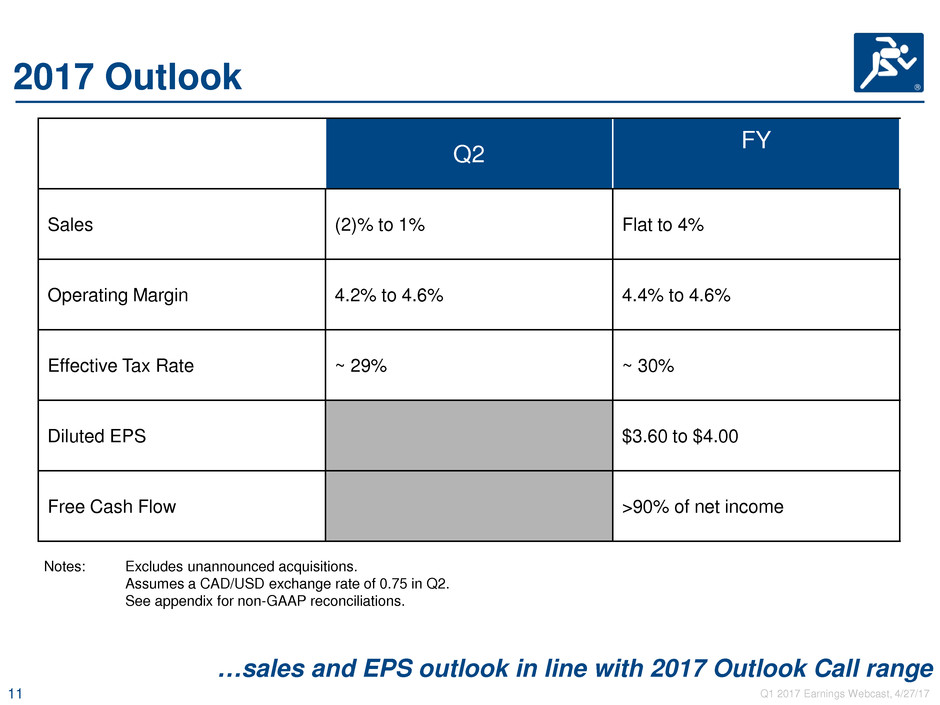

11

Q1 2017 Earnings Webcast, 4/27/17

2017 Outlook

Q2 FY

Sales (2)% to 1% Flat to 4%

Operating Margin 4.2% to 4.6% 4.4% to 4.6%

Effective Tax Rate ~ 29% ~ 30%

Diluted EPS $3.60 to $4.00

Free Cash Flow >90% of net income

Notes: Excludes unannounced acquisitions.

Assumes a CAD/USD exchange rate of 0.75 in Q2.

See appendix for non-GAAP reconciliations.

…sales and EPS outlook in line with 2017 Outlook Call range

12

Q1 2017 Earnings Webcast, 4/27/17

Appendix

NON-GAAP FINANCIAL MEASURES

This presentation includes certain non-GAAP financial measures. These financial measures include

organic sales growth, gross profit, adjusted tax rate, financial leverage, and free cash flow. The

Company believes that these non-GAAP measures are useful to investors in order to provide a

better understanding of the Company's organic sales trends, effective tax rate on a comparable

basis, capital structure position, and liquidity. Management does not use these non-GAAP financial

measures for any purpose other than the reasons stated above.

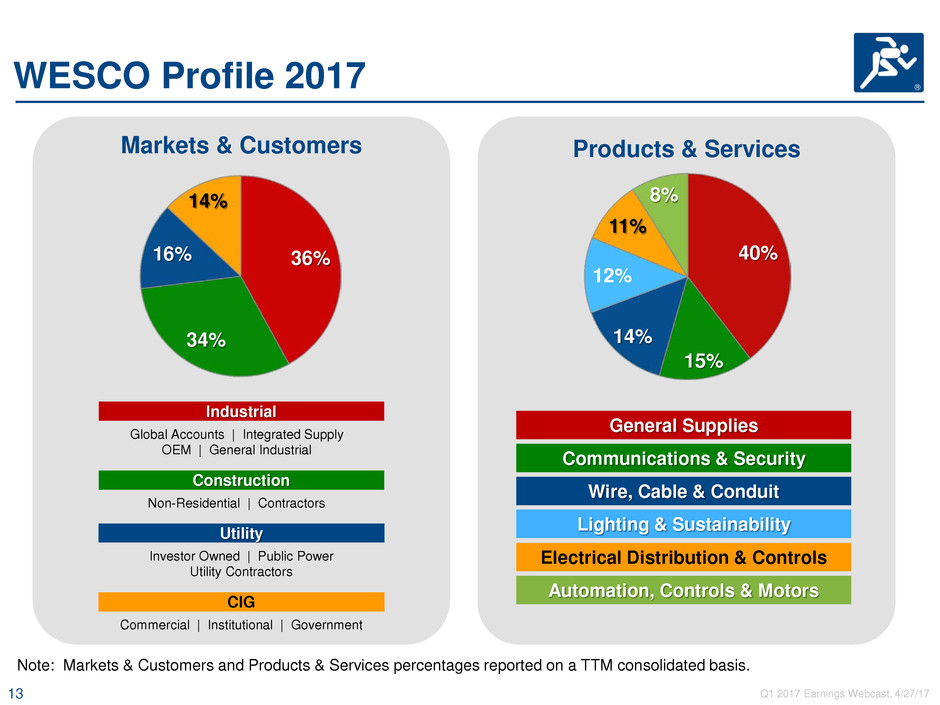

13

Q1 2017 Earnings Webcast, 4/27/17

WESCO Profile 2017

36%

34%

16%

14%

40%

15%

14%

12%

11%

8%

Note: Markets & Customers and Products & Services percentages reported on a TTM consolidated basis.

Products & Services Markets & Customers

Utility

CIG

Industrial

Construction

Investor Owned | Public Power

Utility Contractors

Commercial | Institutional | Government

Global Accounts | Integrated Supply

OEM | General Industrial

Non-Residential | Contractors

Automation, Controls & Motors

Lighting & Sustainability

General Supplies

Communications & Security

Wire, Cable & Conduit

Electrical Distribution & Controls

14

Q1 2017 Earnings Webcast, 4/27/17

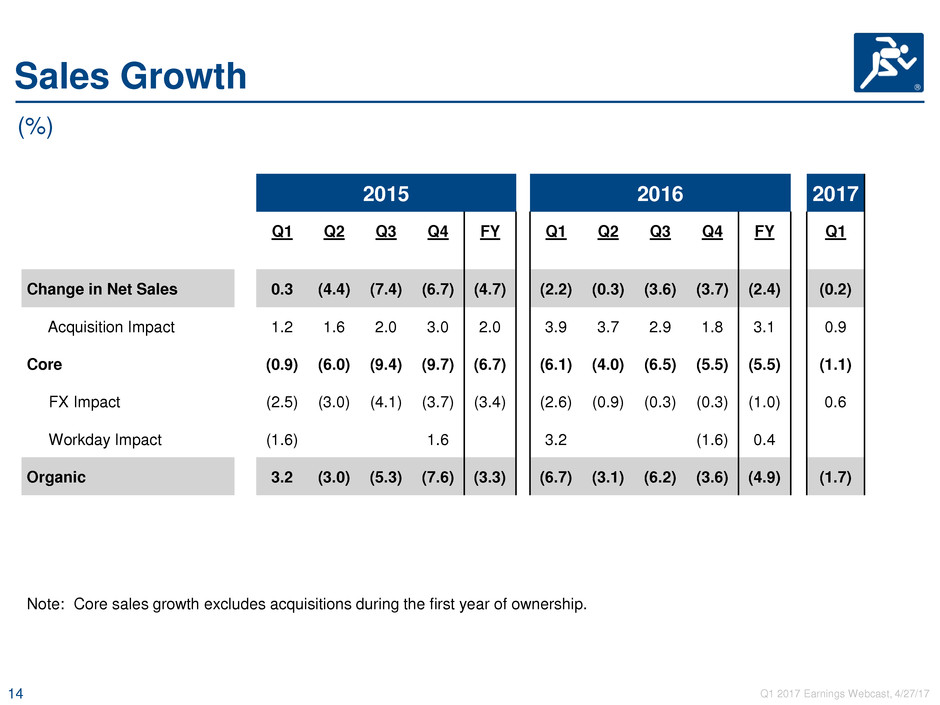

Sales Growth

2015 2016 2017

Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1

Change in Net Sales 0.3 (4.4) (7.4) (6.7) (4.7) (2.2) (0.3) (3.6) (3.7) (2.4) (0.2)

Acquisition Impact 1.2 1.6 2.0 3.0 2.0 3.9 3.7 2.9 1.8 3.1 0.9

Core (0.9) (6.0) (9.4) (9.7) (6.7) (6.1) (4.0) (6.5) (5.5) (5.5) (1.1)

FX Impact (2.5) (3.0) (4.1) (3.7) (3.4) (2.6) (0.9) (0.3) (0.3) (1.0) 0.6

Workday Impact (1.6) 1.6 3.2 (1.6) 0.4

Organic 3.2 (3.0) (5.3) (7.6) (3.3) (6.7) (3.1) (6.2) (3.6) (4.9) (1.7)

(%)

Note: Core sales growth excludes acquisitions during the first year of ownership.

15

Q1 2017 Earnings Webcast, 4/27/17

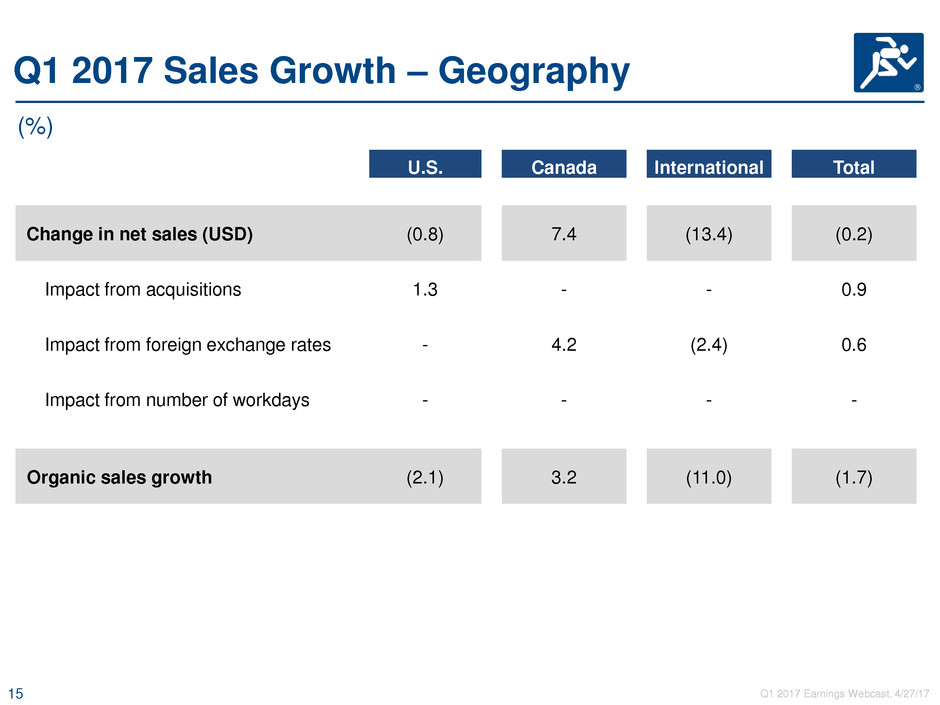

Q1 2017 Sales Growth – Geography

U.S. Canada International Total

Change in net sales (USD) (0.8) 7.4 (13.4) (0.2)

Impact from acquisitions 1.3 - - 0.9

Impact from foreign exchange rates - 4.2 (2.4) 0.6

Impact from number of workdays - - - -

Organic sales growth (2.1) 3.2 (11.0) (1.7)

(%)

16

Q1 2017 Earnings Webcast, 4/27/17

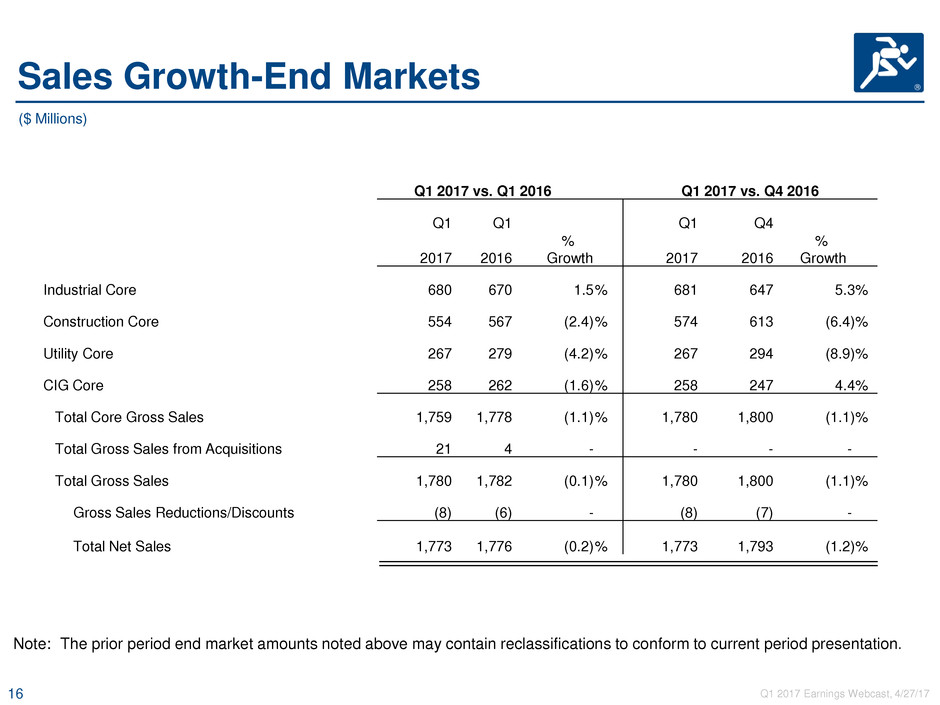

Note: The prior period end market amounts noted above may contain reclassifications to conform to current period presentation.

($ Millions)

Sales Growth-End Markets

Q1 2017 vs. Q1 2016 Q1 2017 vs. Q4 2016

Q1 Q1 Q1 Q4

2017 2016

%

Growth 2017 2016

%

Growth

Industrial Core 680 670 1.5 % 681 647 5.3%

Construction Core 554 567 (2.4) % 574 613 (6.4)%

Utility Core 267 279 (4.2) % 267 294 (8.9)%

CIG Core 258 262 (1.6) % 258 247 4.4%

Total Core Gross Sales 1,759 1,778 (1.1) % 1,780 1,800 (1.1)%

Total Gross Sales from Acquisitions 21 4 - - - -00

Total Gross Sales 1,780 1,782 (0.1) % 1,780 1,800 (1.1)%

Gross Sales Reductions/Discounts (8) (6) - (8) (7) -00

Total Net Sales 1,773 1,776 (0.2) % 1,773 1,793 (1.2)%

17

Q1 2017 Earnings Webcast, 4/27/17

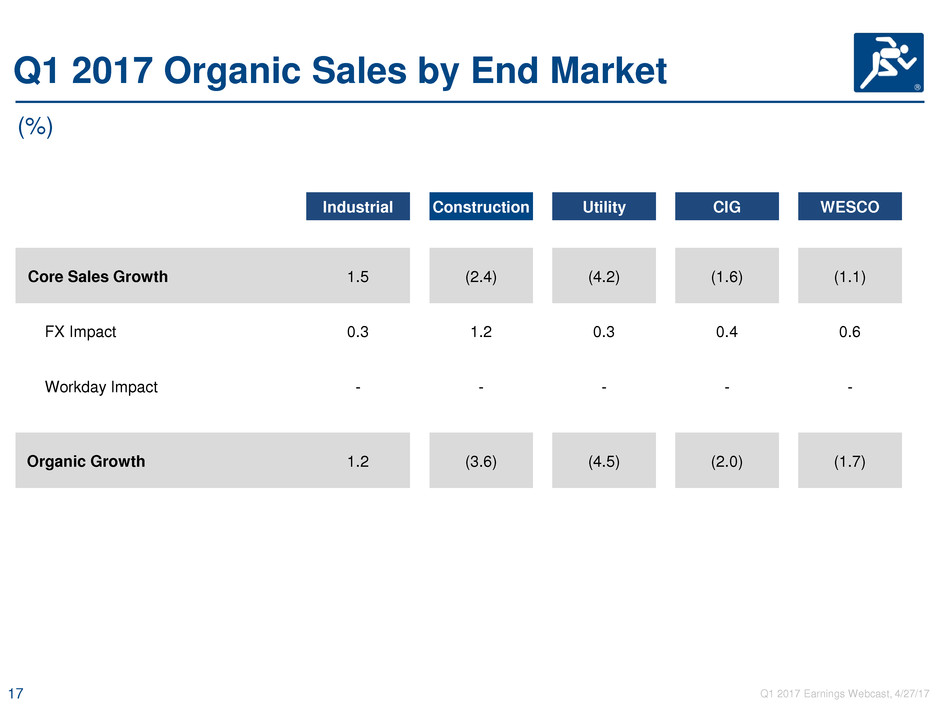

Q1 2017 Organic Sales by End Market

Industrial Construction Utility CIG WESCO

Core Sales Growth 1.5 (2.4) (4.2) (1.6) (1.1)

FX Impact 0.3 1.2 0.3 0.4 0.6

Workday Impact - - - - -

Organic Growth 1.2 (3.6) (4.5) (2.0) (1.7)

(%)

18

Q1 2017 Earnings Webcast, 4/27/17

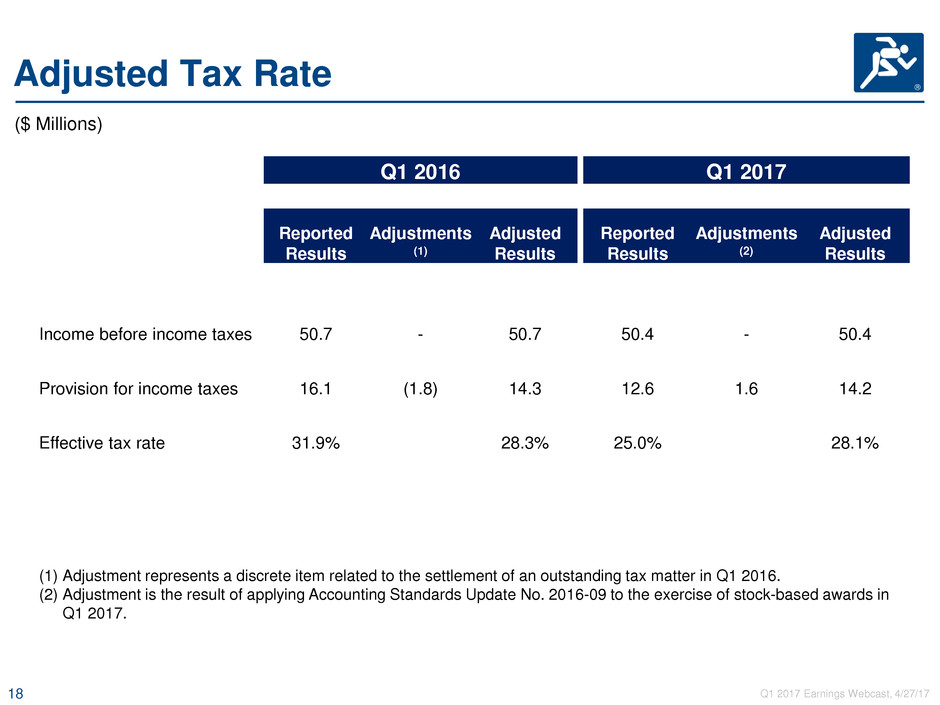

Adjusted Tax Rate

($ Millions)

Q1 2016 Q1 2017

Reported

Results

Adjustments

(1)

Adjusted

Results

Reported

Results

Adjustments

(2)

Adjusted

Results

Income before income taxes 50.7 - 50.7 50.4 - 50.4

Provision for income taxes 16.1 (1.8) 14.3 12.6 1.6 14.2

Effective tax rate 31.9% 28.3% 25.0% 28.1%

(1) Adjustment represents a discrete item related to the settlement of an outstanding tax matter in Q1 2016.

(2) Adjustment is the result of applying Accounting Standards Update No. 2016-09 to the exercise of stock-based awards in

Q1 2017.

19

Q1 2017 Earnings Webcast, 4/27/17

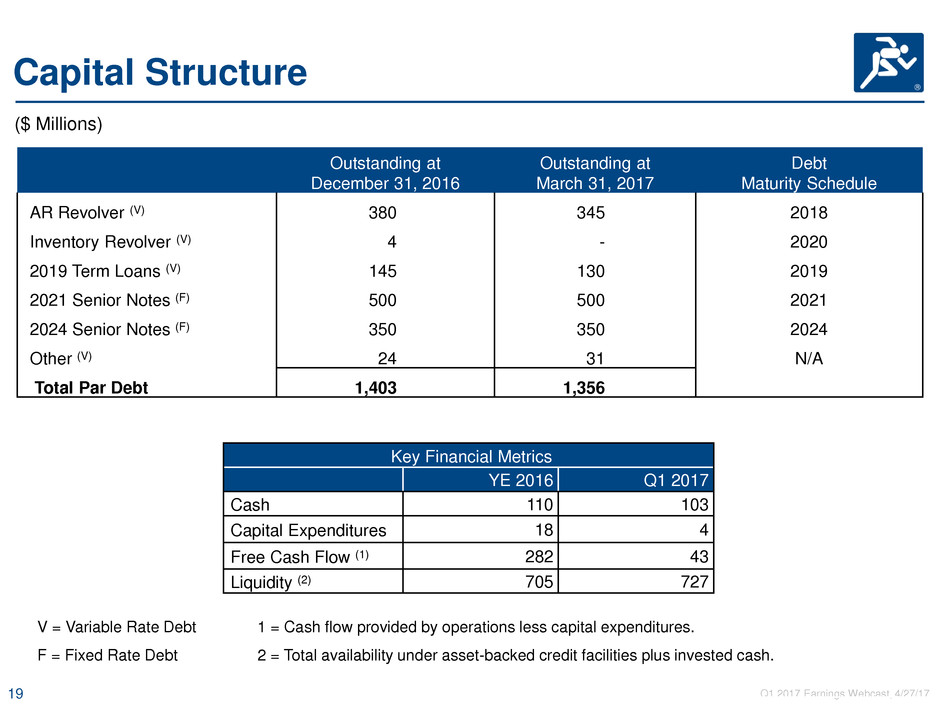

Outstanding at

December 31, 2016

Outstanding at

March 31, 2017

Debt

Maturity Schedule

AR Revolver (V) 380 345 2018

Inventory Revolver (V) 4 - 2020

2019 Term Loans (V) 145 130 2019

2021 Senior Notes (F) 500 500 2021

2024 Senior Notes (F) 350 350 2024

Other (V) 24 31 N/A

Total Par Debt 1,403 1,356

Capital Structure

Key Financial Metrics

YE 2016 Q1 2017

Cash 110 103

Capital Expenditures 18 4

Free Cash Flow (1) 282 43

Liquidity (2) 705 727

($ Millions)

V = Variable Rate Debt 1 = Cash flow provided by operations less capital expenditures.

F = Fixed Rate Debt 2 = Total availability under asset-backed credit facilities plus invested cash.

20

Q1 2017 Earnings Webcast, 4/27/17

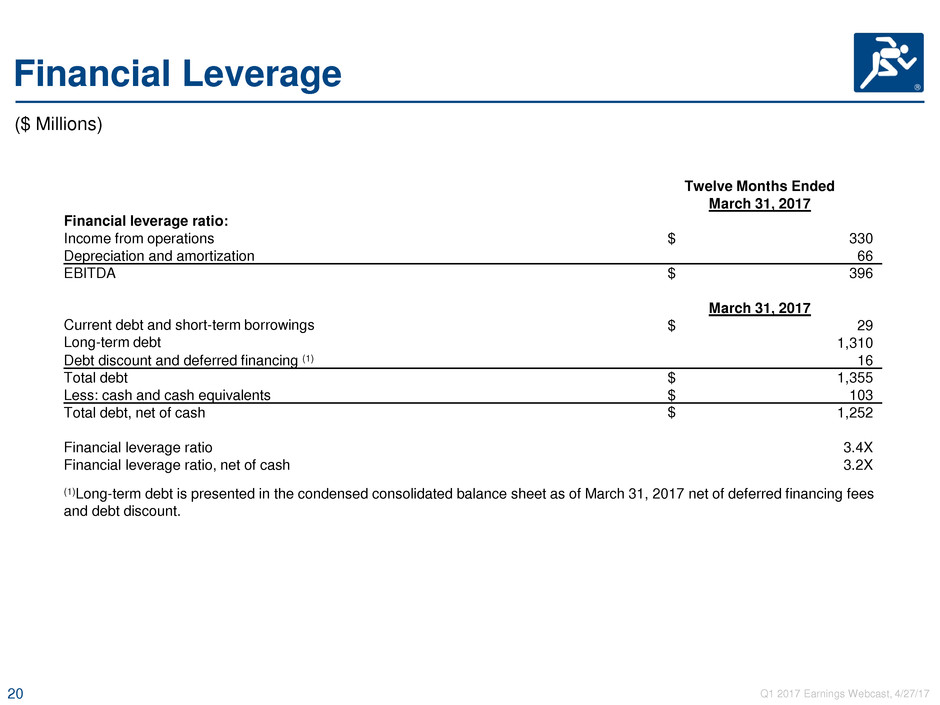

Financial Leverage

Twelve Months Ended

March 31, 2017

Financial leverage ratio:

Income from operations $ 330

Depreciation and amortization 66

EBITDA $ 396

March 31, 2017

Current debt and short-term borrowings $ 29

Long-term debt 1,310

Debt discount and deferred financing (1) 16

Total debt $ 1,355

Less: cash and cash equivalents $ 103

Total debt, net of cash $ 1,252

Financial leverage ratio 3.4X

Financial leverage ratio, net of cash 3.2X

(1)Long-term debt is presented in the condensed consolidated balance sheet as of March 31, 2017 net of deferred financing fees

and debt discount.

($ Millions)

21

Q1 2017 Earnings Webcast, 4/27/17

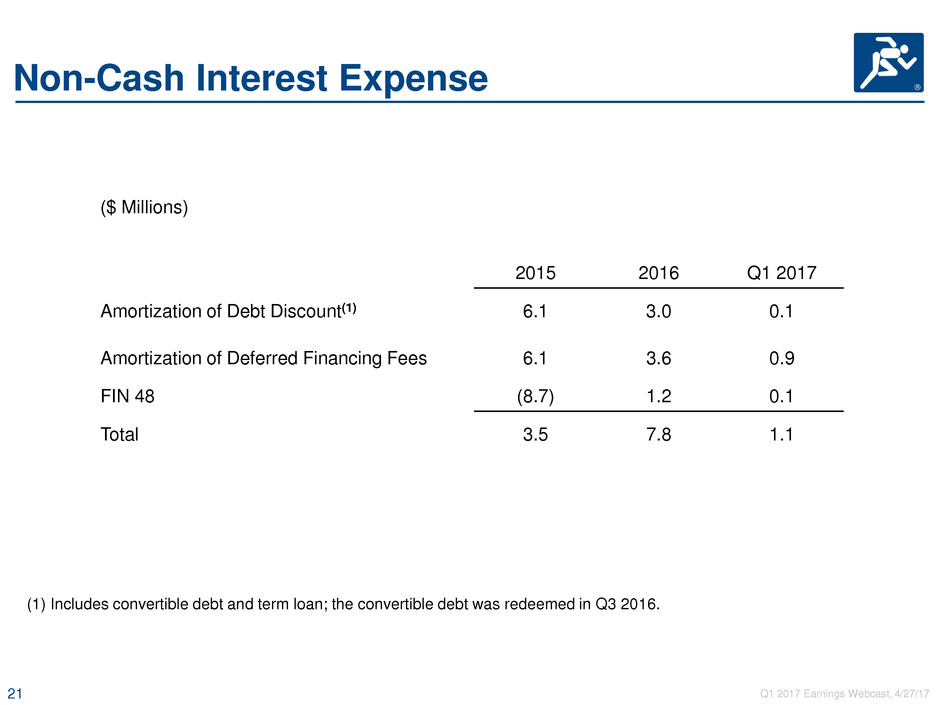

($ Millions)

2015 2016 Q1 2017

Amortization of Debt Discount(1) 6.1 3.0 0.1

Amortization of Deferred Financing Fees 6.1 3.6 0.9

FIN 48 (8.7) 1.2 0.1

Total 3.5 7.8 1.1

Non-Cash Interest Expense

(1) Includes convertible debt and term loan; the convertible debt was redeemed in Q3 2016.

22

Q1 2017 Earnings Webcast, 4/27/17

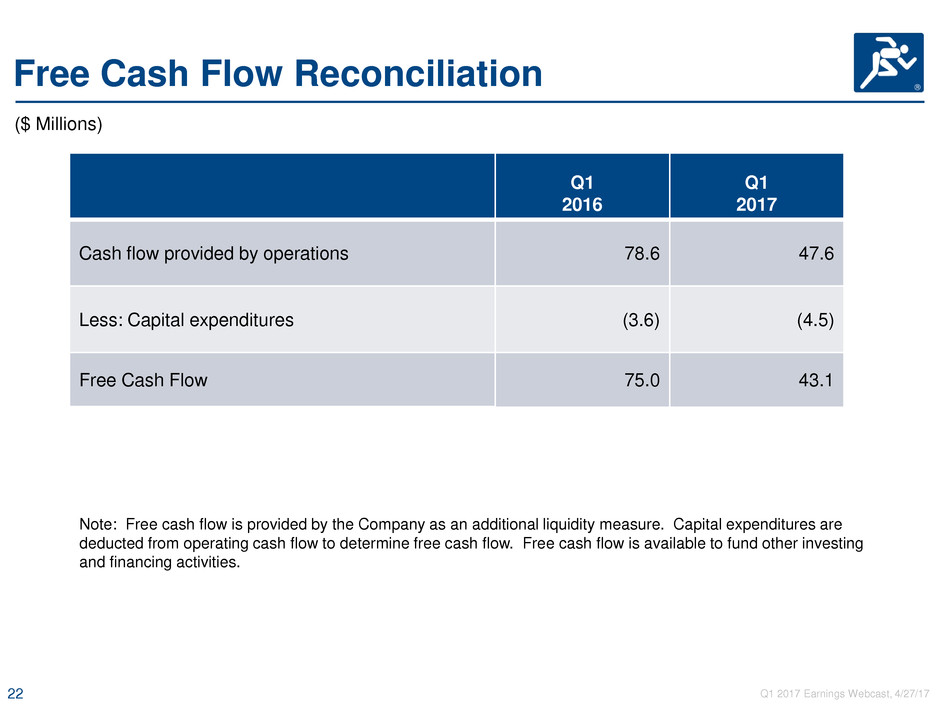

Free Cash Flow Reconciliation

Q1

2016

Q1

2017

Cash flow provided by operations 78.6 47.6

Less: Capital expenditures (3.6) (4.5)

Free Cash Flow 75.0 43.1

Note: Free cash flow is provided by the Company as an additional liquidity measure. Capital expenditures are

deducted from operating cash flow to determine free cash flow. Free cash flow is available to fund other investing

and financing activities.

($ Millions)

23

Q1 2017 Earnings Webcast, 4/27/17

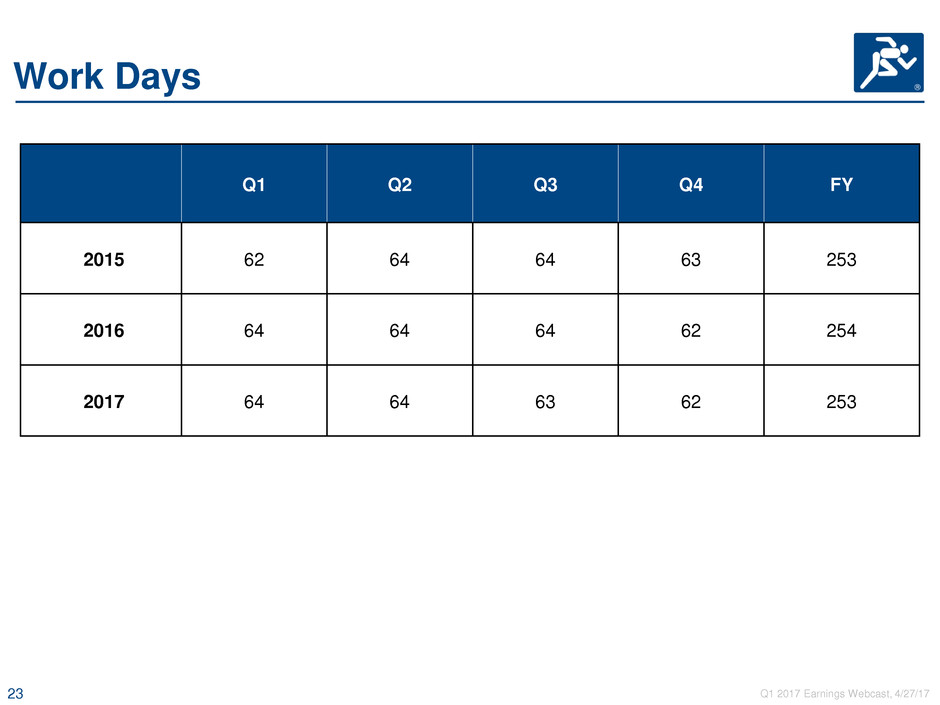

Work Days

Q1

Q2 Q3 Q4 FY

2015 62 64 64 63 253

2016 64 64 64 62 254

2017 64 64 63 62 253