Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE OF SUPER MICRO COMPUTER, INC. - Super Micro Computer, Inc. | exhibit991q3-2017.htm |

| 8-K - FORM 8-K - Super Micro Computer, Inc. | form8-kq3x2017.htm |

1 We Keep IT Green™

Earnings Conference Presentation

FY2017 Q3

April 27, 2017

Charles Liang, CEO

Howard Hideshima, CFO

2

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may relate, among other things, to our expected

financial and operating results, our ability to build and grow Supermicro, the benefit of our products and our ability to achieve our goals, plans and

objectives.

Such forward-looking statements do not constitute guarantees of future performance and are subject to a variety of risks and uncertainties that

could cause our actual results to differ materially from those anticipated. These include, but are not limited to: our dependence on continued

growth in the markets for X86 based servers, blade servers and embedded applications, increased competition, difficulties of predicting timing of

new product introductions, customer acceptance of new products, poor product sales, difficulties in establishing and maintaining successful

relationships with our distributors and vendors, shortages or price fluctuations in our supply chain, our ability to protect our intellectual property

rights, our ability to control the rate of expansion domestically and internationally, difficulty managing rapid growth and general political, economic

and market conditions and events.

For a further list and description of risks and uncertainties, see the reports filed by Supermicro with the Securities and Exchange Commission.

Supermicro disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise. Supplemental information, condensed balance sheets and statements of operations follow. All monetary amounts are

stated in U.S. dollars.

Safe Harbor Statement

3

Non-GAAP gross margin in this presentation excludes stock-based compensation expense. Non-GAAP net income and net income per share in

this presentation exclude stock-based compensation expense and the related tax effect of the applicable items. Management presents non-

GAAP financial measures because it considers them to be important supplemental measures of performance. Management uses the non-GAAP

financial measures for planning purposes, including analysis of the Company's performance against prior periods, the preparation of operating

budgets and to determine appropriate levels of operating and capital investments.

Management also believes that the non-GAAP financial measures provide additional insight for analysts and investors in evaluating the

Company's financial and operating performance. However, these non-GAAP financial measures have limitations as an analytical tool, and are not

intended to be an alternative to financial measures prepared in accordance with GAAP.

Pursuant to the requirements of SEC Regulation G, detailed reconciliations between the Company's GAAP and non-GAAP financial results is

provided at the end of the press release that was issued announcing the Company’s operating and financial results for the quarter ended March

31, 2017. In addition, a reconciliation from GAAP to non-GAAP results is contained in the financial summary attached to today’s presentation and

is available in the Investor Relations section of our website at www.supermicro.com in the Events and Presentations section. Investors are

advised to carefully review and consider this information as well as the GAAP financial results that are disclosed in the Company's SEC filings.

Non-GAAP Financial Measures

4 We Keep IT Green™

Charles Liang

Chairman and Chief Executive Officer

5

Q3 FY2017 Non-GAAP Financial Highlights

(in millions, except per share data)

Change

Q3'17 YoY Sequential

Revenue $631.1 18.5% -3.2%

Profit after Tax $20.3 7.0% -18.8%

EPS $0.38 5.6% -20.8%

$533 $524 $529

$652 $631

$0.36

$0.20

$0.32

$0.48

$0.38

$-

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$-

$100

$200

$300

$400

$500

$600

$700

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

Revenue and EPS Trends

Revenue EPS

6

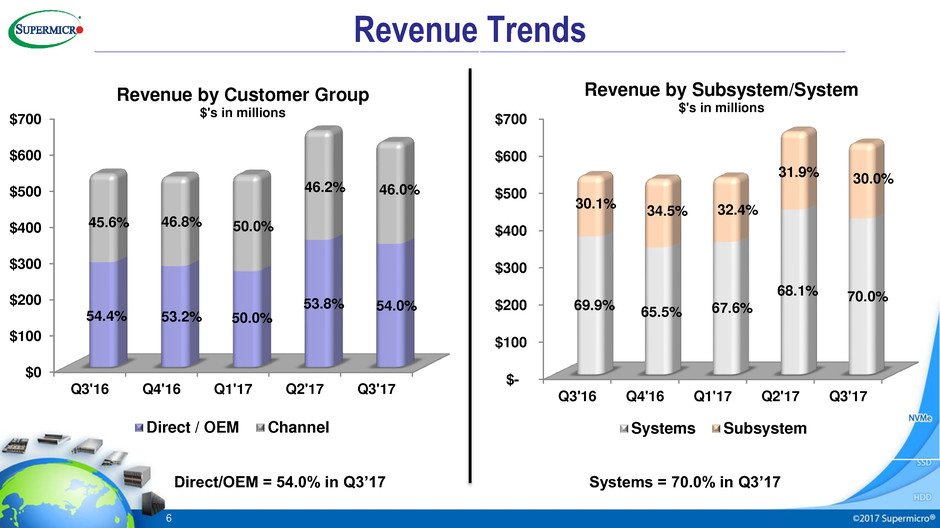

Revenue Trends

Direct/OEM = 54.0% in Q3’17 Systems = 70.0% in Q3’17

$-

$100

$200

$300

$400

$500

$600

$700

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

69.9% 65.5% 67.6%

68.1% 70.0%

30.1%

34.5% 32.4%

31.9% 30.0%

Revenue by Subsystem/System

$'s in millions

Systems Subsystem

$0

$100

$200

$300

$400

$500

$600

$700

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

54.4% 53.2% 50.0%

53.8% 54.0%

45.6% 46.8% 50.0%

46.2% 46.0%

Revenue by Customer Group

$'s in millions

Direct / OEM Channel

7

Q3 Revenue Mix & Growth Highlights

Storage up 28.7% YoY

Next Gen up 74.2% YoY

NVMe design win traction

IOT up 38.0% YoY

Accelerated computing up 176.3% YoY

Deep learning, machine learning, and

Artificial Intelligence ~6% revenue

Enterprise Datacenter up 578.6% YoY

MicroBlade & BigTwin traction

X11 Skylake systems coming

Regional growth

Asia up 92.0%, China up 138.9% YoY

United

States

52.9% Europe

18.2%

Asia

23.9%

Others

5.0%

Revenue by Region

Storage

22.5%

IDC

10.7%

IOT

10.5%

Other

56.3%

Market Verticals

Other includes HPC,

Enterprise, and Channel

8

Vertical Markets

45-Bay JBOD

Top Loading

• 45 Hot-swap 3.5" SAS3/SATA3

drive bays + 2 rear 2.5“

• 6 optional NVMe

% of Revenue: 22.5%

STORAGE

High capacity File

and Object

storage, Backup,

Archive and Cold

storage

% of Revenue: 10.7%

CLOUD

Compute Intensive and Mission-Critical

Applications, Financial Analysis,

Edge Device

High reliability fanless robust design

• Low Power Consumption (9W, 4 core)

• Extreme operation temperature -20 to 60C

• Wall/VESA/DIN Rail mounting

• 7 yr long life cycle

% of Revenue: 10.5%

IoT

Industrial

Automation

Commercial

Appliance

Enviroment

Monitor

Highest performing multi-node system

• 205 Watt CPU Support

• Full 24 DIMMs of memory per node

• 24 All-Flash NVMe or Hybrid Drives

• Three PCI-E 3.0 options per node

SYS-2028BT-HNC0R+

SSG-6048R-E1CR60N

BigTwin

SYS-E100-9AP

9

Vertical Markets

MicroBlade

0.1U per Computing Node

• Up to 40°Coperating temperature

• 20% power savings per node vs. 1U

and OCP

Enterprise

Not just lower

TCO but also

lower initial HW

acquisition cost

% of Revenue: 5.9%

Accelerated

Computing

SuperBlade

Blade computing without the premium

• DP Skylake-EP and beyond

• Up to 255W CPU support

• 200G/100Gps High-speed interconnect

• NVMe Support

Seeding and Early

Deployment Now!

X11 Skylake

Deep Learning, AI and HPC Optimized

• 4 Tesla P100 in 1U

• GPU Direct RDMA support

• Up to 80 GB/s GPU-to-GPU NVLINK

3U MicroBlade

1U Pascal

SYS-1028GR-TXR

Increasing Revenue

10

Progression to Tier 1 Provider

Innovation

Presence

Subsystem Server System

Total Solution

Motherboards

and server

building blocks

Architecture

innovation: BigTwin,

NVMe/Simply Double,

SuperBlade, BBP as

well as GPU/co-

processor solutions

Market Channel:

Distributors/VARs

Verticals:

Cloud, Enterprise,

Accelerated Computing

Fortune 1000:

Brand recognition

Domestic

Asia Pacific

EMEA

Complete solutions:

Management software,

Openstack and Global

Service.

Optimized offerings for

every refresh cycle.

11 We Keep IT Green™

Howard Hideshima

Chief Financial Officer

12

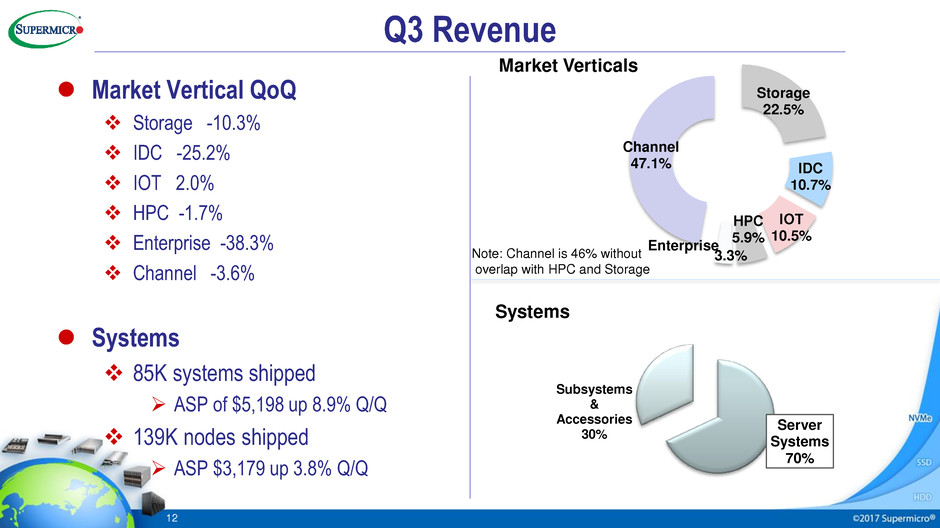

Q3 Revenue

Market Vertical QoQ

Storage -10.3%

IDC -25.2%

IOT 2.0%

HPC -1.7%

Enterprise -38.3%

Channel -3.6%

Systems

85K systems shipped

ASP of $5,198 up 8.9% Q/Q

139K nodes shipped

ASP $3,179 up 3.8% Q/Q

Server

Systems

70%

Subsystems

&

Accessories

30%

Systems

Storage

22.5%

IDC

10.7%

IOT

10.5%

HPC

5.9%

Enterprise

Channel

47.1%

Market Verticals

3.3% Note: Channel is 46% without

overlap with HPC and Storage

13

Non-GAAP Margins

Gross Margin Compare

40 basis points lower QoQ

Prices increases for memory and SSD’s

continued this quarter with only slight

improvement to offset

Utilization was lower at 55%

90 basis points lower YoY

Component pricing, maturing Grantley

product lines and lower utilization

Operating Margin Compare

130 basis points lower QoQ

FX impact from revaluation of offshore loans

was negative

100 basis points lower YoY

Increased compensation expenses primarily

in R&D

14.9%

14.1%

15.2%

14.4% 14.0%

5.3%

3.1%

4.7%

5.6%

4.3%

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

Non-GAAP Margin Trends

Gross Margin Operating Margin

14

Summary P&L non-GAAP

(in millions, except per share data)

Change

Q3'17 YoY Sequential Q3'16 Q2'17

Operating Expense $61.4 $10.3 $4.2 $51.1 $57.2

Operating Expense Ratio 9.7% 0.1% 0.9% 9.6% 8.8%

Operating Income $27.2 -$1.1 -$9.2 $28.3 $36.5

Net Income $20.3 $1.3 -$4.7 $19.0 $25.0

EPS $0.38 $0.02 -$0.10 $0.36 $0.48

Diluted Common Share Count 53.0 53.1 52.6

Effective Quarterly

Tax Rate 23.7% 32.0% 30.5%

15

Cash and Cash Conversion Cycle

Cash & cash equivalents and short &

long-term investments: $110.5M

Down $21.0M QoQ

Down $68.6M YoY

Cash Conversion Cycle (QoQ)

A/R up $24.4M

Inventory up $43.0M

CCC up 12 days

Debt: $145.5M

Short-term debt: $113.3M

Long-term debt: $32.2M

Q3'17 Q2'17 Change

Cash Equivalents &

Investments $110.5 $131.5 $(21.0)

Accounts Receivable $391.3 $366.9 $24.4

Inventory $642.3 $599.3 $43.0

Accounts Payable $348.7 $341.9 $6.8

DSO 54 49 5

DIO 103 91 12

DPO 57 52 5

Cash Cycle Days 100 88 12

16 We Keep IT Green™

Supplemental Financials

Third Quarter Fiscal 2017

Ended March 31, 2017

17

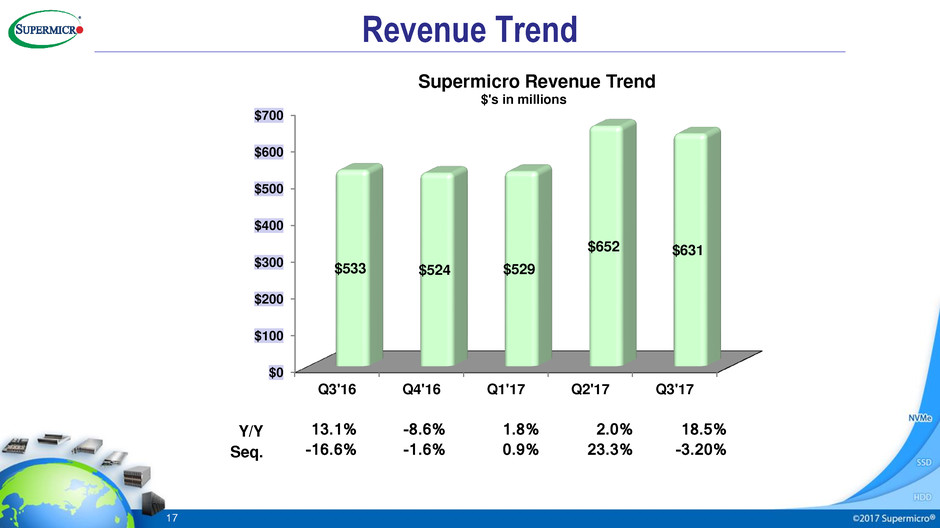

Revenue Trend

Y/Y 13.1% -8.6% 1.8% 2.0% 18.5%

Seq. -16.6% -1.6% 0.9% 23.3% -3.20%

$0

$100

$200

$300

$400

$500

$600

$700

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

$533 $524 $529

$652 $631

Supermicro Revenue Trend

$'s in millions

18

Q3 FY2017 YTD Summary Statement of Cash Flow

($’s millions)

9 Months Ended 9 Months Ended

31-Mar-17 31-Mar-16

Net Income $52.2 $65.1

Depreciation and amortization $11.8 $9.5

Stock-based comp expense $14.0 $11.8

Other reserves $1.2 -$0.3

Net change in AR, Inventory, AP -$200.7 -$8.4

Other prepaids and liabilities $31.2 $15.2

Cash flow from operations -$90.3 $92.8

Capital expenditures -$23.3 -$25.1

Free cash flow -$113.5 $67.7

Net cash - investing activities -$0.3 -$1.0

Net cash - financing activities $40.5 $13.2

Effect of exchange rate fluctuation

on cash and cash equivalents $0.2 $1.1

Net change in cash -$73.2 $81.0

19

Non-GAAP Financial Summary

(in millions, except per share data)

* Note: Non-GAAP, please see Non-GAAP financial measures on page 3.

Q3'17 Q2'17 Q3'16

Net Sales $631.1 $652.0 $532.7

Non-GAAP Gross Margin 14.0% 14.4% 14.9%

Non-GAAP Operating Expenses $61.4 $57.2 $51.1

Non-GAAP Operating Income $27.2 $36.5 $28.3

Non-GAAP Net Income $20.3 $25.0 $19.0

Non-GAAP Net Income per share $0.38 $0.48 $0.36

Fully diluted shares for calculation 53.0 52.6 53.1

20

Prior Period Net Income Comparisons

(in millions, except per share data)

* Note: Non-GAAP, please see Non-GAAP financial measures on page 3.

Q3'17 Q2'17 Q3'16

Net Income (GAAP) $16.7 $22.0 $16.7

Stock-based Compensation Expense (tax affected)* $3.7 $3.0 $2.3

Net Income (Non-GAAP)* $20.3 $25.0 $19.0

Diluted Net Income per common share (GAAP) $0.32 $0.43 $0.32

Stock-based Compensation Expense (tax affected)* $0.06 $0.05 $0.04

Diluted Net Income per share (Non-GAAP)* $0.38 $0.48 $0.36

Shares used in diluted EPS calculation (Non-GAAP) * 53.0 52.6 53.1

21

Quarterly Net Income (Loss) GAAP to Non-GAAP Reconciliation

(in millions, except per share data)

* Note: Non-GAAP, please see Non-GAAP financial measures on page 3.

Q3'17 Q2'17 Q1'17 Q4'16 Q3'16

Net income (GAAP) $16.7 $22.0 $13.5 $7.0 $16.7

Adjustments:

Stock-based compensation expense $4.8 $4.7 $4.5 $4.4 $3.9

Income tax effects of adjustments $(1.2) $(1.7) $(1.3) $(1.0) $(1.6)

Net income (Non-GAAP)* $20.3 $25.0 $16.7 $10.4 $19.0

Diluted Net Income per share (GAAP) $0.32 $0.43 $0.26 $0.13 $0.32

Adjustments: $0.06 $0.05 $0.06 $0.07 $0.04

Diluted Net Income per share (Non-GAAP)* $0.38 $0.48 $0.32 $0.20 $0.36

Diluted shares used in GAAP per share calculation

51.9 51.5 51.1 52.3 52.2

Diluted shares used in Non-GAAP per share calculation 53.0 52.6 52.2 53.0 53.1