Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Extended Stay America, Inc. | exhibit993-distributionann.htm |

| EX-99.1 - EXHIBIT 99.1 - Extended Stay America, Inc. | exhibit991-earningsrelease.htm |

| 8-K - 8-K - Extended Stay America, Inc. | stay-8xkannouncingq12017fo.htm |

April 27, 2017

Extended Stay America, Inc.

ESH Hospitality, Inc.

Q1 2017

Earnings Summary

2

important disclosure information

This presentation contains forward-looking statements within the meaning of the federal securities laws. Statements related to,

among other things, future financial performance, including our 2017 outlook, the expected timing, completion and effects of any

proposed asset disposals, expected performance, free cash flow, debt reduction, distribution growth and other growth

opportunities, as such, involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual

results or performance to differ from those projected in the forward-looking statements, possibly materially. For a description of

factors that may cause the Company’s actual results or performance to differ from future results or performance implied by

forward-looking statements, please review the information under the headings “Cautionary Note Regarding Forward-Looking

Statements” and “Risk Factors” included in the combined annual report on Form 10-K of Extended Stay America, Inc. and ESH

Hospitality, Inc. (collectively, the “Company”) filed with the SEC on February 28, 2017 and other documents of the Company on

file with or furnished to the SEC. Any forward-looking statements made in this presentation are qualified by these cautionary

statements, and there can be no assurance that the actual results or developments anticipated by the Company will be realized or,

even if substantially realized, will have the expected consequences to, or effects on, the Company, its business or operations.

Except as required by law, the Company undertakes no obligation to update publicly or revise any forward-looking statement,

whether as a result of new information, future developments or otherwise. We caution you that actual outcomes and results may

differ materially from what is expressed, implied or forecasted by the Company’s forward-looking statements.

This presentation includes certain non-GAAP financial measures, including Hotel Operating Profit, Hotel Operating Margin,

EBITDA, Adjusted EBITDA, Funds From Operations (“FFO”), Adjusted Funds From Operations (“Adjusted FFO”), Adjusted FFO per

Paired Share, Paired Share Income, Adjusted Paired Share Income and Adjusted Paired Share Income per Paired Share. These non-

GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in

accordance with U.S. GAAP. Please refer to the appendix of this presentation for a reconciliation of these non-GAAP financial

measures to the most directly comparable financial measures prepared in accordance with U.S. GAAP, and to the Company’s

combined annual report on Form 10-K filed with the SEC on February 28, 2017 for definitions of these non-GAAP measures.

3 1See Appendix for Hotel Operating Margin, Adjusted FFO per Paired Share, Adjusted EBITDA and Adjusted Paired Share Income per diluted Paired Share reconciliations.

Q1 2017 Operating Results & Financial Highlights

$44.83 $45.76

Q1 2016 Q1 2017

Revenue Per Available Room (“RevPAR”)

$0.31

$0.35

Q1 2016 Q1 2017

Adjusted FFO per Paired Share1

+2.1%

+11.7%

$14.8

$16.1

Q1 2016 Q1 2017

Net Income (in millions)

$122.8

$129.6

Q1 2016 Q1 2017

Hotel Operating Margin1

50.4%

52.5%

Q1 2016 Q1 2017

Adjusted EBITDA1 (in millions)

+8.9%

+210bps

+5.5%

$0.13

$0.15

Q1 2016 Q1 2017

Adjusted Paired Share Income

Per Paired Share1

+15.7%

4

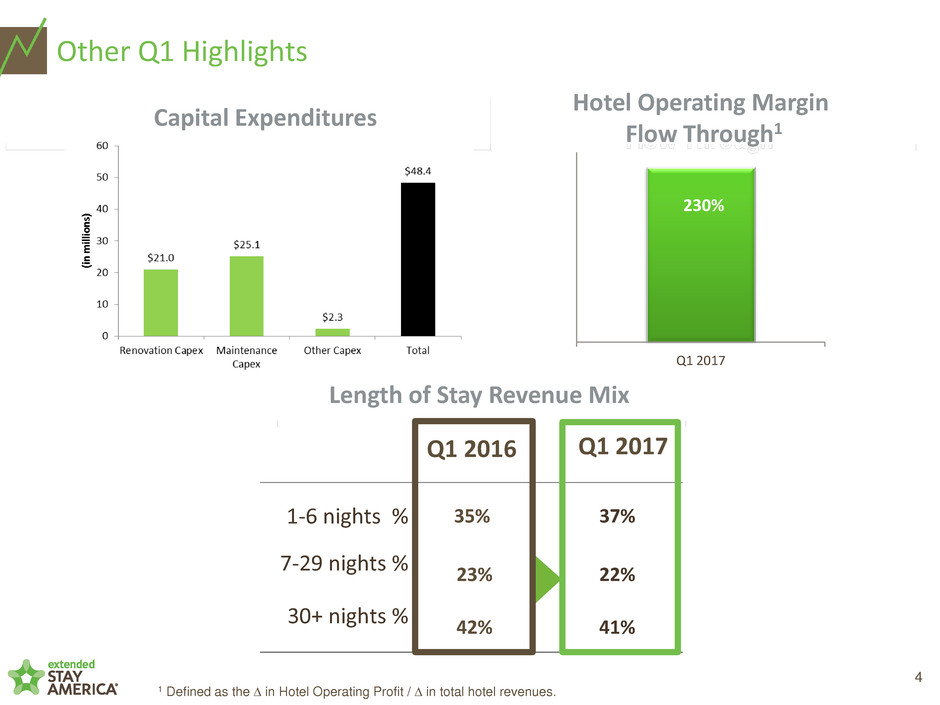

Other Q1 Highlights

Length of Stay Revenue Mix

1-6 nights % 35% 37%

7-29 nights %

23% 22%

30+ nights %

42% 41%

Q1 2017 Q1 2016

Capital Expenditures

Hotel Operating Margin

Flow Through1

230%

Q1 2017

1 Defined as the D in Hotel Operating Profit / D in total hotel revenues.

5

Quarterly Distribution and Select Balance Sheet Amounts

Quarterly Distribution

per Paired Share1

$0.19

$0.21

Q1 2016 Q1 2017

+10.5%

Adjusted Net Debt / TTM Adjusted

EBITDA Ratio3

4.2X

4.1X

Q4 2016 Q1 2017

¹ Distribution dates of May 24, 2016 and May 25, 2017, respectively.

2 Includes unrestricted cash only.

3 Net debt calculation is (total debt – total cash).

4 Includes unamortized deferred financing costs and debt discounts that totaled approximately $56.5 million and $54.6 million as of December 31, 2016 and March 31, 2017, respectively.

Cash Balance (in millions)2

$84

$65

Q4 2016 Q1 2017

Debt Outstanding (in millions)4

$2,663 $2,650

Q4 2016 Q1 2017

6

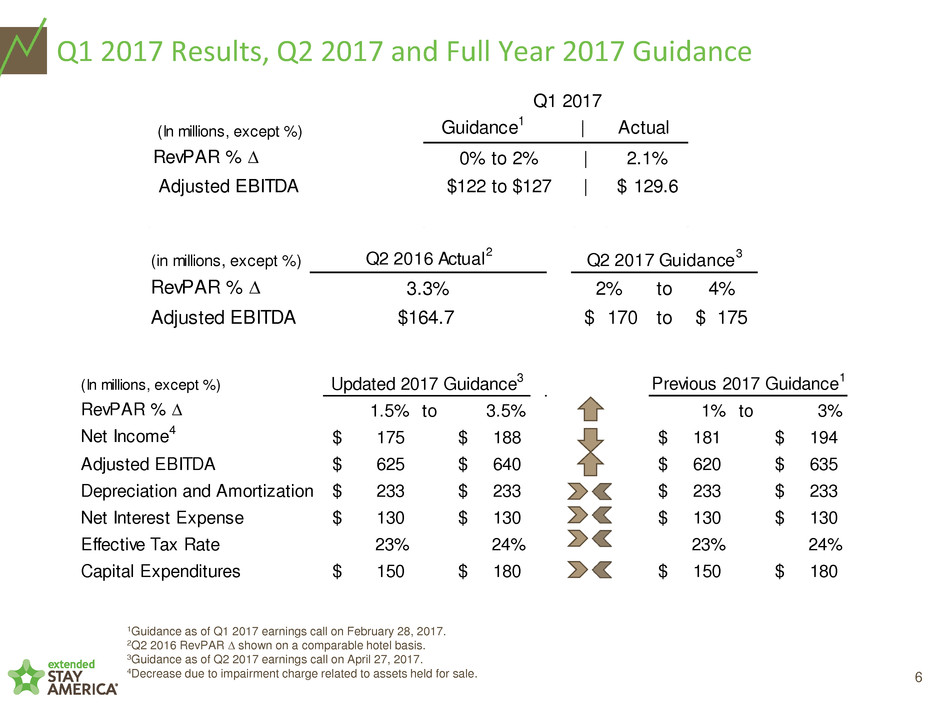

Q1 2017 Results, Q2 2017 and Full Year 2017 Guidance

1% to 3%

181$ 194$

620$ 635$

233$ 233$

130$ 130$

23% 24%

150$ 180$

Previous 2017 Guidance1

1Guidance as of Q1 2017 earnings call on February 28, 2017.

2Q2 2016 RevPAR D shown on a comparable hotel basis.

3Guidance as of Q2 2017 earnings call on April 27, 2017.

4Decrease due to impairment charge related to assets held for sale.

(In millions, except %)

RevPAR % D 1.5% to 3.5%

Net Income4 175$ 188$

Adjusted EBITDA 625$ 640$

Depreciation and Amortization 233$ 233$

Net Interest Expense 130$ 130$

Effective Tax Rate 23% 24%

Capital Expenditures 150$ 180$

Updated 2017 Guidance3

(In millions, except %)

RevPAR % D 0% to 2% | 2.1%

Adjusted EBITDA $122 to $127 | 129.6$

Q1 2017

Guidance1 | Actual

(in millions, except ) Q2 2016 Actual

2

RevPAR % D 3.3% 2% to 4%

Adjusted EBITDA $164.7 170$ to 175$

Q2 2017 Guidance

3

appendix

8

NON-GAAP RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA FOR THE THREE MONTHS

ENDED MARCH 31, 2017 AND 2016

2017 2016

Net income $ 16,063 14,753$

Interest expense, net 33,606 46,985

Income tax expense 4,483 2,896

Depreciation and amortization 57,671 53,308

EBITDA 111,823 117,942

Non-cash equity-based compensation 2,683 2,680

Other non-operating income (1,221) (1) (878) (2)

Impairment of long-lived assets 12,423 -

Other expenses 3,894 (3) 3,055 (4)

Adjusted EBITDA 129,602$ 122,799$

% growth 5.5%

(4)

Includes loss on disposal of assets of approximately $2.9 million and transaction costs of

approximately $0.2 million due to the revision of an estimate related to the sale of 53 hotel

properties in December 2015.

(In thousands)

(Unaudited)

(3)

Includes loss on disposal of assets of approximately $3.5 million and costs incurred in

connection with the March 2017 secondary offering of approximately $0.4 million.

Three Months Ended

March 31,

(1)

Includes change in mark-to-market value of interest rate swap of approximately $1.3 million

and non-cash foreign currency transaction loss of approximately $0.1 million.

(2)

Includes non-cash foreign currency transaction gain of approximately $0.9 million.

9

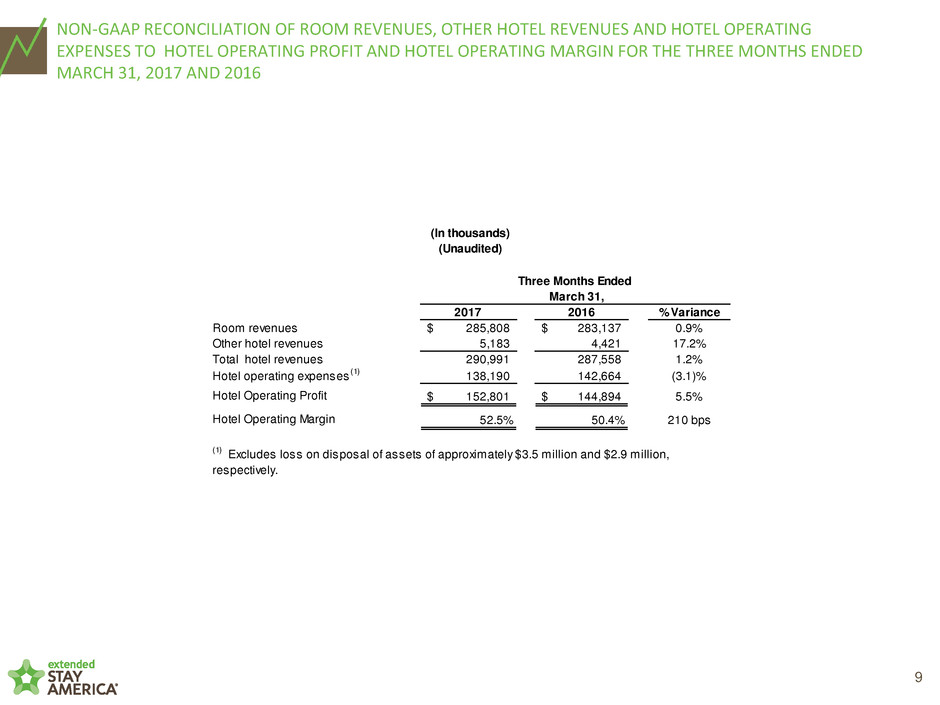

NON-GAAP RECONCILIATION OF ROOM REVENUES, OTHER HOTEL REVENUES AND HOTEL OPERATING

EXPENSES TO HOTEL OPERATING PROFIT AND HOTEL OPERATING MARGIN FOR THE THREE MONTHS ENDED

MARCH 31, 2017 AND 2016

2017 2016 % Variance

Room revenues 285,808$ 283,137$ 0.9%

Other hotel revenues 5,183 4,421 17.2%

Total hotel revenues 290,991 287,558 1.2%

Hotel operating expenses

(1)

138,190 142,664 (3.1)%

Hotel Operating Profit 152,801$ 144,894$ 5.5%

Hotel Operating Margin 52.5% 50.4% 210 bps

(In thousands)

(Unaudited)

Three Months Ended

March 31,

(1)

Excludes loss on disposal of assets of approximately $3.5 million and $2.9 million,

respectively.

10

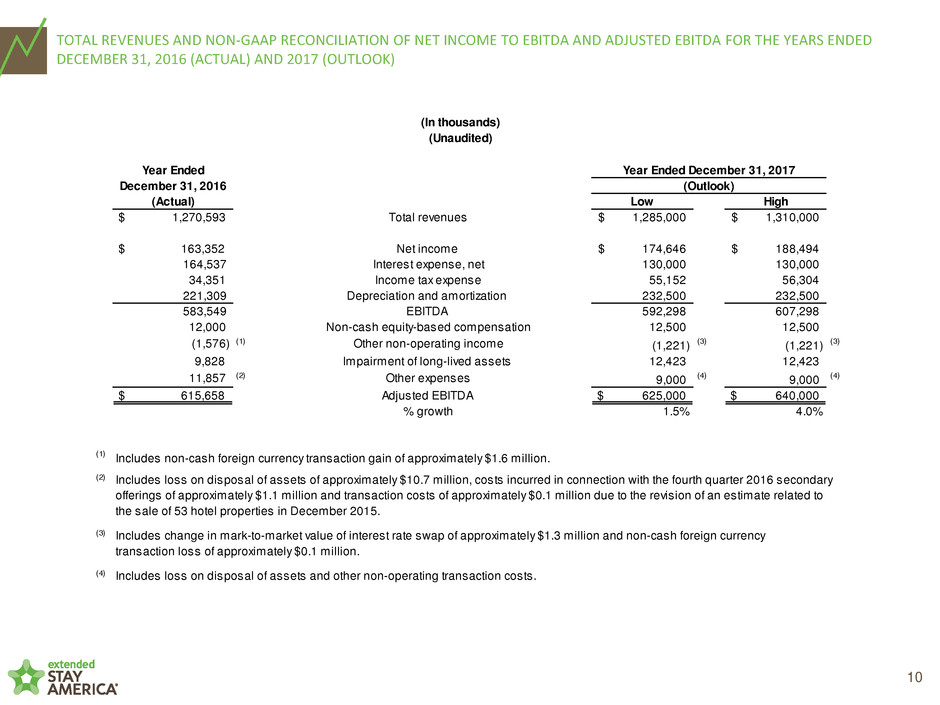

TOTAL REVENUES AND NON-GAAP RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA FOR THE YEARS ENDED

DECEMBER 31, 2016 (ACTUAL) AND 2017 (OUTLOOK)

Year Ended

December 31, 2016

(Actual) Low High

$ 1,270,593 Total revenues 1,285,000$ 1,310,000$

$ 163,352 Net income 174,646$ 188,494$

164,537 Interest expense, net 130,000 130,000

34,351 Income tax expense 55,152 56,304

221,309 Depreciation and amortization 232,500 232,500

583,549 EBITDA 592,298 607,298

12,000 Non-cash equity-based compensation 12,500 12,500

(1,576) (1) Other non-operating income (1,221)

(3)

(1,221)

(3)

9,828 Impairment of long-lived assets 12,423 12,423

11,857 (2) Other expenses 9,000

(4)

9,000

(4)

$ 615,658 Adjusted EBITDA $ 625,000 $ 640,000

% growth 1.5% 4.0%

(1)

(4) Includes loss on disposal of assets and other non-operating transaction costs.

Includes loss on disposal of assets of approximately $10.7 million, costs incurred in connection with the fourth quarter 2016 secondary

offerings of approximately $1.1 million and transaction costs of approximately $0.1 million due to the revision of an estimate related to

the sale of 53 hotel properties in December 2015.

(2)

(In thousands)

(Unaudited)

(Outlook)

Year Ended December 31, 2017

Includes non-cash foreign currency transaction gain of approximately $1.6 million.

Includes change in mark-to-market value of interest rate swap of approximately $1.3 million and non-cash foreign currency

transaction loss of approximately $0.1 million.

(3)

11

NON-GAAP RECONCILIATION OF NET INCOME ATTRIBUTABLE TO EXTENDED STAY AMERICA, INC. COMMON SHAREHOLDERS TO

FUNDS FROM OPERATIONS, ADJUSTED FUNDS FROM OPERATIONS AND ADJUSTED FUNDS FROM OPERATIONS PER PAIRED

SHARE FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

2017 2016

Net income per Extended Stay America, Inc. common share - diluted $ 0.12 $ 0.08

Net income attributable to Extended Stay America, Inc. common shareholders $ 23,101 $ 17,046

Noncontrolling interests attributable to Class B common shares of ESH REIT (7,042) (2,297)

Real estate depreciation and amortization 56,533 52,200

Impairment of long-lived assets 12,423 -

Tax effect of adjustments to net income attributable to Extended Stay

America, Inc. common shareholders (16,274) (11,954)

Funds From Operations 68,741 54,995

Debt modification and extinguishment costs 1,168 12,103

Change in mark-to-market value of interest rate swap (1,242) -

Tax effect of adjustments to Funds from Operations 17 (2,772)

Adjusted Funds From Operations $ 68,684 $ 64,326

Adjusted Funds From Operations per Paired Share – diluted $ 0.35 $ 0.31

Weighted average Paired Shares outstanding – diluted 195,386 204,370

(In thousands, except per share and per Paired Share data)

(Unaudited)

Three Months Ended

March 31,

12

NON-GAAP RECONCILIATION OF NET INCOME ATTRIBUTABLE TO EXTENDED STAY AMERICA, INC. COMMON SHAREHOLDERS TO

PAIRED SHARE INCOME, ADJUSTED PAIRED SHARE INCOME AND ADJUSTED PAIRED SHARE INCOME PER PAIRED SHARE FOR THE

THREE MONTHS ENDED MARCH 31, 2017 AND 2016

2017 2016

Net income per Extended Stay America, Inc. common share - diluted $ 0.12 $ 0.08

Net income attributable to Extended Stay America, Inc. common shareholders 23,101$ 17,046$

Noncontrolling interests attributable to Class B common shares of ESH REIT (7,042) (2,297)

Paired Share Income 16,059 14,749

Debt modification and extinguishment costs 1,168 12,103

Other non-operating income (1,221) (1) (878) (2)

Impairment of long-lived assets 12,423 -

Other expenses 3,894 (3) 3,055 (4)

Tax effect of adjustments to Paired Share Income (3,838) (3,270)

Adjusted Paired Share Income 28,485$ 25,759$

Adjusted Paired Share Income per Paired Share – diluted

0.15$ 0.13$

Weighted average Paired Shares outstanding – diluted

195,386 204,370

(4)

Includes loss on disposal of assets of approximately $2.9 million and transaction costs of approximately $0.2

million due to the revision of an estimate related to the sale of 53 hotel properties in December 2015.

(3)

Includes loss on disposal of assets of approximately $3.5 million and costs incurred in connection with the

March 2017 secondary offering of approximately $0.4 million.

March 31,

Three Months Ended

(In thousands, except per share and per Paired Share data)

(Unaudited)

(1)

Includes change in mark-to-market value of interest rate swap of approximately $1.3 million and non-cash

foreign currency transaction loss of approximately $0.1 million.

(2)

Includes non-cash foreign currency transaction gain of approximately $0.9 million.