Attached files

| file | filename |

|---|---|

| 8-K - 8-K SMARTFINANCIAL INC. EARNINGS RELEASE 1Q2017 - SMARTFINANCIAL INC. | a2017q1earningsreleasecover.htm |

| EX-99.1 - EXHIBIT 99.1 - SMARTFINANCIAL INC. | a2017q1earningsrelease-ex9.htm |

First Quarter 2017 Earnings Call

April 26, 2017

Important Information

Forward Looking Statements

This release contains forward-looking statements about SmartFinancial which we believe are within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include, without limitation, statements with respect to anticipated future operating and

financial performance, growth opportunities, interest rates, and cost savings anticipated to be realized by management. Words such as “may,”

“could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan” and similar expressions are intended to identify these

forward-looking statements. Forward-looking statements by SmartFinancial and its management are based on beliefs, plans, objectives, goals,

expectations, anticipations, estimates and intentions of management and are not guarantees of future performance. We disclaim any obligation to

update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information, or otherwise. The factors

we discuss in our annual report on Form 10-K and other filings with the Securities and Exchange Commission, and those presented elsewhere by our

management from time to time, could cause actual results to differ materially from those indicated by the forward-looking statements made in this

document.

Non-GAAP Measures

Statements included in this press release include non-GAAP financial measures and should be read along with the accompanying tables, which

provide a reconciliation of non-GAAP financial measures to GAAP financial measures. SmartFinancial management uses non-GAAP financial

measures, including: (i) yield on earning assets, taxable equivalent, (ii) net interest margin, taxable equivalent, (iii) net operating earnings available to

common shareholders; (iv) operating efficiency ratio; (v) adjusted allowance for loan losses to loans; and (vi) tangible common equity, in its analysis

of the company's performance. Yield on earning assets, taxable equivalent, and net interest margin, taxable equivalent, take into account income on

assets exempt from income taxes and are stated on a taxable-equivalent basis assuming a federal income tax rate of 34.0 percent. Net operating

earnings available to common shareholders excludes the following from net income available to common shareholders: securities gains and losses,

merger and conversion costs, OREO gain and losses, and the income tax effect of adjustments. The operating efficiency ratio excludes securities

gains and losses, merger and conversion costs, and adjustment for OREO gains and losses from the efficiency ratio. Adjusted allowance for loan losses

adds net acquisition accounting fair value discounts to the allowance for loan losses. Tangible common equity excludes total preferred stock,

preferred stock paid in capital, goodwill, and other intangible assets. Management believes that non-GAAP financial measures provide additional

useful information that allows readers to evaluate the ongoing performance of the company and provide meaningful comparisons to its peers. Non-

GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under

GAAP, and investors should consider SmartFinancial's performance and financial condition as reported under GAAP and all other relevant

information when assessing the performance or financial condition of the company. Non-GAAP financial measures have limitations as analytical tools,

and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP.

2

SmartFinanical Strategic Focus

• Core franchise in

East Tennessee

• Cleveland branch

acquisition fills gap

between Knoxville

and Chattanooga

• Geography

provides multiple

opportunities to fill

in between

Tennessee and

Florida

• Strong capital

position and

management team

provide the means

to execute

3

First Quarter 2017 Highlights

• Net income available to common shareholders totaled $1.4 million during the

first quarter of 2017 compared to $1.1 million during the first quarter of 2016, a

year over year increase of over 27 percent.

• Annualized return on average assets was 0.64 percent in the first quarter of

2017, compared to 0.54 percent a year ago.

• Net interest margin increased quarter to quarter due to increases in average

loan balances, increases in average balances and yields of the securities

portfolio, and reductions in FHLB advances and other borrowings.

• Asset quality was outstanding with nonperforming assets to total assets

dropping to just 0.36 percent.

• Dividends on preferred stock dropped to $195 thousand as the company used

proceeds from the capital raise to redeem the SBLF preferred stock in March.

4

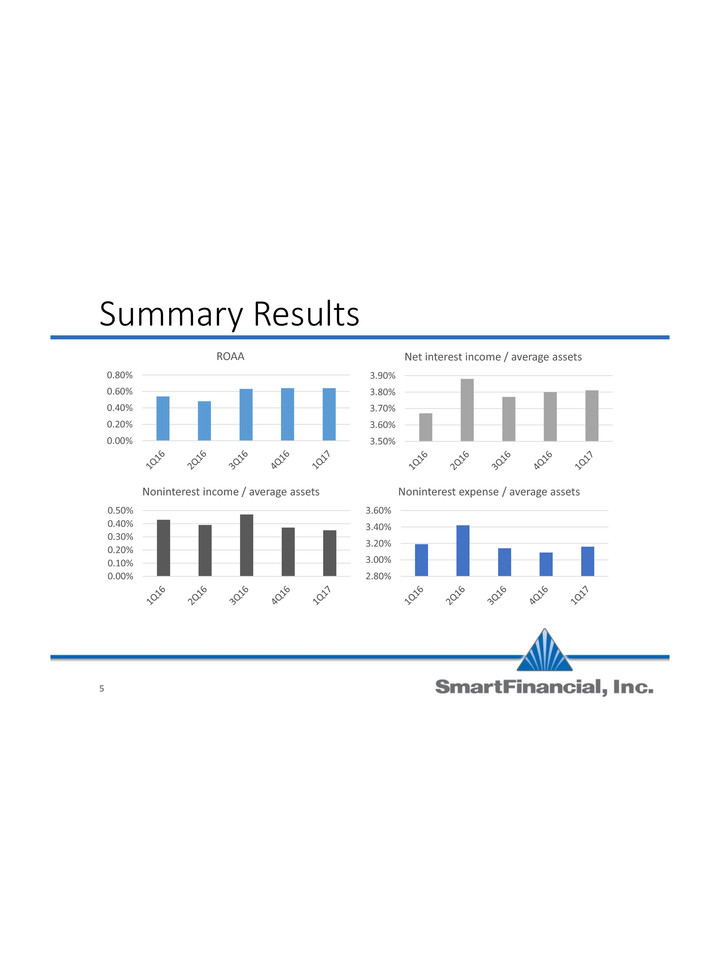

Summary Results

0.00%

0.20%

0.40%

0.60%

0.80%

ROAA

3.50%

3.60%

3.70%

3.80%

3.90%

Net interest income / average assets

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

Noninterest income / average assets

2.80%

3.00%

3.20%

3.40%

3.60%

Noninterest expense / average assets

5

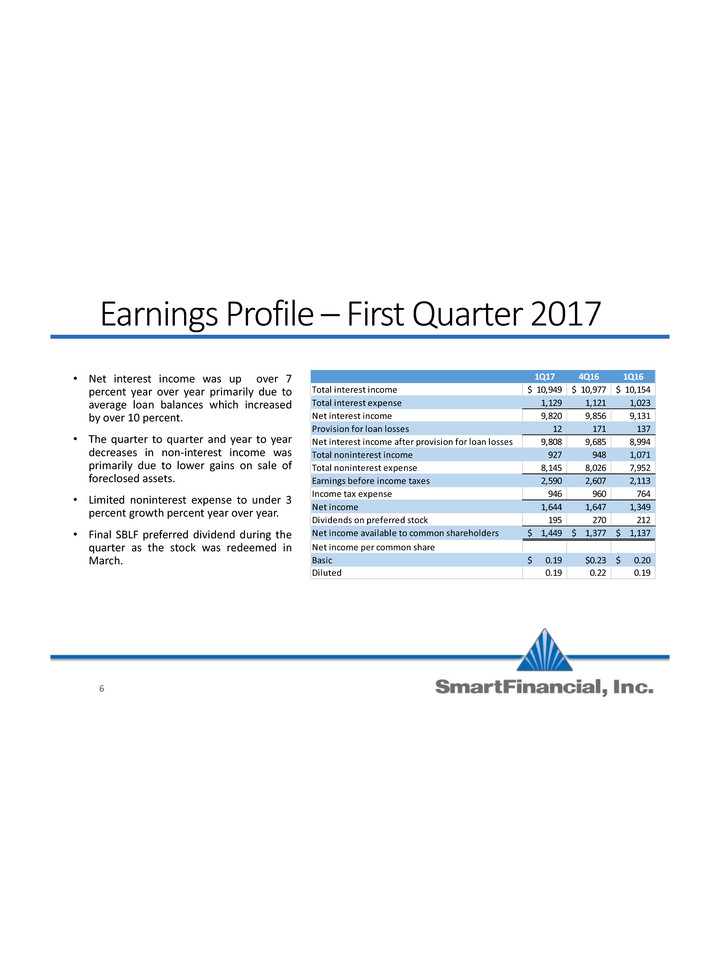

Earnings Profile – First Quarter 2017

• Net interest income was up over 7

percent year over year primarily due to

average loan balances which increased

by over 10 percent.

• The quarter to quarter and year to year

decreases in non-interest income was

primarily due to lower gains on sale of

foreclosed assets.

• Limited noninterest expense to under 3

percent growth percent year over year.

• Final SBLF preferred dividend during the

quarter as the stock was redeemed in

March.

1Q17 4Q16 1Q16

Total interest income 10,949$ 10,977$ 10,154$

Total interest expense 1,129 1,121 1,023

Net interest income 9,820 9,856 9,131

Provision for loan losses 12 171 137

Net interest income after provision for loan losses 9,808 9,685 8,994

Total noninterest income 927 948 1,071

Total noninterest expense 8,145 8,026 7,952

Earnings before income taxes 2,590 2,607 2,113

Income tax expense 946 960 764

Net income 1,644 1,647 1,349

Dividends on preferred stock 195 270 212

Net income available to common shareholders 1,449$ 1,377$ 1,137$

Net income per common share

Basic 0.19$ $0.23 0.20$

Diluted 0.19 0.22 0.19

6

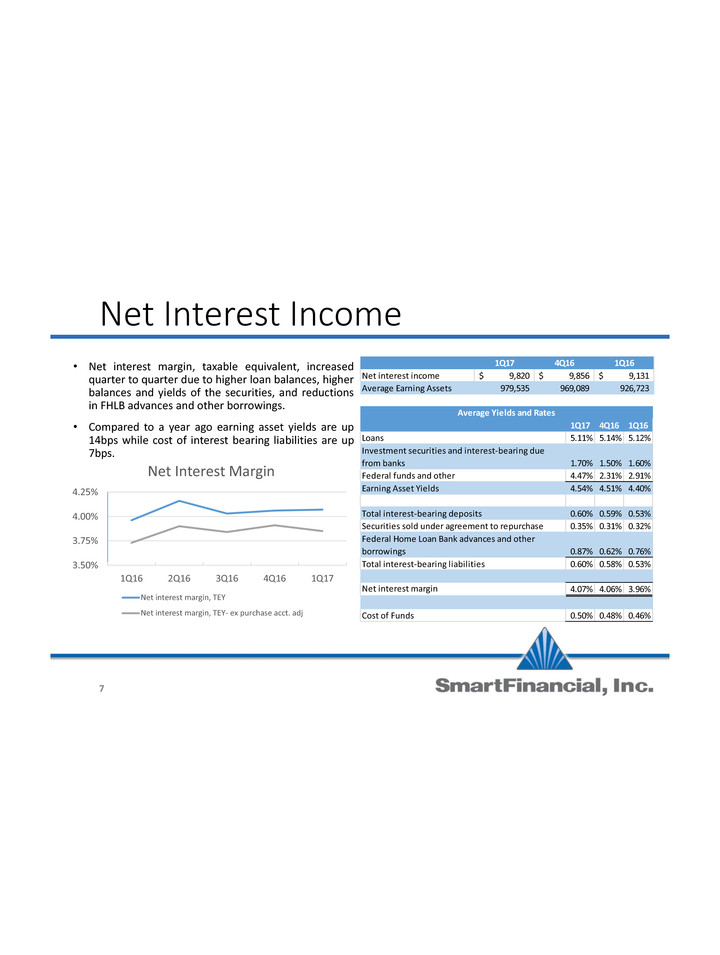

Net Interest Income

• Net interest margin, taxable equivalent, increased

quarter to quarter due to higher loan balances, higher

balances and yields of the securities, and reductions

in FHLB advances and other borrowings.

• Compared to a year ago earning asset yields are up

14bps while cost of interest bearing liabilities are up

7bps.

1Q17 4Q16 1Q16

Loans 5.11% 5.14% 5.12%

Investment securities and interest-bearing due

from banks 1.70% 1.50% 1.60%

Federal funds and other 4.47% 2.31% 2.91%

Earning Asset Yields 4.54% 4.51% 4.40%

Total interest-bearing deposits 0.60% 0.59% 0.53%

Securities sold under agreement to repurchase 0.35% 0.31% 0.32%

Federal Home Loan Bank advances and other

borrowings 0.87% 0.62% 0.76%

Total interest-bearing liabilities 0.60% 0.58% 0.53%

Net interest margin 4.07% 4.06% 3.96%

Cost of Funds 0.50% 0.48% 0.46%

Average Yields and Rates

3.50%

3.75%

4.00%

4.25%

1Q16 2Q16 3Q16 4Q16 1Q17

Net Interest Margin

Net interest margin, TEY

Net interest margin, TEY- ex purchase acct. adj

1Q17 4Q16 1Q16

Net intere t income 9,820$ 9, 56$ 9,131$

Average Earning Assets 979,535 969,089 926,723

7

Noninterest Income

• Total noninterest income has been volatile over the last year due to gains on sales of foreclosed

assets and securities.

• Quarterly recurring core noninterest income of service charges, gains on the sale of loans, and other

noninterest income has trended higher over the last four quarters from approximately $930

thousand in 1Q16 to $945 thousand in 1Q17.

$0

$200,000

$400,000

$600,000

$800,000

$1,000,000

$1,200,000

$1,400,000

1Q16 2Q16 3Q16 4Q16 1Q17

Noninterest Income

Gain (loss) on sale of foreclosed assets

Gain on securites

Other non-interest income

Gain on sale of loans and other assets

Service charges on deposit accounts

Core Recurring Trend

8

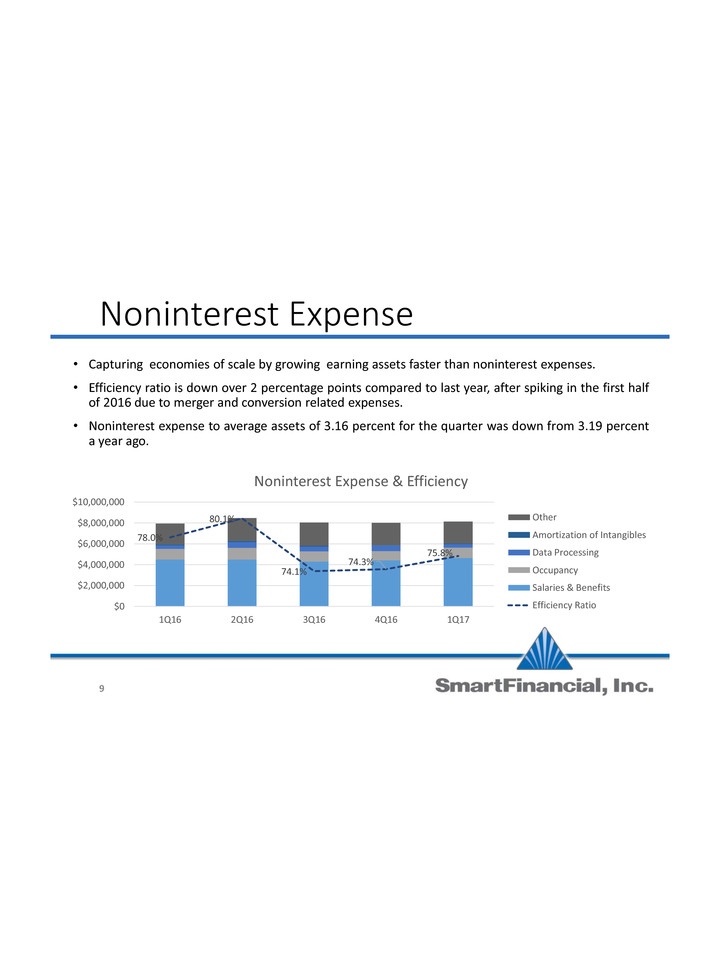

Noninterest Expense

• Capturing economies of scale by growing earning assets faster than noninterest expenses.

• Efficiency ratio is down over 2 percentage points compared to last year, after spiking in the first half

of 2016 due to merger and conversion related expenses.

• Noninterest expense to average assets of 3.16 percent for the quarter was down from 3.19 percent

a year ago.

78.0%

80.1%

74.1%

74.3%

75.8%

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

1Q16 2Q16 3Q16 4Q16 1Q17

Noninterest Expense & Efficiency

Other

Amortization of Intangibles

Data Processing

Occupancy

Salaries & Benefits

Efficiency Ratio

9

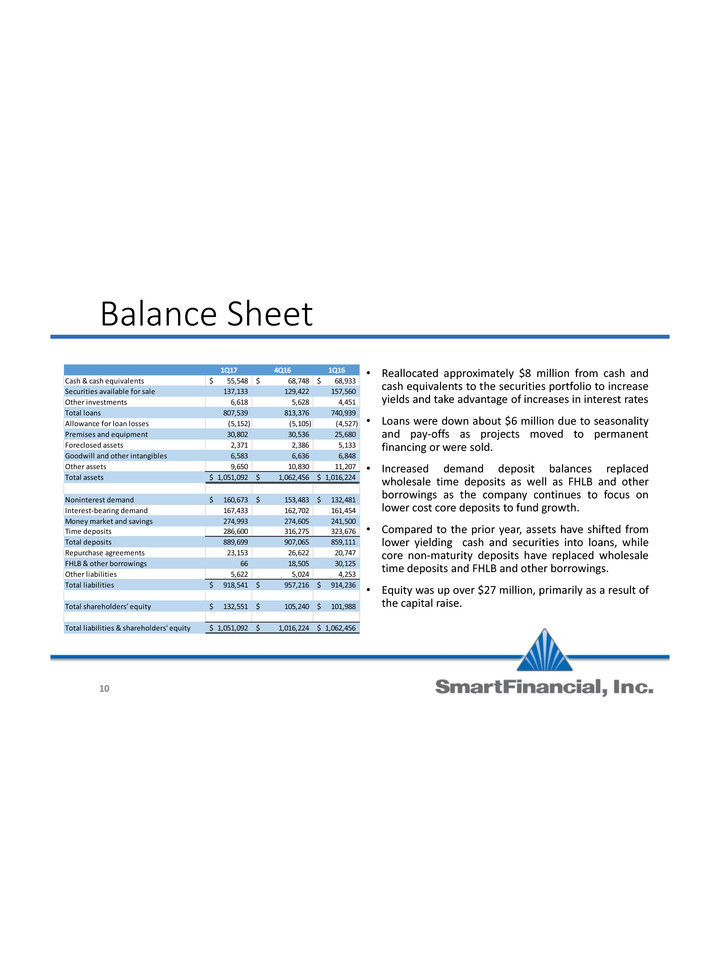

Balance Sheet

• Reallocated approximately $8 million from cash and

cash equivalents to the securities portfolio to increase

yields and take advantage of increases in interest rates

• Loans were down about $6 million due to seasonality

and pay-offs as projects moved to permanent

financing or were sold.

• Increased demand deposit balances replaced

wholesale time deposits as well as FHLB and other

borrowings as the company continues to focus on

lower cost core deposits to fund growth.

• Compared to the prior year, assets have shifted from

lower yielding cash and securities into loans, while

core non-maturity deposits have replaced wholesale

time deposits and FHLB and other borrowings.

• Equity was up over $27 million, primarily as a result of

the capital raise.

1Q17 4Q16 1Q16

Cash & cash equivalents 55,548$ 68,748$ 68,933$

Securities available for sale 137,133 129,422 157,560

Other investments 6,618 5,628 4,451

Total loans 807,539 813,376 740,939

Allowance for loan losses (5,152) (5,105) (4,527)

Premises and equipment 30,802 30,536 25,680

Foreclosed assets 2,371 2,386 5,133

Goodwill and other intangibles 6,583 6,636 6,848

Other assets 9,650 10,830 11,207

Total assets 1,051,092$ 1,062,456$ 1,016,224$

Noninterest demand 160,673$ 153,483$ 132,481$

Interest-bearing demand 167,433 162,702 161,454

Money market and savings 274,993 274,605 241,500

Time deposits 286,600 316,275 323,676

Total deposits 889,699 907,065 859,111

Repurchase agreements 23,153 26,622 20,747

FHLB & other borrowings 66 18,505 30,125

Other liabilities 5,622 5,024 4,253

Total liabilities 918,541$ 957,216$ 914,236$

Total shareholders' quity 132,551$ 105,240$ 101,988$

Total liabilities & shareholders' equity 1,051,092$ 1,016,224$ 1,062,456$

10

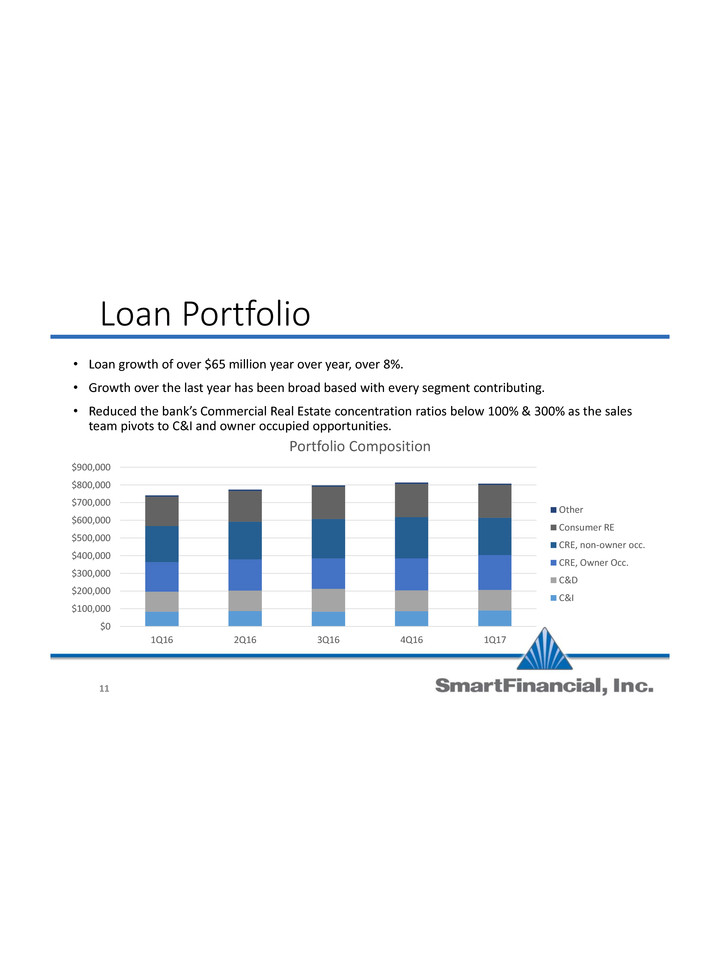

Loan Portfolio

• Loan growth of over $65 million year over year, over 8%.

• Growth over the last year has been broad based with every segment contributing.

• Reduced the bank’s Commercial Real Estate concentration ratios below 100% & 300% as the sales

team pivots to C&I and owner occupied opportunities.

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000

1Q16 2Q16 3Q16 4Q16 1Q17

Portfolio Composition

Other

Consumer RE

CRE, non-owner occ.

CRE, Owner Occ.

C&D

C&I

11

Asset Quality

• Excellent asset quality with nonperforming assets less than 0.40% of total assets.

• Nonperforming assets down over 50% year over year.

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

$0

$2,000

$4,000

$6,000

$8,000

$10,000

1Q16 2Q16 3Q16 4Q16 1Q17

Nonperforming Assets

Foreclosed assets

Nonperforming loans

Nonperforming assets to total assets

0.61% 0.61% 0.62% 0.63% 0.64%

2.11% 2.00% 1.93% 1.86% 1.82%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

1Q16 2Q16 3Q16 4Q16 1Q17

Allowance for Loan Losses to Loans

Allowance for loan losses to loans

Adjusted allowance for loan losses to loans (Non-GAAP)

12

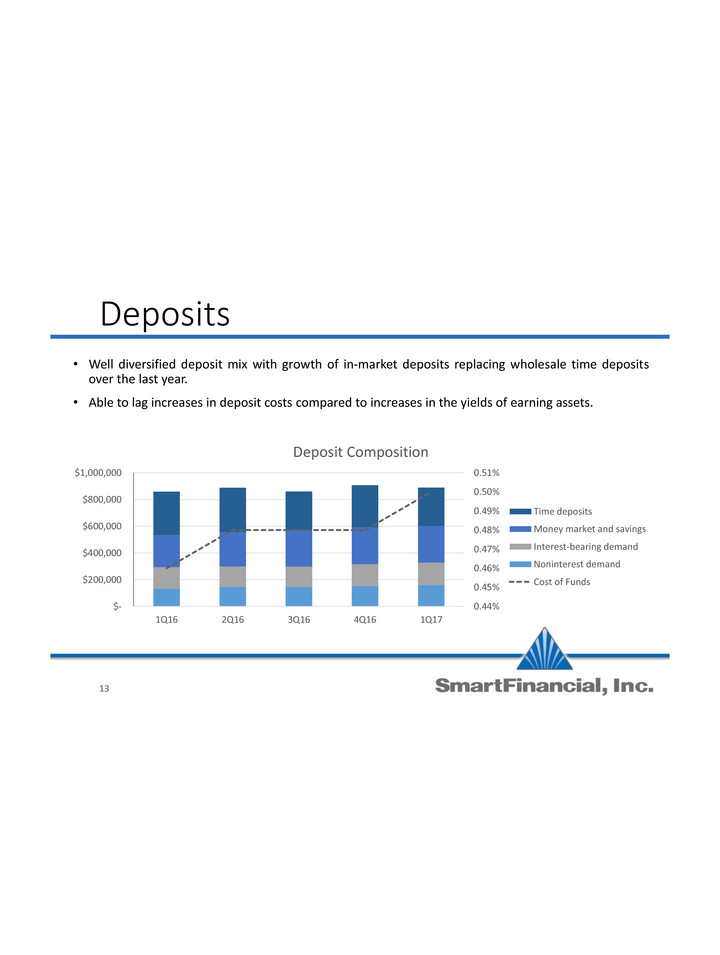

Deposits

• Well diversified deposit mix with growth of in-market deposits replacing wholesale time deposits

over the last year.

• Able to lag increases in deposit costs compared to increases in the yields of earning assets.

0.44%

0.45%

0.46%

0.47%

0.48%

0.49%

0.50%

0.51%

$-

$200,000

$400,000

$600,000

$800,000

$1,000,000

1Q16 2Q16 3Q16 4Q16 1Q17

Deposit Composition

Time deposits

Money market and savings

Interest-bearing demand

Noninterest demand

Cost of Funds

13

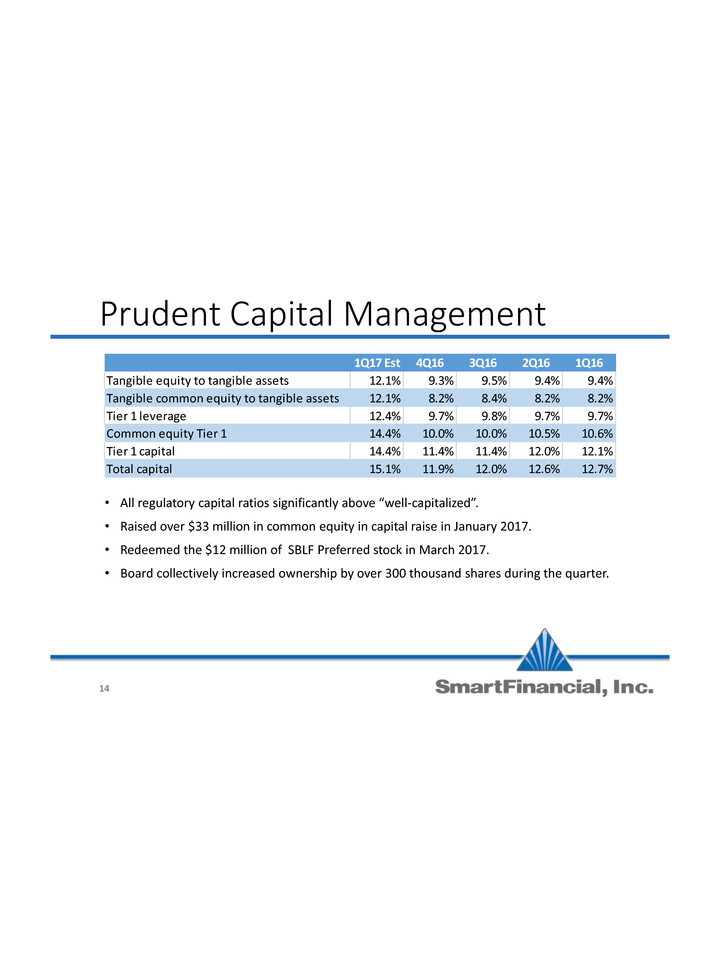

Prudent Capital Management

• All regulatory capital ratios significantly above “well-capitalized”.

• Raised over $33 million in common equity in capital raise in January 2017.

• Redeemed the $12 million of SBLF Preferred stock in March 2017.

• Board collectively increased ownership by over 300 thousand shares during the quarter.

1Q17 Est 4Q16 3Q16 2Q16 1Q16

Tangible equity to tangible assets 12.1% 9.3% 9.5% 9.4% 9.4%

Tangible common equity to tangible assets 12.1% 8.2% 8.4% 8.2% 8.2%

Tier 1 leverage 12.4% 9.7% 9.8% 9.7% 9.7%

Common equity Tier 1 14.4% 10.0% 10.0% 10.5% 10.6%

Tier 1 capital 14.4% 11.4% 11.4% 12.0% 12.1%

Total capital 15.1% 11.9% 12.0% 12.6% 12.7%

14

Conclusions

• First quarter results significantly improved from a year ago

• Second quarter forecast - loan growth driven by:

• Robust pipeline

• Cleveland branch acquisition with approximately $28 million in loans

• New production personnel

• Over $128 million in unfunded commitments

• Capital Raise – redeemed SBLF preferred stock and provides flexibility

• SMBK continues focus on long-term shareholder value by:

• Building the foundation for organic growth and profitability

• Exploring expansion to strategic markets

• Q&A

15

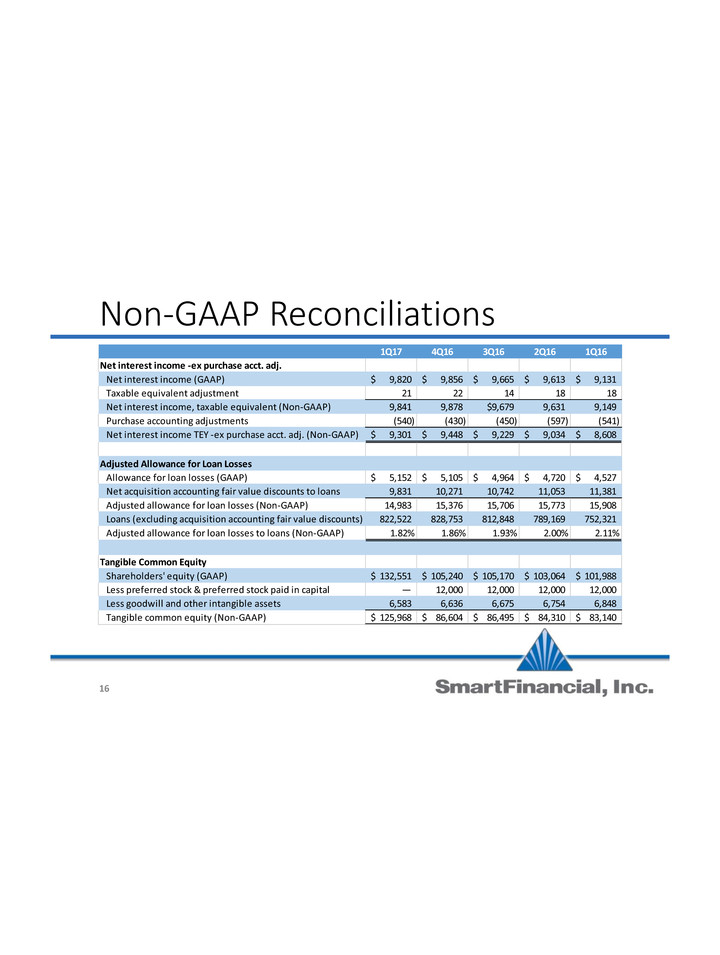

Non-GAAP Reconciliations

1Q17 4Q16 3Q16 2Q16 1Q16

Net interest income -ex purchase acct. adj.

Net interest income (GAAP) 9,820$ 9,856$ 9,665$ 9,613$ 9,131$

Taxable equivalent adjustment 21 22 14 18 18

Net interest income, taxable equivalent (Non-GAAP) 9,841 9,878 $9,679 9,631 9,149

Purchase accounting adjustments (540) (430) (450) (597) (541)

Net interest income TEY -ex purchase acct. adj. (Non-GAAP) 9,301$ 9,448$ 9,229$ 9,034$ 8,608$

Adjusted Allowance for Loan Losses

Allowance for loan losses (GAAP) 5,152$ 5,105$ 4,964$ 4,720$ 4,527$

Net acquisition accounting fair value discounts to loans 9,831 10,271 10,742 11,053 11,381

Adjusted allowance for loan losses (Non-GAAP) 14,983 15,376 15,706 15,773 15,908

Loans (excluding acquisition accounting fair value discounts) 822,522 828,753 812,848 789,169 752,321

Adjusted allowance for loan losses to loans (Non-GAAP) 1.82% 1.86% 1.93% 2.00% 2.11%

Tangible Common Equity

Shareholders' equity (GAAP) 132,551$ 105,240$ 105,170$ 103,064$ 101,988$

Less preferred stock & preferred stock paid in capital — 12,000 12,000 12,000 12,000

Less goodwill and other intangible assets 6,583 6,636 6,675 6,754 6,848

Tangible common equity (Non-GAAP) 125,968$ 86,604$ 86,495$ 84,310$ 83,140$

16