Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - CAMDEN NATIONAL CORP | ex992shareholderletterq117.htm |

| EX-99.1 - EXHIBIT 99.1 - CAMDEN NATIONAL CORP | ex991earningsreleaseq117.htm |

| 8-K - 8-K - CAMDEN NATIONAL CORP | a8k_033117earnings.htm |

2017 Annual

Shareholders Meeting

Welcome to the

2017 Annual Shareholders’ Meeting

Karen W. Stanley

Chairman of the Board

1

Agenda

• Business Meeting

• Introductions

• Reading of the Minutes

• Shareholder Voting

• Presentations

• Financial Results – Debbie Jordan

• Strategic Update – Greg Dufour

• Questions and Answers

2

Camden National Bank

Board of Directors

• Karen Stanley, Chair

• Larry Sterrs, Vice Chair

• Gregory Dufour,

President/CEO

• Ann Bresnahan

• William Dubord

• David Flanagan

• John Holmes

• James Markos, Jr.

• Robert Merrill

• David Ott

• John Rohman

• Carl Soderberg

• Rosemary Weymouth

3

Camden National Corporation

Board of Directors

• Karen Stanley, Chair

• Larry Sterrs, Vice Chair

• Gregory Dufour,

President/CEO

• Ann Bresnahan

• Craig Denekas (new)

• David Flanagan

• John Holmes

• Catherine Longley

• David Ott

• James Page, Ph.D.

• John Rohman

• Carl Soderberg

4

Senior Management Team

• Gregory Dufour, President and Chief Executive Officer

• Joanne Campbell, EVP - Risk Management Officer

• Mary Beth Haut, EVP – Director of Wealth Management

• Mac Hayden, EVP – Chief Credit Officer

• Debbie Jordan, CPA, EVP – COO and CFO

• Tim Nightingale, EVP - Senior Lending Officer

• June Parent, EVP - Senior Retail Banking Officer

• Renee Smyth, SVP – Chief Marketing Officer

• Ted Walbridge, SVP – Director of Human Resources

5

Meeting Minutes

6

• Judges of Election

• Paul Gibbons

• Thomas Jackson

• Proxies

• Jeffrey Weymouth

• Parker Laite, Jr.

• Alternates

• Arthur Sprowl

7

• Proposal 1: Election of Directors

• John Holmes

• David Ott

• John Rohman

• Larry Sterrs

• Proposal 2: “Say On Pay”

• Proposal 3: Frequency of “Say on Pay”

Proposals

8

• Proposal 4: Ratification of 2012 Equity and

Incentive Plan

• Proposal 5: Ratification of Independent

Registered Public Accounting Firm

• RSM US LLP

• Proposal 6: Amendment to the Articles of

Incorporation

Proposals - continued

9

Submission of Proxy Votes

10

Financial Results for 2016 and

First Quarter 2017

Debbie Jordan

Executive Vice President and

Chief Operating and Financial Officer

11

Forward Looking Statements

This presentation contains certain statements that may be considered forward-looking statements under the Private Securities Litigation

Reform Act of 1995 and other federal securities laws, including certain plans, exceptions, goals, projections, and statements, which are

subject to numerous risks, assumptions, and uncertainties. Forward-looking statements can be identified by the use of the words

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “plan,” “target,” or “goal” or future or conditional verbs such as “will,”

“may,” “might,” “should,” “could” and other expressions which predict or indicate future events or trends and which do not relate to

historical matters. Forward-looking statements should not be relied on, because they involve known and unknown risks, uncertainties and

other factors, some of which are beyond the control of Camden National Corporation (the “Company”). These risks, uncertainties and

other factors may cause the actual results, performance or achievements of the Company to be materially different from the anticipated

future results, performance or achievements expressed or implied by the forward-looking statements.

The following factors, among others, could cause the Company’s financial performance to differ materially from the Company’s goals,

plans, objectives, intentions, expectations and other forward-looking statements: weakness in the United States economy in general and

the regional and local economies within the New England region and Maine, which could result in a deterioration of credit quality, an

increase in the allowance for loan losses or a reduced demand for the Company’s credit or fee-based products and services; changes in

trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System;

inflation, interest rate, market, and monetary fluctuations; competitive pressures, including continued industry consolidation and the

increased financial services provided by non-banks; volatility in the securities markets that could adversely affect the value or credit

quality of the Company’s assets, impairment of goodwill, the availability and terms of funding necessary to meet the Company’s liquidity

needs, and could lead to impairment in the value of securities in the Company's investment portfolio; changes in information technology

that require increased capital spending; changes in consumer spending and savings habits; changes in tax, banking, securities and

insurance laws and regulations; and changes in accounting policies, practices and standards, as may be adopted by the regulatory

agencies as well as the Financial Accounting Standards Board ("FASB"), and other accounting standard setters.

You should carefully review all of these factors, and be aware that there may be other factors that could cause differences, including the

risk factors listed in the Company’s filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2016,

as updated by the Company's quarterly reports on Form 10-Q and other filings with the Securities and Exchange Commission. You should

carefully review the risk factors described therein and should not place undue reliance on our forward-looking statements.

These forward-looking statements were based on information, plans and estimates at the date of this report, and we undertake no

obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future

events or other changes, except to the extent required by applicable law or regulation.

12

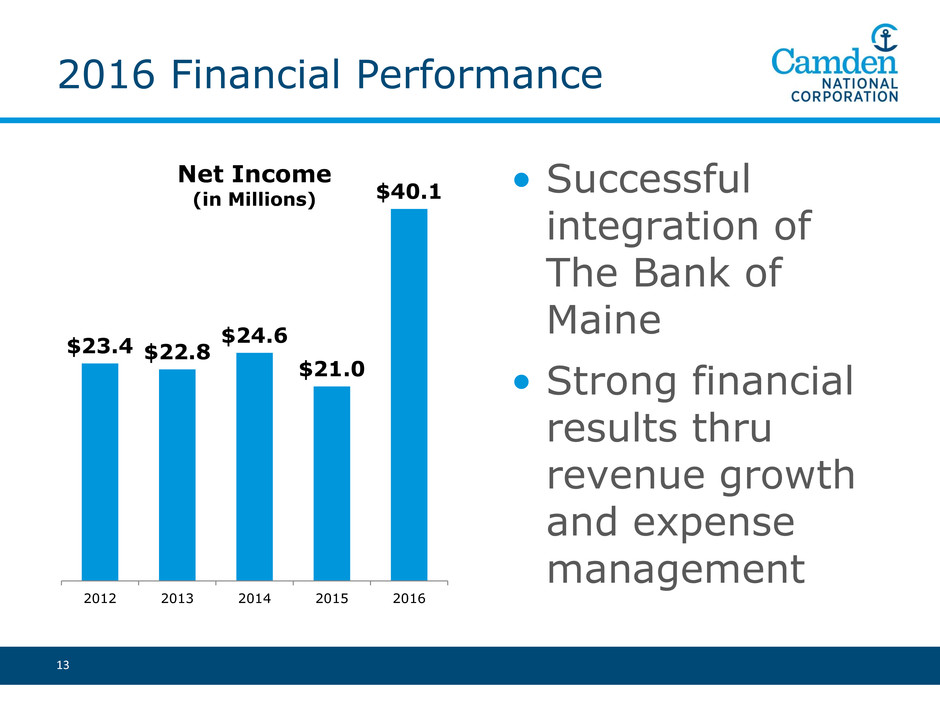

2016 Financial Performance

• Successful

integration of

The Bank of

Maine

• Strong financial

results thru

revenue growth

and expense

management

13

$23.4 $22.8

$24.6

$21.0

$40.1

2012 2013 2014 2015 2016

Net Income

(in Millions)

CAC

INDB

TRST

TMP

WASH

BHLB

BRKLCNBKA

FISI

AROW

UBNK

MBVT

FNLC

EBTC BHB

EBSB

BPFH

HIFS

FBNK

BLMT

CBU

NBTB

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40%

RE

T

URN

ON

AVERAG

E

TA

N

G

I

BLE

EQU

I

T

Y

RETURN ON AVERAGE ASSETS

High Performing Bank

14

Return on Average Tangible Equity is a non-GAAP financial measure.

Source: SNL Financial

Camden National

ROA – 1.04%

ROATE – 14.76%

(1) Non-GAAP measure. Please refer to the earnings release filed on Form 8-K on April 25, 2017 for the “Reconciliation of non-GAAP to GAAP Financial

Measures” section.

1st Quarter 2017 Financial Results

15

March 31, Increase (Decrease)

(in thousands, except per share) 2017 2016 $ %

Revenue (Net Interest Income plus Fee Income) 36,427$ 35,869$ 558$ 2%

Expenses/Provision/Taxes (26,351) (27,223) (872) -3%

Net Income 10,076$ 8,646$ 1,430$ 17%

Return on Average Assets 1.05% 0.93% 0.12% 13%

.

Return on Average Tangible Equity 1 14.37% 13.56% 0.81% 6%

One Year Total Return

16

Proxy Peer – Average of 21 publicly traded commercial and savings banks in the Northeast.

Source: SNL Financial - Total Return includes Stock Appreciation and Dividends from 4/21/16 to 4/21/17

23.25%

32.03%

37.23%

44.07%

53.35%

SNL $1B to $5B Bank

Index

KBW Bank Index

Proxy Peer Group Average

Russell 2000 Index

Camden National

Voting Results

Karen W. Stanley

Chairman of the Board

17

Strategic Overview

Greg Dufour

President and Chief Executive Officer

18

Camden National Corporation

• Headquartered in Maine –

largest bank in Northern New

England

• Full-service community bank

• Focused on delivering long-term

shareholder value through

banking, brokerage and wealth

management services

• Operates in Maine, New

Hampshire and Massachusetts

• Market cap over $650 million

19

Focused on Growing and

Diversifying Revenue

20

Camden National Corporation

• 60 banking centers

• 2 wealth management

offices

• 1 loan production office

(NH)

• 1 mortgage office (MA)

• Robust digital banking

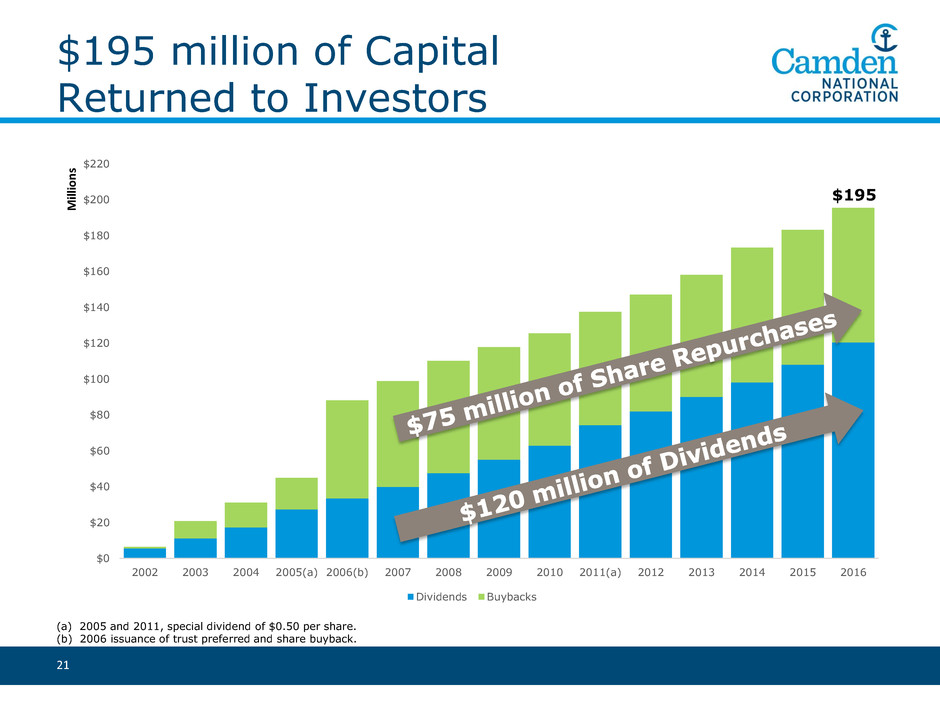

$195 million of Capital

Returned to Investors

21

(a) 2005 and 2011, special dividend of $0.50 per share.

(b) 2006 issuance of trust preferred and share buyback.

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

$200

$220

2002 2003 2004 2005(a) 2006(b) 2007 2008 2009 2010 2011(a) 2012 2013 2014 2015 2016

M

ill

io

n

s

Dividends Buybacks

$195

-50%

0%

50%

100%

150%

200%

250%

300%

350%

Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Apr-11 Apr-12 Apr-13 Apr-14 Apr-15 Apr-16 Apr-17

CAC SNL U.S. Bank $1B-$5B S&P 500

Focused on

Return to Shareholders

22

CAC

308%

183%

152%

Average annual

return of 9.83%

Source: SNL Financial

Why be a Shareholder of Camden

National?

• Track record of consistent and stable earnings

• Diversified business model

• Proven management team

• Favorable trading range to book

• Solid and consistent record of dividends

23

Question & Answers

24