Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - UMB FINANCIAL CORP | d262475dex991.htm |

| EX-10.1 - EX-10.1 - UMB FINANCIAL CORP | d262475dex101.htm |

| EX-2.1 - EX-2.1 - UMB FINANCIAL CORP | d262475dex21.htm |

| 8-K - 8-K - UMB FINANCIAL CORP | d262475d8k.htm |

UMB Financial Corporation April 20, 2017 Announcement of Agreement to Sell Scout Investments, Inc. to Carillon Tower Advisers Exhibit 99.2

Strategic Rationale This transaction allows us to allocate more time, energy and capital to our core banking businesses as well as our asset servicing operations. While Scout has generated shareholder value over the years, it has limited connectivity with our relationship-based banking model and lacks the required scale and diversification for continued growth. Our diversified financial services model stands. This is an opportunity for even greater emphasis on driving results and organic growth in our commercial, private wealth, institutional banking, payments, healthcare, consumer and asset servicing businesses. Scout will benefit from partnering with a firm whose sole focus is on the institutional-quality asset management business, providing an environment that can bring enhanced distribution capabilities, scale, dedicated resources and capital.

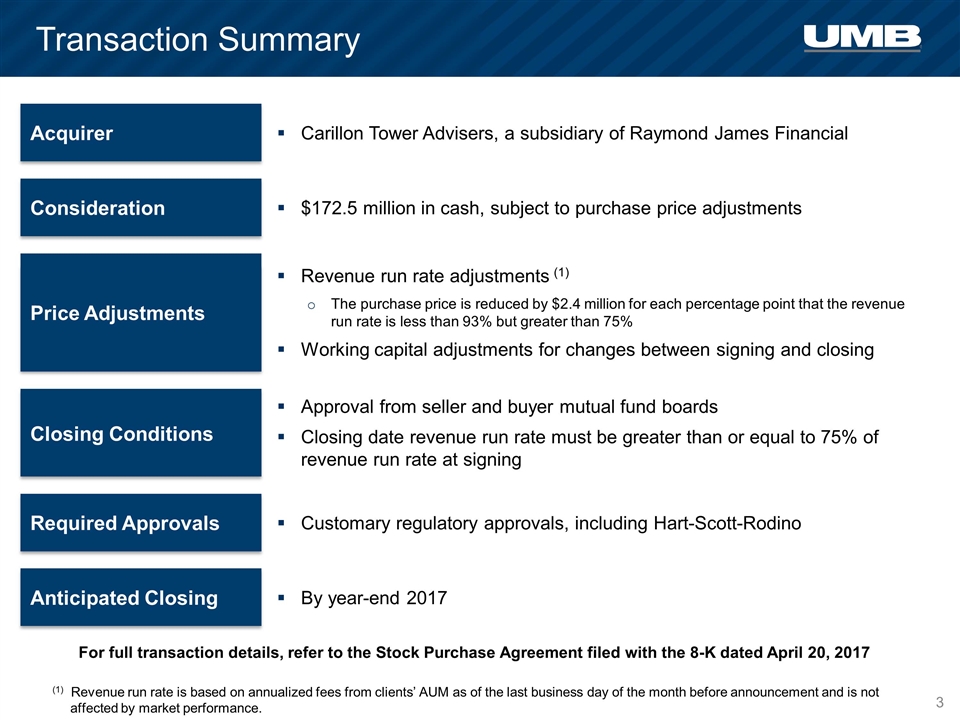

Transaction Summary Consideration $172.5 million in cash, subject to purchase price adjustments Required Approvals Customary regulatory approvals, including Hart-Scott-Rodino Anticipated Closing By year-end 2017 Price Adjustments Revenue run rate adjustments (1) The purchase price is reduced by $2.4 million for each percentage point that the revenue run rate is less than 93% but greater than 75% Working capital adjustments for changes between signing and closing Closing Conditions Approval from seller and buyer mutual fund boards Closing date revenue run rate must be greater than or equal to 75% of revenue run rate at signing (1) Revenue run rate is based on annualized fees from clients’ AUM as of the last business day of the month before announcement and is not affected by market performance. Acquirer Carillon Tower Advisers, a subsidiary of Raymond James Financial For full transaction details, refer to the Stock Purchase Agreement filed with the 8-K dated April 20, 2017

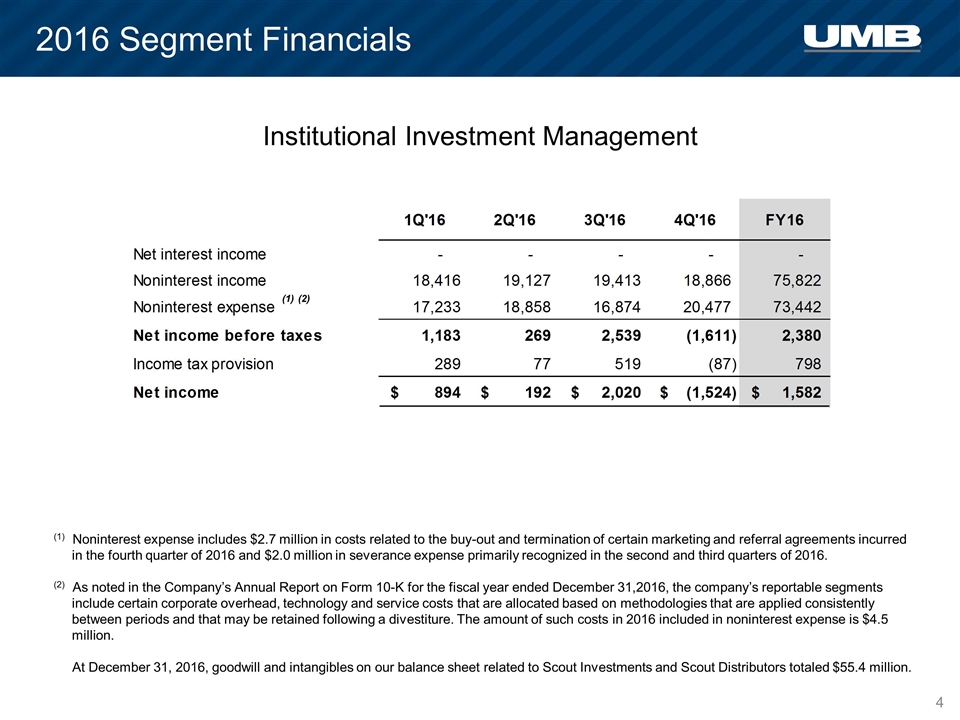

2016 Segment Financials Institutional Investment Management (1) (2) (1) Noninterest expense includes $2.7 million in costs related to the buy-out and termination of certain marketing and referral agreements incurred in the fourth quarter of 2016 and $2.0 million in severance expense primarily recognized in the second and third quarters of 2016. (2) As noted in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31,2016, the company’s reportable segments include certain corporate overhead, technology and service costs that are allocated based on methodologies that are applied consistently between periods and that may be retained following a divestiture. The amount of such costs in 2016 included in noninterest expense is $4.5 million. At December 31, 2016, goodwill and intangibles on our balance sheet related to Scout Investments and Scout Distributors totaled $55.4 million.