Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Riverview Financial Corp | d370238dex991.htm |

| EX-2.1 - EX-2.1 - Riverview Financial Corp | d370238dex21.htm |

| 8-K - 8-K - Riverview Financial Corp | d370238d8k.htm |

Exhibit 99.2

RIVERVIEW FINANCIAL CORPORATION

CBT FINANCIAL CORP.

Merger of Equals Announcement

April 20, 2017

Forward-Looking Statement Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and that the sources from which it has been obtained are reliable. The Company cannot guarantee the accuracy of such information, however, and has not independently verified such information. This presentation contains forward-looking statements, including projections, predictions, expectations or statements as to beliefs or future events or results or refer to other matters that are not historical facts. In some cases you can identify these forward-looking statements by words like “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “intend”, “believe”, “estimate”, “predict”, “potential”, or “continue”. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about the Company’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company’s control. Accordingly, you are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the expected results expressed or implied by such forward-looking statements. Important factors that could cause our actual results to differ materially from those in the forward-looking statements include, but are not limited to: our ability to achieve the intended benefits of acquisitions and integration of previously acquired businesses; restructuring initiatives; changes in interest rates; economic conditions, particularly in our market area; legislative and regulatory changes and the ability to comply with the significant laws and regulations governing the banking and financial services business; monetary and fiscal policies of the U.S. government, including policies of the U.S. Department of Treasury and the Federal Reserve System; credit risk associated with lending activities and changes in the quality and composition of our loan and investment portfolios; demand for loan and other products; deposit flows; competition; changes in the values of real estate and other collateral securing the loan portfolio, particularly in our market area; changes in relevant accounting principles and guidelines; and inability of third party service providers to perform. The forward-looking statements contained in this presentation speak only as of the date of this presentation, and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events. Page | 2 RIVERVIEW FINANCIAL CORPORATION

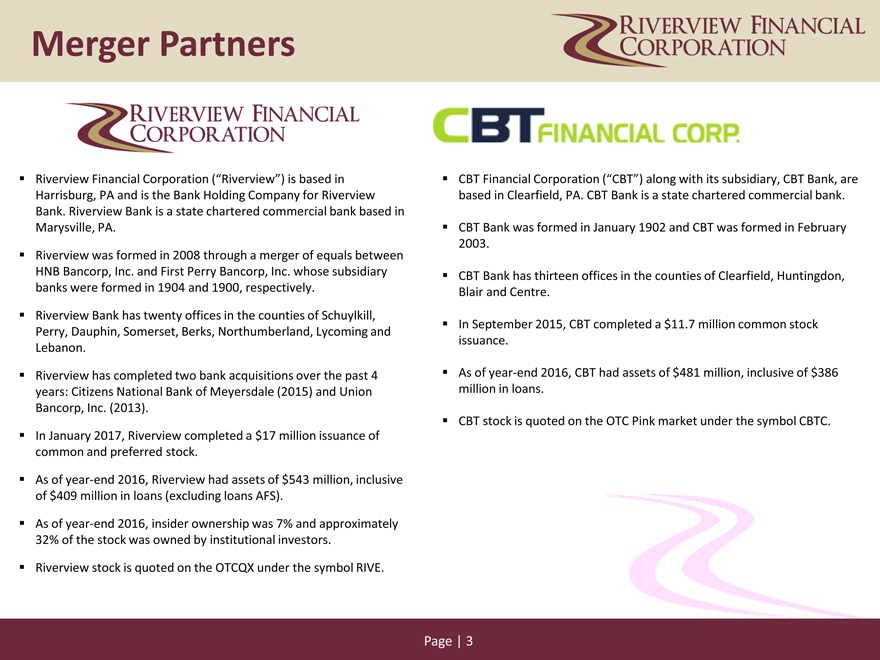

Merger Partners Riverview Financial Corporation (“Riverview”) is based in CBT Financial Corporation (“CBT”) along with its subsidiary, CBT Bank, are Harrisburg, PA and is the Bank Holding Company for Riverview based in Clearfield, PA. CBT Bank is a state chartered commercial bank. Bank. Riverview Bank is a state chartered commercial bank based in Marysville, PA. CBT Bank was formed in January 1902 and CBT was formed in February 2003. Riverview was formed in 2008 through a merger of equals between HNB Bancorp, Inc. and First Perry Bancorp, Inc. whose subsidiary CBT Bank has thirteen offices in the counties of Clearfield, Huntingdon, banks were formed in 1904 and 1900, respectively. Blair and Centre. Riverview Bank has twenty offices in the counties of Schuylkill, In September 2015, CBT completed a $11.7 million common stock Perry, Dauphin, Somerset, Berks, Northumberland, Lycoming and issuance. Lebanon. Riverview has completed two bank acquisitions over the past 4 As of year-end 2016, CBT had assets of $481 million, inclusive of $386 years: Citizens National Bank of Meyersdale (2015) and Union million in loans. Bancorp, Inc. (2013). CBT stock is quoted on the OTC Pink market under the symbol CBTC. In January 2017, Riverview completed a $17 million issuance of common and preferred stock. As of year-end 2016, Riverview had assets of $543 million, inclusive of $409 million in loans (excluding loans AFS). As of year-end 2016, insider ownership was 7% and approximately 32% of the stock was owned by institutional investors. Riverview stock is quoted on the OTCQX under the symbol RIVE. Page | 3 RIVERVIEW FINANCIAL CORPORATION

|

|

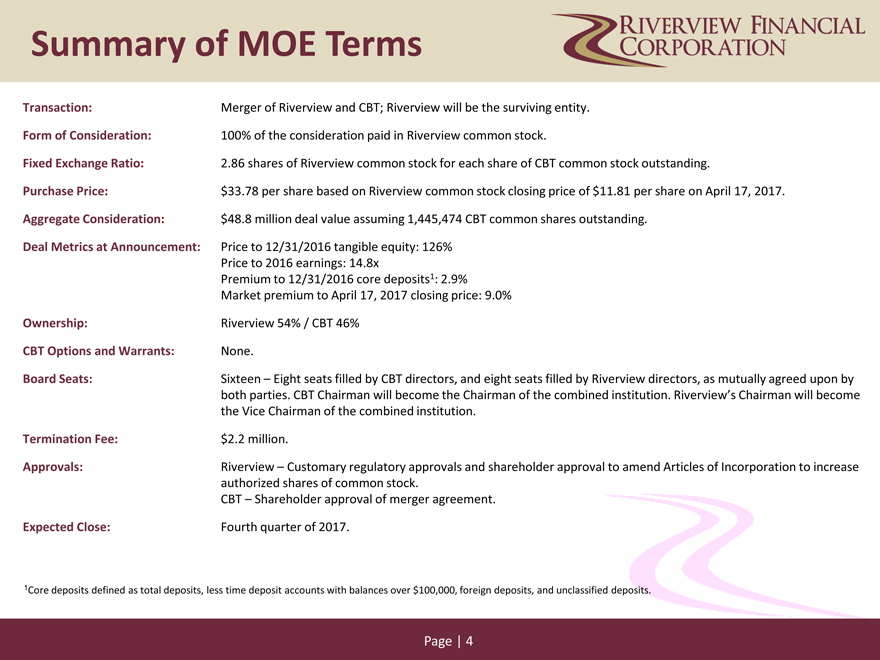

Summary of MOE Terms Transaction: Merger of Riverview and CBT; Riverview will be the surviving entity. Form of Consideration: 100% of the consideration paid in Riverview common stock. Fixed Exchange Ratio: 2.86 shares of Riverview common stock for each share of CBT common stock outstanding. Purchase Price: $33.78 per share based on Riverview common stock closing price of $11.81 per share on April 17, 2017. Aggregate Consideration: $48.8 million deal value assuming 1,445,474 CBT common shares outstanding. Deal Metrics at Announcement: Price to 12/31/2016 tangible equity: 126% Price to 2016 earnings: 14.8x Premium to 12/31/2016 core deposits1: 2.9% Market premium to April 17, 2017 closing price: 9.0% Ownership: Riverview 54% / CBT 46% CBT Options and Warrants: None. Board Seats: Sixteen – Eight seats filled by CBT directors, and eight seats filled by Riverview directors, as mutually agreed upon by both parties. CBT Chairman will become the Chairman of the combined institution. Riverview’s Chairman will become the Vice Chairman of the combined institution. Termination Fee: $2.2 million. Approvals: Riverview – Customary regulatory approvals and shareholder approval to amend Articles of Incorporation to increase authorized shares of common stock. CBT – Shareholder approval of merger agreement. Expected Close: Fourth quarter of 2017. 1Core deposits defined as total deposits, less time deposit accounts with balances over $100,000, foreign deposits, and unclassified deposits. Page | 4 RIVERVIEW FINANCIAL CORPORATION

|

|

Rationale Strategic Rationale: The merger creates a major central PA franchise with assets over $1 billion. Combined trust and retail wealth management assets under management of almost $400 million. The ability to offer customers more banking locations, improved technology and a wider range of products. Larger lending limits. Economies of scale that creates improved earnings and value for shareholders. Improved shareholder liquidity. Greater ability to control destiny and preserve the community bank culture in an increasingly competitive market. A combined and dedicated board drawn evenly from each institution with significant experience in local businesses, community banking and publicly traded companies. Financial Rationale: Payback period of less than 3 years using EPS accretion method. Pro-forma capital ratios remain above “well-capitalized” guidelines. Page | 5 RIVERVIEW FINANCIAL CORPORATION

|

|

Management Team Kirk D. Fox Brett D. Fulk Chief Executive Officer President Kirk D. Fox is the Chief Executive Officer and a Director of Riverview and Brett D. Fulk is President and a Director of Riverview and Riverview Bank, Riverview Bank. He is also one of the founding officers of Riverview and and has been with the Bank since July 2011. Formerly with Susquehanna Riverview Bank. He was an Executive Vice President of HNB Bancorp, Inc. Bank and CommunityBanks and with 26 years banking experience, He and Chief Lending Officer of Halifax National Bank from August 2004 to held the positions of Regional Executive, Commercial Sales Manager and December 2008. He formerly served as a Director of HNB Bancorp, Inc. most recently, Managing Director of Commercial Services, PA Division. He and Halifax National Bank since 2007. Prior to that Mr. Fox was Vice graduated from Shippensburg University of PA with a Bachelors Degree in President and Commercial Loan Officer for Community Bank, where he Business Administration and is a graduate of the Bucknell School of worked since 1988. Graduated from Mansfield University with a Commercial Banking. Bachelor’s Degree and an Associate’s Degree. Graduate of Bucknell Advanced School of Banking and Advanced School of Commercial Lending. Scott A. Seasock Michael J. Bibak Chief Financial Officer Currently: President & CEO (CBT) To be: Chief Operating Officer (Riverview) Scott A. Seasock is the Chief Financial Office of Riverview and Riverview New Position Bank. Mr. Seasock comes to Riverview from Peoples Financial Services Corp. (NASDAQ: PFIS), a SEC reporting company, where he served most recently as its Chief Financial Officer and Executive Vice President, from Michael J. Bibak is Director, President & Chief Executive Officer of CBT January 2010 to April 2016. Prior to Peoples Financial Services, he served Financial Corp. & CBT Bank. Mr. Bibak earned a Bachelor of Science as an Executive Vice President and Chief Financial Officer of Comm degree from the University of Scranton and is a graduate of the Bancorp. Inc. from 1989-2010. He is a graduate of Penn State University, Pennsylvania Banker’s Association Executive Leadership Program. with a bachelors degree in Finance, and holds an MBA from the University of Scranton. Page | 6 RIVERVIEW FINANCIAL CORPORATION

|

|

Board Composition William E. Wood David W. Hoover Currently: Chairman (CBT) Currently: Chairman (Riverview) To be: Chairman (Riverview) To be: Vice Chairman (Riverview) William E. Wood, Director and Chairman of CBT and of CBT Bank. Mr. David W. Hoover is the Owner and President of Hoover Financial Services, Wood holds an MBA from St. Francis University and a Bachelor of Science Inc., which is an accounting/tax preparation/business consulting firm degree in Economics with honors from Robert Morris University. He also located in Halifax, Pennsylvania for nearly 20 years. He formerly served as holds a degree in Electrical Engineering from the Pennsylvania State a Director of HNB Bancorp, Inc. and Halifax National Bank since 2007. Mr. University and is a graduate of the Stonier Graduate School of Banking at Hoover has been the Chairman of the Board of Riverview and Riverview the University of Delaware. Bank since their inception in December 2008. Post closing, Riverview will have a board of sixteen directors, with each party appointing eight of those directors. For three years post-closing, the Chairman of the Board will be a CBT appointee and the Vice Chairman of the Board will be a Riverview appointee. Page | 7 RIVERVIEW FINANCIAL CORPORATION

|

|

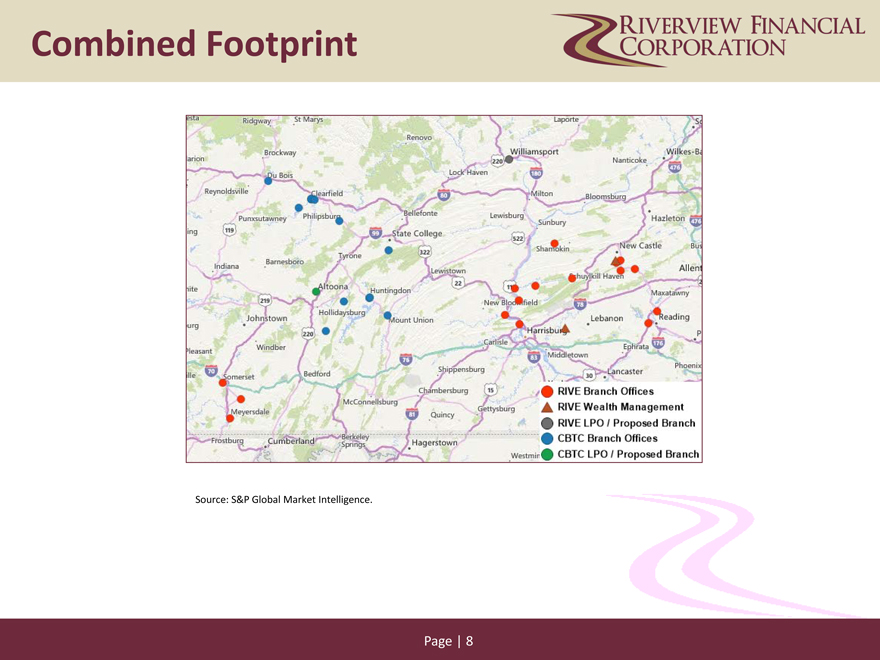

Combined Footprint

Source: S&P Global Market Intelligence.

Page | 8 RIVERVIEW FINANCIAL CORPORATION

|

|

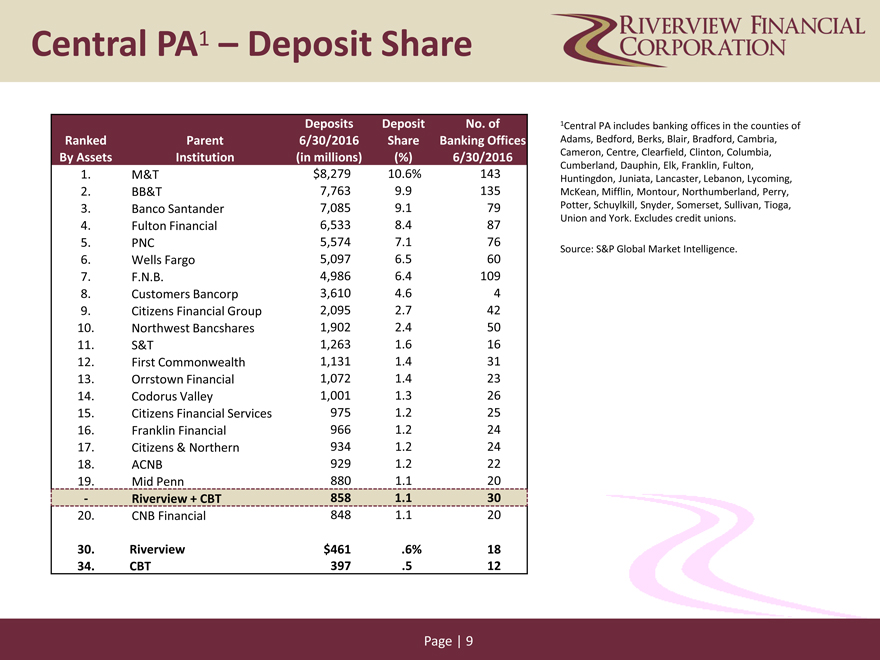

Central PA1 – Deposit Share Deposits Deposit No. of 1Central PA includes banking offices in the counties of Ranked Parent 6/30/2016 Share Banking Offices Adams, Bedford, Berks, Blair, Bradford, Cambria, By Assets Institution (in millions) (%) 6/30/2016 Cameron, Centre, Clearfield, Clinton, Columbia, Cumberland, Dauphin, Elk, Franklin, Fulton, 1. M&T $8,279 10.6% 143 Huntingdon, Juniata, Lancaster, Lebanon, Lycoming, 2. BB&T 7,763 9.9 135 McKean, Mifflin, Montour, Northumberland, Perry, 3. Banco Santander 7,085 9.1 79 Potter, Schuylkill, Snyder, Somerset, Sullivan, Tioga, 4. 6,533 8.4 87 Union and York. Excludes credit unions. Fulton Financial 5. PNC 5,574 7.1 76 Source: S&P Global Market Intelligence. 6. Wells Fargo 5,097 6.5 60 7. F.N.B. 4,986 6.4 109 8. Customers Bancorp 3,610 4.6 4 9. Citizens Financial Group 2,095 2.7 42 10. Northwest Bancshares 1,902 2.4 50 11. S&T 1,263 1.6 16 12. First Commonwealth 1,131 1.4 31 13. Orrstown Financial 1,072 1.4 23 14. Codorus Valley 1,001 1.3 26 15. Citizens Financial Services 975 1.2 25 16. Franklin Financial 966 1.2 24 17. Citizens & Northern 934 1.2 24 18. ACNB 929 1.2 22 19. Mid Penn 880 1.1 20 —Riverview + CBT 858 1.1 30 20. CNB Financial 848 1.1 20 30. Riverview $461 .6% 18 34. CBT 397 .5 12 Page | 9 RIVERVIEW FINANCIAL CORPORATION

|

|

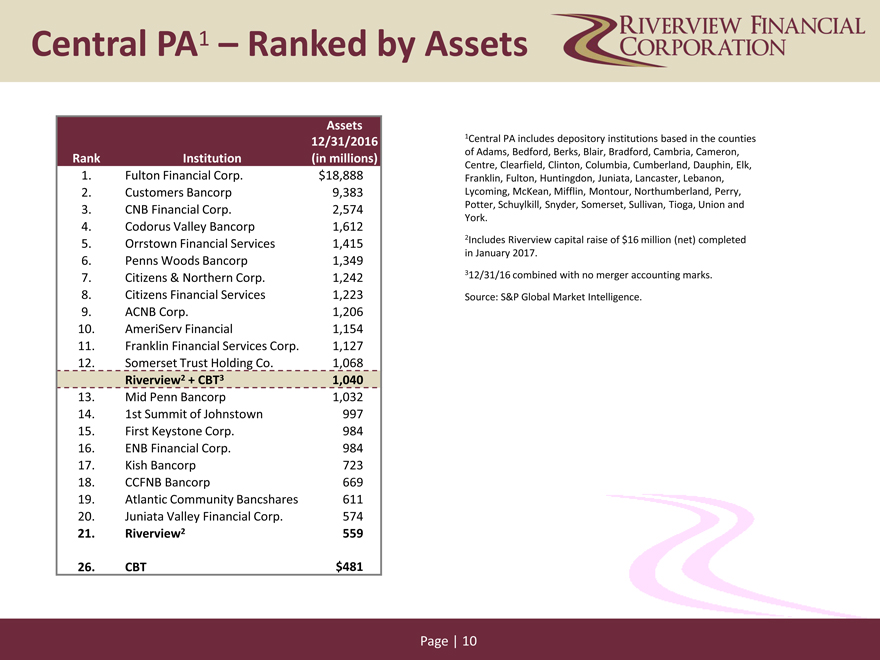

Central PA1 – Ranked by Assets Assets 12/31/2016 1Central PA includes depository institutions based in the counties Rank Institution (in millions) of Adams, Bedford, Berks, Blair, Bradford, Cambria, Cameron, Centre, Clearfield, Clinton, Columbia, Cumberland, Dauphin, Elk, 1. Fulton Financial Corp. $18,888 Franklin, Fulton, Huntingdon, Juniata, Lancaster, Lebanon, 2. Customers Bancorp 9,383 Lycoming, McKean, Mifflin, Montour, Northumberland, Perry, 3. CNB Financial Corp. 2,574 Potter, Schuylkill, Snyder, Somerset, Sullivan, Tioga, Union and York. 4. Codorus Valley Bancorp 1,612 5. Orrstown Financial Services 1,415 2Includes Riverview capital raise of $16 million (net) completed in January 2017. 6. Penns Woods Bancorp 1,349 7. Citizens & Northern Corp. 1,242 312/31/16 combined with no merger accounting marks. 8. Citizens Financial Services 1,223 Source: S&P Global Market Intelligence. 9. ACNB Corp. 1,206 10. AmeriServ Financial 1,154 11. Franklin Financial Services Corp. 1,127 12. Somerset Trust Holding Co. 1,068 Riverview2 + CBT3 1,040 13. Mid Penn Bancorp 1,032 14. 1st Summit of Johnstown 997 15. First Keystone Corp. 984 16. ENB Financial Corp. 984 17. Kish Bancorp 723 18. CCFNB Bancorp 669 19. Atlantic Community Bancshares 611 20. Juniata Valley Financial Corp. 574 21. Riverview2 559 26. CBT $481 Page | 10 RIVERVIEW FINANCIAL CORPORATION

|

|

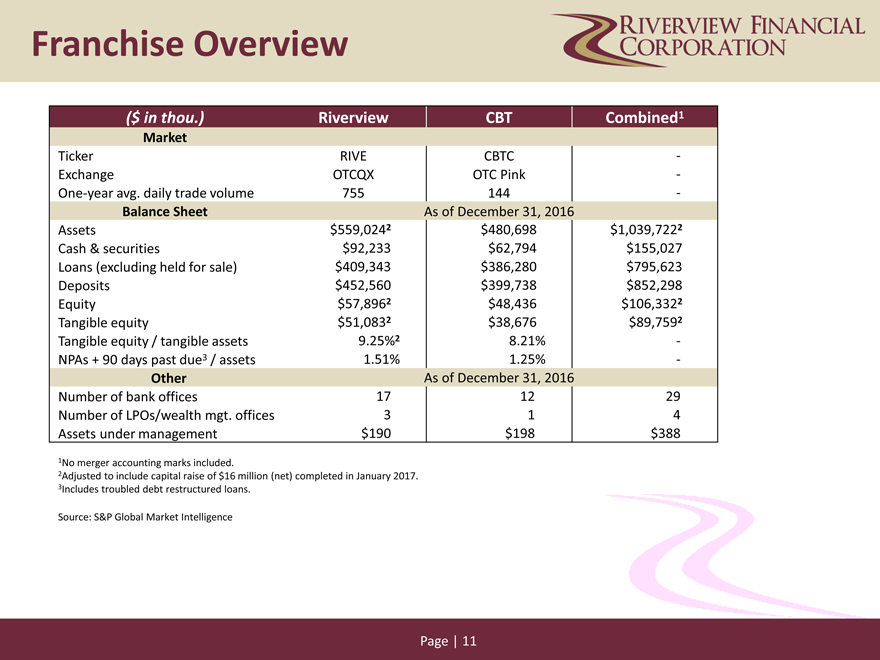

Franchise Overview ($ in thou.) Riverview CBT Combined1 Market Ticker RIVE CBTC -Exchange OTCQX OTC Pink -One-year avg. daily trade volume 755 144 -Balance Sheet As of December 31, 2016 Assets $559,0242 $480,698 $1,039,7222 Cash & securities $92,233 $62,794 $155,027 Loans (excluding held for sale) $409,343 $386,280 $795,623 Deposits $452,560 $399,738 $852,298 Equity $57,8962 $48,436 $106,3322 Tangible equity $51,0832 $38,676 $89,7592 Tangible equity / tangible assets 9.25%2 8.21% -NPAs + 90 days past due3 / assets 1.51% 1.25% -Other As of December 31, 2016 Number of bank offices 17 12 29 Number of LPOs/wealth mgt. offices 3 1 4 Assets under management $190 $198 $388 1No merger accounting marks included. 2Adjusted to include capital raise of $16 million (net) completed in January 2017. 3Includes troubled debt restructured loans. Source: S&P Global Market Intelligence Page | 11 RIVERVIEW FINANCIAL CORPORATION

|

|

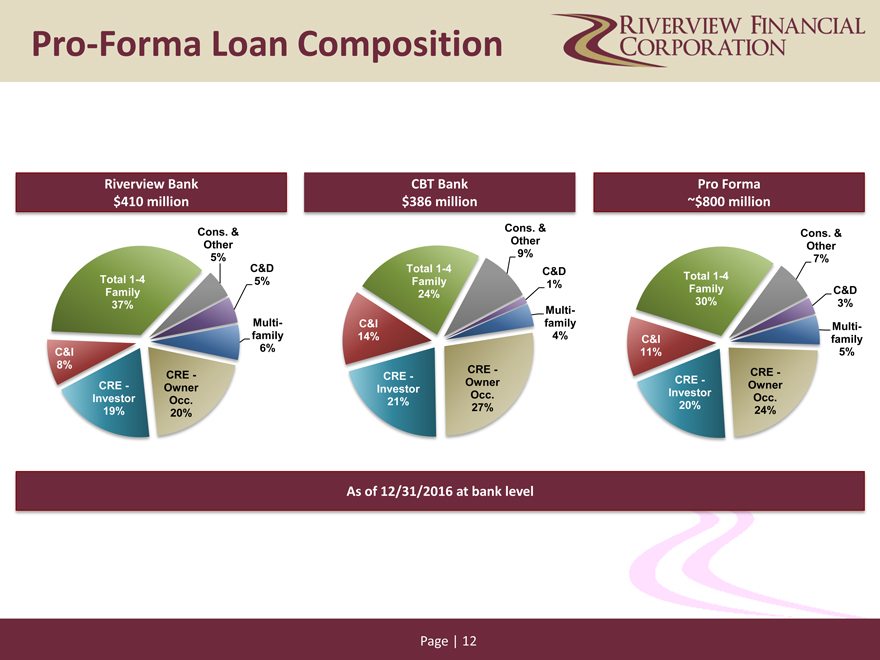

Pro-Forma Loan Composition Riverview Bank CBT Bank Pro Forma $410 million $386 million ~$800 million Cons. & Cons. & Cons. & Other Other Other 5% 9% 7% C&D Total 1-4 C&D Total 1-4 5% Family Total 1-4 1% Family Family 24% 30% C&D 37% 3% Multi-Multi- C&I family Multi-family 14% 4% C&I family C&I 6% 11% 5% 8% CRE—CRE—CRE—CRE -CRE—Owner CRE—Owner Owner Investor Investor Investor Occ. Occ. Occ. 21% 20% 19% 20% 27% 24% As of 12/31/2016 at bank level Page | 12 RIVERVIEW FINANCIAL CORPORATION

|

|

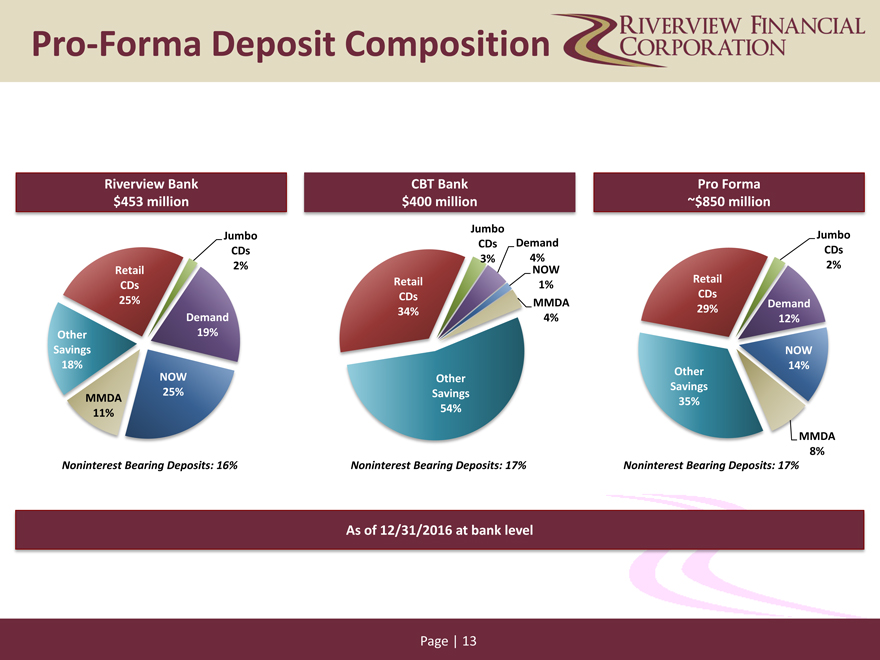

Pro-Forma Deposit Composition Riverview Bank CBT Bank Pro Forma $453 million $400 million ~$850 million Jumbo Jumbo Jumbo CDs Demand CDs CDs 3% 4% Retail 2% NOW 2% Retail 1% Retail CDs CDs CDs 25% MMDA Demand 34% 29% Demand 4% 12% Other 19% Savings NOW 18% 14% NOW Other Other 25% Savings MMDA Savings 35% 11% 54% MMDA 8% Noninterest Bearing Deposits: 16% Noninterest Bearing Deposits: 17% Noninterest Bearing Deposits: 17% As of 12/31/2016 at bank level Page | 13 RIVERVIEW FINANCIAL CORPORATION

|

|

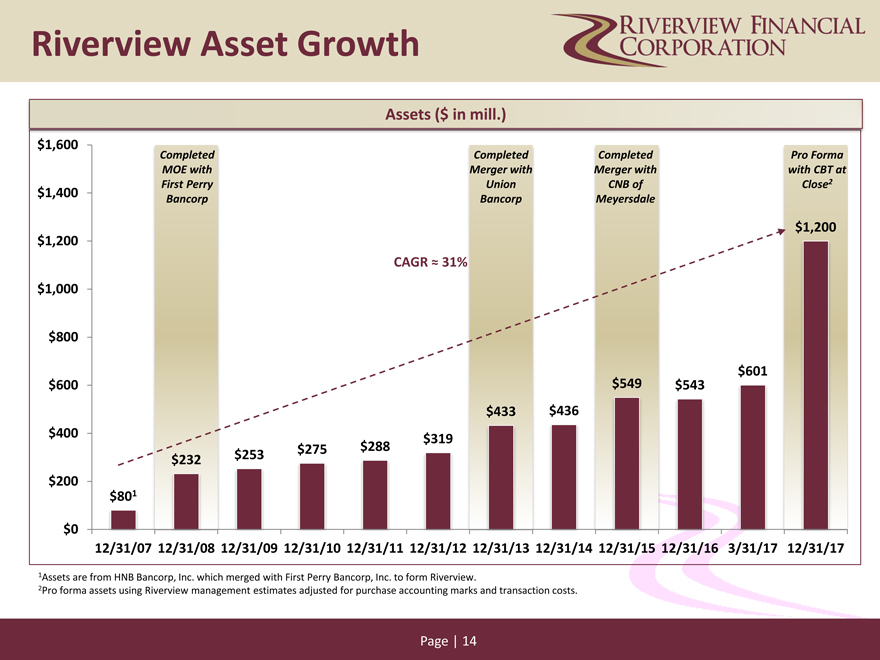

Riverview Asset Growth Assets ($ in mill.) $1,600 Completed Completed Completed Pro Forma MOE with Merger with Merger with with CBT at First Perry Union CNB of Close2 $1,400 Bancorp Bancorp Meyersdale $1,200 $1,200 CAGR 31% $1,000 $800 $601 $600 $549 $543 $433 $436 $400 $319 $275 $288 $232 $253 $200 $801 $0 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 12/31/16 3/31/17 12/31/17 1Assets are from HNB Bancorp, Inc. which merged with First Perry Bancorp, Inc. to form Riverview. 2Pro forma assets using Riverview management estimates adjusted for purchase accounting marks and transaction costs. Page | 14 RIVERVIEW FINANCIAL CORPORATION

|

|

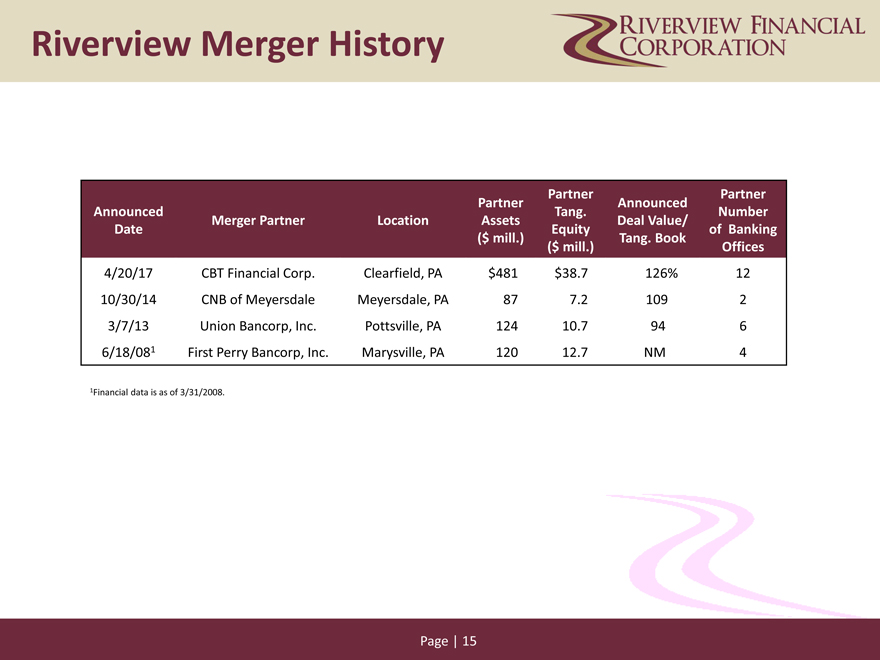

Riverview Merger History Partner Partner Partner Announced Announced Tang. Number Merger Partner Location Assets Deal Value/ Date Equity of Banking ($ mill.) Tang. Book ($ mill.) Offices 4/20/17 CBT Financial Corp. Clearfield, PA $481 $38.7 126% 12 10/30/14 CNB of Meyersdale Meyersdale, PA 87 7.2 109 2 3/7/13 Union Bancorp, Inc. Pottsville, PA 124 10.7 94 6 6/18/081 First Perry Bancorp, Inc. Marysville, PA 120 12.7 NM 4 1Financial data is as of 3/31/2008. Page | 15 RIVERVIEW FINANCIAL CORPORATION

|

|

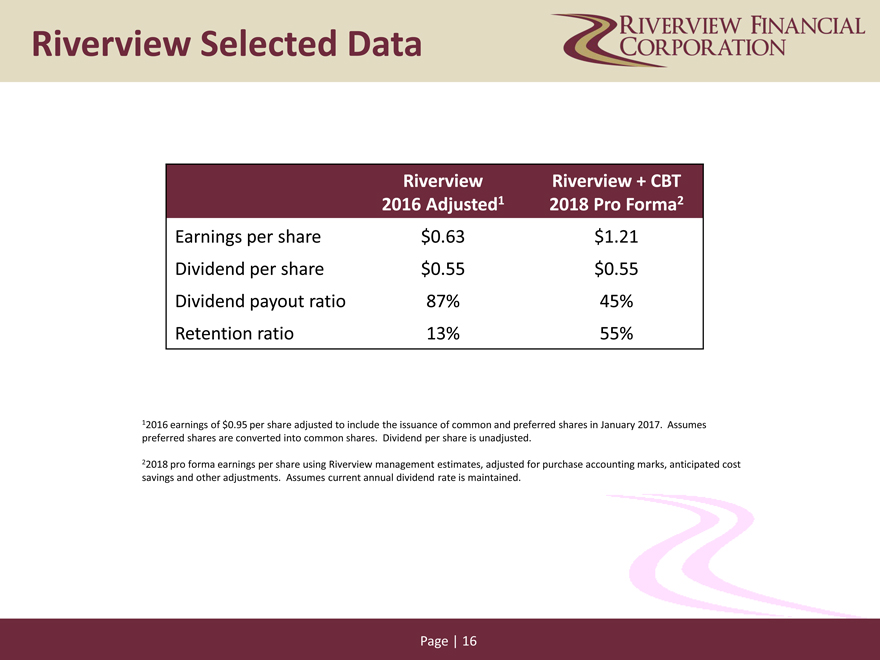

Riverview Selected Data Riverview Riverview + CBT 2016 Adjusted1 2018 Pro Forma2 Earnings per share $0.63 $1.21 Dividend per share $0.55 $0.55 Dividend payout ratio 87% 45% Retention ratio 13% 55% 12016 earnings of $0.95 per share adjusted to include the issuance of common and preferred shares in January 2017. Assumes preferred shares are converted into common shares. Dividend per share is unadjusted. 22018 pro forma earnings per share using Riverview management estimates, adjusted for purchase accounting marks, anticipated cost savings and other adjustments. Assumes current annual dividend rate is maintained. Page | 16 RIVERVIEW FINANCIAL CORPORATION

|

|

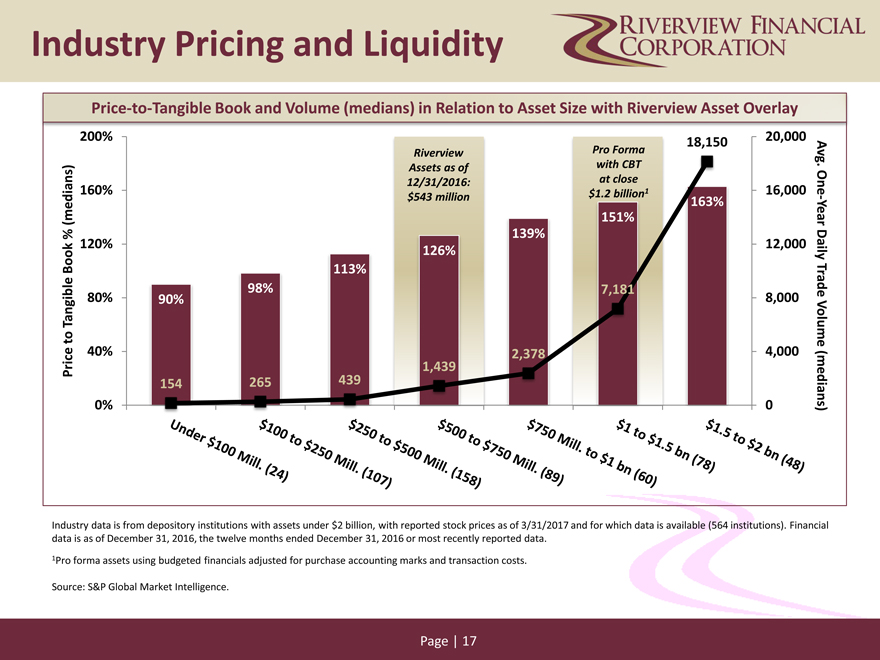

Industry Pricing and Liquidity Price-to-Tangible Book and Volume (medians) in Relation to Asset Size with Riverview Asset Overlay 18,150 Riverview Pro Forma Avg with CBT Assets as of at close One. 12/31/2016: 160% $1.2 billion1 16,000 $543 million 163%—(medians) 151% Year % 139% 120% 126% 12,000 Daily Book 113% 98% 7,181 Trade Tangible 80% 90% 8,000 to Volume 40% 2,378 4,000 Price 1,439 154 265 439 0% 0 (medians) Industry data is from depository institutions with assets under $2 billion, with reported stock prices as of 3/31/2017 and for which data is available (564 institutions). Financial data is as of December 31, 2016, the twelve months ended December 31, 2016 or most recently reported data. 1Pro forma assets using budgeted financials adjusted for purchase accounting marks and transaction costs. Source: S&P Global Market Intelligence. Page | 17 RIVERVIEW FINANCIAL CORPORATION

|

|

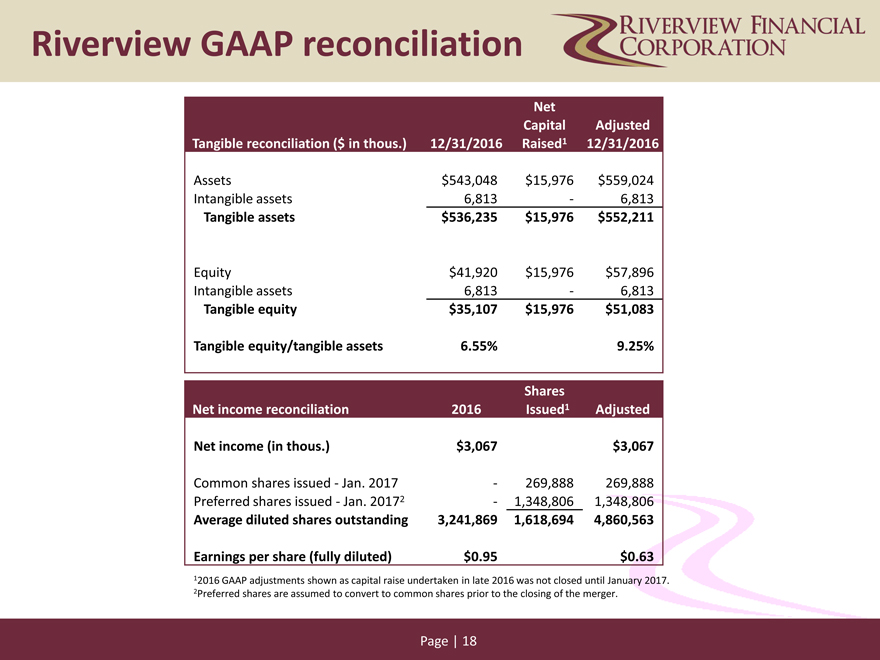

Riverview GAAP reconciliation Net Capital Adjusted Tangible reconciliation ($ in thous.) 12/31/2016 Raised1 12/31/2016 Assets $543,048 $15,976 $559,024 Intangible assets 6,813—6,813 Tangible assets $536,235 $15,976 $552,211 Equity $41,920 $15,976 $57,896 Intangible assets 6,813—6,813 Tangible equity $35,107 $15,976 $51,083 Tangible equity/tangible assets 6.55% 9.25% Shares Net income reconciliation 2016 Issued1 Adjusted Net income (in thous.) $3,067 $3,067 Common shares issued—Jan. 2017—269,888 269,888 Preferred shares issued—Jan. 20172—1,348,806 1,348,806 Average diluted shares outstanding 3,241,869 1,618,694 4,860,563 Earnings per share (fully diluted) $0.95 $0.63 12016 GAAP adjustments shown as capital raise undertaken in late 2016 was not closed until January 2017. 2Preferred shares are assumed to convert to common shares prior to the closing of the merger. Page | 18 RIVERVIEW FINANCIAL CORPORATION

|

|

Riverview Investor Contacts Kirk D. Fox Chief Executive Officer Brett D. Fulk President Scott A. Seasock Executive Vice President & CFO Riverview Financial Corporation 3901 North Front Street Harrisburg, PA 17110 (717) 957-2114 www.riverviewbankpa.com RIVERVIEW FINANCIAL CORPORATION