Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DOVER Corp | a201704208-k.htm |

| EX-99.1 - EXHIBIT 99.1 - DOVER Corp | a201704208-kexhibit991.htm |

Earnings Conference Call

First Quarter 2017

April 20, 2017 – 9:00am CT

2

Forward looking statements and non-GAAP measures

We want to remind everyone that our comments may contain forward-looking

statements that are inherently subject to uncertainties and risks. We caution

everyone to be guided in their analysis of Dover Corporation by referring to the

documents we file from time to time with the SEC, including our Form 10-K for

2016, for a list of factors that could cause our results to differ from those

anticipated in any such forward-looking statements.

We would also direct your attention to our website, dovercorporation.com,

where considerably more information can be found.

This document contains non-GAAP financial information. Reconciliations of

non-GAAP measures are included either in this presentation or Dover’s earnings

release and investor supplement for the first quarter, which are available on our

website.

2

3

$0.00

$0.25

$0.50

$0.75

$1.00

$1.25

Q1 Q2 Q3 Q4 Q1

Earnings per share Adj. EPS*

Q1 2017 Performance

Earnings Per Share

Q1 Q1/Q1

* Excludes gains on dispositions of $0.07 in Q1 2016, $0.36 in Q4 2016, $0.39 in

Q1 2017, and a $0.09 voluntary product recall charge in Q4 2016

(d) See Press Release for free cash flow reconciliation

3

Quarterly Comments

2016

Revenue growth largely driven by acquisitions and strong

recovery in Drilling & Production

Printing & Identification, Refrigeration, Retail Fueling, Hygienic &

Pharma, and most other industrial end markets were solid,

offsetting declines in longer cycle oil & gas markets and the

impact of dispositions

Solid organic growth in U.S., Europe and China

Adjusted segment margin improvement largely driven by strong

conversion on volume in the Energy segment

Bookings growth reflects broad-based organic increases and

acquisitions

Book-to-bill at a seasonally strong 1.12 Note: EPS and Adj. EPS include restructuring costs of $0.07 in Q1 2016, $0.04

in Q2 2016, $0.04 in Q3 2016, $0.04 in Q4 2016, and $0.03 in Q1 2017

Revenue $1.8B 12%

EPS $1.09 70%

Adj. EPS (a) $0.70 25%

Bookings $2.0B 21%

Seg. Margin 16.7% 500 bps

Adj. Seg. Margin (a) 11.8% 80 bps

Organic Rev. (b) 4%

Net Acq. Growth (c) 9%

Cash flow from Ops $78M -41%

FCF (d) $36M -63%

(a) Adjusted for gains on dispositions of $11M in Q1 2016 and $88M in Q1 2017

(b) Change in revenue from businesses owned over 12 months, excluding FX impact

(c) Change in revenue from acquisitions, less revenue from dispositions

2017

4

Revenue

Q1 2017

Energy

Engineered

Systems

Fluids

Refrigeration

& Food Equip

Total

Dover

Organic 15% 2% -2% 5% 4%

Acquisitions - 9% 35% - 12%

Dispositions - -4% - -7% -3%

Currency -1% -1% -1% - -1%

Total 14% 5% 32% -2% 12%

Note: Totals may be impacted due to rounding

5

Energy

Revenue increase driven by

significant improvement in

early cycle oil & gas

fundamentals, particularly U.S.

rig count and well completions

– Q1 revenue up 11%

sequentially

– Bearings & Compression

growth driven by improved

OEM build rates

– Automation benefitting from

customer capex increases

Margin of 12.9% exceeds

expectation, reflecting higher

volume and strong

incrementals

Bookings growth is broad-

based

Book-to-bill at 1.07

5

$ in millions

Q1

2017

Q1

2016

%

Change

%

Organic

Revenue $324 $283 14% 15%

Earnings $ 42 $ 11 271%

Margin 12.9% 4.0% 890 bps

Bookings $348 $273 27% 28%

Revenue by End-Market

% of Q1

Revenue

Q1/Q1

Growth

Organic

Growth

Drilling & Production 67% 14% 14%

Bearings & Compression 22% 13% 16%

Automation 11% 19% 19%

6

Engineered Systems

Organic revenue growth of 2%

– Organic growth in Printing &

Identification driven by strong

marking & coding and digital

textile markets

– Industrial’s organic decline

driven by chassis availability

challenges in Environmental

Solutions Group

Adjusted margin in-line with

expectations

Organic bookings growth is

broad-based

Book-to-bill of 1.11

6

Q1

2017

Q1

2016

%

Change

%

Organic

Revenue(a) $608 $577 5% 2%

Earnings $174 $ 94 86%

Margin 28.7% 16.2% NM

Adj. Earnings* $ 86 $ 83 4%

Adj. Margin* 14.2% 14.3% -10 bps

Bookings(b) $676 $573 18% 12%

Revenue by End-Market

% of Q1

Revenue

Q1/Q1

Growth

Organic

Growth

Printing & Identification 41% 4% 5%

Industrial 59% 6% -1%

$ in millions

(a) Revenue increased 5% overall, reflecting organic growth of 2% and

acquisition growth of 8%, offset by a 4% impact from dispositions and a 1%

unfavorable impact from FX

(b) Bookings growth of 18% reflects organic growth of 12% and acquisition

growth of 9%, partially offset by a 2% impact from dispositions and a 1%

unfavorable impact from FX

* Earnings adjusted for gains on dispositions of $11M in Q1 2016 and $88M in

Q1 2017

7

Fluids

Revenue growth driven by

acquisitions

– Dover Fueling Solutions off

to very strong start

– Organic revenue impacted

by continued weakness in

longer cycle oil & gas

markets, especially

transport

Solid retail fueling and

strong Hygienic &

Pharma markets

Margin primarily impacted by

acquisitions and business mix

Bookings growth is broad-

based

Book-to-bill at 1.08

7

$ in millions

Revenue by End-Market

% of Q1

Revenue

Q1/Q1

Growth

Organic

Growth

Pumps 29% -4% -2%

Fueling & Transport 60% 69% -4%

Hygienic & Pharma 11% 2% 5%

Q1

2017

Q1

2016

%

Change

%

Organic

Revenue $525 $399 32% -2%

Earnings $ 53 $ 46 14%

Margin 10.0% 11.5% -150 bps

Bookings $566 $418 35% 2%

8

Refrigeration & Food Equipment

Organic revenue growth

reflects strong activity in

retail refrigeration market

– Door and specialty case

product lines doing very

well

– Within Food Equipment,

can-shaping equipment

project timing offsets solid

commercial food

equipment activity

Margin performance reflects

impact of dispositions and

$2 million in restructuring

Organic bookings growth is

broad-based

Book-to-bill at seasonally

strong 1.23

8

$ in millions

Revenue by End-Market

% of Q1

Revenue

Q1/Q1

Growth

Organic

Growth

Refrigeration 84% 7% 7%

Food Equipment 16% -31% -3%

(a) Revenue decline of 2% reflects organic growth of 5%, offset by a 7% impact

from dispositions

(b) Bookings growth of 7% reflects organic growth of 13% and a 6% impact

from dispositions

Q1

2017

Q1

2016

%

Change

%

Organic

Revenue(a) $357 $363 -2% 5%

Earnings $34 $ 38 -12%

Margin 9.4% 10.5% -110 bps

Bookings(b) $439 $411 7% 13%

9

Q1 2017 Overview

9

Q1 2017

Net Interest Expense $34 million, in-line with forecast

Corporate Expense $36 million, in-line with forecast

Effective Tax Rate Q1 rate was 25.7%, lower than forecast,

reflecting the impact of a disposition and other

discrete items. Excluding these items,

normalized rate was 27.8%

Capex $42 million, generally in-line with forecast

Share Repurchases No activity

10

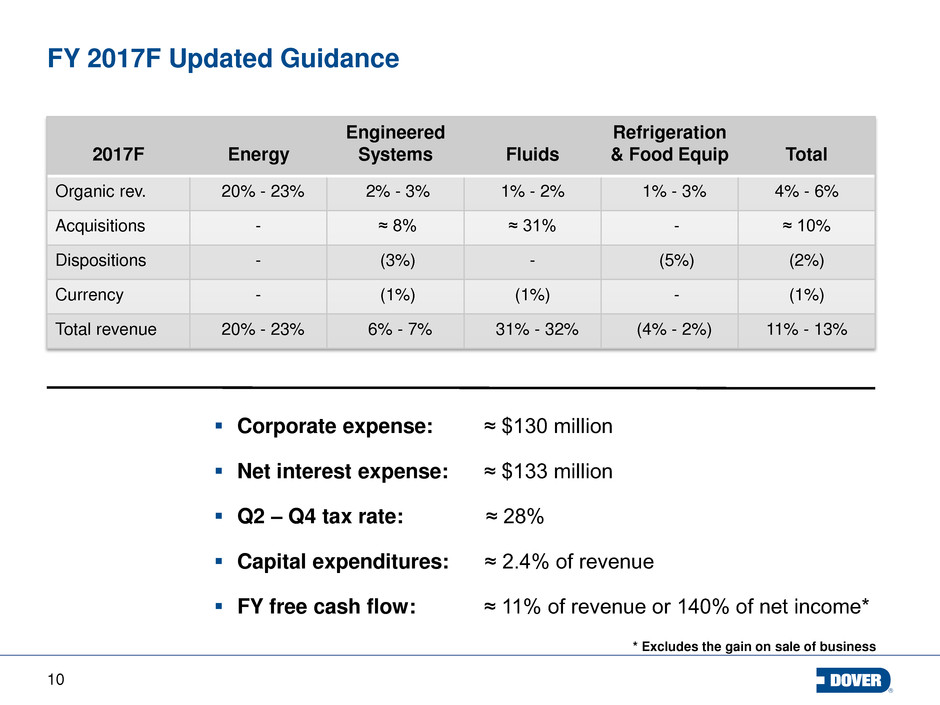

FY 2017F Updated Guidance

Corporate expense: ≈ $130 million

Net interest expense: ≈ $133 million

Q2 – Q4 tax rate: ≈ 28%

Capital expenditures: ≈ 2.4% of revenue

FY free cash flow: ≈ 11% of revenue or 140% of net income*

2017F

Energy

Engineered

Systems

Fluids

Refrigeration

& Food Equip

Total

Organic rev. 20% - 23% 2% - 3% 1% - 2% 1% - 3% 4% - 6%

Acquisitions - ≈ 8% ≈ 31% - ≈ 10%

Dispositions - (3%) - (5%) (2%)

Currency - (1%) (1%) - (1%)

Total revenue 20% - 23% 6% - 7% 31% - 32% (4% - 2%) 11% - 13%

* Excludes the gain on sale of business

11

2017F EPS Guidance – Updated Bridge

2016 EPS – Continuing Ops (GAAP): $3.25

– Less 2016 gain on dispositions(1): (0.44)

– Less 2016 earnings from dispositions(2) : (0.05)

– Plus 2016 charges related to recall: 0.09

2016 Adjusted EPS $2.85

– Net restructuring(3): 0.08 - 0.10

– Performance including restructuring benefits: 1.12 – 1.21

– Compensation & investment: (0.17 - 0.15)

– Interest / Corp. / Tax rate / Shares / Other (net): (0.18 - 0.16)

– Net benefit of disposition(4) 0.35

2017F EPS – Continuing Ops $4.05 - $4.20

(2) Includes 2016 operating earnings from THI and Tipper Tie

(3) Includes restructuring costs of approximately $0.18 in FY 2016 and $0.08 - $0.10 in FY 2017F

(1) Includes $0.07 gain on the disposition of THI in Q1 2016 and $0.36 gain on the disposition of Tipper Tie in Q4 2016

(4) Includes $0.39 gain on the disposition of PMI, partially offset by ($0.04) of PMI operational earnings in the prior forecast