Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Post Holdings, Inc. | d380091dex991.htm |

| EX-2.2 - EX-2.2 - Post Holdings, Inc. | d380091dex22.htm |

| EX-2.1 - EX-2.1 - Post Holdings, Inc. | d380091dex21.htm |

| 8-K - 8-K - Post Holdings, Inc. | d380091d8k.htm |

Post Holdings, Inc. Post Holdings to Acquire Weetabix April 18, 2017 Exhibit 99.2

Certain matters discussed in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on the current expectations of Post Holdings, Inc. (“Post” or “the Company”) and are subject to uncertainty and changes in circumstances. These forward-looking statements include, among others, statements regarding Post’s fiscal 2017 Adjusted EBITDA guidance range, expected synergies and benefits of the acquisition of Weetabix Limited (“Weetabix”), expected sources of financing, expectations about future business plans, prospective performance and opportunities, regulatory approvals, the expected timing of the completion of the transaction and our free cash flow illustrative calculation. These forward-looking statements may be identified by the use of words such as “expect,” “anticipate,” “believe,” “estimate,” “potential,” “should” or similar words. There is no assurance that the acquisition of Weetabix will be consummated, and there are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made herein. These risks and uncertainties include the following: the timing to consummate the acquisition of Weetabix; the ability and timing to obtain required regulatory approvals and satisfy other closing conditions; our ability to promptly and effectively integrate the Weetabix business and obtain expected cost savings and synergies within the expected timeframe; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with Weetabix employees, customers or suppliers) that may be greater than expected following the consummation of the acquisition of Weetabix; our ability to retain certain key employees at Weetabix; our ability to borrow funds under a new senior secured term loan facility on terms acceptable to us or at all; the risks associated with the disruption of management’s attention from ongoing business operations due to this transaction; our ability to continue to compete in our product markets and our ability to retain our market position; our ability to anticipate and respond to changes in consumer preferences and trends; our ability to identify and complete acquisitions and manage our growth; changes in our cost structure, management, financing and business operations; our ability to integrate acquired businesses and whether acquired businesses will perform as expected; changes in economic conditions and consumer demand for our products; significant volatility in the costs of certain raw materials, commodities, packaging or energy used to manufacture our products; impairment in the carrying value of goodwill or other intangibles; our ability to successfully implement business strategies to reduce costs; our ability to comply with increased regulatory scrutiny related to certain of our products and/or international sales; allegations that our products cause injury or illness, product recalls and product liability claims and other litigation; legal and regulatory factors, including environmental laws, advertising and labeling laws, changes in food safety and laws and regulations governing animal feeding and housing operations; Forward-Looking Statements

(Continued from prior page): our ability to maintain competitive pricing, introduce new products and successfully manage our costs; the ultimate impact litigation may have on us; the ultimate outcome of the remaining portions of the Michael Foods egg antitrust litigation, including formal court approval of the announced settlement with the direct purchaser plaintiffs; the loss or bankruptcy of a significant customer; consolidations in the retail grocery and foodservice industries; the ability of our private label products to compete with nationally branded products; disruptions or inefficiencies in supply chain; our reliance on third party manufacturers for certain of our products; disruptions in the U.S. and global capital and credit markets; fluctuations in foreign currency exchange rates; changes in estimates in critical accounting judgments and changes to or new laws and regulations affecting our business; loss of key employees; changes in weather conditions, natural disasters, disease outbreaks and other events beyond our control; labor strikes, work stoppages or unionization efforts; losses or increased funding and expenses related to our qualified pension and other post-retirement plans; business disruptions caused by information technology failures and/or technology hacking; our ability to protect our intellectual property; media campaigns and improper use of social media that damage our brands; our ability to successfully operate our international operations in compliance with applicable laws and regulations; significant differences in our actual operating results from our guidance regarding our future performance; our ability to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, including with respect to acquired businesses; our high leverage and substantial debt, including covenants that restrict the operation of our business; our ability to service our outstanding debt or obtain additional financing, including both secured and unsecured debt; and other risks and uncertainties described in the Company’s filings with the Securities and Exchange Commission. These forward-looking statements represent the Company’s judgment as of the date of this presentation. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company disclaims, however, any intent or obligation to update these forward-looking statements. Forward-Looking Statements (Cont’d)

Prospective Financial Information The prospective financial information provided in this presentation regarding Post’s and Weetabix’s future performance, including Post’s expected Adjusted EBITDA for fiscal 2017, the contribution of Weetabix to Adjusted EBITDA, and specific dollar amounts and other plans, expectations, estimates and similar statements, represents Post management’s estimates as of the date of this presentation only and are qualified by, and subject to, the assumptions and the other information set forth on the slide captioned “Forward-Looking Statements.” The estimated 2017 Adjusted EBITDA, the contribution of Weetabix to Adjusted EBITDA, and the dollar amounts and other plans, expectations, estimates and similar statements contained in this presentation are based upon a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to business, economic and competitive uncertainties and contingencies, many of which are beyond our control, are based upon specific assumptions with respect to future business decisions, some of which will change and are necessarily speculative in nature. It can be expected that some or all of the assumptions of the estimates furnished by us will not materialize or will vary significantly from actual results. Accordingly, the information set forth herein is only an estimate of what management believes is realizable as of the date hereof, and actual results will vary from the estimates set forth herein. Investors should also recognize that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors are urged to put the estimated 2017 Adjusted EBITDA, the contribution of Weetabix to Adjusted EBITDA, and other prospective financial information in context and not to place undue reliance on it. The estimated fiscal 2017 Adjusted EBITDA, including the contribution of Weetabix to Adjusted EBITDA, is not prepared with a view toward compliance with published guidelines of the American Institute of Certified Public Accountants, and neither our independent registered public accounting firms nor any other independent expert or outside party compiles or examines these estimates and, accordingly, no such person expresses any opinion or any other form of assurance with respect thereto. The estimated 2017 Adjusted EBITDA is stated as a high and low range, which is intended to provide a sensitivity analysis as variables are changed but it is not intended to represent that actual results could not fall outside of the estimated ranges. Any failure to successfully implement our operating strategy or the occurrence of any of the events or circumstances set forth under “Forward-Looking Statements” could result in the actual operating results being different than the estimates set forth herein, and such differences may be adverse and material. Market and Industry Data This presentation includes industry and trade association data, forecasts and information that was prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other independent sources available to the Company. Some data also are based on Post’s good faith estimates, which are derived from management’s knowledge of the industry and from independent sources. These third-party publications and surveys generally state that the information included therein has been obtained from sources believed to be reliable, but that the publications and surveys can give no assurance as to the accuracy or completeness of such information. Post has not independently verified any of the data from third-party sources nor has it ascertained the underlying economic assumptions on which such data are based. Additional Information

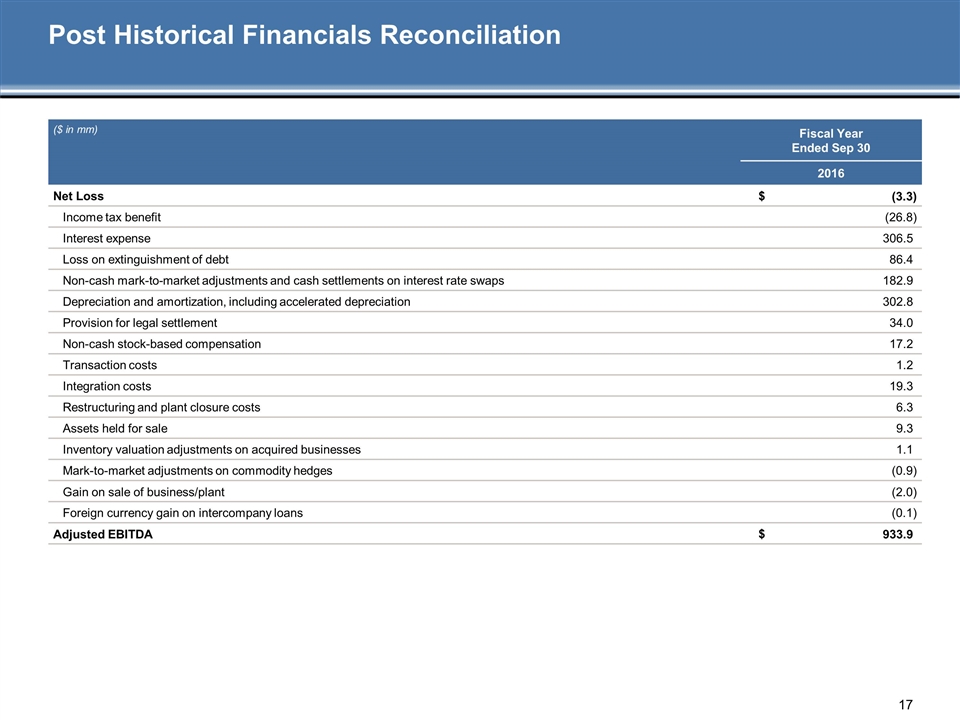

Use of Non-GAAP Measure While Post reports financial results in accordance with accounting principles generally accepted in the U.S., this presentation includes the non-GAAP measure Adjusted EBITDA for Post on both a historical and forecast basis, neither of which is in accordance with or a substitute for GAAP measures, and free cash flow. Adjusted EBITDA is a non-GAAP measure which represents earnings before interest, taxes, depreciation, amortization and other adjustments as detailed later in this presentation under “Explanation and Reconciliation of Non-GAAP Measure”. For a reconciliation of certain Adjusted EBITDA measures in this presentation to the most directly comparable GAAP measure see “Post Historical Financials Reconciliation” in the appendix. Because Post discusses free cash flow in this presentation only in relation to management’s expectations of the future effect of the Weetabix transaction on this non-GAAP measure, Post has not, for the reasons discussed below, provided a reconciliation of its forward-looking free cash flow expectations to the mostly directly comparable GAAP measures. Post Management uses certain non-GAAP measures, including Adjusted EBITDA and free cash flow, as key metrics in the evaluation of underlying Company and segment performance, in making financial, operating and planning decisions, and, in part, in the determination of cash bonuses for its executive officers and employees. Management believes the use of non-GAAP measures, including Adjusted EBITDA and free cash flow, provides increased transparency and assists investors in understanding the underlying operating performance of the Company and its segments and in the analysis of ongoing operating trends. Post considers Adjusted EBITDA an important supplemental measure of performance and ability to service debt. Adjusted EBITDA is often used to assess performance because it allows comparison of operating performance on a consistent basis across periods by removing the effects of various items. Adjusted EBITDA has various limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of results as reported under GAAP. Post provides its fiscal year 2017 Adjusted EBITDA guidance and discloses its expectations as to the effect of the Weetabix transaction on Post’s Adjusted EBITDA, including the expected annual contribution of Weetabix, and free cash flow only on a non-GAAP basis and does not provide a reconciliation of its forward-looking Adjusted EBITDA non-GAAP guidance measures to the mostly directly comparable GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for non-cash mark-to-market adjustments and cash settlements on interest rate swaps, provision for legal settlement, transaction and integration costs, restructuring and plant closure costs, losses on assets held for sale, mark-to-market adjustments on commodity hedges and other charges reflected in the Company’s reconciliation of historic numbers, the amounts of which, based on historical experience, could be significant. Trademarks and Service Brands The logos, trademarks, trade names and service marks mentioned in this presentation, including Honey Bunches of Oats®, Pebbles™, Post Selects®, Great Grains®, Post® Shredded Wheat, Golden Crisp®, Alpha-Bits®, Spoon Size® Shredded Wheat, Post® Raisin Bran, Grape-Nuts®, Honeycomb®, Oh!s™, Shreddies™, Malt-O-Meal®, Farina®, Dyno-Bites®, MOM’s Best®, Better Oats™, Attune®, Uncle Sam®, Erewhon®, Golden Temple™, Peace Cereal®, Sweet Home Farm®, Willamette Valley Granola Company™, Premier Protein®, Joint Juice®, PowerBar®, Dymatize®, Supreme Protein®, Papetti’s®, All Whites®, Better’n Eggs®, Easy Eggs®, Emulsa™, Table Ready™, Davidson’s Safest Choice™, Abbotsford Farms®, Simply Potatoes® and Crystal Farms® brands are currently the property of, or are under license by, Post or its subsidiaries. Additional Information (Cont’d)

Transaction Overview Post to acquire Weetabix Limited (“Weetabix”) for £1.4bn (1) Acquiring a leading brand in a category core to Post Weetabix is the #2 manufacturer in the UK ready-to-eat (RTE) cereal category with an iconic brand portfolio (2) #1 cereal brand in UK (Weetabix) (2) #1 muesli brand in UK (Alpen) (2) Other attractive brands include Barbara’s, Ready Brek, Weetos, and Weetabix On-the-Go Significant value creation opportunity Expected to be immediately accretive to Post’s Adjusted EBITDA margins and free cash flow (3) Expected run-rate cost synergies of approximately £20mm by the third full fiscal year post-closing Purchase price represents 11.7x adjusted EBITDA (4) and 10.0x run-rate synergized adjusted EBITDA (5) Transaction expected to be financed with cash on hand and through borrowings under Post’s existing revolving credit facility and/or, subject to market conditions, a new senior secured term loan facility Expected closing in the third calendar quarter (Post’s fiscal fourth quarter), subject to regulatory approvals and limited closing conditions On a cash-free, debt-free basis. See Post’s April 18, 2017 press release and Form 8-K for further details. Per AC Nielsen Scantrack, 12 months to 31 December 2016. Excluding one-time transaction costs. Multiple of 11.7x represents: (i) purchase price of £1.4bn, divided by (ii) Post management estimate of Weetabix adjusted EBITDA of £120mm on an annual basis. Multiple of 10.0x represents: (i) purchase price of £1.4bn, divided by (ii) Post management estimate of Weetabix adjusted EBITDA of £120mm on an annual basis plus £20mm expected run-rate cost synergies. Please refer to “Additional Information – Prospective Financial Information” and “Additional Information – Use of Non-GAAP Measure.”

Compelling Strategic and Financial Rationale Per AC Nielsen Scantrack, 12 months to 31 December 2016. Strategically, Weetabix Provides… Leadership in the second largest RTE cereal market in the world Weetabix is the clear #1 UK RTE cereal brand with 10.6% market share (1) #1 muesli brand in the UK (Alpen) (1) Access to growing UK active nutrition market Expected to make Post / Weetabix the leader in the growing UK Breakfast Drinks category Strategic optionality for future UK or other international M&A Platform for future packaged food consolidation Unique partnership opportunity Bright Food and Baring Private Equity Asia in China Pioneer Foods in South Africa and Kenya Established presence and operational capabilities in export markets Global reach of over 90 countries Financially, Weetabix Provides… Attractive EBITDA margins Accretive to Post’s EBITDA margins Attractive and reliable free cash flow Modest capital expenditure and working capital needs lead to strong free cash flow generation and free cash flow conversion Stable, recurring and predictable free cash flow Cost and revenue synergies £20mm expected run-rate cost synergies by third full fiscal year post-closing Significant cross-selling revenue opportunities Tax efficiency Lower UK marginal tax rate Attractive after-tax cost of financing

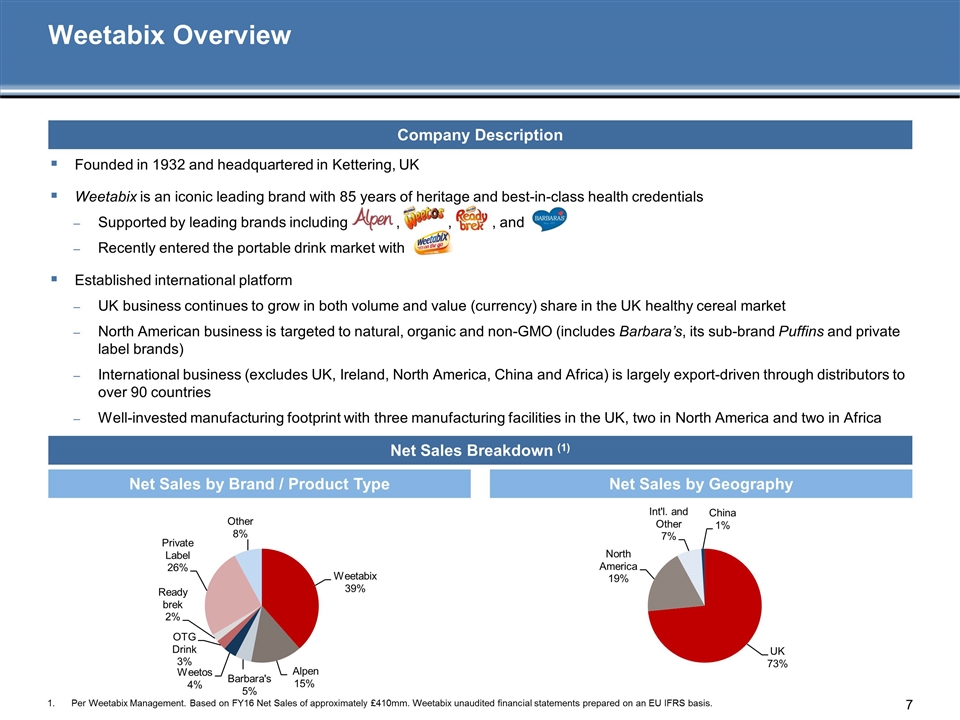

Company Description Net Sales Breakdown (1) Founded in 1932 and headquartered in Kettering, UK Weetabix is an iconic leading brand with 85 years of heritage and best-in-class health credentials Supported by leading brands including , , , and Recently entered the portable drink market with Established international platform UK business continues to grow in both volume and value (currency) share in the UK healthy cereal market North American business is targeted to natural, organic and non-GMO (includes Barbara’s, its sub-brand Puffins and private label brands) International business (excludes UK, Ireland, North America, China and Africa) is largely export-driven through distributors to over 90 countries Well-invested manufacturing footprint with three manufacturing facilities in the UK, two in North America and two in Africa Weetabix Overview Per Weetabix Management. Based on FY16 Net Sales of approximately £410mm. Weetabix unaudited financial statements prepared on an EU IFRS basis. Net Sales by Brand / Product Type Net Sales by Geography

Weetabix is an Iconic Brand that Anchors a Stable and Diversified Portfolio Iconic and Trusted Brand #1 Position in the UK Market Clear #1 brand with 10.6% market share (1) Active leader and “captain” role in category Strong and long-standing relationships with UK retailers Most Trusted Brand in the Category 97% of Weetabix products classified as “healthy” (2) 85 years of British heritage 40% penetration of UK homes (3) Next brand has only 25% penetration (3) Weetabix holds a Royal Warrant from HRH Queen Elizabeth II and the Prince of Wales Stable and Diversified Portfolio of Brands and Products Core UK Weetabix Core UK Alpen On-The-Go Drinks Other Attractive Brands Per AC Nielsen Scantrack, 12 months to 31 December 2016. Per Dunnhumby report, 52 Weeks to May 2015. Per Kantar Worldpanel, 52 Weeks to 6 November 2016.

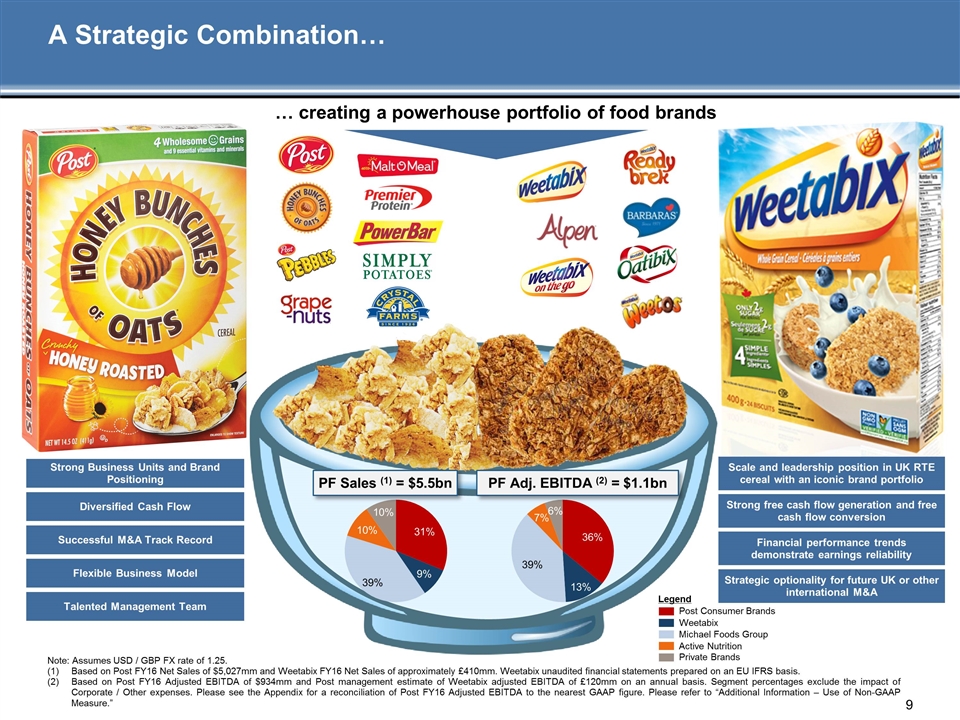

A Strategic Combination… Diversified Cash Flow Strong Business Units and Brand Positioning Successful M&A Track Record Strategic optionality for future UK or other international M&A Flexible Business Model Talented Management Team PF Adj. EBITDA (2) = $1.1bn PF Sales (1) = $5.5bn Post Consumer Brands Weetabix Michael Foods Group Active Nutrition Private Brands Legend … creating a powerhouse portfolio of food brands Scale and leadership position in UK RTE cereal with an iconic brand portfolio Note: Assumes USD / GBP FX rate of 1.25. Based on Post FY16 Net Sales of $5,027mm and Weetabix FY16 Net Sales of approximately £410mm. Weetabix unaudited financial statements prepared on an EU IFRS basis. Based on Post FY16 Adjusted EBITDA of $934mm and Post management estimate of Weetabix adjusted EBITDA of £120mm on an annual basis. Segment percentages exclude the impact of Corporate / Other expenses. Please see the Appendix for a reconciliation of Post FY16 Adjusted EBITDA to the nearest GAAP figure. Please refer to “Additional Information – Use of Non-GAAP Measure.” Strong free cash flow generation and free cash flow conversion Financial performance trends demonstrate earnings reliability

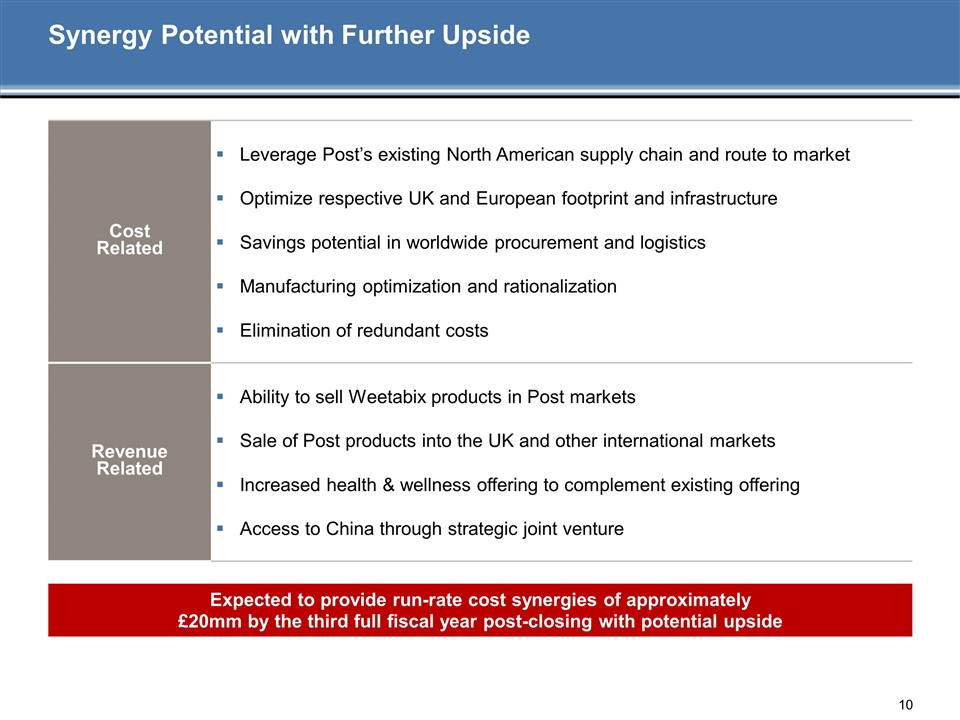

Synergy Potential with Further Upside Cost Related Leverage Post’s existing North American supply chain and route to market Optimize respective UK and European footprint and infrastructure Savings potential in worldwide procurement and logistics Manufacturing optimization and rationalization Elimination of redundant costs Revenue Related Ability to sell Weetabix products in Post markets Sale of Post products into the UK and other international markets Increased health & wellness offering to complement existing offering Access to China through strategic joint venture Expected to provide run-rate cost synergies of approximately £20mm by the third full fiscal year post-closing with potential upside

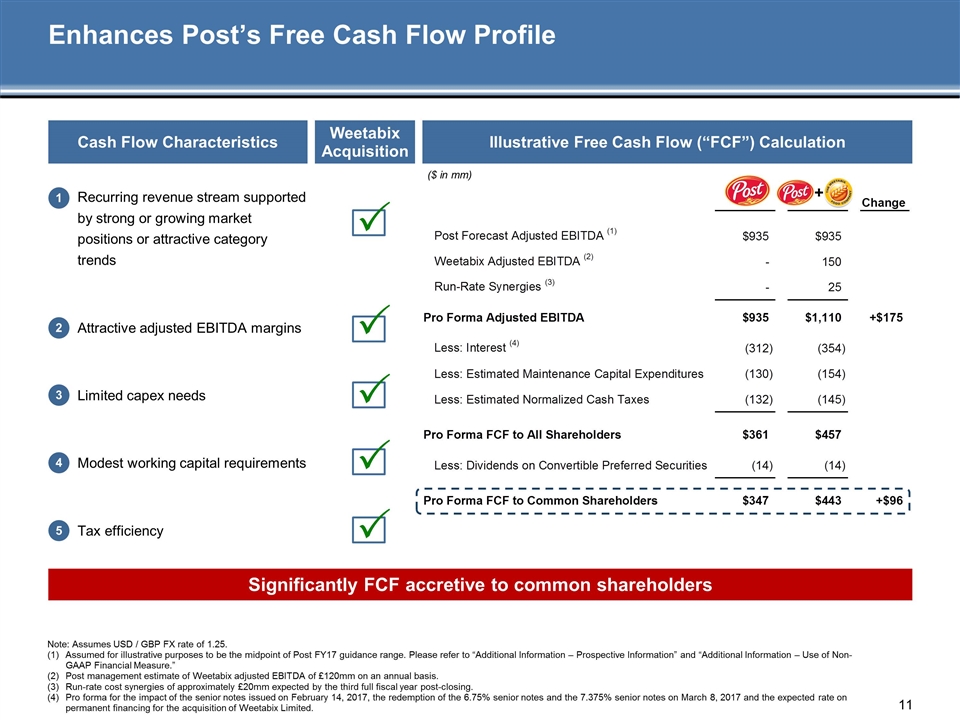

Enhances Post’s Free Cash Flow Profile Illustrative Free Cash Flow (“FCF”) Calculation ($ in mm) + Significantly FCF accretive to common shareholders Recurring revenue stream supported by strong or growing market positions or attractive category trends Attractive adjusted EBITDA margins Limited capex needs Modest working capital requirements Tax efficiency 1 2 3 4 Cash Flow Characteristics Weetabix Acquisition 5 P P P P P Note: Assumes USD / GBP FX rate of 1.25. Assumed for illustrative purposes to be the midpoint of Post FY17 guidance range. Please refer to “Additional Information – Prospective Information” and “Additional Information – Use of Non-GAAP Financial Measure.” Post management estimate of Weetabix adjusted EBITDA of £120mm on an annual basis. Run-rate cost synergies of approximately £20mm expected by the third full fiscal year post-closing. Pro forma for the impact of the senior notes issued on February 14, 2017, the redemption of the 6.75% senior notes and the 7.375% senior notes on March 8, 2017 and the expected rate on permanent financing for the acquisition of Weetabix Limited.

Key Takeaways Highly strategic transaction Acquiring a leading brand in a category core to Post Expands Post’s geographic footprint in the UK and other international markets Expands Post’s platform in health & wellness offerings and natural & organic channels Ability to expand Weetabix’s distribution in North America and Post’s distribution internationally Creates follow-on acquisition opportunities Synergy opportunity in worldwide procurement, international sales, and infrastructure optimization and rationalization Attractive valuation 10.0x run-rate synergized adjusted EBITDA (1) Resulting in compelling financial impact Expected to be immediately accretive to Post’s Adjusted EBITDA margins and free cash flow (2) Meaningful synergy potential Multiple of 10.0x represents: (i) purchase price of £1.4bn, divided by (ii) Post management estimate of Weetabix adjusted EBITDA of £120mm on an annual basis plus £20mm expected run-rate cost synergies. Excluding one-time transaction costs. Please refer to “Additional Information – Prospective Financial Information” and “Additional Information – Use of Non-GAAP Measure.”

Appendix

Post uses Adjusted EBITDA, a non-GAAP measure, in this presentation to supplement the financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP). Adjusted EBITDA is not prepared in accordance with U.S. GAAP, as it excludes certain items as listed below, and may not be comparable to similarly-titled measures of other companies. The Company believes that Adjusted EBITDA is useful to investors in evaluating the Company’s operating performance and liquidity because (i) we believe it is widely used to measure a company’s operating performance without regard to items such as depreciation and amortization, which can vary depending upon accounting methods and the book value of assets, (ii) it presents a measure of corporate performance exclusive of the Company’s capital structure and the method by which the assets were acquired, and (iii) it is a financial indicator of a company’s ability to service its debt, as the Company is required to comply with certain covenants and limitations that are based on variations of EBITDA in the Company’s financing documents. Management uses Adjusted EBITDA to provide forward-looking guidance and to forecast future results. Post’s Adjusted EBITDA for the fiscal year ended September 30, 2016 reflects adjustments for interest expense, net, income tax, depreciation and amortization, as well as the following adjustments: Loss on extinguishment of debt: The Company has excluded losses recorded on extinguishment of debt as such losses are inconsistent in amount and frequency. Additionally, the Company believes that these costs do not reflect expected ongoing future operating expenses and do not contribute to a meaningful evaluation of the Company’s current operating performance or comparisons of the Company’s operating performance to other periods. Non-cash mark-to-market adjustments and cash settlements on interest rate swaps: The Company has excluded the impact of non-cash mark-to-market adjustments and cash settlements on interest rate swaps due to the inherent uncertainty and volatility associated with such amounts based on changes in assumptions with respect to estimates of fair value and economic conditions and the amount and frequency of such adjustments and settlements are not consistent. Provision for legal settlement: The Company has excluded gains and losses recorded to recognize a receivable or liability associated with an anticipated resolution of certain ongoing litigation as the Company believes such gains and losses do not reflect expected ongoing future operating expenses and do not contribute to a meaningful evaluation of the Company’s current operating performance or comparisons of the Company’s operating performance to other periods. Non-cash stock-based compensation: The Company’s compensation strategy includes the use of stock-based compensation to attract and retain executives and employees by aligning their long-term compensation interests with shareholders’ investment interests. The Company has excluded non-cash stock-based compensation as non-cash stock-based compensation can vary significantly based on reasons such as the timing, size and nature of the awards granted and subjective assumptions which are unrelated to operational decisions and performance in any particular period and do not contribute to meaningful comparisons of the Company’s operating performance to other periods. Explanation and Reconciliation of Non-GAAP Measure

Transaction costs and integration costs: The Company has excluded transaction costs related to professional service fees and other related costs associated with signed and closed business combinations and divestitures and integration costs incurred to integrate acquired or to-be-acquired businesses as the Company believes that these exclusions allow for more meaningful evaluation of the Company’s current operating performance and comparisons of the Company’s operating performance to other periods. The Company believes such costs are generally not relevant to assessing or estimating the long-term performance of acquired assets as part of the Company or the performance of the divested assets, and are not factored into management’s evaluation of potential acquisitions or its performance after completion of an acquisition or the evaluation to divest an asset. In addition, the frequency and amount of such charges varies significantly based on the size and timing of the acquisitions and divestitures and the maturities of the businesses being acquired or divested. Also, the size, complexity and/or volume of past acquisitions and divestitures, which often drive the magnitude of such expenses, may not be indicative of the size, complexity and/or volume of future acquisitions or divestitures. By excluding these expenses, management is better able to evaluate the Company’s ability to utilize its existing assets and estimate the long-term value that acquired assets will generate for the Company. Furthermore, the Company believes that the adjustments of these items more closely correlate with the sustainability of the Company’s operating performance. Restructuring and plant closure costs, including accelerated depreciation: The Company has excluded certain costs associated with facility closures as the amount and frequency of such adjustments are not consistent. Additionally, the Company believes that these costs do not reflect expected ongoing future operating expenses and do not contribute to a meaningful evaluation of the Company’s current operating performance or comparisons of the Company’s operating performance to other periods. Assets held for sale: The Company has excluded adjustments recorded to adjust the carrying value of facilities and other assets classified as held for sale as such adjustments represent non-cash items and the amount and frequency of such adjustments are not consistent. Additionally, the Company believes that these adjustments do not reflect expected ongoing future operating expenses and do not contribute to a meaningful evaluation of the Company’s current operating performance or comparisons of the Company’s operating performance to other periods. Inventory valuation adjustments on acquired businesses: The Company has excluded the impact of fair value step-up adjustments to inventory in connection with business combinations as such adjustments represent non-cash items, are not consistent in amount and frequency and are significantly impacted by the timing and size of the Company’s acquisitions. Mark-to-market adjustments on commodity hedges: The Company has excluded the impact of mark-to-market adjustments on commodity hedges due to the inherent uncertainty and volatility associated with such amounts based on changes in assumptions with respect to fair value estimates. Additionally, these adjustments are primarily non-cash items and the amount and frequency of such adjustments are not consistent. Explanation and Reconciliation of Non-GAAP Measure (cont’d)

Gain on sale of business and/or plant: The Company has excluded gains recorded on divestitures as such adjustments represent non-cash items and the amount and frequency of such adjustments are not consistent. Additionally, the Company believes that these costs do not reflect expected ongoing future operating expenses and do not contribute to a meaningful evaluation of the Company’s current operating performance or comparisons of the Company’s operating performance to other periods. Foreign currency gains and losses on intercompany loans: The Company has excluded the impact of foreign currency fluctuations related to intercompany loans denominated in currencies other than the functional currency of the respective legal entity in evaluating Company performance to allow for more meaningful comparisons of performance to other periods. Explanation and Reconciliation of Non-GAAP Measure (cont’d)

($ in mm) Fiscal Year Ended Sep 30 2016 Net Loss $ (3.3) Income tax benefit (26.8) Interest expense 306.5 Loss on extinguishment of debt 86.4 Non-cash mark-to-market adjustments and cash settlements on interest rate swaps 182.9 Depreciation and amortization, including accelerated depreciation 302.8 Provision for legal settlement 34.0 Non-cash stock-based compensation 17.2 Transaction costs 1.2 Integration costs 19.3 Restructuring and plant closure costs 6.3 Assets held for sale 9.3 Inventory valuation adjustments on acquired businesses 1.1 Mark-to-market adjustments on commodity hedges (0.9) Gain on sale of business/plant (2.0) Foreign currency gain on intercompany loans (0.1) Adjusted EBITDA $ 933.9 Post Historical Financials Reconciliation

Post Holdings, Inc.