Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - J CREW GROUP INC | jcg-ex991_7.htm |

| 8-K - FORM 8-K - J CREW GROUP INC | jcg-8k_20170413.htm |

Project Oar PIK Noteholder ad hoc group counterproposal April 13, 2017 Exhibit 99.2

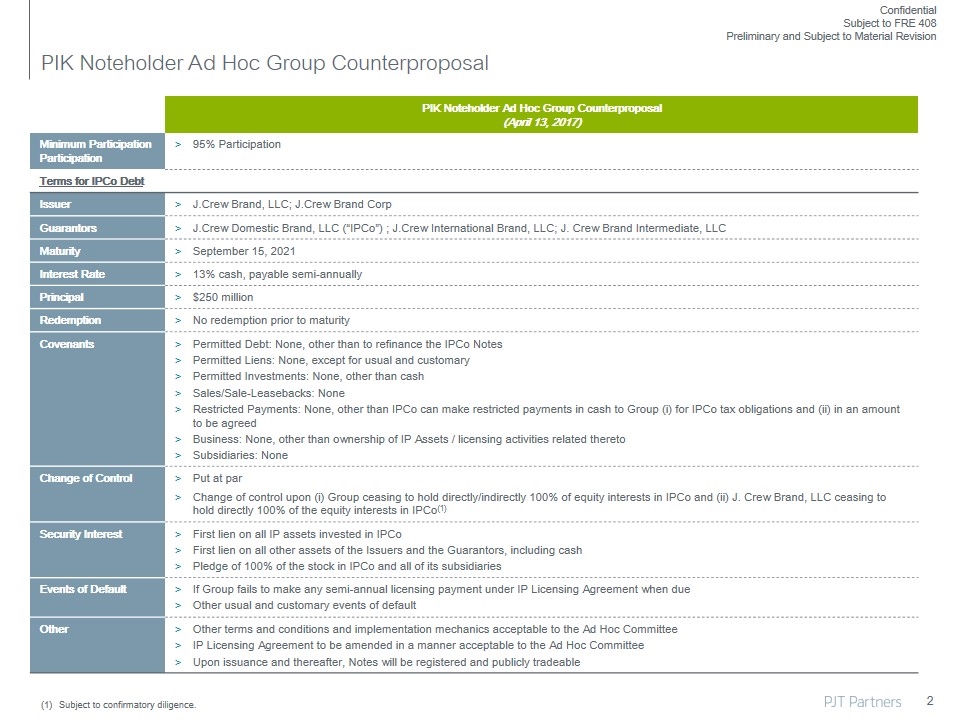

PIK Noteholder Ad Hoc Group Counterproposal (April 13, 2017) Minimum Participation 95% Participation Terms for IPCo Debt Issuer J.Crew Brand, LLC; J.Crew Brand Corp Guarantors J.Crew Domestic Brand, LLC (“IPCo”) ; J.Crew International Brand, LLC; J. Crew Brand Intermediate, LLC Maturity September 15, 2021 Interest Rate 13% cash, payable semi-annually Principal $250 million Redemption No redemption prior to maturity Covenants Permitted Debt: None, other than to refinance the IPCo Notes Permitted Liens: None, except for usual and customary Permitted Investments: None, other than cash Sales/Sale-Leasebacks: None Restricted Payments: None, other than IPCo can make restricted payments in cash to Group (i) for IPCo tax obligations and (ii) in an amount to be agreed Business: None, other than ownership of IP Assets / licensing activities related thereto Subsidiaries: None Change of Control Put at par Change of control upon (i) Group ceasing to hold directly/indirectly 100% of equity interests in IPCo and (ii) J. Crew Brand, LLC ceasing to hold directly 100% of the equity interests in IPCo(1) Security Interest First lien on all IP assets invested in IPCo First lien on all other assets of the Issuers and the Guarantors, including cash Pledge of 100% of the stock in IPCo and all of its subsidiaries Events of Default If Group fails to make any semi-annual licensing payment under IP Licensing Agreement when due Other usual and customary events of default Other Other terms and conditions and implementation mechanics acceptable to the Ad Hoc Committee IP Licensing Agreement to be amended in a manner acceptable to the Ad Hoc Committee Upon issuance and thereafter, Notes will be registered and publicly tradeable PIK Noteholder Ad Hoc Group Counterproposal Subject to confirmatory diligence.

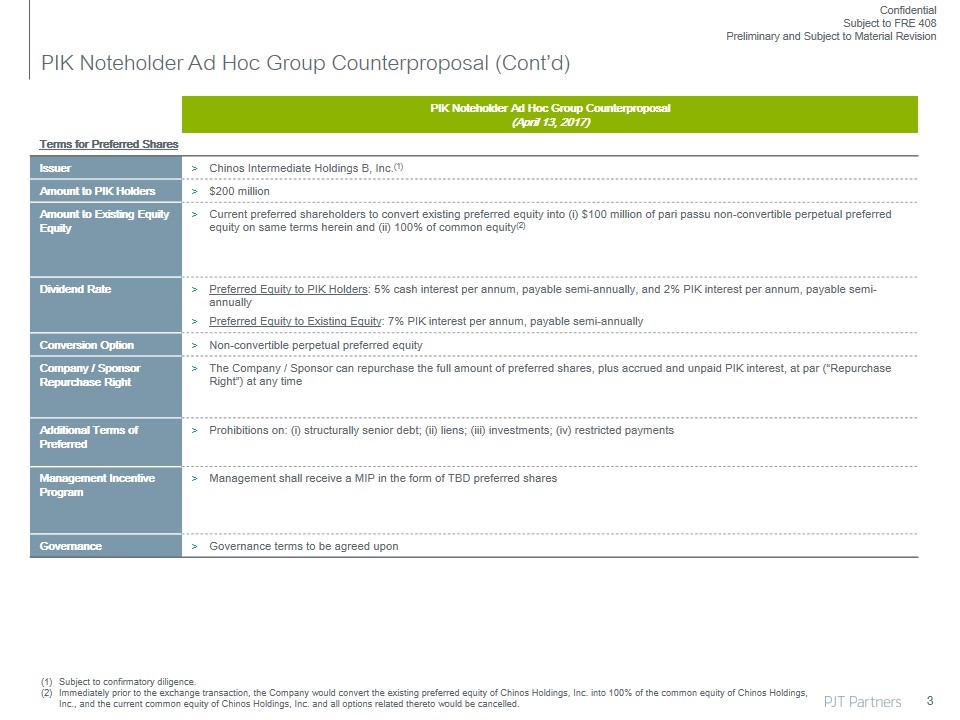

PIK Noteholder Ad Hoc Group Counterproposal (April 13, 2017) Terms for Preferred Shares Issuer Chinos Intermediate Holdings B, Inc.(1) Amount to PIK Holders $200 million Amount to Existing Equity Current preferred shareholders to convert existing preferred equity into (i) $100 million of pari passu non-convertible perpetual preferred equity on same terms herein and (ii) 100% of common equity(2) Dividend Rate Preferred Equity to PIK Holders: 5% cash interest per annum, payable semi-annually, and 2% PIK interest per annum, payable semi-annually Preferred Equity to Existing Equity: 7% PIK interest per annum, payable semi-annually Conversion Option Non-convertible perpetual preferred equity Company / Sponsor Repurchase Right The Company / Sponsor can repurchase the full amount of preferred shares, plus accrued and unpaid PIK interest, at par (“Repurchase Right”) at any time Additional Terms of Preferred Prohibitions on: (i) structurally senior debt; (ii) liens; (iii) investments; (iv) restricted payments Management Incentive Program Management shall receive a MIP in the form of TBD preferred shares Governance Governance terms to be agreed upon PIK Noteholder Ad Hoc Group Counterproposal (Cont’d) Subject to confirmatory diligence. Immediately prior to the exchange transaction, the Company would convert the existing preferred equity of Chinos Holdings, Inc. into 100% of the common equity of Chinos Holdings, Inc., and the current common equity of Chinos Holdings, Inc. and all options related thereto would be cancelled.