Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - J CREW GROUP INC | jcg-ex992_8.htm |

| 8-K - FORM 8-K - J CREW GROUP INC | jcg-8k_20170413.htm |

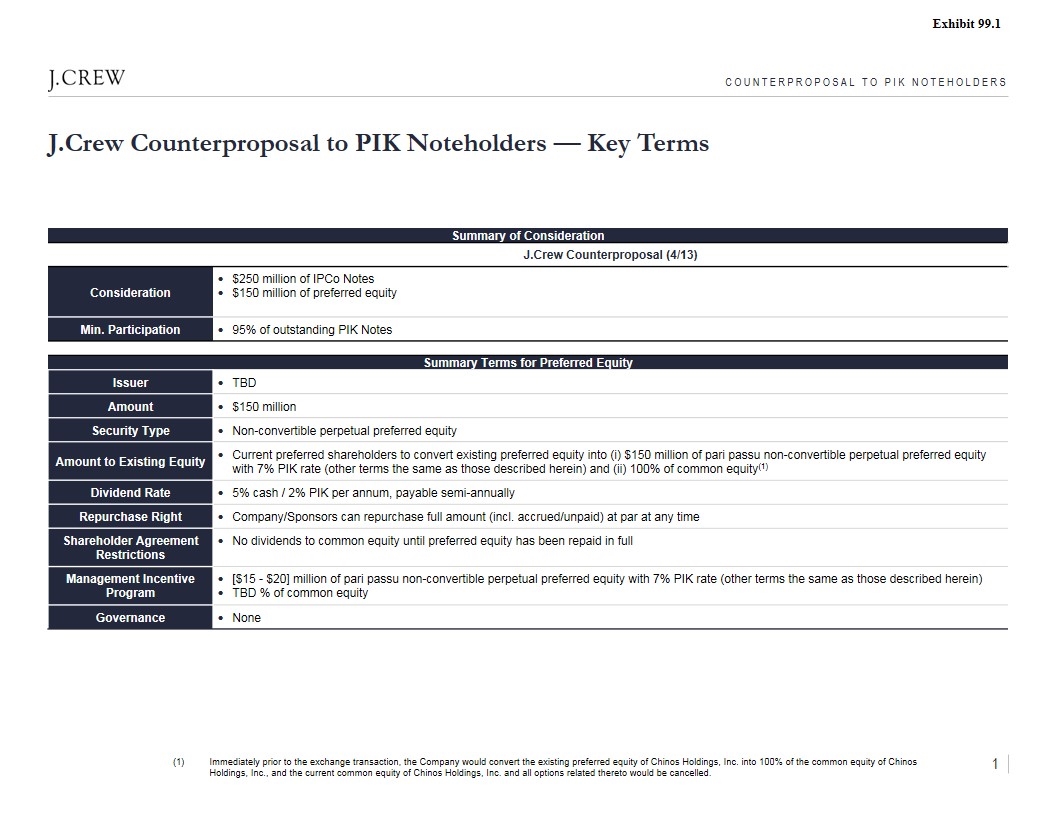

COUNTERPROPOSAL TO PIK NOTEHOLDERS J.Crew 1 J.Crew Counterproposal to PIK Noteholders — Key Terms Summary of Consideration J.Crew Counterproposal (4/13) Consideration $250 million of IPCo Notes $150 million of preferred equity Min. Participation 95% of outstanding PIK Notes Summary Terms for Preferred Equity Issuer TBD Amount $150 million Security Type Non-convertible perpetual preferred equity Amount to Existing Equity Current preferred shareholders to convert existing preferred equity into (i) $150 million of pari passu non-convertible perpetual preferred equity with 7% PIK rate (other terms the same as those described herein) and (ii) 100% of common equity(1) Dividend Rate 5% cash / 2% PIK per annum, payable semi-annually Repurchase Right Company/Sponsors can repurchase full amount (incl. accrued/unpaid) at par at any time Shareholder Agreement Restrictions No dividends to common equity until preferred equity has been repaid in full Management Incentive Program [$15 - $20] million of pari passu non-convertible perpetual preferred equity with 7% PIK rate (other terms the same as those described herein) TBD % of common equity Governance None (1) Immediately prior to the exchange transaction, the Company would convert the existing preferred equity of Chinos Holdings, Inc. into 100% of the common equity of Chinos Holdings, Inc., and the current common equity of Chinos Holdings, Inc. and all options related thereto would be cancelled. Exhibit 99.1

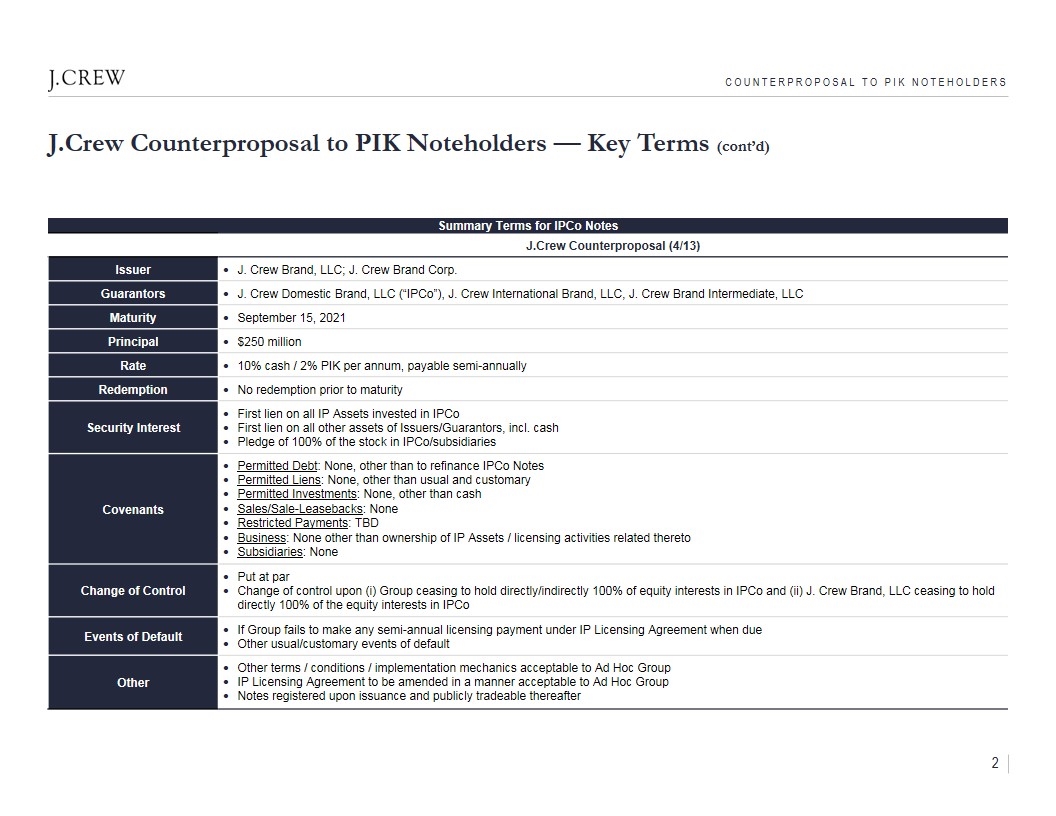

J.Crew 2 J.Crew Counterproposal to PIK Noteholders — Key Terms (cont’d) Summary Terms for IPCo Notes J.Crew Counterproposal (4/13) Issuer J. Crew Brand, LLC; J. Crew Brand Corp. Guarantors J. Crew Domestic Brand, LLC (“IPCo”), J. Crew International Brand, LLC, J. Crew Brand Intermediate, LLC Maturity September 15, 2021 Principal $250 million Rate 10% cash / 2% PIK per annum, payable semi-annually Redemption No redemption prior to maturity Security Interest First lien on all IP Assets invested in IPCo First lien on all other assets of Issuers/Guarantors, incl. cash Pledge of 100% of the stock in IPCo/subsidiaries Covenants Permitted Debt: None, other than to refinance IPCo Notes Permitted Liens: None, other than usual and customary Permitted Investments: None, other than cash Sales/Sale-Leasebacks: None Restricted Payments: TBD Business: None other than ownership of IP Assets / licensing activities related thereto Subsidiaries: None Change of Control Put at par Change of control upon (i) Group ceasing to hold directly/indirectly 100% of equity interests in IPCo and (ii) J. Crew Brand, LLC ceasing to hold directly 100% of the equity interests in IPCo Events of Default If Group fails to make any semi-annual licensing payment under IP Licensing Agreement when due Other usual/customary events of default Other Other terms / conditions / implementation mechanics acceptable to Ad Hoc Group IP Licensing Agreement to be amended in a manner acceptable to Ad Hoc Group Notes registered upon issuance and publicly tradeable thereafter COUNTERPROPOSAL TO PIK NOTEHOLDERS