Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Century Communities, Inc. | d374337d8k.htm |

Investor Presentation | APRIL 11, 2017 Business combination with UCP, Inc. Exhibit 99.1

Certain statements in this Investor Presentation relating to the merger (the “Merger”) of UCP, Inc. (“UCP”) with and into Casa Acquisition Corp., a wholly-owned subsidiary of Century Communities, Inc. (the “Company”), may be regarded as "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Certain forward-looking statements discuss the Company’s plans, strategies and intentions, and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “expects,” “may,” “will,” “believes,” “should,” “would,” “could,” “approximately,” “anticipates,” “estimates,” “targets,” “intends,” “likely,” “projects,” “positioned,” “strategy,” “future,” and “plans.” In addition, these words may use the positive or negative or other variations of those terms. All statements other than statements of historical fact are “forward–looking statements” for purposes of federal and state securities laws. There is no guarantee that any of the events anticipated by these forward-looking statements will occur. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ from those expressed or implied by the forward-looking statement. These forward-looking statements are based on various assumptions and the current expectations of the management of the Company, and may not be accurate because of risks and uncertainties surrounding these assumptions and expectations. Certain factors may cause actual results to differ significantly from these forward-looking statements. If any of the events occur, there is no guarantee what effect they will have on the operations or financial condition of the Company, or the Merger. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, but are not limited to, risks and uncertainties relating to: the ability to satisfy the conditions to consummation of the Merger; timing to consummate the Merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the Merger may not be fully realized or may take longer to realize than expected; disruption from the Merger making it more difficult to maintain relationships with customers, suppliers, or employees; the diversion of management time on issues related to the Merger; the future cash requirements of the combined company and financing availability; any unforeseen changes to or effects on liabilities, future capital expenditures, revenues, expenses, earnings, synergies, indebtedness, financial condition, losses and future prospects; general worldwide economic conditions and related uncertainties, including employment rates, housing starts, interest rate levels, availability of financing for home mortgages, and the strength of the U.S. dollar; and the effect of changes in governmental laws and regulations. These risks and uncertainties, as well as other or new risks and uncertainties that may emerge from time to time affecting the Merger or the combined company, are not intended to represent a complete list of all risks and uncertainties inherent in the Merger or the business of the combined company. There can be no assurance that the Merger will in fact be consummated in the manner described, or at all. However, it is not possible to predict or identify all such factors. In addition, the Company has disclosed under the heading “Risk Factors” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (the “Annual Report”), filed with the U.S. Securities and Exchange Commission on February 15, 2017, the risk factors which materially affect its business, financial condition and operating results. Investors are encouraged to review the Annual Report for additional information regarding the risks and uncertainties that may cause actual results to differ materially from those expressed in any forward-looking statement. Forward-looking statements included herein are made as of the date hereof, and the Company undertakes no obligation to publicly update or revise any forward-looking statement to reflect future events, developments or otherwise, except as may be required by applicable law. Forward-Looking Statements Non-GAAP Financial Information This presentation includes certain non-GAAP financial measures as defined by SEC rules. Such non-GAAP financial measures are presented as a supplemental financial measurements in the evaluation of our business. We believe the presentation of these financial measures helps investors to assess our operating performance from period to period and enhances understanding of our financial performance and highlights operational trends. This measure is widely used by investors in the valuation, comparison, rating and investment recommendations of companies. However, the such measurements may not be comparable to those of other companies in our industry, which limits their usefulness as a comparative measures. Such measures are not required by or calculated in accordance with GAAP and should not be considered as a substitutes for net income or any other measure of financial performance reported in accordance with GAAP or as a measure of operating cash flow or liquidity. Additional Information and Where to Find It In connection with the offering and sale of shares of Company common stock in the Merger, the Company will file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”), which will include a prospectus with respect to the shares of Company common stock to be issued in the Merger and a preliminary and definitive proxy statement for the stockholders of UCP (the “Proxy Statement”), which UCP will mail to its stockholders. The Registration Statement and the definitive Proxy Statement will contain important information about the Merger and related matters. Investors and stockholders are urged to carefully read the Registration Statement, the Proxy Statement and any other relevant documents filed with the SEC, and any amendments or supplements to those documents, when they become available, because they will contain important information about the Company, UCP, and the proposed Merger. Investors and stockholders will be able to obtain copies of the Registration Statement, the Proxy Statement and other documents filed with the SEC by Company and UCP (when they become available) free of charge at the SEC’s website, www.sec.gov. In addition, copies (when they become available) will be available free of charge by accessing the Company’s website at www.centurycommunities.com, then clicking on the “Investors” link, then clicking on “Financial Information” and then clicking on the “SEC Filings” link. Non-Solicitation The information in this Investor Presentation is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities, or the solicitation of any vote or approval, in any jurisdiction pursuant to or in connection with the Merger or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Transaction Overview This morning Century Communities (NYSE: CCS) and UCP, Inc. (NYSE: UCP) jointly announced a strategic business combination Purchase price composed of 0.2309 shares of CCS stock and $5.32 of cash for each share of UCP Implies $11.35 per share of UCP, based on CCS share price of $26.10 as of April 10, 2017 and $336 million aggregate transaction value UCP shareholders to represent ~16% of pro forma company Transaction has been unanimously approved by CCS and UCP Board of Directors Anticipated transaction closing in Q3 2017 Color Scheme 177 118 48 160 160 160 177 154 48 177 66 47 48 147 176 104 60 146

Acquisition of large, high quality land portfolio at an attractive basis Provides entry into California and Pacific Northwest markets and expansion of Southeast presence, meaningfully increasing geographic footprint Wide range of product capabilities, including first-time through active adult Strong cultural fit with similar management philosophies and ability to implement best practices Enhanced growth trajectory from build-out of current inventory and platform for future growth Synergies from reduced corporate and operational costs and economies of scale Accretive to 2018 earnings Increased scale and public equity float Transaction rationale – Century & UCP

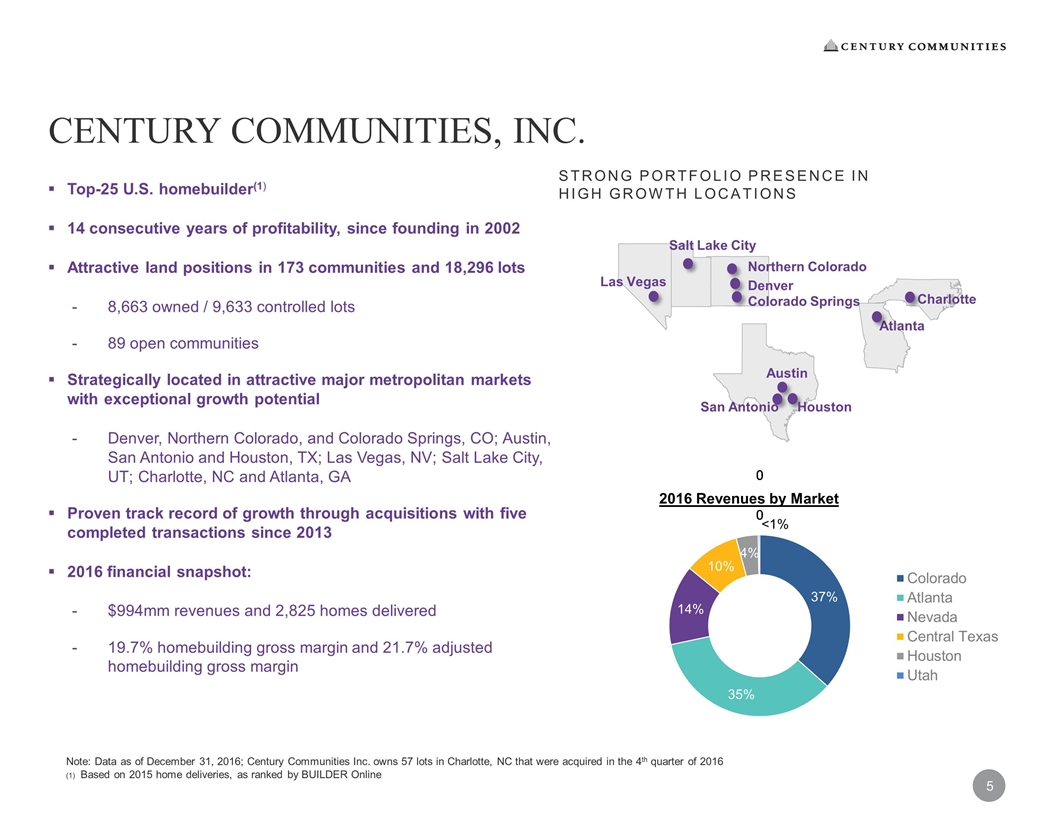

Top-25 U.S. homebuilder(1) 14 consecutive years of profitability, since founding in 2002 Attractive land positions in 173 communities and 18,296 lots 8,663 owned / 9,633 controlled lots 89 open communities Strategically located in attractive major metropolitan markets with exceptional growth potential Denver, Northern Colorado, and Colorado Springs, CO; Austin, San Antonio and Houston, TX; Las Vegas, NV; Salt Lake City, UT; Charlotte, NC and Atlanta, GA Proven track record of growth through acquisitions with five completed transactions since 2013 2016 financial snapshot: $994mm revenues and 2,825 homes delivered 19.7% homebuilding gross margin and 21.7% adjusted homebuilding gross margin Note: Data as of December 31, 2016; Century Communities Inc. owns 57 lots in Charlotte, NC that were acquired in the 4th quarter of 2016 Based on 2015 home deliveries, as ranked by BUILDER Online 2016 Revenues by Market Strong portfolio presence in high growth locations Las Vegas Salt Lake City Northern Colorado Denver Colorado Springs Austin Houston San Antonio Charlotte Atlanta CENTURY COMMUNITIES, iNC.

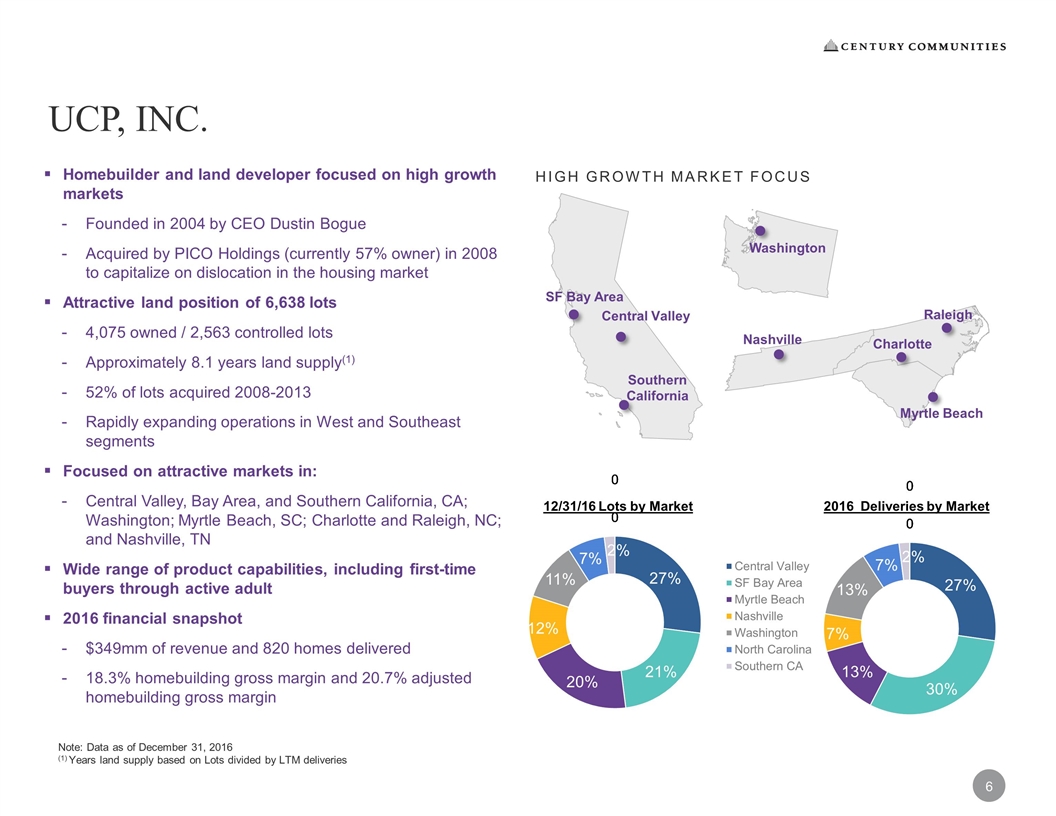

UCP, Inc. High Growth Market Focus Homebuilder and land developer focused on high growth markets Founded in 2004 by CEO Dustin Bogue Acquired by PICO Holdings (currently 57% owner) in 2008 to capitalize on dislocation in the housing market Attractive land position of 6,638 lots 4,075 owned / 2,563 controlled lots Approximately 8.1 years land supply(1) 52% of lots acquired 2008-2013 Rapidly expanding operations in West and Southeast segments Focused on attractive markets in: Central Valley, Bay Area, and Southern California, CA; Washington; Myrtle Beach, SC; Charlotte and Raleigh, NC; and Nashville, TN Wide range of product capabilities, including first-time buyers through active adult 2016 financial snapshot $349mm of revenue and 820 homes delivered 18.3% homebuilding gross margin and 20.7% adjusted homebuilding gross margin 12/31/16 Lots by Market 2016 Deliveries by Market SF Bay Area Central Valley Southern California Washington Charlotte Note: Data as of December 31, 2016 (1) Years land supply based on Lots divided by LTM deliveries Nashville Myrtle Beach Raleigh

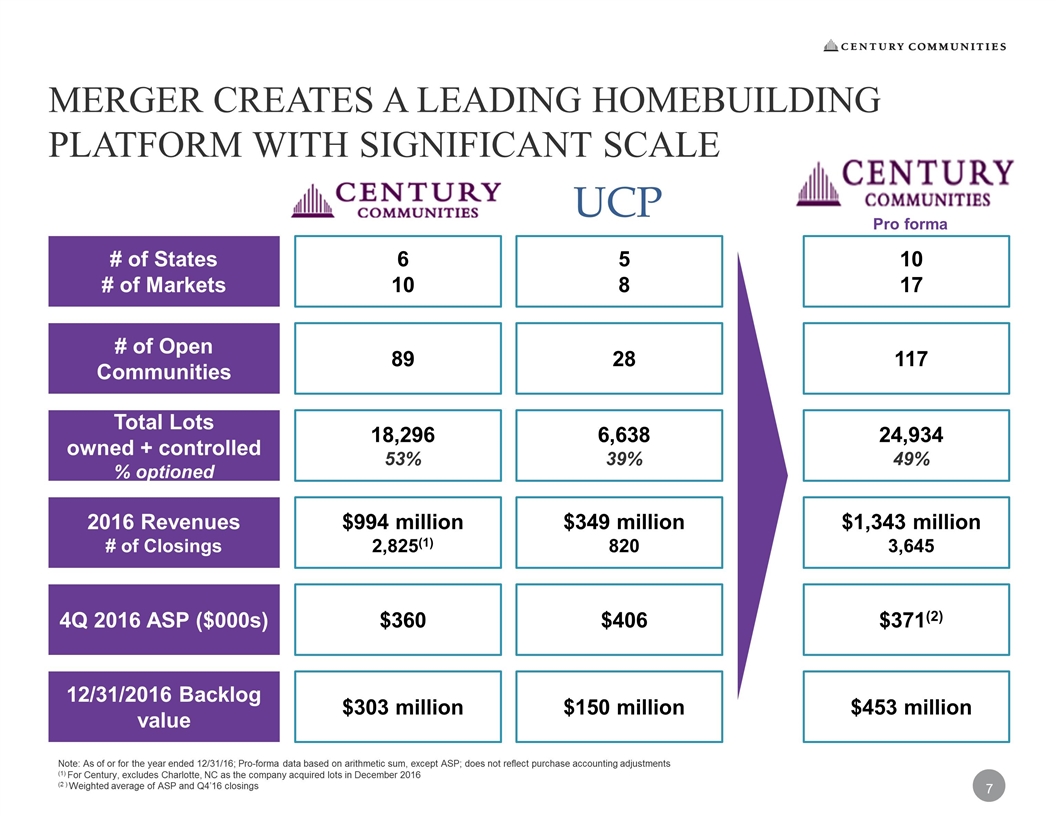

Merger Creates a Leading Homebuilding Platform with Significant Scale Color Scheme 177 118 48 160 160 160 177 154 48 177 66 47 48 147 176 104 60 146 Total Lots owned + controlled % optioned 18,296 53% 6,638 39% 24,934 49% 89 28 117 # of Open Communities $994 million 2,825(1) $349 million 820 $1,343 million 3,645 2016 Revenues # of Closings $360 $406 $371(2) 4Q 2016 ASP ($000s) $303 million $150 million $453 million 12/31/2016 Backlog value Note: As of or for the year ended 12/31/16; Pro-forma data based on arithmetic sum, except ASP; does not reflect purchase accounting adjustments (1) For Century, excludes Charlotte, NC as the company acquired lots in December 2016 (2 ) Weighted average of ASP and Q4’16 closings Pro forma 6 10 5 8 10 17 # of States # of Markets

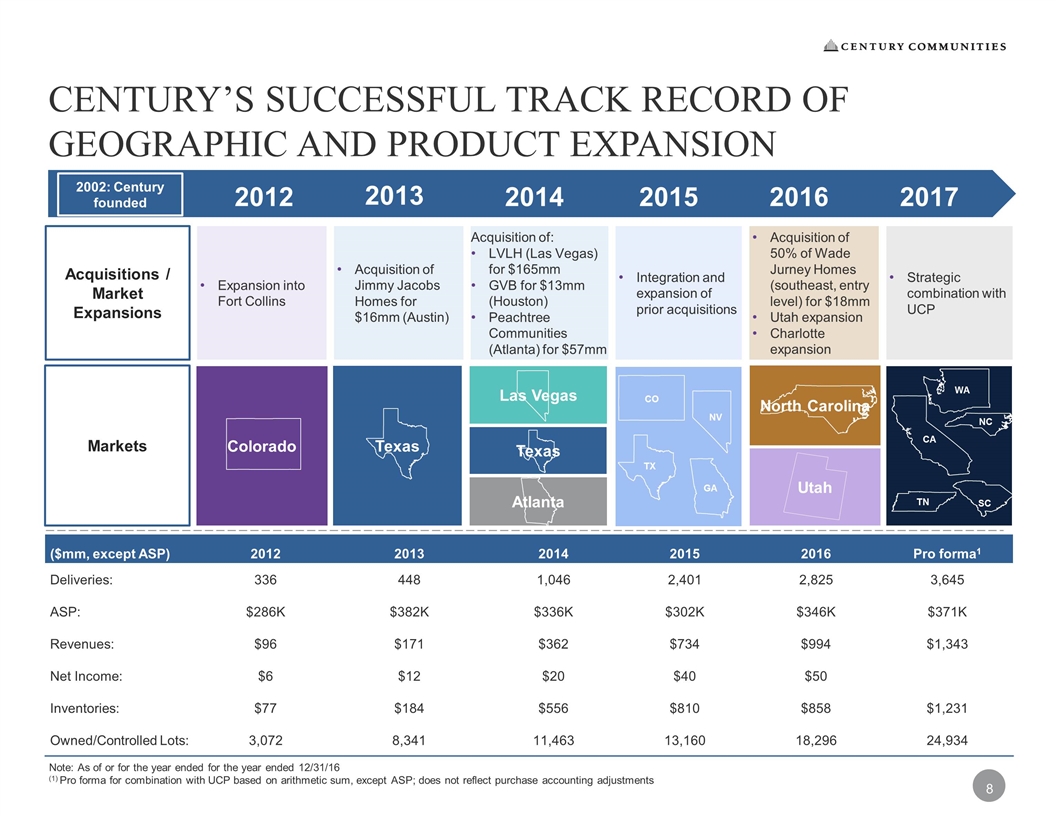

Century’s Successful Track Record of Geographic and product expansion Colorado 2013 2014 2015 Acquisitions / Market Expansions 2002: Century founded Expansion into Fort Collins Acquisition of Jimmy Jacobs Homes for $16mm (Austin) Acquisition of: LVLH (Las Vegas) for $165mm GVB for $13mm (Houston) Peachtree Communities (Atlanta) for $57mm Strategic combination with UCP 2012 2016 2017 North Carolina Acquisition of 50% of Wade Jurney Homes (southeast, entry level) for $18mm Utah expansion Charlotte expansion NC SC CA TN WA ($mm, except ASP) 2012 2013 2014 2015 2016 Pro forma1 Deliveries: 336 448 1,046 2,401 2,825 3,645 ASP: $286K $382K $336K $302K $346K $371K Revenues: $96 $171 $362 $734 $994 $1,343 Net Income: $6 $12 $20 $40 $50 Inventories: $77 $184 $556 $810 $858 $1,231 Owned/Controlled Lots: 3,072 8,341 11,463 13,160 18,296 24,934 Note: As of or for the year ended for the year ended 12/31/16 (1) Pro forma for combination with UCP based on arithmetic sum, except ASP; does not reflect purchase accounting adjustments Markets Texas Las Vegas Atlanta Texas Utah CO NV Integration and expansion of prior acquisitions GA TX

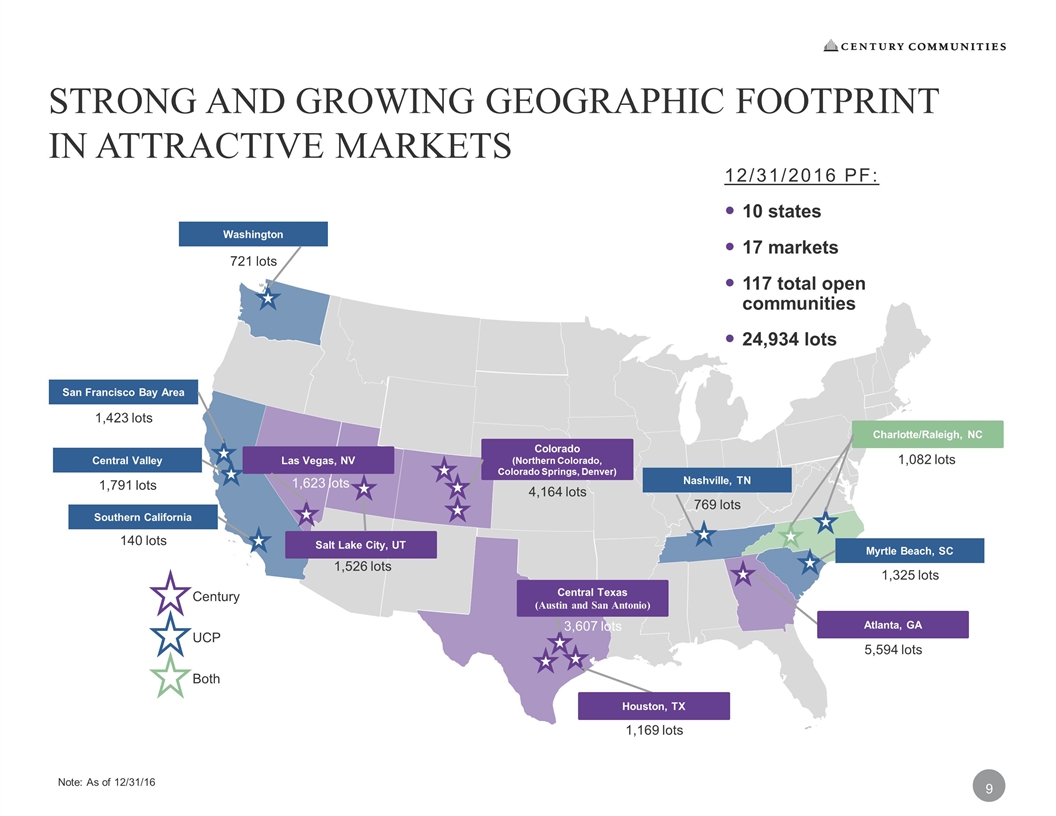

Color Scheme 177 118 48 160 160 160 177 154 48 177 66 47 48 147 176 104 60 146 Las Vegas, NV Colorado (Northern Colorado, Colorado Springs, Denver) Central Texas (Austin and San Antonio) Houston, TX Atlanta, GA Washington San Francisco Bay Area Central Valley Nashville, TN Charlotte/Raleigh, NC Myrtle Beach, SC Southern California 12/31/2016 PF: 10 states 17 markets 117 total open communities 24,934 lots 721 lots 1,423 lots 1,791 lots 140 lots 4,164 lots 1,169 lots 3,607 lots 5,594 lots 1,325 lots 769 lots 1,623 lots Strong and Growing Geographic Footprint in Attractive Markets Salt Lake City, UT 1,526 lots Century UCP Both 1,082 lots Note: As of 12/31/16

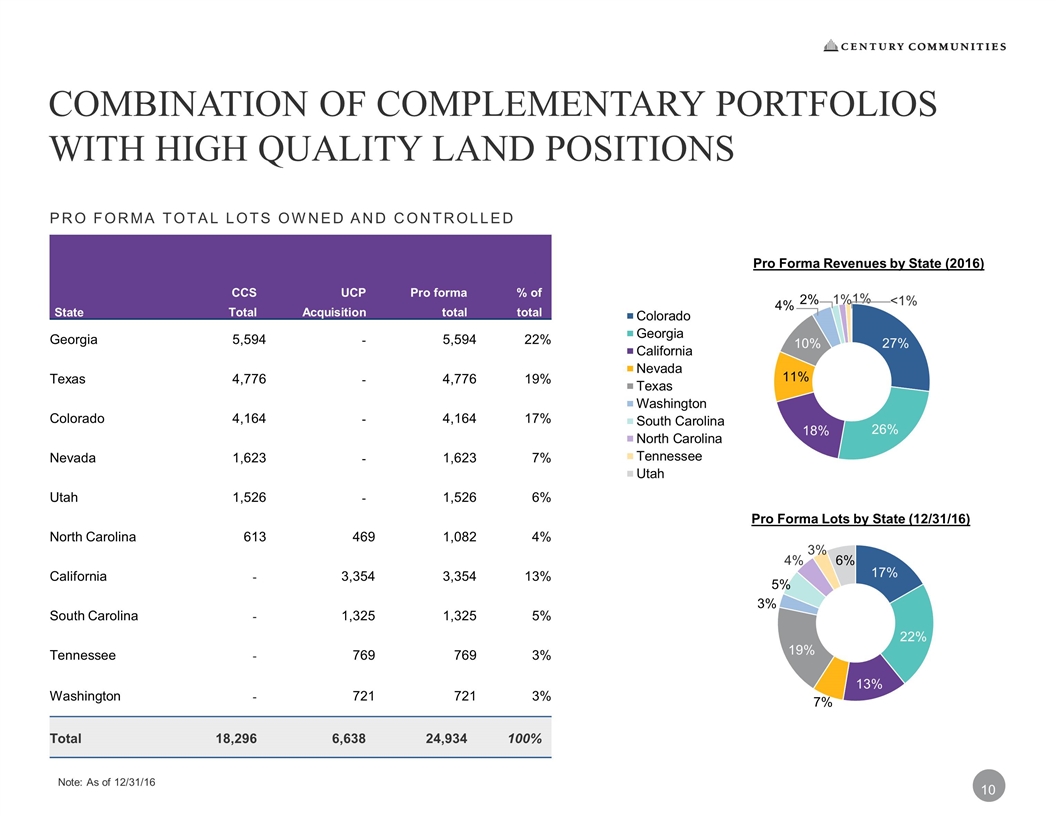

Combination of Complementary Portfolios with High Quality Land Positions Pro forma total lots owned and controlled UCP Acquisition Pro forma total % of total State CCS Total Georgia 5,594 - 5,594 22% Texas 4,776 - 4,776 19% Colorado 4,164 - 4,164 17% Nevada 1,623 - 1,623 7% Utah 1,526 - 1,526 6% North Carolina 613 469 1,082 4% California - 3,354 3,354 13% South Carolina - 1,325 1,325 5% Tennessee - 769 769 3% Washington - 721 721 3% Total 18,296 6,638 24,934 100% Pro Forma Lots by State (12/31/16) Pro Forma Revenues by State (2016) Note: As of 12/31/16 <1%

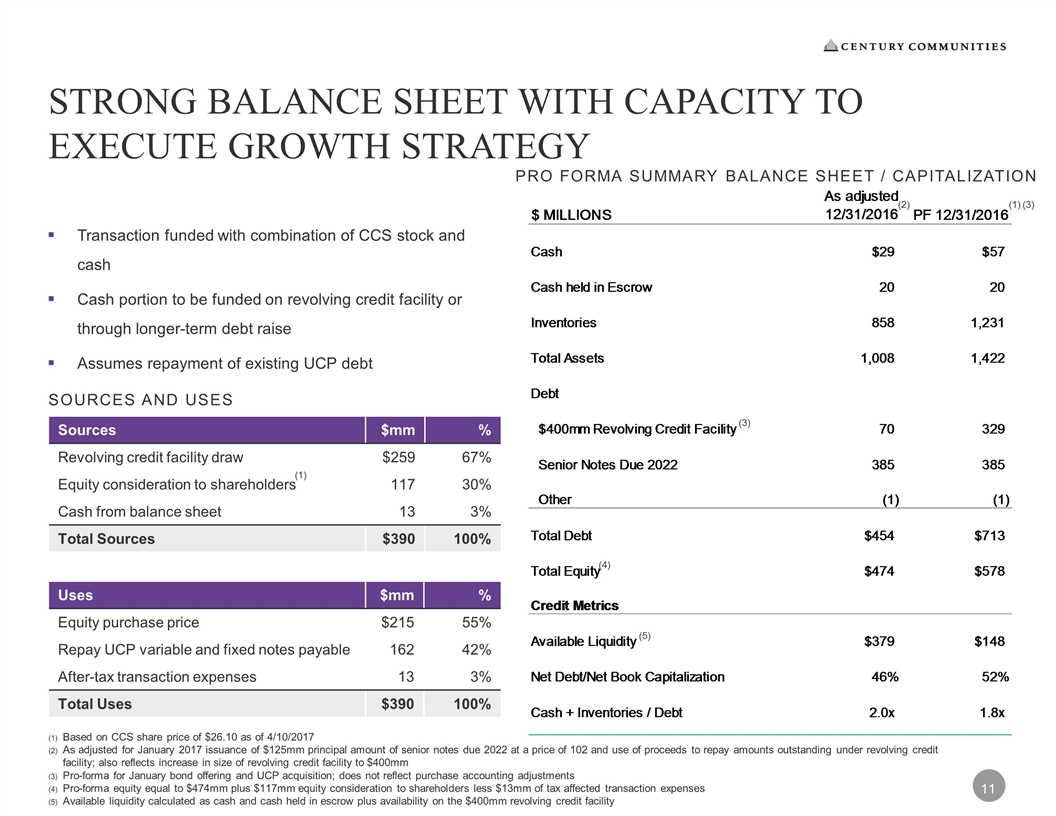

Strong Balance sheet with Capacity to Execute Growth Strategy Transaction funded with combination of CCS stock and cash Cash portion to be funded on revolving credit facility or through longer-term debt raise Assumes repayment of existing UCP debt Pro Forma Summary Balance Sheet / Capitalization Based on CCS share price of $26.10 as of 4/10/2017 As adjusted for January 2017 issuance of $125mm principal amount of senior notes due 2022 at a price of 102 and use of proceeds to repay amounts outstanding under revolving credit facility; also reflects increase in size of revolving credit facility to $400mm Pro-forma for January bond offering and UCP acquisition; does not reflect purchase accounting adjustments Pro-forma equity equal to $474mm plus $117mm equity consideration to shareholders less $13mm of tax affected transaction expenses Available liquidity calculated as cash and cash held in escrow plus availability on the $400mm revolving credit facility Sources and Uses Sources $mm % Revolving credit facility draw $259 67% Equity consideration to shareholders 117 30% Cash from balance sheet 13 3% Total Sources $390 100% Uses $mm % Equity purchase price $215 55% Repay UCP variable and fixed notes payable 162 42% After-tax transaction expenses 13 3% Total Uses $390 100% (1) (2) (3) (3) (1) (5) (4)

Driving Shareholder Value Through Combination of Two Public Homebuilders Color Scheme 177 118 48 160 160 160 177 154 48 177 66 47 48 147 176 104 60 146 Cycle-Tested and Aligned Management Team Strong and Growing Geographical Footprint Superior Operating Performance Attractive and Well-Located Land Positions Diversified Operating Strategy Capacity to Execute Growth Strategy Opportunity to Enhance Profitability through Scale and Efficiencies