Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HYPERDYNAMICS CORP | a17-10287_3ex99d1.htm |

| 8-K - 8-K - HYPERDYNAMICS CORP | a17-10287_38k.htm |

Exhibit 10

Execution Version

FARMOUT AGREEMENT

BY AND BETWEEN

SCS CORPORATION LTD.

AS FARMOR,

AND

SOUTH ATLANTIC PETROLEUM LIMITED

AS FARMEE

DATED MARCH 30, 2017

|

|

|

FARMOUT AGREEMENT FOR: |

|

|

|

50% Participating Interest |

|

|

|

PRODUCTION SHARING CONTRACT |

|

|

|

REPUBLIC OF GUINEA |

|

|

TABLE OF CONTENTS

|

ARTICLE 1 - ASSIGNMENT OF INTEREST |

|

1 | |||

|

|

|

|

|

| |

|

|

Section 1.1 |

|

Assignment |

|

1 |

|

|

|

|

|

|

|

|

|

Section 1.2 |

|

Execution and Delivery of Documents |

|

1 |

|

|

|

|

|

|

|

|

|

Section 1.3 |

|

Submission to the Government |

|

2 |

|

|

|

|

|

|

|

|

|

Section 1.4 |

|

Request for Governmental Approval |

|

2 |

|

|

|

|

|

|

|

|

|

Section 1.5 |

|

Farmee Interest |

|

2 |

|

|

|

|

|

|

|

|

|

Section 1.6 |

|

Ownership |

|

3 |

|

|

|

|

|

|

|

|

|

Section 1.7 |

|

Additional Farmouts and/or Assignments |

|

3 |

|

|

|

|

|

|

|

|

|

Section 1.8 |

|

Cost Recovery Pool |

|

3 |

|

|

|

|

|

| |

|

ARTICLE 2 - CONDITIONS PRECEDENT |

|

3 | |||

|

|

|

|

|

| |

|

|

Section 2.1 |

|

Conditions |

|

3 |

|

|

|

|

|

|

|

|

|

Section 2.2 |

|

Waiver of Conditions |

|

4 |

|

|

|

|

|

|

|

|

|

Section 2.3 |

|

Frustration of Conditions |

|

4 |

|

|

|

|

|

| |

|

ARTICLE 3 - FARM-IN OBLIGATIONS |

|

4 | |||

|

|

|

|

|

| |

|

|

Section 3.1 |

|

Payment Obligations |

|

4 |

|

|

|

|

|

|

|

|

|

Section 3.2 |

|

Payments; Designated Account |

|

6 |

|

|

|

|

|

|

|

|

|

Section 3.3 |

|

Security Instrument |

|

6 |

|

|

|

|

|

| |

|

ARTICLE 4 - TERMINATION |

|

7 | |||

|

|

|

|

|

| |

|

|

Section 4.1 |

|

Termination |

|

7 |

|

|

|

|

|

|

|

|

|

Section 4.2 |

|

Return of Information |

|

7 |

|

|

|

|

|

|

|

|

|

Section 4.3 |

|

Effect of Termination |

|

8 |

|

|

|

|

|

| |

|

ARTICLE 5 - OBLIGATION WELL |

|

8 | |||

|

|

|

|

|

| |

|

|

Section 5.1 |

|

Obligation Well Location |

|

8 |

|

|

|

|

|

| |

|

ARTICLE 6 - WARRANTIES |

|

8 | |||

|

|

|

|

|

| |

|

|

Section 6.1 |

|

Farmor’s Warranties |

|

8 |

|

|

|

|

|

|

|

|

|

Section 6.2 |

|

Farmee’s Warranties |

|

15 |

|

|

|

|

|

|

|

|

|

Section 6.3 |

|

Warranties Regarding Anti-Corruption |

|

17 |

|

|

|

|

|

|

|

|

|

Section 6.4 |

|

Disclaimer |

|

19 |

|

|

|

|

|

|

|

|

|

Section 6.5 |

|

Effectiveness of Warranties |

|

19 |

|

|

|

|

|

|

|

|

|

Section 6.6 |

|

Knowledge |

|

20 |

|

ARTICLE 7 - CERTAIN COVENANTS OF THE PARTIES |

|

20 | |||

|

|

|

|

|

| |

|

|

Section 7.1 |

|

Covenants of Farmor |

|

20 |

|

|

|

|

|

|

|

|

|

Section 7.2 |

|

Covenants of Farmee |

|

23 |

|

|

|

|

|

|

|

|

|

Section 7.3 |

|

Mutual Covenants |

|

23 |

|

|

|

|

|

|

|

|

|

Section 7.4 |

|

Mutual Covenants Regarding Anti-Corruption |

|

24 |

|

|

|

|

|

| |

|

ARTICLE 8 - EXPENSES, STAMP DUTIES AND TAXES |

|

26 | |||

|

|

|

|

|

| |

|

|

Section 8.1 |

|

Expenses |

|

26 |

|

|

|

|

|

|

|

|

|

Section 8.2 |

|

Duties, Taxes and Fees |

|

26 |

|

|

|

|

|

| |

|

ARTICLE 9 - RELATIONSHIP OF THE PARTIES |

|

26 | |||

|

|

|

|

|

| |

|

|

Section 9.1 |

|

Independent Co-Owners |

|

26 |

|

|

|

|

|

|

|

|

|

Section 9.2 |

|

Tax |

|

26 |

|

|

|

|

|

|

|

|

|

Section 9.3 |

|

United States Internal Revenue Code |

|

26 |

|

|

|

|

|

|

|

|

|

Section 9.4 |

|

Area of Mutual Interest |

|

27 |

|

|

|

|

|

|

|

|

|

Section 9.5 |

|

Right of Competition |

|

28 |

|

|

|

|

|

| |

|

ARTICLE 10 - CONFIDENTIALITY |

|

28 | |||

|

|

|

|

|

| |

|

|

Section 10.1 |

|

Obligation of Confidentiality |

|

28 |

|

|

|

|

|

|

|

|

|

Section 10.2 |

|

Publicity |

|

29 |

|

|

|

|

|

|

|

|

|

Section 10.3 |

|

Conflict |

|

29 |

|

|

|

|

|

| |

|

ARTICLE 11 - INDEMNIFICATION |

|

29 | |||

|

|

|

|

|

| |

|

|

Section 11.1 |

|

Indemnification by Farmor |

|

29 |

|

|

|

|

|

|

|

|

|

Section 11.2 |

|

Pre-Closing Date Indemnification |

|

30 |

|

|

|

|

|

|

|

|

|

Section 11.3 |

|

Indemnification by Farmee |

|

30 |

|

|

|

|

|

|

|

|

|

Section 11.4 |

|

Post-Closing Date Indemnification |

|

30 |

|

|

|

|

|

|

|

|

|

Section 11.5 |

|

Indemnification Regarding Anti-Corruption |

|

30 |

|

|

|

|

|

|

|

|

|

Section 11.6 |

|

General Provisions |

|

30 |

|

|

|

|

|

|

|

|

|

Section 11.7 |

|

Indemnification Procedures |

|

32 |

|

|

|

|

|

| |

|

ARTICLE 12 - DISPUTE RESOLUTION |

|

33 | |||

|

|

|

|

|

| |

|

|

Section 12.1 |

|

Agreement to Arbitrate |

|

33 |

|

|

|

|

|

|

|

|

|

Section 12.2 |

|

Number and Appointment of Arbitrators |

|

33 |

|

|

|

|

|

|

|

|

|

Section 12.3 |

|

Venue; Procedural Issues |

|

33 |

|

|

|

|

|

|

|

|

|

Section 12.4 |

|

Powers of the Arbitrators; Limitations On Remedies |

|

34 |

|

|

|

|

|

|

|

|

|

Section 12.5 |

|

Arbitration Awards |

|

34 |

|

|

Section 12.6 |

|

Exclusive Method of Resolving Claims; Assistance of Courts |

|

35 |

|

|

|

|

|

|

|

|

|

Section 12.7 |

|

Confidentiality |

|

35 |

|

|

|

|

|

|

|

|

|

Section 12.8 |

|

Costs of Arbitration |

|

35 |

|

|

|

|

|

|

|

|

|

Section 12.9 |

|

Interest |

|

35 |

|

|

|

|

|

|

|

|

|

Section 12.10 |

|

Consolidation and Joinder |

|

35 |

|

|

|

|

|

| |

|

ARTICLE 13 - PAYMENT DEFAULT |

|

36 | |||

|

|

|

|

|

|

|

|

|

Section 13.1 |

|

Default and Interest |

|

36 |

|

|

|

|

|

|

|

|

|

Section 13.2 |

|

Termination |

|

36 |

|

|

|

|

|

|

|

|

ARTICLE 14 - MISCELLANEOUS |

|

36 | |||

|

|

|

|

|

|

|

|

|

Section 14.1 |

|

Conflict |

|

36 |

|

|

|

|

|

|

|

|

|

Section 14.2 |

|

Assignment |

|

36 |

|

|

|

|

|

|

|

|

|

Section 14.3 |

|

Parties in Interest |

|

37 |

|

|

|

|

|

|

|

|

|

Section 14.4 |

|

Entire Agreement |

|

37 |

|

|

|

|

|

|

|

|

|

Section 14.5 |

|

Amendment, Modification and Waiver |

|

37 |

|

|

|

|

|

|

|

|

|

Section 14.6 |

|

Notices |

|

37 |

|

|

|

|

|

|

|

|

|

Section 14.7 |

|

Counterparts |

|

38 |

|

|

|

|

|

|

|

|

|

Section 14.8 |

|

Severability |

|

38 |

|

|

|

|

|

|

|

|

|

Section 14.9 |

|

Survival of Claims |

|

38 |

|

|

|

|

|

|

|

|

|

Section 14.10 |

|

Governing Law |

|

38 |

|

|

|

|

|

|

|

|

|

Section 14.11 |

|

Language |

|

39 |

|

|

|

|

|

|

|

|

|

Section 14.12 |

|

Independent Accountant |

|

39 |

|

|

|

|

|

|

|

|

|

Section 14.13 |

|

Interpretation |

|

39 |

APPENDICES

Appendix A Definitions

SCHEDULES

Schedule 3.2 Farmor Designated Account

Schedule 6.1(b) Farmor Consents

Schedule 6.1(d) Contract

Schedule 6.1(e) Contract Obligations

Schedule 6.1(f) Other Obligations

Schedule 6.1(g) No Surrender, Relinquishment or Withdrawal

Schedule 6.1(i) Farmor Litigation

Schedule 6.1(q) Insurance

Schedule 6.1(x) Compliance

Schedule 6.1(r) Bonds, Letters of Credit or Guarantees

Schedule 6.2(b) Farmee Consents

Schedule 6.2(c) Farmee Litigation

Schedule 7.1(c) Conduct of Joint Operations

EXHIBITS

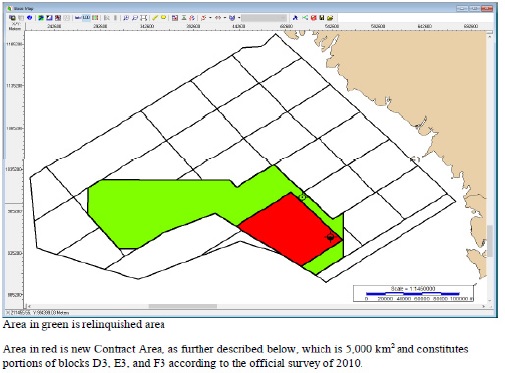

Exhibit A Contract Area

Exhibit B Joint Operating Agreement

Exhibit C Assignment

Exhibit D Farmor Parent Guaranty

Exhibit E Farmee Parent Guaranty

Exhibit F Work Program and Budget

FARMOUT AGREEMENT

THIS FARMOUT AGREEMENT (this “Agreement”) is made and entered on March 30, 2017 (the “Execution Date”) by and between SCS Corporation Ltd., a company registered in the Cayman Islands, with its address at 12012 Wickchester Lane, Suite 475, Houston, TX 77079, USA, a wholly owned subsidiary of Hyperdynamics Corporation, a Delaware corporation traded on the OTCQX (the “Farmor”), and South Atlantic Petroleum Limited, a company registered under the laws of the Federal Republic of Nigeria, with its registered address at 11th and 12th Floors, South Atlantic Petroleum Towers, 1 Adeola Odeku Street, Victoria Island, Lagos, Nigeria (the “Farmee”). Farmor and Farmee are collectively referred to herein as the “Parties” and individually referred to as a “Party.”

Capitalized terms used in this Agreement shall have the meanings ascribed to them in Appendix A to this Agreement or as such terms are otherwise identified and/or defined in this Agreement.

RECITALS

A. Farmor is a party to that certain Hydrocarbons Production Sharing Contract between the Republic of Guinea and SCS Corporation dated September 22, 2006; as amended by that certain Amendment No. 1 to the Hydrocarbons Production Sharing Contract between the Republic of Guinea and SCS Corporation dated March 25, 2010; and as further amended by that memorandum of understanding between the Republic of Guinea and SCS Corporation Ltd. dated August 19, 2016 and that certain Second Amendment to the Hydrocarbons Production Sharing Contract between the Republic of Guinea and SCS Corporation Ltd. dated September 14, 2016 and duly approved by a Decree No. 275/PRG/SGG of the President of the Republic dated 21 September 2016 (“Second PSC Amendment”) (as amended, the “Contract”) covering the area in the Republic of Guinea shown on Exhibit A hereto (the “Contract Area”).

B. Farmor owns a one hundred percent (100%) Participating Interest, and is willing to assign and transfer to Farmee the Farmee Interest upon the terms and conditions set forth in this Agreement.

C. Farmee desires to obtain the Farmee Interest from Farmor and to assume all obligations and liabilities related to such Participating Interest, all upon the terms and conditions set forth in this Agreement.

NOW THEREFORE, in consideration of the mutual premises and covenants contained herein, the Parties hereby agree as follows:

ARTICLE 1 - ASSIGNMENT OF INTEREST

Section 1.1 Assignment. Upon the terms and subject to the conditions of this Agreement, Farmor, as legal and beneficial owner of the Farmee Interest, shall assign and transfer to Farmee the Farmee Interest and Farmee shall accept and acquire the Farmee Interest at the Closing Date, free from and clear of any Encumbrance.

Section 1.2 Execution and Delivery of Documents. On the Execution Date, Farmor

shall deliver to Farmee the Farmor Parent Guaranty from Hyperdynamics Corporation guaranteeing Farmor’s full compliance with, and performance of, Farmor’s duties, obligations and liabilities hereunder.

Section 1.3 Submission to the Government. At such time as Farmor requests Governmental Approval pursuant to Section 1.4., Farmor shall submit a copy of this Agreement (which shall include, as Exhibits, unsigned copies of the Assignment and the JOA) to the Government. If and to the extent requested by Farmor, Farmee shall cooperate with Farmor in connection with the submission. In the event the Government requires any amendments to the Assignment or the JOA and if such amendments are acceptable to the Parties (acting reasonably), the Parties shall make the necessary amendments prior to execution of the Assignment and the JOA on the Closing Date.

Section 1.4 Request for Governmental Approval. As soon as reasonably practicable following the satisfaction or waiver, in accordance with Section 2.2 of the condition set out in Section 2.1(e), Farmor shall request Governmental Approval from the Government. If and to the extent reasonably requested by Farmor, Farmee shall cooperate with Farmor in connection with such submission.

Section 1.5 Farmee Interest.

(a) Farmor shall keep Farmee informed of the progress towards the satisfaction or non-satisfaction of the conditions described in Section 2.1. Within five days following the date (the “Trigger Date”) on which the conditions described in Section 2.1 have been satisfied (or waived by the applicable Parties), Farmor shall deliver a notice (the “Closing Notice”) to Farmee notifying Farmee that such conditions have been satisfied or waived, unless this Agreement has been terminated pursuant to Section 4.1.

(b) Unless Farmee terminates this Agreement pursuant to Section 4.1, the Parties shall proceed to close the assignment and transfer of the Farmee Interest as contemplated by this Agreement on a date within five days following the delivery of the Closing Notice (the “Closing Date”).

(c) On the Closing Date, Farmor shall deliver to Farmee a copy of any written notification of Governmental Approval provided to Farmor by the Government.

(d) On the Closing Date, Farmee shall pay Farmor the Closing Payment in accordance with Section 3.1(b).

(e) On the Closing Date, Farmor and Farmee shall each execute and deliver to the other, the Assignment and the JOA which shall be binding on the Parties and enter into effect on the Closing Date.

Section 1.6 Ownership. Immediately following the Closing Date, upon completion of the actions to be taken by the Parties on the Closing Date, the Participating Interests in the Contract and the JOA shall be as follows:

|

Farmor: |

|

50 |

% |

|

|

|

|

|

|

Farmee: |

|

50 |

% |

Section 1.7 Additional Farmouts and/or Assignments. Notwithstanding anything to the contrary in this Agreement, during the Interim Period, the Farmor may assign or transfer interests in the Contract other than the Farmee Interest (whether pursuant to farm-out agreements or otherwise) to third parties, provided that the Farmor has obtained the Farmee’s written consent for such transfers (such consent not to be unreasonably withheld, and which may be withheld only on the basis of the lack of necessary technical or financial capacity of the assignee), and Farmee shall have no pre-emptive right of any kind whatsoever to acquire such interests under this Agreement.

Section 1.8 Cost Recovery Pool. To the extent allowed by the Government and the Contract without any liability of any kind whatsoever to Farmor, Farmee shall be entitled to receive its Participating Interest share of all cost recovery allocations to the Contractor under the Contract, together with all income, receipts, credits, rebates and other benefits in respect thereof, irrespective of whether the costs and expenditures were incurred in or relate to the period before, on or after the Closing Date. Except as specifically set forth in Section 6.1(v), Farmor makes no representation or warranty whatsoever as to (i) the amount in the of Petroleum Costs (as such term is defined in the Contract) which are accountable for cost recovery purposes under the Contract (the “Cost Recovery Pool”), (ii) the amount of the Cost Recovery Pool that will actually be approved for cost recovery or received by the Contractor as cost recovery allocations, or (iii) whether, or to what extent, the Government will allow Farmee to receive its Participating Interest share of cost recovery allocations to the Contractor.

ARTICLE 2 - CONDITIONS PRECEDENT

Section 2.1 Conditions. The following are conditions to the occurrence of the Trigger Date:

(a) No statute, rule, regulation, temporary restraining order, preliminary or permanent injunction or other order of the Government preventing the transactions contemplated by this Agreement shall be in effect.

(b) There shall not be pending or threatened in writing (by the Government or any other third party) any suit, action or proceeding challenging or seeking to restrain or prohibit the transactions contemplated by this Agreement.

(c) Farmor shall have obtained Governmental Approval.

(d) If (i) required by the Government; and (ii) subject to the Farmor having provided security in respect of its own Participating Interest share, Farmee shall have delivered the Farmee Performance Bond to the Government.

(e) Farmor shall have obtained and maintained as of April 10, 2017 (local time in the Republic of Guinea), to the satisfaction of Farmee acting reasonably, sufficient cash or committed financings to enable it to meet its obligations to pay for its Participating Interest share of the Obligation Well Costs.

Section 2.2 Waiver of Conditions.

(a) Farmor and Farmee may jointly in writing, waive the conditions set out in Sections 2.1(a), (b), (c) and (d) in whole or in part at any time.

(b) Farmee may, by written notice to Farmor, waive the conditions set out in Section 2.1(e) in whole or in part at any time.

Section 2.3 Frustration of Conditions. No Party may rely on the failure of any applicable condition set forth in this Article 2 to be satisfied if such failure was caused solely by its own failure to comply with Section 7.3(d).

ARTICLE 3 - FARM-IN OBLIGATIONS

Section 3.1 Payment Obligations.

(a) Together with the Closing Notice delivered pursuant to Section 1.5(a), Farmor shall deliver to Farmee a statement (“Preliminary Closing Statement”) setting out Farmor’s reasonable and bona fide estimate of the total Closing Payment to be paid by Farmee on the Closing Date.

(b) On the Closing Date, Farmee shall pay Farmor the Closing Payment set out in the Preliminary Closing Statement.

(c) From and after the Closing Date and receipt by Farmor of the Closing Payment, all costs and expenses of the Joint Operations, including Obligation Well Costs and Emergency Costs, shall be paid by Farmor and Farmee in proportion to their respective Participating Interests and in accordance with the Joint Operating Agreement, and the terms of the Joint Operating Agreement shall govern all matters related to all costs and expenses of the Joint Operations, including Obligation Well Costs and Emergency Costs.

(d) Within ten (10) days after the Closing Date occurs, Farmor shall provide Farmee with a final adjustment statement (the “Final Adjustment Statement”) setting out Farmor’s final calculation of the Closing Payment, which shall reflect any amounts:

(i) not previously accounted for at the Closing Date in the Preliminary Closing Statement; and/or

(ii) any necessary correction or adjustment of amounts accounted for in the Preliminary Closing Statement,

together with relevant supporting particulars.

(e) During a period of forty-five (45) days following Farmee’s receipt of the Final Adjustment Statement, Farmee may verify all amounts in the Final Adjustment Statement and Farmor shall procure that Farmee has reasonable access to its books, accounts and records and to its relevant personnel for the purpose of verifying the figures contained in the Final Adjustment Statement.

(f) If Farmee disagrees with any item or amount in the Final Adjustment Statement, Farmee shall within forty-five (45) days of receipt, send Farmor a written objection which includes:

(i) the reasons for the objection;

(ii) any relevant documentation to substantiate such objection; and

(iii) the adjustments which, in Farmee’s opinion, ought to be made to the Final Adjustment Statement so that it is correct and complies with the provisions of this Agreement.

(g) Should Farmor and Farmee fail to reach an agreement on the Final Adjustment Statement within thirty (30) days following Farmee having notified an objection, the matter shall be referred to an Independent Accountant in accordance with Section 14.12.

(h) The Final Adjustment Statement (i) as presented by Farmor if not contested in accordance with Section 3.1(f); or (ii) as otherwise agreed by the Parties or determined by the Independent Accountant shall constitute the Closing Statement.

(i) Within five (5) days of the Closing Statement being established in accordance with Section 3.1(h):

(i) if the final settlement amount set out in the Closing Statement (which amount shall not exceed Ten Million U.S. Dollars (U.S. $10,000,000) without the approval of Farmee) (“Final Settlement Amount”) exceeds the amount set out in the Preliminary Closing Statement, Farmee shall pay Farmor the Final Settlement Amount in immediately available funds by wire transfer to Farmor’s account; or

(ii) if the Final Settlement Amount is less than the amount set out in the Preliminary Adjustment Statement, Farmor shall pay Farmee the Final Settlement Amount in immediately available funds by wire transfer to Farmee’s account.

Section 3.2 Payments; Designated Account.

(a) Payments made pursuant to this Article 3 shall be made by wire transfer in immediately available funds in U.S. Dollars to the appropriate account designated on Schedule 3.2. Farmor or Farmee may change its designated account by providing at least five (5) days advance notice to the other.

(b) Unless otherwise expressly provided in this Agreement, any other amount to be paid or reimbursed in accordance with this Agreement shall be paid or reimbursed within fifteen (15) days of receipt thereof (or, in the case of Losses, within fifteen (15) days of receipt of notification from the Party which has incurred such Losses) to the appropriate account designated on Schedule 3.2. Either Party may change its designated account by providing at least five days advance notice to the other Party.

Section 3.3 Security Instrument. Subject to the following sentence, for any Security Instrument required by the Contract to be provided to the Government, and which has not been provided to the Government by Farmor as of the Closing Date, both Farmor and Farmee shall separately provide a Security Instrument covering that portion of the secured amount that is equal to their Participating Interest share. In the event that the Government requires a single Security Instrument covering one hundred percent (100%) of the secured amount, then:

(a) if Farmor is required to provide the Security Instrument, Farmee shall bear and pay (and/or reimburse Farmor for), and shall indemnify Farmor from and against any Losses arising out of or in relation to, its Participating Interest share of the costs and expenses arising out of providing and maintaining any Security Instrument required by the Contract to be provided to the Government, and which has not been provided to the Government by Farmor as of the Execution Date, including all costs and expenses arising out of such Security Instrument and any liability that may arise thereunder or in relation thereto; and

(b) if Farmee is required to provide the Security Instrument, Farmor shall bear and pay (and/or reimburse Farmee for), and shall indemnify Farmee from and against any Losses arising out of or in relation to, its Participating Interest share of the costs and expenses arising out of providing and maintaining any Security Instrument required by the Contract to be provided to the Government, and which has not been provided to the Government by Farmor as of the Execution Date, including all costs and expenses arising out of such Security Instrument and any liability that may arise thereunder or in relation thereto.

ARTICLE 4 - TERMINATION

Section 4.1 Termination. This Agreement may be terminated at any time prior to the Closing Date (as pertains to (b), (c), (d) and (e) below) and at any time prior to or after the Closing Date (as pertains to (a) and (f) below):

(a) by mutual written consent of Farmee and Farmor;

(b) by either Farmee or Farmor, if the Closing Date does not occur on or prior to May 31, 2017 or if either of the Parties receives final, unappealable written notice from the Government that it will not give the Governmental Approval;

(c) by Farmor, if on or prior to the Trigger Date (i) the representations and warranties of Farmee made in this Agreement are not correct or would not be correct as of the Trigger Date as though made as of such time or (ii) Farmee shall not have performed or complied with all obligations and covenants required by this Agreement to be performed or complied with by Farmee by the Trigger Date;

(d) by Farmee, if on or prior to the Trigger Date (i) the representations and warranties of Farmor made in this Agreement are not correct or would not be correct as of the Trigger Date as though made as of such time; or (ii) Farmor shall not have performed or complied with all obligations and covenants required by this Agreement to be performed or complied with by Farmor by the Trigger Date; or (iii) any Material Development occurs;

(e) by Farmee, if Farmor does not deliver a Closing Notice within five days following the Trigger Date; or

(f) by Farmor, pursuant to Section 13.2,

provided, however, that the Party seeking termination pursuant to Section 4.1(c) or Section 4.1(d), as applicable, is not in breach of any of its representations, warranties, covenants or agreements contained in this Agreement. In the event of termination by Farmee or Farmor pursuant to Section 4.1(b), Section 4.1(c), Section 4.1(d), Section 4.1(e), or Section 4.1(f), as applicable, this Agreement shall be terminated upon written notice by the terminating Party to the other Party, without further action by either Party required in order to terminate this Agreement.

Section 4.2 Return of Information. If this Agreement is terminated as provided in Section 4.1, Farmee shall, within 10 days following such termination: (a) return to Farmor all information, documents and other material received from Farmor, relating to the transactions contemplated hereby, and all information, documents and other materials relating to Joint Operations, whether obtained before or after the Execution Date, and Farmee shall remain subject to the confidentiality provisions of Article 10 in relation to such information, documents and materials; (b) deliver to Farmor any data and/or the derivatives obtained therefrom as part of

the Joint Operations; and (c) grant to Farmor a royalty-free, perpetual license to use such data and/or derivatives.

Section 4.3 Effect of Termination.

(a) If this Agreement is terminated as provided in Section 4.1, this Agreement, and any rights conveyed to Farmee under the Assignment, shall become void and of no further force or effect, except for the provisions of Sections 4.2, 4.3, 8.1 and 9.4 and Articles 10, 12 and 14, which shall survive such termination. Such termination shall not affect the rights and obligations of Farmor or Farmee which have accrued or become due prior to the date of termination.

(b) Upon the termination of this Agreement, Farmee shall promptly reassign to Farmor any rights conveyed to Farmee under the Assignment free and clear of any Encumbrances arising by, through, or under Farmee, and Farmee shall execute such other documents and take such other actions as may be necessary to reassign the Farmee Interest to Farmor, including any related to obtaining approvals or consents of the Government.

ARTICLE 5 - OBLIGATION WELL

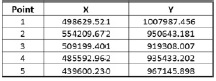

Section 5.1 Obligation Well Location. Farmor and Farmee have agreed on Latitude: 8 deg, 37 min, 30.552829 sec N, Longitude: 14 deg, 54 min, 6.95248 sec W, X Coordinate: 510790 m, Y Coordinate: 953412 m as the bottom-hole location of the Obligation Well, after review of the location proposed by Farmor. The bottom-hole location of the Obligation Well shall not be amended without the written consent of both Parties which consent shall not be unreasonably withheld, conditioned or delayed.

ARTICLE 6 - WARRANTIES

Section 6.1 Farmor’s Warranties. Farmor warrants to Farmee as follows:

(a) Organization, Authority. Farmor is registered, validly existing and in good standing under the laws of the Cayman Islands. Farmor has the corporate power and authority to own its property and to carry on its business as presently conducted, and to enter into and to comply with the terms of this Agreement. The execution, delivery, and performance of this Agreement (and all documents required to be executed and delivered by Farmor hereunder), and the consummation of the transactions contemplated hereby and thereby, have been duly authorized by all necessary corporate action on the part of Farmor. This Agreement has been duly executed and delivered by Farmor, and all documents required to be executed and delivered by Farmor hereunder shall be duly executed and delivered by Farmor. This Agreement and any other documents to which Farmor is a party, or is to become a party, pursuant to or in connection with this Agreement constitute legal, valid and binding

obligations of Farmor enforceable in accordance with their respective terms.

(b) No Conflicts. The execution, delivery, and performance of this Agreement (and all documents required to be executed and delivered by Farmor hereunder) by Farmor, the consummation of the transactions contemplated hereby and thereby and the compliance by Farmor with the terns hereof and thereof will not (i) violate any provision of the certificate of incorporation, memorandum and articles of association, bylaws or other governing documents of Farmor, (ii) result in a material default (with due notice or lapse of time or both) or the creation of any lien or encumbrance or give rise to any right of termination, cancellation, or acceleration under any material agreement to which Farmor is a party or by which it is bound, (iii) violate any judgment, order, ruling, or decree applicable to Farmor or, to Farmor’s knowledge, the Joint Operations, (iv) violate any Laws applicable to Farmor or to Farmor’s knowledge the Joint Operations (subject to obtaining any necessary approvals for the transfer of the Farmee Interest under applicable Laws of the Republic of Guinea), or (v) to Farmor’s knowledge, except as disclosed on Schedule 6.1(b), require any consent, approval, or waiver from any Person other than the Government.

(c) No Judgments, Lawsuits, Investigations. Except as disclosed on Schedule 6.1(i), there are no (i) outstanding judgments, orders, injunctions or decrees of any judicial, governmental or regulatory body or arbitral tribunal against or affecting Farmor in relation to the Contract or the Contract Area; (ii) lawsuits, actions or proceedings commenced, pending or, to the knowledge of Farmor, threatened in writing against Farmor in relation to the Contract or the Contract Area; or (iii) investigations by any Governmental Entity which have been commenced or are pending or threatened in writing against Farmor, in all cases which would prevent Farmor from performing its obligations under this Agreement and any other documents to which it is a party, or is to become a party, pursuant to or in connection with this Agreement.

(d) Contract.

(i) The Contract entered into force on 22 September 2006 and all rights and obligations thereunder commenced with effect from such date. There are no rights, obligations, duties or liabilities affecting the Participating Interest, the Contract Area or the Farmee Interest under or in respect of the UOC PSCs.

(ii) The Contract, and all rights and interests deriving from it, are in full force and effect, and neither Farmor nor any other Person has been or is in breach or default thereunder (or with the giving of notice or lapse of time or both, would be in breach or default).

Except as otherwise set forth in the Contract, or Schedule 6.1(d), or applicable Law, Farmor’s interest in the Contract and the Farmee Interest is held by Farmor free and clear of any Encumbrance, and there is not in effect any agreement or commitment to create the same; nor are there any other matters which would restrict Farmor’s ability to freely dispose of the Farmee Interest. Farmor is the sole legal and beneficial owner of the Farmee Interest and, following satisfaction of the conditions set out in Article 2, Farmor will have the right to transfer and assign full legal and beneficial ownership of the Farmee Interest to Farmee. The Contract is the only document of which Farmor is aware which governs the creation, existence and validity of the Farmee Interest and is the only agreement to which Farmor is a party relating to the Farmee Interest.

(e) Contract Obligations. Other than as disclosed on Schedules 6.1(d) or (e), all obligations and liabilities imposed by the Contract, including work obligations, have been duly fulfilled and discharged and, save for the Obligation Well, there is no outstanding work obligation to be fulfilled pursuant to the Contract in respect of the current, or any earlier, exploration period.

(f) Other Obligations. All parties to the Settlement and Release Agreement have complied in full with the terms thereof and such agreement is in full force and effect. Save as expressly provided in the Settlement and Release Agreement, (i) Farmor has no obligations to any of the other parties thereto, and (ii) none of the parties thereto (other than Farmor) have any rights, interests or entitlements in respect of the Contract, the Participating Interest or the Contract Area. The Offshore Drilling Contract is in full force and effect and each party is in compliance with their material obligations in respect thereof, other than as disclosed on Schedule 6.1(f). All conditions precedent to the Commencement Date (as such term is defined therein) have been satisfied and discharged, other than as disclosed on Schedule 6.1(f).

(g) No Surrender, Relinquishment or Withdrawal. No part of the Contract Area is in the process of being surrendered or relinquished. Farmor has not given any notice of withdrawal in connection with the Contract. Other than as disclosed on Schedule 6.1(g), there are no obligations to relinquish or surrender the Contract Area (or any part thereof) and all previous relinquishments or surrenders of the Contract Area (or any part thereof) have been pursuant to the terms of the Contract and applicable Laws.

(h) Force Majeure. There are no events of force majeure being claimed under the Contract.

(i) Litigation. Other than as disclosed on Schedule 6.1(i), there are no actions, suits, arbitrations, mediations, investigations or similar proceedings pending, or to Farmor’s knowledge, threatened, with respect to the Joint Operations, the Contract, or the environmental condition of the Contract Area, nor are there any presently outstanding judgments, decrees, injunctions, orders or awards specifically affecting the Joint Operations, the Contract, or the environmental condition of the Contract Area, nor are there any investigation by any Governmental Entity which have been commenced or are pending or threatened in writing against Farmor, which would prevent Farmor from performing its obligation under this Agreement or any other document to which it is a party, or is to become a party, pursuant to this Agreement.

(j) Judgments. Except as disclosed on Schedule 6.1(i), there has been no judgment or award given or issued by any Governmental Entity which relates to Farmor or the Contract which would materially affect the rights and obligations to be assigned by Farmor to Farmee.

(k) Compliance with Laws. Farmor has conducted operations in substantial compliance with all applicable Laws, to the extent not in conflict with the Laws of the United States of America or subject to penalty under such Laws.

(l) Consents, Approvals, Etc. All licences, permissions, consents, approvals and agreements required for the conduct of the operations under the Contract by Farmor have been obtained and complied with and are in full force and effect and Farmor is not aware of any circumstances indicating that any licences, permissions, consents, approvals or agreements obtained by for the conduct of operations under the Contract by Farmor are likely to be revoked or not renewed in the ordinary course, or which may prevent or delay materially the obtaining of any further licences, permissions, consents, approvals or agreements which are necessary for any part of the operations under the Contract by Farmor. The Contract and each amendment thereto has been duly executed, approved and entered into full force in accordance with all applicable Laws and the terms of the Contract.

(m) Operations under the Contract. The Farmee Interest has been owned and operated in accordance with good oilfield practice and in compliance in all material respects with all applicable Laws including any laws, international treaties, national, federal, provincial, state or local statutes, the common law, and any codes of law applicable to the Farmee Interest; and Farmor has received no written notice that its ownership and operation of the Farmee Interest violates in any material respects any applicable Laws. Other than as disclosed on Schedule 6.1(i), Farmor has not received or given any notice of termination of the Contract and, to Farmor’s knowledge, no event or circumstance exists that, with notice of

the lapse of time or both, would constitute a breach thereof or a default thereunder or would result in a termination, modification, acceleration or vesting of any rights or obligations or loss of benefits thereunder.

(n) Work Programs and Budgets.

(i) Farmor has disclosed to Farmee copies of the current Work Programs and Budget in respect of the Contract Area and all correspondence with the Government that relate thereto.

(ii) Farmor has disclosed to Farmee copies of minutes of all meetings of the Oil and Gas Operations Management Committee for the past two (2) years.

(o) Health and Safety. Farmor is not aware of and has not been notified of the occurrence of any material health or safety incident concerning the Contract and the operations related thereto.

(p) Environmental Laws.

(i) Farmor has not received any notices, orders or directives under any Environmental Laws or laws relating to health and safety which require any work, repairs, construction or capital expenditures in connection with the Contract or the operations related thereto which have not been fully complied with.

(ii) To Farmor’s knowledge, no event or incident has occurred in respect of the Participating Interests, the Contract Area or the Farmee Interest which has given rise or would be expected to rise to any Environmental Liabilities.

(iii) To Farmor’s knowledge, there has been no infringement or alleged infringement (in writing received by Farmor) of any Environmental Laws during any Petroleum Operations conducted in relation to the Participating Interests or the Farmee Interest.

(iv) Farmor has not received, and is not aware of, any notice of any lawsuit or formal administrative proceeding issued before or by any Governmental Entity or any other public organisation the subject matter of which is an infringement or breach of Environmental Law relating to the Participating Interests or the Contract Area (or any part thereof).

(q) Insurance. Except as disclosed on Schedule 6.1(q), the insurance policies of Farmor are in full force and effect and all premia have been paid to date. No claim has been made under the insurance policies of Farmor which is still pending at the date of this Agreement and, to the knowledge of Farmor, there are no circumstances likely to give rise to any such claim

(r) Bonds, Letters of Credit or Guarantees. Except as set forth on Schedule 6.1(r), Farmor has no bonds, letters of credit or guarantees posted with the Government with respect to the Contract, and any bond, letter of credit or guarantee or similar instrument required by the Contract to be posted with the Government as of the Execution Date has been posted.

(s) Broker’s Fees. Farmor has not incurred any liability, contingent or otherwise, for broker’s or finder’s fees or commissions relating to this Agreement for which Farmee shall have responsibility.

(t) Material Data, Documents and Information. To the knowledge of Farmor, Farmor is in possession or has access to all data and information relating to the Farmee Interest to which it is entitled under the terms of the Contract. Farmor has made available for review by Farmee all data, contracts, agreements, documents and information which it believes are material to the Contract, the Farmee Interest, or the transactions contemplated by this Agreement; provided, however, that Farmor makes no representation and warranty in relation to the accuracy or completeness of any interpretation or translation into, or from, the English language. All information and documents relating to the Farmee Interest disclosed or supplied by Farmor or to Farmee during or with a view to the negotiations leading up to this Agreement are, to Farmor’s knowledge, true and accurate in all material respects, and, to Farmor’s knowledge, there is no fact not disclosed which would render any such information or document inaccurate or misleading in any material respect or which, if disclosed, might reasonably affect the willingness of a third party acting reasonably to acquire the Farmee Interest on the terms of this Agreement or otherwise on the terms specified in this Agreement.

(u) True and Correct. The copy of the Contract provided to Farmee by Farmor is a true and correct copy of the original Contract; provided, however, that Farmor makes no representation and warranty in relation to the accuracy or completeness of any interpretation or translation into, or from, the English language.

(v) Cost Recovery Pool. Farmor has submitted, in accordance with the relevant provisions of Contract and Laws, at least One Hundred Sixty-Five Million U.S. Dollars (U.S. $165,000,000) of Petroleum Costs (as such term is defined in the Contract) for cost recovery under the Contract, and has not received any notices, or other indication, from the Government that any of such costs are not cost-recoverable under the Contract.

(w) Bankruptcy.

(i) As at the Closing Date, Farmor is not subject to any actual or threatened insolvency proceedings, is able to pay its debts as they

are due, is not bankrupt and has not stopped paying its material debts as and when they fall due.

(ii) No order has been made and no resolution has been passed for the winding up, dissolution or administration of Farmor or for a receiver, administrator, trustee in bankruptcy liquidator or similar office to be appointed in respect of it or any of its assets and no petition has been presented and no meeting has been convened for the purposes of any of the foregoing in relation to Farmor.

(iii) No event analogous to any of the events specified in (i) and (ii) above has occurred in respect of Farmor in any jurisdiction.

(x) Compliance.

(i) Farmor has conducted its business and corporate affairs in accordance with its memorandum and articles of association, by-laws or other equivalent documents and in all material respects in accordance with all applicable Laws. Farmor is not in default of any statute, regulation, order, decree or judgment of any court of any other Governmental Entity in any applicable jurisdiction.

(ii) Farmor has not received any notice or other communication (official or otherwise) from any court, tribunal, arbitrator, administrative authority, regulatory authority or Governmental Entity:

(1) with respect to an alleged actual or potential violation and/or any failure to comply with any applicable Laws or any applicable administrative or regulatory practice or guidance of any Governmental Entity in any applicable jurisdiction; or

(2) except as disclosed on Schedules 6.1(d) or 6.1(x), requiring it to take or omit any action which has had or may have a material adverse effect upon the Petroleum Operations or the Contract.

(iii) Farmor has:

(1) procedures in place designed to prevent it or any of its Affiliates (or any of their respective officers, representatives or employees) from violating applicable Anti-Corruption Legislation; and

(2) kept accurate records of its activities, including financial records in a form and manner appropriate for a business of its size and resources.

(y) Exports. Farmor is not prohibited by the Laws of the USA from, and has obtained any licenses required thereby for: (i) exporting from the USA (or any other country) items to be utilized in Joint Operations, (ii) receiving exports of items to be utilized in Joint Operations and (iii) receiving exports of U.S. goods or technology to be utilized in Joint Operations.

(z) Sanctions. Farmor is not subject to economic, financial, trade or other sanctions or restrictions imposed by the Laws or treaties or conventions of the USA or its Home Country Governmental Authority or by treaties or conventions of the United Nations.

Section 6.2 Farmee’s Warranties. Farmee warrants to Farmor as follows:

(a) Organization, Authority. Farmee is registered, validly existing and in good standing under the laws of the Federal Republic of Nigeria. Farmee has the corporate power and authority to own its property and to carry on its business as presently conducted, and to enter into and to comply with the terms of this Agreement. The execution, delivery, and performance of this Agreement (and all documents required to be executed and delivered by Farmee hereunder), and the consummation of the transactions contemplated hereby and thereby, have been duly authorized by all necessary corporate action on the part of Farmee. This Agreement has been duly executed and delivered by Farmee, and all documents required to be executed and delivered by Farmee hereunder shall be duly executed and delivered by Farmee. This Agreement and any other document to which Farmee is a party, or is to become a party, pursuant to or in connection with this Agreement constitute legal, valid and binding obligations of Farmee enforceable in accordance with their respective terms.

(b) No Conflicts. The execution, delivery, and performance of this Agreement (and all documents required to be executed and delivered by Farmee hereunder) by Farmee, the consummation of the transactions contemplated hereby and thereby and the compliance by Farmee with the terms hereof and thereof will not (i) violate any provision of the certificate of incorporation, memorandum and articles of association, bylaws or other governing documents of Farmee, (ii) result in a material default (with due notice or lapse of time or both) or the creation of any lien or encumbrance or give rise to any right of termination, cancellation, or acceleration under any material agreement to which Farmee is a party or by which it is bound, (iii) to Farmee’s knowledge, violate any judgment, order, ruling, or decree applicable to Farmee, (iv) to Farmee’s knowledge, violate any Laws applicable to Farmee, or (v) to Farmee’s knowledge, except as disclosed on Schedule 6.2(b) require any consent, approval, or waiver from any Person other than the Government.

(c) Litigation. Except as disclosed on Schedule 6.2(c). there are no actions, suits, arbitrations, mediations, investigations or similar proceedings pending, or to Farmee’s knowledge, threatened, before any Governmental Entity with respect to Farmee, nor are there any presently outstanding judgments, decrees, injunctions, orders or awards applicable to Farmee, in each case that could adversely affect the ability of Farmee to consummate the transactions contemplated hereby or the obligations attributable to the Farmee Interest under the Contract.

(d) Availability of Funds. Farmee has cash available or has existing borrowing facilities or other sources of immediately available funds which together are sufficient to enable it to consummate the transactions contemplated herein and the obligations attributable to the Farmee Interest under the Contract and this Agreement.

(e) Technical Capability. Farmee has the technical capability, personnel, and resources to fulfill its obligations under this Agreement and the obligations attributable to the Farmee Interest under the Contract.

(f) Investment. Farmee is familiar with investments of the nature of the Farmee Interest and the Joint Operations and is capable of evaluating, and has evaluated, the merits and risks inherent in acquiring the Farmee Interest.

(g) Guinean Law. Farmee has retained advisors who are familiar with the Laws of the Republic of Guinea that are relevant to oil and gas operations, and with the Contract and the Joint Operating Agreement.

(h) No Knowledge of Farmor’s Breach. Farmee has no knowledge of any undisclosed breach of Farmor’s representations and warranties hereunder.

(i) Broker’s Fees. Farmee has incurred no liability, contingent or otherwise, for broker’s or finder’s fees or commissions relating to this Agreement for which Farmor shall have responsibility.

(j) Bankruptcy.

(i) Farmee is not subject to any actual or threatened insolvency proceedings, is able to pay its debts as they are due, is not bankrupt and has not stopped paying its material debts as and when they fall due.

(ii) No order has been made and no resolution has been passed for the winding up, dissolution or administration of Farmee or for a receiver, administrator, trustee, liquidator or similar officer to be appointed in respect of it or any of the assets and no petition has been presented and no meeting has been convened for the purposes of any of the foregoing in relation to Farmee.

(iii) No event analogous to any of the events specified in (i) and (ii) above has occurred in respect of Farmee in any jurisdiction.

(k) Exports. Farmee is not prohibited by the Laws of the USA from, and has obtained any licenses required thereby for: (i) exporting from the USA (or any other country) items to be utilized in Joint Operations, (ii) receiving exports of items to be utilized in Joint Operations and (iii) receiving exports of U.S. goods or technology to be utilized in Joint Operations.

(l) Sanctions. Farmee is not subject to economic, financial, trade or other sanctions or restrictions imposed by the Laws or treaties or conventions of the USA or its Home Country Governmental Authority or by treaties or conventions of the United Nations.

Section 6.3 Warranties Regarding Anti-Corruption.

(a) Without prejudice to Section 7.4, each Party, in recognition of the OECD Principles warrants that it and its Affiliates have not knowingly, either directly or indirectly, paid, made, offered, given, promised, or authorized and will not knowingly pay, make, offer, give, promise or authorize, in connection with this Agreement, the Contract or the operations associated therewith, commission, money, payment, gift (other than promotional and marketing gifts of nominal value), loan, fee, reward, travel, entertainment, transfer anything of value or any other advantage, to or for the use or benefit of any Official or Commercial Agent for the purposes of:

(i) influencing any act, omission or decision on the part of any such Official or Commercial Agent, in his or her official capacity;

(ii) securing any improper advantage from such Official or Commercial Agent; or

(iii) inducing any such Official or Commercial Agent to use his or her influence with another Official or Governmental Authority (or with his employer or company) to affect or influence any official act or to direct business to any Person, or to obtain or retain business related to this Agreement and/or the Contract;

where such bribe, commission, money, payment, gift (other than promotional and marketing gifts of nominal value), loan, fee, reward, travel, entertainment, transfer of anything of value or any other advantage, would violate the Anti-Corruption Legislation (each a “Corrupt Act”).

(b) Each Party warrants that it and its Affiliates:

(i) have not accepted or agreed to receive; and

(ii) will not accept or agree to receive,

with respect to any of the matters which are the subject of this Agreement, the Contract or the operations associated therewith, any financial or other advantage, whether directly or indirectly, from an Official or Commercial Agent, as an inducement or reward for taking or omitting to take any action, in any case where such payment, gift, promise or advantage would violate any Anti-Corruption Legislation.

(c) Each Party warrants that it and its Affiliates have not either directly or indirectly paid, made, offered, given, promised or authorized, and will not pay, make, offer, give, promise or authorize, in connection with this Agreement, the Contract (including as regards Farmee obtaining an interest in the Contract), or the operations associated therewith, to or for the use or benefit of any other Person, any bribe, commissions, money, payment, gift (other than promotional and marketing gifts of nominal value), loan, fee, reward, travel, entertainment, anything of value or any other advantage, if the Party or Affiliate knows, has a firm belief or is aware that there is a high probability that the other Person would use the bribe, commissions, money, payment, gift (other than promotional and marketing gifts of nominal value), loan, fee, reward, travel, entertainment, or anything of value or any other advantage for any of the purposes prohibited by Section 6.3 or Section 7.4.

(d) Each Party warrants that it and its Affiliates have not either directly or indirectly taken or authorized, and will not take or authorize, any act in connection with this Agreement, or the Contract or the operations associated therewith that could give rise to either civil or criminal liability for any Party under any Anti-Corruption Legislation applicable to such Party.

(e) Farmor warrants to Farmee that it, in the exercise of its rights under the Contract (including without limitation obtaining the award of such Contract and all activities relating to the Contract Area):

(i) has properly recorded all material transactions;

(ii) has in place and, since 1 May 2012, has implemented internal controls which would be seen as adequate procedures in respect of the Anti-Corruption Legislation (as amended from time to time);

(f) Each Party agrees and confirms that it will, in connection with all activities pursuant to this Agreement, the Contract and the Contract Area:

(i) properly record all material transactions; and

(ii) have in place and implement internal controls in order to comply with any anti-corruption Laws and which would be seen as adequate procedures in respect of s7(2) of the UK’s Bribery Act 2010 (as amended from time to time).

(g) Each Party agrees and confirms that it will:

(i) provide any such information as the other Party may reasonably require by notice in writing in order to monitor compliance with obligations under this Section 6.3; and

(ii) notify the other Party immediately in writing if, at any time, it becomes aware that any of the warranties set out in this clause is no longer correct.

(h) Each of the Parties agrees to indemnify and hold the other Party harmless for any claims, causes of action or liabilities which arise out of the breach by a Party of any of its warranties under this Section 6.3.

Section 6.4 Disclaimer. Except as expressly set forth in this Agreement, neither Party makes any representation or warranty, express or implied. WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, EXCEPT AS EXPRESSLY REPRESENTED OTHERWISE IN THIS AGREEMENT, THE FARMOR EXPRESSLY DISCLAIMS ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, AS TO (A) THE CONTENTS, CHARACTER, OR NATURE OF ANY DESCRIPTIVE MEMORANDUM, OR ANY REPORT OF ANY PETROLEUM ENGINEERING CONSULTANT, OR ANY GEOLOGICAL OR SEISMIC DATA OR INTERPRETATION, RELATING TO THE CONTRACT OR THE JOINT OPERATIONS, (B) THE QUANTITY, QUALITY, OR RECOVERABILITY OF HYDROCARBONS IN OR FROM THE CONTRACT AREA, (C) ANY ESTIMATES OF THE VALUE OF THE CONTRACT, RESERVES CONTAINED IN THE CONTRACT AREA OR FUTURE REVENUES GENERATED BY THE CONTRACT, (D) THE MAINTENANCE, REPAIR, CONDITION, QUALITY, SUITABILITY, DESIGN, OR MARKETABILITY OF THE JOINT ACCOUNT ASSETS, (E) THE ENVIRONMENTAL CONDITION OF THE CONTRACT AREA, THE JOINT OPERATIONS AND THE JOINT ACCOUNT ASSETS, (F) ANY ENVIRONMENTAL, ABANDONMENT OR DECOMMISSIONING OBLIGATIONS OR LIABILITIES IN RELATION TO THE CONTRACT OR CONTRACT AREA (INCLUDING ANY ABANDONMENT OR DECOMMISSIONING OBLIGATIONS IN RESPECT OF WELLS, PLATFORMS, RIGS OR PIPELINES), (G) THE ABILITY TO OBTAIN GOVERNMENTAL APPROVAL, (H) THE LAWS OF THE REPUBLIC OF GUINEA, OR (I) ANY OTHER MATERIALS OR INFORMATION THAT MAY HAVE BEEN MADE AVAILABLE OR COMMUNICATED TO FARMEE OR ITS AFFILIATES, OR ITS OR THEIR REPRESENTATIVES IN CONNECTION WITH THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT OR ANY DISCUSSION OR REPRESENTATION RELATING THERETO. THERE ARE NO IMPLIED REPRESENTATIONS OR WARRANTIES. FARMEE HAS MADE OR CAUSED TO BE MADE SUCH INSPECTIONS AND INVESTIGATIONS AS FARMEE DEEMS APPROPRIATE.

Section 6.5 Effectiveness of Warranties. Unless otherwise specifically stated within a warranty, all warranties given under this Article 6 shall be made as of the Execution Date and deemed repeated and valid, true and correct as of the Closing Date, and each Party agrees to

inform the other Party of any material changes to the facts in its warranties prior to the Closing Date.

Section 6.6 Knowledge. Where a warranty is qualified by the expression “to Farmor’s knowledge” or “to Farmee’s knowledge”, or any similar expression, the Party giving the warranty acknowledges that it has warranted to the other Party after due enquiry by the following individuals: (a) with respect to Farmor: Ray Leonard, President/CEO, Sergey Alekseev, Vice-President, Commercial Development and Forrest Estep, Vice-President, Operations, only; and (b) with respect to Farmee: Dale Rollins, Managing Director, only and that the Party giving the warranty has used all reasonable endeavors to ensure that the statement contained in that warranty is accurate. Except as set forth in the previous sentence, “knowledge” does not include knowledge or awareness of any other individual, or constructive or imputed knowledge.

ARTICLE 7 - CERTAIN COVENANTS OF THE PARTIES

Section 7.1 Covenants of Farmor.

(a) Access to Information. Subject to Section 8.1 and applicable Laws, upon reasonable notice to Farmor, Farmor shall allow Farmee reasonable access, during normal business hours in the Interim Period (unless this Agreement is otherwise terminated), to its properties, books, contracts and records as well as to its management personnel, in each case to the extent relating to the Joint Operations; provided, however, that (i) such access shall be provided on a basis that minimizes the disruption to the operations of Farmor, and (ii) Farmor shall have no obligation to disclose or provide access to any information the disclosure of which Farmor has concluded would be in violation of a confidentiality obligation binding on Farmor. Subject to Section 8.1 and the confidentiality provisions of the Joint Operating Agreement, to the extent permitted by the Contract, from the Execution Date until the Closing Date (unless this Agreement is otherwise terminated), Farmor shall provide to Farmee copies of the information that is required to be distributed by the operator to non-operators under the Joint Operating Agreement.

(b) Certain Events. During the Interim Period (unless this Agreement is otherwise terminated), Farmor shall promptly notify Farmee of and furnish Farmee with any information with respect to the occurrence of any event or condition known to Farmor that could reasonably be expected to (i) cause any of the conditions set forth in Section 2.1 not to be satisfied, or (ii) have a Material Adverse Effect. If Farmor discovers the existence of a breach by Farmee of the representations, warranties, obligations or covenants contained in this Agreement (or the existence of any matter that would have been such a breach had it been in existence as the date hereof), then Farmor shall notify Farmee in writing of such information within five days after such discovery or the day prior to the Closing Date, whichever is earlier.

(c) Conduct of Joint Operations. During the Interim Period, Farmor shall:

(i) conduct Petroleum Operations in accordance and substantial compliance with the Contract, the Joint Operating Agreement, and all applicable Laws, in the normal course of business, and in accordance with good international petroleum industry practice and in substantially the same manner as the Petroleum Operations have been carried on before the Execution Date;

(ii) maintain and renew all governmental licences, permits, authorisations, consents and permissions necessary to own and operate the Participating Interests;

(iii) except as set forth on Schedule 7.1(c), not (by act or omission) breach any of the provisions of:

(1) the Contract;

(2) the MSA;

(3) the Offshore Drilling Contract; and/or

(4) the Settlement and Release Agreement;

and Farmor shall notify Farmee in a timely manner of any facts or circumstances of which it is aware which indicate that there has been such a material breach by any other party or that such a material breach by Farmor has occurred;

(iv) comply in all material respects with applicable Laws;

(v) ensure that all insurance policies in place as at the date of this Agreement in relation to the Contract remain in full force and effect and that all premiums for such insurance policies are paid in full;

(vi) not, without the prior written consent of Farmee:

(1) trade, relinquish, surrender, sell, lease or assign the Farmee Interest or create or permit to subsist any Encumbrance over the Farmee Interest;

(2) terminate, amend, or permit any termination or amendment of, the Contract (other than any amendment expressly referred to in this Agreement);

(3) withdraw from any portion of the Contract;

(4) do or omit to do anything that would constitute a waiver of any of Contractor’s rights under the Contract;

(5) approve any voluntary relinquishment or surrender of any part of the area covered by the Contract;

(6) other than as contained in the Work Program and Budget, approve any work program, budget, expenditure or capital commitment relating to the Farmee Interest involving expenditure in excess of Five Hundred Thousand U.S. Dollars (U.S. $500,000);

(7) enter into or become a party to or amend any exploration or exploitation authorisations, licences, operating agreements, unitisation agreements, transportation agreements, supply agreements, cooperation agreements, area of mutual interest agreements or any agreement or undertaking in relation to the Farmee Interest;

(8) amend the bottom-hole location of the Obligation Well; or

(9) incur any Obligation Well Costs which would result in the total Obligation Well Costs described in the Work Program and Budget being in excess of Fifty Million Six Hundred Thousand U.S. Dollars (U.S. $50,600,000);

(vii) consult with Farmee in advance in relation to any material decision in connection with the Farmee Interest and, to the extent lawful, take account of Farmee’s reasonable suggestions;

(viii) obtain the prior written approval of Farmee prior to submitting any proposal in respect of any mandatory relinquishment of the area covered by the Contract;

(ix) subject to any obligations of confidentiality, make available or allow Farmee access to all information, data or other material relating to the Farmee Interest of which the Farmor becomes aware or reasonably requested by the Farmee from time to time;

(x) cooperate with Farmee so as to ensure an efficient handover of the Farmee Interest on the Closing Date; and

(xi) use its reasonable endeavours to enable Farmee to attend, as an observer, any meetings of the relevant operating or other committee established under the Contract.

(d) No Restriction. Nothing in this Section 7.1 is intended to:

(i) restrict Farmor’s ability to do such things as it may consider necessary (acting reasonably):

(1) to preserve all rights and interests under the Contract; or

(2) due to emergency operational requirements; or

(ii) impose any obligation that may be inconsistent with the obligations under the Contract or applicable Laws,

provided that Farmor shall notify Farmee of any action required to be taken in accordance with Section 7.1(d) or, where not feasible to do so, promptly thereafter.

Section 7.2 Covenants of Farmee.

(a) Approvals. If and to the extent requested by Farmor, Farmee shall cooperate with Farmor in connection with Farmor’s obligations under Section 1.3 and Section 1.4 and in connection with Section 4.3(b), and shall participate in discussions with the Government relating thereto. If and to the extent requested by Farmor, Farmee shall provide such evidence of its financial, administrative and technical capability as may reasonably be necessary in connection with Farmor’s obligations under Section 1.3 and Section 1.4.

(b) Certain Events. From the Execution Date until the Closing Date (unless this Agreement is otherwise terminated), Farmee shall promptly notify Farmor of and furnish Farmor with any information with respect to the occurrence of any event or condition known to Farmee that could reasonably be expected to cause any of the conditions set forth in Section 2.1 not to be satisfied. If Farmee discovers the existence of a breach by Farmor of the representations, warranties, obligations or covenants contained in this Agreement (or the existence of any matter that would have been such a breach had it been in existence on the date hereof), then Farmee shall notify Farmor in writing of such information within five days after such discovery or the day prior to the Closing Date, whichever is earlier.

(c) Government Contact. Farmee shall not contact the Government in relation to this Agreement or the Contract without Farmor’s prior consent.

Section 7.3 Mutual Covenants.

(a) Obligation Well Commencement Date. Farmor and Farmee shall each use commercially reasonable efforts (i) to cause operations in anticipation of drilling of the Obligation Well to commence on a date that would allow the drilling rig to commence actual drilling operations on or before May 31, 2017, and (ii) thereafter to cause the Obligation Well to be drilled

to the Objective Depth with diligence and reasonable dispatch, and without unnecessary delay.

(b) Conduct. On and from Closing Date, Farmor and Farmee shall each be subject to and comply with the terms and provisions of the Joint Operating Agreement and the Contract.

(c) Warranties. The Parties shall not take any action nor fail to take any action prior to the Closing Date that would result in a breach of any of its warranties under this Agreement.

(d) Commercially Reasonable Efforts; Further Assurances. Upon the terms and subject to the conditions hereof, each of the Parties shall use its commercially reasonable efforts to take, or cause to be taken, all appropriate action, and to do or cause to be done, all things necessary, proper or advisable under applicable Laws to consummate and make effective the transactions and actions contemplated by this Agreement. Without limiting the foregoing, but subject to the other terms of this Agreement, the Parties agree that, from time to time, whether before, at or after the Closing Date, each of them will execute and deliver, or cause to be executed and delivered, such instruments of assignment, assumption, transfer, conveyance, endorsement, direction or authorization as may be necessary to consummate and make effective the transactions and actions contemplated by this Agreement.

(e) Sanctions; Export Administration. Neither Farmor nor Farmee shall take any action in relation to this Agreement, the Contract, the Joint Operating Agreement or Joint Operations that would cause it (or would be likely to cause it) to violate (i) any economic, financial, trade or other sanctions or restrictions imposed by the Laws or treaties or conventions of the USA or its Home Country Governmental Authority or by treaties or conventions of the United Nations or (ii) any export administration Laws of the USA.

Section 7.4 Mutual Covenants Regarding Anti-Corruption.

(a) Conduct of the Parties. No Party to this Agreement shall knowingly permit or allow, by act or omission, the paying, making, offering, promising, authorizing or causing to pay, make, offer, give, promise or authorize, either directly or indirectly, by it or any of its Affiliates, of any bribe, commission, money, payment, gift (other than promotional and marketing gifts of nominal value), loan, fee, reward, travel, entertainment, transfer of anything of value or any other advantage to or for the use or benefit of any Official of a nature and cost which is not permitted under the Anti-Corruption Legislation, in connection with this Agreement, the JOA, the Contract or the operations associated therewith.

(b) Internal Controls. In connection with this Agreement, the JOA and the Contract and the operations associated therewith, each Party shall (1) maintain adequate internal controls, including having in place a Code of Business Conduct and Ethics; (2) properly record and report all transactions and keep such books, accounts and records for a period of at least seven years following the period to which they relate; and (3) procure that its officers, directors, employees, agents and subcontractors comply with the Code of Business Conduct and Ethics (as amended from time to time) and provide adequate training to their officers, directors, employees, agents and subcontractors in respect of the Code of Business Conduct and Ethics; and (4) comply with the Anti-Corruption Legislation. Each Party shall be entitled to rely on the other Party’s system of internal controls and record keeping, and on the adequacy and full disclosure of the facts, transactions, and financial and other data regarding the Contract and/or the JOA and any other activity undertaken under this Agreement, the Contract and/or the JOA. No Party is in any way authorized to take any action on behalf of another Party that would result in an inadequate or inaccurate recording and reporting of assets, liabilities or any other transaction, or which would cause such Party to be in violation of its obligations under the Anti-Corruption Legislation or any other Laws applicable in connection with this Agreement, the Contract, the JOA or the operations associated therewith.

(c) Audit Rights. During the term of this Agreement and for a period of five (5) years thereafter, each Party shall in a timely manner:

(i) respond in reasonable detail as to itself and its Affiliates after reasonable inquiry and investigation to any notice or request from the other Party reasonably connected with the representations, warranties and covenants set forth in Section 6.3 and Section 7.4;

(ii) furnish relevant documentary support for such responses upon request from such other Party; and

(iii) in general, cooperate in good faith with such other Party in determining whether a breach of the representations and warranties has occurred.

(d) Whistle-Blowing. Each Party shall implement and maintain a process or policy in respect of whistle-blowing, the sharing of any allegations and investigating and acting on any reported violations as regards this Agreement, the Contract, the JOA and/or the operations associated therewith. This policy may be included as part of the Code of Business Conduct and Ethics referenced above.

ARTICLE 8 - EXPENSES, STAMP DUTIES AND TAXES

Section 8.1 Expenses. Whether or not the transactions contemplated hereby are consummated, and except as otherwise specifically provided in this Agreement, all costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby shall be paid by the Party incurring such costs or expenses.

Section 8.2 Duties, Taxes and Fees. All Taxes, duties, levies, and fees, if any, (other than Taxes which may be based upon the income, profits, revenues, gross receipts or capital gains of Farmor), payable to the Government in respect of the farm-in for and transfer of the Farmee Interest shall be paid by Farmee. Each Party shall use commercially reasonable efforts to avail itself of any available exemptions from any such Taxes, duties, levies, or fees, and to cooperate with the other Party in providing any information and documentation that may be necessary to obtain such exemptions. If the Government imposes joint and several liability on the Parties for any fees, levy, charge or Tax, the Parties agree to cross indemnify each other to the extent that such fees, levy, charge or Tax is owed by one Party individually.

ARTICLE 9 - RELATIONSHIP OF THE PARTIES