Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - HYPERDYNAMICS CORP | a11-26226_1ex31d2.htm |

| EX-32.1 - EX-32.1 - HYPERDYNAMICS CORP | a11-26226_1ex32d1.htm |

| EX-31.1 - EX-31.1 - HYPERDYNAMICS CORP | a11-26226_1ex31d1.htm |

| EX-32.2 - EX-32.2 - HYPERDYNAMICS CORP | a11-26226_1ex32d2.htm |

| EX-23.2 - EX-23.2 - HYPERDYNAMICS CORP | a11-26226_1ex23d2.htm |

| EX-23.1 - EX-23.1 - HYPERDYNAMICS CORP | a11-26226_1ex23d1.htm |

| EX-21.1 - EX-21.1 - HYPERDYNAMICS CORP | a11-26226_1ex21d1.htm |

| EX-3.1.5 - EX-3.1.5 - HYPERDYNAMICS CORP | a11-26226_1ex3d1d5.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2011

or

o TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-32490

HYPERDYNAMICS CORPORATION

(Exact name of registrant as specified in its charter)

|

DELAWARE |

|

87-0400335 |

|

(State or other jurisdiction |

|

(IRS Employer |

|

of incorporation or organization) |

|

Identification Number) |

12012 Wickchester Lane, #475

Houston, Texas 77079

(Address of principal executive offices, including zip code)

(713) 353-9400

(Issuer’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Stock, $0.001 par value |

|

NYSE |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act x Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained in herein, and will not be contained, to the best of the registrant’s knowledge , in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer o |

|

Accelerated filer x |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12-b-2 of the Exchange Act) o Yes x No

As of December 31, 2010, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $541,813,030 based on the closing sale price as reported on the NYSE Amex. We had 156,116,692 shares of common stock outstanding on September 9, 2011.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This Report contains “forward-looking statements” within the meaning of Section 27 A of the Securities Act of 1933, as amended, and Section 21 E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, future events or performance and underlying assumptions and other statements which are other than statements of historical facts. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “plan,” “project,” “anticipate,” “estimate,” “believe,” or “think.” Forward-looking statements involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. We assume no duty to update or revise our forward-looking statements based on changes in plans or expectations or otherwise.

As used herein, references to “Hyperdynamics,” “Company,” “we,” “us,” and “our” refer to Hyperdynamics Corporation and our subsidiaries.

We are an independent oil and gas exploration company founded in 1996 with large prospects in offshore Republic of Guinea (“Guinea”) in Northwest Africa. We are currently engaged in the development of our rights to a Concession offshore Guinea (approximately 9,650 square miles) (the “Concession”), of which we are the operator and hold a 77% working interest. Our participant, Dana Petroleum plc (“Dana”), which is a wholly-owned subsidiary of the Korean National Oil Corporation, holds the remaining 23% working interest in the Concession. We have conducted 2-dimensional (“2-D”) and 3-dimensional (“3-D”) seismic surveys of a portion of the Concession. We plan to drill our first well in 2011, and a second well shortly thereafter. A new deep water 3-D seismic survey will be conducted for us that is expected to begin before the end of 2011.

Offshore Guinea is a vast frontier which we believe is dramatically underexplored compared to other countries along the coast of West Africa. Our Guinea prospects are centered in a virgin basin among multiple highly prospective trends/plays, which we believe hold great resource potential. In addition, we have recently established an office in London to review new prospects to further diversify our asset base, which may include acquiring producing properties.

Our rights to the Concession derive from a Hydrocarbon Production Sharing Contract that we entered into in 2006 with Guinea and modified by amendment in March 2010 (the “PSC”). The PSC was approved by the government of Guinea through the issuance of a Presidential Decree in May 2010. We believe we have established good relations with the government of Guinea and its political leaders.

We intend to diversify away from holding only a large concentrated position in Guinea, though we expect exploration offshore Guinea will remain our core focus. We intend to retain a majority interest in our Guinea Concession, but we may bring in an additional industry participant by selling an interest provided that suitable contractual arrangements can be made and our value expectations are met. We would expect a sale of an interest to include both a payment for the interest and a commitment to fund a portion of our exploratory program in the Concession. We intend to source new opportunities in international resource exploration and to grow by exploring opportunities to acquire producing assets that generate regular cash flow and other prospective assets that we believe hold significant potential.

Our principal executive offices are located at 12012 Wickchester Lane, #475, Houston, Texas 77079, and our telephone number is (713) 353-9400.

OPERATIONS IN THE REPUBLIC OF GUINEA

Production Sharing Contract

We have been conducting exploration work related to the area off the coast of Guinea since 2002. On September 22, 2006, we, acting through our wholly owned subsidiary, SCS, entered into the PSC with Guinea. Under that agreement, we were granted certain exclusive contractual rights by Guinea to explore and exploit offshore oil and gas reserves, if any, off the coast of Guinea. We refer to the rights granted to us by Guinea as the “Concession” and to the offshore area subject to the Concession as the “Contract Area.”

2009 Memorandum of Understanding

On September 11, 2009, we entered into a Memorandum of Understanding (MOU) with Guinea in which we agreed with the government to resolve certain issues related to the PSC. The MOU required negotiation between the parties concerning the terms and conditions of the provisions in the PSC to ensure that such terms were consistent with the Guinea Petroleum Code and usually applicable international standards and practices.

Amendment No.1 to PSC

On March 25, 2010, we entered into Amendment No. 1 to the PSC (the “PSC Amendment”) with Guinea. The PSC Amendment was signed by the Guinean Minister of Mines and Geology, Mahmoud Thiam; the Guinean Minister of Finances and Economy, Kerfala Yansane, and Ray

Leonard, President and Chief Executive Officer of Hyperdynamics and SCS. The PSC Amendment was entered into pursuant to the MOU. The PSC Amendment provides that the parties to the MOU have fully complied with the terms of the MOU.

The PSC Amendment clarified that we retained a Contract Area of approximately 9,650 square miles, which is approximately equivalent to 30% of the original Contract Area under the PSC, following a December 31, 2009 relinquishment of approximately 70% of the original Contract Area. The PSC Amendment requires that we relinquish an additional 25% of the retained Contract Area by September 2013. Under the terms of the PSC Amendment, the first exploration period ended and we entered into the second exploration period on September 21, 2010. The second exploration period runs until September 2013, may be renewed to September 2016 and may be extended for one additional year to allow the completion of a well in process and for two additional years to allow the completion of the appraisal of any discovery made. Under the PSC Amendment, we are required to drill an exploration well, which is to be commenced by the year-end 2011, to a minimum depth of 2,500 meters below seabed and to drill an additional exploration well, which is to be commenced by the end of September 2016, to a minimum depth of 2,500 meters below seabed. The PSC Amendment requires the expenditure of $15 million on each of the exploration wells ($30 million in the aggregate). We were also required to acquire a minimum of 2,000 square kilometers of 3D seismic data by September 2013 with a minimum expenditure of $12 million, which we fulfilled in fiscal 2011 by the PGS 3D Seismic Contract described below. Fulfillment of work obligations exempts us from expenditure obligations, and exploration work in excess of minimum work obligations for each exploration period may be carried forward to the following exploration period.

Under the PSC Amendment, Guinea may participate in development of any discovery at a participating interest of up to 15% of costs being carried for its share. The cost of that carry is to be recovered out of 62.5% of Guinea’s share of cost and profit oil. The PSC Amendment removed the right of first refusal held by us covering the relinquished acreage under the original PSC. The PSC Amendment clarified that only those eligible expenditures, which were made following the date the PSC was signed, on September 22, 2006, are eligible for cost recovery. We are required to establish an annual training budget of $200,000 for the benefit of Guinea’s oil industry personnel, and we are also obliged to pay an annual surface tax of $2.00 per square kilometer on our retained Concession acreage. The PSC Amendment also provides that should the Guinea government note material differences between provisions of the PSC Amendment and international standards or the Petroleum Code, the parties will renegotiate the relevant articles.

Presidential Decree

In May 2010, the government of Guinea issued a Presidential Decree approving the PSC, as amended by the PSC Amendment (referred to as the “PSC”).

Assignment of Participating Interest

On December 4, 2009, we entered into a Sale and Purchase Agreement (“SPA”) with Dana for Dana to acquire a 23% participating interest in the PSC. On January 28, 2010, we closed on the transaction with Dana, and we entered into an Assignment of Participating Interest (the “Assignment”) with Dana, a Deed of Assignment and Joint Operating Agreement (“JOA”). Pursuant to the Assignment, we assigned to Dana an undivided 23% of our participating interest in the contractual interests, rights, obligations and duties under the PSC. As required by the PSC, the Deed of Assignment was delivered as the necessary notice of the Assignment to be given to the Guinean government.

As part of the obligation to bear the proportionate share of costs, the SPA required Dana to make a cash payment to us upon closing the Assignment to Dana in the amount of $ 1.7 million for Dana’s pro-rata portion of accrued expenditures associated with our marine 2D seismic data acquisition program within the Contract Area. The $1.7 million payment was received by us on February 4, 2010 and was recorded as a reduction in the carrying value of our Concession.

The JOA appoints us as the operator for purposes of conducting oil and gas exploration and production activities within the retained Contract Area. We share operating costs of joint operations with Dana in proportion to the parties’ respective participating interests (Hyperdynamics, 77% and Dana, 23%). An operating committee and voting procedures are established in the JOA whereby managerial and technical representatives of Hyperdynamics and Dana make decisions regarding joint operations, exploration and appraisal of commercial discoveries, and the disposition of commercial production. The JOA places restrictions upon the transfer of the parties’ respective participating interests in the form of a right of first purchase that is triggered by a proposed transfer or certain changes in control of us or Dana.

In May 2010, we received an administrative order from the Ministry of Mines and Geology of Guinea, referred to as an arrêté, confirming the Guinea government’s approval of the assignment of a 23% participating interest in the PSC to Dana. On May 20, 2010, we received a payment of $19.6 million in cash from Dana as payment for the assigned 23% participating interest in the contractual interests, rights, obligations and duties under the PSC. We have subsequently received payments from Dana for its proportionate share of costs.

PGS Geophysical AS, Norway

On June 11, 2010, we entered into an Agreement for the Supply of Marine Seismic Data (“3D Seismic Contract”) with PGS Geophysical AS, Norway (“PGS”). Under the terms of the 3D Seismic Contract, PGS agreed to conduct the acquisition phase of a 3,635 square kilometer 3D seismic survey of the area that is subject to our rights, or concession, to explore and exploit offshore oil and gas reserves off the coast of

Guinea. The intended purpose of the 3D seismic survey was to obtain detailed imaging of the multiple prospects which were identified from our prior 2D seismic data acquisition over the Concession.

Under the terms of the 3D Seismic Contract, PGS agreed to carry out the survey in two separate portions that commenced in August 2010. The 3D Seismic Contract was initially for $21.0 million, including mobilization and demobilization expenses. The acquisition work was completed in December 2010, with a final cost under the 3D Seismic Contract of approximately $24.7 million, including mobilization and demobilization expenses. Our share of the cost was 77% of that amount, or approximately $19.0 million.

PGS Americas, Inc.

We contracted with PGS Americas, Inc. to process the data from the 3D seismic acquisition surveys. The seismic data processing contract was for $2.5 million. The processing work was completed in June 2011. The processing costs incurred as of June 30, 2011 amount to approximately $3,489,000 with our 77% share being approximately $2,686,000 and is capitalized in unevaluated oil and gas properties.

AGR Peak Well Management Limited

We have contracted with AGR Peak Well Management Limited (“AGR”) to manage our exploration drilling project in offshore Republic of Guinea. AGR will handle well construction project management services, logistics, tendering and contracting for materials as well as overall management responsibilities for the drilling program. The drilling project management contract, entered into on November 30, 2010, was for an estimated $6.8 million, of which we expect our 77% share to be $5.2 million of that amount. The costs incurred as of June 30, 2011 amount to approximately $1,022,000 with our 77% share being approximately $787,000 and is capitalized in unevaluated oil and gas properties.

We have advanced to AGR approximately $10.7 million on a gross basis, or approximately $8.2 million for our current 77% interest, for them to purchase on our behalf long lead items such as wellhead and drilling pipe. These items will be delivered to us prior to our commencing drilling on this well, which is expected to commence in the fourth quarter of 2011. Our well management company, AGR, signed a drilling contract with Jasper Drilling Private Limited (“Jasper”) for the provision of the drill ship Jasper Explorer for drilling in our Guinea Concession. The Jasper Explorer is a modern Pelican Class self-propelled drill ship capable of operating in water depths up to 5,000 feet. Conditions to the drilling contract include satisfactory HSEQ Audits of the drill ship, acceptance of equipment, personnel, and the delivery of the drill ship ready to drill between October 1, 2011 and December 15, 2011. The duration of the contract is the time required to drill two “firm wells” offshore Guinea.

Exploration Strategies and Work to Date

Our business plan incorporates a multi-channel approach to exploring and developing our Contract Area under the PSC. We plan to continue to develop and evaluate drilling targets and complete technical work and planning with Dana to implement drilling in the fourth quarter of 2011. Additionally, on July 15, 2011, we issued an Invitation to Tender for a 3-D seismic survey covering approximately 4,000 square kilometers on our Contract Area. Acquisition of the new 3-D survey was approved by the Guinea project’s Petroleum Operations Management Committee during its recent semi-annual meeting in Conakry, Guinea. The new deep water survey will be adjacent to our Survey A, acquired as a part of our initial 3,635-square-kilometer 3-D seismic survey in 2010. The new deep water 3-D survey will allow us to study Upper Cretaceous submarine fan structures along the Transform Margin trend of Guinea in Northwest Africa. We reached a tender agreement with a Company in August 2011 and plan to finalize the related contract soon. We expect that the survey will begin before the end of 2011. The Petroleum Operations Management Committee also approved a revised budget of $95 million for 2011. The revised budget includes the previously approved drilling of two exploration wells planned for the fourth quarter, as well as the new seismic survey.

From the inception of our involvement in Guinea beginning in 2002, we, in conjunction with certain key vendors, have accomplished critical exploration work including:

· a 1,000 kilometer 2D seismic data shoot, the processing of the seismic data acquired, and the evaluation of that data and data that had been acquired in the past;

· a 4,000 kilometer 2D seismic data shoot, the processing of the seismic data acquired, and the evaluation of that data and data that had been acquired in the past;

· acquisition and geochemical analysis of core samples from the Contract Area and a satellite seeps study;

· third party interpretation and analysis of our seismic data, performed by Petroleum Geo Services (PGS);

· reconnaissance within Guinea to evaluate drilling infrastructure, support services, and the operating environment;

· a 2,800 kilometer 2D seismic data shoot, the processing of the seismic data acquired, and the evaluation of that data and data that had been acquired in the past;

· an oil seep study performed by TDI Brooks; and

· a 10,400 kilometer 2D seismic data shoot, the processing of the seismic data acquired, and the evaluation of that data.

· a 3,635 square kilometer 3-D seismic data shoot, the processing of the seismic data acquired, and the evaluation of that data.

· contracting AGR to manage our exploration drilling project to handle well construction project management services, logistics, and tendering of materials as well as overall management responsibilities for the drilling program to commence in the fourth quarter of 2011.

Political Climate and Social Responsibility in Guinea

We established in Guinea, SCS Corporation Guinea SARL (“SCSG”), as a wholly owned subsidiary of SCS. SCSG’s results are included in SCS. SCSG maintains a visible in-country presence and conducts public relations programs to educate the Guinea people and its government about the importance of their petroleum resources and our role in helping Guinea realize the benefits from exploiting these resources. As part of the public relations program, SCSG makes donations to projects which improve conditions in villages, to non-governmental organizations, to schools, and to religious organizations in order to support these efforts as well as to cultivate positive public sentiment towards Hyperdynamics in Guinea. Guinea is an emerging democracy, and it has unique social, political, and economic challenges. Public opinion strongly influences the political decision-making process. Therefore, our public relations and social programs support a strategy to maintain a corporate image for us in Guinea.

DESCRIPTION OF OIL AND GAS PROPERTIES

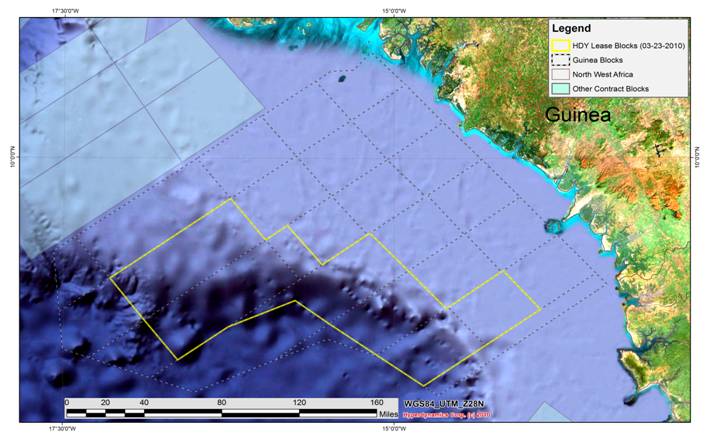

The Contract Area for the Concession is represented on the below map and consists of an area of approximately 9,650 square miles.

Sale of Oil and Gas Properties in 2009

In April 2009, we entered into a transaction to sell our oil and gas operations located in the United States, which consisted of working interests in several oil and gas properties in Northeast Louisiana. Due to the structure of the agreement, the transaction was accounted for as three separate sales. The first two sales were completed in May 2009, and included the sale of all of our working interests associated with proved

reserves. The third sale was completed in August 2009. We accounted for this as a discontinued operation. As a result of the sale of our oil and gas operations in the United States, at June 30, 2010 and 2011, we did not have, nor do we currently have, any proved reserves or producing properties or source of operating revenue and there is no assurance of when we will, if ever.

Reserves Reported To Other Agencies

We have not reported any estimates of proved or probable net oil or gas reserves to any federal authority or agency since July 1, 2008.

Production

The following table shows our annual sales volume, average sales prices per barrel of oil, and average production costs per barrel of oil for our last three fiscal years. Production costs are costs incurred to operate and maintain our wells and related equipment. Production costs include cost of labor, well service and repair, location maintenance, power and fuel, property taxes, and severance taxes.

As a result of the 2009 sale of our oil and gas operations located in the United States, we currently have no producing properties.

|

|

|

2011 |

|

2010 |

|

2009 |

| |||

|

United States |

|

|

|

|

|

|

| |||

|

Barrels of oil sold |

|

|

|

|

|

|

| |||

|

Gross |

|

— |

|

— |

|

55,446 |

| |||

|

Net |

|

— |

|

— |

|

34,770 |

| |||

|

Sales price per barrel |

|

$ |

— |

|

$ |

— |

|

$ |

68.94 |

|

|

|

|

|

|

|

|

|

| |||

|

Production cost per barrel |

|

$ |

— |

|

$ |

— |

|

$ |

38.28 |

|

Delivery Commitments

We currently have no existing contracts or agreements obligating us to provide a fixed or determinable quantity of oil or gas in the future.

Employees and Independent Contractors

As of September 9, 2011, we have 32 full time employees based in the United States, 2 full time employees in the United Kingdom and 8 full time employees in Guinea. Additionally, we use independent contractors in the United States and the United Kingdom to help manage fixed overhead expenses. No employees are represented by a union.

Competition

Many companies and individuals engage in drilling for gas and oil and there is competition for the most desirable prospects. We expect to encounter intense competition from other companies and other entities in the sale of our oil and gas. We could be competing with numerous oil and gas companies which may have financial resources significantly greater than ours.

Productive Wells and Acreage; Undeveloped Acreage

We currently do not have any productive oil or gas wells, and do not have any developed acres (i.e. acres spaced or assignable to productive wells). The following table sets forth undeveloped acreage that we held as of June 30, 2011:

|

|

|

Undeveloped Acreage (1)(2) |

| ||

|

|

|

Gross Acres |

|

Net Acres |

|

|

Foreign |

|

|

|

|

|

|

Offshore Guinea |

|

6,176,000 |

|

4,755,520 |

|

|

Total (3) |

|

6,176,000 |

|

4,755,520 |

|

(1) A gross acre is an acre in which a working interest is owned. A net acre is deemed to exist when the sum of fractional ownership working or participation interests in gross acres equals one. The number of net acres is the sum of the fractional working interests owned in gross acres expressed as whole numbers and fractions thereof. Undeveloped acreage is considered to be those leased acres on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of crude oil and natural gas regardless of whether or not such acreage contains proved reserves.

(2) One square mile equals 640 acres. Our Contract Area is approximately 9,650 square miles. We have a 77% working interest in this contract area.

(3) The PSC requires that we relinquish 25% of the retained Contract Area by September 2013.

Drilling Activity

We drilled no exploratory or development wells for each of the years ended June 30, 2011, 2010, and 2009. An exploratory well is a well drilled to find and produce crude oil or natural gas in an unproved area, to find a new reservoir in a field previously found to be productive of crude oil or natural gas in another reservoir, or to extend a known reservoir. A development well is a well drilled within the proved area of a crude oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

Geographical Information

The following table sets out certain geographical information about our operations in Guinea:

|

|

|

June 30, |

|

June 30, |

|

June 30, |

| |||

|

|

|

2011 |

|

2010 |

|

2009 |

| |||

|

Long-lived assets related to Guinea |

|

$ |

36,716,000 |

|

$ |

339,000 |

|

$ |

7,764,000 |

|

Long-lived assets include our investment in the Concession offshore Guinea as well as fixed assets. The seismic data we have collected and our geological and geophysical work product are maintained in our offices in the United States. During the 2010 period, we sold a 23% interest in the Concession to Dana Petroleum. This sale was recognized in May 2010 and the $19.6 million proceeds received exceeded the amount of our investment in Guinea as of that date, resulting in the investment being reduced to zero, with a $2,955,000 gain being recognized. Investment in the Concession of $92,000 was incurred in June 2010 after the investment was reduced to zero in May 2010.

Cost of Compliance with Environmental Laws

Environmental laws have not materially hindered nor adversely affected our business. Capital expenditures relating to environmental control facilities have not been prohibitive to our operations. We believe we are in compliance with all applicable environmental laws.

Available Information

We are currently subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We file periodic reports, proxy materials and other information with the SEC. In addition, we expect to furnish stockholders with annual reports containing audited financial statements certified by our independent registered public accounting firm and interim reports containing unaudited financial information as may be necessary or desirable. We will provide without charge to each person who receives a copy of this report, upon written or oral request, a copy of any information that is incorporated by reference in this report (not including exhibits to the information that is incorporated by reference unless the exhibits are themselves specifically incorporated by reference). Such request should be directed to: Jason Davis, Secretary, Hyperdynamics Corporation, 12012 Wickchester Lane, #475, Houston, Texas 77079, voice: (713) 353-9400, fax: (713) 353-9421. Our website Internet address is www.hyperdynamics.com.

We provide free of charge on our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable.

Members of the public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, and Washington, DC 20549. Members of the public may obtain information on the operation of the Public Reference Room by calling the SEC at 1—800—SEC—0330. The Internet address of the Commission is www.sec.gov. That website contains reports, proxy and information statements and other information regarding issuers, like Hyperdynamics, that file electronically with the Commission. Visitors to the Commission’s website may access such information by searching the EDGAR database.

An investment in our common stock involves significant risks. Prior to making a decision about investing in common stock, and in consultation with your own financial and legal advisors, you should carefully consider, among other matters, the following risk factors. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also inadvertently affect us. If any of the following risks occur, our business, financial condition or results of operations could be materially harmed.

Risks Relating to Our Business and the Industry in Which We Operate.

We depend on a single exploration asset.

The Concession is currently our single most important asset and constitutes all of our potential for the future generation of revenue. Our rights to the Concession are set forth in the PSC. We are required under the PSC to spud our first well no later than December 31, 2011, and to drill a minimum of one additional exploration well to a minimum depth of 2,500 meters below the seabed at a minimum cost of $15 million by September 21, 2016. The PSC has other work and additional obligations that we will need to perform to maintain compliance with the PSC. Failure to comply could subject us to risk of loss of the Concession. In addition, oil and natural gas operations in Africa may be subject to higher political and security risks than operations in the United States. Upon commencing operations at the Concession, any adverse development affecting our progress such as, but not limited to, the drilling and operational hazards described below, could result in damage to, or destruction of, any wells and producing facilities constructed on the Concession as well as damage to life. Although we may acquire producing assets to diversify our asset base, given that the Concession is currently our only major asset, any adverse development affecting it could have a material adverse effect on our financial position and results of operations.

We have no revenue producing assets, a history of losses, and negative cash flow that we expect to continue in the near term.

We have a history of losses, and our accumulated deficit at June 30, 2011 was $86.9 million. We plan to drill our first well in 2011, and a second well soon thereafter. We also expect to continue additional exploration activities, including new 3-D seismic surveys. We plan to expend considerable resources in the near term, and we expect that our negative cash flows will continue.

We have no proved reserves and our exploration program may not yield oil in commercial quantities or quality, or at all.

We have no proved reserves. We have identified leads based on seismic and geological information that indicates the potential presence of oil. However, the areas we decide to drill may not yield oil in commercial quantities or quality, or at all. Even when properly used and interpreted, 2-D and 3-D seismic data and visualization techniques are only tools used to assist geoscientists in identifying subsurface structures and hydrocarbon indicators and do not enable the interpreter to know whether hydrocarbons are, in fact, present in those structures. Accordingly, we do not know if any of our prospects will contain oil in sufficient quantities or quality to recover drilling and completion costs or to be economically viable. Even if oil is found in commercial quantities, construction costs of oil pipelines or floating production systems, as applicable, and transportation costs may prevent such leads from being economically viable. If our exploration efforts do not prove to be successful, our business, financial condition and results of operations will be materially adversely affected.

Offshore Guinea, the area of all of our exploration, appraisal and development efforts, has not yet proved to be an economically viable production area. We know of only one exploration well drilled in the area of our Concession, and that was a dry hole in 1977. Although there have been significant technological advancements in geophysical and petroleum science since 1977, and we have acquired significant 2-D and 3-D seismic data, exploration activities are subject to a high degree of risk, and there is no assurance of a commercially successful discovery or production in this region.

We do not have reserve reports for the Concession and our expectations as to oil and gas reserves are uncertain and may vary substantially from any actual production.

We do not have any reserve reports for the Concession. A reserve report is the estimated quantities of oil and gas based on reports prepared by third party reserve engineers. Reserve reporting is a subjective process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact manner. Expectations as to oil and gas reserves are uncertain and may vary substantially from any actual production.

The PSC is subject to renegotiation under certain conditions, which may have an adverse impact upon our operations and profitability.

The PSC provides that should the Guinea government note material differences between provisions of the PSC and international standards or the Guinea Petroleum Code, the parties will renegotiate the relevant articles of the PSC. If the Guinea government identifies material differences between the PSC’s provisions and international standards or the Guinea Petroleum Code, there is no assurance that we will be able to negotiate an acceptable modification to the PSC. If the parties are not successful in renegotiating the relevant articles of the PSC, the parties may be required to submit the matter to international arbitration. There is no assurance that any arbitration would be successful or otherwise lead to articles that are more favorable to us than the present articles. Therefore, the results of such negotiations or arbitration could be unfavorable to us and, as a result, could have a material adverse effect on our business, financial position, results of operation and future cash flows.

We are highly dependent on our management team and consultants, and any failure to retain the services of such parties could adversely affect our ability to effectively manage our operations or successfully execute our business plan.

Our business is dependent on retaining the services of a small number of key personnel of the appropriate caliber as the business develops. Our success is, and will continue to be to a significant extent, dependent upon the expertise and experience of the directors, senior management and

certain key geoscientists, geologists, engineers and other professionals we engage. While we have entered into contractual arrangements with the aim of securing the services of the key management team, the retention of their services cannot be guaranteed. The loss of key members of our management team or other highly qualified technical professionals could adversely affect our ability to effectively manage our overall operations or successfully execute current or future business strategies. If any member of management or director were to leave our company, it may have a material adverse effect on our business, financial condition, results of operations and/or growth prospects.

Drilling wells is speculative and potentially hazardous. Actual costs may be more than our estimates, and may not result in any discoveries.

Exploring for and developing oil reserves involves a high degree of operational and financial risk, which precludes definitive statements as to the time required and costs involved in reaching certain objectives. The budgeted costs of drilling, completing and operating wells are often exceeded and can increase significantly when drilling costs rise due to a tightening in the supply of various types of oilfield equipment and related services.

Drilling may be unsuccessful for many reasons, including geological conditions, weather, cost overruns, equipment shortages and mechanical difficulties. Exploratory wells bear a much greater risk of loss than development wells. The successful drilling of an oil well may not be indicative of the potential for the development of a commercially viable field and will not necessarily result in a profit on investment. A variety of factors, both geological and market-related, can cause a well to become uneconomic or only marginally economic.

There are a variety of operating risks, including:

· blowouts, cratering and explosions;

· mechanical and equipment problems;

· uncontrolled flows of oil and gas or well fluids;

· fires;

· marine hazards with respect to offshore operations;

· formations with abnormal pressures;

· pollution and other environmental risks; and

· weather conditions and natural disasters.

Offshore operations are subject to a variety of operating risks particular to the marine environment, such as capsizing and collisions. Also, offshore operations are subject to damage or loss from adverse weather conditions. Any of these events could result in loss of human life, significant damage to property, environmental pollution, impairment of our operations and substantial losses.

Deepwater drilling generally requires more time and more advanced drilling technologies than exploration in shallower waters, involving a higher risk of equipment failure and usually higher drilling costs. In addition, there may be production risks of which we are currently unaware. If we participate in the development of new subsea infrastructure and use floating production systems to transport oil from producing wells, these operations may require substantial time for installation or encounter mechanical difficulties and equipment failures that could result in significant liabilities, cost overruns or delays. Furthermore, deepwater operations generally, and operations in West Africa in particular, lack the physical and oilfield service infrastructure present in other regions. As a result, a significant amount of time may elapse between a deepwater discovery and the marketing of the associated oil and natural gas, increasing both the financial and operational risks involved with these operations. Because of the lack and high cost of this infrastructure, further discoveries we may make in Guinea may never be economically producible.

We may not be able to meet our substantial capital requirements to conduct our operations or achieve our business plan.

Our business is capital intensive, and we must invest a significant amount in our activities. We intend to make substantial capital expenditures to find, develop and produce natural gas and oil reserves.

Additional capital could be obtained from a combination of funding sources. The current potential funding sources, and the potential adverse effects attributable thereto, include:

· offerings of equity, equity-linked and convertible debt securities, which would dilute the equity interests of our stockholders;

· sales or assignments of interests in the Concession and exploration program, which would reduce any future revenues from that program while at the same time offsetting potential expenditures;

· debt and convertible debt offerings, which would increase our leverage and add to our need for cash to service such debt and which could result in assets being pledged as collateral; and

· borrowings from financial institutions, which may subject us to certain restrictive covenants, including covenants restricting our ability to raise additional capital or pay dividends.

It is difficult to quantify the amount of financing we may need to fund our business plan in the longer term. The amount of funding we may need in the future depends on various factors such as:

· our financial position;

· the cost of exploration and drilling;

· the prevailing market price of natural gas and oil; and

· the lead time required to bring any discoveries to production.

Our ability to raise additional capital will depend on the results of operations and the status of various capital and industry markets at the time such additional capital is sought. Historically, we have been able to raise capital from equity sources to finance our activities, but there is no assurance that we will be able to do so in the future or on acceptable terms, if at all. Further, we currently have no operating revenue. While we have sufficient working capital for at least the next 12 months, additional capital will likely be required beyond this period. If we do not obtain capital resources in the future, we may not be able to meet the obligations under the PSC and thereby could be required to surrender the Concession. The Concession is our single most important asset and, although we are considering other opportunities, the loss of the Concession would significantly reduce our ability to eventually become a profit-generating company.

We also expect to continue to incur significant expenses over the next several years with our operations, including further 3-D seismic studies and exploratory drilling. We may not be able to raise or expend the capital necessary to undertake or complete future drilling programs or acquisition opportunities unless we raise additional funds through debt or equity financings, which may not be available on acceptable terms to us or at all. We may not be able to obtain debt or equity financing or enter into and complete additional strategic relationships with an industry partner to meet our capital requirements on acceptable terms, if at all. Further, our future cash flow from operations may not be sufficient for continued exploration, development or acquisition activities, and we may not be able to obtain the necessary funds from other sources.

New investors or commercial partners may require participation interests which could decrease future profitability.

Due to funding limitations or other factors, we may conduct exploration activities under agreements that provide investors or commercial partners with a participation interest in a particular property held by us. Under this type of arrangement, an investor or commercial partner would invest in specific property and receive a negotiated interest in that specific property. This could reduce the potential profitability of the remaining interest in the property and reduce our ability to control and manage the property. We expect that entering into these partnering relationships would entail transferring a portion of our interest in the Concession, or other properties that we may acquire in the future, to such partner.

We have no ability to control the prices that we may receive for oil or gas. Oil and gas prices are volatile, and a substantial or extended decline in prices could adversely affect our financial condition, liquidity, ability to obtain financing and future operating results.

We currently have no source of revenue. Our financial condition is based solely on our ability to sell equity or debt securities to investors, enter into an additional joint operating or similar strategic relationship with an industry partner, sell interests related to the Concession or borrow funds. We expect that entering into these joint operating or similar relationships would entail transferring a portion of our interest in the Concession to such partner. Such investors would consider the price of oil and gas in making an investment decision. Declines in oil and gas prices may adversely affect our financial condition, liquidity, ability to obtain financing and operating results. Low oil and gas prices also may reduce the amount of oil and gas that we could produce economically. Low oil and gas prices in the future could have a negative effect on our future financial results. Historically, oil and gas prices and markets have been volatile, with prices fluctuating widely, and they are likely to continue to be volatile. Prices for oil and gas are subject to wide fluctuations in response to relatively minor changes in supply and demand, market uncertainty and a variety of additional factors that are beyond our control. These factors include:

· the level of domestic and foreign supplies of oil;

· the level of consumer product demand;

· weather conditions and natural disasters;

· political conditions in oil producing regions throughout the world;

· the ability of the members of the Organization of Petroleum Exporting Countries to agree to and maintain oil production;

· speculation as to the future price of oil and natural gas and the speculative trading of oil and natural gas futures contracts;

· price and production controls;

· political and economic conditions, including embargoes in oil-producing countries or affecting other oil-producing activities, particularly in the Middle East, Africa, Russia and South America;

· the continued threat of terrorism and the impact of military and other action, including U.S. military operations in the Middle East;

· the level of global oil and natural gas exploration and production activity;

· the price of foreign oil imports;

· actions of governments;

· domestic and foreign governmental regulations;

· the price, availability and acceptance of alternative fuels;

· technological advances affecting energy consumption;

· global economic conditions; and

· the value of the U.S. dollar, the Euro and fluctuations in exchange rates generally.

These factors and the volatile nature of the energy markets make it impossible to predict oil and gas prices. Our inability to respond appropriately to changes in these factors could have a material adverse effect on our business plan, financial position, results of operations and future cash flows.

The unavailability or high cost of drilling rigs, equipment, supplies, personnel and oilfield services, as well as gathering systems and processing facilities, and our dependence on industry contractors generally, could adversely impact us.

We are dependent on industry contractors for the success of our oil and gas exploration projects. In particular, our drilling activity offshore of Guinea will require that we have access to offshore drilling rigs and contracts with experienced operators of such rigs. The availability and cost of drilling rigs and other equipment and services, and the skilled personnel required to operate those rigs and equipment is affected by the level and location of drilling activity around the world. An increase in drilling operations worldwide may reduce the availability and increase the cost to us of drilling rigs, other equipment and services, and appropriately experienced drilling contractors. The reduced availability of such equipment and services may delay our ability to discover reserves and higher costs for such equipment and services may increase our costs, both of which may have a material adverse effect on our business, results of operations and future cash flow. If we succeed in constructing oil wells, we may be required to shut them because access to pipelines, gathering systems or processing facilities may be limited or unavailable. If that were to occur, we would be unable to realize revenue from those wells until arrangements were made to deliver the production to market, which could cause a material adverse effect on our results of operations and financial condition.

We are exposed to the failure or non-performance of commercial counterparties.

Our operations will be dependent on certain third parties with whom we have commercial agreements (such as drilling project management contractors, drilling contractors and the parties responsible for transporting and/or storing our production) for our future exploration, development, production, sales or other activities. The efficiency, timeliness and quality of contract performance by third party providers are largely beyond our direct control. If one or more of these third parties fails to meet its contractual obligations to us, or if such services are temporarily or permanently unavailable (for example, as a result of technical problems or industrial action), or not available on commercially acceptable terms, we may experience a material adverse effect on our business, results of operations, financial condition and future cash flow. In addition, as a named party under the PSC, we could be held liable for the environmental, health and safety impacts arising out of the

activities of our drilling project management contractor or any other third party service provider contracted by us or on our behalf, which could have a material adverse effect on our business, results of operations and future cash flow.

Participants in the oil and gas industry are subject to numerous laws that can affect the cost, manner or feasibility of doing business.

Exploration and production activities in the oil and gas industry are subject to local laws and regulations. We may be required to make large expenditures to comply with governmental laws and regulations, particularly in respect of the following matters:

· licenses for drilling operations;

· tax increases, including retroactive claims;

· unitization of oil accumulations;

· local content requirements (including the mandatory use of local partners and vendors); and

· environmental requirements and obligations, including investigation and/or remediation activities.

Under these and other laws and regulations, we could be liable for personal injuries, property damage and other types of damages. Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, new laws and regulations may be enacted, and current laws and regulations could change or their interpretations could change, in ways that could substantially increase our costs. These risks may be higher in the developing countries in which we conduct our operations, where there could be a lack of clarity or lack of consistency in the application of these laws and regulations. Any resulting liabilities, penalties, suspensions or terminations could have a material adverse effect on our financial condition and results of operations.

Furthermore, the explosion and sinking in April 2010 of the Deepwater Horizon oil rig during operations on the Macondo exploration well in the Gulf of Mexico, and the resulting oil spill, may have increased certain of the risks faced by those drilling for oil in deepwater regions, including increased industry standards, governmental regulation and enforcement, and less favorable investor perception of the risk-adjusted benefits of deepwater offshore drilling.

The occurrence of any of these factors, or the continuation thereof, could have a material adverse effect on our business, financial position or future results of operations.

We may not be able to commercialize our interests in any natural gas produced from our Guinea Concession

The development of the market for natural gas in West Africa is in its early stages. Currently there is no infrastructure to transport and process natural gas on commercial terms in Guinea, and the expenses associated with constructing such infrastructure ourselves may not be commercially viable given local prices currently paid for natural gas. We will not receive any payment for this quantity of natural gas. Accordingly, there may be limited or no value derived from any natural gas produced from our Guinea Concession.

Our insurance coverage may be insufficient to cover losses, or we could be subject to uninsured liabilities which could materially affect our business, results of operations or financial condition.

There are circumstances where insurance will not cover the consequences of an event, or where we may become liable for costs incurred in events or incidents against which we either cannot insure or may elect not to have insured (whether on account of prohibitive premium costs or for other commercial reasons). Further, insurance covering certain matters (such as sovereign risk, terrorism and many environmental risks) may not be available to us. Moreover, we may be subject to large excess payments in the event a third party has a valid claim against us, and therefore may not be entitled to recover the full extent of our loss, or may decide that it is not economical to seek to do so. The realization of any significant liabilities in connection with our future activities could have a material adverse effect on our business, results of operations, financial condition and future cash flow.

There are risks associated with the drilling of oil and natural gas wells which could significantly reduce our revenues or cause substantial losses, impairing our future operating results. We may become subject to liability for pollution, blow-outs or other hazards, including those arising out of the activities of our third-party contractors. We intend to obtain insurance with respect to certain of these hazards, but such insurance likely will have limitations that may prevent us from recovering the full extent of such liabilities. The payment by us of such liabilities could reduce the funds available to us or could, in an extreme case, result in a total loss of our properties and assets. Moreover, oil and natural gas production operations are also subject to all the risks typically associated with such operations, including premature decline of reservoirs and the invasion of water into producing formations.

We have competition from other companies that have larger financial and other resources than we do, which puts us at a competitive disadvantage.

A large number of companies and individuals engage in drilling for gas and oil, and there is competition for the most desirable prospects. We are likely to face competition from international oil and gas companies, which already may have significant operations in a region, together with potential new entrants into such markets, any of which may have greater financial, technological and other resources than us. There is a high degree of competition for the discovery and acquisition of properties considered to have a commercial potential. We compete with other companies for the acquisition of oil and gas interests, as well as for the recruitment and retention of qualified employees and other personnel.

There can be no assurance that we will be able to continue to compete effectively with other existing oil and gas companies, or any new entrants to the industry. Any failure by us to compete effectively could have a material adverse effect on our business, results of operations, financial condition and future cash flow.

We may incur a variety of costs to engage in future acquisitions, and the anticipated benefits of those acquisitions may never be realized.

As a part of our business strategy, we may make acquisitions of, or significant investments in, other assets, particularly those that would allow us to produce oil and natural gas and generate revenue to fund our exploration activities, although no acquisitions or investments are currently pending. Any future acquisitions would be accompanied by risks such as:

· diversion of our management’s attention from ongoing business concerns;

· our potential inability to maximize our financial and strategic position through the successful development of the asset or assets acquired;

· impairment of our relationship with our existing employees if we cannot hire employees to staff any new operations and our existing employees are required to staff both old and new operations; and

· maintenance of uniform standards, controls, procedures and policies.

We cannot guarantee that we will be able to successfully integrate any business, products, technologies or personnel that we might acquire in the future, and our failure to do so could harm our business.

Risks Relating to Operating in Guinea

Geopolitical instability where we operate subjects us to political, economic and other uncertainties.

We conduct business in Guinea, which is in a region of the world where there have been recent civil wars, revolutions, coup d’etats and internecine conflicts. There is the risk of political violence and increased social tension in Guinea as a result of the past political upheaval, and there is a risk of civil unrest, crime and labor unrest at times. For example, in September 2009, the military government intervened to stop pro-democracy rallies, resulting in a number of civilian deaths and casualties. This led to the African Union, United States and European Union imposing sanctions upon the former government. A successful mediation organized by the international community (African Union, United States and European Union) between the opposition and the military junta resulted in the appointment of a Prime Minister of Guinea from the opposition. In 2010 democratic elections were held, and a president was elected and inaugurated. While these developments indicate that the political situation in Guinea is improving, external or internal political forces potentially could create a political or military climate that might cause a change in political leadership, the outbreak of hostilities, or civil unrest. Such uncertainties could result in our having to cease our Guinea operations and result in the loss or delay of our rights under the PSC.

Further, we face political and economic risks and other uncertainties with respect to our operations, which may include, among other things:

· loss of future revenue, property and equipment, as a result of hazards such as expropriation, war, acts of terrorism, insurrection and other political risks;

· increases in taxes and governmental royalties;

· unilateral renegotiation or cancellation of contracts by governmental entities;

· difficulties enforcing our rights against a governmental agency because of the doctrine of sovereign immunity and foreign sovereignty over international operations;

· changes in laws and policies governing operations of foreign-based companies; and

· currency restrictions and exchange rate fluctuations.

Our operations in Guinea also may be adversely affected by laws and policies of the United States affecting foreign trade and taxation. Realization of any of these factors could have a material adverse effect on our business, financial condition, results of operations and/or growth prospects.

Guinea’s political uncertainties could adversely affect our rights under the Concession or obligations under the PSC.

Guinea has faced and continues to face political, economic and social uncertainties which are beyond our control. Maintaining a good working relationship with the Guinea government is important because the Concession is granted under the terms of the PSC, with the Guinea government. In June 2010, a democratic election was held that identified two main candidates for a run-off election that was held on November 7, 2010. On December 21, 2010, President Alpha Conde was inaugurated. The newly-elected government has replaced the transitional government. Although we believe that our management has a positive working relationship with the new Guinea government, we cannot predict future political events and changing relationships. Political instability, substantial changes in government laws, policies or officials, and attitudes of officials toward us could have a material adverse effect on our business, financial position, results of operations and future cash flow.

We operate in Guinea, a country where corrupt behavior exists that could impair our ability to do business in the future or result in significant fines or penalties.

We operate in Guinea, a country where governmental corruption has been known to exist. There is a risk of violating either the US Foreign Corrupt Practices Act, laws or legislation promulgated pursuant to the 1997 OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions or other applicable anti-corruption regulations that generally prohibit the making of improper payments to foreign officials for the purpose of obtaining or keeping business. In addition, the future success of our Guinea operations may be adversely affected by risks associated with international activities, including economic and labor conditions, political instability, risk of war, expropriation, terrorism, renegotiation or modification of existing contracts, tax laws and changes in exchange rates.

We are subject to governmental regulations, the cost of compliance with which may have an adverse effect on our financial condition, results of operations and future cash flow.

Oil and gas operations in Guinea will be subject to government regulation and to interruption or termination by governmental authorities on account of ecological and other considerations. It is impossible to predict future government proposals that might be enacted into law, future interpretation of existing laws or future amendments to the Guinea Petroleum Code or any other laws, or the effect those new or amended laws or changes in interpretation of existing laws might have on us. Restrictions on oil and gas activities, such as production restrictions, price controls, tax increases and pollution and environmental controls may have a material adverse effect on our financial condition, results of operations and future cash flows.

Political, social and economic conditions in Guinea may adversely affect our business, results of operation, financial condition and future cash flow.

As all of our potential revenue generating assets are currently located in Guinea, our operations are dependant on the economic and political conditions prevailing in Guinea. Accordingly, we are subject to the risks associated with conducting business in and with a foreign country, including the risks of changes in the country’s laws and policies (including those relating to taxation, royalties, acquisitions, disposals, imports and exports, currency, environmental protection, management of natural resources, exploration and development of mines, labor and safety standards, and historical and cultural preservation). The costs associated with compliance with these laws and regulations are substantial, and possible future laws and regulations as well as changes to existing laws and regulations could impose additional costs on us, require us to incur additional capital expenditures and/or impose restrictions on or suspensions of our operations and delays in the development of our assets.

Further, these laws and regulations may allow government authorities and private parties to bring legal claims based on damages to property and injury to persons resulting from the environmental, health and safety impacts of our past and current operations and could lead to the imposition of substantial fines, penalties or other civil or criminal sanctions. If material, these compliance costs, claims or fines could have a material adverse effect on our business, results of operations, financial condition and/or growth prospects.

In addition, Guinea has high levels of unemployment, poverty and crime. These problems have, in part, hindered investments in Guinea, prompted emigration of skilled workers and affected economic growth negatively. While it is difficult to predict the effect of these problems on businesses operating in Guinea or the Guinea government’s efforts to solve them, these problems, or the solutions proposed, could have a material adverse effect on our business, results of operations, financial condition and/or growth prospects.

The legal and judicial system in Guinea is relatively undeveloped and subject to frequent changes, and we may be exposed to similar risks if we operate in certain other jurisdictions.

Guinea has a less developed legal and judicial system than more established economies which could result in risks such as: (i) effective legal redress in the courts of such jurisdictions, whether in respect of a breach of contract, law or regulation, or in an ownership dispute, being more difficult to obtain; (ii) a higher degree of discretion on the part of Governmental authorities who may be susceptible to corruption; (iii) the lack of judicial or administrative guidance on interpreting applicable rules and regulations; (iv) inconsistencies or conflicts between and within various laws, regulations, decrees, orders and resolutions; or (v) relative inexperience of the judiciary and courts in such matters. In Guinea and certain other jurisdictions, the commitment of local business people, government officials and agencies and the judicial system to abide by legal requirements and negotiated agreements may be more uncertain, creating particular concerns with respect to the Concession or other licenses, permits or approvals required by us for the operation of our business, which may be susceptible to revision or cancellation, and legal redress may be uncertain or delayed. There can be no assurance that joint ventures, licenses, license applications or other legal arrangements will not be adversely affected by the actions of government authorities or others, and the effectiveness of and enforcement of such arrangements in these jurisdictions cannot be assured.

Risks Relating to Our Common Stock

The price of our common stock historically has been volatile. This volatility may affect the price at which you could sell your common stock, and the sale of substantial amounts of our common stock could adversely affect the price of our common stock.

The closing price for our common stock has varied between a high of $7.40 on January 13, 2011 and a low of $0.99 on July 23, 2010 in the fiscal year ended on June 30, 2011. This volatility may affect the price at which an investor could sell the common stock, and the sale of substantial amounts of our common stock could adversely affect the price of our common stock. Our stock price is likely to continue to be volatile and subject to significant price and volume fluctuations in response to market and other factors, including the other factors discussed in “— Risks Relating to Our Business and the Industry in Which We Operate”; variations in our quarterly operating results from our expectations or those of securities analysts or investors; downward revisions in securities analysts’ estimates; and announcement by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments.

We may issue additional shares of common stock in the future, which could adversely affect the market price of our shares and cause dilution to existing stockholders.

We may issue additional shares of our common stock in the future which could adversely affect the market price of our shares. Significant sales of shares of our common stock by major stockholders, or the public perception that an offering or sale may occur also could have an adverse effect on the market price of shares of our common stock. Issuance of additional shares of common stock will dilute the percentage ownership interest of the existing stockholders, and may dilute the book value per share of our shares of common stock held by existing stockholders.

Sales of substantial amounts of shares of our common stock in the public market could harm the market price of the shares of common stock.

The sale of substantial amounts of shares of our common stock (including shares issuable upon exercise of outstanding options and warrants to purchase shares) may cause substantial fluctuations in the price of shares of our common stock. Because investors may be more reluctant to purchase shares of our common stock following substantial sales or issuances, the sale of shares in an offering could impair our ability to raise capital in the near term.

We have identified material weaknesses in our internal controls for the year ended June 30, 2011, and if we fail to adequately remediate, we may be unable to accurately report our financial results in the future and the market price of our shares may be adversely affected.

We and our independent registered public accounting firm, in connection with the audit of our internal control over financial reporting, for the fiscal year ended June 30, 2011, have identified certain control deficiencies resulting from the lack of effective detective and monitoring controls being designed within internal control over financial reporting. Such deficiencies related to oversight and review of information as prepared or received from external service providers covering marketable securities, income taxes and equity awards and over the presentation of the financial statements and the application of certain accounting principles. In addition, we identified certain control deficiencies in our general computer control environment, resulting from the lack of effective controls around the areas of approval and review of information technology changes and system security, including the enforcement of segregation of duties and appropriate user access restrictions. We plan to take measures to remedy these weaknesses. A failure to address any control deficiency could result in inaccuracies in our financial statements and could also impair our ability to comply with applicable financial reporting requirements. As a result, our business and the market price of our shares may be adversely affected.

Delaware law and our charter documents may impede or discourage a takeover, which could adversely impact the market price of our shares.

We are a Delaware corporation, and the anti-takeover provisions of Delaware law impose various impediments to the ability of a third party to acquire control of us, even if a change in control would be beneficial to our existing stockholders. Certain provisions of Delaware law and our certificate of incorporation and bylaws could impede a merger, takeover or other business combination involving us or discourage a potential acquirer from making a tender offer for our common stock, which, under certain circumstances, could reduce the market price of our common stock.

Item 1B. Unresolved Staff Comments

None.

Information on Oil and Gas Properties is included in Item 1. Business above in this Annual Report on Form 10-K.

Our executive and administrative offices are located at 12012 Wickchester Lane, Suite 475, Houston, Texas 77079 where we lease 14,673 square feet of space pursuant to a lease agreement with a 60 month term.

The lease agreement is for 60 months beginning on March 1, 2010, the date we took possession of the property. We are obligated to make the following base rental payments: (i) $0.00 per month during months 1 — 9; (ii) $17,472 per month during months 10 — 12; (iii) $17,957 per month during months 13 — 24; (iv) $19,413 per month during months 25 — 36; (v) $21,354 per month during months 37 — 48; and (vi) $24,266 per month during months 49 — 60.

During the fourth quarter of fiscal 2011, the lease was amended to include additional square footage. Under the amended lease agreement, we are obligated to make the following additional rental payments: (i) $4,537.50 per month from the date the expansion is complete through January 31, 2012; (ii) $4,663.54 per month from February 1, 2012 through January 31, 2013; (iii) $4,789.58 per month from February 1, 2013 through January 31, 2014; and (iv) $4,915.63 per month from February 1, 2015 through January 31, 2016. We expect to complete the expansion and begin making lease payments during the first quarter of fiscal 2012.

In addition to the base rent, we are also responsible for the pro-rata share (10.664%) of excess operating expenses in connection with the property. We also paid a security deposit of $50,000 at the time of execution of the lease agreement of which $35,000 is expected to be refunded at the end of February 2012, subject to certain conditions.

From time to time, we and our subsidiaries are involved in business disputes. We are unable to predict the outcome of such matters when they arise. Currently pending proceedings, in our opinion, will not have a material adverse effect upon our consolidated financial statements.

Item 4. Submission of Matters to a Vote of Securities Holders

None.

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Price Range of Common Stock

Shares of our common stock, for the periods presented below, were traded on the NYSE Amex (formerly known as the American Stock Exchange). The following table sets forth the quarterly high and low sales prices per share for our common stock, as reported by the NYSE Amex. Our common stock began trading on the NYSE on July 11, 2011 under our same ticker symbol, “HDY.”

|

|

|

High |

|

Low |

| ||

|

Fiscal 2011: |

|

|

|

|

| ||

|

Fourth Quarter |

|

$ |

4.75 |

|

$ |

3.18 |

|

|

Third Quarter |

|

7.40 |

|

3.91 |

| ||

|

Second Quarter |

|

5.21 |

|

2.26 |

| ||

|

First Quarter |

|

2.49 |

|

0.99 |

| ||

|

|

|

|

|

|

| ||

|

Fiscal 2010: |

|

|

|

|

| ||

|

Fourth Quarter |

|

$ |

1.65 |

|

$ |

0.92 |

|

|

Third Quarter |

|

1.42 |

|

0.65 |

| ||

|

Second Quarter |

|

1.85 |

|

0.79 |

| ||

|

First Quarter |

|

1.92 |

|

0.38 |

| ||

On September 9, 2011, the last price for our common stock as reported by the NYSE was 4.23 per share and there were approximately 191 stockholders of record of the common stock.

Dividends

We have not paid, and we do not currently intend to pay in the foreseeable future, cash dividends on our common stock. The current policy of our Board of Directors is to retain all earnings, if any, to provide funds for operation and expansion of our business. The declaration of dividends, if any, will be subject to the discretion of the Board of Directors, which may consider such factors as our results of operations, financial condition, capital needs and acquisition strategy, among others.

Equity Compensation Plan Information

The following table gives aggregate information under all equity compensation plans of Hyperdynamics as of June 30, 2011.

Equity Compensation Plan Information

|

|

|

Number of Securities |

|

Weighted-Average |

|

Number of Securities |

| |

|

Plan Category |

|

A |

|

B |

|

C |

| |

|

Equity compensation plans approved by security holders |

|

9,274,854 |

|

$ |

1.85 |

|

1,069,480 |

|

|

Equity compensation plans not approved by security holders |

|

N/A |

|

N/A |

|

N/A |

| |

|

Total |

|

9,274,854 |

|

$ |

1.85 |

|

1,069,480 |

|

The Stock and Stock Option Plan (the “1997 Plan”) of Hyperdynamics was adopted May 7, 1997 and amended on December 3, 2001, on January 21, 2005, and on February 20, 2008. The total number of shares authorized under the Plan, as amended, was 14,000,000. The Board terminated the 1997 Plan effective upon approval of the 2010 Plan by our stockholders as discussed below.