Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CU Bancorp | d372099dex991.htm |

| 8-K - FORM 8-K - CU Bancorp | d372099d8k.htm |

Acquisition of CU Bancorp April 6, 2017 Exhibit 99.2

This communication contains certain forward-looking information about PacWest Bancorp (“PacWest”), CU Bancorp, and the combined company after the close of the transaction that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. Such statements involve inherent risks, uncertainties, and contingencies, many of which are difficult to predict and are generally beyond the control of PacWest, CU Bancorp and the combined company. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. In addition to factors previously disclosed in reports filed by PacWest and CU Bancorp with the Securities and Exchange Commission (“SEC”), risks and uncertainties for each institution and the combined institution include, but are not limited to: lower than expected revenues; credit quality deterioration or a reduction in real estate values could cause an increase in the provision for credit losses and allowance for credit losses and a reduction in net earnings; increased competitive pressure among depository institutions; the ability to complete the proposed transaction, including by obtaining regulatory approvals and approval by the shareholders of CU Bancorp, or any future transaction, successfully integrate such acquired entities, or achieve expected beneficial synergies and/or operating efficiencies, in each case within expected time-frames or at all; regulatory approvals may not be received on expected timeframes or at all; the possibility that personnel changes/retention will not proceed as planned; the possibility that a change in the interest rate environment may reduce net interest margins; higher than anticipated operating expenses; the effectiveness of our risk management framework; asset/liability re-pricing risks and liquidity risks; the costs and effects of legal, compliance, and regulatory actions, changes and developments, including the impact of adverse judgments or settlements in litigation, the initiation and resolution of regulatory or other governmental inquiries or investigations, and/or the results of regulatory examinations or reviews; general economic conditions, either nationally or in the market areas in which the entities operate or anticipate doing business, are less favorable than expected; and other risk factors described in documents filed by PacWest and CU Bancorp with the SEC. All forward-looking statements included in this communication are based on information available at the time of the communication. Pro forma, projected and estimated numbers are used for illustrative purposes only and are not forecasts, and actual results may differ materially. We are under no obligation to (and expressly disclaim any such obligation to) update or alter our forward-looking statements, whether as a result of new information, future events or otherwise except as required by law. Forward-Looking Statements

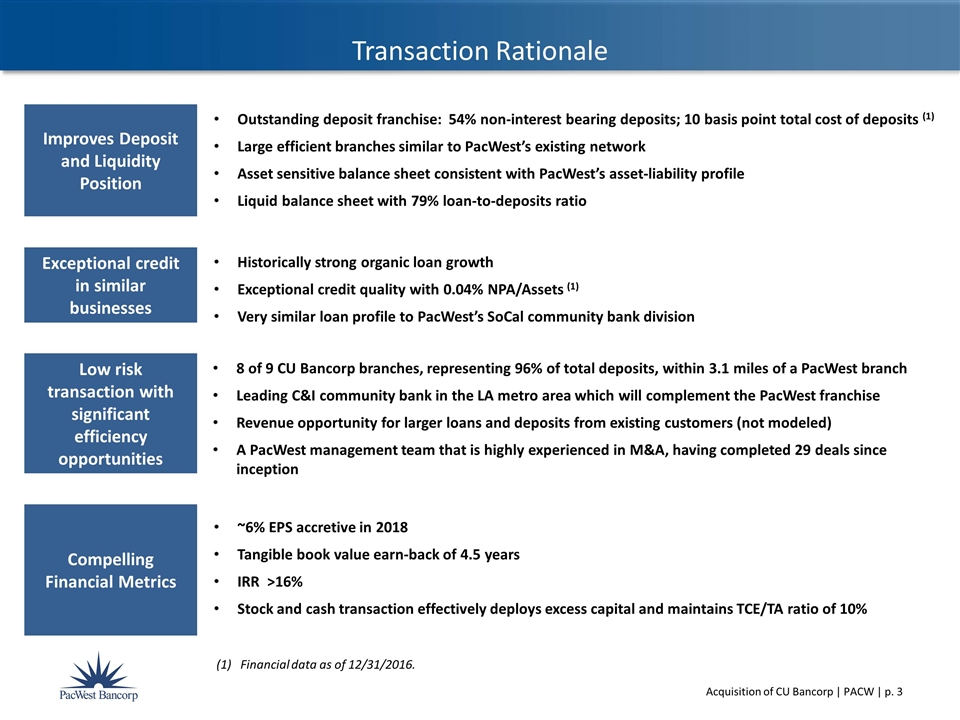

Transaction Rationale 8 of 9 CU Bancorp branches, representing 96% of total deposits, within 3.1 miles of a PacWest branch Leading C&I community bank in the LA metro area which will complement the PacWest franchise Revenue opportunity for larger loans and deposits from existing customers (not modeled) A PacWest management team that is highly experienced in M&A, having completed 29 deals since inception Low risk transaction with significant efficiency opportunities Exceptional credit in similar businesses Historically strong organic loan growth Exceptional credit quality with 0.04% NPA/Assets (1) Very similar loan profile to PacWest’s SoCal community bank division ~6% EPS accretive in 2018 Tangible book value earn-back of 4.5 years IRR >16% Stock and cash transaction effectively deploys excess capital and maintains TCE/TA ratio of 10% Compelling Financial Metrics Improves Deposit and Liquidity Position Outstanding deposit franchise: 54% non-interest bearing deposits; 10 basis point total cost of deposits (1) Large efficient branches similar to PacWest’s existing network Asset sensitive balance sheet consistent with PacWest’s asset-liability profile Liquid balance sheet with 79% loan-to-deposits ratio Financial data as of 12/31/2016.

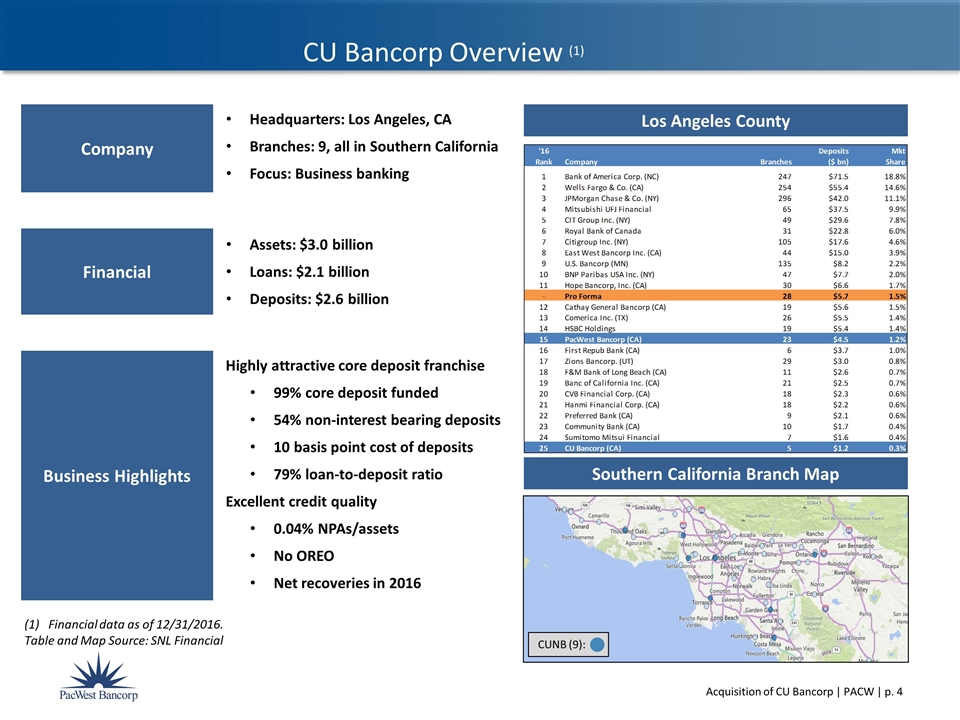

CU Bancorp Overview (1) Table and Map Source: SNL Financial Headquarters: Los Angeles, CA Branches: 9, all in Southern California Focus: Business banking Company Highly attractive core deposit franchise 99% core deposit funded 54% non-interest bearing deposits 10 basis point cost of deposits 79% loan-to-deposit ratio Excellent credit quality 0.04% NPAs/assets No OREO Net recoveries in 2016 Business Highlights Assets: $3.0 billion Loans: $2.1 billion Deposits: $2.6 billion Financial Financial data as of 12/31/2016. Los Angeles County Southern California Branch Map CUNB (9):

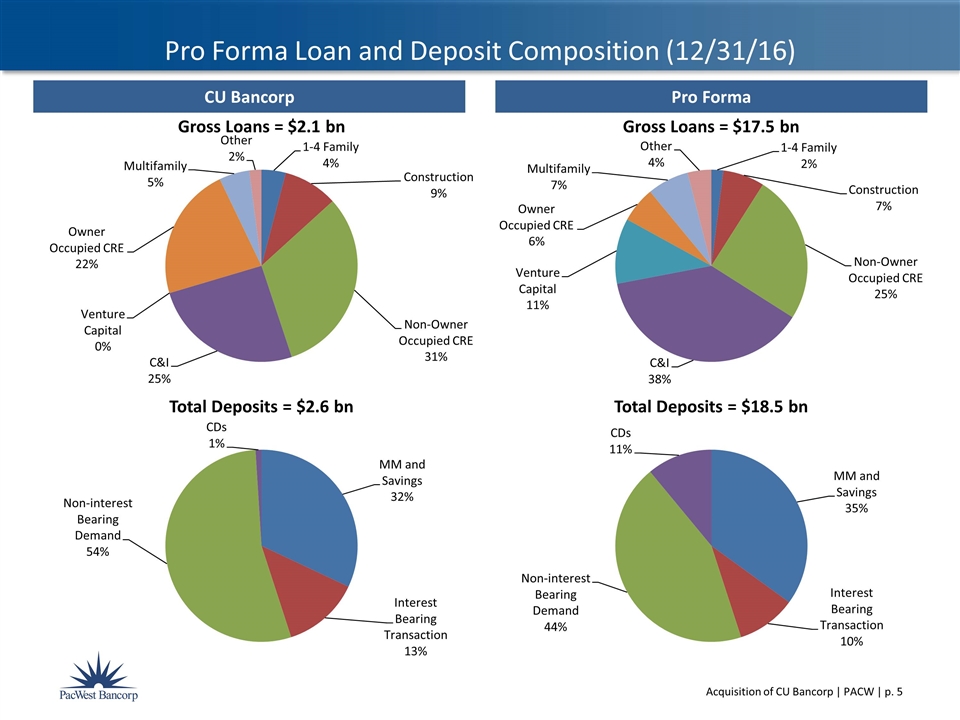

Pro Forma Loan and Deposit Composition (12/31/16) CU Bancorp Pro Forma

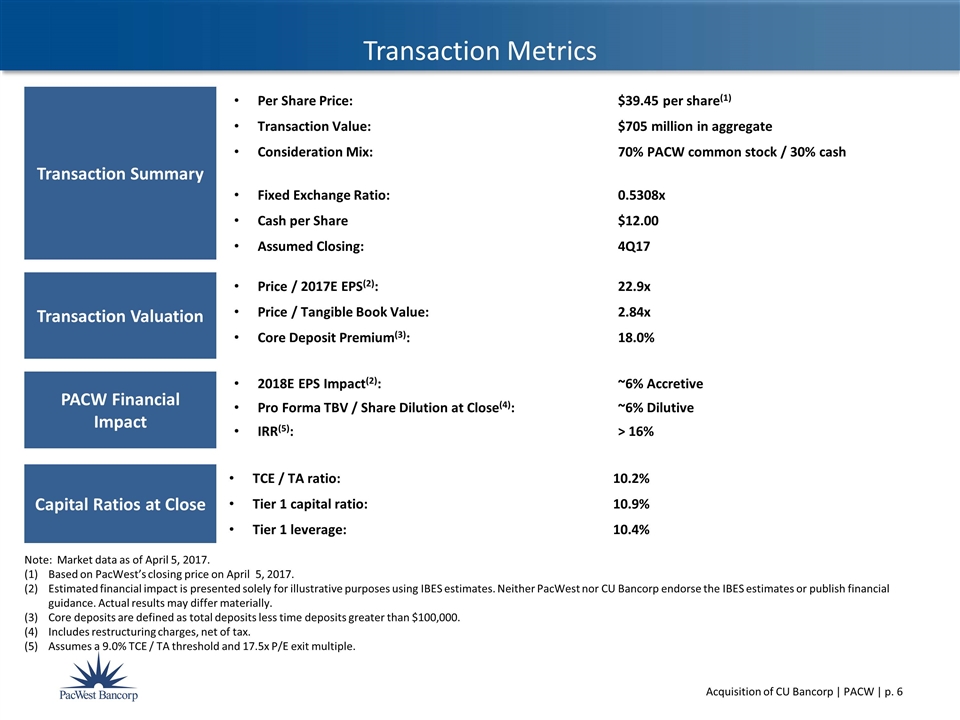

Transaction Metrics Per Share Price:$39.45 per share(1) Transaction Value:$705 million in aggregate Consideration Mix: 70% PACW common stock / 30% cash Fixed Exchange Ratio: 0.5308x Cash per Share$12.00 Assumed Closing:4Q17 Transaction Summary Capital Ratios at Close TCE / TA ratio:10.2% Tier 1 capital ratio:10.9% Tier 1 leverage:10.4% Price / 2017E EPS(2): 22.9x Price / Tangible Book Value:2.84x Core Deposit Premium(3):18.0% Transaction Valuation 2018E EPS Impact(2): ~6% Accretive Pro Forma TBV / Share Dilution at Close(4): ~6% Dilutive IRR(5):> 16% PACW Financial Impact Note: Market data as of April 5, 2017. Based on PacWest’s closing price on April 5, 2017. Estimated financial impact is presented solely for illustrative purposes using IBES estimates. Neither PacWest nor CU Bancorp endorse the IBES estimates or publish financial guidance. Actual results may differ materially. Core deposits are defined as total deposits less time deposits greater than $100,000. Includes restructuring charges, net of tax. Assumes a 9.0% TCE / TA threshold and 17.5x P/E exit multiple.

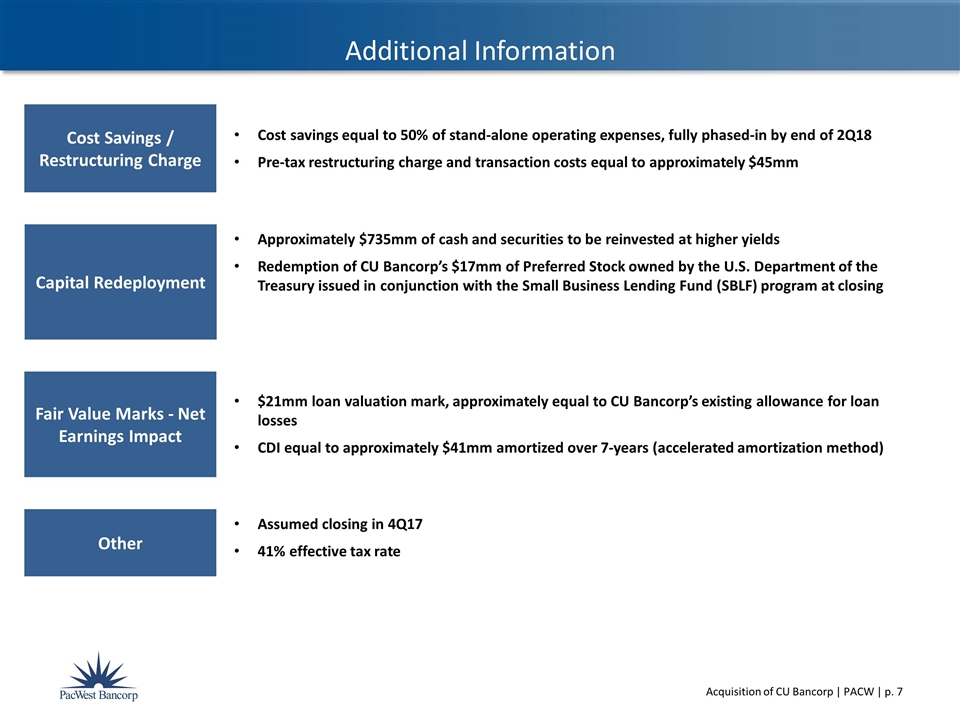

Additional Information Other Assumed closing in 4Q17 41% effective tax rate Cost Savings / Restructuring Charge Cost savings equal to 50% of stand-alone operating expenses, fully phased-in by end of 2Q18 Pre-tax restructuring charge and transaction costs equal to approximately $45mm Capital Redeployment Approximately $735mm of cash and securities to be reinvested at higher yields Redemption of CU Bancorp’s $17mm of Preferred Stock owned by the U.S. Department of the Treasury issued in conjunction with the Small Business Lending Fund (SBLF) program at closing Fair Value Marks - Net Earnings Impact $21mm loan valuation mark, approximately equal to CU Bancorp’s existing allowance for loan losses CDI equal to approximately $41mm amortized over 7-years (accelerated amortization method)

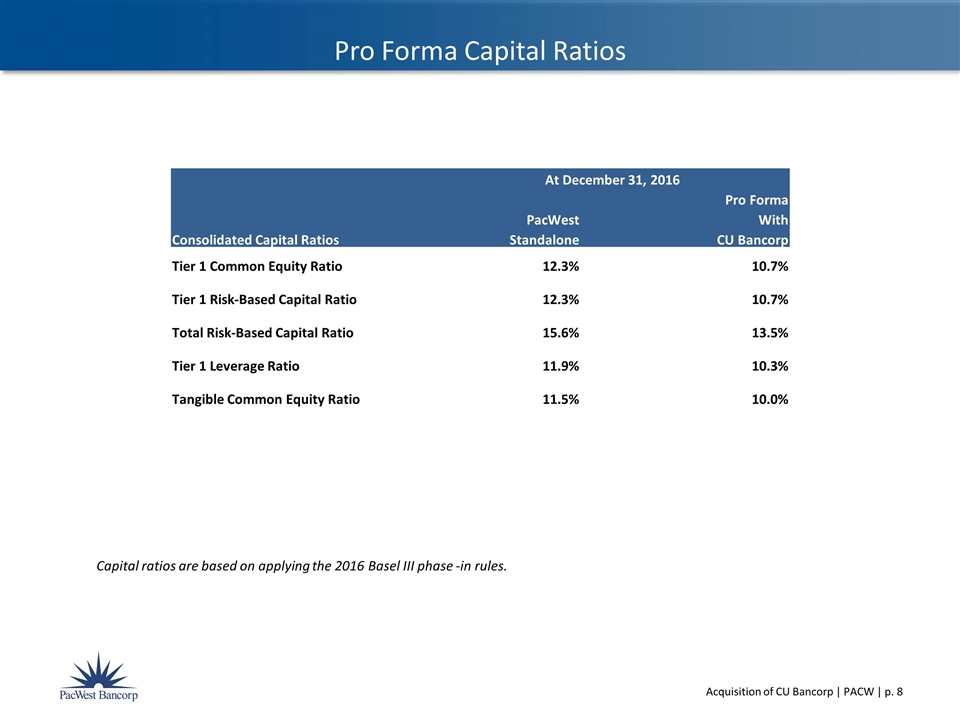

Pro Forma Capital Ratios Capital ratios are based on applying the 2016 Basel III phase -in rules. At December 31, 2016 Pro Forma PacWest With Consolidated Capital Ratios Standalone CU Bancorp Tier 1 Common Equity Ratio 12.3% 10.7% Tier 1 Risk-Based Capital Ratio 12.3% 10.7% Total Risk-Based Capital Ratio 15.6% 13.5% Tier 1 Leverage Ratio 11.9% 10.3% Tangible Common Equity Ratio 11.5% 10.0%

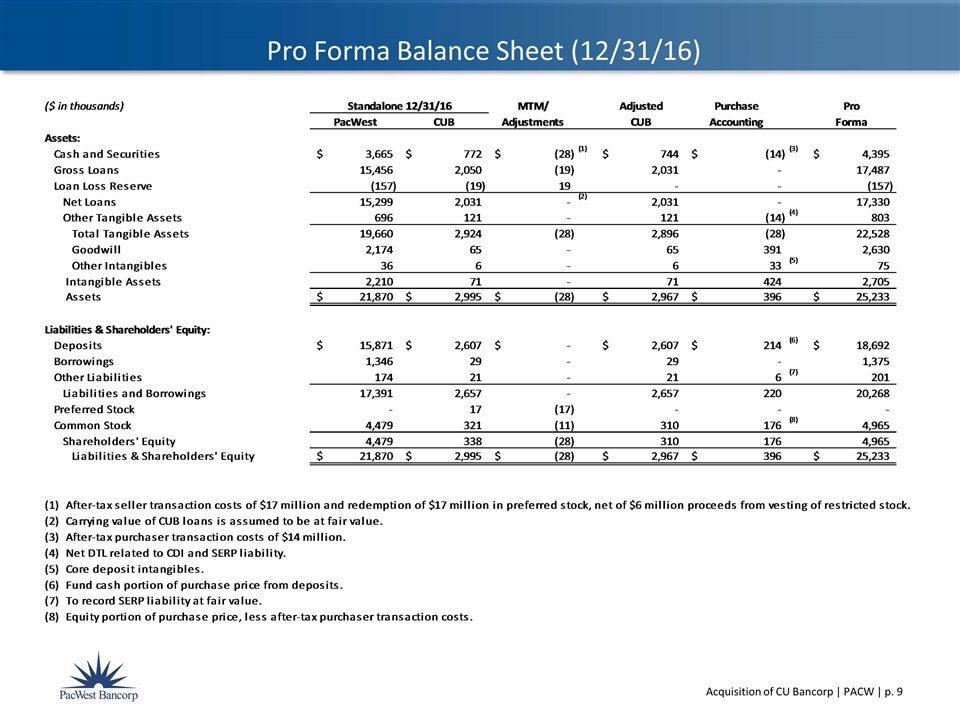

Pro Forma Balance Sheet (12/31/16)

Investors and security holders are urged to carefully review and consider each of PacWest Bancorp’s (“PacWest”) and CU Bancorp’s public filings with the SEC, including but not limited to their Annual Reports on Form 10-K, their proxy statements, their Current Reports on Form 8-K and their Quarterly Reports on Form 10-Q. The documents filed by PacWest with the SEC may be obtained free of charge at PacWest’s website at www.pacwestbancorp.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from PacWest by requesting them in writing to PacWest Bancorp, 9701 Wilshire Boulevard, Suite 700, Beverly Hills, CA 90212; Attention: Investor Relations, or by telephone at (310) 887-8521 or via e-mail to investor-relations@pacwestbancorp.com. The documents filed by CU Bancorp with the SEC may be obtained free of charge at CU Bancorp’s website at www.cubancorp.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from CU Bancorp by requesting them in writing to CU Bancorp, 818 W. 7th Street, Suite 220, Los Angeles, CA 90017; Attention: Investor Relations, or by telephone at (818) 257-7700. PacWest intends to file a registration statement with the SEC which will include a proxy statement of CU Bancorp and a prospectus of PacWest, and each party will file other documents regarding the proposed transaction with the SEC. Before making any voting or investment decision, investors and security holders of CU Bancorp are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. A definitive proxy statement/prospectus will be sent to the shareholders of CU Bancorp seeking any required shareholder approvals. Investors and security holders will be able to obtain the registration statement and the proxy statement/prospectus free of charge from the SEC’s website or from PacWest or CU Bancorp by writing to the addresses provided for each company set forth in the paragraphs above. PacWest, CU Bancorp, their directors, executive officers and certain other persons may be deemed to be participants in the solicitation of proxies from CU Bancorp shareholders in favor of the approval of the transaction. Information about the directors and executive officers of PacWest and their ownership of PacWest common stock is set forth in the proxy statement for PacWest’s 2017 annual meeting of stockholders, as previously filed with the SEC. Information about the directors and executive officers of CU Bancorp and their ownership of CU Bancorp common shares set forth in the proxy statement for CU Bancorp’s 2016 annual meeting of shareholders, as previously filed with the SEC. Shareholders may obtain additional information regarding the interests of such participants by reading the registration statement and the proxy statement/prospectus when they become available. Additional Information About the Transaction and Where to Find It