Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Great Elm Capital Corp. | gecc-8k_20170324.htm |

| EX-99.4 - EX-99.4 - Great Elm Capital Corp. | gecc-ex994_59.htm |

| EX-99.3 - EX-99.3 - Great Elm Capital Corp. | gecc-ex993_6.htm |

| EX-99.1 - EX-99.1 - Great Elm Capital Corp. | gecc-ex991_7.htm |

Great Elm Capital Corp. (NASDAQ: GECC) Investor Presentation – Quarter Ended December 31, 2016 March 29, 2017 © 2017 Great Elm Capital Corp. Exhibit 99.2

© 2017 Great Elm Capital Corp. Disclaimer Statements in this communication that are not historical facts are “forward-looking” statements within the meaning of the federal securities laws. These statements are often, but not always, made through the use of words or phrases such as “believe,” “expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,” “estimated,” “aim,” “target,” “opportunity,” “sustained,” “positioning,” “designed,” “create,” “seek,” “would,” “could”, “potential,” “continue,” “ongoing,” “upside,” “increases,” and “potential,” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following: conditions in the credit markets, the price of GECC common stock, performance of GECC’s portfolio and investment manager. Additional information concerning these and other factors can be found in GECC’s Form 10-K and other reports filed with the SEC. GECC assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. The discussion of the tender offer described herein is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares. The offer to purchase and the solicitation of GECC's shares are made only pursuant to the Offer to Purchase, the related Letter of Transmittal, and other related materials mailed or otherwise delivered to stockholders. Stockholders should read those materials and the documents incorporated therein by reference carefully when they become available because they will contain important information, including the terms and conditions of the tender offer. GECC will file a Tender Offer Statement on Schedule TO (the “Tender Offer Statement”) with the SEC. The Tender Offer Statement, including the Offer to Purchase, the related Letter of Transmittal and other related materials, will also be available to stockholders at no charge on the SEC’s website at www.sec.gov or from the information agent for the tender offer, MacKenzie Partners. Stockholders are urged to read those materials carefully prior to making any decisions with respect to the tender offer.

© 2017 Great Elm Capital Corp. About The Company, Team & Approach

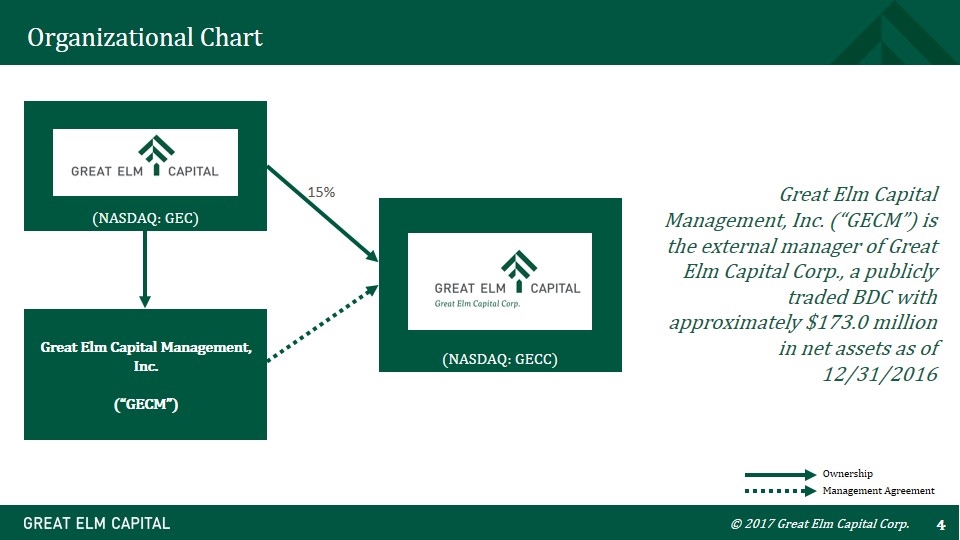

15% Organizational Chart Great Elm Capital Management, Inc. (“GECM”) Ownership Management Agreement (NASDAQ: GEC) (NASDAQ: GECC) Great Elm Capital Management, Inc. (“GECM”) is the external manager of Great Elm Capital Corp., a publicly traded BDC with approximately $173.0 million in net assets as of 12/31/2016 © 2017 Great Elm Capital Corp.

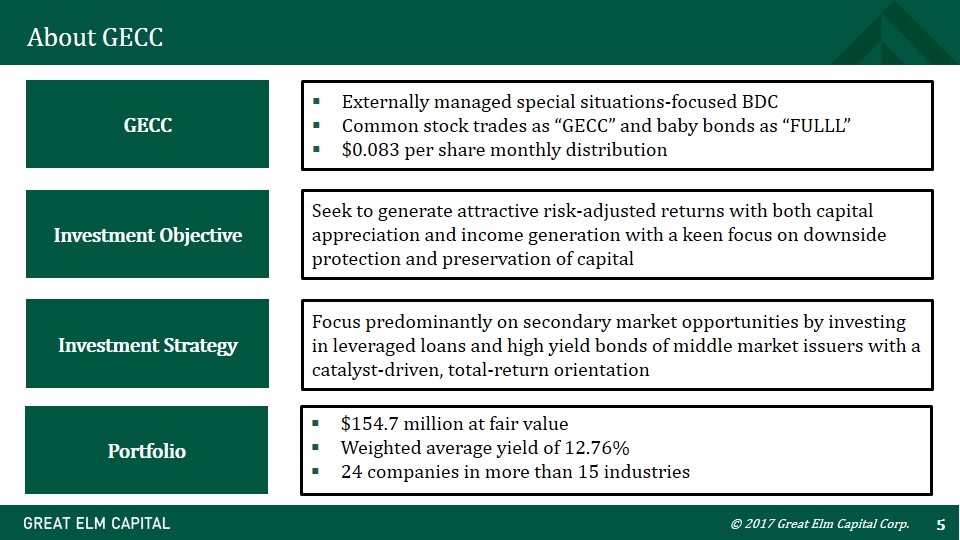

© 2017 Great Elm Capital Corp. About GECC GECC Investment Objective Investment Strategy Externally managed special situations-focused BDC Common stock trades as “GECC” and baby bonds as “FULLL” $0.083 per share monthly distribution Seek to generate attractive risk-adjusted returns with both capital appreciation and income generation with a keen focus on downside protection and preservation of capital Focus predominantly on secondary market opportunities by investing in leveraged loans and high yield bonds of middle market issuers with a catalyst-driven, total-return orientation Portfolio $154.7 million at fair value Weighted average yield of 12.76% 24 companies in more than 15 industries

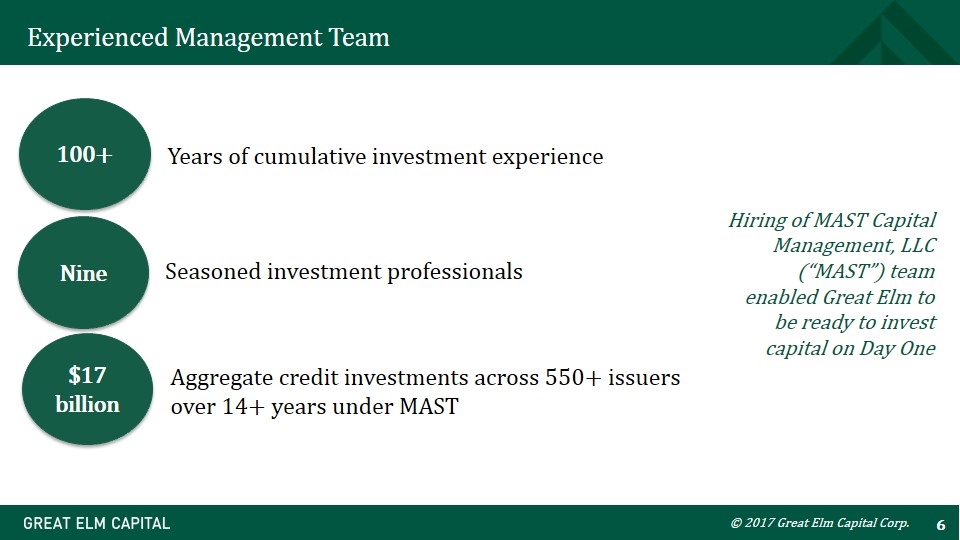

Experienced Management Team 100+ Years of cumulative investment experience Nine Seasoned investment professionals $17 billion Aggregate credit investments across 550+ issuers over 14+ years under MAST Hiring of MAST Capital Management, LLC (“MAST”) team enabled Great Elm to be ready to invest capital on Day One © 2017 Great Elm Capital Corp.

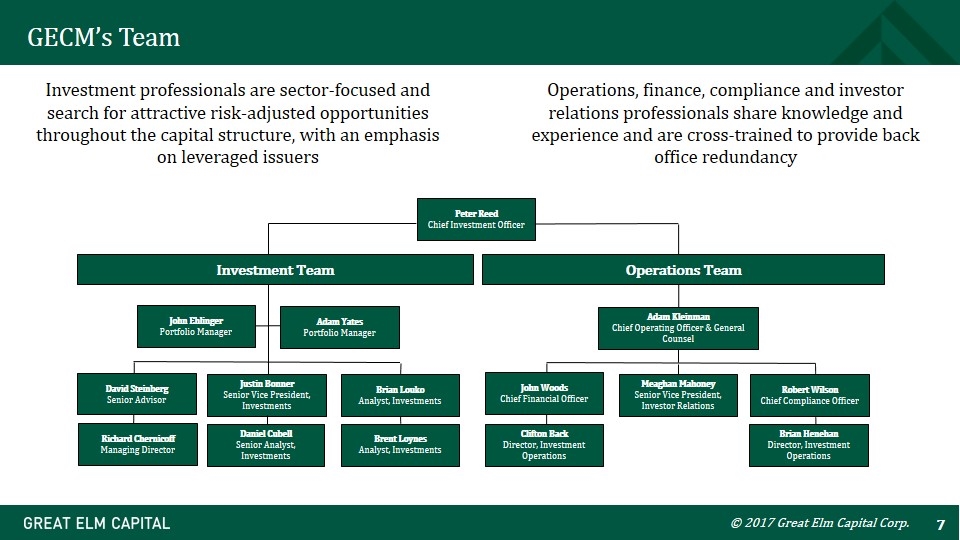

GECM’s Team Investment professionals are sector-focused and search for attractive risk-adjusted opportunities throughout the capital structure, with an emphasis on leveraged issuers Operations, finance, compliance and investor relations professionals share knowledge and experience and are cross-trained to provide back office redundancy Peter Reed Chief Investment Officer Richard Chernicoff Managing Director Investment Team Operations Team Robert Wilson Chief Compliance Officer Meaghan Mahoney Senior Vice President, Investor Relations Adam Kleinman Chief Operating Officer & General Counsel Justin Bonner Senior Vice President, Investments David Steinberg Senior Advisor Adam Yates Portfolio Manager Clifton Back Director, Investment Operations Brent Loynes Analyst, Investments Brian Louko Analyst, Investments Daniel Cubell Senior Analyst, Investments John Ehlinger Portfolio Manager John Woods Chief Financial Officer Brian Henehan Director, Investment Operations © 2017 Great Elm Capital Corp.

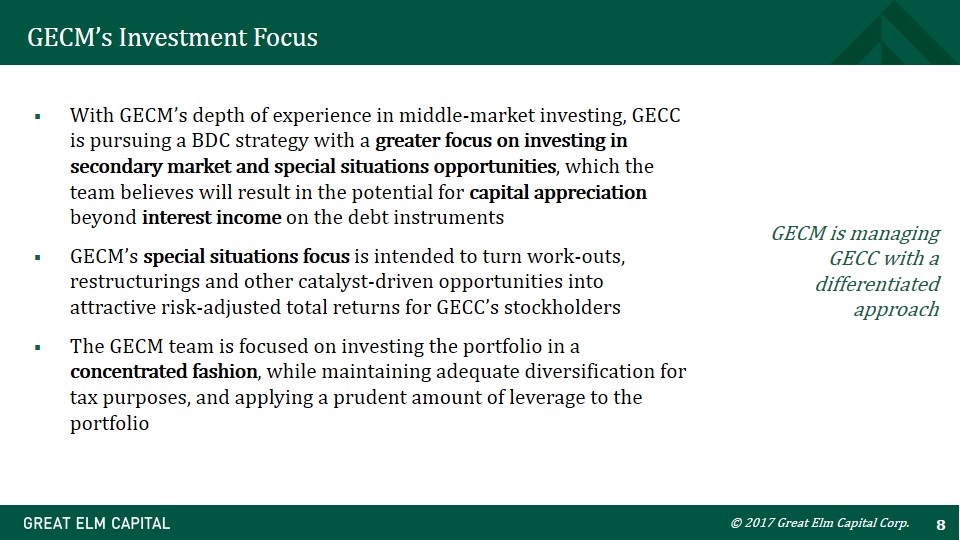

GECM’s Investment Focus With GECM’s depth of experience in middle-market investing, GECC is pursuing a BDC strategy with a greater focus on investing in secondary market and special situations opportunities, which the team believes will result in the potential for capital appreciation beyond interest income on the debt instruments GECM’s special situations focus is intended to turn work-outs, restructurings and other catalyst-driven opportunities into attractive risk-adjusted total returns for GECC’s stockholders The GECM team is focused on investing the portfolio in a concentrated fashion, while maintaining adequate diversification for tax purposes, and applying a prudent amount of leverage to the portfolio GECM is managing GECC with a differentiated approach © 2017 Great Elm Capital Corp.

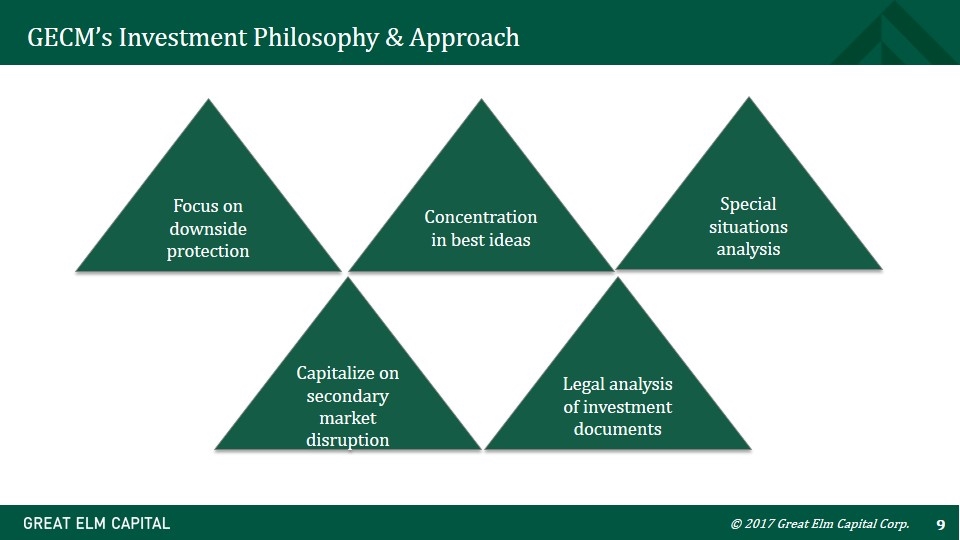

GECM’s Investment Philosophy & Approach © 2017 Great Elm Capital Corp. Capitalize on secondary market disruption Focus on downside protection Special situations analysis Legal analysis of investment documents Concentration in best ideas

GECM’s Underwriting Philosophy In implementing the investment strategy, GECM seeks to: Preserve capital Identify the margin of safety Concentrate in the team’s best ideas Invest with an edge by seeking investments where GECM’s view is differentiated from the market’s and mispricing provides risk-adjusted opportunities GECM executes on this investment philosophy by applying the key principles of value investing to leveraged capital structures, utilizing its research team to underwrite new investments. This process is steeped in in-depth, fundamental research coupled with significant in-house legal expertise. © 2017 Great Elm Capital Corp.

© 2017 Great Elm Capital Corp. Financial & Portfolio Review

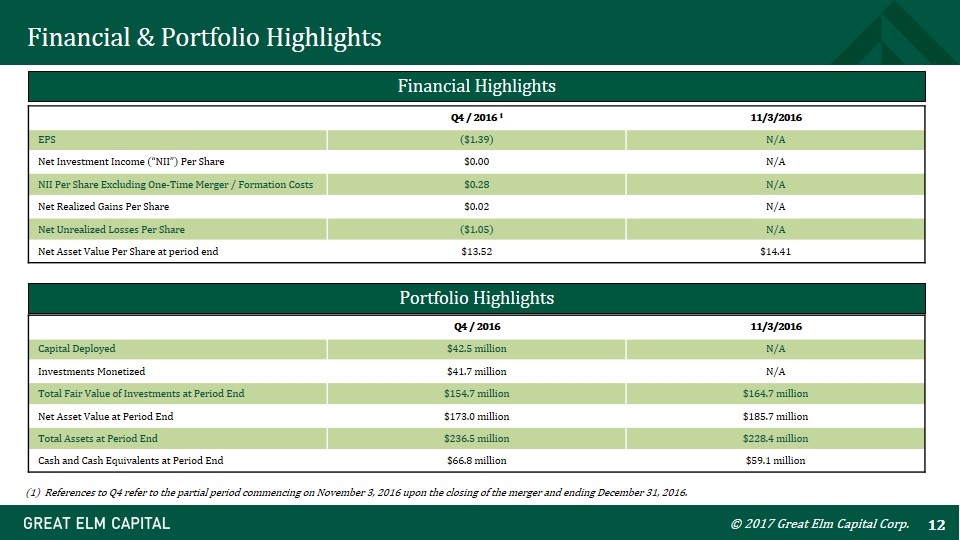

© 2017 Great Elm Capital Corp. Financial & Portfolio Highlights Q4 / 2016 1 11/3/2016 EPS ($1.39) N/A Net Investment Income (“NII”) Per Share $0.00 N/A NII Per Share Excluding One-Time Merger / Formation Costs $0.28 N/A Net Realized Gains Per Share $0.02 N/A Net Unrealized Losses Per Share ($1.05) N/A Net Asset Value Per Share at period end $13.52 $14.41 Financial Highlights Q4 / 2016 11/3/2016 Capital Deployed $42.5 million N/A Investments Monetized $41.7 million N/A Total Fair Value of Investments at Period End $154.7 million $164.7 million Net Asset Value at Period End $173.0 million $185.7 million Total Assets at Period End $236.5 million $228.4 million Cash and Cash Equivalents at Period End $66.8 million $59.1 million Portfolio Highlights (1) References to Q4 refer to the partial period commencing on November 3, 2016 upon the closing of the merger and ending December 31, 2016.

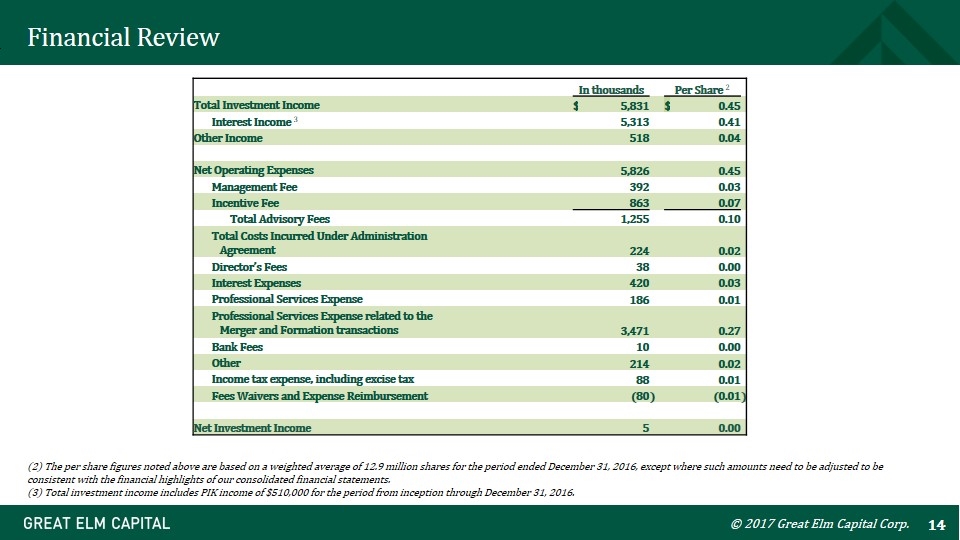

© 2017 Great Elm Capital Corp. Financial Review Total investment income for the period ended December 31, 2016 was approximately $5.8 million, or $0.45 per share Total net expenses for the period ended December 31, 2016 was approximately $5.8 million, or $0.45 per share Included in this quarter’s operating expenses was $3.5 million, or approximately $0.27 per share, in professional fees associated with the Full Circle / Great Elm merger and formation transactions that are one-time in nature Net investment income for the period ended December 31, 2016 was $5,000, which equated to approximately $0.00 per share Net realized gains for the period ended December 31, 2016 were $0.3 million, or approximately $0.02 per share Net unrealized depreciation of investments for the period ended December 31, 2016 was $13.5 million, or approximately ($1.05) per share

© 2017 Great Elm Capital Corp. Financial Review In thousands Per Share 2 Total Investment Income $ 5,831 $ 0.45 Interest Income 3 5,313 0.41 Other Income 518 0.04 Net Operating Expenses 5,826 0.45 Management Fee 392 0.03 Incentive Fee 863 0.07 Total Advisory Fees 1,255 0.10 Total Costs Incurred Under Administration Agreement 224 0.02 Director’s Fees 38 0.00 Interest Expenses 420 0.03 Professional Services Expense 186 0.01 Professional Services Expense related to the Merger and Formation transactions 3,471 0.27 Bank Fees 10 0.00 Other 214 0.02 Income tax expense, including excise tax 88 0.01 Fees Waivers and Expense Reimbursement (80 ) (0.01 ) Net Investment Income 5 0.00 (2) The per share figures noted above are based on a weighted average of 12.9 million shares for the period ended December 31, 2016, except where such amounts need to be adjusted to be consistent with the financial highlights of our consolidated financial statements. (3) Total investment income includes PIK income of $510,000 for the period from inception through December 31, 2016.

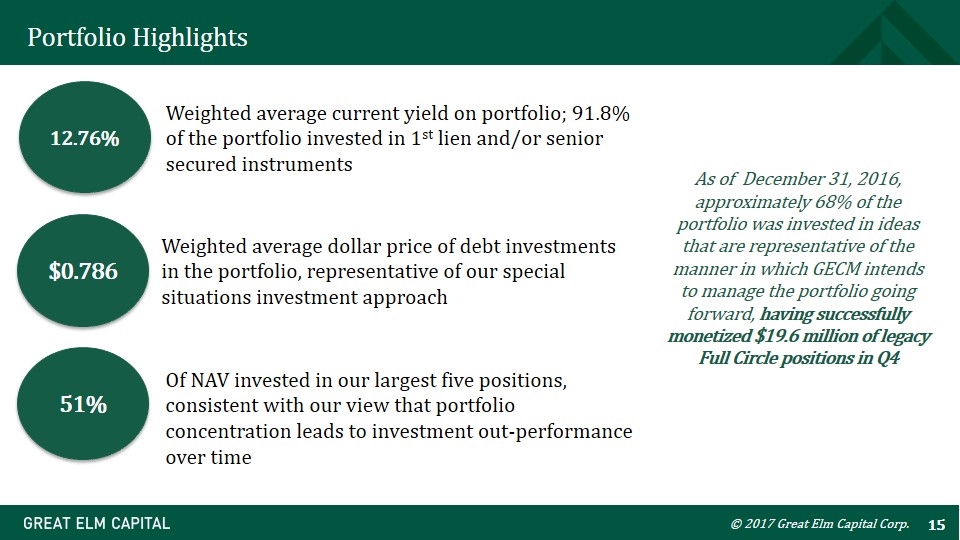

© 2017 Great Elm Capital Corp. Portfolio Highlights 12.76% Weighted average current yield on portfolio; 91.8% of the portfolio invested in 1st lien and/or senior secured instruments 51% Of NAV invested in our largest five positions, consistent with our view that portfolio concentration leads to investment out-performance over time $0.786 Weighted average dollar price of debt investments in the portfolio, representative of our special situations investment approach As of December 31, 2016, approximately 68% of the portfolio was invested in ideas that are representative of the manner in which GECM intends to manage the portfolio going forward, having successfully monetized $19.6 million of legacy Full Circle positions in Q4

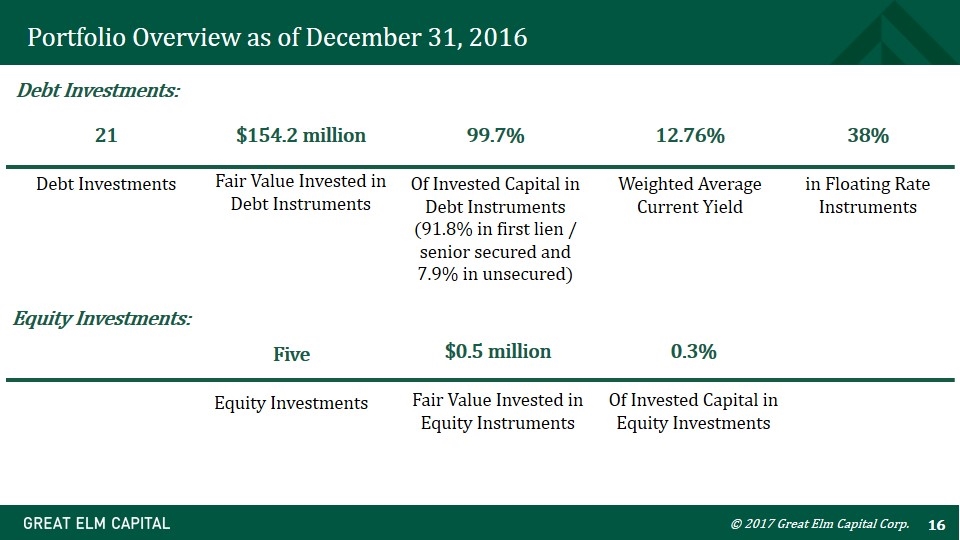

© 2017 Great Elm Capital Corp. Portfolio Overview as of December 31, 2016 21 Debt Investments $154.2 million Fair Value Invested in Debt Instruments 38% in Floating Rate Instruments 12.76% Weighted Average Current Yield 99.7% Of Invested Capital in Debt Instruments (91.8% in first lien / senior secured and 7.9% in unsecured) Five Equity Investments $0.5 million Fair Value Invested in Equity Instruments Debt Investments: Equity Investments: 0.3% Of Invested Capital in Equity Investments

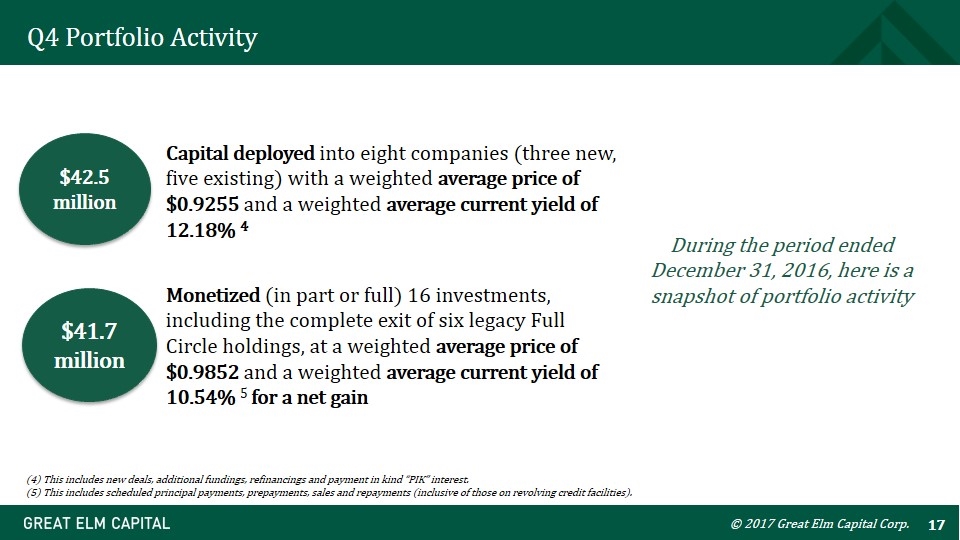

© 2017 Great Elm Capital Corp. Q4 Portfolio Activity $42.5 million Capital deployed into eight companies (three new, five existing) with a weighted average price of $0.9255 and a weighted average current yield of 12.18% 4 $41.7 million Monetized (in part or full) 16 investments, including the complete exit of six legacy Full Circle holdings, at a weighted average price of $0.9852 and a weighted average current yield of 10.54% 5 for a net gain During the period ended December 31, 2016, here is a snapshot of portfolio activity (4) This includes new deals, additional fundings, refinancings and payment in kind “PIK” interest. (5) This includes scheduled principal payments, prepayments, sales and repayments (inclusive of those on revolving credit facilities).

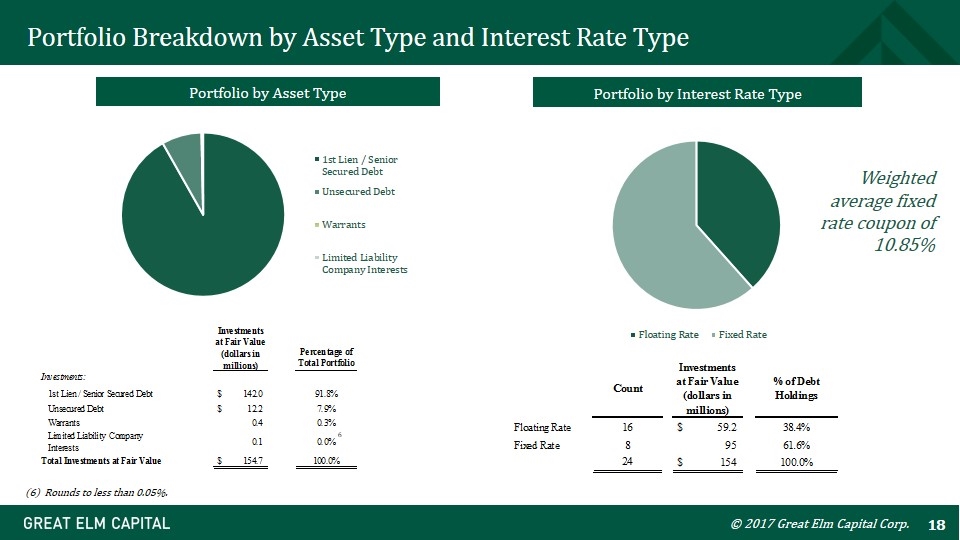

© 2017 Great Elm Capital Corp. Portfolio Breakdown by Asset Type and Interest Rate Type Portfolio by Asset Type Portfolio by Interest Rate Type (6) Rounds to less than 0.05%. 6 Weighted average fixed rate coupon of 10.85%

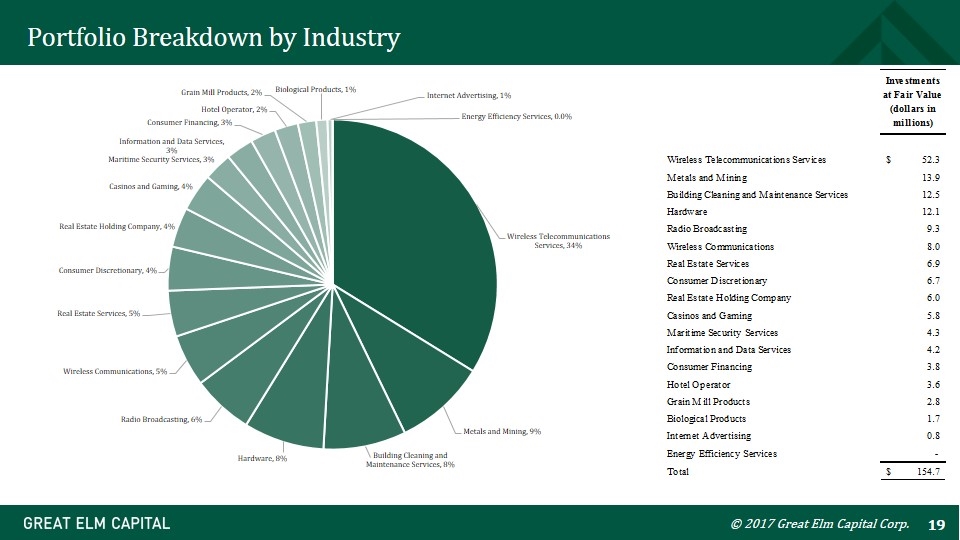

© 2017 Great Elm Capital Corp. Portfolio Breakdown by Industry

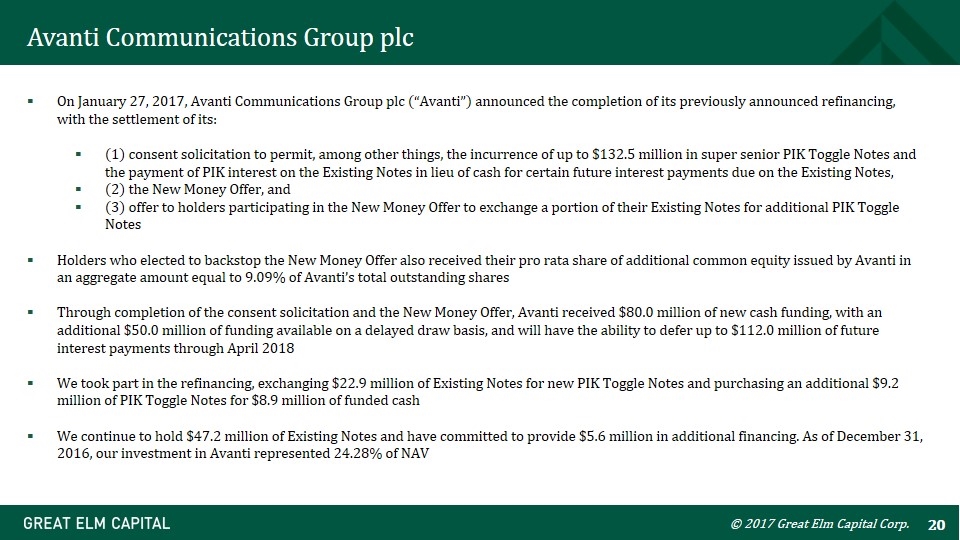

© 2017 Great Elm Capital Corp. Avanti Communications Group plc On January 27, 2017, Avanti Communications Group plc (“Avanti”) announced the completion of its previously announced refinancing, with the settlement of its: (1) consent solicitation to permit, among other things, the incurrence of up to $132.5 million in super senior PIK Toggle Notes and the payment of PIK interest on the Existing Notes in lieu of cash for certain future interest payments due on the Existing Notes, (2) the New Money Offer, and (3) offer to holders participating in the New Money Offer to exchange a portion of their Existing Notes for additional PIK Toggle Notes Holders who elected to backstop the New Money Offer also received their pro rata share of additional common equity issued by Avanti in an aggregate amount equal to 9.09% of Avanti’s total outstanding shares Through completion of the consent solicitation and the New Money Offer, Avanti received $80.0 million of new cash funding, with an additional $50.0 million of funding available on a delayed draw basis, and will have the ability to defer up to $112.0 million of future interest payments through April 2018 We took part in the refinancing, exchanging $22.9 million of Existing Notes for new PIK Toggle Notes and purchasing an additional $9.2 million of PIK Toggle Notes for $8.9 million of funded cash We continue to hold $47.2 million of Existing Notes and have committed to provide $5.6 million in additional financing. As of December 31, 2016, our investment in Avanti represented 24.28% of NAV

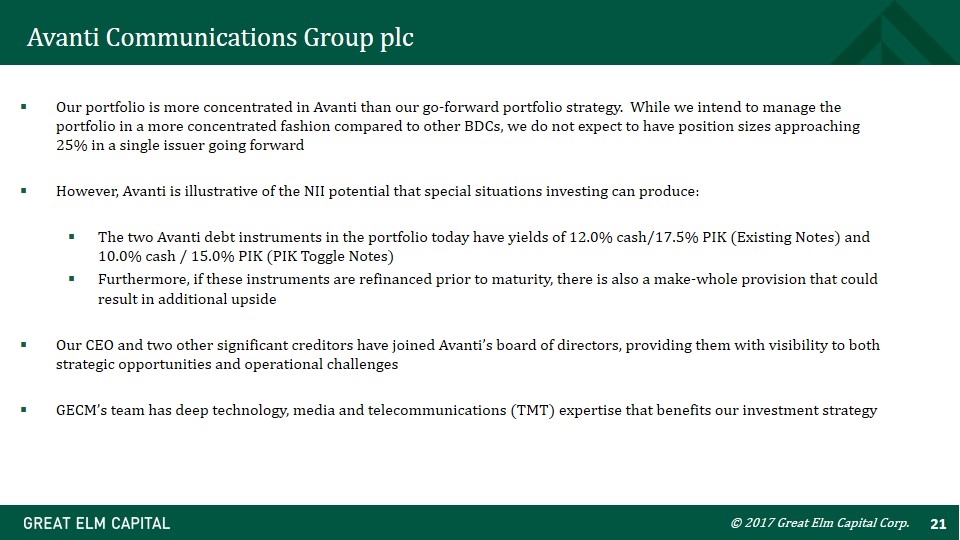

Our portfolio is more concentrated in Avanti than our go-forward portfolio strategy. While we intend to manage the portfolio in a more concentrated fashion compared to other BDCs, we do not expect to have position sizes approaching 25% in a single issuer going forward However, Avanti is illustrative of the NII potential that special situations investing can produce: The two Avanti debt instruments in the portfolio today have yields of 12.0% cash/17.5% PIK (Existing Notes) and 10.0% cash / 15.0% PIK (PIK Toggle Notes) Furthermore, if these instruments are refinanced prior to maturity, there is also a make-whole provision that could result in additional upside Our CEO and two other significant creditors have joined Avanti’s board of directors, providing them with visibility to both strategic opportunities and operational challenges GECM’s team has deep technology, media and telecommunications (TMT) expertise that benefits our investment strategy © 2017 Great Elm Capital Corp. Avanti Communications Group plc

© 2017 Great Elm Capital Corp. Capital Activity

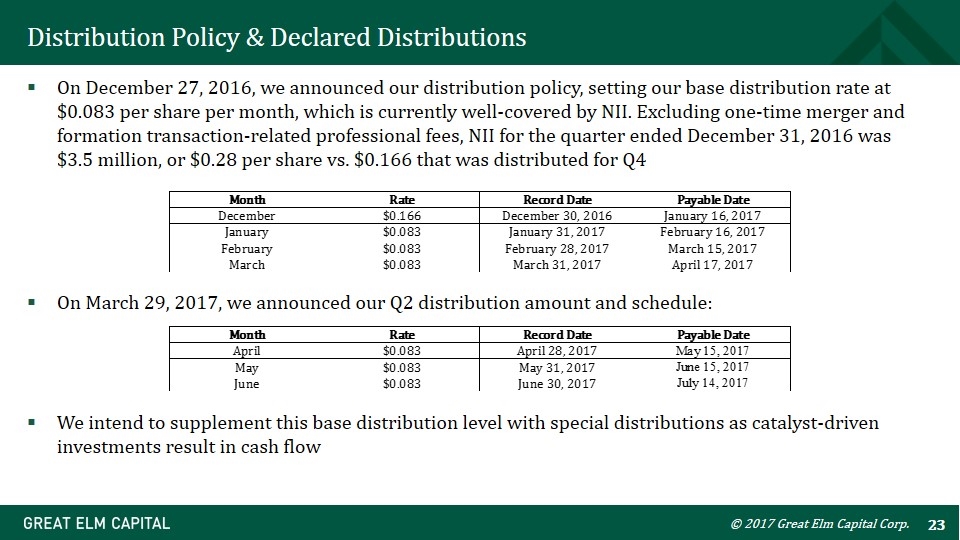

© 2017 Great Elm Capital Corp. Distribution Policy & Declared Distributions On December 27, 2016, we announced our distribution policy, setting our base distribution rate at $0.083 per share per month, which is currently well-covered by NII. Excluding one-time merger and formation transaction-related professional fees, NII for the quarter ended December 31, 2016 was $3.5 million, or $0.28 per share vs. $0.166 that was distributed for Q4 On March 29, 2017, we announced our Q2 distribution amount and schedule: We intend to supplement this base distribution level with special distributions as catalyst-driven investments result in cash flow

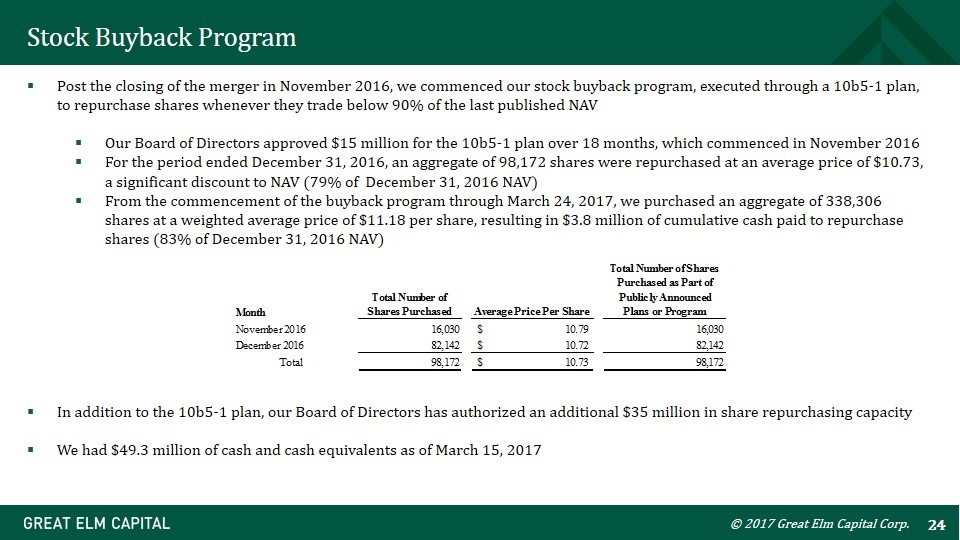

© 2017 Great Elm Capital Corp. Stock Buyback Program Post the closing of the merger in November 2016, we commenced our stock buyback program, executed through a 10b5-1 plan, to repurchase shares whenever they trade below 90% of the last published NAV Our Board of Directors approved $15 million for the 10b5-1 plan over 18 months, which commenced in November 2016 For the period ended December 31, 2016, an aggregate of 98,172 shares were repurchased at an average price of $10.73, a significant discount to NAV (79% of December 31, 2016 NAV) From the commencement of the buyback program through March 24, 2017, we purchased an aggregate of 338,306 shares at a weighted average price of $11.18 per share, resulting in $3.8 million of cumulative cash paid to repurchase shares (83% of December 31, 2016 NAV) In addition to the 10b5-1 plan, our Board of Directors has authorized an additional $35 million in share repurchasing capacity We had $49.3 million of cash and cash equivalents as of March 15, 2017

We intend to commence a tender offer for $10 million (approximately 7% of our market capitalization) of our common stock Our stockholders may: Agree to accept the price determined in the tender offer Specify the price at which they are willing to sell shares back to us Maximum = $12.17 per share (90% of December 31, 2016 NAV per share) Minimum = $11.50 per share (85% of December 31, 2016 NAV per share) This structure is referred to as a modified Dutch-auction Cash consideration from our balance sheet No minimum condition Initial expiration date (and last possible date to withdraw tenders) = May 5, 2017 Stockholders may tender all, some or none of the shares of our common stock that they beneficially own Subject to customary conditions If more than $10 million of shares are tendered, we will pro-rate (subject to a preference for holders of less than 100 shares) payments among shares tendered at or above the best price paid in the tender offer © 2017 Great Elm Capital Corp. Common Stock Self Tender

© 2017 Great Elm Capital Corp. Resale Registration Statement We are filing a Form N-2 to register the shares that were issued to GEC and the MAST Funds in the private placement contemplated by the June 2016 Subscription Agreement We contractually agreed to register these shares no later than Q1 2017 GEC’s shares are subject to a contractual lock-up until November 2017

© 2017 Great Elm Capital Corp. Appendix

The Merger © 2017 Great Elm Capital Corp. On June 23, 2016, Full Circle Capital Corp. (“Full Circle”) announced its intent to merge with and into Great Elm Capital Corp. (“GECC”), a newly formed entity, formed by funds (the “MAST Funds”) managed by MAST Capital Management, LLC (“MAST Capital”) and Great Elm Capital Group, Inc. (“Great Elm”) GECC, which was the surviving entity, elected to be regulated as a business development company (“BDC”) and applied for listing on NASDAQ under the symbol “GECC” On October 31, 2016, the majority of Full Circle stockholders voted in favor of the merger; the merger closed on November 3, 2016

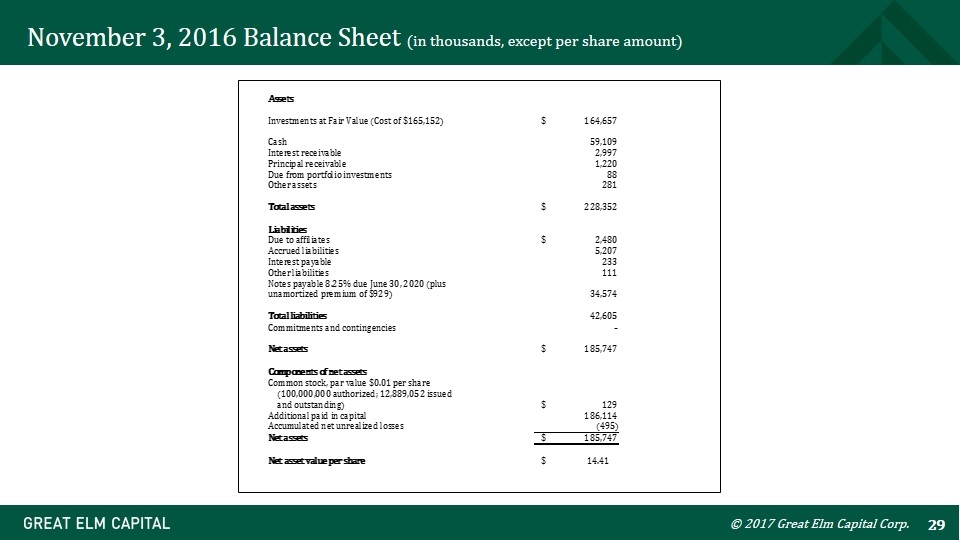

November 3, 2016 Balance Sheet (in thousands, except per share amount) © 2017 Great Elm Capital Corp.

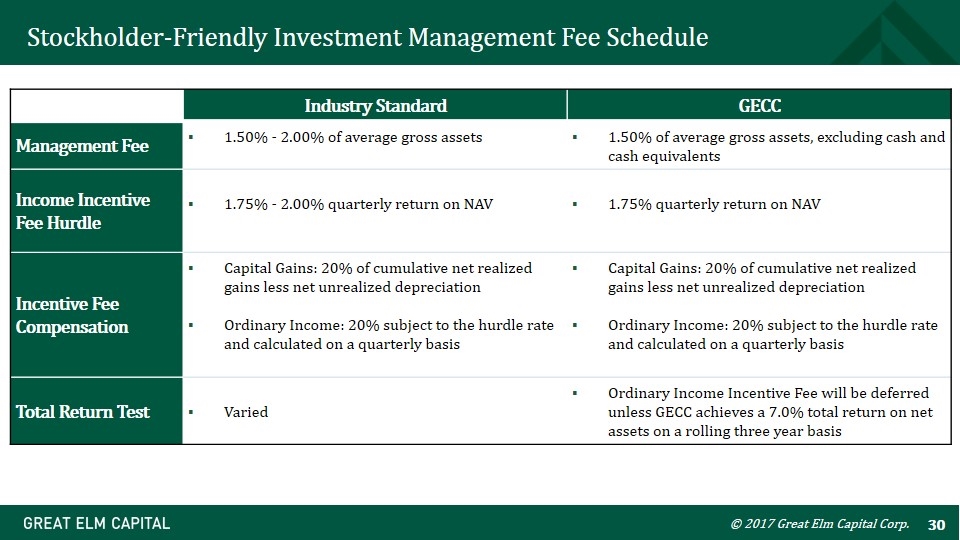

Stockholder-Friendly Investment Management Fee Schedule © 2017 Great Elm Capital Corp. Industry Standard GECC Management Fee 1.50% - 2.00% of average gross assets 1.50% of average gross assets, excluding cash and cash equivalents Income Incentive Fee Hurdle 1.75% - 2.00% quarterly return on NAV 1.75% quarterly return on NAV Incentive Fee Compensation Capital Gains: 20% of cumulative net realized gains less net unrealized depreciation Ordinary Income: 20% subject to the hurdle rate and calculated on a quarterly basis Capital Gains: 20% of cumulative net realized gains less net unrealized depreciation Ordinary Income: 20% subject to the hurdle rate and calculated on a quarterly basis Total Return Test Varied Ordinary Income Incentive Fee will be deferred unless GECC achieves a 7.0% total return on net assets on a rolling three year basis

Contact Information © 2017 Great Elm Capital Corp. Investor Relations Meaghan K. Mahoney Senior Vice President 200 Clarendon Street, 51st Floor Boston, MA 02116 Phone: +1 (617) 375-3006 investorrelations@greatelmcap.com