Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - MID PENN BANCORP INC | mpb-ex993_152.htm |

| EX-99.1 - EX-99.1 - MID PENN BANCORP INC | mpb-ex991_153.htm |

| 8-K - 8-K - MID PENN BANCORP INC | mpb-8k_20170329.htm |

Pending Merger of Mid Penn Bancorp, Inc. and The Scottdale Bank & Trust Company Exhibit 99.2

Highlights Chartered in 1901 Total Assets of approximately $263 Million Headquartered in Scottdale, Pennsylvania with five retail offices in Westmoreland and Fayette counties, expanding Mid Penn’s presence into western Pennsylvania Strong tradition of community involvement & support Proud of the highly personalized service that they have provided to generations of customers Following completion of the merger, Scottdale will be merged into Mid Penn Bank and will operate as “Scottdale Bank & Trust, a division of Mid Penn Bank”

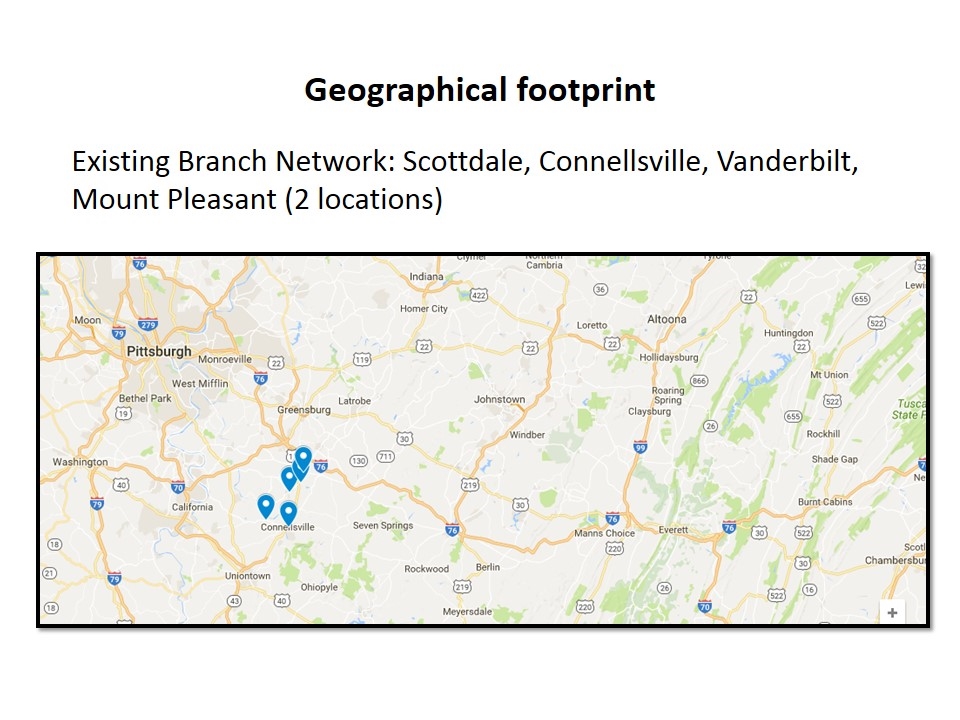

Geographical footprint Existing Branch Network: Scottdale, Connellsville, Vanderbilt, Mount Pleasant (2 locations)

County statistical data Fayette County Population of 136,606 59,969 households Median age = 40 years County Seat is Uniontown (population 10,372) Home to Penn State Fayette, Falling Water, Nemacolin & Ohiopyle Westmoreland County Population of 369,993 149,813 households Median age = 41 County Seat is Greensburg (population 14,892) Home to Penn State New Kensington, U of Pittsburgh –Greensburg, Saint Vincent College & Seton Hill College

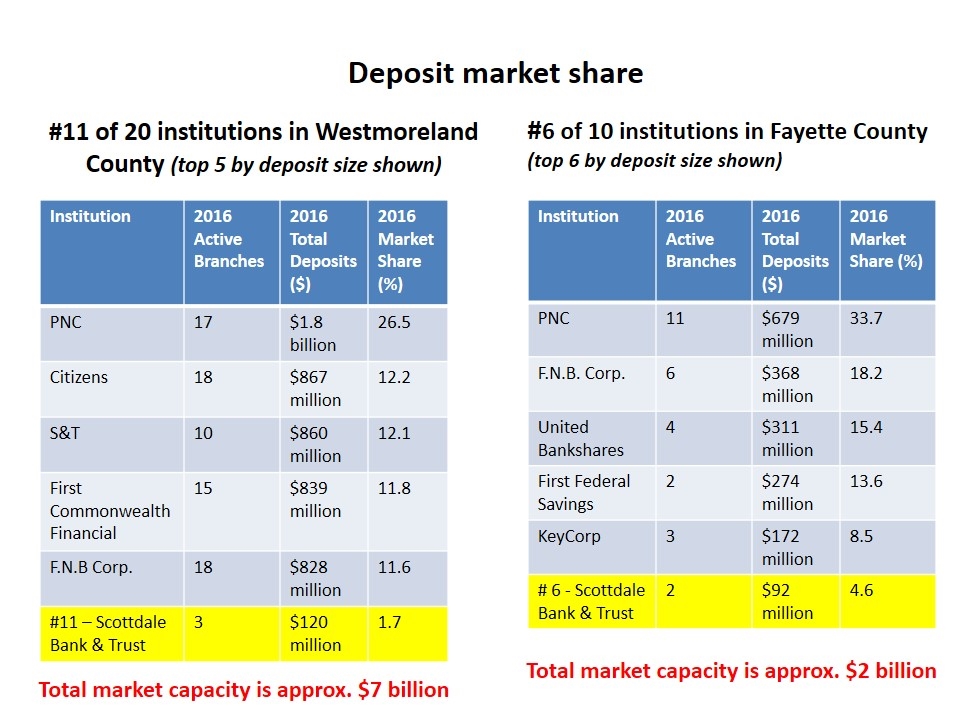

Deposit market share #6 of 10 institutions in Fayette County (top 6 by deposit size shown) #11 of 20 institutions in Westmoreland County (top 5 by deposit size shown) Institution 2016 Active Branches 2016 Total Deposits ($) 2016 Market Share (%) PNC 17 $1.8 billion 26.5 Citizens 18 $867 million 12.2 S&T 10 $860 million 12.1 First Commonwealth Financial 15 $839 million 11.8 F.N.B Corp. 18 $828 million 11.6 #11 – Scottdale Bank & Trust 3 $120 million 1.7 Institution 2016 Active Branches 2016 Total Deposits ($) 2016 Market Share (%) PNC 11 $679 million 33.7 F.N.B. Corp. 6 $368 million 18.2 United Bankshares 4 $311 million 15.4 First Federal Savings 2 $274 million 13.6 KeyCorp 3 $172 million 8.5 # 6 - Scottdale Bank & Trust 2 $92 million 4.6 Total market capacity is approx. $7 billion Total market capacity is approx. $2 billion

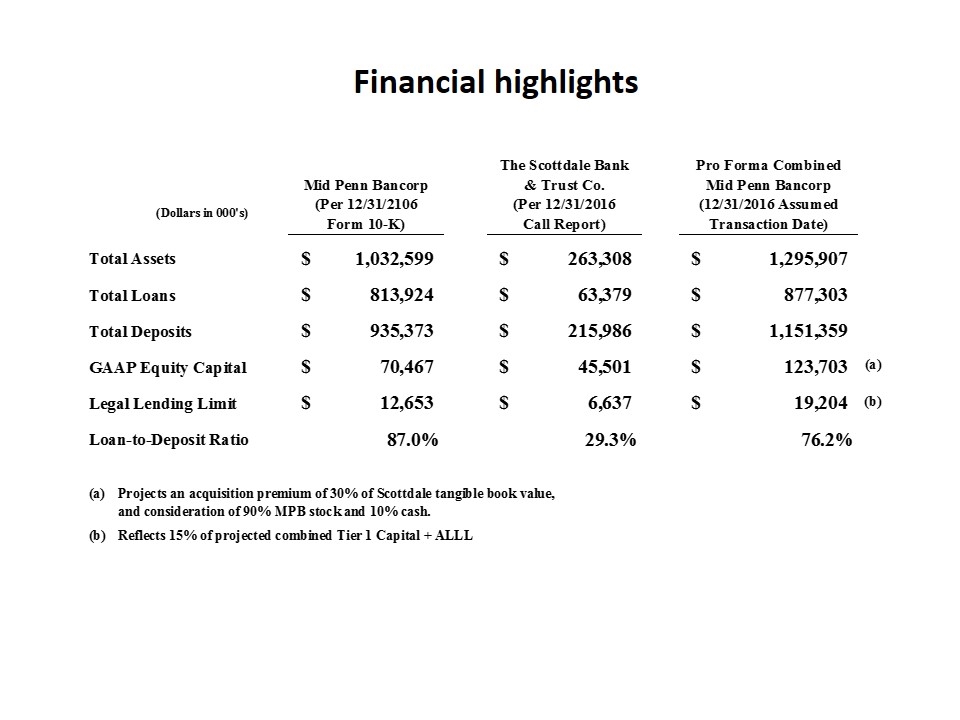

Financial highlights

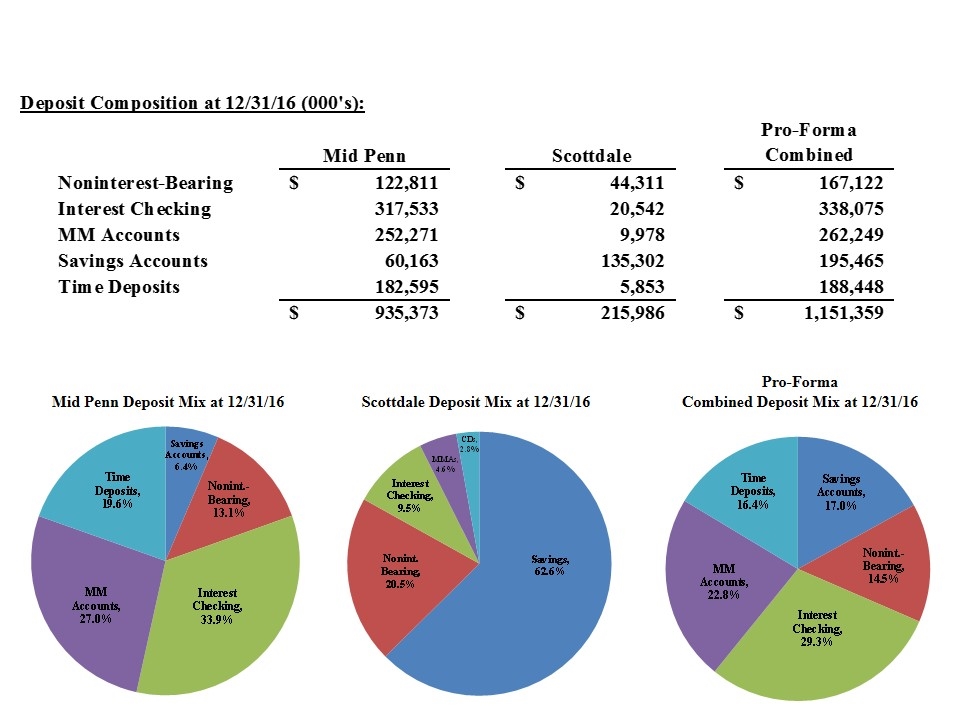

Scottdale Deposit Mix at 12/31/16 Mid Penn Deposit Mix at 12/31/16 Pro-Forma Combined Deposit Mix at 12/31/16

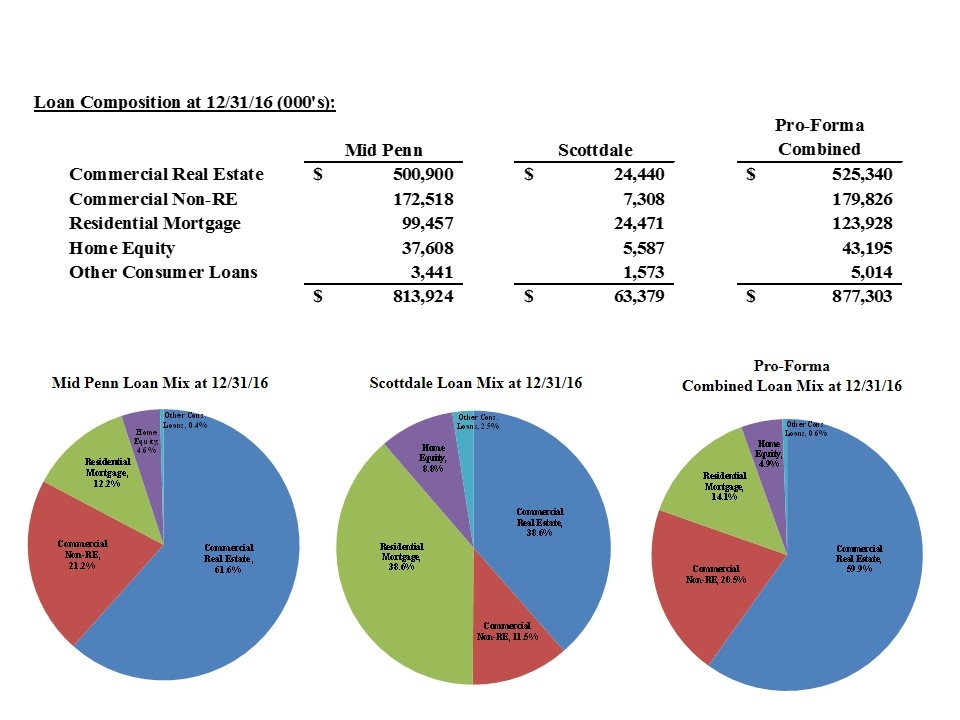

Scottdale Loan Mix at 12/31/16 Mid Penn Loan Mix at 12/31/16 Pro-Forma Combined Loan Mix at 12/31/16

Additional Information About the Merger and Where to Find It In connection with the proposed merger, Mid Penn will file with the Securities and Exchange Commission (the "SEC") a registration statement on Form S-4 to register the shares of Mid Penn common stock to be issued to the shareholders of Scottdale. The registration statement will include a joint proxy statement/prospectus, which will be sent to the shareholders of Mid Penn and Scottdale seeking their respective approvals of the merger. In addition, each of Mid Penn and Scottdale may file other relevant documents concerning the proposed merger with the SEC. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MID PENN, SCOTTDALE AND THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of these documents, when they become available, through the website maintained by the SEC at www.sec.gov. Free copies of the joint proxy statement/prospectus, when it becomes available, also may be obtained by directing a request by telephone or mail to Mid Penn Bancorp, Inc., 349 Union Street, Millersburg, Pennsylvania 17061, Attention: Investor Relations (telephone: 717-692-7105) or The Scottdale Bank & Trust Company, 150 Pittsburgh Street, Scottdale, Pennsylvania 15683, Attention: Investor Relations (telephone: 724-227-8330) or by accessing Mid Penn's website at www.midpennbank.com under "Investors". The information on Mid Penn's and Scottdale's websites is not, and shall not be deemed to be, a part of this release or incorporated into other filings either company makes with the SEC. Mid Penn, Scottdale and their respective directors, executive officers and members of management may be deemed to be participants in the solicitation of proxies from the shareholders of Mid Penn and Scottdale in connection with the transaction. Information about the directors and executive officers of Mid Penn is set forth in the proxy statement for Mid Penn's 2016 annual meeting of shareholders filed with the SEC on March 28, 2016. Additional information regarding the interests of these participants and other persons who may be deemed participants in the merger may be obtained by reading the joint proxy statement/prospectus regarding the merger when it becomes available.