Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bristow Group Inc | d363836d8k.htm |

Scotia Howard Weil 45th Annual Energy Conference Bristow Group Inc. March 29, 2017 EXHIBIT 99.1

Forward-looking statements Statements contained in this presentation regarding the Company’s or management’s intentions, hopes, beliefs, expectations or predictions of the future are forward-looking statements. These forward-looking statements include statements regarding capital deployment strategy, operational and capital performance, impact of new contracts, cost reduction initiatives, capex deferral, shareholder return, liquidity, market and industry conditions. It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Risks and uncertainties include, without limitation: fluctuations in the demand for our services; fluctuations in worldwide prices of and supply and demand for oil and natural gas; fluctuations in levels of oil and natural gas production, exploration and development activities; the impact of competition; actions by clients and suppliers; the risk of reductions in spending on helicopter services by governmental agencies; changes in tax and other laws and regulations; changes in foreign exchange rates and controls; risks associated with international operations; operating risks inherent in our business, including the possibility of declining safety performance; general economic conditions including the capital and credit markets; our ability to obtain financing; the risk of grounding of segments of our fleet for extended periods of time or indefinitely; our ability to re-deploy our aircraft to regions with greater demand; our ability to acquire additional aircraft and dispose of older aircraft through sales into the aftermarket; the possibility that we do not achieve the anticipated benefit of our fleet investment and Operational Excellence programs; availability of employees with the necessary skills; and political instability, war or acts of terrorism in any of the countries in which we operate. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in the Company’s SEC filings, including but not limited to the Company’s annual report on Form 10-K for the fiscal year ended March 31, 2016 and quarterly report on Form 10-Q for the three months ended December 31, 2016. Bristow Group Inc. disclaims any intention or obligation to revise any forward-looking statements, including financial estimates, whether as a result of new information, future events or otherwise.

Ticker: BRS; stock price1 of $13.23/share with a market cap ~$460 million 345 aircraft in ~20 countries with ~4,500 employees2 Successful launch of U.K. SAR contract (not tied to oil and gas) Improved liquidity and financial flexibility with recent secured financings $67 Based on stock price as of March 24, 2017 As of December 31, 2016 Bristow transports crews for oil and gas companies and provides search and rescue (SAR) services for them and governments alike Bristow is the leader in industrial aviation services

Continued focus on our FY17 Safety Improvement Plan with full air and ground YTD Target Zero performance in AFR and APR Enhanced one-time inspections of S-92s complete with limited disruption to service; elevated monitoring continues Our global H225 operations remain suspended and we continue to evaluate a return to service, monitor litigation and explore our options with Airbus HeliOffshore is proving important in our rapid response to new Airworthiness Directives Our Target Zero safety culture is the key component of our core values

Recent events and outlook The December 2016 quarter results reflect the continued pressure on our oil and gas operations due to the industry downturn; however, they were above our internal expectations Improving our liquidity runway by $630 million through: Funding of $200 million Lombard seven-year equipment financings Funding of $200 million secured equipment financing with Macquarie Executed commitment letter with Milestone / GE Capital Aviation Services for $230 million secured equipment financing; expected to close no later than June 2017 Recent tender successes reflect our global position, reliable operations and creative solutions in oil and gas transportation and SAR While we expect offshore E&P spend to be down again in FY18 and challenging market conditions to continue, green shoots are beginning to appear

Liquidity runway increased with $400 million now funded of the $630 million equipment financings announced We expect new leased aircraft will offset rent savings from returned aircraft in the short term as we manage fleet operations We continue to reduce incremental lease costs Funded Lombard $200 million, five-year term, L+2.25% Funded Macquarie $200 million, five-year term, L+5.35% earlier than initial expectations Executed Milestone/GECAS $230 million commitment letter, six-year term, L+5.00% We intend to continue to return aircraft to lessors as planned in future years (first two in process) CY16 amendments to credit facilities demonstrate bank group support Capex deferrals (on top of ~$95 million FY17/18 capex deferral) Self-help Secured equipment financing Leased fleet

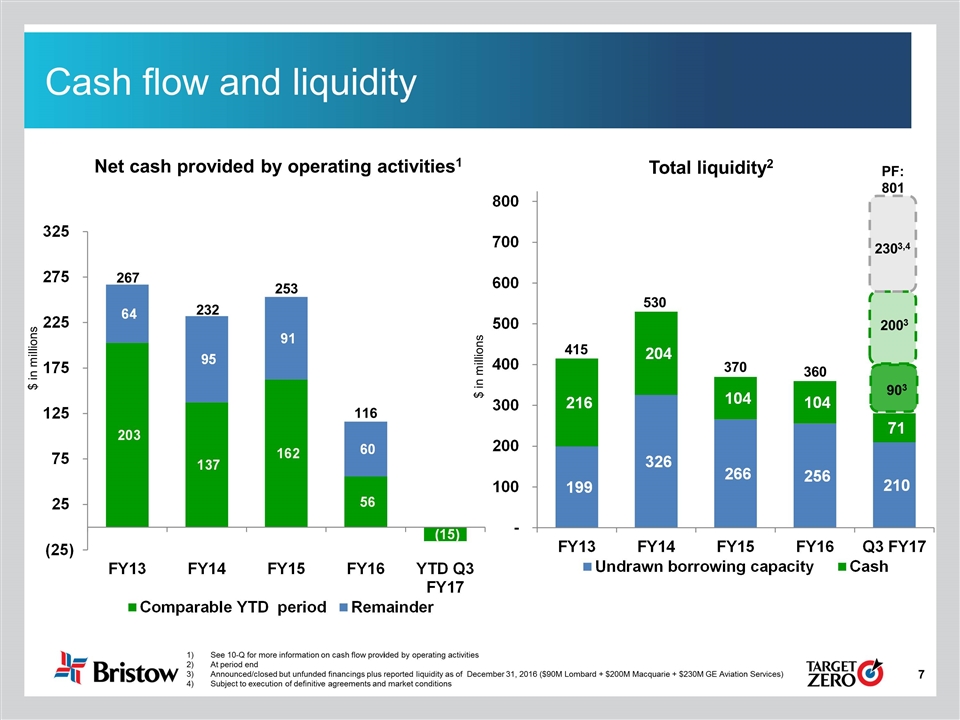

Cash flow and liquidity $ in millions Net cash provided by operating activities1 Total liquidity2 $ in millions See 10-Q for more information on cash flow provided by operating activities At period end Announced/closed but unfunded financings plus reported liquidity as of December 31, 2016 ($90M Lombard + $200M Macquarie + $230M GE Aviation Services) Subject to execution of definitive agreements and market conditions 415 530 370 360 267 232 253 116 PF: 801 2003 903 2303,4

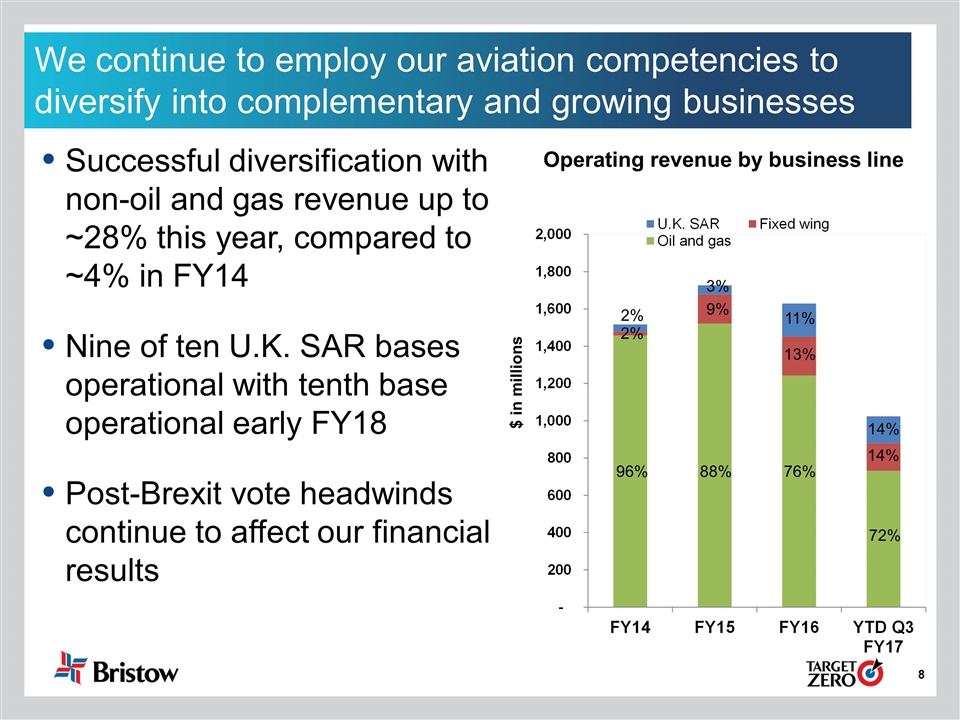

We continue to employ our aviation competencies to diversify into complementary and growing businesses 96% 2% 76% 13% 11% Operating revenue by business line $ in millions Successful diversification with non-oil and gas revenue up to ~28% this year, compared to ~4% in FY14 Nine of ten U.K. SAR bases operational with tenth base operational early FY18 Post-Brexit vote headwinds continue to affect our financial results 88% 3% 9% 2% 72% 14% 14%

Bristow continues to execute successfully to maintain leadership position during this downturn Primary focus remains on continuing to improve upon our safety performance Like our offshore services peers, we expect offshore E&P spend to be down again in FY18; we remain focused on improving our essential service for our clients as we anticipate offshore spend to increase in FY19/20 Unlike our offshore services peers, we have diversified business lines that provide relatively stable cash flow through this prolonged downturn Funding of $200 million Lombard financings and $200 million Macquarie financing plus anticipated $230 million GE secured financing improves liquidity by terming out bank debt and improving our financial health through the oil and gas cycle Successful execution of FY17 Action Plan and recent tender successes are evidence to our stakeholders that we can maintain our leadership position during this prolonged downturn

We are Bristow

Appendix

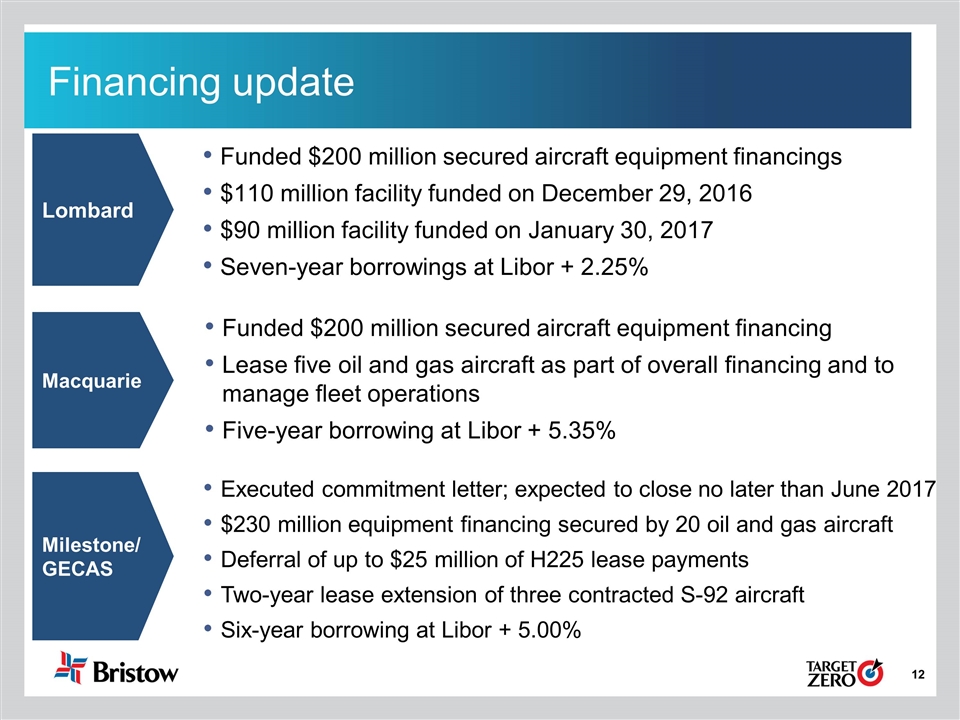

Financing update Funded $200 million secured aircraft equipment financing Lease five oil and gas aircraft as part of overall financing and to manage fleet operations Five-year borrowing at Libor + 5.35% Funded $200 million secured aircraft equipment financings $110 million facility funded on December 29, 2016 $90 million facility funded on January 30, 2017 Seven-year borrowings at Libor + 2.25% Executed commitment letter; expected to close no later than June 2017 $230 million equipment financing secured by 20 oil and gas aircraft Deferral of up to $25 million of H225 lease payments Two-year lease extension of three contracted S-92 aircraft Six-year borrowing at Libor + 5.00% Lombard Macquarie Milestone/ GECAS

Bristow Group Inc. (NYSE: BRS) 2103 City West Blvd., 4th Floor Houston, Texas 77042 t 713.267.7600 f 713.267.7620 bristowgroup.com Contact us