Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Energy Inc. | a8-kpbfenergyneworleansinv.htm |

Private and Confidential – For Internal Use Only

PBF Energy

March 2017

1

This presentation contains forward-looking statements made by PBF Energy Inc. (“PBF Energy”), the indirect parent of PBF Logistics LP (“PBFX”, or

“Partnership”, and together with PBF Energy, the “Companies”, or “PBF”), and their management teams. Such statements are based on current

expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and

intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and

may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements

are based on information available at the time, and are subject to various risks and uncertainties that could cause the Companies’ actual

performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not

limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products;

the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics

infrastructure; effects of litigation and government investigations; the timing and announcement of any potential acquisitions and subsequent

impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or

regulations or differing interpretations or enforcement thereof affecting our business or industry; actions taken or non-performance by third

parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other

labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to

complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; ability to consummate potential

acquisitions, the timing for the closing of any such acquisition and our plans for financing any acquisition; unforeseen liabilities associated with any

potential acquisition; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future

laws and governmental regulations, including environmental, health and safety regulations; and, various other factors.

Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Companies assume no

responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors

affecting forward-looking information after such date.

Safe Harbor Statements

Second most complex independent refiner with regionally-advantaged asset base

Significantly advantaged crude and feedstock optionality provides access to most

economic input slate

Strategic relationship with PBF Logistics (NYSE:PBFX) provides growth partnership

Long and successful history of executing accretive acquisitions and driving growth

Track record of investing in organic, margin-improvement projects

Targeting self-help projects to enhance margin capture and increase commercial

flexibility

Focused internal investment to drive growth and enhance margins

Maintain conservative balance sheet and strong liquidity

Continue to reward shareholders with attractive dividend yield and returns

Refining and Logistics segments provide dual growth platforms

Optimize refining profitability

Diversify logistics footprint through third-party transactions

Attractive

Asset Base

PBF – A Compelling Investment

Proven

Track Record

Disciplined

Allocation

of Capital

Future

Growth Opportunities

3

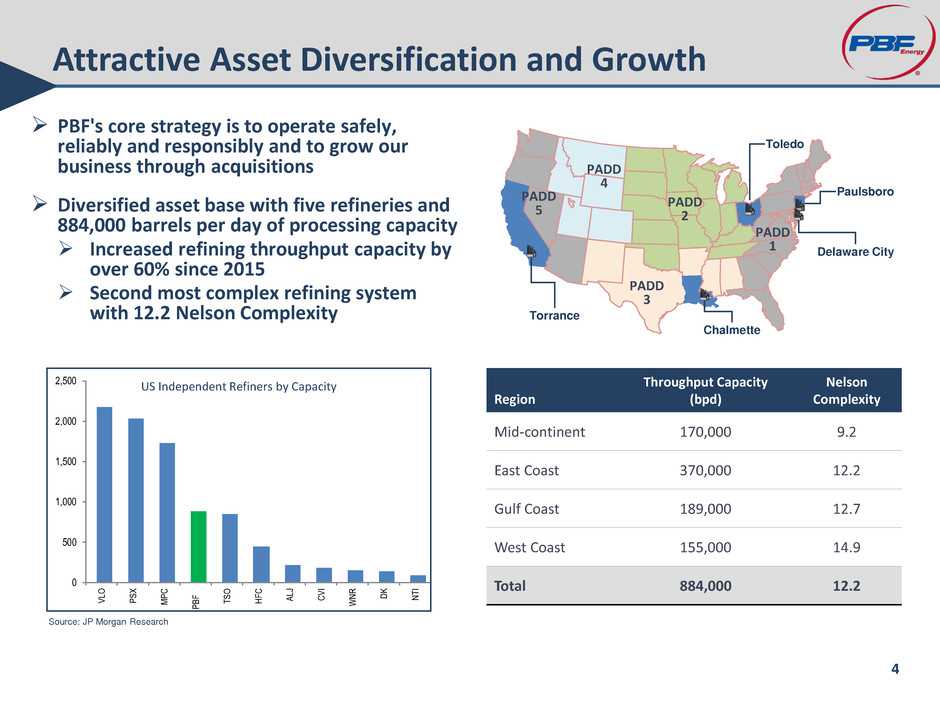

Attractive Asset Diversification and Growth

PBF's core strategy is to operate safely,

reliably and responsibly and to grow our

business through acquisitions

Diversified asset base with five refineries and

884,000 barrels per day of processing capacity

Increased refining throughput capacity by

over 60% since 2015

Second most complex refining system

with 12.2 Nelson Complexity

Region

Throughput Capacity

(bpd)

Nelson

Complexity

Mid-continent 170,000 9.2

East Coast 370,000 12.2

Gulf Coast 189,000 12.7

West Coast 155,000 14.9

Total 884,000 12.2

Source: JP Morgan Research

0

500

1,000

1,500

2,000

2,500

V

LO

P

S

X

M

P

C

P

B

F

T

S

O

H

F

C

A

LJ

C

V

I

W

N

R

D

K

N

T

I

US Independent Refiners by Capacity

Paulsboro

Toledo

Chalmette

Torrance

PADD

2

PADD

3

PADD

5

Delaware City

PADD

4

PADD

1

4

Implementing System-wide Commercial Optimization

Crude sourcing flexibility and optionality

PBF uses its complex crude processing

capacity to source lowest cost input slate

PBF is benefiting from the global over-

supply of crude which is driving increased

competition and favorable pricing

dislocations

PBF is leveraging its expanded coastal

refining portfolio to capitalize on economies

of scale by sharing larger cargoes between

assets

Pursuing highest netback product distribution

channels

The East Coast Terminals acquisition by

PBFX provides additional capability in the

greater Philadelphia market

Penetrating additional regional markets on

Gulf and West Coasts

Entering the gasoline and distillate product

export markets

Refining Group Crude Slate Breakdown

Source: Company reports, JP Morgan Research

0%

20%

40%

60%

80%

100%

PBF PSX MPC TSO VLO HFC NTI ALJ DK WNR CVRR

Medium / Heavy Light

5

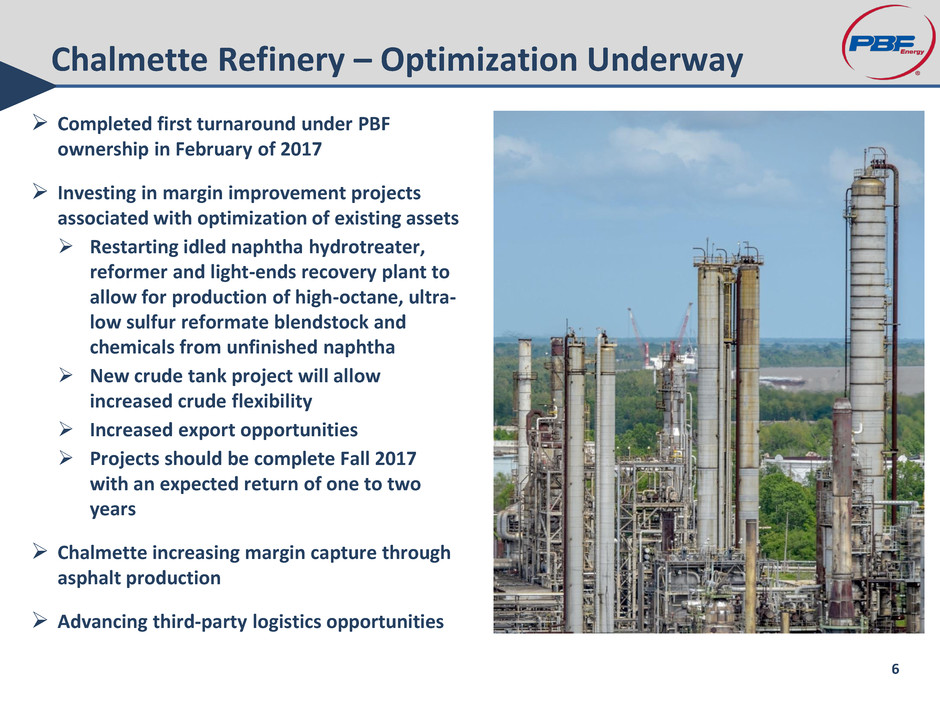

Completed first turnaround under PBF

ownership in February of 2017

Investing in margin improvement projects

associated with optimization of existing assets

Restarting idled naphtha hydrotreater,

reformer and light-ends recovery plant to

allow for production of high-octane, ultra-

low sulfur reformate blendstock and

chemicals from unfinished naphtha

New crude tank project will allow

increased crude flexibility

Increased export opportunities

Projects should be complete Fall 2017

with an expected return of one to two

years

Chalmette increasing margin capture through

asphalt production

Advancing third-party logistics opportunities

Chalmette Refinery – Optimization Underway

6

Torrance Refinery – Focus on Operations

Focus on stable and reliable operations

Working with local partners to ensure reliable

power supply to refinery

Executing first major turnarounds in the second

quarter

Targeting $50 million operating cost reductions over

the next two years

Putting the right team in place to execute key

turnarounds and promote operational excellence

Margin enhancement

Rack throughput grown to approximately 70% of

gasoline yield

Increased rack sales provide higher product

netbacks and RINs offset

Optimizing distillate margin contribution

through rapid, low-cost opportunities

Successfully entering new markets, including

exports

7

East Coast and Mid-Continent Opportunity

Focus on operational excellence and cost

control

Paulsboro is our leader in turnaround

execution and we are sharing that

expertise across our system

Expanding feedstock optionality

Mid-Continent infrastructure build-out

has eliminated bottlenecks

Increasing domestic production has a

cascading impact on waterborne

barrels

Focus on product distribution and regional

opportunities

Potential asphalt tailwind with large

producer leaving the market

Improved chemicals yield and margins

Extending clean product distribution

avenues around refineries

Identifying opportunities for exports

8

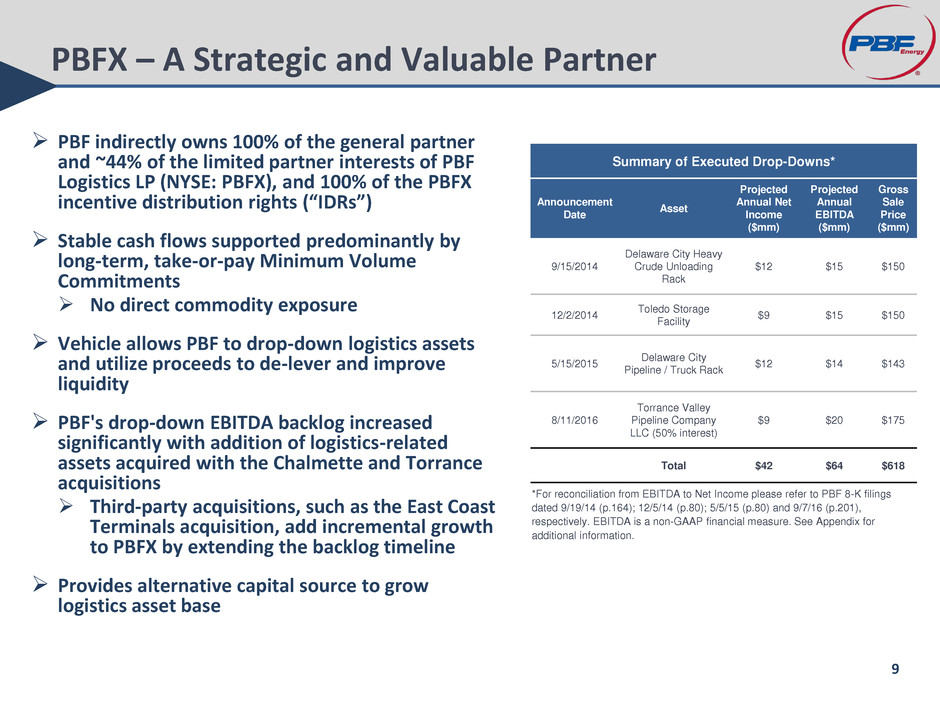

PBFX – A Strategic and Valuable Partner

PBF indirectly owns 100% of the general partner

and ~44% of the limited partner interests of PBF

Logistics LP (NYSE: PBFX), and 100% of the PBFX

incentive distribution rights (“IDRs”)

Stable cash flows supported predominantly by

long-term, take-or-pay Minimum Volume

Commitments

No direct commodity exposure

Vehicle allows PBF to drop-down logistics assets

and utilize proceeds to de-lever and improve

liquidity

PBF's drop-down EBITDA backlog increased

significantly with addition of logistics-related

assets acquired with the Chalmette and Torrance

acquisitions

Third-party acquisitions, such as the East Coast

Terminals acquisition, add incremental growth

to PBFX by extending the backlog timeline

Provides alternative capital source to grow

logistics asset base

Summary of Executed Drop-Downs*

Announcement

Date

Asset

Projected

Annual Net

Income

($mm)

Projected

Annual

EBITDA

($mm)

Gross

Sale

Price

($mm)

9/15/2014

Delaware City Heavy

Crude Unloading

Rack

$12 $15 $150

12/2/2014

Toledo Storage

Facility

$9 $15 $150

5/15/2015

Delaware City

Pipeline / Truck Rack

$12 $14 $143

8/11/2016

Torrance Valley

Pipeline Company

LLC (50% interest)

$9 $20 $175

Total $42 $64 $618

*For reconciliation from EBITDA to Net Income please refer to PBF 8-K filings

dated 9/19/14 (p.164); 12/5/14 (p.80); 5/5/15 (p.80) and 9/7/16 (p.201),

respectively. EBITDA is a non-GAAP financial measure. See Appendix for

additional information.

9

PBFX Growing Asset Base is Ideally Situated

PBF Logistics Mid-Continent Assets

Toledo Storage Facility

Toledo LPG Truck Rack

Toledo Truck Terminal

PBF Logistics East Coast Assets

East Coast Terminals

DC Products Pipeline

DC Truck Rack (Products)

DC Truck Rack (LPG)

DC Rail Terminal

DC West Rack

PBF Logistics assets directly support the

operations of the Toledo, Delaware City,

Paulsboro and Torrance refineries

Approximately 255 million barrels of annual

refining capacity

Strategic third-party acquisitions, such as the

East Coast Terminals, allow PBF Logistics to

independently grow its revenue base and

leverage its relationship with PBF Energy

PBFX continues to target logistics assets for

feedstock movement and product distribution

that complement its existing operations and

provide synergies due to proximity to PBF

Energy operations

Developing organic growth opportunities to

enhance asset base and diversify revenue

streams

Drop-downs from PBF Energy, as it grows,

remain a valuable source of future growth

Paulsboro

Toledo

Chalmette

Torrance

PADD

2

PADD

3

PADD

5

Delaware City

PADD

4

PADD

1

PBF Logistics West Coast Assets

Torrance Valley Pipeline

10

Regulatory Outlook

RINs – change is likely – we’ve seen RINs drop more than 50%

Corporate Tax Reform – Potentially lowers our corporate rate

Border Adjustment Tax – doubtful whether it passes in its

current form but could have a major impact on the economy,

oil movements and product flows and regional refining

performance

MARPOL – Marine Diesel Standards 2020 – New marine diesel

standards will highlight the value of our four coking refineries

11

Appendix

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

R

e

fi

n

e

ry

C

o

st

, $/

C

o

m

p

le

xi

ty

-B

ar

re

l

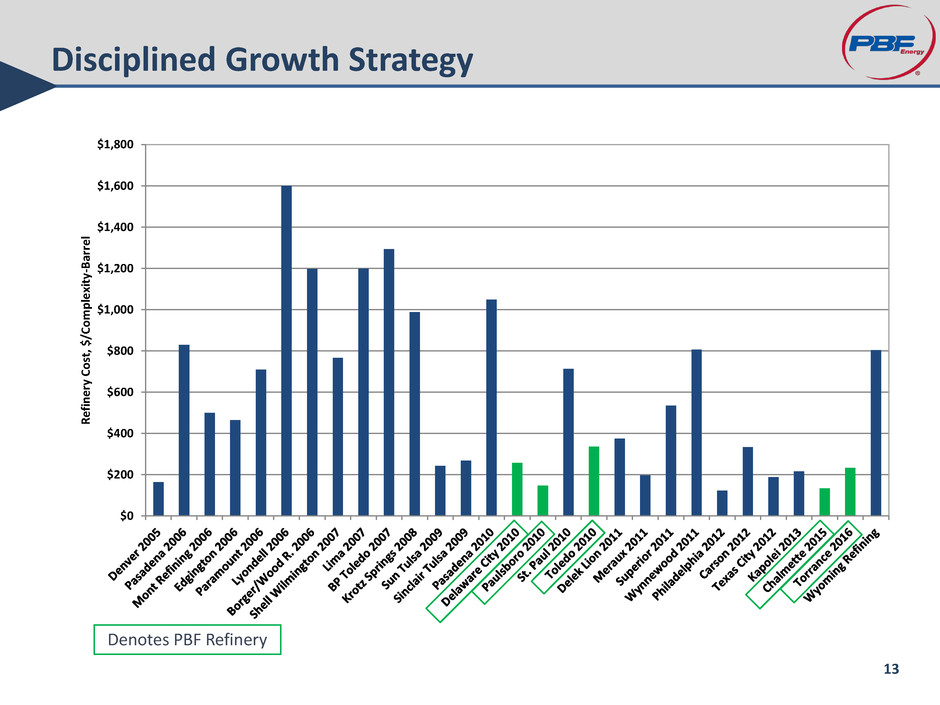

Disciplined Growth Strategy

Denotes PBF Refinery

13

PBF Energy 2017 Initial Guidance

Initial guidance provided constitutes forward-looking information and is based on current PBF Energy operating plans, company assumptions

and company configuration. All figures are subject to change based on market and macroeconomic factors, as well as company strategic

decision-making and overall company performance.

(Figures in millions except per barrel

amounts)

Q1-2017E (Revised)

East Coast Throughput 290,000 – 310,000 bpd

Mid-Continent Throughput 115,000 – 125,000 bpd

Gulf Coast Throughput 145,000 – 155,000 bpd

West Coast Throughput 130,000 – 140,000 bpd

Total Throughput 680,000 – 730,000 bpd

Refining operating expenses $5.25 - $5.50 / bbl

SG&A expenses(1) $140 - $150

D&A(1) $270 - $280

Interest expense, net(1) $155 - $165

Capital expenditures(1) $625 - $650

Turnaround Schedule Period

Delaware City – FCC/Alky units Q1-2 (45-55 days)

Chalmette – Crude unit Q1 (complete)

Torrance – Hydrocracker, hydrogen plant Q2 (45-55 days)

Torrance – Crude and Coker units Q2 (45-55 days)

___________________________

1. Guidance expense figures include consolidated amounts for PBF Logistics LP

14

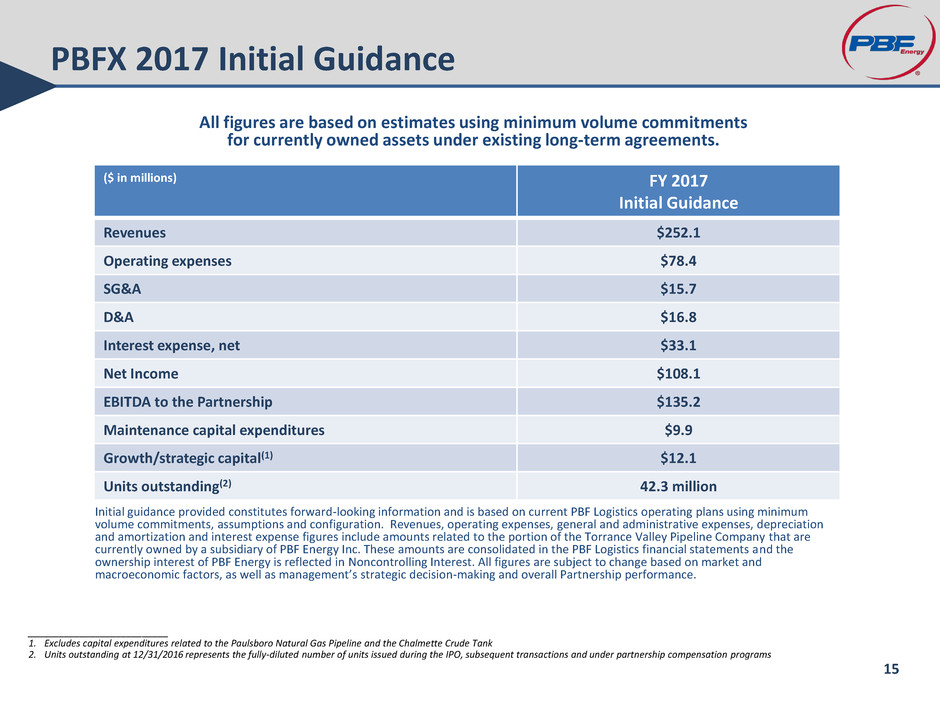

PBFX 2017 Initial Guidance

Initial guidance provided constitutes forward-looking information and is based on current PBF Logistics operating plans using minimum

volume commitments, assumptions and configuration. Revenues, operating expenses, general and administrative expenses, depreciation

and amortization and interest expense figures include amounts related to the portion of the Torrance Valley Pipeline Company that are

currently owned by a subsidiary of PBF Energy Inc. These amounts are consolidated in the PBF Logistics financial statements and the

ownership interest of PBF Energy is reflected in Noncontrolling Interest. All figures are subject to change based on market and

macroeconomic factors, as well as management’s strategic decision-making and overall Partnership performance.

($ in millions) FY 2017

Initial Guidance

Revenues $252.1

Operating expenses $78.4

SG&A $15.7

D&A $16.8

Interest expense, net $33.1

Net Income $108.1

EBITDA to the Partnership $135.2

Maintenance capital expenditures $9.9

Growth/strategic capital(1) $12.1

Units outstanding(2) 42.3 million

All figures are based on estimates using minimum volume commitments

for currently owned assets under existing long-term agreements.

___________________________

1. Excludes capital expenditures related to the Paulsboro Natural Gas Pipeline and the Chalmette Crude Tank

2. Units outstanding at 12/31/2016 represents the fully-diluted number of units issued during the IPO, subsequent transactions and under partnership compensation programs

15

Our management uses EBITDA (earnings before interest, income taxes, depreciation and amortization) as a measure

of operating performance to assist in comparing performance from period to period on a consistent basis and to

readily view operating trends, as a measure for planning and forecasting overall expectations and for evaluating

actual results against such expectations, and in communications with our board of directors, creditors, analysts and

investors concerning our financial performance.

EBITDA is not a presentation made in accordance with GAAP and our computation of EBITDA may vary from others in

our industry. EBITDA should not be considered as an alternative to operating income (loss) or net income (loss) as

measures of operating performance. In addition, EBITDA is not presented as, and should not be considered, an

alternative to cash flows from operations as a measure of liquidity.

This presentation includes references to EBITDA and EBITDA attributable to PBFX, which is a non-GAAP financial

measure that is reconciled to its most directly comparable GAAP measure in the quarterly and annual reports on

Forms 10-Q and 10-K for PBFX. We define EBITDA attributable to PBFX as net income (loss) attributable to PBFX

before net interest expense, income tax expense, depreciation and amortization expense attributable to PBFX, which

excludes the results attributable to noncontrolling interests and acquisitions from affiliate companies under common

control prior to the effective dates of such transactions. With respect to projected MLP-qualifying EBITDA, we are

unable to prepare a quantitative reconciliation to the most directly comparable GAAP measure without unreasonable

effort, as, among other things, certain items that impact these measures, such as the provision for income taxes,

depreciation of fixed assets, amortization of intangibles and financing costs have not yet occurred, are subject to

market conditions and other factors that are out of our control and cannot be accurately predicted.

Non-GAAP Financial Measures

16

Non-GAAP Financial Measures

PBF Logistics LP Reconciliation of amounts under US GAAP to Forecasted EBITDA (unaudited, in millions)

Reconciliation of Net Income to estimated EBITDA:

The Partnership defines EBITDA as net income (loss) before net interest expense, income tax expense, depreciation and amortization expense. We

define EBITDA attributable to PBFX as net income (loss) attributable to PBFX before net interest expense, income tax expense, depreciation and

amortization expense attributable to PBFX, which excludes the results attributable to noncontrolling interests and acquisitions from affiliate companies

under common control prior to the effective dates of such transactions. EBITDA is a non-GAAP supplemental financial measure that management

and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, may use to assess:

• our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost

basis or financing methods;

• the ability of our assets to generate sufficient cash flow to make distributions to our unit holders;

• our ability to incur and service debt and fund capital expenditures; and

• the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities.

The Partnership’s management believes that the presentation of EBITDA and EBITDA attributable to PBFX provides useful information to investors in

assessing our financial condition and results of operations. These measures should not be considered an alternative to net income, operating income,

cash from operations or any other measure of financial performance or liquidity presented in accordance with GAAP. EBITDA has important

limitations as an analytical tool because it excludes some but not all items that affect net income. Additionally, because EBITDA may be defined

differently by other companies in our industry, our definition of EBITDA may not be comparable to similarly titled measures of other companies,

thereby diminishing its utility. Due to the forward-looking nature of forecasted EBITDA, information to reconcile forecasted EBITDA to forecasted cash

flow from operating activities is not available as management is unable to project working capital changes for future periods at this time.

($ in millions) FY 2017 Initial Guidance

Net Income $108.1

Add: Interest expense, net $33.1

Add: Depreciation and amortization $16.8

EBITDA $158.0

Less: Noncontrolling interest EBITDA $22.8

EBITDA attributable to PBFX $135.2

17