Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d364625dex992.htm |

| EX-10.4 - EX-10.4 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d364625dex104.htm |

| EX-10.3 - EX-10.3 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d364625dex103.htm |

| EX-10.2 - EX-10.2 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d364625dex102.htm |

| EX-10.1 - EX-10.1 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d364625dex101.htm |

| EX-2.2 - EX-2.2 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d364625dex22.htm |

| EX-2.1 - EX-2.1 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d364625dex21.htm |

| 8-K - FORM 8-K - SUPERIOR INDUSTRIES INTERNATIONAL INC | d364625d8k.htm |

Superior Industries International, Inc. Acquisition of UNIWHEELS AG Investor Conference Call March 23, 2017 Exhibit 99.1

Forward-Looking Statements This webcast and presentation contain statements that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts and can generally be identified by the use of future dates or words such as "may," "should," "could," “will,” "expects," "seeks to," "anticipates," "plans," "believes," "estimates," "intends," "predicts," "projects," "potential" or "continue" or the negative of such terms and other comparable terminology. These statements also include, but are not limited to, the 2017 outlook included herein, and the Company’s strategic and operational initiatives, including obtaining integration synergies, product mix and overall cost improvement and are based on current expectations, estimates, and projections about the Company's business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements due to numerous factors, risks, and uncertainties discussed in the Company's Securities and Exchange Commission filings and reports, including the Company's Annual Report on Form 10-K for the year-ended December 25, 2016, Quarterly Reports on Form 10-Q and other reports from time to time filed with the Securities and Exchange Commission. You are cautioned not to unduly rely on such forward looking statements when evaluating the information presented in this press release. Such forward-looking statements speak only as of the date on which they are made and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this webcast and presentation. Use of Non-GAAP Financial Measures In addition to the results reported in accordance with GAAP included throughout this presentation, this presentation refers to “Adjusted EBITDA,” which we have defined as earnings before interest, taxes, depreciation, amortization, restructuring charges and impairments of long-lived assets and investments and “Value-Added Sales,” which we define as net sales less pass-through charges primarily for the value of aluminum. Adjusted EBITDA as a percentage of value-added sales is a key measure that is not calculated according to GAAP. Adjusted EBITDA as a percentage of value-added sales is defined as adjusted EBITDA divided by value-added sales. Management believes the non-GAAP financial measures used in this presentation are useful to both management and investors in their analysis of the Company’s financial position and results of operations. Further, management uses these non-GAAP financial measures for planning and forecasting future periods. This non-GAAP financial information is provided as additional information for investors and is not in accordance with or an alternative to GAAP. These non-GAAP measures may be different from similar measures used by other companies. For reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP, see the appendix of this presentation. In reliance on the safe harbor provided under section 10(e) or Regulation S-K, we have not quantitatively reconciled differences between adjusted EBITDA presented in our 2017 Outlook to net income, the most comparable GAAP measure, as Superior is unable to quantify certain amounts that would be required to be included in net income without unreasonable efforts and due to the inherent uncertainty regarding such variables. Superior also believes that such a reconciliation would imply a degree of precision that could potentially be confusing or misleading to investors. However, the magnitude of these amounts may be significant. Non-GAAP Financial Measures and Forward-Looking Statements

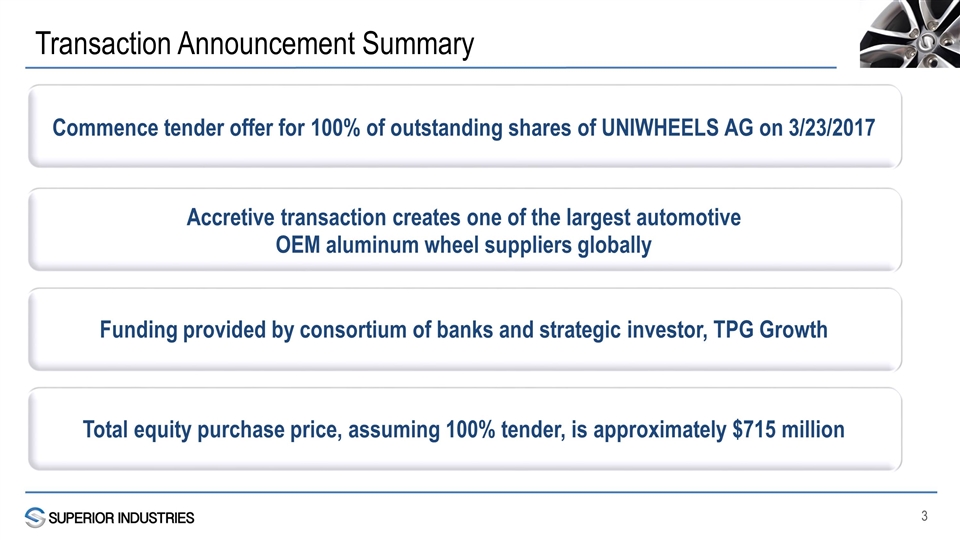

Transaction Announcement Summary Commence tender offer for 100% of outstanding shares of UNIWHEELS AG on 3/23/2017 Accretive transaction creates one of the largest automotive OEM aluminum wheel suppliers globally Total equity purchase price, assuming 100% tender, is approximately $715 million Funding provided by consortium of banks and strategic investor, TPG Growth

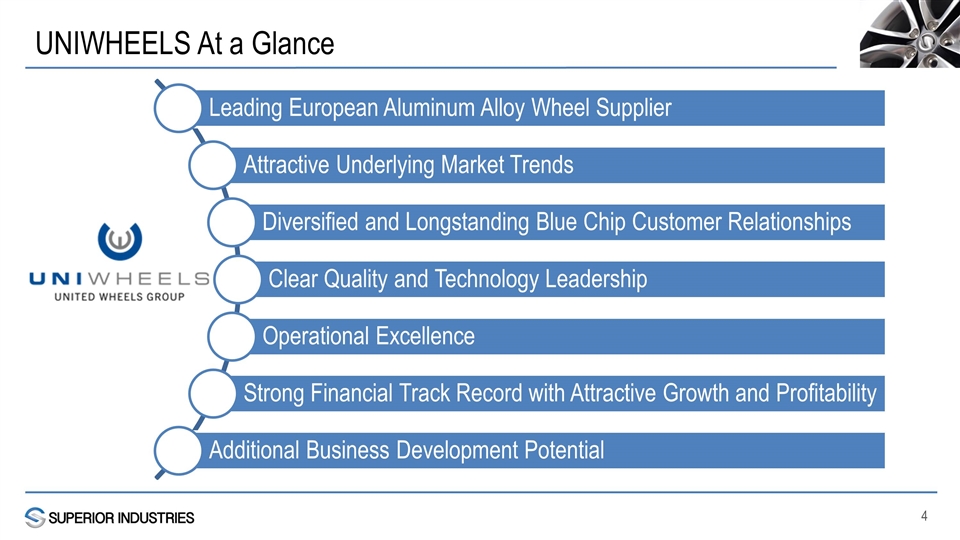

UNIWHEELS At a Glance Leading European Aluminum Alloy Wheel Supplier Attractive Underlying Market Trends Diversified and Longstanding Blue Chip Customer Relationships Clear Quality and Technology Leadership Operational Excellence Strong Financial Track Record with Attractive Growth and Profitability Additional Business Development Potential

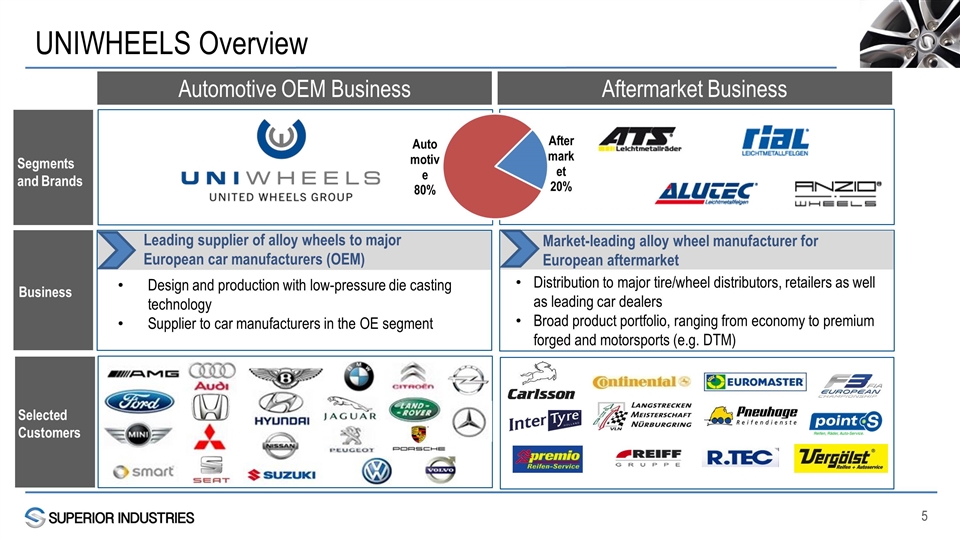

UNIWHEELS Overview Automotive OEM Business Segments and Brands Selected Customers Aftermarket Business Business Design and production with low-pressure die casting technology Supplier to car manufacturers in the OE segment Leading supplier of alloy wheels to major European car manufacturers (OEM) Market-leading alloy wheel manufacturer for European aftermarket Distribution to major tire/wheel distributors, retailers as well as leading car dealers Broad product portfolio, ranging from economy to premium forged and motorsports (e.g. DTM)

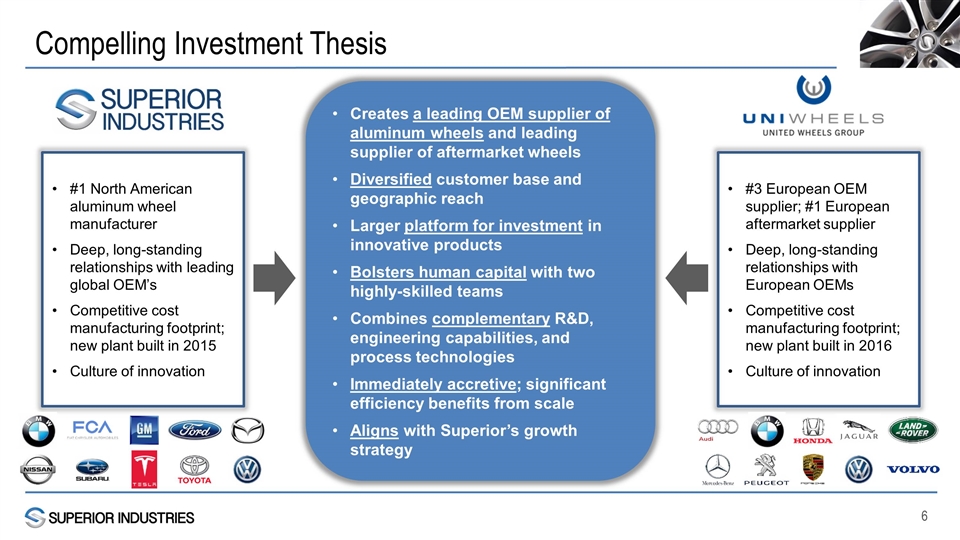

Creates a leading OEM supplier of aluminum wheels and leading supplier of aftermarket wheels Diversified customer base and geographic reach Larger platform for investment in innovative products Bolsters human capital with two highly-skilled teams Combines complementary R&D, engineering capabilities, and process technologies Immediately accretive; significant efficiency benefits from scale Aligns with Superior’s growth strategy #3 European OEM supplier; #1 European aftermarket supplier Deep, long-standing relationships with European OEMs Competitive cost manufacturing footprint; new plant built in 2016 Culture of innovation Compelling Investment Thesis #1 North American aluminum wheel manufacturer Deep, long-standing relationships with leading global OEM’s Competitive cost manufacturing footprint; new plant built in 2015 Culture of innovation

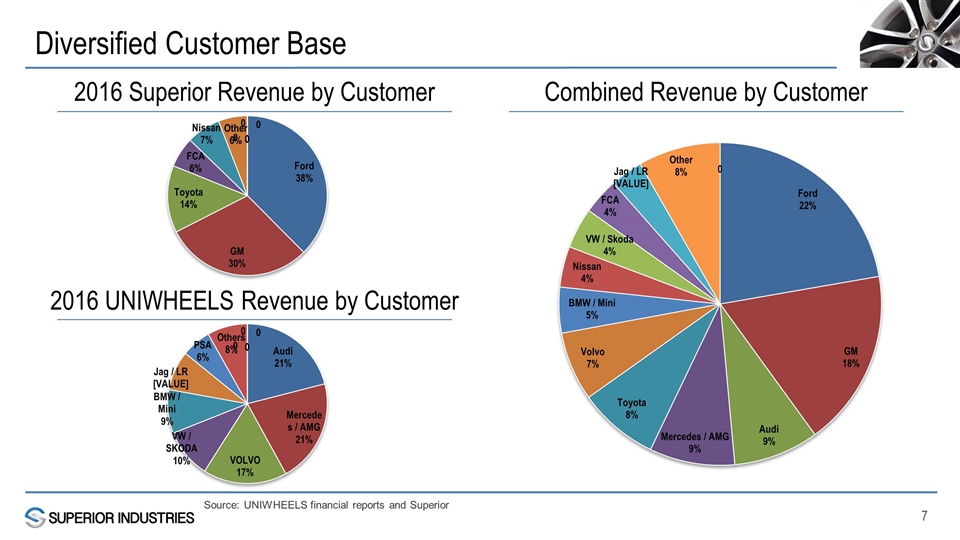

Diversified Customer Base Combined Revenue by Customer 2016 Superior Revenue by Customer 2016 UNIWHEELS Revenue by Customer Source: UNIWHEELS financial reports and Superior

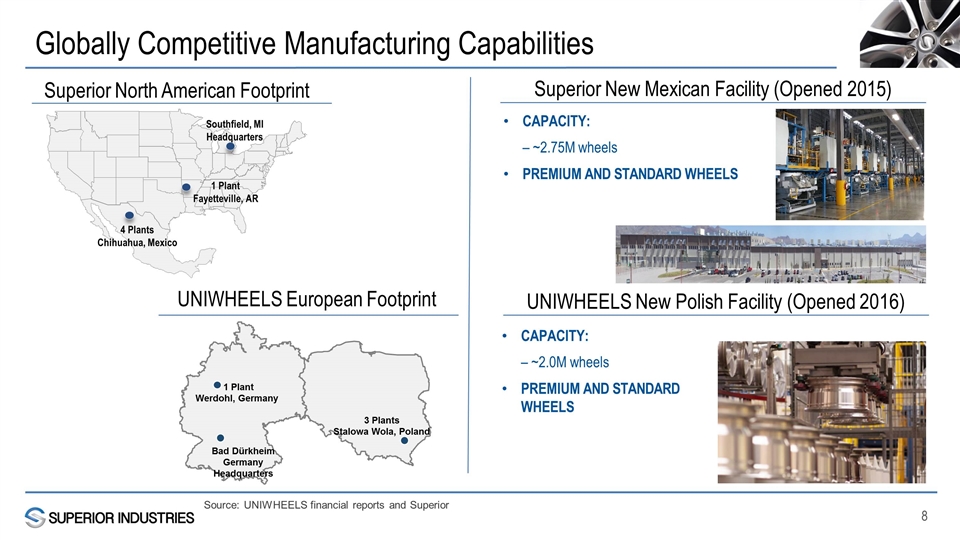

Globally Competitive Manufacturing Capabilities 3 Plants Stalowa Wola, Poland 1 Plant Werdohl, Germany Bad Dürkheim Germany Headquarters 4 Plants Chihuahua, Mexico 1 Plant Fayetteville, AR Southfield, MI Headquarters CAPACITY: – ~2.0M wheels PREMIUM AND STANDARD WHEELS Superior North American Footprint UNIWHEELS European Footprint Superior New Mexican Facility (Opened 2015) UNIWHEELS New Polish Facility (Opened 2016) CAPACITY: – ~2.75M wheels PREMIUM AND STANDARD WHEELS Source: UNIWHEELS financial reports and Superior

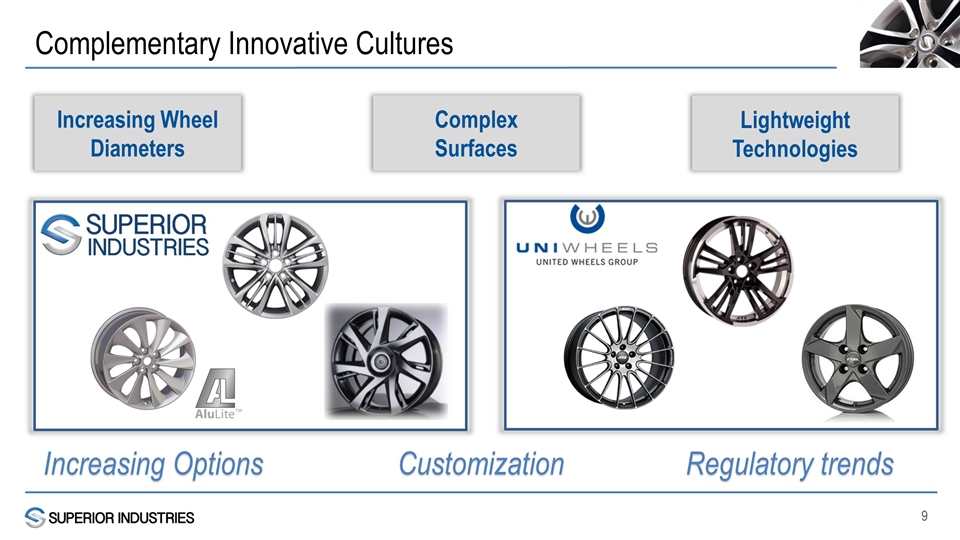

Complementary Innovative Cultures Increasing Wheel Diameters Complex Surfaces Lightweight Technologies Increasing OptionsCustomization Regulatory trends

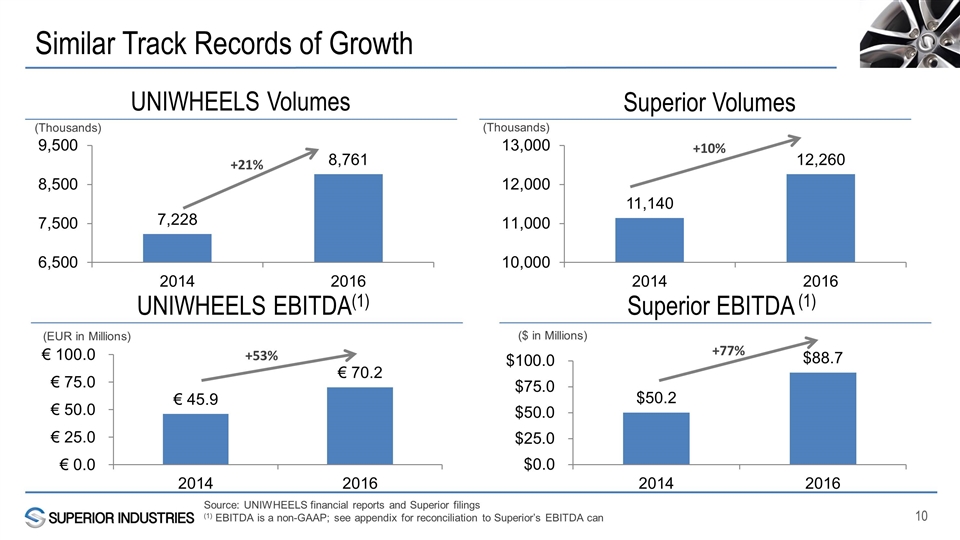

Similar Track Records of Growth +21% UNIWHEELS Volumes Source: UNIWHEELS financial reports and Superior filings (1) EBITDA is a non-GAAP; see appendix for reconciliation to Superior’s EBITDA can Superior Volumes +10% (Thousands) (Thousands) (EUR in Millions) +53% UNIWHEELS EBITDA(1) ($ in Millions) +77% Superior EBITDA (1)

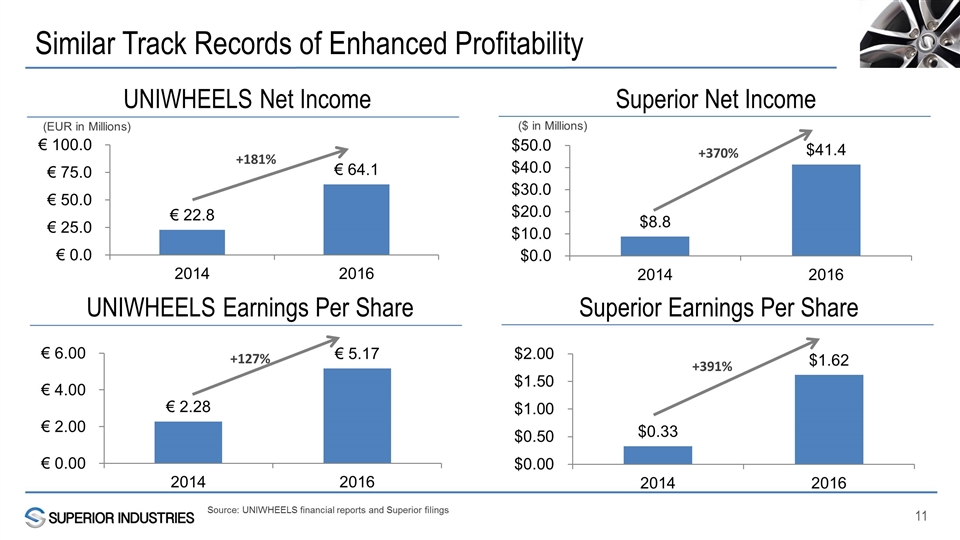

Similar Track Records of Enhanced Profitability Source: UNIWHEELS financial reports and Superior filings +391% Superior Earnings Per Share +127% UNIWHEELS Earnings Per Share +370% Superior Net Income +181% UNIWHEELS Net Income (EUR in Millions) ($ in Millions)

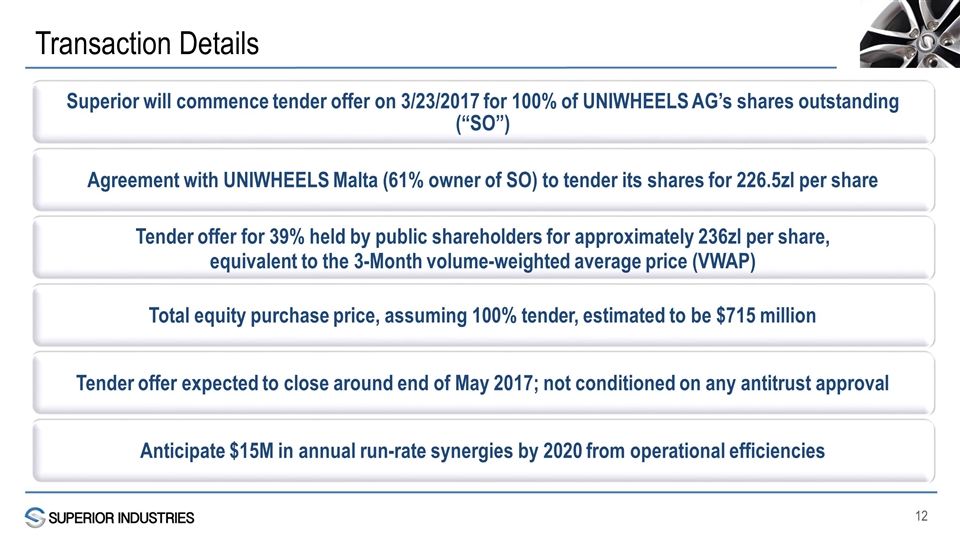

Transaction Details Superior will commence tender offer on 3/23/2017 for 100% of UNIWHEELS AG’s shares outstanding (“SO”) Total equity purchase price, assuming 100% tender, estimated to be $715 million Tender offer for 39% held by public shareholders for approximately 236zl per share, equivalent to the 3-Month volume-weighted average price (VWAP) Agreement with UNIWHEELS Malta (61% owner of SO) to tender its shares for 226.5zl per share Anticipate $15M in annual run-rate synergies by 2020 from operational efficiencies Tender offer expected to close around end of May 2017; not conditioned on any antitrust approval

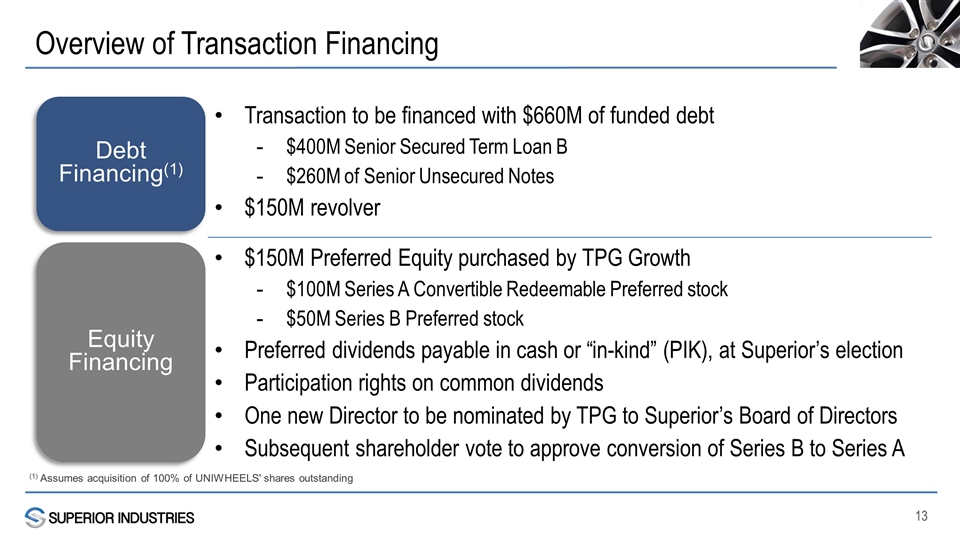

Overview of Transaction Financing $150M Preferred Equity purchased by TPG Growth $100M Series A Convertible Redeemable Preferred stock $50M Series B Preferred stock Preferred dividends payable in cash or “in-kind” (PIK), at Superior’s election Participation rights on common dividends One new Director to be nominated by TPG to Superior’s Board of Directors Subsequent shareholder vote to approve conversion of Series B to Series A Equity Financing Debt Financing(1) Transaction to be financed with $660M of funded debt $400M Senior Secured Term Loan B $260M of Senior Unsecured Notes $150M revolver (1) Assumes acquisition of 100% of UNIWHEELS' shares outstanding

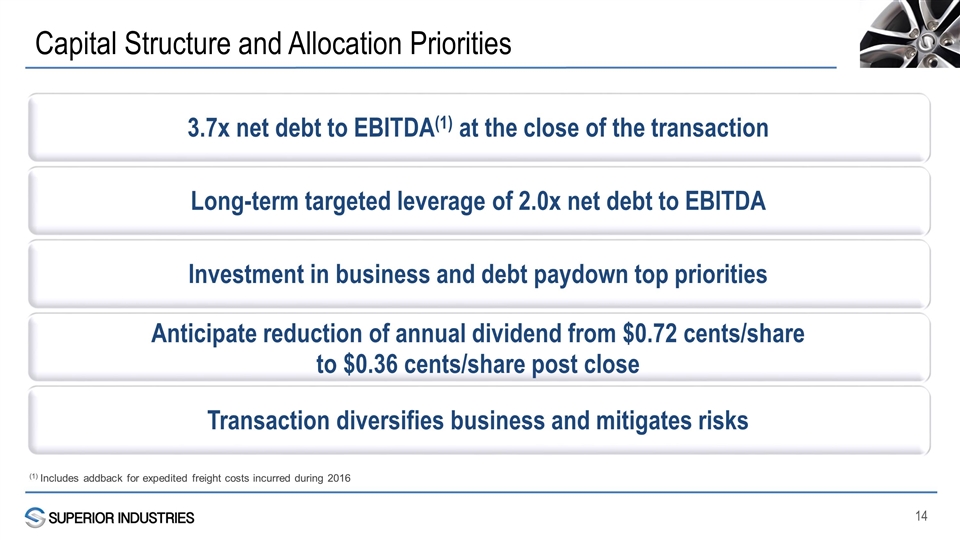

Capital Structure and Allocation Priorities (1) Includes addback for expedited freight costs incurred during 2016 3.7x net debt to EBITDA (1) at the close of the transaction Anticipate reduction of annual dividend from $0.72 cents/share to $0.36 cents/share post close Transaction diversifies business and mitigates risks Investment in business and debt paydown top priorities Long-term targeted leverage of 2.0x net debt to EBITDA

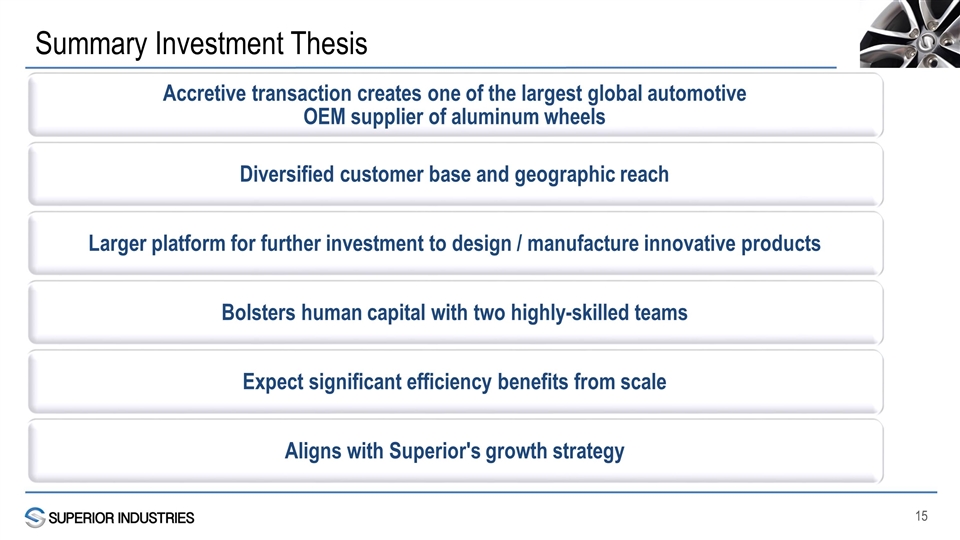

Summary Investment Thesis Accretive transaction creates one of the largest global automotive OEM supplier of aluminum wheels Diversified customer base and geographic reach Larger platform for further investment to design / manufacture innovative products Bolsters human capital with two highly-skilled teams Expect significant efficiency benefits from scale Aligns with Superior's growth strategy

Appendix

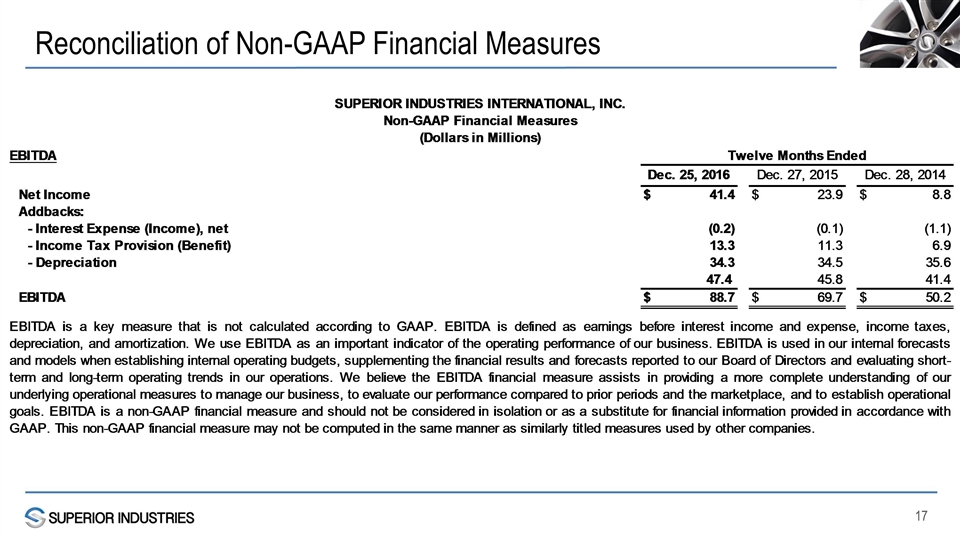

Reconciliation of Non-GAAP Financial Measures