Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Air Transport Services Group, Inc. | a2017form8kcovermar22inves.htm |

The global leader in midsize wide-body

leasing and operating solutions

Joe Hete

President & CEO

Quint Turner

Chief Financial Officer

Rich Corrado

Chief Commercial Officer

Seaport Global Securities

Transports & Industrials Conference

March 22, 2017

Coral Gables, Fla.

Safe Harbor Statement

Except for historical information contained herein, the matters discussed in this presentation contain

forward-looking statements that involve risks and uncertainties. There are a number of important

factors that could cause Air Transport Services Group's ("ATSG's") actual results to differ materially

from those indicated by such forward-looking statements. These factors include, but are not limited to,

changes in market demand for our assets and services; our operating airlines' ability to maintain on-

time service and control costs; the cost and timing with respect to which we are able to purchase and

modify aircraft to a cargo configuration; the number and timing of deployments and redeployments of

our aircraft to customers; the ability and timeliness with which the China-based joint venture is able to

secure the necessary approvals from the People’s Republic of China and execute its business plan;

the completion of anticipated commercial arrangements with new and existing customers, and other

factors that are contained from time to time in ATSG's filings with the U.S. Securities and Exchange

Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers

should carefully review this presentation and should not place undue reliance on ATSG's forward-

looking statements. These forward-looking statements were based on information, plans and estimates

as of the date of this presentation. ATSG undertakes no obligation to update any forward-looking

statements to reflect changes in underlying assumptions or factors, new information, future events or

other changes.

2

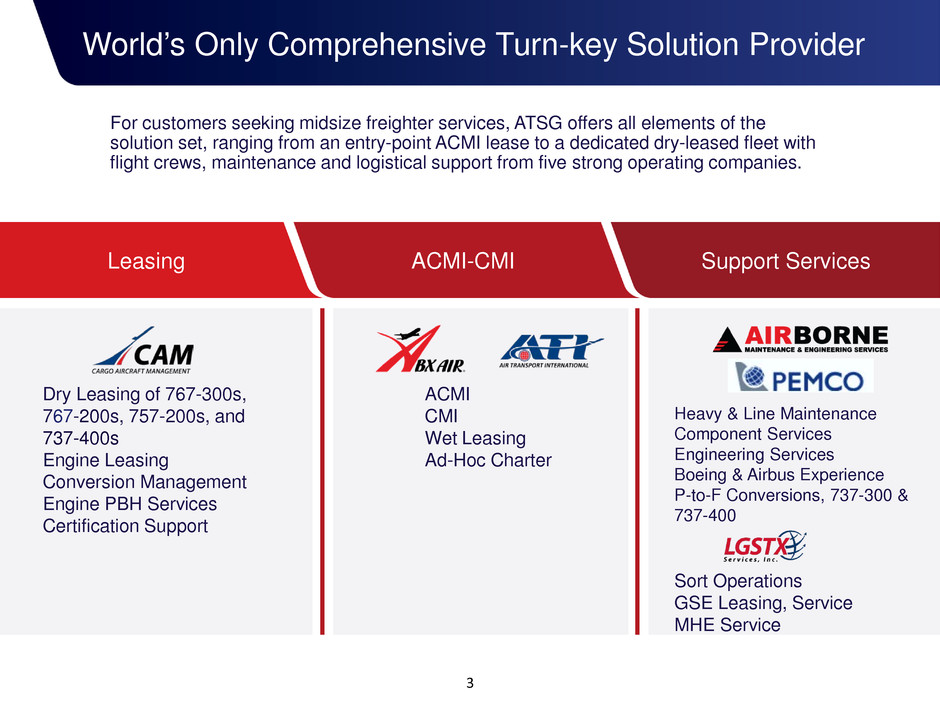

World’s Only Comprehensive Turn-key Solution Provider

For customers seeking midsize freighter services, ATSG offers all elements of the

solution set, ranging from an entry-point ACMI lease to a dedicated dry-leased fleet with

flight crews, maintenance and logistical support from five strong operating companies.

Dry Leasing of 767-300s,

767-200s, 757-200s, and

737-400s

Engine Leasing

Conversion Management

Engine PBH Services

Certification Support

Leasing ACMI-CMI Support Services

ACMI

CMI

Wet Leasing

Ad-Hoc Charter

Heavy & Line Maintenance

Component Services

Engineering Services

Boeing & Airbus Experience

P-to-F Conversions, 737-300 &

737-400

3

Sort Operations

GSE Leasing, Service

MHE Service

2016 Accomplishments

Freighter fleet expands as five Boeing 767s entered service in 2016; eleven more due in 2017, six

in 2018. 80% of 767s in service YE2016 were dry-leased. Typical lease durations are 5 to 8 years.

Agreements with Amazon completed in March call for long-term placements of 20 leased and

operated 767 freighters, plus warrants for Amazon to acquire up to 19.9% of ATSG shares.

Diversified, growing revenue streams 2016 revenues up 18% excluding reimbursements. DHL

represented 34% of revenues; Amazon 29%, U.S. Military 12%.

Record Adjusted EBITDA for 2016 of $212MM, up 7%.

Logistics business grows through expanded ground support roles for major customers.

PEMCO acquired at year-end, expanding AMES’s MRO capabilities and capacity, and adding

conversion and MRO facilities in China, S. America and U.S. serving Boeing and Airbus airframes.

Improved shareholder value as stock price grew more than 2x major market indexes and most

peers in 2016, backed by $64MM in share repurchases. Credit facility amendment added $100MM

in capacity and more buyback flexibility.

4

11

52

6

10

41

7

17

30

2

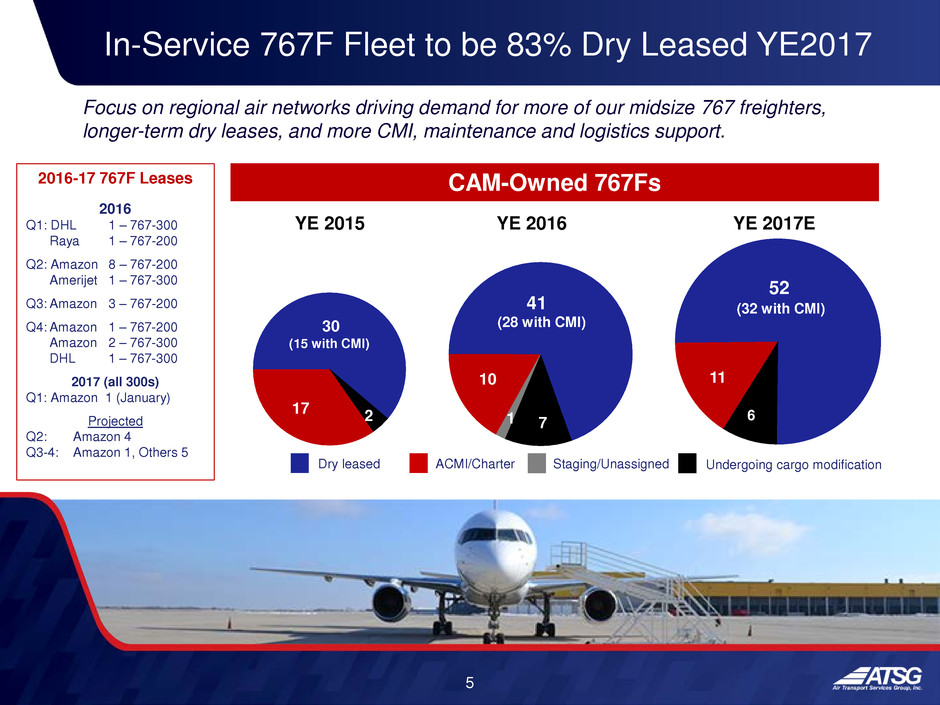

In-Service 767F Fleet to be 83% Dry Leased YE2017

5

YE 2015

CAM-Owned 767Fs

YE 2016

Focus on regional air networks driving demand for more of our midsize 767 freighters,

longer-term dry leases, and more CMI, maintenance and logistics support.

(15 with CMI)

(28 with CMI)

Dry leased ACMI/Charter Staging/Unassigned Undergoing cargo modification

2016-17 767F Leases

2016

Q1: DHL 1 – 767-300

Raya 1 – 767-200

Q2: Amazon 8 – 767-200

Amerijet 1 – 767-300

Q3: Amazon 3 – 767-200

Q4: Amazon 1 – 767-200

Amazon 2 – 767-300

DHL 1 – 767-300

2017 (all 300s)

Q1: Amazon 1 (January)

Projected

Q2: Amazon 4

Q3-4: Amazon 1, Others 5

YE 2017E

(32 with CMI)

1

Targeting Growing Global Network Demand

E-commerce, distributed manufacturing trends creating demand for new express networks

Abundant ACMI and Dry Lease Opportunities

MIDDLE EAST

• 6.9% market growth in 2016: IATA

• Aging network fleets due for replacement

• CAM has leased two 767s to DHL in Mideast network

ASIA

• Rapid regional e-commerce, distributed manufacturing

growth

• PEMCO’s strong position in 737 freighter conversions in

China creates new opportunities

• Preparing for joint-venture launch in China with leases of

CAM-owned 737s to partner Okay Airways

AMERICAS

• Steady growth; DHL’s Americas region revenues grew

7.1% in 2016 to lead all DHL regions.

• Amazon’s air-network growth will continue via 50-yr. lease

for hub at CVG with ramp space for 100 aircraft

• PEMCO’s MRO facilities in Tampa support Latin America

trade lanes

• 767 range/payload an ideal fit for north-south routes

EUROPE

• 2016’s fastest-growing airfreight market at 7.1%: IATA

• Investment in Sweden’s West Atlantic AB yields additional

767 dry leases 6

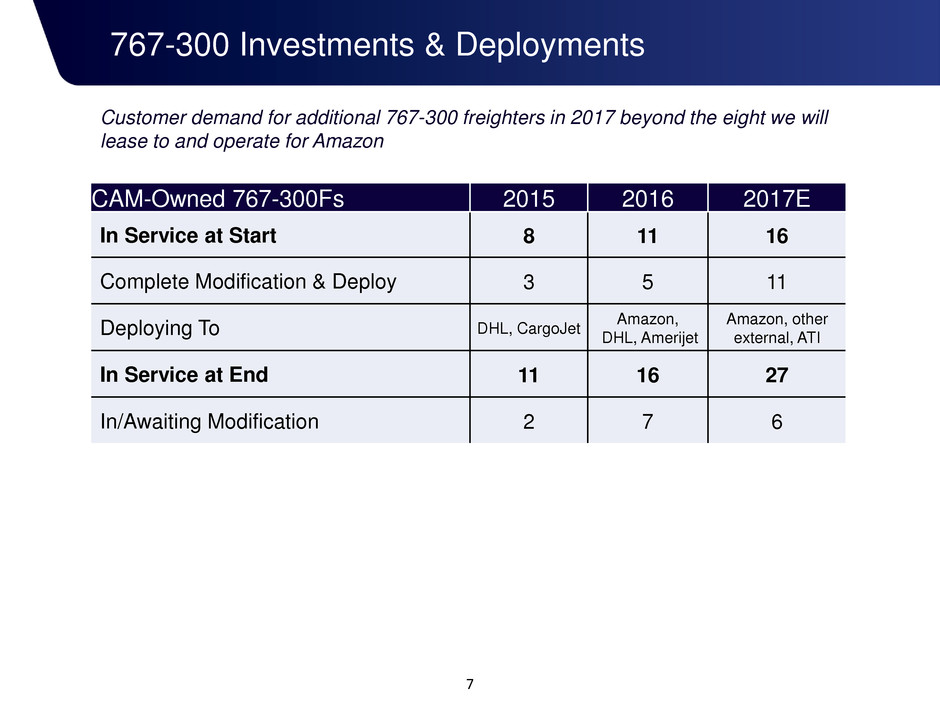

767-300 Investments & Deployments

7

CAM-Owned 767-300Fs 2015 2016 2017E

In Service at Start 8 11 16

Complete Modification & Deploy 3 5 11

Deploying To DHL, CargoJet Amazon, DHL, Amerijet

Amazon, other

external, ATI

In Service at End 11 16 27

In/Awaiting Modification 2 7 6

Customer demand for additional 767-300 freighters in 2017 beyond the eight we will

lease to and operate for Amazon

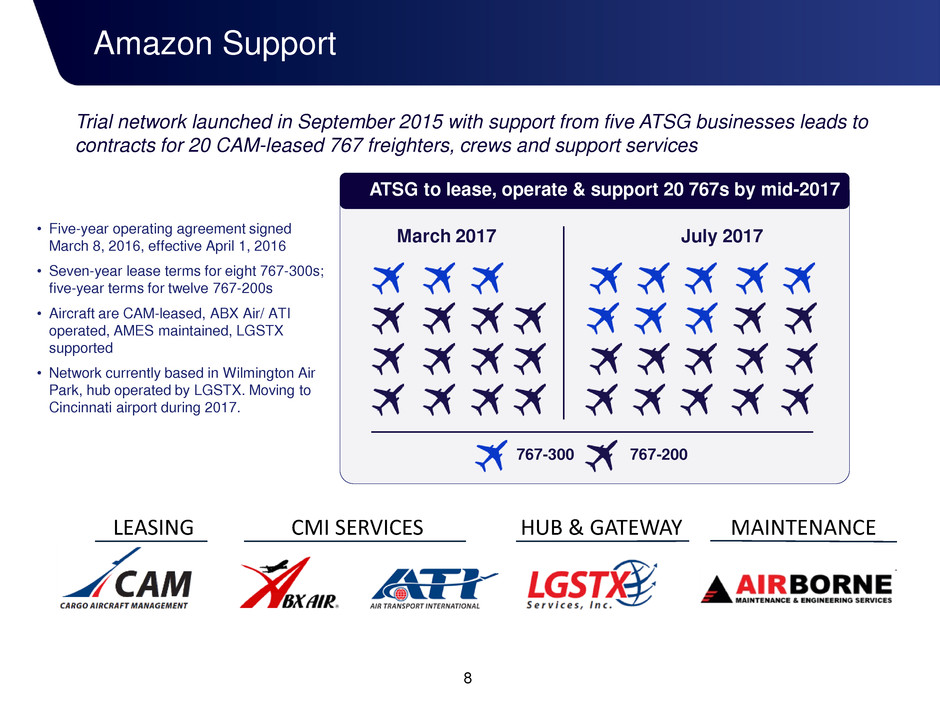

• Five-year operating agreement signed

March 8, 2016, effective April 1, 2016

• Seven-year lease terms for eight 767-300s;

five-year terms for twelve 767-200s

• Aircraft are CAM-leased, ABX Air/ ATI

operated, AMES maintained, LGSTX

supported

• Network currently based in Wilmington Air

Park, hub operated by LGSTX. Moving to

Cincinnati airport during 2017.

Trial network launched in September 2015 with support from five ATSG businesses leads to

contracts for 20 CAM-leased 767 freighters, crews and support services

ATSG to lease, operate & support 20 767s by mid-2017

March 2017 July 2017

767-300 767-200

Amazon Support

LEASING CMI SERVICES HUB & GATEWAY MAINTENANCE

8

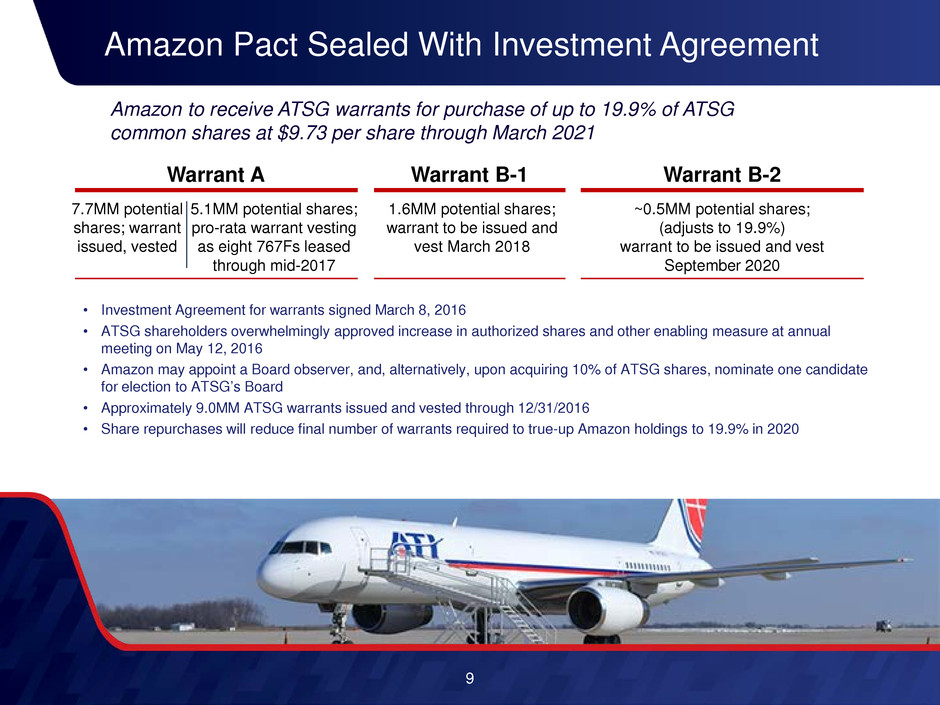

9

Amazon to receive ATSG warrants for purchase of up to 19.9% of ATSG

common shares at $9.73 per share through March 2021

Warrant A Warrant B-1

7.7MM potential

shares; warrant

issued, vested

1.6MM potential shares;

warrant to be issued and

vest March 2018

Warrant B-2

~0.5MM potential shares;

(adjusts to 19.9%)

warrant to be issued and vest

September 2020

5.1MM potential shares;

pro-rata warrant vesting

as eight 767Fs leased

through mid-2017

• Investment Agreement for warrants signed March 8, 2016

• ATSG shareholders overwhelmingly approved increase in authorized shares and other enabling measure at annual

meeting on May 12, 2016

• Amazon may appoint a Board observer, and, alternatively, upon acquiring 10% of ATSG shares, nominate one candidate

for election to ATSG’s Board

• Approximately 9.0MM ATSG warrants issued and vested through 12/31/2016

• Share repurchases will reduce final number of warrants required to true-up Amazon holdings to 19.9% in 2020

Amazon Pact Sealed With Investment Agreement

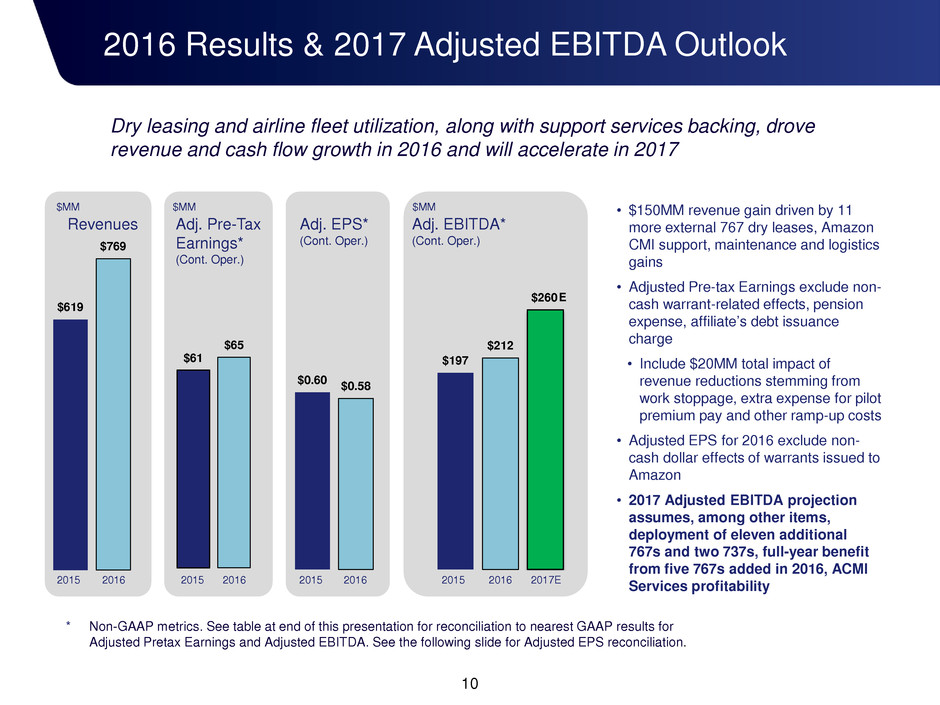

Dry leasing and airline fleet utilization, along with support services backing, drove

revenue and cash flow growth in 2016 and will accelerate in 2017

10

• $150MM revenue gain driven by 11

more external 767 dry leases, Amazon

CMI support, maintenance and logistics

gains

• Adjusted Pre-tax Earnings exclude non-

cash warrant-related effects, pension

expense, affiliate’s debt issuance

charge

• Include $20MM total impact of

revenue reductions stemming from

work stoppage, extra expense for pilot

premium pay and other ramp-up costs

• Adjusted EPS for 2016 exclude non-

cash dollar effects of warrants issued to

Amazon

• 2017 Adjusted EBITDA projection

assumes, among other items,

deployment of eleven additional

767s and two 737s, full-year benefit

from five 767s added in 2016, ACMI

Services profitability

$619

$769

$61

$65

$0.60 $0.58

$197

$212

$260

2016 Results & 2017 Adjusted EBITDA Outlook

Revenues Adj. Pre-Tax

Earnings*

(Cont. Oper.)

Adj. EPS*

(Cont. Oper.)

Adj. EBITDA*

(Cont. Oper.)

2015 2016 2015 2016 2015 2016 2015 2016

* Non-GAAP metrics. See table at end of this presentation for reconciliation to nearest GAAP results for

Adjusted Pretax Earnings and Adjusted EBITDA. See the following slide for Adjusted EPS reconciliation.

$MM $MM $MM

2017E

E

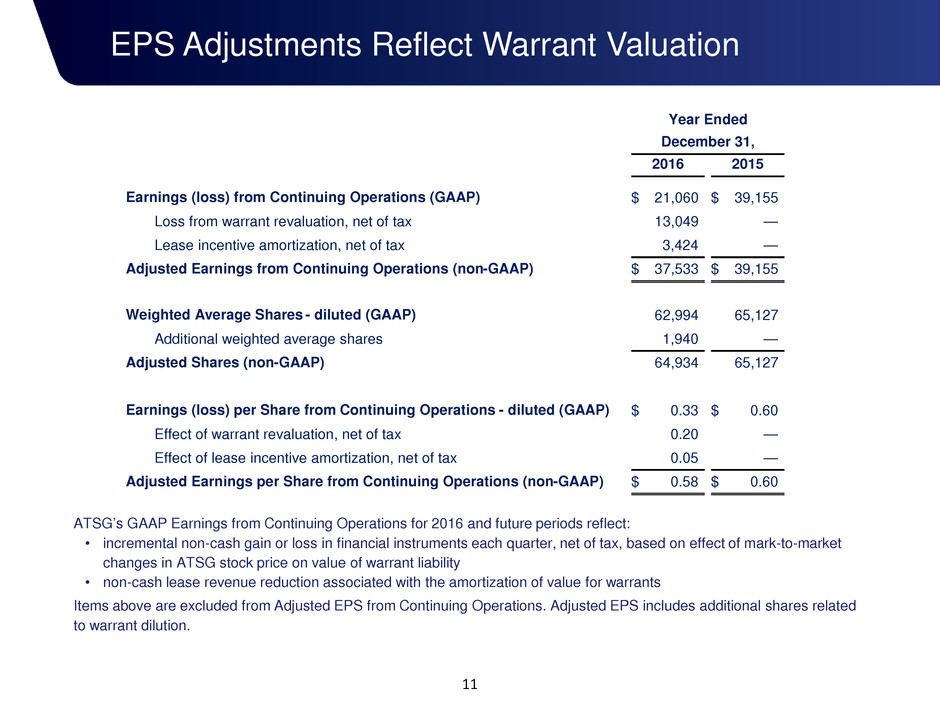

EPS Adjustments Reflect Warrant Valuation

11

ATSG’s GAAP Earnings from Continuing Operations for 2016 and future periods reflect:

• incremental non-cash gain or loss in financial instruments each quarter, net of tax, based on effect of mark-to-market

changes in ATSG stock price on value of warrant liability

• non-cash lease revenue reduction associated with the amortization of value for warrants

Items above are excluded from Adjusted EPS from Continuing Operations. Adjusted EPS includes additional shares related

to warrant dilution.

Year Ended

December 31,

2016 2015

Earnings (loss) from Continuing Operations (GAAP) $ 21,060 $ 39,155

Loss from warrant revaluation, net of tax 13,049 —

Lease incentive amortization, net of tax 3,424 —

Adjusted Earnings from Continuing Operations (non-GAAP) $ 37,533 $ 39,155

Weighted Average Shares - diluted (GAAP) 62,994 65,127

Additional weighted average shares 1,940 —

Adjusted Shares (non-GAAP) 64,934 65,127

Earnings (loss) per Share from Continuing Operations - diluted (GAAP) $ 0.33 $ 0.60

Effect of warrant revaluation, net of tax 0.20 —

Effect of lease incentive amortization, net of tax 0.05 —

Adjusted Earnings per Share from Continuing Operations (non-GAAP) $ 0.58 $ 0.60

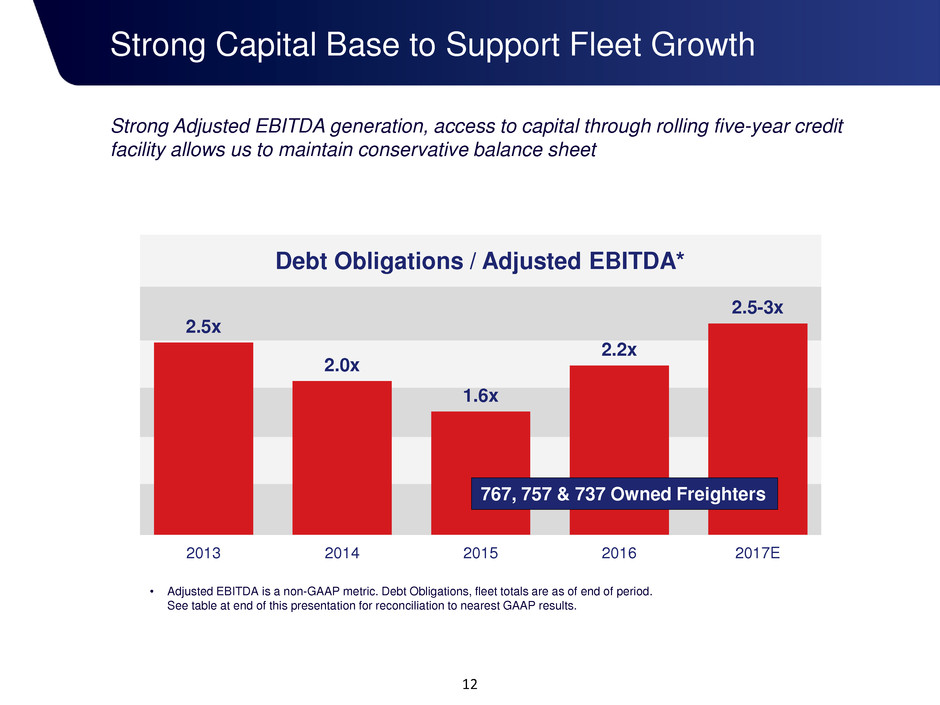

49

53

55

60

73

2.5x

2.0x

1.6x

2.2x

2.5-3x

2013 2014 2015 2016 2017E

Debt Obligations / Adjusted EBITDA*

Strong Capital Base to Support Fleet Growth

• Adjusted EBITDA is a non-GAAP metric. Debt Obligations, fleet totals are as of end of period.

See table at end of this presentation for reconciliation to nearest GAAP results.

12

Strong Adjusted EBITDA generation, access to capital through rolling five-year credit

facility allows us to maintain conservative balance sheet

767, 757 & 737 Owned Freighters

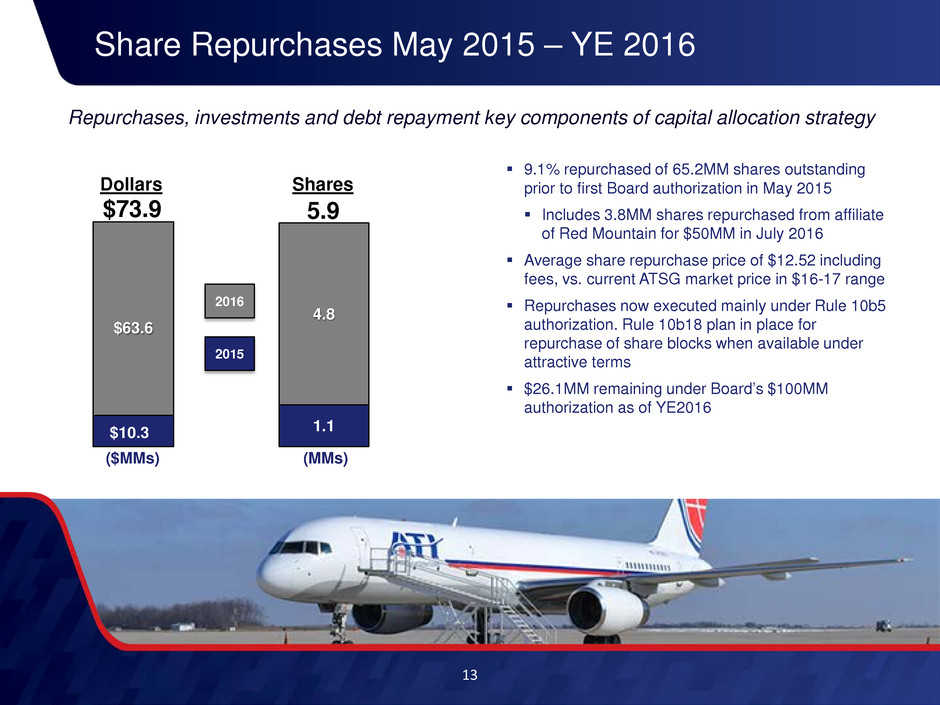

Share Repurchases May 2015 – YE 2016

13

Repurchases, investments and debt repayment key components of capital allocation strategy

1.1

4.8

5.9

(MMs)

$10.3

$63.6

$73.9

($MMs)

2016

2015

9.1% repurchased of 65.2MM shares outstanding

prior to first Board authorization in May 2015

Includes 3.8MM shares repurchased from affiliate

of Red Mountain for $50MM in July 2016

Average share repurchase price of $12.52 including

fees, vs. current ATSG market price in $16-17 range

Repurchases now executed mainly under Rule 10b5

authorization. Rule 10b18 plan in place for

repurchase of share blocks when available under

attractive terms

$26.1MM remaining under Board’s $100MM

authorization as of YE2016

Dollars Shares

Highlights and Outlook

Strong growth trajectory Double-digit revenue growth from business with new express networks, global

network integrators and regional operators attracted to midsize freighter assets, and unique model that offers

short-term ACMI flexibility and long-term dry-leasing cost advantages backed by support services.

Attractive assets World’s largest fleet of 100% owned midsize converted Boeing freighters available on a

dedicated basis, with wide range of freighter network applications. Converted freighters offer decades of reliable

service with lower investment, backed by best-in-class maintenance and conversion capabilities.

Lease-driven sustained cash flow Business model emphasizes long-term returns from dry-leasing

freighter assets to leading network operators, enhanced by unique combinations of airline, maintenance, logistics

and network management services. Not a federal cash taxpayer until 2019 or later.

Strong balance sheet Debt leverage 2.2X Adjusted EBITDA at YE2016. Will remain below 3x in 2017

even as borrowings increase for $355MM capex program that is 80% growth weighted. Credit facility amended in

2016 for more credit at attractive rates; anticipate another amendment in 2017 to fund fleet growth program.

Appetite for strategic growth through targeted, complementary acquisitions such as PEMCO to

extend footprint, add capabilities and support capacity for current and prospective customers worldwide.

Delivering shareholder value Fleet investments and share repurchases will continue to generate

attractive returns, generating even greater ATSG value. Adjusted EBITDA for 2017 projected at $260MM, up 23%

14

ATSG – a solid growth story with value appeal

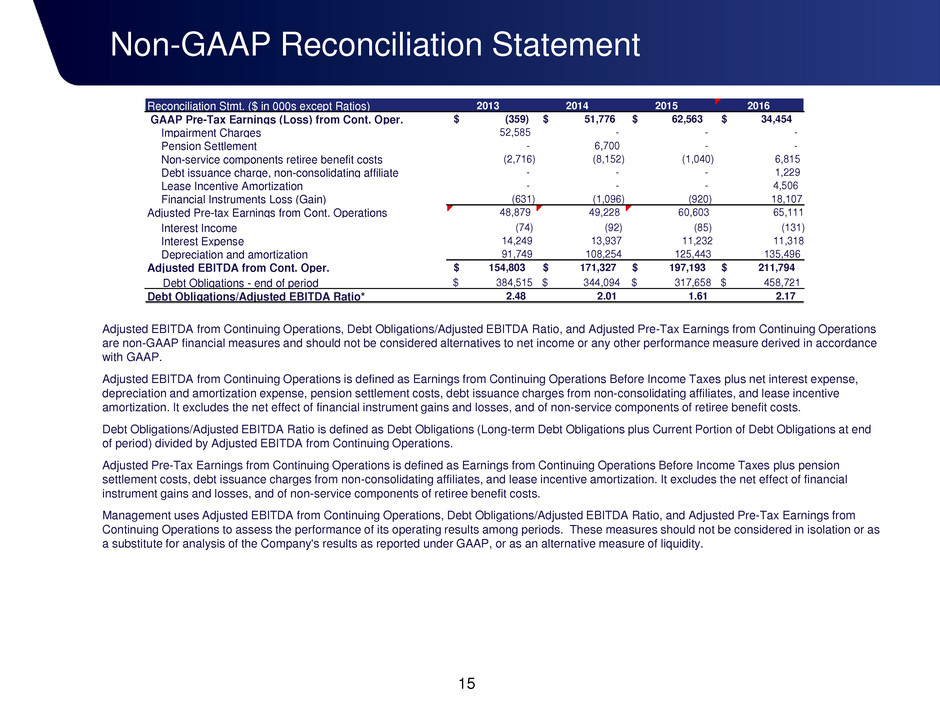

Non-GAAP Reconciliation Statement

15

2013 2014 2015 2016

(359)$ 51,776$ 62,563$ 34,454$

Impairment Charges 52,585 - - -

Pension Settlement - 6,700 - -

Non-service components retiree benefit costs (2,716) (8,152) (1,040) 6,815

Debt issuance charge, non-consolidating affiliate - - - 1,229

Lease Incentive Amortization - - - 4,506

Financial Instruments Loss (Gain) (631) (1,096) (920) 18,107

48,879 49,228 60,603 65,111

Interest Income (74) (92) (85) (131)

Interest Expense 14,249 13,937 11,232 11,318

Depreciation and amortization 91,749 108,254 125,443 135,496

154,803$ 171,327$ 197,193$ 211,794$

384,515$ 344,094$ 317,658$ 458,721$

2.48 2.01 1.61 2.17

Reconciliation Stmt. ($ in 000s except Ratios)

Debt Obligations/Adjusted EBITDA Ratio*

GAAP Pre-Tax Earnings (Loss) from Cont. Oper.

Adjusted EBITDA from Cont. Oper.

Debt Obligations - end of period

Adjusted Pre-tax Earnings from Cont. Operations

Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA Ratio, and Adjusted Pre-Tax Earnings from Continuing Operations

are non-GAAP financial measures and should not be considered alternatives to net income or any other performance measure derived in accordance

with GAAP.

Adjusted EBITDA from Continuing Operations is defined as Earnings from Continuing Operations Before Income Taxes plus net interest expense,

depreciation and amortization expense, pension settlement costs, debt issuance charges from non-consolidating affiliates, and lease incentive

amortization. It excludes the net effect of financial instrument gains and losses, and of non-service components of retiree benefit costs.

Debt Obligations/Adjusted EBITDA Ratio is defined as Debt Obligations (Long-term Debt Obligations plus Current Portion of Debt Obligations at end

of period) divided by Adjusted EBITDA from Continuing Operations.

Adjusted Pre-Tax Earnings from Continuing Operations is defined as Earnings from Continuing Operations Before Income Taxes plus pension

settlement costs, debt issuance charges from non-consolidating affiliates, and lease incentive amortization. It excludes the net effect of financial

instrument gains and losses, and of non-service components of retiree benefit costs.

Management uses Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA Ratio, and Adjusted Pre-Tax Earnings from

Continuing Operations to assess the performance of its operating results among periods. These measures should not be considered in isolation or as

a substitute for analysis of the Company's results as reported under GAAP, or as an alternative measure of liquidity.