Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Tabula Rasa HealthCare, Inc. | trhc-20161231ex32103cdc3.htm |

| EX-31.2 - EX-31.2 - Tabula Rasa HealthCare, Inc. | trhc-20161231ex3129673e6.htm |

| EX-31.1 - EX-31.1 - Tabula Rasa HealthCare, Inc. | trhc-20161231ex311c999d6.htm |

| EX-23.1 - EX-23.1 - Tabula Rasa HealthCare, Inc. | trhc-20161231ex231b19403.htm |

| EX-21.1 - EX-21.1 - Tabula Rasa HealthCare, Inc. | trhc-20161231ex211457414.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2016

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-37888

Tabula Rasa HealthCare, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

45-5726437 |

|

(State of incorporation) |

(I.R.S. Employer Identification No.) |

|

|

|

|

228 Strawbridge Drive, Suite 100 |

|

|

Moorestown, NJ 08057 |

(866) 648 - 2767 |

|

(Address of Principal Executive Offices, including Zip Code) |

(Registrant’s Telephone Number, including Area Code) |

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

|

|

Title of Each Class |

Name of Each Exchange on Which Registered |

|

Common Stock, par value $0.0001 per share |

The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S ‑K (§299.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10 ‑K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☒ |

Smaller reporting company ☐ |

|

(Do not check if a |

|||

|

smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b2 of the Exchange Act). Yes ☐ No ☒

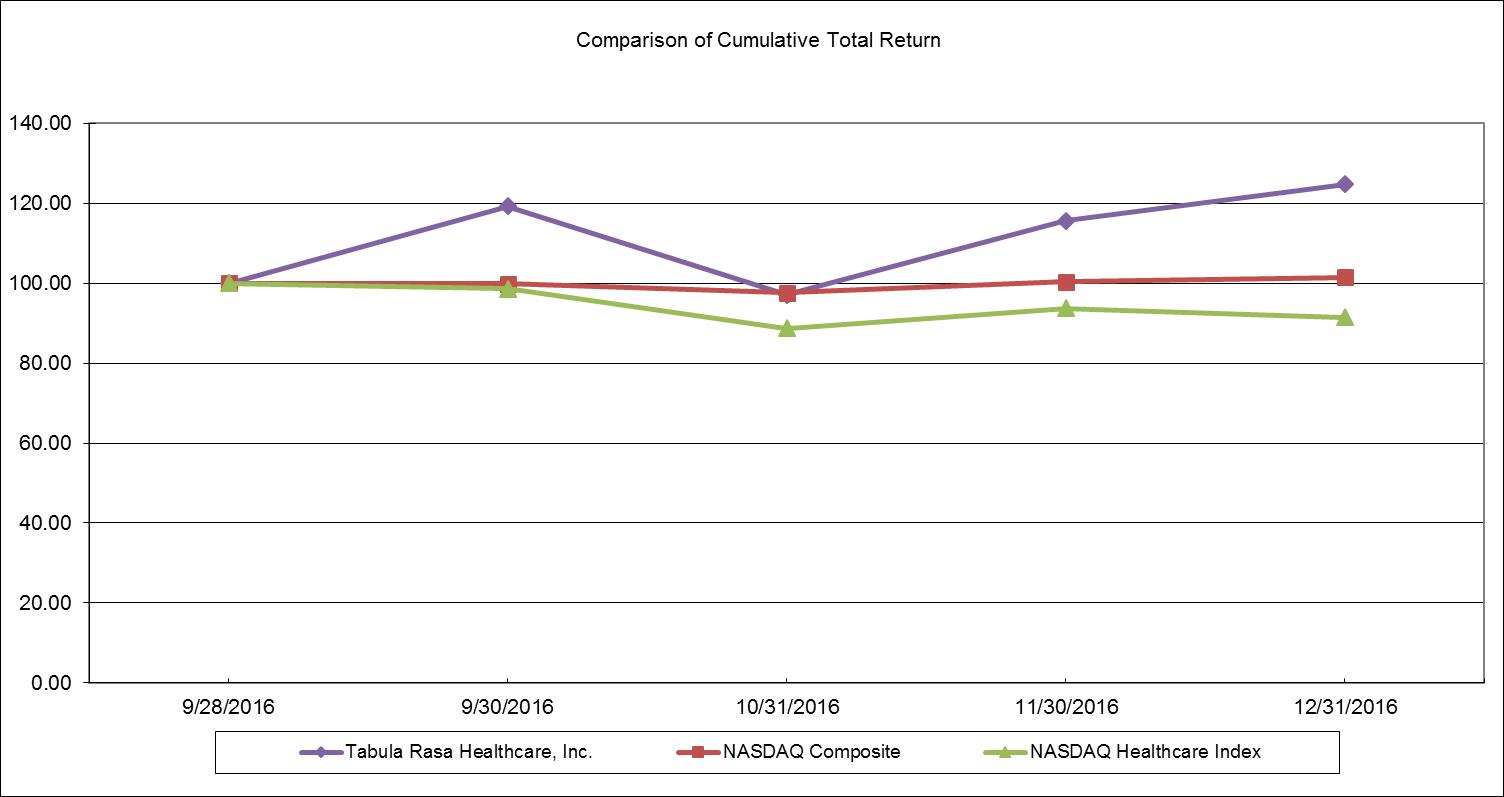

As of June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, there was no established public market for the registrant’s common stock and, therefore, the registrant cannot calculate the aggregate market value of its common stock held by non-affiliates as of such date. The registrant’s common stock began trading on September 29, 2016.

As of February 28, 2017, the Registrant had 17,073,067, shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement to be filed subsequently and delivered to stockholders in connection with the 2017 annual meeting of stockholders are incorporated herein by reference in response to Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the Registrant's fiscal year ended December 31, 2016

2

Special Note Regarding Forward Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. The statements contained in this Annual Report on Form 10-K that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “will,” “plan,” “project,” “seek,” “should,” “target,” “would,” and similar expressions or variations intended to identify forward-looking statements. The forward-looking statements in this Annual Report on Form 10-K include, among other things, statements about

|

· |

our expectations regarding industry and market trends, including the expected growth and continued structural change and consolidation in the market for healthcare in the United States; |

|

· |

our expectations about the growth of PACE organizations; |

|

· |

our expectations about private payors establishing their own at-risk programs; |

|

· |

the advantages of our solutions as compared to those of competitors; |

|

· |

our estimates about our financial performance and that some of our expenses will decline as a percentage of total revenue; |

|

· |

the visibility into future cash flows from our business model; |

|

· |

our growth strategy, including our ability to grow our client base; |

|

· |

our plans to further penetrate existing markets and enter new markets; |

|

· |

expectations of earnings, revenue or other financial items; |

|

· |

plans, strategies and objectives of management for future operations; |

|

· |

our ability to establish and maintain intellectual property rights; |

|

· |

our ability to retain and hire necessary associates and appropriately staff our operations; |

|

· |

future capital expenditures; |

|

· |

future economic conditions or performance; |

|

· |

our plans to pursue strategic acquisitions and partnerships and international expansion; |

|

· |

our plans to expand and enhance our solutions; and |

|

· |

our estimates regarding capital requirements and needs for additional financing. |

These statements are based on the beliefs and assumptions of our management based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to:

|

· |

our ability to adapt to changes or trends within the market for healthcare in the United States; |

|

· |

a significant increase in competition from a variety of companies in the health care industry; |

|

· |

developments and changes in laws and regulations, including increased regulation of the healthcare industry through legislative action and revised rules and standards; |

|

· |

the extent to which we are successful in gaining new long-term relationships with clients or retaining existing clients; |

|

· |

the growth and success of our clients, which is difficult to predict and is subject to factors outside of our control; |

|

· |

our ability to maintain relationships with a specified drug wholesaler; |

|

· |

increasing consolidation in the healthcare industry; |

|

· |

managing our growth effectively; |

|

· |

failure or disruption of our information technology and security systems; |

|

· |

dependence on our senior management and key employees; |

|

· |

our future indebtedness and our ability to obtain additional financing; |

|

· |

our ability to achieve profitability in the future; |

3

|

· |

the requirements of being a public company; and |

|

· |

those discussed in the section titled “Risk Factors” included in Item 1A of Part I of this Annual Report on Form 10-K, and the risks discussed in our other SEC filings. |

Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Unless the context requires otherwise, the terms the “Company,” “Tabula Rasa HealthCare Inc.,” “we,” “us” and “our” mean Tabula Rasa HealthCare, Inc., a Delaware Corporation, and its consolidated subsidiaries.

4

Overview

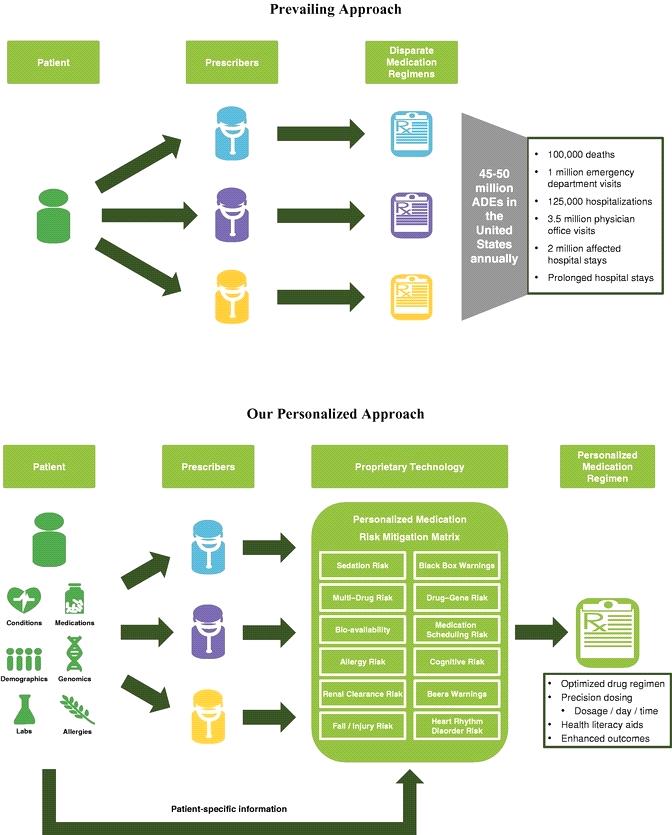

We are a healthcare technology company disrupting the field of medication safety. For over thirty years, traditional pharmacy software systems have offered clinicians a binary view of drug-to-drug interactions, presenting an assessment of one single drug against one single drug. These legacy systems may be adequate to assess the safety of a medication regimen consisting of only one or two medications. However, the elderly, the chronically ill and those with behavioral health challenges, who are more often times more likely to be subject to a medication profile of more than two medications, are typically at high risk of an adverse drug effect, or ADE. In these cases, the average patient often takes over 10 different medications a day and the current technologies are inadequate to optimize safety and minimize risk. Our novel and proprietary Medication Risk Mitigation Matrix, or MRM Matrix, delivers a simultaneous, multi-drug review which identifies medication-related risks across a variety of safety factors and presents meaningful opportunities to mitigate such risks. We partner with health plans and provider groups in comprehensive medication management and care transitions programs to identify and substantially mitigate the risks associated with ADEs. By working with us, health plans and provider groups have reduced their pharmacy spend and admissions rates.

We are a leader in providing patient-specific, data-driven technology and solutions that enable healthcare organizations to optimize medication regimens to improve patient outcomes, reduce hospitalizations, lower healthcare costs and manage risk. We deliver our solutions through a comprehensive suite of technology-enabled products and services for medication risk management, which includes bundled prescription fulfillment and reminder packaging services for client populations with complex prescription needs. We also provide risk adjustment services and pharmacy cost management services, which help our clients to properly characterize a patient's acuity, or severity of health condition, and optimize the associated payments for care. With 4.7 billion prescriptions filled in the United States in 2016, medication treatment is the most common medical intervention, and its imprecise use represents the fourth leading cause of death and contributes to an estimated 45 to 50 million ADEs annually with 2.5 to 4.0 million of those ADEs considered serious, disabling or fatal. The incidence of ADEs is highly correlated to the number of medications an individual is taking and non-adherence to prescribed regimens, and thus is particularly relevant to populations with complex healthcare needs. Our technology-driven approach to medication risk management represents an evolution from prevailing non-personalized approaches that primarily rely on single drug-to-drug interaction analysis. We currently serve approximately 133 healthcare organizations that focus on populations with complex healthcare needs and extensive medication requirements.

Our suite of cloud-based software solutions provides prescribers, pharmacists and healthcare organizations with sophisticated and innovative tools to better manage the medication-related needs of their patients. We believe we offer the first prospective clinical approach to medication risk management, which is designed to increase patient safety and promote adherence to a patient's personalized medication regimen. Furthermore, our medication risk management technology helps healthcare organizations lower costs by reducing ADEs, enhancing quality of care and avoiding preventable hospital admissions. Our products and services are built around our novel and proprietary MRM Matrix which enables optimization of a patient's medication regimen, involving personalizing medication selection, dosage levels, time-of-day administration and reducing the total medication burden by eliminating unnecessary prescriptions. The MRM Matrix analyzes a combination of clinical and pharmacology data, population-based algorithms and extensive patient-specific data, including medical history, lab results, medication lists and individual genomic data, to deliver "precision medicine." We provide software-enabled solutions that can be bundled with prescription fulfillment and reminder packaging services, which are informed by a patient's personalized MRM Matrix to increase adherence to a patient's optimized regimen, through our three prescription fulfillment pharmacies. Our prescription fulfillment pharmacies are strategically located to efficiently distribute medications nationwide for our clients and medications are packaged to promote adherence to their patients' personalized regimens and dosing schedules. Our team of clinical pharmacists is available to support prescribers at the point of care through our proprietary technology platform, including real-time secure messaging, with more than 136,000 messages exchanged during December 2016.

Total spending in the United States on prescription medicines was $462 billion in 2016, according to a report issued by the QuintilesIMS Institute. According to the Centers for Disease Control and Prevention, in any given month, 48% of Americans take a prescription medication, and 11% take five or more prescription medications. According to the U.S. Food and Drug Administration, ADEs result in more than 100,000 deaths annually in the United States, and a study by the U.S. Department of Health and Human Services, or HHS, notes that ADEs cause approximately 125,000 hospitalizations, one million emergency room visits, two million affected hospital stays and 3.5 million physician office

5

visits every year. According to a book published by the National Academy of Sciences in 2000, for every dollar spent on ambulatory medications, another dollar is spent to treat new health problems caused by the medication. These statistics indicate that medication treatment is complex, and current tools available to healthcare organizations have been largely unsuccessful in mitigating ADEs.

To enhance healthcare outcomes and better control costs, employers, health insurers and government agencies are restructuring health coverage and care models to make healthcare providers more accountable for healthcare utilization and quality of care. As the U.S. healthcare market continues to evolve from a fee-for-service to a value-based model of care, healthcare organizations require new and emerging technologies to optimize treatment and manage risk on a patient-specific, customized basis. Our solutions are targeted currently to "at-risk" healthcare organizations that are clinically and financially responsible for the populations they serve, receiving a fixed payment for the care provided to each patient for an entire episode of care or enrollment period. According to the Centers for Medicare & Medicaid Services, or CMS, and the Congressional Budget Office, or CBO, there were approximately 138 million people in the United States covered under government-sponsored programs in 2016, and this number is expected to reach 154 million by 2020. Government-sponsored programs are leading the shift to value-based healthcare. Our solutions support our clients in achieving the Institute for Healthcare Improvement, or IHI, "Triple Aim" of improving a patient's experience, while managing the health of a client's population and controlling costs.

We are led by highly experienced and entrepreneurial executive officers with more than 70 years of cumulative experience in the healthcare industry. Our co-founder, Dr. Calvin H. Knowlton, founded excelleRx, Inc., and along with Dr. Orsula Knowlton and other members of our management team, built it into the largest national hospice medication management pharmacy in the United States servicing approximately 400 hospice agencies with approximately 48,000 patients in 46 states, at the time it was sold to Omnicare, Inc. in 2005.

Since our first year of active operations in 2011, our revenue has grown to $94.1 million for the year ended December 31, 2016, with a net loss of $6.3 million and Adjusted EBITDA of $13.6 million. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures — Adjusted EBITDA" for our definition of Adjusted EBITDA, why we present Adjusted EBITDA and a reconciliation of net losses to Adjusted EBITDA. We had an annual revenue retention rate of 98% and client retention rate of 93% in 2016. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Key Business Metrics" for our definitions of revenue retention rate and client retention rate.

Corporate Information

We were incorporated in Delaware in May 2014. We completed our initial public offering in October 2016 and our common stock is listed on The NASDAQ Global Market under the symbol “TRHC.” Our principal executive offices are located at 228 Strawbridge Drive, Suite 100, Moorestown, NJ 08057, and our telephone number is (866) 648-2767.

Information about Segment and Geographic Revenue

We manage our operations and allocate resources as a single reportable segment. All of our revenue is recognized in the United States and all of our assets are located in the United States.

Recent Developments

Initial Public Offering

On October 4, 2016, we completed an initial public offering (the “IPO”) of our common stock pursuant to which we issued 4,300,000 shares of our common stock, plus the exercise of the underwriters’ option to purchase an additional 645,000 shares of common stock, at an issuance price of $12.00 per share. We received net proceeds of $55.2 million after deducting underwriting discounts and commissions of $4.2 million, but before deducting other offering expenses. Immediately prior to the completion of the IPO, all of the Company’s then outstanding Class A Non-Voting common stock and Class B Voting common stock, totaling 5,583,405 shares, were redesignated into shares of common stock, par value $.0001 per share, and all of the Company’s then outstanding convertible preferred stock converted into an aggregate of 5,089,436 million shares of common stock, par value $.0001 per share. Our common stock is listed on the NASDAQ Global Market under the symbol “TRHC.”

6

Acquisitions

In September 2016, we acquired certain assets, consisting primarily of intellectual property and software assets of 9176-1916 Quebec Inc. (an entity indirectly controlled by our Chief Scientific Officer, Jacques Turgeon). The intellectual property and software assets were previously licensed by us and are integrated into the MRM Matrix. The acquisition consideration consisted of cash consideration of up to $6.0 million, consisting of $1.0 million which was paid upon closing, $2.2 million paid on November 2, 2016, $2.2 million paid on December 9, 2016, and $600 thousand following the 12-month anniversary of the closing date of the acquisition, which is contingent upon no claims for indemnification being made pursuant to the purchase agreement. In addition to the cash consideration, the purchase price included $5.0 million worth of common stock, consisting of $2.5 million, or 201,353 shares, of common stock issued on November 15, 2016 and $2.5 million, or 194,054 shares, of common stock issued on December 29, 2016. The stock consideration issued on November 15, 2016 and on December 29, 2016 was calculated based on the arithmetic average of the daily volume-weighted average price of the Company’s common stock for the 30 business days ending on, and including, the 30th and 60th business day, respectively, following the completion of the IPO.

We account for acquisitions using the purchase method of accounting. We allocated the purchase price to the assets acquired, including intangible assets and liabilities assumed, based on estimated fair values at the date of the acquisition. The results of operations from the acquisition are included in our consolidated financial statements from the acquisition date.

Financing

On April 29, 2015 we entered into a revolving line of credit, which was amended on July 1, 2016, or the 2015 Line of Credit, with a lender pursuant to the terms of a loan and security agreement, which provides for borrowings in an aggregate amount up to $25.0 million to be used for general corporate purposes, including repayment of a prior line of credit. We borrowed $10.0 million under the 2015 Line of Credit at that time. As of December 31, 2016, we had no amounts outstanding under the 2015 Line of Credit. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Revolving Credit Facility" below for additional information with respect to the 2015 Line of Credit.

On July 1, 2016, we entered into a term loan facility with ABC Funding, LLC, an affiliate of Summit Partners, L.P., or the ABC Credit Facility. The proceeds of the initial term loan advance of $30.0 million under the ABC Credit Facility were used to repay all outstanding amounts under the promissory notes related to the acquisition of Medliance LLC, or the Medliance Notes, and loans entered into with Eastward Capital Partners V, L.P. and its affiliates in April 2014 and December 2014. At the closing of the IPO in October 2016, we used a portion of the net proceeds from the offering to repay in full all outstanding amounts due under the ABC Credit Facility and the ABC Credit Facility was subsequently terminated. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Term Loan Facility" below for additional information with respect to the ABC Credit Facility.

Enhanced Medication Therapy Management Program Development Opportunity

We have been selected to participate with a large, regional Medicare Part D Prescription Drug Plan, or Regional PDP, to develop and deliver an Enhanced Medication Therapy Management, or EMTM, program. We believe this EMTM program will address the requirements of the Part D Enhanced Medication Therapy Management Model test, which the Centers for Medicare and Medicaid Innovation, or CMMI, proposed in September 2015 and recently approved.

The Part D EMTM model created by the Centers for Medicare & Medicaid Services, or CMS, is designed to test strategies to improve medication use among Medicare beneficiaries enrolled in Part D and to assess whether providing selected Regional PDPs with additional incentives and increased flexibility to design and implement innovative programs will better achieve the overall goals for EMTM programs.

We launched the EMTM program on January 1, 2017. To execute this EMTM program, we are using our MRM Matrix and certain other services to perform medication risk stratification and reviews and safety assessments of complex medication regimens, providing an innovative, alternative approach to pharmacotherapy to the 240,000 members of this Regional PDP, representing less than one percent of the entire eligible Part D market. In 2016, the

7

number of individuals covered through Medicare Part D programs was nearly 41 million. We believe if we are successful in developing and delivering an EMTM program to the Regional PDP, we will be able to expand into a greater portion of the Part D market. There can be no assurances that our EMTM program will be successful or we will actually be able to expand this program as currently contemplated.

Our Solutions

Medication risk management is our leading offering, and our cloud-based software applications, including EireneRx and MedWise Advisor, together with our bundled prescription fulfillment and reminder packaging services, provide solutions for a range of payors, providers and other healthcare organizations. Our products and services are built around our proprietary MRM Matrix, which combines clinical and pharmacology data, population-based algorithms and extensive patient-specific data, including medical history, lab results, medication lists and personal genomic information, to deliver what the U.S. Food and Drug Administration, or FDA, refers to as "precision medicine." Precision medicine combines traditional evidence-based medication selection with new patient-specific medication selection to better optimize a patient's medication therapy. Our suite of technology products is built on a powerful rules engine that houses comprehensive pharmacotherapy profiles, provides risk alerts and includes a combination of proprietary decision-support tools, real-time secure messaging, e-prescribing and advanced precision-dosing functionality, among other functions. Our software applications help reduce ADEs, enhance medication adherence and quality of care, improve medication safety at the individual patient level and reduce the total medication burden by eliminating unnecessary prescriptions.

We also provide risk adjustment services and pharmacy cost management services to help our clients achieve correct reimbursement, maintain regulatory compliance and optimize pharmacy spend.

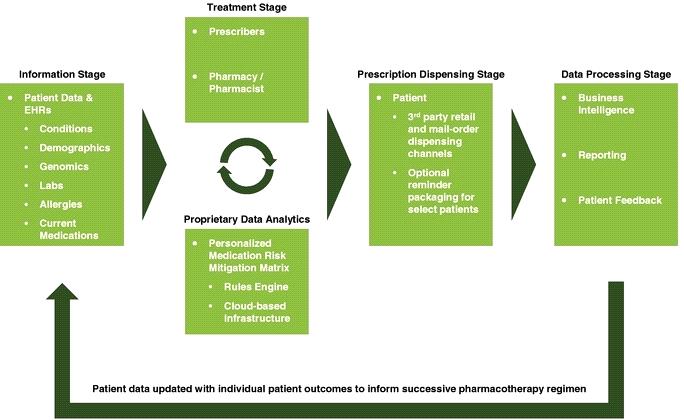

The following chart sets forth the environment within which our solutions, enabled by our personalized MRM Matrix, apply precision medicine practices to collect, analyze and process patient information to accurately inform each patient's medication regimen.

8

Our Strategy

Further Penetrate and Grow with the Expansion of Our Current At-Risk Markets

By leveraging our industry expertise and thought leadership and expanding our sales and marketing efforts, we believe that we can increasingly penetrate the market for existing and new at-risk clients. We are the market leader in providing medication risk management to Programs of All-Inclusive Care for the Elderly, or PACE, a CMS sponsored program through which participating healthcare organizations provide fully integrated healthcare delivery on an at-risk basis for elderly adults, most of whom are dually eligible for Medicare and Medicaid. Our PACE clients cover approximately 20% of the total PACE enrollees nationwide. We believe that we have a significant opportunity to continue to grow within this market. From 2012 to 2016, the number of PACE organizations has increased from 84 to 116 and the number of PACE centers has increased from 126 to 228. The number of participants enrolled in PACE organizations, who have a typical length of stay exceeding four years, has doubled over the last five years, yet, according to a study we commissioned from AEC Consulting, LLC, represents only 4% of the total eligible individuals within current PACE service areas.

We expect our PACE clients to continue to grow to cover more eligible lives. This growth may be facilitated by existing state and federal initiatives that present expansion opportunities for PACE, including recently allowing the formation of PACE organizations by for-profit providers, and the creation of other PACE-like, at-risk organizations, many of which would be targets for our solutions. For example, the PACE Innovation Act of 2015 allows CMS to develop pilot programs using the PACE model of care to serve individuals under age 55 and at risk of needing nursing home care as well as other patients with chronic diseases. On April 4, 2016, CMS announced payment changes that will impact PACE organizations in 2017, and we believe that such changes will produce increased payments of approximately 2%. Further, in August 2016, CMS proposed a rule to update and modernize the PACE program, which would include strengthening protections and improving care for beneficiaries, as well as providing administrative flexibility and regulatory relief for PACE organizations, resulting in program expansion. Working with our scalable solutions can help PACE organizations facilitate their growth.

Furthermore, in Medicare Advantage and similar value-based care models, patients are assigned relative risk scores based on diagnosis, which need to be documented accurately each year for proper reimbursement. We are also the market leader in risk adjustment and front-end coding for PACE organizations, and we plan to continue to expand these services to other Medicare Advantage programs as well as at-risk provider groups.

We have been selected to participate with a large, regional Medicare Part D Prescription Drug Plan, or Regional PDP, to develop and deliver an Enhanced Medication Therapy Management, or EMTM, program. We believe this EMTM program will address the requirements of the Part D Enhanced Medication Therapy Management Model test, which the Centers for Medicare and Medicaid Innovation, or CMMI, proposed in December 2015 and recently approved.

The Part D EMTM model created by the Centers for Medicare & Medicaid Services, or CMS, is designed to test strategies to improve medication use among Medicare beneficiaries enrolled in Part D and to assess whether providing selected Regional PDPs with additional incentives and increased flexibility to design and implement innovative programs will better achieve the overall goals for EMTM programs.

We launched the EMTM program on January 1, 2017. To execute this EMTM program, we are using our MRM Matrix and certain other services to perform medication risk stratification and reviews and safety assessments of complex medication regimens, providing an innovative, alternative approach to pharmacotherapy to the 240,000 members of this Regional PDP, representing less than one percent of the entire eligible Part D market. In 2016, the number of individuals covered through Medicare Part D programs was nearly 41 million. We believe if we are successful in developing and delivering an EMTM program to the Regional PDP, we will be able to expand into a greater portion of the Part D market. There can be no assurances that our EMTM program will be successful or we will actually be able to expand this program as currently contemplated.

9

Continue Expansion into Emerging At-Risk Provider and Payor Markets

We intend to leverage our expertise and experience from our existing clients to expand to other at-risk providers and payors through increased investment in our sales force and marketing efforts.

We believe that the growth in government healthcare programs and the shift to value-based care models are creating opportunities for many organizations to capture growing portions of the expanding healthcare market. Accordingly, we are actively targeting at-risk, value-based markets, including managed care organizations, physician provider groups, self-insured companies and Accountable Care Organizations, or ACOs, which are healthcare organizations characterized by a payment and care delivery model that ties provider reimbursement to quality metrics and the total cost of care for an assigned population. We also target post-acute healthcare organizations, which provide a range of medical services to support an individual's recovery or manage chronic illness after a period of in-patient care. We believe non-PACE ACOs offer another large market for our solutions, as they operate under a similar at-risk reimbursement model. The number of ACOs in the United States has increased from 64 in 2011 to 857 in the third quarter of 2016, collectively covering approximately 28.6 million individuals. Many physician provider groups are moving to at-risk, capitated payment models in response to incentives from managed care organizations and government programs.

Many post-acute healthcare services are also transitioning to value-based care models. On April 1, 2015, the CMS Innovation Center's Bundled Payments for Care Improvement, or BPCI, initiative began, which comprises four broadly defined models of care designed to improve the coordination and quality of care at a lower cost to Medicare. In the BPCI initiative, post-acute care facilities and home health agencies receive bundled payments for episodes of care. According to a recent report by the Advisory Board Company, more than 4,000 post-acute facilities and a number of home health agencies have already signed up to participate in the BPCI program. As the market leader in pharmacy cost management solutions in the post-acute market, we believe we are also well positioned to further serve these organizations with medication risk management solutions as they continue migrating to an at-risk reimbursement structure.

Expand Offerings to a Large and Growing Behavioral Health Market

We believe our solutions have the potential to offer substantial value to the behavioral health market. Behavioral health medications are powerful, are subject to trial-and-error prescribing methods and are prone to side effects and ADEs. The behavioral health market is growing in part as a result of the Patient Protection and Affordable Care Act, or ACA, which significantly expanded coverage for mental health and substance use disorder services. These protections build on the Mental Health Parity and Addiction Equity Act of 2008 provisions to expand mental health and substance use disorder benefits and federal parity protections to an estimated 62 million Americans.

Accordingly, we are pursuing intervention studies or pilot programs to evaluate the benefits of our medication risk management solutions in the behavioral health population. In addition, we were recently asked to participate in Medicaid 2.0: Blueprint for the Future in the state of New Jersey, which lays out a plan to redesign and modernize New Jersey’s Medicaid program. Since behavioral health patients represent a large number of the population that Medicaid serves, our participation in this program would enable us to expand our solutions to the behavioral health markets. We continue to explore additional expansion opportunities with behavioral health providers as this market evolves.

Continue to Innovate and Expand Platform Offerings to Meet Evolving Market Needs

We believe our investments in human capital, technology and services capabilities position us to continue to pursue rapid innovation and expand our medication risk management solutions and other platform offerings to the broader healthcare marketplace. For example, we are developing high-throughput medication risk stratification technology for identification of high-risk patients in need of clinical intervention, and we are developing a patient engagement application of our MRM Matrix solution. In addition, to further our commitment to innovation in the healthcare technology sector, we have established the Jack Russell Software Innovation Center which works collaboratively with our corporate university, TRHC University, to provide technology leadership, creative problem solving skills and training to our employees as well as the healthcare community more broadly. We also believe there is a substantial opportunity in our existing client base to cross-sell our full set of solutions.

10

Selectively Pursue Strategic Acquisitions and Partnerships

Since our founding in 2009, we have successfully completed and integrated five acquisitions, which have significantly expanded our market footprint and broadened our medication risk management and risk adjustment offerings. We plan to continue to acquire assets and businesses and may enter into strategic partnerships that strengthen or expand our service offerings, capabilities and geographic reach and facilitate our entry into new markets. Our acquisition strategy is driven by our commitment to serving client needs, and we are continuously assessing the market for potential opportunities.

Develop International Market Opportunities

We believe we are well positioned to provide our products and services to international healthcare organizations that face challenges similar to those that our clients face domestically. Our solutions are readily scalable and can be utilized by healthcare organizations abroad seeking to achieve the IHI Triple Aim. We believe our solutions would provide significant value to the international healthcare landscape, which is frequently characterized by single-payor government-administered healthcare.

Our Core Technology

ADEs often result from unintended drug overdoses due to factors such as multi-drug interactions, impaired renal function, medication-related genomic variants and the cumulative impact of drug-related sensitivities, such as excess sedation and increased risk of falls and injury. Combining medications with anticholinergic drugs, which are drugs that block the action of the neurotransmitter acetylcholine to the nervous system, increases the likelihood of these and other similar ADEs. The risk of ADEs resulting from combining certain drugs with those that have anticholinergic properties is high given the fact that many common over-the-counter and prescription medications contain anticholinergic ingredients. Our goal is to enable prescribers to optimize the use of medications using a prospective approach to medication risk management in order to avoid ADEs and improve patient outcomes. Our technology suite enables a novel approach to optimize the medication regimen of individual patients and address the issues with prevailing prescribing methodologies.

Utilizing our technology, prescribers obtain real-time information about the factors impacting a medication's effectiveness and safety for a particular patient grounded in evidence-based clinical data and extensive patient-specific data. Our technologies deliver prospective intervention and are designed to reduce ADEs, increase medication adherence and quality of care and improve medication safety at the individual patient level. Our cloud-based applications are scalable, easily accessible to healthcare organizations, seamlessly integrated with client applications and databases and customized for use across the healthcare continuum of care. Our software systems provide secure communication between prescribers and our pharmacists, and our sophisticated medication decision-support tools are interoperable with many industry-leading electronic health record systems, or EHRs. We believe our innovative technology platform offers a means of improving patient outcomes while mitigating medication-related and financial risk for healthcare organizations.

Our suite of cloud-based software solutions incorporates comprehensive pharmacotherapy profiles, a combination of proprietary decision-support tools, risk alerts, e-prescribing, advanced precision-dosing functionality, real-time secure messaging and health literacy aids, among other functions. At the core of our technology platform is our proprietary MRM Matrix. Through a sophisticated rules engine, the MRM Matrix combines patient-specific data with the science of pharmacokinetics, the effects of what the body does to drugs, and pharmacodynamics, the effects of what the drug does to the body, to enable our clients to personalize the medication regimen of each patient. The MRM Matrix also draws upon pharmacoevidence, which considers published guidelines that denote potentially inappropriate medications for older adults such as the Beers Criteria and potentially unsafe medications in various age groups such as the FDA's Black Box warnings, as well as pharmacoeconomics, which compares the cost, expressed in monetary terms, and effects, expressed in terms of monetary value, efficacy or enhanced quality of life, of one pharmaceutical drug or drug therapy to another.

11

The following charts contrast the prevailing approach to prescribing medications, which is often uncoordinated and non-personalized and results in inconsistent and ineffective medication regimens for the same patient, with our personalized approach utilizing our proprietary MRM Matrix.

Our software offerings are developed by our in-house team of software engineers that continuously enhances our solutions and their functionality. By maintaining in-house development and support, we can efficiently leverage our institutional knowledge to augment our solutions while protecting our intellectual property. Our solutions are further protected by patent, copyright, trademark and trade secret laws as well as confidentiality agreements, licenses and other agreements with employees, consultants, vendors and clients. Our software offerings are scalable, fault-tolerant and compliant with the Health Insurance Portability and Accountability Act of 1996, or HIPAA, and Health Information Technology for Economic and Clinical Health Act, or HITECH, regulations and are Meaningful-Use certified, which

12

means they qualify in determining eligibility for EHR incentive payments from CMS under the American Recovery and Reinvestment Act of 2009.

Our Software and Services

Our Software

Our cloud-based software applications include EireneRx, which is used by at-risk healthcare organizations to access their patients' medication-related information through our dashboard that shows the results of the MRM Matrix and medication recommendations, MedWise Advisor, which allows for components of EireneRx to be used independently and by a broader healthcare audience, and NiaRx, which is our educational software platform designed to facilitate brand awareness of our solutions in the pharmacy educational community. These software-enabled solutions are offered on a standalone basis or bundled with prescription fulfillment and reminder packaging services for client populations with complex prescription needs.

Our personalized medication risk management services are based on our MRM Matrix technology. For each patient, our software creates a personalized MRM Matrix, which incorporates personal medical history data inputs, summarizes the medications the patient is taking and provides clinical alerts, including for the risk of falls and injury, sedation risk and medication scheduling risk. This MRM Matrix is utilized by prescribers independently and, in some cases, in conjunction with our pharmacists, to optimize each patient's medication regimen utilizing one of our proprietary software solutions below:

|

EireneRx |

MedWise Advisor |

|||

|

Revenue Model |

Per-member per-month Fee-for-service model (for prescription fulfillment and reminder packaging services) |

Recurring monthly subscription SaaS model |

||

|

Current Target Clients |

Healthcare organizations with all-inclusive, or closed, care models with an emphasis on coordination of care, such as PACE, ACOs, Integrated Delivery Networks and Patient Centered-Medical Homes Risk-bearing provider groups |

Healthcare organizations able to leverage the MRM Matrix Health plans Risk-bearing provider groups Hospitals and health systems Pharmacies and pharmacists Potential patient engagement application through existing relationships |

||

|

EireneRx |

MedWise Advisor |

|||

|

Key Technology Features |

Cloud-based electronic portal MRM Matrix e-prescribing Decision support at the point of care Computerized physician order entry Modular certified for Meaningful Use Real-time secure messaging capabilities with our pharmacists Storage of personalized actionable pharmacogenomic data, which is data on how genes affect a person's response to drugs |

Cloud-based electronic portal MRM Matrix Decision support at the point of care Real-time secure messaging capabilities with our pharmacists Storage of personalized actionable pharmacogenomic data |

13

|

Service Features |

Fully interoperable with many industry-leading EHRs and dispensing software Sophisticated medication decision-support tools Precision dosing systems May be combined with prescription fulfillment and adherence packaging, patient-focused health literacy and adherence tools and pharmacist consultation |

Used independently or readily integrated with other pharmacy management systems, long-term care clinical systems, case management platforms, industry-leading EHRs or dispensing software Sophisticated medication decision-support tools Precision dosing systems |

||

|

Differentiated Attributes |

Enables physicians and pharmacists to collaborate on a patient's medication management in real time Offers clinical analysis and aggregates reports that optimize outcomes and show risk mitigation results Compatible with third-party dispensing-systems |

Sophisticated alert functionalities and patient risk evaluation Built-in module with capabilities to remove repetitive components of a comprehensive medication review |

||

EireneRx

EireneRx is our cloud-based medication decision-support and e-prescribing platform, which includes a computerized order entry module used by healthcare organizations to access patient medication-related information and utilize our personalized proprietary MRM Matrix. EireneRx provides a single version of a patient's medication profile, enabling prescribers and our pharmacists to collaborate on a patient's medication management in real time. The EireneRx platform provides a dashboard report that shows the results of the MRM Matrix. We have a team of pharmacists available to perform a clinical analysis of the results and, when necessary, offer guidance to the prescriber based upon its assessment of the MRM Matrix and the individual patient's medical history. EireneRx provides several communication workflows through which our pharmacists can answer questions and make recommendations to prescribers.

Medication decision-support tools and precision-dosing aides are presented to prescribers at the point-of-prescribing, during pharmacist consultation and at periodic patient reviews, providing detailed patient-specific information. These tools are Meaningful Use Stage I and II certified, meaning they qualify in determining eligibility for EHR incentive payments from CMS under the American Recovery and Reinvestment Act of 2009. EireneRx is integrated with our prescription fulfillment pharmacies, which can deliver medications to our clients' patients nationally. The platform is also capable of sending prescriptions to substantially all pharmacies in the United States.

MedWise Advisor

MedWise Advisor software provides the medication decision support components of EireneRx, primarily our MRM Matrix, to support clients seeking to manage their medication risk and improve medication outcomes and patient relationships by enhancing their existing systems. MedWise Advisor can be integrated with a variety of e-prescribing modules, EHRs, pharmacy management systems, clinical systems, case management platforms and other clinical databases. The software enables a prescribing environment where the physician prescribes medication with real-time pharmacist consultation. We have a team of pharmacists available to perform clinical analysis of the results and, when necessary, offer guidance to the prescriber based upon their review of the MRM Matrix and the individual patient's medical history. We believe MedWise Advisor is broadly applicable to all healthcare organizations that employ clinicians who prescribe medications and those with pharmacists or other clinicians that provide support to prescribers. We are currently working with managed care and behavioral health organizations that are utilizing MedWise Advisor to improve medication therapy outcomes, and we are targeting a broad range of healthcare systems, hospitals, post-acute providers and pharmacies and intend to target consumers with this solution.

14

NiaRx

NiaRx is a cloud-based software platform designed to facilitate the cognitive practice of pharmacy through case-based learning utilizing the MRM Matrix. NiaRx is in use by six schools of pharmacy, with over 2,000 registered academic users, and is intended to build literacy and brand awareness of our suite of technology solutions with thought-leaders and students in the pharmacy educational community, and drive adoption in the professional pharmacy community.

Our Services

Our clinical pharmacist collaboration service, prescription fulfillment and reminder packaging service and pharmacy cost management service are designed to improve patient experiences and outcomes and contain costs while our risk adjustment services help optimize revenue. The revenue models under these service contracts typically include payments on a per-member per-month basis, payments on a subscription basis and charges and dispensing fees for medication fulfillment for our clients' patients.

Clinical Pharmacist Collaboration

We have a team of pharmacists available to perform medication risk analysis and offer guidance, including the clinical application of pharmacogenomic test results and data application, to the prescriber based upon their assessment of the MRM Matrix and the individual patient's medical history. Our clinical pharmacists provide these personalized medication recommendations predominantly through secure real-time messaging. Available 24/7, 365 days per year, this service supports the medication risk management clinical decision making process with medication safety recommendations, including to eliminate unnecessary prescriptions, and execution of the optimized medication regimen. We exchanged over 136,000 secure real-time messages in December 2016.

Prescription Fulfillment and Reminder Packaging

We operate three prescription fulfillment pharmacies strategically located to efficiently distribute medications nationwide for our clients. Informed by each patient's personalized MRM Matrix, we package, synchronize and aggregate medications by day, time-of-day and dosage to increase the ease of adherence by patients to their optimized medication regimens. Using automated, robotic dispensing machines, our scalable, high-performance systems allow for an array of medication packaging options, including multi-dose deep well cards and multi-dose pouches.

Effective March 2016, we entered into a prime vendor agreement with AmerisourceBergen Drug Corporation, or AmerisourceBergen, a drug wholesaler, to provide us with the pharmaceutical products we sell. The prime vendor agreement was subsequently amended and restated effective May 1, 2016. As part of this agreement, we are obligated to purchase at least 95% of the total dollar amount of prescription pharmaceutical products we sell from AmerisourceBergen. The contract also commits us to a monthly minimum purchase obligation of approximately $1.75 million. Our amended and restated contract with AmerisourceBergen has an initial term of three years expiring April 30, 2019, and can be terminated by, among other things, either party's material breach that continues for 30 days. Pursuant to the terms of a security agreement entered into in connection with the prime vendor agreement, AmerisourceBergen also holds a subordinated security interest in all of our assets.

The reason we purchase large quantities of pharmaceutical products from a single wholesaler is primarily for ease of administration and pricing. In the event of a termination of our relationship with AmerisourceBergen, we believe that there is typically at least one alternative drug wholesaler from whom we could source each non-limited distribution drug we dispense. We further believe that we could replace the inventories without a material disruption to our operations.

Risk Adjustment

We take a prospective approach to risk adjustment, going beyond the typical strategy of providing retrospective reviews and claims data analysis. We identify opportunities for efficiency and performance improvement in coding patterns, data integrity and diagnosis volumes and trends. Our consultants help clients to refine processes and systems to capture timely, complete and accurate claims data. Our team of expert physicians and nurse consultants trains client staff

15

and providers about documentation and diagnosis coding, analyzes client data collection and submission processes and delivers meaningful analytics for understanding reimbursement complexities.

Long-term optimization of risk adjustment outcomes is complex and, for many organizations, significantly affects financial performance. We specialize in helping clients optimize processes and systems to capture timely, complete and accurate data. Through these services, we currently help PACE and other healthcare organizations remain compliant with regulations, make reliable comparisons to internal and external benchmarks and identify high-volume/high-cost issues for quality program initiatives.

Pharmacy Cost Management

We design, implement and manage pharmacy cost-containment strategies for our post-acute care clients. Pharmacy cost management services help our clients reduce risk, increase compliance and optimize spending. For many of our clients, excessive pharmacy costs are a common driver of shrinking profit margins. Complex contract language, atypical dispensing practices and a lack of recourse for pricing errors contribute to inaccurate pharmacy budgets, improper reimbursement and waste. Our analytics provide real-time reporting, simplify drug-spend data and are designed to create contract transparency for our clients. By simplifying and adding oversight to the adjudication process, we help clients avoid risks associated with managing pharmacy costs by preventing overpayments and ensuring appropriate reimbursements.

Our Clients

Our clients are at-risk healthcare organizations, primarily PACE organizations, managed-care organizations, including government and commercial plans, post-acute care facilities, behavioral health organizations and other provider groups. We have strong and long-standing relationships with our clients, providing services under multi-year contracts. At the end of 2014, 2015, and 2016, we were serving 51, 119, and 133 healthcare organizations, respectively. Our annual revenue retention rate was 98%, 99%, and 95% for 2016, 2015, and 2014, respectively, and our client retention rate was 93%, 96% and 97%, respectively, which we believe reflects strong client satisfaction with our solutions. No single client accounted for more than 10% of our revenue during the year ended December 31, 2016. For the year ended December 31, 2015, our largest client accounted for 10% of our revenue, and for the year ended December 31, 2014, our two largest clients accounted for 11% and 10% of our revenue, respectively. We believe our clients view us as a trusted partner that shares their commitment to improving medication-related health outcomes and reducing overall healthcare costs.

Providers Serving Dual-eligible Patients

The majority of our clients serve dual-eligible patients as of December 31, 2016. Dual-eligible patients, who are eligible for coverage under both Medicare and Medicaid, are typically among the most vulnerable and highest-acuity beneficiaries covered by the healthcare system, with some of the most complex medication requirements. They represent 19% of the Medicare population and 15% of the Medicaid population, but account for 25% of total Medicare costs and 37% of total Medicaid costs. Because of the high costs associated with care for these patients, the federal government and many states are implementing systems and service models to integrate care and align reimbursement under at-risk structures.

PACE Organizations

PACE, a federal and state collaboration, is one growing model serving the dual-eligible patient population that focuses on averting institutional-based placement. PACE embodies many of the characteristics and trends affecting the healthcare industry as a whole. Our proof of concept was to provide medication risk management technology and services to PACE organizations, which are responsible for elderly patients, typically with complex medication regimens. Over the past four years, we have become the market-leader in providing PACE with medication risk management. Our PACE clients cover approximately 20% of the total PACE enrollees nationwide. However, the existing PACE enrollees represent only 4% of the 900,000 total eligible individuals within current PACE service areas, according to a study we commissioned from AEC Consulting, LLC. In addition to personalized medication management, we also provide risk adjustment services and intend to provide pharmacy cost management services to PACE organizations.

16

Managed Care Organizations

Since 2004, the number of beneficiaries enrolled in Medicare Advantage, or MA, plans has more than tripled from 5.3 million to 17.6 million in 2016 and is expected to grow to 22 million by 2020. MA is a capitated program with payment rates that are calculated based on the acuity of the patients served. Accordingly, patients are assigned relative risk scores based on diagnosis, which need to be documented accurately each year for appropriate reimbursement. We have become the market leader in risk adjustment and front-end coding for PACE organizations and we plan to continue to expand these services to other MA programs. Furthermore, we believe our solutions are broadly applicable throughout the managed care landscape, including to the self-funded employer groups. According to CMS and the CBO, in 2016 there were approximately 56 million people in the United States covered under Medicare, approximately 77 million people covered under Medicaid and 214 million people covered under commercial managed care. These numbers are expected to reach 63 million, 76 million and 220 million, respectively, by 2020.

Acute and Post-Acute Care Providers

Acute and post-acute care providers are increasingly operating in value-based care models. Under the BPCI, providers such as hospitals, skilled nursing facilities, in-patient rehabilitation facilities and home health agencies began to receive bundled payments for episodes of care. According to a recent report, more than 4,000 facilities and agencies have already signed up to participate in the BPCI program.

We are the market leader in pharmacy cost management solutions in the post-acute arena, helping facilities manage their pharmacy spend for their capitated patients. Our clients include approximately 1,000 of the more than 15,400 post-acute facilities in the United States. We believe there are significant opportunities to cross-sell our medication risk management solutions within this client base.

Physician Provider Groups

We contract with physician provider groups across the country for care transitions support and comprehensive medication management services. We risk-stratify patient cohorts for these groups and identify patients at risk of an ADE. We then collaborate with these groups on appropriate levels of intervention to mitigate that risk.

Behavioral Health Organizations

According to the National Institute of Mental Health, in 2014 there were 13.6 million people in the United States with a chronic severe mental illness like schizophrenia, major depression or bipolar disorder. According to the Substance Abuse and Mental Health Services Administration, total spending on mental health treatment is projected to increase from $147 billion in 2009 to $239 billion in 2020. For these individuals, in 2014, prescription medications were the most significant mental health spend, accounting for 30% of total expenditures by provider, more than total hospital costs, physician expenses and insurance administration, according to a 2014 study by HHS. Behavioral health organizations are increasingly operating under value-based care models, and according to the National Council for Behavioral Health, there are over 2,200 behavioral health organizations in the United States. We are currently pursuing intervention studies or pilot programs to evaluate the benefits of clinical interventions in the behavioral health setting.

17

Intellectual Property

We create, own and maintain a wide array of intellectual property assets which, in the aggregate, are of material importance to our business. Our intellectual property assets include: one patent and three pending patent applications related to our innovations, products and services; trademarks and trademark applications related to our brands, products and services; copyrights in software, documentation, content and databases; trade secrets relating to data processing, statistical methodologies, data security and other aspects of our business; and other intellectual property rights and licenses of various kinds. We are licensed to use certain technology and other intellectual property rights owned and controlled by others, and, similarly, other companies are licensed on a non-exclusive basis to use certain technology and other intellectual property rights owned and controlled by us.

We rely on patent, copyright, trademark and trade secret laws as well as confidentiality agreements, licenses and other agreements with employees, consultants, vendors and clients. We also seek to control access to and distribution of our proprietary software, confidential information and know-how, technology and other intellectual property. We have one issued patent for our medication management system and method (U.S. Pat. No. 8,392,220, issued March 2013) and three patent applications pending in the United States, the first, filed in December 2014, relates to our Medication Risk Mitigation System and Method and the second and third, filed in January 2016 and May 2016, respectively, relate to our MRM Matrix. Our issued patent expires on November 8, 2031. We own one registered copyright protecting the code and documentation related to EireneRx, initially filed in 2012 and updated in 2015.

We own and use trademarks in connection with products and services, including both unregistered common law marks and issued trademark registrations in the United States. Our material trademarks, service marks and other marks include: EireneRx®, Medication Risk Mitigation by CareKinesis®, MedWise Advisor®, NiaRx®, CareVentions™, Tabula Rasa HealthCare™, Medliance™, Capstone Performance Systems™, Medication Risk Mitigation™ and Medication Risk Mitigation Matrix™. We also have trademark applications pending to register marks in the United States.

Our Competitive Landscape

We compete with a broad and diverse set of businesses. We believe the competitive landscape is highly fragmented with no single competitor offering similarly expansive capabilities and solution offerings in medication risk management. Our competitive advantage is largely based on our analytical capabilities, healthcare industry expertise, breadth and depth of services, intellectual property, the size and quality of our underlying datasets and benchmarks, ease of use, reputation, innovation, security, price, reliability and client service. Our primary competitive challenge is to demonstrate to our existing and potential clients the value of utilizing our platforms rather than developing or assembling their own alternative capabilities or utilizing providers offering a subset of our services. However, we believe that the combination of our competitive strengths and successful culture of innovation, including our industry-leading analytics, the real-world-tested nature of our platforms and subject matter expertise of our associates, make it time and cost prohibitive for our clients or competitors to replace or replicate all that we offer without facing material risk.

Current industry players providing medication risk management and related service offerings include large and small healthcare data analytics and consulting companies, community or long-term care pharmacies, national pharmacy providers, health plans, genomic testing labs and healthcare information technology companies, among others. Many of our competitors' solutions are regulatory-driven, retrospective in nature and offer no intervention at the point of care. The services offered by these organizations may include e-prescribing and EHRs utilizing single drug-to-drug interaction analysis, lab-based genomic evaluation, basic risk stratification solutions and other prevailing approaches to medication therapy management. Many health plans attempt to address non-adherence through outreach efforts, which often require the intervention of in-house or third-party consultants and have low success rates. Some healthcare information technology providers offer risk adjustment and pharmacy cost management services, but lack the comprehensive solutions we provide. Many genomic testing labs lack the ability to apply patient test results in a useful way at the point of care. Post-acute providers typically employ pharmacist consultants to review prescription regimens every 30 days, which is retrospective in nature and generally ineffective in improving patient outcomes. Furthermore, typical prescription fulfillment models are reimbursed on a fee-for-service basis and are incentivized based on prescription dispensing volumes. Our clients partner with us in order to prospectively address ADEs, lower healthcare costs and improve overall health outcomes, which often involves utilizing our software to reduce the number of prescriptions per patient to optimize prescription regimens.

18

While we believe that no competitor provides the breadth of our suite of solutions, we nevertheless compete with other companies with regards to specific products or solutions and markets or care settings. We expect that competition will continue to increase as a result of consolidation in both the information technology and healthcare industries. The anticipated growth in healthcare spending, the shift to a value-based payment model, the rise of consumerism and changes in government regulation may draw increasing attention to healthcare data and analytics, and new competitors, such as management consultants, technology companies and start-ups may enter the market, and we may face increased competition from these sources.

Healthcare Regulatory Environment

We operate in a highly regulated industry and our business operations must comply with a number of complex and evolving federal and state agency requirements. While we believe we comply in all material respects with applicable healthcare laws and regulations, these laws can vary significantly from jurisdiction to jurisdiction, and the state and federal interpretation of existing laws and regulations, and their enforcement, may change from time to time. Additionally, a state or federal government enforcement body may disagree that we are in material compliance with applicable healthcare laws and regulations. Federal and state legislatures also may enact various legislative proposals that could materially impact certain aspects of our business.

A non-exhaustive list of federal and state statutes, regulations, sub-regulatory guidance and contractual provisions that may apply to our business activities include:

Healthcare Legislation

In 2010, Congress passed major health reform legislation, mostly through the ACA. Generally, the ACA was designed to expand coverage for the uninsured while at the same time containing overall healthcare costs. While not all of these reforms affect our business directly, many affect the coverage and plan designs that are or will be provided by many of our clients. Consequently, these reforms could impact some or many of our business arrangements directly or indirectly.

Given that certain regulations implementing ACA are still being formulated and finalized, and given that sub-regulatory guidance is still being promulgated by federal agencies, such as HHS and the Internal Revenue Service, and state agencies, we cannot predict with any certainty the outcome of any future legislation, regulation or litigation related to healthcare reform.

President Trump and the United States Congress are considering a number of legislative and regulatory proposals which could impact the healthcare system, the ACA, and/or the Medicare and Medicaid programs. While not all of the contemplated changes, if enacted, would affect our business directly, many could impact some or many of our business arrangements directly or indirectly. Given that legislative and regulatory change is still being formulated, we cannot predict with any certainty the outcome of any future legislation or regulation.

PACE Organizations

Our partnership with PACE organizations is a significant source of our current revenue stream. The PACE program is a unique, comprehensive managed care benefit for certain frail elderly individuals, most of whom are dually eligible for Medicare and Medicaid benefits, provided by a not-for-profit or public entity. The PACE program features a comprehensive medical and social service delivery system using an interdisciplinary team approach in an adult day health center that is supplemented by in-home and referral services in accordance with participants' needs. Financing for the program is capped, which allows providers to deliver all services participants need rather than only those reimbursable under Medicare and Medicaid fee-for-service plans. PACE is a program under Medicare, and states can elect to provide PACE services to Medicaid program beneficiaries as an optional Medicaid benefit. The PACE program becomes the sole source of Medicaid and Medicare benefits for PACE participants.

As PACE organization contractors, we are subject to numerous contractual obligations imposed by our partner organizations, as well as to various audit and certification requirements.

19

HIPAA Healthcare Fraud Provisions

HIPAA also created additional federal criminal statutes regarding fraud. Specifically, the HIPAA healthcare fraud statute prohibits, among other things, knowingly and willfully executing or attempting to execute a scheme to defraud any healthcare benefit program, or to obtain by false or fraudulent pretenses any of the money or property owned by a healthcare benefit program, knowingly and willfully embezzling or stealing from a healthcare benefit program, and willfully obstructing a criminal investigation of a healthcare offense. The HIPAA healthcare fraud statutes also prohibit, among other things, concealing a material fact or making a materially false statement in connection with the delivery of or payment for healthcare benefits, items or services. Like the federal Anti-Kickback Statute, the ACA amended the intent standard for certain healthcare fraud statutes under HIPAA such that a person or entity no longer needs to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. Those found to have aided in a violation of these prohibitions are deemed by statute to have committed the offense and are punishable as a principal offender.

State and Federal Data Privacy and Security Laws

We process, collect, use and disclose individual patient data for patients directly or for our clients and therefore, are subject to various laws protecting privacy and security of the patient information. Certain segments of our company qualify as a "Covered Entity" under HIPAA, and others qualify as a "Business Associate" to our partners who are Covered Entities and as such we are required to comply with HIPAA and HITECH, as implemented through regulations promulgated thereunder by HHS, including the HIPAA Omnibus Final Rule, the HIPAA Privacy Rule and the HIPAA Security Rule. HIPAA generally requires Covered Entities and their Business Associates to adopt certain safeguards to ensure the privacy and security of protected health information, or PHI, and to limit uses and disclosures of such PHI to those permissible under the law. When Covered Entities utilize Business Associates to provide services, pursuant to which the Business Associate may access the Covered Entity's PHI, the parties must enter into a Business Associate agreement through which the Business Associate must contractually agree to safeguard PHI in certain ways and to notify the Covered Entity of improper uses or disclosures of PHI.

Covered Entities and Business Associates are required to have written policies and procedures addressing HIPAA compliance and must designate a Security Officer to oversee the development and implementation of the policies and procedures related to the safeguards to protect privacy of electronic PHI. Covered Entities must also designate a Privacy Officer, although the Privacy Officer and the Security Officer may be the same person. As part of their security policies and procedures, Covered Entities and Business Associates are required to conduct periodic risk assessments to identify vulnerabilities to electronic PHI. Additionally, Covered Entities and Business Associates are required to train all employees on their HIPAA policies and procedures. Further, in the event of a breach of PHI as defined by HIPAA, Covered Entities must notify affected individuals, HHS and sometimes the media, as well as take steps to mitigate damage, and they may be subject to fines and penalties. HIPAA violations can result in significant civil monetary penalties and/or imprisonment for up to ten years depending on the facts surrounding the violation.

Many states also have similar data privacy and security laws that track federal requirements or impose different and/or more stringent conditions for use and disclosure of protected health information. Failure to comply with these laws may also result in the imposition of significant civil and/or criminal penalties.

Federal and State Oversight of Medical Devices, Genomic Testing, Drugs, and Controlled Substances

Some technologies and software applications used in connection with healthcare analytics and genomic testing and analysis are considered medical devices and are subject to regulation by the FDA. The 21st Century Cures Act (Pub. L. 114-255), enacted in December 2016, included certain changes to the Federal Food, Drug, and Cosmetic Act to exempt certain medical-related software from FDA regulation. Although we believe that our technologies and software are not subject to active FDA regulation, there is a risk that the FDA could disagree. If the FDA determines that any of our current or future services, technologies or software applications are regulated by the FDA as medical devices, we would become subject to various statutes, regulations and policies enforced by the FDA and other governmental authorities including both premarket and post-market requirements, and we would need to bring the affected services, technologies, and/or software into compliance with such requirements.

20

Clinical laboratories that perform human genomic testing are subject to oversight by CMS and state regulators. The laboratories that we partner with for genomic testing must comply with the relevant CMS and state laws and regulations applicable to clinical laboratories and genomic testing.

The Drug Enforcement Administration, or DEA, FDA, and state regulators, such as state boards of pharmacy, regulate drug and controlled substance packaging, repackaging, purchasing, handling, storage, distribution, security, and dispensing activities. Our prescription fulfillment pharmacies must comply with the applicable FDA, DEA, and state statutes, regulations, and policies. In addition, our prescription fulfillment pharmacies may be subject to periodic audits by state regulators, DEA, and/or FDA to assess our compliance with these requirements.

Noncompliance with applicable federal or state requirements, as described above, can result in an enforcement action that could substantially harm our business.

Anti-Kickback Laws