Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AutoWeb, Inc. | ex99-1.htm |

| 8-K - FORM 8-K - AutoWeb, Inc. | abtl8k_mar92017.htm |

Exhibit 99.2

AUTOBYTEL INC.

Moderator: Sean Mansouri

March 9, 2017

5:00 p.m. ET

Operator:

This is conference

# 77540425.

Good

afternoon, everyone. Thank you for participating in today's

conference call to discuss Autobytel's financial results for the

fourth quarter and full-year, ended December 31, 2016.

Joining

us today are Autobytel's President and CEO, Jeff Coats; the

Company's CFO, Kimberly Boren; and the Company's Outside Investor

Relations Advisor, Sean Mansouri, with Liolios group. Following

their remarks, we will open the call for your

questions.

I will

now turn the call over to Mr. Mansouri for some introductory

comments.

Sean

Mansouri:

Thank you,

Karen.

Before

I introduce Jeff, I remind you that during today's call, including

the question and answer session, any projections and

forward-looking statements made regarding future events or

Autobytel's future financial performance are covered by the safe

harbor statements contained in today's press release, the slides

accompanying this presentation and the Company's public filings

with the SEC. Actual events may differ materially from those

forward-looking statements.

Specifically,

please refer to the company's form 10-K for the year ended December

31, 2016, which was filed prior to this call as well as other

filings made with Autobytel with the SEC from time to time. These

filings identify factors that could cause results to differ

materially from those forward-looking statements.

There

are slides included with today's presentation to help illustrate

some of the points being made and discussed during the call. The

slides can be accessed by visiting Autobytel's website at

www.autobytel.com. When there, go to "Investor Relations" and then

click on "Events and Presentations".

Please

also note that during this call and/or in the accompanying slides,

management will be disclosing non-GAAP income and non-GAAP EPS. And

for purposes of 2017 guidance, we'll be adjusting 2016 revenues,

non-GAAP income and non-GAAP EPS to reflect the exclusion of the

Company's specialty finance leads product that was divested on

December 31, 2016.

These

are non-GAAP financial measures as defined by SEC Regulation G.

Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP measures are included in today's press

release and/or in the slides, which are posted on the company's

website. And with that, I'll turn the call over to

Jeff.

Jeff

Coats:

Thank you, Sean.

Good afternoon, everyone. Thank you for joining us today to discuss

our record fourth-quarter and full-year 2016 results. As a reminder

to those of you who are new to Autobytel, we are a pioneer and

leading provider of online digital automotive services, connecting

in-market buyers with our dealer and manufacturer

customers.

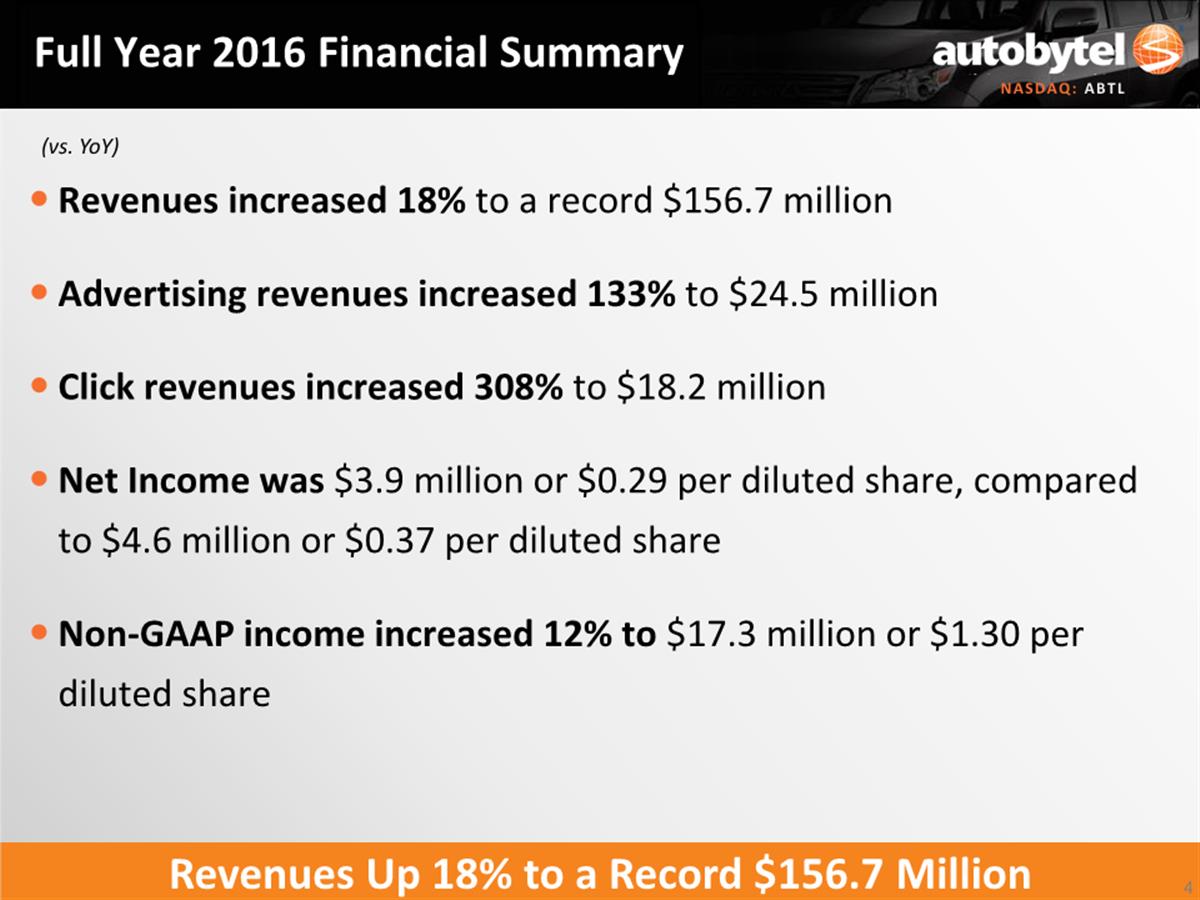

We are

pleased to announce, we generated record revenues in both Q4 2016

and in full-year 2016, while maintaining our commitment to

high-quality products for our dealer and OEM customers as you can

see on slide 3 and 4.

2016

represented a year of integration, execution and investment. We

completed the integration of the Dealix and AutoWeb acquisitions

from 2015, each of which brought us extremely important strategic

assets. Additionally we rolled out the new beta version of our

usedcars.com site and we invested in increasing our internal lead

generation capabilities and in developing and optimizing new

traffic sources to further accelerate the growth of both our

high-quality clicks and leads products.

The

AutoWeb acquisition brought us both our exciting

advertising-related click products, which has dramatically

strengthened our technology leadership in the automotive digital

landscape and additional talented cost-effective technology

resources in our Guatemala operations. Our click product continues

to exceed our expectations, with revenues growing more than 300

percent in 2016 and is already accelerating our overall company

growth.

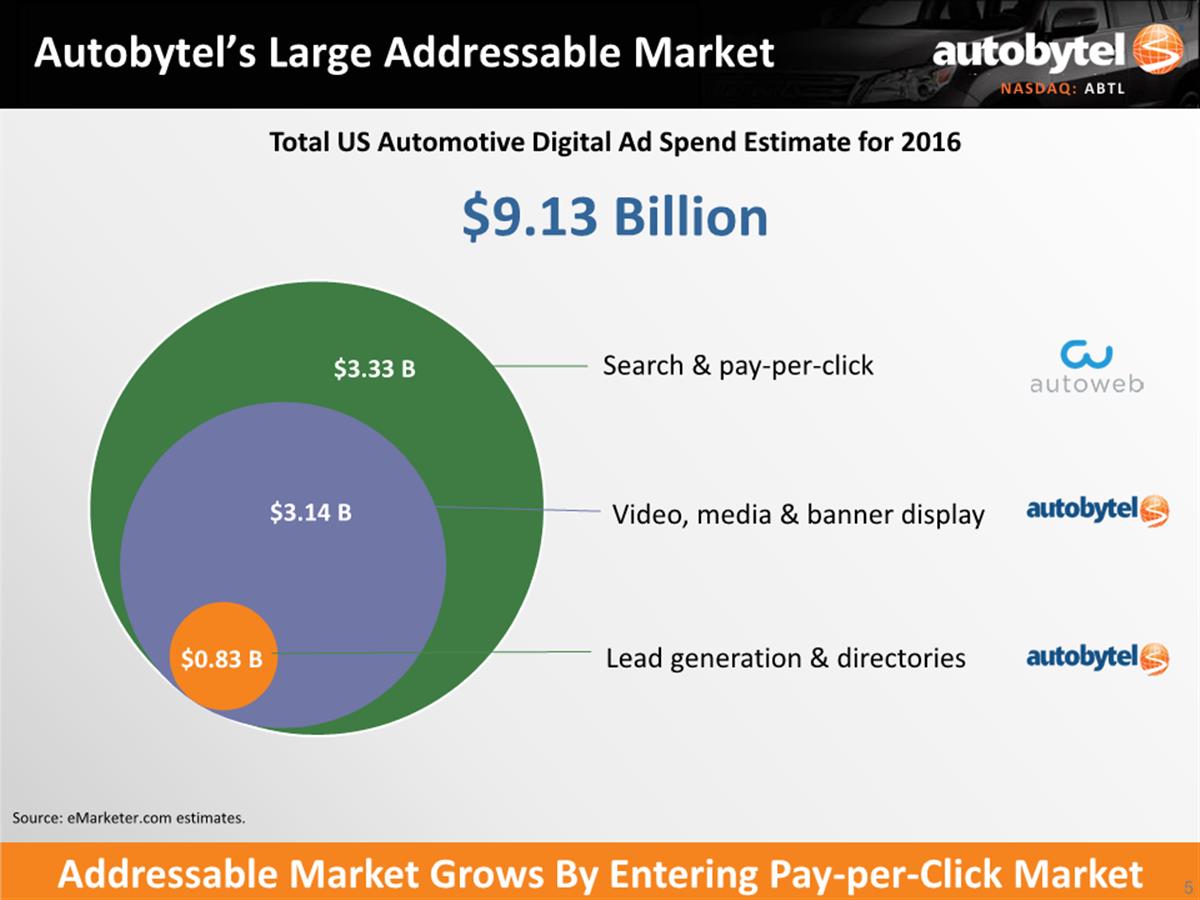

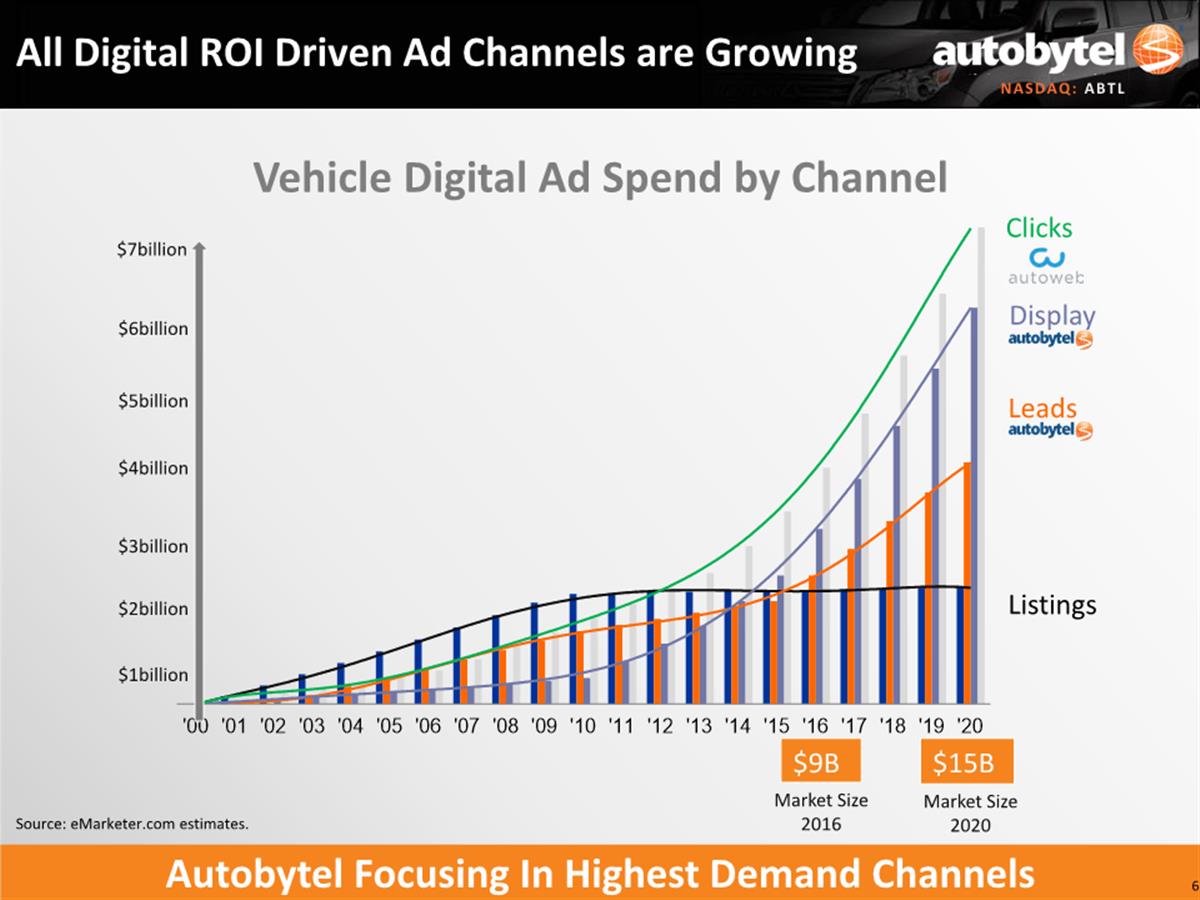

This

high-growth product has also propelled Autobytel from just the lead

generation market into the much larger search and pay-per-click

automotive market, as you can see on slides 5 and 6. Although we

have been methodical in our rollout of this product, having thus

far only introduced it to a small number of our customers, during

2017 we are making it available to many more of our thousands of

dealer and OEM customers. We also experienced approximately 98

percent customer retention with the product in 2016, further

validating its exceptional quality of high-intent consumer

traffic.

The

usedcars.com site, which came to us with Dealix, is the core around

which we are building our used car leads and used car clicks

business. This represents a particularly attractive growth

opportunity for us because used car represents less than 10 percent

of our revenues today. Even though the volume of annual used car

sales in the United States is generally to 2 to 3 times that of new

cars.

In Q3

of 2016, we began increasing our investment in traffic acquisition

to bolster our leads business with high-quality in-market consumers

and to increase the volume of consumers to our click products. We

continued that investment in Q4 2016 and as a result, increased our

click volume by over 160 percent and at the same time increased our

effective CPMs by over 80 percent.

At the

end of the fourth quarter we divested our specialty finance leads

product, which now enables us to further dedicate time and

resources to our core vehicle leads and fast-growing clicks

products for both new and used. Before commenting further, I would

like to turn the call over to Kim and have her take us through the

important details of our financial results. Kim?

Kimberly

Boren:

Thanks, Jeff and

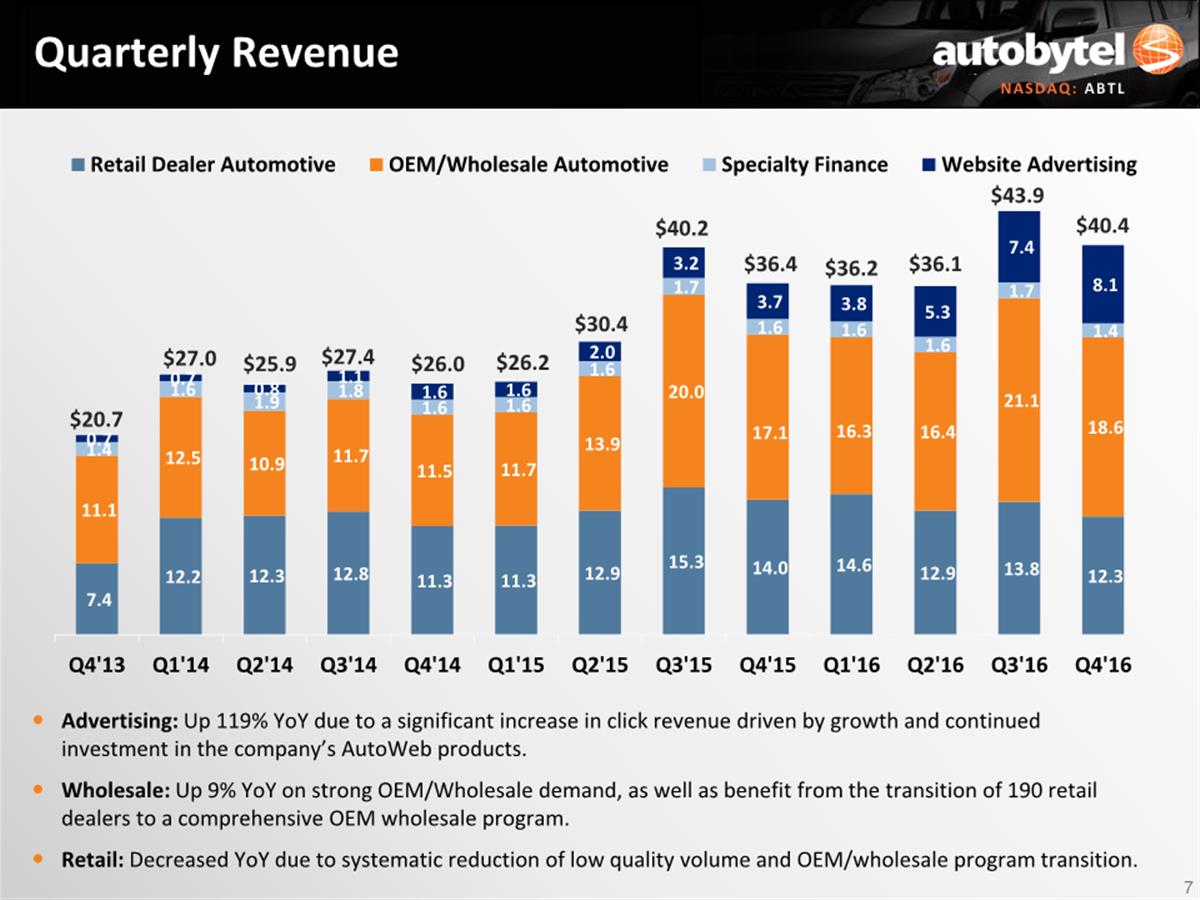

good afternoon everyone. For those of you following along with our

earnings presentation, on slide 7, you can see our fourth-quarter

revenues increased 11 percent to $40.4 million, compared to $36.4

million in the year ago quarter. The increase was primarily driven

by growth in advertising click revenues and wholesale lead

revenues.

Lead

revenues from automotive manufacturers and wholesale customers, our

wholesale channel, increased 9 percent to $18.6 million from $17.1

million in the prior year period. While lead revenue from

automotive dealers, our retail channel, decreased 12 percent to

$12.3 million, compared to $14 million last year.

Both

the wholesale and retail channels were impacted by the systematic

reduction of lower quality lead supply, which effectively began in

Q4 of 2015 and continued through Q2 of 2016. Further, the expected

impact to retail revenues was driven by the transition of 190

retail dealers into one comprehensive OEM program in the second

quarter of 2016. This has proven to be a success, as overall

revenues for this OEM have expanded 21 percent since initiating the

transition.

Moving

on to advertising, our advertising revenues increased 119 percent

to $8.1 million, compared to $3.7 million in the year ago quarter.

The growth was due to a significant increase in click revenue

driven by the continued investment in our AutoWeb

products.

Additionally on

slide 8, you will see click revenues in the fourth quarter

increasing 219 percent to $6.4 million compared to $2 million in

the same period last year. The triple digit year-over-year increase

in click revenue was driven by continued strong growth in AutoWeb

as we continue to grow impressions and effective CPMs. The momentum

in our click product is further evidenced by the 16 percent

sequential increase from Q3, even with seasonal headwinds in

Q4.

Moving

now to slide 9, you'll see that we delivered approximately $2.3

million automotive leads during the fourth quarter, compared to

$2.4 million last year, as we worked to replace a meaningful amount

of the eliminated low-quality volume with higher quality leads from

our internal lead generation. Consistent with lead revenue, retail

new leads were down 12 percent compared to the prior-year quarter,

while used leads were down slightly by 2 percent.

76

percent of leads were delivered to the wholesale channel, with the

remaining 24 percent to the retail channel. Retail new leads

invoiced per dealer was up 3 percent compared to the year ago

quarter and retail used leads invoiced per dealer was up 8 percent.

This is consistent with our strategy of focusing on larger

dealerships.

On

slide 10 you will see that dealer count stood at 4,115 at December

31, a 4 percent decline from Q3. The decrease was driven by dealer

churn as we continue to focus on building stronger relationships

with larger, more profitable dealers. I remind listeners that this

figure would be closer to 22,000 dealer franchises in total, if

dealers in our OEM network were included.

At the

end of the fourth quarter we sold our specialty finance leads

product to internet brands. Total consideration included $3.2

million of cash, as well as additional transition licensing income,

totaling $1.6 million over a five-year period.

In

accordance with recent accounting literature released in 2014, the

divestiture of the finance leads product does not meet this

discontinued operation tests and therefore is included in our 2016

results. For future comparative purposes, we calculated the 2016

revenue impact to be approximately $6.3 million, the non-GAAP

income to be just under $0.5 million and the non-GAAP EPS to be

$0.03 on a full-year basis. As Jeff mentioned earlier, with the

divestiture of the finance leads product we can now dedicate

greater time, energy, and resources to our core vehicle lead and

fast growing click products.

Now

moving to slide 11, gross profit during the fourth quarter

increased 1 percent to $14.6 million and gross margin was 36.2

percent, compared to 39.7 percent in the year ago quarter, in line

with our expectations. In Q3 we made the decision to further invest

in our traffic acquisition in order to accelerate the growth of our

lead and click products.

The

decline in gross margin was due to the corresponding increase in

our traffic acquisition and technology related costs as we focus

more on accelerated growth and incremental gross profit dollars as

opposed to gross margin percentage. We expect gross margin to

continue in the mid 30 percent range over the next several quarters

as we invest in our core products to grow revenues and ultimately,

gross profit dollars.

Total

operating expenses in the fourth quarter were $12.8 million,

roughly flat compared to the year ago quarter. As a percentage of

revenues total operating expenses were 31.7 percent compared to

35.5 percent in the fourth-quarter of 2015, with the improvement

largely attributable to operating leverage experienced with top

line growth. While we have realized considerable leverage over the

course of the year, we plan to reinvest more going forward and

further accelerate the growth opportunities we see in our

business.

On a

GAAP basis, net income in the fourth quarter was $1.4 million or

$0.10 per diluted share on 13.3 million diluted shares, compared to

$1.4 million or $0.10 per diluted share on 13.4 million diluted

shares in the year ago quarter. We expect our quarterly diluted

share count in 2017 to remain around 13.5 million, contingent upon

our share price and assuming current outstanding shares, warrants,

options, and convertible debt remain constant.

For the

fourth quarter, non-GAAP income, which adds back amortization on

acquired intangibles, non-cash stock-based compensation,

acquisition costs, severance costs, gain or loss on investment or

sale, litigation settlement, and income taxes increased 7 percent

to $4.7 million or $0.35 per diluted share compared to $4.4 million

or $0.33 in the year ago quarter. Cash provided by operations for

the 2016 fourth quarter improved to $6.2 million, compared to $4.6

million in the prior-year quarter.

On

slide 12 you'll see that our cash balance remains strong, with cash

and cash equivalents of $38.5 million at December 31, 2016, which

represents a 61 percent increase from December 31, 2015. Total debt

at December 31, 2016, was reduced to $23.1 million compared to $27

million at the end of 2015. With that, I'll now turn the call back

over to Jeff.

Jeff

Coats:

Thank you, Kim. As

I mentioned earlier, 2016 represented a year of integration,

execution, and investment. We completed the integrations of AutoWeb

and Dealix, each of which had meaningful impacts to our business in

its own right. With AutoWeb we acquired the technology and

development operation that powers our growing clicks business. With

Dealix we added an extensive network of dealers and bolstered our

used car practice with the acquired usedcars.com consumer facing

website.

At the

end of the third quarter we launched a new version of usedcars.com

with fully responsive technology and mobile friendly application.

We remain very excited about the strength of the usedcars.com

domain and will continue to invest in it in an effort to make it

the premier used vehicle destination for consumers. As a reminder,

retail used car leads still only represent about 7 percent of our

total leads business today and approximately 9 percent of revenue,

even though used car sales in the United States are 2 to 3 times

that of new car sales by volume. This provides us with a strong

growth path in the months and years ahead.

During

the fourth quarter, our click volumes from AutoWeb continued to

exceed our expectations. As Kim mentioned, volumes were up even

sequentially, despite seasonal slowdown we typically experience in

Q4. Customer feedback has been very positive.

We are

continuing to increase click volumes with existing clients and plan

to add OEMs, large dealer groups, dealer agencies, and tier 2

dealer associations throughout 2017. As I mentioned earlier, our

strong growth in clicks up to this point has only come from a small

number of dealer and OEM customers, and it is also important to

note the minimal churn we continue to experience with the

product.

As

previously announced in Q3, we began heavily investing in traffic

acquisition to accelerate the continued growth of both our

high-quality clicks product and our high quality lead supply. As we

have mentioned in previous quarters, OEMs tend to be very selective

in the digital marketing spend and they continue to demonstrate

increasing demand for our high-quality leads and

clicks.

Before

getting into more detail about 2017, I would like to quickly walk

through some of our strong industry metrics from the quarter. On

slide 13 you can see that we estimate sales from consumers

submitting leads through Autobytel's network accounted for

approximately 5 percent of all new light vehicle retail sales in

the United States in 2016, and approximately 2 percent of all used

car sales. On slide 14 you'll see that our estimated average buy

rate for internally generated leads in the fourth quarter was 17

percent, which remains in our targeted range of 16 percent to 24

percent.

Because

of our ongoing commitment to lead quality, we are continuing to

focus on enhanced methodologies to meaningfully increase the mix of

internally generated leads from the current 80 percent level, while

only utilizing volume from the small number of trusted suppliers

who share our commitment to quality. On slide 15 you'll note that

these estimated buy rates have remained consistently strong since

Q1 2011, with Autobytel.com generating an average buy rate of 25

percent and all Autobytel internally generated leads at about 18

percent.

Now

moving onto 2017. 2017 will be a year of growth and continued

investment for Autobytel. Specifically we will focus on investments

in technology including investments in our consumer acquisition

technology, the AutoWeb ad platform and our consumer facing

websites, which includes car.com, AutoWeb.com, autobytel.com and

usedcars.com. We expect these investments to ultimately enhance and

simplify the consumer’s path to purchase of new or used cars

and trucks.

As

mentioned before, we've migrated our previously outsourced

development resources to our in-house Guatemala operations. And

during the fourth quarter we further repositioned our resources by

removing redundant positions at the corporate level and

strengthened our US and Guatemala development teams. We plan to

continue investing in these development teams throughout 2017 as we

believe this will further accelerate the growth of both our click

and core leads products, and especially our used cars.com

website.

As we

continue to optimize our products and service offerings, we will

also continue to bolster our sales and marketing efforts. Our used

car business remains a focal point for growth and we continue to

increase the level of resources dedicated to ramping our used car

platforms for internal lead generation.

Moving

onto the industry outlook, as you can see on slide 16, automotive

news has the seasonally adjusted run rate, or SAAR, for total sales

at 17.7 million units for February 2017, up from 17.6 million units

one year ago and 17.5 million units in January. And on slide 17

you'll see that in February, J.D. Power, LMC Automotive maintained

their full year 2017 total light vehicle sales forecast at 17.6

million, an increase of 0.2 percent from 2016. The forecast for

retail light vehicle sales also remains at 14.1 million units,

essentially flat from 2016.

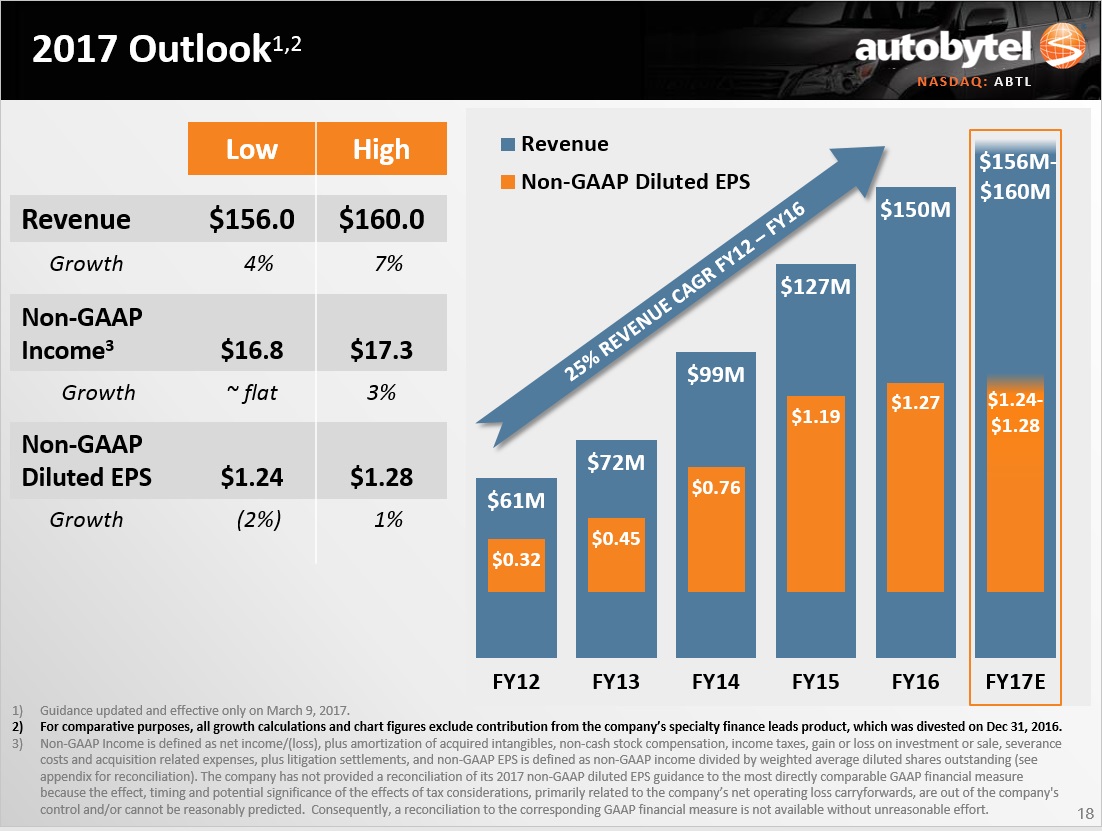

Now

moving onto our 2017 business outlook highlighted on slide 18. We

currently expect revenue to range between $156 million and $160

million, an increase of approximately 4 percent to 7 percent in

2016. We also expect non-GAAP income to range from $16.8 million

and $17.3 million, representing an increase of up to approximately

3 percent, with non-GAAP diluted EPS ranging between $1.24 and

$1.28 on 13.5 million shares.

Note

that for comparative purposes, the foregoing percentage growth

calculations and the 2016 non-GAAP diluted EPS exclude 2016

revenues, non-GAAP income and non-GAAP EPS related to our specialty

finance leads products that was divested on December 31, 2016. As

we stated last year, our outlook reflects our continued expectation

to grow both revenues and profit dollars in 2017.

As we

look ahead to the remainder of 2017, we will continue to reinvest

in our business to drive sustainable, long-term organic growth and

further solidify Autobytel's position as a leader in the digital

automotive landscape. We will also maintain our keen focus on

providing our dealer and OEM customers with high-quality,

high-intent car buyers. Be it through new or used car leads, clicks

or one of our many value-added product offerings, we remain

committed to helping our customers sell more cars and trucks.

Karen, at this time we would like to open the call for

questions.

Operator:

Thank you,

sir.

Ladies

and gentlemen, if you have a question at this time, please press

star followed by the number one key on your telephone keypad. If

your question has been answered, or you’d like to remove your

line from the queue, you may press the pound key. Our first

question comes from the line of Sameet Sinha, from B.

Riley.

Sameet

Sinha:

Yes, thank you very

much. Couple of questions here. Let's talk about the clicks

business. This was pretty strong, much more than we had expected.

What sort of growth should we be expecting as you open up the

program to more dealers and partners and OEMs? And this opening up,

should we expect more of a second half weighted results or do you

think the benefits will start to accrue from the Q1

itself?

Secondly, can you

talk about experience with this increased traffic investment --

gross margins came in a little higher than we had expected. But can

you talk about the different sources that you started using and

where you have been able to optimize and in case, the mid 30s

guidance that you had given from gross margin, is that more a

function that you will keep? Do you keep those margins and try to

grow revenues? Or that you would try to optimize for gross

margins?

Jeff

Coats:

Sameet, I would say

that -- let me answer your second question first. We have been

working through a lot of the new traffic sources. I would say we

are still in the middle of it. We will be doing it throughout this

year. We have identified a few that are working nicely for us thus

far where we are getting pretty interesting volume and margins that

are probably a little better than we initially

anticipated.

I

wouldn't necessarily take that as something that we are going to

see on everything that we do or on a continued basis. Is just too

early to make that call in terms of what we are doing. But it is

looking pretty good so far from that standpoint in terms of

qualifying these new traffic sources.

Kimberly

Boren:

And then Sameet, I

can answer your first question around growth. We are expecting

right now to continue to see somewhat of linear growth into 2017,

so I would have the growth roughly at a linear level. There will be

some seasonal impact in Q3 because that is clearly our strongest

quarter and the traffic drives it.

But

that is how I would go ahead and model it. We haven't necessarily

provided guidance in terms of the growth in the click revenues, but

I would anticipate seeing the same growth dollars next year that we

saw in 2015 to 2016.

Sameet

Sinha:

Okay. One follow-up

question. You spoke about investments in some of the consumer

sites, seems like there's going to be a major overhaul that you

intend to do on all your sites. And on that usedcars.com, Jeff, I

was under the impression that you're probably going to push that

investment out into 2018 considering there is so much traction that

you're getting on the clicks business. It seems like you are now

saying you have been investing in it right now. Is that a fair

assessment?

Jeff

Coats:

It is. We are

investing in it now. We launched the new beta version of the used

car site in September. I would say there is a fairly large amount

of additional capabilities and bells and whistles that we are in

the process of adding to it. One of the really extremely positive

benefits of promoting internally, Billy Ferriolo, from running our

Tampa operation to being Chief Operating Officer, is he has been

working with the development teams in both the United States and in

Guatemala to reorganize how we do some of our development work in

order to accelerate making product improvements to both our clicks

business, our lead engine and the way we are doing our lead

generation, as well as to the consumer facing

websites.

I would

say that the biggest beneficiary of the current investment in the

consumer facing sites will continue to be the usedcars.com site as

well as the car.com site. We have already largely overhauled the

car.com site previously and again, we are adding bells and whistles

to that. We will be making investments in the other sites along the

way, but I would say those two currently are receiving the primary

investment dollars.

Sameet

Sinha:

Okay. Thank you

very much.

Jeff

Coats:

And those

investments will be made within the context of the financial

outlook that we just provided.

Sameet

Sinha:

Understood. Thank

you.

Jeff

Coats:

Thank

you.

Operator:

Thank you, and our

next question comes from the line of Eric Martinuzzi, from Lake

Street Capital.

Eric

Martinuzzi:

Thanks. I wanted to

go a layer deeper on the guidance here. First of all, I just want

to make sure I have the apples to apples correct on the specialty

finance leads impact. If I take the midpoint of the 2017 guidance

for revenue, that is $158 million. So on apples to apples, I would

add $6.3 million to that assuming no growth in the specialty

finance lead, if you haven't sold it. We'd be talking about $164.3

million number for a pro forma 2017, is that the right way to think

about it?

Kimberly

Boren:

Correct.

Eric

Martinuzzi:

Okay and then the

same thing on the EPS? About 26 midpoint plus $0.03, it would be

about 29, had you not sold it for pro forma 2017.

Kimberly

Boren:

Correct, on heavier

share count.

Eric

Martinuzzi:

Okay. And then

going into the seasonality. I know you guys are trying not to be in

a quarterly earnings guidance business, but given what happened

last year where so much of the year was backend loaded I'm just

curious to know -- let's talk about revenue first.

If I

look back in 2016, obviously a lot of moving parts. You've got the

pay-per-click growth in one hand, you've got the Dealix cleansing

on the other hand, but it was kind of 45 percent, 46 percent of

revenue on the front half with 54 percent in the back half. For a

year, last year where you did $157 million and then we are talking

about midpoint $158 million this year -- does that topline front

half/back half hold true this year?

Kimberly

Boren:

There will still be

further growth on the back half of the year, Eric, it probably

won't be as skewed because of what we were able to do after we cut

out the low-quality lead supply in the first quarter in 2016. So it

will be a little heavier from the 45 percent, I don't have accounts

in front of me, but I am using your numbers, but not

materially.

Eric

Martinuzzi:

Okay. Well, maybe I

could go a little more granular. The consensus estimates for Q1 --

you probably don't happen to have in front of you, but I do. We've

got a revenue consensus of around $36 million and EPS of $21

million. Is there a comfort level or discomfort level? Can you

comment at all on that?

Kimberly

Boren:

I'm sorry, Eric. I

can't give quarterly guidance at this point in time.

Eric

Martinuzzi:

Okay. And then as

far as the layout and earnings throughout the year, you have talked

about -- we won't have as maybe as much seasonality on the revenue

side on the top line, but the EPS -- I did the same quick math on

your backend loaded 2016 and it was pretty breathtaking that you

did $0.46 in the front half and $0.84 in the back half to get to

your $1.30.

Given

the midpoint guide now, again, we are talking about $1.26, so down

$0.04, and I understand all the reasoning behind that. But that the

laying out of the EPS, given your commentary on the revenue, does

that same logic flow for their expense items that would skew

different from the revenue waiting that you've already commented

on?

Kimberly

Boren:

Yes. The non-GAAP

income and EPS should flow similarly to last year in the same

fashion that we have significantly higher employee related and

trade cost in the first half of the year. Those will continue. So

again, it won't be as skewed, similarly to the revenue, but it will

still be skewed in the same direction.

Eric

Martinuzzi:

Okay. That is

helpful. As I look to the pay-per-click investments here, obviously

we're getting terrific growth, but we're also spending a good bit

of money on pay-per-click. We're trying a lot of different things

here. You are working with a select group of partners, but it feels

like there is an element of -- I don't know, profitless prosperity,

but when do we get a return on this investment? Is it shifting this

from the point players to the more broader adoption, we start to

see some leverage, is that what turns it into the profit engine

that we hope it will be?

Jeff

Coats:

I think the way for

you to look at that is, as we have stated before and as we stated

today, we have really been slow walking the rollout of that

product. Particularly since we completed the acquisition and

brought it internally. And that was done in part because we really

needed to integrate it into our existing financial system and we've

been doing development work on top of that integration in order to

have better visibility and to grow margin and other things like

that within the clicks product.

We are

now ready to start rolling it out. We have already begun to start

rolling it out on a more accelerated basis. And so, it will be

somewhat straight-line during the year as Kim mentioned, but that

is also going to be a function of growth with the existing

customers, as well as signing on new customers throughout the

course of the year. (multiple speakers)

Eric

Martinuzzi:

I follow the

topline part of that. I was just more about the adjusted EBITDA or

the adjusted operating flow through contribution margin below the

revenue line.

Jeff

Coats:

Well, there is

always leverage in a situation. We pay our sales organization a

salary which is a fixed component and then their commissions based

on sales are variable. So we do have a certain amount of a fixed

component to our expenses related to that, that we need to cover.

Candidly, it is one of the reasons why in the third quarter every

year, you always see a generally much more robust bottom line,

because that is where you can really see the leverage in our

business as revenue increases based on the seasonal uptick based on

our existing cost structure, but a lot more of those dollars fall

through to the bottom line. The metrics that we saw in the fourth

quarter after taking out some costs, some incremental cost in the

business -- we did shift some cost out of the business during the

fourth quarter and got our percentage of OpEx down to 31 percent

from 35 percent; a very nice move from a leverage

standpoint.

Eric

Martinuzzi:

And then last

question for me. You attended the NADA conference. I know when

people hear the name Autobytel, they immediately think leads. As

far as your conversations with key partners at NADA, is there any

feedback, any anecdotal feedback that you could share with us as

far as, either on the lead side or on the pay-per-click side? Where

there were any “a-ha” moments, some light bulb moments

for prospects or existing customers?

Jeff

Coats:

I don't really know

how to think about it from an “a-ha” moment. I can tell

you that NADA this year was overall, extremely positive. It was in

New Orleans this year, it was one of the largest attendances in

years. So despite the fact that there is some level of concern,

certainly in the stock market and to some extent in the automotive

market about automobile sales starting to touch a ceiling, there

was a great deal of excitement in the industry.

Now

some of that is also coming because we have a new, more

conservative anti-regulation regime in Washington. There is an

expectation that some of the cafe rules and other things may be

softened somewhat, which will help the manufacturers, which will

help the dealers. So I would say overall there was a real positive

sentiment. We saw a lot of traffic in our booth at NADA. We always

have a booth there. In fact for this past NADA, we actually sold

more new relationships than we have in several of the recent

ones.

So I

would say overall -- people do know Autobytel as a recognized

player in the industry. We are getting credit for our many years of

focus on improving the quality of the leads product that we sell

and helping bring up the overall lead quality in the industry. I

would say a lot of people are very excited about our new clicks

product. So we are definitely moving in the right direction from

that standpoint.

Eric

Martinuzzi:

Great. Thanks for

taking my questions.

Jeff

Coats:

Thank you,

Eric.

Operator:

Thank you. And as a

reminder, if you do have a question you may press star and one on

your telephone keypad. And our next question comes from Ed Woo,

from Ascendiant.

Ed

Woo:

Yes.

Congratulations on the quarter, guys.

I had

at question in terms of, now that you guys are transitioning more

or growing your pay-per-click business much more, how do you see

the competitive environment?

Do you

still see your biggest competitors the same as before? Or are you

having a new focus on different competition?

Jeff

Coats:

Ed, I think the way

to think about that is, it is not so much product to product that

we are competing with. It is marketing dollar, budget allocation.

So a dealer is only going to spend so many dollars on their digital

marketing. We vie for a piece of that budget, so do the other

players who have been our traditional competitors

historically.

We are

-- I would say in the clicks side of the business, to some extent

dealing with a larger number of relatively small players at the

dealer level, who don't necessarily have the scale nor scope that

we do to drive high volume of really high quality traffic. And of

course we get that because of our 14 years of long tail search

traffic from our lead generation operation in Tampa. The two are

absolutely interconnected. Our legacy of the being the largest,

oldest lead company has been a huge plus for us in developing the

new pay-per-click business, because it's that high quality traffic

that we are now also converting instead of just in the leads, also

in the clicks for our dealer and manufacturer

customers.

Ed

Woo:

There are some

discussions last year about a lot of these retailers or dealers

wanted to establish their own direct relationships with the

consumers and trying to develop their own digital strategy. Have

you seen any change in dealers focusing on allocating their digital

marketing budgets to internal sources versus using people like you

guys

Jeff

Coats:

I would say it is

similar to what -- it's not really different than what we have seen

for the last couple, three years. Dealers are interested in

developing relations as much as they can directly with consumers. I

would say however, they all recognize and value strongly the leads

they get, especially from us, but also from a few other

players.

Having

said that, our click product is absolutely allowing them to

establish that direct relationship with the consumer. So we kind of

have a very nice bag of products that we can lay out for a dealer

to help them the traditional lead way and a new updated, more

direct relationship with the consumer by dropping that consumer

onto a dealer's website on a vehicle description page or a specials

page or something like that. So I don't know that it's changed

dramatically over the last two or three years, but we now certainly

are participating more on the pay-per-click side and are becoming

one of the larger players as that piece of the market continues to

grow.

Ed

Woo:

Great. Well, thank

you and good luck.

Jeff

Coats:

Thanks

Ed.

Operator:

Thank you. And that

does conclude our question and answer session. I'd like to turn the

call back over to Mr. Coats for closing remarks.

Jeff

Coats:

Thank you, Karen.

Thanks everybody for joining us on the call today. I would like to

thank our team of hard-working and dedicated employees. We look

forward to speaking with our investors during our Q1 call in May.

In addition, I am doing several non-deal roadshow investor meetings

with two of our analysts in San Francisco, Denver, and Salt Lake

City later this month, and in New York in April. We look forward to

speaking with you. Thank you.

Operator:

Ladies and

gentlemen this does conclude today's teleconference. You may

disconnect your lines at this time. Thank you for your

participation.

END