Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - GAIN Capital Holdings, Inc. | ex99112-31x16earningsrelea.htm |

| 8-K - 8-K - GAIN Capital Holdings, Inc. | form8-kq42016earnings.htm |

Q4 & Full Year 2016 Results

1

March 2017

SAFE HARBOR STATEMENT

2

Forward Looking Statements

In addition to historical information, this earnings presentation contains "forward-looking" statements that reflect management's expectations for the future. A variety of

important factors could cause results to differ materially from such statements.. These factors are noted throughout GAIN Capital's annual report on Form 10-K/A for the

year ended December 31, 2015, as filed with the Securities and Exchange Commission on May 2, 2016, and include, but are not limited to, the actions of both current and

potential new competitors, fluctuations in market trading volumes, financial market volatility, evolving industry regulations, errors or malfunctions in GAIN Capital’s

systems or technology, rapid changes in technology, effects of inflation, customer trading patterns, the success of our products and service offerings, our ability to

continue to innovate and meet the demands of our customers for new or enhanced products, our ability to successfully integrate assets and companies we have acquired,

our ability to effectively compete, changes in tax policy or accounting rules, fluctuations in foreign exchange rates and commodity prices, adverse changes or volatility in

interest rates, as well as general economic, business, credit and financial market conditions, internationally or nationally, and our ability to continue paying a quarterly

dividend in light of future financial performance and financing needs. The forward-looking statements included herein represent GAIN Capital’s views as of the date of this

release. GAIN Capital undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law.

Non-GAAP Financial Measures

This presentation contains various non-GAAP financial measures, including adjusted EBITDA, adjusted net income, adjusted EPS and various “pro forma” non-GAAP

measures. These non-GAAP financial measures have certain limitations, including that they do not have a standardized meaning and, therefore, our definitions may be

different from similar non-GAAP financial measures used by other companies and/or analysts. Thus, it may be more difficult to compare our financial performance to that

of other companies. We believe our reporting of these non-GAAP financial measures assists investors in evaluating our historical and expected operating performance.

However, because these are not measures of financial performance calculated in accordance with GAAP, such measures should be considered in addition to, but not as a

substitute for, other measures of our financial performance reported in accordance with GAAP, such as net income.

FOURTH QUARTER AND FULL YEAR REVIEW

3

• Quarterly GAAP net income of $20.8 million increased 91% year-over-year, while full year 2016 GAAP net income of $35.3 million

increased 243% from $10.3 million in 2015

• Achieved approximately $100 million in adjusted EBITDA for the full year, driven by a strong fourth quarter performance, with

quarterly adjusted EBITDA of $36.9 million

• Reported GAAP diluted EPS of $0.42 for Q4 2016 and $0.67 for full year 2016

• Adjusted diluted EPS of $0.43 for Q4 2016 and $0.92 for full year 2016

• Completed realization of over $45 million of run-rate synergies from City Index acquisition

• Continued to focus on return of capital to shareholders, with $20 million in buybacks and dividends for full year 2016

• Approximately 45% of adjusted net income returned to shareholders

• Increased quarterly dividend to $0.06 in December, a 20% increase from 2015

• Maintain strong balance sheet, which positions us well for future strategic opportunities

2017/2018 STRATEGIC PLAN: ORGANIC GROWTH, COMPLEMENTED BY M&A

4

• Acquisitions have provided GAIN with scale, a wider product offering, increased

diversity of revenue streams and a broader geographic footprint

• As a result, GAIN is well-positioned to now invest in organic growth

• Our organic plan is focused on growth, diversification and margin enhancement:

• Grow share in markets where we already operate

• Introduce new products and services to diversify into new markets and new client bases

• Improve our operating leverage by driving process efficiency

• In parallel, regulatory change & market dislocation continue to produce corporate

development opportunities

• Our strong financial position and experience as an industry consolidator positions us

well to take advantage of opportunistic M&A

ORGANIC GROWTH INITIATIVES UNDERWAY

5

GAIN is working on several key initiatives that we expect will drive long-term organic growth:

1. Redesigned trading experience – upgraded mobile apps, enhanced tools &

trade ideas

2. Easier account opening and more funding options for clients

3. Introduction of a global, cross brand affiliate marketing program

4. Expansion into Digital Advisory – relaunch of existing advisory business &

developing new products for clients seeking personalized trading advice

STRENGTHENING ROLE AS INDUSTRY LEADING CONSOLIDATOR

6

• On February 6, GAIN announced the acquisition of U.S. client assets from FXCM

• Transferred 47,000 accounts with total assets of approximately $142 million as of February

25

• Expect $15-$20 million of incremental revenue in FY 2017 with minimal costs

• Acquisition marks a continuation of GAIN’s role as a leading consolidator

• Successfully integrated 10 acquisitions over the last 5 years

• FOREX.com is now #1 provider of Retail FX in the U.S., with over 70,000 accounts

Financial Review

7

KEY FINANCIAL RESULTS & OPERATING METRICS

8

Note: Dollars in millions, except per share data. Columns may not add due to rounding.

(1) Adjusted EBITDA is a non-GAAP financial measure that represents our earnings before interest, taxes, depreciation, amortization and other one-time items. A reconciliation of net income/(loss) to adjusted EBITDA is available in the appendix to this presentation.

(2) Adjusted net income/(loss) is a non-GAAP financial measure that represents net income/(loss) excluding the impact of one-time items. A reconciliation of GAAP net income/(loss) to adjusted net income/(loss) is available in the appendix to this presentation.

(3) Adjusted EPS is a non-GAAP financial measure that represents net income/(loss) per share excluding the impact of one-time items. A reconciliation of GAAP EPS to adjusted EPS is available in the appendix to this presentation.

(4) Represents the simple addition of GAIN Capital and City Index.

(5) Definitions for operating metrics are available in the appendix to this presentation.

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31, % Change

2016 2015 2016 2015 Q4 Full Year

As Reported

Net Revenue $115.8 $102.8 $411.8 $435.4 13% (5%)

Operating Expenses (78.9) (79.1) (312.2) (348.1) (0%) (10%)

Galvan Earnout Adjustment - (2.3) - (6.7) NA NA

Adjusted EBITDA(1) $36.9 $21.4 $99.6 $80.6 72% 24%

Net Income $20.8 $10.9 $35.3 $10.3 91% 242%

Adjusted Net Income(2) 20.8 7.2 45.0 32.3 188% 39%

GAAP Diluted EPS $0.42 $0.23 $0.67 $0.22 83% 205%

Adjusted Diluted EPS(3) 0.43 0.15 0.92 0.67 192% 38%

Pro Forma( 4 )

Net Revenue $115.8 $102.8 $411.8 $471.1 13% (13%)

Operating Expenses (78.9) (79.1) (312.2) (381.5) (0%) (18%)

Galvan Earnout Adjustment - (2.3) - (6.7) NA NA

Adjusted EBITDA(1) $36.9 $21.4 $99.6 $82.9 72% 20%

Operating Metrics ( 5 )

Retail OTC ADV (bns) $9.8 $12.5 $10.9 $15.4 (22%) (29%)

Institutional ADV (bns) $12.8 $9.2 $11.4 $10.3

ECN 9.4 6.4 8.4 7.2 47% 16%

Swap Dealer 3.3 2.8 3.0 3.1 18% (4%)

Avg. Daily Futures Contracts 29,117 32,779 32,954 34,683 (11%) (5%)

OPERATING SEGMENT RESULTS: RETAIL

9 Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding.

Retail Financial & Operating Results

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2016 2015 2016 2015

Trading Revenue $96.2 $81.7 $330.7 $347.5

Other Retail Revenue 1.3 1.1 5.6 4.0

Total Revenue $97.5 $82.8 $336.3 $351.5

Employee Comp & Ben 15.0 16.2 62.4 67.5

Marketing 9.9 6.5 27.7 26.1

Referral Fees 13.5 14.6 55.1 87.2

Other Operating Exp. 18.3 20.7 75.5 76.3

Segment Profit $40.8 $24.8 $115.7 $94.4

% Margin 42% 30% 34% 27%

Operating Metrics

ADV (bns) $9.8 $12.5 $10.9 $15.4

Active Accounts 129,036 146,977 129,036 146,977

Client Assets $599.4 $675.1 $599.4 $675.1

PnL/mm $151 $99 $117 $86

Segment Highlights:

• FY 2016 segment profit of $115.7

million with margin of 34%

• Expense synergy realization complete

– Over $45 million of run-rate savings

• Expect marketing expense to taper

from Q4 levels in first half of 2017

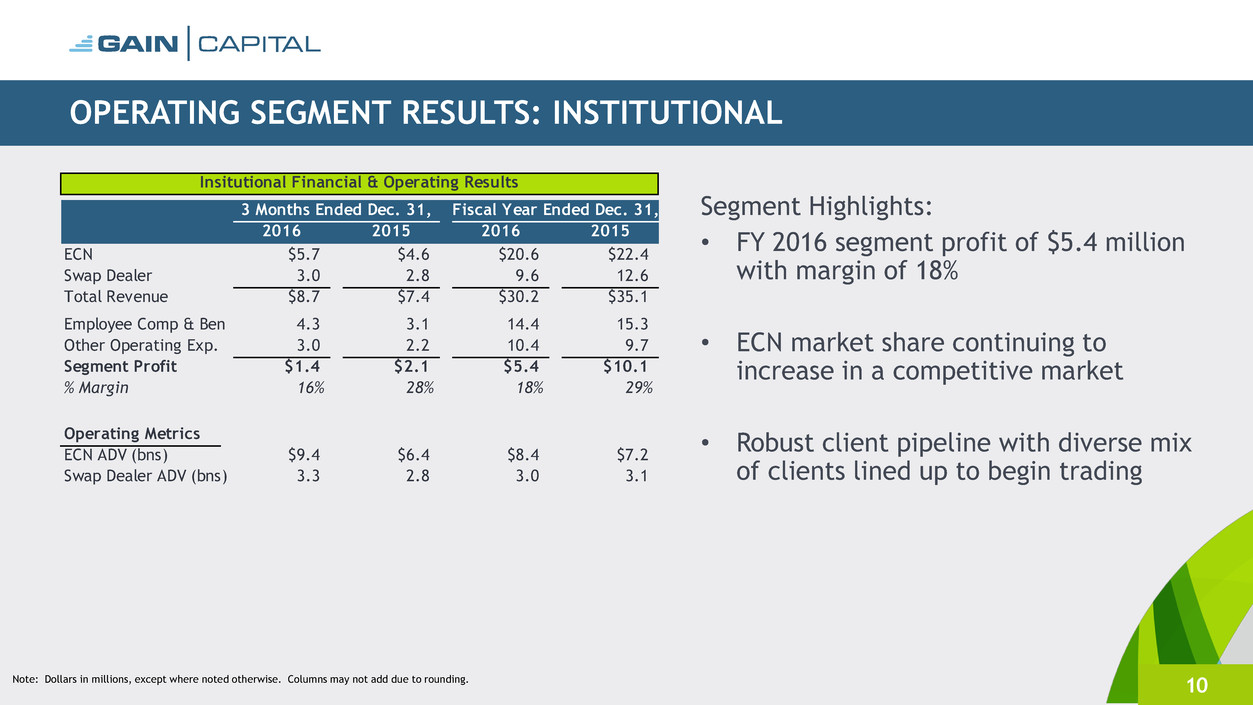

OPERATING SEGMENT RESULTS: INSTITUTIONAL

10 Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding.

Insitutional Financial & Operating Results

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2016 2015 2016 2015

ECN $5.7 $4.6 $20.6 $22.4

Swap Dealer 3.0 2.8 9.6 12.6

Total Revenue $8.7 $7.4 $30.2 $35.1

Employee Comp & Ben 4.3 3.1 14.4 15.3

Other Operating Exp. 3.0 2.2 10.4 9.7

Segment Profit $1.4 $2.1 $5.4 $10.1

% Margin 16% 28% 18% 29%

Operating Metrics

ECN ADV (bns) $9.4 $6.4 $8.4 $7.2

Swap Dealer ADV (bns) 3.3 2.8 3.0 3.1

Segment Highlights:

• FY 2016 segment profit of $5.4 million

with margin of 18%

• ECN market share continuing to

increase in a competitive market

• Robust client pipeline with diverse mix

of clients lined up to begin trading

OPERATING SEGMENT RESULTS: FUTURES

11 Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding.

Segment Highlights:

• FY 2016 segment profit of $4.7 million

with margin of 10%

• Client assets up 41% year-over-year to

$346 million as of December 31, 2016

• Top 10 non-bank FCM as of January

2017

Futures Financial & Operating Results

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2016 2015 2016 2015

Revenue $10.5 $10.9 $48.1 $45.8

Employee Comp & Ben 2.6 2.4 12.0 10.6

Marketing 0.3 0.2 1.0 0.9

Referral Fees 3.8 4.2 15.7 16.3

Other Operating Exp. 3.3 3.4 14.8 14.0

Segment Profit $0.6 $0.7 $4.7 $4.0

% Margin 6% 6% 10% 9%

Operating Metrics

Avg. Daily Contracts 29,117 32,779 32,954 34,683

Active Accounts 8,368 8,668 8,368 8,668

Client Assets $346.1 $245.6 $346.1 $245.6

Revenue/Contract $6.54 $5.28 $5.79 $5.19

CONSOLIDATED OPERATING EXPENSES

12

• Over $45 million of run-rate savings from

City Index synergies reduced fixed costs

• Lower referral fees as a result of partnership

optimization resulted in lower variable costs

• 10% year-over-year decline in annual fixed

operating expenses

Note: Dollars in millions. Q1 2015 operating expenses shown on a pro forma basis based on the simple addition of GAIN Capital and City Index.

(1) Excludes bad debt & other variable expenses, referral fees and marketing expense. Details available in appendix to this presentation.

$61.5 $58.8 $58.6

$52.0 $54.9 $54.6 $48.2 $49.1

$106.6

$98.0 $98.0

$79.1

$83.8

$80.7

$68.9

$78.9

$0

$20

$40

$60

$80

$100

$120

Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 Q4 16

Fixed Op. Expenses Variable Operating Expenses

(1)

Q4 operating expenses reflect GAIN’s successful execution of several cost

reduction initiatives

ACTIVELY RETURNING CAPITAL TO SHAREHOLDERS

13

Required Liquidity

Reserves

Strategic

Acquisitions

Quarterly Dividends

Buyback Program

Returned over $20 million to investors via buybacks and dividends in 2016

Conservatively retain excess capital over regulatory requirements

As of December 31, 2016, maintained $160.1 million in excess

of regulatory requirements

Successfully integrated 10 acquisitions over the last 5 years

Well positioned for future opportunities like the FXCM transaction

$10.2 million in 2016

Quarterly dividend of $0.06 per share approved

Record date: March 28, 2017

Payment date: March 31, 2017

$9.8 million in 2016

Equity: $8.1 million

Convertible: $1.7 million

Repurchased 541,445 shares at an average price of $6.46 in Q4 2016

~$21 million remains authorized for future opportunistic share repurchases

1. Liquidity table available in appendix to this presentation.

CLOSING REMARKS

14

Strong Market

Position

Highly Scalable

Business Model

Superior Risk

Management and

Liquidity

Attractive Financial

Profile

• Global leader and #1 provider in the US of retail FX

• Institutional FX market share increasing with focus on expansion of ECN

• Top 10 non-bank FCM in Futures

• Efficiently managing customer acquisition costs / referral fees

• Focus on strong execution and risk management

• Diverse mix of products and platforms offers stability and multiple opportunities for growth

• GAIN has weathered all major market disruptions

• Uncertainty around Fed rates hike and disparity in monetary policy across leading economies create

environment for further volatility, benefiting risk aware players

• Regulatory pressure and increasing capital requirements underline the importance of scale

• Strong balance sheet positions us well for future strategic opportunities

• Continue to deliver on both organic and acquired growth

• Margin expansion from continued cost management efforts

Appendix

15

CONSOLIDATED STATEMENT OF OPERATIONS

16 Note: Dollars in millions, except per share data. Columns may not add due to rounding. (1) Earnings per share includes an adjustment for the redemption value of the NCI put option.

Three Months Ended Fiscal Year Ended

December 31, December 31,

2016 2015 2016 2015

Revenue

Retail revenue 96.2$ 81.7$ 330.7 347.5$

Institutional revenue 8.5 7.1 29.0 33.8

Futures revenue 10.3 10.6 47.4 45.4

Interest & Other revenue 0.8 3.4 4.6 8.7

Net revenue 115.8$ 102.8$ 411.8$ 435.4$

Expenses

Employee compensation and benefits 25.1 24.9 101.9 106.6

Selling and marketing 10.2 6.8 28.7 27.2

Referral Fees 17.3 18.8 70.8 103.5

Trading expenses 8.1 7.8 31.2 31.9

General and administrative 18.1 20.7 79.7 81.5

Depreciation and amortization 7.3 9.4 28.9 27.7

One-Time Expenses 0.3 11.6 13.0 39.4

Total expenses 86.4 100.0 354.2 417.7

Operating profit 29.4$ 2.8$ 57.7$ 17.6$

Interest expense on long term borrowings 2.6 2.6 10.4 9.2

Income before income tax expense 26.7$ 0.2$ 47.2$ 8.4$

Income tax expense/(benefit) 5.6 (11.1) 9.8 (3.5)

Equity in net loss of affiliate - - (0.1) -

Net income 21.1$ 11.2$ 37.4$ 11.9$

Net income attributable to non-controlling interests 0.3 0.3 2.1 1.7

Net income applicable to Gain Capital Holdings Inc. 20.8$ 10.9$ 35.3$ 10.3$

Earnings per common share(1)

Basic $0.42 $0.23 $0.67 $0.22

Diluted $0.42 $0.23 $0.67 $0.22

Weighted average common shares outstanding used

in computing earnings per common share:

Basic 48,535,293 48,902,186 48,588,917 47,601,979

Diluted 48,763,072 49,379,362 48,785,674 48,379,051

CONSOLIDATED BALANCE SHEET

17 Note: Dollars in millions. Columns may not add due to rounding.

As of

12/31/2016 12/31/2015

ASSETS:

Cash and cash equivalents 234.8$ 171.9$

Cash and securities held for customers 945.5 920.6

Receivables from brokers 61.1 121.2

Property and equipment - net of accumulated depreciation 36.5 30.4

Intangible assets, net 67.4 91.5

Goodwill 32.1 34.0

Other assets 52.8 55.0

Total assets 1,430.1$ 1,424.6$

LIABILITIES AND SHAREHOLDERS' EQUITY:

Payables to customers 945.5$ 920.6$

Accrued compensation & benefits 13.6 12.4

Accrued expenses and other liabilities 41.5 51.6

Income tax payable 4.0 1.1

Convertible senior notes 124.8 121.7

Total liabilities 1,129.3$ 1,107.4$

Non-controlling interest 6.6$ 11.0$

Shareholders' Equity 294.2 306.1

Total liabilities and shareholders' equity 1,430.1$ 1,424.6$

LIQUIDITY

18

Note: Dollars in millions. Columns may not add due to rounding.

(1) Reflects cash that would be received from brokers following the close-out of all open positions.

(2) Relates to regulatory capital requirements or capital charges, depending upon regulatory jurisdiction.

As of

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015

Cash and cash equivalents $234.8 $235.7 $89.4 $189.7 $171.9

Receivable from banks and brokers (1) 61.1 52.3 218.1 120.0 121.2

Less: Payable to brokers - - (4.8) - -

Less: Regulatory capital requirements/charges (2) (113.0) (117.0) (123.3) (121.4) (114.5)

Liquidity $182.9 $171.0 $179.5 $188.3 $178.6

Regulatory Capital Requirements/Charges

US $28.7 $29.4 $28.6 $29.3 $26.3

UK 78.9 79.9 89.2 86.2 83.0

Other jurisdictions 5.4 7.7 5.5 5.9 5.2

Total Regulatory Capital Requirements/Charges (2) $113.0 $117.0 $123.3 $121.4 $114.5

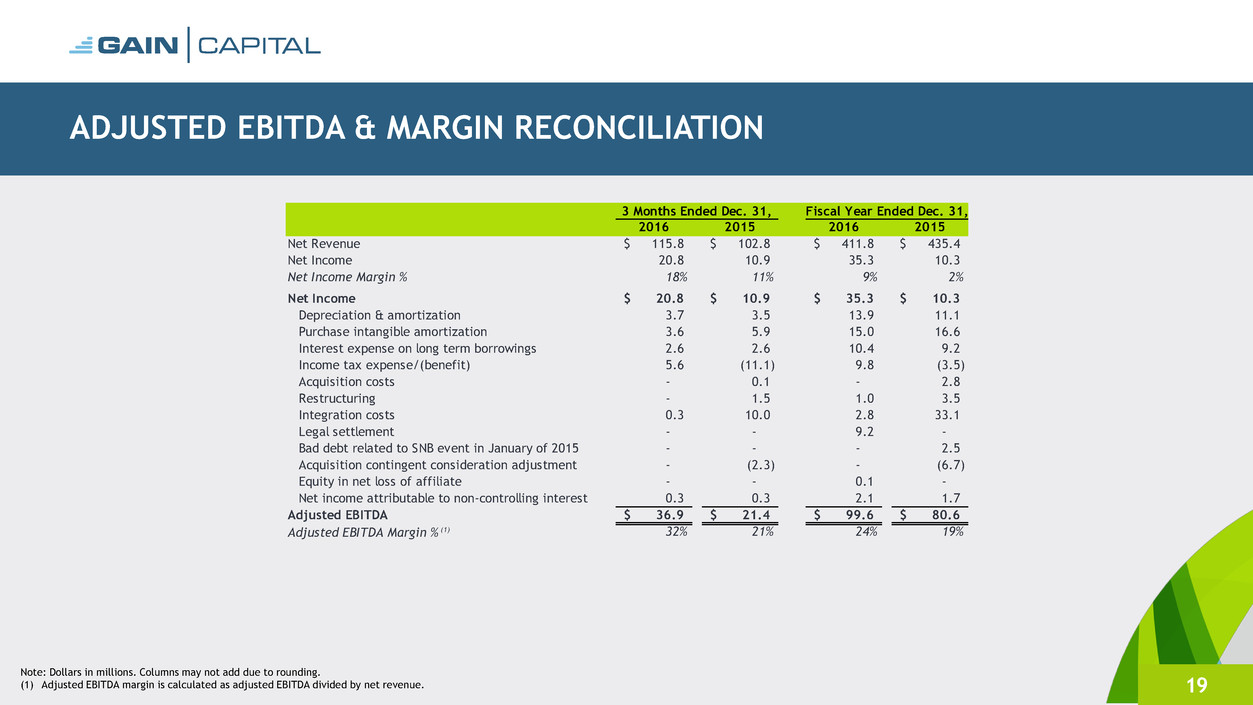

ADJUSTED EBITDA & MARGIN RECONCILIATION

19

Note: Dollars in millions. Columns may not add due to rounding.

(1) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue.

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2016 2015 2016 2015

Net Revenue 115.8$ 102.8$ 411.8$ 435.4$

Net Income 20.8 10.9 35.3 10.3

Net Income Margin % 18% 11% 9% 2%

Net Income 20.8$ 10.9$ 35.3$ 10.3$

Depreciation & amortization 3.7 3.5 13.9 11.1

Purchase intangible amortization 3.6 5.9 15.0 16.6

Interest expense on long term borrowings 2.6 2.6 10.4 9.2

Income tax expense/(benefit) 5.6 (11.1) 9.8 (3.5)

Acquisition costs - 0.1 - 2.8

Restructuring - 1.5 1.0 3.5

Integration costs 0.3 10.0 2.8 33.1

Legal settlement - - 9.2 -

Bad debt related to SNB event in January of 2015 - - - 2.5

Acquisition contingent consideration adjustment - (2.3) - (6.7)

Equity in net loss of affiliate - - 0.1 -

Net income attributable to non-controlling interest 0.3 0.3 2.1 1.7

Adjusted EBITDA 36.9$ 21.4$ 99.6$ 80.6$

Adjusted EBITDA Margin % (1) 32% 21% 24% 19%

ADJUSTED NET INCOME AND EPS RECONCILIATION

20

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2016 2015 2016 2015

Net Income $20.8 $10.9 $35.3 $10.3

Income Tax Expense/(Benefit) 5.6 (11.1) 9.8 (3.5)

Equity in net loss of affilate - - 0.1 -

Non-controlling Interest 0.3 0.3 2.1 1.7

Pre-Tax Income $26.7 $0.2 $47.2 $8.4

Plus: Adjustments 0.3 9.3 13.0 35.2

Adjusted Pre-Tax Income $27.0 $9.5 $60.3 $43.6

Normalized Income Tax(1) (5.9) (2.1) (13.3) (9.6)

Equity in net loss of affilate - - (0.1) -

Non-controlling interest (0.3) (0.3) (2.1) (1.7)

Adjusted Net Income $20.8 $7.2 $45.0 $32.3

Adjusted Earnings per Common Share:

Basic $0.43 $0.15 $0.93 $0.68

Diluted $0.43 $0.15 $0.92 $0.67

Note: Dollars in millions, except per share and share data. Columns may not add due to rounding.

(1) Assumes 22% tax rate.

EPS COMPUTATION

21

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2016 2015 2016 2015

Net income applicable to GAIN Capital Holdings Inc. 20.8$ 10.9$ 35.3$ 10.3$

Adjustment(1) (0.4) 0.3 (2.7) 0.3

Net income available to GAIN common shareholders 20.4$ 11.2$ 32.6$ 10.6$

Earnings per common share

Basic $0.42 $0.23 $0.67 $0.22

Diluted $0.42 $0.23 $0.67 $0.22

Weighted average common shares outstanding used

in computing earnings per common share:

Basic 48,535,293 48,902,186 48,588,917 47,601,979

Diluted 48,763,072 49,379,362 48,785,674 48,379,051

Note: Dollars in millions, except per share and share data. Columns may not add due to rounding.

(1) The Company's redeemable non-controlling interests were less than its redemption value. The adjustment to increase

carrying value reduces earnings available to the Company's shareholders.

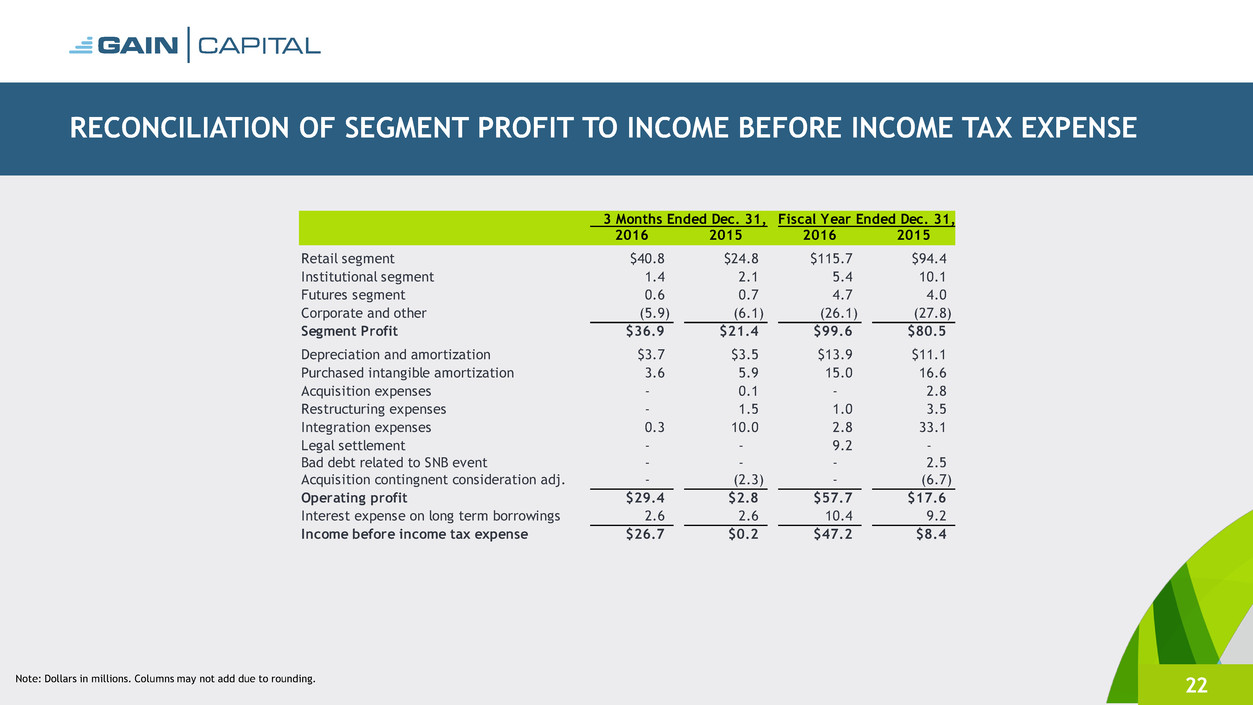

RECONCILIATION OF SEGMENT PROFIT TO INCOME BEFORE INCOME TAX EXPENSE

22 Note: Dollars in millions. Columns may not add due to rounding.

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2016 2015 2016 2015

Retail segment $40.8 $24.8 $115.7 $94.4

Institutional segment 1.4 2.1 5.4 10.1

Futures segment 0.6 0.7 4.7 4.0

Corporate and other (5.9) (6.1) (26.1) (27.8)

Segment Profit $36.9 $21.4 $99.6 $80.5

Depreciation and amortization $3.7 $3.5 $13.9 $11.1

Purchased intangible amortization 3.6 5.9 15.0 16.6

Acquisition expenses - 0.1 - 2.8

Restructuring expenses - 1.5 1.0 3.5

Integration expenses 0.3 10.0 2.8 33.1

Legal settlement - - 9.2 -

Bad debt related to SNB event - - - 2.5

Acquisition contingnent consideration adj. - (2.3) - (6.7)

Operating profit $29.4 $2.8 $57.7 $17.6

Interest expense on long term borrowings 2.6 2.6 10.4 9.2

Income before income tax expense $26.7 $0.2 $47.2 $8.4

FY 2015 PRO FORMA RECONCILIATION

23

Note: Dollars in millions. Columns may not add due to rounding.

(1) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue.

City Index Pro Forma

FY 2015 Q1 2015 FY 2015

Net Revenue 435.4$ 35.7$ 471.1$

Net Income/(loss) 10.3 (6.9) 3.4

Net Income Margin % 2% (19%) 1%

Net Income 10.3$ (6.9)$ 3.4$

Depreciation & amortization 11.1 2.3 13.4

Purchase intangible amortization 16.6 3.1 19.7

Interest expense on long term borrowings 9.2 - 9.2

Income tax expense (3.5) - (3.5)

Acquisition costs 2.8 - 2.8

Restructuring 3.5 - 3.5

Integration costs 33.1 0.2 33.3

Legal settlement - - -

Bad debt related to SNB event in January of 2015 2.5 3.6 6.1

Acquisition contingent consideration adjustment (6.7) - (6.7)

Equity in net loss of affiliate - - -

Net income attributable to non-controlling interest 1.7 - 1.7

Adjusted EBITDA 80.6$ 2.3$ 82.9$

Adjusted EBITDA Margin % (1) 19% 6% 18%

OPERATING EXPENSES

24

Note: Dollars in millions. Columns may not add due to rounding. Q1 2015 operating expenses shown on a pro forma basis based on the simple addition of GAIN Capital and City Index.

(1) As restated. See the Company’s Form 10-Q/A filed on May 3, 2016 for additional information.

2015(1) 2016

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Total Op. Expenses 106.6$ 98.0$ 98.0$ 79.1$ 83.8$ 80.7$ 68.9$ 78.9$

Bad Debt and other variable 3.0 1.3 3.4 1.5 1.8 1.7 0.2 2.2

Referral Fees 33.0 29.5 28.6 18.8 20.7 17.6 15.2 17.3

Marketing 9.0 8.4 7.4 6.8 6.4 6.8 5.3 10.2

Fixed Op. Expenses 61.5$ 58.8$ 58.6$ 52.0$ 54.9$ 54.6$ 48.2$ 49.1$

RETAIL REVENUE PER MILLION

25

$107 $99

$151

$95

$86

$102

$89

$117

$0

$20

$40

$60

$80

$100

$120

$140

$160

Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 Q4 16

Quarterly Trailing 12 Months Trailing 12 Months - Pro Forma

QUARTERLY OPERATING METRICS

26

Note: Volumes in billions; assets in millions. Definitions for all operating metrics are available on page 28.

Three Months Ended,

Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16

Retail

OTC Trading Volume $1,118.4 $812.6 $861.7 $710.9 $612.4 $637.0

OTC Average Daily Volume $16.9 $12.5 $13.5 $10.9 $9.3 $9.8

Active OTC Accounts 149,846 146,977 136,559 139,022 133,009 129,036

Institutional

ECN Volume $451.2 $415.4 $531.6 $526.9 $509.9 $612.2

ECN Average Daily Volume $6.8 $6.4 $8.3 $8.1 $7.7 $9.4

Swap Dealer Volume $198.5 $184.3 $186.6 $186.2 $190.0 $216.6

Swap Dealer Average Daily Volume $3.0 $2.8 $2.9 $2.9 $2.9 $3.3

Futures

Futures Contracts 2,203,456 2,065,094 2,334,308 2,223,501 1,912,174 1,834,393

Futures Average Daily Contracts 34,429 32,779 38,267 34,742 29,878 29,117

Active Futures Accounts 8,567 8,668 8,890 8,822 8,594 8,368

FEBRUARY 2017 OPERATING METRICS

27

$13.2

$11.6

$12.2

$10.2

$10.5

$10.1

$8.3

$9.4

$9.1

$11.7

$8.6

$9.5

$8.5

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

OTC Average Daily Volume ($ bns)

143.7

136.6 140.3 139.0 139.0 139.0 135.6 133.0 131.3 131.1 129.0 127.2

133.0

-

20.0

40.0

60.0

80.0

100.0

120.0

140.0

160.0

Active OTC Accounts (000s)

$8.3

$7.4

$7.8

$6.9

$9.6

$8.3

$6.5

$8.5 $8.7

$10.3

$9.2

$12.1

$11.1

$0.0

$2.0

$4.0

6.

8.

$10.

$12.

$14.

ECN Average Daily Volume ($ bns)

37.0

35.6 36.5 34.7

33.

29.6

28.3

31.9

28.3

32.9

26.2

32.2

31.0

0.0

5.0

10.0

15.0

20.0

25.0

30.0

35.0

40.0

Futures Average Daily Contracts (000s)

8.8 8.9 8.9 8.9 8.8 8.7 8.6 8.6 8.5 8.5 8.4 8.3 8.2

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7

8.0

9.0

10.0

Active Futures Accounts (000s)

$3.0

$2.8

$3.3

$2.9

$2.4 $2.4

$3.2 $3.1

$2.8

$4.0

$3.2

$4.4

$3.1

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

$4.5

$5.0

Swap Dealer Average Da ly Volum ($ bns)

DEFINITION OF METRICS

28

• Active Accounts: Accounts who executed a transaction within the last 12 months

• Trading Volume: Represents the U.S. dollar equivalent of notional amounts traded

• Customer Assets: Represents amounts due to clients, including customer deposits and unrealized

gains or losses arising from open positions

Q4 & Full Year 2016 Results

29

March 2017