Attached files

| file | filename |

|---|---|

| 8-K - UMH PROPERTIES, INC. | form8-k.htm |

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 2 |

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 3 |

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 4 |

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 5 |

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 6 |

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 7 |

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 8 |

Notes:

(1) Includes a variable rate mortgage with a balance of $10,625,352 and $11,416,309 as of December 31, 2016 and December 31, 2015, respectively, which has been effectively fixed at an interest rate of 3.89% with an interest rate swap agreement.

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 9 |

(unaudited)

As of 12/31/2016:

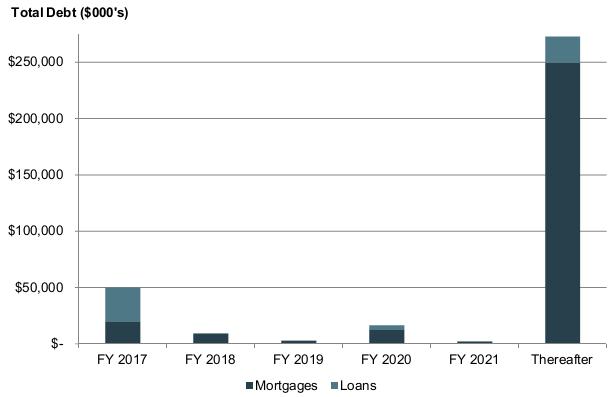

| Year Ended | Mortgages | Loans | Total | % of Total | ||||||||||||

| 2017 | $ | 19,660,598 | $ 30,566,256 | (1) | $ | 50,226,854 | 14.1 | % | ||||||||

| 2018 | 9,173,393 | 255,164 | 9,428,557 | 2.7 | % | |||||||||||

| 2019 | 2,889,970 | 255,955 | 3,145,925 | 0.9 | % | |||||||||||

| 2020 | 12,525,896 | 4,245,631 | 16,771,527 | 4.7 | % | |||||||||||

| 2021 | 2,228,629 | 136,771 | 2,365,400 | 0.7 | % | |||||||||||

| Thereafter | 250,085,497 | 22,933,662 | 273,019,159 | 76.9 | % | |||||||||||

| Total Debt Before Unamortized Debt Issuance Cost | 296,563,983 | 58,393,439 | 354,957,422 | 100.0 | % | |||||||||||

| Unamortized Debt Issuance Cost | (3,538,391 | ) | (108,054 | ) | (3,646,445 | ) | ||||||||||

| Total Debt, Net of Unamortized Debt Issuance Costs | $ | 293,025,592 | $ | 58,285,385 | $ | 351,310,977 | ||||||||||

Notes:

(1) Includes $20 million balance outstanding on the Company’s Line of Credit due March 2017.

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 10 |

(unaudited)

| 12/31/2016 | 12/31/2015 | % Change | ||||||||||

| Communities | 101 | 98 | 3.1 | % | ||||||||

| Developed Sites | 18,054 | 17,793 | 1.5 | % | ||||||||

| Occupied | 14,499 | 14,013 | 3.5 | % | ||||||||

| Occupancy % (1) | 81.0 | % | 79.5 | % | 1.5 | % | ||||||

| Monthly Rent Per Site | $ | 422 | $ | 411 | 2.7 | % | ||||||

| Total Rentals | 4,659 | 3,732 | 24.8 | % | ||||||||

| Occupied Rentals | 4,261 | 3,466 | 22.9 | % | ||||||||

| Rental Occupancy % | 91.5 | % | 92.9 | % | -1.4 | % | ||||||

| Monthly Rent per Home Rental | $ | 709 | $ | 696 | 1.9 | % | ||||||

| Region | Number | Total Acreage | Developed Acreage | Vacant Acreage | Total Sites | Occupied Sites | Occupancy Percentage | Monthly Rent Per Site | Total Rentals | Occupied Rentals | Rental Occupancy Percentage | Monthly Rent Per Home Rental | ||||||||||||||||||||||||||||||||||||

| (2) | (2) | (1) | (3) | |||||||||||||||||||||||||||||||||||||||||||||

| Indiana | 9 | 661 | 561 | 100 | 2,657 | 1,907 | 71.8 | % | $ | 395 | 858 | 795 | 92.7 | % | $ | 707 | ||||||||||||||||||||||||||||||||

| Michigan | 2 | 68 | 68 | -0- | 354 | 239 | 67.5 | % | $ | 421 | 129 | 112 | 86.8 | % | $ | 702 | ||||||||||||||||||||||||||||||||

| New Jersey | 4 | 348 | 187 | 161 | 1,006 | 969 | 96.3 | % | $ | 592 | 40 | 38 | 95.0 | % | $ | 907 | ||||||||||||||||||||||||||||||||

| New York | 7 | 396 | 301 | 95 | 1,131 | 912 | 80.6 | % | $ | 490 | 261 | 234 | 89.7 | % | $ | 855 | ||||||||||||||||||||||||||||||||

| Ohio | 30 | 1,324 | 961 | 363 | 4,592 | 3,614 | 78.7 | % | $ | 354 | 1,083 | 982 | 90.7 | % | $ | 645 | ||||||||||||||||||||||||||||||||

| E. Pennsylvania | 26 | 963 | 805 | 158 | 3,591 | 3,034 | 84.5 | % | $ | 463 | 766 | 689 | 89.9 | % | $ | 737 | ||||||||||||||||||||||||||||||||

| W. Pennsylvania | 16 | 904 | 723 | 181 | 2,910 | 2,252 | 77.4 | % | $ | 393 | 767 | 696 | 90.7 | % | $ | 715 | ||||||||||||||||||||||||||||||||

| Tennessee | 7 | 413 | 321 | 92 | 1,813 | 1,572 | 86.7 | % | $ | 430 | 755 | 715 | 94.7 | % | $ | 708 | ||||||||||||||||||||||||||||||||

| Total as of December 31, 2016 | 101 | 5,077 | 3,927 | 1,150 | 18,054 | 14,499 | 81.0 | % | $ | 422 | 4,659 | 4,261 | 91.5 | % | $ | 709 | ||||||||||||||||||||||||||||||||

| Acquisitions (4) | 5 | 382 | 288 | 94 | 1,291 | 860 | 66.6 | % | $ | 362 | 110 | 65 | 59.1 | % | $ | 691 | ||||||||||||||||||||||||||||||||

| Grand Total | 106 | 5,459 | 4,215 | 1,244 | 19,345 | 15,359 | 80.0 | % | $ | 419 | 4,769 | 4,326 | 90.7 | % | $ | 708 | ||||||||||||||||||||||||||||||||

Notes:

(1) The 156 Vacant Sites at Memphis Blues are not included in the calculation of occupancy.

(2) Total and Vacant Acreage of 220 for the Mountain View Estates property is not included in the summary since there are no current sites and approval for sites is still in process.

(3) Includes home and site rent charges.

(4) Acquisitions of 5 communities, 2 in Indiana and 2 in Ohio on 1/20/17, and 1 in Pennsylvania on 1/24/17.

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 11 |

| As of | ||||||||||||

| 12/31/2016 | 12/31/2015 | % Change | ||||||||||

| Other Information | ||||||||||||

| Total Sites | 14,829 | 14,856 | -0.2 | % | ||||||||

| Occupied Sites | 12,577 | 12,322 | 2.1 | % | ||||||||

| Occupancy % | 84.8 | % | 82.9 | % | 1.9 | % | ||||||

| Number of Properties | 88 | 88 | N/A | |||||||||

| Developed Acreage | 3,223 | 3,223 | N/A | |||||||||

| Vacant Acreage | 894 | 894 | N/A | |||||||||

| Monthly Rent Per Site | $ | 427 | $ | 414 | 3.1 | % | ||||||

| Total Rentals | 4,042 | 3,313 | 22.0 | % | ||||||||

| Occupied Rentals | 3,721 | 3,117 | 19.4 | % | ||||||||

| Rental Occupancy | 92.1 | % | 94.1 | % | -2.0 | % | ||||||

| Monthly Rent Per Home Rental | $ | 715 | $ | 700 | 2.1 | % | ||||||

Notes:

Same Property includes all properties owned as of January 1, 2015, with the exception of Memphis Blues.

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 12 |

At Acquisition:

| Year of Acquisition | Number of Communities | Sites | Occupied Sites | Occupancy % | Price | Total Acres | ||||||||||||||||||

| 2015 | 10 | 2,774 | 1,764 | 64 | % | $ | 81,217,000 | 717 | ||||||||||||||||

| 2016 | 3 | 289 | 215 | 74 | % | $ | 7,277,000 | 192 | ||||||||||||||||

| 2017 | 5 | 1,291 | 860 | 67 | % | $ | 36,510,000 | 382 | ||||||||||||||||

| 2016 Acquisitions | ||||||||||||||||||||

| Community | Date of Acquisition | State | Number of Sites | Purchase Price | Number of Acres | Occupancy | ||||||||||||||

| Lakeview Meadows | September 1, 2016 | OH | 81 | 1,355,000 | 53 | 53 | % | |||||||||||||

| Wayside | September 1, 2016 | OH | 84 | 1,599,000 | 18 | 74 | % | |||||||||||||

| Springfield Meadows | December 19, 2016 | OH | 124 | 4,323,000 | 121 | 89 | % | |||||||||||||

| Total 2016 to Date | 289 | 7,277,000 | 192 | 74 | % | |||||||||||||||

| 2017 Acquisitions | ||||||||||||||||||||

| Community | Date of Acquisition | State | Number of Sites | Purchase Price | Number of Acres | Occupancy | ||||||||||||||

| Hillcrest Estates and Marysville Estates | January 20, 2017 | OH | 532 | 9,588,000 | 149 | 57 | % | |||||||||||||

| Boardwalk and Parke Place | January 20, 2017 | IN | 559 | 24,437,000 | 155 | 77 | % | |||||||||||||

| Hillcrest Crossing | January 24, 2017 | PA | 200 | 2,485,000 | 78 | 40 | % | |||||||||||||

| Total 2017 to Date | 1,291 | 36,510,000 | 382 | 67 | % | |||||||||||||||

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 13 |

Investors and analysts following the real estate industry utilize funds from operations (“FFO”), core funds from operations (“Core FFO”), normalized funds from operations (“Normalized FFO”), community NOI, same property NOI, and earnings before interest, taxes, depreciation and amortization (“EBITDA”), variously defined, as supplemental performance measures. While the Company believes net income available to common stockholders, as defined by accounting principles generally accepted in the United States of America (U.S. GAAP), is the most appropriate measure, it considers Community NOI, Same Property NOI, EBITDA, FFO, Core FFO and Normalized FFO, given their wide use by and relevance to investors and analysts, appropriate supplemental performance measures. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of U.S. GAAP depreciation and amortization of real estate assets. Core FFO reflects the same assumptions as FFO except that it also adjusts for the effects of acquisitions costs and costs of early extinguishment of debt. Normalized FFO reflects the same assumptions as Core FFO except that it also adjusts for gains and losses realized on securities investments and certain one-time charges. Community NOI and Same Property NOI provides a measure of rental operations, and does not factor in depreciation and amortization and non-property specific expenses such as general and administrative expenses. EBITDA provides a tool to further evaluate the ability to incur and service debt and to fund dividends and other cash needs. In addition, Community NOI, Same Property NOI, EBITDA, FFO, Core FFO and Normalized FFO are commonly used in various ratios, pricing multiples, yields and returns and valuation of calculations used to measure financial position, performance and value.

As used herein, the Company calculates FFO, as defined by The National Association of Real Estate Investment Trusts (“NAREIT”), to be equal to net income (loss) applicable to common shareholders, as defined by U.S. GAAP, excluding extraordinary items as defined by U.S. GAAP, gains or losses from sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, plus certain non-cash items such as real estate asset depreciation and amortization. FFO includes gains and losses realized on securities investments.

Core FFO is calculated as FFO plus acquisition costs and costs of extinguishment of debt.

Normalized FFO is calculated as Core FFO excluding gains and losses realized on securities investments and certain one-time charges.

Core FFO per Diluted Common Share and Normalized FFO per Diluted Common Share is calculated using diluted weighted shares outstanding of 29,279,000 and 28,136,000 shares for the three and twelve months ended December 31, 2016, respectively, and 27,024,000 and 25,973,000 for the three and twelve months ended December 31, 2015, respectively. Common stock equivalents resulting from stock options in the amount of 449,000 and 327,000 shares for the three and twelve months ended December 31, 2016, respectively, and 46,000 and 40,000 shares for the three and twelve months ended December 31, 2015, respectively, are included in the diluted weighted shares outstanding. Common stock equivalents were excluded from the computation of the Diluted Net Loss per Share as their effect would be anti-dilutive.

Community NOI is calculated as rental and related income less community operating expenses such as real estate taxes, repairs and maintenance, community salaries, utilities, insurance and other expenses. Community NOI excludes realized gains (losses) on securities transactions.

Same Property NOI is calculated as Community NOI, using all properties owned as of January 1, 2015, with the exception of Memphis Blues.

EBITDA is calculated as net income plus interest expense, franchise taxes,depreciation expense and acquisition costs.

Community NOI, Same Property NOI, EBITDA, FFO, Core FFO and Normalized FFO do not represent cash generated from operating activities in accordance with U.S. GAAP and are not necessarily indicative of cash available to fund cash needs, including the repayment of principal on debt and payment of dividends and distributions. Community NOI, Same Property NOI, EBITDA, FFO, Core FFO and Normalized FFO should not be considered as substitutes for net income applicable to common shareholders (calculated in accordance with U.S. GAAP) as a measure of results of operations, or cash flows (calculated in accordance with U.S. GAAP) as a measure of liquidity. Community NOI, Same Property NOI, EBITDA, FFO, Core FFO and Normalized FFO as currently calculated by the Company may not be comparable to similarly titled, but variously calculated, measures of other REITs.

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 14 |

Press Release Dated March 8, 2017

| FOR IMMEDIATE RELEASE | March 8, 2017 |

| Contact: Nelli Madden | |

| 732-577-9997 |

UMH PROPERTIES, INC. REPORTS RESULTS FOR THE YEAR ENDED AND THE FOURTH QUARTER ENDED DECEMBER 31, 2016

FREEHOLD, NJ, March 8, 2017........ UMH Properties, Inc. (NYSE:UMH) reported Total Income of $99,214,000 for the year ended December 31, 2016 as compared to $81,517,000 for the year ended December 31, 2015, representing an increase of 22%. Total Income for the quarter ended December 31, 2016 was $25,144,000 as compared to $21,924,000 for the quarter ended December 31, 2015, representing an increase of 15%. Net Loss Attributable to Common Shareholders amounted to $2,569,000 or $0.09 per diluted share for the year ended December 31, 2016 as compared to $6,123,000 or $0.24 per diluted share for the year ended December 31, 2015, representing an improvement of 58%. Net Loss Attributable to Common Shareholders amounted to $413,000 or $0.01 per diluted share for the quarter ended December 31, 2016 as compared to $2,425,000 or $0.10 per diluted share for the quarter ended December 31, 2015, representing an improvement of 83%.

Core Funds from Operations (“Core FFO”) was $20,731,000 or $0.74 per diluted share for the year ended December 31, 2016 as compared to $14,267,000 or $0.55 per diluted share for the year ended December 31, 2015, representing an increase in Core FFO per diluted share of 35%. Core FFO was $5,719,000 or $0.20 per diluted share for the quarter ended December 31, 2016 as compared to $3,894,000 or $0.14 per diluted share for the quarter ended December 31, 2015, representing an increase in Core FFO per diluted share of 43%. Normalized Funds from Operations (“Normalized FFO”), was $18,446,000 or $0.66 per diluted share for the year ended December 31, 2016, as compared to $14,188,000 or $0.55 per diluted share for the year ended December 31, 2015, representing an increase in Normalized FFO per diluted share of 20%. Normalized FFO was $5,333,000 or $0.18 per diluted share for the quarter ended December 31, 2016, as compared to $3,817,000 or $0.14 per diluted share for the quarter ended December 31, 2015, representing an increase in Normalized FFO per diluted share of 29%.

A summary of significant financial information for the three and twelve months ended December 31, 2016 and 2015 is as follows:

| For the Three Months Ended | ||||||||

| December 31, | ||||||||

| 2016 | 2015 | |||||||

| Total Income | $ | 25,144,000 | $ | 21,924,000 | ||||

| Total Expenses | $ | 20,635,000 | $ | 19,256,000 | ||||

| Gain on Sales of Securities, net | $ | 386,000 | $ | 77,000 | ||||

| Net Loss Attributable to Common Shareholders | $ | (413,000 | ) | $ | (2,425,000 | ) | ||

| Net Loss Attributable to Common Shareholders per Diluted Common Share | $ | (0.01 | ) | $ | (0.10 | ) | ||

| Core FFO (1) | $ | 5,719,000 | $ | 3,894,000 | ||||

| Core FFO (1) per Diluted Common Share | $ | 0.20 | $ | 0.14 | ||||

| Normalized FFO (1) | $ | 5,333,000 | $ | 3,817,000 | ||||

| Normalized FFO (1) per Diluted Common Share | $ | 0.18 | $ | 0.14 | ||||

| Weighted Average Diluted Shares Outstanding | 28,830,000 | 26,978,000 | ||||||

(continued on next page)

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 15 |

| For the Twelve Months Ended | ||||||||

| December 31, | ||||||||

| 2016 | 2015 | |||||||

| Total Income | $ | 99,214,000 | $ | 81,517,000 | ||||

| Total Expenses | $ | 83,256,000 | $ | 72,077,000 | ||||

| Gain on Sales of Securities, net | $ | 2,285,000 | $ | 204,000 | ||||

| Net Loss Attributable to Common Shareholders | $ | (2,569,000 | ) | $ | (6,123,000 | ) | ||

| Net Loss Attributable to Common Shareholders per Diluted Common Share | $ | (0.09 | ) | $ | (0.24 | ) | ||

| Core FFO (1) | $ | 20,731,000 | $ | 14,267,000 | ||||

| Core FFO (1) per Diluted Common Share | $ | 0.74 | $ | 0.55 | ||||

| Normalized FFO (1) | $ | 18,446,000 | $ | 14,188,000 | ||||

| Normalized FFO (1) per Diluted Common Share | $ | 0.66 | $ | 0.55 | ||||

| Weighted Average Diluted Shares Outstanding | 27,809,000 | 25,933,000 | ||||||

A summary of significant balance sheet information as of December 31, 2016 and 2015 is as follows:

| December 31, 2016 | December 31, 2015 | |||||||

| Gross Real Estate Investments | $ | 640,217,000 | $ | 577,709,000 | ||||

| Securities Available for Sale at Fair Value | $ | 108,755,000 | $ | 75,011,000 | ||||

| Total Assets | $ | 680,445,000 | $ | 600,317,000 | ||||

| Mortgages Payable, net | $ | 293,026,000 | $ | 283,050,000 | ||||

| Loans Payable, net | $ | 58,285,000 | $ | 57,862,000 | ||||

| Total Shareholders’ Equity | $ | 317,032,000 | $ | 246,238,000 | ||||

Samuel A. Landy, President and CEO, commented on the 2016 results.

“We are pleased to announce another excellent year of increasing financial operating results and strong overall performance. Our accomplishments during the year included:

| ● | Generated an increase in Normalized FFO share growth of 20.0%, representing our fourth consecutive year of double-digit growth; |

| ● | Increased Community Net Operating Income (“NOI”) by 27.4%; |

| ● | Increased same property Community NOI by 18.9%; |

| ● | Increased same property occupancy from 82.9% to 84.8%; |

| ● | Improved our Operating Expense Ratio from 49.6% to 47.0%; |

| ● | Generated approximately $2.3 million in net realized gains in addition to the $16.7 million in unrealized gains we held at yearend on our REIT securities investments; |

| ● | Acquired 3 communities containing approximately 300 home sites for a total cost of $7.3 million; |

| ● | Increased our rental home portfolio by 900 homes, representing an increase of 25% to 4,700 total rental homes; |

| ● | Raised approximately $22 million in common equity capital through our Dividend Reinvestment and Stock Purchase Plan; |

| ● | Issued 2 million shares of our 8.0% Series B Cumulative Redeemable Preferred Stock raising net proceeds of approximately $49 million; |

| ● | Financed/refinanced four communities for a total of $32 million; and |

| ● | Reduced our weighted average mortgage interest rate from 4.6% to 4.4%.” |

(continued on next page)

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 16 |

Mr. Landy stated, “UMH was one of the top performing REITs in 2016, with a total shareholder return of 59%. This year also marks our fourth consecutive year of double-digit earnings per share growth, increasing Normalized FFO per diluted share by 20.0%, from $0.55 per diluted share in 2015 to $0.66 per diluted share in 2016. For the fourth quarter, our Normalized FFO was $0.18 per diluted share as compared to $0.14 per diluted share in the prior year period, representing an increase of 28.6%. We have reached the point where our dividends are once again covered by our Normalized FFO.”

“Our excellent results are fueled by our solid same property metrics. Year over year, same property revenue increased 12.9% while expenses only increased 6.1% resulting in an increase in same property NOI of 18.9%. These results were led by a same property occupancy gain of 190 basis points.”

“We have continued to acquire value-add communities and in 2016 we purchased 3 communities containing approximately 300 developed homesites for an aggregate cost of approximately $7.3 million. Subsequent to yearend, we completed the acquisition of an additional 5 communities containing approximately 1,300 developed homesites for an aggregate cost of approximately $36.5 million. These communities are located in regions where we are seeing increased demand and should provide us with an opportunity to significantly improve community operating results.”

“Our securities portfolio delivered exceptional results this year. We are very pleased with our current holdings which had $16.7 million in net unrealized gains at yearend, in addition to the $6.6 million in dividend income and $2.3 million in net realized gains generated during the year.”

“With respect to our capital markets activity, during 2016 we raised approximately $49 million through the issuance of 2 million shares of our 8% Series B Cumulative Redeemable Perpetual Preferred Stock. This offering further strengthens our balance sheet and positions the Company to continue to deliver these positive results.”

“Our 2016 results reflect consistent strong performance across our portfolio and positions us for continued success in 2017.”

UMH Properties, Inc. will host its Fourth Quarter and Year End 2016 Financial Results Webcast and Conference Call. Senior management will discuss the results, current market conditions and future outlook on Thursday, March 9, 2017 at 10:00 a.m. Eastern Time.

The Company’s 2016 fourth quarter and yearend financial results being released herein will be available on the Company’s website at www.umh.reit in the “Financial Information and Filings” section.

To participate in the webcast, select the microphone icon found on the homepage www.umh.reit to access the call. Interested parties can also participate via conference call by calling toll free 877-513-1898 (domestically) or 412-902-4147 (internationally).

The replay of the conference call will be available at 12:00 p.m. Eastern Time on Thursday, March 9, 2017. It will be available until May 1, 2017, and can be accessed by dialing toll free 877-344-7529 (domestically) and 412-317-0088 (internationally) and entering the passcode 10100433. A transcript of the call and the webcast replay will be available at the company’s website, www.umh.reit.

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 106 manufactured home communities containing approximately 19,300 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana and Michigan. In addition, the Company owns a portfolio of REIT securities.

(continued on next page)

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 17 |

Certain statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

Note:

(1) Non-GAAP Information: We assess and measure our overall operating results based upon an industry performance measure referred to as Funds From Operations (“FFO”), which management believes is a useful indicator of our operating performance. FFO is used by industry analysts and investors as a supplemental operating performance measure of a REIT. FFO, as defined by The National Association of Real Estate Investment Trusts (“NAREIT”), represents Net Income (Loss) Attributable to Common Shareholders, as defined by accounting principles generally accepted in the United States of America (“U.S. GAAP”), excluding extraordinary items, as defined under U.S. GAAP, gains or losses from sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, plus certain non-cash items such as real estate asset depreciation and amortization. NAREIT created FFO as a non-U.S. GAAP supplemental measure of REIT operating performance. We define Core Funds From Operations (“Core FFO”) as FFO plus acquisition costs and costs of early extinguishment of debt. We define Normalized Funds From Operations (“Normalized FFO”) as Core FFO excluding gains and losses realized on securities investments and certain non-recurring charges. We define Community NOI as rental and related income less community operating expenses such as real estate taxes, repairs and maintenance, community salaries, utilities, insurance and other expenses. FFO, Core FFO and Normalized FFO, as well as Community NOI, should be considered as supplemental measures of operating performance used by REITs. FFO, Core FFO and Normalized FFO exclude historical cost depreciation as an expense and may facilitate the comparison of REITs which have a different cost basis. However, other REITs may use different methodologies to calculate FFO, Core FFO, Normalized FFO and Community NOI and, accordingly, our FFO, Core FFO, Normalized FFO and Community NOI may not be comparable to all other REITs. The items excluded from FFO, Core FFO and Normalized FFO are significant components in understanding the Company’s financial performance.

FFO, Core FFO and Normalized FFO (i) do not represent Cash Flow from Operations as defined by U.S. GAAP; (ii) should not be considered as an alternative to net income (loss) as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity.

The reconciliation of the Company’s U.S. GAAP net loss to the Company’s FFO, Core FFO and Normalized FFO for the three and twelve months ended December 31, 2016 and 2015 are calculated as follows:

| Three Months Ended | Twelve Months Ended | |||||||||||||||

| 12/31/16 | 12/31/15 | 12/31/16 | 12/31/15 | |||||||||||||

| Net Loss Attributable to Common Shareholders | $ | (413,000 | ) | $ | (2,425,000 | ) | $ | (2,569,000 | ) | $ | (6,123,000 | ) | ||||

| Depreciation Expense | 6,121,000 | 5,412,000 | 23,214,000 | 18,878,000 | ||||||||||||

| (Gain) Loss on Sales of Depreciable Assets | (22,000 | ) | 14,000 | 2,000 | 80,000 | |||||||||||

| FFO Attributable to Common Shareholders | 5,686,000 | 3,001,000 | 20,647,000 | 12,835,000 | ||||||||||||

| Acquisition Costs | 28,000 | 508,000 | 79,000 | 957,000 | ||||||||||||

| Cost of Early Extinguishment of Debt | 5,000 | 385,000 | 5,000 | 475,000 | ||||||||||||

| Core FFO Attributable to Common Shareholders | 5,719,000 | 3,894,000 | 20,731,000 | 14,267,000 | ||||||||||||

| Gain on Sales of Securities, net | (386,000 | ) | (77,000 | ) | (2,285,000 | ) | (204,000 | ) | ||||||||

| Settlement of Litigation | -0- | -0- | -0- | 125,000 | ||||||||||||

| Normalized FFO Attributable to Common Shareholders | $ | 5,333,000 | $ | 3,817,000 | $ | 18,446,000 | $ | 14,188,000 | ||||||||

The diluted weighted shares outstanding used in the calculation of Core FFO per Diluted Common Share and Normalized FFO per Diluted Common Share were 29,279,000 and 28,136,000 shares for the three and twelve months ended December 31, 2016, respectively, and 27,024,000 and 25,973,000 for the three and twelve months ended December 31, 2015, respectively. Common stock equivalents resulting from stock options in the amount of 449,000 and 327,000 shares for the three and twelve months ended December 31, 2016, respectively, and 46,000 and 40,000 shares for the three and twelve months ended December 31, 2015, respectively, are included in the diluted weighted shares outstanding. Common stock equivalents were excluded from the computation of the Diluted Net Loss per Share as their effect would be anti-dilutive.

(continued on next page)

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 18 |

The following are the cash flows provided (used) by operating, investing and financing activities for the twelve months ended December 31, 2016 and 2015:

| 2016 | 2015 | |||||||

| Operating Activities | $ | 29,353,000 | $ | 25,708,000 | ||||

| Investing Activities | (77,567,000 | ) | (148,675,000 | ) | ||||

| Financing Activities | 45,895,000 | 121,420,000 | ||||||

# # # #

| UMH Properties, Inc. | Fourth Quarter FY 2016 Supplemental Information | 19 |