Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - KEYW HOLDING CORP | a201738sonicexhibit992.htm |

| EX-99.1 - EXHIBIT 99.1 - KEYW HOLDING CORP | a20161231erexhibit991.htm |

| 8-K - 8-K - KEYW HOLDING CORP | keyw-20161231x8kearningsre.htm |

Acquisition of

Sotera Defense

Solutions

March 8, 2017

2

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995, including, but not limited to, statements regarding KeyW’s future prospects, projected financial results,

estimated integration costs and acquisition related amortization expenses, business plans and the benefits of the

business combination transaction involving KeyW and Sotera, including future financial and operating results such as

fiscal year 2017 expected or projected revenue, adjusted EBITDA and debt to adjusted EBITDA ratio, the combined

company’s plans, objectives, expectations and intentions and other statements that are not historical facts. Words

such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates” and

similar expressions are also used to identify these forward-looking statements. These statements are based on the

current beliefs and expectations of KeyW’s management and are subject to significant risks and uncertainties. Actual

results may differ from those set forth in the forward-looking statements. Forward-looking statements are made only as

of the date hereof, and KeyW does not undertake any obligation to update or revise the forward-looking statements,

whether as a result of new information, future events or otherwise, except as required by law. In addition, historical

information should not be considered as an indicator of future performance.

In addition to factors previously disclosed in KeyW’s reports filed with the Securities and Exchange Commission

(“SEC”), the following factors could cause actual results to differ materially from forward-looking statements: (i) the

Sotera transaction not being timely completed, if completed at all, including the ability to obtain regulatory approvals

and meet other closing conditions to the transaction in a timely manner, if at all; (ii) risks associated with obtaining the

financing for the transaction on the expected terms and schedule, or at all; (iii) KeyW’s or Sotera’s respective

businesses experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to

maintain relationships with employees, business partners or governmental entities; (iv) the parties being unable to

successfully implement integration strategies or realize the anticipated benefits of the acquisition, including the

possibility that the expected synergies and cost reductions from the proposed acquisition will not be realized or will not

be realized within the expected time period; (v) the increased leverage and interest expense of the combined

company; (vi) general economic conditions and/or conditions affecting the parties’ current and prospective customers

and/or (vii) difficulties with, delays in or the inability to achieve the parties’ and combined company’s revenue and

adjusted EBITDA guidance for 2017, due to, among other things, unanticipated circumstances, trends or events

affecting the combined company's financial performance. Factors other than those referred to above could also cause

KeyW’s or Sotera’s results to differ materially from expected results.

Forward Looking Statements

3

Non-GAAP Financial Measures

This presentation contains forward looking estimates of adjusted EBITDA, including adjusted EBITDA margin. Adjusted EBITDA, as defined by KeyW, is a financial measure that

is not calculated in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP. Adjusted EBITDA should not be considered as an

alternative to net income, operating income or any other measure of financial performance calculated and presented in accordance with U.S. GAAP. Our adjusted EBITDA may

not be comparable to similarly titled measures of other companies because other companies may not calculate adjusted EBITDA or similarly titled measures in the same manner

as we do. We prepare adjusted EBITDA to eliminate the impact of items that we do not consider indicative of our core operating performance. We encourage you to evaluate

these adjustments and the reasons we consider them appropriate.

We believe adjusted EBITDA is useful to investors in evaluating our operating performance for the following reasons:

– we have various non-recurring transactions or non-operating transactions and expenses that directly impact our net income. Adjusted EBITDA is intended to approximate

the net cash provided by operations by adjusting for non-recurring or non-operating items; and

– securities analysts use adjusted EBITDA as a supplemental measure to evaluate the overall operating performance of companies.

Our board of directors and management use adjusted EBITDA:

as a measure of operating performance;

– to determine a significant portion of management's incentive compensation;

– for planning purposes, including the preparation of our annual operating budget; and

– to evaluate the effectiveness of our business strategies.

Although adjusted EBITDA is frequently used by investors and securities analysts in their evaluations of companies, adjusted EBITDA has limitations as an analytical tool, and

you should not consider it in isolation or as a substitute for analysis of our results of operations as reported under GAAP. Some of these limitations are:

– adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or other contractual commitments;

– adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

– adjusted EBITDA does not reflect interest expense or interest income;

– adjusted EBITDA does not reflect cash requirements for income taxes;

– adjusted EBITDA does not include non-cash expenses related to stock compensation;

Although depreciation and amortization are non-cash charges, the assets being depreciated or amortized will often have to be replaced in the future, and adjusted EBITDA does

not reflect any cash requirements for these replacements; and

– other companies in our industry may calculate adjusted EBITDA or similarly titled measures differently than we do, limiting i ts usefulness as a comparative measure.

4

Presenters

Bill Weber

President & Chief Executive Officer, KeyW

Mike Alber

Executive Vice President, Chief Financial Officer, KeyW

5

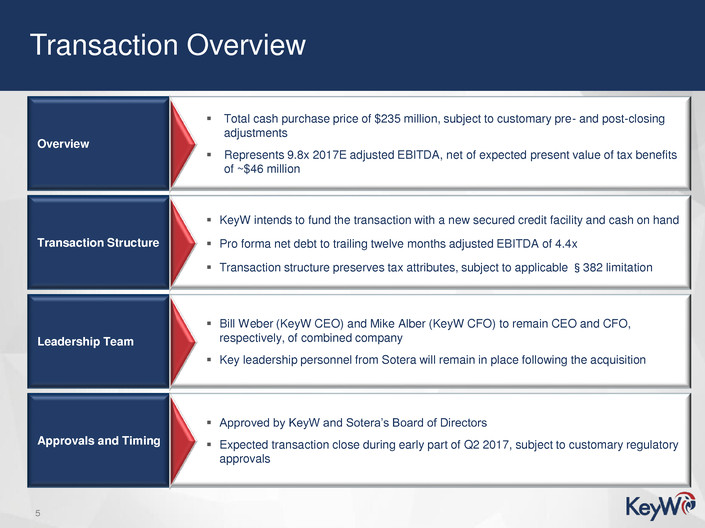

Approvals and Timing

Approved by KeyW and Sotera’s Board of Directors

Expected transaction close during early part of Q2 2017, subject to customary regulatory

approvals

Overview

Total cash purchase price of $235 million, subject to customary pre- and post-closing

adjustments

Represents 9.8x 2017E adjusted EBITDA, net of expected present value of tax benefits

of ~$46 million

Transaction Overview

Transaction Structure

KeyW intends to fund the transaction with a new secured credit facility and cash on hand

Pro forma net debt to trailing twelve months adjusted EBITDA of 4.4x

Transaction structure preserves tax attributes, subject to applicable §382 limitation

Leadership Team

Bill Weber (KeyW CEO) and Mike Alber (KeyW CFO) to remain CEO and CFO,

respectively, of combined company

Key leadership personnel from Sotera will remain in place following the acquisition

6

Defense Intelligence

Counterterrorism

Other Fed. / Comm.

National

Intelligence

17%

FBI CT

28%

DHS CT

2%

DoD Intel

31%

DoD S&T

18%

Other Federal &

Commercial

4%

Sotera: Overview

A pure-play provider of innovative technology systems, solutions and services

for critical U.S. national security missions

Overview Core Competencies & Capabilities

Sotera delivers systems, solutions and services to the

Intelligence Community, Department of Defense,

Department of Homeland Security and federal law

enforcement agencies

− Key customers include FBI and DoD intelligence

agencies

− 1,100 employees, with ~80% of direct employees with

TS or greater clearance levels

− 79% of revenues derived from prime contracts

− 50% Cost Plus / 45% T&M and Fixed Price

Segment Overview Revenue Mix by End-Customer

Analytics / Visualization

Agile Development

Cyber Security

Internet of Things

Cloud Computing

Big Data

Machine Learning /

Artificial Intelligence

National Intelligence National

Intelligence

Defense

Intelligence

Advanced Programs

& Technologies

Counterterrorism

Watchlisting

Agile Software

Development

Classified

Networks

Next Generation

IT Solutions

Cloud Migration

Scientific Services

Life-Cycle

Software Support

Secure IT /

Communications

Networks

Systems

Integration

Cyber Solutions

Big Data Analytics

& Fusion

Cloud

Engineering

Agile Lifecycle

Engineering

7

Transaction Rationale: Strategic

Adds New and Complementary Capabilities

Adds Significant Scale, Creating Unique, IC-focused Provider

Provides Access to Large Portfolio of Prime Contracts and IDIQ Vehicles

Provides New and Enhanced Access to Agencies within the IC

8

Provides New and Enhanced Access to Target

Agencies within the IC

Sotera Customers Increased Access to the IC

FBI

NAVY

ARMY

USMC

NSA

USASAC

DISA

ARCYBER

DARPA

DIA

25%

60%

9

Adds Significant Scale, Creating Unique, IC-

focused Provider

The acquisition of Sotera creates a pure-play, IC-focused

services provider of scale

– ~2,100 skilled employees, of which ~80% will have Top

Secret or greater clearance

Scale provides a more competitive cost model to drive

additional growth

Sotera also provides greater access to traditional

Department of Defense intelligence customers

– Creates opportunity to cross-sell KeyW’s solutions to

additional IC customers

Combined Company Pro Forma FY2017 Revenue Overview

IC

87%

DoD &

Other

13%

IC

78%

DoD &

Other

22%

IC

83%

DoD &

Other

17%

$310 (1)

$225

$535

(1) Represents midpoint of FY2017 KeyW revenue guidance.

($ in millions)

10

Adds New and Complementary Capabilities

Agile Development

Designs, develops, documents, tests, integrates and implements custom software modules and solutions focused on C4ISR

and intelligence-related applications

Services range from firmware development for weapons systems to web-based portal development for network operations

centers

Cloud Computing

Provides leading edge cloud architecture and software engineering solutions to the IC / DoD

Combines cloud capabilities with data fusion and visual analytics to create new capabilities for intelligence analysis

Big Data

Offers tools which provide multiple data science analytical capabilities including: distributed graph analytics, aggregate

micro-paths, social media analysis and community tracking

Analytics /

Visualization

Delivers data analytics, cyber and visualization solutions for IC and DoD Tactical ISR mission systems operating in a cloud

computing environment

Analytic capabilities include all-source analysis, watchlisting, targeting and DOMEX utilizing community standard messing

handling, data visualization and collaboration tools

Machine Learning /

Artificial Intelligence

Design deep learning (Neural Network)

Develop Learning Models (Supervised, Semi-Supervised, Unsupervised)

Correlation, Discovery, Pattern of Life

Internet of Things

(“IoT”)

Exploration of IoT data for information discovery

Modeling IoT data for Extract Transform and Load

Developing predictive analytics for IoT challenge problems

Cyber Security

Supports cyber signals intelligence and cyber warfare priorities by leveraging systems engineering, network architecture,

software development, intelligence analysis and IT security capabilities to defend or exploit vital information

Protects against threats including bot net attacks, network infiltration and attacker reconnaissance

11

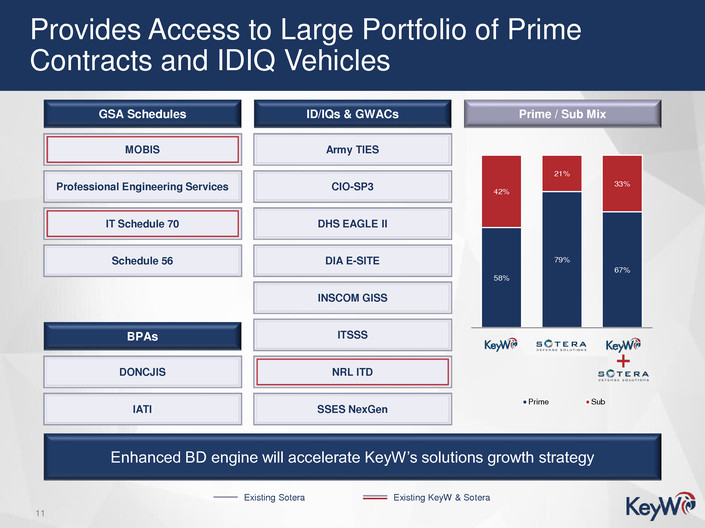

Provides Access to Large Portfolio of Prime

Contracts and IDIQ Vehicles

Enhanced BD engine will accelerate KeyW’s solutions growth strategy

GSA Schedules ID/IQs & GWACs Prime / Sub Mix

GSA Schedules Professional Engineering Services

GSA Schedules MOBIS

GSA Schedules IT Schedule 70

GSA Schedules Schedule 56

Existing Sotera Existing KeyW & Sotera

GSA Schedules INSCOM GISS

GSA Schedules CIO-SP3

GSA Schedules SSE NexGen

GSA Schedules NRL ITD

GSA Schedules Army TIES

GSA Schedules ITSSS

GSA Schedules DHS EAGLE II

58%

79%

67%

42%

21%

33%

Prime Sub

BPAs

GSA Schedules DONCJIS

GSA Schedules IATI

GSA Schedules DIA E-SITE

12

Only public pure-play provider to the Intelligence Community and its mission

High-end portfolio of products and services in support of the most difficult and

complex national security and counterterrorism missions

Proprietary and highly-engineered solutions to address a larger segment of the

Intelligence Community

13

Highly-Achievable

Cost Synergies

$3.5 million of synergies expected to be realized in the 2nd half of 2017

Total expected long-term synergies of $7 – $10 million

Transaction Rationale: Financial

Enhanced Cash Flow

Profile

Projected cash flow profile of the combined business enables rapid deleveraging: ~$43

million of pro forma 2017 operating cash flow

Tax attributes of an expected $46 million at NPV increase net cash flow through reduction

of cash tax expense

Accretive to Earnings

per Share (EPS)

Expect immediate accretion to EPS (GAAP excluding transaction expenses and before

amortization of acquired intangibles) in FY2017

Expect significant accretion to EPS (both GAAP and before amortization of acquired

intangibles) in FY2018

Creates IC-Focused

Company of Scale

Combined pro forma 2017 revenues of $535 million

Combined pro forma 2017 adjusted EBITDA of $62 million

Maintains long-term adjusted EBITDA margin profile of 10+%

Further diversifies contract base

14

Capitalization and Leverage

Commentary Pro Forma Capitalization Table

The acquisition of Sotera is expected to

be funded through existing balance sheet

cash and a new $135 million 5-year Term

Loan

Committed financing in place

Provides a well-balanced capital structure

with flexibility for continued capital

deployment and debt repayment

Attractive interest rates and acquired tax

assets expected to provide strong and

stable cash flow

Amount (1) Leverage (2)

Cash $10.0

New Term Loan 135.0

Existing Debt 149.5

Total Net Debt $274.5 4.4x

(1) PF as of Dec-31-2016.

(2) Based on ~$62 million of Adj. EBITDA.

($ in millions)

15

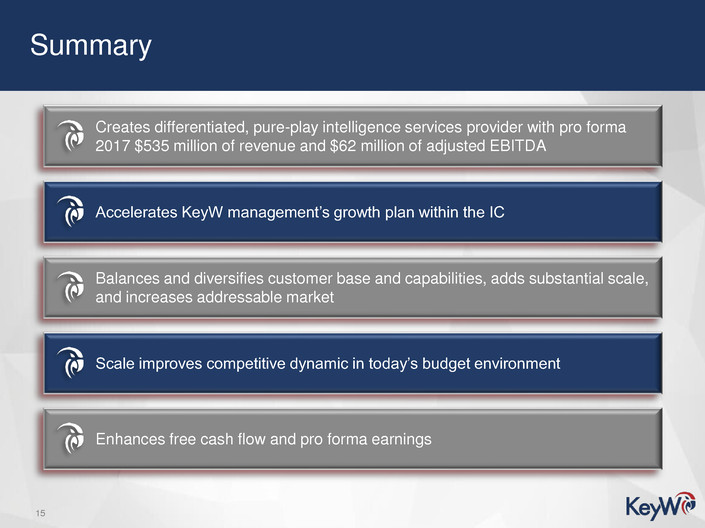

Summary

Creates differentiated, pure-play intelligence services provider with pro forma

2017 $535 million of revenue and $62 million of adjusted EBITDA

Accelerates KeyW management’s growth plan within the IC

Balances and diversifies customer base and capabilities, adds substantial scale,

and increases addressable market

Scale improves competitive dynamic in today’s budget environment

Enhances free cash flow and pro forma earnings