Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - HOOPER HOLMES INC | ex992pressrelease.htm |

| EX-10.1 - EXHIBIT 10.1 - HOOPER HOLMES INC | ex101securitiespurchaseagr.htm |

| EX-4.1 - EXHIBIT 4.1 - HOOPER HOLMES INC | ex41warrant.htm |

| EX-2.1 - EXHIBIT 2.1 - HOOPER HOLMES INC | ex21hhmergeragreement.htm |

| 8-K - 8-K - HOOPER HOLMES INC | hhform8-kremergerand2017pr.htm |

(NYSE Mkt: HH)

Hooper Holmes and Provant to Merge

Combination to Benefit Shareholders, Customers, and Wellness Industry

March 8, 2017

Safe Harbor

2

Special Note Regarding Forward-Looking Statements

This presentation contains forward-looking statements, as such term is defined in the Private Securities Litigation Reform Act of 1995,

concerning the Company’s plans, objectives, goals, strategies, future events or performances, which are not statements of historical

fact and can be identified by words such as: “expect,” “continue,” “should,” “may,” “will,” “project,” “anticipate,” “believe,” “plan,”

“goal,” and similar references to future periods. The forward-looking statements contained in this presentation reflect our current

beliefs and expectations. Actual results or performance may differ materially from what is expressed in the forward looking statements.

Among the important factors that could cause actual results to differ materially from those expressed in, or implied by, the forward-

looking statements contained in this presentation are our ability to realize the expected benefits from the acquisition of Accountable

Health Solutions and our strategic alliance with Clinical Reference Laboratory; our ability to close the merger transaction with Provant

Health Solutions and to realize the expected synergies and other benefits from the merger; our ability to successfully implement our

business strategy and integrate Accountable Health Solutions’ and Provant Health Solutions’ business with ours; our ability to retain

and grow our customer base; our ability to recognize operational efficiencies and reduce costs; uncertainty as to our working capital

requirements over the next 12 to 24 months; our ability to maintain compliance with the financial covenants contained in our credit

facilities; the rate of growth in the Health and Wellness market and such other factors as discussed in Part I, Item 1A, Risk Factors, and

Part II, Item 7, Management’s Discussion and Analysis of Financial Conditions and Results of Operations of our Annual Report on Form

10-K for the year ended December 31, 2015. The Company undertakes no obligation to update or release any revisions to these

forward-looking statements to reflect events or circumstances, or to reflect the occurrence of unanticipated events, after the date of

this presentation, except as required by law. This presentation contains information from third-party sources, including data from

studies conducted by others and market data and industry forecasts obtained from industry publications. Although the Company

believes that such information is reliable, the Company has not independently verified any of this information and the Company does

not guarantee the accuracy or completeness of this information. Any references to documents not included in the presentation itself

are qualified by the full text and content of those documents. During our prepared comments or responses to your questions, we may

offer incremental metrics to provide greater insight into the dynamics of our business or our quarterly results, such as references to

EBITDA, adjusted EBITDA and other measures of financial performance. Please be advised that this additional detail may be one-time

in nature and we may or may not provide an update in the future. These and other financial measures may also have been prepared on

a non-GAAP basis.

3

Creating one of the

largest pure-play

Health & Wellness

companies

Merger quickly enhances

financial model and increases

competitiveness

On-site screenings, risk

assessments, and immunizations

Technology platform capabilities

and coaching

Engagement and advanced data

management

4

Transaction Overview

› Merger of two leading health & well-being

companies

› Committed financing enhances capital position

to support integration and growth

› All-stock transaction increasing scale and

enhancing scope

› Expected transaction closing in 2Q 2017

Hooper Holmes to merge with Provant

› Combined pro-forma revenues of $67 million in 2016

› Annualized synergistic savings of $7+ million

› Transaction expected to be accretive to

adjusted EBITDA, projected to be $3 million

in last 9 months of 2017, once combined

› No overlap of existing customer base

› Increases to scale as a combined entity with

complementary strengths in both operations and

technology

› Significant operational synergies and improved

financial performance

Merger creates a compelling

financial model

› 3 directors from existing HH board

› 3 directors from Provant board

› 1 independent director

Support of Board of Directors

› Provant shareholders and existing HH shareholders

to contribute $3.5 million of additional capital on

an equal basis

Commitment from existing shareholders

5

Management Team

Henry Dubois Chief Executive Officer

› Track record of accelerating value creation through improved

business performance

› Extensive public company experience

Heather Provino Chief Strategy Officer

› Deep healthcare and well-being domain expertise

› Well-being industry thought leader with significant innovation

& product development experience

Mark Clermont President

› Experienced architect of high performance corporate cultures

› Proven leadership success with expertise in global growth,

operational integration and transformation

Steven Balthazor Chief Financial Officer

› Analytical expertise specializing in complex integrations

› Significant executive-level financial, operational and consulting

experience

Shared culture

to drive growth

through

improving

participants’

health.

Combining Management Strengths

Combines strategic, operational and financial expertise

6

Provant Overview

Founded in 2001,

Provant improves the

health, well-being, and

productivity of

employees while

helping employers make

healthcare affordable.

Scale

› 4,400 active providers and health coaches

› Over 13,000 available health professionals in

network

› 6,700 event locations served in 2016

› Serves 10% of Fortune 100, including 3 in

Fortune 50

Services

› Biometric Screenings, Health Assessments, &

Vaccinations

› Well-Being Platform & Advanced Data Management

› Health Coaching & Advocacy

› Additional Consulting & Custom Communications

7

A New Comprehensive, Pure-Play Wellness Leader

Value and Growth Drivers

Biometric screenings,

complex blood analysis

Health coaching &

condition management

Well-being portal,

personalized nutrition, sleep,

finance, trackers, challenges

Advanced data

management, analysis,

reporting

› Innovation capabilities – Driving

evidence-based, actionable

screenings and digital interventions

› Scale – Large portfolio of clinical

screenings and next-generation

digital technologies

› Growth in adjacent sales

opportunities – Tools and resources

to take advantage of potential sales

opportunities across customer

categories

› Leverage client and channel

relationships – Complementary

sales channels and revenue sources

Combination of Hooper Holmes

and Provant will create a

wellness leader across four

high growth segments:

› Biometric screenings

› Flu vaccinations

› Client management

› Member platform

› Advanced data

management

› Health coaching

› Implementation

management

› Data & reporting, plus

other ancillary services

› Call center / Customer

service

8

Accelerate Strategy

On-site,

face-to-face

employee

engagement

Remote, ongoing

employee

engagement

Deep expertise as a pure-play, comprehensive well-being service provider

› Strategic expertise

› Highly flexible and configurable solutions

› Fully integrated well-being capabilities

Meaningful scale with a network of thousands of health professionals across the

country servicing tens of thousands of participants at more than 3,000 end-clients

Enabled by proprietary technology and tech-enabled high-touch services that expand

customer value proposition and increase margins

› Well-being platform

› Advanced data

management

› Integrated data analytics

› Personalized interventions

› Telephonic and digital

therapeutics

› Remote screening and flu

vaccinations network

› Aggregated best-in-class

partners

National Service Delivery

Complementary Core Competencies

Proprietary Technology

9

Value Creation for Shareholders

Merger

Expected to be

Accretive to

Adjusted

EBITDA in Year 1

Delivers advanced and scalable data hub technology

Diversifies sales channels

Expands management team

Infrastructure to Accelerate Growth

Improves cost structure with shift towards higher

margin, recurring revenue mix (e.g., Portal & Coaching)

Increases scale to provide operating leverage

Enhances innovation and speed to market

Road Map to Profitability

10

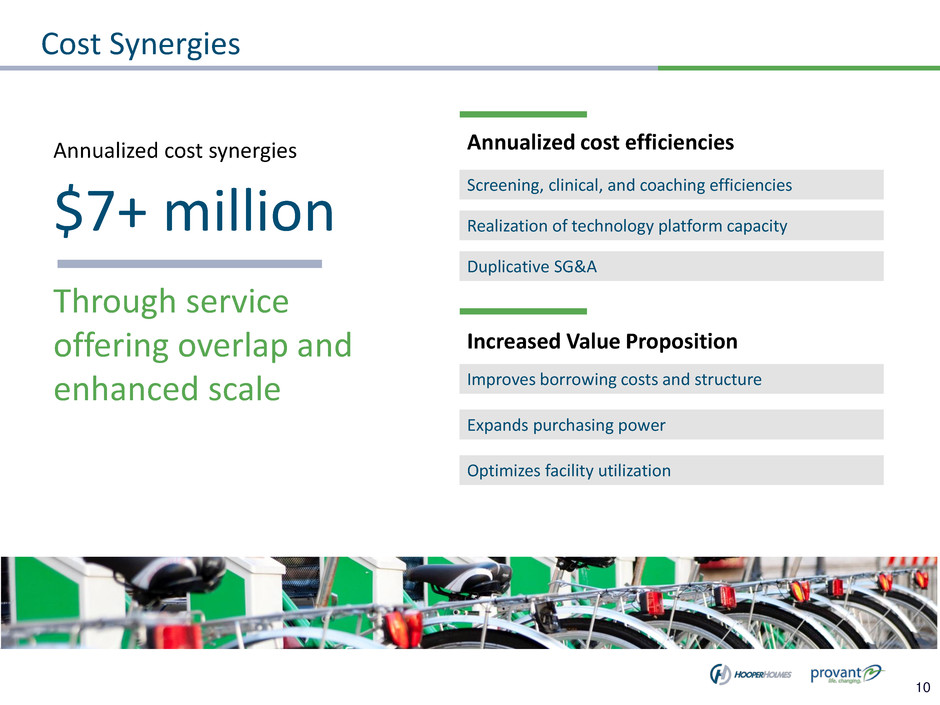

Cost Synergies

Annualized cost synergies

$7+ million

Through service

offering overlap and

enhanced scale

Duplicative SG&A

Screening, clinical, and coaching efficiencies

Realization of technology platform capacity

Annualized cost efficiencies

Improves borrowing costs and structure

Expands purchasing power

Increased Value Proposition

Optimizes facility utilization

11

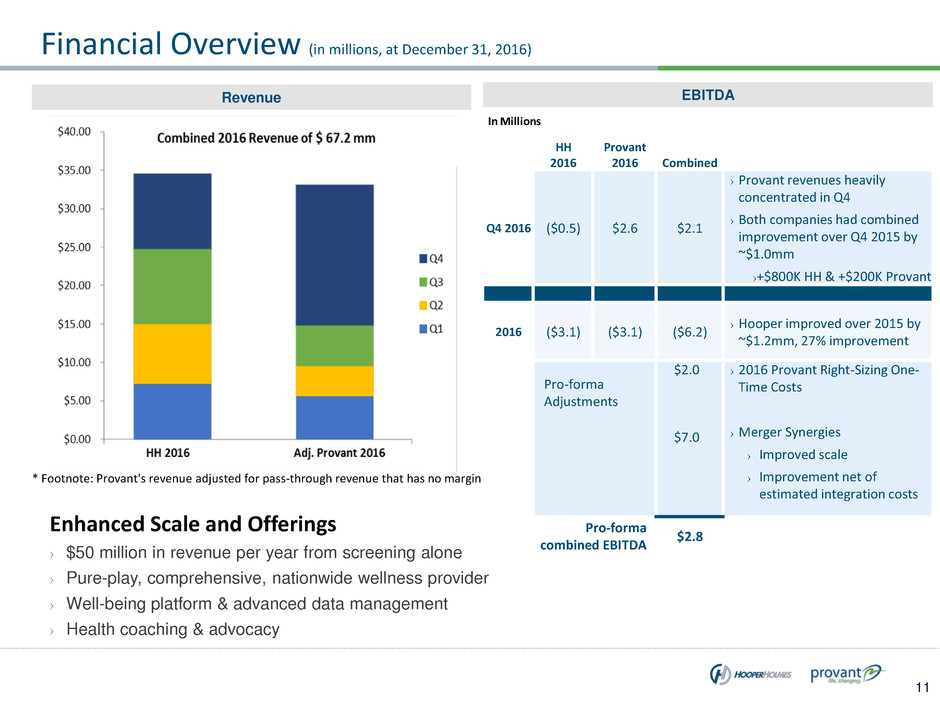

Financial Overview (in millions, at December 31, 2016)

Revenue

Enhanced Scale and Offerings

› $50 million in revenue per year from screening alone

› Pure-play, comprehensive, nationwide wellness provider

› Well-being platform & advanced data management

› Health coaching & advocacy

EBITDA

In Millions

HH

2016

Provant

2016 Combined

Q4 2016 ($0.5) $2.6 $2.1

› Provant revenues heavily

concentrated in Q4

› Both companies had combined

improvement over Q4 2015 by

~$1.0mm

›+$800K HH & +$200K Provant

2016 ($3.1) ($3.1) ($6.2)

› Hooper improved over 2015 by

~$1.2mm, 27% improvement

Pro-forma

Adjustments

$2.0

$7.0

› 2016 Provant Right-Sizing One-

Time Costs

› Merger Synergies

› Improved scale

› Improvement net of

estimated integration costs

Pro-forma

combined EBITDA

$2.8

* Footnote: Provant's revenue adjusted for pass-through revenue that has no margin

12

Commitment to Customers

Combined company will have

335 customers

serving over 3,000

organizations

Includes channel partners,

direct customers, and clinical

research organizations.

Overview: Provide white label support services

Services: Screenings, Flu Shots & Data Management

Customers: Health Plans & Wellness Providers

Channel Partners

Overview: Comprehensive Well-Being Programs

Services: Screenings, Coaching, Technology & Data

Customers: Fortune 100 including 3 Fortune 50

Direct Customers

Clinical Research Organizations

Overview: Sample & Data Collection

Customers: University of Michigan & NIH PATH

Services: Screenings & Sample and Data Collection

13

$7.4 Billion Addressable Market

Source: IBIS 2016 Corporate Wellness Services Industry Report

2016 TAM: $7.4bn

› Total Addressable Market is expected to grow 27% in coaching services and when paired with technology

platform growth expected growth at 11% and with screenings and immunizations at expected growth 8%

› A combined organization of Hooper Holmes and Provant results in one of the largest pure-play well-being

providers, which can capture an outsized share of this growing market by selling additional high-tech portal

and coaching/disease management solutions on top of their existing screening footprint

40%

Large private sector

businesses

20%

Mid-size private sector businesses

17%

Public sector

13%

Small private sector

businesses

10%

Nonprofit organizations

TAM

Screenings and HRAs $1.09

Nutrition & Weight

Management

$1.12

Smoking Cessation $1.09

Fitness Services $1.02

Immunizations $0.98

Alcohol and Drug Abuse $0.74

Stress Management $0.73

Health Education $0.51

Other $0.08

$7.35

14

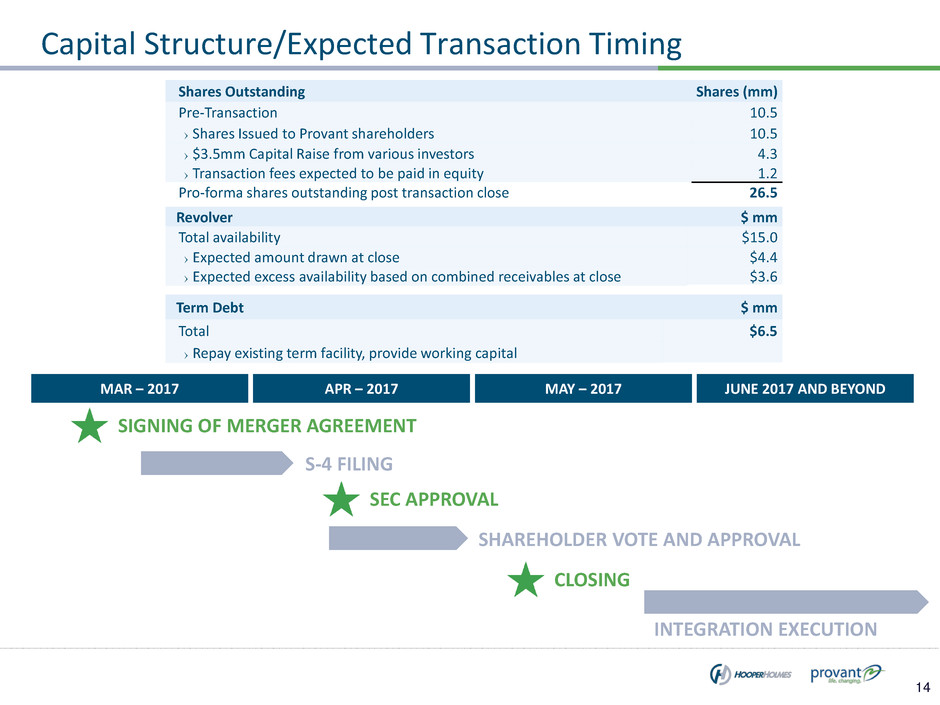

Capital Structure/Expected Transaction Timing

Shares Outstanding Shares (mm)

Pre-Transaction 10.5

› Shares Issued to Provant shareholders 10.5

› $3.5mm Capital Raise from various investors 4.3

› Transaction fees expected to be paid in equity 1.2

Pro-forma shares outstanding post transaction close 26.5

Revolver $ mm

Total availability $15.0

› Expected amount drawn at close $4.4

› Expected excess availability based on combined receivables at close $3.6

Term Debt $ mm

Total $6.5

› Repay existing term facility, provide working capital

SIGNING OF MERGER AGREEMENT

SEC APPROVAL

INTEGRATION EXECUTION

CLOSING

S-4 FILING

SHAREHOLDER VOTE AND APPROVAL

MAR – 2017 APR – 2017 MAY – 2017 JUNE 2017 AND BEYOND

15

Conclusion

› All-stock, accretive transaction increasing scale

› Expected to improve gross margins due to

combined revenues

› Expected to increase operational synergies;

decreases cost of goods sold

› Anticipated strong growth within business

verticals

› Anticipated $54 million in combined revenues in

last 3 quarters of 2017

› Targeting $5+ million of EBITDA and positive

net income in 2018

› Full spectrum of expertise combining

high-touch interventions, high-value technology

and comprehensive clinical services

› Greater personalization, enhanced member

experiences, increased engagement, and

improved outcomes

› Faster innovation

› Advanced technology platforms

› Expanded nationwide health professional network

Creating Shareholder Value Enhancing Direct & Channel Partner Value