Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Veritex Holdings, Inc. | a8k-sandlerwestcoastinvest.htm |

V E R I T E X

Sandler O’Neill + Partners, L.P.

West Coast Financial Services Conference

March 7, 2017

2

Safe Harbor Statement

ABOUT VERITEX HOLDINGS, INC.

Headquartered in Dallas, Texas, Veritex Holdings, Inc. (“VBTX”, “Veritex” or the “Company”) is a bank holding company that conducts banking activities

through its wholly-owned subsidiary, Veritex Community Bank, with locations throughout the Dallas metropolitan area. Veritex Community Bank is a

Texas state chartered bank regulated by the Texas Department of Banking and the Board of Governors of the Federal Reserve System. For more

information, visit www.veritexbank.com.

NO OFFER OR SOLICITATION

This communication does not constitute an offer to sell, a solicitation of an offer to sell, the solicitation or an offer to buy any securities or a solicitation

of any vote or approval. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirement of Section 10 of the Securities Act of 1933, as amended.

ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT

In connection with the proposed merger of Veritex and Sovereign Bancshares, Inc. (“Sovereign”) Veritex filed with the Securities and Exchange

Commission (the “SEC”) a registration statement on Form S-4 that includes a joint proxy statement of Veritex and Sovereign and a prospectus of Veritex,

and will file other relevant documents concerning the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE

REGISTRATION STATEMENT ON FORM S-4, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, THE JOINT PROXY

STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH

THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VERITEX, SOVEREIGN AND

THE PROPOSED MERGER. The joint proxy statement/prospectus has or will be sent to the shareholders of each institution seeking the required

shareholder approvals. Investors and security holders may obtain free copies of the registration statement on Form S-4 and the related joint proxy

statement/prospectus, as well as other documents filed with the SEC by Veritex through the web site maintained by the SEC at www.sec.gov. Documents

filed with the SEC by Veritex will also be available free of charge by directing a written request to Veritex Holdings, Inc., 8214 Westchester Drive, Suite

400, Dallas, Texas 75225 Attn: Investor Relations. Veritex’s telephone number is (972) 349-6200.

NON-GAAP FINANCIAL MEASURES

Veritex reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that

certain non-GAAP performance measures used in managing the business may provide meaningful information about underlying trends in its business.

Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Veritex’s reported results prepared in accordance with

GAAP. Please see Reconciliation of Non-GAAP Measures at the end of this presentation for a reconciliation to the nearest GAAP financial measure.

PARTICIPANTS IN THE TRANSACTION

Veritex, Sovereign and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from

the respective shareholders of Veritex and Sovereign in connection with the proposed transaction. Certain information regarding the interests of these

participants and a description of their direct and indirect interests, by security holdings or otherwise, are included in the joint proxy

statement/prospectus regarding the proposed transaction. Additional information about Veritex and its directors and officers may be found in the

definitive proxy statement of Veritex relating to its 2016 Annual Meeting of Stockholders filed with the SEC on April 7, 2016. The definitive proxy

statement can be obtained free of charge from the sources described above.

3

Forward Looking Statements

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This release may contain certain forward-looking statements

within the meaning of the securities laws that are based on various facts and derived utilizing important assumptions, current expectations, estimates

and projections about Veritex and its subsidiaries. Forward-looking statements include information regarding Veritex’s future financial performance,

business and growth strategy, projected plans and objectives, and related transactions, integration of the acquired businesses, ability to recognize

anticipated operational efficiencies, and other projections based on macroeconomic and industry trends, which are inherently unreliable due to the

multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include

the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as

“will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking statements

include the foregoing. Further, certain factors that could affect Veritex’s future results and cause actual results to differ materially from those expressed

in the forward-looking statements include, but are not limited to whether Veritex can: successfully implement its growth strategy, including identifying

acquisition targets and consummating suitable acquisitions; continue to sustain internal growth rate; provide competitive products and services that

appeal to its customers and target market; continue to have access to debt and equity capital markets; and achieve its performance goals. For discussion

of these and other risks that may cause actual results to differ from expectations, please refer to “Special Cautionary Notice Regarding Forward-Looking

Statements” and “Item 1A. Risk Factors” in Veritex’s Annual Report on Form 10-K filed with the SEC on March 15, 2016 and any updates to those risk

factors set forth in Veritex’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other

risks or uncertainties materialize, or if Veritex’s underlying assumptions prove to be incorrect, actual results may differ materially from what Veritex

anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of

the date on which it is made, and Veritex does not undertake any obligation to publicly update or review any forward-looking statement, whether as a

result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for us to predict

those events or how they may affect us. In addition, Veritex cannot assess the impact of each factor on Veritex’s business or the extent to which any

factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-

looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This

cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Veritex or persons

acting on Veritex’s behalf may issue. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts

and may not reflect actual results.

4

Headquartered in Dallas, Texas

Established in 2010

Twelve locations within one of the fastest

growing metropolitan areas in the U.S.

Strong core deposit mix and commercial

lending focus

Significant organic growth profile

complemented by disciplined M&A

Franchise FootprintOverview

Veritex – “Truth in Texas Banking”

Financial Highlights

Source: SNL Financial and Company documents; financial data as of 12/31/16.

VBTX (11)

(Dollars in Millions)

Total Assets $ 1,408

Tangible Common Equity $ 210

ROAA (MRQ) 0.97%

NPAs/ Assets 0.17%

VBTX (12)

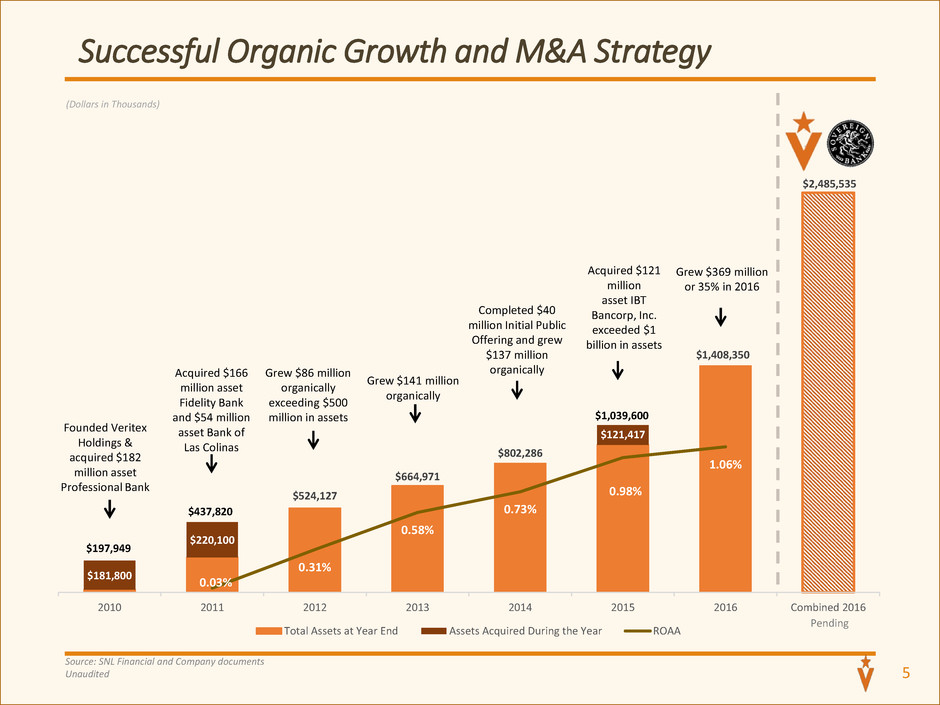

Successful Organic Growth and M&A Strategy

Source: SNL Financial and Company documents

Unaudited 5

$524,127

$664,971

$802,286

$1,408,350

$2,485,535

$181,800

$220,100

$121,417

0.03%

0.31%

0.58%

0.73%

0.98%

1.06%

2010 2011 2012 2013 2014 2015 2016 Combined 2016

Total Assets at Year End Assets Acquired During the Year ROAA

$197,949

$437,820

$1,039,600

(Dollars in Thousands)

Pending

Completed $40

million Initial Public

Offering and grew

$137 million

organically

Founded Veritex

Holdings &

acquired $182

million asset

Professional Bank

Acquired $166

million asset

Fidelity Bank

and $54 million

asset Bank of

Las Colinas

Grew $86 million

organically

exceeding $500

million in assets

Grew $141 million

organically

Acquired $121

million

asset IBT

Bancorp, Inc.

exceeded $1

billion in assets

Grew $369 million

or 35% in 2016

6

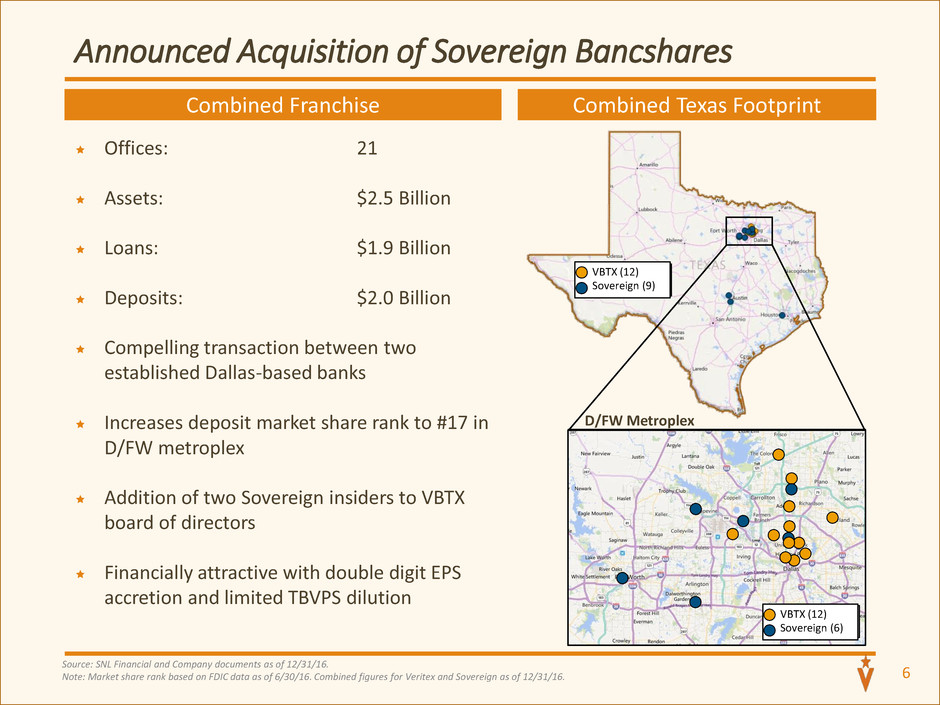

Combined Texas Footprint

Announced Acquisition of Sovereign Bancshares

VBTX (11)

Sovereign (10)

D/FW Metroplex

VBTX (11)

Sovereign (7)

Source: SNL Financial and Company documents as of 12/31/16.

Note: Market share rank based on FDIC data as of 6/30/16. Combined figures for Veritex and Sovereign as of 12/31/16.

Combined Franchise

Offices: 21

Assets: $2.5 Billion

Loans: $1.9 Billion

Deposits: $2.0 Billion

Compelling transaction between two

established Dallas-based banks

Increases deposit market share rank to #17 in

D/FW metroplex

Addition of two Sovereign insiders to VBTX

board of directors

Financially attractive with double digit EPS

accretion and limited TBVPS dilution

VBTX (12)

Sovereign (9)

VBTX (12)

Sovereign (6)

7

Transaction Impact

Strategic

Rationale

Attractive

Financial

Returns(b)

Capital

Impact

Strengthens presence in Dallas with meaningful expansion into other key areas

of the D/FW metroplex, including Fort Worth

Expansion into Austin ($69 million loans; $100 million deposits) and Houston

($168 million loans; $72 million deposits)

Significantly enhances VBTX liquidity and institutional ownership

Note: Reconciliation of the non-GAAP financial measure tangible common equity to tangible assets (TCE / TA) can be found at the end of the presentation.

(a) Reported as of 09/30/2016 prior to equity raise in December 2016.

(b) Assumes transaction closes in 2Q17. Assumes impact of proposed merger, equity raise, and SBLF redemption.

EPS accretion in the first twelve months of ~11% with partial realization of

anticipated expense savings

EPS accretion in the second twelve months of ~13% with full realization of

expense savings

TBVPS accretion of ~11%, inclusive of all estimated one-time deal related

charges

As Reported (a) Pro Forma (b)

TCE / TA 9.1% 9.6%

Leverage Ratio 9.8% 10.6%

Total RBC Ratio 13.4% 12.5%

$116.8

$80.7

9/30/15 9/30/16

8

Thorough Due Diligence & Credit Review Process

Combined Loans (9/30/16)

Credit review conducted by highly experienced third party team

alongside Veritex

Reviewed 85% of total loan portfolio

Reviewed 99% of energy loans

Last twelve months cumulative energy charge offs of $917 thousand

Out of 31 energy credits:

11 are classified, representing 29% of energy loans

15 are criticized, representing 52% of energy loans

Energy specific credit marks represent over 9% of total energy loans

Total credit mark represents approximately 3% of total loans

Reduction in Energy Exposure

(31%)

Last Twelve Months

Source: SNL Financial and Company documents as of 9/30/16.

Note: Total loans excludes loans HFS. Combined loans for Veritex and Sovereign as of 9/30/16.

C&I

26.5% Energy

4.5%

CRE - OO

14.3%

CRE - NOO

25.6%

C&D

16.5%

1-4 Family

8.7%

Other

3.9%

Midstream

Services

$56.1

69.5%

$11.7

14.5%

$12.9

16.0%

E&P

Experienced Leadership

9

Executive Management

C. Malcolm Holland, III

Chairman of the Board,

Chief Executive Officer

35 years of banking experience, all in the Dallas metropolitan area

Former CEO of Texas region for Colonial Bank, which grew from $625 million to

$1.6 billion

Former President of First Mercantile Bank

William C. Murphy

Vice Chairman

45 years of banking experience

Former Chairman or CEO of several Dallas community banks

Has led 25 financial institution transactions

Noreen E. Skelly

Chief Financial Officer

30 years of banking experience

Former CFO of Highlands Bancshares, Inc.

Former SVP and Retail line of business chief finance officer for Comerica and

LaSalle Banks

Jeff Kesler

Chief Lending Officer

16 years of banking experience

Former president of Dallas and Austin markets for Colonial Bank

Clay Riebe

Chief Credit Officer

30 years of banking experience

Former Chief Lending Officer of American Momentum Bank

Former market president of Citibank’s Bryan/College Station markets

LaVonda Renfro

Chief Retail Officer

32 years of banking experience

Former Retail Executive of Colonial Bank/BB&T

Former Senior Vice President, District Manager for Bank of America’s Austin

and San Antonio markets

Angela Harper

Chief Risk Officer

25 years of banking experience

Former Senior Vice President, Credit Administration Officer and Risk

Management Officer for the Texas Region of Colonial Bank

Commitment to Delivering Shareholder Value

Source: SNL Financial and Company documents; information as of and for the year ended unless otherwise noted.

Note: Reconciliation of the non-GAAP financial measure tangible book value per share can be found at the end of the presentation.

Loans & Deposits

10

Tangible Book Value per Share

Return on Average Assets Efficiency Ratio

(Dollars in Millions, Except Per Share)

0.03%

0.31%

0.58%

0.75%

0.98%

1.06%

2011 2012 2013 2014 2015 2016

92.2%

78.0%

69.8%

66.5%

60.8%

55.5%

2011 2012 2013 2014 2015 2016

$298

$398

$495

$603

$821

$992

$365

$448

$574

$639

$868

$1,120

2011 2012 2013 2014 2015 2016

Total Loans Total Deposits

$5.28 $5.77

$6.46

$8.96

$9.59

$13.81

2011 2012 2013 2014 2015 2016

Veritex Plan for 2017

11

Focus on seamless integration of the Sovereign acquisition

Maintain strong underwriting standards and excellent credit quality

Continue strong pace of organic growth in loans and EPS

Add experienced bankers to enhance our growth profile

Seek accretive acquisitions that strengthen our presence in new and

existing markets

We are committed to the significant ongoing expansion of Veritex and

expect the robust pace of our growth and momentum to continue

12

Reconciliation of Non-GAAP Measures

The Company’s management uses certain non-GAAP (generally accepted accounting principles) financial measures to

evaluate its performance including tangible book value per common share and tangible common equity to tangible assets.

The Company has included in this presentation information related to these non-GAAP financial measures for the applicable

periods presented. Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial

measures are presented in the table below.

(Dollars in Thousands, Except Per Share)

Source: Company documents.

2011 2012 2013 2014 2015 2016

Total Stockholders' Equity 58,676$ 61,860$ 66,239$ 113,312$ 132,046$ 238,888$

Preferred Stock (8,000) (8,000) (8,000) (8,000) - -

Common Equity 50,676 53,860 58,239 105,312 132,046 238,888

Goodwill (19,148) (19,148) (19,148) (19,148) (26,865) (26,865)

Intangible Assets (2,183) (1,875) (1,567) (1,261) (2,410) (2,181)

Tangible Common Equity 29,345 32,837 37,524 84,903 102,771 209,842

Common Shares Outstanding 5,554 5,694 5,805 9,471 10,712 15,195

Tangible Book Value per Share 5.28$ 5.77$ 6.46$ 8.96$ 9.59$ 13.81$

Total Assets 437,820$ 524,127$ 664,971$ 802,286$ 1,039,600$ 1,408,350$

G odwill (19,148) (19,148) (19,148) (19,148) (26,865) (26,865)

Intangible Assets (2,183) (1,875) (1,567) (1,261) (2,410) (2,181)

Tangible Assets 416,489 503,104 644,256 781,877 1,010,325 1,379,304

Tangible Common Equity 29,345 32,837 37,524 84,903 102,771 209,842

TCE / TA 7.0% 6.5% 5.8% 10.9% 10.2% 15.2%

As of December 31,

13