Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED INSURANCE HOLDINGS CORP. | form8-kq12017investorprese.htm |

United Insurance Holdings Corp.

NASDAQ: UIHC

Investor Presentation March 2017

“Moving Forward”

2 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Executive Summary

• Our strategy is intact

• Execution of organic growth and geographic

diversification has exceeded plans

• Business outside Florida is growing and profitable

• Over 60% of exposure and 85% of new business is

outside Florida

• All non-Florida regions were solidly profitable in 2016

• AOB exposure is confined, small, and shrinking

• Miami/Dade and Broward counties represent only ~5% of

the Company’s total PIF

• Nonrenewals, cessation of new business, and no planned

takeouts will accelerate shrinkage of this exposure

• Pending American Coastal merger will…….

• increase scale, reduce earnings volatility, improve

returns, provide additional resiliency, and open up new

growth opportunities

MARCH 2017 INVESTOR PRESENTATION

OUR STRATEGY IS INTACT

4 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Company Evolution

Merger with

American Coastal

creates a leading

specialty cat

underwriter in

both personal and

commercial

property

Added 3 new

Directors with

extensive

insurance

experience

Rollout of

additional property

products in

existing states

Continue

diversification of

exposure by peril

and geography

Phase 4

(2017-Forward)

Reconstituted

original Board of

Directors and

revamped

Executive Team

Public offering of

common stock &

became listed on

NASDAQ

Diversified outside

FL into 11 new

states

Strong organic

growth

complemented by

two strategic

acquisitions

Phase 3

(2012-2016)

Became a public

company

Legislative and

regulatory

changes

temporarily slow

growth and

profitability

Avoided Sinkhole

crisis through

disciplined

underwriting

Phase 2

(2008-2011)

Begin operations

in Florida with

$5.5m of capital

Maintained

profitability every

year despite 8

hurricanes in

2004-05

Phase 1

(1999-2007)

VISION: To be the premier provider of property

insurance in catastrophe-exposed areas

5 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

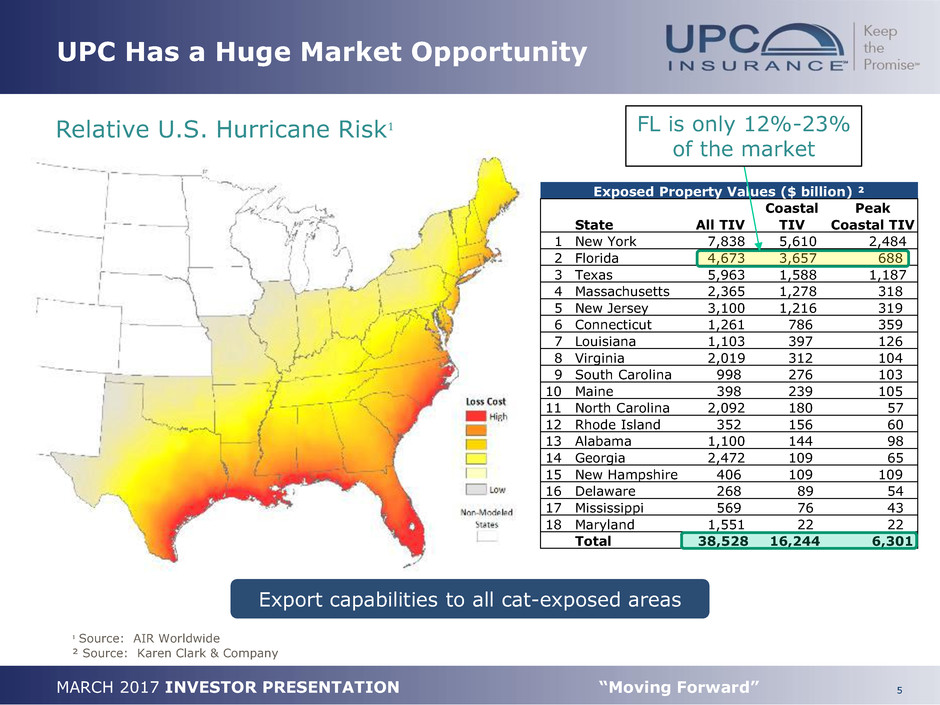

UPC Has a Huge Market Opportunity

Relative U.S. Hurricane Risk¹

¹ Source: AIR Worldwide

² Source: Karen Clark & Company

Export capabilities to all cat-exposed areas

Exposed Property Values ($ billion) ²

Coastal Peak

State All TIV TIV Coastal TIV

1 New York 7,838 5,610 2,484

2 Florida 4,673 3,657 688

3 Texas 5,963 1,588 1,187

4 Massachusetts 2,365 1,278 318

5 New Jersey 3,100 1,216 319

6 Connecticut 1,261 786 359

7 Louisiana 1,103 397 126

8 Virginia 2,019 312 104

9 South Carolina 998 276 103

10 Maine 398 239 105

11 North Carolina 2,092 180 57

12 Rhode Island 352 156 60

13 Alabama 1,100 144 98

14 Georgia 2,472 109 65

15 New Hampshire 406 109 109

16 Delaware 268 89 54

17 Mississippi 569 76 43

18 Maryland 1,551 22 22

Total 38,528 16,244 6,301

FL is only 12%-23%

of the market

6 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

UPC is Achieving Growth and

Geographic Diversification

Policies in-force at

12/31/2016

Policies in-force at

12/31/2015

Total PIF: 347,015

Total PIF: 451,155

Y/Y PIF growth

+30%

7 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Property Exposure is Well Balanced

Total Insured Value

12/31/2016

Total Insured Value

12/31/2015

TIV = $159.6B

TIV = $214.1B

49%

22%

15%

14%

FL Northeast Southeast Gulf

37%

29%

15%

19%

FL Northeast Southeast Gulf

8 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Quality Growth Continues to

Exceed Expectations

Consistent, controlled and well managed growth over time…

$-

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

2012 2013 2014 2015 2016

Gross Premiums Earned - All States

CAGR = 31.0%

9 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

UPC’s Four Proven Pathways for Growth

Organic

Underwriting

Carrier

Partnerships

Policy/Portfolio

Assumption

Mergers &

Acquisitions

12,000 Appointed

Independent

Agencies & MGA’s

Nationally.

Highest

PIF of any

producer

Largest

producer

of new

business

UPC has executed

two accretive

acquisitions and the

pending American

Coastal merger holds

great promise

Completed 1st ever

assumption from

TWIA in Q4-16

UPC is building significant value for shareholders through multi-

faceted distribution

MARCH 2017 INVESTOR PRESENTATION

BUSINESS OUTSIDE FLORIDA IS

GROWING AND PROFITABLE

11 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Growth Outside Florida Has Been HUGE…

$-

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

2012 2013 2014 2015 2016

Gross Premiums Earned - Excluding FL

CAGR = 77.5%

12 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

…….. And Profitable…….

Numbers in thousands ($000) FL Gulf NE SE Total

Total Revenue $ 218,023 $ 116,389 $ 94,787 $ 58,018 $ 487,217

Total Expense $ 233,571 $ 95,129 $ 81,677 $ 69,837 $ 480,214

Income (loss) before tax $ (15,547) $ 21,260 $ 13,110 $ (11,819) $ 7,003

Hurricane Matthew $ (13,002) $ - $ - $ (16,998) $ (30,000)

EBIT X-Matthew (2,545) 21,260 13,110 5,179 37,003

UPC Had Underlying Profitability in Every Zone Outside of Florida

13 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

….. And Sticky

Strong Retention Supports UPC’s First Mover Advantage

2014 2015 2016

Retained At Renewal 90% 92% 92%

Retained Through Full Policy Term 81% 84% 85%

74%

76%

78%

80%

82%

84%

86%

88%

90%

92%

94%

2014 2015 2016

Retention Rates

Retained At Renewal Retained Through Full Policy Term

MARCH 2017 INVESTOR PRESENTATION

AOB EXPOSURE IS CONFINED,

SMALL, AND SHRINKING

15 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Perspective on Assignment of Benefits

• AOB is an industry problem impacting all property insurers in

Florida

• It is predominantly contained to water losses in Broward and

Miami-Dade counties (BMD)

• UPC had ~24,000 policies in BMD at 12/31/16 which is ~5% of

total policies in-force.

• UPC has stopped writing new business with very limited exceptions

in BMD, and is nonrenewing policies in accordance with regulatory

guidelines

• The Company has also adopted policy language changes that are

expected to curb loss costs

AOB is largely confined to a small

area of Florida that is a negligible

part of our overall risk portfolio

16 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

“Big 3” Operational Initiatives to Combat

AOB and Improve Overall Results

• Organizational redesign focused on reducing independent adjuster

utilization in favor of dedicated and highly trained UPC associates.

• Reducing the cycle time of the average claim through better

scoping, estimating and performance management

• Increased service level standards and vendor management

1. Claims Adjusting Capabilities

• Rate increase filed in Texas and will be filed in Florida Q1; other

states to come in Q2

• Coverage and rule changes designed to improve underwriting

results

2. Product Hygiene

• Focus on reduced claims cycle time and reserving to the ultimate

expected loss faster

• Improved file handling means fewer reopens

3. Control Development

MARCH 2017 INVESTOR PRESENTATION

FINANCIAL PERSPECTIVE

18 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

2016 Financial Highlights

36.2%

Revenue

Growth

2.4%

ROAE

89.0%

Underlying

Combined

Ratio ¹

Results for the year ended

December 31, 2016:

¹ “Underlying” results exclude losses incurred from catastrophes and prior year reserve development

Remained profitable despite $55.8 million of net catastrophe losses

2017 Goal: Earn >10% ROAE even with same level of CAT losses

19 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

How Have We Done Over the

Long-term? – Part 1

Year Ended

Key Metrics 12/31/2013 12/31/2014 12/31/2015 12/31/2016

Gross premium earned ($000) $ 316,708 $ 400,695 $ 504,215 $ 666,829

Net income ($000) $ 20,342 $ 41,013 $ 27,358 $ 5,698

EPS $ 1.26 $ 2.05 $ 1.28 $ 0.26

Combined ratio 87.7% 81.4% 94.0% 104.9%

ROAE 20.8% 27.2% 12.4% 2.4%

Net retained cat losses ($000) $ 5,666 $ 829 $ 28,565 $ 55,842

Net income ex-cat ($000) $ 23,690 $ 41,541 $ 46,027 $ 40,849

EPS ex-cat $ 1.46 $ 2.05 $ 2.14 $ 1.89

Underlying combined ratio ¹ 83.8% 82.6% 86.2% 89.0%

ROAE ex-cat 23.6% 22.3% 20.6% 17.4%

¹ Excludes catastrophe losses and prior year reserve development

Underlying results

represent the true

earnings power of

UPC Insurance over

the long-term

Property CAT is

inherently volatile

20 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Underwriting Profits Drive Returns

Core

Results

Driving

Returns

20.8% 27.2% 2.4% ROAE

2013 2014 2016

$28.6m &

$55.8M of

CAT loss in

2015 & 2016

-80,000

-60,000

-40,000

-20,000

0

20,000

40,000

60,000

80,000

2013 2014 2015 2016

Underwriting Gain Investment Income CAT Losses Reserve Development

12.4%

2015

5-Year (2012-2016)

Average ~13%

21 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Investments Avoid Asset Risk

• Designed to preserve capital, maximize

after-tax investment income & liquidity

while minimizing asset & interest rate risk

• As of December 31, 2016, 99.7% of the

Company’s fixed maturity portfolio

was rated investment grade

– Average duration: 3.7 years

– Composite rating: A

– Average coupon: 3.05%

All data as of December 31, 2016

Securities Portfolio

Value

($mm)

% of total

Cash and

Investments

Fixed Maturities $494.5 72.8%

Cash & Cash Equivalents 150.7 22.2%

Equity Securities 28.4 4.2%

Other Long-Term Investments 5.7 0.8%

Total cash and investments $679.3 100%

22.4%

24.9%

25.4%

4.3%

0.8%

22.2%

Government & Agency

Municipal Bonds

Corporate Bonds

Common & Preferred

Equity

Other long-term

investments

Cash & cash equivalents

-

10,000,000

20,000,000

30,000,000

40,000,000

50,000,000

60,000,000

70,000,000

80,000,000

90,000,000

100,000,000

FY'17 FY'18 FY'19 FY'20

Agencies Corporates CMOs Int Govt. Municipals US. Govt. Pfd. Stock

Fixed Income Maturities

Asset Allocation

22 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Expense Ratio History

• Net Expense Ratio still declining excluding non-recurring items in

2015 and 2016.

• Quota-share reinsurance will impact comparability in 2017 since

ceding commission income is classified as “Other Revenue”, not a

reduction to PAC on a GAAP basis.

37.2% 32.3% 30.2% 25.6% 24.8% 26.0% 25.7%

5.9%

5.7% 7.1%

4.7% 4.4% 4.6% 4.5%

11.2%

10.7% 9.6%

7.4% 7.6% 8.9% 9.4%

54.4%

48.6% 46.9%

37.7% 36.8%

39.5% 39.6%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

2010 2011 2012 2013 2014 2015 2016

Net Expense Ratio

Net PAC Ratio Net Operating Ratio Net Admin Ratio Net Expense Ratio

23 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

How Have We Done Over the

Long-term? – Part 2

Consistent

Dividend & Book

Value Growth

Strong

Performance

Relative to Indices

$-

$0.05

$0.10

$0.15

$0.20

$0.25

FY13 FY14 FY15 FY16

Common Stock Dividends Paid

$-

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

FY12 FY13 FY14 FY15 FY16

Book Value Per Share

2012 2013 2014 2015 2016

UIHC $198.68 $469.44 $737.16 $581.00 $514.06

Russell 2000 $108.38 $148.49 $153.73 $144.95 $173.18

NASDAQ Insr Index (KIX) $117.01 $150.69 $163.56 $174.12 $207.78

S&P Insr EFT (KIE) $106.07 $154.18 $165.93 $175.78 $213.36

$-

$100.00

$200.00

$300.00

$400.00

$500.00

$600.00

$700.00

$800.00

Cumulative Value of $100 Investment from 1/1/12 to 12/31/16

MARCH 2017 INVESTOR PRESENTATION

PENDING MERGER WITH AMERICAN

COASTAL PROMISES HUGE BENEFITS

25 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Merger Partner Brings Long Track Record

of Strong Underwriting Results

American Coastal is the largest writer of commercial residential insurance in Florida

•Attractive commercial property platform for expansion and diversification

•Superior underwriting and proven track record

5-year average combined ratio of 63%

5-year average ROE of 21%

5-year cumulative net earnings of $190mm

•Highest market share of private players in Florida Commercial Residential with 30%

•Long standing service to the Florida market and 15+ years since inception of AmRisc

•Exclusively short-tail property business with MINIMAL AOB EXPOSURE.

•Sophisticated multi-model underwriting approach

•Data capture is best in the industry

•100% Voluntary / No takeout business

•Strong relationship / growth opportunity with BB&T (AmRisc/CRC/BB&T/McGriff)

26 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

New Vice-Chairman of the Board

Dan Peed Background

• Currently serves as CEO of American Coastal and President and CEO of

AmRisc, LLC

• Mr. Peed has over 30 years of experience in the insurance industry

Includes both insurance and reinsurance underwriting focused on commercial property risk

• Mr. Peed previously was a Senior Vice President at Sorema N.A. Reinsurance

Company from 1991 – 2000

• He started his career as a Loss Prevention Consultant at Factory Mutual

Insurance Company (FM Global) from 1985 - 1991

• Mr. Peed received his MBA with insurance focus from University of North

Texas and a B.S. in Petroleum Engineering from Texas A&M University

AmRisc Overview

• AmRisc is a specialty windstorm MGA that has produced and underwritten

over $7 billion of direct written premium at a cumulative combined ratio of

approximately 55% since its founding in 2000

• These results include all the hurricane activity of 2004, 2005, 2008, and

2011

• AmRisc underwrites commercial property risks, including commercial

property construction, catastrophe property, commercial flood, residential

flood, tech property, and county habitational property risks

• The company was founded by Mr. Peed and others in 2000 and is based in

Houston, Texas

27 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Transaction Benefits

•Diminished volatility of earnings

•Increased access to capital

•Rating agency benefits

Positive effects of increased size, scale, stability and market

presence

•Reduction in aggregate PML

•Expected annual cost savings

•Larger volume means greater market impact

Reinsurance optimization and expense reduction

•Minimal integration risk given ACIC’s infrastructure and limited overlap of resources

•Disciplined, risk-management oriented operating environments

Strategic, Operational & Cultural Fit

•Ability to increase participation in AmRisc E&S book over time

•Sale of admitted commercial policies through UPC agency network outside of Florida

•Opportunity to increase business with other parts of BB&T Insurance

Growth Opportunities

•Personal lines and Commercial lines

•Admitted and E&S

•Independent retail agents, aggregators, wholesale brokers and carrier partnerships

Diversification

1

2

3

4

5

Combined entity creates a leading specialty insurance underwriter

of catastrophe exposed property in the U.S.

28 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Pro Forma Results with AmCo

With AmCo, UIHC would have achieved

its goal in 2016 and expects to in 2017

UIHC UIHC UIHC+AmCo UIHC+AmCo

as reported pro forma ¹ pro forma ¹ pro forma ²

2016 2016 2016 2017

Total Revenue $ 487.2 $ 487.2 $ 661.9 $ 742.5

NonCAT Loss & LAE $ 242.5 $ 242.5 $ 266.2 $ 269.4

CAT Loss & LAE $ 55.8 $ 45.0 $ 45.0 $ 80.0

Total Loss & LAE Incurred $ 298.3 $ 287.5 $ 311.2 $ 349.4

Operating Expenses $ 181.9 $ 181.9 $ 260.1 $ 271.5

Total Expenses $ 480.2 $ 469.4 $ 571.3 $ 620.9

Earnings before tax $ 7.0 $ 17.8 $ 90.6 $ 121.6

Income Tax Expense $ 1.3 $ 6.2 $ 31.7 $ 42.6

Net Income $ 5.7 $ 11.6 $ 58.9 $ 79.0

ROAE 2.4% 4.8% 12.3% 16.5%

¹ Actual CAT losses adjusted to just include 1 full Hurricane ($30m) and Aggregate retention ($15m)

² Pro forma CAT losses in UIHC’s proxy adjusted to just include 1 full Hurricane ($50m) and Aggregate retention ($30m)

29 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

AmCo Financial Summary

¹ Preliminary unaudited results

Consolidated GAAP ($000) 2016 2015

Revenue UIHC AmCo ¹ UIHC AmCo

Gross Earned $ 666,829 $ 281,041 $ 504,215 $ 313,298

Ceded Earned (209,898) (110,596) (168,257) (137,887)

Net Earned 456,931 170,445 335,958 175,411

Investment Income 10,679 4,333 9,212 2,867

Realized gain(loss) 547 14 827 4

Other revenue 18,960 — 11,572 —

Total Revenue 487,117 174,792 357,569 178,282

Expenses

Loss & LAE - NonCAT 242,511 23,739 154,543 33,370

Loss & LAE - CAT 55,842 26,000 28,565 —

Policy Acquisition 117,658 67,195 87,401 75,618

Operating & Admin 63,480 11,046 45,168 9,419

Interest Expense 723 — 326 —

Total Expense 480,214 127,980 316,003 118,407

Earnings before tax 6,903 46,812 41,566 59,875

Other Inc (Exp) 100 — 294 —

Income Tax 1,305 16,444 14,502 23,399

Net Income 5,698 30,368 27,358 36,476

Combined Ratio (CR) 104.9% 75.1% 94.0% 67.5%

Underlying CR 89.0% 60.1% 86.2% 67.5%

Net Income X-CAT $ 40,850 $ 47,235 $ 45,776 $ 36,476

UPC + AmCo = Stability of UIHC Earnings

MARCH 2017 INVESTOR PRESENTATION

CONCLUSION

31 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Conclusion

• Our strategy is intact

• Execution of organic growth and geographic

diversification has exceeded plans

• Business outside Florida is growing and profitable

• Over 60% of exposure and 85% of new business is

outside Florida

• All non-Florida regions were solidly profitable in 2016

• AOB exposure is confined, small, and shrinking

• Miami/Dade and Broward counties represent only ~5% of

the Company’s total PIF

• Nonrenewals, cessation of new business, and no planned

takeouts will accelerate shrinkage of this exposure

• Pending American Coastal merger will…..

• increase scale, reduce volatility, improve returns, provide

additional resiliency, and open up new growth

opportunities

32 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Safe Harbor – At a Glance

Statements in this presentation that are not historical facts are forward-looking

statements that are subject to certain risks and uncertainties that could cause

actual events and results to differ materially from those discussed herein.

Without limiting the generality of the foregoing, words such as “may,” “will,”

“expect,” “believe,” “anticipate,” “intend,” “could,” “would,” “estimate,” “or

“continue” or the other negative variations thereof or comparable terminology

are intended to identify forward-looking statements. The forward-looking

statements in this presentation include statements regarding the Company’s or

management’s plans, objectives, goals, strategies, expectations, estimates,

beliefs or projections, or any other statements concerning future performance

or events. The risks and uncertainties that could cause our actual results to

differ from those expressed or implied herein include, without limitation, the

success of the Company’s marketing initiatives, inflation and other changes in

economic conditions (including changes in interest rates and financial

markets); the impact of new regulations adopted which affect the property and

casualty insurance market; the costs of reinsurance and the collectability of

reinsurance, assessments charged by various governmental agencies; pricing

competition and other initiatives by competitors; or ability to obtain regulatory

approval for requested rate changes, and the timing thereof; legislative and

regulatory developments; the outcome of litigation pending against us,

including the terms of any settlements; risks related to the nature of our

business; dependence on investment income and the composition of our

investment portfolio; the adequacy of our liability for loss and loss adjustment

expense; insurance agents; claims experience; ratings by industry services;

catastrophe losses; reliance on key personnel; weather conditions (including

the severity and frequency of storms, hurricanes, tornadoes and hail); changes

in loss trends; acts of war and terrorist activities; court decisions and trends in

litigation, and health care; and other matters described from time to time by

us in our filings with the SEC, including, but not limited to, the Company’s

Annual Report on Form 10-K for the year ended December 31, 2015. In

addition, investors should be aware that generally accepted accounting

principles prescribe when a company may reserve for particular risks, including

litigation exposures. Accordingly, results for a given reporting period could be

significantly affected if and when a reserve is established for a major

contingency. Reported results may therefore, appear to be volatile in certain

accounting periods. The Company undertakes no obligations to update, change

or revise any forward-looking statement, whether as a result of new

information, additional or subsequent developments or otherwise.

CORPORATE OVERVIEW

Exchange:Ticker NASDAQ : UIHC

Industry

Property/Casualty

Insurance

Business

Personal & Commercial

Property Insurance in

AL, CT, DE, FL, GA, HI,

LA, MA, MD, MS, NC,

NH, NJ, NY, RI, SC, TX

& VA

HQ St. Petersburg, FL

Employees 160

Policies in Force

451,771

(at 12/31/16)

Total Assets

$994M

(at 12/31/2016)

Dividend

$0.06

(at 2/22/2017)

33 MARCH 2017 INVESTOR PRESENTATION “Moving Forward”

Definitions of Non-GAAP Measures

We believe that investors’ understanding of UPC Insurance’s performance is enhanced by our

disclosure of the following non-GAAP measures. Our methods for calculating these measures may

differ from those used by other companies and therefore comparability may be limited.

Combined ratio excluding the effects of current year catastrophe losses, prior year

development from lines in run-off and prior year development (underlying combined ratio)

is a non-GAAP ratio, which is computed as the difference between four GAAP operating ratios: the

combined ratio, the effect of current year catastrophe losses on the combined ratio, and prior year

development on the combined ratio. We believe that this ratio is useful to investors and it is used by

management to reveal the trends in our business that may be obscured by current year catastrophe

losses, losses from lines in run-off and prior year development. Current year catastrophe losses cause

our loss trends to vary significantly between periods as a result of their incidence of occurrence and

magnitude, and can have a significant impact on the combined ratio. Prior year development from

lines in run-off is caused by unexpected development from our commercial auto product that is no

longer offered by the Company. Prior year development is unexpected loss development on historical

reserves. We believe it is useful for investors to evaluate these components separately and in the

aggregate when reviewing our performance. The most direct comparable GAAP measure is the

combined ratio. The underlying combined ratio should not be considered as a substitute for the

combined ratio and does not reflect the overall profitability of our business.