Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - STAAR SURGICAL CO | v459997_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - STAAR SURGICAL CO | v459997_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - STAAR SURGICAL CO | v459997_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - STAAR SURGICAL CO | v459997_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - STAAR SURGICAL CO | v459997_ex21-1.htm |

| EX-10.44 - EXHIBIT 10.44 - STAAR SURGICAL CO | v459997_ex10-44.htm |

| EX-10.43 - EXHIBIT 10.43 - STAAR SURGICAL CO | v459997_ex10-43.htm |

| EX-10.42 - EXHIBIT 10.42 - STAAR SURGICAL CO | v459997_ex10-42.htm |

| EX-10.41 - EXHIBIT 10.41 - STAAR SURGICAL CO | v459997_ex10-41.htm |

| EX-10.40 - EXHIBIT 10.40 - STAAR SURGICAL CO | v459997_ex10-40.htm |

| EX-10.38 - EXHIBIT 10.38 - STAAR SURGICAL CO | v459997_ex10-38.htm |

| EX-10.37 - EXHIBIT 10.37 - STAAR SURGICAL CO | v459997_ex10-37.htm |

| EX-10.36 - EXHIBIT 10.36 - STAAR SURGICAL CO | v459997_ex10-36.htm |

| EX-10.35 - EXHIBIT 10.35 - STAAR SURGICAL CO | v459997_ex10-35.htm |

| 10-K - 10-K - STAAR SURGICAL CO | v459997_10k.htm |

EXHIBIT 10.39 Loan Application (for Market Rate) Date received November 15, 2016 Mizuho Bank, Ltd. Name: STAAR Surgical AG Representative Member Managing Partner: Toshikazu Kikuchi Address: STAAR Japan Incorporated 1-5-2, Irifune, Urayasu City Chiba 279-0012 I hereby apply for the following transaction, under the terms shown below. Please note that this document does not automatically effect a loan agreement or an advance commitment. Description of Terms Transaction Terms (Please check the appropriate boxes.) Transaction type „Y Loan on note „Ñ Special overdraft Amt. of desired transaction (insert the ¢D symbol in front of the amount) billion million thousand yen ¢D 5 0 0 0 0 0 0 0 0 Scheduled transaction date November 21, 2016 implementation date Scheduled repayment date November 21, 2017 Repayment method „Ñ Lump sum at maturity „Y ¢D____ on the first repayment date of ________(mm/dd/yyyy), then ¢D____ on the ___ day of every ____ month(s). The final payment shall be ¢D____. Interest rate „Y __% per annum „Y ____ month(s) + ____% per annum (initial interest rate: __%) Interest payment method „Ñ Pay in advance on the scheduled transaction date „Y Deferred payment on the scheduled transaction date „Y Pay in advance on the scheduled transaction date and on the __ day every ___ month(s) from _______(mm/dd/yyyy) onward. „Y Deferred payment on the scheduled transaction date on the __ day every ____ month(s) from ________(mm/dd/yyyy) onward. „Y ___________________________________________________________________________ Reset of applicable interest rate „Ñ Same interest rate applicable until the scheduled repayment date „Y Reset on every interest payment date „Y Reset every ____ month(s) from _______________(mm/dd/yyyy) onward. Interest calculation method „Ñ Prorated over 365 days „Y Prorated over 360 days / „Ñ Include beginning and ending dates in calculation „Y Include only beginning or ending date in calculation When the repayment date falls on a non-work day „Ñ Business day immediately preceding „Y Next business day Other terms End (For bank use only) When accepting submission of an agreement when the interest rate has not yet been determined, and concluding the agreement by phone at a later date: ¡E Date/time of call: ________(mm/dd/yyyy) _______________(hr./mm) ¡E Phone call participants: (Borrower) ___________ (Lender) _____________ [Loan transaction seal] STAAR Japan, Inc. CMR Settlement No. Loan No. 1013912 Manager Checked by Rep.

Date: November 21, 2016 Name: STAAR Surgical AG Representative Member Managing Partner: Toshikazu Kikuchi STAAR Japan Incorporated 1-5-2, Irifune, Urayasu City Chiba 279-0012 • Details of phone call: Print number 54T56-CRQDP-PYLD3-PNSGW-URB3V-3 3601Y159 “Loan Application (for Market Rate)” 16.06 Overdraft Repayment Invoice (for Overdrafts Only) Date of implementation <Please> Only write inside the bold lines. Section for Bank Use *1 It is not necessary to enter the repayment date for an overdraft (special account). *2 Display the year with four digits. Transaction Code Ringi Number Implementation Category New / Rewrite Next interest date (Business day) Date (mm/dd/yyyy) * A third party other than the operator confirms that there is no discrepancy between the amount on the repayment invoice and the implementation amount to which the seal was imprinted on the implementation entry slip. End of month (EoM) designation code Other than EoM / EoM Interest payment period Lump sum payment / ( ) months Holiday adjustment code Next business day Prior business date Date management category Own branch / Center Interest withdrawal date ___ day Next rate reset date Date (mm/dd/yyyy) / None Base interest rate type Mizuho TIBOR ( ) months / JBA TIBOR ( ) months / ( ) Mizuho Bank, Ltd. 3603C069(5Y)(1 bundle 100 sheets) 15.08 - Stamp #103 Enter only for application to open an account style Overdraft (Special account) Account number Maximum limit Manager Checked by Rep. Payment Number Cat. No. Loan Number (copy from implementation slip) Check the appropriate box. Special account Special account (MML) Payment date *1 *2 Year Month Day 2 0 1 7 1 1 2 1 Loan transaction seal STAAR Japan, Inc. Please insert the ¥ symbol in front of the amount bn 100 mn 10 mn mn 100 th 10 th th 100 10 yen Amount ¥ 5 0 0 0 0 0 0 0 0 Amt. Confirmed* M

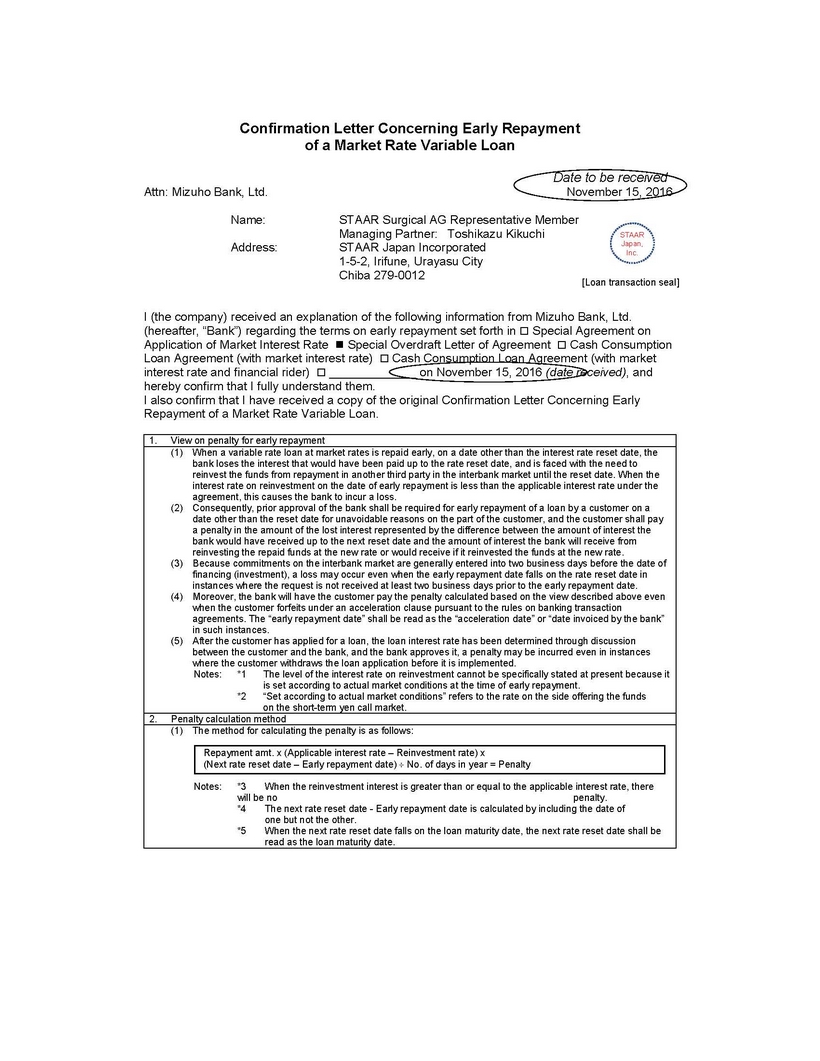

Confirmation Letter Concerning Early Repayment of a Market Rate Variable Loan Date to be received Attn: Mizuho Bank, Ltd. November 15, 2016 Name: STAAR Surgical AG Representative Member Managing Partner: Toshikazu Kikuchi Address: STAAR Japan Incorporated 1-5-2, Irifune, Urayasu City Chiba 279-0012 the company) received an explanation of the following information from Mizuho Bank, Ltd. hereafter, ¡§Bank¡¨) regarding the terms on early repayment set forth in „Y Special Agreement on Application of Market Interest Rate Þ Special Overdraft Letter of Agreement „Y Cash Consumption Loan Agreement (with market interest rate) „Y Cash Consumption Loan Agreement (with market interest rate and financial rider) „Y _____________ on November 15, 2016 (date received), and hereby confirm that I fully understand them. also confirm that I have received a copy of the original Confirmation Letter Concerning Early Repayment of a Market Rate Variable Loan. View on penalty for early repayment (1) When a variable rate loan at market rates is repaid early, on a date other than the interest rate reset date, the bank loses the interest that would have been paid up to the rate reset date, and is faced with the need to reinvest the funds from repayment in another third party in the interbank market until the reset date. When the interest rate on reinvestment on the date of early repayment is less than the applicable interest rate under the agreement, this causes the bank to incur a loss. (2) Consequently, prior approval of the bank shall be required for early repayment of a loan by a customer on a date other than the reset date for unavoidable reasons on the part of the customer, and the customer shall pay a penalty in the amount of the lost interest represented by the difference between the amount of interest the bank would have received up to the next reset date and the amount of interest the bank will receive from reinvesting the repaid funds at the new rate or would receive if it reinvested the funds at the new rate. (3) Because commitments on the interbank market are generally entered into two business days before the date of financing (investment), a loss may occur even when the early repayment date falls on the rate reset date in instances where the request is not received at least two business days prior to the early repayment date. (4) Moreover, the bank will have the customer pay the penalty calculated based on the view described above even when the customer forfeits under an acceleration clause pursuant to the rules on banking transaction agreements. The ¡§early repayment date¡¨ shall be read as the ¡§acceleration date¡¨ or ¡§date invoiced by the bank¡¨ in such instances. (5) After the customer has applied for a loan, the loan interest rate has been determined through discussion between the customer and the bank, and the bank approves it, a penalty may be incurred even in instances where the customer withdraws the loan application before it is implemented. Notes: *1 The level of the interest rate on reinvestment cannot be specifically stated at present because is set according to actual market conditions at the time of early repayment. *2 ¡§Set according to actual market conditions¡¨ refers to the rate on the side offering the funds on the short-term yen call market. Penalty calculation method (1) The method for calculating the penalty is as follows: Repayment amt. x (Applicable interest rate ¡V Reinvestment rate) x (Next rate reset date ¡V Early repayment date) ¡Ò No. of days in year = Penalty Notes: *3 When the reinvestment interest is greater than or equal to the applicable interest rate, there will be no penalty. *4 The next rate reset date - Early repayment date is calculated by including the date of one but not the other. *5 When the next rate reset date falls on the loan maturity date, the next rate reset date shall be read as the loan maturity date. [Loan transaction seal] STAAR Japan, Inc.

*6 When the loan application is withdrawn, the period on which the penalty is calculated will from the scheduled date of implementation to the next rate reset date. (2) An example calculation based on the calculation method above is shown below: • Repayment amt.: ¥30,000,000 • Applicable interest rate: 3.000% • Reinvestment rate: 1.000% • Next rate reset date: Sep. 30 • Early repayment date: Jul. 10 • No. of days in the year: 365 ¥30,000,000 x (3.000% - 1.000%) x (Sep. 30 – Jul. 10) ÷ 365 = ¥134,794 *7 Generally speaking, the lower the reinvestment rate is on the early repayment date, the the penalty. *8 This example calculation only represents one example and is not based on the actual transaction terms with the customer. [For bank use only] Branch No. Transaction Code Settlement Code Category Code Document No. 148 1013912 1 <<Explanation of important matters>> • Date/Time explained: (mm/dd/yyyy) _____________ (hr./min.) ___________ • Meeting participants: (borrower) _______________ (lender) ____________ • Details explained: Manager Checked by Accepted Print number 38ZYZ-5JU2V-9TN83-696JM-A9DXA-9 3601Y234 “Confirmation Letter Concerning Early Repayment of a Market Rate Variable Loan 14.12