Attached files

| file | filename |

|---|---|

| 10-K - 10-K - New York REIT Liquidating LLC | nyrt1231201610-kss.htm |

| EX-32 - EXHIBIT 32 - New York REIT Liquidating LLC | nyrt12312016ex3210-kss.htm |

| EX-31.2 - EXHIBIT 31.2 - New York REIT Liquidating LLC | nyrt12312016ex31210-k.htm |

| EX-31.1 - EXHIBIT 31.1 - New York REIT Liquidating LLC | nyrt12312016ex31110-k.htm |

| EX-23.1 - EXHIBIT 23.1 - New York REIT Liquidating LLC | nyrt12312016ex23110-k.htm |

| EX-21.1 - EXHIBIT 21.1 - New York REIT Liquidating LLC | nyrt12312016ex21110-k.htm |

| EX-10.62 - EXHIBIT 10.62 - New York REIT Liquidating LLC | nyrt12312016ex106210-k.htm |

| EX-10.45 - EXHIBIT 10.45 - New York REIT Liquidating LLC | nyrt12312016ex104510-k.htm |

Exhibit 10.61

AMENDMENT NO. 1 TO LOAN AGREEMENT

This Amendment No. 1 to Loan Agreement (this “Amendment”) is entered into as of April 19, 2016 by and between STRATEGIC ASSET SERVICES LLC, a Delaware limited liability company, not individually but solely in its capacity as Agent for the Lenders as set forth in the Loan Agreement (together with its permitted successors and assigns, the “Lender”), and ARC NY1440BWY1, LLC, a Delaware limited liability company, a Delaware limited liability company, as borrower (together with its permitted successors and assigns, “Borrower”), and amends that certain Loan Agreement, dated as of September 30, 2015, by and between H/2 FINANCIAL FUNDING I LLC, a Delaware limited liability company, as lender (“Original Lender”) and Borrower (the “Original Loan Agreement”). Capitalized terms used herein and not otherwise defined shall have the meanings given such terms in the Loan Agreement.

WHEREAS, Lender and Borrower desire to amend the Original Loan Agreement with respect to the matters set forth herein (the Original Loan Agreement, as so amended by this Amendment, and as the same be further amended, restated, replaced, supplemented or otherwise modified from time to time, shall hereinafter be referred to as the “Loan Agreement”).

NOW THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows, effective from and after the date hereof:

Section 1. Amendments to Loan Agreement. Lender and Borrower hereby agree to amend the terms of the Loan Agreement as follows:

(a) Definitions.

(i) The definition of “Borrower’s Pro Rata Share” in the Definitions Section of the Loan Agreement is hereby deleted in its entirety and replaced with the following:

““Borrower’s Pro Rata Share” means 30%, except that with respect to any re-tenanting of the premises under the Ford Lease following expiration or earlier termination thereof, Borrower’s Pro Rata Share shall be 53.5%.”

(ii) The following defined terms are hereby added to the Definitions Section of the Loan Agreement:

““Ford Lease” means the Lease between the Borrower, as landlord, and The Ford Foundation, as tenant, dated as of December 16, 2015, relating to space at the Property.”

““Ford Lease Costs” has the meaning set forth in Section 1.7(h).”

““Lender’s Pro Rata Share” means 70% with respect to all Leases, except that, with respect to any re-tenanting of the premises under the Ford Lease

following expiration or earlier termination thereof, Lender’s Pro Rata Share shall be 46.5%.”

(b) Notwithstanding anything to the contrary contained in the Original Loan Agreement, the Ford Lease shall not constitute a Qualified Lease for the purpose of calculating Debt Yield in connection with an extension of the Loan pursuant to Section 1.1(d) of the Loan Agreement.

(c) Section 1.7(b)(vii) of the Loan Agreement is hereby amended by deleting the percentage “70%” therefrom and replacing it with the term “Lender’s Pro Rata Share”.

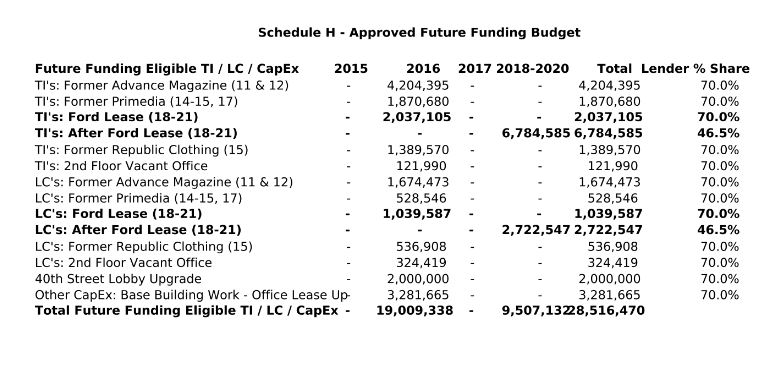

(d) Schedule H attached to the Loan Agreement is hereby deleted in its entirety and replaced with Exhibit A attached hereto.

Section 2. Miscellaneous.

(a) All of the terms and conditions of the Loan Agreement are incorporated herein by reference with the same force and effect as if fully set forth herein. Except as expressly amended or modified hereby, the Loan Agreement and each of the other Loan Documents remains in full force and effect in accordance with its terms.

(b) This Amendment shall be governed by and construed and interpreted in accordance with the laws of the State of New York without regard to principles of conflicts of law.

(c) Guarantor hereby unconditionally approves and consents to the execution by Borrower of this Amendment and the modifications to the Loan Documents set forth herein.

(d) This Amendment may be executed in any number of counterparts, each of which when so executed and delivered shall be an original, but all of which shall together constitute one and the same instrument. Copies of originals, including copies delivered by facsimile, pdf or other electronic means, shall have the same import and effect as original counterparts and shall be valid, enforceable and binding for the purposes of this Amendment.

(e) From and after the date hereof, (i) all references in the Loan Agreement to “this Agreement”, “hereunder”, “hereof” or words of like import referring to the Original Loan Agreement shall mean and refer to the Loan Agreement as modified by this Amendment and (ii) all references in the Loan Documents to the “Loan Agreement” shall mean the Loan Agreement as modified by this Amendment.

Section 3. Consent of Mezzanine Lender. By its signature below, Mezzanine Lender hereby consents to this Amendment and the modifications to the Loan Documents effected thereby.

[Signatures appear on following page.]

2

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their duly authorized representatives, all as of the date first above written.

LENDER: STRATEGIC ASSET SERVICES LLC, a Delaware limited liability company, as Agent By: /s/ Ashwin B. Rao Name: Ashwin B. Rao Title: Authorized Signatory |

BORROWER: ARC NY1440BWY1, LLC, a Delaware limited liability company By: ARC NY1440BWY1 MEZZ, LLC, its sole member By: New York Recovery Operating Partnership, L.P., its sole member By: New York REIT, Inc., its general partner By: /s/ Michael Ead Name: Michael Ead Title: Authorized Signatory | ||||

Solely with respect to Section 2(c) hereof: | ||||

GUARANTOR: NEW YORK REIT, INC., a Maryland corporation By: /s/ Michael Ead Name: Michael Ead Title: Authorized Signatory NEW YORK RECOVERY OPERATING PARTNERSHIP, L.P., a Delaware limited partnership By: New York REIT, Inc., its general partner By: /s/ Michael Ead Name: Michael Ead Title: Authorized Signatory | ||||

SOLELY FOR PURPOSES OF SECTION 3 HEREOF: | |

MEZZANINE LENDER: PARAMOUNT GROUP FUND VIII 1440 BROADWAY MEZZ LP, a Delaware limited partnership By: Paramount Group Fund VIII Debt Holdings GP LLC, its general partner By: /s/ Michael Jackowitz Name: Michael Jackowitz Title: Assistant Vice President | |

EXHIBIT A