Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - KERYX BIOPHARMACEUTICALS INC | ex211201610k.htm |

| 10-K - FORM 10-K - KERYX BIOPHARMACEUTICALS INC | kerx-12312016x10k.htm |

| EX-32.2 - EXHIBIT 32.2 - KERYX BIOPHARMACEUTICALS INC | ex322201610k.htm |

| EX-32.1 - EXHIBIT 32.1 - KERYX BIOPHARMACEUTICALS INC | ex321201610k.htm |

| EX-31.2 - EXHIBIT 31.2 - KERYX BIOPHARMACEUTICALS INC | ex312201610k.htm |

| EX-31.1 - EXHIBIT 31.1 - KERYX BIOPHARMACEUTICALS INC | ex311201610k.htm |

| EX-23.1 - EXHIBIT 23.1 - KERYX BIOPHARMACEUTICALS INC | ex231201610k.htm |

| EX-10.23 - EXHIBIT 10.23 - KERYX BIOPHARMACEUTICALS INC | ex1023201610k.htm |

| EX-10.22 - EXHIBIT 10.22 - KERYX BIOPHARMACEUTICALS INC | ex1022201610k.htm |

| EX-10.21 - EXHIBIT 10.21 - KERYX BIOPHARMACEUTICALS INC | ex1021201610k.htm |

| EX-10.12 - EXHIBIT 10.12 - KERYX BIOPHARMACEUTICALS INC | ex1012201610k.htm |

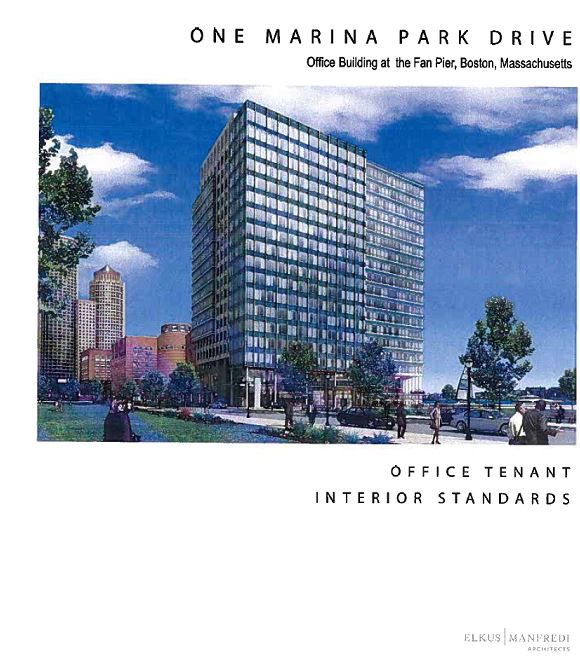

ONE MARINA PARK DRIVE

OFFICE LEASE

OFFICE LEASE

THIS LEASE (this “Lease”), made as of April 29, 2015, by and between FALLON CORNERSTONE ONE MPD LLC, a Delaware limited liability company (“Landlord”), and KERYX BIOPHARMACEUTICALS, INC., a Delaware corporation (“Tenant”).

INDEX

Article Title

1. | Basic Provisions |

2. | Premises, Term and Commencement Date |

3. | Rent |

4. | Taxes and Operating Expenses |

5. | Delivery of Premises, Tenant’s Work, Alterations and Additions |

6. | Tenant’s Use, Restrictions and Compliance with Laws |

7. | Services |

8. | Insurance |

9. | Indemnification |

10. | Casualty Damage |

11. | Condemnation |

12. | Repair and Maintenance |

13. | Inspection of Premises |

14. | Surrender of Premises |

15. | Holding Over |

16. | Subletting and Assignment |

17. | Subordination, Non-Disturbance, Attornment and Mortgagee Protection; Lease Subject to Project Documents |

18. | Estoppel Certificate |

19. | Defaults |

20. | Remedies |

21. | Quiet Enjoyment |

22. | Accord and Satisfaction |

23. | Security Deposit |

24. | Brokerage Commission |

25. | Force Majeure |

26. | Parking |

27. | Hazardous Materials |

28. | Additional Rights Reserved by Landlord |

29. | Defined Terms |

30. Miscellaneous Provisions

31. Right of First Offer

EXHIBITS

1

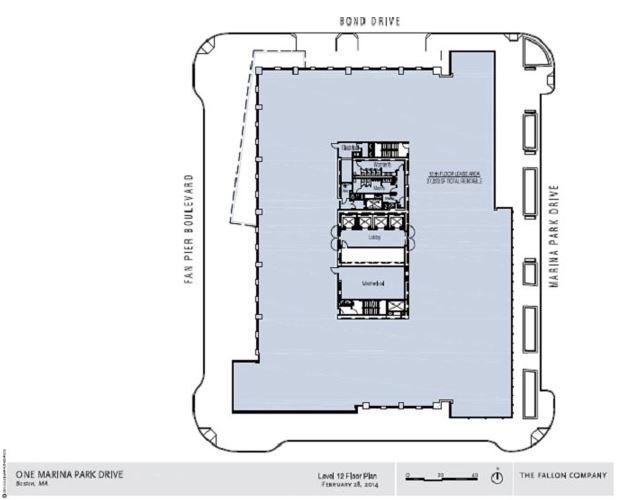

Exhibit A | Space/Floor Plan Showing Premises |

Exhibit B | Tenant’s Work Exhibit |

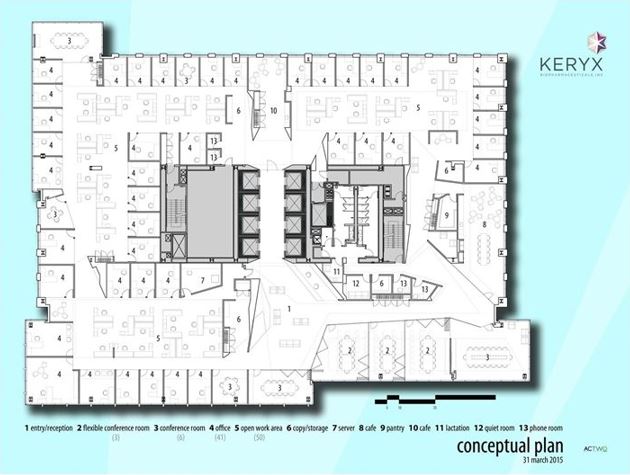

Exhibit B-1 | Tenant’s Conceptual Space Plan |

Exhibit C | Form of Sublease Consent |

Exhibit D | Building’s Rules and Regulations and Janitorial Specifications |

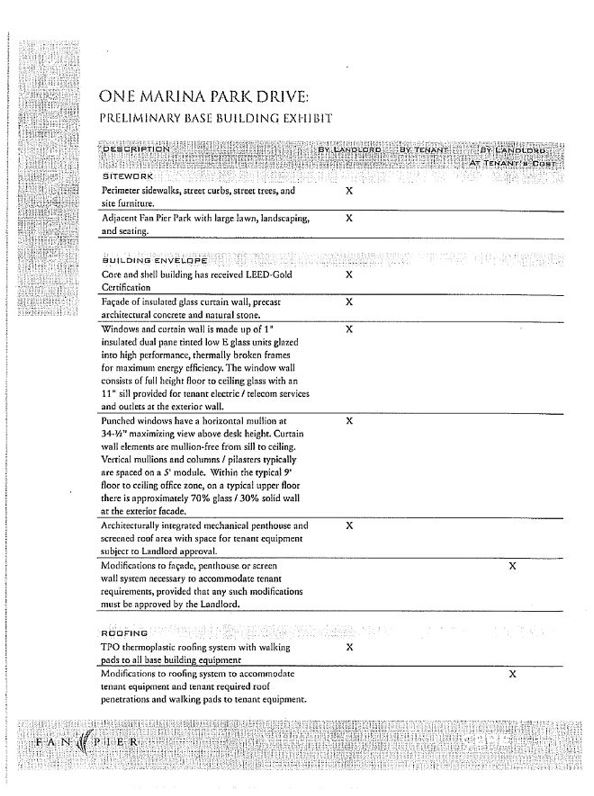

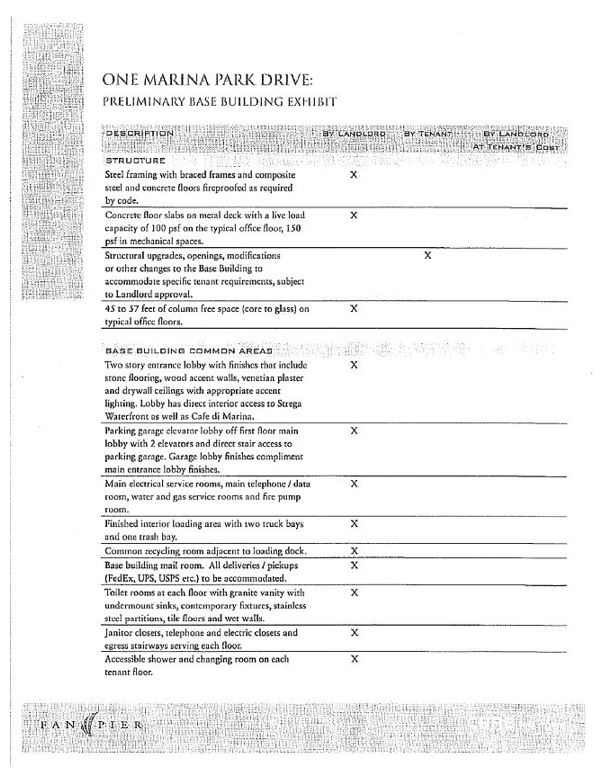

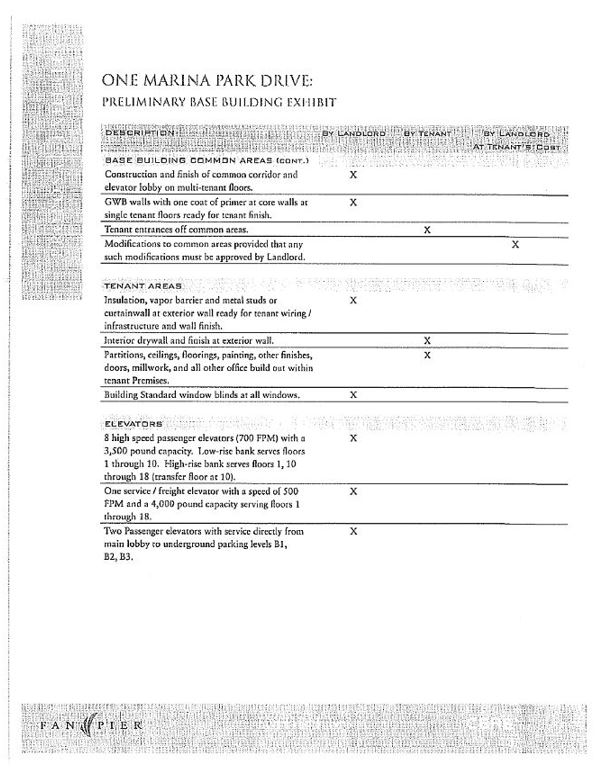

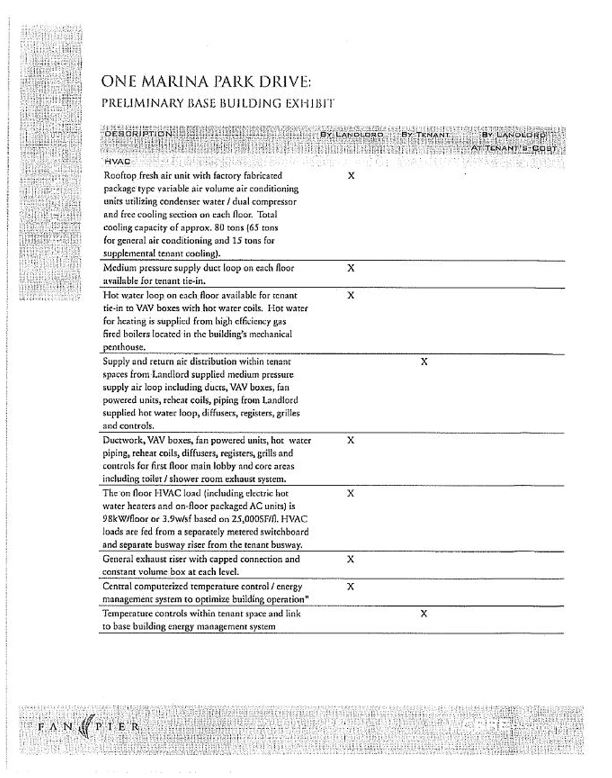

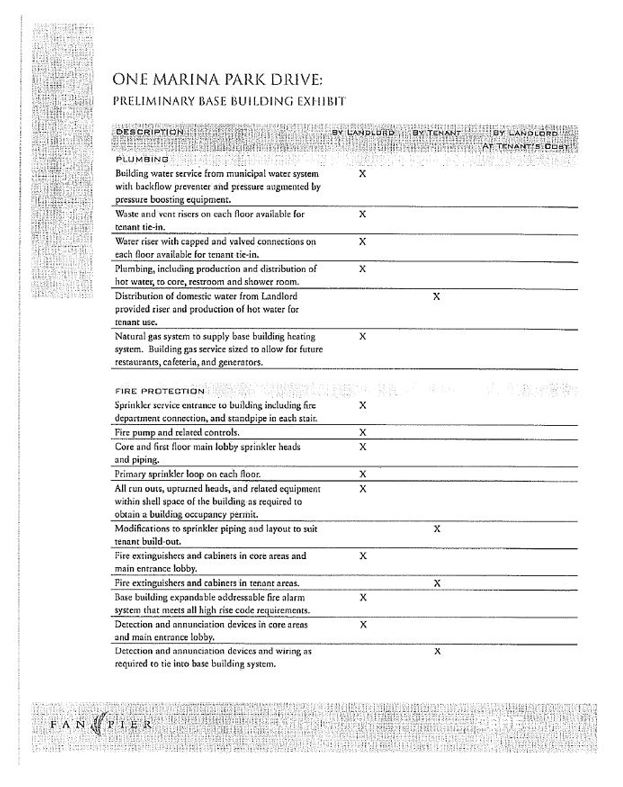

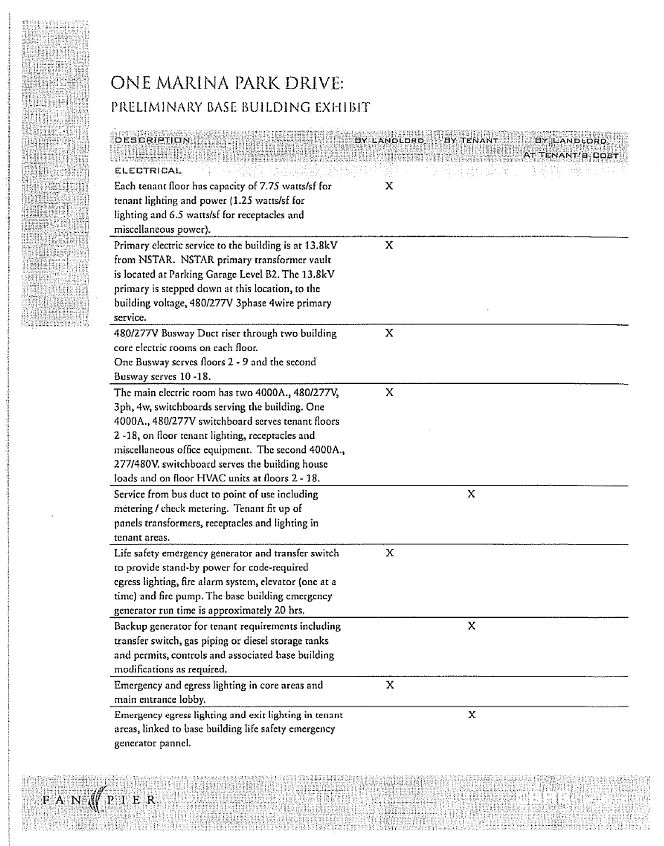

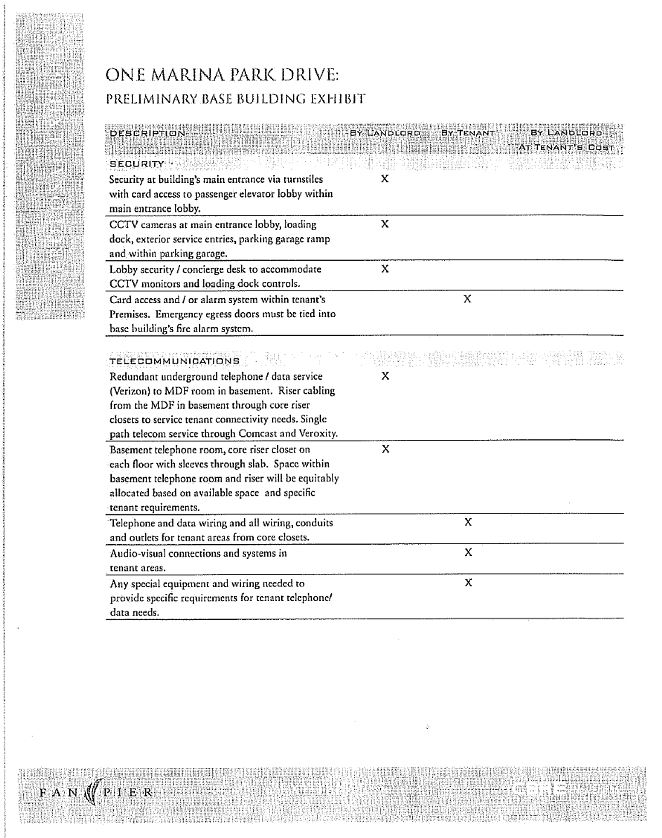

Exhibit E | Description of Base Building Condition |

Exhibit F | Option to Extend Term |

Exhibit G | Form of SNDA |

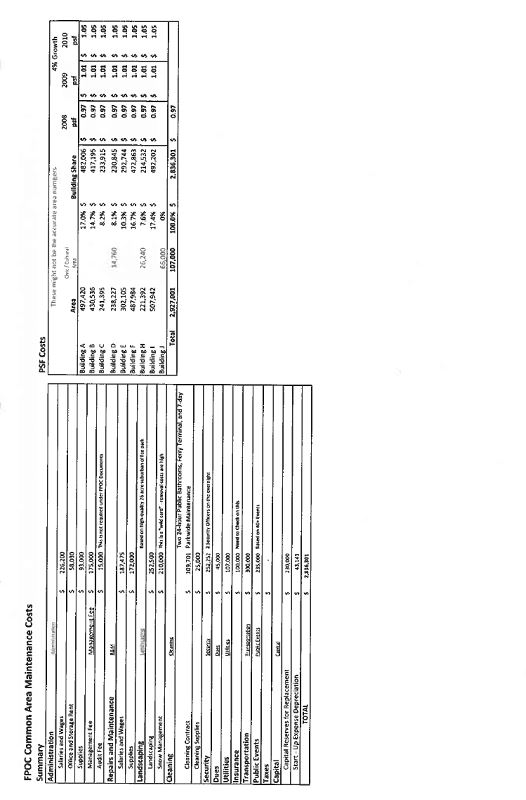

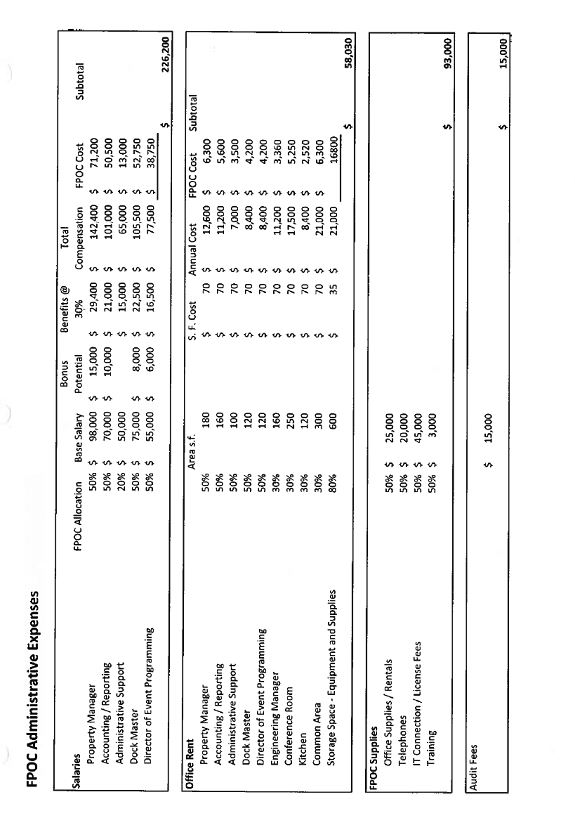

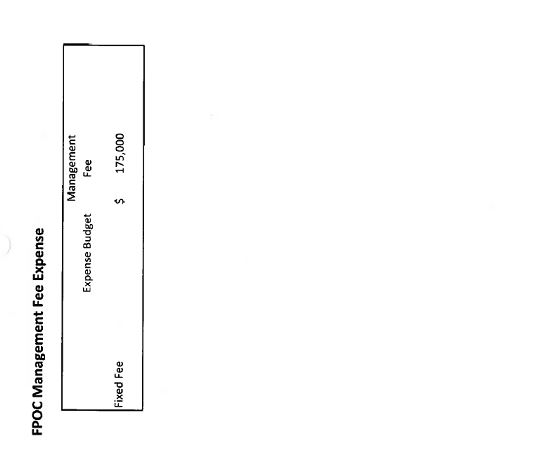

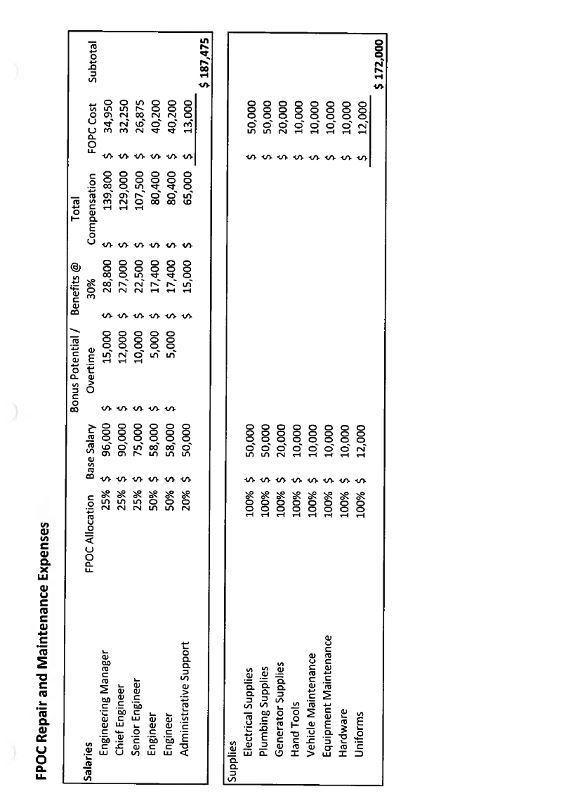

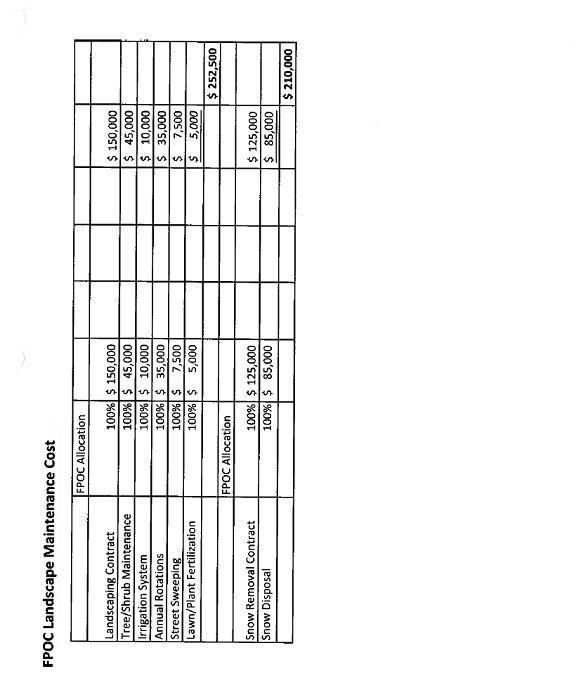

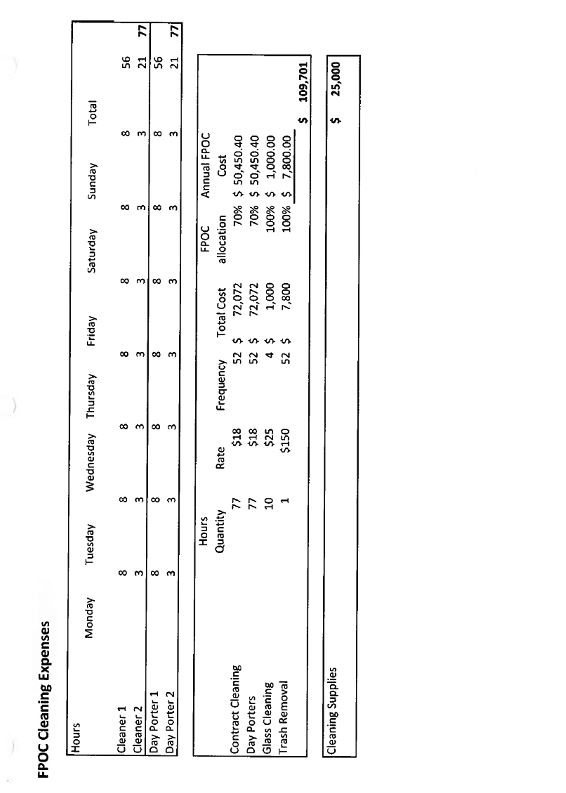

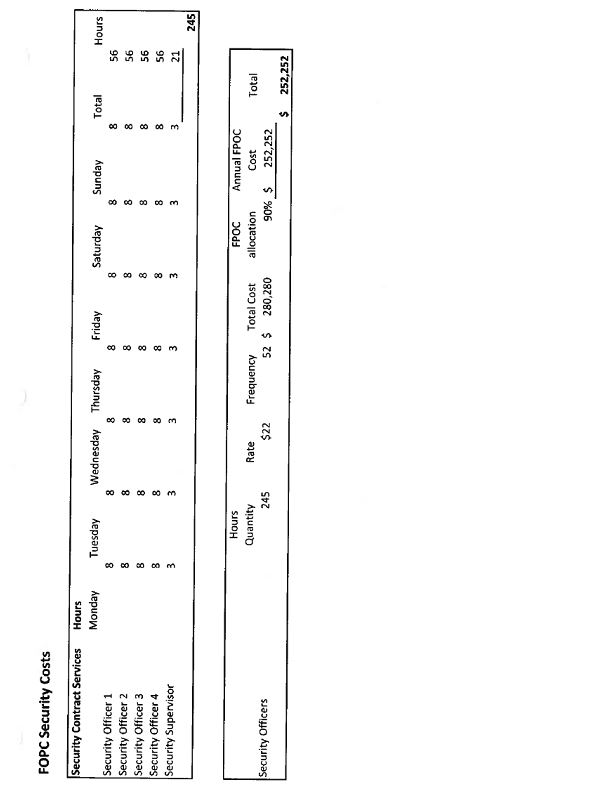

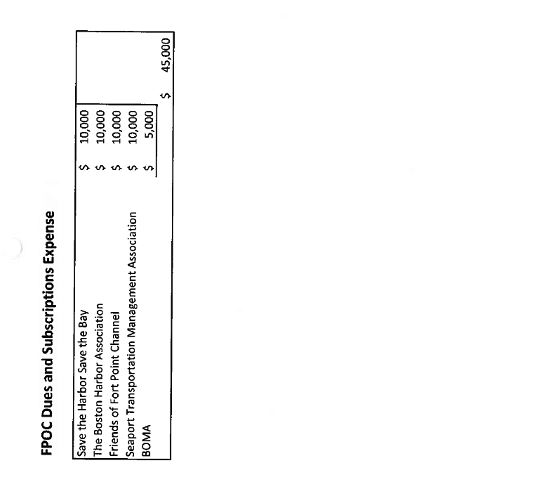

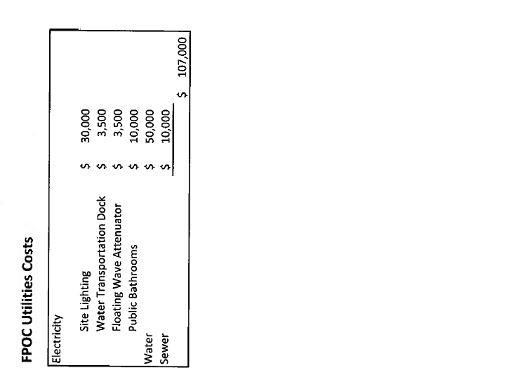

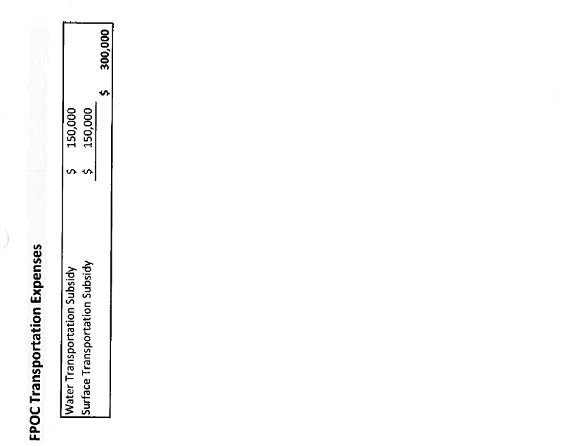

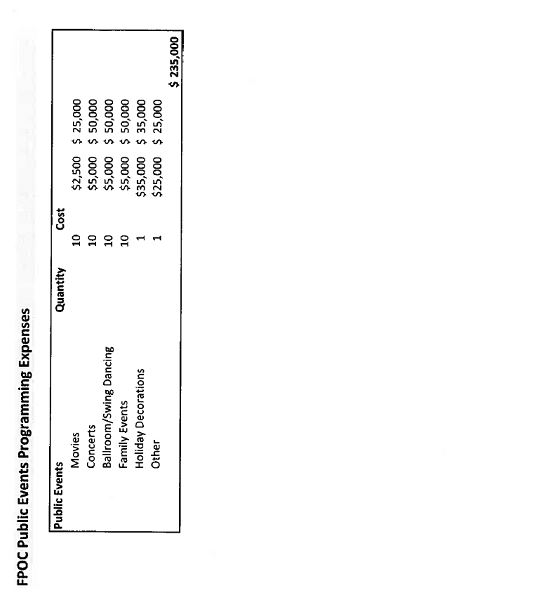

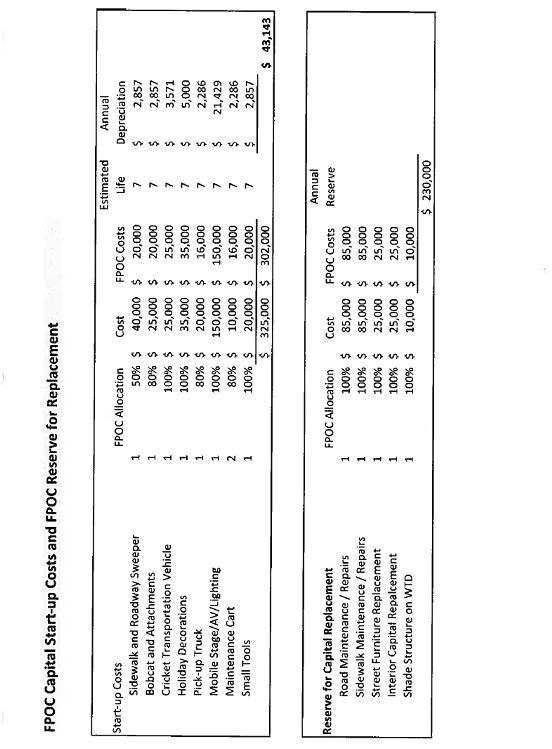

Exhibit H | Pro Forma Budget of FPOC Expenses |

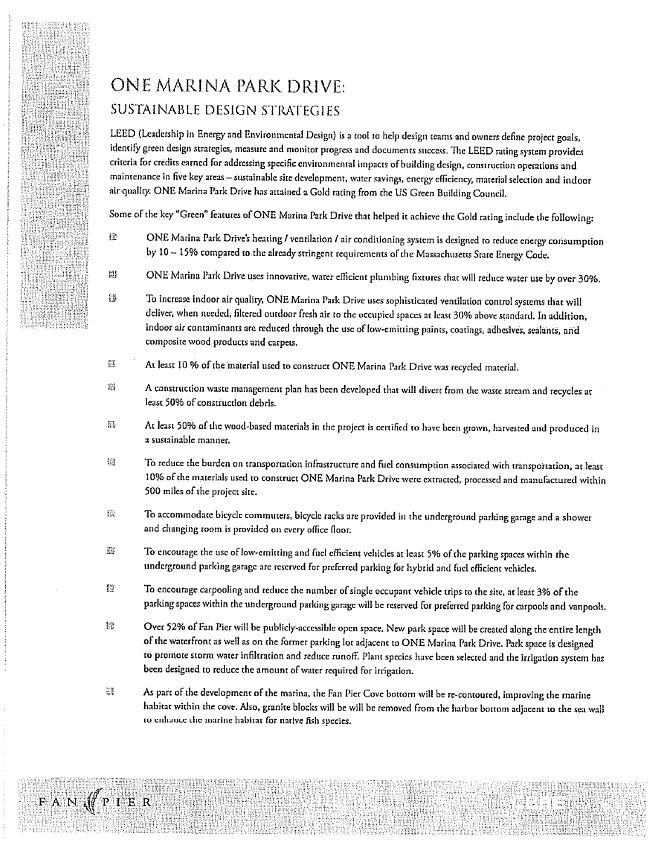

Exhibit I | Memorandum Outlining Landlord’s Sustainable Design Strategies |

Exhibit J | OTIS |

Exhibit K | Form of Commencement Date Confirmation |

ARTICLE 1.

BASIC PROVISIONS

BASIC PROVISIONS

A. Tenant’s Trade Name: | Keryx Biopharmaceuticals, Inc. (or such other trade name as Tenant may select from time to time, provided that Tenant shall promptly provide Landlord with written notice of any such trade name change) |

B. Tenant’s Address: | Prior to Tenant’s occupancy of the Premises: One Marina Park Drive, 10th Floor Boston, Massachusetts 02210 Attention: General Counsel On and after Tenant’s occupancy of the Premises: One Marina Park Drive, Suite 1200 Boston, Massachusetts 02210 Attention: General Counsel |

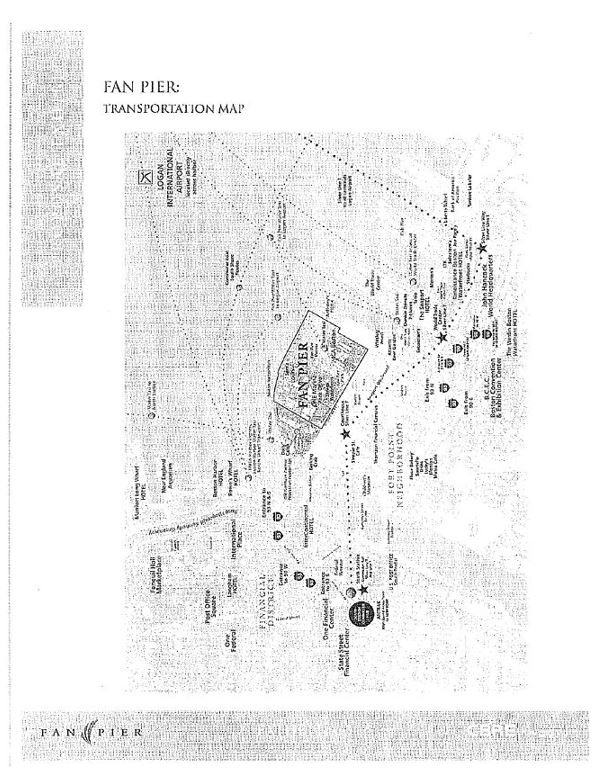

C. Building Name and Address: | One Marina Park Drive Boston, Massachusetts 02210 |

D. Premises: | Suite 1200, comprising the entire (12th) floor of the Building and consisting of 27,323 rentable square feet, as shown on the space plan attached hereto as Exhibit A. |

E. Landlord: | Fallon Cornerstone One MPD LLC |

F. Landlord’s Address: | c/o Cornerstone Real Estate Advisers LLC 180 Glastonbury Boulevard, Suite 200 Glastonbury, Connecticut 06033 Attention: Linda C. Houston, Senior Vice President |

G. Building Manager Name and Address: | CB Richard Ellis – N.E. Partners LP One Marina Park Drive Boston, Massachusetts 02210 |

H. Commencement Date: | The later of (i) the date of full execution of this Lease, and (ii) the date on which possession of the Premises is delivered to Tenant in the Delivery Condition (as defined in Article 5.A. of this Lease). | |

I. Rent Commencement Date: | March 1, 2016 | |

J. Expiration Date: | February 28, 2023, unless the Term (as hereinafter defined) is sooner terminated or further extended as provided in this Lease. | |

K. Security Deposit: | $788,951.64, to be held by Landlord subject to periodic reduction and other terms and conditions set forth in Article 23 of this Lease. | |

L. Monthly Base Rent: | Time Period | Monthly Base Rent |

Lease Year 1 (March 1, 2016 through February 28, 2017) | $131,491.94 | |

Lease Year 2 (March 1, 2017 through February 28, 2018) | $133,768.85 | |

Lease Year 3 (March 1, 2018 through February 28, 2019) | $136,045.77 | |

Lease Year 4 (March 1, 2019 through February 29, 2020) | $138,322.69 | |

Lease Year 5 (March 1, 2020 through February 28, 2021) | $140,599.60 | |

Lease Year 6 (March 1, 2021 through February 28, 2022) | $142,876.52 | |

Lease Year 7 (March 1, 2022 through February 28, 2023) | $145,153.44 | |

M. Tenant’s Pro Rata Share: | 5.80% (based on 27,323 rentable square feet/470,949 rentable square feet, which is the rentable square footage of the Office Component as provided in Article 29.M. of this Lease) | |

N. Normal Business Hours of Building: | Monday through Friday: 8:00 a.m. to 6:00 p.m. Saturday: 8:00 a.m. to 1:00 p.m. (upon written request by Tenant only, but at no additional cost) Sunday: None (Excepting local and national holidays) | |

O. Permitted Use: | General office use, and for no other purpose. | |

P. Broker(s): | CB Richard Ellis – N.E. Partners L.P., representing Landlord, and Transwestern RBJ, representing Tenant. | |

Q. Parking Access Rights: | Nine (9) parking access devices for unreserved parking spaces in the Parking Garage (as hereinafter defined), subject to the terms and conditions of Article 26 of this Lease. | |

R. Base Year: | Calendar year 2016 for Operating Expenses (as hereinafter defined), and fiscal year 2016 for Taxes (as hereinafter defined). | |

S. Allowance: | $70.00 per rentable square feet of the Premises, subject to the terms and conditions of Exhibit B attached hereto. |

The foregoing provisions shall be interpreted and applied in accordance with the other provisions of this Lease set forth below. The capitalized terms, and the terms defined in Article 29, shall have the meanings set forth herein or therein (unless otherwise modified in the Lease) when used as capitalized terms in other provisions of the Lease.

Landlord and Tenant hereby agree that the Premises contain the number of rentable square feet specified in Article 1 above.

ARTICLE 2.

PREMISES, TERM AND COMMENCEMENT DATE

PREMISES, TERM AND COMMENCEMENT DATE

Subject to the terms and conditions set forth herein, Landlord hereby leases and demises to Tenant and Tenant hereby leases from Landlord the Premises identified in Article 1 above for a term (“Term”) commencing on the Commencement Date and ending on the Expiration Date set forth in Article 1, unless sooner terminated as provided herein. Such date shall be confirmed by execution of the Commencement Date Confirmation in the form as set forth in Exhibit K, which Tenant shall execute and return to Landlord within fifteen (15) days after receipt thereof. Tenant shall be permitted to extend the original Term hereof in accordance with the provisions of Exhibit F attached hereto.

ARTICLE 3.

RENT

RENT

A. Monthly Base Rent. Commencing on the Rent Commencement Date, Tenant shall pay Monthly Base Rent in advance on or before the first (1st) day of each month of the Term without demand, setoff or deduction except as otherwise expressly set forth in this Lease. If the Term shall end on a day other than the first (1st) day of a month, the Monthly Base Rent for the last partial month of the Term shall be prorated on a per diem basis.

B. Additional Rent. All costs and expenses, other than Monthly Base Rent, which Tenant assumes or agrees to pay and any other sum payable by Tenant pursuant to this Lease, including, without limitation, its Pro Rata Share of Taxes and Operating Expenses (both as hereinafter defined), shall be deemed Additional Rent.

C. Rent. Monthly Base Rent, Additional Rent, and any other amounts of every nature which Tenant is or becomes obligated to pay Landlord under this Lease are herein referred to collectively as “Rent,” and all remedies applicable to the nonpayment of Rent shall be applicable thereto. Landlord may apply payments received from Tenant to any obligations of Tenant then accrued and due, without regard to such obligations as may be designated by Tenant.

D. Place of Payment, Late Charge, Default Interest. Rent and other charges required to be paid under this Lease, no matter how described, shall be paid by Tenant to Landlord without offset, deduction, credit or the like, at the Building Manager’s address listed in Article 1, or to such other person and/or address as Landlord may designate in writing. In the event Tenant fails to pay Rent due under this Lease within ten (10) business days of the due date of said Rent, Tenant shall pay to Landlord a late charge of three percent (3%) of the amount overdue; provided, however, that no such late charge will be charged for the first (1st) late payment in any rolling twelve (12) month period during the Term. Any Rent not paid within ten (10) business days of the due date of said Rent shall also bear interest at the Default Rate from and after the date due through the date on which Landlord receives payment. This provision shall in no way be construed to modify Tenant’s obligation to pay Rent on or before the first (1st) day of the month.

ARTICLE 4.

TAXES AND OPERATING EXPENSES

TAXES AND OPERATING EXPENSES

A. Payment of Taxes and Operating Expenses. Commencing upon the expiration of the Base Year (i.e., January 1, 2017 for Operating Expenses and July 1, 2016 for Taxes) and for each year, or portion thereof, thereafter during the Term (hereinafter each referred to as a “Comparison Year”), Tenant shall pay Landlord an amount equal to Tenant’s Pro Rata Share of increases in Operating Expenses and Taxes over the Operating Expenses and Taxes for the relevant Base Year (collectively, the “Escalation Increase”). Landlord shall have the right to change the Comparison Year from a calendar year to a fiscal year from time to time (or vice versa), provided that equitable adjustment is made so that Tenant shall not be charged more than once for the same period. Commencing with the first (1st) month of the first (1st) Comparison Year and on the first (1st) day of each month thereafter during the original Term or any extension thereof, Tenant shall pay Escalation Increases to Landlord, as Additional Rent due concurrently with Monthly Base Rent, in installments equal to one-twelfth (1/12) of Landlord’s commercially reasonable estimate of any projected Escalation Increase for the particular Comparison Year (the “Estimated Escalation Increase”). A final adjustment (“Escalation Reconciliation”) shall be made by Landlord and Tenant as soon as practicable (but in any event within one hundred twenty (120) days) following the end of each Comparison Year. In computing the Estimated Escalation Increase for any particular Comparison Year, Landlord shall take into account any prior increases in Tenant’s Pro Rata Share of Taxes and Operating Expenses. Landlord’s Estimated Escalation Increase for Taxes in any Comparison Year will not exceed the Taxes then reflected on Landlord’s real estate tax bill from the City of Boston. If any Estimated Escalation Increase is less than the Estimated Escalation Increase for the immediately preceding Comparison Year, the payments to be paid by Tenant for the new Comparison Year attributable to said Estimated Escalation Increase shall be decreased accordingly; provided, however, in no event will the Rent paid by Tenant hereunder ever be less than the Monthly Base Rent.

B. Escalation Reconciliation. Within one hundred twenty (120) days after the last day of such Comparison Year, Landlord shall submit to Tenant a statement setting forth the actual Escalation Increase for the Comparison Year which was just completed and the Estimated Escalation Increase for the current Comparison Year (the “Escalation Statement”). To the extent that the actual Escalation Increase exceeds the Estimated Escalation Increase paid by Tenant for the Comparison Year just completed, Tenant shall pay Landlord the difference, in cash within thirty (30) days following receipt by Tenant from Landlord of the Escalation Statement. If the actual Escalation Increase for the Comparison Year just completed is less than the Estimated Escalation Increase paid by Tenant for such year, then Tenant shall receive a credit on future Rent owing under this Lease (or cash, if there is no future Rent owing hereunder). Until Tenant receives the Escalation Statement, Tenant’s Estimated Escalation Increases for the new Comparison Year shall continue to be paid at the rate being paid for the particular Comparison Year just completed. Tenant shall commence payment to Landlord of the Estimated Escalation Increase for the then current Comparison Year, beginning on the first (1st) day of the month following the month in which Tenant receives the applicable Escalation Statement. Any amount described in this Article 4 that is not billed to Tenant within two (2) years after the end of the Comparison Year in question shall be deemed forever waived by Landlord, and Tenant shall have no further obligation therefor.

C. Changes in Escalations During the Lease Year. In addition to the above, if, during any particular Comparison Year, there is a change in the information upon which the then current Estimated Escalation Increase is based, Landlord shall be permitted (but in no event more than one time in any calendar year) to revise such Estimated Escalation Increase by notifying Tenant, and such adjustment shall be made in the payment of Estimated Escalation Increases, commencing on the first day of the month following the delivery of such notice to Tenant. When the Escalation Statement for the Comparison Year in which this Lease terminates is delivered to the Tenant, Tenant shall pay to Landlord within thirty (30) days after Landlord’s delivery of the same, any additional amounts due as calculated pursuant to this Article 4. Landlord’s and Tenant’s responsibilities with respect to Escalation Increases shall survive the expiration or early termination of this Lease.

If the Building is less than ninety-five percent (95%) occupied during the Base Year or any particular Comparison Year, Landlord shall adjust those particular components of Operating Expenses which are affected by Building occupancy for the Base Year or the particular Comparison Year, or portion thereof, as the case may be, to reflect an occupancy of not less than ninety-five percent (95%) of all such rentable area of the Building.

D. Disputes Over Taxes or Operating Expenses. If Tenant disputes the amount of an Estimated Escalation Increase or an actual Escalation Increase, Tenant shall give Landlord written notice of such dispute within one hundred fifty (150) days after Landlord delivers the applicable Escalation Statement. Tenant’s failure to give such notice shall waive its right to audit the amounts so determined. Tenant shall not be entitled to audit the foregoing amounts if an Event of Default by Tenant then exists and remains uncured. Said audit will be conducted at Tenant’s expense by a certified public accountant or by a qualified and reputable real estate professional, in either case paid on an hourly basis unrelated to actual savings identified. Tenant shall only be permitted to conduct such a review during regular business hours at Landlord’s office, after Tenant gives Landlord twenty (20) days prior written notice, and no more than once with respect to any one Comparison Year. If such review discloses that the charges actually incurred by Landlord are less than those used by Landlord in calculating Escalation Increases, then Landlord shall reimburse Tenant for the amount Tenant paid in excess of Tenant’s actual Escalation Increases. If any such review discloses that the charges for Operating Expenses or Taxes used by Landlord in calculating the Escalation Increases exceeds the actual charges for Operating Expenses and Taxes (the “Actual Expenses”) by five percent (5%) or more of the Actual Expenses for such Comparison Year, then Landlord shall pay the reasonable costs of such review. If Tenant does not review Landlord’s records within two hundred seventy (270) days after receipt of the Escalation Statement, Tenant shall have no further right to review Landlord’s records for the applicable period. No subtenant shall have the right to conduct an audit and no assignee shall conduct an audit for any period during which such assignee was not in possession of the Premises.

In the event Tenant elects to exercise its audit rights hereunder, Tenant shall nevertheless timely pay Landlord the amount of the prior year’s Escalation Reconciliation and continue to pay Estimated Escalation Increases (without prejudice to Tenant’s position) as set forth in the then applicable Escalation Statement until the parties have agreed as to the appropriate adjustment.

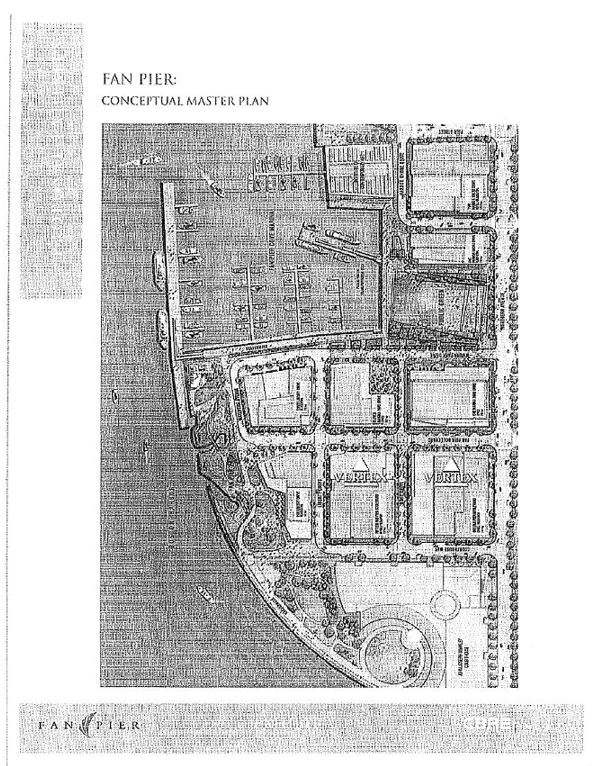

E. Building as Part of Multi-Building Development. Tenant acknowledges that the Building is part of the Project. As a result thereof, any Operating Expenses and Taxes attributable in part to the Building and in part to other portions of the Project, including, without limitation, the Building Common Areas (as hereinafter defined), shall be allocated to the Building and said other portions of the Project pursuant to the Declaration or any other applicable reciprocal easement agreement and otherwise on an equitable basis. In addition, any Operating Expenses and Taxes attributable in part to the Office Component and in part to the Retail Component shall be allocated to the Office Component or the Retail Component, as the case may be, on an equitable basis.

F. Tenant’s Taxes. Tenant shall pay, prior to delinquency, all taxes assessed against or levied upon trade fixtures, furnishings, equipment and all other personal property of Tenant located in the Premises and any excise, sales or use taxes related to Tenant’s business. In the event any or all of Tenant’s trade fixtures, furnishings, equipment and other personal property shall be assessed and taxed with property of Landlord, or if the cost or value of any leasehold improvements in the Premises exceeds the cost or value of a standard build out for general office use and, as a result, real property taxes for the Building are increased, Tenant shall pay to Landlord its share of such taxes within thirty (30) days after delivery to Tenant by Landlord of a statement in writing setting forth the amount of such taxes applicable to Tenant’s property or above-standard improvements. Tenant shall pay directly to the party or entity entitled thereto all business license fees, gross receipts taxes and similar taxes and impositions which may from time to time be assessed against or levied upon Tenant, as and when the same become due and before delinquency. Notwithstanding anything to the contrary contained herein, any sums payable by Tenant under this Article 4 shall not be included in the computation of “Taxes.”

ARTICLE 5.

DELIVERY OF PREMISES, TENANT’S WORK, ALTERATIONS AND ADDITIONS

DELIVERY OF PREMISES, TENANT’S WORK, ALTERATIONS AND ADDITIONS

A. Delivery of Premises. On the next business day following the execution and delivery of this Lease by Landlord and Tenant, Landlord shall deliver, and Tenant shall accept, the Premises in the “Delivery Condition,” which shall mean that the Premises will be delivered vacant and broom clean, free of construction debris, tools and other personal property, and free of any unlawful Hazardous Materials (as hereinafter defined), but otherwise in their current “as is,” “where is” condition. Landlord shall have no obligation to construct any improvements in and to the Premises or to perform any other work therein, the parties acknowledging and agreeing that Tenant shall be solely responsible for improving the Premises as provided in Article 5.B. below and Exhibit B attached hereto, provided that the foregoing shall in no event derogate from or diminish Landlord’s ongoing repair and maintenance obligations under this Lease. Notwithstanding anything contained herein to the contrary, Landlord hereby represents and warrants to Tenant that, as of the Commencement Date, the Common Areas of the Building and the Base Building Condition of the Premises comply with all applicable Laws, including, without limitation, the ADA (as hereinafter defined) and all other applicable laws and rules governing access to and use of facilities by people with disabilities, including the Massachusetts Architectural Access Board regulations. The “Base Building Condition” is as described on Exhibit E attached hereto.

B. Tenant’s Work. On and after the Commencement Date, Tenant shall be entitled to construct certain initial improvements in and to the Premises and prepare same for occupancy in accordance with the terms and conditions of the work exhibit attached hereto as Exhibit B (collectively, “Tenant’s Work”).

C. Alterations. Except as otherwise provided in Article 5.B. above and Exhibit B attached hereto, Tenant shall make no alterations or additions to the Premises (“Alterations”) without the prior written consent of Landlord, which consent may be withheld in Landlord’s sole discretion as to Alterations which adversely affect or impair the structural integrity of or the efficient and proper operation of the operating systems of the Building, and which consent shall not be unreasonably withheld, delayed or conditioned as to all other Alterations. Any Alterations shall only be performed by contractors or mechanics approved by Landlord in writing (which approval shall not be unreasonably withheld, conditioned or delayed), and only upon the approval by Landlord in writing of fully detailed and dimensioned plans and specifications pertaining to the Alterations in question (to the extent such plans and/or specifications would customarily be prepared for work of such nature), to be prepared and submitted by Tenant, at its sole cost and expense, which approval shall not be unreasonably withheld, conditioned or delayed. Tenant shall, at its sole cost and expense, obtain all necessary approvals and permits pertaining to any Alterations approved by Landlord. Tenant hereby indemnifies, defends and agrees to hold Landlord free and harmless from all liens and claims of lien, and all other liability, claims and demands arising out of any work done or material supplied to the Premises by or at the request of Tenant in connection with any Alterations. If permitted Alterations are made by, on behalf of, or at the request of, Tenant, they shall be made at Tenant’s sole cost and expense and shall be and become the property of Landlord, except that Landlord may, by written notice to Tenant given at the time of approval of such Alterations, require Tenant, at Tenant’s expense, to remove all partitions, counters, railings and other Alterations installed by Tenant, and to repair any damages to the Premises caused by such removal. Unless Landlord notifies Tenant in writing of such removal obligation at the time of Landlord’s approval of the plans and specifications therefor in accordance with the terms and conditions of Exhibit B attached hereto, Tenant shall not be required to remove any alterations or improvements made to prepare the Premises for Tenant’s initial occupancy; provided, however, that Landlord agrees that Tenant shall not be obligated to remove any of the improvements conceptually shown on the space plan hereto as Exhibit B-1, subject to the terms and conditions of Exhibit B attached hereto. Any and all costs attributable to or related to the applicable building codes of the City of Boston (or any other authority having jurisdiction over the Building) arising from Tenant’s plans, specifications, improvements, Alterations or otherwise shall be paid by Tenant at its sole cost and expense. With regard to repairs, Alterations or any other work arising from or related to this Article 5, Landlord shall be entitled to receive a commercially reasonable administrative/supervision fee, not to exceed three percent (3%) of the so-called “hard” costs of any such work, to compensate Landlord for costs and expenses arising from Landlord’s review and approval processes.

D. Liens. Tenant will not cause or permit any mechanic’s, materialman’s or similar liens or encumbrances to be filed or exist against the Premises or the Building or Tenant’s interest in this Lease in connection with work done under this Article 5 or in connection with any other work, and Tenant agrees to defend, indemnify and hold harmless Landlord from and against any such lien or claim or action thereon, together with costs of suit and reasonable attorneys’ fees incurred by Landlord in connection with any such claim or action. Tenant shall remove any such lien or encumbrance by bond or otherwise within twenty (20) days from the date of receipt of notice of its existence. If Tenant fails to do so, Landlord may, without being responsible to investigate the validity or lawfulness of the lien, pay the amount or take such other action as Landlord deems necessary to remove any such lien or encumbrance or require that Tenant deposit with Landlord in cash and lawful money of the United States, one hundred ten percent (110%) of the amount of such claim, which sum may be retained by Landlord until such claim shall have been removed of record or until judgment shall have been rendered on such claim and such judgment shall have become final, at which time Landlord shall have the right to apply such deposit in discharge of the judgment on said claim and any costs, including attorneys’ fees incurred by Landlord, and shall remit the balance thereof to Tenant. The amounts so paid and costs incurred by Landlord shall be deemed Additional Rent under this Lease and payable in full upon demand, but shall be applied only to the lien or judgment in question, and any excess will be refunded to Tenant.

E. Compliance with ADA. Landlord represents and warrants to Tenant that, as of the Commencement Date hereof, the Building and the Premises are in compliance with ADA (as defined below). Landlord and Tenant agree that responsibility for compliance with the Americans With Disabilities Act of 1990, as amended (the “ADA”) shall be allocated as follows: (i) Landlord shall be responsible for compliance with the provisions of Title III of the ADA for all Building Common Areas, including exterior and interior areas of the Building not included within the Premises or the premises of other tenants; (ii) Landlord shall be responsible for compliance with the provisions of Title III of the ADA for any construction, renovations, alterations and repairs made within the Premises if such construction, renovations, alterations or repairs are made by Landlord for the purpose of improving the Building generally; and (iii) Tenant shall be responsible for compliance with the provisions of Title III of the ADA for any construction, renovations, Alterations and repairs made within the Premises if such construction, renovations, Alterations and repairs are made by Tenant, its employees, agents or contractors, at the direction of Tenant or done pursuant to final construction plans and specifications prepared or provided by Tenant or Tenant’s architect or space planner.

F. Labor Covenant. As a condition precedent to any proposed construction work or Alteration, Tenant shall deliver to Landlord evidence satisfactory to Landlord that Tenant shall cause such construction, alteration or service contract work to be performed solely by contractors whose employees are represented by unions and such employment will conform to the traditional craft jurisdictions in the area (the “Labor Covenant”). Tenant shall include the Labor Covenant in each of its contracts for such construction or alteration work and in each of its service contracts for any maintenance, repair and services relating to, or to be performed for the benefit of, the Premises. Tenant shall also provide such evidence as Landlord may reasonably require, from time to time during the course of such construction or alteration work or the performance of such services, that the Labor Covenant is being fully and faithfully observed and Tenant shall include the obligation to provide such evidence in each contract entered into by Tenant for such construction or alteration work or service being provided to the Premises. Tenant further agrees that it shall incorporate the foregoing requirements in any sublease of the Premises. Tenant improvement or Alteration work requiring specialized skills that are not available through unionized contractors may be exempted from the Labor Covenant, subject to prior approval by Landlord.

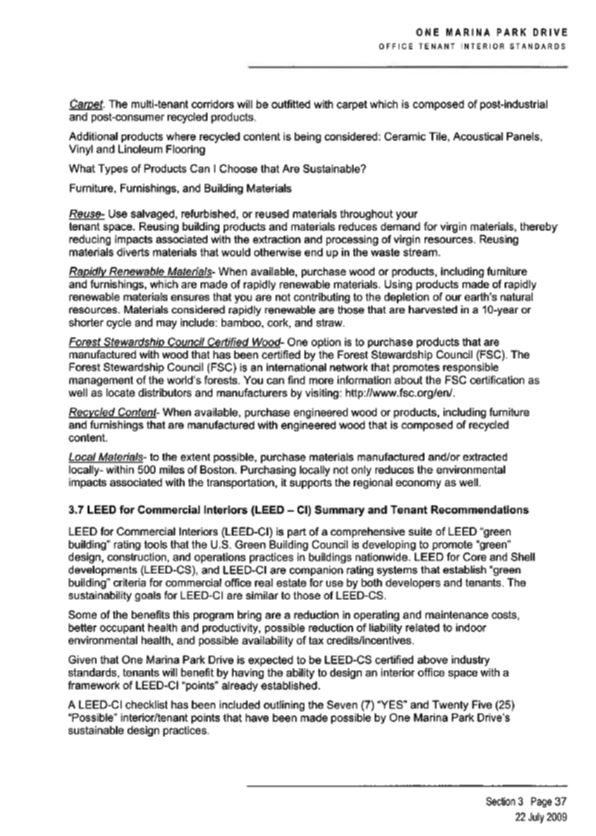

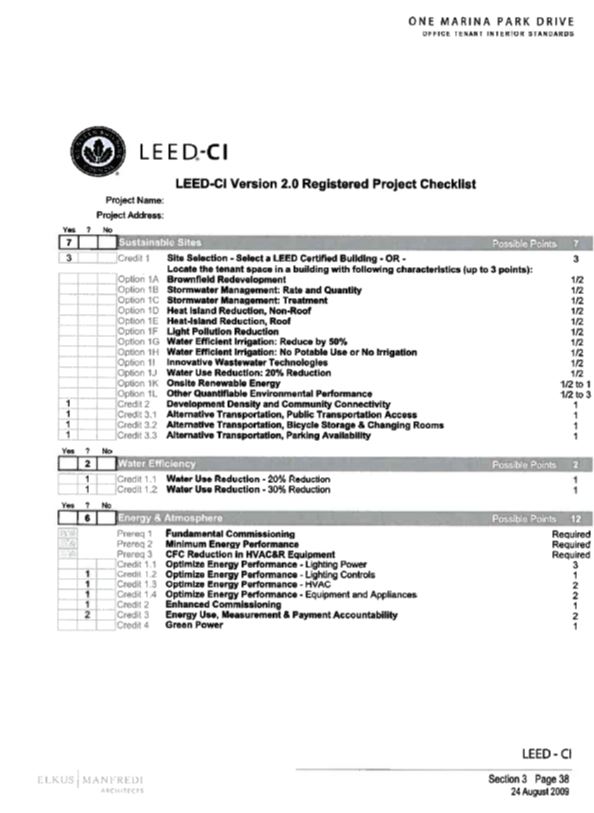

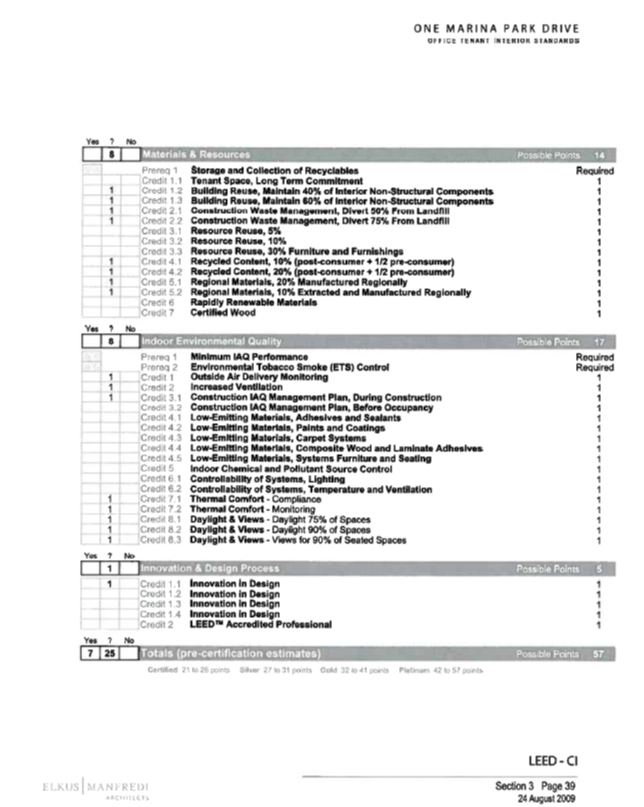

G. Building Sustainability Strategies. Landlord has received LEED-Core and Shell Gold Certification, a rating established by the U.S. Green Building Council. A memorandum outlining Landlord’s “Sustainable Design Strategies” is attached hereto as Exhibit I.

ARTICLE 6.

TENANT’S USE, RESTRICTIONS AND COMPLIANCE WITH LAWS

TENANT’S USE, RESTRICTIONS AND COMPLIANCE WITH LAWS

A. Tenant’s Use. Tenant shall use the Premises for the Permitted Use as provided in Article 1 above, and for no other purpose whatsoever, subject to and in compliance with all other provisions of this Lease, including without limitation the Building’s Rules and Regulations attached as Exhibit D hereto. Tenant and its invitees shall also have the non-exclusive right, along with other tenants of the Building, others authorized by Landlord, and others having the right to the use thereof, to use the Building Common Areas subject to the Project Documents and such rules and regulations as Landlord may impose from time to time in its sole discretion provided the same are enforced in a non-discriminatory manner. Landlord makes no representation that the Premises are suitable for Tenant’s purposes.

B. Tenant’s Restrictions. Tenant shall not at any time use or occupy, or suffer or permit anyone to use or occupy, the Premises or do or permit anything to be done in the Premises which: (a) causes or is liable to cause injury to persons, to the Building or its equipment, facilities or systems; (b) impairs the character, reputation or appearance of the Building as a first class office building; (c) impairs the proper and economic maintenance, operation and repair of the Building or its equipment, facilities or systems; or (d) would invalidate or increase the cost of any fire and extended coverage insurance policy covering the Building and/or the property located therein. Tenant shall comply with all rules, orders, regulations and requirements of any organization which sets out standards and requirements commonly referred to by major fire insurance underwriters. Landlord shall notify Tenant if Landlord reasonably believes that Tenant’s use of the Premises is in violation of any such standard or requirement. Tenant shall promptly, upon demand, reimburse Landlord for any additional premium charges for any such insurance policy assessed or increased by reason of Tenant’s failure to comply with the provisions of this Article 6.

C. Tenant’s Compliance with Laws. Tenant shall, at Tenant’s sole cost and expense, keep and maintain the Premises, its use thereof and its business in compliance with all Laws now in force or which may hereafter be in force or effect. Tenant shall comply with all Laws relating to the Premises and Tenant’s use or occupancy thereof, including without limitation Laws in connection with the health, safety and building codes, and any permit or license requirements. Tenant shall not be required to make any alterations to the Premises in order to comply with laws or codes that are applicable to the operation and maintenance generally of a commercial rental property such as the Project, as opposed to Tenant’s specific use of the Premises or any Alterations or other work by Tenant.

ARTICLE 7.

SERVICES

SERVICES

A. Climate Control. Landlord shall furnish heat or air conditioning to the Premises during Normal Business Hours of the Building as set forth in Article 1, as required in Landlord’s reasonable judgment for the comfortable use and occupancy of the Premises and otherwise in accordance with the standards attached hereto as Exhibit J (such standards being referred to herein as “OTIS” or “OTIS standards”). If Tenant requires heat or air conditioning at any other time (“After Hours Services”), Landlord shall use reasonable efforts to furnish such After Hours Services upon at least twenty-four (24) hours advance notice by Tenant, and Tenant shall pay Landlord, as Additional Rent, the then current rate for such After Hours Services that is applicable to office tenants of the Building generally. The current estimated rate for After Hours Services is Fifty Dollars ($50.00) per hour, which rate is subject to change from time to time in Landlord’s sole, but reasonable discretion.

The performance by Landlord of its obligations under this Article 7 is subject to Tenant’s compliance with the terms of this Lease regarding any connected electrical load reasonably established by Landlord, and Landlord shall promptly notify Tenant of any respect in which Landlord reasonably believes Tenant is not so complying. Tenant shall not use the Premises or any part thereof in a manner exceeding the heating, ventilating or air-conditioning (“HVAC”) design conditions (including any occupancy or connected electrical load conditions) set forth in OTIS, including the rearrangement of partitioning which may interfere with the normal operation of the HVAC equipment, or the use of computer or data processing machines or other machines or equipment in excess of the capacities (if any) and standards set forth in OTIS. If any such use of the Premises by Tenant requires changes in the HVAC or plumbing systems or controls servicing the Premises or portions thereof in order to provide comfortable occupancy in accordance with OTIS standards, such changes may be made by Landlord at Tenant’s expense, and Tenant agrees to promptly pay any such amount to Landlord as Additional Rent.

If Tenant shall install supplemental HVAC equipment in the Premises to serve its needs, chilled water/condenser water shall be made available to Tenant in accordance with OTIS standards.

B. Elevator Service. Landlord, during Normal Business Hours of the Building, shall furnish passenger and freight elevator service to Tenant to be used in common with others. At least one (1) passenger elevator shall remain in service during all other hours. Landlord may designate a specific elevator for use as a service elevator.

C. Janitorial Services. Landlord shall provide janitorial and cleaning services to the Premises, substantially as described in Exhibit D attached hereto. Tenant shall pay to Landlord within thirty (30) days after receipt of an invoice therefor the actual and reasonable costs incurred by Landlord for (i) any cleaning of the Premises in excess of the specifications in Exhibit D for any reason, including, without limitation, cleaning required because of (A) unreasonable misuse or neglect on the part of Tenant or Tenant’s agents, contractors, invitees, employees and customers, (B) the use of portions of the Premises for special purposes requiring greater or more difficult cleaning work than office areas, (C) unusual quantities of interior glass partitions or interior glass surfaces, and (D) non-building standard materials or finishes installed by Tenant or at its request; and (ii) removal from the Premises of any refuse and rubbish of Tenant in excess of that ordinarily accumulated in general office occupancy or at times other than Landlord’s standard cleaning times as reflected on such Exhibit D.

D. Water and Electricity. Landlord shall make available domestic water in reasonable quantities to the Building Common Areas and cause electric service sufficient for lighting the Premises and for the operation of Ordinary Office Equipment. “Ordinary Office Equipment” shall mean equipment not exceeding the standards and capacities set forth in OTIS. Landlord shall have the exclusive right to make any replacement of lamps, fluorescent tubes and lamp ballasts in the Premises (provided, however, that replacements of specialty lighting shall be at Tenant’s sole cost and expense). Landlord may adopt a system of re-lamping and ballast replacement periodically on a group basis in accordance with good management practice. Tenant’s use of electric energy or water in the Premises shall not at any time exceed the capacity of any of the risers, piping, electrical conductors and other equipment in or serving the Premises. In order to insure that such capacity is not exceeded and to avert any possible adverse effect upon the Building’s electric system, Tenant shall not, without Landlord’s prior written consent in each instance, connect appliances or heavy duty equipment, other than Ordinary Office Equipment, to the Building’s electric system or make any alteration or addition to the Building’s electric system. Should Landlord grant its consent in writing, which Landlord may withhold in its sole discretion, all additional risers, piping and electrical conductors or other equipment therefor shall be provided by Landlord and the cost thereof shall be paid by Tenant within thirty (30) days of Landlord’s demand therefor. As a condition to granting such consent, Landlord may require Tenant to agree to a reasonable increase in Monthly Base Rent to offset the expected cost to Landlord of such additional service, that is, the cost of the additional electric energy to be made available to Tenant based upon the estimated additional capacity of such additional risers, piping and electrical conductors or other equipment. If Landlord and Tenant cannot agree thereon, such cost shall be determined by an independent electrical engineer, to be selected by Landlord and reasonably approved by Tenant and paid equally by both parties.

E. Separate Meters. As part of Tenant’s Work, by no later than the thirtieth (30th) day following the Commencement Date, Tenant shall cause the Premises to be separately metered for lights, plugs and power and the electricity to power the VAV boxes in the Premises, and Tenant shall pay a monthly electricity charge to the applicable electricity provider, based on Tenant’s separately metered use and consumption of such electricity in the Premises. If a direct metering arrangement is not reasonably feasible, then Tenant shall install a so-called submeter for electricity and Tenant shall pay a monthly electricity charge to Landlord, as Additional Rent, based on usage as indicated by such submeter and calculated at Landlord’s actual rate(s) for such electricity (without add-on or mark-up). If the Premises are separately metered for any other utility, Tenant shall pay a utility charge directly to the utility company (or, if such arrangement is not reasonably feasible, to Landlord, as Additional Rent) based upon Tenant’s actual consumption as measured by the meter. Landlord also reserves the right (at its expense) to install separate meters for the Premises to register the usage of all or any one of the utilities, and, in such event, Landlord shall pay the cost of installation and Tenant shall pay for the cost of utility usage as metered to the Premises. As to the separate metering of any service or utility, the cost of which was previously included in the Monthly Base Rent and/or Base Year for Operating Expenses or Taxes, there shall be a reasonable and equitable adjustment to Monthly Base Rent and Operating Expenses (for the Base Year and each subsequent year) following such separate metering to reflect that Tenant will thereafter be paying the cost of such service or utility directly. The term “utility” for purposes hereof may refer to but is not limited to gas, water, sewer, steam, fire protection system, telephone or other communication or alarm service, as well as HVAC, and all taxes or other charges thereon.

F. Interruptions. Landlord does not represent or warrant that any of the services referred to above, or any other services which Landlord may supply, will be free from interruption and Tenant acknowledges that any one or more of such services may be suspended by reason of accident, repairs, inspections, alterations or improvements necessary to be made, or by Force Majeure. Any interruption, reduction or discontinuance of service shall not be deemed an eviction or disturbance of Tenant’s use and possession of the Premises, or any part thereof, nor, except as otherwise set forth herein, render Landlord liable to Tenant for damages, nor relieve Tenant from performance of Tenant’s obligations under this Lease. Landlord shall however, exercise reasonable diligence to restore any service so interrupted.

Notwithstanding the foregoing, if any essential services to be supplied by Landlord under this Lease are interrupted, and such interruption has resulted from an act or omission of Landlord and as a result of such cessation of service, the Premises, or a material portion thereof, is rendered untenantable (meaning that Tenant is unable to use and gain reasonable access to the Premises, or such material portion thereof, in the normal course of its business) and Tenant provides written notice of such interruption to Landlord, Tenant shall be entitled to an abatement of a proportionate share of the Monthly Base Rent and all Additional Rent and charges, allocable to the affected material portion of the Premises commencing on the third (3rd) consecutive business day of the interruption following the date on which Tenant notifies Landlord of the cessation of such service, and ending on the date such essential services and Tenant’s access and use of the Premises are restored. If any such interruption continues for fifteen (15) business days after the date of such notice, then for each day thereafter that the interruption continues, Tenant shall be granted a credit of one and one-half (1.5) days’ Monthly Base Rent and Additional Rent, to be applied following the resumption of such services. If such interruption continues for twenty-five (25) business days after the date of such notice, then for each day thereafter that the interruption continues, Tenant shall be granted a credit of two (2) days’ Monthly Base Rent and Additional Rent, instead of the prior one and one-half (1.5) day rent credit, to be applied following the resumption of such services.

G. Additional Utilities Provided by Tenant. Tenant shall make application in Tenant’s own name for all utilities not provided herein by Landlord and shall: (i) comply with all utility company regulations for such utilities, including requirements for the installation of meters, and (ii) obtain such utilities directly from, and pay for the same when due directly to, the applicable utility companies. The term “utilities” for purposes hereof shall include but not be limited to telephone and other communication and alarm services, and all taxes or other charges thereon. Tenant shall install and connect all equipment and lines required to supply such additional utilities to the extent not already available at or serving the Premises, or at Landlord’s option shall repair, alter or replace any such existing items. Tenant shall maintain, repair and replace all such items, operate the same, and keep the same in good working order and condition. Tenant shall not install any equipment or fixtures, or use the same, so as to exceed the safe and lawful capacity of any utility equipment or lines serving the same. The installation, alteration, replacement or connection of any utility equipment and lines shall be subject to the requirements for Alterations of the Premises set forth in Article 5, and Tenant will have the right to use, in common with other tenants and occupants of the Building, common ducts, chases, conduits, and pipes in order to make necessary connections with the Premises. Tenant shall ensure that all of Tenant’s HVAC equipment that is installed by, on behalf of, or at the request of, Tenant is installed and operated at all times in a manner to prevent roof leaks, damage, or noise due to vibrations or improper installation, maintenance or operation. Except as specifically provided in this Article 7, Tenant agrees to pay for all utilities and other services utilized by Tenant and additional services furnished to Tenant not uniformly furnished to all tenants of the Office Component at the rate actually paid by Landlord to the utility provider.

H. Additional Installations. If any lights, machines or equipment (including but not limited to computers) used by Tenant in the Premises materially and adversely affect the temperature otherwise maintained by the air conditioning system, or generate substantially more heat in the Premises than would be generated by the building standard lights and Ordinary Office Equipment, and if such adverse effect continues for more than ten (10) business days after notice thereof from Landlord, Landlord shall have the right to install any machinery and equipment which Landlord reasonably deems necessary to restore temperature balance, including but not limited to modifications to the standard air conditioning equipment, and the cost thereof, including the cost of installation and any additional cost of operation and maintenance occasioned thereby, shall be paid by Tenant to Landlord upon demand by Landlord. Landlord shall not be liable under any circumstances for loss of or injury to property, however occurring, through or in connection with or incidental to failure to furnish any of the foregoing.

I. Access to Building Common Areas. Tenant shall have access to the Building Common Areas twenty-four (24) hours per day, seven (7) days per week, three hundred sixty-five (365) days per year. Upon initial occupancy, Tenant will be entitled to one (1) access card or other access device per employee for use at the Building turnstiles and elevators. Thereafter, additional access cards or devices may be obtained at the rate of Twenty-Five and 00/100 Dollars ($25.00) per additional card or device, which rate is subject to change from time to time in Landlord’s sole but reasonable discretion.

ARTICLE 8.

INSURANCE

INSURANCE

A. Required Insurance. Tenant shall, at all times during the Term of this Lease, and at its own cost and expense, maintain insurance policies, with responsible companies licensed to do business in the Commonwealth of Massachusetts and reasonably satisfactory to Landlord, naming Landlord, the Building Manager, Cornerstone Real Estate Advisers LLC, Tenant and any Mortgagee of Landlord, as their respective interests may appear, including: (i) a policy of standard fire, extended coverage and special extended coverage property insurance which shall be primary on the lease improvements referenced in Article 5 and Tenant’s property, including its goods, equipment and inventory, in an amount adequate to cover their insurable replacement cost, including a vandalism and malicious mischief endorsement, and sprinkler leakage coverage; (ii) business interruption insurance, loss of income and extra expense insurance covering the failure of Tenant’s telecommunications equipment and all other perils, failures or interruptions; (iii) commercial general liability insurance on an occurrence basis with limits of liability in an amount not less than Two Million Dollars ($2,000,000) combined single limit for each occurrence, and Three Million Dollars ($3,000,000) in the annual aggregate; and (iv) Worker’s Compensation Coverage as required by law. The commercial general liability policy shall include contractual liability, provided that contractual liability coverage shall not provide coverage for losses arising from the negligence or willful misconduct of an additional insured.

On or before the Commencement Date, Tenant shall furnish to Landlord and the Building Manager, certificates of insurance evidencing the insurance coverage set forth above, including naming Landlord, Cornerstone Real Estate Advisers LLC and the Building Manager as additional insureds. Renewal certificates must be furnished to Landlord at least ten (10) days prior to the renewal or replacement of such insurance policies showing the above coverage to be in full force and effect.

The foregoing policy sets forth minimum limits of liability and Tenant’s procurement and maintenance thereof shall in no event limit the liability of Tenant under this Lease. All such general liability insurance policies carried by Tenant shall be with companies having a rating of not less than A-VIII in Best’s Insurance Guide. All such policies shall be endorsed to agree that Tenant’s policy is primary and that any insurance covered by Landlord is excess and not contributing with any Tenant insurance requirement hereunder. Tenant agrees that if Tenant does not take out and maintain such insurance or furnish Landlord with renewals or binders, Landlord may (but shall not be required to) procure said insurance on Tenant’s behalf and charge Tenant the cost thereof, which amount shall be payable by Tenant upon demand with interest from the date such sums are extended. Tenant agrees that no policy required hereunder will be canceled except upon thirty (30) days prior written notice (except ten (10) days in the case of non-payment of premium) from Tenant or its insurance agent or consultant. Tenant shall comply with all reasonable and generally applicable rules and directives of any insurance board, company or agency determining rates of hazard coverage for the Premises, including but not limited to the installation of any equipment and/or the correction of any condition necessary to prevent any increase in such rates such as may result from a violation by Tenant.

B. Landlord’s Insurance. During the Term of this Lease, Landlord shall maintain ”Special Form” property and commercial general liability insurance covering the Building. The Special Form property insurance policy shall cover all structures and improvements for full replacement value, with replacement cost endorsement, above foundation walls. Landlord’s Commercial General Liability Insurance shall be written on an occurrence basis with minimum limits of liability in an amount of not less than $5,000,000.00, combined single limit, for bodily injury or death including personal injury, and with respect to damage to the property of others, including legal liability arising out of any one occurrence, which insurance shall contain contractual liability insurance coverage. The commercial general liability insurance shall insure against claims for bodily injury and property damage occurring in or about the Building. Such insurance may be included in blanket policies carried by Landlord so long as such blanket policies do not reduce the amount of insurance available to pay any claim with respect to the Building.

C. Waiver of Subrogation. Landlord and Tenant each agree that neither Landlord nor Tenant will have any claim against the other for any loss, damage or injury which is covered by insurance carried by either party and for which recovery from such insurer is made, notwithstanding the negligence of either party in causing the loss, and each agree to have their respective insurers issuing the insurance described in this Article 8 waive any rights of subrogation that such companies may have against the other party. Each party agrees to use commercially reasonable efforts to obtain such an agreement from its insurer if the policy does not expressly permit a waiver of subrogation.

D. Waiver of Claims. Except for claims arising from Landlord’s willful misconduct or negligence that are not covered by Tenant’s insurance required hereunder, Tenant waives all claims against Landlord for injury or death to persons, damage to property or to any other interest of Tenant sustained by Tenant or any party claiming, through Tenant resulting from: (i) any occurrence in or upon the Premises; (ii) leaking of roofs, bursting, stoppage or leaking of water, gas, sewer or steam pipes or equipment, including sprinklers; (iii) wind, rain, snow, ice, flooding, freezing, fire, explosion, earthquake, excessive heat or cold, or other casualty; (iv) the Building, Premises, or the operating and mechanical systems or equipment of the Building, being defective, or failing; and (v) vandalism, malicious mischief, theft or other acts or omissions of any other parties including, without limitation, other tenants, contractors and invitees at the Building. In no event will Landlord or Tenant be responsible for any consequential damages incurred by the other party, including but not limited to, lost profits or interruption of business as a result of any alleged default hereunder; provided, however, that no remedies or damages expressly provided in this Lease shall be considered indirect or consequential, and that the provisions of this Article 8.D. shall not apply to Articles 15 and 27 of this Lease.

ARTICLE 9.

INDEMNIFICATION

INDEMNIFICATION

A. Tenant Indemnity of Landlord. Except to the extent resulting from the willful misconduct or negligence of Landlord or its agents, employees or contractors, and subject to Article 8.C., Tenant shall defend, indemnify and hold harmless Landlord and its agents, successors and assigns, including the Building Manager, from and against any and all injury, loss, costs, expenses, liabilities, claims or damage (including attorneys’ fees and disbursements) to any person or property (i) arising from, related to, or in connection with any use or occupancy of the Premises by Tenant, or (ii) arising from, related to, or in connection with any negligent or willful and wrongful act or omission (including, without limitation, construction and repair of the Premises arising out of any Alterations) of Tenant, its agents, contractors, employees, customers, and invitees, or (iii) or arising from any uncured default by Tenant under this Lease. This indemnification shall survive the expiration or termination of the Lease Term.

B. Landlord Indemnity of Tenant. Landlord shall defend, indemnify and hold Tenant harmless from and against all claims, causes of action, liabilities, losses, costs and expenses arising from or in connection with (i) any injury or other damage to any person or property resulting from any act or omission of Landlord, or (ii) any uncured default by Landlord under this Lease. This indemnification shall survive the expiration or termination of the Lease Term.

C. Indemnity Limitations. The indemnity obligations set forth in Sections A. and B. above shall not apply (i) to any costs or expenses not reasonably incurred by the indemnitee, or (ii) to any claims, causes of action, liabilities, losses, costs and expenses resulting from a default by the indemnitee hereunder.

D. Indemnitees; Acceptable Attorneys. Whenever, in this Article 9 and throughout this Lease, Landlord or Tenant is required to defend, indemnify and hold the other harmless, such obligations shall extend to the successors, assigns, officers, partners, members, managers, directors, employees and other agents of the indemnitee. In any instance where this Lease requires either party to defend the other, such defense shall involve an attorney or attorneys reasonably acceptable to the indemnitee.

E. Limitation on Liability. Landlord shall not be liable to Tenant for any damage by or from any act or negligence of any tenant or other occupant of the Building, or by any owner or occupants (other than Landlord or its affiliated entities) of adjoining or contiguous property. Landlord shall not be liable for any injury or damage to persons or property resulting in whole or in part from the criminal activities or willful misconduct of others. Subject to Article 8.C. above, Tenant agrees to pay for all damage to the Building, as well as all damage to persons or property of other tenants or occupants thereof, caused by the negligence, fraud or willful misconduct of Tenant or any of its agents, contractors, employees, customers (while located in the Premises) and invitees (while located in the Premises). Nothing contained herein shall be construed to relieve Landlord from liability for any personal injury resulting from its negligence, fraud or willful misconduct and that of its agents, employees or contractors.

F. Surveillance. Tenant acknowledges that Landlord’s election to provide mechanical surveillance or to post security personnel in the Building is subject to Landlord’s sole discretion. Except to the extent resulting from the willful misconduct or negligence of Landlord or its agents, employees or contractors, and then subject to Article 8.C. above, Landlord shall have no liability in connection with the decision whether or not to provide such services and Tenant hereby waives all claims based thereon. Landlord shall not be liable for losses due to theft, vandalism, or like causes.

ARTICLE 10.

CASUALTY DAMAGE

CASUALTY DAMAGE

Tenant shall promptly notify Landlord or the Building Manager of any fire or other casualty to the Premises, or, to the extent it knows of damage, to the Building. In the event the Premises or any substantial part of the Building is wholly or partially damaged or destroyed by fire or other casualty which is covered by the insurance that Landlord is required to carry hereunder, Landlord will proceed to restore the same to substantially the same condition existing immediately prior to such damage or destruction unless Landlord notifies Tenant (the “Casualty Notice”) that (i) such damage or destruction is incapable of repair or restoration within three hundred sixty-five (365) days from commencement thereof as reasonably determined by Landlord’s architect; or (ii) the insurance proceeds recovered by reason of the damage or destruction (together with the amount of any deductible) are, in Landlord’s commercially reasonable judgment, inadequate to complete the restoration of the Building; or (iii) Landlord elects not to repair or restore the Building; in any of which events Landlord or Tenant may, by written notice given to the other party within twenty (20) days of Tenant’s receipt of the Casualty Notice, declare this Lease terminated as of the happening of such damage or destruction. Any Casualty Notice must be delivered within forty-five (45) days after the date of such damage. To the extent after fire or other casualty that Tenant shall be deprived of the use and occupancy of the Premises or any portion thereof as a result of any such damage, destruction or the repair thereof, providing Tenant did not intentionally cause the fire or other casualty, then Tenant shall be relieved of the same ratable portion of the Monthly Base Rent and all additional rent due under this Lease as the amount of damaged or useless space in the Premises bears to the rentable square footage of the Premises until such time as the Premises may be restored. Landlord shall reasonably determine the amount of damaged or useless space and the square footage of the Premises referenced in the prior sentence and whether or not its insurance covers the payment of Rent. Tenant may elect to terminate this Lease: (a) if the Casualty Notice states that it will take greater than three hundred sixty-five (365) days to complete the restoration or repair from the time that such restoration or repair commences, provided that Tenant gives such notice within thirty (30) days after delivery of the Casualty Notice; or (b) if the restoration or repair is not completed within three hundred sixty-five (365) days (or such longer period as is specified in the Casualty Notice, plus an additional contingency period equal to twenty percent (20%) of such scheduled period) of the casualty, plus an additional period of up to sixty (60) days on account of Force Majeure; provided however, that if such restoration or repair is completed within thirty (30) days following receipt of Tenant’s notice of termination, then such notice of termination shall be deemed null and void and of no further force or effect.

ARTICLE 11.

CONDEMNATION

CONDEMNATION

In the event of a condemnation or taking of the entire Premises by a public or quasi-public authority, this Lease shall terminate as of the date title vests in the public or quasi-public authority. In the event of (i) a taking or condemnation of fifteen percent (15%) or more (but less than the whole) of the Building and without regard to whether the Premises are part of such taking or condemnation; (ii) a taking or condemnation which results in Landlord electing not to restore the Building; or (iii) a taking or condemnation which results in Landlord electing to change the use of the land upon which the Building is located, Landlord may elect to terminate this Lease by giving notice to Tenant within sixty (60) days of Landlord receiving notice of such condemnation. In the event of a partial taking as described in this Article 11, or a sale, transfer or conveyance in lieu thereof, which does not result in the termination of this Lease, Rent shall be apportioned according to the ratio that the part of the Premises remaining usable by Tenant bears to the total area of the Premises. All compensation awarded for any condemnation shall be the property of Landlord, whether such damages shall be awarded as a compensation for diminution in the value of the leasehold or to the fee of the Premises, and Tenant hereby assigns to Landlord all of Tenant’s right, title and interest in and to any and all such compensation; provided, however that in the event this Lease is terminated, Tenant shall be entitled to make a separate claim for the taking of Tenant’s personal property (including fixtures paid for by Tenant), and for costs of moving, provided that any such award to Tenant is payable separately and does not diminish the award available to Landlord or any Lender of Landlord. Any additional portion of such award shall belong to Landlord. Tenant hereby waives any and all rights, imposed by law, statute, ordinance, governmental regulation or requirement of the United States, the Commonwealth of Massachusetts or any local government authority or agency or any political subdivision thereof, now or hereafter in effect, it might otherwise have to petition a court to terminate the Lease. In the event that any portion of the Premises shall be the subject to condemnation or a taking and Tenant determines that the remainder, even after restoration, would not be reasonably suitable for Tenant’s continued use, then this Lease may be terminated at the election of Tenant, which election shall be made by giving of notice by Tenant to Landlord within thirty (30) days after the date of the condemnation or taking.

ARTICLE 12.

REPAIR AND MAINTENANCE

REPAIR AND MAINTENANCE

A. Tenant’s Obligations. Tenant shall keep the Premises in good working order, repair (and in compliance with all Laws now or hereafter adopted) and condition (which condition shall be neat, clean and sanitary) and shall make all necessary non-structural repairs thereto and any repairs to non-Building standard mechanical, HVAC, electrical and plumbing systems or components located in and exclusively serving the Premises. Tenant’s obligations hereunder shall include, but not be limited to, Tenant’s trade fixtures and equipment, security systems, signs, interior decorations, floor-coverings, wall-coverings, entry and interior doors, interior glass, light fixtures and bulbs, keys and locks, and Alterations to the Premises whether installed by Tenant or Landlord. Landlord may make any repairs which are not promptly made by Tenant after Tenant’s receipt of written notice and the reasonable opportunity of Tenant to make said repair within five thirty (30) days from receipt of said written notice, and charge Tenant for the cost thereof, which cost shall be paid by Tenant within thirty (30) days from invoice therefor from Landlord. Tenant waives all rights to make repairs at the expense of Landlord, or to deduct the cost thereof from Rent.

B. Landlord’s Obligations. Landlord shall maintain, in a condition similar to other first-class office buildings in the Boston market and in material compliance with all applicable Laws (other than those Laws applicable to a tenant’s unique use and occupancy of its premises or to any alterations or other work performed by, on behalf of, or at the request of, such tenant), (i) the foundations, roof, perimeter walls and exterior windows and all structural aspects of the Building, and (ii) all nonstructural aspects of the Building which relate to the Building Common Areas or to more than one tenant’s premises, or which no tenant of the Building is required to maintain and repair, including all systems and facilities necessary for the operation of the Building and the provision of services and utilities as required herein (except to the extent that any of the foregoing items are installed by or on behalf of, or are the property of, Tenant). Landlord shall also make all necessary structural repairs to the Building and any necessary repairs to the Building standard mechanical, HVAC, electrical, and plumbing systems in or servicing the Premises (the cost of which shall be included in Operating Expenses to the extent permitted under Article 4), excluding repairs required to be made by Tenant pursuant to this Article 12. Landlord shall have no responsibility to make any repairs unless and until Landlord receives written notice of the need for such repair or otherwise becomes aware. Landlord shall not be liable for damages arising from any failure to make repairs or to perform any maintenance unless such failure shall persist for an unreasonable period of time after written notice of the need for such repairs or maintenance is received by Landlord from Tenant or after Landlord otherwise becomes aware. Landlord shall make every reasonable effort to perform all such repairs or maintenance in such a manner (in its judgment) so as to cause minimum interference with Tenant and the Premises but Landlord shall not be liable to Tenant (except as may otherwise be expressly provided in this Lease) for any interruption or loss of business pertaining to such activities. Landlord shall have the right to require (subject to Article 8.C.) that any damage caused by the willful misconduct of Tenant or any of Tenant’s agents, contractors or employees, be paid for and performed by the Tenant (without limiting Landlord’s other remedies herein).

C. General Obligations. Alterations to the Premises required from time to time to comply with applicable Laws, requirements of any board of property insurance underwriters or similar entity, or reasonable requirements of Landlord’s or Tenant’s insurers shall be made by the party to this Lease responsible for maintaining and repairing the applicable aspect of the Premises hereunder, provided that Landlord shall be responsible for any such alteration that is not required solely on account of Tenant’s particular use (other than general business offices) of the Premises or Alterations to the Premises. Landlord warrants to Tenant that, as of the Commencement Date, all aspects of the Premises comprising the Base Building Condition shall comply with all applicable Laws, with the requirements of Landlord’s insurers, and with the requirements of all boards of property insurance underwriters and similar entities.

D. Signs and Obstructions. Tenant shall not obstruct or permit the obstruction of lights, halls, Building Common Areas, roofs, parapets, stairways or entrances to the Building or the Premises and will not affix, paint, erect or inscribe any sign, projection, awning, signal or advertisement of any kind to any part of the Building outside of the Premises, including the inside or outside of the windows or doors, or within the Premises if same can be seen from outside of the Premises, without the written consent of Landlord. If such work is done by Tenant through any person, firm or corporation not approved by Landlord, or without the express written consent of Landlord, Landlord shall have the right to remove such signs, projections, awnings, signals or advertisements without being liable to the Tenant by reason thereof and to charge the cost of such removal to Tenant as Additional Rent, payable within ten (10) days of Landlord’s demand therefor. Tenant shall be entitled to Building-standard lobby directory signage, in common with other tenants of the Building, at no additional cost.

E. Outside Services. Tenant shall not permit, except by Landlord or a person or company reasonably satisfactory to and approved by Landlord: (i) the servicing of Tenant’s supplemental heating, ventilating and air conditioning equipment in the Premises and (ii) window cleaning, janitorial services or similar work in or about the Premises.

F. Condition of Premises. Except as otherwise provided herein to the contrary (including without limitation Landlord’s ongoing repair and maintenance obligations), Tenant hereby agrees that the Premises shall be taken “as is,” “with all faults,” and “without any representations or warranties,” and Tenant hereby acknowledges and agrees that it has investigated and inspected the condition of the Premises and the suitability of same for Tenant’s purposes, and except for matters or conditions that could not reasonably be detected by a reasonably careful inspection, Tenant does hereby waive and disclaim any objection to, cause of action based upon, or claim that its obligations hereunder should be reduced or limited because of the condition of the Premises or the Building or the suitability of same for Tenant’s purposes. Tenant acknowledges that neither Landlord nor any agent nor any employee of Landlord has made any representation or warranty with respect to the suitability of the Premises or the Building for the conduct of Tenant’s business and Tenant expressly represents and warrants that Tenant has relied solely on its own investigation and inspection of the Premises and the Building in its decision to enter into this Lease and let the Premises in an “As Is” condition. The Premises shall be initially improved by Tenant as provided in, and subject to, the terms and conditions of Exhibit B attached hereto and made a part hereof. The Tenant Improvements (as defined in Exhibit B), together with any subsequent Alterations during the Term of this Lease, may be collectively referred to herein as the “Premises Improvements.” The taking of possession of the Premises by Tenant shall conclusively establish that the Premises and the Building were at such time in satisfactory condition.

Landlord reserves the right from time to time, but subject to payment by and/or reimbursement from Tenant as otherwise provided herein: (i) to install, use, maintain, repair, replace and relocate for service to the Premises and/or other parts of the Building pipes, ducts, conduits, wires, appurtenant fixtures, and mechanical systems, wherever located in the Premises or the Building, (ii) to alter, close or relocate any facility in the Premises or the Building Common Areas or otherwise conduct any of the above activities for the purpose of complying with a general plan for fire/life safety for the Building or otherwise and (iii) to comply with any Law with respect thereto or the regulation thereof not currently in effect. Landlord shall attempt to perform any such work with the least inconvenience to Tenant as possible, but, except as otherwise expressly provided herein, so long as the activities by Landlord set forth in (i) and (ii) do not unreasonably interfere with Tenant’s operations in the Premises, Tenant shall not be permitted to withhold or reduce Rent or other charges due hereunder as a result of same or otherwise make claim against Landlord for interruption or interference with Tenant’s business and/or operations.

ARTICLE 13.

INSPECTION OF PREMISES

INSPECTION OF PREMISES

Tenant shall permit the Landlord, the Building Manager and its authorized representatives to enter the Premises upon at least twenty-four (24) hours’ advance notice to show the Premises during Normal Business Hours of the Building (provided, however, that Landlord’s right to show the Premises to prospective tenants shall be limited to the last twelve (12) months of the Term) and at other reasonable times to inspect the Premises, to clean the Premises, to serve or post notices as provided by law or which Landlord reasonably deems necessary for the protection of Landlord or Landlord’s property, and to make such repairs, improvements, alterations or additions in the Premises or in the Building of which they are a part as Landlord may deem necessary or appropriate and at any time in the event of an emergency. If Tenant shall not be personally present to open and permit an entry into the Premises at any time when such an entry is necessary or permitted hereunder, Landlord may enter by means of a master key or may enter forcibly, only in the case of an emergency, without liability to Tenant and without affecting this Lease. Landlord shall (except in cases of emergency) use commercially reasonable efforts to avoid unnecessary interruption of Tenant’s use of the Premises in any entry authorized hereby. Except in cases of emergency, Landlord will cooperate with Tenant to schedule such entry in a manner so as to minimize interference with Tenant’s operations, and, if Tenant requests and pays for any incremental premium cost actually incurred by Landlord as a result of such request, Landlord will enter after hours.

ARTICLE 14.

SURRENDER OF PREMISES

SURRENDER OF PREMISES

Upon the expiration of the Term, or sooner termination of the Lease, Tenant shall quit and surrender to Landlord the Premises, broom clean, in good order and condition, normal wear and tear and damage by fire and other casualty which are Landlord’s obligation excepted. All Premises Improvements and other fixtures, such as light fixtures and HVAC equipment, wall coverings, carpeting and drapes, in or serving the Premises, whether installed by Tenant or Landlord, shall be Landlord’s property and shall remain, all without compensation, allowance or credit to Tenant; provided that Tenant shall, at its expense, remove any Alterations made by tenant after completion of the Tenant Improvements and that were required to be so removed by Landlord in any notice given to Tenant at the time of approval of such Alterations in accordance with Article 5.C. above and/or Exhibit B attached hereto, and repair any damages to the Premises caused by such removal, all at Tenant’s sole cost and expense. Unless Landlord has otherwise directed Tenant to do so in writing under Exhibit B attached hereto at the time of Landlord’s approval, Tenant shall not be required to remove any of the Tenant Improvements. Upon the expiration or earlier termination of this Lease, Tenant shall remove from the Premises all of Tenant’s furniture, trade fixtures, furnishings, equipment and other personal property and repair any damage caused by such removal, at Tenant’s sole cost and expense. Any property not removed shall be deemed to have been abandoned by Tenant and may be retained or disposed of by Landlord at Tenant’s expense free of any and all claims of Tenant, as Landlord shall desire. All property not removed from the Premises by Tenant may be handled or stored by Landlord at Tenant’s expense and Landlord shall not be liable for the value, preservation or safekeeping thereof. At Landlord’s option all or part of such property may be conclusively deemed to have been conveyed by Tenant to Landlord as if by bill of sale without payment by Landlord. Tenant hereby waives, to the maximum extent allowable, the benefit of all Laws now or hereafter in force in the Commonwealth of Massachusetts or elsewhere exempting property from liability for rent or for debt.

ARTICLE 15.

HOLDING OVER

HOLDING OVER