Attached files

| file | filename |

|---|---|

| EX-32.2 - JIVE-12.31.2016-EX32.2 - Jive Software, Inc. | jive-12312016xex322.htm |

| EX-32.1 - JIVE-12.31.2016-EX32.1 - Jive Software, Inc. | jive-12312016xex321.htm |

| EX-31.2 - JIVE-12.31.2016-EX31.2 - Jive Software, Inc. | jive-12312016xex312.htm |

| EX-31.1 - JIVE-12.31.2016-EX31.1 - Jive Software, Inc. | jive-12312016xex311.htm |

| EX-23.1 - JIVE-12.31.2016-EX23.1 - Jive Software, Inc. | jive-12312016xex231.htm |

| EX-21.1 - JIVE-12.31.2016-EX21.1 - Jive Software, Inc. | jive-12312016xex211.htm |

| EX-10.11 - JIVE-12.31.2016-EX10.11 - Jive Software, Inc. | jive-12312016xex1011.htm |

| 10-K - JIVE-12.31.2016-10-K - Jive Software, Inc. | jive-12312016x10k.htm |

BASIC LEASE INFORMATION

OFFICE GROSS

LEASE DATE: (same as date in first paragraph of Lease) | October 14, 2016 | |||

TENANT: | JIVE SOFTWARE, INC., a Delaware corporation | |||

TENANT’S NOTICE ADDRESS PRIOR TO TERM COMMENCEMENT DATE: | Jive Software 915 SW Start St. Suite 200 Portland, OR 97205 Attn: Greg Webber With a copy to: Jive Software 915 SW Start St. Suite 200 Portland, OR 97205 Attn: General Counsel | |||

TENANT’S NOTICE ADDRESS ON AND AFTER TERM COMMENCEMENT DATE: | Jive Software 915 SW Start St. Suite 200 Portland, OR 97205 Attn: Greg Webber With a copy to: Jive Software 915 SW Start St. Suite 200 Portland, OR 97205 Attn: General Counsel Notwithstanding anything to the contrary set forth in this Lease with respect to Tenant’s address for notices, Landlord does not waive and shall not be deemed to have waived any right it may have to deliver notice in accordance with any applicable statute. | |||

TENANT’S BILLING ADDRESS: | 300 Orchard City Drive, Suite Nos. 100A and 100B Campbell, California 95008 | |||

TENANT CONTACT: | Greg Webber | PHONE NUMBER: FAX NUMBER: | 503-200-7495 Gregg.webber@jivesoftware.com | |

LANDLORD: | WATER TOWER FEE OWNER, LLC, a Delaware limited liability company | |||

LANDLORD’S NOTICE ADDRESS: | FCP Management, Inc. 339 S. San Antonio Road, Suite 2B Los Altos, CA 94022 Attn: Asset Manager | |||

LANDLORD’S REMITTANCE ADDRESS: | Water Tower Fee Owner LLC P.O. Box 740232 Los Angeles, CA 90074-0232 By Wire: Bank of America Routing number 026009593 Account number 1453422647 | |||

Project Description: | 300 Orchard City Drive, Campbell, California 95008 | |||

Building Description: | 300 Orchard City Drive, Campbell, California 95008 | |||

Premises: | Approximately 12,543 rentable square feet located at 300 Orchard City Drive, Suite Nos. 100A and 100B, Campbell, California 95008 | |||

Permitted Use: | General office use | |||

{2089-00107/00654094;7}

CA Office Gross Lease (10.4) 1

Parking: | Parking for the Project is available on a first come, first served basis in the surface area parking lot adjacent to the Project and in the parking garage on First Street, both of which are owned and operated by the City of Campbell and maintained by Landlord. | |||

Scheduled Term Commencement Date: | March 1, 2017 | |||

Scheduled Length of Term: | Sixty-three (63) months | |||

Scheduled Term Expiration Date: | The last day of the sixty-third (63rd) full calendar month after the Term Commencement Date, which Termination Date is estimated to be June 30, 2022. | |||

Base Rent: | $52,680.60 per month (subject to adjustment as provided in Paragraph 39. A hereof) | |||

Base Year: | 2017 | |||

Security Deposit: | Letter of Credit in the amount of Three Hundred Sixty-Six Thousand Three Hundred and Eighty-One Dollars ($366,381.00) | |||

Tenant’s Proportionate Share: | ||||

Of Building: | 12.24% | |||

Of Project: | 12.24% | |||

Tenant’s Broker: | Savills-Studley | |||

Landlord’s Broker: | Cassidy Turley Commercial Real Estate Services, Inc., dba Cushman & Wakefield | |||

Guarantor(s): | None as of the date of this Lease | |||

The foregoing Basic Lease Information is incorporated into and made a part of this Lease. Each reference in this Lease to any of the Basic Lease Information shall mean the respective information above and shall be construed to incorporate all of the terms provided under the particular Lease paragraph pertaining to such information. In the event of any conflict between the Basic Lease Information and the Lease, the latter shall control.

{2089-00107/00654094;7} 2

CA Office Gross Lease (10.4)

TABLE OF CONTENTS | |||

Page | |||

Basic Lease Information | 1 | ||

Table of Contents | 3 | ||

1. | Premises | 4 | |

2. | Possession and Lease Commencement | 4 | |

3. | Term | 5 | |

4. | Use | 5 | |

5. | Rules and Regulations | 6 | |

6. | Rent | 6 | |

7. | Operating Expenses | 6 | |

8. | Insurance and Indemnification | 9 | |

9. | Waiver of Subrogation | 10 | |

10. | Landlord’s Repairs and Maintenance | 10 | |

11. | Tenant’s Repairs and Maintenance | 11 | |

12. | Alterations | 11 | |

13. | Signs | 12 | |

14. | Inspection/Posting Notices | 12 | |

15. | Services and Utilities | 12 | |

16. | Subordination | 14 | |

17. | Financial Statements | 14 | |

18. | Estoppel Certificate | 14 | |

19. | Security Deposit | 15 | |

20. | Limitation of Tenant’s Remedies | 15 | |

21. | Assignment and Subletting | 15 | |

22. | Authority | 16 | |

23. | Condemnation | 16 | |

24. | Casualty Damage | 17 | |

25. | Holding Over | 18 | |

26. | Default | 18 | |

27. | Liens | 19 | |

28. | [Intentionally Omitted | 20 | |

29. | Transfers by Landlord | 20 | |

30. | Right of Landlord to Perform Tenant’s Covenants | 20 | |

31. | Waiver | 20 | |

32. | Notices | 20 | |

33. | Attorneys’ Fees | 20 | |

34. | Successors and Assigns | 21 | |

35. | Force Majeure | 21 | |

36. | Surrender of Premises | 21 | |

37. | Parking | 21 | |

38. | Miscellaneous | 21 | |

39. | Additional Provisions | 23 | |

40. | Jury Trial Waiver | 26 | |

Signatures | 26 | ||

Exhibits: | |||

Exhibit A | Rules and Regulations | ||

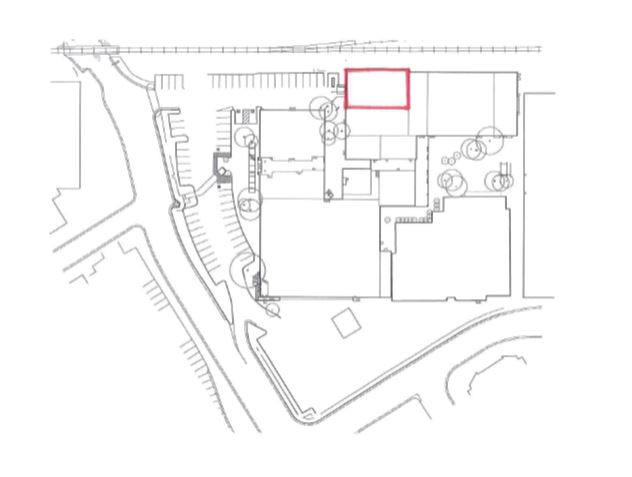

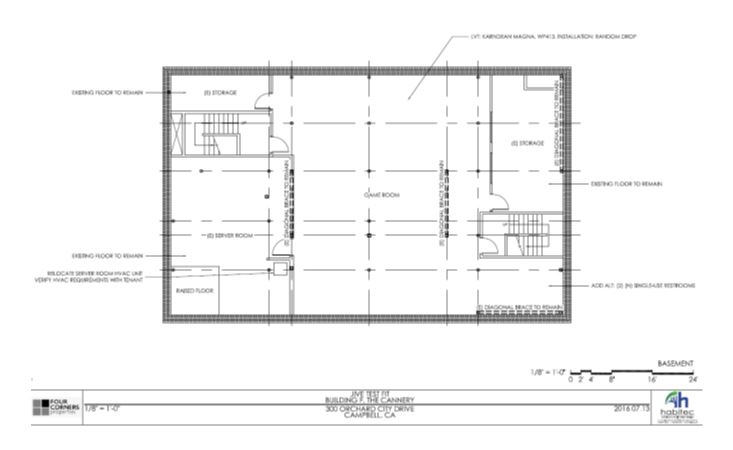

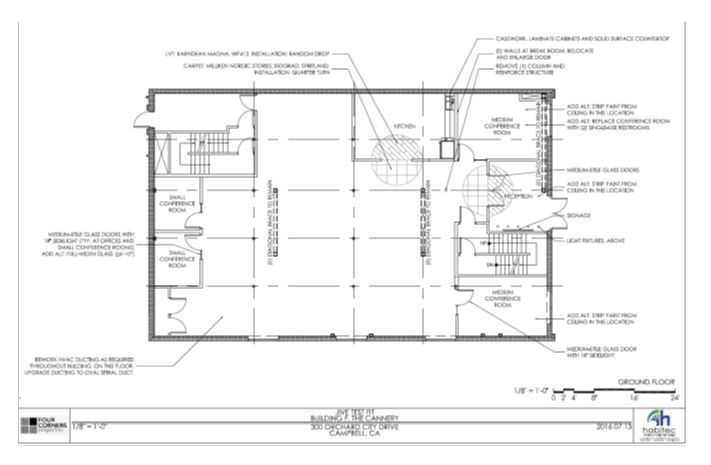

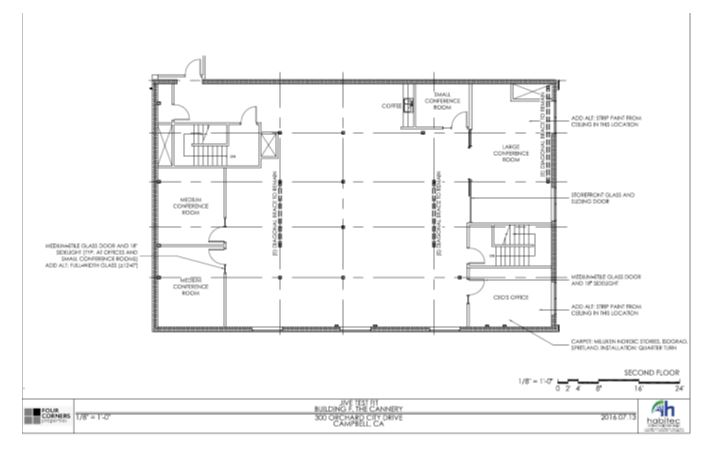

Exhibit B | Outline and Location of Premises | ||

Exhibit C | Work Letter | ||

Exhibit C-1 | Space Plan | ||

Exhibit D | Asbestos Notification | ||

Exhibit E | Form of Letter of Credit | ||

Exhibit F | Form of Subordination, Non-Disturbance and Attornment Agreement | ||

{2089-00107/00654094;7} 3

CA Office Gross Lease (10.4)

LEASE

THIS LEASE (the “Lease”) is made as of October 14, 2016, by and between WATER TOWER FEE OWNER, LLC, a Delaware limited liability company (“Landlord”), and JIVE SOFTWARE, a Delaware corporation (“Tenant”).

{2089-00107/00654094;7} 4

1. PREMISES

Landlord leases to Tenant and Tenant leases from Landlord, upon the terms and conditions hereinafter set forth, those premises (the “Premises”) outlined on Exhibit B and described in the Basic Lease Information. The Premises shall be all or part of a building (the “Building”) and of a project (the “Project”), which may consist of more than one building and additional facilities, as described in the Basic Lease Information. Landlord and Tenant acknowledge that physical changes may occur from time to time in the Premises, Building or Project, and that the number of buildings and additional facilities which constitute the Project may change from time to time, which may result in an adjustment in Tenant’s Proportionate Share, as defined in the Basic Lease Information, as provided in Paragraph 7.A.

2. POSSESSION AND LEASE COMMENCEMENT

The term commencement date (“Term Commencement Date”) shall be the earlier of the date on which: (1) Tenant takes possession of some or all of the Premises, other than in connection with Tenant’s Early Access rights (defined below); and (2) the Initial Alterations to be constructed or performed in the Premises by Landlord shall have been Substantially Completed in accordance with the plans and specifications described on Exhibit C. Tenant’s taking of possession of the Premises or any part thereof, other than in connection with Tenant’s Early Access rights, shall constitute Tenant’s confirmation of Substantial Completion the Initial Alterations for all purposes hereof, whether or not substantial completion of the Building or Project shall have occurred. The Initial Alterations shall be deemed to be “Substantially Complete” (which definition shall include the variations “Substantial Completion,” or “Substantially Completed”) on the later of (i) the date that all of the Initial Alterations have been performed pursuant to the Approved Plans (as defined in Exhibit C attached hereto) in good and workmanlike manner and in compliance with all applicable laws, with the exception of any Punchlist Items and other details of construction, mechanical adjustment or any other similar matters, the noncompletion of which does not materially interfere with Tenant’s use of the Premises (collectively, the “Punchlist Items”); and (ii) the date Landlord and Tenant receive from the appropriate governmental authorities, with respect to the Initial Alterations performed by Landlord or its contractors in the Premises, all approvals necessary for the occupancy of the Premises. Substantial Completion shall be deemed to have occurred notwithstanding a requirement to complete Punchlist Items. If for any reason Landlord cannot deliver possession of the Premises to Tenant on the Scheduled Term Commencement Date with the Initial Alterations Substantially Complete, Landlord shall not be subject to any liability therefor, nor shall Landlord be in default hereunder nor shall such failure affect the validity of this Lease, and Tenant agrees to accept possession of the Premises at such time as the Initial Alterations have been Substantially Completed, which date shall then be deemed the Term Commencement Date, except to the extent such delay is the result of a Tenant Delay (defined below). Tenant shall not be liable for any Rent for any period prior to the Term Commencement Date (but without affecting any obligations of Tenant under any improvement agreement appended to this Lease), except that the actual Term Commencement Date shall be postponed until the date that Landlord delivers possession of the Premises to Tenant with the Initial Alterations Substantially Complete, except to the extent that such delay is arising from or related to the acts or omissions of Tenant or any Tenant’s Parties, including, without limitation, as a result of: (a) Tenant’s failure to agree to plans and specifications and/or construction cost estimates or bids within five (5) days of submittal; (b) Tenant’s request for materials, finishes or installations other than Landlord’s standard except those, if any, that Landlord shall have expressly agreed to furnish without extension of time agreed by Landlord; (c) Tenant’s change in any Approved Plans; or, (d) performance or completion by a party employed by Tenant (each of the foregoing, a “Tenant Delay”). If any delay is the result of a Tenant Delay, the Term Commencement Date and the payment of rent under this Lease shall be accelerated by the number of days of such Tenant Delay. Notwithstanding the foregoing, Tenant shall only be responsible for Tenant Delays to the extent that they actually prevent Landlord from Substantially Completing the Initial Alterations by the Scheduled Term Commencement Date. Accordingly, the number of days of Tenant Delay shall not exceed the actual number of days between the Scheduled Term Commencement Date and the date of Substantial Completion of Initial Alterations. Landlord shall use reasonable efforts to notify Tenant in writing of any circumstances of which Landlord is aware that have caused or may cause a Tenant Delay, so that Tenant may take whatever action is appropriate to minimize or prevent such Tenant Delay. In the event of any dispute as to Substantial Completion of the Initial Alterations required to be performed by Landlord, the certificate of Landlord’s architect or general contractor shall be conclusive. Substantial Completion of the Initial Alterations shall have occurred notwithstanding Tenant’s submission of the Punchlist Items to Landlord, which Tenant shall submit, if at all, within ten (10) days after the Term Commencement Date or otherwise in accordance with any improvement agreement appended to this Lease. Upon Landlord’s request, Tenant shall promptly execute and return to Landlord a “Start-Up Letter” in which Tenant shall agree, among other things, to acceptance of the Premises and to the determination of the Term Commencement Date, in accordance with the terms of this Lease, but Tenant’s failure or refusal to do so shall not negate Tenant’s acceptance of the Premises or affect determination of the Term Commencement Date.

Notwithstanding the foregoing, if the Term Commencement Date has not occurred on or before the Required Completion Date (defined below), Tenant, as its sole remedy, may terminate this Lease by giving Landlord written notice of termination on or before the earlier to occur of: (a) five (5) business days after the Required Completion Date; and (b) the Term Commencement Date. In such event, this Lease shall be deemed null and void and of no further force and effect and Landlord shall promptly refund any prepaid rent, return the Letter of Credit previously provided by Tenant under this Lease and, so long as Tenant has not previously defaulted under any of its obligations under Exhibit C, the parties hereto shall have no further responsibilities or obligations to each other with respect to this Lease. The “Required Completion Date” shall mean the date which is two hundred ten (210) days after the later of the date this Lease is properly executed and delivered by Tenant and the date all prepaid rental and the Letter of Credit required under this Lease are delivered to Landlord. Landlord and Tenant acknowledge and agree that: (i) the determination of the Term Commencement Date shall take into consideration the effect of any Tenant Delays; and (ii) the Required Completion Date shall be postponed by the number of days the Term Commencement Date is delayed due to events of Force Majeure (defined below). Notwithstanding anything herein to the contrary, if Landlord determines in good faith that it will be unable to cause the Term Commencement Date to occur by the Required Completion Date, Landlord shall have the right to immediately cease its performance of the Initial Alterations and provide Tenant with written notice (the “Completion Date Extension Notice”) of such inability, which Completion Date Extension Notice shall set forth the date on which Landlord reasonably believes that the Term Commencement Date will occur. Upon receipt of the Completion Date Extension Notice, Tenant shall have the right to terminate this Lease by providing written notice of termination to Landlord within five (5) business days after the date of

{2089-00107/00654094;7} 5

the Completion Date Extension Notice. If Tenant does not terminate this Lease within such five (5) business day period, the Required Completion Date automatically shall be amended to be the date set forth in Landlord’s Completion Date Extension Notice.

Subject to the terms of this Paragraph 2 and provided that this Lease has been fully executed by all parties and Tenant has delivered all prepaid rental, the Letter of Credit, and insurance certificates required hereunder, Landlord grants Tenant the right to enter the Premises fourteen (14) days prior to the Term Commencement Date, at Tenant’s sole risk, solely for the purpose of installing telecommunications and data cabling, equipment, furnishings and other personalty (“Early Access”). Such Early Access shall be subject to all of the terms and conditions of this Lease, except that Tenant shall not be required to pay Base Rent or Tenant’s Proportionate Share of Operating Expenses with respect to the period of time prior to the Term Commencement Date during which Tenant occupies the Premises solely for such purposes. However, Tenant shall be liable for any special services requested by Tenant during such period. Notwithstanding the foregoing, if Tenant takes possession of the Premises before the Term Commencement Date for any purpose other than as expressly provided in this paragraph, such Early Access shall be subject to the terms and conditions of this Lease and Tenant shall pay Base Rent, Tenant’s Proportionate Share of Operating Expenses, and any other charges payable hereunder to Landlord for each day of possession before the Term Commencement Date. Said Early Access shall not advance the Term Expiration Date. Landlord may withdraw such permission to enter the Premises prior to the Term Commencement Date at any time that Landlord reasonably determines that such entry by Tenant is causing a dangerous situation for Landlord, Tenant or their respective contractors or employees, or if Landlord reasonably determines that such entry by Tenant is hampering or otherwise preventing Landlord from proceeding with the completion of the Initial Alterations described in Exhibit C at the earliest possible date

3. TERM

The term of this Lease (the “Term”) shall commence on the Term Commencement Date and continue in full force and effect for the number of months specified as the Length of Term in the Basic Lease Information or until this Lease is terminated as otherwise provided herein. If the Term Commencement Date is a date other than the first day of the calendar month, the Term shall be the number of months of the Length of Term in addition to the remainder of the calendar month following the Term Commencement Date.

4. USE

A. General. Tenant shall use the Premises for the permitted use specified in the Basic Lease Information (“Permitted Use”) and for no other use or purpose. Tenant’s employees, agents, customers, visitors, invitees, licensees, contractors, assignees and subtenants shall be collectively referred to herein as the “Tenant’s Parties.” So long as Tenant is occupying the Premises, Tenant and Tenant’s Parties shall have the nonexclusive right to use, in common with other parties occupying the Building or Project, driveways and other common areas of the Building and Project, subject to the terms of this Lease and such reasonable rules and regulations as Landlord may from time to time prescribe. Landlord reserves the right, without notice or liability to Tenant, and without the same constituting an actual or constructive eviction, to alter or modify the common areas from time to time, including the location and configuration thereof, and the amenities and facilities which Landlord may determine to provide from time to time, provided that Landlord shall use commercially reasonable efforts to minimize interference with Tenant’s access to and use of the Premises.

B. Limitations. Tenant shall not permit any odors, smoke, dust, gas, substances, noise or vibrations to emanate from the Premises or from any portion of the common areas as a result of Tenant’s or any Tenant’s Party’s use thereof, nor take any action which would constitute a nuisance or would disturb, obstruct or endanger any other tenants or occupants of the Building or Project or elsewhere, or interfere with their use of their respective premises or common areas. Storage outside the Premises of materials, vehicles or any other items is prohibited. Tenant shall not use or allow the Premises to be used for any immoral, improper or unlawful purpose, nor shall Tenant cause or maintain or permit any nuisance in, on or about the Premises. Tenant shall not commit or suffer the commission of any waste in, on or about the Premises. Tenant shall not allow any sale by auction upon the Premises, or place any loads upon the floors, walls or ceilings which could endanger the structure, or place any harmful substances in the drainage system of the Building or Project. No waste, materials or refuse shall be dumped upon or permitted to remain outside the Premises. Landlord shall not be responsible to Tenant for the non-compliance by any other tenant or occupant of the Building or Project with any of the above-referenced rules or any other terms or provisions of such tenant’s or occupant’s lease or other contract.

C. Compliance with Regulations. Tenant shall at its sole cost and expense strictly comply with all existing or future applicable municipal, state and federal and other governmental statutes, rules, requirements, regulations, laws and ordinances, including zoning ordinances and regulations, and covenants, easements and restrictions of record governing and relating to the use, occupancy or possession of the Premises, to Tenant’s use of the common areas, or to Tenant’s use, storage, generation or disposal of Hazardous Materials (hereinafter defined) (collectively “Regulations”). Tenant shall at its sole cost and expense obtain any and all licenses or permits necessary for Tenant’s use of the Premises. Tenant shall at its sole cost and expense promptly comply with the requirements of any board of fire underwriters or other similar body now or hereafter constituted. Tenant shall not do or permit anything to be done in, on, under or about the Project or bring or keep anything which will in any way increase the rate of any insurance upon the Premises, Building or Project or upon any contents therein or cause a cancellation of said insurance or otherwise affect said insurance in any manner. Tenant shall indemnify, defend (by counsel reasonably acceptable to Landlord), protect and hold Landlord harmless from and against any loss, cost, expense, damage, attorneys’ fees or liability arising out of the failure of Tenant to comply with any Regulation as required by this Paragraph. Tenant’s obligations pursuant to the foregoing indemnity shall survive the expiration or earlier termination of this Lease.

{2089-00107/00654094;7} 6

D. Hazardous Materials. As used in this Lease, “Hazardous Materials” shall include, but not be limited to, hazardous, toxic and radioactive materials and those substances defined as “hazardous substances,” “hazardous materials,” “hazardous wastes,” “toxic substances,” or other similar designations in any Regulation. Tenant shall not cause, or allow any of Tenant’s Parties to cause, any Hazardous Materials to be handled, used, generated, stored, released or disposed of in, on, under or about the Premises, the Building or the Project or surrounding land or environment in violation of any Regulations. Tenant must obtain Landlord’s written consent prior to the introduction of any Hazardous Materials onto the Project. Notwithstanding the foregoing, Tenant may handle, store, use and dispose of products containing small quantities of Hazardous Materials for “general office purposes” (such as toner for copiers and typical and customary cleaning products) to the extent customary and necessary for the Permitted Use of the Premises; provided that Tenant shall always handle, store, use, and dispose of any such Hazardous Materials in a safe and lawful manner and never allow such Hazardous Materials to contaminate the Premises, Building, or Project or surrounding land or environment. Tenant shall immediately notify Landlord in writing of any Hazardous Materials’ contamination of any portion of the Project of which Tenant becomes aware, whether or not caused by Tenant. Landlord shall have the right at all reasonable times and if Landlord determines in good faith that Tenant may not be in compliance with this Paragraph 4.D to inspect the Premises and to conduct tests and investigations to determine whether Tenant is in compliance with the foregoing provisions, the costs of all such inspections, tests and investigations to be borne by Tenant if Tenant is found to be in violation of its obligations under this Paragraph. Tenant shall indemnify, defend (by counsel reasonably acceptable to Landlord), protect and hold Landlord and the Landlord Indemnities (as defined in Paragraph 8.C. below) harmless from and against any and all claims, liabilities, losses, costs, loss of rents, liens, damages, injuries or expenses (including reasonable attorneys’ and consultants’ fees and court costs), demands, causes of action, or judgments directly or indirectly arising out of or related to the use, generation, storage, release, or disposal of Hazardous Materials by Tenant or any of Tenant’s Parties in, on, under or about the Premises, the Building or the Project or surrounding land or environment, which indemnity shall include, without limitation, damages for personal or bodily injury, property damage, damage to the environment or natural resources occurring on or off the Premises, losses attributable to diminution in value or adverse effects on marketability, the cost of any investigation, monitoring, government oversight, repair, removal, remediation, restoration, abatement, and disposal, and the preparation of any closure or other required plans, whether such action is required or necessary prior to or following the expiration or earlier termination of this Lease. Neither the consent by Landlord to the use, generation, storage, release or disposal of Hazardous Materials nor the strict compliance by Tenant with all laws pertaining to Hazardous Materials shall excuse Tenant from Tenant’s obligation of indemnification pursuant to this Paragraph 4.D. Tenant’s obligations pursuant to the foregoing indemnity shall survive the expiration or earlier termination of this Lease. Tenant shall not be liable for any cost or expense related to the investigation, removal, cleaning, abatement or remediation of Hazardous Materials existing in the Premises prior to the date Landlord tenders possession of the Premises to Tenant, including, without limitation, Hazardous Materials in the ground water or soil, except to the extent that any of the foregoing results directly or indirectly from any act or omission by Tenant or any Tenant’s Parties or any Hazardous Materials disturbed, distributed or exacerbated by Tenant or any Tenant’s Parties.

5. RULES AND REGULATIONS

Tenant shall faithfully observe and comply with the building rules and regulations attached hereto as Exhibit A and any other reasonable rules and regulations and any modifications or additions thereto which Landlord may from time to time prescribe in writing for the purpose of maintaining the proper care, cleanliness, safety, traffic flow and general order of the Premises or the Building or Project. Tenant shall cause Tenant’s Parties to comply with such rules and regulations. Landlord shall not be responsible to Tenant for the non-compliance by any other tenant or occupant of the Building or Project with any of such rules and regulations, any other tenant’s or occupant’s lease or any Regulations. In the event of a conflict between the rules and regulations and the terms of the Lease, the terms of the Lease shall control.

6. RENT

A.Base Rent. Tenant shall pay to Landlord and Landlord shall receive, without notice or demand throughout the Term, Base Rent as specified in the Basic Lease Information, payable in monthly installments in advance on or before the first day of each calendar month, in lawful money of the United States, without deduction or offset whatsoever, at the Remittance Address specified in the Basic Lease Information or to such other place as Landlord may from time to time designate in writing. Base Rent for the first full month of the Term for which Base Rent is payable shall be paid by Tenant upon Tenant’s execution of this Lease. If the obligation for payment of Base Rent commences on a day other than the first day of a month, then Base Rent shall be prorated and the prorated installment shall be paid on the first day of the calendar month next succeeding the month in which Base Rent is payable. The Base Rent payable by Tenant hereunder is subject to adjustment as provided elsewhere in this Lease, as applicable. As used herein, the term “Base Rent” shall mean the Base Rent specified in the Basic Lease Information as it may be so adjusted from time to time.

B.Additional Rent. All monies other than Base Rent required to be paid by Tenant hereunder, including, but not limited to, Tenant’s Proportionate Share of Operating Expenses, as specified in Paragraph 7 of this Lease, charges to be paid by Tenant under Paragraph 15, the interest and late charge described in Paragraphs 26.D. and E., and any monies spent by Landlord pursuant to Paragraph 30, shall be considered additional rent (“Additional Rent”). “Rent” shall mean Base Rent and Additional Rent.

{2089-00107/00654094;7} 7

7. OPERATING EXPENSES

A. Operating Expenses. In addition to the Base Rent required to be paid hereunder, beginning with the expiration of the Base Year specified in the Basic Lease Information (the “Base Year”) Tenant shall pay as Additional Rent, Tenant’s Proportionate Share of the Building and/or Project (as applicable), as defined in the Basic Lease Information, of increases in Operating Expenses (defined below) over the Operating Expenses incurred by Landlord during the Base Year (the “Base Year Operating Expenses”) in the manner set forth below. Base Year Operating Expenses shall not include market-wide labor-rate increases due to extraordinary circumstances including, but not limited to, boycotts and strikes, and utility rate increases due to extraordinary circumstances including, but not limited to, conservation surcharges, boycotts, embargoes or other shortages, or amortized costs relating to capital improvements. Tenant shall pay the applicable Tenant’s Proportionate Share of each such increases in Operating Expenses. Landlord and Tenant acknowledge that if the number of buildings which constitute the Project increases or decreases, or if changes are made to the physical size of the Premises, Building or Project or the configuration of any thereof, Landlord may at its discretion reasonably and equitably adjust Tenant’s Proportionate Share of the Building or Project to reflect the change. Landlord’s determination of Tenant’s Proportionate Share of the Building and of the Project shall be conclusive so long as the method of calculation used is reasonably and consistently applied to all leases in the Building and Project. “Operating Expenses” shall mean all expenses and costs of every kind and nature which Landlord shall pay or become obligated to pay, because of or in connection with the ownership, management, maintenance, repair, preservation, replacement and operation of the Building or Project and its supporting facilities and such additional facilities now and in subsequent years as may be determined by Landlord to be necessary or desirable to the Building and/or Project (as determined in a reasonable manner) other than those expenses and costs which are specifically attributable to Tenant or which are expressly made the financial responsibility of Landlord or specific tenants of the Building or Project pursuant to this Lease. Notwithstanding anything in this Lease to the contrary, in no event shall the component of Operating Expenses for any Lease year consisting of electrical costs be less than the component of Base Year Operating Expenses consisting of electrical costs. Operating Expenses shall include, but are not limited to, the following:

(1) Taxes. All real property taxes and assessments, possessory interest taxes, sales taxes, personal property taxes, business or license taxes or fees, gross receipts taxes, service payments in lieu of such taxes or fees, annual or periodic license or use fees, excises, transit charges, and other impositions, general and special, ordinary and extraordinary, unforeseen as well as foreseen, of any kind (including fees “in-lieu” of any such tax or assessment) which are now or hereafter assessed, levied, charged, confirmed, or imposed by any public authority upon the Building or Project, its operations or the Rent (or any portion or component thereof), or any tax, assessment or fee imposed in substitution, partially or totally, of any of the above. Operating Expenses shall also include any taxes, assessments, reassessments, or other fees or impositions with respect to the development, leasing, management, maintenance, alteration, repair, use or occupancy of the Premises, Building or Project or any portion thereof, including, without limitation, by or for Tenant, and all increases therein or reassessments thereof whether the increases or reassessments result from increased rate and/or valuation (whether upon a transfer of the Building or Project or any portion thereof or any interest therein or for any other reason). Operating Expenses shall not include inheritance or estate taxes imposed upon or assessed against the interest of any person in the Project, or taxes computed upon the basis of the net income of any owners of any interest in the Project. If it shall not be lawful for Tenant to reimburse Landlord for all or any part of such taxes, the monthly rental payable to Landlord under this Lease shall be revised to net Landlord the same net rental after imposition of any such taxes by Landlord as would have been payable to Landlord prior to the payment of any such taxes.

(2) Insurance. All insurance premiums and costs, including, but not limited to, any deductible amounts, premiums and other costs of insurance incurred by Landlord, including for the insurance coverage set forth in Paragraph 8.A. herein, so long as neither the premiums nor the deductible amounts are materially in excess of those typically maintained by owners of comparable properties in the greater San Jose, California area.

(3) Common Area Maintenance.

(a) Repairs, replacements, and general maintenance of and for the Building and Project and public and common areas and facilities of and comprising the Building and Project, including, but not limited to, the roof and roof membrane, windows, elevators, restrooms, conference rooms, health club facilities, lobbies, mezzanines, balconies, mechanical rooms, building exteriors, alarm systems, pest extermination, landscaped areas, parking and service areas, driveways, sidewalks, loading areas, fire sprinkler systems, sanitary and storm sewer lines, utility services, heating/ventilation/air conditioning systems, electrical, mechanical or other systems, telephone equipment and wiring servicing, plumbing, lighting, and any other items or areas which affect the operation or appearance of the Building or Project, which determination shall be at Landlord’s commercially reasonable discretion, except for: those items to the extent paid for by the proceeds of insurance; and those items attributable solely or jointly to specific tenants of the Building or Project.

(b) Repairs, replacements, and general maintenance shall include the cost of any improvements made to or assets acquired for the Project or Building that in Landlord’s commercially reasonable discretion may reduce any other Operating Expenses, including present or future repair work, are reasonably necessary for the health and safety of the occupants of the Building or Project, or for the operation of the Building systems, services and equipment, or are required to comply with any Regulation, such costs or allocable portions thereof to be amortized over the useful life thereof, as Landlord shall determine in a commercially reasonable manner, together with interest on the unamortized balance at the publicly announced “prime rate” charged by Wells Fargo Bank, N.A. (San Francisco) or its successor at the time such improvements or capital assets are constructed or acquired,

{2089-00107/00654094;7} 8

plus two (2) percentage points, or in the absence of such prime rate, then at the U.S. Treasury six-month (6-month) market note (or bond, if so designated) rate as published by any national financial publication selected by Landlord, plus four (4) percentage points, but in no event more than the maximum rate permitted by law.

(c) Payment under or for any easement, license, permit, operating agreement, declaration, restrictive covenant or instrument relating to the Building or Project.

(d) All expenses and rental related to services and costs of supplies, materials and equipment used in operating, managing and maintaining the Premises, Building and Project, the equipment therein and the adjacent sidewalks, driveways, parking and service areas, including, without limitation, expenses related to service agreements regarding security, fire and other alarm systems, janitorial services, window cleaning, elevator maintenance, Building exterior maintenance, landscaping and expenses related to the administration, management and operation of the Project (not materially in excess of those typically charged or paid by owners of comparable properties in the greater San Jose, California area), including without limitation salaries, wages and benefits and management office rent.

(e) The cost of supplying any services and utilities which benefit all or a portion of the Premises, Building or Project, including without limitation services and utilities provided pursuant to Paragraph 15 hereof.

(f) Legal expenses and the cost of audits by certified public accountants; provided, however, that legal expenses chargeable as Operating Expenses shall not include the cost of negotiating leases, collecting rents, evicting tenants nor shall it include costs incurred in legal proceedings with or against any tenant or to enforce the provisions of any lease.

(g) A management and accounting cost recovery fee, not materially in excess of those typically charged by owners of comparable properties in the greater San Jose, California area.

If the rentable area of the Building and/or Project is not fully occupied during the Base Year or any fiscal year of the Term as determined by Landlord, an adjustment shall be made in Landlord’s discretion in computing the Operating Expenses for such year so that Tenant pays an equitable portion of all variable items (e.g., utilities, janitorial services and other component expenses that are affected by variations in occupancy levels) of Operating Expenses, as reasonably determined by Landlord; provided, however, that in no event shall Landlord be entitled to collect in excess of one hundred percent (100%) of the total Operating Expenses from all of the tenants in the Building or Project, as the case may be.

Notwithstanding anything to the contrary contained in this Lease, Operating Expenses shall not include (i) the cost of providing tenant improvements or other specific costs incurred for the account of, separately billed to and paid by specific tenants of the Building or Project, (ii) the initial construction cost of the Building, or debt service on any mortgage or deed of trust recorded with respect to the Project other than pursuant to Paragraph 7.A(3)(b) above, (iii) Sums paid to subsidiaries or other affiliates of Landlord for services on or to the Project and/or Premises, but only to the extent that the costs of such services exceed the competitive cost for such services rendered by persons or entities of similar skill, competence and experience, (iv) any fines, penalties or interest resulting from the negligence or willful misconduct of the Landlord or its agents, contractors, or employees, (v) fines, costs or penalties incurred as a result and to the extent of a violation by Landlord or other tenants of the Project of any applicable Regulations, (vi) Landlord’s charitable and political contributions, (vii) ground lease rental, (viii) attorney's fees and other expenses incurred in connection with negotiations or disputes with prospective tenants or tenants or other occupants of the Project, (ix) the cost or expense of any services or benefits provided generally to other tenants in the Project and not provided or available to Tenant, (x) all costs of purchasing or leasing major sculptures, paintings or other major works or objects of art (as opposed to decorations purchased or leased by Landlord for display in the common areas of the Project), (xi) any expenses for which Landlord has received actual reimbursement (other than through Operating Expenses), (xii) penalties, interest and other costs incurred by Landlord in connection with Landlord’s failure to comply with conditions, covenants and restrictions applicable to the Project, (xiii) interest (except as provided in this Lease for the amortization of capital improvements and except to the extent incurred as a result of any act or omission of Tenant), (xiv) the cost of complying with any Regulations in effect (and as interpreted and enforced) on the date of this Lease, provided that if any portion of the common areas of the Project that was in compliance with all applicable Regulations on the date of this Lease becomes out of compliance due to normal wear and tear, the cost of bringing such portion of the Project into compliance shall be included in Operating Expenses unless otherwise excluded pursuant to the terms hereof, (xv) costs incurred in connection with any relocation of tenants within the Project, (xvi) the cost of repairs or replacements incurred by reason of fire or other casualty, or condemnation, to the extent Landlord actually receives proceeds of property and casualty insurance policies or condemnation awards or would have received such proceeds had Landlord maintained the insurance required to be maintained by Landlord under this Lease, (xvii) deductibles materially greater than those typically carried by landlords for comparable properties in the greater San Jose area, and (xviii) any cost or expense related to removal, cleaning, abatement or remediation of Hazardous Materials existing as of the date of this Lease in or about the Building, common areas or Project except to the extent such removal, cleaning, abatement or remediation is related to the general repair and maintenance of the Project. Notwithstanding anything herein to the contrary, in any instance wherein Landlord, in Landlord’s sole but reasonable discretion, believes Tenant to be responsible for any amounts greater than Tenant’s Proportionate Share, Landlord shall have the right to allocate costs in an equitable manner Landlord deems appropriate.

{2089-00107/00654094;7} 9

The above enumeration of services and facilities shall not be deemed to impose an obligation on Landlord to make available or provide such services or facilities except to the extent if any that Landlord has specifically agreed elsewhere in this Lease to make the same available or provide the same. Without limiting the generality of the foregoing, Tenant acknowledges and agrees that it shall be responsible for providing adequate security for its use of the Premises, the Building and the Project and that Landlord shall have no obligation or liability with respect thereto, except to the extent if any that Landlord has specifically agreed elsewhere in this Lease to provide the same.

B. Payment of Estimated Operating Expenses. “Estimated Operating Expenses” for any particular year shall mean Landlord’s estimate of the Operating Expenses for such fiscal year made with respect to such fiscal year as hereinafter provided. Landlord shall have the right from time to time to revise its fiscal year and interim accounting periods so long as the periods as so revised are reconciled with prior periods in a reasonable manner. During the last month of each fiscal year during the Term, or as soon thereafter as practicable, Landlord shall give Tenant written notice of the Estimated Operating Expenses and Base Year Operating Expenses for the ensuing fiscal year. Tenant shall pay Tenant’s Proportionate Share of the difference between Estimated Operating Expenses and Base Year Operating Expenses with installments of Base Rent for the fiscal year to which the Estimated Operating Expenses applies in monthly installments on the first day of each calendar month during such year, in advance. Such payment shall be construed to be Additional Rent for all purposes hereunder. If at any time during the course of the fiscal year, Landlord determines that Operating Expenses are projected to vary from the then Estimated Operating Expenses, Landlord may, by written notice to Tenant, revise the Estimated Operating Expenses for the balance of such fiscal year, and Tenant’s monthly installments for the remainder of such year shall be adjusted so that by the end of such fiscal year Tenant has paid to Landlord Tenant’s Proportionate Share of the revised difference between Estimated Operating Expenses and Base Year Operating Expenses for such year, such revised installment amounts to be Additional Rent for all purposes hereunder.

C. Computation of Operating Expense Adjustment. “Operating Expense Adjustment” shall mean the difference between Estimated Operating Expenses and actual Operating Expenses for any fiscal year over Base Year Operating Expenses, determined as hereinafter provided. Within one hundred twenty (120) days after the end of each fiscal year, or as soon thereafter as practicable, Landlord shall deliver to Tenant a statement of actual Operating Expenses for the fiscal year just ended, accompanied by a computation of Operating Expense Adjustment. If such statement shows that Tenant’s payment based upon Estimated Operating Expenses is less than Tenant’s Proportionate Share of actual increases in Operating Expenses over the Base Year Operating Expenses, then Tenant shall pay to Landlord the difference within thirty (30) days after receipt of such statement, such payment to constitute Additional Rent for all purposes hereunder. If such statement shows that Tenant’s payments of Estimated Operating Expenses exceed Tenant’s Proportionate Share of actual increases in Operating Expenses over the Base Year Operating Expenses, then (provided that Tenant is not in default under this Lease) Landlord shall pay to Tenant the difference within thirty (30) days after delivery of such statement to Tenant or credit such difference to the next installment of Base Rent and/or Tenant’s Proportionate Share of Operating Expenses due hereunder. If this Lease has been terminated or the Term hereof has expired prior to the date of such statement, then the Operating Expense Adjustment shall be paid by the appropriate party within thirty (30) days after the date of delivery of the statement. Tenant’s obligation to pay increases in Operating Expenses over the Base Year Operating Expenses shall commence on January 1 of the year succeeding the Base Year. Should this Lease commence or terminate at any time other than the first day of the fiscal year, Tenant’s Proportionate Share of the Operating Expense Adjustment shall be prorated based on a month of thirty (30) days and the number of calendar months during such fiscal year that this Lease is in effect. Tenant shall in no event be entitled to any credit if Operating Expenses in any year are less than Base Year Operating Expenses. Notwithstanding anything to the contrary contained in Paragraph 7.A or 7.B, Landlord’s failure to provide any notices or statements within the time periods specified in those paragraphs shall in no way excuse Tenant from its obligation to pay Tenant’s Proportionate Share of increases in Operating Expenses.

D. Gross Lease. This shall be a gross Lease, however, it is intended that Base Rent shall be paid to Landlord absolutely net of all costs and expenses, other than Operating Expenses each year equal to Tenant’s Proportionate Share of Base Year Operating Expenses, except as otherwise specifically provided to the contrary in this Lease, and the Operating Expense Adjustment are intended to pass on to Tenant and reimburse Landlord for all costs and preservation, replacement and operation of the Building and/or Project and its supporting facilities and such additional facilities, in excess of the Base Year Operating Expenses, except as specifically provided to the contrary in this Lease. The provisions for payment of increases in Operating Expenses and the Operating Expense Adjustment are intended to pass on to Tenant and reimburse Landlord for all costs and expenses of the nature described in Paragraph 7.A. incurred in connection with the ownership, management, maintenance, repair, preservation, replacement and operation of the Building and/or Project and its supporting facilities and such additional facilities, in excess of the Base Year Operating Expenses, now and in subsequent years as may be determined by Landlord to be necessary or desirable to the Building and/or Project.

E. Tenant Audit. If Tenant shall dispute the amount set forth in any statement provided by Landlord under Paragraph 7.B. or 7.C. above, Tenant shall have the right (at Tenant’s sole cost and expense), not later than thirty (30) days following receipt of such statement and upon the condition that Tenant shall first deposit with Landlord the full amount in dispute, to notify Landlord that it wishes to audit Landlord’s books and records with respect to Operating Expenses for such fiscal year. Such audit shall be conducted by certified public accountants selected by Tenant and subject to Landlord’s reasonable right of approval. The Operating Expense Adjustment shall be appropriately adjusted on the basis of such audit, and any overpayment returned to Tenant within thirty (30) days of determination of such overpayment. If such audit reveals that Tenant was overcharged by five percent (5%) or more, Landlord, within forty-five (45) days after its receipt of paid invoices therefor from Tenant, shall reimburse Tenant for the reasonable amounts paid by Tenant to third parties in connection with such review by Tenant; provided, however, that in no event shall Landlord be obligated to reimburse Tenant for costs in excess of $2,000.00. If Tenant shall not request an audit in

{2089-00107/00654094;7} 10

accordance with the provisions of this Paragraph 7.E. within thirty (30) days after receipt of Landlord’s statement provided pursuant to Paragraph 7.B. or 7.C., such statement shall be final and binding for all purposes hereof. Tenant acknowledges and agrees that any information revealed in the above described audit may contain proprietary and sensitive information and that significant damage could result to Landlord if such information were disclosed to any party other than Tenant’s auditors. Except in connection with any legal action relating to such dispute, Tenant shall not in any manner disclose, provide or make available any information revealed by the audit to any person or entity without Landlord’s prior written consent, which consent may be withheld by Landlord in its sole and absolute discretion. The information disclosed by the audit will be used by Tenant solely for the purpose of evaluating Landlord’s books and records in connection with this Paragraph 7.E.

8. INSURANCE AND INDEMNIFICATION

A. Tenant’s Insurance. Tenant shall procure at Tenant’s sole cost and expense and keep in effect from the date of this Lease and at all times until the end of the Term the following:

(1) Property Insurance. Property/Business Interruption Insurance written on an All Risk or Special Cause of Loss Form, including earthquake sprinkler leakage, at replacement cost value and with a replacement cost endorsement covering all of Tenant’s business and trade fixtures, equipment, movable partitions, furniture, merchandise and other personal property within the Premises (“Tenant’s Property”) and any Leasehold Improvements (as defined in Paragraph 12.C below) performed by or for the benefit of Tenant.

(2) Liability Insurance. Commercial General Liability insurance covering bodily injury and property damage liability occurring in or about the Premises or arising out of the use and occupancy of the Premises and the Project, and any part of either, and any areas adjacent thereto, and the business operated by Tenant or by any other occupant of the Premises. Such insurance shall include contractual liability insurance coverage insuring all of Tenant’s indemnity obligations under this Lease. Such coverage shall have a minimum combined single limit of liability of at least Two Million Dollars ($2,000,000.00), and a minimum general aggregate limit of Three Million Dollars ($3,000,000.00), with an “Additional Insured – Managers or Lessors of Premises Endorsement.” All such policies shall be written to apply to all bodily injury (including death), property damage or loss, personal and advertising injury and other covered loss, however occasioned, occurring during the policy term, shall include Landlord and any party holding an interest to which this Lease may be subordinated as an additional insured, and shall provide that such coverage shall be “primary” and non-contributing with any insurance maintained by Landlord, which shall be excess insurance only. Such coverage shall contain coverage including employees as additional insureds if not covered by Tenant’s Commercial General Liability Insurance. All such insurance shall provide for the severability of interests of insureds; and shall be written on an “occurrence” basis, which shall afford coverage for all claims based on acts, omissions, injury and damage, which occurred or arose (or the onset of which occurred or arose) in whole or in part during the policy period. So long as the coverage afforded Landlord, the other additional insureds and any designees of Landlord holding an interest to which this Lease may be subordinated shall not be reduced or otherwise adversely affected, all or part of Tenant’s insurance may be carried under a blanket policy covering the Premises and any other of Tenant’s locations, or by means of a so called “Umbrella” policy.

(3) Workers’ Compensation and Employers’ Liability Insurance. Workers’ Compensation Insurance as required by any Regulation, and Employers’ Liability Insurance in amounts not less than One Million Dollars ($1,000,000) each accident for bodily injury by accident; One Million Dollars ($1,000,000) policy limit for bodily injury by disease; and One Million Dollars ($1,000,000) each employee for bodily injury by disease.

(4) Commercial Auto Liability Insurance. Commercial auto liability insurance with a combined limit of not less than One Million Dollars ($1,000,000) for bodily injury and property damage for each accident. Such insurance shall cover liability relating to any auto (including owned, hired and non-owned autos).

(5) Alterations Requirements. In the event Tenant shall desire to perform any Alterations, Tenant shall deliver to Landlord, prior to commencing such Alterations (i) evidence satisfactory to Landlord that Tenant carries “Builder’s Risk” insurance covering construction of such Alterations in an amount and form approved by Landlord, (ii) such other insurance as Landlord shall nondiscriminatorily require, and (iii) a lien and completion bond or other security in form and amount satisfactory to Landlord.

(6) General Insurance Requirements. All coverages described in this Paragraph 8.A. shall be endorsed to (i) provide Landlord with thirty (30) days’ notice of cancellation or change in terms; and (ii) waive all rights of subrogation by the insurance carrier against Landlord. If at any time during the Term the amount or coverage of insurance which Tenant is required to carry under this Paragraph 8.A. is, in Landlord’s reasonable judgment, materially less than the amount or type of insurance coverage typically carried by owners or tenants of properties located in the general area in which the Premises are located which are similar to and operated for similar purposes as the Premises or if Tenant’s use of the Premises should change with or without Landlord’s consent, Landlord shall have the right to require Tenant to increase the amount or change the types of insurance coverage required under this Paragraph 8.A. All insurance policies required to be carried by Tenant under this Lease shall be written by companies rated A X or better in “Best’s Insurance Guide” and authorized to do business in the State of California. In any event deductible amounts under all insurance policies required to be carried by Tenant under this Lease shall not exceed Five Thousand Dollars ($5,000.00) per occurrence. Tenant shall deliver to Landlord on or before the Term Commencement Date, and thereafter at least thirty (30) days before the expiration dates of the expired policies, certified copies of Tenant’s insurance policies, or a certificate evidencing the same issued by the insurer thereunder; and, if Tenant shall fail to procure such insurance, or to deliver such policies or certificates, Landlord may, at Landlord’s option and in addition to Landlord’s other

{2089-00107/00654094;7} 11

remedies in the event of a default by Tenant hereunder, procure the same for the account of Tenant, and the cost thereof shall be paid to Landlord as Additional Rent.

B. Landlord’s Insurance. All insurance maintained by Landlord shall be for the sole benefit and under the control of Landlord. Landlord agrees to maintain property insurance insuring the Building against damage or destruction due to risk including fire, vandalism, and malicious mischief in an amount not less than the replacement cost thereof, in form and with deductibles and endorsements as selected by Landlord. At its election, Landlord may instead (but shall have no obligation to) obtain “All Risk” coverage and liability insurance, and may also obtain earthquake, pollution and/or flood insurance, and loss of rents coverage, in each case in amounts selected from time to time by Landlord. Landlord shall not be obligated to insure, and shall have no responsibility whatsoever for any damage to, any furniture, machinery, goods, inventory or supplies, or other personal property or fixtures which Tenant may keep or maintain in the Premises, or any Alterations within the Premises. The cost of all such insurance is included in Operating Expenses.

C. Indemnification. Tenant shall indemnify, defend by counsel reasonably acceptable to Landlord, protect and hold Landlord and each of Landlord’s respective directors, shareholders, partners, lenders, members, managers, contractors, affiliates and employees (collectively, “Landlord Indemnities”) harmless from and against any and all claims, liabilities, losses, costs, loss of rents, liens, damages, injuries or expenses, including reasonable attorneys’ and consultants’ fees and court costs, demands, causes of action, or judgments, directly or indirectly arising out of or related to: (1) claims of injury to or death of persons or damage to property or business loss occurring or resulting directly or indirectly from the use or occupancy of the Premises, Building or Project by Tenant or Tenant’s Parties, or from activities or failures to act of Tenant or Tenant’s Parties; (2) claims arising from work or labor performed, or for materials or supplies furnished to or at the request or for the account of Tenant in connection with performance of any work done for the account of Tenant within the Premises or Project; (3) claims arising from any breach or default on the part of Tenant in the performance of any covenant contained in this Lease; and (4) claims arising from the negligence or intentional acts or omissions of Tenant or Tenant’s Parties. The foregoing indemnity by Tenant shall not be applicable to claims to the extent arising from the gross negligence or willful misconduct of Landlord or any of Landlord’s agents or employees. Landlord shall not be liable to Tenant and Tenant hereby waives all claims against Landlord for any injury to or death of, or damage to any person or property or business loss in or about the Premises, Building or Project by or from any cause whatsoever (other than Landlord’s gross negligence or willful misconduct) and, without limiting the generality of the foregoing, whether caused by water leakage of any character from the roof, walls, basement or other portion of the Premises, Building or Project, or caused by gas, fire, oil or electricity in, on or about the Premises, Building or Project, acts of God or of third parties, or any matter outside of the reasonable control of Landlord. Nothing herein shall be construed as to diminish the repair and maintenance obligations of Landlord contained elsewhere in this Lease. The provisions of this Paragraph shall survive the expiration or earlier termination of this Lease.

9. WAIVER OF SUBROGATION

Landlord and Tenant hereby waive and shall cause their respective insurance carriers to waive any and all rights of recovery, claims, actions or causes of action against the other for any loss or damage with respect to Tenant’s Property, Leasehold Improvements (defined in Paragraph 12.C), the Building, the Premises, or any contents thereof, including rights, claims, actions and causes of action based on negligence, which loss or damage is (or would have been, had the insurance required by this Lease been carried) covered by insurance. For the purposes of this waiver, any deductible with respect to a party’s insurance shall be deemed covered by and recoverable by such party under valid and collectable policies of insurance.

10. LANDLORD’S REPAIRS AND MAINTENANCE

Landlord shall maintain in good repair, reasonable wear and tear and uninsured losses and damages caused by Tenant, its agents and contractors excluded, the structural soundness of the roof (which does not include the roof membrane), the structural soundness of the foundation, and the structural soundness of the exterior walls of the Building at Landlord’s sole cost and expense, and, notwithstanding anything to the contrary contained in this Lease, no portion of such costs and expenses shall be passed though to Tenant as part of Operating Expenses. The term “exterior walls” as used herein shall not include windows, glass or plate glass, doors, special store fronts or office entries. Any damage caused by or repairs necessitated by any negligence or act of Tenant or Tenant’s Parties may be repaired by Landlord at Landlord’s option and Tenant’s expense. In addition, Landlord shall maintain in good repair, reasonable wear and tear excepted, the common areas, Building systems, exterior windows, exterior glass and exterior doors, and the costs and expenses incurred in connection with doing so shall be handled in accordance with the provisions of Paragraph 7. Tenant shall immediately give Landlord written notice of any defect or need of repairs in such components of the Building for which Landlord is responsible, after which Landlord shall have a reasonable opportunity and the right to enter the Premises at all reasonable times to repair same. Landlord’s liability with respect to any defects, repairs, or maintenance for which Landlord is responsible under any of the provisions of this Lease shall be limited to the cost of such repairs or maintenance, and there shall be no abatement of rent and no liability of Landlord by reason of any injury to or interference with Tenant’s business arising from the making of repairs, alterations or improvements in or to any portion of the Premises, the Building or the Project or to fixtures, appurtenances or equipment in the Building, except as provided in Paragraph 24. By taking possession of the Premises, and subject to the completion of the Punchlist Items (as set forth above), Tenant accepts them “as is,” as being in good order, condition and repair and the condition in which Landlord is obligated to deliver them and suitable for the Permitted Use and Tenant’s intended operations in the Premises, whether or not any notice of acceptance is given. Landlord agrees that the roof and base Building electrical, heating, life safety, ventilation and air conditioning and plumbing systems located in the Premises shall be in good working order as of the date Landlord delivers possession of the Premises, with the Initial Alterations Substantially Complete, to Tenant. Except to the extent caused by the acts or omissions of Tenant or any Tenant’s Parties or by any alterations or improvements performed by or on behalf of Tenant, if such systems are not in good working order as of

{2089-00107/00654094;7} 12

the date possession of the Premises is delivered to Tenant and Tenant provides Landlord with notice of the same within thirty (30) days following the date Landlord delivers possession of the Premises to Tenant, Landlord shall be responsible for repairing or restoring the same, at its sole cost and expense.

11. TENANT’S REPAIRS AND MAINTENANCE

Tenant shall periodically inspect the Premises to identify any conditions that are dangerous or in need of maintenance or repair. Tenant shall promptly provide Landlord with notice of any such conditions. Tenant shall, at its sole cost and expense, perform all maintenance and repairs to the Premises that are not Landlord’s express responsibility under this Lease, and keep the Premises in good condition and repair, reasonable wear and tear excepted. Tenant’s repair and maintenance obligations include, without limitation, repairs to: (a) floor covering; (b) interior partitions; (c) doors; (d) the interior side of demising walls; (e) electronic, fiber, phone and data cabling and related equipment that is installed by or for the exclusive benefit of Tenant (collectively, “Cable”); (f) supplemental air conditioning units solely serving the Premises (if any), kitchens, including hot water heaters, plumbing, and similar facilities exclusively serving the Premises; and (g) Alterations. Subject to the terms of Paragraph 9, to the extent Landlord is not reimbursed by insurance proceeds, Tenant shall reimburse Landlord for the cost of repairing damage to the Building caused by the acts of Tenant, Tenant’s Parties and their respective contractors and vendors. If Tenant fails to commence making any repairs to the Premises for more than twenty (20) days after notice from Landlord (although notice shall not be required in an emergency), Landlord may make the repairs, and Tenant shall pay the reasonable cost of the repairs, together with an administrative charge in an amount equal to five percent (5%) of the cost of the repairs.

12. ALTERATIONS

A. Tenant shall not make, or allow to be made, any alterations, physical additions, improvements or partitions, including without limitation the attachment of any fixtures or equipment, in, about or to the Premises (“Alterations”) without obtaining the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed with respect to proposed Alterations which: (a) comply with all applicable Regulations; (b) are, in Landlord’s reasonable opinion, compatible with the Building or the Project and its mechanical, plumbing, electrical, heating/ventilation/air conditioning systems, and will not cause the Building or Project or such systems to be required to be modified to comply with any Regulations (including, without limitation, the Americans With Disabilities Act); and (c) will not interfere with the use and occupancy of any other portion of the Building or Project by any other tenant or its invitees. Specifically, but without limiting the generality of the foregoing, Landlord shall have the right of written consent for all plans and specifications for the proposed Alterations, construction means and methods, all appropriate permits and licenses, any contractor or subcontractor to be employed on the work of Alterations, and the time for performance of such work, and may impose rules and regulations for contractors and subcontractors performing such work. Tenant shall also supply to Landlord any documents and information reasonably requested by Landlord in connection with Landlord’s consideration of a request for approval hereunder. Tenant shall cause all Alterations to be accomplished in a first-class, good and workmanlike manner, and to comply with all applicable Regulations and Paragraph 27 hereof. Tenant shall at Tenant’s sole expense, perform any additional work required under applicable Regulations due to the Alterations hereunder. No review or consent by Landlord of or to any proposed Alteration or additional work shall constitute a waiver of Tenant’s obligations under this Paragraph 12, nor constitute any warranty or representation that the same complies with all applicable Regulations, for which Tenant shall at all times be solely responsible. Tenant shall reimburse Landlord for all costs which Landlord may incur in connection with granting approval to Tenant for any such Alterations, including any costs or expenses which Landlord may incur in electing to have outside architects and engineers review said plans and specifications, and shall pay Landlord an administration fee of three percent (3%) of the cost of the Alterations as Additional Rent hereunder. All such Alterations shall remain the property of Tenant until the expiration or earlier termination of this Lease, at which time they shall be and become the property of Landlord; provided, however, that Landlord may, at Landlord’s option, require that Tenant, at Tenant’s expense, remove any or all Alterations made by Tenant and restore the Premises by the expiration or earlier termination of this Lease, to their condition existing prior to the construction of any such Alterations. All such removals and restoration shall be accomplished in a first-class and good and workmanlike manner so as not to cause any damage to the Premises or Project whatsoever. If Tenant fails to remove such Alterations or Tenant’s trade fixtures or furniture or other personal property prior to the expiration or earlier termination of this Lease, Landlord may keep and use them or remove any of them and cause them to be stored or sold in accordance with applicable Regulations, at Tenant’s sole expense. In addition to and wholly apart from Tenant’s obligation to pay Tenant’s Proportionate Share of Operating Expenses, Tenant shall be responsible for and shall pay prior to delinquency any taxes or governmental service fees, possessory interest taxes, fees or charges in lieu of any such taxes, capital levies, or other charges imposed upon, levied with respect to or assessed against its fixtures or personal property, on the value of Alterations within the Premises, and on Tenant’s interest pursuant to this Lease, or any increase in any of the foregoing based on such Alterations. To the extent that any such taxes are not separately assessed or billed to Tenant, Tenant shall pay the amount thereof as invoiced to Tenant by Landlord.

Notwithstanding the foregoing, if Tenant fails to timely perform its removal and repair obligations as set forth under this Lease, Tenant shall pay to Landlord the cost of removing any such Alterations and restoring the Premises to their original condition and such cost shall include a reasonable charge for Landlord’s overhead and profit as provided above, and such amount may be deducted from the Security Deposit or any other sums or amounts held by Landlord under this Lease.

B. In compliance with Paragraph 27 hereof, at least ten (10) business days before beginning construction of any Alteration, Tenant shall give Landlord written notice of the expected commencement date of that construction to permit Landlord to post and record a notice of non-responsibility. Upon substantial completion of construction, if the law so provides, Tenant shall cause a timely notice of completion to be recorded in the office of the recorder of the county in which the Building is located.

{2089-00107/00654094;7} 13

C. All improvements in and to the Premises, including any Alterations (collectively, “Leasehold Improvements”) shall remain upon the Premises at the end of the Term without compensation to Tenant, provided that Tenant, at its expense, in compliance with the National Electric Code or other applicable Regulations, shall remove any Cable. In addition, Landlord, by written notice to Tenant at least thirty (30) days prior to the Term Expiration Date, may require Tenant, at its expense, to remove any Leasehold Improvements that, in Landlord’s reasonable judgment, are of a nature that would require removal and repair costs that are materially in excess of the removal and repair costs associated with standard office improvements (the Cable and such other items collectively are referred to as “Required Removables”). Required Removables shall include, without limitation, internal stairways, raised floors, personal baths and showers, vaults, rolling file systems and structural alterations and modifications. The Required Removables shall be removed by Tenant before the Term Expiration Date. Tenant shall repair damage caused by the installation or removal of Required Removables. If Tenant fails to perform its obligations in a timely manner, Landlord may perform such work at Tenant’s expense. Tenant, at the time it requests approval for a proposed Alteration, including any Initial Alterations, as such terms may be defined in the Work Letter attached as Exhibit C, may request in writing that Landlord advise Tenant whether the Alteration, including any Initial Alterations, or any portion thereof, is a Required Removable. Within ten (10) days after receipt of Tenant’s request, Landlord shall advise Tenant in writing as to which portions of the alteration or other improvements are Required Removables. Notwithstanding anything to the contrary contained in this Lease, Tenant shall have no obligation to remove any portion of the Initial Alterations, as such term is defined in Exhibit C, except for any non-Building standard improvements or alterations and any portion of the Initial Alterations which Landlord has advised Tenant to be a Required Removables.

Notwithstanding anything to the contrary contained herein, so long as Tenant’s written request for consent for a proposed Alterations substantially contains the following language “PURSUANT TO ARTICLE 12 OF THE LEASE, IF LANDLORD CONSENTS TO THE SUBJECT ALTERATIONS, LANDLORD SHALL NOTIFY TENANT IN WRITING WHETHER OR NOT LANDLORD WILL REQUIRE SUCH ALTERATIONS BE REMOVED AT THE EXPIRATION OR EARLIER TERMINATION OF THE LEASE.”, at the time Landlord gives its consent for any such Alterations, if it so does, Tenant shall also be notified whether or not Landlord will require that such Alterations be removed upon the expiration or earlier termination of this Lease. Notwithstanding anything to the contrary contained in this Lease, at the expiration or earlier termination of this Lease and otherwise in accordance with Article 36 hereof, Tenant shall be required to remove all Alterations made to the Premises except for any such Alterations which Landlord expressly indicates or is deemed to have indicated shall not be required to be removed from the Premises by Tenant. If Tenant’s written notice strictly complies with the foregoing and if Landlord fails to notify Tenant within twenty (20) days whether Tenant shall be required to remove the subject Alterations at the expiration or earlier termination of this Lease, it shall be assumed that Landlord shall require the removal of the subject Alterations.

13. SIGNS

Tenant shall not place, install, affix, paint or maintain any signs, notices, graphics or banners whatsoever or any window decor which is visible in or from public view or corridors, the common areas or the exterior of the Premises or the Building, in or on any exterior window or window fronting upon any common areas or service area without Landlord’s prior written approval which Landlord shall have the right to withhold in its absolute and sole discretion; provided that Tenant’s name shall be included in any Building-standard door and directory signage, if any, in accordance with Landlord’s Building signage program, including without limitation, payment by Tenant of any reasonable fee charged by Landlord for maintaining such signage, which fee shall constitute Additional Rent hereunder. Any installation of signs, notices, graphics or banners on or about the Premises or Project approved by Landlord shall be subject to any Regulations and to any other requirements imposed by Landlord. Tenant shall remove all such signs or graphics by the expiration or any earlier termination of this Lease. Such installations and removals shall be made in such manner as to avoid injury to or defacement of the Premises, Building or Project and any other improvements contained therein, and Tenant shall repair any injury or defacement including without limitation discoloration caused by such installation or removal.

14. INSPECTION/POSTING NOTICES

Upon twenty-four (24) hours’ notice, except in emergencies where no such notice shall be required, Landlord and Landlord’s agents and representatives, shall have the right to enter the Premises to inspect the same, to clean, to perform such work as may be permitted or required hereunder, to make repairs, improvements or alterations to the Premises, Building or Project or to other tenant spaces therein, to deal with emergencies, to post such notices as may be permitted or required by law to prevent the perfection of liens against Landlord’s interest in the Project or to exhibit the Premises to prospective tenants (during the last nine (9) months of the Term), purchasers, encumbrancers or to others, or for any other purpose as Landlord may deem reasonably necessary or desirable; provided, however, that Landlord shall use reasonable efforts not to unreasonably interfere with Tenant’s business operations. Tenant shall not be entitled to any abatement of Rent by reason of the exercise of any such right of entry. Tenant waives any claim for damages for any injury or inconvenience to or interference with Tenant’s business, any loss of occupancy or quiet enjoyment of the Premises, and any other loss occasioned thereby. Landlord shall at all times have and retain a key with which to unlock all of the doors in, upon and about the Premises, excluding Tenant’s vaults and safes or special security areas (designated in advance), and Landlord shall have the right to use any and all means which Landlord may deem necessary or proper to open said doors in an emergency, in order to obtain entry to any portion of the Premises, and any entry to the Premises or portions thereof obtained by Landlord by any of said means, or otherwise, shall not be construed to be a forcible or unlawful entry into, or a detainer of, the Premises, or an eviction, actual or constructive, of Tenant from the Premises or any portions thereof. At any time within six (6) months prior to the expiration of the Term or following any earlier termination of this Lease or agreement to terminate this Lease, Landlord shall have the right to erect on the Premises, Building and/or Project a suitable sign indicating that the Premises are available for lease.

{2089-00107/00654094;7} 14

15. SERVICES AND UTILITIES