Attached files

| file | filename |

|---|---|

| EX-10.22 - EXHIBIT 10.22 - W.W. GRAINGER, INC. | exhibit1022summarydescript.htm |

| EX-32 - EXHIBIT 32 - W.W. GRAINGER, INC. | gww-20161231xex32.htm |

| EX-31.2 - EXHIBIT 31.2 - W.W. GRAINGER, INC. | gww-20161231xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - W.W. GRAINGER, INC. | gww-20161231xex311.htm |

| EX-23 - EXHIBIT 23 - W.W. GRAINGER, INC. | exhibit23consent2016.htm |

| EX-21 - EXHIBIT 21 - W.W. GRAINGER, INC. | exhibit21subsidiaries2016.htm |

| EX-10.12 - EXHIBIT 10.12 - W.W. GRAINGER, INC. | exhibit1012summarydescript.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to _______

Commission file number 1-5684

W.W. Grainger, Inc.

(Exact name of registrant as specified in its charter)

Illinois | 36-1150280 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

100 Grainger Parkway, Lake Forest, Illinois | 60045-5201 | |

(Address of principal executive offices) | (Zip Code) | |

(847) 535-1000 | ||

(Registrant’s telephone number including area code) | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common Stock $0.50 par value | New York Stock Exchange | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [X] | Accelerated filer [ ] | Non-accelerated filer [ ] | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting common equity held by nonaffiliates of the registrant was $12,999,003,606 as of the close of trading as reported on the New York Stock Exchange on June 30, 2016. The Company does not have nonvoting common equity.

The registrant had 58,837,353 shares of the Company’s Common Stock outstanding as of January 31, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement relating to the annual meeting of shareholders of the registrant to be held on April 26, 2017, are incorporated by reference into Part III hereof.

1

TABLE OF CONTENTS | Page(s) | |||||

PART I | ||||||

Item 1: | BUSINESS | |||||

Item 1A: | RISK FACTORS | |||||

Item 1B: | UNRESOLVED STAFF COMMENTS | |||||

Item 2: | PROPERTIES | |||||

Item 3: | LEGAL PROCEEDINGS | |||||

Item 4: | MINE SAFETY DISCLOSURES | |||||

PART II | ||||||

Item 5: | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER | |||||

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | ||||||

Item 6: | SELECTED FINANCIAL DATA | |||||

Item 7: | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL | |||||

CONDITION AND RESULTS OF OPERATIONS | ||||||

Item 7A: | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |||||

Item 8: | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |||||

Item 9: | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS | |||||

ON ACCOUNTING AND FINANCIAL DISCLOSURE | ||||||

Item 9A: | CONTROLS AND PROCEDURES | |||||

Item 9B: | INFORMATION REQUIRED TO BE DISCLOSED IN A FORM 8-K | |||||

PART III | ||||||

Item 10: | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |||||

Item 11: | EXECUTIVE COMPENSATION | |||||

Item 12: | DIRECTORS AND EXECUTIVE OFFICERS | |||||

Item 13: | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | |||||

Item 14: | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |||||

PART IV | ||||||

Item 15: | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | |||||

Signatures | ||||||

2

PART I

Item 1: Business

The Company

W.W. Grainger, Inc., incorporated in the State of Illinois in 1928, is a broad line distributor of maintenance, repair and operating (MRO) supplies and other related products and services used by businesses and institutions primarily in the United States (U.S.) and Canada, with a presence also in Europe, Asia and Latin America. In this report, the words “Grainger” or “Company” mean W.W. Grainger, Inc. and its subsidiaries.

Grainger uses a combination of multichannel and single channel online business models to provide customers with a range of options for finding and purchasing MRO products, utilizing sales representatives, contact centers, direct marketing materials, catalogs and eCommerce technology. Grainger serves approximately 3 million customers worldwide through a network of highly integrated distribution centers, websites and branches.

Products are regularly added to and deleted from Grainger's product lines on the basis of customer demand, market research, recommendations of suppliers, sales volumes and other factors.

Grainger's centralized business support functions provide coordination and guidance in the areas of accounting and finance, strategy and business development, communications and investor relations, compensation and benefits, information systems, health and safety, global supply chain functions, human resources, risk management, internal audit, legal, real estate, security, tax and treasury. These services are provided in varying degrees to all business units.

Grainger’s two reportable segments are the U.S. and Canada, and they are described further below. Other businesses include Zoro Tools, Inc. (Zoro), the single channel online business in the U.S., MonotaRO Co. (MonotaRO) in Japan and operations in Europe, Asia and Latin America. These businesses generate revenue through the distribution of MRO supplies and products and provide related services. For segment and geographical information and consolidated net sales and operating earnings, see “Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 16 to the Consolidated Financial Statements.

United States

The U.S. business offers a broad selection of MRO supplies and other related products and services through sales representatives, catalogs, eCommerce and local branches. A combination of product breadth, local availability, speed of delivery, detailed product information and competitively priced products and services is provided by this business. Products offered include material handling equipment, safety and security supplies, lighting and electrical products, power and hand tools, pumps and plumbing supplies, cleaning and maintenance supplies, building and home inspection supplies, vehicle and fleet components and many other items primarily focused on the facilities maintenance market. Services offered primarily relate to inventory management solutions. In 2016, service fee revenue represented less than 1% of sales.

The majority of products sold by the U.S. business are nationally branded products. In addition, 22% of 2016 sales were private label items bearing Grainger’s registered trademarks, such as DAYTON® motors, power transmission, HVAC and material handling equipment, SPEEDAIRE® air compressors, AIR HANDLER® air filtration equipment, TOUGH GUY® cleaning products, WESTWARD® tools, CONDOR® safety products and LUMAPRO® lighting products. Grainger has taken steps to protect these trademarks against infringement and believes that they will remain available for future use in its business. The U.S. business purchases products for sale from more than 2,600 suppliers, most of which are manufacturers. Through a global sourcing operation, the business procures competitively priced, high-quality products produced outside the U.S. from approximately 400 suppliers. Grainger sells these items primarily under the private label brands listed above. No single supplier comprised more than 5% of total purchases and no significant difficulty has been encountered with respect to sources of supply.

3

The U.S. business operates and fulfills orders in all 50 states through a network of distribution centers (DCs), branches and contact centers. Customers range from small and medium-sized businesses to large corporations, government entities and other institutions. They are primarily represented by purchasing managers or workers in facilities maintenance departments and service shops across a wide range of industries such as manufacturing, hospitality, transportation, government, retail, healthcare and education. Sales in 2016 were made to approximately 1.1 million customers averaging 111,000 daily transactions. Approximately 79% of sales are concentrated with large customers and no single customer accounted for more than 3% of total sales.

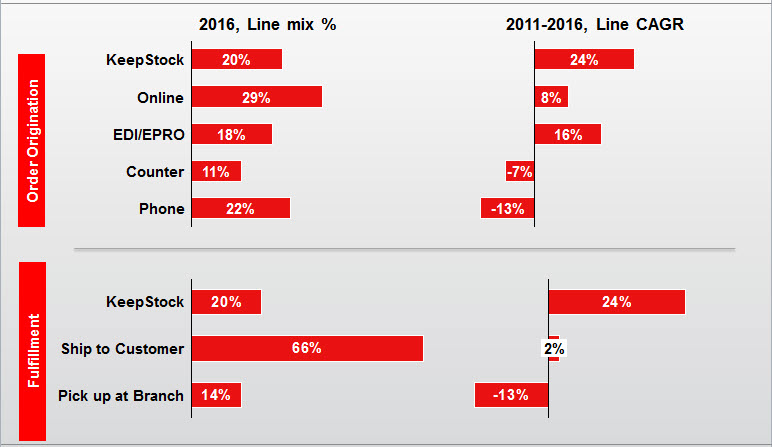

Macro trends are changing the way Grainger's customers behave. Customers want highly tailored solutions with real-time access to information and just-in-time delivery of products and services. Demands for transparency are also increasing as access to information expands. These changes in behaviors are reflected in how customers do business with Grainger as demonstrated in the following chart:

Customers continue to migrate to online and electronic purchasing platforms such as EDI and eProcurement. Through Grainger.com and other branded websites, which serve as prominent channels in the U.S. business, customers have access to approximately 1.9 million products. Grainger.com provides real-time price and product availability and detailed product information and offers advanced features such as product search and compare capabilities. For customers with sophisticated electronic purchasing platforms, the U.S. business utilizes technology that allows these systems to communicate directly with Grainger.com. eCommerce revenues in the U.S. were $3.7 billion in 2016, an increase of 12% versus 2015, and represented 46% of total revenues.

Inventory management services is another area where the U.S. business helps customers be more productive. KeepStock® inventory solutions is a comprehensive program that includes vendor-managed inventory, customer-managed inventory and on-site vending machines. Grainger's KeepStock program currently provides services to almost 23,000 customers and completed approximately 11,000 installations in 2016. As of December 31, 2016, there were approximately 59,500 total installations. If the Company included KeepStock®, the electronic inventory management offering, total eCommerce and KeepStock® revenue for the U.S. business would represent 57% of total sales.

Due to the customer migration to online and electronic purchasing, Grainger initiated a restructuring that resulted in the closing of 49 branches in 2015 and 55 branches in 2016. As of December 31, 2016, the U.S. business had 284 branches (254 stand alone, 28 on-site and 2 will-call express locations), 18 DCs, 3 national contact centers and 39 regional contact centers, which are located within branches.

4

DCs range in size from 45,000 square feet to 1.3 million square feet, the largest of which can stock up to 500,000 products. Automated equipment and processes allow larger DCs to handle the majority of the customer shipping for next-day product availability and replenish the branches that provide same-day availability. The DC network increasingly fulfills a larger portion of customer orders, especially as customers migrate to online and electronic purchasing. Grainger completed the construction of a new 1.3 million square-foot DC in New Jersey and began operations in 2016.

Branches serve the immediate needs of customers in their local markets by allowing them to pick up items directly. In addition, branches support local KeepStock® operations. The branch network has approximately 1,800 employees who primarily fulfill counter and will-call product purchases and provide customer service. Grainger's contact center network consists of approximately 2,000 employees who handle about 74,000 orders per day via phone, e-mail and fax. The contact centers will be consolidating to 3 national contact centers with expanded work-from-home arrangements over the next 18 months, which will enable improved customer service, better team member engagement and efficiencies.

The U.S. business has a sales force of approximately 3,600 professionals who help businesses and institutions select the right products to find immediate solutions to maintenance problems and reduce operating expenses by utilizing Grainger as a consistent source of supply across multiple locations. In 2016, Grainger continued to focus its outside sales force on facilitating growth with large customers who typically have more complex purchasing requirements than small and medium-sized customers. To meet the needs of the medium-sized customers, Grainger added approximately 260 inside sellers during 2016 with a plan to add 115 in the second half of 2017.

The Grainger catalog, most recently issued in February 2017, offers approximately 383,000 MRO products and is used by customers to assist in product selection. The 2017 catalog includes almost 21,000 new items and approximately 1.1 million copies of the catalog were produced.

Grainger estimates the U.S. market for MRO products to be approximately $125 billion in 2016, of which Grainger’s share is approximately 6%.

Canada

Acklands – Grainger Inc. (Acklands – Grainger) is Canada’s leading broad line distributor of industrial and safety supplies. This business provides a combination of product breadth, local availability, speed of delivery, detailed product information and competitively priced products and services.

The Canadian business serves customers through branches, sales and service representatives and DCs across Canada. The business initiated a restructuring in 2015 in response to the decline in oil prices and the resultant weak economy and low MRO market growth. The restructuring resulted in the closure of 16 branches in 2015 and an additional 14 branches in 2016. As of December 31, 2016, Acklands – Grainger had 151 branches and 5 DCs. Approximately 12,000 sales transactions are completed daily. Customers have access to more than 152,000 stocked products through a comprehensive catalog. The most recent catalog, printed in both English and French, was issued in February 2017. In addition, customers can purchase products through Acklandsgrainger.com, a fully bilingual website. Grainger estimates the 2016 Canadian market for MRO products to be approximately $11 billion, of which Acklands – Grainger’s share is approximately 7%.

Other Businesses

Included in Other Businesses is Zoro in the U.S., MonotaRO in Japan and other operations in Europe, Asia and Latin America. The more significant businesses in this group, those with revenues of more than $100 million in 2016, are described below.

Zoro

Zoro is an online distributor of MRO products serving U.S. businesses and consumers through its website, Zoro.com. Zoro serves Canadian customers through ZoroCanada.com via export from the U.S. Zoro offers a broad selection of more than one million products at single, competitive prices. Zoro has no branches or sales force, and customer orders are fulfilled through the U.S. business supply chain.

MonotaRO

Grainger operates in Japan and other Asian countries primarily through its 51% interest in MonotaRO Co (MonotaRO). MonotaRO provides small and mid-sized Japanese businesses with products that help them operate and maintain their facilities. MonotaRO is a catalog and web-based direct marketer with approximately 91% of orders being conducted through Monotaro.com, through which customers have access to approximately 10 million products. MonotaRO predominantly fulfills all orders from three DCs, the largest of which is a 425,000 square-foot DC in the Osaka area. MonotaRO is currently building a 590,000 square-foot DC in the Tokyo area, which it plans to put into operation in April

5

2017. Grainger estimates the 2016 Japanese market for MRO products to be approximately $41 billion, of which MonotaRO’s share is approximately 2%.

Cromwell

Cromwell is a broad line industrial distributor of MRO products in the United Kingdom (U.K.) serving approximately 70,000 industrial and manufacturing customers. Headquartered in Leicester, England, Cromwell has 52 U.K. branches and 10 international branches. Customers have access to almost 80,000 MRO products through a catalog and through cromwell.co.uk. Grainger estimates the U.K. market for MRO products to be approximately $16 billion, of which Cromwell's share is approximately 2%.

Fabory

The Fabory Group (Fabory) is a European specialty distributor of fasteners, tools and industrial supplies. Fabory is headquartered in Tilburg, the Netherlands. As of December 31, 2016, Fabory has 70 branches in 13 countries. Customers have access to more than 100,000 products through a catalog and Fabory.com. Grainger estimates the 2016 European market (in which Fabory has its primary operations) for MRO products, including fasteners, to be approximately $34 billion, of which Fabory’s share is approximately 1%.

Grainger Mexico

Grainger’s operations in Mexico provide local businesses with MRO supplies and other related products primarily from Mexico and the U.S. The business in Mexico distributes products through a network of branches and two DCs where customers have access to approximately 310,000 products through a Spanish-language catalog and through Grainger.com.mx. Grainger estimates the 2016 Mexican market for MRO products to be approximately $10 billion, of which Grainger Mexico’s share is approximately 1%.

Seasonality

Grainger’s business in general is not seasonal, however, there are some products that typically sell more often during the winter or summer season. In any given month, unusual weather patterns, i.e., unusually hot or cold weather, could impact the sales volumes of these products, either positively or negatively.

Competition

Grainger faces competition in all the markets it serves, from manufacturers (including some of its own suppliers) that sell directly to certain segments of the market, wholesale distributors, catalog houses, retail enterprises and Internet-based businesses. Grainger provides local product availability, a broad product line, sales representatives, competitive pricing, catalogs (which include product descriptions and, in certain cases, extensive technical and application data) and electronic and eCommerce technology. Other services, such as inventory management, are also offered. Grainger believes that it can effectively compete with manufacturers on small orders, but manufacturers may have an advantage in filling large orders. There are several large competitors, although the majority of the market is served by small local and regional competitors.

Employees

As of December 31, 2016, Grainger had approximately 25,600 employees, of whom approximately 24,400 were full-time and 1,200 were part-time or temporary. Grainger has never had a major work stoppage and considers employee relations to be adequate.

Website Access to Company Reports

Grainger makes available, through its website, free of charge, its Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments to those reports, as soon as reasonably practicable after these materials are electronically filed with or furnished to the Securities and Exchange Commission. This material may be accessed by visiting www.grainger.com/investor.

6

Item 1A: Risk Factors

The following is a discussion of significant risk factors relevant to Grainger’s business that could adversely affect its financial condition, results of operations and cash flows. The risk factors discussed in this section should be considered together with information included elsewhere in this Annual Report on Form 10-K and should not be considered the only risks to which the Company is exposed.

Weakness in the economy, market trends and other conditions affecting the profitability and financial stability of Grainger’s customers could negatively impact Grainger’s sales growth and results of operations.

Economic and industry trends affect Grainger’s business environments. Grainger serves several industries in which the demand for its products and services is sensitive to the production activity, capital spending and demand for products and services of Grainger’s customers. Many of these customers operate in markets that are subject to cyclical fluctuations resulting from market uncertainty, costs of goods sold, currency exchange rates, foreign competition, offshoring of production, oil and natural gas prices, geopolitical developments and a variety of other factors beyond Grainger’s control. Any of these factors could cause customers to idle or close facilities, delay purchases, reduce production levels or experience reductions in the demand for their own products or services.

Any of these events could impair the ability of Grainger’s customers to make full and timely payments or reduce the volume of products and services these customers purchase from Grainger and could cause increased pressure on Grainger’s selling prices and terms of sale. Accordingly, a significant or prolonged slowdown in activity in the United States (U.S.), Canada or any other major world economy, or a segment of any such economy, could negatively impact Grainger’s sales growth and results of operations.

The facilities maintenance industry is highly fragmented, and changes in competition could result in decreased demand for Grainger’s products and services.

There are several large competitors in the industry, although most of the market is served by small local and regional competitors. Grainger faces competition in all markets it serves, from manufacturers (including some of its own suppliers) that sell directly to certain segments of the market, wholesale distributors, catalog houses, retail enterprises and Internet-based businesses that compete with price transparency. The industry is also consolidating as customers are increasingly aware of the total costs of fulfillment and of the need to have consistent sources of supply at multiple locations. This consolidation could cause the industry to become more competitive as greater economies of scale are achieved by competitors, or as competitors with new lower cost business models are able to operate with lower prices and gross profit on products. These competitive pressures could adversely affect Grainger’s sales and profitability.

Changes in inflation may adversely affect gross margins.

Inflation impacts the costs at which Grainger can procure product and the ability to increase prices to customers over time. Prolonged periods of deflation could adversely affect the degree to which Grainger is able to increase sales through price increases.

Volatility in commodity prices may adversely affect gross margins.

Some of Grainger’s products contain significant amounts of commodity-priced materials, such as steel, copper, petroleum derivatives or rare earth minerals, and are subject to price changes based upon fluctuations in the commodities market. Fluctuations in the price of fuel could affect transportation costs. Grainger’s ability to pass on such increases in costs in a timely manner depends on market conditions. The inability to pass along cost increases could result in lower gross margins. In addition, higher prices could impact demand for these products, resulting in lower sales volumes.

Unexpected product shortages could negatively impact customer relationships, resulting in an adverse impact on results of operations.

Grainger’s competitive strengths include product selection and availability. Products are purchased from more than 5,100 suppliers located in various countries around the world, no one of which accounted for more than 5% of total purchases. Historically, no significant difficulty has been encountered with respect to sources of supply; however, disruptions could occur due to factors beyond Grainger’s control, including economic downturns, political unrest, port slowdowns, trade issues and other factors, any of which could adversely affect a supplier’s ability to manufacture or

7

deliver products. As Grainger continues to source lower cost products from Asia and other areas of the world, the risk for disruptions has increased due to the additional lead time required and distances involved. If Grainger was to experience difficulty in obtaining products, there could be a short-term adverse effect on results of operations and a longer-term adverse effect on customer relationships and Grainger’s reputation. In addition, Grainger has strategic relationships with a number of vendors. In the event Grainger was unable to maintain those relations, there might be a loss of competitive pricing advantages which could, in turn, adversely affect results of operations.

Changes in customer or product mix could cause the gross margin percentage to decline.

From time to time, Grainger experiences changes in customer and product mix that affect gross margin. Changes in customer and product mix result primarily from business acquisitions, changes in customer demand, customer acquisitions, selling and marketing activities and competition. If rapid growth with lower margin customers continues, Grainger will face pressure to maintain current gross margins, as these customers receive more discounted pricing due to their higher sales volume. There can be no assurance that Grainger will be able to maintain historical gross margins in the future.

Disruptions in Grainger’s supply chain could result in an adverse impact on results of operations.

A disruption within Grainger’s logistics or supply chain network, including damage, destruction, extreme weather and other events, which could cause one or more of Grainger’s distribution centers to become non-operational, could adversely affect Grainger’s ability to obtain or deliver inventory in a timely manner, impair Grainger’s ability to meet customer demand for products and result in lost sales or damage to Grainger’s reputation. Grainger’s ability to provide same-day shipping and next-day delivery is an integral component of Grainger’s business strategy and any such disruption could adversely impact results of operations.

Interruptions in the proper functioning of information systems could disrupt operations and cause unanticipated increases in costs and/or decreases in revenues.

The proper functioning of Grainger’s information systems is critical to the successful operation of its business. Grainger continues to invest in software, hardware and network infrastructures in order to effectively manage its information systems. Although Grainger’s information systems are protected with robust backup and security systems, including physical and software safeguards and remote processing capabilities, information systems are still vulnerable to natural disasters, power losses, computer viruses, telecommunication failures and other problems. If critical information systems fail or otherwise become unavailable, among other things, Grainger’s ability to process orders, maintain proper levels of inventories, collect accounts receivable and disburse funds could be adversely affected. Any such interruption of Grainger’s information systems could also subject Grainger to additional costs.

Breaches of information systems security could damage Grainger’s reputation, disrupt operations, increase costs and/or decrease revenues.

Through Grainger’s sales and eCommerce channels, Grainger collects and stores personally identifiable, confidential, proprietary and other information from customers so that they may, among other things, purchase products or services, enroll in promotional programs, register on Grainger’s websites or otherwise communicate or interact with the Company. Moreover, Grainger’s operations routinely involve receiving, storing, processing and transmitting sensitive information pertaining to its business, customers, suppliers and employees, and other sensitive matters.

While Grainger has instituted safeguards for the protection of such information, during the normal course of business, Grainger has experienced and expects to continue to experience attempts to breach the Company’s information systems, and Grainger may be unable to protect sensitive data and/or the integrity of the Company’s information systems. A cybersecurity incident could be caused by malicious outsiders using sophisticated methods to circumvent firewalls, encryption and other security defenses. Because techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until they are launched against a target, Grainger may be unable to anticipate these techniques or implement adequate preventative measures.

Moreover, from time to time, Grainger may share information with vendors and other third parties that assist with certain aspects of the business. While Grainger requires assurances that these vendors and other parties will protect confidential information, there is a risk that the confidentiality of data held or accessed by them may be compromised. If successful, those attempting to penetrate Grainger’s or its vendors’ information systems may misappropriate

8

personally identifiable, credit card, confidential, proprietary or other sensitive customer, supplier, employee or business information.

In addition, a Grainger employee, contractor or other third party with whom Grainger does business may attempt to circumvent security measures in order to obtain such information or inadvertently cause a breach involving such information. Further, Grainger’s systems are integrated with customer systems in certain cases, and a breach of the Company’s information systems could be used to gain illicit access to customer systems and information.

Loss of customer, supplier, employee or other business information could disrupt operations, damage Grainger’s reputation and expose Grainger to claims from customers, suppliers, financial institutions, regulators, payment card associations, employees and others, any of which could have a material adverse effect on Grainger, its financial condition and results of operations.

Fluctuations in foreign currency have an effect on reported results of operations.

Grainger’s exposure to fluctuations in foreign currency rates results primarily from the translation exposure associated with the preparation of the Consolidated Financial Statements, as well as from transaction exposure associated with transactions in currencies other than an entity’s functional currency. While the Consolidated Financial Statements are reported in U.S. dollars, the financial statements of Grainger’s subsidiaries outside the U.S. are prepared using the local currency as the functional currency and translated into U.S. dollars. In addition, Grainger is exposed to foreign currency exchange rate risk with respect to the U.S. dollar relative to the local currencies of Grainger’s international subsidiaries, primarily the Canadian dollar, euro, pound sterling, Mexican peso, renminbi and yen, arising from transactions in the normal course of business, such as sales and loans to wholly owned subsidiaries, sales to third-party customers, purchases from suppliers and bank loans and lines of credit denominated in foreign currencies. Grainger also has foreign currency exposure to the extent receipts and expenditures are not denominated in the subsidiary’s functional currency and that could have an impact on sales, costs and cash flows. These fluctuations in foreign currency exchange rates could affect Grainger’s results of operations and impact reported net sales and net earnings.

Changes in Grainger’s credit ratings and outlook may reduce access to capital and increase borrowing costs.

Grainger’s credit ratings are based on a number of factors, including Grainger’s financial strength and factors outside of Grainger’s control, such as conditions affecting Grainger’s industry generally or the introduction of new rating practices and methodologies. Grainger cannot provide assurances that Grainger’s current credit ratings will remain in effect or that the ratings will not be lowered, suspended or withdrawn entirely by the rating agencies. If rating agencies lower, suspend or withdraw the ratings, the market price or marketability of Grainger’s securities may be adversely affected. In addition, any change in ratings could make it more difficult for the Grainger to raise capital on acceptable terms, impact the ability to obtain adequate financing and result in higher interest costs for Grainger’s existing credit facilities or on future financings.

Acquisitions, partnerships, joint ventures and other business combination transactions involve a number of inherent risks, any of which could result in the benefits anticipated not being realized and could have an adverse effect on results of operations.

Acquisitions, partnerships, joint ventures and other business combination transactions, both foreign and domestic, involve various inherent risks, such as uncertainties in assessing value, strengths, weaknesses, liabilities and potential profitability. There is also risk relating to Grainger’s ability to achieve identified operating and financial synergies anticipated to result from the transactions. Additionally, problems could arise from the integration of acquired businesses, including unanticipated changes in the business or industry or general economic conditions that affect the assumptions underlying the acquisition. Any one or more of these factors could cause Grainger to not realize the benefits anticipated or have a negative impact on the fair value of the reporting units. Accordingly, goodwill and intangible assets recorded as a result of acquisitions could become impaired.

In order to compete, Grainger must attract, retain and motivate key employees, and the failure to do so could have an adverse effect on results of operations.

In order to compete and have continued growth, Grainger must attract, retain and motivate executives and other key employees, including those in managerial, technical, sales, marketing and support positions. Grainger competes to hire employees and then must train them and develop their skills and competencies. Grainger’s results of operations

9

could be adversely affected by increased costs due to increased competition for employees, higher employee turnover or increased employee benefit costs.

Grainger’s continued success is substantially dependent on positive perceptions of Grainger’s reputation.

One of the reasons why customers choose to do business with Grainger and why employees choose Grainger as a place of employment is the reputation that Grainger has built over many years. To be successful in the future, Grainger must continue to preserve, grow and leverage the value of Grainger’s brand. Reputational value is based in large part on perceptions of subjective qualities. Even an isolated incident, or the aggregate effect of individually insignificant incidents, can erode trust and confidence, particularly if they result in adverse publicity, governmental investigations or litigation, and as a result, could tarnish Grainger’s brand and lead to adverse effects on Grainger’s business.

Grainger is subject to various domestic and foreign laws, regulations and standards. Failure to comply or unforeseen developments in related contingencies such as litigation could adversely affect Grainger’s financial condition, results of operations and cash flows.

Grainger’s business is subject to a wide array of laws, regulations and standards in every domestic and foreign jurisdiction where it operates, including advertising and marketing regulations, anti-bribery and corruption laws, anti-competition regulations, data protection (including payment card industry data security standards), data privacy (including in the U.S. and the European Union, which has traditionally imposed strict obligations under data privacy laws and regulations that vary from country to country) and cybersecurity requirements (including as to protection of information and incident responses), environmental protection laws, foreign exchange controls and cash repatriation restrictions, government business regulations applicable to Grainger as a government contractor selling to federal, state and local government entities, health and safety laws, import and export requirements, intellectual property laws, labor laws, product compliance laws, supplier regulations regarding the sources of supplies or products, tax laws (including as to U.S. taxes on foreign subsidiaries), unclaimed property laws and laws, regulations and standards applicable to other commercial matters. Moreover, Grainger is also subject to audits and inquiries in the normal course of business.

Failure to comply with any of these laws, regulations and standards could result in civil, criminal, monetary and non-monetary penalties as well as potential damage to the Company’s reputation. Changes in these laws, regulations and standards, or in their interpretation, could increase the cost of doing business, including, among other factors, as a result of increased investments in technology and the development of new operational processes. Furthermore, while Grainger has implemented policies and procedures designed to facilitate compliance with these laws, regulations and standards, there can be no assurance that employees, contractors or agents will not violate such laws, regulations and standards or Grainger’s policies. Any such failure to comply or violation could individually or in the aggregate materially adversely affect Grainger’s financial condition, results of operations and cash flows.

Grainger also is, and from time to time may become, party to a number of legal proceedings incidental to Grainger’s business involving alleged damages or injuries arising out of the use of Grainger’s products and services or violations of these laws, regulations or standards. The defense of these proceedings may require significant expenses and divert management’s time and attention, and Grainger may be required to pay damages that could individually or in the aggregate materially adversely affect its financial condition, results of operations and cash flows. In addition, any insurance or indemnification rights that Grainger may have with respect to such matters may be insufficient or unavailable to protect the Company against potential loss exposures.

Tax changes could affect Grainger’s effective tax rate and future profitability.

Grainger’s future results could be adversely affected by changes in the effective tax rate as a result of changes in Grainger’s overall profitability and changes in the mix of earnings in countries with differing statutory tax rates, changes in tax legislation, the results of the examination of previously filed tax returns and continuing assessment of the Company’s tax exposures.

Item 1B: Unresolved Staff Comments

None.

10

Item 2: Properties

As of December 31, 2016, Grainger’s owned and leased facilities totaled approximately 29.3 million square feet. The U.S. and Canada businesses accounted for the majority of the total square footage. Grainger believes that its properties are generally in excellent condition, well maintained and suitable for the conduct of business.

A brief description of significant facilities follows:

Location | Facility and Use (6) | Size in Square Feet (in 000's) | |||

U.S. (1) | 284 U.S. branch locations | 6,477 | |||

U.S. (2) | 18 Distribution Centers | 8,721 | |||

U.S. (3) | Other facilities | 4,846 | |||

Canada (4) | 159 Acklands – Grainger facilities | 3,284 | |||

Other Businesses (5) | Other facilities | 4,771 | |||

Chicago Area (2) | Headquarters and General Offices | 1,226 | |||

Total Square Feet | 29,325 | ||||

(1) | Consists of 211 owned and 73 leased properties located throughout the U.S. ranging in size from approximately 1,000 to 109,000 square feet. |

(2) | These facilities are primarily owned and they range in size from approximately 45,000 square feet to 1.3 million square feet. |

(3) | These facilities include both owned and leased locations, consisting of storage facilities, office space, call centers and idle properties. |

(4) | Consists of general offices, distribution centers and branches located throughout Canada, of which 66 are owned and 93 leased. |

(5) | These facilities include owned and leased locations in Europe, Asia, Latin America and other U.S. operations. |

(6) | Owned facilities are not subject to any mortgages. |

Item 3: Legal Proceedings

Environmental Matters

As previously disclosed, on August 5, 2015, Environment Canada initiated a proceeding against the Company’s Canadian subsidiary, Acklands-Grainger, in the Provincial Court of Alberta seeking monetary sanctions based on allegations that Acklands-Grainger sold certain products containing an ozone-depleting substance in violation of the Canadian Environmental Protection Act, 1999 and prohibited by the Ozone-Depleting Substances Regulations, 1998. On December 12, 2016, as part of a negotiated plea agreement, Acklands-Grainger pleaded guilty in the Provincial Court of Alberta to two counts of violating the Ozone-Depleting Substances Regulations and agreed to pay a fine of C$500,000. Acklands-Grainger intends to seek indemnification from the suppliers that sold Acklands-Grainger the products in question.

Other Matters

For a description of other legal proceedings, see Note 17 to the Consolidated Financial Statements included under Item 8.

Item 4: Mine Safety Disclosures

Not applicable.

11

PART II

Item 5: Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Market Information and Dividends

Grainger's common stock is listed on the New York Stock Exchange, with the ticker symbol GWW. Effective January 1, 2015, Grainger voluntarily delisted its common stock from the Chicago Stock Exchange to eliminate duplicative administrative requirements. The high and low sales prices for the common stock and the dividends declared and paid per share for each calendar quarter during 2016 and 2015 are shown below.

Prices | ||||||||||||

Quarters | High | Low | Dividends | |||||||||

2016 | First | $ | 234.77 | $ | 176.85 | $ | 1.17 | |||||

Second | 239.95 | 212.64 | 1.22 | |||||||||

Third | 235.53 | 212.54 | 1.22 | |||||||||

Fourth | 240.74 | 201.94 | 1.22 | |||||||||

Year | $ | 240.74 | $ | 176.85 | $ | 4.83 | ||||||

2015 | First | $ | 256.97 | $ | 228.15 | $ | 1.08 | |||||

Second | 252.87 | 228.05 | 1.17 | |||||||||

Third | 240.00 | 194.42 | 1.17 | |||||||||

Fourth | 233.00 | 189.60 | 1.17 | |||||||||

Year | $ | 256.97 | $ | 189.60 | $ | 4.59 | ||||||

Grainger expects that its practice of paying quarterly dividends on its common stock will continue, although the payment of future dividends is at the discretion of Grainger’s Board of Directors and will depend upon Grainger’s earnings, capital requirements, financial condition and other factors.

Holders

The approximate number of shareholders of record of Grainger’s common stock as of January 31, 2017, was 720 with approximately 218,500 additional shareholders holding stock through nominees.

Issuer Purchases of Equity Securities - Fourth Quarter

Period | Total Number of Shares Purchased (A) | Average Price Paid Per Share (B) | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (C) | Maximum Number of Shares That May Yet be Purchased Under the Plans or Programs | ||

Oct. 1 – Oct. 31 | 306,313 | $212.89 | 306,313 | 6,367,978 | shares | |

Nov. 1 – Nov. 30 | 239,007 | $216.57 | 239,007 | 6,128,971 | shares | |

Dec. 1 – Dec. 31 | 270,264 | $236.75 | 270,264 | 5,858,707 | shares | |

Total | 815,584 | $221.87 | 815,584 | |||

(A) | There were no shares withheld to satisfy tax withholding obligations in connection with the vesting of employee restricted stock awards. |

(B) | Average price paid per share includes any commissions paid and includes only those amounts related to purchases as part of publicly announced plans or programs. |

(C) | Purchases were made pursuant to a share repurchase program approved by Grainger's Board of Directors. Activity is reported on a trade date basis. |

12

Company Performance

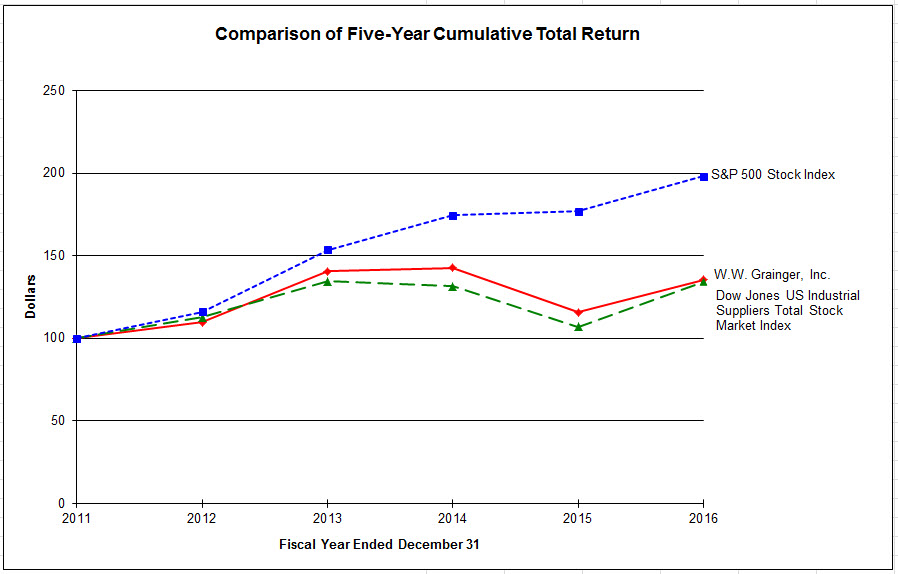

The following stock price performance graph compares the cumulative total return on an investment in Grainger common stock with the cumulative total return of an investment in each of the Dow Jones US Industrial Suppliers Total Stock Market Index and the S&P 500 Stock Index. It covers the period commencing December 31, 2011, and ending December 31, 2016. The graph assumes that the value for the investment in Grainger common stock and in each index was $100 on December 31, 2011, and that all dividends were reinvested.

December 31, | ||||||||||||||||||

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||

W.W. Grainger, Inc. | $ | 100 | $ | 110 | $ | 141 | $ | 143 | $ | 116 | $ | 136 | ||||||

Dow Jones US Industrial Suppliers Total Stock Market Index | 100 | 113 | 135 | 132 | 107 | 134 | ||||||||||||

S&P 500 Stock Index | 100 | 116 | 154 | 175 | 177 | 198 | ||||||||||||

13

Item 6: Selected Financial Data

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

(In thousands of dollars, except for per share amounts) | |||||||||||||||||||

Net sales | $ | 10,137,204 | $ | 9,973,384 | $ | 9,964,953 | $ | 9,437,758 | $ | 8,950,045 | |||||||||

Net earnings attributable to W.W. Grainger, Inc. | 605,928 | 768,996 | 801,729 | 797,036 | 689,881 | ||||||||||||||

Net earnings per basic share | 9.94 | 11.69 | 11.59 | 11.31 | 9.71 | ||||||||||||||

Net earnings per diluted share | 9.87 | 11.58 | 11.45 | 11.13 | 9.52 | ||||||||||||||

Total assets | 5,694,307 | 5,857,755 | 5,283,049 | 5,266,328 | 5,014,598 | ||||||||||||||

Long-term debt (less current maturities) and other long-term liabilities | 2,159,602 | 1,716,507 | 737,232 | 743,702 | 817,229 | ||||||||||||||

Cash dividends paid per share | $ | 4.83 | $ | 4.59 | $ | 4.17 | $ | 3.59 | $ | 3.06 | |||||||||

Net earnings for 2016 included a net expense of $105 million, or $1.71 per share, consisting of the following:

• | Restructuring: A net charge of $26 million, or $0.43 after-tax earnings per share expense related to restructuring actions. These actions primarily included branch closures, net of gains on sale of branch real estate in the United States (U.S.) and Canadian businesses. |

• | Goodwill and intangible impairments: A non-cash impairment charge of $52 million, or $0.85 after-tax earning per share, related to goodwill and intangible impairments in Other Businesses. |

• | Unclaimed property contingency: A charge of $23 million, or $0.37 after-tax earnings per share, related to an adjustment for unclaimed property in the U.S. business primarily related to activity from 2008 through 2012. |

• | General Services Administration (GSA) contingency: An expense of $6 million, or $0.09 after-tax earnings per share, to increase the U.S. business reserve for certain tax, freight and miscellaneous billing issues in connection with the audit of government contracts with the GSA first entered in 1999. |

• | Inventory adjustment: A charge of $7 million, or $0.12 after-tax earnings per share, related to an inventory adjustment in the Canadian business to reflect on updated reserve methodology and better visibility to inventory performance provided by the conversion to the U.S. ERP system. |

• | Discrete tax items: A benefit of $9 million, or $0.15 earnings per share, related to the conclusion of the federal income tax audit for the years 2009 through 2012 in the U.S. business and other discrete tax items. |

Net earnings for 2015 included a $0.33 per share expense related to reorganization in the U.S. business and at the corporate office, a $0.05 per share expense related to reorganization in the Canadian business and a $0.07 per share expense for restructuring in Other Businesses. Results also included a $0.09 per share benefit primarily related to revaluation of deferred tax liabilities resulting from tax law changes in the United Kingdom. When combined, these items had a net expense effect of $0.36 per share.

Net earnings for 2014 included a $0.40 per share expense related to closing of the business in Brazil, a $0.15 per share non-cash charge due to the retirement plan transition in Europe and a $0.15 per share expense related to restructuring the business in Europe. Results also included a $0.11 per share expense related to a non-cash goodwill impairment charge in Other Businesses. When combined, these items had a net expense effect of $0.81 per share.

Net earnings for 2013 included a $0.29 per share expense related to non-cash impairment charges in Other Businesses, primarily for goodwill. Results also included a $0.10 per share expense related to restructuring the businesses in Europe and China. When combined, these items had a net expense effect of $0.39 per share.

14

Net earnings for 2012 included a $0.66 per share expense related to the settlement of disputes involving the GSA and United States Postal Service (USPS) contracts in the U.S. business. Results also included a $0.18 per share expense related to restructuring the businesses in Europe, India and China; a $0.04 per share expense due to a non-cash impairment charge in the U.S. business and a $0.03 per share expense related to U.S. branch closures. When combined, these items had a net expense effect of $0.91 per share.

Grainger completed several acquisitions for the years presented above, all of which were immaterial individually and in the aggregate. Operating results have included the results of each business acquired since the respective acquisition dates.

For further information see “Item 7: Management's Discussion and Analysis of Financial Condition and Results of Operations.”

15

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

General. Grainger is a broad line distributor of maintenance, repair and operating (MRO) supplies and other related products and services used by businesses and institutions. Grainger’s operations are primarily in the United States (U.S.) and Canada, with a presence in Europe, Asia and Latin America. Grainger uses a combination of multichannel and single channel business models to provide customers with a range of options for finding and purchasing products utilizing sales representatives, catalogs, direct marketing materials and eCommerce. Grainger serves approximately 3 million customers worldwide through a network of highly integrated branches, distribution centers and websites.

Grainger’s two reportable segments are the U.S. and Canada. The U.S. operating segment reflects the results of Grainger’s U.S. business. The Canada operating segment reflects the results for Acklands – Grainger Inc., Grainger’s Canadian business. Other Businesses include single channel online businesses such as MonotaRO in Japan and Zoro in the U.S., and business units in Europe, Asia and Latin America.

Business Environment. Given Grainger's large number of customers and the diverse industries it serves, several economic factors and industry trends tend to shape Grainger’s business environment. The overall economy and leading economic indicators provide general insight into projecting Grainger's growth. Grainger’s sales in the U.S. and Canada tend to positively correlate with Business Investment, Business Inventory, Exports and Industrial Production. In the U.S., sales tend to positively correlate with Gross Domestic Product (GDP). In Canada, sales tend to positively correlate with oil prices. The table below provides these estimated indicators for 2016 and 2017:

U.S. | Canada | ||||||||||

Estimated 2016 | Forecasted 2017 | Estimated 2016 | Forecasted 2017 | ||||||||

Business Investment | (2.8 | )% | 3.4 | % | (2.8 | )% | 0.7 | % | |||

Business Inventory | 1.0 | % | 0.6 | % | — | — | |||||

Exports | 0.4 | % | 1.9 | % | 1.0 | % | 1.9 | % | |||

Industrial Production | (1.0 | )% | 1.4 | % | (0.5 | )% | 1.9 | % | |||

GDP | 1.6 | % | 2.3 | % | 1.3 | % | 2.1 | % | |||

Oil Prices | — | — | $43/barrel | $57/barrel | |||||||

Source: Global Insight (February 2017) | |||||||||||

In the U.S., Business Investment and Exports are two major indicators of MRO spending. Per the Global Insight February 2017 forecast, Business Investment is forecast to improve in 2017 through equipment related spendings as the influence from slow growth abroad and in the United States fades. Export growth is expected to improve in 2017 as the global economy stabilizes and attracts more capital to the United States.

Per the Global Insight February 2017 forecast, Canada economic growth in 2016 is forecast to continue to remain low but improve in 2017. For the year, the Canadian economy, as measured by GDP, is forecast to grow to 2.1% in 2017 compared to the 2016 estimate of 1.3%. The 2017 forecast assumes that oil prices will continue a slow but steady rise and that business nonresidental investment (a component of Business Investment) will begin to increase. The latest forecast for the Canadian dollar includes further downward adjustments and weakness over the next two years compared to the U.S. dollar.

Outlook. Grainger plans to continue to make investments in its supply chain, eCommerce capabilities, information systems, sales force productivity tools and inventory management services. These investments will support the Company’s revenue growth objectives of (i) continuing to grow its share of business with large, complex customers; (ii) creating a unique value proposition to further penetrate the medium customer segment and (iii) further leveraging its eCommerce capabilities to serve smaller customers. Through the execution of continuous improvement initiatives, the U.S. business will reduce its cost base while ensuring that it continues to deliver an effortless customer experience. In Canada, the Company took aggressive actions in 2016 that will position the business for long-term sustainable growth and profitability. These actions, which included business and personnel reorganization, branch closures, ERP and eCommerce investments, should position the Canadian business for growth in 2017 and restore the business to break even by the end of 2017.

On January 25, 2017, Grainger reiterated its 2017 sales and earnings per share guidance issued on November 11, 2016, and continues to expect 2 to 6 percent sales growth and earnings per share of $11.30 to $12.40 for 2017.

16

Matters Affecting Comparability. There were 255 sales days in the full year 2016 and 2015. Grainger completed one acquisition in 2015 and one in 2014, both of which were immaterial individually and in the aggregate. Grainger’s operating results have included the results of each business acquired since the respective acquisition dates.

Results of Operations

The following table is included as an aid to understanding changes in Grainger's Consolidated Statements of Earnings (in millions of dollars):

For the Years Ended December 31, | ||||||||||||||||||||||||||

Percent Increase/(Decrease) from Prior Year | As a Percent of Net Sales | |||||||||||||||||||||||||

2016 (A) | 2015 (A) | 2014 (A) | 2016 | 2015 | 2016 | 2015 | 2014 | |||||||||||||||||||

Net sales | $ | 10,137 | $ | 9,973 | $ | 9,965 | 2 | % | — | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||

Cost of merchandise sold | 6,023 | 5,742 | 5,651 | 5 | % | 2 | % | 59.4 | 57.6 | 56.7 | ||||||||||||||||

Gross profit | 4,115 | 4,231 | 4,314 | (3 | )% | (2 | )% | 40.6 | 42.4 | 43.3 | ||||||||||||||||

Operating expenses | 2,995 | 2,931 | 2,967 | 2 | % | (1 | )% | 29.6 | 29.4 | 29.8 | ||||||||||||||||

Operating earnings | 1,119 | 1,300 | 1,347 | (14 | )% | (4 | )% | 11.0 | 13.0 | 13.5 | ||||||||||||||||

Other expense | 100 | 50 | 13 | 102 | % | 290 | % | 1.0 | 0.5 | 0.1 | ||||||||||||||||

Income taxes | 386 | 466 | 522 | (17 | )% | (11 | )% | 3.8 | 4.7 | 5.2 | ||||||||||||||||

Noncontrolling interest | 27 | 16 | 11 | 66 | % | 53 | % | 0.3 | 0.2 | 0.1 | ||||||||||||||||

Net earnings attributable to W.W. Grainger, Inc. | $ | 606 | $ | 769 | $ | 801 | (21 | )% | (4 | )% | 6.0 | % | 7.7 | % | 8.1 | % | ||||||||||

(A) May not sum due to rounding

2016 Compared to 2015

Grainger's net sales of $10,137 million for 2016 were an increase of 2% when compared with net sales of $9,973 million for the comparable 2015 period. The 2% increase for the year consisted of the following:

Percent Increase/ (Decrease) | |

Cromwell acquisition | 3 |

Volume | 1 |

Price | (2) |

Total | 2% |

Sales growth to government, retail and light manufacturing customers were offset by a decline in sales to natural resource customers, resellers, contractors and heavy manufacturing customers. In 2016, eCommerce sales for Grainger were $4,757 million, an increase of 15% over the prior year and represented 47% of total sales. The increase was primarily driven by an increase in sales via EDI and electronic purchasing platforms in the U.S. and Japan businesses. If the Company included KeepStock®, the electronic inventory management offering, total eCommerce and KeepStock® sales would represent 56% of total sales. Refer to the Segment Analysis below for further details.

Gross profit of $4,115 million for 2016 decreased 3%. The gross profit margin for 2016 was 40.6%, down 1.8 percentage points versus 2015, primarily due to price deflation exceeding cost deflation and unfavorable customer mix.

17

Operating expenses of $2,995 million for 2016 increased 2% from $2,931 million for 2015. The increase was primarily due to the following:

• | $35 million of restructuring charges primarily in the U.S. and Canadian businesses. |

• | $52 million of impairment charges for goodwill and intangible assets in Other Businesses. |

• | $36 million adjustment for unclaimed property in the U.S. business, primarily for the five years 2008 through 2012. |

• | $9 million increase in the U.S. business reserve related to certain tax, freight and miscellaneous billing issues in connection with the audit of government contracts with the General Services Administration first entered in 1999. |

In 2015, operating expenses included $42 million related to restructuring and other charges primarily in the U.S. and Canadian business. Excluding the charges from both years, operating expenses were down 1%.

Operating earnings of $1,119 million for 2016 decreased 14% from $1,300 million for 2015. The decrease in operating earnings was driven by lower gross profit margin and higher restructuring costs and other charges. Operating earnings included the charges noted above. Excluding these charges from both years, operating earnings decreased 6%.

Net earnings attributable to Grainger for 2016 decreased by 21% to $606 million from $769 million in 2015. The decrease in net earnings primarily resulted from lower operating earnings, partially offset by lower income taxes. Excluding the charges from both years mentioned above and discrete tax items, net earnings decreased 10%.

Diluted earnings per share of $9.87 in 2016 were 15% lower than $11.58 for 2015, due to lower earnings, partially offset by lower average shares outstanding as a result of share repurchases. Excluding the charges mentioned above diluted earnings per share would have been $11.58 compared to $11.94 in 2015, a decrease of 3%.

The table below reconciles reported diluted earnings per share determined in accordance with generally accepted accounting principles (GAAP) in the U.S. to adjusted diluted earnings per share, a non-GAAP measure. Management believes adjusted diluted earnings per share is an important indicator of operations because it excludes items that may not be indicative of core operating results. Because non-GAAP financial measures are not standardized, it may not be possible to compare this financial measure with other companies' non-GAAP financial measures having the same or similar names.

Twelve Months Ended December 31, | |||||||||

2016 | 2015 | % | |||||||

Diluted earnings per share reported | $ | 9.87 | $ | 11.58 | (15 | )% | |||

Adjustments, pretax (1) | 2.41 | 0.69 | |||||||

Tax effect (1)(2) | (0.55 | ) | (0.24 | ) | |||||

Discrete tax items | (0.15 | ) | (0.09 | ) | |||||

Subtotal | 1.71 | 0.36 | |||||||

Diluted earnings per share adjusted | $ | 11.58 | $ | 11.94 | (3 | )% | |||

(1) Adjustments discussed in detail in Item 6.

(2) The tax impact of adjustments is calculated based on the income tax rate in each applicable jurisdiction.

18

Segment Analysis

Grainger’s two reportable segments are the U.S. and Canada. The U.S. operating segment reflects the results of Grainger’s U.S. business. The Canada operating segment reflects the results for Acklands – Grainger Inc., Grainger’s Canadian business. Other businesses include single channel online businesses such as MonotaRO in Japan and Zoro in the U.S., and business units in Europe, Asia and Latin America.

The following comments at the reportable segment and other business unit level include external and intersegment net sales and operating earnings. See Note 16 to the Consolidated Financial Statements.

United States

Net sales were $7,870 million for 2016, a decrease of $93 million, or 1% when compared with net sales of $7,963 million for 2015. The 1% decrease for the year consisted of the following contributors:

Percent Increase/(Decrease) | |

Intercompany sales to Zoro | 1 |

Volume | (1) |

Price | (1) |

Total | (1)% |

Mid-single-digit sales growth to government and retail customers and low single-digit growth to light manufacturing was offset by mid-teen declines in sales to natural resource and reseller customers and mid-single-digit declines to heavy manufacturing customers and contractors.

In 2016, eCommerce sales for the U.S. business were $3,660 million, an increase of 12% over the prior year and represented 46% of total sales. The increase was primarily driven by an increase in sales via EDI and electronic purchasing platforms. If the Company included KeepStock®, the electronic inventory management offering, total eCommerce and KeepStock® sales would represent 57% of total sales.

The segment gross profit margin decreased 1.3 percentage points in 2016 compared to 2015, driven by price deflation exceeding cost deflation and stronger sales growth to lower margin customers.

Operating expenses were down 2% for 2016 versus 2015. The decrease in operating expenses was driven by lower employees benefit costs, partially offset by higher restructuring costs and other charges discussed above. Excluding the restructuring and other charges in both periods, operating expenses would have been down 4%.

For the segment, operating earnings of $1,275 million for 2016 decreased 7% versus $1,372 million in 2015. The decline in operating earnings for 2016 was primarily driven by lower sales and gross profit margin, partially offset by lower operating expenses. Excluding the restructuring costs and other charges in both periods, operating earnings decreased 5%.

Canada

Net sales were $734 million for 2016, a decrease of $157 million, or 18%, when compared with $891 million for 2015. In local currency, sales decreased 15% for 2015. The 18% decrease for the year consisted of the following contributors:

Percent Decrease | |

Volume | (10) |

Foreign exchange | (3) |

Price | (2) |

ERP implementation | (2) |

Wildfire impact | (1) |

Total | (18)% |

Sales performance in Canada was primarily driven by declines within the oil and gas sector in Alberta, combined with declines in all other end markets across the country. The Alberta region, which represents about one-third of the sales in the Canadian business, decreased 23% versus prior year, as it was negatively impacted by oil prices. Sales growth

19

for the remaining regions in aggregate was down 10% in local currency. In addition, the Canadian business implemented the U.S. ERP system in February 2016, which negatively impacted sales as employees transitioned to operating with the new system.

In 2016, eCommerce sales for the Canada business were $98 million, a decrease of 8% over the prior year and represented 13% of total sales. The decrease was primarily driven by lower sales volume. If the Company included KeepStock®, the electronic inventory management offering, total eCommerce and KeepStock® sales would represent 26% of total sales.

The segment gross profit margin decreased 7.8 percentage points in 2016 versus 2015, due to an inventory adjustment of $10 million in the second quarter of 2016, along with price deflation versus cost inflation and higher freight costs from an increase in shipping directly to customers. As a result of service issues due to the ERP system implementation, the Company did not increase prices to customers during 2016.

Operating expenses decreased 8% in 2016 versus 2015. The decrease was due to the benefit of a $7 million gain from the sale of the former Toronto DC in the first quarter of 2016 and lower ERP system project costs, partially offset by higher restructuring costs. Excluding the restructuring costs from both periods, operating expenses decreased 11%.

Operating losses of $65 million for 2016 versus operating earnings of $27 million in 2015, a decrease of $92 million. Excluding the restructuring costs mentioned above, the operating losses would have been $41 million due to lower sales and gross profit margin and operating expenses declining at a slower rate than sales when compared to the prior period.

Other Businesses

Net sales for other businesses, which include MonotaRO in Japan, Zoro in the U.S. and operations in Europe, Asia, Latin America and Cromwell in the United Kingdom (U.K.) (acquired September 1, 2015) were $1,885 million for 2016, an increase of $479 million, or 34%, when compared to $1,406 million for 2015. The net sales increase was primarily due to the Cromwell acquisition and incremental sales at Zoro and MonotaRO. The 34% increase for the year consisted of the following contributors:

Percent Increase | |

Cromwell acquisition | 18 |

Volume | 15 |

Foreign exchange | 1 |

Total | 34% |

Operating earnings for other businesses were $41 million for 2016 compared to $48 million for 2015. Excluding goodwill and intangible impairment charges of $52 million in the Fabory and Colombia businesses and other restructuring charges in the prior year, operating earnings for other business increased by $39 million driven by strong performance from MonotaRO, Zoro and the earnings contribution from Cromwell.

Other Income and Expense

Other expense was $100 million in 2016 compared to $50 million of expense in 2015. The following table summarizes the components of other income and expense (in thousands of dollars):

For the Years Ended December 31, | |||||||

2016 | 2015 | ||||||

Interest income (expense) - net | $ | (65,615 | ) | $ | (32,405 | ) | |

Loss from equity method investment | (31,193 | ) | (11,740 | ) | |||

Other non-operating income | 1,300 | 1,102 | |||||

Other non-operating expense | (4,931 | ) | (6,572 | ) | |||

Total | $ | (100,439 | ) | $ | (49,615 | ) | |

The increase in expense was driven by higher interest expense from the $1 billion in long-term debt issued in June 2015 and $400 million in long-term debt issued in May 2016, as well as higher operating losses from the Company's clean energy investments.

20

Income Taxes

Income taxes of $386 million in 2016 decreased 17% compared with $466 million in 2015. Grainger's effective tax rates were 37.9% and 37.2% in 2016 and 2015, respectively. The year-over-year increase in the tax rate was primarily due to a larger proportion of earnings from higher tax rate jurisdictions, partially offset by a higher benefit from the Company’s clean energy investments. The twelve months ended December 31, 2016, included a benefit from the conclusion of the federal income tax audit for the years 2009 through 2012 and other discrete items. Excluding the discrete tax benefits and non-deductible intangible write-downs, the Company’s effective tax rate was 37.1%. The Company's clean energy investment generated $0.15 per share of earnings for the year ended December 31, 2016.

2015 Compared to 2014

Grainger's net sales of $9,973 million for 2015 were flat when compared with net sales of $9,965 million for 2014. Contributors to the sales performance for 2015 were as follows:

Percent Increase/ (Decrease) | |

Volume | 2 |

Business acquisition | 2 |

Price | (1) |

Foreign exchange | (3) |

Total | —% |

Sales growth to light manufacturing and government customers were offset by a decline in sales to natural resource customers, contractors, resellers and heavy manufacturing customers. In 2015, eCommerce sales for Grainger were $4,133 million, an increase of 16% over the prior year and represented 41% of total sales. The increase was primarily driven by an increase in sales via EDI and electronic purchasing platforms in the U.S. If the Company included KeepStock®, the electronic inventory management offering, total eCommerce and KeepStock® sales would represent 50% of total sales. Refer to the Segment Analysis below for further details.

Gross profit of $4,231 million for 2015 decreased 2%. The gross profit margin for 2015 was 42.4%, down 0.9 percentage point versus 2014, primarily driven by higher sales to lower margin customers and price deflation exceeding cost deflation.

Operating expenses of $2,931 million for 2015 decreased 1% from $2,967 million for 2014. The decrease was primarily driven by lower employee benefits, partially offset by higher severance and contract services costs. Operating expenses included new sales representatives, supply chain and inventory management solutions, as well as $42 million of charges primarily related to reorganizing the businesses in the U.S. and Canada. In 2014, operating expenses included $51 million related to the closing of the business in Brazil, restructuring costs, the transition of the retirement plan in Europe and an impairment charge for the business in Colombia. Excluding the reorganization and restructuring costs from both years, operating expenses were down 1%.

Operating earnings of $1,300 million for 2015 decreased 3% from $1,347 million for 2014. Operating earnings declined due to a lower gross profit margin, partially offset by operating expense leverage. Operating earnings included the charges noted above. Excluding these charges from both years, operating earnings decreased 5%.

Net earnings attributable to Grainger for 2015 decreased by 4% to $769 million from $802 million in 2014. The decrease in net earnings primarily resulted from lower operating earnings, partially offset by lower income taxes. Diluted earnings per share of $11.58 in 2015 were 1% higher than $11.45 for 2014, due to lower average shares outstanding.

The following table reconciles reported diluted earnings per share determined in accordance with generally accepted accounting principles (GAAP) in the U.S. to adjusted diluted earnings per share, a non-GAAP measure. Management believes adjusted diluted earnings per share is an important indicator of operations because it excludes items that may not be indicative of core operating results. Because non-GAAP financial measures are not standardized, it may not be possible to compare this financial measure with other companies' non-GAAP financial measures having the same or similar names.

21

Twelve Months Ended December 31, | |||||||||

2015 | 2014 | % | |||||||

Diluted earnings per share reported | $ | 11.58 | $ | 11.45 | 1 | % | |||

Adjustments, pretax | 0.69 | 0.94 | |||||||

Tax effect (1) | (0.24 | ) | (0.13 | ) | |||||

Discrete tax items | (0.09 | ) | — | ||||||

Total, net of tax | 0.36 | 0.81 | |||||||

Diluted earnings per share adjusted | $ | 11.94 | $ | 12.26 | (3 | )% | |||

(1) The tax impact of adjustments is calculated on the income tax rate in each applicable jurisdiction.

Segment Analysis

The following comments at the reportable segment and other business unit level include external and intersegment net sales and operating earnings. See Note 16 to the Consolidated Financial Statements.

United States

Net sales were $7,963 million for 2015, an increase of $37 million, or flat when compared with net sales of $7,926 million for 2014. Contributors to the sales performance for 2015 were as follows:

Percent Increase/(Decrease) | |

Volume | — |

Intercompany sales to Zoro | 1 |

Price | (1) |

Total | —% |

Mid-single-digit sales growth to light manufacturing and government customers and low single-digit growth to commercial services were offset by a mid-teen decline in sales to natural resource customers and low-single-digit declines to heavy manufacturing customers and contractors. In 2015, eCommerce sales for the U.S. business were $3,275 million, an increase of 16% over the prior year, and represented 41% of total sales. The increase was primarily driven by an increase in sales via EDI and electronic purchasing platforms. If the Company included KeepStock®, the electronic inventory management offering, total eCommerce and KeepStock® sales would represent 51% of total sales.

The segment gross profit margin decreased 1.0 percentage point in 2015 compared to 2014, primarily driven by price decreases exceeding product cost decreases and higher sales to lower margin customers.

Operating expenses were up 1% for 2015 versus 2014. Operating expenses included an incremental $96 million in growth-related spending on eCommerce, new sales representatives, supply chain and inventory management solutions, as well as $32 million of charges related to reorganizing the business, including branch closures. Excluding the reorganization costs, operating expenses decreased 1% primarily due to lower employee benefit costs.

For the segment, operating earnings of $1,372 million for 2015 decreased 5% versus $1,444 million in 2014. Excluding the reorganization expenses mentioned above, operating earnings were down 3%. The decline in operating earnings for 2015 was due to a lower gross profit margin, partially offset by positive operating expense leverage.

22

Canada

Net sales were $891 million for 2015, a decrease of $185 million, or 17%, when compared with $1,076 million for 2014. In local currency, sales increased 5% for 2015. The 17% decrease for the year consisted of the following contributors:

Percent Increase/ (Decrease) | |

Volume | (14) |

Foreign exchange | (12) |

Acquisition | 5 |

Price | 4 |

Total | (17)% |

Sales performance in Canada was driven by mid-teen declines in the oil and gas, contractor, commercial services, heavy manufacturing, resellers and retail markets. Net sales in the agriculture and mining and utilities end markets were up in the mid-single digits. In 2015, eCommerce sales for Canada were $107 million, a decrease of 13% versus the prior year and represented 12% of total sales. If the Company included KeepStock®, the electronic inventory management offering, total eCommerce and KeepStock® sales would represent 23% of total sales.

The segment gross profit margin decreased 0.4 percentage point in 2015 versus 2014, primarily driven by product cost inflation exceeding price inflation driven by unfavorable foreign exchange, partially offset by higher supplier rebates.

Operating expenses decreased 4% in 2015. In local currency, operating expenses increased 11%, primarily due to higher severance costs related to reorganizing the business, higher depreciation driven primarily by a new DC and incremental costs from the WFS Enterprises Inc. (WFS) acquisition as 2014 included a partial year. Excluding the reorganization costs, operating expenses increased 9%.