Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 - HEALTHCARE SERVICES GROUP INC | exhibit23-2016consentofind.htm |

| EX-32.2 - EXHIBIT 32.2 - HEALTHCARE SERVICES GROUP INC | exhibit322-2016cfosection9.htm |

| EX-32.1 - EXHIBIT 32.1 - HEALTHCARE SERVICES GROUP INC | exhibit321-2016ceosection9.htm |

| EX-31.2 - EXHIBIT 31.2 - HEALTHCARE SERVICES GROUP INC | exhibit312-2016cfosection3.htm |

| EX-31.1 - EXHIBIT 31.1 - HEALTHCARE SERVICES GROUP INC | exhibit311-2016ceosection3.htm |

| EX-21 - EXHIBIT 21 - HEALTHCARE SERVICES GROUP INC | exhibit21-2016subsidiaries.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended December 31, 2016

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from to

Commission file number: 0-12015

HEALTHCARE SERVICES GROUP, INC.

(Exact name of registrant as specified in its charter)

Pennsylvania | 23-2018365 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3220 Tillman Drive, Suite 300, Bensalem, PA | 19020 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(215) 639-4274

Securities registered pursuant to Section 12(b) of the 1934 Act:

Common Stock ($.01 par value) | The NASDAQ Global Select Market | |

Title of each class | Name of each exchange on which registered | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES þ NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | þ | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

(Do not check if a smaller reporting company) | ||||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO þ

The aggregate market value of the voting stock (Common Stock, $.01 par value) held by non-affiliates of the Registrant as of the close of business on June 30, 2016 was approximately $2.15 billion based on the closing sale price of the Common Stock on the NASDAQ Global Select Market on that date. The determination of affiliate status is not a determination for any other purpose. The Registrant does not have any non-voting common equity authorized or outstanding.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock (Common Stock, $.01 par value) as of the latest practicable date (February 21, 2017). 72,812,000

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the Registrant’s Annual Meeting of Shareholders to be held on May 30, 2017 have been incorporated by reference into Parts II and III of this Annual Report on Form 10-K.

1

Healthcare Services Group, Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2016

TABLE OF CONTENTS

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-K may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, which are not historical facts but rather are based on current expectations, estimates and projections about our business and industry, our beliefs and assumptions. Words such as “believes,” “anticipates,” “plans,” “expects,” “will,” “goal,” and similar expressions are intended to identify forward-looking statements. The inclusion of forward-looking statements should not be regarded as a representation by us that any of our plans will be achieved. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Such forward-looking information is also subject to various risks and uncertainties. Such risks and uncertainties include, but are not limited to, risks arising from our providing services exclusively to the health care industry, primarily providers of long-term care; credit and collection risks associated with this industry; having several clients who individually contributed over 5%, with one as high as 9.5%, of our total consolidated revenues for the year ended December 31, 2016; our claims experience related to workers’ compensation and general liability insurance; the effects of changes in, or interpretations of laws and regulations governing the industry, our workforce and services provided, including state and local regulations pertaining to the taxability of our services and other labor related matters such as minimum wage increases; continued realization of tax benefits arising from our corporate reorganization and self-funded health insurance program; risks associated with the reorganization of our corporate structure; and the risk factors described in Part I in this report under “Government Regulation of Clients,” “Competition” and “Service Agreements and Collections,” and under Item IA “Risk Factors.”

These factors, in addition to delays in payments from clients and/or clients in bankruptcy or clients for which we are in litigation to collect payment, have resulted in, and could continue to result in, significant additional bad debts in the near future. Additionally, our operating results would be adversely affected if unexpected increases in the costs of labor and labor-related costs, materials, supplies and equipment used in performing services could not be passed on to our clients.

In addition, we believe that to improve our financial performance we must continue to obtain service agreements with new clients, retain and provide new services to existing clients, achieve modest price increases on current service agreements with existing clients and maintain internal cost reduction strategies at our various operational levels. Furthermore, we believe that our ability to sustain the internal development of managerial personnel is an important factor impacting future operating results and the successful execution of our projected growth strategies.

3

PART I

In this Annual Report on Form 10-K for the year ended December 31, 2016, Healthcare Services Group, Inc. (together with its wholly-owned subsidiaries, included in Exhibit 21 which has been filed as part of this Report) is referred to using terms such as the “Company,” “we,” “us” or “our.”

Item I. Business.

General

The Company is a Pennsylvania corporation, incorporated on November 22, 1976. We provide management, administrative and operating expertise and services to the housekeeping, laundry, linen, facility maintenance and dietary service departments of the health care industry, including nursing homes, retirement complexes, rehabilitation centers and hospitals located throughout the United States. We believe that we are the largest provider of our services to the long-term care industry in the United States, rendering such services to over 3,500 facilities in the continental United States as of December 31, 2016. We provide our Housekeeping services to essentially all of our client facilities and we provide Dietary services to over 1,000 facilities. Although we do not directly participate in any government reimbursement programs, our clients receive government reimbursements related to Medicare and Medicaid. Therefore, they are directly affected by any legislation and regulations relating to Medicare and Medicaid reimbursement programs.

Segment Information

The information called for herein is discussed below in Description of Services, and within Item 8 of this Annual Report on Form 10-K under Note 14 of Notes to Consolidated Financial Statements for the years ended December 31, 2016, 2015 and 2014.

Description of Services

We are organized into, and provide our services through two reportable segments: housekeeping, laundry, linen and other services (“Housekeeping”), and dietary department services (“Dietary”). The Company’s corporate headquarters provides centralized financial management and support, legal services, human resources management and other administrative services to the Housekeeping and Dietary business segments.

Both segments provide our services primarily pursuant to full service agreements with our clients. In such agreements, we are responsible for the management of the department serviced, employing the Housekeeping or Dietary personnel located at our clients’ facilities and providing certain supplies. We also provide services on the basis of management-only agreements for a limited number of clients. Under a management-only agreement, we provide management and supervisory services while the client facility retains payroll responsibility for the non-supervisory staff. Our agreements with clients typically provide for renewable one year service terms, cancelable by either party upon 30 to 90 days’ notice after an initial period of 60 to 120 days.

We typically adopt and follow our clients’ employee wage structure, including policies of wage rate increases, and pass through to the client any labor cost increases associated with such wage rate adjustments.

Our labor force is interchangeable with respect to the services within Housekeeping, while our Dietary labor force is specific to Dietary operations. In addition, there are some differences in the expertise of the professional management personnel responsible for the services of the respective segments. We believe the services of each segment provide opportunities for growth.

Housekeeping

Housekeeping represented approximately 61.3%, or $957.1 million, of consolidated revenues in 2016. The services provided under this segment include managing the client’s housekeeping department which is principally responsible for the cleaning, disinfecting and sanitizing of resident rooms and common areas of a client’s facility, as well as the laundering and processing of the bed linens, uniforms, resident personal clothing and other assorted linen items utilized at a client facility. Upon beginning service with a client facility, we typically hire and train the employees that were previously employed by such facility and assign an on-site manager to supervise and train the front line personnel and coordinate housekeeping services with other facility support functions in accordance with client request. Such management personnel also oversee the execution of various of quality and cost-control procedures including continuous training and employee evaluation, and on-site testing for infection control.

Housekeeping’s operating performance is significantly impacted by our management of labor costs. Labor accounted for approximately 80.2% of Housekeeping revenues. Changes in employee compensation resulting from legislative or other

4

governmental actions, anticipated staffing levels, and our use of labor may adversely impact these costs. Similarly, an increase in the costs of supplies, including linen costs, consumed in performing Housekeeping services may impact Housekeeping’s operating performance. In 2016, the cost of Housekeeping supplies as a percentage of Housekeeping revenues was 7.8%. Generally, the cost of such supplies is dictated by specific product market conditions, which are subject to price fluctuations influenced by factors outside of our control. Where possible, we negotiate fixed pricing from vendors for an extended period of time on certain supplies to mitigate such price fluctuations.

Dietary

Dietary services represented approximately 38.7%, or $605.5 million, of consolidated revenues in 2016. Dietary consists of managing the client’s dietary department which is principally responsible for food purchasing, meal preparation and professional dietitian services, which includes the development of menus that meet the dietary needs of residents. On-site management is responsible for all daily dietary department activities, with regular support being provided by a District Manager specializing in Dietary services, as well as a registered dietitian. We also offer clinical consulting services to facilities to assist them in cost containment and to promote improvement in their dietary department service operations.

Dietary operating performance is also impacted by price fluctuations in labor and supply costs resulting from similar factors discussed above in Housekeeping. In 2016, the costs of labor and food-related supplies represented approximately 53.8% and 38.0% of Dietary revenues, respectively.

Operational Management Structure

By applying our professional management techniques, we offer our clients the ability to manage certain housekeeping, laundry, linen, facility maintenance and dietary services and costs. We manage and provide our services through a network of management personnel, as illustrated below.

Divisional Manager | ||||||||||||

↓ | ||||||||||||

Regional Manager and Director | ||||||||||||

↓ | ||||||||||||

District Manager | ||||||||||||

↓ | ||||||||||||

Facility Manager | ||||||||||||

Facilities are managed by an on-site Facility Manager, and if necessary, additional supervisory personnel. Such facility-level management personnel are responsible for the management of staff, scheduling, procurement, customer service, quality control and overall day-to-day management of the Housekeeping or Dietary function.

Districts typically consist of eight to twelve facilities and District Managers oversee the operations of the facilities within their districts. Their responsibilities include oversight of Facility Managers through management of personnel, operational performance, quality control monitoring, customer satisfaction and adherence to our systems and budgets.

Districts are organized into regions, which are headed by Regional Managers who oversee approximately four to six districts. Regional Managers provide management support, training and personnel management, while ensuring operational performance consistent with our systems and budgets. Regional Directors are primarily responsible for marketing our services within their regions, which involves industry outreach, overseeing and participation in contract negotiation, and working closely with Regional Managers to ensure customer satisfaction and promote retention and growth.

Divisions generally consist of four to six regions and are overseen by Divisional Managers, who are ultimately responsible for all aspects of the operational, compliance and financial-based performance of their divisions.

We believe that our divisional, regional and district organizational structure facilitates our ability to best serve our clients, expand our service offerings to existing clients and obtain new clients.

5

Market

The market for our services consists of a large number of facilities involved in various aspects of the health care industry, including long-term and post-acute care facilities (skilled nursing facilities, residential care and assisted living facilities, etc.) and hospitals (acute care, critical access, psychiatric, etc.).

These facilities range in size from smaller facilities to facilities with over 500 beds. Such facilities may be specialized or general, privately owned or public, profit or not-for-profit, and may serve residents on a long-term or short-term basis. We market our services to facilities after consideration of a variety of factors including facility type, size, location, and service opportunities (Housekeeping or Dietary). The market for our services, particularly in long-term and post-acute care, is expected to continue to grow as the population of the United States ages and as government reimbursement policies require increased cost control or containment by the constituents that comprise our target market.

Marketing and Sales

Our services are marketed at four levels of our organization: at the corporate level by the President & Chief Executive Officer, Executive Vice Presidents and Senior Vice Presidents; at the divisional level by Divisional Vice Presidents; at the regional level by the Regional Vice Presidents/Divisional Managers and Directors; and at the district level by District Managers. We provide incentive compensation to our operational personnel based on achieving financial and non-financial goals and objectives which are aligned with the key elements the Company believes are necessary for it to achieve overall improvement in its financial results, along with continued business development.

Our services are marketed primarily through referrals and in-person solicitation of target facilities. We also participate in industry trade shows, health care trade associations and health care support service seminars that are offered in conjunction with state or local health authorities in many of the states in which we conduct our business. Such programs are typically attended by facility owners, administrators and supervisory personnel, thus presenting marketing opportunities for us. Indications of interest in our services arising from initial marketing efforts are followed up with a presentation regarding our services and an assessment of the service requirements of the facility. Thereafter, a formal proposal including operational recommendations and proposed costs is submitted to the prospective client. Once the prospective client accepts the proposal and executes our service agreement, we are structured to timely and efficiently establish our operations and systems at the client facilities.

Government Regulation of Clients

Our clients are subject to government regulation. Although laws and rulings directly affect how clients are paid for certain services, we do not directly participate in any government reimbursement programs. Accordingly, our contractual relationships with our clients determine the clients’ payment obligations to us. However, because clients’ revenues are generally highly reliant on Medicare and Medicaid reimbursement funding rates, the overall effect of these laws and trends in the long term care industry have affected and could adversely affect our clients’ cash flows, resulting in their inability to make payments to us on agreed upon payment terms (see “Liquidity and Capital Resources” included in our “Management’s Discussion and Analysis of Financial Condition and Results of Operations”).

The prospects for legislative action, both on the federal and state level, regarding funding for nursing homes are uncertain. We are unable to predict or to estimate the ultimate impact of any further changes in reimbursement programs affecting our clients’ future results of operations and/or their impact on our cash flows and operations.

Environmental Regulation

The Company’s operations are subject to various federal, state and/or local laws concerning emissions into the air, discharges into the waterways and the generation, handling and disposal of waste and hazardous substances. The Company’s past expenditures relating to environmental compliance have not had a material effect on the Company and are included in normal operating expenses. These laws and regulations are constantly evolving, and it is impossible to predict accurately the effect they may have upon the capital expenditures, earnings and competitive position of the Company in the future. Based upon information currently available, management believes that expenditures relating to environmental compliance will not have a material impact on the financial position of the Company.

6

Service Agreements and Collections

We provide our services primarily pursuant to full service agreements with our clients. In such agreements, we are responsible for the management of the department serviced, employing the Housekeeping or Dietary personnel located at our clients’ facilities and providing certain supplies. We also provide services on the basis of management-only agreements for a limited number of clients. In such agreements, our services involve providing on-site management personnel, while the non-supervisory staff remain employees of the respective client. Although many of our service agreements are cancelable on short notice, we have historically had a favorable client retention rate and expect to continue to maintain satisfactory relationships with our clients.

We have had varying collections experiences with respect to our accounts and notes receivable. We have sometimes been required to extend the period of payment for certain clients beyond contractual terms. Such clients include those who have terminated service agreements and slow payers experiencing financial difficulties. Related to these collection problems, we have recorded bad debt provisions (in an Allowance for Doubtful Accounts) of $4.6 million, $4.3 million and $4.5 million in the years ended December 31, 2016, 2015 and 2014, respectively (see Schedule II - Valuation and Qualifying Accounts and Reserves for year-end balances). As a percentage of total revenues, these provisions represented approximately 0.3% for each of the years ended December 31, 2016, 2015 and 2014. In making our credit evaluations, we consider customer-specific risks as well as the general collection risk associated with trends in the long-term care industry. We establish credit limits, perform ongoing credit evaluations and monitor accounts to minimize the risk of loss. Despite our efforts to minimize credit risk exposure, our clients could be adversely affected if future industry trends change in such a manner as to negatively impact their cash flows, as discussed in “Government Regulation of Clients” and “Risk Factors” in this report. If our clients experience a negative impact in their cash flows, it could have a material adverse effect on our consolidated results of operations and financial condition.

Competition

We compete primarily with the in-house service departments of our potential clients. Most health care facilities perform their own support service functions without relying upon outside management firms. In addition, a number of local firms compete with us in the regional markets in which we conduct business. Several national service firms are larger and have greater financial and marketing resources than us, although historically such firms have concentrated their marketing efforts primarily on hospitals, rather than the long-term care facilities typically serviced by us. Although the competition to provide service to health care facilities is strong, we believe that we compete effectively for new agreements, as well as renewals of existing agreements, based upon the quality and dependability of our services and the cost savings we can secure for clients.

Employees

At December 31, 2016, we employed approximately 48,900 people, of which 5,800 were corporate and field management personnel.

Approximately 11% of our employees are unionized. The majority of these union employees are subject to collective bargaining agreements that are negotiated by individual client facilities and are assented by us, so as to bind us as an “employer” under the agreements. In other cases, we are direct parties to the agreements. We may be adversely affected by relations between our client facilities and the employee unions or between us and such unions. We consider our relationship with our employees to be good.

Available Information

Healthcare Services Group, Inc. is a reporting company under the Securities Exchange Act of 1934, as amended, and files reports, proxy statements and other information with the Securities and Exchange Commission (the “Commission” or “SEC”). The public may read and copy any of our filings at the Commissioner’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. Additionally, because we make filings to the Commission electronically, you may access this information at the Commission’s internet site: www.sec.gov. This site contains reports, proxies and information statements and other information regarding issuers that file electronically with the Commission.

Website Access

Our website address is www.hcsg.com. Our filings with the Commission, as well as other pertinent financial and Company information are available at no cost on our website as soon as reasonably practicable after the filing of such reports with the Commission.

7

Item 1A. Risk Factors.

You should carefully consider the risk factors we have described below, as well as other related information contained within this annual report on Form 10-K as these factors could materially and adversely affect our business, results of operations, financial condition and cash flows. We believe that the risks described below are our most significant risk factors but there may be risks and uncertainties that are not currently known to us or that we currently deem to be immaterial.

We provide services to several clients which contribute significantly, on an individual as well as aggregate basis, to our total revenues.

We have several clients who individually contributed over 5%, with one as high as 9.5%, of our total consolidated revenues for the year ended December 31, 2016. Although we expect to continue the relationship with these clients, there can be no assurance thereof. The loss, individually or in aggregate, of such clients, or a significant reduction in the revenues we receive from such clients, could have a material adverse effect on the results of operations of our two operating segments. In addition, if any of these clients change or alter current payment terms it could increase our accounts receivable balance and have a material adverse effect on our cash flows.

Our clients are concentrated in the health care industry which is subject to changes in government regulation. Many of our clients rely on reimbursement from Medicare, Medicaid and other third-party payors. Rates from such payors may be altered or reduced, thus affecting our clients’ results of operations and cash flows.

We provide our services primarily to providers of long-term and post-acute care. We cannot predict what efforts, and to what extent, legislation and proposals to contain health care costs will ultimately impact our clients’ revenues through reimbursement rate modifications. Congress has enacted a number of laws during the past decade that have significantly altered, or may alter, overall government reimbursement for nursing home services. Because many of our clients’ revenues are generally highly reliant on Medicare, Medicaid and other third-party payors’ reimbursement funding rates and mechanisms, the overall effect of these laws and trends in the long term care industry have affected and could adversely affect our clients’ cash flows, resulting in their inability to make payments to us on agreed upon payment terms. These factors, in addition to delays in payments from clients have resulted in, and could continue to result in, significant additional bad debts in the future.

Changes to federal health care reform legislation may adversely affect our operating costs and results of operations.

Continued changes to the health care structure and regulations related to the health insurance industry in the United States could have a continuing impact on our operating costs. Any requirements to provide additional benefits to our employees or the payment of penalties if such benefits are not provided, would increase our expense. If we are unable to pass-through these charges to our clients to cover this expense, such increases in expense could adversely impact our operating costs and results of operations.

In addition, often new regulations result in additional reporting requirements for businesses. These and other requirements could result in increased costs, expanded liability exposure, and other changes in the way we provide health care insurance and other benefits to our employees.

We have clients located in many states which have had and may continue to experience significant budget deficits and such deficits may result in reduction of reimbursements to nursing homes.

Many states in which our clients are located have significant budget deficits as a result of lower than projected revenue collections and increased demand for the funding of entitlements. As a result of these and other adverse economic factors, state Medicaid programs have and may continue to revise reimbursement structures for nursing home services. Any disruption or delay in the distribution of Medicaid and related payments to our clients will adversely affect their cash flows and impact their ability to pay us as agreed upon for the services provided.

8

The Company has substantial investment in the creditworthiness and financial condition of our customers.

The largest current asset on our balance sheet is our accounts and notes receivable balance from our customers. We grant credit to substantially all of our customers. Deterioration in the financial condition of a significant component of our customer base could hinder our ability to collect amounts from our customers. The potential causes of such decline include national or local economic downturns, customers’ dependence on continued Medicare and Medicaid funding and the impact of additional regulatory actions. We have sometimes been required to extend the period of payment for certain clients beyond contractual terms. Such clients include those who have terminated service agreements and slow payers experiencing financial difficulties. In making our credit evaluations, in addition to analyzing and anticipating where possible the specific cases described above, we consider the general collection risk associated with trends in the long-term care industry. We also establish credit limits, perform ongoing credit evaluations and monitor accounts to minimize the risk of loss. Despite our efforts to minimize credit risk exposure, our clients could be adversely affected if future industry trends change in such a manner as to negatively impact their cash flows. If our clients experience a negative impact in their cash flows, it could have a material adverse effect on our consolidated results of operations, financial condition and cash flows.

We have a Paid Loss Retrospective Insurance Plan for general liability and workers’ compensation insurance.

We carry a high deductible general liability and workers’ compensation program and therefore retain a substantial portion of the risk associated with the expected losses under such programs. Under our insurance plans for general liability and workers’ compensation, predetermined loss limits are arranged with our insurance company to limit both our per occurrence cash outlay and annual insurance plan cost. We regularly evaluate our claims pay-out experience and other factors related to the nature of specific claims in arriving at the basis for our accrued insurance claims estimate. Our evaluation is based primarily on current information derived from reviewing our claims experience and industry trends. In the event that our known claims experience and/or industry trends result in an unfavorable change in initial estimates of costs to settle such claims resulting from, among other factors, the severity levels of reported claims and medical cost inflation, it would have an adverse effect on our consolidated results of operations, financial condition and cash flows. During 2014, the Company recorded a one-time, non-cash adjustment of $37.4 million related to a change in estimate and reserve methodology through the utilization of a third party actuary. Although we engage third-party experts to assist us in estimating appropriate insurance accounting reserves, the determination of the required reserves is dependent upon significant actuarial judgments that have a material impact on our reserves. Changes in our insurance reserves as a result of our periodic evaluation of the related liabilities may cause significant fluctuations in our operating results.

Federal, state and local tax rules can adversely impact our results of operations and financial position.

We are subject to Federal, state and local taxes in the United States. Significant judgment is required in determining the provision of income taxes. We believe our income tax estimates are reasonable. Although, if the Internal Revenue Service or other taxing authority disagrees with a taken tax position and upon final adjudication we are unsuccessful, we could incur additional tax liability, including interest and penalties. Such costs and expenses could have a material adverse impact on our results of operations and financial position. Additionally, the taxability of our services is subject to various interpretations within the taxing jurisdictions of our markets. Consequently, in the ordinary course of business, a jurisdiction may contest our reporting positions with respect to the application of its tax code to our services. A conflicting position taken by a state or local taxation authority on the taxability of our services could result in additional tax liabilities and could negatively impact our competitive position in that jurisdiction. Additionally, if we fail to comply with applicable tax laws and regulations, we could suffer civil or criminal penalties in addition to the delinquent tax assessment. In the taxing jurisdictions where our services have been determined to be subject to tax, the jurisdiction may increase the tax rate assessed on such services. We seek to pass-through to our clients such tax increases. In the event we are not able to pass-through any portion of the tax increase, our gross margin could be adversely impacted.

9

Our business and financial results could be adversely affected by unfavorable results of material litigation or governmental inquiries.

We are currently involved in civil litigations and government inquiries which arise in the ordinary course of business. These matters relate to, among other things, general liability, payroll or employee-related matters, as well as inquiries from governmental agencies. Legal actions could result in substantial monetary damages and expenses and may adversely affect our reputation and business status with our clients, whether we are ultimately determined to be liable or not. The outcome of litigation, particularly class action and collective action lawsuits and regulatory actions, is difficult to assess or quantify. The plaintiffs in these types of actions may seek recovery of very large or indeterminate amounts, and estimates may remain unknown for substantial periods of time.

We assess contingencies to determine the degree of probability and range of possible loss for potential accrual in our financial statements. We would accrue an estimated loss contingency in our financial statements if it were probable that a liability had been incurred and the amount of the loss could be reasonably estimated. Due to the unpredictable and unfavorable nature of litigation, assessing contingencies is highly subjective and requires judgments about future events. The amount of actual losses may differ from our current assessment. As a result of the costs and expenses of defending ourselves against lawsuits or claims, and risks and consequences of legal actions, regardless of merit, our results of operations and financial position could be adversely affected or cause variability in our results compared to expectations.

We primarily provide our services pursuant to agreements which have a one year term, cancelable by either party upon 30 to 90 days’ notice after an initial 60 to 120 day service agreement period.

We do not enter into long-term contractual agreements with our clients for the rendering of our services. Consequently, our clients can unilaterally decrease the amount of services we provide or terminate all services pursuant to the terms of our service agreements. Any loss of a significant number of clients during the first year of providing services, for which we have incurred significant start-up costs or have invested in an equipment installation, could in the aggregate materially adversely affect our consolidated results of operations and financial position.

The Company’s business success depends on the management experience of our key personnel.

We manage and provide our services through a network of management personnel, from on-site facility managers to our executive officers. Therefore, we believe that our ability to recruit and sustain the internal development of managerial personnel is an important factor impacting future operating results and our ability to successfully execute projected growth strategies. Our professional management personnel are the key personnel in maintaining and selling additional services to current clients and obtaining new clients.

Governmental regulations related to labor, employment, immigration and health and safety could adversely impact our results of operations and financial condition.

Our business is subject to various federal, state, and local laws and regulations, in areas such as labor, employment, immigration, and health and safety. These laws frequently evolve through case law, legislative changes and changes in regulatory interpretation, implementation and enforcement. Our policies and procedures and compliance programs are subject to adjustments in response to these changing regulatory and enforcement environments, which could increase our cost of services provided. Although we have contractual rights to pass cost increases we incur to our clients due to regulatory changes, our delay in, or inability to pass such costs of our compliance with legislative changes and changes in regulatory interpretation or enforcement in general, through to our clients, could have a material adverse effect on our financial condition, results of operations and cash flows.

In addition, if we fail to comply with applicable laws, we may be subject to lawsuits, investigations, criminal sanctions or civil remedies, including fines, penalties, damages, reimbursement, or injunctions. Also, our clients’ facilities are subject to periodic inspection by federal, state, and local authorities for compliance with state and local departments of health requirements. Expenses resulting from failed inspections of the departments that we service could result in our clients being fined and seeking recovery from us, which could also adversely impact our financial condition, results of operations and cash flows.

10

We may be adversely affected by inflationary or market fluctuations in the cost of products consumed in providing our services or our cost of labor. Additionally, we rely on certain vendors for housekeeping, laundry and dietary supplies.

The prices we pay for the principal items we consume in performing our services are dependent primarily on current market prices. We have consolidated certain supply purchases with national vendors through agreements containing negotiated prospective pricing. In the event such vendors are not able to comply with their obligations under the agreements and we are required to seek alternative suppliers, we may incur increased costs of supplies.

Dietary supplies, to a much greater extent than Housekeeping supplies, are impacted by commodity pricing factors, which in many cases are unpredictable and outside of our control. We seek to pass on to clients such increased costs but sometimes we are unable to do so. Even when we are able to pass on the incremental costs to our clients, from time to time, sporadic unanticipated increases in the costs of certain supply items due to market economic conditions may result in a timing delay in passing on such increases to our clients. It is this type of spike in Dietary supplies costs that could most adversely affect Dietary’s operating performance. The adverse effect would be realized if we delay in passing on such costs to our clients or in instances where we may not be able to pass such increase on to our clients until the time of our next scheduled service billing review. We seek to mitigate the impact of an unanticipated increase in such supplies’ costs through consolidation of vendors, which increases our ability to obtain reduced pricing.

Our cost of labor may be influenced by unanticipated factors in certain market areas or increases in the respective collective bargaining agreements that we are a party to. A substantial number of our employees are hourly employees whose wage rates are affected by increases in the federal or state minimum wage rates. As collective bargaining agreements are renegotiated, we may need to increase the wages paid to bargaining unit employees covered by such collective bargaining agreements. Although we have contractual rights to pass such union and minimum wage increases through to our clients, our delay in, or inability to pass such wage increases through to our clients could have a material adverse effect on our financial condition, results of operations and cash flows.

Any perceived or real health risks related to the food industry could adversely affect our Dietary segment.

We are subject to risks affecting the food industry generally, including food spoilage and food contamination. Our products are susceptible to contamination by disease-producing organisms, or pathogens, such as listeria monocytogenes, salmonella, campylobacter, hepatitis A, trichinosis and generic E. coli. Because these pathogens are generally found in the environment, there is a risk that these pathogens could be introduced to our products as a result of improper handling at the manufacturing, processing or food service level. Our suppliers’ manufacturing facilities and products are subject to extensive laws and regulations relating to health, food preparation, sanitation and safety standards. Difficulties or failures by these companies in obtaining any required licenses or approvals or otherwise complying with such laws and regulations could adversely affect our revenue that is generated from these companies. Furthermore, there can be no assurance that compliance with governmental regulations by our suppliers will eliminate the risks related to food safety.

Additionally, the Company may be subject to liability if the consumption of our food products causes injury, illness or death. Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertion that the Company’s products caused injury or illness could adversely affect the Company’s reputation.

Events reported in the media, such as incidents involving food-borne illnesses or food tampering, whether or not accurate, can cause damage to the reputation of our dietary segment. In addition, to the extent there is an outbreak of food related illness in any of our client facilities, it could materially harm our business, results of operations and financial condition.

Changes in interest rates and changes in financial market conditions may result in fluctuating and even negative returns in our investments, and could increase the cost of the borrowings under our borrowing agreements.

Although management believes we have a prudent investment policy, we are exposed to fluctuations in interest rates and in the market values of our investment portfolio which could adversely impact our financial condition and results of operations. Our marketable securities are primarily invested in municipal bonds. We believe that our investment criteria, which include limiting our concentrations of investments in individual locations’ bonds, requiring certain credit ratings and monitoring our investments’ duration period, reduce our exposure related to the financial distress and budget shortfalls that many state and local governments currently face. Increases in market interest rates in our borrowing agreements that have variable interest rates could adversely affect our payment obligations and adversely affect our liquidity and earnings.

11

Investor and market expectations regarding our financial performance are high and rely greatly on execution of our growth strategy and related increases in financial performance.

Management believes the historical performance of our Common Stock reflect high market expectations for our future operating results. Our ability to attract new clients through organic growth or acquisitions, and retain existing clients, has enabled us to execute our growth strategy and increase market share historically, however this cannot be guaranteed in the future. Our business strategy focuses on growth and improving profitability through obtaining service agreements with new clients, providing new services to existing clients, obtaining modest price increases on service agreements with clients and maintaining internal cost reduction strategies at our various operational levels. In respect to providing new services to new or existing clients, our strategy is to achieve corresponding profit margins in each of our segments. If we are unable to continue either historical client revenue and profitability growth rates or projected improvement, our operating performance may be adversely affected and the high expectations for our market performance may not be met. Any failure to meet the market’s high expectations for our revenue and operating results may have an adverse effect on the market price of our Common Stock.

Failure to maintain effective internal control over financial reporting could have a material adverse effect on our ability to report our financial results on a timely and accurate basis.

Failure to maintain appropriate and effective internal controls over our financial reporting could result in misstatements in our financial statements and potentially subject us to sanctions or investigations by the SEC or other regulatory authorities, and could cause us to delay the filing of required reports with the SEC and our reporting of financial results. Any of these events could result in a decline in the market price of our Common Stock. Although we have taken steps to maintain our internal control structure as required, we cannot guarantee that control deficiencies will not result in a misstatement in the future.

Any decrease in or suspension of our dividend could cause our stock price to decline.

We expect to continue to pay a regular quarterly cash dividend. However, our dividend policy and the payment of future cash dividends under the policy are subject to the final determination each quarter by our Board of Directors that (i) the dividend will be made in compliance with laws applicable to the declaration and payment of cash dividends, including Section 1551(b) of the Pennsylvania Business Corporation Law, and (ii) the policy remains in our best interests, which determination will be based on a number of factors, including the impact of changing laws and regulations, economic conditions, our results of operations and/or financial condition, capital resources, the ability to satisfy financial covenants and other factors considered relevant by the Board of Directors. While we have continually increased the amount of our dividends, given these considerations, there can be no assurance these increases will continue and our Board of Directors may increase or decrease the amount of the dividend at any time and may also decide to suspend or discontinue the payment of cash dividends in the future. Any decrease in the amount of the dividend, or suspension or discontinuance of payment of a dividend, could cause our stock price to decline.

12

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We lease our corporate offices, located at 3220 Tillman Drive, Suite 300, Bensalem, Pennsylvania 19020. We also lease office space at other locations in Pennsylvania, Colorado, South Carolina, Connecticut, Georgia, Illinois, California and New Jersey. The New Jersey office is the headquarters of our subsidiaries, including HCSG Insurance Corp. The other locations serve as divisional or regional offices providing management and administrative services to both of our operating segments in their respective geographical areas.

We are also provided with office and storage space at each of our client facilities.

Management does not foresee any difficulties with regard to the continued utilization of all of the aforementioned premises. We also believe that such properties are sufficient to support our current operations.

We own office furniture and equipment, housekeeping and laundry equipment, and vehicles. The office furniture and equipment and vehicles are primarily located at our corporate office, divisional and regional offices. We have housekeeping equipment at all client facilities where we provide services under a full service housekeeping agreement. Generally, the aggregate cost of housekeeping equipment located at each client facility is approximately $3,000. Additionally, we have laundry installations at certain client facilities. Our cost of such laundry installations ranges between $5,000 and $100,000. We believe that such laundry equipment, office furniture and equipment, housekeeping equipment and vehicles are sufficient to support our current operations.

Item 3. Legal Proceedings.

In the normal course of business, the Company is involved in various administrative and legal proceedings, including labor and employment, contractual, personal injury, workers compensation and insurance matters. The Company believes it is not a party to, nor are any of its properties the subject of, any pending legal proceeding or governmental examination that would have a material adverse effect on the Company’s consolidated financial condition or liquidity. However, in light of the uncertainties involved in such proceedings, the ultimate outcome of a particular matter could become material to the Company’s results of operations for a particular period depending on, among other factors, the size of the loss or liability imposed and the level of the Company’s operating income for that period.

Item 4. Mine Safety Disclosures.

Not applicable.

13

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock, $.01 par value (the “Common Stock”), is traded under the symbol “HCSG” on the NASDAQ Global Select Market. As of February 21, 2017, there were approximately 72,812,000 shares of our Common Stock outstanding.

The high and low sales price quotations for our Common Stock during the years ended December 31, 2016 and 2015 were as follows:

2016 | ||||||||

Quarter Ended | High | Low | ||||||

March 31, 2016 | $ | 36.99 | $ | 31.50 | ||||

June 30, 2016 | $ | 41.40 | $ | 36.47 | ||||

September 30, 2016 | $ | 42.18 | $ | 36.58 | ||||

December 31, 2016 | $ | 40.88 | $ | 34.83 | ||||

2015 | ||||||||

Quarter Ended | High | Low | ||||||

March 31, 2015 | $ | 34.75 | $ | 29.93 | ||||

June 30, 2015 | $ | 33.90 | $ | 29.42 | ||||

September 30, 2015 | $ | 35.49 | $ | 31.57 | ||||

December 31, 2015 | $ | 38.49 | $ | 33.10 | ||||

Holders

As of February 21, 2017, we had approximately 500 holders of record of our Common Stock. Based on reports of security position listings compiled for the 2016 annual meeting of shareholders, we believe we may have approximately 7,000 beneficial owners of our Common Stock.

Dividends

During 2016, we paid regular quarterly cash dividends totaling $53.3 million as detailed below:

Quarter Ended | |||||||||||||||

March 31, 2016 | June 30, 2016 | September 30, 2016 | December 31, 2016 | ||||||||||||

(in thousands, except per share data) | |||||||||||||||

Cash dividend per common share | $ | 0.18125 | $ | 0.18250 | $ | 0.18375 | $ | 0.18500 | |||||||

Total cash dividends paid | $ | 13,158 | $ | 13,293 | $ | 13,398 | $ | 13,493 | |||||||

Record date | February 19, 2016 | May 20, 2016 | August 19, 2016 | November 18, 2016 | |||||||||||

Payment date | March 25, 2016 | June 24, 2016 | September 23, 2016 | December 23, 2016 | |||||||||||

On January 31, 2017, our Board of Directors declared a regular quarterly cash dividend of $0.18625 per common share, which will be paid on March 24, 2017 to shareholders of record as of the close of business on February 17, 2017.

Our Board of Directors reviews our dividend policy on a quarterly basis. Although there can be no assurance that we will continue to pay dividends or the amount of the dividends, we expect to continue to pay a regular quarterly cash dividend. In connection with the establishment of our dividend policy, we adopted a Dividend Reinvestment Plan in 2003.

14

Performance Graph

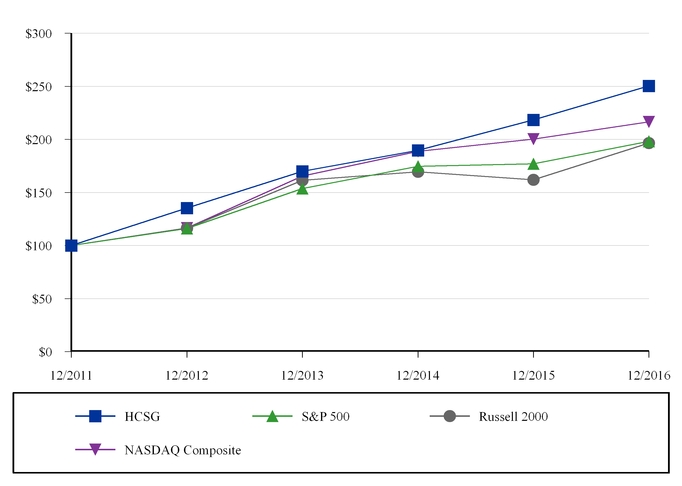

The graph below matches Healthcare Services Group, Inc.’s cumulative five-year total shareholder return on common stock with the cumulative total returns of the S&P 500 index, the NASDAQ Composite index and the Russell 2000 index. The graph tracks the performance of a $100 investment in our common stock and in each index (with the reinvestment of all dividends) from December 31, 2011 to December 31, 2016. The stock price performance included in this graph is not necessarily indicative of future stock price performance.

The Company has not defined a peer group based on either industry classification or financial characteristics. The Company believes it is unique in its service offerings and client base, and among its closest industry peers, it is unique in size and financial profile. As such, the Company opted to utilize the Russell 2000 index to compare our performance to issuers with similar market capitalization.

Comparison of 5 Year Cumulative Total Return*

Among Healthcare Services Group, Inc., the S&P 500 Index, the NASDAQ Composite Index and the Russell 2000 Index

*$100 invested on December 31, 2011 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

Copyright© 2017 Standard & Poor’s, a division of S&P Global. All rights reserved.

Copyright© 2017 Russell Investment Group. All rights reserved.

Fiscal year ending December 31.

Copyright© 2017 Standard & Poor’s, a division of S&P Global. All rights reserved.

Copyright© 2017 Russell Investment Group. All rights reserved.

December 31, | ||||||||||||||||||||||||

Company/Index | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||||||||

Healthcare Services Group, Inc. | $ | 100.00 | $ | 135.33 | $ | 169.87 | $ | 189.76 | $ | 218.52 | $ | 250.36 | ||||||||||||

S&P 500 | $ | 100.00 | $ | 116.00 | $ | 153.58 | $ | 174.60 | $ | 177.01 | $ | 198.18 | ||||||||||||

Russell 2000 | $ | 100.00 | $ | 116.35 | $ | 161.52 | $ | 169.43 | $ | 161.95 | $ | 196.45 | ||||||||||||

NASDAQ Composite | $ | 100.00 | $ | 116.41 | $ | 165.47 | $ | 188.69 | $ | 200.32 | $ | 216.54 | ||||||||||||

15

Item 6. Selected Financial Data.

The following selected condensed consolidated financial data has been derived from, and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and Notes thereto, included elsewhere in this report on Form 10-K and incorporated herein by reference.

Years Ended December 31, | |||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

(in thousands, except per share amounts) | |||||||||||||||||||

Selected Operating Results | |||||||||||||||||||

Revenues | $ | 1,562,662 | $ | 1,436,849 | $ | 1,293,183 | $ | 1,149,890 | $ | 1,077,435 | |||||||||

Net income | $ | 77,396 | $ | 58,024 | $ | 21,850 | $ | 47,129 | $ | 44,214 | |||||||||

Basic earnings per common share | $ | 1.06 | $ | 0.81 | $ | 0.31 | $ | 0.68 | $ | 0.65 | |||||||||

Diluted earnings per common share | $ | 1.05 | $ | 0.80 | $ | 0.31 | $ | 0.67 | $ | 0.65 | |||||||||

Selected Balance Sheet Data | |||||||||||||||||||

Total assets | $ | 528,446 | $ | 480,949 | $ | 469,579 | $ | 425,342 | $ | 331,183 | |||||||||

Stockholders’ equity | $ | 338,842 | $ | 296,456 | $ | 275,830 | $ | 285,143 | $ | 229,570 | |||||||||

Selected Other Financial Data | |||||||||||||||||||

Working capital | $ | 313,753 | $ | 269,277 | $ | 213,414 | $ | 207,750 | $ | 200,182 | |||||||||

Cash dividends declared per common share | $ | 0.73750 | $ | 0.71750 | $ | 0.69750 | $ | 0.67750 | $ | 0.65750 | |||||||||

Weighted average number of common shares outstanding - basic | 72,754 | 71,826 | 70,616 | 69,206 | 67,511 | ||||||||||||||

Weighted average number of common shares outstanding - diluted | 73,474 | 72,512 | 71,341 | 70,045 | 68,485 | ||||||||||||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

You should read the following discussion and analysis of our financial condition and results of our operations in conjunction with our consolidated financial statements and the related notes to those statements included elsewhere in this report. This discussion contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. Our actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed in the section entitled “Risk Factors,” and elsewhere in this report on Form 10-K. We are on a calendar year end, and except where otherwise indicated, “2016” refers to the year ended December 31, 2016, “2015” refers to the year ended December 31, 2015 and “2014” refers to the year ended December 31, 2014.

Results of Operations

The following discussion is intended to provide the reader with information that will be helpful in understanding our financial statements, including the changes in certain key items in comparing financial statements period to period. We also intend to provide the primary factors that accounted for those changes, as well as a summary of how certain accounting principles affect our financial statements. In addition, we are providing information about the financial results of our two operating segments to further assist in understanding how these segments and their results affect our consolidated results of operations. This discussion should be read in conjunction with our financial statements as of December 31, 2016 and the year then ended and the notes accompanying those financial statements.

Overview

We provide management, administrative and operating expertise and services to the housekeeping, laundry, linen, facility maintenance and dietary service departments of the health care industry, including nursing homes, retirement complexes, rehabilitation centers and hospitals located throughout the United States. We believe that we are the largest provider of housekeeping and laundry management services to the long-term care industry in the United States, rendering such services to over 3,500 facilities throughout the continental United States as of December 31, 2016.

16

We provide our services primarily pursuant to full service agreements with our clients. In such agreements, we are responsible for the management of the department serviced, employing the Housekeeping or Dietary personnel located at our clients’ facilities and providing certain supplies. We also provide services on the basis of a management-only agreements for a limited number of clients. Our agreements with clients typically provide for renewable one year service terms, cancelable by either party upon 30 to 90 days’ notice after an initial period of 60 to 120 days.

We are organized into two reportable segments; housekeeping, laundry, linen and other services (“Housekeeping”) and dietary department services (“Dietary”).

Housekeeping consists of managing the client’s housekeeping department which is principally responsible for the cleaning, disinfecting and sanitizing of resident rooms and common areas of a client’s facility, as well as laundering and processing of the bed linens, uniforms, resident personal clothing and other assorted linen items utilized at a client facility.

Dietary consists of managing the client’s dietary department which is principally responsible for food purchasing, meal preparation and dietitian professional services, which includes the development of menus that meet residents’ dietary needs.

At December 31, 2016, Housekeeping services were provided at essentially all of our more than 3,500 client facilities, generating approximately 61.3% or $957.1 million of 2016 total revenues. Dietary services were provided to over 1,000 client facilities at December 31, 2016 and contributed approximately 38.7% or $605.5 million of 2016 total revenues.

The Company’s workers compensation, general liability and certain employee health and welfare insurance programs are provided by HCSG Insurance Corp. (“HCSG Insurance” or the “Captive”), the Company’s wholly owned captive insurance subsidiary. HCSG Insurance provides the Company with greater flexibility and cost efficiency in meeting its insurance needs. In 2015, the Company completed a corporate restructuring by capitalizing three new operating entities and transitioning the Company’s facility-based employees to such entities based on the geography served. As a result, (i) HCSG Insurance provides workers’ compensation, general liability and other insurance coverages to such entities with respect to such transitioned workforce, (ii) such entities provide housekeeping, laundry and dietary services as a subcontracted provider to the Company, and (iii) the Company provides strategic client-service management and administrative support services to such entities.

Our ability to acquire new clients, retain existing clients and increase revenues are affected by many factors. Competitive factors consist primarily of competing with potential clients’ usage of in-house support staff, as well as local companies providing services similar to ours. We are unaware of any other companies, on a national or local level, which have a significant presence or impact on our procurement of new clients in our market. We believe the primary revenue drivers of our business are our ability to obtain new clients and to pass through, by means of service billing increases, increases in our cost of providing the services. In addition to the recoupment of costs increases, we aim to obtain modest annual revenue increases from our existing clients to attain desired profit margins at the facility level. The primary economic factor in acquiring new clients is our ability to demonstrate the cost-effectiveness of our services, because many of our clients’ revenues are generally highly reliant on Medicare and Medicaid reimbursement funding rates and mechanisms. Therefore, their economic decision-making process is driven significantly by their reimbursement funding rate structure and the financial impact on their reimbursement as a result of engaging us for the respective services. The primary operational factor is our ability to demonstrate to potential clients the benefit of being relieved of the administrative and operational challenges related to the day-to-day management of their housekeeping and dietary operations. In addition, we must be able to assure new clients that we can improve the quality of service that they are providing to their residents. We believe the factors discussed above are equally applicable to each of our segments with respect to acquiring new clients and increasing revenues.

The following table sets forth, for the years indicated, the percentage which certain items bear to consolidated revenues:

Relation to Consolidated Revenues Years Ended December 31, | ||||||||

2016 | 2015 | 2014 | ||||||

Revenues | 100.0 | % | 100.0 | % | 100.0 | % | ||

Operating costs and expenses: | ||||||||

Costs of services provided | 85.7 | % | 86.0 | % | 89.3 | % | ||

Selling, general and administrative | 6.7 | % | 7.8 | % | 8.3 | % | ||

Net investment and interest income | 0.2 | % | 0.0 | % | 0.1 | % | ||

Income before income taxes | 7.8 | % | 6.2 | % | 2.5 | % | ||

Income taxes | 2.8 | % | 2.2 | % | 0.8 | % | ||

Net income | 5.0 | % | 4.0 | % | 1.7 | % | ||

17

Subject to the factors noted in the Cautionary Statement Regarding Forward Looking Statements included in this report on Form 10-K, we anticipate, our financial performance in 2017 may be comparable to historical ranges, absent non-recurring charges, as they relate to consolidated revenues. The 2015 percentages were negatively impacted by mediated settlements regarding certain labor and employment related matters. The Company agreed to these mediated settlements while denying any violations. The 2014 percentages were negatively impacted by a one-time, non-cash adjustment related to a change in estimate in our self-insurance reserve methodology.

Although there can be no assurance thereof, we believe that in 2017, Dietary revenues as a percentage of consolidated revenues, will increase from its respective 2016 percentages noted above. Furthermore, we expect the sources of growth in 2017 for the respective operating segments will mirror those historically experienced: growth in Dietary is expected to come from our current Housekeeping client base, while growth in Housekeeping will primarily come from obtaining new clients.

Our costs of services can vary and may impact our operating performance. Management reviews two key cost indicators: costs of labor and costs of supplies, to monitor and manage such costs. The variability of these costs may impact each segment differently due to the respective costs as a percentage of that segment’s revenues. Housekeeping is more significantly impacted by costs of labor than Dietary. Labor costs accounted for approximately 80.2% of Housekeeping revenues in 2016. Dietary labor costs accounted for approximately 53.8% of Dietary revenues in 2016. Changes in wage rates as a result of legislative or collective bargaining actions, anticipated staffing levels, and other unforeseen variations in our use of labor or in management labor costs will result in variability of these costs. Housekeeping supplies, including linen products, accounted for approximately 7.8% of Housekeeping revenues in 2016. In contrast, supplies consumed in performing our Dietary services accounted for approximately 38.0% of Dietary revenues. Generally, fluctuations in these expenses are influenced by factors outside of our control and are unpredictable. This is because Housekeeping and Dietary supplies are principally commodity products and are affected by market conditions specific to the respective products.

Our clients are concentrated in the health care industry and are primarily providers of long-term care. Many of our clients’ revenues are highly reliant on Medicare, Medicaid and third-party payors’ reimbursement funding rates. Legislation can significantly alter overall government reimbursement for nursing home services and such changes, as well as other trends in the long-term care industry, have affected and could adversely affect our clients’ cash flows, resulting in their inability to make payments to us in accordance with agreed-upon payment terms. The climate of legislative uncertainty has posed, and will continue to pose, both risks and opportunities for us: the risks are related to our clients’ cash flows and solvency, while the opportunities are related to our ability to offer our clients cost stability and cost efficiencies.

18

Years Ended December 31, 2016 and 2015

The following table sets forth 2016 income statement key components that we use to evaluate our financial performance on a consolidated and reportable segment basis compared to 2015. The differences between the reportable segments’ operating results and other disclosed data and our consolidated financial statements relate primarily to corporate level transactions and adjustments related to transactions recorded at the reportable segment level which use methods other than generally accepted accounting principles.

Year Ended December 31, | |||||||||||

2016 | 2015 | % Change | |||||||||

(in thousands) | |||||||||||

Revenues | |||||||||||

Housekeeping services | $ | 957,148 | $ | 909,709 | 5.2 | % | |||||

Dietary services | 605,514 | 527,140 | 14.9 | % | |||||||

Consolidated | $ | 1,562,662 | $ | 1,436,849 | 8.8 | % | |||||

Costs of services provided | |||||||||||

Housekeeping services | $ | 866,392 | $ | 825,238 | 5.0 | % | |||||

Dietary services | 570,873 | 495,528 | 15.2 | % | |||||||

Corporate and eliminations | (97,773 | ) | (84,658 | ) | 15.5 | % | |||||

Consolidated | $ | 1,339,492 | $ | 1,236,108 | 8.4 | % | |||||

Selling, general and administrative expense | |||||||||||

Corporate and eliminations | $ | 105,417 | $ | 111,689 | (5.6 | )% | |||||

Investment and interest income | |||||||||||

Corporate and eliminations | $ | 2,634 | $ | 712 | 269.9 | % | |||||

Income (loss) before income taxes | |||||||||||

Housekeeping services | $ | 90,756 | $ | 84,471 | 7.4 | % | |||||

Dietary services | 34,641 | 31,612 | 9.6 | % | |||||||

Corporate and eliminations | (5,010 | ) | (26,319 | ) | (81.0 | )% | |||||

Consolidated | $ | 120,387 | $ | 89,764 | 34.1 | % | |||||

Revenues

Consolidated

Consolidated revenues increased 8.8% to $1.56 billion in 2016 compared to $1.44 billion in 2015 as a result of the factors discussed below under Reportable Segments.

Reportable Segments

Housekeeping’s 5.2% increase in reportable segment revenues resulted primarily from service agreements entered into with new clients.

Dietary’s 14.9% increase in reportable segment revenues resulted primarily from providing these services to a greater number of existing Housekeeping clients.

19

Costs of services provided

Consolidated

Consolidated costs of services increased 8.4% to $1.34 billion in 2016 compared to $1.24 billion in 2015. The increase in costs of services is primarily driven by higher labor and other labor related costs associated with overall growth. Such costs of services, along with the costs of supplies, are subject to fluctuation with the changes in our business and client base. Historically, these significant components accounted for approximately 96% to 98% of consolidated costs of services.

As a percentage of consolidated revenues, cost of services decreased to 85.7% in 2016 from 86.0% in 2015. The following table provides a comparison of the key indicators we consider when managing the consolidated cost of services:

Year Ended December 31, | ||||||

Costs of Services Provided - Key Indicators as % of Consolidated Revenue | 2016 | 2015 | % Change | |||

Bad debt provision | 0.3% | 0.3% | —% | |||

Workers’ compensation and general liability insurance | 3.0% | 3.4% | (0.4)% | |||

The bad debt provision remained consistent due to our assessment of the collectability of our accounts and notes receivables.

The decrease in workers’ compensation and general liability insurance expense as a percentage of consolidated revenue is primarily the result of the Company’s ongoing initiative to promote safety and accident prevention in the workplace, as well as proactive management of workers’ compensation claims, which have positively impacted our claims experience.

Reportable Segments

Costs of services provided for Housekeeping, as a percentage of Housekeeping revenues for 2016, decreased to 90.5% compared to 90.7% in 2015. Cost of services provided for Dietary, as a percentage of Dietary revenues for 2016, increased to 94.3% compared to 94.0% in 2015.

The following table provides a comparison of the key indicators we consider when managing cost of services at the segment level, as a percentage of the respective segment’s revenues:

Year Ended December 31, | ||||||

Costs of Services Provided - Key Indicators as % of Segment Revenue | 2016 | 2015 | % Change | |||

Housekeeping labor and other labor costs | 80.2% | 79.4% | 0.8% | |||

Housekeeping supplies | 7.8% | 8.3% | (0.5)% | |||

Dietary labor and other labor costs | 53.8% | 52.9% | 0.9% | |||

Dietary supplies | 38.0% | 38.7% | (0.7)% | |||

The ratios of these key indicators remain relatively consistent. Variations relate to the provision of services at new facilities and changes in the mix of clients for whom we provide supplies or do not provide supplies. Management focuses on building efficiencies and managing labor and other costs at the facility level, as well as managing supply chain costs, for new and existing facilities.

Consolidated Selling, General and Administrative Expense

Year Ended December 31, | ||||||||||

2016 | 2015 | % Change | ||||||||

(in thousands) | ||||||||||

Selling, general and administrative expense excluding deferred compensation change (1) | $ | 103,922 | $ | 111,751 | (7.0 | )% | ||||

Loss / (gain) on deferred compensation plan investments (2) | (1,495 | ) | 62 | (2,511.3 | )% | |||||

Selling, general and administrative expense | $ | 105,417 | $ | 111,689 | (5.6 | )% | ||||

(1) Selling, general and administrative expense excluding the change in the market value of the deferred compensation fund.

(2) Gains on the deferred compensation plan investments are reflected as increases to selling, general and administrative expense, as such gains increase the amount of the deferred compensation liability. Losses on the deferred compensation plan

20

investments are reflected as decreases to selling, general and administrative expense, as such losses decrease the amount of the deferred compensation liability.

Excluding the change in the deferred compensation plan, consolidated selling, general and administrative expense for 2016 decreased $7.8 million or 7.0% compared to 2015, in which consolidated selling, general and administrative expense was negatively impacted by legal expenses associated with settlements regarding certain employment-related matters. The change in the value of the deferred compensation plan is a result of changes in the market value on the balance of investments held in our deferred compensation plan.

Consolidated Investment and Net Interest Income

Investment and interest income, as a percentage of consolidated revenues, increased to 0.2% for 2016 compared to less than 0.1% for 2015, primarily due to favorable market fluctuations in the value of our investments.

Consolidated Income Taxes

Our effective tax rate was 35.7% for 2016 and 35.4% for 2015. Differences between the effective tax rates and the applicable U.S. federal statutory rate arise primarily from the effect of state and local taxes and tax credits available to the Company. The Company participates in the Work Opportunity Tax Credit (“WOTC”) program, through which we hire and retain employees from target groups with significant barriers to employment. As part of the program, the Company receives tax credits, and although the Company has increased its participation in the program year-over-year, the increase in the effective tax rate is primarily related to the ratio of the tax credits to higher pre-tax book income in 2016 as compared to the prior year. This credit is currently scheduled to expire on December 31, 2019.

21

Years Ended December 31, 2015 and 2014

The following table sets forth 2015 income statement key components that we use to evaluate our financial performance on a consolidated and reportable segment basis compared to 2014. The differences between the reportable segments’ operating results and other disclosed data and our consolidated financial statements relate primarily to corporate level transactions and adjustments related to transactions recorded at the reportable segment level which use methods other than generally accepted accounting principles.

Year Ended | |||||||||||

2015 | 2014 | % Change | |||||||||

(in thousands) | |||||||||||

Revenues | |||||||||||

Housekeeping services | $ | 909,709 | $ | 846,610 | 7.5 | % | |||||

Dietary services | 527,140 | 446,573 | 18.0 | % | |||||||

Consolidated | $ | 1,436,849 | $ | 1,293,183 | 11.1 | % | |||||

Costs of services provided | |||||||||||

Housekeeping services | $ | 825,238 | $ | 776,220 | 6.3 | % | |||||

Dietary services | 495,528 | 420,230 | 17.9 | % | |||||||

Corporate and eliminations | (84,658 | ) | (41,157 | ) | 105.7 | % | |||||

Consolidated | $ | 1,236,108 | $ | 1,155,293 | 7.0 | % | |||||

Selling, general and administrative expense | |||||||||||