Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TELEFLEX INC | ex991to2-23x20178kreearnin.htm |

| 8-K - 8-K - TELEFLEX INC | a2-23x20178xkreearningsrel.htm |

1

Teleflex Incorporated

Fourth Quarter 2016

Earnings Conference Call

2

Conference Call Logistics

The release, accompanying slides, and replay webcast are available online at

www.teleflex.com (click on “Investors”)

Telephone replay available by dialing 855-859-2056 or for international calls, 404-

537-3406, pass code number 65576607

3

Introductions

Benson Smith

Chairman and CEO

Liam Kelly

President and COO

Thomas Powell

Executive Vice President and CFO

Jake Elguicze

Treasurer and Vice President of Investor Relations

4

Note on Forward-Looking Statements

This presentation and our discussion contain forward-looking information and statements including, but not

limited to, expected 2017 revenue growth from new product sales; our expectation that our acquisition of

Vascular Solutions, Inc. will be accretive to our 2017 adjusted earnings per share results; forecasted 2017

GAAP and constant currency revenue growth, GAAP and adjusted gross and operating margins and adjusted

earnings per share and the items that are expected to impact each of those forecasted results; our

assumptions with respect to the euro to U.S. dollar exchange rate for 2017 and our adjusted weighted

average shares for 2017; estimated pre-tax charges we expect to incur and annualized pre-tax savings we

expect to realize in connection with our restructuring programs; our expectations with respect to when we

will begin to realize savings from our restructuring programs and when those programs will be substantially

completed; and other matters which inherently involve risks and uncertainties which could cause actual

results to differ from those projected or implied in the forward–looking statements. These risks and

uncertainties are addressed in our SEC filings, including our most recent Form 10-K.

Note on Non-GAAP Financial Measures

This presentation refers to certain non-GAAP financial measures, including, but not limited to, constant

currency revenue growth, adjusted diluted earnings per share, adjusted gross and operating margins and

adjusted tax rate. These non-GAAP financial measures should not be considered replacements for, and

should be read together with, the most comparable GAAP financial measures. Tables reconciling these

non-GAAP financial measures to the most comparable GAAP financial measures are contained within the

appendices to this presentation.

Additional Notes

Unless otherwise noted, the following slides reflect continuing operations.

5

Executive Summary

Fourth quarter 2016 revenue of $513.9 million

• Up 6.1% vs. prior year period on an as-reported basis

• Up 6.9% vs. prior year period on a constant currency basis

Fourth quarter 2016 Earnings Per Share

• GAAP EPS of $1.29, down 31.4% vs. prior year period

• Adjusted EPS of $2.13, up 6.0% vs. prior year period

Full year 2016 revenue of $1.87 billion

• Up 3.2% vs. prior year on an as-reported basis

• Up 4.1% vs. prior year on a constant currency basis

Full year 2016 Earnings Per Share

• GAAP EPS of $4.98, up 1.4% vs. prior year

• Adjusted EPS of $7.34, up 16.0% vs. prior year

Note: See appendices for reconciliations of non-GAAP information

6

Executive Summary

Succession Planning Update

• Benson Smith to retire as Chief Executive Officer effective December 31, 2017

• Mr. Smith, a Teleflex Board member since 2005, will continue to serve as Teleflex’s

Chairman of the Board. He has been nominated by Teleflex’s Board of Directors to

serve for another three year term if elected by Teleflex’s stockholders at the 2017

annual meeting to be held in May, 2017

• Liam Kelly, who currently serves as Teleflex’s President and Chief Operating Officer,

has been named by the Teleflex Board of Directors to succeed Mr. Smith as Chief

Executive Officer following Mr. Smith’s retirement

7

Fourth Quarter Highlights

Fourth quarter 2016 constant currency revenue growth of 6.9%

• Sales volume of existing products contribute 4.5% of constant currency growth

• Sales volume of new products contribute 1.6% of constant currency growth

• Acquisitions contribute 0.4% of constant currency revenue growth

• Pricing increases contribute 0.4% of constant currency growth

Note: See appendices for reconciliations of non-GAAP information

8

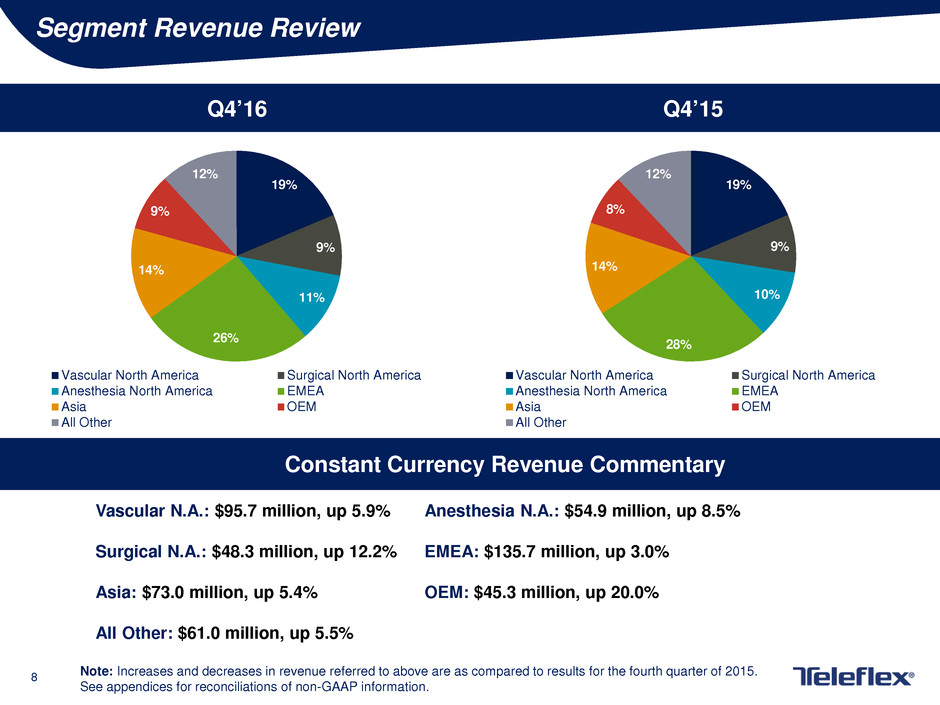

Segment Revenue Review

Q4’16 Q4’15

Constant Currency Revenue Commentary

Vascular N.A.: $95.7 million, up 5.9% Anesthesia N.A.: $54.9 million, up 8.5%

Surgical N.A.: $48.3 million, up 12.2% EMEA: $135.7 million, up 3.0%

Asia: $73.0 million, up 5.4% OEM: $45.3 million, up 20.0%

All Other: $61.0 million, up 5.5%

Note: Increases and decreases in revenue referred to above are as compared to results for the fourth quarter of 2015.

See appendices for reconciliations of non-GAAP information.

19%

9%

11%

26%

14%

9%

12%

Vascular North America Surgical North America

Anesthesia North America EMEA

Asia OEM

All Other

19%

9%

10%

28%

14%

8%

12%

Vascular North America Surgical North America

Anesthesia North America EMEA

Asia OEM

All Other

9

Group Purchasing Organization and IDN Review

Track record of expansion of contractual agreements continues in Q4’16

Group Purchasing Organization Update

• 3 renewed agreements

• 1 existing agreement not renewed

IDN Update

• 15 renewed agreements

• 4 new agreements

• 3 existing agreements not renewed

10

Product Introductions and Regulatory Approvals

Arrow® VPS Rhythm™ Device with Optional TipTracker™ Technology

PRODUCT DESCRIPTION

Recently received FDA 510(k) clearance for the

Arrow ® VPS Rhythm ™ Device expands Teleflex’s

Catheter Tip Navigation and Placement portfolio

to now include familiar ECG-only technology for

the elimination of confirmatory chest X-ray.

The Arrow® VPS Rhythm™ Device assists in

placement and confirmation of a catheter tip in

the SVC-CAJ (superior vena-cava-cavoatrial

junction); it may be used with a broad range of

catheter types and brands. Intravascular P-wave

changes are saved as the catheter approaches the

SVC, helping to identify the lower 1/3 of the SVC,

near the CAJ, eliminating the need for

confirmatory chest X-ray or fluoroscopy in adult

patients. When paired with the single-use

TipTracker™ Stylet for insertion of peripherally-

inserted central catheters (PICCs), the Arrow® VPS

Rhythm™ Device provides real-time visual

navigation by tracing the catheter pathway with a

blue line on a color screen. The Device has an

expansive sphere of visual navigation to provide

easy navigation of the PICC during insertion.

11

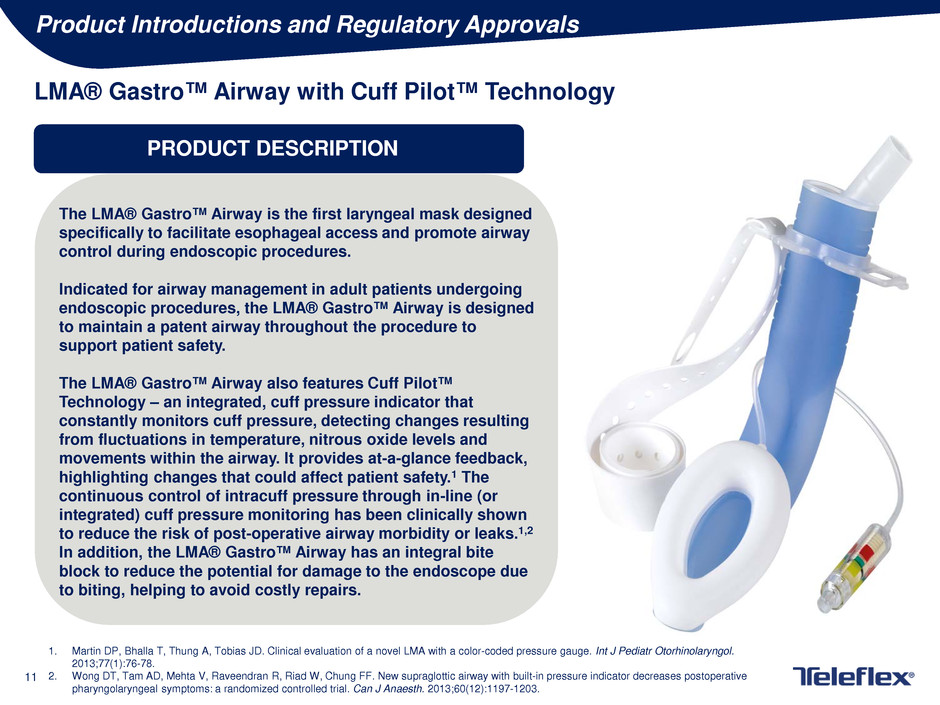

Product Introductions and Regulatory Approvals

LMA® Gastro™ Airway with Cuff Pilot™ Technology

PRODUCT DESCRIPTION

The LMA® Gastro™ Airway is the first laryngeal mask designed

specifically to facilitate esophageal access and promote airway

control during endoscopic procedures.

Indicated for airway management in adult patients undergoing

endoscopic procedures, the LMA® Gastro™ Airway is designed

to maintain a patent airway throughout the procedure to

support patient safety.

The LMA® Gastro™ Airway also features Cuff Pilot™

Technology – an integrated, cuff pressure indicator that

constantly monitors cuff pressure, detecting changes resulting

from fluctuations in temperature, nitrous oxide levels and

movements within the airway. It provides at-a-glance feedback,

highlighting changes that could affect patient safety.1 The

continuous control of intracuff pressure through in-line (or

integrated) cuff pressure monitoring has been clinically shown

to reduce the risk of post-operative airway morbidity or leaks.1,2

In addition, the LMA® Gastro™ Airway has an integral bite

block to reduce the potential for damage to the endoscope due

to biting, helping to avoid costly repairs.

1. Martin DP, Bhalla T, Thung A, Tobias JD. Clinical evaluation of a novel LMA with a color-coded pressure gauge. Int J Pediatr Otorhinolaryngol.

2013;77(1):76-78.

2. Wong DT, Tam AD, Mehta V, Raveendran R, Riad W, Chung FF. New supraglottic airway with built-in pressure indicator decreases postoperative

pharyngolaryngeal symptoms: a randomized controlled trial. Can J Anaesth. 2013;60(12):1197-1203.

12

New Product Revenue Growth Trend

25 new products and line extensions introduced in 2016 and 88 since 2013

Revenue growth acceleration from new product introductions expected to continue in 2017

driven by contributions from MiniLap, Percuvance, VPS CG+, VPS Rhythm, AC3, LMA Protector

0.9%

1.1%

1.3%

1.4%

to

1.6%

0.4%

0.9%

2.0%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

2014 2015 2016 2017E

Total Company North America

13

Acquisition Update

Completed Acquisition of Vascular Solutions

1. Highly strategic and complementary acquisition

− Significantly advances Teleflex’s offering of vascular and interventional solutions

− Adds over 90 proprietary products and services that are sold to interventional cardiologists,

interventional radiologists, electrophysiologists and vein specialists

2. Accelerates Teleflex’s sales growth trajectory and provides sales channel opportunity

− Vascular Solutions has consistently generated > 10% revenue growth per year

− Ability to capitalize on Teleflex’s existing international infrastructure to drive further O.U.S.

penetration of Vascular Solutions product offerings

3. Improves R&D pipeline

− Acquisition provides a robust pipeline of new and next-generation products that address

complex interventions, radial artery catheterizations and embolization procedures

4. Compelling financial profile that substantially improves Teleflex’s revenue growth,

margins, earnings and cash flow generation capabilities

− Expected to be accretive to adjusted earnings per share1 in 2017, including the impact of

incremental interest expense associated with financing the transaction

− Fits into existing strategic business unit franchises and call points allowing for synergies

1 - Adjusted earnings per share excludes specified items such as amortization of acquired intangibles, inventory step-up, restructuring costs and other costs incurred

to execute the transaction. Adjusted earnings per share is a non-GAAP financial measure and should not be considered a replacement for GAAP results.

14

Fourth Quarter Financial Review

Revenue of $513.9 million

• Up 6.1% vs. prior year period on an as-reported basis

• Up 6.9% vs. prior year period on a constant currency basis

Gross Margin

• GAAP gross margin of 53.1%, down 60 bps vs. prior year period

• Adjusted gross margin of 53.8%, down 30 bps vs. prior year period

Operating Margin

• GAAP operating margin of 13.0%, down 700 bps vs. prior year period

• Adjusted operating margin of 25.0%, up 130 bps vs. prior year period

Tax Rate

• GAAP tax rate of (19.8%), down 1,070 bps vs. prior year period

• Adjusted tax rate of 16.5%, up 290 bps vs. prior year period

Earnings Per Share

• GAAP EPS of $1.29, down 31.4% vs. prior year period

• Adjusted EPS of $2.13, up 6.0% vs. prior year period

Note: See appendices for reconciliations of non-GAAP information

15

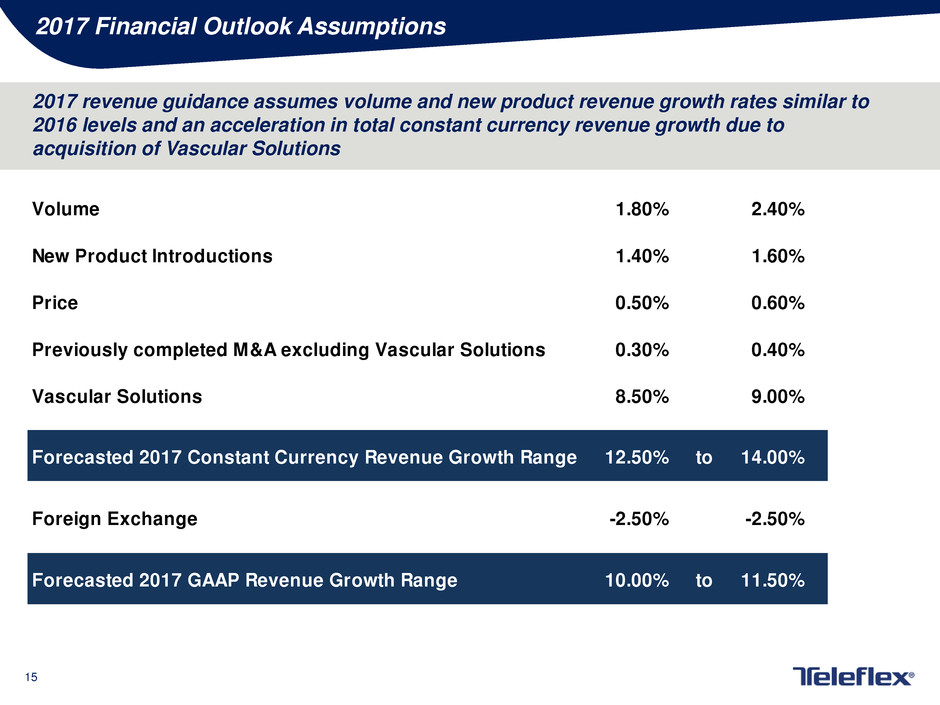

2017 Financial Outlook Assumptions

2017 revenue guidance assumes volume and new product revenue growth rates similar to

2016 levels and an acceleration in total constant currency revenue growth due to

acquisition of Vascular Solutions

Volume 1.80% 2.40%

New Product Introductions 1.40% 1.60%

Price 0.50% 0.60%

Previously completed M&A excluding Vascular Solutions 0.30% 0.40%

Vascular Solutions 8.50% 9.00%

Forecasted 2017 Constant Currency Revenue Growth Range 12.50% to 14.00%

Foreign Exchange -2.50% -2.50%

Forecasted 2017 GAAP Revenue Growth Range 10.00% to 11.50%

16

2017 Financial Outlook Assumptions

2017 Adjusted Gross Margin Drivers

Gross margin expansion in 2017 as compared to 2016

expected to be driven by:

• Cost improvement programs

• Benefits from 2014 and 2016 restructuring plans

• Favorable product mix

• Improved pricing

• New product introductions

• Vascular Solutions acquisition

Gross margin impacted negatively in 2017 as compared

to 2016 due to:

• Foreign currency exchange rates

Note: figures represent adjusted gross margin. See Appendices for reconciliation of actual and forecasted GAAP

results to actual and forecasted adjusted results.

+140 bps

17

2017 Financial Outlook Assumptions

2017 Adjusted Operating Margin Drivers

Improved financial leverage generated during

2015 and 2016 expected to continue in 2017

Adjusted gross margin improvement expected to

contribute between 130 and 190 basis points

SG&A expense cost control allows for

investment into R&D productivity initiatives

while still driving more than a one-for-one flow

through between adjusted gross and operating

margin expansion:

• Additional R&D investments in both Vascular and

Surgical product development

• Additional investments in sales force in North

America and Asia

• Reduced spending due to benefits from 2016

SG&A focused restructuring initiative

Note: figures represent adjusted operating margin. See Appendices for reconciliation of actual and forecasted

GAAP results to actual and forecasted adjusted results.

+260 bps

18

2017 Financial Outlook Assumptions

Base business portfolio capable of generating consistent revenue growth and operating leverage, coupled

with addition of Vascular Solutions, expected to lead to 2017 adjusted EPS growth of 9.0% to 11.0%

Note: see Appendices for tables reconciling actual and forecasted adjusted earnings per share results to actual and

forecasted GAAP earnings per share results.

2016 Adjusted Earnings per Share $7.34 $7.34

Base business $1.12 to $1.17

China Go-Direct ($0.15) to ($0.12)

Interest expense base TFX excluding Vascular Solutions ($0.09) to ($0.08)

Weighted average shares ($0.12) to ($0.11)

Foreign currency exchange rates ($0.30) to ($0.30)

Vascular Solutions $0.20 to $0.25

2017 Adjusted Earnings per Share Outlook $8.00 to $8.15

19

Any Questions?

20

Thank You

21

Appendices

22

Non-GAAP Financial Measures

The following appendices include, among other things, tables reconciling the following non-GAAP financial

measures to the most comparable GAAP financial measure:

• Constant currency revenue growth. This measure excludes the impact of translating the results of

international subsidiaries at different currency exchange rates from period to period.

• Adjusted diluted earnings per share. This measure excludes, depending on the period presented (i)

restructuring and other impairment charges; (ii) certain losses and other charges, including charges

related to acquisition and facility consolidations, net of reversals related to contingent consideration

liabilities and the medical device tax; (iii) amortization of the debt discount on the Company’s convertible

notes; (iv) intangible amortization expense; and (v) tax benefits resulting primarily from the expiration of

applicable statutes of limitations for prior year returns and/or the resolution of audits or filing of emended

returns with respect to prior tax years, and tax law changes affecting the Company’s deferred tax liability.

In addition, the calculation of diluted shares within adjusted earnings per share gives effect to the anti-

dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic

dilution that otherwise would occur upon conversion of the Company’s senior subordinated convertible

notes (under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in

diluted shares).

• Adjusted gross margin. This measure excludes, depending on the period presented, certain losses, other

charges and charge reversals, primarily related to facility consolidations.

• Adjusted operating margin. This measure excludes, depending on the period presented, (i) the impact of

restructuring and other impairment charges; (ii) losses and other charges primarily related to acquisition

and facility consolidations, net of reversals related to contingent consideration liabilities and the medical

device tax; and (iii) intangible amortization expense.

• Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from

continuing operations to its adjusted income from continuing operations before taxes. Adjusted taxes on

income from continuing operations excludes, depending on the period presented, the impact of tax

benefits or costs associated with (i) restructuring and impairment charges; (ii) amortization of the debt

discount on the Company’s convertible notes; (iii) intangible amortization expense; (iv) the resolution of, or

expiration of statutes of limitations with respect to, various prior years’ tax matters and tax law changes

affecting our deferred tax liability; and (vii) losses and other charges primarily related to acquisition and

facility consolidation charges, net of reversals related to contingent consideration liabilities and the

medical device excise tax.

23

APPENDIX A –

RECONCILIATION OF CONSTANT CURRENCY REVENUE GROWTH

DOLLARS IN MILLIONS

December 31, 2016 December 31, 2015 Constant Currency Currency Total

Vascular North America 95.7$ 90.3$ 5.9% 0.0% 5.9%

Anesthesia North America 54.9 50.6 8.5% 0.0% 8.5%

Surgical North America 48.3 43.1 12.2% 0.0% 12.2%

EMEA 135.7 135.2 3.0% (2.6%) 0.4%

Asia 73.0 69.2 5.4% 0.0% 5.4%

OEM 45.3 37.8 20.0% (0.2%) 19.8%

All Other 61.0 58.3 5.5% (0.8%) 4.7%

Net Revenues 513.9$ 484.5$ 6.9% (0.8%) 6.1%

Three Months Ended % Increase / (Decrease)

24

APPENDIX B –

RECONCILIATION OF CONSTANT CURRENCY REVENUE GROWTH

DOLLARS IN MILLIONS

December 31, 2016 December 31, 2015 Constant Currency Currency Total

Vascular North America 350.5$ 334.9$ 4.8% (0.2%) 4.6%

Anesthesia North America 198.8 189.2 5.2% (0.2%) 5.0%

Surgical North America 172.2 161.3 7.1% (0.3%) 6.8%

EMEA 510.9 514.5 1.1% (1.8%) (0.7%)

Asia 249.4 241.7 4.3% (1.1%) 3.2%

OEM 161.0 149.4 7.8% 0.0% 7.8%

All Other 225.2 218.7 4.2% (1.2%) 3.0%

Net Revenues 1,868.0$ 1,809.7$ 4.1% (0.9%) 3.2%

Twelve Months Ended % Increase / (Decrease)

25

APPENDIX C –

RECONCILIATION OF REVENUE GROWTH

DOLLARS IN MILLIONS

% Basis Points

Three Months Ended December 31, 2015 Revenue As-Reported $484.5

Foreign Currency (3.9) -0.8% (81)

Sales Volume Existing Products 21.6 4.5% 445

New Product Sales 7.8 1.6% 161

Pricing 1.8 0.4% 37

Acquisitions 2.2 0.4% 44

Three Months Ended December 31, 2016 Revenue As-Reported $513.9 6.1%

Year-over-year growth

26

APPENDIX D –

RECONCILIATION OF ADJUSTED GROSS PROFIT AND MARGIN

DOLLARS IN THOUSANDS

December 31, 2016 December 31, 2015

Teleflex gross profit as-reported 273,052$ 260,316$

Teleflex gross margin as-reported 53.1% 53.7%

Losses and other charges, net (A) 3,686 1,895

Adjusted Teleflex gross profit 276,738$ 262,211$

Adjusted Teleflex gross margin 53.8% 54.1%

Teleflex revenue as-reported 513,933$ 484,501$

Three Months Ended

(A) In 2016 and 2015, losses and other charges, net related primarily to facility consolidations.

27

APPENDIX E –

RECONCILIATION OF ADJUSTED GROSS PROFIT AND MARGIN

DOLLARS IN THOUSANDS

12/31/16 12/31/15 12/31/14

Teleflex gross profit as-reported 996,200$ 944,403$ 942,428$

Teleflex gross margin as-reported 53.3% 52.2% 51.2%

Losses and other charges, net (A) 14,559 9,449 4,886

Adjusted Teleflex gross profit 1,010,759$ 953,852$ 947,314$

Adjusted Teleflex gross margin 54.1% 52.7% 51.5%

Teleflex revenue as-reported 1,868,027$ 1,809,690$ 1,839,832$

Year Ended

(A) In 2016, 2015 and 2014, losses and other charges, net related primarily to facility consolidations.

28

APPENDIX F –

RECONCILIATION OF ADJUSTED OPERATING PROFIT AND MARGIN

DOLLARS IN THOUSANDS

(A) In 2016, “other impairment charges” included pre-tax, non-cash impairment charges of $41.0 million related to the Company’s Semprus

technology and $2.4 million related to two properties, one of which was classified as an asset held for sale. In 2015, there were no “other impairment

charges”.

(B) In 2016, losses and other charges, net related primarily to reversals related to contingent consideration liabilities, including $8.3 million related to

the Company’s Semprus technology, somewhat offset by acquisition and facility consolidation costs. In 2015 losses and other charges, net related

primarily to facility consolidations and reflect reversals of previously recorded charges related to contingent consideration liabilities and the medical

device excise tax.

December 31, 2016 December 31, 2015

Teleflex income from continuing operations before interest and taxes 67,028$ 96,747$

Teleflex income from continuing operations before interest and taxes margin 13.0% 20.0%

Restructuring and other impairment charges (A) 46,351 2,131

Losses and other charges, net (B) (919) (1,189)

Intangible amortization expense 16,005 17,102

Adjusted Teleflex income from continuing operations before interest, taxes and

intangible amortization expense 128,465$ 114,791$

Adjusted Teleflex income from continuing operations before interest, taxes and

intangible amortization expense margin 25.0% 23.7%

Teleflex revenue as-reported 513,933$ 484,501$

Three Months Ended

29

APPENDIX G –

RECONCILIATION OF ADJUSTED OPERATING PROFIT AND MARGIN

DOLLARS IN THOUSANDS

(A) In 2016, “other impairment charges” included pre-tax, non-cash impairment charges of $41.0 million related to the Company’s Semprus

technology and $2.4 million related to two properties, one of which was classified as an asset held for sale. In 2015, there were no “other impairment

charges”.

(B) In 2016 losses and other charges, net related primarily to facility consolidation and acquisition costs, net of reversals related to contingent

consideration liabilities, including $8.3 million related to the Company’s Semprus technology, and the gain on sale of assets. In 2015 losses and

other charges, net related primarily to facility consolidation costs and reflects reversals of previously recorded charges related to contingent

consideration liabilities, the medical device excise tax and a litigation verdict against the Company with respect to a non-operating joint venture. In

2014, losses and other charges, net related primarily to facility consolidations.

12/31/16 12/31/15 12/31/14

Teleflex income from continuing operations before interest and taxes 319,453$ 315,891$ 284,862$

Teleflex income from continuing operations before interest and taxes margin 17.1% 17.5% 15.5%

Restructuring and other impairment charges (A) 59,227 7,819 17,869

Losses and other charges, net (B) 8,504 2,957 3,931

Intangible amortization expense 63,491 62,380 60,926

Adjusted Teleflex income from continuing operations before interest, taxes and

intangible amortization expense 450,675$ 389,047$ 367,588$

Adjusted Teleflex income from continuing operations before interest, taxes and

intangible amortization expense margin 24.1% 21.5% 20.0%

Teleflex revenue as-reported 1,868,027$ 1,809,690$ 1,839,832$

Year Ended

30

APPENDIX H –

RECONCILIATION OF ADJUSTED EPS FROM CONTINUING OPERATIONS

QUARTER ENDED – DECEMBER 31, 2016

DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA

Cost of

goods

sold

Selling, general

and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

(Gain) loss on

sale of business

and assets

Interest

expense, net

Income

taxes

Net income (loss)

attributable to common

shareholders from

continuing operations

Diluted earnings

per share available

to common

shareholders

Shares used in

calculation of GAAP

and adjusted

earnings per share

GAAP Basis $240.9 $144.2 $15.7 $46.4 ($0.2) $16.2 ($10.1) $60.9 $1.29 47,112

Adjustments

Restructuring and

other impairment

charges (A)

— — — 46.4 — — 16.5 29.8 $0.63 —

Losses and other

charges, net (B)

3.7 (4.4) 0.0 — (0.2) 3.4 3.4 (1.0) ($0.01) —

Amortization of debt

discount on

convertible notes

— — — — — 1.1 0.4 0.7 $0.02 —

Intangible

amortization

expense

— 15.9 0.1 — — — 4.0 12.0 $0.26 —

Tax adjustment (C) — — — — — — 4.9 (4.9) ($0.10) —

Shares due to

Teleflex under note

hedge (D)

— — — — — — — — $0.06 (1,343)

Adjusted basis $237.2 $132.7 $15.6 — — $11.7 $19.3 $97.5 $2.13 45,769

(B) In 2016, losses and other charges, net related primarily to reversals related to contingent consideration liabilities, including $8.3 million related to the Company's Semprus technology,

somewhat offset by acquisition and facility consolidation costs.

(C) The tax adjustment represents a net benefit resulting primarily from (1) the expiration of applicable statutes of limitations for prior year returns and/or the resolution of audits or filing of

amended returns with respect to prior tax years, and (2) tax law changes affecting our deferred tax liability.

(D) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of the Company's convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in diluted shares.

(A) In 2016, "other impairment charges" included (1) a pre-tax, non-cash $41.0 million impairment charge and $14.9 million reduction in related deferred tax liabilities in connection with the

Company's Semprus technology; and (2) $2.4 million in pre-tax, non-cash impairment charges related to two properties, one of which was classified as an asset held for sale and $0.7 million

reduction in related deferred tax liabilities.

31

APPENDIX I –

RECONCILIATION OF ADJUSTED EPS FROM CONTINUING OPERATIONS

QUARTER ENDED – DECEMBER 31, 2015

DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA

Cost of

goods

sold

Selling, general

and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

Interest

expense,

net

Income

taxes

Net income (loss)

attributable to common

shareholders from

continuing operations

Diluted earnings

per share available

to common

shareholders

Shares used in

calculation of GAAP

and adjusted

earnings per share

GAAP Basis $224.2 $148.2 $13.2 $2.1 $13.6 ($7.6) $90.6 $1.88 48,323

Adjustments

Restructuring and

other impairment

charges

— — — 2.1 — 0.8 1.3 $0.03 —

Losses and other

charges, net (A)

1.9 (3.1) — — — 0.3 (1.5) ($0.03) —

Amortization of

debt discount on

convertible notes

— — — — 3.4 1.2 2.1 $0.04 —

Intangible

amortization

expense

— 17.1 — — — 4.6 12.5 $0.26 —

Tax adjustment (B) — — — — — 14.9 (14.9) ($0.31) —

Shares due to

Teleflex under note

hedge (C)

— — — — — — — $0.14 (3,440)

Adjusted basis $222.3 $134.2 $13.2 — $10.2 $14.2 $90.2 $2.01 44,883

(A) In 2015 losses and other charges, net related primarily to facility consolidations and reflect reversals of previously recorded charges related to contingent

consideration liabilities and the medical device excise tax.

(B) The tax adjustment represents a net benefit resulting primarily from (1) the expiration of applicable statutes of limitations for prior year returns and/or the resolution

of audits or filing of amended returns with respect to prior tax years, and (2) tax law changes affecting our deferred tax liability.

(C) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential

economic dilution that otherwise would occur upon conversion of our senior subordinated convertible notes. Under GAAP, the anti-dilutive impact of the convertible note

hedge agreements is not reflected in diluted shares.

32

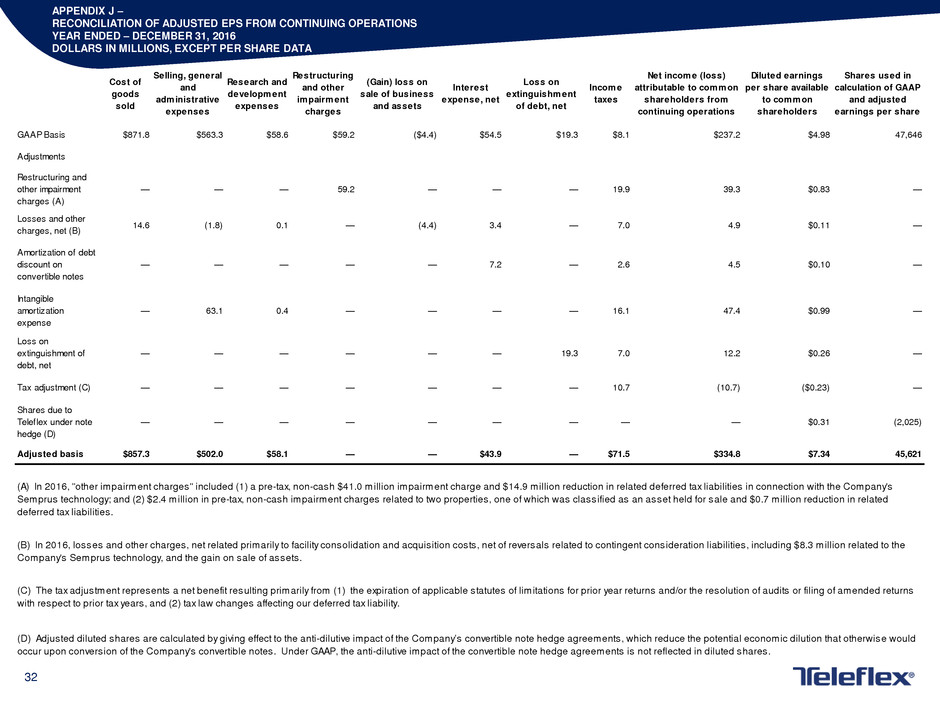

APPENDIX J –

RECONCILIATION OF ADJUSTED EPS FROM CONTINUING OPERATIONS

YEAR ENDED – DECEMBER 31, 2016

DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA

Cost of

goods

sold

Selling, general

and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

(Gain) loss on

sale of business

and assets

Interest

expense, net

Loss on

extinguishment

of debt, net

Income

taxes

Net income (loss)

attributable to common

shareholders from

continuing operations

Diluted earnings

per share available

to common

shareholders

Shares used in

calculation of GAAP

and adjusted

earnings per share

GAAP Basis $871.8 $563.3 $58.6 $59.2 ($4.4) $54.5 $19.3 $8.1 $237.2 $4.98 47,646

Adjustments

Restructuring and

other impairment

charges (A)

— — — 59.2 — — — 19.9 39.3 $0.83 —

Losses and other

charges, net (B)

14.6 (1.8) 0.1 — (4.4) 3.4 — 7.0 4.9 $0.11 —

Amortization of debt

discount on

convertible notes

— — — — — 7.2 — 2.6 4.5 $0.10 —

Intangible

amortization

expense

— 63.1 0.4 — — — — 16.1 47.4 $0.99 —

Loss on

extinguishment of

debt, net

— — — — — — 19.3 7.0 12.2 $0.26 —

Tax adjustment (C) — — — — — — — 10.7 (10.7) ($0.23) —

Shares due to

Teleflex under note

hedge (D)

— — — — — — — — — $0.31 (2,025)

Adjusted basis $857.3 $502.0 $58.1 — — $43.9 — $71.5 $334.8 $7.34 45,621

(A) In 2016, "other impairment charges" included (1) a pre-tax, non-cash $41.0 million impairment charge and $14.9 million reduction in related deferred tax liabilities in connection with the Company's

Semprus technology; and (2) $2.4 million in pre-tax, non-cash impairment charges related to two properties, one of which was classified as an asset held for sale and $0.7 million reduction in related

deferred tax liabilities.

(B) In 2016, losses and other charges, net related primarily to facility consolidation and acquisition costs, net of reversals related to contingent consideration liabilities, including $8.3 million related to the

Company's Semprus technology, and the gain on sale of assets.

(C) The tax adjustment represents a net benefit resulting primarily from (1) the expiration of applicable statutes of limitations for prior year returns and/or the resolution of audits or filing of amended returns

with respect to prior tax years, and (2) tax law changes affecting our deferred tax liability.

(D) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic dilution that otherwise would

occur upon conversion of the Company's convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in diluted shares.

33

APPENDIX K –

RECONCILIATION OF ADJUSTED EPS FROM CONTINUING OPERATIONS

YEAR ENDED – DECEMBER 31, 2015

DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA

Cost of

goods

sold

Selling, general

and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

(Gain) loss

on sale of

business

and

assets

Interest

expense,

net

Loss on

extinguishment

of debt, net

Income

taxes

Net income (loss)

attributable to common

shareholders from

continuing operations

Diluted earnings

per share available

to common

shareholders

Shares used in

calculation of GAAP

and adjusted

earnings per share

GAAP Basis $865.3 $569.0 $52.1 $7.8 ($0.4) $60.8 $10.5 $7.8 $236.0 $4.91 48,058

Adjustments:

Restructuring and

other impairment

charges

— — — 7.8 — — — 2.9 4.9 $0.10 —

Losses and other

charges, net (A)

9.4 (6.1) — — (0.4) — — 2.5 0.4 $0.01 —

Amortization of debt

discount on

convertible notes

— — — — — 13.2 — 4.8 8.4 $0.17 —

Intangible

amortization

expense

— 62.4 — — — — — 16.6 45.8 $0.95 —

Loss on extinguish-

ment of debt, net

— — — — — — 10.5 3.8 6.6 $0.14 —

Tax adjustment (B) — — — — — — — 19.0 (19.0) ($0.39) —

Shares due to

Teleflex under note

hedge (C)

— — — — — — — — — $0.44 (3,350)

Adjusted basis $855.8 $512.7 $52.1 — — $47.6 — $57.4 $283.2 $6.33 44,708

(A) In 2015 losses and other charges, net primarily related to facility consolidation costs and reflect reversals of previously recorded charges related to contingent consideration liabilities, the medical

device excise tax and a litigation verdict against the Company with respect to a non-operating joint venture.

(B) The tax adjustment represents a net benefit resulting primarily from (1) the expiration of applicable statutes of limitations for prior year returns and/or the resolution of audits or filing of amended

returns with respect to prior tax years, and (2) tax law changes affecting our deferred tax liability.

(C) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic dilution that otherwise

would occur upon conversion of our senior subordinated convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in diluted shares.

34

APPENDIX L –

RECONCILIATION OF ADJUSTED TAX RATE

DOLLARS IN THOUSANDS

Three Months Ended December 31, 2016

Income from

continuing

operations

before taxes

Taxes on

income from

continuing

operations Tax rate

GAAP basis $50,816 ($10,060) -19.8%

Restructuring and impairment charges (A) 46,351 16,505

Losses and other charges, net (B) 2,460 3,469

Amortization of debt discount on convertible notes 1,125 418

Intangible amortization expense 16,005 3,984

Tax adjustment (C) 0 4,942

Adjusted basis $116,757 $19,258 16.5%

Three Months Ended December 31, 2015

GAAP basis $83,188 ($7,577) -9.1%

Restructuring and impairment charges (A) 2,131 797

Losses and other charges, net (B) (1,189) 306

Amortization of debt discount on convertible notes 3,379 1,232

Intangible amortization expense 17,102 4,576

Tax adjustment (C) 0 14,885

Adjusted basis $104,611 $14,219 13.6%

(A) In 2016, "other impairment charges" included (1) a pre-tax, non-cash $41.0 million impairment charge and $14.9 million

reduction in related deferred tax liabilities in connection w ith the Company's Semprus technology; and (2) $2.4 million in pre-

tax, non-cash impairment charges related to tw o properties, one of w hich w as classif ied as an asset held for sale and

$0.7 million reduction in related deferred tax liabilities. In 2015, there w ere no "other impairment charges".

(C) The tax adjustment represents a net benefit resulting primarily from (1) the expiration of applicable statutes of

limitations for prior year returns and/or the resolution of audits or f iling of amended returns w ith respect to prior tax years,

and (2) tax law changes affecting our deferred tax liability.

(B) In 2016, losses and other charges, net related primarily to reversals related to contingent consideration liabilities,

including $8.3 million related to the Company's Semprus technology, somew hat offset by acquisition and facility

consolidation costs. In 2015, losses and other charges, net related primarily to facility consolidations and reflect reversals

of previously recorded charges related to contingent consideration liabilities and the medical device excise tax.

35

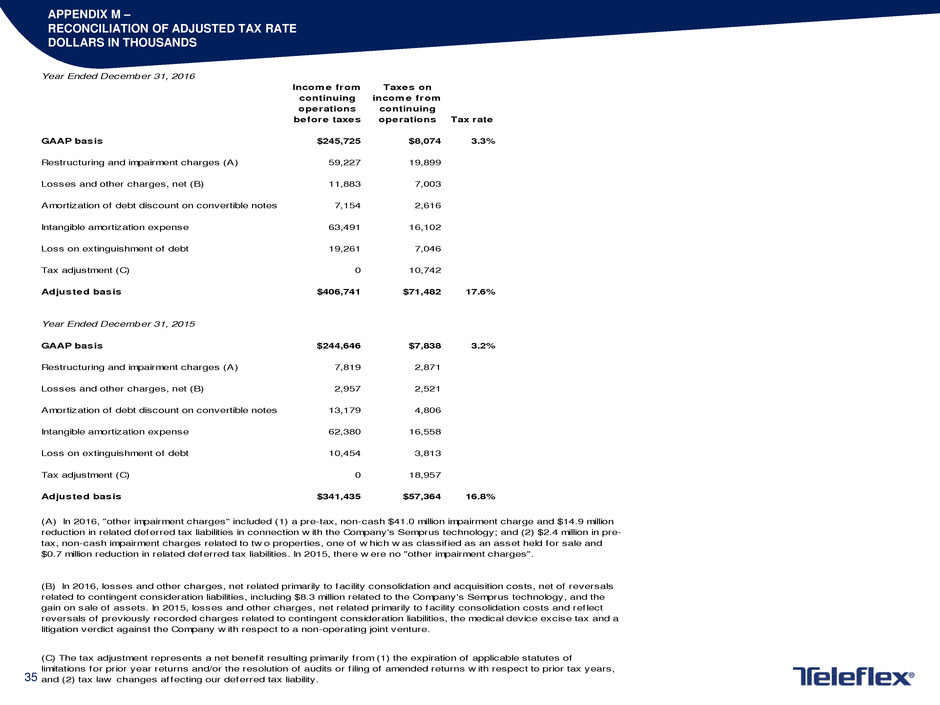

APPENDIX M –

RECONCILIATION OF ADJUSTED TAX RATE

DOLLARS IN THOUSANDS

Year Ended December 31, 2016

Income from

continuing

operations

before taxes

Taxes on

income from

continuing

operations Tax rate

GAAP basis $245,725 $8,074 3.3%

Restructuring and impairment charges (A) 59,227 19,899

Losses and other charges, net (B) 11,883 7,003

Amortization of debt discount on convertible notes 7,154 2,616

Intangible amortization expense 63,491 16,102

Loss on extinguishment of debt 19,261 7,046

Tax adjustment (C) 0 10,742

Adjusted basis $406,741 $71,482 17.6%

Year Ended December 31, 2015

GAAP basis $244,646 $7,838 3.2%

Restructuring and impairment charges (A) 7,819 2,871

Losses and other charges, net (B) 2,957 2,521

Amortization of debt discount on convertible notes 13,179 4,806

Intangible amortization expense 62,380 16,558

Loss on extinguishment of debt 10,454 3,813

Tax adjustment (C) 0 18,957

Adjusted basis $341,435 $57,364 16.8%

(A) In 2016, "other impairment charges" included (1) a pre-tax, non-cash $41.0 million impairment charge and $14.9 million

reduction in related deferred tax liabilities in connection w ith the Company's Semprus technology; and (2) $2.4 million in pre-

tax, non-cash impairment charges related to tw o properties, one of w hich w as classif ied as an asset held for sale and

$0.7 million reduction in related deferred tax liabilities. In 2015, there w ere no "other impairment charges".

(C) The tax adjustment represents a net benefit resulting primarily from (1) the expiration of applicable statutes of

limitations for prior year returns and/or the resolution of audits or f iling of amended returns w ith respect to prior tax years,

and (2) tax law changes affecting our deferred tax liability.

(B) In 2016, losses and other charges, net related primarily to facility consolidation and acquisition costs, net of reversals

related to contingent consideration liabilities, including $8.3 million related to the Company's Semprus technology, and the

gain on sale of assets. In 2015, losses and other charges, net related primarily to facility consolidation costs and reflect

reversals of previously recorded charges related to contingent consideration liabilities, the medical device excise tax and a

litigation verdict against the Company w ith respect to a non-operating joint venture.

36

APPENDIX N –

RECONCILIATION OF 2017 CONSTANT CURRENCY REVENUE GROWTH GUIDANCE

Low High

Forecasted GAAP Revenue Growth 10.0% 11.5%

Estimated Impact of Foreign Currency Exchange Rate Fluctuations 2.5% 2.5%

Forecasted Constant Currency Revenue Growth 12.5% 14.0%

37

APPENDIX O –

RECONCILIATION OF 2017 ADJUSTED GROSS MARGIN GUIDANCE

Note: In 2017, estimated losses and other charges, net relate primarily to facility consolidation and acquisition related

expenses.

Low High

Forecasted GAAP Gross Margin 54.15% 54.70%

Estimated losses and other charges, net 1.25% 1.30%

Forecasted Adjusted Gross Margin 55.40% 56.00%

38

APPENDIX P –

RECONCILIATION OF 2017 ADJUSTED OPERATING MARGIN GUIDANCE

Note: In 2017, estimated losses and other charges, net relate primarily to facility consolidation and acquisition related

expenses.

Low High

Forecasted GAAP Operating Margin 16.50% 17.10%

Estimated losses and other charges, net 3.85% 3.90%

Estimated intangible amortization expense 5.25% 5.30%

Forecasted Adjusted Operating Margin 25.60% 26.30%

39

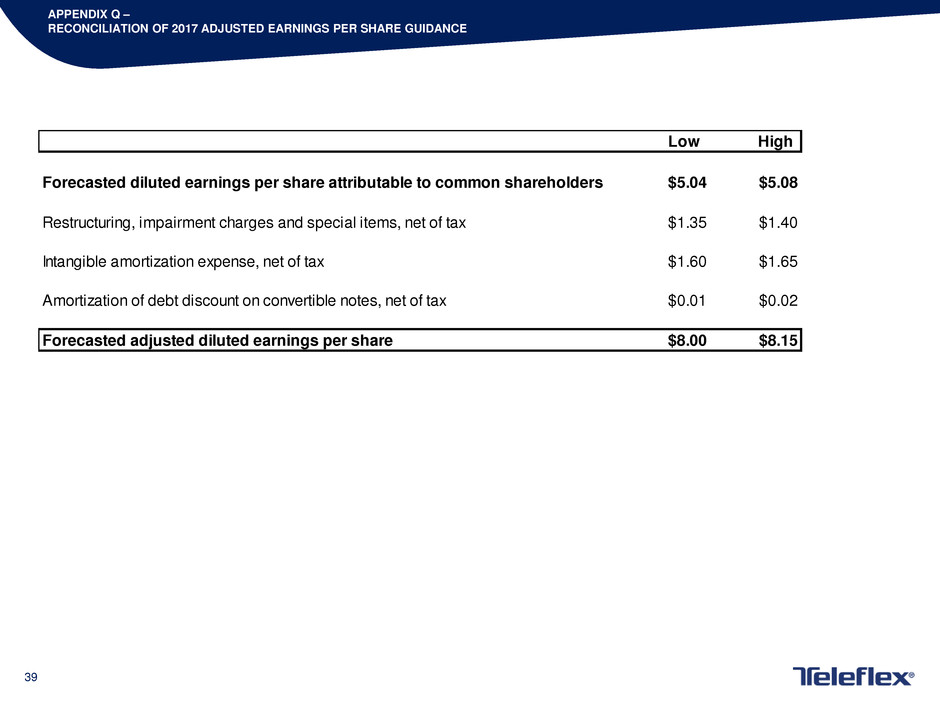

APPENDIX Q –

RECONCILIATION OF 2017 ADJUSTED EARNINGS PER SHARE GUIDANCE

Low High

Forecasted diluted earnings per share attributable to common shareholders $5.04 $5.08

Restructuring, impairment charges and special items, net of tax $1.35 $1.40

Intangible amortization expense, net of tax $1.60 $1.65

Amortization of debt discount on convertible notes, net of tax $0.01 $0.02

Forecasted adjusted diluted earnings per share $8.00 $8.15

40

Euro to U.S. Dollar exchange rate assumed to be ~1.04 for full year 2017

Adjusted weighted average shares expected to be approximately 46.3 to 46.4

million for full year 2017

Calendar of shipping days:

• 5 additional shipping days in Q1’17 vs. Q1’16

• 1 less shipping day in Q2’17 vs. Q2’16

• 5 less shipping days in Q4’17 vs. Q4’16

APPENDIX R –

2017 FINANCIAL OUTLOOK ASSUMPTIONS

41

APPENDIX S –

TELEFLEX RESTRUCTURING PLAN SUMMARY

Program

Estimated Pre-Tax Charges

Range

Estimated Annualized Pre-Tax

Savings Range Once Program

is Substantially Complete

Year Savings

Expected to Begin

Year Program Expected to

be Substantially Complete

2014 Manufacturing Footprint Realignment Plan $43.0 million to $48.0 million $28.0 million to $33.0 million 1 2015 End of First Half of 2020

2015 Restructuring Programs $6.4 million $15.0 million to $18.0 million 2015 End of 2017

2016 Manufacturing Footprint Realignment Plan $34.0 million to $44.0 million $12.0 million to $16.0 million 2017 End of 2018

Other 2016 Restructuring Programs $5.3 million to $6.2 million $6.9 million to $8.5 million 2017 End of Q1 2018

Total $88.7 million to $104.6 million $61.9 million to $75.5 million

1 = includes expected increase in annual revenues resulting from improved pricing on Vascular kits of between $5 million to $6 million.