Attached files

| file | filename |

|---|---|

| EX-99.01 - EARNINGS PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | exh990112-31x2016.htm |

| 8-K - FORM 8-K - EL PASO ELECTRIC CO /TX/ | form8k12-31x16.htm |

Fourth Quarter 2016

Earnings Conference Call

February 23, 2017

2

A

A

a

This presentation includes statements that are forward-looking statements made pursuant to the safe harbor provisions of the Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. This information may involve

risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Additional information

concerning factors that could cause actual results to differ materially from those expressed in forward-looking statements is contained in EE's

most recently filed periodic reports and in other filings made by EE with the U.S. Securities and Exchange Commission (the "SEC"), and

include, but is not limited to:

Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased

costs to customers or to recover previously incurred fuel costs in rates

Full and timely recovery of capital investments and operating costs through rates in Texas and New Mexico

Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability

Changes in customers’ demand for electricity as a result of energy efficiency initiatives and emerging competing services and

technologies, including distributed generation

Unanticipated increased costs associated with scheduled and unscheduled outages of generating plant

Unanticipated maintenance, repair, or replacement costs for generation, transmission, or distribution facilities and the recovery of

proceeds from insurance policies providing coverage for such costs

The size of our construction program and our ability to complete construction on budget and on time

Potential delays in our construction schedule due to legal challenges or other reasons

Costs at Palo Verde

Deregulation and competition in the electric utility industry

Possible increased costs of compliance with environmental or other laws, regulations and policies

Possible income tax and interest payments as a result of audit adjustments proposed by the IRS or state taxing authorities

Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets

Possible physical or cyber attacks, intrusions or other catastrophic events

Other factors of which we are currently unaware or deem immaterial

EE’s filings are available from the SEC or may be obtained through EE’s website, http://www.epelectric.com. Any such forward-looking

statement is qualified by reference to these risks and factors. EE cautions that these risks and factors are not exclusive. Management cautions

against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior

earnings levels. Forward-looking statements speak only as of the date of this news release, and EE does not undertake to update any forward-

looking statement contained herein.

Safe Harbor Statement

3

Financial Overview

Reported 4th Quarter net income of $5.7 million or $0.14 per

share, compared to 4th Quarter 2015 net income of $0.6

million or $0.02 per share

Reported annual net income of $96.8 million or $2.39 per

share, compared to YTD 2015 net income of $81.9 million or

$2.03 per share

42016/Recent Accomplishments

Obtained Final Orders in Texas and New Mexico 2015 Rate Cases and

recognized financial impact

Became a coal-free utility by selling interest in the Four Corners Plant

Received regulatory approvals for large-scale solar projects

Voluntary Texas Community Solar Pilot Program- 3 MW

Holloman Air Force Base- 5 MW

Completed construction and started commercial operation of Montana

Power Station (MPS) Units 3 & 4

Set multiple new native system peaks with the highest being 1,892 MW

on July 14, 2016

Refined the dividend policy to include achieving an annual 55% to 65%

payout ratio by 2020

Reopened and issued $150 million of the 5.00% Senior Notes

Extended the revolving credit facility by one year to 2020 and

increased the size to $350 million

52016/Recent Accomplishments (cont.)

Palo Verde Unit 3 recorded shortest refueling outage in its history

Ranked #1 in reliability by the Public Utility Commission of Texas

(PUCT) for the System Average Interruption Duration Index (SAIDI)

and the System Average Interruption Frequency Index (SAIFI)

Finalized a new collective bargaining agreement on September 3,

2016 with IBEW Local 960, which represents 38% of EE’s workforce

Achieved above target customer satisfaction and call center

performance

Employees contributed 9,500 hours to various volunteer organizations

through the Volunteers in Action Program

Combined employee/company contributions to the United Way

Campaign totaled more than $235,000

62017 Objectives

File general rate cases in Texas and New Mexico

In Q2 2017, initiate the first annual dividend increase (beyond

the historical $0.06 annual increase per share) to move

towards achieving an annual 55% to 65% payout ratio by 2020

Complete construction and implement large-scale solar

projects

Voluntary Texas Community Solar Pilot Program (3 MW)

Holloman Air Force Base (5 MW)

Implement 3 year pilot project for demand response

Issue an all-source Request for Proposal (RFP) for generation

resources

Continue to support the economic growth in our community by

delivering clean, safe, reliable and affordable service

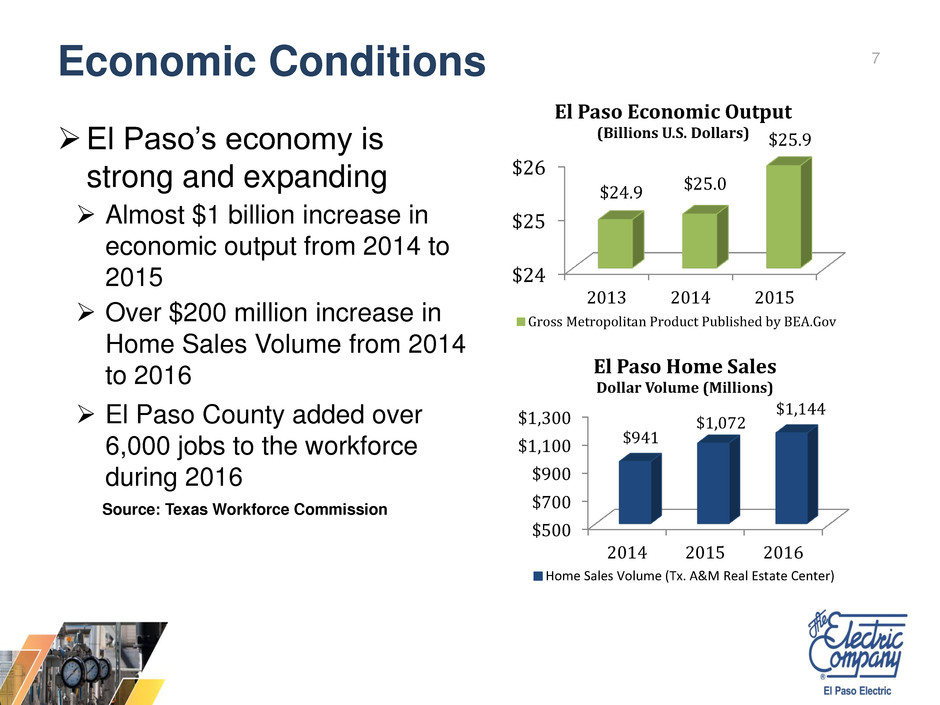

7Economic Conditions

$24

$25

$26

2013 2014 2015

$24.9 $25.0

$25.9

El Paso Economic Output

(Billions U.S. Dollars)

Gross Metropolitan Product Published by BEA.Gov

El Paso’s economy is

strong and expanding

Almost $1 billion increase in

economic output from 2014 to

2015

Over $200 million increase in

Home Sales Volume from 2014

to 2016

El Paso County added over

6,000 jobs to the workforce

during 2016

Source: Texas Workforce Commission

$500

$700

$900

$1,100

$1,300

2014 2015 2016

$941

$1,072

$1,144

El Paso Home Sales

Dollar Volume (Millions)

Home Sales Volume (Tx. A&M Real Estate Center)

8Summary of 2017 Rate Cases

Filed a general rate case in Texas on February 13, 2017

Requested a non-fuel base revenue increase of $42.5 million

Anticipate a final order in Q4 2017 with rates relating back to July

18, 2017

Case No. 15-00109-UT requires EE to make a rate filing in

New Mexico in Q2 2017 using a historical test year ended

December 31, 2016

9

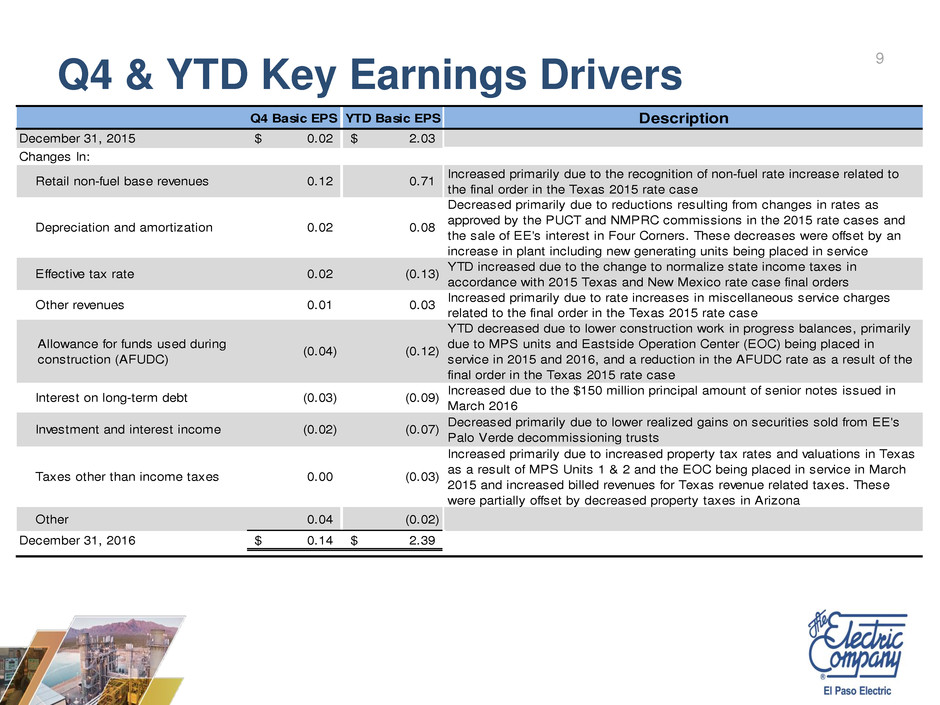

Q4 & YTD Key Earnings Drivers

Q4 Basic EPS YTD Basic EPS Description

December 31, 2015 0.02$ 2.03$

Changes In:

Retail non-fuel base revenues 0.12 0.71

Increased primarily due to the recognition of non-fuel rate increase related to

the final order in the Texas 2015 rate case

Depreciation and amortization 0.02 0.08

Decreased primarily due to reductions resulting from changes in rates as

approved by the PUCT and NMPRC commissions in the 2015 rate cases and

the sale of EE's interest in Four Corners. These decreases were offset by an

increase in plant including new generating units being placed in service

Effective tax rate 0.02 (0.13)

YTD increased due to the change to normalize state income taxes in

accordance with 2015 Texas and New Mexico rate case final orders

Other revenues 0.01 0.03

Increased primarily due to rate increases in miscellaneous service charges

related to the final order in the Texas 2015 rate case

Allowance for funds used during

construction (AFUDC)

(0.04) (0.12)

YTD decreased due to lower construction work in progress balances, primarily

due to MPS units and Eastside Operation Center (EOC) being placed in

service in 2015 and 2016, and a reduction in the AFUDC rate as a result of the

final order in the Texas 2015 rate case

Interest on long-term debt (0.03) (0.09)

Increased due to the $150 million principal amount of senior notes issued in

March 2016

Investment and interest income (0.02) (0.07)

Decreased primarily due to lower realized gains on securities sold from EE's

Palo Verde decommissioning trusts

Taxes other than income taxes 0.00 (0.03)

Increased primarily due to increased property tax rates and valuations in Texas

as a result of MPS Units 1 & 2 and the EOC being placed in service in March

2015 and increased billed revenues for Texas revenue related taxes. These

were partially offset by decreased property taxes in Arizona

Other 0.04 (0.02)

December 31, 2016 0.14$ 2.39$

10

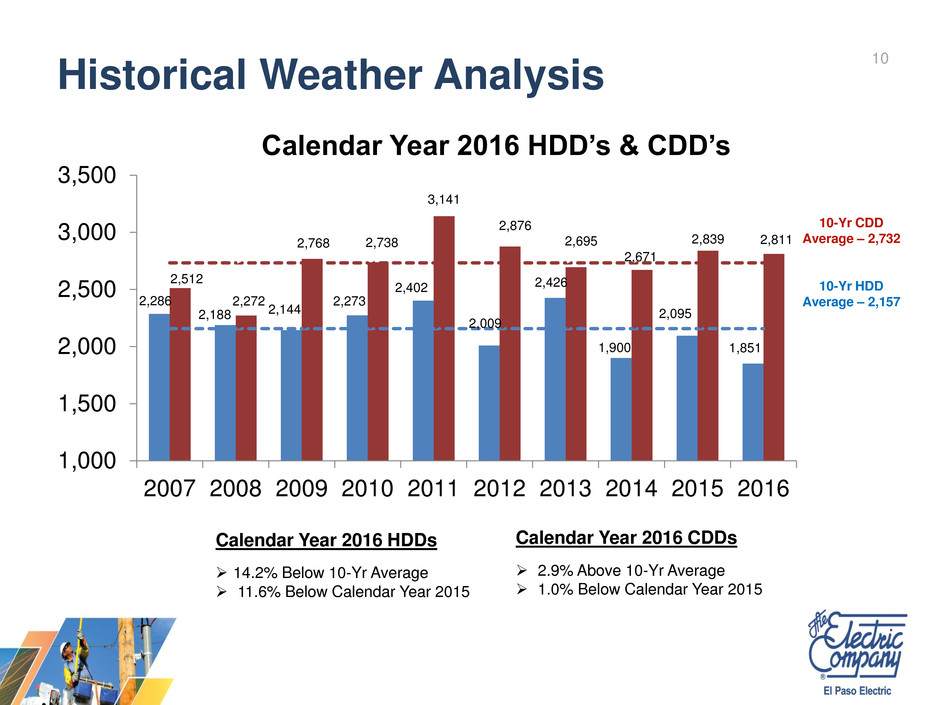

Historical Weather Analysis

2,286

2,188 2,144

2,273

2,402

2,009

2,426

1,900

2,095

1,851

2,512

2,272

2,768 2,738

3,141

2,876

2,695

2,671

2,839 2,811

1,000

1,500

2,000

2,500

3,000

3,500

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Calendar Year 2016 HDD’s & CDD’s

10-Yr HDD

Average – 2,157

10-Yr CDD

Average – 2,732

Calendar Year 2016 HDDs

14.2% Below 10-Yr Average

11.6% Below Calendar Year 2015

Calendar Year 2016 CDDs

2.9% Above 10-Yr Average

1.0% Below Calendar Year 2015

11

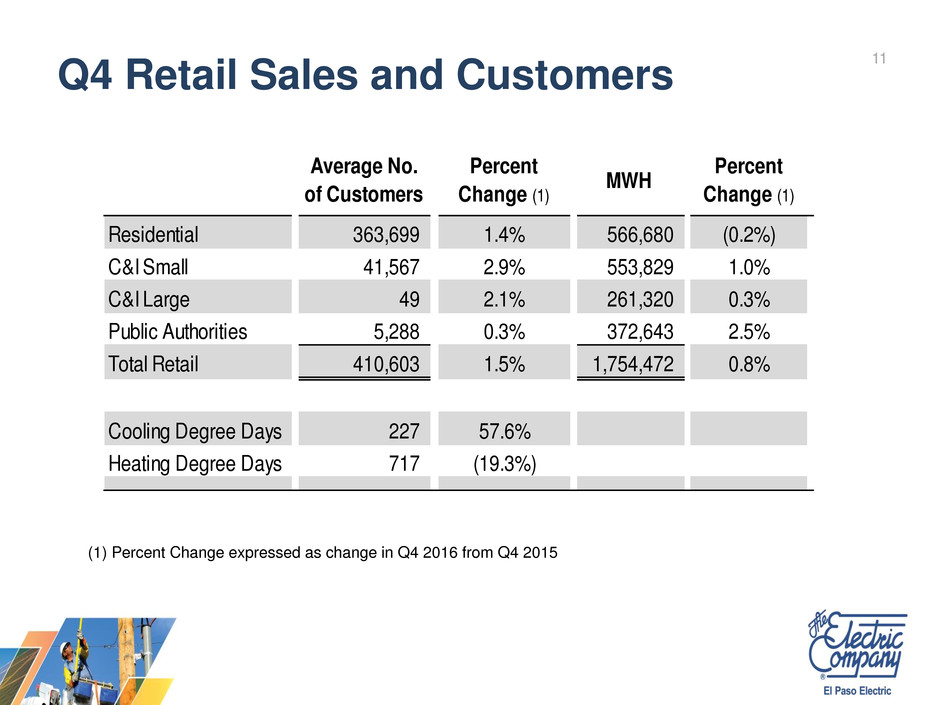

Q4 Retail Sales and Customers

(1) Percent Change expressed as change in Q4 2016 from Q4 2015

Average No.

of Customers

Percent

Change (1)

MWH

Percent

Change (1)

Residential 363,699 1.4% 566,680 (0.2%)

C&I Small 41,567 2.9% 553,829 1.0%

C&I Large 49 2.1% 261,320 0.3%

Public Authorities 5,288 0.3% 372,643 2.5%

Total Retail 410,603 1.5% 1,754,472 0.8%

Cooling Degree Days 227 57.6%

Heating Degree Days 717 (19.3%)

12

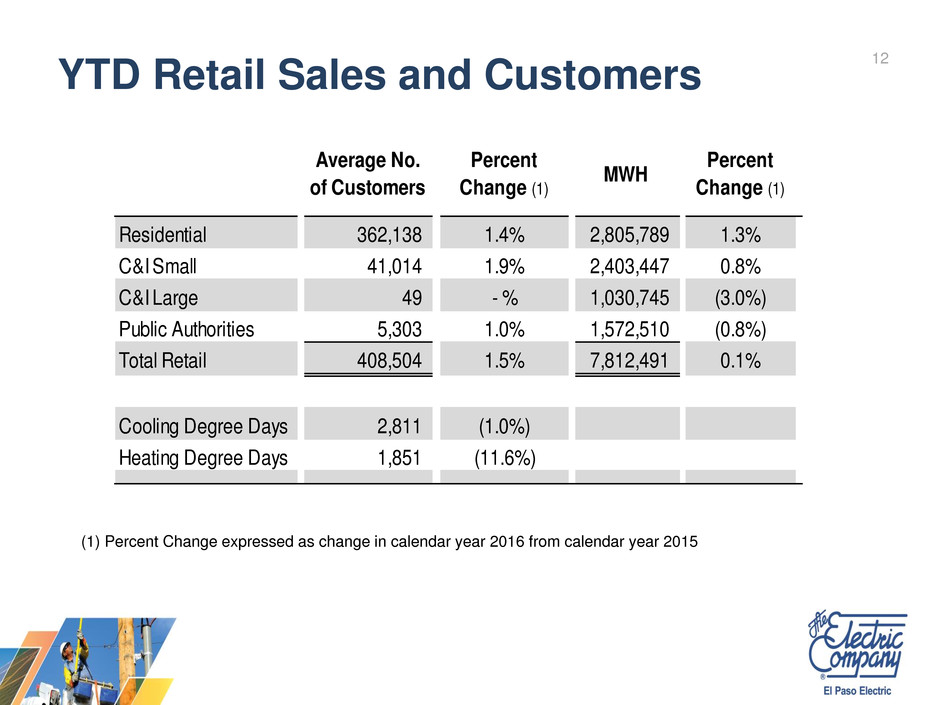

YTD Retail Sales and Customers

(1) Percent Change expressed as change in calendar year 2016 from calendar year 2015

Average No.

of Customers

Percent

Change (1)

MWH

Percent

Change (1)

Residential 362,138 1.4% 2,805,789 1.3%

C&I Small 41,014 1.9% 2,403,447 0.8%

C&I Large 49 - % 1,030,745 (3.0%)

Public Authorities 5,303 1.0% 1,572,510 (0.8%)

Total Retail 408,504 1.5% 7,812,491 0.1%

Cooling Degree Days 2,811 (1.0%)

Heating Degree Days 1,851 (11.6%)

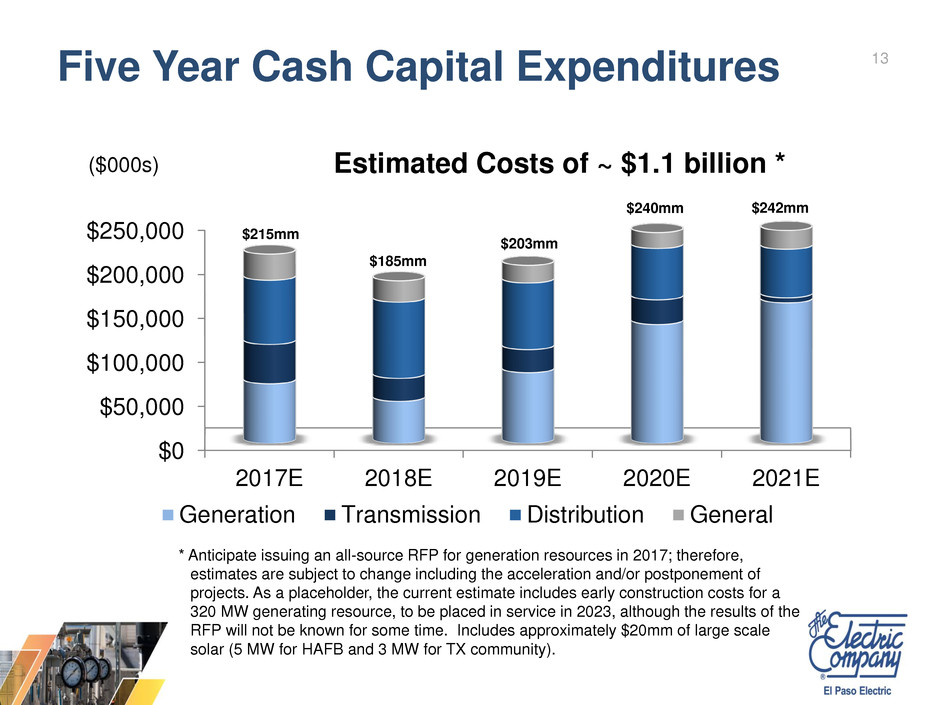

13Five Year Cash Capital Expenditures

$0

$50,000

$100,000

$150,000

$200,000

$250,000

2017E 2018E 2019E 2020E 2021E

Estimated Costs of ~ $1.1 billion *

Generation Transmission Distribution General

$215mm

$185mm

$203mm

$240mm $242mm

($000s)

* Anticipate issuing an all-source RFP for generation resources in 2017; therefore,

estimates are subject to change including the acceleration and/or postponement of

projects. As a placeholder, the current estimate includes early construction costs for a

320 MW generating resource, to be placed in service in 2023, although the results of the

RFP will not be known for some time. Includes approximately $20mm of large scale

solar (5 MW for HAFB and 3 MW for TX community).

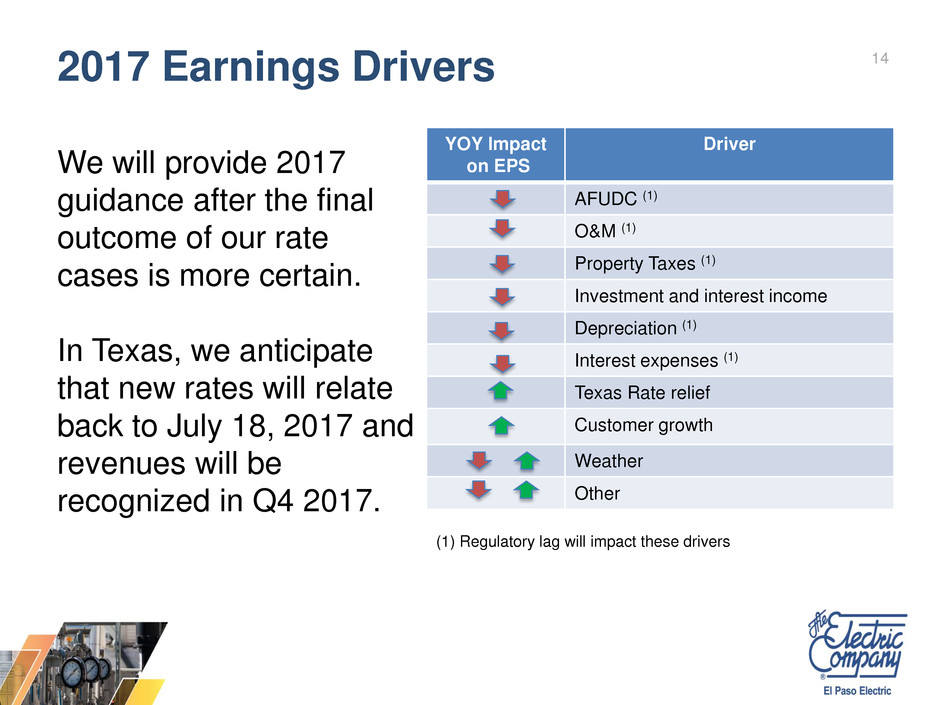

142017 Earnings Drivers

We will provide 2017

guidance after the final

outcome of our rate

cases is more certain.

In Texas, we anticipate

that new rates will relate

back to July 18, 2017 and

revenues will be

recognized in Q4 2017.

YOY Impact

on EPS

Driver

AFUDC (1)

O&M (1)

Property Taxes (1)

Investment and interest income

Depreciation (1)

Interest expenses (1)

Texas Rate relief

Customer growth

Weather

Other

(1) Regulatory lag will impact these drivers

15

Appendix

16Texas Rate Case Summary

Filed Texas Rate Case on February 13, 2017, Docket No.

46831, based on a historical test year ended September 30,

2016

Rate case request includes:

Non-fuel base revenue increase of $42.5 million

Investment in new plant of approximately $444.3 million since the

2015 Texas rate case

Return on Equity of 10.50% with an equity ratio of 48.35%

Baseline revenue requirements for transmission and distribution to

enable future application of cost recovery factors

New three part rate structure for residential and small commercial

distributed generation (DG) customers

Propose separate rate class for residential DG customers

Final rates relating back to July 18, 2017*

* 155 days after the rate case was filed on February 13, 2017

17

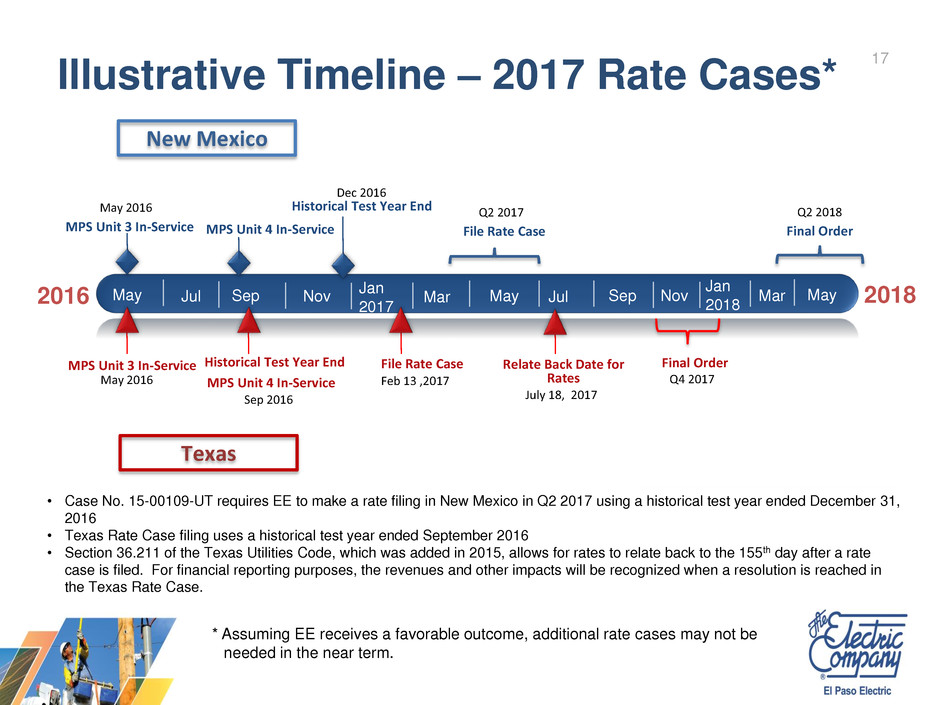

Illustrative Timeline – 2017 Rate Cases*

New Mexico

Texas

May Jul Sep Nov

Jan

2017

Mar May Jul Sep Nov

Jan

2018 2018

Final Order

Q2 2018

Final Order

Q4 2017

Relate Back Date for

Rates

July 18, 2017

File Rate Case

Q2 2017

File Rate Case

Feb 13 ,2017MPS Unit 4 In-Service

MPS Unit 4 In-Service

Historical Test Year End

Dec 2016

Historical Test Year End

Sep 2016

MPS Unit 3 In-Service

May 2016

MPS Unit 3 In-Service

May 2016

2016

• Case No. 15-00109-UT requires EE to make a rate filing in New Mexico in Q2 2017 using a historical test year ended December 31,

2016

• Texas Rate Case filing uses a historical test year ended September 2016

• Section 36.211 of the Texas Utilities Code, which was added in 2015, allows for rates to relate back to the 155th day after a rate

case is filed. For financial reporting purposes, the revenues and other impacts will be recognized when a resolution is reached in

the Texas Rate Case.

May

* Assuming EE receives a favorable outcome, additional rate cases may not be

needed in the near term.

Mar