Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESS RELEASE - CAMBER ENERGY, INC. | ex99-2.htm |

| 8-K - CURRENT REPORT - CAMBER ENERGY, INC. | cei-8k_020717.htm |

Exhibit 99.1

www.camber.energy NYSE MKT: CEI FEBRUARY 2017

Forward - Looking and Cautionary Statements Safe Harbor Statement and Disclaimer This presentation includes “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Forward - looking statements give our current expectations, opinions, belief or forecasts of future events and performance . A statement identified by the use of forward - looking words including “may,” “will,” “expect,” “anticipate,” “estimate,” “hope,” “plan,” “believe,” “predict,” “envision,” “if,” “intend,” “would,” “probable,” “project,” “forecasts,” “outlook,” “aim,” “might,” “likely” “positioned,” “strategy,” “continue,” “potential,” “ensure,” “should,” “confident,” “could” and similar words and expressions, and the negative thereof, and certain of the other foregoing statements may be deemed forward - looking statements . Although the Company believes that the expectations reflected in such forward - looking statements are reasonable, these statements involve risks and uncertainties that may cause actual future activities and results to be materially different from those suggested or described in this presentation, including our ability to integrate and realize the benefits expected from the Segundo acquisition and future acquisitions that we may complete ; the availability of funding and the terms of such funding ; our growth strategies ; anticipated trends in our business ; our ability to repay outstanding loans and satisfy our outstanding liabilities ; our liquidity and ability to finance our exploration, acquisition and development strategies ; market conditions in the oil and gas industry ; the timing, cost and procedure for future acquisitions ; the impact of government regulation ; estimates regarding future net revenues from oil and natural gas reserves and the present value thereof ; legal proceedings and/or the outcome of and/or negative perceptions associated therewith ; planned capital expenditures (including the amount and nature thereof) ; increases in oil and gas production ; changes in the market price of oil and gas ; changes in the number of drilling rigs available ; the number of wells we anticipate drilling in the future ; estimates, plans and projections relating to acquired properties ; the number of potential drilling locations ; our financial position, business strategy and other plans and objectives for future operations ; and other risks described in the Company’s Annual Report on Form 10 - K and other filings with the SEC, available at the SEC’s website at www . sec . gov . Investors are cautioned that any forward - looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected . The forward - looking statements in this presentation are made as of the date hereof . The Company takes no obligation to update or correct its own forward - looking statements, except as required by law, or those prepared by third parties that are not paid for by the Company . The Company's SEC filings are available on its website or at http : //www . sec . gov . 2 The information and estimates contained in this document may include certain statements, estimates and projections developed by the company . Such statements, estimates and projections reflect various assumptions by Camber Energy concerning anticipated oil in place, recoverability and production, which assumptions may or may not occur . No representations are made as to the accuracy of such statements, estimates or projections and actual performance may be materially different from that set forth in such statements, estimates or projections .

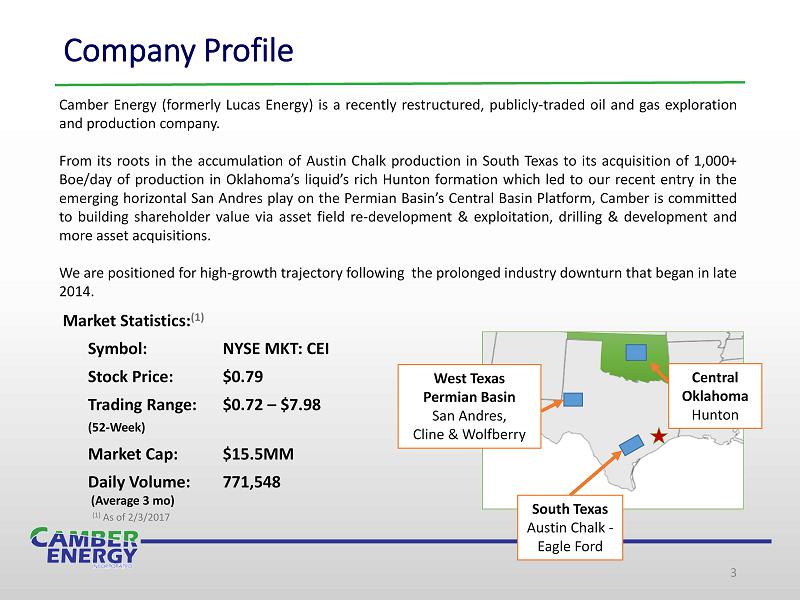

Market Statistics: (1) Symbol: NYSE MKT: CEI Stock Price: $0.79 Trading Range: $0.72 – $7.98 (52 - Week) Market Cap: $15.5MM Daily Volume: 771,548 (Average 3 mo) Company Profile Camber Energy (formerly Lucas Energy) is a recently restructured, publicly - traded oil and gas exploration and production company . From its roots in the accumulation of Austin Chalk production in South Texas to its acquisition of 1 , 000 + Boe/day of production in Oklahoma’s liquid’s rich Hunton formation which led to our recent entry in the emerging horizontal San Andres play on the Permian Basin’s Central Basin Platform, Camber is committed to building shareholder value via asset field re - development & exploitation, drilling & development and more asset acquisitions . We are positioned for high - growth trajectory following the prolonged industry downturn that began in late 2014 . 3 Central Oklahoma Hunton South Texas Austin Chalk - Eagle Ford West Texas Permian Basin San Andres, Cline & Wolfberry (1) As of 2/3/2017

Transitional / Restructuring Complete 4 Lucas Energy Appoints New CEO, T. Schnur; Completion $4mm Non - Core Asset Sale Dec 2012 Restructured Term Loan; Completed $3.5mm Equity Raise Aug/Sep 2013 Nov/Dec 2013 Closes Segundo & Related Financings Aug 2016 Approval to Change Name to Camber Energy Dec 2015 Raised $2mm Equity; Restructured Term Loan; Completed Cost Containment Program LEI 1 - for - 25 Reverse Stock Split Jul 2015 Sourced Various Transaction Alternatives Jan 2015 Mar/Sep 2014 Sep 2015 Amended LOC & Sr. Secured Note; Regains Compliance with NYSE MKT Listing Announces Segundo Agreement to Acquire Hunton Properties Aug 2016 Enters Agreement to Fund EF Shale Development Jan 2017 Acquires Initial 3,600+ Net Acres in emerging Hz San Andres Play of Permian Basin … 2012 Present Settlement $24mm lawsuit and $1.3mm Other Litigation Mar/Apr 2013 Drilled lateral well, completed 4 workovers Sep 14/ Jan 15 Granted NYSE MKT Listing; Extension; Pursued Funding for EF Shale Development CEI Begins Trading on NYSE MKT Dec 2016 Jan 6, 2017 Feb 2016 WTI Hits $26/bbl Low Nov 2016 Completed Second Tranche of SPA with Discover Growth Fund Moving Forward Restructuring Plan for Development Structure for the Downturn Prime for Growth Sep 2016 Expanded Management Team

Camber Energy Management Team 5 Anthony “Tony” Schnur CEO & Director • 30+ Year Turn - Around Specialist • Formerly with Chroma O&G, Aquila Energy Capital Ken Sanders COO • 40+ Year Petroleum Engineer, MBA • Formerly with Seagull Energy, Shell Oil, Kerr McGee Paul Pinkston CAO • 20+ Year CPA, Accounting & Audit • Formerly with Baker Hughes, Arthur Anderson Thomas “Tommy” Hardisty SVP, Land & Business Development • 30+ Year Professional Landman and Business Development Leader • Formerly with Davis Petroleum, Particle Drilling, PetroCorp • Former Director, Eco - Stim Energy J. Mark Bunch SVP, Engineering & Operations • 30+ Year Petroleum Engineer • Produced Clastic & Carbonate Reservoirs throughout N.A. • Formerly with Davis Petroleum, Mecom Oil, Huddleston, PetroCorp , Arco

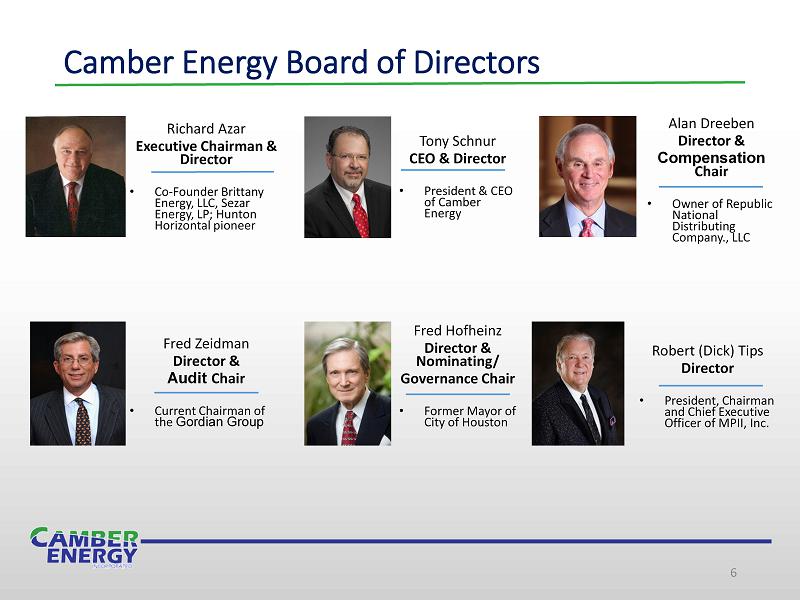

Camber Energy Board of Directors 6 Tony Schnur CEO & Director • President & CEO of Camber Energy Robert (Dick) Tips Director • President, Chairman and Chief Executive Officer of MPII, Inc. Richard Azar Executive Chairman & Director • Co - Founder Brittany Energy, LLC, Sezar Energy, LP; Hunton Horizontal pioneer Alan Dreeben Director & Compensation Chair • Owner of Republic National Distributing Company., LLC Fred Hofheinz Director & Nominating/ Governance Chair • Former Mayor of City of Houston Fred Zeidman Director & Audit Chair • Current Chairman of the Gordian Group

South Texas: Austin Chalk & Eagle Ford Shale 7 *Eagle Ford Acreage is a subset of the Austin Chalk Acreage Highlights • Legacy Assets • 24 Active Wells • 7,300 Net Acres (Austin Chalk) • 2,000 Net Acres (Eagle Ford) • 90 BOE/d - Q4 2016 Operations Update • Well Workovers / Mechanical Repairs • Stimulation • Potential for Selective Drilling

Central Oklahoma: Hunton Highlights • Acquired liquid - rich Hunton assets • 122 Producing Wells [26 Operated] • 875 BOE/d - Q4 2016 • 13,000+ Net Acres • 40+ Drilling Locations o Open hole completions o Acid Stimulation • Key Fields: o Coyle - Payne & Logan Cos (Operated) o Twin Cities Dolomite – Lincoln Co (Non - Op) Operations Update Field Engineering & Re - development Program • Well Work - overs & Repairs • Compression initiative • 4+ Well Drilling Program 8

West Texas: Permian Basin/Central Basin Platform 9 Highlights San Andres Hz Play (Rapidly Emerging) • 3,600+ net acres acquired, initial “toe hold” • 20,000+ net acre position targeted • Located in the Permian Basin/Central Basin Platform • Strong technical & analog support for residual oil zone “ROZ” production • Geologic & operational attributes of the San Andres ~ Hunton! (carbonate reservoir, de - water play, similar drlg . & infrastructure) • Technically “fits” Camber’s core competencies • Play being de - risked, but still early “fast follower” Cline & Wolfberry Assets • 21 producing wells (non - op), Glasscock Co, TX • 80 BOE/d - Q4 2016 • Approx. 500 Net Acres – 100% HBP • Small WI (5% - 7%); Apache operated Operations Update • Build San Andres land position for long - term inventory • 6+ well drilling San Andres program in 2017

Building on the Platform Platform for Growth | The formation of Camber with a NYSE MKT listing and combination of operational, management, financial and restructuring wisdom have come together at this pivotal time to provide the right platform for substantial growth opportunities . We are expanding our platform and drilling inventory with an aggressive move into the Permian Basin . Transaction Flexibility | Camber can acquire assets using less cash by utilizing more structured transactions such as earn - outs, conditional option payments ; convertible debt and other structures in order to capitalize the growth initiative . Optimization Upside | The Camber team is not only experienced in the operation of various properties including that of significant water distribution and disposal, but also in the management and financial restructuring of troubled properties and entities . This group has the cumulative wisdom through those experiences to manage more efficiently, both operationally and fiscally . 10 Optimize Upside (Execution) Transaction Flexibility (Capitalization) Platform for Growth (Production, Drilling Inventory & Team)

New Strategic Entry x Diversification x Geologic & Strategic Fit x Extend Technical Capability x Drilling Inventory x Future Cash Flow Exploit Resources x Well Workovers x Compression x Operating Efficiency x Production Optimization & Maintenance x Cost Reduction Bolt - On x Acquire additional WI in Offset Fields x Apply Technical Focus x Cash Flow x Scale & Leverage Existing Operations & Infrastructure Company Strategy 11 Development Drilling x Rationalize Acreage Inventory x Convert PUDs to PDP x Cash Flow x Expand Proven Reserves Higher Upside Potential & Risk Lower Upside Potential & Risk Balanced Approach to Increase Cash Flow and Valuation

Exploitation: Existing Fields & Assets 12 Central Oklahoma - Hunton ▪ Install and/or upgrade compression to lower surface pressure and increase rate ▪ Well work to reactivate shut - in producers ▪ Well work to convert lower rate producers from ESP to rod pump Legacy South Texas - Eagle Ford / Austin Chalk ▪ Well work to reactivate shut - in producers

Bolt - On (or off) Strategy 13 Central Oklahoma - Hunton ▪ Actively engaged in A&D market for producing assets to create scale ▪ 2 potential, complementary transactions targeted & being pursued ▪ Engaged in leasing program to secure offset/adjacent acreage Legacy South Texas - Eagle Ford / Austin Chalk ▪ Continue to review tactical opportunities to grow ▪ Selective acreage purchase, farm - in / farm - outs ▪ Review and rationalize assets & acreage inventory ▪ Possible strategic exit to monetize & redeploy in more strategic areas

Development Drilling 14 Central Oklahoma - Hunton ▪ Planning 4+ well (vertical) drilling program in 2017 ▪ Estimated D+C = $0.8 million per vertical Hunton well ▪ Initial targeted to spud in March Legacy South Texas - Eagle Ford / Austin Chalk ▪ Negotiating with capital partner for potential drilling 1H 2017 ▪ Estimated D+C = $5.3 million per Hz EF well ▪ Company to retain carried WI to minimize capital exposure

New Strategic Entry 15 West Texas Permian Basin / Central Basin Platform - San Andres ▪ Focus on acquiring acreage in first half of 2017 ▪ To date 3,600 acres acquired ▪ Targeting acquisition of 20,000 acres ▪ Estimated 4 wells per 640 acres ▪ Estimated 50 wells per 10,000 acres ▪ Drilling anticipated in 2 nd half 2017 but dependent upon successful leasehold acquisition program ▪ Estimated 300 thousand BOE recoverable per well ▪ Estimated 1.2 million BOE recoverable per 640 acre section ▪ Estimated 15.0 million BOE recoverable per 10,000 acres

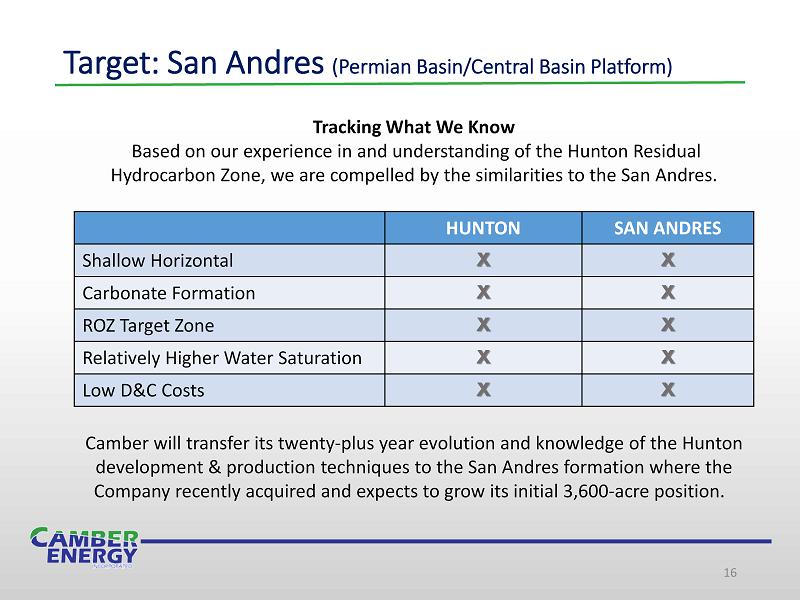

Target: San Andres (Permian Basin/Central Basin Platform) 16 HUNTON SAN ANDRES Shallow Horizontal X X Carbonate Formation X X ROZ Target Zone X X Relatively Higher Water Saturation X X Low D&C Costs X X Tracking What We Know Based on our experience in and understanding of the Hunton Residual Hydrocarbon Zone, we are compelled by the similarities to the San Andres. Camber will transfer its twenty - plus year evolution and knowledge of the Hunton development & production techniques to the San Andres formation where the Company recently acquired and expects to grow its initial 3,600 - acre position.

Horizontal San Andres Permian Basin • 80 years of production – 30 billion barrels produced • Contains estimated 22% of remaining U.S. oil reserves • 29% of estimated U.S. reserve growth San Andres Zone Facts • ~6 billion San Andres barrels produced • Over 2 billion barrels from the Central Basin Platform San Andres Geology • Lithology = Limestone & Dolomite • Average Well Depth – 4,800 feet • Average Zone Thickness – 200 - 400+ feet • Porosity – 8% to 16% 17 Source: National Energy Technology Laboratory (5/04)

Horizontal San Andres 18 San Andres Horizontal Play Participants A. Element B. Elk River C. Henry D. Apache E. Stewart F. Custer & Wright G. Monandnock H. ER Operating I. Manzano J. Walsh K. Riley L. Wishbone M. Kinder Morgan N. Forge O. Elk Meadows P. Ring Q. Parallel San Andres Horizontal Play Development Earliest ROZ SA Hz Well Drilled in 2014 Current successful D&C methodologies refined during 2014 Now over 100 SA Hz Wells Drilled & Proof of Concept verified Acreage Costs Now Advancing Estimated $1+ billion Private Equity committed and growing Source: Melzer Consulting

Horizontal San Andres - The ROZ Concept 19 National Energy Technology Laboratory Additional Information: residualoilzones.com Melzer Consulting As a simplified explanation, dewatering occurs in formations with relatively high water saturations (> 50 % . ) Oil and gas resides in pore spaces of conventional subsurface rock formations and is held in place by the pressurized water . By producing the water (dewatering), the pressure holding the hydrocarbon in place is lowered, the hydro carbon expands, and transitions from a residual state to a mobile state, allowing for commercial production . This concept is now used in the Mid - Continent to produce large quantities of oil and gas from the Hunton formation, and has recently been applied with increasing success to the San Andres formation in West Texas .

Horizontal San Andres - Economics 20

Appendix 21

Management 22 Tony Schnur, President and Chief Executive Officer, Director Significant Accomplishments : Drove Cultural and Operating Change . Redirected Lucas’ corporate focus from a state of turmoil to stability by eliminating unnecessary spending, strengthening financial flexibility, and expanding the asset base while resolving outstanding litigation . Turned Around Distressed Organizations . Successfully restored viability of financially - stressed company by aggressively cutting operating costs, redirecting strategic focus, restoring financial discipline, and share swap at acquisition, maximizing stakeholders’ return . Protected Investor Capital . Saved private equity company from foreclosure & within an eight - month period refocused operations, reduced operating costs, and sold company affording investors a 26 . 3 % IRR and an ROI of $ 4 M on the initial $ 17 M investment, along with equity holders’ capital return . Recent Career History : CEO, Lucas Energy, Inc (Camber Energy) : 2012 to present Interim CEO & CFO, Chroma Oil & Gas, LP : 2010 - 2012 Independent Consultant : 2002 - 2012 Director, Aquila Energy Capital Corp : 1999 - 2002 Education : MBA (Finance), Case Western Reserve University, 1992 BSBA in Finance, Gannon University, 1987 Ken Sanders, Chief Operating Officer Significant Accomplishments : Evaluated Reserves & Development Potential in Multiple Basins . Performed production engineering study for major Gulf of Mexico gas field re - development & optimization . Engineered reserves determinations & property valuations in most of the basins all across North America . Managed Large - scale Asset Exploitation & CAPEX Programs . Directed the efforts of multidisciplinary regional teams of geologists, engineers and land - men in optimizing the economic development of nearly $ 1 billion in natural gas reserves through a 150 - well annual drilling budget focused primarily in the U . S . Onshore basins of Anadarko, Arkoma & the ArkLaTex . Executed Successful Public Co . Financial Restructuring & Turn - around . As President and CEO, developed and executed an agreed Plan of Reorganization resulting in a newly recapitalized private company . Technical high - grading of assets & drilling inventory lead to development drilling program yielding significantly increased net production . Marketed to industry and closed profitable $ 146 million sale of the entire company . Recent Career History : COO Camber Energy (VP Asset Development, Lucas Energy) : 2013 - present President & CEO, KRS Resources, LLC & ReSearch Exploration : 2003 - 2016 President & CEO, Contour Energy, Inc : 1999 - 2003 Vice President Exploitation and A&D - Seagull Energy E&P, Inc : 1991 - 1999 Sr . VP – Keplinger & Assoc . (petroleum eng . consultants) ; 1975 – 1986 Education : MBA (Finance), University of Houston, 1981 BS in Petroleum Engineering, Mississippi State University, 1972

Management 23 Paul Pinkston, CPA, Chief Accounting Officer Significant Accomplishments : Improved Financial Reporting and Accounting Functions . Streamlined accounting and financial reporting during restructuring and transition period . Team lead in the transition of the shared service/close function of a major oil field service company to a third - party provider, including consolidating the world - widemonthly close function . Conducted Audits and Oversaw Compliance Practices . Experienced in performing various audit and financial consulting services, internal audits both public and private . Led international SOX testing projects, including the supervision and review of local international public accounting staff and performed quality control review of SOX testing documentation and results as well as remediation analysis Awarded for Clearing Services : At Baker Hughes, received the Chairman’s Award for work performed in clearing $ 24 million in advance and intercompany and other general outages for BHI world - wide Recent Career History : Chief Accounting Officer, Lucas (now Camber Energy) : 2013 to present Senior Consultant, Sirius Solutions, LLLP : 2006 - 2013 Corporate Auditor, Baker Hughes, Inc .: 2002 - 2005 Senior Auditor, Arthur Anderson, LLP : 1998 - 2001 Education : MBA (Accounting), University of Houston BA in Finance and Marketing, University of Texas Thomas E . Hardisty, Senior Vice President, Land & Business Development Significant Accomplishments : Seasoned Land & Business Development Professional . Accountable for all land dept . functions & business development activities . At Davis Petroleum, led negotiations for all key, strategic agreements and closed multiple A&D transactions having $ 170 mm combined value ; also closed JV agreements with combined exposure > 80 , 000 acres, and managed company’s participation . Previously identified patented drilling tech that led to formation of a new company . Key Role in Strategic Transactions . In the past 2 companies, instrumental in identifying the counterparties that led to strategic transactions and facilitated corporate/legal due diligence, and either led or heavily participated in the negotiation and closing of definitive agreements . Managed and Favorably Resolved Disputes . At prior companies, inherited legacy disputes and resolved them all via negotiated settlements, mediations and arbitration with favorable outcomes in 5 of the 6 of the most material, including a contract breach in GOM asset, resulting in $ 11 + mm award . Recent Career History : SVP, Land & Business Dev, Lucas (Camber) Energy : 2016 to present VP, Land & Business Dev, Davis Petroleum : 2009 - 2016 VP, Land & Business Dev, Kerogen Resources, Inc : January to August 2009 SVP, Corp . Dev, Particle Drilling Technologies, Inc : 2003 - 2009 VP, Land & Business Dev, Shoreline Partners, LLC : 2001 - 2003 Education : BBA / Petroleum Land Management, University of Texas at Austin, 1984 Certified Phase I & II Environmental Assessment, Texas A&M University, 1992

Management 24 Mark Bunch – Senior Vice President, Engineering & Operations Significant Accomplishments : Evaluated and Increased Reserves and Returns . Critical role in merger, leading the team that developed & executed the plan to dramatically increase reserves & rate and cash flow ; increased net reserves by 175 % from 2 . 8 to 2 . 9 million BOE while producing 1 . 9 million BOE . Net reserves increased by 175 % . Successful Well Discovery . Successfully developed a non - op new discovery in South Texas Wilcox with 25 , 000 MCFPD from three wells . Experienced in Infrastructure Development . Designed & installed 20 - mile gas gathering system that spanned two Indian reservations in Southwest Colorado . Presented proposal to Ute Mountain Ute, Minister of Energy for tribe approval . Career History : SVP, Engineering & Operations, Lucas (Camber) Energy : 2016 to present Asset Manager, Davis Petroleum Corp : 2012 - 2016 COO & Partner, Mecom Oil, LLC : 2007 - 2012 Vice President, Huddleston & Co . , Inc & Peter Paul Petroleum : 1999 - 2007 Engineering Manager, Petrocorp, Inc : 1993 - 1999 Reservoir & Production Engineer, Arco Oil & Gas Co : 1981 - 1992 Education : BS in Petroleum Engineering, Texas A&M University

Oil & Gas Reserves 25 Reserves as Pro Forma Published at the Segundo Acquisition Lucas Energy, Inc. Segundo Acquisiton Properties Pro forma Combined Proved Developed Reserves Crude Oil (Bbls) 114,798 183,834 298,632 Natural Gas (Mcf) - 13,021,027 13,021,027 Natural Gas Liquids (NGL) in BBLs - 2,681,914 2,681,914 Oil Equivalents (Boe) 114,798 5,035,919 5,150,717 Proved Undeveloped Reserves Crude Oil (Bbls) 3,723,585 46,440 3,770,025 Natural Gas (Mcf) 2,513,691 4,155,620 6,669,311 Natural Gas Liquids (NGL) in BBLs - 1,020,470 1,020,470 Oil Equivalents (Boe) 4,142,534 1,759,513 5,902,047 Proved Reserves Crude Oil (Bbls) 3,838,383 230,274 4,068,657 Natural Gas (Mcf) 2,513,691 17,176,647 19,690,338 Natural Gas Liquids (NGL) in BBLs - 3,702,384 3,702,384 Oil Equivalents (Boe) 4,257,332 6,795,432 11,052,764 8/25/16

Public Information 26 Lucas Energy, Inc. / Camber Energy, Inc. 450 Gears Rd., Suite 860 Houston, TX 77067 Phone: (713) 528 - 1881 Fax: (713) 337 - 1510 www.lucasenergy.com COMPANY DETAIL Dennard Lascar Associates (713) 529 - 6600 M. Carol Coale ccoale@dennardlascar.com Kenneth S. Dennard ken@dennardlascar.com INVESTOR RELATIONS CONTACT